UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4520 Main Street, Suite 1425 Kansas City, MO | 64111 |

| (Address of principal executive offices) | (Zip code) |

Matrix 360 Administration, LLC

4520 Main Street

Suite 1425

Kansas City, MO 64111

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-934-5550

Date of fiscal year end: 06/30/2015

Date of reporting period: 06/30/2015

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the IMS Family of Funds, series of the 360 Funds (the “registrant”) for the year ended June 30, 2015 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

| |

IMS Capital Value Fund IMS Strategic Income Fund IMS Dividend Growth Fund |

Annual Report

June 30, 2015

Fund Advisor:

IMS Capital Management, Inc.

8995 S.E. Otty Road

Portland, OR 97086

Toll Free (800) 934-5550

IMS CAPITAL VALUE FUND

MANAGEMENT’S DISCUSSION AND ANALYSIS

Annual Report

June 30, 2015

Dear Fellow Shareholders,

The IMS Capital Value Fund returned +8.07% while its benchmark, the S&P 500 Index returned +1.23% over the six-month period ended June 30, 2015. For the twelve-month period, ended June 30, 2015, the Fund returned +9.76% compared to the benchmark return of +7.42%. Stocks in general produced fairly flat results for the first half of 2015, however the economy continues to slowly expand. If the trend continues, the economic expansion will soon reach seven years. The rally in stocks began in March of 2009 and is now the third longest in U.S. history, behind only the 1987 (13 year) and 1949 (7 year) rallies.

Our focus on finding undervalued companies that are well-positioned to benefit from one or more of our investment themes, worked well over both time periods. We seek to identify undervalued companies that are poised to benefit from various trends in society. The Fund’s 49 holdings were diversified across all of the market’s major sectors with the exception of utilities. Three of our larger sector weightings in the Fund include consumer discretionary 23.1%, healthcare 18.8% and financials 13.2%. The three lowest sector weightings were telecommunications 2.6%, industrials 3.5% and utilities 0%. We deliberately avoided the utility sector as most of the companies appeared overvalued after last year’s run up, and unattractive, given the fact that interest rates are poised to rise at some point in the near future. The Fed has kept its benchmark federal funds rate pinned near zero since December 2008 to bolster the U.S. economy. A number of Fed policy makers have signaled the first rate increase may come as early as the upcoming September or December meeting.

Over half of the Fund is invested in large cap companies, while 24% is invested in mid cap companies with just 8% in small cap companies. Our sector bets tended to pay off as the highest weighted sectors had some of the best returns and the lowest weighted sectors had some of the lowest returns during the year.

During the past year, major contributors to the Fund were mainly healthcare stocks: InVivo Therapeutics was up +288.22% for the year. This biomaterials company has an innovative, and so far, promising treatment for paralyzing spinal cord injuries. The company is conducting a five-patient pilot study which has shown positive results in the first three patients who have had the Neuro-Spinal Scaffold surgically implanted to aid the body in healing the injury. Following successful completion of the pilot study, InVivo expects to obtain FDA approval to commence commercialization of its product. The second best performer was Opko Health, +81.90%. This biopharmaceutical and diagnostic company has many potential successes under its belt, including its blood tests for advanced prostate cancer. If the company can convince doctors to prescribe it and insurers to pay for it, it could end up being a standard test that will be used prior to subjecting patients to a biopsy. In 2009, the company acquired the rights from Schering-Plough to the nausea and vomiting drug which has a pending FDA decision in September and it has a new treatment for vitamin D deficiency which could be available to patients as early as next year. The third best performer was Edwards Lifesciences Corp. up +65.92%. The company spun off from Baxter in 2000 and is engaged in designing, manufacturing and marketing a range of medical devices and equipment for advanced stages of heart disease. The company grew EPS by +11.8% last year and is expected to grow +24.5% this year. Long term growth is an impressive +15.4%. It has achieved this by maintaining dominance in the high margin surgical heart valves and pioneered new minimally invasive heart valve therapy.

Companies that detracted from the Fund’s performance over the last year included Sprint, the third largest wireless carrier in the U.S., which was down -46.54% due to weak financial performance. The firm’s wireless spectrum position is the strongest in the industry and Softbank’s backing should enable Sprint to greatly enhance its competitive position and create value for shareholders over time. The second worst performer was Houston-based oil exploration and production company, Apache Corporation, down -41.73% due to declining oil prices. The company has been restructuring and unloading several of its international assets to reduce debt and focus on shale drilling in the U.S. The company has reduced its net debt load from $12 billion to $6.7 billion. As a result, several research firms have upgraded their ratings on the company. Finally, Texas-based pawn shop operator EZCorp, Inc. dropped -35.67% due to an earnings restatement at one of its divisions and the announcement that it is exiting the payday, auto title, and installment lending business to focus on its more profitable pawn shop business. The strategy is expected to produce annual expense savings of around $34 million after three years. The company expects to start seeing the savings begin in the fourth quarter of 2015.

The U.S. stock market is in the seventh year of one of the most sustained expansions in U.S. history. We still feel, however, that the expansion can continue for several more years. Regardless, it is our belief that our focus on finding the right undervalued companies should continue to benefit our shareholders. Going forward, we continue to focus on undervalued stocks that we believe have the potential to grow earnings, are down in price, are seasoned and are poised to benefit from one or more of our investment themes. For instance, we have been investing in companies that should benefit from baby boomer spending habits, an eventual rise in interest rates, an eventual rise in oil prices, the pending housing shortage and the trend towards healthy eating. We thank you for continuing to invest alongside us in the IMS Capital Value Fund as we focus on building wealth wisely.

Sincerely,

Carl W. Marker

Portfolio Manager

IMS Capital Value Fund

INVESTMENT RESULTS – (Unaudited)

| Average Annual Total Returns (for periods ended June 30, 2015) |

| One Year | Five Year | Ten Year |

| IMS Capital Value Fund* | 9.76% | 12.79% | 5.20% |

S&P 500® Index** | 7.42% | 17.33% | 7.89% |

| Total annual operating expenses as disclosed in the Fund’s current prospectus dated October 31, 2014, were 2.05% of average daily net assets (1.95% after fee waivers/expense reimbursements by the Advisor). The Advisor has contractually agreed to waive its management fee and/or reimburse expenses so that total annual fund operating expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses such as acquired fund fees and expenses; and 12b-1 fees; and extraordinary litigation expenses) do not exceed 1.95% of the Fund’s average daily net assets through October 31, 2015, subject to the Advisor’s right to recoup payments on a rolling three-year basis so long as the payment would not exceed the 1.95% expense cap. This expense cap may not be terminated prior to October 31, 2015 except by the Board of Trustees of 360 Funds. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling Shareholder Services at 1-800-934-5550.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The annual total returns included for the above Fund are net of the total annual operating expenses for the Fund, while no annual operating expenses are deducted for S&P 500 Index. |

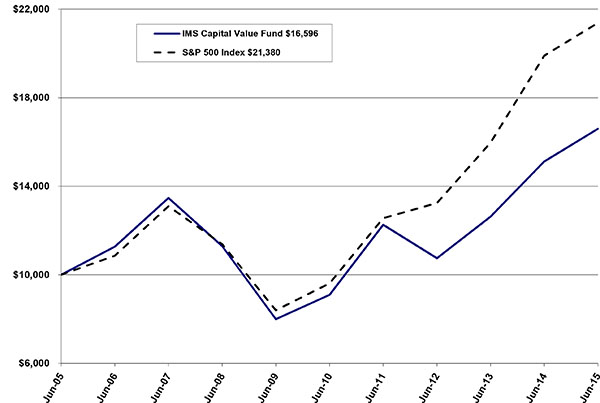

Comparison of the Growth of a $10,000 Investment in the IMS Capital Value Fund and

the S&P 500® Index for the 10 Years Ended June 30, 2015 (Unaudited)

The chart above assumes an initial investment of $10,000 made on June 30, 2005 and held through June 30,2015. The chart also assumes reinvestment of all dividends and distributions on the reinvestment dates during the period. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

IMS STRATEGIC INCOME FUND

MANAGEMENT’S DISCUSSION AND ANALYSIS

Annual Report

June 30, 2015

Dear Fellow Shareholders,

The U.S. economy continues to struggle with slow growth and higher than average unemployment. The Fed has continued to keep short-term interest rates exceptionally low, which has helped sustain the current economic expansion that is now in its 7th year. The exact date of a Federal Reserve tightening is less important than the fact that more Americans are working, and therefore spending is improving. Housing and auto sales are showing signs of strength, as consumers are benefitting from lower borrowing costs. We believe that when rates do begin to rise, the rate of change will be slower than most people fear. The Financial sector stands to benefit most from rising rates. Examples include banks, insurance companies, payroll processors and firms that provide money market funds. Lower prices at the pump have helped the consumer; however, the sudden and historically large drop in energy prices has had a negative impact on the IMS Strategic Income Fund.

In this environment, the IMS Strategic Income Fund returned -4.37% over the first six months of 2015, and -16.13% over the twelve-month period ending June 30, 2015. The Barclay’s Aggregate Bond Index, the Fund’s benchmark, returned -0.10% and 1.86% over the same periods, respectively. The index is comprised of 100% domestic, investment grade bonds while the Fund holds just 26% in these securities. In many ways, the index looks very different from the Fund. By contrast, the index has little or no exposure to stocks, high yield bonds or international bonds. For example, as of June 30, 2015, the Fund had 37% in stocks, 29% in high yield bonds and 6% in international high yield bonds. Looking back over the past year, our biggest mistake was being incorrect about the direction of energy and commodity prices, as both dropped sharply. The v-shaped bottom, production cuts and rebound in price we expected to occur has not yet materialized. Our energy-related holdings had a material negative impact on the Fund’s performance during the period. While we feel the current low prices are unsustainable, it is impossible to know how long they will persist.

