UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4520 Main Street, Suite 1425 Kansas City, MO | 64111 |

| (Address of principal executive offices) | (Zip code) |

Matrix 360 Administration, LLC

4520 Main Street

Suite 1425

Kansas City, MO 64111

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-244-6235

Date of fiscal year end: 02/28/2015

Date of reporting period: 02/28/2015

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the Snow Capital Funds, series of the 360 Funds (the “registrant”) for the period ended February 28, 2015 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

Snow Capital Focused Value Fund Class A Shares (Ticker Symbol: SFOAX) Class I Shares (Ticker Symbol: SFOIX) Snow Capital Hedged Equity Fund Class A Shares (Ticker Symbol: SHEAX) Class I Shares (Ticker Symbol: SHEIX) Snow Capital Market Plus Fund Class A Shares (Ticker Symbol: SPLAX) Class I Shares (Ticker Symbol: SPLIX) Snow Capital Inflation Advantaged Equities Fund Class A Shares (Ticker Symbol: SIAAX) Class I Shares (Ticker Symbol: SIAIX) Snow Capital Dividend Plus Fund Class A Shares (Ticker Symbol: SDPAX) Class I Shares (Ticker Symbol: SDPIX) Snow Capital Mid Cap Value Fund Class A Shares (Ticker Symbol: SNMAX) Class I Shares (Ticker Symbol: SNMIX) each a series of the 360 Funds |

ANNUAL REPORT

February 28, 2015

Investment Adviser

Snow Capital Management L.P.

2000 Georgetowne Drive, Suite 200

Sewickley, Pennsylvania 15143

TABLE OF CONTENTS

| MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE | 2 |

| INVESTMENT HIGHLIGHTS | 17 |

| SCHEDULES OF INVESTMENTS | 26 |

| STATEMENTS OF ASSETS AND LIABILITIES | 41 |

| STATEMENTS OF OPERATIONS | 43 |

| STATEMENTS OF CHANGES IN NET ASSETS | 45 |

| FINANCIAL HIGHLIGHTS | 51 |

| NOTES TO FINANCIAL STATEMENTS | 57 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 69 |

| ADDITIONAL INFORMATION | 70 |

| EXPENSE EXAMPLES | 74 |

BOARD APPROVAL OF RENEWAL OF INVESTMENT ADVISORY AGREEMENT | 77 |

Dear Shareholder:

The 15.5% return for the S&P 500 Index (“S&P 500”) over the past year ended Febrary 28, 2015 has once again taken investors by surprise. In the 1950s, investors quipped that “the market climbs a wall of worry” as they watched equities rise despite widespread concern that the end of World War II would drive the country back into the Great Depression. It took a dozen years for that bull market to play out. Today, seven years after the financial crisis, we cannot seem to shake the fear of systemic failure and lost retirements, of frauds, bubbles and bankruptcies. And yet the market climbs to new highs, resiliently barreling past all macroeconomic obstacles.

Not all stocks are outperforming. The markets have been led by a very narrow group of companies in the most recent year making outperformance of the S&P 500 very difficult for active managers. A number of factors have contributed to this phenomenon including falling interest rates, a rapidly rising U.S. dollar, a mania for dividend paying non-cyclical stocks and relatively high valuations. One of the stocks leading the charge for this narrow group is Apple (AAPL). Apple alone represented 11.2% of the S&P 500 Index’s return for the trailing year ended February 2015. The combination of high valuation Consumer Staples stocks and Apple constituted 25% of the return for the S&P 500 Index, presenting a relative return problem for value conscious investors. Such momentum-driven markets generally occur during the latter part of an investment cycle.

Many equity investors are narrowly focused on “safe” equities that offer “high quality” and higher yield at any valuation, particularly stocks in the non-cyclical sectors of Consumer Staples and Utilities. The Consumer Staples sector has outperformed the S&P 500 by 59.5% from August 2007 to February 2015, more than 4.4% annually over the time period. This same sector outperformed the S&P 500 in the trailing one-year period from February 2014 to February 2015 by 5.7%.

The Consumer Staples sector is the home for such household names as Clorox (CLX), Colgate-Palmolive (CL) and Costco (COST). The entire sector trades at a price to earnings (P/E) ratio of 21.7 times trailing twelve month earnings as of the end of February 2015. Blue chip names like Clorox, Colgate-Palmolive and Costco trade at valuations even higher than the sector group (22.9 times, 23.2 times, and 27.1 times, respectively). This compares to a P/E of 18.9 times trailing earnings for the S&P 500 index as a whole. Such a high relative valuation in a sector is not uncommon but is usually a sign of depressed earnings or the anticipation of future growth in earnings. In this case, investors seem to be drawn to the dividend yield as well as the low, slow and steady growth of these companies – so much so that they trade at a 15% premium to the S&P 500 Index on average despite analyst growth estimates for the next 3 to 5 years that indicate 5% slower growth.

The Utilities sector outperformed every sector in the S&P 500 in 2014. With a Fed rate hike looming and concerns over the sector being overvalued, 2015 poses some challenges for the sector as it outperformed the S&P 500 by a comparatively paltry 0.2% in the trailing one year period and is generating a dividend yield of only 3.5% as of the end of February 2015, which is substantially lower than its long-term average of 4.5%. Given the historical correlation between the Utilities sector earnings yield and the yield of the ten-year U.S. Treasury, one could assume that a mere one-percent rise in yield of the ten-year Treasury could push the P/E ratio for the Utilities sector down by an equal amount. Assuming no change to earnings, such a change in P/E would result in approximately a 28% drop in market price for the constituents of that sector. This could be a large risk for the potential to earn a 3.5% dividend yield in that sector.

Beyond the largest and the “safest” stocks in the market, investors are hesitant to hold equities. Proof of this fear of equities can be found in the mutual fund flow data as reported by the Investment Company Institute (ICI). Since August of 2007, domestic equity mutual funds have seen cumulative withdrawals of approximately $640 billion. Compare that to approximately $1,048 billion of inflows into bond mutual funds and $225 billion of inflows into hybrid (balanced or alternative) mutual funds.

This massive shift in assets is perverse. While such a move might suggest risk aversion, the crowding of the bond market would appear to have exposed a large number of investors to a potential long-term bottom in interest rates. In fact, many are reporting that the recent low rates experienced by the United States 10-year Treasury and the 10-year German Bund signify lows in interest rates not seen in the hundreds of years of estimated data. The risk of owning bonds in today’s environment may be more significant than bondholders estimate.

We are not proposing that there is a bubble in supposedly “safe” assets but all the warning signs seem to be in place for rising rates for the intermediate to long term. The recent low 10-year U.S. Treasury yield of 1.6% on January 30, 2015 was a very quick dip in yields that failed to match the July 2012 all-time low of 1.4%.

With a massive outflow from domestic equities as a backdrop, one would assume very poor returns over the same time period. However, from the end of August 2007 to the end of February 2015 the S&P 500 has returned 7.2% annualized largely driven by the Health Care, Consumer Discretionary and Consumer Staples sectors. Meanwhile the 10-year U.S. Treasury note has declined in yield by approximately 56%. The Bloomberg/EFFAS Index of 7-10 year U.S. government bonds has produced an annualized return of 6.4% over the same time period. Despite massive inflows into bonds and outflows from equities, the returns of both assets have been positive and similar.

There are strong cross currents in the economy as the nation’s factories contend with weaker equipment demand. Lower energy prices are hurting industries exposed to oil and export markets are soft due to the recent sharp rise in the value of the U.S. dollar. Meanwhile, consumers are benefiting as the strong dollar reduces prices for imports and relief at the pump provides additional discretionary income. In addition, sustained job creation, the falling unemployment rate and lower commodity prices should bode well for consumer spending.

The 2014 calendar year fourth quarter earnings for S&P 500 Index companies are again exceeding analysts’ expectations by more than 5%. Sales are also beating expectations, up 1.6% for the period. Valuations are on the high end of the reasonable range, with the index trading at about 17 times expected 2016 operating earnings. Earnings growth exceeds sales growth, as profit margins continue to trend higher and buybacks reduce share count, but the strong U.S. dollar presents a headwind to future earnings growth, particularly for large multinational corporations. We continue to find many attractive investment opportunities in U.S. stocks.

At Snow Capital Management L.P. (“Snow Capital” the “Firm,” “we,” “our”), we remain bottom-up fundamental stock pickers; we do not time the market. We stay fully invested at all times. Being fully invested when an unexpected market moving event produces short-term losses and can be difficult to endure, but one does not realize long-term returns by continually trying to guess the next market move. Real wealth is built over long periods of time by sticking to an investment discipline, both in good times and bad.

Snow Capital offers mutual funds that provide an investor the opportunity to leverage the Firm’s value investing process, our resources as an institutional investor, and our professional investment discipline. The funds all implement the same investment process. Your financial professional can help you determine which fund is best suited to you.

