UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4520 Main Street, Suite 1425 Kansas City, MO | 64111 |

| (Address of principal executive offices) | (Zip code) |

Matrix 360 Administration, LLC

4520 Main Street

Suite 1425

Kansas City, MO 64111

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-244-6235

Date of fiscal year end: 12/31/2014

Date of reporting period: 12/31/2014

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the Foundry Partners, LLC Funds, series of the 360 Funds (the “registrant”) for the period ended December 31, 2014 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

FOUNDRY PARTNERS, LLC FUNDS

Foundry Micro Cap Value Fund

Class I Shares (Ticker Symbol: FMCIX)

Foundry Small Cap Value Fund

Class I Shares (Ticker Symbol: FSVIX)

Series of the

360 Funds

ANNUAL REPORT

December 31, 2014

Investment Adviser:

Foundry Partners, LLC

510 First Avenue North,

Suite 409

Minneapolis, MN 55403

TABLE OF CONTENTS

| LETTER TO SHAREHOLDERS | 1 |

| INVESTMENT HIGHLIGHTS | 3 |

| SCHEDULES OF INVESTMENTS | 7 |

| STATEMENTS OF ASSETS AND LIABILITIES | 14 |

| STATEMENTS OF OPERATIONS | 16 |

| STATEMENTS OF CHANGES IN NET ASSETS | 18 |

| FINANCIAL HIGHLIGHTS | 20 |

| NOTES TO FINANCIAL STATEMENTS | 22 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 29 |

| ADDITIONAL INFORMATION | 30 |

| EXPENSE EXAMPLES | 34 |

| Foundry Partners, LLC Funds | ANNUAL REPORT |

Foundry Micro Cap Value Fund

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2014 (Unaudited)

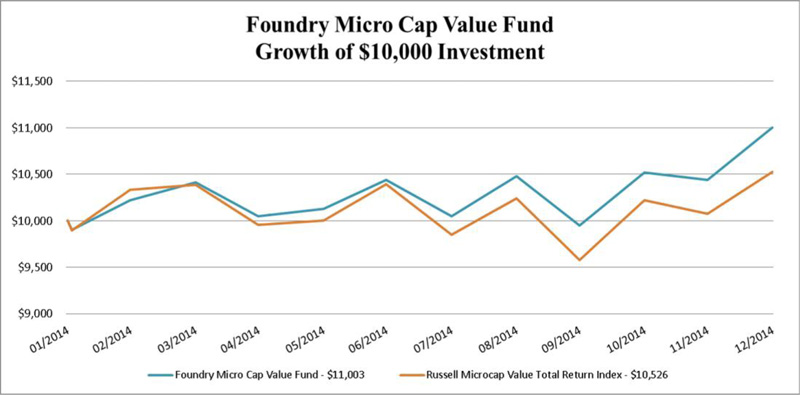

Portfolio performance – The Foundry Micro Cap Value Fund (the “Fund”) outperformed the Russell Microcap® Value Total Return Index(a) from its 1/30/14 inception through year end. The Fund returned 10.03%(b) compared to 5.26% for the benchmark.

Global Macro environment – The U.S. equity markets faced significant volatility in 2014, as the year was filled with a seemingly unrelenting series of geopolitical and exogenous events: unrest in Ukraine, Russian annexation of Crimea, the rise of ISIS, pro-democracy protests in Hong Kong, and an outbreak of Ebola. The global economic environment provided no source of relief for investors as worsening economic conditions (Europe, Japan, China), major quantitative easing programs (Japan, Europe), and the end of quantitative easing in the U.S. created another year of macro related uncertainty. By the end of the year, the economic sanctions against Russia restricting access to capital markets, combined with the crash in oil prices, instigated a crisis with the Ruble while Europe began to contemplate its own U.S.-styled bond buying program.

U.S. Economic environment – U.S. consumer confidence rose to a seven year high on the heels of falling gasoline prices and continued job growth. The Federal Reserve officially ended asset purchases bringing quantitative easing to a close; its balance sheet more than doubling to $4.48 trillion since November 2008. For the first time, the Fed’s governing board did not describe the slack in the economy as “significant”. In fact, the U.S. economy expanded at the fastest pace in more than a decade during the third quarter coming in at 5.0%.

Benchmark Observations – Despite high valuations, Real Estate Investment Trusts ("REITs") and Utilities generated the strongest performance within the benchmark (Russell Microcap Value Total Return Index) in 2014 as the rate on U.S. 10-year Treasury Notes reversed the 2013 uptick by declining to 2.2% from 3.0%. Significant quantitative easing by foreign central banks and improving fiscal deficits in the U.S. lead to a decline in the issuance of U.S. Treasuries which served to drive rates lower. Investors reacted by bidding up interest rate sensitive and high yield groups in the equity market such as REITs and Utilities. In other segments of the Financial Sector, valuations improved in response to three fundamental factors: higher acquisition activity among Banks and Thrifts, accelerating loan growth throughout the year, and abating credit issues. On the negative side of the index, oil price driven volatility contributed to the -34% decline in the Energy sector - one of the largest deviations from the benchmark by any individual sector over the past ten years.

| Foundry Micro Cap Value Fund | |

Holdings Data As Of 12/31/2014 (as a percentage of market value) | |

| Sector | Portfolio Weight |

| Consumer Discretionary | 14.81 |

| Consumer Staples | 2.91 |

| Energy | 3.87 |

| Financials | 33.23 |

| Health Care | 3.95 |

| Industrials | 19.76 |

| Information Technology | 13.60 |

| Materials | 1.00 |

| Telecommunication Services | 1.34 |

| Cash | 5.53 |

Foundry Micro Cap Value Fund – Our bottom up process consists of identifying companies poised to benefit from turnarounds, new management or restructurings, or stocks that are simply priced attractively compared to their normalized earnings power. The blend of our company specific research and our top-down analysis produces our sector weights. The Funds underweight towards REITs and Utilities stemmed from our value discipline and stock selection process. Despite the drag on relative performance from underweighting these groups, stock selection clearly carried the Fund as 9 out of 10 sectors were positive contributors. Stock selection among Trucking companies, an acquisition in Business Services, and other solid performers within Industrials drove performance. Specialty Retailers, Luxury Goods, Durables, and Restaurants delivered exceptional returns as stronger than expected consumer spending helped to leverage margin enhancement initiatives among our Consumer Discretionary holdings. Energy, Technology, Materials, and Consumer Staples also generated sizable contributions to relative performance. Entering 2015, the Micro Cap Value Fund is overweight in Consumer Discretionary, Energy, and Industrials while underweight Financials, Healthcare, Materials, and Utilities.

| Foundry Partners, LLC Funds | ANNUAL REPORT |

Foundry Micro Cap Value Fund

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2014 (Unaudited)

(a) | The Russell Microcap® Value Total Return Index measures the performance of the microcap value segment of the U.S. equity market. It includes those Russell Microcap® Index companies with lower price-to-book ratios and lower forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index. |

(b) | The performance information quoted assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235. Investors should consider the investment objectives, risks, charges and expenses carefully before investing or sending money. This and other important information about the Fund can be found in the Fund’s prospectus. Please read it carefully before investing. |

| Foundry Partners, LLC Funds | ANNUAL REPORT |

Foundry Small Cap Value Fund

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2014 (Unaudited)

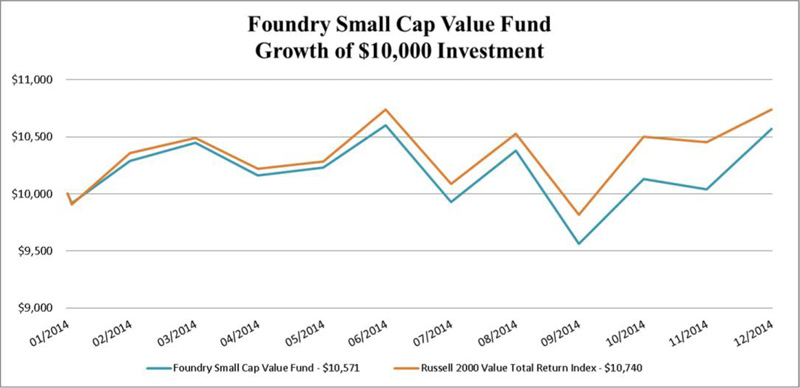

Portfolio performance – The Foundry Small Cap Value Fund underperformed the Russell 2000® Value Total Return Index(a) from its 1/30/14 inception through year end. The Fund returned 5.71%(b) compared to 7.40% for the benchmark.