The IMS Strategic Income Fund is as the name suggests, “strategic” in that we take positions in areas where we see the most opportunity. Right now we see opportunity in several areas, however, we have the greatest conviction in the opportunity for higher interest rates and higher energy prices. We are confident that eventually higher levels will materialize in both areas and we have invested accordingly. What we don’t know is how long it may take for these higher levels to materialize. Longer-term interest rates have started to climb in anticipation of the Federal Reserve starting to raise short-term rates. However, energy and commodity prices have recently hit fresh lows, so as usual, the timing of any rebound is difficult to predict.

We have very little exposure to emerging markets, traditional investment grade bonds or treasuries as we believe there is significant risk in the emerging markets and that the 30-year bull market in bonds is ending which means that traditional investment grade bonds and treasuries should have dim prospects going forward. Providing a regular monthly dividend remains a top priority. The IMS Strategic Income Fund has paid a dividend every month, without interruption for over 12 years now. We continue to look for the best combination of current income, moderate volatility, and appreciation potential with a willingness to take strategic positions where we see opportunity. We thank you for investing alongside us in the IMS Strategic Income Fund as we focus on building wealth wisely.

Sincerely,

Carl W. Marker

Portfolio Manager

IMS Strategic Income Fund

INVESTMENT RESULTS – (Unaudited)

| | Average Annual Total Returns |

| | (for periods ended June 30, 2015) |

| | One Year | Five Year | Ten Year |

| IMS Strategic Income Fund* | (16.13)% | 2.20% | 0.96% |

| Barclays Capital Aggregate Bond Index** | 1.86% | 3.35% | 4.44% |

| Total annual operating expenses disclosed in the Fund’s current prospectus dated October 31, 2014, were 2.12% of average daily net assets (1.95% after fee waivers/expense reimbursements by the Advisor). The Advisor has contractually agreed to waive its management fee and/or reimburse expenses so that total annual fund operating expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses such as acquired fund fees and expenses; and 12b-1 fees; and extraordinary litigation expenses) do not exceed 1.95% of the Fund’s average daily net assets through October 31, 2015, subject to the Advisor’s right to recoup payments on a rolling three-year basis so long as the payment would not exceed the 1.95% expense cap. This expense cap may not be terminated prior to October 31, 2015 except by the Board of Trustees of 360 Funds. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling Shareholder Services at 1-800-934-5550.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The Barclays Capital Aggregate Bond Index is a widely-used indicator of the bond market. The index is market capitalization-weighted and is made up of U.S. bonds that are primarily investment grade, which has a greater number of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The annual total returns included for the above Fund are net of the total annual operating expenses for the Fund, while no annual operating expenses are deducted for the Barclays Capital Aggregate Bond Index. |

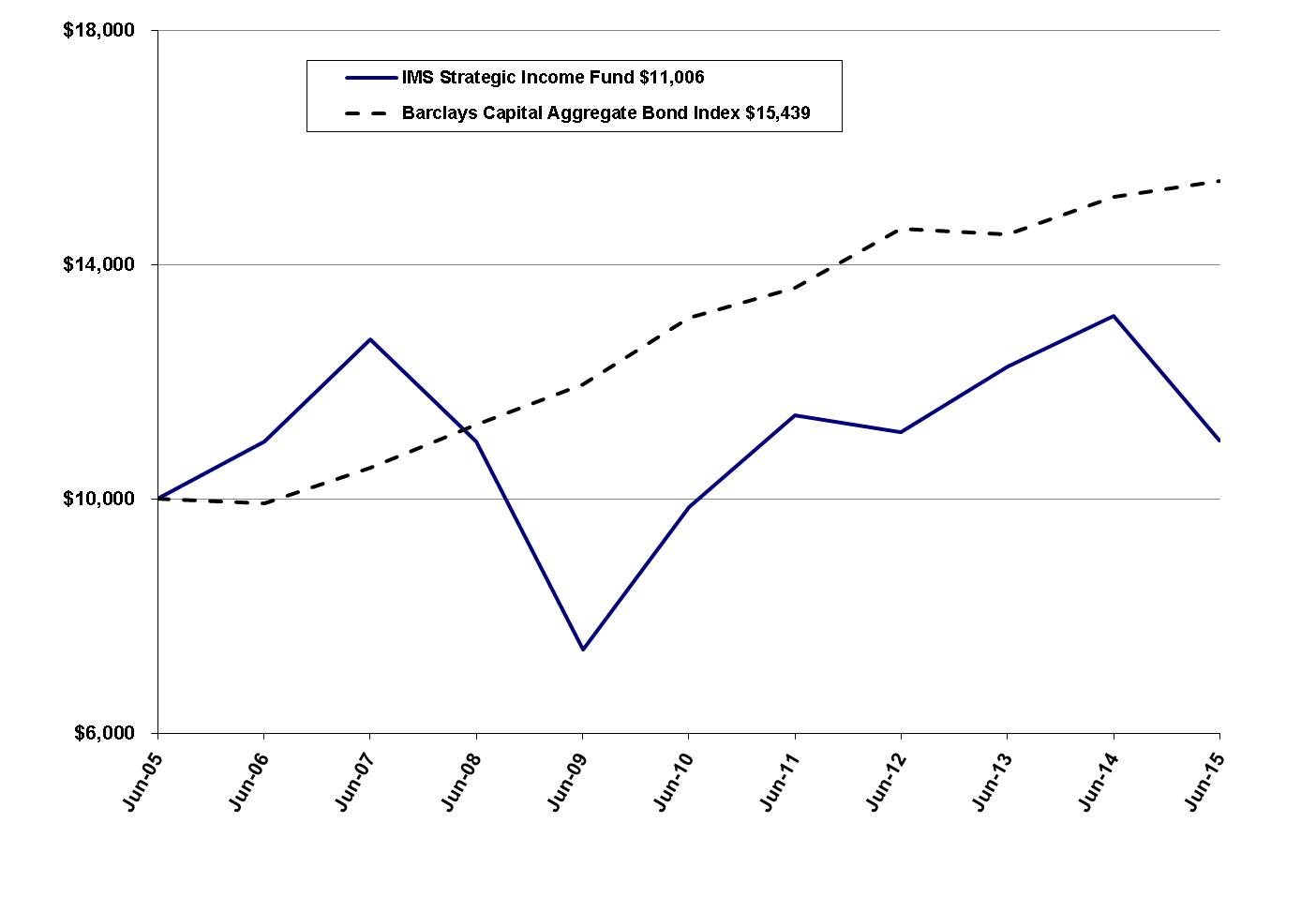

Comparison of the Growth of a $10,000 Investment in the IMS Strategic Income Fund and the

Barclays Captial Aggregate Bond Index for the 10 Years Ended June 30, 2015 (Unaudited)

The chart above assumes an initial investment of $10,000 made on June 30, 2005 and held through June 30,2015. The chart also assumes reinvestment of all dividends and distributions on the reinvestment dates during the period. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

IMS DIVIDEND GROWTH FUND

MANAGEMENT’S DISCUSSION AND ANALYSIS

Annual Report

June 30, 2015

Dear Fellow Shareholders,

The U.S. economy continued its modest improvement adding speculation that the Federal Open Market Committee (FOMC) will raise interest rates sooner rather than later. The U.S. and global economy continues to cope with debt issues in Greece, the severe correction in Chinese equities, volatile energy markets and the impact of a strong U.S. Dollar. The U.S. stock market and economy continue to outperform most other mature economies on a variety of metrics. For example, during the one-year period ending June 30, 2015, the S&P 500 index, the Fund’s benchmark, which is made up primarily of large-cap U.S. stocks, rose +7.42%, while the MSCI EAFE International index declined -4.6%.

Over the one-year period ended June 30, 2015, the IMS Dividend Growth Fund returned +5.48%. The Fund’s return was lower than the index for the one-year period for several reasons. First, dividend-paying stocks were out of favor. While the S&P 500 returned +7.42% for the trailing twelve months ending June 30, 2015, the S&P Dividend Aristocrat Index returned +4.43% and the Dow Jones US Select Dividend Index returned an even lower +0.79%. Both S&P Dividend Aristocrat and the Dow Jones US Select Dividend Index are popular benchmarks for U.S. dividend paying stocks. Second, our energy and energy-related service stocks materially underperformed the broader markets. For the period, SM Energy was down -20%, Chevron (CVX) was down -16% and oil and gas driller Helmerich & Payne was down -14.4%. Lastly, the Fund’s positive performance was masked by our diversification in terms of market cap and international exposure. Over 30% of the Fund’s assets are mid and small-cap stocks and the Fund has about 15% in international stocks. The primary purpose of the Fund is capital appreciation and dividend income from companies that provide growing dividends. The Fund is truly all-cap and global in nature, which historically has provided for strong long-term performance.

Our top three sector weightings as of June 30, 2015 were financials, industrials and consumer discretionary at 20%, 13.9% and 13.3%, respectively. Both financial and industrials are cyclical and tend to perform well as the US and global economy improves and conversely, if the economy slows, these sectors historically underperform. The consumer discretionary sector tends to be less sensitive to changes in the overall economy.

The Fund’s best performers over the past year included Apple Incorporated, the technology device maker, which returned +93%. Apple continues to deliver strong new products and reward shareholders with both dividend increases and share repurchases. Sturm, Ruger & Company, the firearms manufacturer, returned +58%. This firearms manufacturer has made an impressive turnaround after falling from $80 in January 2014 to a low of around $30 in December of 2014. The Fund started purchasing shares in late December around $36 per share. Altria Group, a domestic tobacco company, returned +31.5% due to improved cost management and strong brand loyalty.