Thank you for choosing the Snow Capital Family of Funds.

Snow Capital Focused Value Fund

How did the Fund perform?

For the fiscal year ended February 28, 2015, the return for Class I shares return was 9.21% compared to a return of 13.49% for the Russell 1000 Value Total Return Index. For the six-month period ended February 28, 2015, the Class I shares for the Snow Capital Focused Value Fund recorded a return of -3.34% compared to a return of 3.48% for the Russell 1000 Value Total Return Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Snow Capital Focused Value Fund’s portfolio includes a concentrated group of 18 to 24 stocks that is assembled using a collaborative approach, with weekly input from analysts and portfolio managers. Positions are conviction weighted to reflect potential upside and near-term catalysts.

Top Positive Contributors to the Fund’s Return

For the full year, the Information Technology, Health Care, Consumer Discretionary, Financials, Utilities, and Industrials sectors added to overall performance.

The best performing stock was Spirit AeroSystems (SPR), a tier one aerospace supplier. After years of disappointments, SPR has reported several quarters of consistent topline growth, solid earnings, and free cash flow generation, greatly improving investor sentiment. Management will reveal its plans for the increased free cash flow in 2015, with M&A, dividends, and/or share repurchases all under consideration. Community Health Systems (CYH), a hospital operator, benefitted from trends that are playing out due to the implementation of The Affordable Care Act. The company is also realizing significant synergies from their acquisition of Health Management Associates, which was purchased in early 2014. PBF Energy (PBF) outperformed during the quarter, as the company benefitted from flexible crude-oil processing capacity. Higher than anticipated throughput and above market gross margins also contributed to PBF’s strong operating performance. Health Net (HNT), a managed care company, steadily increased throughout the year on solid membership and higher earnings. An initiative to save up to $200 million over three years by streamlining back office operations was well received by investors. Voya Financial (VOYA) surpassed low expectations and increased their long-term return on equity target to 14% after reaching their initial goal of 12-13% in 2014. The company has sound capital levels and is actively repurchasing shares with the stock trading at a discount to tangible book value.

Top Detractors from the Fund’s Return

For the full year, the Energy and Materials sectors detracted from overall performance. The worst performing stock was Tidewater (TDW), a provider of offshore supply vessels and services for the energy industry, declined with the offshore rig count as customers adjusted to lower oil prices. Abercrombie & Fitch (ANF) fired their dominant CEO Mike Jeffries after several years of disappointing results and significant turnover on the Board. The stock was weak as investors prepared for a longer road to recovery, which has been impeded by promotional activity, significant merchandise changes, and a strong US dollar. British Petroleum (BP) fell with the global drop in oil prices. Exposure to Russia through the company’s 20% stake in Rosneft, Russia’s state-owned oil company, has also negatively impacted earnings and sentiment as sanctions punished the Ruble. Kennametal, Inc. (KMT) disappointed on a combination of macro headwinds, including weakness in the Euro, oil and gas price erosion, softening infrastructure demand, and exchange rate fluctuations. A combination of these factors led management to revise guidance downward just one quarter after issuing their projections. Genworth Financial (GNW), a multi-line insurance company, declined after reporting an increase in long-term care reserves. Reserve adjustments in the most recent quarter were better than expected, providing some support for the stock

Were there significant changes to the portfolio?

As of February 28, 2015, the Fund held an overweight position in the Consumer Discretionary, Industrials, Information Technology, Financials, Materials, and Energy sectors compared to the Russell 1000 Value Total Return Index. The Fund held below average positions in the Health Care sector while maintaining no position in Consumer Staples, Utilities, or Telecommunications.

We reduced our exposure to Energy, Health Care, Utilities, and Materials while increasing our investments in Financials, Consumer Discretionary, Information Technology, and Industrials during the fiscal year.

Snow Capital Focused Value Fund (continued)

Comments on the Fund’s Five Largest Holdings

J.P. Morgan Chase (JPM)

After navigating the financial crisis and a slew of negative headlines under the leadership of CEO Jamie Dimon, JPM remains the premier lender in the banking industry. We think JPM should benefit from rising interest rates and reduced overhead costs as well as stabilized credit trends and a well-capitalized balance sheet. With most of its legal woes behind it and ever-increasing clarity on capital regulations, we believe investor sentiment will improve over time.

British Petroleum (BP)

Since the Deepwater Horizon spill, BP has aggressively shed assets to bolster the balance sheet and to reinvest in attractive growth areas. While production growth may be challenging in the short term, we believe the company has set the stage for strong, higher margin production in the future.

Rio Tinto PLC (RIO)

A low cost producer of iron ore, RIO is a diversified mining company that stands to benefit from China’s urbanization even as iron ore prices remain suppressed. The new CEO has done well to manage costs, reducing capital expenditures by over half the $17 Billion spent in 2012.

MetLife, Inc (MET)

A market leader in the life insurance industry, MET should benefit from rising demand for life insurance in emerging markets and variable annuity products that mitigate the risk of volatile equity market returns for investors near or in retirement. The company is well-capitalized, actively repurchases shares, and would benefit from an increase in interest rates.

Teva Pharmaceutical Industries (TEVA)

The world’s largest generic pharmaceutical company, TEVA should benefit from an aging population that faces rising health care costs. Branded pharmaceuticals are set to lose patent protection at a historic rate, and TEVA is well-positioned to effectively gain market share. TEVA also has a growing biosimilar portfolio.

Snow Capital Hedged Equity Fund

How did the Fund perform?

For the year period ended February 28, 2015, the return for Class I shares return was 7.62% compared to a return of 15.51% for the S&P 500 Total Return Index, 13.49% for the Russell 1000 Value Total Return Index and 1.38% for the HFRX Equity Hedge Index. For the six-month period ended February 28, 2015, the Snow Capital Hedged Equity Fund Class I shares recorded a return of -2.77% compared to a return of 6.12% for the S&P 500 Total Return Index, 3.48% for the Russell 1000 Value Total Return Index and 1.66% for the HFRX Equity Hedge Index.

How is the Fund managed?

We employ a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Snow Capital Hedged Equity Fund will invest primarily in equity securities, that Snow Capital believes are undervalued and selling short equity securities the Firm believes are overvalued.

Under normal market conditions, the Fund will invest approximately 80 to100% of its net assets in long equity securities, or other similar investments. Using a bottom-up approach that seeks to identify companies that the Firm believes are undervalued and are likely to experience a rebound in earnings due to an event or series of events that creates a price to earnings expansion leading to higher stock price valuations. The Fund may invest in securities of companies of any size and is not managed toward sector or industry weights.

The Fund will also sell securities short. Under normal market conditions, short sales will typically represent 20 to 40% of net assets. The Fund will employ short positions in an attempt to increase returns and/or to reduce risk. Short sales are placed after performing a bottom-up approach, and it is believed that the price of a particular security is overvalued.

Top Positive Contributors to the Fund’s Return

For the full year, the Information Technology, Health Care, Consumer Discretionary, Financials, Utilities, and Industrials sectors added to overall performance.

In order of magnitude, the best performing stock for the year was Spirit AeroSystems (SPR), a tier one aerospace supplier. After years of disappointments, SPR has reported several quarters of consistent topline growth, solid earnings, and free cash flow generation, greatly improving investor sentiment. Management will reveal its plans for the increased free cash flow in 2015, with M&A, dividends, and/or share repurchases all under consideration. Health Net (HNT), a managed care company, steadily increased throughout the year on solid membership and higher earnings. An initiative to save up to $200 million over three years by streamlining back office operations was well received by investors. Symantec Corporation (SYMC) delivered solid, steady results throughout the year, as the implementation of a restructuring plan announced in 2013 began to improve margins. The separation of the salesforce into new business and renewal teams led to improved results, particularly in North America. Broadcom (BRCM) positively contributed to the Fund’s return as Investors cheered the announcement that the company would discontinue their unprofitable Cellular Baseband business. BRCM also reported continued strong results in their Broadband and Connectivity segments, which drove earnings higher throughout 2014. Community Health Systems (CYH), a hospital operator, benefitted from trends that are playing out due to the implementation of The Affordable Care Act. The company is also realizing significant synergies from their acquisition of Health Management Associates, which was purchased in early 2014.