Global Macro environment – The U.S. equity markets faced significant volatility in 2014, as the year was filled with a seemingly unrelenting series of geopolitical and exogenous events: unrest in Ukraine, Russian annexation of Crimea, the rise of ISIS, pro-democracy protests in Hong Kong, and an outbreak of Ebola. The global economic environment provided no source of relief for investors as worsening economic conditions (Europe, Japan, China), major quantitative easing programs (Japan, Europe), and the end of quantitative easing in the U.S. created another year of macro related uncertainty. By the end of the year, the economic sanctions against Russia restricting access to capital markets, combined with the crash in oil prices, instigated a crisis with the Ruble while Europe began to contemplate its own U.S.-styled bond buying program.

U.S. Economic environment – U.S. consumer confidence rose to a seven year high on the heels of falling gasoline prices and continued job growth. The Federal Reserve officially ended asset purchases bringing quantitative easing to a close; its balance sheet more than doubling to $4.48 trillion since November 2008. For the first time, the Fed’s governing board did not describe the slack in the economy as “significant”. In fact, the U.S. economy expanded at the fastest pace in more than a decade during the third quarter coming in at 5.0%.

Benchmark Observations – Despite high valuations, REITs and Utilities generated the strongest performance within the benchmark (Russell 2000 Value Index) in 2014 as the rate on U.S. 10-year Treasury Notes reversed the 2013 uptick by declining to 2.2% from 3.0%. Significant quantitative easing by foreign central banks and improving fiscal deficits in the U.S. lead to a decline in the issuance of U.S. Treasuries which served to drive rates lower. Investors reacted by bidding up interest rate sensitive and high yield groups in the equity market such as REITs and Utilities. The Fund was significantly underweight to both groups as our value discipline and stock selection process prevented us from taking larger positions. Volatility also reared its ugly head in 2014 - in one of the largest deviations from the index by any individual sector over the past ten years, Energy tumbled -35% managing to drag the index down by 2.4%.

| Foundry Small Cap Value Fund |

Holdings Data As Of 12/31/2014 (as a percentage of market value) | |

Sector | Portfolio Weight |

| Consumer Discretionary | 15.67 |

| Consumer Staples | 2.95 |

| Energy | | 4.91 |

| Financials | 30.58 |

| Health Care | 3.44 |

| Industrials | 16.02 |

| Information Technology | 12.39 |

| Materials | 5.64 |

| Telecommunication Services | 0.90 |

| Utilities | | 2.50 |

| Cash | | 5.00 |

Portfolio performance – Our bottom up process consists of identifying companies poised to benefit from turnarounds, new management or restructurings, or stocks that are simply priced attractively compared to their normalized earnings power. The blend of our company specific research and our top-down analysis produces our sector weights. Much of the underperformance can be traced to the underweight in REITs and Utilities; however, stock selection in general largely added to our relative performance. Although the Fund was overweight to Energy during the year, good stock selection and early-in-the-year sales enabled us to outperform in this difficult sector. Our consumer holdings in Specialty Retailers, Luxury Goods, Durables and Restaurants delivered exceptional performance as stronger than expected consumer spending allowed our companies’ restructuring efforts to return to normalized earnings faster than market expectations. Acquisition activity in the Banking industry benefited the Fund as our holdings initiated value-enhancing deals and one of our banks was bought out as well. Entering the year, the Foundry Small Cap Value Fund was overweight in Consumer Discretionary, Energy, Industrials, Technology, and Materials while underweight Financials, Healthcare, and Utilities.

| Foundry Partners, LLC Funds | ANNUAL REPORT |

Foundry Small Cap Value Fund

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2014 (Unaudited)

(a) | The Russell 2000® Value Total Return Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index. |

(b) | The performance information quoted assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235. Investors should consider the investment objectives, risks, charges and expenses carefully before investing or sending money. This and other important information about the Fund can be found in the Fund’s prospectus. Please read it carefully before investing. |

| Foundry Partners, LLC Funds | ANNUAL REPORT |

Foundry Micro Cap Value Fund

INVESTMENT HIGHLIGHTS

December 31, 2014 (Unaudited)

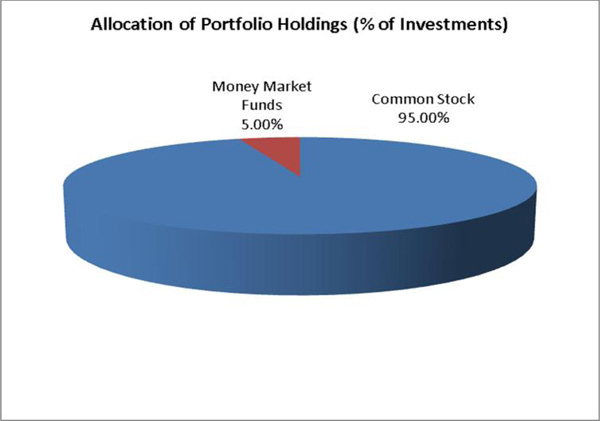

The investment objective of the Foundry Micro Cap Value Fund (the “Micro Cap Fund”) is capital appreciation. To meet the investment objective of this Fund, the Fund will invest at least 80% of its assets in equity securities of micro-cap companies. Micro-cap companies are those companies contained within the Russell Microcap® Value Total Return Index, or companies with similar size characteristics. Equity securities consist of common stock and securities convertible into common stock.

As of December 31, 2014, the median market capitalization of companies included in the Russell Microcap® Value Total Return Index was approximately $231 million; the average market capitalization for companies contained within the Russell Microcap® Value Total Return Index was approximately $492 million; and the largest stock in the index had a market capitalization of $3.867 billion.

The Micro Cap Fund seeks to provide broad exposure to micro-cap domestic equity securities and seeks to outperform the Russell Microcap® Value Total Return Index after fees over a long-term investment horizon. Foundry Partners, LLC (the "Adviser") seeks to invest in companies that it considers to be “statistically cheap” (based on factors which may include, for example, low ratio of price to earnings, price to cash flow, price to book value, and price to sales). The Adviser also looks for companies that it believes are undervalued relative to their earning power and long term earnings growth prospects, adjusted for risk. The Adviser may filter less attractive companies by analyzing cash flows, evaluating financial strength, performing earnings analysis and reviewing purchase and sale activity in company shares by company executives, and through fundamental analysis, which may include a review of assets, earnings, sales, products, markets, and management, among other indicators. Ideally, after filtering out companies that do not meet the Adviser’s criteria above, the Adviser looks for companies that have a positive catalyst, (e.g., new products, management changes, acquisition, etc.).

The Adviser also utilizes a sell discipline and may consider selling a security when: it becomes fully valued in the Adviser’s opinion or less attractive to the Adviser; one of the Fund’s holdings has performed well and reached or approached the Adviser’s price target; a company fails to pass the Adviser’s investment screens; or there is deterioration in a company’s fundamentals, management or financial reporting.

The Adviser will look to manage risk through several strategies, which typically include: maintaining minimum and maximum sector weightings relative to the Russell Microcap® Value Total Return Index; monitoring risk statistics relative to the Russell Microcap® Value Total Return Index; and, monitoring trade volume.

The percentages in the above graph are based on the portfolio holdings of the Fund as of December 31, 2014 and are subject to change. For a detailed break-out of holdings by industry, please refer to the Schedules of Investments.

| Foundry Partners, LLC Funds | ANNUAL REPORT |

Foundry Micro Cap Value Fund

INVESTMENT HIGHLIGHTS

December 31, 2014 (Unaudited)

| Returns as of December 31, 2014 | Since Inception from January 30, 2014 through December 31, 2014 (1) |

| | |

| Foundry Micro Cap Value Fund Institutional Class shares | 10.03% |

| Russell Microcap® Value Total Return Index | 5.26% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Foundry Micro Cap Value Fund versus the Russell Microcap® Value Total Return Index. The Russell Microcap® Value Total Return Index measures the performance of the microcap value segment of the U.S. equity market. It includes those Russell Microcap® Index companies with lower price-to-book ratios and lower forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell Microcap® Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Foundry Micro Cap Value Fund, which will generally not invest in all the securities comprising the index.

| Foundry Partners, LLC Funds | ANNUAL REPORT |

Foundry Small Cap Value Fund

INVESTMENT HIGHLIGHTS

December 31, 2014 (Unaudited)

The investment objective of the Foundry Small Cap Value Fund (the “Small Cap Fund”) is capital appreciation. The Fund plans to meet its investment objective by investing at least 80% of its assets in the equity securities of small cap companies. Small cap companies are defined as those companies included in the Russell 2000® Value Total Return Index and companies with similar market capitalizations. Market capitalization, a common measure of the size of a company, is the market price of a share of a company’s stock multiplied by the number of shares that are outstanding. Equity securities consist of common stock and securities convertible into common stock.