The Fund’s worst performers included Veritiv Corporation, which has been public only 13 months. The company, which handles business-to-business printing, packaging and logistics, has seen its long-term earnings power masked by restructuring costs and weak revenue in the first quarter. During our holding period, we showed a loss of -25.9%. SM Energy Company is an independent natural gas company. The volatility in the energy markets and natural gas supply glut pushed shares down -20.3% since we started investing. Copa Holding SA, is an airline passenger and cargo service company in Latin America. Copa has industry leading on-time and flight completion stats, but passenger and freight traffic has declined resulting in a -17.7% decline since our purchase.

Historically over full market cycles dividends have contributed a meaningful portion of the stock market’s total returns. While dividend-paying stocks have categorically been out of favor over the last twelve months, we continue to think dividend payers will serve investors well.

We believe that the companies in the Fund have unique operating franchises, strong financial positioning and opportunities for long-term future growth. We believe these characteristics increase the likelihood that the companies in our Fund will continue to pay and increase dividends over time. We thank you for investing alongside us in the IMS Dividend Growth Fund as we continue to focus on building wealth wisely.

Sincerely,

Carl W. Marker & Christopher L. Magana

Co-Portfolio Managers

IMS Dividend Growth Fund

INVESTMENT RESULTS – (Unaudited)

| | Average Annual Total Returns |

| | (for periods ended June 30, 2015) |

| | One Year | Five Year | Ten Year |

| IMS Dividend Growth Fund* | 5.48% | 12.71% | 4.56% |

| S&P 500® Index** | 7.42% | 17.33% | 7.89% |

| Total annual operating expenses as disclosed in the Fund’s current prospectus dated October 31, 2014, were 2.50% of average daily net assets (1.96% after fee waivers/expense reimbursements by the Advisor). The Advisor has contractually agreed to waive its management fee and/or reimburse expenses so that total annual fund operating expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses such as acquired fund fees and expenses; and 12b-1 fees; and extraordinary litigation expenses) do not exceed 1.95% of the Fund’s average daily net assets through October 31, 2015, subject to the Advisor’s right to recoup payments on a rolling three-year basis so long as the payment would not exceed the 1.95% expense cap. This expense cap may not be terminated prior to October 31, 2015 except by the Board of Trustees of 360 Funds. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling Shareholder Services at 1-800-934-5550.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index is a widely recognized unmanaged index of equity prices and has a greater number of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The annual total returns included for the above Fund are net of the total annual operating expenses for the Fund, while no annual operating expenses are deducted for the S&P 500 Index. |

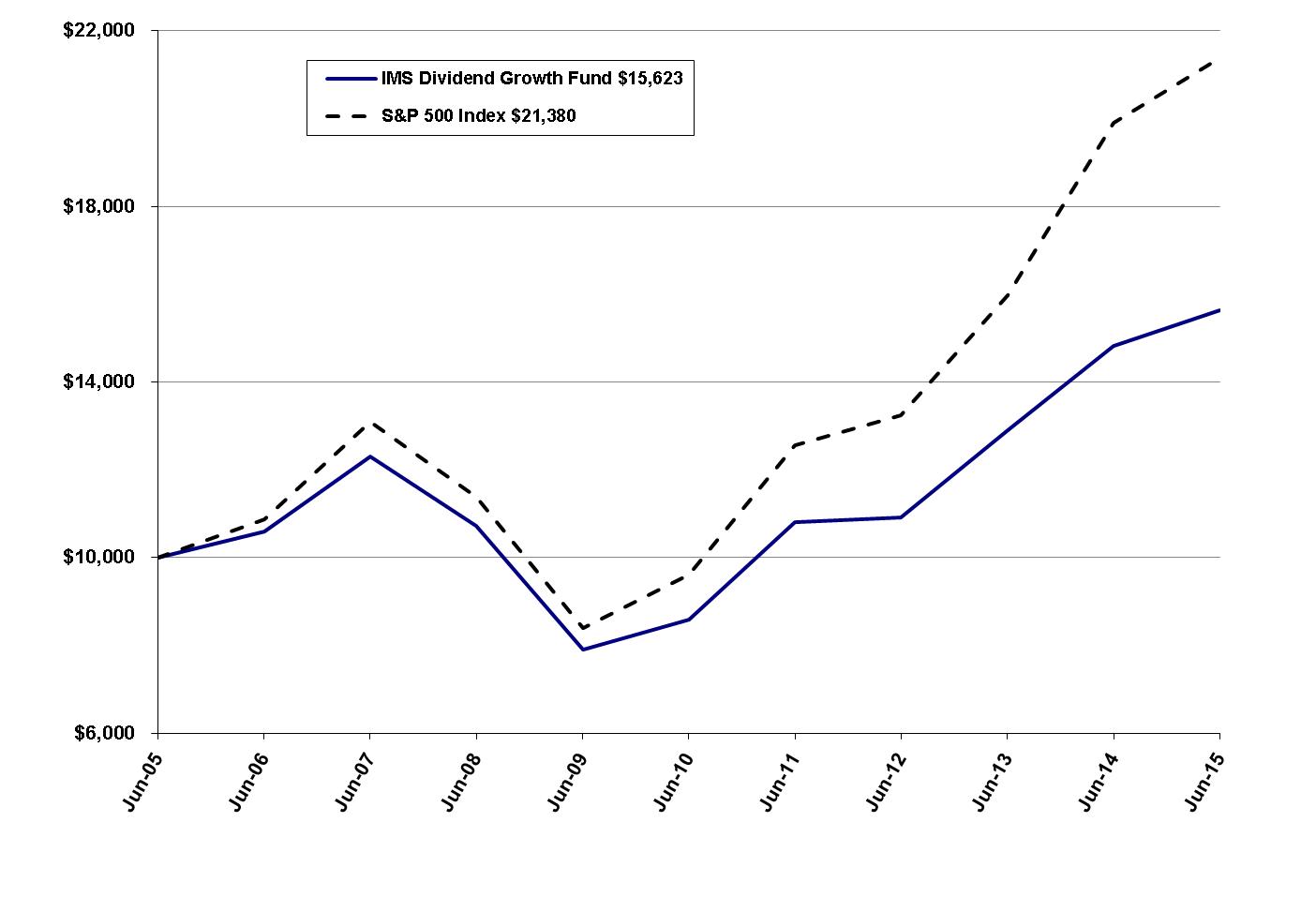

Comparison of the Growth of a $10,000 Investment in the IMS Dividend Growth

and the S&P 500® Index for the 10 years Ended June 30, 2015 (Unaudited)

The chart above assumes an initial investment of $10,000 made on June 30, 2005 and held through June 30, 2015. The chart also assumes reinvestment of all dividends and distributions on the reinvestment dates during the period. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

FUND HOLDINGS – (Unaudited)

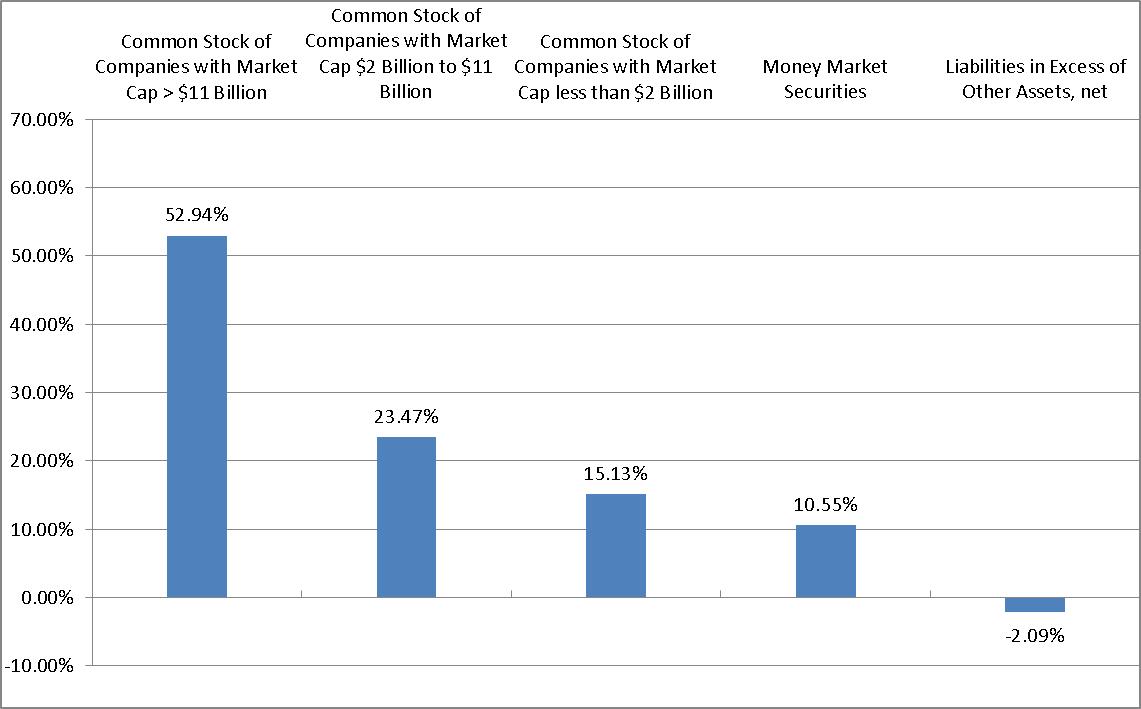

IMS Capital Value Fund Holdings as of June 30, 20151

1 | As a percent of net assets. |

The investment objective of the IMS Capital Value Fund is long-term growth from capital appreciation and, secondarily, income from dividends and interest. The Capital Value Fund invests primarily in the common stocks of mid-cap and large-cap U.S. companies, with mid-cap companies generally having a total market capitalization of $2 billion to $11 billion and large-cap U.S. companies generally having a total market capitalization greater than $11 billion.