Top Detractors from the Fund’s Return

For the full year, Energy and Materials detracted from overall performance. In order of magnitude, the worst performing stock over the last year was Tidewater (TDW), a provider of offshore supply vessels and services for the energy industry, declined with the offshore rig count as customers adjusted to lower oil prices. British Petroleum (BP) fell with the global drop in oil prices. Exposure to Russia through the company’s 20% stake in Rosneft, Russia’s state-owned oil company, has also negatively impacted earnings and sentiment as sanctions punished the Ruble. Kennametal Inc. (KMT) disappointed on a combination of macro headwinds, including weakness in the Euro, oil and gas price erosion, softening infrastructure demand, and exchange rate fluctuations. A combination of these factors led management to revise guidance downward just one quarter after issuing their projections. KBR, Inc. (KBR), an engineering and construction company, was impacted by lower oil prices and cost overruns in its Canadian segment. We exited the position during the year in response to growing headwinds in LNG and energy markets. Abercrombie & Fitch (ANF) fired their dominant CEO Mike Jeffries after several years of disappointing results and significant turnover on the Board. The stock was weak as investors prepared for a longer road to recovery, which has been impeded by promotional activity, significant merchandise changes, and a strong US dollar.

Snow Capital Hedged Equity Fund (continued)

Were there significant changes to the portfolio?

As of February 28, 2015, the Fund held an overweight in the Consumer Discretionary, Information Technology, Industrials, and Materials sectors compared to the Russell 1000 Value Total Return Index. The Fund held below average positions in the Financials, Utilities, Health Care, Consumer Staples, and Energy sectors while maintaining no position in Telecommunications.

We reduced our exposure to Health Care, Energy, Utilities, Materials, and Industrials and increased our investments in Financials, Consumer Discretionary, Information Technology, and Consumer Staples during the fiscal year.

Comments on the Fund’s Five Largest Holdings

Teva Pharmaceutical Industries (TEVA)

The world’s largest generic pharmaceutical company, TEVA should benefit from an aging population that faces rising health care costs. Branded pharmaceuticals are set to lose patent protection at a historic rate, and TEVA is well-positioned to effectively gain market share. TEVA also has a growing biosimilar portfolio.

J.P. Morgan Chase (JPM)

After navigating the financial crisis and a slew of negative headlines under the leadership of CEO Jamie Dimon, JPM remains the premier lender in the banking industry. We think JPM should benefit from rising interest rates and reduced overhead costs as well as stabilized credit trends and a well-capitalized balance sheet. With most of its legal woes behind it and ever-increasing clarity on capital regulations, we believe investor sentiment will improve over time.

Community Health Systems (CYH)

A strong operator of non-urban hospitals, CYH should benefit from increased access to health insurance through the Affordable Care Act. Reduced exposure to bad debt due to expanding coverage coupled with positive long-term demographic trends should be a net benefit to the company. Integration synergies from CYH’s purchase of Health Management Associates will provide cost savings in the near term.

Macy’s Inc (M)

After delivering on a sales and margin recovery plan, M still has significant opportunities for sales growth through store optimization and online channels. The company pays a dividend, actively repurchases shares, and continues to trade at a discount to peers.

Consumer Staples Select Sector SPDR (XLP)

Consumer Staples Select Sector SPDR Fund (XLP) is an exchange-traded fund that tracks The Consumer Staples Select Sector Index. The ETF holds large cap consumer staples stocks.

Snow Capital Market Plus Fund

How did the Fund perform?

For the fiscal year ended February 28, 2015, the return for Class I shares return was 10.73% compared to a return of 12.70% for the Russell 3000 Value Total Return Index. For the six-month period ended February 28, 2015, the Snow Capital Market Plus Fund Class I shares recorded a return of -0.61% compared to a return of 3.39% for the Russell 3000 Value Total Return Index.

How is the Fund managed?

The Snow Capital Market Plus Fund typically maintains a portfolio of 50 to 80 U.S.-listed securities. The Fund invests approximately 50% of its net assets in equity securities of companies that are among the top 300 securities by weighting in the Russell 3000 Value Total Return Index. The Fund invests in each of the top 20 securities by weighting in the Russell 3000 Value Total Return Index. We use fundamental analysis and valuation techniques to determine an optimum weight for each position.

With respect to its remaining 50% of assets, the Fund mirrors the Snow Capital Focused Value strategy. Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Focused Value strategy’s portfolio includes a concentrated group of 18 to 24 stocks that is assembled using a collaborative approach, with weekly input from analysts and portfolio managers. Positions are conviction weighted to reflect potential upside and near-term catalysts.

Top Positive Contributors to the Fund’s Return

For the full year, the Information Technology, Health Care, Financials, Consumer Discretionary, Utilities, Consumer Staples, Industrials, and Telecommunications sectors added to overall performance.

The Fund’s top contributor was Spirit AeroSystems (SPR), a tier one aerospace supplier. After years of disappointments, SPR has reported several quarters of consistent topline growth, solid earnings, and free cash flow generation, greatly improving investor sentiment. Management will reveal its plans for the increased free cash flow in 2015, with M&A, dividends, and/or share repurchases all under consideration. Intel (INTC) outperformed the market on higher shipments of PCs and tablets. The company’s Data Center business also exceeded expectations on strong sales to cloud customers. Community Health Systems (CYH), a hospital operator, benefitted from trends that are playing out due to the implementation of The Affordable Care Act. The company is also realizing significant synergies from their acquisition of Health Management Associates, which was purchased in early 2014. J.P. Morgan Chase (JPM) continues to bolster capital levels, manage costs, and produce solid results despite an uncertain regulatory environment. Still trading a discount to its peers, we believe fears over legal costs and headline risk may be overwrought. PBF Energy (PBF) outperformed during the quarter, as the company benefitted from flexible crude-oil processing capacity. Higher than anticipated throughput and above market gross margins also contributed to PBF’s strong operating performance.

Top Detractors from the Fund’s Return

For the full year, Energy and Materials detracted from overall performance. The worst performing stock over the last year was Tidewater (TDW), a provider of offshore supply vessels and services for the energy industry, declined with the offshore rig count as customers adjusted to lower oil prices. Abercrombie & Fitch (ANF) fired their dominant CEO Mike Jeffries after several years of disappointing results and significant turnover on the Board. The stock was weak as investors prepared for a longer road to recovery, which has been impeded by promotional activity, significant merchandise changes, and a strong U.S. dollar. British Petroleum (BP) fell with the global drop in oil prices. Exposure to Russia through the company’s 20% stake in Rosneft, Russia’s state-owned oil company, has also negatively impacted earnings and sentiment as sanctions punished the Ruble. KBR Inc. (KBR), an engineering and construction company, was impacted by lower oil prices and cost overruns in its Canadian segment. We exited the position during the year in response to growing headwinds in LNG and energy markets. Kennametal Inc. (KMT) disappointed on a combination of macro headwinds, including weakness in the Euro, oil and gas price erosion, softening infrastructure demand, and exchange rate fluctuations. A combination of these factors led management to revise guidance downward just one quarter after issuing their projections.

Were there significant changes to the portfolio?

As of February 28, 2015, the Fund held an overweight position in the Energy, Industrials, Information Technology, and Consumer Discretionary sectors compared to the Russell 3000 Value Total Return Index. The Fund held below average positions in the Utilities, Consumer Staples, Health Care, Telecommunications, Financials, and Materials sectors.

We reduced our exposure to Energy, Health Care, Utilities, and Materials and increased our investments in Industrials, Financials, Consumer Discretionary, Consumer Staples, Information Technology, and Telecommunications during the fiscal year.

Snow Capital Market Plus Fund (continued)

Comments on the Fund’s Five Largest Holdings

J.P. Morgan Chase (JPM)

After navigating the financial crisis and a slew of negative headlines under the leadership of CEO Jamie Dimon, JPM remains the premier lender in the banking industry. We think JPM should benefit from rising interest rates and reduced overhead costs as well as stabilized credit trends and a well-capitalized balance sheet. With most of its legal woes behind it and ever-increasing clarity on capital regulations, we believe investor sentiment will improve over time.

Bank of America (BAC)

One of the largest financial institutions in the United States, we believe that BAC will benefit from less competition and greater economies of scale over the long-term. Capital levels have been bolstered and the business model has been simplified under the direction of CEO Brian Moynihan.

Exxon Mobil Corporation (XOM)

The largest position in the Russell 3000-Value, XOM is a global petroleum and petrochemicals exploration and production company. XOM continues to focus on fundamentals in the current low price environment, selectively investing while growing higher margin production.

British Petroleum (BP)

Since the Deepwater Horizon spill, BP has aggressively shed assets to bolster the balance sheet and to reinvest in attractive growth areas. While production growth may be challenging in the short term, we believe the company has set the stage for strong, higher margin production in the future.

Rio Tinto PLC (RIO)

A low cost producer of iron ore, RIO is a diversified mining company that stands to benefit from China’s urbanization even as iron ore prices remain suppressed. The new CEO has done well to manage costs, reducing capital expenditures by over half the $17 Billion spent in 2012.

Snow Capital Inflation Advantaged Equities Fund

How did the Fund perform?