As of December 31, 2014, the median market capitalization of companies included in the Russell 2000® Value Total Return Index was approximately $639 million; the average market capitalization for companies contained within the Russell 2000® Value Total Return Index was approximately $1.727 billion; and the largest stock in the index had a market capitalization of $4.914 billion.

The Small Cap Fund seeks to outperform the Russell 2000® Value Total Return Index after fees over a long-term investment horizon. The Adviser seeks to invest in companies that it considers to be “statistically cheap” (based on factors which may include, for example, low ratio of price to earnings, price to cash flow, price to book value, and price to sales). The Adviser also looks for companies that it believes are undervalued relative to their earning power and long term earnings growth prospects, adjusted for risk. The Adviser may filter less attractive companies by analyzing cash flows, evaluating financial strength, performing earnings analysis and reviewing purchase and sale activity in company shares by company executives, and through fundamental analysis. Ideally, attractive companies will have a positive catalyst (e.g., new products, management changes, acquisition, etc.).

The Adviser also utilizes a sell discipline and may consider selling a security when: it becomes fully valued in the Adviser’s opinion or less attractive to the Adviser; one of the Fund’s holdings has performed well and reached or approached the Adviser’s price target; a company fails to pass the Adviser’s investment screens; or there is a deterioration in a company’s fundamentals, management or financial reporting.

The Adviser will look to manage risk through several strategies, which typically include maintaining minimum and maximum sector weightings relative to the Russell 2000® Value Total Return Index and monitoring risk statistics relative to the Russell 2000® Value Total Return Index.

The percentages in the above graph are based on the portfolio holdings of the Fund as of December 31, 2014 and are subject to change. For a detailed break-out of holdings by industry, please refer to the Schedules of Investments.

| Foundry Partners, LLC Funds | ANNUAL REPORT |

Foundry Small Cap Value Fund

INVESTMENT HIGHLIGHTS

December 31, 2014 (Unaudited)

| Returns as of December 31, 2014 | Since Inception from January 30, 2014 through December 31, 2014 (1) |

| | |

| Foundry Small Cap Value Fund Institutional Class shares | 5.71% |

| Russell 2000® Value Total Return Index | 7.40% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Foundry Small Cap Value Fund versus the Russell 2000® Value Total Return Index. The Russell 2000® Value Total Return Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 2000® Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Foundry Small Cap Value Fund, which will generally not invest in all the securities comprising the index.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY MICRO CAP VALUE FUND

SCHEDULE OF INVESTMENTS

| December 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 96.41% | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Aerospace & Defense - 1.16% | | | | | | |

Ducommun, Inc. (a) | | | 685 | | | $ | 17,317 | |

| | | | | | | | | |

| Apparel - 0.79% | | | | | | | | |

Perry Ellis International, Inc. (a) | | | 450 | | | | 11,668 | |

| | | | | | | | | |

| Auto Parts & Equipment - 1.36% | | | | | | | | |

| Spartan Motors, Inc. | | | 3,850 | | | | 20,251 | |

| | | | | | | | | |

| Banks - 15.59% | | | | | | | | |

| Bank of Commerce Holdings | | | 1,310 | | | | 7,821 | |

| Bar Harbor Bankshares | | | 450 | | | | 14,400 | |

| Capital City Bank Group, Inc. | | | 1,075 | | | | 16,706 | |

| Financial Institutions, Inc. | | | 580 | | | | 14,587 | |

| First Financial Corp. | | | 510 | | | | 18,166 | |

| First Internet Bancorp | | | 880 | | | | 14,731 | |

First NBC Bank Holding Co. (a) | | | 500 | | | | 17,600 | |

| Hanmi Financial Corp. | | | 800 | | | | 17,448 | |

| Independent Bank Corp. MI | | | 1,075 | | | | 14,029 | |

| MainSource Financial Group, Inc. | | | 1,065 | | | | 22,280 | |

| Monarch Financial Holdings, Inc. | | | 1,375 | | | | 18,906 | |

| Northrim BanCorp, Inc. | | | 340 | | | | 8,922 | |

| Simmons First National Corp. | | | 350 | | | | 14,227 | |

| Towne Bank - Portsmouth, VA | | | 950 | | | | 14,364 | |

| Washington Trust Bancorp, Inc. | | | 435 | | | | 17,478 | |

| | | | | | | | 231,665 | |

| Biotechnology - 0.62% | | | | | | | | |

Cambrex Corp. (a) | | | 425 | | | | 9,189 | |

| | | | | | | | | |

| Building Materials - 1.19% | | | | | | | | |

Gibraltar Industries, Inc. (a) | | | 1,085 | | | | 17,642 | |

| | | | | | | | | |

| Commercial Services - 6.14% | | | | | | | | |

CBIZ, Inc. (a) | | | 1,675 | | | | 14,338 | |

CRA International, Inc. (a) | | | 225 | | | | 6,822 | |

Cross Country Healthcare, Inc. (a) | | | 1,300 | | | | 16,224 | |

Global Cash Access Holdings, Inc. (a) | | | 2,350 | | | | 16,803 | |

Great Lakes Dredge & Dock Corp. (a) | | | 2,280 | | | | 19,517 | |

Hill International, Inc. (a) | | | 4,560 | | | | 17,510 | |

| | | | | | | | 91,214 | |

| Computers - 0.99% | | | | | | | | |

| Computer Task Group, Inc. | | | 1,550 | | | | 14,771 | |

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY MICRO CAP VALUE FUND

SCHEDULE OF INVESTMENTS

| December 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 96.41% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Diversified Financial Services - 2.70% | | | | | | |

Consumer Portfolio Services, Inc. (a) | | | 1,925 | | | $ | 14,168 | |

| Federal Agricultural Mortgage Corp. | | | 345 | | | | 10,467 | |

| Gain Capital Holdings, Inc. | | | 1,720 | | | | 15,514 | |

| | | | | | | | 40,149 | |

| Electrical Components - 1.06% | | | | | | | | |

| Powell Industries, Inc. | | | 320 | | | | 15,702 | |

| | | | | | | | | |

| Electronics - 1.90% | | | | | | | | |

| Electro Scientific Industries, Inc. | | | 1,750 | | | | 13,580 | |

ZAGG, Inc. (a) | | | 2,165 | | | | 14,700 | |

| | | | | | | | 28,280 | |

| Engineering & Construction - 3.49% | | | | | | | | |

| Comfort Systems USA, Inc. | | | 990 | | | | 16,949 | |

Orion Marine Group, Inc. (a) | | | 1,660 | | | | 18,343 | |

Sterling Construction Co., Inc. (a) | | | 2,600 | | | | 16,614 | |

| | | | | | | | 51,906 | |

| Environmental Control - 1.20% | | | | | | | | |

| Ceco Environmental Corp. | | | 1,150 | | | | 17,871 | |

| | | | | | | | | |

| Food - 1.99% | | | | | | | | |

| SpartanNash Co. | | | 1,130 | | | | 29,538 | |

| | | | | | | | | |

| Hand & Machine Tools - 1.13% | | | | | | | | |

| Hardinge, Inc. | | | 1,415 | | | | 16,867 | |

| | | | | | | | | |

| Healthcare - Products - 0.89% | | | | | | | | |

Synergetics USA, Inc. (a) | | | 3,035 | | | | 13,202 | |

| | | | | | | | | |

| Healthcare - Services - 0.67% | | | | | | | | |

Almost Family, Inc. (a) | | | 345 | | | | 9,988 | |

| | | | | | | | | |

| Home Builders - 1.26% | | | | | | | | |

WCI Communities, Inc. (a) | | | 955 | | | | 18,699 | |

| | | | | | | | | |

| Home Furnishings - 2.12% | | | | | | | | |

| Daktronics, Inc. | | | 1,200 | | | | 15,012 | |

| Hooker Furniture Corp. | | | 965 | | | | 16,569 | |

| | | | | | | | 31,581 | |

| Household Products & Wares - 0.98% | | | | | | | | |

Central Garden and Pet Co. (a) | | | 1,525 | | | | 14,564 | |

| | | | | | | | | |

| Insurance - 1.47% | | | | | | | | |

| Meadowbrook Insurance Group, Inc. | | | 2,590 | | | | 21,911 | |

| | | | | | | | | |

| Internet - 1.32% | | | | | | | | |

1-800-Flowers.com, Inc. (a) | | | 900 | | | | 7,416 | |

Safeguard Scientifics, Inc. (a) | | | 615 | | | | 12,189 | |

| | | | | | | | 19,605 | |

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY MICRO CAP VALUE FUND

SCHEDULE OF INVESTMENTS

| December 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 96.41% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Investment Companies - 1.38% | | | | | | |