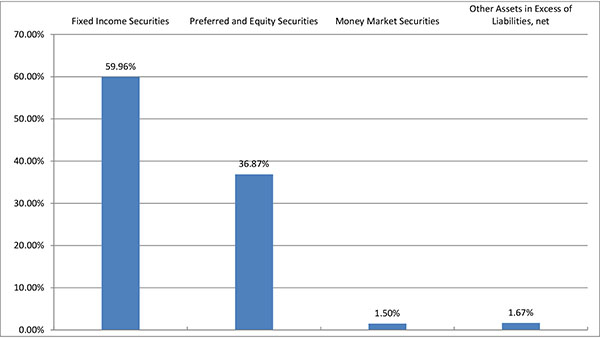

IMS Strategic Income Fund Holdings as of December 31, 20141

1 | As a percent of net assets. |

The investment objective of the IMS Strategic Income Fund is current income, and a secondary objective of capital appreciation. In pursuing its investment objectives, the Strategic Income Fund generally invests in corporate bonds, government bonds, dividend-paying common stocks, preferred and convertible preferred stocks, income trusts (including business trusts, oil royalty trusts and real estate investment trusts), money market instruments and cash equivalents. The Strategic Income Fund may also invest in structured products, such as reverse convertible notes, a type of structured note, and in 144A securities that are purchased in private placements and thus are subject to restrictions on resale (either as a matter of contract or under federal securities laws), but only where the Adviser has determined that a liquid trading market exists. Under normal circumstances, the Strategic Income Fund will invest at least 80% of its assets in dividend paying or other income producing securities.

FUND HOLDINGS – (Unaudited) (continued)

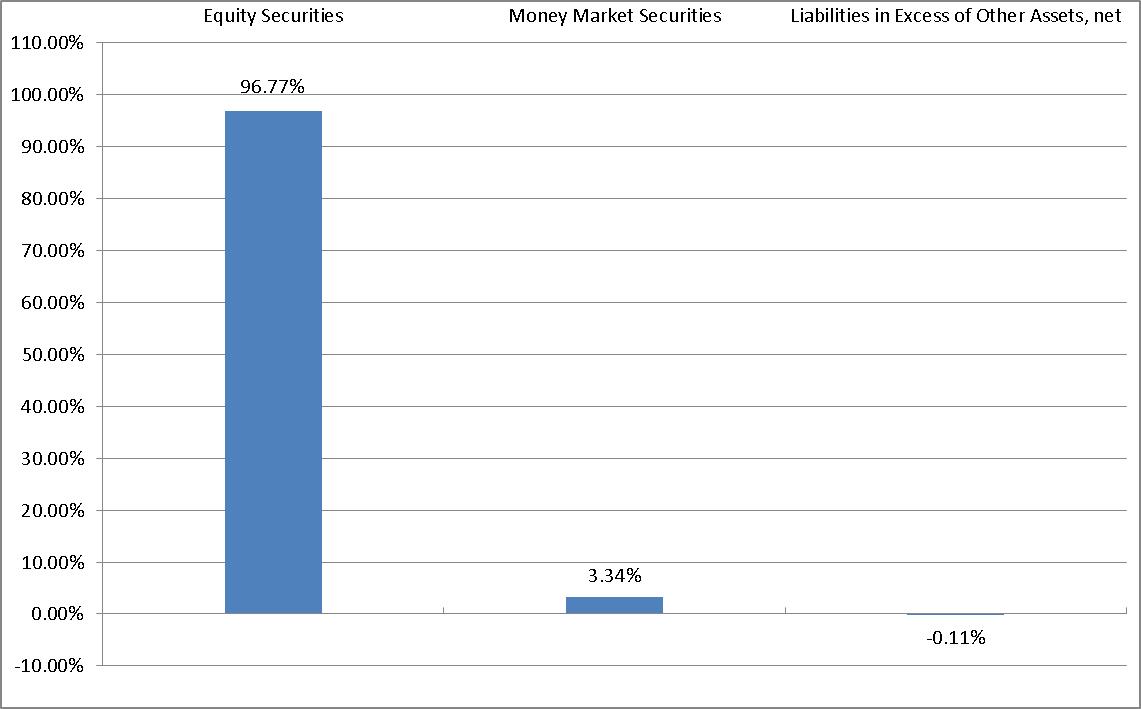

IMS Dividend Growth Fund Holdings as of December 31, 20141

1 | As a percent of net assets. |

The investment objective of the IMS Dividend Growth Fund is long-term growth from capital appreciation and dividends. The Dividend Growth Fund invests primarily in a diversified portfolio of dividend–paying common stocks. The Dividend Growth Fund’s advisor, IMS Capital Management, Inc., employs a combination of fundamental, technical and macro market research to identify companies that the Adviser believes have the ability to maintain or increase their dividend payments, because of their significant cash flow production.

Availability of Portfolio Schedules – (Unaudited)

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available at the SEC’s website at www.sec.gov. The Funds’ Forms N-Q may be reviewed and copied at the Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Summary of Funds’ Expenses – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2015 through June 30, 2015).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant only to highlight your ongoing costs and do not reflect any transactional costs, such as short-term redemption fees. Therefore, the second line is only useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if these transactions costs were included, your costs would have been higher.

IMS Funds | Beginning Account Value January 1, 2015 | Ending Account Value June 30, 2015 | Expenses Paid During the Period* January 1, 2015 – June 30, 2015 |

Capital Value Fund Actual (+8.07%) Hypothetical** | $ 1,000.00 $ 1,000.00 | $ 1,080.70 $ 1,016.10 | $ 9.08 $ 8.80 |

Strategic Income Fund Actual (-4.37)% Hypothetical** | $ 1,000.00 $ 1,000.00 | $ 956.30 $ 1,015.10 | $ 9.51 $ 9.79 |

Dividend Growth Fund Actual (-1.06%) Hypothetical** | $ 1,000.00 $ 1,000.00 | $ 989.40 $ 1,015.10 | $ 9.67 $ 9.79 |

| * | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the partial year period). The annualized expense ratios for the Capital Value Fund, Strategic Income Fund, and the Dividend Growth Fund were 1.76%, 1.96%, and 1.96%, respectively. |

| ** | Assumes a 5% annual return before expenses. |

IMS CAPITAL VALUE FUND

SCHEDULE OF INVESTMENTS

June 30, 2015

| COMMON STOCK - 91.54% | | Shares | | | Fair Value | |

| | | | | | | |

| Consumer Discretionary - 23.09% | | | | | | |

Amazon.com, Inc. (a) | | | 1,920 | | | $ | 833,452 | |

AutoZone, Inc. (a) | | | 1,400 | | | | 933,660 | |

Dollar Tree, Inc. (a) | | | 13,500 | | | | 1,066,365 | |

| Domino's Pizza, Inc. | | | 9,600 | | | | 1,088,640 | |

| DR Horton, Inc. | | | 34,300 | | | | 938,448 | |

| Home Depot, Inc. | | | 7,000 | | | | 777,910 | |

Noodles & Co. (a) | | | 47,400 | | | | 692,040 | |

| PetMed Express, Inc. | | | 46,600 | | | | 804,782 | |

| Service Corp. International | | | 22,300 | | | | 656,289 | |

| Starbucks Corp. | | | 13,200 | | | | 707,718 | |

| Yum! Brands, Inc. | | | 10,000 | | | | 900,800 | |

| | | | | | | | 9,400,104 | |

| Consumer Staples - 4.49% | | | | | | | | |

| Dr Pepper Snapple Group, Inc. | | | 10,900 | | | | 794,610 | |

| Whole Foods Market, Inc. | | | 26,200 | | | | 1,033,328 | |

| | | | | | | | 1,827,938 | |

| Energy - 12.85% | | | | | | | | |

| Apache Corp. | | | 15,600 | | | | 899,028 | |

| ConocoPhillips | | | 12,200 | | | | 749,202 | |

| EOG Resources, Inc. | | | 8,200 | | | | 717,910 | |

| National Oilwell Varco, Inc. | | | 15,700 | | | | 757,996 | |

| Noble Energy, Inc. | | | 13,000 | | | | 554,840 | |

| Occidental Petroleum Corp. | | | 10,200 | | | | 793,254 | |

| Schlumberger Ltd. | | | 8,800 | | | | 758,472 | |

| | | | | | | | 5,230,702 | |

| Financials - 13.16% | | | | | | | | |

| American Express Co. | | | 10,800 | | | | 839,376 | |

Ezcorp, Inc. - Class A (a) | | | 159,800 | | | | 1,187,314 | |

| Federated Investors, Inc. - Class B | | | 24,000 | | | | 803,760 | |

| First Niagara Financial Group, Inc. | | | 91,200 | | | | 860,928 | |

| Lincoln National Corp. | | | 14,200 | | | | 840,924 | |

| Umpqua Holdings Corp. | | | 46,000 | | | | 827,540 | |

| | | | | | | | 5,359,842 | |

| Health Care - 18.75% | | | | | | | | |

Edwards Lifesciences Corp. (a) | | | 4,400 | | | | 626,692 | |

IDEXX Laboratories, Inc. (a) | | | 9,400 | | | | 602,916 | |

InVivo Therapeutics Holdings Corp. (a) | | | 134,333 | | | | 2,169,478 | |

OPKO Health, Inc. (a) | | | 24,500 | | | | 393,960 | |

| Patterson Cos., Inc. | | | 19,600 | | | | 953,540 | |

Sarepta Therapeutics, Inc. (a) | | | 12,900 | | | | 392,547 | |

Tenet Healthcare Corp. (a) | | | 16,000 | | | | 926,080 | |

| Zimmer Biomet Holdings, Inc. | | | 6,100 | | | | 666,303 | |

| Zoetis, Inc. | | | 18,700 | | | | 901,714 | |

| | | | | | | | 7,633,230 | |

IMS CAPITAL VALUE FUND

SCHEDULE OF INVESTMENTS

June 30, 2015

| COMMON STOCK - 91.54% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Industrials - 3.47% | | | | | | |