For the fiscal year ended February 28, 2015, the return for Class I shares return was 9.36% compared to a return of 14.12% for the Russell 3000 Total Return Index. For the six-month period ended February 28, 2015, the Snow Capital Inflation Advantage Fund Class I shares recorded a return of -0.81% compared to a return of 5.98% for the Russell 3000 Total Return Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance, seeking to yield a portfolio that is amply diversified across a wide spectrum of economic classifications and sectors. The Snow Capital Inflation Advantaged Equities Fund typically maintains a portfolio between 30 and 50 securities with a focus on companies who may prosper from inflation, evidenced by growing revenues, expanding margins, or other drivers of income. Inflation may be driven by macroeconomic factors, but it can also be company or sector specific, enabling a broad array of investment candidates in any economic environment. Under normal market conditions, at least 80% of the Fund’s net assets are invested in equity securities of companies with market capitalizations greater than $1 billion, and up to 15% of its net assets may be invested in U.S. Government or U.S agency obligations.

Top Positive Contributors to the Fund’s Return

For the full year, the Financials, Health Care, Consumer Staples, Materials, Industrials, Consumer Discretionary, Information Technology, and Utilities sectors added to overall performance.

The best performing stock was Health Net (HNT), a managed care company, steadily increased throughout the year on solid membership and higher earnings. An initiative to save up to $200 million over three years by streamlining back office operations was well received by investors. Target Corp. (TGT) exited their unprofitable Canada business as new CEO Brian Cornell began to implement his turnaround plan. Results were solid, and concerns over the liability of the data breach in late 2013 began to dissipate. Protective Life Corp. (PL), a life insurance company, was acquired by Tokyo based Dai-ichi for $70 per share in the summer of 2014, representing a 35% premium. Community Health Systems (CYH), a hospital operator, benefitted from trends that are playing out due to the implementation of The Affordable Care Act. The company is also realizing significant synergies from their acquisition of Health Management Associates, which was purchased in early 2014. OmniVision Technologies (OVTI) disclosed a non-binding acquisition proposal from a Beijing based investment manager in August for $29/share in cash, and the company is still reviewing the offer. Results also drove outperformance, as OVTI, a provider of image sensors, benefitted from smartphone growth in China and India.

Top Detractors from the Fund’s Return

For the full year, Energy was the only sector to detract from performance. The worst performing stock was McDermott International (MDR), a worldwide energy services company, which was negatively impacted by falling global oil prices which delayed the company’s turn-around. We sold the position during the year in response to lower oil prices and balance sheet deterioration. Freeport-McMoRan (FCX), an international miner of copper, gold, and other minerals detracted on global copper price weakness. The company also operates an oil and gas business that has been hurt by the fall in energy prices. British Petroleum (BP) fell with the global drop in oil prices. Exposure to Russia through the company’s 20% stake in Rosneft, Russia’s state-owned oil company, has also negatively impacted earnings and sentiment as sanctions punished the Ruble. Kennametal, Inc. (KMT) disappointed on a combination of macro headwinds, including weakness in the Euro, oil and gas price erosion, softening infrastructure demand, and exchange rate fluctuations. A combination of these factors led management to revise guidance downward just one quarter after issuing their projections. Johnson Controls (JCI) disappointed due to some weakness in some of their end markets and concerns over the short term impacts of some restructuring initiatives put in place by new CEO Alex Molinari. The Fund exited the position in October.

Were there significant changes to the portfolio?

As of February 28, 2015, the Fund held an overweight position the Materials, Financials, Energy, and Industrials sectors compared to the Russell 3000 Total Return Index. The Fund held below average positions in the Consumer Discretionary, Health Care, Utilities, and Consumer Staples sectors while maintaining no position in Information Technology or Telecommunications.

We reduced our exposure to Energy, Consumer Staples, Health Care, and Utilities and increased our investments in Materials, Consumer Discretionary, Financials, and Industrials during the fiscal year.

Snow Capital Inflation Advantaged Equities Fund (continued)

Comments on the Fund’s Five Largest Holdings

J.P. Morgan Chase (JPM)

After navigating the financial crisis and a slew of negative headlines under the leadership of CEO Jamie Dimon, JPM remains the premier lender in the banking industry. We think JPM should benefit from rising interest rates and reduced overhead costs as well as stabilized credit trends and a well-capitalized balance sheet. With most of its legal woes behind it and ever-increasing clarity on capital regulations, we believe investor sentiment will improve over time.

Hartford Financial Services (HIG)

Once one of the largest life insurance companies in the United States, Hartford Financial Services Group has transformed itself into a stable property and casualty business focused on personal lines, small business, and middle markets. HIG’s new management team is focused on risk control, expense reduction, improved underwriting, and capital returns for shareholders.

MetLife, Inc (MET)

A market leader in the life insurance industry, MET should benefit from rising demand for life insurance in emerging markets and variable annuity products that mitigate the risk of volatile equity market returns for investors near or in retirement. The company is well-capitalized, actively repurchases shares, and would benefit from an increase in interest rates.

E.I. du Pont de Nemours and Company (DD)

Global chemical and life sciences company DD harnesses science to address issues such as food security and renewable energy. Recently corporate activists have become involved in the name, as they look to maximize shareholder value. The company has returned over $10 billion to shareholders over the last five years in dividends and stock repurchases.

British Petroleum (BP)

Since the Deepwater Horizon spill, BP has aggressively shed assets to bolster the balance sheet and to reinvest in attractive growth areas. While production growth may be challenging in the short term, we believe the company has set the stage for strong, higher margin production in the future.

Snow Capital Dividend Plus Fund

How did the Fund perform?

For the fiscal year ended February 28, 2015, the return for Class I shares return was 11.21% compared to a return of 13.49% for the Russell 1000 Value Total Return Index. For the six-month period ended February 28, 2015, the Snow Capital Dividend Plus Fund Class I shares recorded a return of -0.25% compared to a return of 3.48% for the Russell 1000 Value Total Return Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Snow Capital Dividend Plus Fund builds on our bottom-up value process with an emphasis on both income and capital appreciation. The portfolio consists of 40 to 70 investments that are weighted according to total expected return with up to 25% invested in foreign equity or fixed income.

Top Positive Contributors to the Fund’s Return

For the full year, the Financials, Consumer Discretionary, Information Technology, Health Care, Consumer Staples, Utilities, Materials, and Telecommunications sectors added to overall performance.

The best performing stock was Intel (INTC) which outperformed the market on higher shipments of PCs and tablets. The company’s Data Center business also exceeded expectations on strong sales to cloud customers. We sold the position after it hit our target price. Exelon Corp. (EXC) added to performance due in part to anticipated coal retirements that should increase PJM electric prices over the near term. The company also acquired regulated utility Pepco in April, which diversifies the business while increasing the customer base by more than 20%. The management team of Quest Diagnostics (DGX), a full-service diagnostic testing provider, has spent the last two years integrating acquisitions and streamlining the company for greater efficiencies. Focus on higher growth and higher margin areas have improved results. The company has also benefitted from the Affordable Care Act, as demand for clinical testing has risen with the number of newly insured. Lorillard, Inc (LO) added to overall performance after rumors of a takeout finally came to fruition in July, when Reynolds American (RAI) agreed to purchase the company for about $25 Billion, or $70/share. The Fund exited the position with shares at a slight discount to the deal’s closing price amid concerns the FTC may not allow the deal to go through. American Eagle Outfitters (AEO) showed signs of executing their turnaround plan as declining promotional activity, improved inventory control, and reduced corporate overhead spending began to drive improvements.

Top Detractors from the Fund’s Return

For the full year, the Energy and Industrials sectors detracted from overall performance. The worst performing stock was Paragon Offshore (PGN), a provider of offshore drilling rigs that was spun out of Noble Corp. (NE) in July. The company disappointed investors as capital allocation assumptions were changed as the price of oil began to fall shortly after the stock began trading. Concerns over the long-term outlook of the global jack-up market also pressured share prices. KBR, Inc. (KBR), an engineering and construction company, was impacted by lower oil prices and cost overruns in its Canadian segment. We exited the position during the year in response to growing headwinds in LNG and energy markets. Noble Corp. (NE) declined as the offshore drilling industry repositioned itself amid falling oil prices. Investor concerns continued when Royal Dutch Shell (RDS), which represents half of NE’s backlog, announced capex spending cuts of 15% over the next three years. Kennametal, Inc. (KMT) disappointed on a combination of macro headwinds, including weakness in the Euro, oil and gas price erosion, softening infrastructure demand, and exchange rate fluctuations. A combination of these factors led management to revise guidance downward just one quarter after issuing their projections. British Petroleum (BP) fell with the global drop in oil prices. Exposure to Russia through the company’s 20% stake in Rosneft, Russia’s state-owned oil company, has also negatively impacted earnings and sentiment as sanctions punished the Ruble.