| Gladstone Capital Corp. | | | 770 | | | $ | 6,368 | |

| MVC Capital, Inc. | | | 595 | | | | 5,849 | |

| Saratoga Investment Corp. | | | 560 | | | | 8,316 | |

| | | | | | | | 20,533 | |

| Iron & Steel - 1.02% | | | | | | | | |

Universal Stainless & Alloy Products, Inc. (a) | | | 605 | | | | 15,216 | |

| | | | | | | | | |

| Leisure Time - 0.70% | | | | | | | | |

| Callaway Golf Co. | | | 1,350 | | | | 10,395 | |

| | | | | | | | | |

| Lodging - 0.97% | | | | | | | | |

Century Casinos, Inc. (a) | | | 2,840 | | | | 14,342 | |

| | | | | | | | | |

| Machinery - Diversified - 1.07% | | | | | | | | |

| Global Power Equipment Group, Inc. | | | 1,150 | | | | 15,882 | |

| | | | | | | | | |

| Metal Fabricate & Hardware - 0.65% | | | | | | | | |

Northwest Pipe Co. (a) | | | 320 | | | | 9,638 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 0.93% | | | | | | | | |

| FreightCar America, Inc. | | | 525 | | | | 13,813 | |

| | | | | | | | | |

| Office & Business - 1.15% | | | | | | | | |

| Barrett Business Services, Inc. | | | 625 | | | | 17,125 | |

| | | | | | | | | |

| Oil & Gas - 0.71% | | | | | | | | |

PetroQuest Energy, Inc. (a) | | | 2,830 | | | | 10,584 | |

| | | | | | | | | |

| Oil & Gas Services - 1.80% | | | | | | | | |

| Gulf Island Fabrication, Inc. | | | 530 | | | | 10,277 | |

| North American Energy Partners, Inc. | | | 1,895 | | | | 5,950 | |

| Tesco Corp. | | | 820 | | | | 10,512 | |

| | | | | | | | 26,739 | |

| Pharmaceuticals - 0.76% | | | | | | | | |

BioScrip. Inc. (a) | | | 1,625 | | | | 11,359 | |

| | | | | | | | | |

| Real Estate Investment Trusts - 2.66% | | | | | | | | |

| Gladstone Commercial Corp. | | | 460 | | | | 7,898 | |

| Independence Realty Trust, Inc. | | | 2,090 | | | | 19,458 | |

| Monmouth Real Estate Investment Corp. | | | 1,105 | | | | 12,232 | |

| | | | | | | | 39,588 | |

| Retail - 7.44% | | | | | | | | |

Christopher & Banks Corp. (a) | | | 916 | | | | 5,230 | |

Destination XL Group, Inc. (a) | | | 2,750 | | | | 15,015 | |

Kirkland's, Inc. (a) | | | 720 | | | | 17,021 | |

Ruby Tuesday, Inc. (a) | | | 2,280 | | | | 15,595 | |

| Stein Mart, Inc. | | | 1,345 | | | | 19,664 | |

TravelCenters of America LLC (a) | | | 1,550 | | | | 19,561 | |

West Marine, Inc. (a) | | | 1,430 | | | | 18,476 | |

| | | | | | | | 110,562 | |

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY MICRO CAP VALUE FUND

SCHEDULE OF INVESTMENTS

| December 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 96.41% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Savings & Loans - 9.28% | | | | | | |

| Banc of California, Inc. | | | 1,575 | | | $ | 18,065 | |

| Berkshire Hills Bancorp, Inc. | | | 600 | | | | 15,996 | |

| Dime Community Bancshares, Inc. | | | 1,100 | | | | 17,908 | |

| ESSA Bancorp, Inc. | | | 1,180 | | | | 14,160 | |

HomeTrust Bancshares, Inc. (a) | | | 621 | | | | 10,346 | |

| Meta Financial Group, Inc. | | | 500 | | | | 17,520 | |

| SI Financial Group, Inc. | | | 1,415 | | | | 15,763 | |

| Territorial Bancorp, Inc. | | | 800 | | | | 17,240 | |

| United Community Financial Corp./OH | | | 2,050 | | | | 11,008 | |

| | | | | | | | 138,006 | |

| Semiconductors - 5.12% | | | | | | | | |

Alpha & Omega Semiconductor Ltd. (a) | | | 1,600 | | | | 14,160 | |

| IXYS Corp. | | | 1,345 | | | | 16,947 | |

Pericom Semiconductor Corp. (a) | | | 1,205 | | | | 16,316 | |

Photronics, Inc. (a) | | | 1,665 | | | | 13,836 | |

Rudolph Technologies, Inc. (a) | | | 1,450 | | | | 14,834 | |

| | | | | | | | 76,093 | |

| Software - 2.31% | | | | | | | | |

| American Software, Inc./Georgia | | | 1,500 | | | | 13,665 | |

| Concurrent Computer Corp. | | | 1,800 | | | | 12,762 | |

| Wayside Technology Group, Inc. | | | 460 | | | | 7,917 | |

| | | | | | | | 34,344 | |

| Telecommunications - 3.78% | | | | | | | | |

| Black Box Corp. | | | 640 | | | | 15,296 | |

EXFO, Inc. (a) | | | 3,110 | | | | 10,730 | |

Premiere Global Services, Inc. (a) | | | 1,075 | | | | 11,417 | |

| Spok Holdings, Inc. | | | 515 | | | | 8,940 | |

Westell Technologies, Inc. (a) | | | 6,500 | | | | 9,750 | |

| | | | | | | | 56,133 | |

| Transportation - 4.66% | | | | | | | | |

| Aegean Marine Petroleum Network, Inc. | | | 1,530 | | | | 21,451 | |

| Celadon Group, Inc. | | | 855 | | | | 19,400 | |

Covenant Transportation Group, Inc. (a) | | | 505 | | | | 13,691 | |

| Marten Transport Ltd. | | | 670 | | | | 14,646 | |

| | | | | | | | 69,188 | |

| Total Common Stocks (Cost $1,369,699) | | | | | | | 1,433,120 | |

| | | | | | | | | |

| MONEY MARKET FUND - 5.65% | | | | | | | | |

First American Prime Obligations Fund Class Z, 0.02% (b) (Cost $83,941) | | | 83,941 | | | | 83,941 | |

| | | | | | | | | |

| Total Investments at Fair Value - 102.06% (Cost $1,453,640) | | | | | | | 1,517,061 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets, Net - (2.06)% | | | | | | | (30,609 | ) |

| | | | | | | | | |

| Net Assets - 100.00% | | | | | | $ | 1,486,452 | |

(a) Non-income producing security.

(b) Rate shown represents the 7-day yield at December 31, 2014, is subject to change and resets daily.

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS

| December 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 98.35% | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Banks - 16.30% | | | | | | |

| Banner Corp. | | | 465 | | | $ | 20,004 | |

| Financial Institutions, Inc. | | | 620 | | | | 15,593 | |

| First Financial Corp. IN | | | 550 | | | | 19,591 | |

First NBC Bank Holding Co. (a) | | | 537 | | | | 18,902 | |

| Hanmi Financial Corp. | | | 835 | | | | 18,211 | |

| Independent Bank Corp./Rockland MA | | | 460 | | | | 19,693 | |

| MainSource Financial Group, Inc. | | | 1,085 | | | | 22,698 | |

| Old National Bancorp IN | | | 1,190 | | | | 17,707 | |

| Susquehanna Bancshares Inc | | | 800 | | | | 10,744 | |

| Towne Bank - Portsmouth, VA | | | 1,225 | | | | 18,522 | |

| | | | | | | | 181,665 | |

| Building Materials - 1.83% | | | | | | | | |

Gibraltar Industries, Inc. (a) | | | 1,255 | | | | 20,406 | |

| | | | | | | | | |

| Commercial Services - 3.58% | | | | �� | | | | |

| Aaron's, Inc. | | | 650 | | | | 19,870 | |

Great Lakes Dredge & Dock Corp. (a) | | | 2,340 | | | | 20,030 | |

| | | | | | | | 39,900 | |

| Computers - 2.50% | | | | | | | | |

| Mentor Graphics Corp. | | | 725 | | | | 15,892 | |

Synaptics, Inc. (a) | | | 175 | | | | 12,047 | |

| | | | | | | | 27,939 | |

| Diversified Financial Services - 1.25% | | | | | | | | |

| FXCM, Inc. | | | 845 | | | | 14,002 | |

| | | | | | | | | |

| Electric - 1.67% | | | | | | | | |

| Portland General Electric Co. | | | 492 | | | | 18,612 | |

| | | | | | | | | |

| Electrical Components & Equipment - 3.05% | | | | | | | | |

| Encore Wire Corp. | | | 450 | | | | 16,799 | |

| Powell Industries, Inc. | | | 350 | | | | 17,175 | |

| | | | | | | | 33,974 | |

| Electronics - 2.36% | | | | | | | | |

| AVX Corp. | | | 920 | | | | 12,880 | |

Plexus Corp. (a) | | | 325 | | | | 13,393 | |

| | | | | | | | 26,273 | |

| Engineering & Construction - 2.11% | | | | | | | | |

| Comfort Systems USA, Inc. | | | 1,375 | | | | 23,540 | |

| | | | | | | | | |

| Environmental Control - 1.63% | | | | | | | | |

| Ceco Environmental Corp. | | | 1,168 | | | | 18,151 | |

| | | | | | | | | |

| Food - 1.75% | | | | | | | | |

| SpartanNash Co. | | | 745 | | | | 19,474 | |

| | | | | | | | | |

| Forest Products & Paper - 3.07% | | | | | | | | |

| Deltic Timber Corp. | | | 270 | | | | 18,468 | |

| PH Glatfelter Co. | | | 615 | | | | 15,726 | |

| | | | | | | | 34,194 | |

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS

| December 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 98.35% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Gas - 0.92% | | | | | | |

| ONE Gas, Inc. | | | 250 | | | $ | 10,305 | |

| | | | | | | | | |

| Home Builders - 1.71% | | | | | | | | |

WCI Communities, Inc. (a) | | | 975 | | | | 19,090 | |

| | | | | | | | | |

| Home Furnishings - 4.80% | | | | | | | | |

| Daktronics, Inc. | | | 1,125 | | | | 14,074 | |

| Ethan Allen Interiors, Inc. | | | 580 | | | | 17,963 | |

| La-Z-Boy, Inc. | | | 800 | | | | 21,472 | |

| | | | | | | | 53,509 | |

| Household Products & Wares - 1.31% | | | | | | | | |

Central Garden and Pet Co. (a) | | | 1,525 | | | | 14,564 | |

| | | | | | | | | |

| Insurance - 2.05% | | | | | | | | |

| Meadowbrook Insurance Group, Inc. | | | 2,700 | | | | 22,842 | |

| | | | | | | | | |

| Iron & Steel - 1.61% | | | | | | | | |

| Carpenter Technology Corp. | | | 365 | | | | 17,976 | |

| | | | | | | | | |

| Machinery - Diversified - 1.36% | | | | | | | | |

| Global Power Equipment Group, Inc. | | | 1,100 | | | | 15,191 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 2.65% | | | | | | | | |

| FreightCar America, Inc. | | | 631 | | | | 16,602 | |

LSB Industries, Inc. (a) | | | 410 | | | | 12,890 | |

| | | | | | | | 29,492 | |

| Oil & Gas - 1.12% | | | | | | | | |

Goodrich Petroleum Corp. (a) | | | 650 | | | | 2,886 | |

PetroQuest Energy, Inc. (a) | | | 2,570 | | | | 9,612 | |

| | | | | | | | 12,498 | |

| Oil & Gas Services - 2.18% | | | | | | | | |

Helix Energy Solutions Group, Inc. (a) | | | 375 | | | | 8,137 | |

Matrix Service Co. (a) | | | 450 | | | | 10,044 | |

| North American Energy Partners, Inc. | | | 1,940 | | | | 6,092 | |

| | | | | | | | 24,273 | |

| Pharmaceuticals - 2.24% | | | | | | | | |

BioScrip. Inc. (a) | | | 1,649 | | | | 11,527 | |

Impax Laboratories, Inc. (a) | | | 425 | | | | 13,464 | |

| | | | | | | | 24,991 | |

| Real Estate - 1.10% | | | | | | | | |

Forestar Group, Inc. (a) | | | 800 | | | | 12,320 | |

| | | | | | | | | |

| Real Estate Investment Trusts - 5.22% | | | | | | | | |

| Brandywine Realty Trust | | | 817 | | | | 13,056 | |

| Hersha Hospitality Trust | | | 2,092 | | | | 14,707 | |

| LaSalle Hotel Properties | | | 405 | | | | 16,390 | |

| Lexington Realty Trust | | | 1,275 | | | | 14,000 | |

| | | | | | | | 58,153 | |

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS

| December 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 98.35% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Retail - 9.19% | | | | | | |

| Big Lots, Inc. | | | 260 | | | $ | 10,405 | |

Bloomin' Brands, Inc. (a) | | | 775 | | | | 19,189 | |

Kirkland's, Inc. (a) | | | 775 | | | | 18,321 | |

Ruby Tuesday, Inc. (a) | | | 2,300 | | | | 15,732 | |

| Stein Mart, Inc. | | | 1,400 | | | | 20,468 | |

| TravelCenters of America LLC | | | 1,450 | | | | 18,299 | |

| | | | | | | | 102,414 | |

| Savings & Loans - 5.74% | | | | | | | | |

| Banc of California, Inc. | | | 1,655 | | | | 18,983 | |

| Berkshire Hills Bancorp, Inc. | | | 680 | | | | 18,129 | |

BofI Holding, Inc. (a) | | | 225 | | | | 17,507 | |

HomeTrust Bancshares, Inc. (a) | | | 562 | | | | 9,363 | |

| | | | | | | | 63,982 | |

| Semiconductors - 4.45% | | | | | | | | |

Entegris, Inc. (a) | | | 875 | | | | 11,559 | |

Photronics, Inc. (a) | | | 1,525 | | | | 12,673 | |

QLogic Corp. (a) | | | 900 | | | | 11,988 | |

Rudolph Technologies, Inc. (a) | | | 1,311 | | | | 13,412 | |

| | | | | | | | 49,632 | |

| Software - 1.32% | | | | | | | | |

Allscripts Healthcare Solutions,. Inc. (a) | | | 1,150 | | | | 14,686 | |

| | | | | | | | | |

| Telecommunications - 3.18% | | | | | | | | |

| Black Box Corp. | | | 550 | | | | 13,145 | |

| Plantronics, Inc. | | | 225 | | | | 11,929 | |

Premiere Global Services, Inc. (a) | | | 975 | | | | 10,354 | |

| | | | | | | | 35,428 | |

| Transportation - 5.10% | | | | | | | | |

| Aegean Marine Petroleum Network, Inc. | | | 1,420 | | | | 19,908 | |

| Celadon Group, Inc. | | | 834 | | | | 18,923 | |

| Marten Transport Ltd. | | | 825 | | | | 18,035 | |

| | | | | | | | 56,866 | |

| Total Common Stocks (Cost $1,026,190) | | | | | | | 1,096,342 | |

| | | | | | | | | |

| MONEY MARKET FUND - 5.18% | | | | | | | | |

First American Prime Obligations Fund Class Z, 0.02% (b) (Cost $57,761) | | | 57,761 | | | | 57,761 | |

| | | | | | | | | |

| Total Investments at Fair Value - 103.53% (Cost $1,083,951) | | | | | | | 1,154,103 | |

| | | | | | | | | |

| Liabilities in Excess of other Assets, Net - (3.53%) | | | | | | | (39,369 | ) |

| | | | | | | | | |

| Net Assets - 100.00% | | | | | | $ | 1,114,734 | |

(a) Non-income producing security.

(b) Rate shown represents the 7-day yield at December 31, 2014, is subject to change and resets daily.

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY MICRO CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

| December 31, 2014 | ANNUAL REPORT |

| Assets: | | | |

| Investments, at value (identified cost $1,453,640) | | $ | 1,517,061 | |

| Due from advisor | | | 6,455 | |

| Receivables: | | | | |

| Interest | | | 1 | |

| Dividends | | | 1,354 | |

| Investment securities sold | | | 8,511 | |

| Prepaid expenses | | | 929 | |

| Total assets | | | 1,534,311 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Investment securities purchased | | | 21,826 | |

| Due to administrator | | | 2,780 | |

| Due to trustees | | | 1,791 | |

| Accrued expenses | | | 21,462 | |

| Total liabilities | | | 47,859 | |

| Net Assets | | $ | 1,486,452 | |

| | | | | |

| Sources of Net Assets: | | | | |

| Paid-in capital | | $ | 1,384,401 | |

| Accumulated net realized gain on investments | | | 38,630 | |

| Net unrealized appreciation on investments | | | 63,421 | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 1,486,452 | |

| | | | | |

| | | | | |

| Institutional Class Shares: | | | | |

| Net assets applicable to 137,876 shares outstanding | | $ | 1,486,452 | |

| Net Asset Value and Offering Price Per Share | | $ | 10.78 | |

| Minimum Redemption Price Per Share (a) | | $ | 10.56 | |

(a) A 2.00% redemption fee is assessed on redemption transactions of shares that are held for 90 days or less.

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY SMALL CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

| December 31, 2014 | ANNUAL REPORT |

| Assets: | | | |

| Investments, at value (identified cost $1,083,951) | | $ | 1,154,103 | |

| Due from advisor | | | 3,049 | |

| Receivables: | | | | |

| Dividends | | | 1,691 | |

| Investment securities sold | | | 6,507 | |

| Prepaid expenses | | | 929 | |

| Total assets | | | 1,166,279 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Investment securities purchased | | | 27,145 | |

| Due to administrator | | | 2,680 | |

| Due to trustees | | | 1,792 | |

| Accrued expenses | | | 19,928 | |

| Total liabilities | | | 51,545 | |

| Net Assets | | $ | 1,114,734 | |

| | | | | |

| Sources of Net Assets: | | | | |

| Paid-in capital | | $ | 1,065,413 | |

| Accumulated net realized loss on investments | | | (20,831 | ) |

| Net unrealized appreciation on investments | | | 70,152 | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 1,114,734 | |

| Institutional Class Shares: | | | | |

| Net assets applicable to 107,731 shares outstanding | | $ | 1,114,734 | |

| Net Asset Value and Offering Price Per Share | | $ | 10.35 | |

Minimum Redemption Price Per Share (a) | | $ | 10.14 | |

(a) A 2.00% redemption fee is assessed on redemption transactions of shares that are held for 90 days or less.

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY MICRO CAP VALUE FUND

STATEMENT OF OPERATIONS

| December 31, 2014 | ANNUAL REPORT |

| | | For the | |

| | | Period Ended | |

| | | December 31, 2014 (a) | |

| | | | |

| Investment income: | | | |

| Dividends (net of foreign withholding taxes of $32) | | $ | 11,046 | |

| Interest | | | 8 | |

| Total investment income | | | 11,054 | |

| | | | | |

| Expenses: | | | | |

| Management fees (Note 5) | | | 8,281 | |

| Accounting and transfer agent fees and expenses | | | 28,967 | |

| Audit fees | | | 15,750 | |

| Legal fees | | | 11,682 | |

| Custodian fees | | | 11,586 | |

| Miscellaneous | | | 8,925 | |

| Trustee fees and expenses | | | 8,820 | |

| Pricing fees | | | 7,732 | |

| Insurance fees | | | 987 | |

| Reports to shareholders | | | 500 | |

| Registration and filing fees | | | 364 | |

| Total expenses | | | 103,594 | |

| Less: fees waived and expenses absorbed | | | (89,103 | ) |

| Net expenses | | | 14,491 | |

| | | | | |

| Net investment loss | | | (3,437 | ) |

| | | | | |

| Realized and unrealized gain (loss): | | | | |

| Net realized gain on: | | | | |

| Investments | | | 71,586 | |

| Net realized gain on investments | | | 71,586 | |

| | | | | |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | 63,421 | |

| Net change in unrealized appreciation | | | 63,421 | |

| | | | | |

| Net gain on investments | | | 135,007 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 131,570 | |

(a) The Foundry Micro Cap Value Fund commenced operations on January 30, 2014.

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY SMALL CAP VALUE FUND

STATEMENT OF OPERATIONS

| December 31, 2014 | ANNUAL REPORT |

| | | For the | |

| | | Period Ended | |

| | | December 31, 2014 (a) | |

| | | | |

| Investment income: | | | |

| Dividends (net of foreign withholding taxes of $21) | | $ | 11,016 | |

| Interest | | | 5 | |

| Total investment income | | | 11,021 | |

| | | | | |

| Expenses: | | | | |

| Management fees (Note 5) | | | 6,770 | |

| Accounting and transfer agent fees and expenses | | | 28,999 | |

| Audit fees | | | 15,750 | |

| Legal fees | | | 11,682 | |

| Miscellaneous | | | 8,925 | |

| Trustee fees and expenses | | | 8,820 | |

| Custodian fees | | | 7,590 | |

| Pricing fees | | | 5,537 | |

| Insurance fees | | | 987 | |

| Reports to shareholders | | | 500 | |

| Registration and filing fees | | | 364 | |

| Total expenses | | | 95,924 | |

| Less: fees waived and expenses absorbed | | | (83,230 | ) |

| Net expenses | | | 12,694 | |

| | | | | |

| Net investment loss | | | (1,673 | ) |

| | | | | |

| Realized and unrealized gain (loss): | | | | |

| Net realized gain on: | | | | |

| Investments | | | 3,599 | |

| Net realized gain on investments | | | 3,599 | |

| | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 70,152 | |

| Net change in unrealized appreciation | | | 70,152 | |

| | | | | |

| Net gain on investments | | | 73,751 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 72,078 | |

(a) The Foundry Small Cap Value Fund commenced operations on January 30, 2014.

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY MICRO CAP VALUE FUND

STATEMENT OF CHANGES IN NET ASSETS

| December 31, 2014 | ANNUAL REPORT |

| | | | |

| Increase (decrease) in net assets from: | | | |

| Operations: | | | |

| Net investment loss | | $ | (3,437 | ) |

| Net realized gain on investments | | | 71,586 | |

| Net unrealized appreciation on investments | | | 63,421 | |

| Net increase in net assets resulting from operations | | | 131,570 | |

| | | | | |

| Distributions to shareholders from: | | | | |

| Net realized capital gains | | | (29,519 | ) |

| Decrease in net assets resulting from distributions | | | (29,519 | ) |

| | | | | |

| Capital share transactions (Note 3): | | | | |

| Increase in net assets from capital share transactions | | | 1,384,401 | |

| | | | | |

| Increase in net assets | | | 1,486,452 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | - | |

| | | | | |

| End of period | | $ | 1,486,452 | |

| Undistributed net investment income | | $ | - | |

(a) The Foundry Micro Cap Value Fund commenced operations on January 30, 2014.

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY SMALL CAP VALUE FUND

STATEMENT OF CHANGES IN NET ASSETS

| December 31, 2014 | ANNUAL REPORT |

| | | For the | |

| | | Period Ended | |

| | | December 31, 2014 (a) | |

| | | | |

| Increase (decrease) in net assets from: | | | |

| Operations: | | | |

| Net investment loss | | $ | (1,673 | ) |

| Net realized gain on investments | | | 3,599 | |

| Net unrealized appreciation on investments | | | 70,152 | |

| Net increase in net assets resulting from operations | | | 72,078 | |

| | | | | |

| Distributions to shareholders from: | | | | |

| Net realized capital gains | | | (22,757 | ) |

| Decrease in net assets resulting from distributions | | | (22,757 | ) |

| | | | | |

| Capital share transactions (Note 3): | | | | |

| Increase in net assets from capital share transactions | | | 1,065,413 | |

| | | | | |

| Increase in net assets | | | 1,114,734 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | - | |

| | | | | |

| End of period | | $ | 1,114,734 | |

| Undistributed net investment income | | $ | - | |

(a) The Foundry Small Cap Value Fund commenced operations on January 30, 2014.

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY MICRO CAP VALUE FUND

FINANCIAL HIGHLIGHTS

| December 31, 2014 | | ANNUAL REPORT |

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | FOUNDRY MICRO CAP VALUE FUND | | |

| | | For the | | |

| | | Period Ended | | |

| | | December 31, 2014 (a) | | |

| | | | | |

| | | | | |

| Net Asset Value, Beginning of Period | | $ | 10.00 | | |

| | | | | | |

| Investment Operations: | | | | | |

| Net investment loss | | | (0.02 | ) | |

| Net realized and unrealized gain on investments | | | 1.02 | | |

| Total from investment operations | | | 1.00 | | |

| | | | | | |

| Distributions: | | | | | |

| From net realized capital gains | | | (0.22 | ) | |

| Total distributions | | | (0.22 | ) | |

| | | | | | |

| Net Asset Value, End of Year/Period | | $ | 10.78 | | |

| | | | | | |

Total Return (b) | | | 10.03 | % | (c)(d) |

| | | | | | |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of period (in 000's) | | $ | 1,486 | | |

| | | | | | |

Ratio of expenses to average net assets (e): | | | | | |

| Before fees waived and expenses absorbed | | | 12.51 | % | (f) |

| After fees waived and expenses absorbed | | | 1.75 | % | (f) |

| | | | | | |

Ratio of net investment income (loss) (e): | | | | | |

| Before fees waived and expenses absorbed | | | (11.18 | )% | (f) |

| After fees waived and expenses absorbed | | | (0.42 | )% | (f) |

| | | | | | |

| Portfolio turnover rate | | | 58 | % | (c) |

(a) | The Foundry Micro Cap Value Fund commenced operations on January 30, 2014. |

(b) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

(d) | Total Return is for the period from January 30, 2014, the date of initial portfolio trades, through December 31, 2014. |

(e) | Ratios are for the period from January 30, 2014, the date of initial expense accruals, through December 31, 2014. |

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS

FOUNDRY SMALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

| December 31, 2014 | ANNUAL REPORT |

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | FOUNDRY SMALL CAP VALUE FUND | | |

| | | For the | | |

| | | Period Ended | | |

| | | December 31, 2014 (a) | | |

| | | | | |

| | | | | |

| Net Asset Value, Beginning of Period | | $ | 10.00 | | |

| | | | | | |

| Investment Operations: | | | | | |

| Net investment loss | | | (0.02 | ) | |

| Net realized and unrealized gain on investments | | | 0.59 | | |

| Total from investment operations | | | 0.57 | | |

| | | | | | |

| Distributions: | | | | | |

| From net realized capital gains | | | (0.22 | ) | |

| Total distributions | | | (0.22 | ) | |

| | | | | | |

| Net Asset Value, End of Year/Period | | $ | 10.35 | | |

| | | | | | |

Total Return (b) | | | 5.71 | % | (c)(d) |

| | | | | | |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of period (in 000's) | | $ | 1,115 | | |

| | | | | | |

Ratio of expenses to average net assets (e): | | | | | |

| Before fees waived and expenses absorbed | | | 11.34 | % | (f) |

| After fees waived and expenses absorbed | | | 1.50 | % | (f) |

| | | | | | |

Ratio of net investment income (loss) (e): | | | | | |

| Before fees waived and expenses absorbed | | | (10.03 | )% | (f) |

| After fees waived and expenses absorbed | | | (0.19 | )% | (f) |

| | | | | | |

| Portfolio turnover rate | | | 75 | % | (c) |

(a) | The Foundry Small Cap Value Fund commenced operations on January 30, 2014. |

(b) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

(d) | Total Return is for the period from January 30, 2014, the date of initial portfolio trades, through December 31, 2014. |

(e) | Ratios are for the period from January 30, 2014, the date of initial expense accruals, through December 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| Foundry Partners, LLC Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2014

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

The Foundry Partners, LLC Funds (the “Funds”) are series of 360 Funds (the “Trust”). The Trust was organized on February 24, 2005, as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The following series of funds advised by Foundry Partners, LLC: (i) Foundry Micro Cap Value Fund (“Micro Cap Value Fund”), and (ii) Foundry Small Cap Value Fund (“Small Cap Value Fund”), (each a “Fund” and collectively, the “Funds”) are each an open end management investment company and separate series of the Trust. The investment objective of the Foundry Micro Cap Value Fund is capital appreciation. The investment objective of the Foundry Small Cap Value Fund is capital appreciation. The Funds are diversified Funds. The Funds’ investment adviser is Foundry Partners, LLC (the “Adviser”). The Funds each have one class of shares, Institutional Class Shares. The Institutional Class Shares commenced operations on January 30, 2014.

a) Security Valuation – All investments in securities are recorded at their estimated fair value, as described in note 2.

b) Exchange Traded Funds – The Funds may invest in Exchange Traded Funds (“ETFs”). ETFs are registered investment companies and incur fees and expenses such as operating expenses, licensing fees, registration fees, trustees fees, and marketing expenses, and ETF shareholders, such as a Fund, pay their proportionate share of these expenses. Your cost of investing in a Fund will generally be higher than the cost of investing directly in ETFs. By investing in a Fund, you will indirectly bear fees and expenses charged by the underlying ETFs in which a Fund invests in addition to a Fund's direct fees and expenses.

c) Federal Income Taxes – The Funds intend to qualify as regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Funds to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of their net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

As of December 31, 2014 and during the period since inception from January 30, 2014 through December 31, 2014, the Funds did not have a liability for any unrecognized tax expenses. The Funds recognize interest and penalties, if any, related to unrecognized tax liability as income tax expense in the statement of operations. During the period since inception from January 30, 2014 through December 31, 2014, the Funds did not incur any interest or penalties. The Funds identify their major tax jurisdictions as U.S. Federal and Delaware state.

d) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. Accounting principles generally accepted in the United States of America ("GAAP") requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains. As of December 31, 2014, the Funds recorded reclassifications to increase (decrease) the capital accounts as follows:

| Fund | | Net Investment Loss | | | Paid-in Capital | | | Net Realized Capital Gains | |

| Micro Cap Value Fund: | | $ | 3,437 | | | $ | - | | | $ | (3,437 | ) |

| Small Cap Value Fund | | | 1,673 | | | | - | | | | (1,673 | ) |

e) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Other – Investment and shareholder transactions are recorded on trade date. The Funds determine the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Funds and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Funds' understanding of the applicable country’s tax rules and rates.

| Foundry Partners, LLC Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2014

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

g) Investments in Small-Cap Companies and Micro-Cap Companies – A Fund may invest a significant portion of its assets in securities of companies with small market capitalizations or micro market capitalizations. Certain small-cap companies and micro-cap companies may offer greater potential for capital appreciation than larger companies. However, investors should note that this potential for greater capital appreciation is accompanied by a substantial risk of loss and that, by their very nature, investments in small-cap companies and micro-cap companies tend to be very volatile and speculative. Small-cap companies and micro-cap companies may have a small share of the market for their products or services, their businesses may be limited to regional markets, or they may provide goods and services for a limited market. For example, they may be developing or marketing new products or services for markets that are not yet established or may never become established. In addition, small-cap companies and micro-cap companies may have or will develop only a regional market for products or services and thus be affected by local or regional market conditions. In addition, small-cap companies and micro-cap companies may lack depth of management or they may be unable to generate funds necessary for growth or potential development, either internally or through external financing on favorable terms. Such companies may also be insignificant in their industries and be subject to or become subject to intense competition from larger companies. Due to these and other factors, a Fund’s investments in small-cap companies and micro-cap companies may suffer significant losses. Further, there is typically a smaller market for the securities of a small-cap company or micro-cap company than for securities of a large company. Therefore, investments in small-cap companies and micro-cap companies may be less liquid and subject to significant price declines that result in losses for a Fund.

h) Redemption fees - Shareholders that redeem shares within 90 days of purchase will be assessed a redemption fee of 2.00% of the amount redeemed. The redemption fee is paid directly to and retained by the Funds, and is designed to deter excessive short-term trading and to offset brokerage commissions, market impact and other costs that may be associated with short-term money movement in and out of the Funds. No redemption fees were paid to the Funds during the period since inception from January 30, 2014 through December 31, 2014.

Processes and Structure

The Funds' Board of Trustees has adopted guidelines for valuing securities and other derivative instruments including in circumstances in which market quotes are not readily available, and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board of Trustees.

Hierarchy of Fair Value Inputs

The Funds utilize various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| • | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| • | Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| • | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Funds' own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

| Foundry Partners, LLC Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2014

| 2. | SECURITIES VALUATIONS (continued) |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Value Measurements

A description of the valuation techniques applied to the Funds' major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock and ETFs) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts, financial futures, Exchange Traded Funds, and the movement of certain indexes of securities based on a statistical analysis of the historical relationship and are categorized in Level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in Level 2.

Money market funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1.

The following table summarizes the inputs used to value the Funds' assets and liabilities measured at fair value as of December 31, 2014:

Categories (a) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Micro Cap Value Fund: | | | | | | | | | | | | |

Common Stock (b) | | $ | 1,433,120 | | | | - | | | | - | | | $ | 1,433,120 | |

| Money market funds | | | 83,941 | | | | - | | | | - | | | | 83,941 | |

| Total Investments in Securities | | $ | 1,517,061 | | | | - | | | | - | | | $ | 1,517,061 | |

| Small Cap Value Fund: | | | | | | | | | | | | | | | | |

Common Stock (b) | | $ | 1,096,342 | | | | - | | | | - | | | $ | 1,096,342 | |

| Money market funds | | | 57,761 | | | | - | | | | - | | | | 57,761 | |

| Total Investments in Securities | | $ | 1,154,103 | | | | - | | | | - | | | $ | 1,154,103 | |

(a) As of December 31, 2014 and during the period since inception from January 30, 2014 through December 31, 2014, the Funds held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

(b) All common stock held in the Funds are Level 1 securities. For a detailed break-out of common stock by industry, please refer to the Schedules of Investments.

The Funds recognize transfers, if any, between fair value hierarchy levels at the reporting period end. There were no transfers between levels as of December 31, 2014, from the valuation input levels used on January 30, 2014 (inception date).

During the period since inception from January 30, 2014 through December 31, 2014, no securities were fair valued.

| Foundry Partners, LLC Funds | | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2014

| 3. | CAPITAL SHARE TRANSACTIONS |

Transactions in shares of capital stock for the Funds for the period since inception from January 30, 2014 through December 31, 2014 were as follows:

| MicroCap Value Fund: | | Sold | | | Redeemed | | | Reinvested | | | Net Increase | |

| Institutional Class Shares | | | | | | | | | | | | |

| Shares | | | 140,143 | | | | (5,062 | ) | | | 2,795 | | | | 137,876 | |

| Value | | $ | 1,406,000 | | | $ | (51,118 | ) | | $ | 29,519 | | | $ | 1,384,401 | |

| Small Cap Value Fund: | | Sold | | | Redeemed | | | Reinvested | | | Net Increase | |

| Institutional Class Shares | | | | | | | | | | | | |

| Shares | | | 110,625 | | | | (5,143 | ) | | | 2,249 | | | | 107,731 | |

| Value | | $ | 1,094,642 | | | $ | (51,986 | ) | | $ | 22,757 | | | $ | 1,065,413 | |

| 4. | INVESTMENT TRANSACTIONS |

For the period since inception from January 30, 2014 through December 31, 2014, aggregate purchases and sales of investment securities (excluding short-term investments) were as follows:

| Fund | | Purchases | | | Sales | |

| Micro Cap Value Fund | | $ | 1,789,004 | | | $ | 489,547 | |

| Small Cap Value Fund | | | 1,671,694 | | | | 648,307 | |

There were no government securities purchased or sold during the period.

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

The Funds have entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations of the Funds and manages the Funds' investments in accordance with the stated policies of the Funds. As compensation for the investment advisory services provided to the Funds, the Adviser will receive a monthly management fee equal to an annual rate of each Fund’s net assets for Institutional Class shares as follows:

Fund | | Management Fee Rate | | | Incurred | |

| Micro Cap Value Fund: | | | 1.00 | % | | $ | 8,281 | |

| Small Cap Value Fund | | | 0.80 | % | | | 6,770 | |

The Adviser and the Funds have entered into an Expense Limitation Agreement (“Expense Agreements”) under which the Adviser has agreed to waive or reduce its fees and to assume other expenses of each Fund, if necessary, in an amount that limits annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, acquired fund fees and expenses, shareholder servicing fees, extraordinary expenses, dividend and interest expenses in connection with securities sold short and payments, if any, under the Rule 12b-1 Plan) to not more than the following percentages of average daily net assets of each of the Funds through April 30, 2016:

Fund | | Expense Limitation | | | Management Fees Waived | | | Expenses Reimbursed | |

| Micro Cap Value Fund: | | | 1.75 | % | | $ | 8,281 | | | $ | 80,822 | |

| Small Cap Value Fund | | | 1.50 | % | | | 6,770 | | | | 76,460 | |

| Foundry Partners, LLC Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2014

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued) |

If, at any time, the annualized expenses of Funds were less than the annualized expense ratios, the Funds would reimburse the Adviser for any fees previously waived and/or expenses previously assumed; provided, however, that repayment would be payable only to the extent that it (a) can be made during the three (3) years following the time at which the Adviser waived fees or assumed expenses for the Funds, and (b) can be repaid without causing the expenses of Funds to exceed the annualized expense ratios.

At December 31, 2014, the cumulative unreimbursed amounts paid and/or waived by the Adviser on behalf of the Funds that may be recouped no later than the dates stated below are as follows:

| Fund | | December 31, 2017 | | | Totals | |

| Micro Cap Value Fund: | | $ | 89,103 | | | $ | 89,103 | |

| Small Cap Value Fund | | | 83,230 | | | | 83,230 | |

The Funds have entered into an Investment Company Services Agreement (“Services Agreement”) with Matrix 360 Administration, LLC (“M3Sixty”). Under the Services Agreement, M3Sixty is responsible for a wide variety of functions, including but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Funds’ portfolio securities; (d) pricing the Funds’ shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Funds’ legal compliance; (j) maintaining shareholder account records.

For the period since inception from January 30, 2014 through December 31, 2014, the Funds incurred fees pursuant to the Services Agreement as follows:

| Fund | | Service Fees | |

| Micro Cap Value Fund: | | $ | 28,967 | |

| Small Cap Value Fund | | | 28,999 | |

Certain officers and a Trustee of the Funds are also employees of M3Sixty.

The Funds have entered into a Distribution Agreement with Matrix Capital Group, Inc. (the “Distributor”). Pursuant to the Distribution Agreement, the Distributor will provide distribution services to the Funds. The Distributor serves as underwriter/distributor of the Funds. Fees incurred pursuant to the Distribution Agreement are paid by the Funds' Adviser, not the Funds, therefore, there were no payments made to the Distributor by the Funds during the period since inception from January 30, 2014 through December 31, 2014.

The Distributor is not affiliated with the Adviser. The Distributor is an affiliate of M3Sixty.

For U.S. Federal income tax purposes, the cost of securities owned, gross appreciation, gross depreciation, and net unrealized appreciation/(depreciation) of investments at December 31, 2014 were as follows:

Fund | | Tax Cost | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized Appreciation | |

| Micro Cap Value Fund: | | $ | 1,456,054 | | | $ | 129,211 | | | $ | (68,204 | ) | | $ | 61,007 | |

| Small Cap Value Fund | | | 1,085,221 | | | | 109,245 | | | | (40,363 | ) | | | 68,882 | |

The difference between book basis unrealized appreciation and tax-basis unrealized appreciation for the Funds is attributable primarily to the tax deferral of losses on wash sales.

| Foundry Partners, LLC Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTSDecember 31, 2014

| 6. | TAX MATTERS (continued) |

The Funds’ tax basis distributable earnings are determined only at the end of each fiscal year. The tax character of distributable earnings (deficit) at December 31, 2014, the Funds’ most recent fiscal year end, was as follows:

Fund | | Unrealized Appreciation (Depreciation) | | | Undistributed Ordinary Income | | | Undistributed Capital Gains | | | Post-October Losses | | | Total Distributable Earnings | |

| Micro Cap Value Fund: | | $ | 61,007 | | | $ | 40,686 | | | $ | 358 | | | $ | - | | | $ | 102,051 | |

| Small Cap Value Fund | | | 68,882 | | | | 285 | | | | 75 | | | | (19,921 | ) | | | 49,321 | |

The undistributed ordinary income and capital gains shown above differ from corresponding accumulated net investment income and accumulated net realized gain (loss) figures reported in the statements of assets and liabilities due to differing book/tax treatment of short-term capital gains, and certain temporary book/tax differences due to the tax deferral of losses on wash sales.