| Stanley Black & Decker, Inc. | | | 8,000 | | | | 841,920 | |

| Union Pacific Corp. | | | 6,000 | | | | 572,220 | |

| | | | | | | | 1,414,140 | |

| Information Technology - 13.17% | | | | | | | | |

Cirrus Logic, Inc. (a) | | | 16,100 | | | | 547,883 | |

eBay, Inc. (a) | | | 7,700 | | | | 463,848 | |

Google, Inc. - Class C (a) | | | 1,400 | | | | 728,714 | |

| Jabil Circuit, Inc. | | | 26,200 | | | | 557,798 | |

| Paychex, Inc. | | | 16,200 | | | | 759,456 | |

Rovi Corp. (a) | | | 23,000 | | | | 366,850 | |

| Symantec Corp. | | | 18,600 | | | | 432,450 | |

Take-Two Interactive Software, Inc. (a) | | | 14,600 | | | | 402,522 | |

Teradata Corp. (a) | | | 14,700 | | | | 543,900 | |

Yahoo!, Inc. (a) | | | 14,200 | | | | 557,918 | |

| | | | | | | | 5,361,339 | |

| Telecommunication Services - 2.56% | | | | | | | | |

Sprint Corp. (a) | | | 92,200 | | | | 420,432 | |

| Verizon Communications, Inc. | | | 13,400 | | | | 624,574 | |

| | | | | | | | 1,045,006 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $31,282,434) | | | | | | | 37,272,301 | |

| | | | | | | | | |

| MONEY MARKET SECURITIES - 10.55% | | | | | | | | |

Federated Prime Obligations Fund - Institutional Shares, 0.07% (b) | | | 4,295,981 | | | | 4,295,981 | |

| | | | | | | | | |

| TOTAL MONEY MARKET SECURITIES (Cost $4,295,981) | | | | | | | 4,295,981 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $35,578,415) - 102.09% | | | | | | $ | 41,568,282 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (2.09%) | | | | | | | (852,603 | ) |

| NET ASSETS - 100.00% | | | | | | $ | 40,715,679 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the yield at June 30, 2015, is subject to change and resets daily. |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

SCHEDULE OF INVESTMENTS

June 30, 2015

| COMMON STOCK - 36.87% | | Shares | | | Fair Value | |

| | | | | | | |

| Consumer Discretionary - 4.79% | | | | | | |

| Rent-A-Center, Inc. | | | 11,200 | | | $ | 317,520 | |

| Staples, Inc. | | | 21,000 | | | | 321,510 | |

| Yum! Brands, Inc. | | | 4,000 | | | | 360,320 | |

| | | | | | | | 999,350 | |

| Consumer Staples - 4.81% | | | | | | | | |

| B&G Foods, Inc. | | | 11,300 | | | | 322,389 | |

| General Mills, Inc. | | | 6,600 | | | | 367,752 | |

| Sysco Corp. | | | 8,700 | | | | 314,070 | |

| | | | | | | | 1,004,211 | |

| Energy - 3.28% | | | | | | | | |

| LinnCo, LLC. | | | 72,400 | | | | 684,180 | |

| | | | | | | | | |

| Financials - 13.09% | | | | | | | | |

| Bank of Nova Scotia | | | 6,000 | | | | 309,780 | |

| Chubb Corp. | | | 3,600 | | | | 342,504 | |

| Franklin Resources, Inc. | | | 6,800 | | | | 333,404 | |

| JPMorgan Chase & Co. | | | 10,000 | | | | 677,600 | |

| Toronto-Dominion Bank | | | 8,500 | | | | 361,335 | |

| Umpqua Holdings Corp. | | | 20,000 | | | | 359,800 | |

| US Bancorp | | | 8,000 | | | | 347,200 | |

| | | | | | | | 2,731,623 | |

| Health Care - 1.76% | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 5,500 | | | | 365,970 | |

| | | | | | | | | |

| Industrials - 3.17% | | | | | | | | |

| Raytheon Co. | | | 3,400 | | | | 325,312 | |

| Republic Services, Inc. | | | 8,600 | | | | 336,862 | |

| | | | | | | | 662,174 | |

| Information Technology - 1.47% | | | | | | | | |

| Cisco Systems, Inc. | | | 11,200 | | | | 307,552 | |

| | | | | | | | | |

| Materials - 3.12% | | | | | | | | |

| Dow Chemical Co. | | | 6,600 | | | | 337,722 | |

| Nucor Corp. | | | 7,100 | | | | 312,897 | |

| | | | | | | | 650,619 | |

| Telecommunication Services - 1.38% | | | | | | | | |

| Windstream Holdings, Inc. | | | 45,000 | | | | 287,100 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $8,126,232) | | | | | | | 7,692,779 | |

IMS STRATEGIC INCOME FUND

SCHEDULE OF INVESTMENTS

June 30, 2015

| CORPORATE BONDS - 28.75% | | Principal Amount | | | Fair Value | |

| | | | | | | |

Bridgemill Finance LLC, 8.000%, 07/15/2017 (b) (d) | | $ | 929,400 | | | $ | 924,753 | |

| Clayton Williams Energy, Inc., 7.750%, 04/01/2019 | | | 500,000 | | | | 475,000 | |

| Community Choice Financial, Inc., 10.750%, 05/01/2019 | | | 1,000,000 | | | | 511,250 | |

| GrafTech International Ltd., 6.375%, 11/15/2020 | | | 650,000 | | | | 591,500 | |

| JC Penney Corp., Inc., 7.950%, 04/01/2017 | | | 398,000 | | | | 415,910 | |

| Linn Energy LLC/Linn Energy Finance Corp. , 6.250%, 11/01/2019 | | | 900,000 | | | | 704,250 | |

Performance Drilling Co. LLC, 6.000%, 09/30/2022 (b) (f) | | | 1,420,804 | | | | 951,939 | |

Plaza of Orlando Condominium Finance Co. LLC, 5.500%, 05/15/2031 (b) (d) (f) | | | 361,000 | | | | 299,630 | |

Sabine Oil & Gas Corp., 7.250%, 06/15/2019 (g) (i) | | | 1,375,000 | | | | 302,500 | |

| Sanchez Energy Corp., 7.750%, 06/15/2021 | | | 500,000 | | | | 497,500 | |

Thornton Drilling Co., 5.000%, 06/15/2018 (b) (e) (f) (g) | | | 477,977 | | | | 325,024 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS (Cost $8,083,326) | | | | | | | 5,999,256 | |

| | | | | | | | | |

| FOREIGN BONDS DENOMINATED IN US DOLLARS - 5.79% | | | | | | | | |

Cash Store Financial Services, Inc., 11.500%, 01/31/2017 (d) (e) (f) (g) | | | 1,289,000 | | | | 197,359 | |

Newland International Properties Corp., 9.500%, 07/03/2017 (d) (i) | | | 632,850 | | | | 264,215 | |

Newland International Properties Corp., 9.500%, 07/03/2017 (h) (i) | | | 385,990 | | | | 161,151 | |

Oceanografia SA de CV, 11.250%, 07/15/2015 (e) (g) (h) | | | 1,150,000 | | | | 23,000 | |

Panama Canal Railway Co., 7.000%, 11/01/2026 (h) | | | 567,700 | | | | 562,023 | |

| | | | | | | | | |

| TOTAL FOREIGN BONDS DENOMINATED IN US DOLLARS (Cost $3,646,348) | | | | | | | 1,207,748 | |

IMS STRATEGIC INCOME FUND

SCHEDULE OF INVESTMENTS

June 30, 2015

| STRUCTURED NOTES - 25.42% | | Principal | | | Fair Value | |

| | | | | | | |

Bank of Nova Scotia Callable Steepener Note Series A, 5.360%, 07/29/2033 (c) | | | 1,100,000 | | | | 1,012,000 | |

Barclays Bank PLC Callable Leveraged Steepener Note, 10.000%, 07/31/2034 (c) | | | 750,000 | | | | 633,750 | |

Citigroup, Inc. Callable Barrier Range Accrual Index Linked Note, 8.000%, 01/30/2023 (c) | | | 448,000 | | | | 436,531 | |

JP Morgan Chase & Co. Callable Range Accrual Rate Linked Note, 10.000%, 05/06/2030 (c) | | | 500,000 | | | | 480,000 | |

Morgan Stanley Senior Floating Rate Conversion CMS and Index Linked Note, 7.485%, 03/25/2031 (c) | | | 600,000 | | | | 584,250 | |

Morgan Stanley Fixed to Floating Rate Leveraged CMS and Index Linked Note, 8.890%, 08/30/2028 (c) | | | 350,000 | | | | 316,750 | |

Morgan Stanley Senior Fixed/Floating Rate CMS and Index Linked Note, 9.000%, 06/30/2031 (c) | | | 900,000 | | | | 905,625 | |

Natixis US Medium-Term Note Program LLC Callable Fixed-to Floating Capped Range Accrual Note, 8.000%, 10/31/2034 (c) | | | 500,000 | | | | 425,000 | |

SG Structured Products, Inc. Callable Fixed to Variable Barrier Range Dual Index Linked Note, 10.750%, 11/27/2028 (c) | | | 600,000 | | | | 510,000 | |

| | | | | | | | | |

| TOTAL STRUCTURED NOTES (Cost $5,633,043) | | | | | | | 5,303,906 | |

| | | | | | | | | |

| MONEY MARKET SECURITIES - 1.50% | | Shares | | | | | |

Federated Prime Obligations Fund - Institutional Shares, 0.07% (a) | | | 313,101 | | | | 313,101 | |

| | | | | | | | | |

| TOTAL MONEY MARKET SECURITIES (Cost $313,101) | | | | | | | 313,101 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $25,802,050) - 98.33% | | | | | | $ | 20,516,790 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 1.67% | | | | | | | 347,917 | |

| NET ASSETS - 100.00% | | | | | | $ | 20,864,707 | |

Percentages are stated as a percent of net assets.