Were there significant changes to the portfolio?

As of February 28th, 2015, the Fund held an overweight position in the Materials, Financials, Telecommunications, Industrials, and Consumer Discretionary sectors compared to the Russell 1000 Value Total Return Index. The Fund held below average positions in the Health Care, Information Technology, Consumer Staples, and Energy sectors while maintaining no position in Utilities.

We reduced our exposure to Information Technology, Utilities, Energy, Health Care, and Telecommunications while increasing our investments in Financials, Industrials, Materials, Consumer Staples, and Consumer Discretionary during the fiscal year.

Snow Capital Dividend Plus Fund (continued)

Comments on the Fund’s Five Largest Holdings

J.P. Morgan Chase (JPM)

After navigating the financial crisis and a slew of negative headlines under the leadership of CEO Jamie Dimon, JPM remains the premier lender in the banking industry. We think JPM should benefit from rising interest rates and reduced overhead costs as well as stabilized credit trends and a well-capitalized balance sheet. With most of its legal woes behind it and ever-increasing clarity on capital regulations, we believe investor sentiment will improve over time.

Rio Tinto PLC (RIO)

A low cost producer of iron ore, RIO is a diversified mining company that stands to benefit from China’s urbanization even as iron ore prices remain suppressed. The new CEO has done well to manage costs, reducing capital expenditures by over half the $17 Billion spent in 2012.

Verizon Communication (VZ)

A U.S. wireless leader, VZ should continue to deliver substantial free cash flow as EBITDA climbs and capex declines with the FIOS rollout winding down. Growth potential from the Internet of Things (IoT) and LTE penetration is significant without incurring incremental costs.

AllianceBernstein Holding LP (AB)

Investment manager AB, with nearly $500 Billion in assets under management, is a leading global investment management firm offering research and diversified investment services to institutional investors, individuals, and private wealth clients across the world.

PBF Energy (PBF)

A domestic refinery with best-in-class assets, PBF offers a unique opportunity to invest in an East Coast refinery that should benefit from the continued development of advantaged North American crudes.

Snow Capital Mid Cap Value Fund

How did the Fund perform?

For the fiscal year ended February 28, 2015, the return for Class I shares return was 9.84% compared to a return of 6.95% for the Russell 2500 Value Total Return Index. For the six-month period ended February 28, 2015, the Snow Capital Mid Cap Value Fund Class I shares recorded a return of -1.58% compared to a return of 1.87% for the Russell 2500 Value Total Return Index.

How is the Fund managed?

We employ a contrarian value process rooted in the fundamental analysis of individual companies to build a portfolio of investments. The Snow Capital Mid Cap Value Fund typically maintains a portfolio between 30 to 50 U.S.-listed equities. We weight position sizes based upon our assessment of upside potential and near-term catalysts. The Fund draws at least 80% of its investments from companies with market capitalizations between $3 billion and $25 billion.

Top Positive Contributors to the Fund’s Return

For the full year, the Consumer Discretionary, Information Technology, Health Care, Materials, Financials, Utilities, and Consumer Staples sectors added to overall performance.

In order of magnitude, the best performing stock for the year was Spirit AeroSystems (SPR), a tier one aerospace supplier. After years of disappointments, SPR has reported several quarters of consistent topline growth, solid earnings, and free cash flow generation, greatly improving investor sentiment. Management will reveal its plans for the increased free cash flow in 2015, with M&A, dividends, and/or share repurchases all under consideration. Discount retailer Big Lots (BIG) reported four consecutive quarters of positive comparable same store sales, leading to increasing gross and operating margins and suggesting that the new CEO’s turnaround plan is well underway. The ongoing operational strength provided management the confidence to initiate a dividend program and repurchase shares, which was well-received by the market. Health Net (HNT), a managed care company, steadily increased throughout the year on solid membership and higher earnings. An initiative to save up to $200 million over three years by streamlining back office operations was well received by investors. Broadcom (BRCM) positively contributed to the Fund’s return as Investors cheered the announcement that the company would discontinue their unprofitable Cellular Baseband business. BRCM also reported continued strong results in their Broadband and Connectivity segments, which drove earnings higher throughout 2014.

Community Health Systems (CYH), a hospital operator, benefitted from trends that are playing out due to the implementation of The Affordable Care Act. The company is also realizing significant synergies from their acquisition of Health Management Associates, which was purchased in early 2014.

Top Detractors from the Fund’s Return

For the full year, Industrials and Energy detracted from overall performance. In order of magnitude, the worst performing stock over the last year was Tidewater (TDW), a provider of offshore supply vessels and services for the energy industry, declined with the offshore rig count as customers adjusted to lower oil prices. KBR Inc. (KBR), an engineering and construction company, was impacted by lower oil prices and cost overruns in its Canadian segment. We exited the position during the year in response to growing headwinds in LNG and energy markets. Genworth Financial (GNW), a multi-line insurance company, declined after reporting an increase in long-term care reserves. Reserve adjustments in the most recent quarter were better than expected, providing some support for the stock. Diversified industrial company Terex Corporation (TEX) underperformed due to weakness in their Aerial Work Platforms business, which caused management to revise down their 2015 outlook. Continued weakness in emerging economies also negatively impacted results. Kennametal Inc. (KMT) disappointed on a combination of macro headwinds, including weakness in the Euro, oil and gas price erosion, softening infrastructure demand, and exchange rate fluctuations. A combination of these factors led management to revise guidance downward just one quarter after issuing their projections.

Were there significant changes to the portfolio?

As of February 28th, 2015, the Fund held an overweight in the Information Technology, Industrials, Materials, Energy, and Consumer Discretionary sectors compared to the Russell 2500 Value Index. The Fund held below average positions in the Financials, Utilities, Health, and Consumer Staples sectors while maintaining no position in Telecommunications.

We reduced our exposure to Energy, Consumer Discretionary, Health Care, Consumer Staples, and Utilities and increased our investments in Information Technology, Materials, Industrials, and Financials during the fiscal year.

Snow Capital Mid Cap Value Fund (continued)

Comments on the Fund’s Five Largest Holdings

Hartford Financial Services (HIG)

Once one of the largest life insurance companies in the United States, Hartford Financial Services Group has transformed itself into a stable property and casualty business focused on personal lines, small business, and middle markets. HIG’s new management team is focused on risk control, expense reduction, improved underwriting, and capital returns for shareholders.

Voya Financial (VOYA)

Formerly ING U.S., VOYA provides retirement solutions, investment management, and insurance options to more than 13 million customers. Management is targeting a 12 to 13% return-on-equity by 2016, which would equate to about $1.7 billion in excess capital generation that could be put towards increasing the dividend or buying back shares. A significant deferred tax asset will also help the company in the near term.

NCR Corporation (NCR)

NCR is a computer hardware, software, and electronics company that provides payment products and services that enable businesses to connect, interact, and transact with their customers. Main products include self-service kiosks, point-of-sale terminals, ATMs, check processing systems, barcode scanners, and business consumables, in addition to providing IT maintenance and support services.

Avnet Inc (AVT)

A value-added technology distribution company, AVT’s focus on distribution and enterprise/industrial markets provides stability in a volatile sector. The company boasts a free-cash-flow yield greater than 10% while continuing to return cash to shareholders.

First Niagara Financial Group (FNFG)

A regional bank with branches throughout the northeast, FNFG boasts stable credit metrics, a well-diversified balance sheet, and industry leading loan growth.

Past performance is not a guarantee of future results.

The views expressed herein are solely the opinions of Snow Capital Management L.P. We make no representations as to their accuracy. This communication is intended for informational purposes only and does not constitute a solicitation to invest money nor a recommendation to buy or sell certain securities. Equity investments are not appropriate for all investors. Individual investment decisions should be discussed with a financial advisor.

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in foreign securities involve political, economic, and currency risks, greater volatility and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Snow Capital Market Plus Fund, Snow Capital Mid Cap Value Fund, Snow Capital Hedged Equity Fund, Snow Capital Inflation Advantaged Equities Fund, Snow Capital Dividend Plus Fund, and Snow Capital Focused Value Fund may use options or futures contracts which have the risks of unlimited losses and the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of the securities prices, interest rates, and currency exchange rates. This investment may not be suitable for all investors.

Please see the Total Return Tables on the following pages for performance information on the Funds’ Class A and Class I shares. The performance information quoted assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235. Investors should consider the investment objectives, risks, charges and expenses carefully before investing or sending money. This and other important information about the Fund can be found in the Fund’s prospectus. Please read it carefully before investing.

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of fund holdings.

The holdings identified as top performance contributors/detractors relate to the fiscal year ended February 28, 2015 (the “measurement period”). The holdings identified in this communication do not represent all of the securities purchased, sold, or recommended for our advisory clients and are subject to change. Past performance does not guarantee future results. To obtain the calculation methodology used and a list showing every holding’s contribution to the overall fund’s performance during the measurement period, please send a request to info@snowcm.com.

The S&P 500® Total Return Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Russell 1000® Value Total Return Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values.

The Russell 2500® Value Total Return Index measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500® companies that are considered more value oriented relative to the overall market as defined by Russell’s leading style methodology.

The Russell 3000® Total Return Index measures the performance of the 3000 large US companies as determined by market capitalization. It represents approximately 98% of the investable US equity market and includes stocks within the Russell 1000® and Russell 2000® Indices.

The Russell 3000® Value Total Return Index measures the performance of the broad value segment of U.S. equity value universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values.

The HFRX Equity Hedge Index uses quantitative techniques to maximize representation of the Hedge Fund Universe.

Indexes are unmanaged. It is not possible to invest directly in an index.

The Price-to-Earnings (P/E) ratio is calculated as the current price of a of stock divided by its trailing twelve month operating earnings per diluted share of equity.

The Price/Book ratio is calculated as the current share price of a stock divided by its book value per diluted share of equity.

The CPI or Consumer price index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services as defined by the Bureau of Labor Statistics.

Cash flow is calculated as the most recent four quarters of income before extraordinary and discontinued items plus accumulated depreciation and amortization.

Return on Equity or ROE is calculated as net income divided by common stockholders’ equity.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015

Snow Capital Focused Value Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and exchange-traded funds (“ETFs”) that invest in equity securities, fixed income securities, or other similar investments. Under normal market conditions the Fund will invest at least 80% of its net assets in equity securities of companies with market capitalizations greater than $1 billion.

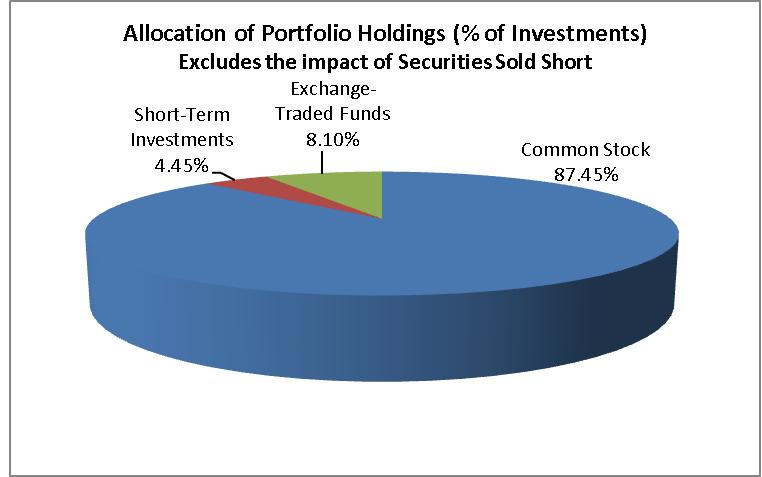

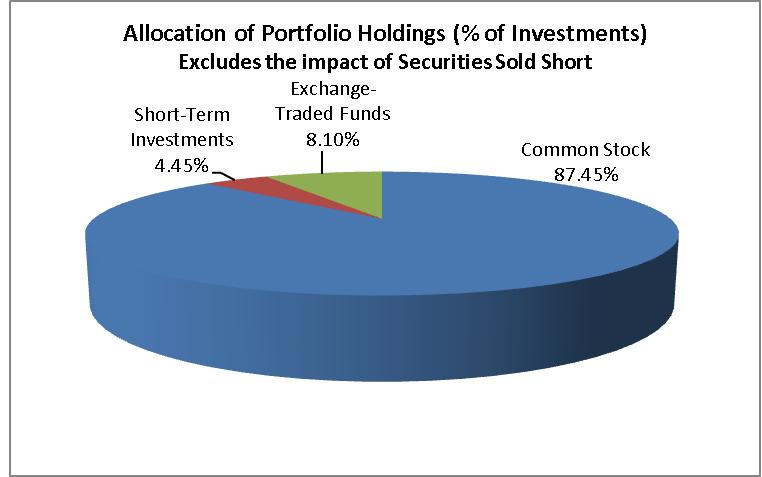

Snow Capital Hedged Equity Fund

The investment objective of the Fund is long-term growth of capital and protection of investment principal with lower volatility than the U.S. equity market. The Fund’s principal investment strategy is to invest at least 80% of long net assets in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and exchange-traded funds (“ETFs”) that invest in equity securities. The Adviser will utilize short equity positions in individual equity securities and ETFs to reduce the portfolio’s overall market exposure. The Fund may borrow money from banks or other financial institutions to purchase securities, commonly known as “leveraging,” in an amount not to exceed one-third of its total assets, as permitted by the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund may invest in equity and/or fixed income securities of companies of any size. In addition to domestic securities, the Fund may also directly or indirectly invest in foreign equity, including investments in emerging markets.

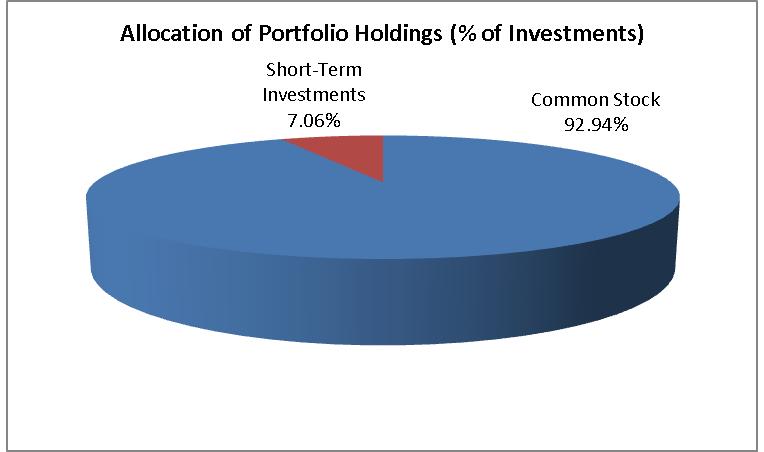

The percentages in the above graphs are based on the portfolio holdings of the Fund as of February 28, 2015 and are subject to change.

For a detailed break-out of holdings by industry and exchange traded funds by investment type, please refer to the Schedules of Investments.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015

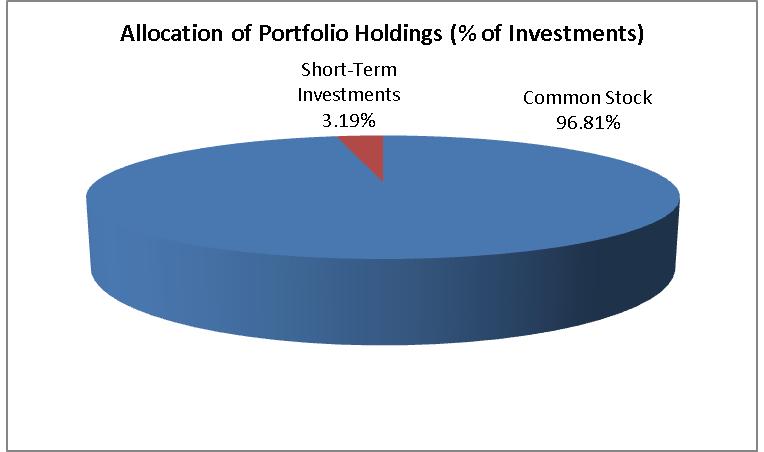

Snow Capital Market Plus Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities. Under normal market conditions, the Fund will invest approximately 80% of its net assets in equity securities of companies that are among the top 300 securities by weighting in the Russell 3000 Value Index. The Fund will invest in each of the top 20 securities by weighting in the Russell 3000 Value Index. The Adviser will use fundamental analysis and valuation techniques to determine an appropriate weight for each position.

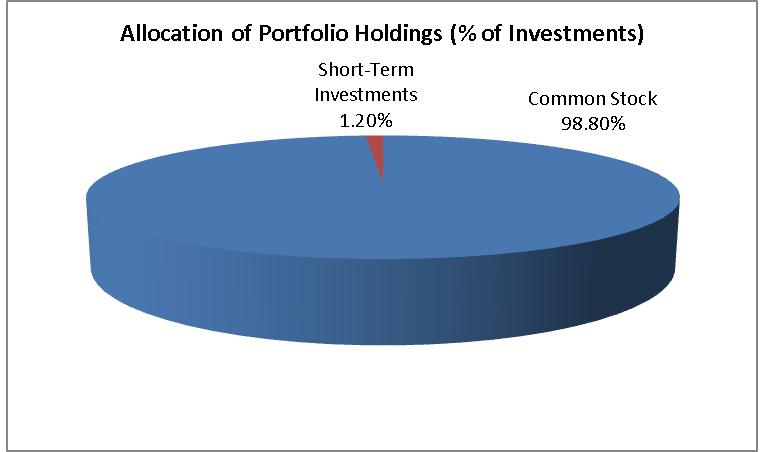

Snow Capital Inflation Advantaged Equities Fund

The investment objective of the Fund is long-term growth of capital and protection of investment principal. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities.

The percentages in the above graphs are based on the portfolio holdings of the Fund as of February 28, 2015 and are subject to change.

For a detailed break-out of holdings by industry and exchange traded funds by investment type, please refer to the Schedules of Investments.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015

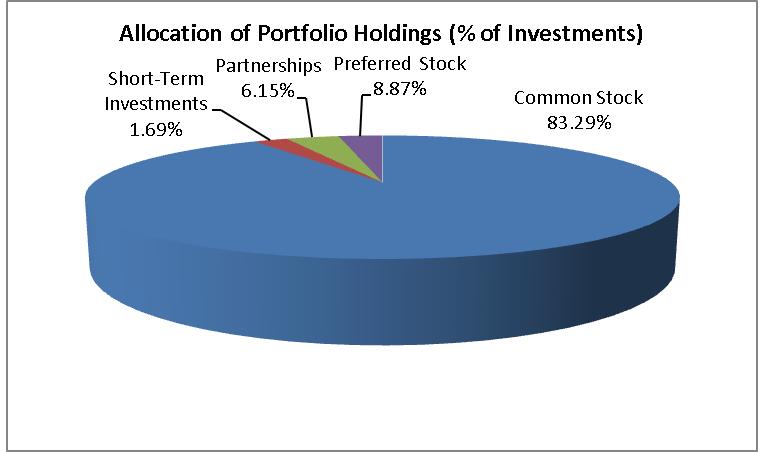

Snow Capital Dividend Plus Fund

The investment objective of the Fund is long-term growth of capital and income. The Fund’s principal investment strategy is to invest in a diversified portfolio of equities, bonds, preferred stock, and options. Under normal market conditions, the Fund will invest at least 80% of its net assets in equity securities that pay a dividend and are within the market capitalization range of the Russell 1000 Value Index. With respect to its remaining assets, the Fund may invest in corporate bonds, sovereign bonds, convertible bonds, preferred stocks, or other securities or instruments whose prices are linked to the value of the underlying common stock of the issuer of the securities. The Fund may have up to 25% of its net assets invested directly or indirectly in foreign equity securities, including investments in emerging markets.

Snow Capital Mid Cap Value Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest at least 80% of its net assets in equity securities of companies within the market capitalizations range of the Russell Mid Cap Value Index (“mid-cap securities”). The Fund’s investments in equity securities may include common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities of mid-cap companies. In addition to equity securities, the Fund may also invest up to 15% of its net assets in U.S. Government or U.S. agency obligations. The Fund may have up to 20% of its net assets invested directly or indirectly in foreign equity securities, including investments in emerging markets.

The percentages in the above graphs are based on the portfolio holdings of the Fund as of February 28, 2014 and are subject to change.

For a detailed break-out of holdings by industry and exchange traded funds by investment type, please refer to the Schedules of Investments.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015 (Unaudited)

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2015 | One Year ended February 28, 2015 | Since Inception from March 27, 2013 through February 28, 2015 |

| Snow Capital Focused Value Fund Class A without sales charge | 8.91% | 21.89% |

Snow Capital Focused Value Fund Class A with sales charge (2) | 3.19% | 18.53% |

| Snow Capital Focused Value Fund Class I | 9.21% | 22.22% |

| Russell 1000 Value Total Return Index | 13.49% | 16.99% |

| (2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Focused Value Fund versus the Russell 1000 Value Total Return Index. The Russell 1000 Value Index is an unmanaged index of those Russell 1000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 1000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Focused Value Fund, which will generally not invest in all the securities comprising the index.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015 (Unaudited)

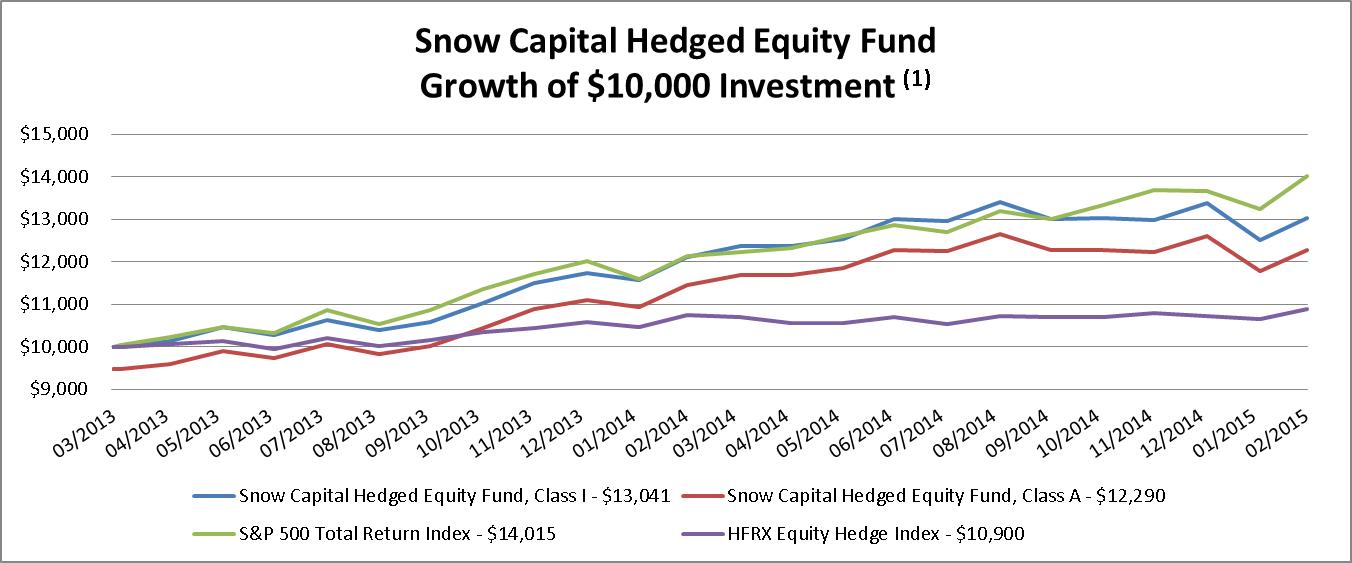

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2015 | One Year ended February 28, 2015 | Since Inception from March 27, 2013 through February 28, 2015 |

| Snow Capital Hedged Equity Fund Class A without sales charge | 7.31% | 14.45% |

Snow Capital Hedged Equity Fund Class A with sales charge (2) | 1.68% | 11.29% |

| Snow Capital Hedged Equity Fund Class I | 7.62% | 14.77% |

| S&P 500 Total Return Index | 15.51% | 19.18% |

| HFRX Equity Hedge Index | 1.38% | 4.58% |

| (2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Hedged Equity Fund versus the S&P 500 Total Return Index and the HFRX Equity Hedge Index. The S&P 500 Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The HFRX Equity Hedge Index uses quantitative techniques to maximize representation of the Hedge Fund Universe. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Total Return Index and the HFRX Equity Hedge Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Snow Hedged Equity Fund, which will generally not invest in all the securities comprising the indices.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015 (Unaudited)

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2015 | One Year ended February 28, 2015 | Since Inception from March 27, 2013 through February 28, 2015 |

| Snow Capital Market Plus Fund Class A without sales load | 10.48% | 19.08% |

Snow Capital Market Plus Fund Class A with sales load (2) | 4.67% | 15.79% |

| Snow Capital Market Plus Fund Class I | 10.73% | 19.38% |

| Russell 3000 Value Total Return Index | 12.70% | 16.65% |

| (2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Market Plus Fund versus the Russell 3000 Value Total Return Index. The Russell 3000 Value Index is an unmanaged index of those Russell 3000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 3000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Market Plus Fund, which will generally not invest in all the securities comprising the index.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015 (Unaudited)