(a) | Variable rate security. Rate shown represents the yield at June 30, 2015 and resets daily. |

(b) | This security is currently valued by the Advisor using fair valuation procedures approved by the Board of Trustees under the oversight of the Fair Valuation Committee. |

(c) | Variable rate security. Rate shown represents the rate in effect at June 30, 2015. |

(d) | Security exempted from registration under Rule 144A of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional investors. |

(e) | Non-income producing security. |

(f) | Security is illiquid at June 30, 2015, at which time the aggregate value of illiquid securities is $1,773,952 or 8.50% of net assets. |

(h) | Security exempted from registration under Regulation S of the Securities Act of 1933. |

(i) | Partial interest payments made during the period ended June 30, 2015. |

See accompanying notes which are an integral part of these financial statements.

IMS DIVIDEND GROWTH FUND

SCHEDULE OF INVESTMENTS

June 30, 2015

| COMMON STOCK - 96.77% | | Shares | | | Fair Value | |

| | | | | | | |

| Consumer Discretionary - 13.25% | | | | | | |

| General Motors Co. | | | 9,950 | | | $ | 331,634 | |

| McDonald's Corp. | | | 1,900 | | | | 180,633 | |

| PetMed Express, Inc. | | | 17,700 | | | | 305,679 | |

| Sturm Ruger & Co., Inc. | | | 5,000 | | | | 287,250 | |

| Twenty-First Century Fox, Inc. - Class B | | | 8,000 | | | | 257,760 | |

| | | | | | | | 1,362,956 | |

| Consumer Staples - 11.80% | | | | | | | | |

| Altria Group, Inc. | | | 4,500 | | | | 220,095 | |

| Nestle SA - ADR | | | 4,200 | | | | 303,072 | |

| Philip Morris International, Inc. | | | 4,200 | | | | 336,714 | |

| Unilever NV - ADR | | | 6,100 | | | | 255,224 | |

| Unilever PLC - ADR | | | 2,300 | | | | 98,808 | |

| | | | | | | | 1,213,913 | |

| Energy - 10.62% | | | | | | | | |

| Chevron Corp. | | | 2,700 | | | | 260,469 | |

| Halliburton Co. | | | 8,000 | | | | 344,560 | |

| Helmerich & Payne, Inc. | | | 3,000 | | | | 211,260 | |

| SM Energy Co. | | | 6,000 | | | | 276,720 | |

| | | | | | | | 1,093,009 | |

| Financials - 19.98% | | | | | | | | |

| Axis Capital Holdings Ltd. | | | 5,700 | | | | 304,209 | |

| CME Group, Inc. | | | 4,000 | | | | 372,240 | |

| Franklin Resources, Inc. | | | 3,300 | | | | 161,799 | |

| M&T Bank Corp. | | | 3,000 | | | | 374,790 | |

| Outfront Media, Inc. | | | 12,000 | | | | 302,880 | |

PRA Group, Inc. (a) | | | 4,800 | | | | 299,088 | |

| T. Rowe Price Group, Inc. | | | 3,100 | | | | 240,963 | |

| | | | | | | | 2,055,969 | |

| Health Care - 12.80% | | | | | | | | |

| Abbott Laboratories | | | 6,500 | | | | 319,020 | |

| AbbVie, Inc. | | | 4,800 | | | | 322,512 | |

| Johnson & Johnson | | | 2,900 | | | | 282,634 | |

| Zoetis, Inc. | | | 8,150 | | | | 392,993 | |

| | | | | | | | 1,317,159 | |

IMS DIVIDEND GROWTH FUND

SCHEDULE OF INVESTMENTS

June 30, 2015

| COMMON STOCK - 96.77% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Industrials - 13.92% | | | | | | |

| Copa Holdings SA - Class A | | | 2,400 | | | $ | 198,216 | |

| Houston Wire & Cable Co. | | | 19,300 | | | | 191,456 | |

| Lockheed Martin Corp. | | | 1,700 | | | | 316,030 | |

| Parker-Hannifin Corp. | | | 2,200 | | | | 255,926 | |

| United Technologies Corp. | | | 2,600 | | | | 288,418 | |

Veritiv Corp. (a) | | | 5,000 | | | | 182,300 | |

| | | | | | | | 1,432,346 | |

| Information Technology - 12.31% | | | | | | | | |

| Apple, Inc. | | | 1,400 | | | | 175,595 | |

| CDK Global, Inc. | | | 6,900 | | | | 372,462 | |

| Microsoft Corp. | | | 7,100 | | | | 313,465 | |

| QUALCOMM, Inc. | | | 4,650 | | | | 291,230 | |

| Sabre Corp. | | | 4,800 | | | | 114,240 | |

| | | | | | | | 1,266,992 | |

| Materials - 2.09% | | | | | | | | |

| FMC Corp. | | | 4,100 | | | | 215,454 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $9,948,996) | | | | | | | 9,957,798 | |

| | | | | | | | | |

| MONEY MARKET SECURITIES - 3.34% | | | | | | | | |

Federated Prime Obligations Fund - Institutional Shares, 0.07% (b) | | | 343,827 | | | | 343,827 | |

| | | | | | | | | |

| TOTAL MONEY MARKET SECURITIES (Cost $343,827) | | | | | | | 343,827 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $10,292,823) - 100.11% | | | | | | $ | 10,301,625 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (0.11%) | | | | | | | (10,871 | ) |

| NET ASSETS - 100.00% | | | | | | $ | 10,290,754 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the yield at June 30, 2015, is subject to change and resets daily. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

IMS FAMILY OF FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2015

| | | IMS Capital Value Fund | | | IMS Strategic Income Fund | | | IMS Dividend Growth Fund | |

| Assets: | | | | | | | | | |

| Investments in securities: | | | | | | | | | |

| At cost | | $ | 35,578,415 | | | $ | 25,802,050 | | | $ | 10,292,823 | |

| At fair value | | $ | 41,568,282 | | | $ | 20,516,790 | | | $ | 10,301,625 | |

| Receivables: | | | | | | | | | | | | |

| Interest | | | 245 | | | | 238,914 | | | | 17 | |

| Dividends | | | 28,930 | | | | 71,397 | | | | 9,365 | |

| Fund shares sold | | | 18,163 | | | | 68,227 | | | | - | |

| Investments sold | | | - | | | | 38,877 | | | | - | |

| Prepaid expenses | | | 17,504 | | | | 21,123 | | | | 7,310 | |

| Total assets | | | 41,633,124 | | | | 20,955,328 | | | | 10,318,317 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | |

| Investments purchased | | | 844,158 | | | | - | | | | - | |

| Fund shares redeemed | | | - | | | | 13,145 | | | | - | |

| Due to advisor | | | 40,606 | | | | 43,851 | | | | 5,423 | |

| Due to administrator | | | 8,897 | | | | 4,699 | | | | 3,018 | |

| Accrued expenses | | | 23,784 | | | | 28,926 | | | | 19,122 | |

| Total liabilities | | | 917,445 | | | | 90,621 | | | | 27,563 | |

| Net Assets | | $ | 40,715,679 | | | $ | 20,864,707 | | | $ | 10,290,754 | |

| | | | | | | | | | | | | |

| Net Assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 36,428,851 | | | $ | 74,073,316 | | | $ | 10,895,640 | |

| Accumulated undistributed net investment income (loss) | | | (82,414 | ) | | | - | | | | 3,082 | |

| Accumulated net realized loss on investments | | | (1,620,625 | ) | | | (47,923,349 | ) | | | (616,770 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 5,989,867 | | | | (5,285,260 | ) | | | 8,802 | |

| Total Net Assets | | $ | 40,715,679 | | | $ | 20,864,707 | | | $ | 10,290,754 | |

| | | | | | | | | | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,757,850 | | | | 4,609,871 | | | | 789,953 | |

| Net asset value and offering price per share | | $ | 23.16 | | | $ | 4.53 | | | $ | 13.03 | |

Minimum redemption price per share (a) | | $ | 23.04 | | | $ | 4.51 | | | $ | 12.96 | |

| (a) | A redemption fee of 0.50% will be assessed on shares of the Fund that are redeemed within 90 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

IMS FAMILY OF FUNDS

STATEMENTS OF OPERATIONS

For the Year Ended June 30, 2015

| | | IMS Capital Value Fund | | | IMS Strategic Income Fund | | | IMS Dividend Growth Fund | |

| | | | | | | | | | |

| Investment income: | | | | | | | | | |

| Dividends (net of foreign withholding taxes of $234, $9,161 and $3,393) | | $ | 614,108 | | | $ | 1,265,013 | | | $ | 252,027 | |

| Interest | | | 545 | | | | 1,821,201 | | | | 63 | |

| Total investment income | | | 614,653 | | | | 3,086,214 | | | | 252,090 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

Investment Advisor fees (a) | | | 473,967 | | | | 358,008 | | | | 120,173 | |

Accounting, administration and transfer agent fees and expenses (a) | | | 103,872 | | | | 70,357 | | | | 35,841 | |

| Registration expenses | | | 24,596 | | | | 23,415 | | | | 9,611 | |

| Miscellaneous expenses | | | 38,456 | | | | 33,442 | | | | 29,022 | |

| Audit expenses | | | 15,250 | | | | 21,250 | | | | 16,250 | |

Custodian expenses (a) | | | 8,199 | | | | 12,708 | | | | 5,476 | |

| Trustee expenses | | | 9,999 | | | | 10,874 | | | | 9,999 | |

| Pricing expenses | | | 4,815 | | | | 9,328 | | | | 3,965 | |

| Insurance expenses | | | 2,578 | | | | 2,590 | | | | 2,590 | |

| Legal expenses | | | - | | | | - | | | | 2,941 | |

| Printing expenses | | | - | | | | - | | | | 2,732 | |

| Interest expense | | | 785 | | | | 2,869 | | | | 282 | |

| Total expenses | | | 682,517 | | | | 544,841 | | | | 238,882 | |

Less: Fees recouped (waived) by Advisor (a) | | | - | | | | 12,089 | | | | (52,469 | ) |

| Net expenses | | | 682,517 | | | | 556,930 | | | | 186,413 | |

| | | | | | | | | | | | | |

| Net Investment Income (Loss) | | | (67,864 | ) | | | 2,529,284 | | | | 65,677 | |

| | | | | | | | | | | | | |

| Realized and unrealized gain (loss): | | | | | | | | | | | | |

| Net realized gain (loss) on investment securities | | | 1,957,469 | | | | (5,508,272 | ) | | | 1,091,602 | |

| Change in unrealized appreciation (depreciation) on investment securities and foreign currency | | | 1,733,525 | | | | (2,244,701 | ) | | | (704,954 | ) |

| Net realized and unrealized gain (loss) on investment securities and foreign currency | | | 3,690,994 | | | | (7,752,973 | ) | | | 386,648 | |

| | | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 3,623,130 | | | $ | (5,223,689 | ) | | $ | 452,325 | |

| (a) | See Note 4 in the Notes to Financial Statements. |

IMS STRATEGIC INCOME FUND

STATEMENT OF CASH FLOWS

For the Year Ended June 30, 2015

| Increase (decrease) in cash: | | | |

| Cash flows from operating activities: | | | |

| Net Decrease in net assets from operations | | $ | (5,223,689 | ) |

| Adjustments to reconcile net decrease in net assets from operations to net cash provided from operating activities: | | | | |

| Return of capital dividends received | | | 29,236 | |

| Accretion of discount/Amortization of premium, net | | | (156,283 | ) |

| Purchase of investment securities | | | (145,682,690 | ) |

| Proceeds from disposition of investment securities | | | 154,700,924 | |

| Sale of short-term investment securities, net | | | 904,891 | |

| Decrease in deposits with brokers for options transactions | | | 48,146 | |

| Decrease in dividends and interest receivable | | | 136,095 | |

| Decrease in receivables for securities sold | | | 903,042 | |

| Increase in prepaid expenses | | | (10,522 | ) |

| Decrease in payable for securities purchased | | | (1,714,582 | ) |

| Increase in accrued expenses | | | 5,735 | |

| Net unrealized depreciation on investment securities and foreign currency | | | 2,244,701 | |

| Net realized loss on investment securities | | | 5,508,272 | |

| Net cash provided from operating activities | | | 11,693,276 | |

| | | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from loan | | | 12,154,719 | |

| Payments on loan | | | (12,154,719 | ) |

| Proceeds from Fund shares sold | | | 2,818,793 | |

| Payment on Fund shares redeemed | | | (14,258,672 | ) |

| Cash distributions paid | | | (253,397 | ) |

| | | | | |

| Net cash used in financing activities | | | (11,693,276 | ) |

| | | | | |

| Net increase in cash | | $ | - | |

| | | | | |

| Cash: | | | | |

| Beginning of year | | $ | - | |

| End of year | | $ | - | |

Supplemental disclosure of cash flow information:

Noncash financing activities not included herein consist of reinvestment of distributions of $2,497,602, a decrease in receivable for fund shares sold of $35,773 and a decrease in payable for Fund shares redeemed of $12,855.

Interest paid by the Fund for outstanding balances on the line of credit amounted to $2,869.

See accompanying notes which are an integral part of these financial statements.

IMS CAPITAL VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2015 | | | June 30, 2014 | |

| | | | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (67,864 | ) | | $ | (192,221 | ) |

| Net realized gain on investment securities | | | 1,957,469 | | | | 7,563,621 | |

| Change in unrealized appreciation (depreciation) on investment securities | | | 1,733,525 | | | | (550,075 | ) |

| Net increase in net assets resulting from operations | | | 3,623,130 | | | | 6,821,325 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 2,803,048 | | | | 3,256,485 | |

| Amount paid for shares redeemed | | | (5,972,903 | ) | | | (4,846,257 | ) |

| Proceeds from redemption fees | | | 40 | | | | 85 | |

| Net decrease in net assets from share transactions | | | (3,169,815 | ) | | | (1,589,687 | ) |

| | | | | | | | | |

| Total Increase in Net Assets | | | 453,315 | | | | 5,231,638 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 40,262,364 | | | | 35,030,726 | |

| | | | | | | | | |

| End of year | | $ | 40,715,679 | | | $ | 40,262,364 | |

| Accumulated net investment loss included in net assets at end of year | | $ | (82,414 | ) | | $ | (116,946 | ) |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 125,688 | | | | 166,089 | |

| Shares issued in reinvestment of distributions | | | - | | | | - | |

| Shares redeemed | | | (276,324 | ) | | | (245,923 | ) |

| Net decrease in capital shares | | | (150,636 | ) | | | (79,834 | ) |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2015 | | | June 30, 2014 | |

| | | | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 2,529,284 | | | $ | 3,629,439 | |

| Net realized gain (loss) on investment securities and foreign currency | | | (5,508,272 | ) | | | 557,493 | |

| Change in unrealized depreciation on investment securities and foreign currency | | | (2,244,701 | ) | | | (1,576,872 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (5,223,689 | ) | | | 2,610,060 | |

| | | | | | | | | |

| Distributions | | | | | | | | |

| From net investment income | | | (2,125,624 | ) | | | (3,247,197 | ) |

| Return of capital | | | (625,375 | ) | | | (428,250 | ) |

| Total distributions | | | (2,750,999 | ) | | | (3,675,447 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 2,783,020 | | | | 9,712,152 | |

| Reinvestment of distributions | | | 2,497,602 | | | | 3,335,136 | |

| Amount paid for shares redeemed | | | (14,247,967 | ) | | | (13,123,886 | ) |

| Proceeds from redemption fees | | | 2,150 | | | | 1,855 | |

| Net decrease in net assets from share transactions | | | (8,965,195 | ) | | | (74,743 | ) |

| | | | | | | | | |

| Total Decrease in Net Assets | | | (16,939,883 | ) | | | (1,140,130 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 37,804,590 | | | | 38,944,720 | |

| | | | | | | | | |

| End of year | | $ | 20,864,707 | | | $ | 37,804,590 | |

| Accumulated undistributed net investment income (loss) included in net assets at end of year | | $ | - | | | $ | - | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 538,510 | | | | 1,594,465 | |

| Shares issued in reinvestment of distributions | | | 480,708 | | | | 554,149 | |

| Shares redeemed | | | (2,760,334 | ) | | | (2,174,936 | ) |

| Net decrease in capital shares | | | (1,741,116 | ) | | | (26,322 | ) |

See accompanying notes which are an integral part of these financial statements.

IMS DIVIDEND GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2015 | | | June 30, 2014 | |

| | | | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 65,677 | | | $ | 117,493 | |

| Net realized gain on investment securities | | | 1,091,602 | | | | 699,608 | |

| Change in unrealized appreciation (depreciation) on investment securities | | | (704,954 | ) | | | 342,320 | |

| Net increase in net assets resulting from operations | | | 452,325 | | | | 1,159,421 | |

| | | | | | | | | |

| Distributions | | | | | | | | |

| From net investment income | | | (66,410 | ) | | | (101,121 | ) |

| Total distributions | | | (66,410 | ) | | | (101,121 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 2,335,156 | | | | 898,365 | |

| Reinvestment of distributions | | | 66,190 | | | | 100,331 | |

| Amount paid for shares redeemed | | | (1,167,031 | ) | | | (1,387,981 | ) |

| Proceeds from redemption fees | | | 49 | | | | 1,766 | |

| Net increase (decrease) in net assets from share transactions | | | 1,234,364 | | | | (387,519 | ) |

| | | | | | | | | |

| Total Increase in Net Assets | | | 1,620,279 | | | | 670,781 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 8,670,475 | | | | 7,999,694 | |

| | | | | | | | | |

| End of year | | $ | 10,290,754 | | | $ | 8,670,475 | |

| Accumulated undistributed net investment income included in net assets at end of year | | $ | 2,658 | | | $ | 3,391 | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 176,154 | | | | 77,340 | |

| Shares issued in reinvestment of distributions | | | 5,134 | | | | 8,671 | |

| Shares redeemed | | | (88,322 | ) | | | (119,180 | ) |

| Net increase (decrease) in capital shares | | | 92,966 | | | | (33,169 | ) |

See accompanying notes which are an integral part of these financial statements.