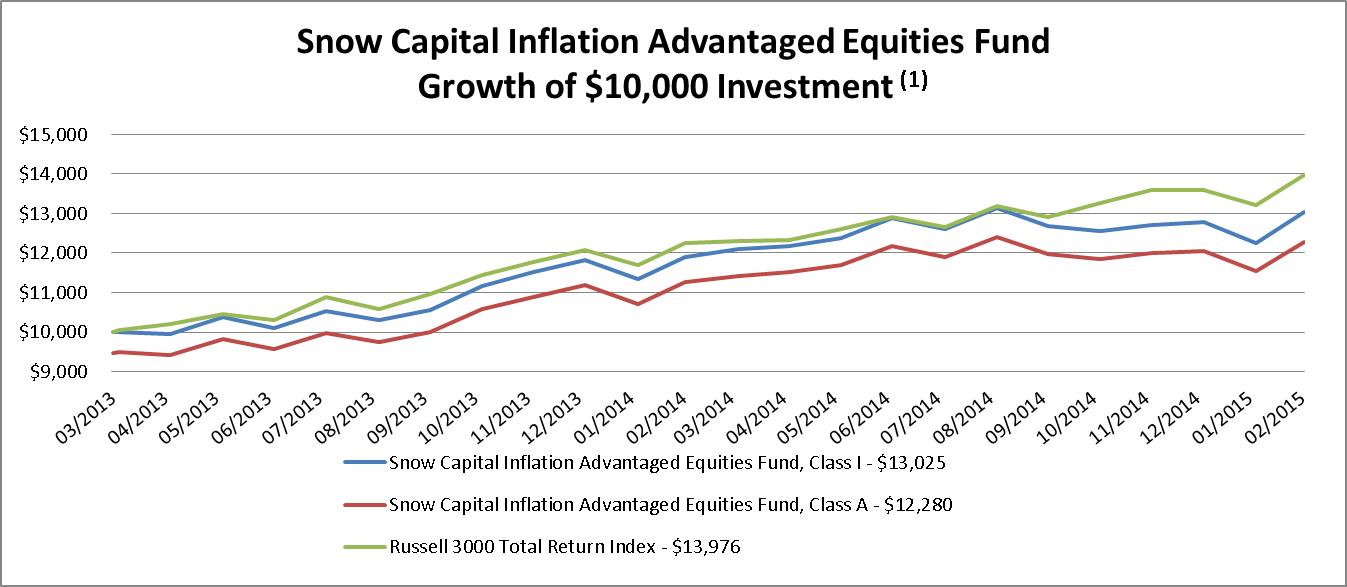

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2015 | One Year ended February 28, 2015 | Since Inception from March 27, 2013 through February 28, 2015 |

| Snow Capital Inflation Advantaged Equities Fund Class A without sales charge | 9.05% | 14.40% |

Snow Capital Inflation Advantaged Equities Fund Class A with sales charge (2) | 3.32% | 11.24% |

| Snow Capital Inflation Advantaged Equities Fund Class I | 9.36% | 14.69% |

| Russell 3000 Total Return Index | 14.12% | 19.01% |

| (2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Inflation Advantaged Equities Fund versus the Russell 3000 Total Return Index. The Russell 3000 Index is an unmanaged index of those Russell 3000 companies based on total market capitalization which represents approximately 98% of the investable U.S. equity market. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 3000 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Inflation Advantaged Equities Fund, which will generally not invest in all the securities comprising the index.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015 (Unaudited)

(1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2015 | One Year ended February 28, 2015 | Since Inception from March 27, 2013 through February 28, 2015 |

| Snow Capital Dividend Plus Fund Class A without sales charge | 10.90% | 17.16% |

Snow Capital Dividend Plus Fund Class A with sales charge (2) | 5.07% | 13.93% |

| Snow Capital Dividend Plus Fund Class I | 11.21% | 17.46% |

| Russell 1000 Value Total Return Index | 13.49% | 16.99% |

| (2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Dividend Plus Fund versus the Russell 1000 Value Total Return Index. The Russell 1000 Value Index is an unmanaged index of those Russell 1000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 1000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Dividend Plus Fund, which will generally not invest in all the securities comprising the index.

| Snow Family of Funds | ANNUAL REPORT |

Investment HighlightsFebruary 28, 2015 (Unaudited)

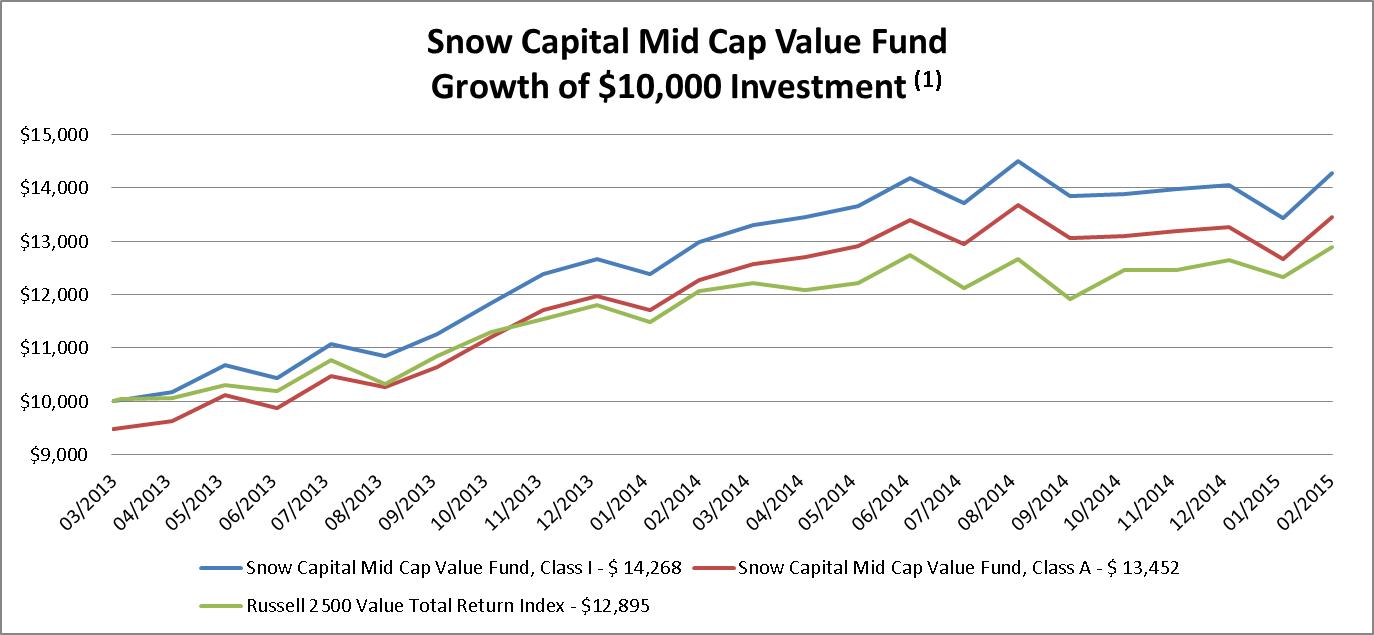

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2015 | One Year ended February 28, 2015 | Since Inception from March 27, 2013 through February 28, 2015 |

| Snow Capital Mid Cap Value Fund Class A without sales charge | 9.58% | 19.94% |

Snow Capital Mid Cap Value Fund Class A with sales charge (2) | 3.82% | 16.63% |

| Snow Capital Mid Cap Value Fund Class I | 9.84% | 20.25% |

| Russell 2500 Value Total Return Index | 6.95% | 14.13% |

| (2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Mid Cap Value Fund versus the Russell 2500 Value Total Return Index. The Russell 2500 Value Index is an unmanaged index of those Russell 2500 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 2500 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Mid Cap Value Fund, which will generally not invest in all the securities comprising the index.

| Snow Family of Funds | ANNUAL REPORT |

Snow Capital Focused Value Fund

SCHEDULE OF INVESTMENTS

February 28, 2015

| COMMON STOCK - 98.72% | | Shares | | | Fair Value | |

| | | | | | | |

| Aerospace & Defense - 8.69% | | | | | | |

| Spirit AeroSystems Holdings, Inc. (a) | | | 340 | | | $ | 16,731 | |

| Triumph Group, Inc. | | | 255 | | | | 15,246 | |

| | | | | | | | 31,977 | |

| Auto Manufacturers - 3.55% | | | | | | | | |

| General Motors Co. | | | 350 | | | | 13,059 | |

| | | | | | | | | |

| Banks - 10.31% | | | | | | | | |

| Bank of America Corp. | | | 830 | | | | 13,122 | |

| JPMorgan Chase & Co. | | | 405 | | | | 24,818 | |

| | | | | | | | 37,940 | |

| Computers - 12.00% | | | | | | | | |

| Hewlett-Packard Co. | | | 420 | | | | 14,633 | |

| NCR Corp. (a) | | | 550 | | | | 16,176 | |

| NetApp, Inc. | | | 345 | | | | 13,334 | |

| | | | | | | | 44,143 | |

| Hand & Machine Tools - 4.05% | | | | | | | | |

| Kennametal, Inc. | | | 425 | | | | 14,875 | |

| | | | | | | | | |

| Healthcare - Services - 4.35% | | | | | | | | |

| Community Health Systems, Inc. (a) | | | 330 | | | | 16,012 | |