IMS CAPITAL VALUE FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | | Year Ended | |

| | | June 30, 2015 | | | June 30, 2014 | | | June 30, 2013 | | | June 30, 2012 | | | | June 30, 2011 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 21.10 | | | $ | 17.62 | | | $ | 14.99 | | | $ | 17.11 | | | | $ | 12.69 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.04 | ) | | | (0.10 | ) | | | 0.01 | | | | (0.07 | ) | (a) | | | (0.12 | ) |

| Net realized and unrealized gain (loss) on investments | | | 2.10 | | | | 3.58 | | | | 2.62 | | | | (2.05 | ) | | | | 4.54 | |

| Total from investment operations | | | 2.06 | | | | 3.48 | | | | 2.63 | | | | (2.12 | ) | | | | 4.42 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Less Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | - | | | | - | | | | - | | | | - | | | | | - | |

| Total distributions | | | - | | | | - | | | | - | | | | - | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (b) | | | - | | | | - | | | | - | | | | - | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 23.16 | | | $ | 21.10 | | | $ | 17.62 | | | $ | 14.99 | | | | $ | 17.11 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Return (c) | | | 9.76 | % | | | 19.75 | % | | | 17.54 | % | | | (12.39 | )% | | | | 34.83 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 40,716 | | | $ | 40,262 | | | $ | 35,031 | | | $ | 40,283 | | | | $ | 59,509 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.74 | % | | | 2.05 | % | | | 2.06 | % | | | 1.87 | % | | | | 1.85 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to average net assets: | | | (0.17 | )% | | | (0.50 | )% | | | 0.12 | % | | | (0.46 | )% | | | | (0.71 | )% |

| | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 62.98 | % | | | 110.42 | % | | | 146.53 | % | | | 98.21 | % | | | | 126.11 | % |

| (a) | Per share net investment income has been calculated using the average shares method. |

| (b) | Redemption fees resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | Year Ended | | | Year Ended | | | | Year Ended | | | | Year Ended | | | Year Ended | |

| | | June 30, 2015 | | | June 30, 2014 | | | | June 30, 2013 | | | | June 30, 2012 | | | June 30, 2011 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 5.95 | | | $ | 6.11 | | | | $ | 6.08 | | | | $ | 6.89 | | | $ | 6.50 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.45 | | | | 0.56 | | | | | 0.59 | | | | | 0.62 | | | | 0.62 | |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | (1.37 | ) | | | (0.15 | ) | | | | 0.01 | | (a) | | | (0.82 | ) | | | 0.38 | |

| Total from investment operations | | | (0.92 | ) | | | 0.41 | | | | | 0.60 | | | | | (0.20 | ) | | | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Less Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.39 | ) | | | (0.57 | ) | | | | (0.56 | ) | | | | (0.60 | ) | | | (0.58 | ) |

| Tax return of capital | | | (0.11 | ) | | | - | | | | | (0.01 | ) | | | | (0.01 | ) | | | (0.03 | ) |

| Total distributions | | | (0.50 | ) | | | (0.57 | ) | | | | (0.57 | ) | | | | (0.61 | ) | | | (0.61 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (b) | | | - | | | | - | | | | | - | | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 4.53 | | | $ | 5.95 | | | | $ | 6.11 | | | | $ | 6.08 | | | $ | 6.89 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Return (c) | | | (16.13 | )% | | | 7.00 | % | | | | 10.02 | % | | | | (2.59 | )% | | | 15.88 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 20,865 | | | $ | 37,805 | | | | $ | 38,945 | | | | $ | 34,026 | | | $ | 42,924 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.96 | %(f) | | | 1.94 | % | (e) | | | 1.95 | % | (d) | | | 2.01 | % | | | 1.97 | % |

| Ratio of expenses to average net assets before recoupment and/or waiver & reimbursement: | | | 1.92 | %(f) | | | 2.12 | % | | | | 2.06 | % | | | | 2.01 | % | | | 1.97 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets: | | | 8.94 | %(f) | | | 9.27 | % | (e) | | | 9.27 | % | (d) | | | 9.90 | % | | | 9.05 | % |

Ratio of net investment income to average net assets before recoupment and/or waiver & reimbursement: | | | 8.90 | %(f) | | | 9.08 | % | | | | 9.16 | % | | | | 9.90 | % | | | 9.05 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 562.40 | % | | | 371.35 | % | | | | 389.36 | % | | | | 392.81 | % | | | 400.03 | % |

| (a) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the changes in net assets value per share for the period, and may not reconcile with the aggregate gains and losses in the statement of operations. |

| (b) | Redemption fees resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (d) | Effective November 1, 2012, the Advisor agreed to waive fees to maintain Fund expenses at 1.89% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). |

| (e) | Effective November 1, 2013, the Advisor agreed to waive fees to maintain Fund expenses at 1.95% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). |

| (f) | The ratios include 0.01% of interest expense during the year ended June 30, 2015. |

See accompanying notes which are an integral part of these financial statements.

IMS DIVIDEND GROWTH FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | | Year Ended | |

| | | June 30, 2015 | | | June 30, 2014 | | | June 30, 2013 | | | June 30, 2012 | | | | June 30, 2011 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 12.44 | | | $ | 10.96 | | | $ | 9.73 | | | $ | 9.85 | | | | $ | 7.93 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.09 | | | | 0.16 | | | | 0.30 | | | | 0.25 | | | | | 0.15 | |

| Net realized and unrealized gain (loss) on investments | | | 0.59 | | | | 1.46 | | | | 1.44 | | | | (0.17 | ) | | | | 1.90 | |

| Total from investment operations | | | 0.68 | | | | 1.62 | | | | 1.74 | | | | 0.08 | | | | | 2.05 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Less Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.09 | ) | | | (0.14 | ) | | | (0.38 | ) | | | (0.20 | ) | | | | (0.13 | ) |

| Tax return of capital | | | - | | | | - | | | | (0.13 | ) | | | - | | | | | - | |

| Total distributions | | | (0.09 | ) | | | (0.14 | ) | | | (0.51 | ) | | | (0.20 | ) | | | | (0.13 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (a) | | | - | | | | - | | | | - | | | | - | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 13.03 | | | $ | 12.44 | | | $ | 10.96 | | | $ | 9.73 | | | | $ | 9.85 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Return (b) | | | 5.48 | % | | | 14.88 | % | | | 18.10 | % | | | 0.86 | % | | | | 25.91 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 10,291 | | | $ | 8,670 | | | $ | 8,000 | | | $ | 7,881 | | | | $ | 8,622 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.95 | % | | | 1.96 | % | | | 1.97 | % | | | 2.09 | % | (c) | | | 2.66 | % |

| Ratio of expenses to average net assets before waiver & reimbursement: | | | 2.50 | % | | | 2.50 | % | | | 2.43 | % | | | 2.25 | % | | | | 2.66 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets: | | | 0.69 | % | | | 1.39 | % | | | 2.85 | % | | | 2.51 | % | (c) | | | 1.48 | % |

| Ratio of net investment income to average net assets before waiver & reimbursement: | | | 0.14 | % | | | 0.86 | % | | | 2.39 | % | | | 2.35 | % | | | | 1.48 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 86.92 | % | | | 240.61 | % | | | 97.55 | % | | | 47.08 | % | | | | 161.85 | % |

| (a) | Redemption fees resulted in less than $0.005 per share. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (c) | Effective September 1, 2011, the Advisor agreed to waive fees to maintain Fund expenses at 1.95% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). Prior to that date, the Fund did not have an expense cap. |

See accompanying notes which are an integral part of these financial statements.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2015

NOTE 1. ORGANIZATION

The IMS Family of Funds (the “Funds”), comprising the IMS Capital Value Fund (the “Value Fund”), IMS Strategic Income Fund (the “Income Fund”) and IMS Dividend Growth Fund (the “Dividend Growth Fund”), were each organized as a diversified series of 360 Funds (the “Trust”) on June 20, 2014. The Trust was organized on February 24, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The investment objective of the Value Fund is to provide long-term growth from capital appreciation and secondarily, income from dividends. The investment objective of the Income Fund is to provide current income and secondarily, capital appreciation. The investment objective of the Dividend Growth Fund is to provide long-term growth from capital appreciation and dividends. The investment advisor of each Fund is IMS Capital Management, Inc. (the “Advisor”).

Effective as of the close of business on June 20, 2014, pursuant to an Agreement and Plan of Reorganization (the "Reorganization"), the 360 Fund's Value Fund, Income Fund and Dividend Growth Fund (the "New Funds") received all the assets and liabilities of the Unified Series Trust's (the "Former Trust") IMS Capital Value Fund (the "Predecessor Value Fund "), IMS Strategic Income Fund (the Predecessor Income Fund") and IMS Dividend Growth Fund (the "Predecessor Dividend Growth Fund") (together, the "Predecessor Funds"), respectively. The shareholders of the Predecessor Funds received shares of the New Funds with aggregate net asset values equal to the aggregate net asset values of their shares in the Predecessor Funds immediately prior to the Reorganization. The Predecessor Funds' investment objectives, policies and limitations were substantially identical to those of the New Funds, which had no operations prior to the Reorganization. For financial reporting purposes, the Predecessor Funds' operating history prior to the Reorganization is reflected in the financial statements and financial highlights. The Reorganization was treated as a tax-free reorganization for federal income tax purposes and, accordingly, the basis of the assets of the New Funds reflected the historical basis of the assets of the Predecessor Funds as of the date of the Reorganization. The Reorganization is also considered tax-free based on accounting principles generally accepted in the United States of America ("GAAP").

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by each Fund in the preparation of its financial statements.

Securities Valuations – All investments in securities are recorded at their estimated fair value as described in Note 3.

Foreign Currency – Investment securities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. Reported net realized foreign exchange gains or losses arise from currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid. The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

June 30, 2015

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued