UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

(Exact name of registrant as specified in charter)

| 4520 Main Street, Suite 1425 Kansas City, MO | 64111 |

| (Address of principal executive offices) | (Zip code) |

Matrix 360 Administration, LLC

4520 Main Street

Suite 1425

Kansas City, MO 64111

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-244-6235

Date of fiscal year end: 08/31/2014

Date of reporting period: 08/31/2014

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the WP Large Cap Income Plus Fund, a series of the 360 Funds (the “registrant”), for the period ended August 31, 2014 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

WP Large Cap Income Plus Fund

Institutional Class Shares (Ticker Symbol: WPLCX)

A series of the

360 Funds

ANNUAL REPORT

August 31, 2014

Investment Adviser

Winning Points Advisers, LLC

129 NW 13th Street, Suite D-26

Boca Raton, Florida 33431

| LETTER TO SHAREHOLDERS | 1 |

| INVESTMENT HIGHLIGHTS | 3 |

| SCHEDULE OF INVESTMENTS | 5 |

| SCHEDULE OF PURCHASED OPTIONS | 8 |

| SCHEDULE OF WRITTEN OPTIONS | 9 |

| STATEMENT OF ASSETS AND LIABILITIES | 11 |

| STATEMENT OF OPERATIONS | 12 |

| STATEMENT OF CHANGES IN NET ASSETS | 13 |

| FINANCIAL HIGHLIGHTS | 14 |

| NOTES TO FINANCIAL STATEMENTS | 15 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 23 |

| ADDITIONAL INFORMATION | 24 |

| INFORMATION ABOUT YOUR FUND’S EXPENSES | 28 |

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

LETTER TO SHAREHOLDERS

August 31, 2014 (Unaudited)

Dear Shareholders,

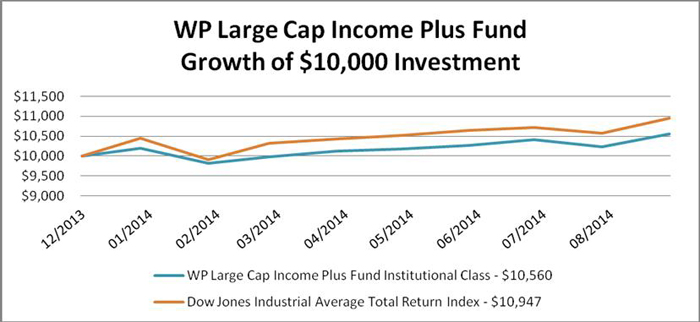

What a great year it has been. We launched the WP Large Cap Income Plus Fund (the “Fund) in the fourth quarter of last year during a time in which the markets reached new highs and continued this trend into the current year. During the period from December 4, 2013, the date of initial portfolio trades, to August 31, 2014, the Fund delivered a return of 5.60% (a) versus a return of 9.47% for the Dow Jones Industrial Average Total Return Index(b), the Fund’s general benchmark, during the same period. To put this in perspective, however, we view the performance of the Fund during this period with a sense of accomplishment recognizing that this was a start-up period in which the Fund was trying to grow assets and the challenges faced in fully implementing our options overlay strategy which did not occur until the last quarter of the fiscal year.

As we have been commenting for a while, we believe there are few places other than stocks to invest money for income. Our portfolio of income producing stocks has a high exposure to multi-nationals and companies that are buying their own shares back which tend to increase their earnings and raise dividends. We think it's likely that this trend may continue even in the near future when our Federal Reserve may finally start to raise interest rates, which is just another sign that the economy is on solid footing.

Our portfolio is not just structured around high dividend stocks. We also search for stocks that we believe will be stronger when inflation returns, which we believe is a necessary evil if the world governments are going to be able to pay back all the debt they have run up. We want our investments to be on the right side of that reality as it starts to surface in the coming years. Perhaps, as is common, the markets will anticipate this well ahead of its actual appearance. With this in mind, we have tried to be ahead of the curve in our selection of stocks for the portfolio. Inflation is generally the enemy to investors in fixed income securities, but can be a friend to those who own companies or assets that might benefit from it. We strive to be that smart investor who understands that a certain amount of inflation can be the solution, not the problem.

A key challenge that we have faced and believe we have made significant progress on since the launch of the Fund last December, is the cost of its operations. Every fund is more expensive to operate at the beginning as its starting size must carry the full fixed costs comparable to funds that are larger. There were certain legal and administrative costs borne by our firm in establishing and launching the Fund and such expenses have not, nor will be, passed on to the Fund and its shareholders. Since the Fund started paying its expenses, the estimated annual operating costs have dropped and have continued to drop for several reasons, but primarily because the Fund has grown in size from additional inflows causing the fixed costs to be spread over more dollars. As the assets of the Fund continue to grow, we believe that the declining costs will continue their further downward trend, which is a primary goal of ours.

Our options trading strategy is an integral part of managing the portfolio and a primary reason for our selection to manage this Fund. The trading platform became fully operational in the last quarter of the fiscal year and we believe that the results since its implementation suggest that the process is working in line with our original math and expectations. To the extent trades from this strategy generate positive economic returns, if any, come in part due primarily to the simple passage of time, which has a long history of continuing to relentlessly pass by. That's yet another trend that we want to get in front of, the passage of time.

All in all, we believe the Fund is a position to meet several macro trends we see on the horizon, including: (i) the desire of a whole generation of baby boomers for income; (ii) the necessary inflation the world’s governments need; (iii) the burgeoning cash coffers of the world’s largest companies, who are still skinny after the cuts they made during the crash; and of course, (iv) in the options side of the portfolio, where the simple ticking of the clock benefits us. We see all of these macro movements as undeniable, but other than the passage of time, they will appear in fits and starts as that's the nature of the markets.

We are of course very interested in hearing from you on any of these or other topics, thank you for your trust.

Signed:

Charles S. Stoll

Portfolio Manager

| (a) | The performance information quoted assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235. Investors should consider the investment objectives, risks, charges and expenses carefully before investing or sending money. This and other important information about the Fund can be found in the Fund’s prospectus. Please read it carefully before investing. |

| (b) | The Dow Jones Industrial Average Total Return Index tracks the total return of the member stocks of the Dow Jones Industrial Index, which is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index. |

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

INVESTMENT HIGHLIGHTS

August 31, 2014 (Unaudited)

The investment objective of the WP Large Cap Income Plus Fund (the “Fund”) is total return. To meet its investment objective, the Fund will invest 80% of its total assets in large cap domestic equity securities and exchange traded funds that primarily invest in large cap domestic equity securities. The Fund will seek income through dividends paid on such securities. The Fund will also seek to produce income (e.g., premium income on the sale of an option) and return stability through an options strategy.

Winning Points Advisers, LLC (the “Adviser”) intends to sell covered call options on a portion of the Fund’s stock holdings. The extent of option selling will depend on market conditions and the Adviser’s consideration of the advantages of selling call options on the Fund’s equity investments.

The Fund may also sell put options on stocks and ETFs the Adviser believes are attractive for purchase at prices at or above the exercise price of the put options sold. The Fund may, in certain circumstances, purchase put options on the S&P 500 Composite Stock Price Index (the “S&P 500”) and on individual stocks to protect against a loss of principal value due to stock price decline. The extent of option selling depends on market conditions and the Adviser’s judgment. The Fund may also seek to pursue its investment objective by selling a series of call and put option spread combinations on the S&P 500.

The Fund may be appropriate for investors with long-term horizons who are not sensitive to short-term losses and want to participate in the long-term growth of the financial markets. The Fund seeks to minimize the effects of inflation on its portfolio.

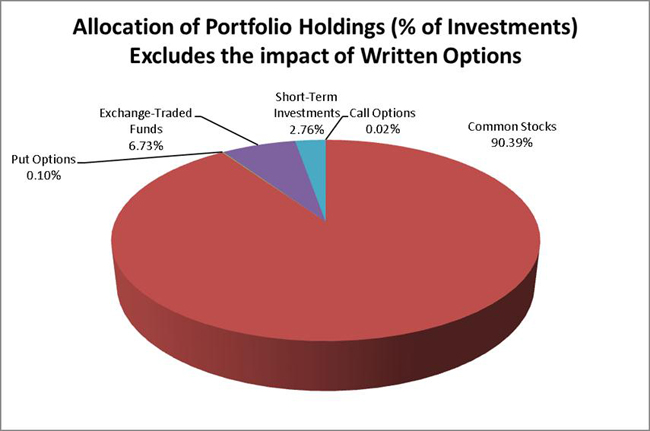

The percentages in the above graph are based on the portfolio holdings of the Fund as of August 31, 2014 and are subject to change.

For a detailed break-out of holdings by industry and exchange traded funds by investment type, please refer to the Schedules of Investments.

| Winning Points Funds | ANNUAL REPORT |

August 31, 2014 (Unaudited)

| Returns as of August 31, 2014 | | Since Inception of December 4, 2013 through August 31, 2014 (1) |

| WP Large Cap Income Plus Fund Institutional Class shares | | 5.60% |

| Dow Jones Industrial Average Total Return Index | | 9.47% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the WP Large Cap Income Plus Fund versus the Dow Jones Industrial Average Total Return Index. The Dow Jones Industrial Average Index is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Dow Jones Industrial Average Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the WP Large Cap Income Plus Fund, which will generally not invest in all the securities comprising the index.

| WINNING POINTS LARGE CAP INCOME PLUS FUND | |

| SCHEDULE OF INVESTMENTS | |

| AUGUST 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 92.95% | | Shares | | | Fair Value | |

| | | | | | | |

| Aerospace & Defense - 2.91% | | | | | | |

| Lockheed Martin Corp. (b) | | | 3,200 | | | $ | 556,800 | |

| | | | | | | | | |

| Agriculture - 2.77% | | | | | | | | |

| Alico, Inc. | | | 400 | | | | 15,616 | |

| Altria Group, Inc. (b) | | | 11,900 | | | | 512,652 | |

| | | | | | | | 528,268 | |

| Banks - 16.09% | | | | | | | | |

| Bank of America Corp. (b) | | | 50,900 | | | | 818,981 | |

| Barclays PLC - ADR (b) | | | 600 | | | | 9,000 | |

| BB&T Corp. (b) | | | 2,300 | | | | 85,859 | |

| Citigroup, Inc. (b) | | | 15,800 | | | | 816,070 | |

| Deutsche Bank AG (b) | | | 200 | | | | 6,862 | |

| Goldman Sachs Group, Inc./The (b) | | | 2,000 | | | | 358,220 | |

| JPMorgan Chase & Co. (b) | | | 15,200 | | | | 903,640 | |

| PNC Financial Services Group, Inc./The (b) | | | 900 | | | | 76,275 | |

| | | | | | | | 3,074,907 | |

| Beverages - 5.69% | | | | | | | | |

| Diageo PLC - ADR (b) | | | 4,600 | | | | 551,402 | |

| PepsiCo, Inc. (b) | | | 5,800 | | | | 536,442 | |

| | | | | | | | 1,087,844 | |

| Biotechnology - 0.60% | | | | | | | | |

| Biogen Idec, Inc. (a) (b) | | | 300 | | | | 102,912 | |

| Isis Pharmaceuticals, Inc. (a) (b) | | | 300 | | | | 12,228 | |

| | | | | | | | 115,140 | |

| Computers - 6.28% | | | | | | | | |

| Apple, Inc. (b) | | | 8,700 | | | | 891,750 | |

| International Business Machines Corp. (b) | | | 1,600 | | | | 307,680 | |

| | | | | | | | 1,199,430 | |

| Diversified Financial Services - 4.92% | | | | | | | | |

| BlackRock, Inc. (b) | | | 2,700 | | | | 892,431 | |

| Calamos Asset Management, Inc. | | | 2,000 | | | | 25,780 | |

| Ladenburg Thalmann Financial Services, Inc. (a) | | | 6,100 | | | | 21,838 | |

| | | | | | | | 940,049 | |

| Food - 2.67% | | | | | | | | |

| Sysco Corp. (b) | | | 13,500 | | | | 510,705 | |

| | | | | | | | | |

| Healthcare - Products - 2.24% | | | | | | | | |

| Baxter International, Inc. (b) | | | 5,400 | | | | 404,892 | |

| Meridian Bioscience, Inc. (b) | | | 200 | | | | 3,914 | |

| Thoratec Corp. (a) (b) | | | 800 | | | | 20,000 | |

| | | | | | | | 428,806 | |

| WINNING POINTS LARGE CAP INCOME PLUS FUND | |

| SCHEDULE OF INVESTMENTS | |

| AUGUST 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 92.95% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Insurance - 4.59% | | | | | | |

| Allianz SE - ADR | | | 900 | | | $ | 15,404 | |

| American Equity Investment Life Holding Co. | | | 200 | | | | 4,948 | |

| AXA SA - ADR | | | 400 | | | | 9,948 | |

| Berkshire Hathaway, Inc. - Class B (a) (b) | | | 6,000 | | | | 823,500 | |

| Genworth Financial, Inc. (a) (b) | | | 1,600 | | | | 22,704 | |

| | | | | | | | 876,504 | |

| Investment Companies - 0.83% | | | | | | | | |

| Apollo Investment Corp. | | | 4,500 | | | | 39,465 | |

| Ares Capital Corp. | | | 2,300 | | | | 39,445 | |

| BlackRock Kelso Capital Corp. | | | 4,500 | | | | 42,075 | |

| Full Circle Capital Corp. | | | 5,000 | | | | 36,750 | |

| | | | | | | | 157,735 | |

| Lodging - 0.22% | | | | | | | | |

| MGM Resorts International (a) (b) | | | 1,700 | | | | 41,599 | |

| | | | | | | | | |

| Media - 0.95% | | | | | | | | |

| Comcast Corp. (b) | | | 3,300 | | | | 180,609 | |

| | | | | | | | | |

| Mining - 0.14% | | | | | | | | |

| Southern Copper Corp. (b) | | | 800 | | | | 26,248 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 3.60% | | | | | | | | |

| General Electric Co. (b) | | | 17,800 | | | | 462,444 | |

| Siemens AG - ADR (b) | | | 1,800 | | | | 225,540 | |

| | | | | | | | 687,984 | |

| Oil & Gas - 21.54% | | | | | | | | |

| BP PLC - ADR (b) | | | 18,200 | | | | 870,688 | |

| Chevron Corp. (b) | | | 4,000 | | | | 517,800 | |

| China Petroleum & Chemical Corp. - ADR (b) | | | 3,700 | | | | 373,700 | |

| ConocoPhillips (b) | | | 9,500 | | | | 771,590 | |

| Exxon Mobil Corp. (b) | | | 8,400 | | | | 835,464 | |

| Gazprom OAO - ADR | | | 49,400 | | | | 355,112 | |

| Magnum Hunter Resources Corp. (a) (b) | | | 4,000 | | | | 27,640 | |

| Transocean Ltd. (b) | | | 9,400 | | | | 363,310 | |

| | | | | | | | 4,115,304 | |

| Pharmaceuticals - 1.21% | | | | | | | | |

| AstraZeneca PLC - ADR (b) | | | 1,400 | | | | 106,414 | |

| GW Pharmaceuticals PLC - ADR (a) (b) | | | 400 | | | | 36,608 | |

| Pfizer, Inc. (b) | | | 3,000 | | | | 88,170 | |

| | | | | | | | 231,192 | |

| Real Estate - 0.14% | | | | | | | | |

| St Joe Co./The (a) (b) | | | 1,200 | | | | 25,992 | |

| WINNING POINTS LARGE CAP INCOME PLUS FUND | |

| SCHEDULE OF INVESTMENTS | |

| AUGUST 31, 2014 | ANNUAL REPORT |

| COMMON STOCKS - 92.95% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Retail - 4.32% | | | | | | |

| McDonald's Corp. (b) | | | 8,800 | | | $ | 824,736 | |

| | | | | | | | | |

| Savings & Loans - 0.12% | | | | | | | | |

| BofI Holding, Inc. (a) (b) | | | 300 | | | | 23,097 | |

| | | | | | | | | |

| Semiconductors - 4.04% | | | | | | | | |

| GT Advanced Technologies, Inc. (a) (b) | | | 3,000 | | | | 53,430 | |

| Intel Corp. (b) | | | 20,100 | | | | 701,892 | |

| Skyworks Solutions, Inc. (b) | | | 300 | | | | 16,998 | |

| | | | | | | | 772,320 | |

| Software - 4.28% | | | | | | | | |

| Microsoft Corp. (b) | | | 18,000 | | | | 817,740 | |

| | | | | | | | | |

| Telecommunications - 2.80% | | | | | | | | |

| China Mobile Ltd. - ADR (b) | | | 8,600 | | | | 535,608 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $16,572,897) | | | | | | | 17,758,617 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS - 6.92% | | | | | | | | |

| Closed-end Funds - 4.76% | | | | | | | | |

| Eaton Vance Short Duration Diversified Income Fund | | | 61,000 | | | | 910,730 | |

| | | | | | | | | |

| Equity Funds - 2.16% | | | | | | | | |

| iShares U.S. Financial Services ETF (b) | | | 4,800 | | | | 412,272 | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $1,328,436) | | | | | | | 1,323,002 | |

| | | | | | | | | |

| OPTIONS PURCHASED (Cost $47,248) - 0.12% (c) | | | | | | | 22,800 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 2.83% | | | | | | | | |

| Federated Government Obligations Fund, 0.01% (d) | | | 541,634 | | | | 541,634 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $541,634) | | | | | | | 541,634 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $18,490,215) – 102.82% | | | | | | | 19,646,053 | |

| | | | | | | | | |

| OPTIONS WRITTEN (Proceeds $1,206,431) - (7.35)% | | | | | | | (1,405,167 | ) |

| | | | | | | | | |

| OTHER ASSETS LESS LIABILITIES, NET - 4.53% | | | | | | | 865,646 | |

| NET ASSETS - 100.00% | | | | | | $ | 19,106,532 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is segregated as collateral for call options written. |

| (c) | Please refer to the Schedule of Purchased Options for details of options purchased. |

| (d) | Rate shown represents the rate at August 31, 2014, is subject to change and resets daily. |

ADR - American Depository Receipt.

The accompanying notes are an integral part of the financial statements.

| WINNING POINTS LARGE CAP INCOME PLUS FUND | |

| SCHEDULE OF PURCHASED OPTIONS | |

| AUGUST 31, 2014 | ANNUAL REPORT |

OPTIONS PURCHASED - 0.12%

CALL OPTIONS PURCHASED - 0.02%

| | | Strike | | Expiration | | Contracts 1 | | | Fair Value | |

| | | | | | | | | | | |

| S&P 500 Index | | $ | 2,125.00 | | 9/20/2014 | | | 190 | | | $ | 3,800 | |

| TOTAL CALL OPTIONS PURCHASED (Cost $8,082) | | | | | | | | | | | | 3,800 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| PUT OPTIONS PURCHASED - 0.10% | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| S&P 500 Index | | $ | 1,630.00 | | 9/20/2014 | | | 10 | | | | 250 | |

| S&P 500 Index | | $ | 1,650.00 | | 9/20/2014 | | | 20 | | | | 700 | |

| S&P 500 Index (d) | | $ | 1,655.00 | | 9/20/2014 | | | 190 | | | | 7,600 | |

| S&P 500 Index (d) | | $ | 1,520.00 | | 10/18/2014 | | | 220 | | | | 10,450 | |

| TOTAL PUT OPTIONS PURCHASED (Cost $39,166) | | | | | | | | | | | | 19,000 | |

| | | | | | | | | | | | | | |

| TOTAL OPTIONS PURCHASED (Cost $47,248) | | | | | | | | | | | $ | 22,800 | |

| 1 | Each option contract is equivalent to 100 shares of common stock. All options are non-income producing. |

| (d) | Categorized in Level 2 of the Hierarchy of Fair Value Inputs; for additional information and description of the levels, refer to the table included in Note 2 of the accompanying notes to the financial statements. |

ADR - American Depository Receipt.

The accompanying notes are an integral part of the financial statements.

| WINNING POINTS LARGE CAP INCOME PLUS FUND | |

| SCHEDULE OF WRITTEN OPTIONS | |

| AUGUST 31, 2014 | ANNUAL REPORT |

OPTIONS WRITTEN - (7.35)%

CALL OPTIONS WRITTEN - (4.56)%

| | | Strike | | Expiration | | Contracts 1 | | | Fair Value | |

| | | | | | | | | | | |

| Altria Group, Inc. | | $ | 47.00 | | 1/15/2016 | | | (90 | ) | | $ | (9,000 | ) |

| Altria Group, Inc. | | $ | 50.00 | | 1/15/2016 | | | (29 | ) | | | (1,363 | ) |

| Apple, Inc. | | $ | 105.00 | | 1/15/2016 | | | (49 | ) | | | (53,165 | ) |

| Apple, Inc. | | $ | 120.00 | | 1/15/2016 | | | (38 | ) | | | (23,370 | ) |

| AstraZeneca PLC - ADR (d) | | $ | 82.50 | | 1/15/2016 | | | (14 | ) | | | (6,090 | ) |

| Bank of America Corp. | | $ | 20.00 | | 1/15/2016 | | | (193 | ) | | | (12,738 | ) |

| Bank of America Corp. | | $ | 22.00 | | 1/15/2016 | | | (316 | ) | | | (12,640 | ) |

| Barclays PLC - ADR | | $ | 17.00 | | 1/15/2016 | | | (6 | ) | | | (582 | ) |

| Baxter International, Inc. (d) | | $ | 85.00 | | 1/15/2016 | | | (34 | ) | | | (4,641 | ) |

| Baxter International, Inc. (d) | | $ | 90.00 | | 1/15/2016 | | | (10 | ) | | | (835 | ) |

| Baxter International, Inc. (d) | | $ | 95.00 | | 1/15/2016 | | | (10 | ) | | | (450 | ) |

| BB&T Corp. (d) | | $ | 42.00 | | 1/15/2016 | | | (23 | ) | | | (2,668 | ) |

| Berkshire Hathaway, Inc. - Class B | | $ | 160.00 | | 1/15/2016 | | | (27 | ) | | | (7,560 | ) |

| Berkshire Hathaway, Inc. - Class B | | $ | 140.00 | | 1/15/2016 | | | (33 | ) | | | (33,660 | ) |

| Biogen Idec, Inc. | | $ | 370.00 | | 1/17/2015 | | | (3 | ) | | | (4,383 | ) |

| BlackRock, Inc. | | $ | 360.00 | | 1/17/2015 | | | (15 | ) | | | (6,000 | ) |

| BlackRock, Inc. | | $ | 380.00 | | 1/15/2016 | | | (10 | ) | | | (12,900 | ) |

| BlackRock, Inc. (d) | | $ | 360.00 | | 1/15/2016 | | | (2 | ) | | | (3,880 | ) |

| BofI Holding, Inc. (d) | | $ | 100.00 | | 1/17/2015 | | | (3 | ) | | | (180 | ) |

| BP PLC - ADR | | $ | 55.00 | | 1/15/2016 | | | (76 | ) | | | (6,840 | ) |

| BP PLC - ADR | | $ | 60.00 | | 1/15/2016 | | | (100 | ) | | | (3,800 | ) |

| BP PLC - ADR (d) | | $ | 57.50 | | 1/15/2016 | | | (6 | ) | | | (354 | ) |

| Chevron Corp. | | $ | 140.00 | | 1/15/2016 | | | (25 | ) | | | (10,500 | ) |

| Chevron Corp. (d) | | $ | 150.00 | | 1/15/2016 | | | (15 | ) | | | (3,262 | ) |

| China Mobile Ltd. - ADR | | $ | 60.00 | | 1/15/2016 | | | (86 | ) | | | (52,718 | ) |

| China Petroleum & Chemical Corp. - ADR | | $ | 110.00 | | 1/17/2015 | | | (13 | ) | | | (1,625 | ) |

| China Petroleum & Chemical Corp. - ADR (d) | | $ | 105.00 | | 1/17/2015 | | | (24 | ) | | | (7,500 | ) |

| Citigroup, Inc. | | $ | 57.50 | | 1/15/2016 | | | (53 | ) | | | (19,080 | ) |

| Citigroup, Inc. | | $ | 60.00 | | 1/15/2016 | | | (94 | ) | | | (26,226 | ) |

| Citigroup, Inc. (d) | | $ | 62.50 | | 1/15/2016 | | | (11 | ) | | | (2,409 | ) |

| Comcast Corp. (d) | | $ | 62.50 | | 1/15/2016 | | | (18 | ) | | | (3,798 | ) |

| Comcast Corp. (d) | | $ | 65.00 | | 1/15/2016 | | | (15 | ) | | | (2,355 | ) |

| ConocoPhillips | | $ | 100.00 | | 1/15/2016 | | | (43 | ) | | | (4,730 | ) |

| ConocoPhillips | | $ | 90.00 | | 1/15/2016 | | | (52 | ) | | | (13,988 | ) |

| Deutsche Bank AG (d) | | $ | 45.00 | | 1/15/2016 | | | (2 | ) | | | (210 | ) |

| Diageo PLC - ADR | | $ | 130.00 | | 1/17/2015 | | | (7 | ) | | | (672 | ) |

| Diageo PLC - ADR (d) | | $ | 140.00 | | 1/17/2015 | | | (21 | ) | | | (472 | ) |

| Diageo PLC - ADR (d) | | $ | 150.00 | | 1/17/2015 | | | (18 | ) | | | (450 | ) |

| Exxon Mobil Corp. | | $ | 120.00 | | 1/15/2016 | | | (40 | ) | | | (4,480 | ) |

| Exxon Mobil Corp. (d) | | $ | 130.00 | | 1/15/2016 | | | (2 | ) | | | (96 | ) |

| Exxon Mobil Corp. (d) | | $ | 125.00 | | 1/15/2016 | | | (42 | ) | | | (3,192 | ) |

| General Electric Co. | | $ | 30.00 | | 1/15/2016 | | | (108 | ) | | | (5,508 | ) |

| General Electric Co. | | $ | 32.00 | | 1/15/2016 | | | (70 | ) | | | (2,100 | ) |

| Genworth Financial, Inc. (d) | | $ | 20.00 | | 1/15/2016 | | | (10 | ) | | | (670 | ) |

| Genworth Financial, Inc. (d) | | $ | 22.00 | | 1/15/2016 | | | (3 | ) | | | (128 | ) |

| Genworth Financial, Inc. (d) | | $ | 20.00 | | 1/17/2015 | | | (3 | ) | | | (21 | ) |

| Goldman Sachs Group, Inc./The | | $ | 190.00 | | 1/15/2016 | | | (10 | ) | | | (10,800 | ) |

| Goldman Sachs Group, Inc./The (d) | | $ | 200.00 | | 1/15/2016 | | | (10 | ) | | | (7,175 | ) |

| GT Advanced Technologies, Inc. | | $ | 35.00 | | 1/15/2016 | | | (30 | ) | | | (6,150 | ) |

| GW Pharmaceuticals PLC - ADR (d) | | $ | 130.00 | | 2/20/2015 | | | (4 | ) | | | (3,320 | ) |

| Intel Corp. | | $ | 40.00 | | 1/15/2016 | | | (198 | ) | | | (34,452 | ) |

| Intel Corp. | | $ | 45.00 | | 1/15/2016 | | | (3 | ) | | | (267 | ) |

| International Business Machines Corp. | | $ | 215.00 | | 1/17/2015 | | | (10 | ) | | | (920 | ) |

| International Business Machines Corp. (d) | | $ | 230.00 | | 1/15/2016 | | | (6 | ) | | | (2,325 | ) |

| iShares U.S. Financial Services ETF (d) | | $ | 90.00 | | 1/17/2015 | | | (18 | ) | | | (2,475 | ) |

| WINNING POINTS LARGE CAP INCOME PLUS FUND | |

| SCHEDULE OF WRITTEN OPTIONS | |

| AUGUST 31, 2014 | ANNUAL REPORT |

OPTIONS WRITTEN - (7.35)% (continued)

CALL OPTIONS WRITTEN - (4.56)% (continued)

| | | Strike | | Expiration | | Contracts 1 | | | Fair Value | |

| | | | | | | | | | | |

| Isis Pharmaceuticals, Inc. (d) | | $ | 75.00 | | 1/17/2015 | | | (3 | ) | | $ | (75 | ) |

| JPMorgan Chase & Co. | | $ | 65.00 | | 1/15/2016 | | | (84 | ) | | | (24,360 | ) |

| JPMorgan Chase & Co. | | $ | 70.00 | | 1/15/2016 | | | (55 | ) | | | (8,855 | ) |

| JPMorgan Chase & Co. | | $ | 75.00 | | 1/15/2016 | | | (13 | ) | | | (1,170 | ) |

| Lockheed Martin Corp. | | $ | 185.00 | | 1/17/2015 | | | (16 | ) | | | (3,920 | ) |

| Lockheed Martin Corp. (d) | | $ | 200.00 | | 1/15/2016 | | | (16 | ) | | | (8,080 | ) |

| Magnum Hunter Resources Corp. | | $ | 12.00 | | 1/15/2016 | | | (40 | ) | | | (2,600 | ) |

| McDonald's Corp. (d) | | $ | 115.00 | | 1/15/2016 | | | (88 | ) | | | (7,348 | ) |

| Meridian Bioscience, Inc. (d) | | $ | 22.50 | | 1/17/2015 | | | (2 | ) | | | (85 | ) |

| MGM Resorts International | | $ | 30.00 | | 1/15/2016 | | | (12 | ) | | | (1,908 | ) |

| MGM Resorts International | | $ | 35.00 | | 1/15/2016 | | | (5 | ) | | | (390 | ) |

| Microsoft Corp. | | $ | 55.00 | | 1/15/2016 | | | (16 | ) | | | (1,808 | ) |

| Microsoft Corp. | | $ | 50.00 | | 1/15/2016 | | | (164 | ) | | | (36,900 | ) |

| PepsiCo, Inc. | | $ | 105.00 | | 1/15/2016 | | | (29 | ) | | | (5,220 | ) |

| PepsiCo, Inc. (d) | | $ | 97.50 | | 1/15/2016 | | | (29 | ) | | | (10,730 | ) |

| Pfizer, Inc. | | $ | 35.00 | | 1/15/2016 | | | (30 | ) | | | (1,650 | ) |

| PNC Financial Services Group, Inc./The (d) | | $ | 90.00 | | 1/17/2015 | | | (9 | ) | | | (1,103 | ) |

| Siemens AG - ADR (d) | | $ | 150.00 | | 1/17/2015 | | | (15 | ) | | | (7,200 | ) |

| Skyworks Solutions, Inc. (d) | | $ | 75.00 | | 1/15/2016 | | | (3 | ) | | | (1,035 | ) |

| Southern Copper Corp. | | $ | 35.00 | | 1/17/2015 | | | (6 | ) | | | (600 | ) |

| Southern Copper Corp. (d) | | $ | 35.00 | | 1/15/2016 | | | (2 | ) | | | (555 | ) |

| SPDR S&P 500 ETF Trust | | $ | 210.00 | | 1/17/2015 | | | (300 | ) | | | (45,900 | ) |

| SPDR S&P 500 ETF Trust | | $ | 210.00 | | 2/20/2015 | | | (100 | ) | | | (21,800 | ) |

| SPDR S&P 500 ETF Trust | | $ | 215.00 | | 6/19/2015 | | | (250 | ) | | | (71,500 | ) |

| SPDR S&P 500 ETF Trust | | $ | 210.00 | | 12/20/2014 | | | (1,250 | ) | | | (140,000 | ) |

| St Joe Co./The | | $ | 30.00 | | 12/20/2014 | | | (9 | ) | | | (180 | ) |

| St Joe Co./The (d) | | $ | 27.00 | | 3/20/2015 | | | (3 | ) | | | (113 | ) |

| Sysco Corp. (d) | | $ | 40.00 | | 1/15/2016 | | | (85 | ) | | | (14,025 | ) |

| Sysco Corp. (d) | | $ | 42.00 | | 1/15/2016 | | | (30 | ) | | | (3,375 | ) |

| Sysco Corp. (d) | | $ | 47.00 | | 1/15/2016 | | | (20 | ) | | | (750 | ) |

| Thoratec Corp. (d) | | $ | 40.00 | | 1/17/2015 | | | (8 | ) | | | (200 | ) |

| Transocean Ltd. (d) | | $ | 50.00 | | 1/15/2016 | | | (17 | ) | | | (1,564 | ) |

| Transocean Ltd. (d) | | $ | 52.50 | | 1/15/2016 | | | (77 | ) | | | (5,005 | ) |

| TOTAL CALL OPTIONS WRITTEN (Proceeds $700,934) | | | | | | | | | | | | (871,177 | ) |

| | | Strike | | Expiration | | Contracts 1 | | | Fair Value | |

| PUT OPTIONS WRITTEN - (2.79)% | | | | | | | | | | |

| | | | | | | | | | | |

| iShares iBoxx $ High Yield Corporate Bond ETF (d) | | $ | 86.00 | | 1/15/2016 | | | (10 | ) | | $ | (4,550 | ) |

| iShares iBoxx $ High Yield Corporate Bond ETF (d) | | $ | 87.00 | | 1/15/2016 | | | (20 | ) | | | (9,900 | ) |

| iShares iBoxx $ High Yield Corporate Bond ETF (d) | | $ | 88.00 | | 1/15/2016 | | | (20 | ) | | | (10,540 | ) |

| iShares iBoxx $ High Yield Corporate Bond ETF (d) | | $ | 89.00 | | 1/15/2016 | | | (20 | ) | | | (11,200 | ) |

| iShares iBoxx $ High Yield Corporate Bond ETF (d) | | $ | 90.00 | | 1/15/2016 | | | (20 | ) | | | (12,700 | ) |

| SPDR S&P 500 ETF Trust (b) | | $ | 171.00 | | 3/20/2015 | | | (2,200 | ) | | | (485,100 | ) |

| TOTAL PUT OPTIONS WRITTEN (Proceeds $505,497) | | | | | | | | | | | | (533,990 | ) |

| | | | | | | | | | | | | | |

| TOTAL OPTIONS WRITTEN (Proceeds $1,206,431) | | | | | | | | | | | $ | (1,405,167 | ) |

| 1 | Each option contract is equivalent to 100 shares of common stock. All options are non-income producing. |

| (b) | All or a portion of the security is segregated as collateral for call options written. |

| (d) | Categorized in Level 2 of the Hierarchy of Fair Value Inputs; for additional information and description of the levels, refer to the table included in Note 2 of the accompanying notes to the financial statements. |

ADR - American Depository Receipt.

The accompanying notes are an integral part of the financial statements.

| WINNING POINTS FUNDS | |

| | | | |

| WP LARGE CAP INCOME PLUS FUND | |

| STATEMENT OF ASSETS AND LIABILITIES | |

| | | | |

| August 31, 2014 | ANNUAL REPORT |

| Assets: | | | |

| Investments, at value (identified cost $18,490,215) | | $ | 19,646,053 | |

| Deposits at broker | | | 981,350 | |

| Receivables: | | | | |

| Interest | | | 8 | |

| Dividends | | | 62,689 | |

| Prepaid expenses | | | 4,062 | |

| Total assets | | | 20,694,162 | |

| | | | | |

| Liabilities: | | | | |

| Options written, at value (identified proceeds $1,206,431) | | | 1,405,167 | |

| Payables: | | | | |

| Investment securities purchased | | | 120,312 | |

| Due to advisor | | | 20,819 | |

| Accrued distribution (12b-1) fees | | | 5,271 | |

| Due to administrator | | | 14,702 | |

| Trustee expenses | | | 1,125 | |

| Accrued expenses | | | 20,234 | |

| Total liabilities | | | 1,587,630 | |

| Net Assets | | $ | 19,106,532 | |

| | | | | |

| Sources of Net Assets: | | | | |

| Paid-in capital | | $ | 18,239,220 | |

| Accumulated net realized loss on investments and options | | | (5,358 | ) |

| Accumulated net investment loss | | | (84,432 | ) |

| Net unrealized appreciation on investments and options | | | 957,102 | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 19,106,532 | |

| | | | | |

| Institutional Class Shares: | | | | |

| Net assets applicable to 1,809,149 shares outstanding | | $ | 19,106,532 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 10.56 | |

The accompanying notes are an integral part of these financial statements.

| WINNING POINTS FUNDS | |

| | |

| WP LARGE CAP INCOME PLUS FUND | |

| STATEMENT OF OPERATIONS | |

| | |

| August 31, 2014 | ANNUAL REPORT |

| | | For the | |

| | | Period Ended | |

| | | August 31, 2014 (a) | |

| | | | |

| Investment income: | | | |

| Dividends (net of foreign withholding taxes of $4,213) | | $ | 238,396 | |

| Interest | | | 192 | |

| Total investment income | | | 238,588 | |

| | | | | |

| Expenses: | | | | |

| Management fees (Note 5) | | | 138,944 | |

| Distribution (12b-1) fees - Institutional Class | | | 25,730 | |

| Accounting and transfer agent fees and expenses | | | 122,384 | |

| Audit fees | | | 14,000 | |

| Miscellaneous | | | 11,589 | |

| Custodian fees | | | 4,644 | |

| Legal fees | | | 9,678 | |

| Pricing fees | | | 7,723 | |

| Trustee fees and expenses | | | 5,259 | |

| Registration and filing fees | | | 1,569 | |

| Reports to shareholders | | | 237 | |

| Insurance | | | 24 | |

| Total expenses | | | 341,781 | |

| | | | | |

| Net investment loss | | | (103,193 | ) |

| | | | | |

| Realized and unrealized gain (loss): | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 2,903 | |

| Options | | | (8,261 | ) |

| Net realized loss on investments | | | (5,358 | ) |

| | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 1,180,286 | |

| Options | | | (223,184 | ) |

| Net change in unrealized appreciation | | | 957,102 | |

| | | | | |

| Net gain on investments | | | 951,744 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 848,551 | |

| (a) | The WP Large Cap Income Plus Fund commenced operations on December 4, 2013. |

The accompanying notes are an integral part of these financial statements.

| WINNING POINTS FUNDS | |

| | |

| WP LARGE CAP INCOME PLUS FUND | |

| STATEMENT OF CHANGES IN NET ASSETS | |

| | |

| August 31, 2014 | ANNUAL REPORT |

| | | For the | |

| | | Period Ended | |

| | | August 31, 2014 (a) | |

| | | | |

| Increase (decrease) in net assets from: | | | |

| Operations: | | | |

| Net investment loss | | $ | (103,193 | ) |

| Net realized loss on investments and options | | | (5,358 | ) |

| Net unrealized appreciation on investments and options | | | 957,102 | |

| Net increase in net assets resulting from operations | | | 848,551 | |

| | | | | |

| Capital share transactions (Note 4): | | | | |

| Increase in net assets from capital share transactions | | | 18,257,981 | |

| | | | | |

| Increase in net assets | | | 19,106,532 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | - | |

| | | | | |

| End of period | | $ | 19,106,532 | |

| Accumulated net investment loss | | $ | (84,432 | ) |

| (a) | The WP Large Cap Income Plus Fund commenced operations on December 4, 2013. |

The accompanying notes are an integral part of these financial statements.

| WINNING POINTS FUNDS | |

| | | |

| WP LARGE CAP INCOME PLUS FUND | |

| FINANCIAL HIGHLIGHTS | |

| | | |

| August 31, 2014 | ANNUAL REPORT |

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Institutional Class | | |

| | | For the | | |

| | | Period Ended | | |

| | | August 31, 2014 (a) | | |

| | | | | |

| Net Asset Value, Beginning of Period | | $ | 10.00 | | |

| | | | | | |

| Investment Operations: | | | | | |

| Net investment loss | | | (0.06 | ) | |

| Net realized and unrealized gain on investments | | | 0.62 | | |

| Total from investment operations | | | 0.56 | | |

| | | | | | |

| Net Asset Value, End of Period | | $ | 10.56 | | |

| | | | | | |

Total Return (b) | | | 5.60 | % | (c)(d) |

| | | | | | |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of period (in 000's) | | $ | 19,107 | | |

| | | | | | |

Ratio of expenses to average net assets (e): | | | 3.32 | % | (f) |

| | | | | | |

Ratio of net investment income (loss) (e): | | | (1.00 | )% | (f) |

| | | | | | |

| Portfolio turnover rate | | | 1.78 | % | (c) |

| (a) | The WP Large Cap Income Plus Fund commenced operations on December 4, 2013. |

| (b) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (d) | Total Return is for the period from December 4, 2013, the date of initial portfolio trades, through August 31, 2014. |

| (e) | Ratios are for the period from December 4, 2013, the date of initial expense accruals, through August 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2014

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

The WP Large Cap Income Plus Fund (the “Fund”) is a series of 360 Funds (the “Trust”). The Trust was organized on February 25, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund is a diversified Fund. The Fund’s investment objective is total return. The Fund’s investment adviser is Winning Points Advisers, LLC (the “Adviser”). The Fund has three classes of shares, Class A, Class C and Institutional Class shares. Currently only the Institutional Class shares are being offered for sale. The Institutional Class shares commenced operations on December 4, 2013.

a) Security Valuation – All investments in securities are recorded at their estimated fair value, as described in note 2.

b) Written Options – When a Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. If an option sold by the Fund expires unexercised, the Fund realizes a capital gain equal to the premium received at the time the option was written. The Fund will realize a capital gain from a closing purchase transaction if the cost of the closing option is less than the premium received from writing the option, or, if the cost is more, the Fund will realize a capital loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss.

c) Exchange Traded Funds – The Fund may invest in Exchange Traded Funds (“ETFs”). ETFs are registered investment companies and incur fees and expenses such as operating expenses, licensing fees, registration fees, trustees fees, and marketing expenses, and ETF shareholders, such as a Fund, pay their proportionate share of these expenses. Your cost of investing in a Fund will generally be higher than the cost of investing directly in ETFs. By investing in a Fund, you will indirectly bear fees and expenses charged by the underlying ETFs in which a Fund invests in addition to a Fund's direct fees and expenses.

d) Federal Income Taxes – The Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

As of and during the period since inception from December 4, 2013 through August 31, 2014, the Fund did not have a liability for any unrecognized tax expenses. The Fund recognizes interest and penalties, if any, related to unrecognized tax liability as income tax expense in the statement of operations. During the period since inception from December 4, 2013 through August 31, 2014, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdictions as U.S. Federal and Delaware state.

e) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains.

f) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

g) Other – Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2014

Processes and Structure

The Fund’s Board of Trustees has adopted guidelines for valuing securities and other derivative instruments including in circumstances in which market quotes are not readily available, and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board of Trustees.

Hierarchy of Fair Value Inputs

The company utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| • | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the company has the ability to access. |

| • | Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| • | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the company's own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Value Measurements

A description of the valuation techniques applied to the company's major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock and ETFs) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts, financial futures, Exchange Traded Funds, and the movement of the certain indexes of securities based on a statistical analysis of the historical relationship and that are categorized in level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in level 2.

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2014

| 2. | SECURITIES VALUATIONS (continued) |

Money market funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1.

Derivative instruments – Listed derivatives, including options, that are actively traded are valued based on quoted prices from the exchange and categorized in level 1 of the fair value hierarchy. Options held by the Fund for which no current quotations are readily available and which are not traded on the valuation date are valued at the mean price and are categorized within level 2 of the fair value heirarchy. Over-the-counter (OTC) derivative contracts include forward, swap, and option contracts related to interest rates; foreign currencies; credit standing of reference entities; equity prices; or commodity prices, and warrants on exchange-traded securities. Depending on the product and terms of the transaction, the fair value of the OTC derivative products can be modeled taking into account the counterparties' creditworthiness and using a series of techniques, including simulation models. Many pricing models do not entail material subjectivity because the methodologies employed do not necessitate significant judgments, and the pricing inputs are observed from actively quoted markets, as is the case of interest rate swap and option contracts. OTC derivative products valued using pricing models are categorized within level 2 of the fair value hierarchy.

The following table summarizes the inputs used to value the Fund’s assets and liabilities measured at fair value as of August 31, 2014.

WP Large Cap Income Plus Fund

Financial Instruments – Assets

Security Classification (1) | | Level 1 | | | Level 2 | | | Level 3 | | | Totals | |

Common Stock (2) | | $ | 17,758,617 | | | $ | - | | | $ | - | | | $ | 17,758,617 | |

Exchange-Traded Funds (2) | | | 1,323,002 | | | | - | | | | - | | | | 1,323,002 | |

| Call Options Purchased | | | 3,800 | | | | - | | | | - | | | | 3,800 | |

| Put Options Purchased | | | 950 | | | | 18,050 | | | | - | | | | 19,000 | |

| Short-Term Investments | | | 541,634 | | | | - | | | | - | | | | 541,634 | |

| Total Assets | | $ | 19,628,003 | | | $ | 18,050 | | | $ | - | | | $ | 19,646,053 | |

| | | | | | | | | | | | | | | | | |

| Derivative Instruments – Liabilities | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Security Classification (1) | | Level 1 | | | Level 2 | | | Level 3 | | | Totals | |

| Call Options Written | | $ | 750,978 | | | $ | 120,199 | | | $ | - | | | $ | 871,177 | |

| Put Options Written | | | 485,100 | | | | 48,890 | | | | - | | | | 533,990 | |

| Total Liabilities | | $ | 1,236,078 | | | $ | 169,089 | | | $ | - | | | $ | 1,405,167 | |

| (1) | As of and during the period since inception from December 4, 2013 through August 31, 2014, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable. |

| (2) | All common stock and exchange traded funds (“ETFs”) held in the Fund are Level 1 securities. For a detailed break-out of common stock by industry and ETFs by investment type, please refer to the Schedule of Investments. |

There were no transfers into and out of any Level during the period since inception from December 4, 2013 through August 31, 2014. It is the Fund’s policy to recognize transfers between Levels at the end of the reporting period.

During the period since inception from December 4, 2013 through August 31, 2014, no securities were fair valued.

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2014

| 3. | DERIVATIVES TRANSACTIONS |

As of August 31, 2014, portfolio securities valued at $18,987,479 were held in escrow by the custodian as cover for options written by the Fund.

Transactions in options written during the period since inception from December 4, 2013 through August 31, 2014 were as follows:

| | | Call Options | |

| | | Number of Options* | | | Option Premiums | |

| Options outstanding at beginning of period | | | - | | | $ | - | |

| Options written | | | 6,709 | | | | 875,739 | |

| Options covered | | | (1,676 | ) | | | (166,621 | ) |

| Options exercised | | | (60 | ) | | | (4,800 | ) |

| Options expired | | | (36 | ) | | | (3,384 | ) |

| Options outstanding end of period | | | 4,937 | | | $ | 700,934 | |

| | | | |

| | | Put Options | |

| | | Number of Options* | | | Option Premiums | |

| Options outstanding at beginning of period | | | - | | | $ | - | |

| Options written | | | 7,290 | | | | 1,416,007 | |

| Options covered | | | (5,000 | ) | | | (910,510 | ) |

| Options exercised | | | - | | | | - | |

| Options expired | | | - | | | | - | |

| Options outstanding end of period | | | 2,290 | | | $ | 505,497 | |

| * | One option contract is equivalent to one hundred shares of common stock. |

As of August 31, 2014, the Statement of Assets and Liabilities included the following financial derivative instrument fair values:

| Assets | | Equity Contracts | | | Total | |

| Call options purchased, at value | | $ | 3,800 | | | $ | 3,800 | |

| Put options purchased, at value | | | 19,000 | | | | 19,000 | |

| Total Assets | | $ | 22,800 | | | $ | 22,800 | |

| | | | | | | | | |

| Liabilities | | Equity Contracts | | | Total | |

| Call options written, at value | | $ | 871,177 | | | $ | 871,177 | |

| Put options written, at value | | | 533,990 | | | | 533,990 | |

| Total Liabilities | | $ | 1,405,167 | | | $ | 1,405,167 | |

For the period since inception from December 4, 2013 through August 31, 2014, financial derivative instruments had the following effect on the Statement of Operations:

| Net change in unrealized depreciation on: | | Equity Contracts | | | Total | |

| Call options purchased | | $ | (4,282 | ) | | $ | (4,282 | ) |

| Put options purchased | | | (20,166 | ) | | | (20,166 | ) |

| Call options written | | | (170,243 | ) | | | (170,243 | ) |

| Put option written | | | (28,493 | ) | | | (28,493 | ) |

| | | $ | (223,184 | ) | | $ | (223,184 | ) |

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2014

| 3. | DERIVATIVES TRANSACTIONS (continued) |

| Net realized gain (loss) on: | | Equity Contracts | | | Total | |

| Call options purchased | | $ | - | | | $ | - | |

| Put options purchased | | | (13,286 | ) | | | (13,286 | ) |

| Call options written | | | (196,990 | ) | | | (196,990 | ) |

| Put option written | | | 202,015 | | | | 202,015 | |

| | | $ | (8,261 | ) | | $ | (8,261 | ) |

For the period since inception from December 4, 2013 through August 31, 2014, the total amount of all open purchased options and written options, as presented in the Schedule of Investments and Schedule of Written Options, is representative of the volume of activity for this derivative type during the period.

The following table presents the Funds’ liability derivatives available for offset under a master netting arrangement net of collateral pledged as of August 31, 2014.

| Liabilities: | | Gross Amounts of Assets Presented in the Statement of Assets & Liabilities | |

| | | Gross Amounts of Recognized Liabilities | | | Financial Instruments Pledged | | | Cash Collateral Pledged | | | Net Amount of Assets | |

| Options Written Contracts | | $ | 1,405,167 | (1) | | $ | 1,405,167 | (2) | | $ | - | | | $ | - | |

| Total | | $ | 1,405,167 | (1) | | $ | 1,405,167 | (2) | | $ | - | | | $ | - | |

| (1) | Written options at value as presented in the Portfolio of Investments. |

| (2) | The amount is limited to the derivative liability balance and accordingly does not include excess collateral pledged. |

| 4. | CAPITAL SHARE TRANSACTIONS |

Transactions in shares of capital stock for the Fund for the period since inception from December 4, 2013 through August 31, 2014 were as follows:

| WP Large Cap Income Plus Fund: | | Sold | | | Redeemed | | | Reinvested | | | Net Increase | |

| Institutional Class | | | | | | | | | | | | |

| Shares | | | 1,839,641 | | | | (30,492 | ) | | | - | | | | 1,809,149 | |

| Value | | $ | 18,574,888 | | | $ | (316,907 | ) | | | - | | | $ | 18,257,981 | |

| 5. | INVESTMENT TRANSACTIONS |

For the period since inception from December 4, 2013 through August 31, 2014, aggregate purchases and sales of investment securities (excluding short-term investments) for the Fund were as follows:

| Purchases | | | Sales | |

| $ | 18,130,593 | | | $ | 221,965 | |

There were no government securities purchased or sold during the period.

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2014

| 6. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

The Fund has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations of the Fund and manages the Fund’s investments in accordance with the stated policies of the Fund. As compensation for the investment advisory services provided to the Fund, the Adviser will receive a monthly management fee equal to an annual rate of 1.35% of the Fund’s net assets. For the period since inception from December 4, 2013 through August 31, 2013, the Adviser earned $138,944 of advisory fees.

The Fund has entered into an Investment Company Services Agreement (“ICSA”) with Matrix 360 Administration, LLC (“M3Sixty”). Pursuant to the ICSA, M3Sixty will provide day-to-day operational services to the Fund including, but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund's portfolio securities; (d) pricing the Fund's shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Fund's legal compliance; (j) maintaining shareholder account records.

For the period since inception from December 4, 2013 through August 31, 2014, M3Sixty earned $122,384, including out of pocket expenses with $14,702 remaining payable at August 31, 2014.

Certain officers of the Fund are also employees of M3Sixty.

The Fund has entered into a Distribution Agreement with Matrix Capital Group, Inc. (the “Distributor”). Pursuant to the Distribution Agreement, the Distributor will provide distribution services to the Fund. The Distributor serves as underwriter/distributor of the Fund.

The Distributor is an affiliate of M3Sixty.

The Fund has adopted a Distribution Plan (“Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940. The Fund may expend up to 0.25% for Institutional Class shares of the Fund’s average daily net assets annually to pay for any activity primarily intended to result in the sale of shares of the Fund and the servicing of shareholder accounts, provided that the Trustees have approved the category of expenses for which payment is being made.

The distribution plan for the Institutional Class shares of the Fund took effect December 4, 2013. For the period since inception from December 4, 2013 through August 31, 2014, the Fund accrued $25,730 in 12b-1 expenses attributable to Institutional Class shares.

For U.S. Federal income tax purposes, the cost of securities owned, gross appreciation, gross depreciation, and net unrealized appreciation/(depreciation) of investments at August 31, 2014 were as follows:

| | Cost | | | Gross Appreciation | | | Gross Depreciation | | | Net Appreciation |

| $ | 17,284,521 | | $ | 1,479,419 | | $ | (498,605 | ) | $ | 980,814 |

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2014

| 7. | TAX MATTERS (continued) |

The Fund’s tax basis distributable earnings are determined only at the end of each fiscal year. The tax character of distributable earnings (deficit) at August 31, 2014, the Fund’s most recent fiscal year end, was as follows:

| Unrealized Appreciation (Depreciation) | | | Undistributed Ordinary Income | | | Undistributed Long-Term Capital Gains | | | Capital Loss Carry Forwards | | | Post-October Loss and Late Year Loss | | | Total Distributable Earnings | |

| $ | 980,814 | | | $ | - | | | $ | - | | | $ | - | | | $ | (113,502 | ) | | $ | 867,312 | |

The difference between book basis and tax basis unrealized appreciation (depreciation), post-October loss and late year loss and accumulated net realized losses from investments is primarily attributable to the tax deferral of losses on wash sales and mark-to-market on 1256 contracts.

Under current tax law, net capital losses realized after October 31st and net ordinary losses incurred after December 31st may be deferred and treated as occurring on the first day of the following fiscal year. The Fund’s carryforward losses, post-October losses and post-December losses are determined only at the end of each fiscal year. As of August 31, 2014, the Fund elected to defer net capital losses as indicated in the chart below.

| Post-October Losses | | | Post-December Losses | |

| Deferred | | | Utilized | | | Deferred | | | Utilized | |

| $ | 29,070 | | | $ | - | | | $ | 84,432 | | | $ | - | |

Under the Regulated Investment Company Modernization Act of 2010 (the Act), net capital losses recognized after December 31, 2010, may be carried forward indefinitely, and their character is retained as short-term and/or long-term. As of August 31, 2014, the Fund had no capital loss carryforwards for federal income tax purposes.

In accordance with accounting pronouncements, the Fund has recorded reclassifications in the capital accounts. These reclassifications have no impact on the net asset value of the Fund and are designed generally to present accumulated undistributed net investment income (loss) and accumulated realized gains/(losses) on a tax basis which is considered to be more informative to the shareholder. As of August 31, 2014, the Fund recorded reclassifications to increase (decrease) the capital accounts as follows:

| Net Investment Loss | | | Paid-in Capital | |

| $ | 18,761 | | | $ | (18,761 | ) |

There were no distributions paid by the Fund during the period since inception from December 4, 2014 through August 31, 2014.

| 8. | COMMITMENTS AND CONTINGENCIES |

In the normal course of business, the Trust may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

In accordance with GAAP, Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued, and has determined that there were no other subsequent events requiring recognition or disclosure in the financial statements.

| Winning Points Funds | ANNUAL REPORT |

WP Large Cap Income Plus Fund

NOTES TO THE FINANCIAL STATEMENTS

August 31, 2014

| 10. | RECENT ACCOUNTING PRONOUNCEMENTS |

In June 2013, the FASB issued ASU 2013-08, Financial Services Investment Companies, which updates the scope, measurement, and disclosure requirements for U.S. GAAP including identifying characteristics of an investment company, measurement of ownership in other investment companies and requires additional disclosures regarding investment company status and following guidance in Topic 946 of the FASB Accounting Standards Codification (“FASC”). The ASU is effective for interim and annual reporting periods that begin after December 15, 2013. Management is currently evaluating the impact that these pronouncements may have on the Fund's financial statements.

In June 2014, the Financial Accounting Standard Board issued ASU No. 2014-11 “Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures.” ASU No. 2014- 11 makes limited changes to the accounting for repurchase agreements, clarifies when repurchase agreements and securities lending transactions should be accounted for as secured borrowings, and requires additional disclosures regarding these types of transactions. The guidance is effective for fiscal years beginning after December 15, 2014, and for interim periods within those fiscal years. Management is currently evaluating the impact these disclosures will have on the Fund’s financial statement disclosures.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees

of WP Large Cap Income Plus Fund, a series of 360 Funds

We have audited the accompanying statements of assets and liabilities of WP Large Cap Income Plus Fund, (the "Fund"), a series of 360 Funds (the “Trust”), including the schedule of investments and schedule of call options written and purchased, as of August 31, 2014 and the related statements of operations, changes in net assets and financial highlights, for the period December 4, 2013 (commencement of investment operations) through August 31, 2014. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund was not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities and cash owned as of August 31, 2014, by correspondence with the custodian and brokers. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of August 31, 2014, the results of its operations, the statement of changes in net assets, and the financial highlights, for the period December 4, 2013 (commencement of investment operations) through August 31, 2014 in conformity with accounting principles generally accepted in the United States of America.

Abington Pennsylvania

October 27, 2014

| Winning Points Funds | ANNUAL REPORT |

August 31, 2014 (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Shareholder Tax Information - The Fund is required to advise you within 60 days of the Fund’s fiscal year end regarding the federal tax status of distributions received by shareholders during the fiscal year. The Fund did not pay any distributions during the period since inception from December 4, 2013 through August 31, 2014.

Tax information is reported from the Fund’s fiscal year and not calendar year, therefore, shareholders should refer to their Form 1099-DIV or other tax information which will be mailed in 2015 to determine the calendar year amounts to be included on their 2014 tax returns. Shareholders should consult their own tax advisors.

| Winning Points Funds | ANNUAL REPORT |

August 31, 2014 (Unaudited)

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited)

The Trustees are responsible for the management and supervision of the Funds. The Trustees approve all significant agreements between the Trust, on behalf of the Funds, and those companies that furnish services to the Funds; review performance of the Funds; and oversee activities of the Funds. This section of the SAI provides information about the persons who serve as Trustees and Officers to the Trust and Funds, respectively, as well as the entities that provide services to the Funds.

Trustees and Officers. Following are the Trustees and Officers of the Trust, their age and address, their present position with the Trust or the Funds, and their principal occupation during the past five years. As described above under “Description of the Trust”, each of the Trustees of the Trust will generally hold office indefinitely. The Officers of the Trust will hold office indefinitely, except that: (1) any Officer may resign or retire and (2) any Officer may be removed any time by written instrument signed by at least two-thirds of the number of Trustees prior to such removal. In case a vacancy or an anticipated vacancy on the Board of Trustees shall for any reason exist, the vacancy shall be filled by the affirmative vote of a majority of the remaining Trustees, subject to certain restrictions under the 1940 Act. Those Trustees who are “interested persons” (as defined in the 1940 Act) by virtue of their affiliation with either the Trust or the Adviser, are indicated in the table.

| Name, Address and Age | Position(s) Held with Trust | Length of Service | Principal Occupation(s) During Past 5 Years | Number of Series Overseen | Other Directorships During Past 5 Years |

| Independent Trustees |

Art Falk 4520 Main Street Suite 1425 Kansas City, Missouri 64111 Age 76 | Trustee and Independent Chairman | Since June 2011 | Mr. Falk has retired from Murray Hill Financial Marketing, a financial marketing consulting firm. He was President of the Company from 1990 to 2012. | Thirteen | None |

Thomas Krausz 4520 Main Street Suite 1425 Kansas City, Missouri 64111 Age 69 | Trustee | Since June 2011 | Mr. Krausz has been an independent management consultant to private enterprises since 2007. From 2005 to 2007 he was the Chief Technology Officer for IDT Ventures, a venture capital and business development firm. Prior to 2005, he was President of Mentorcom Services, Inc., a consulting and services company focusing on networking and web development. | Thirteen | None |

| Tom M. Wirtshafter 4520 Main Street Suite 1425 Kansas City, Missouri 64111 Age 59 | Trustee | Since June 2011 | Mr. Wirtshafter has been the Senior Vice President of each of American Portfolios Financial Services, a broker-dealer, and American Portfolios Advisors, an investment adviser, since 2009. From 2005 to 2008 Mr. Wirtshafter was a business consultant. | Thirteen | None |

| Interested Trustee* |

| Randall K. Linscott 4520 Main Street Suite 1425 Kansas City, Missouri 64111 Age 43 | President | Since July 2013 | Mr. Linscott has been the Chief Executive Officer for M3Sixty Administration LLC since 2011. Prior to 2011, Mr. Linscott served as a Division Vice President at Boston Financial Data Services from 2005 until 2011. | Thirteen | N/A |

| Winning Points Funds | ANNUAL REPORT |

ADDITIONAL INFORMATION

August 31, 2014 (Unaudited)

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited)(continued)

| Officers* |

Robert S. Driessen 4520 Main Street Suite 1425 Kansas City, Missouri 64111 Age 66 | Chief Compliance Officer and Secretary | Since July 2013 | Prior to 2013, Mr. Driessen served as the Senior Vice President and Chief Compliance Officer for Aquila Distributors, Inc., and Vice President and Chief Compliance Officer of its advisory affiliate, Aquila Investment Management LLC from November 2009 until December 2012. Prior to 2009, Mr. Driessen served as the Vice President and Chief Compliance Officer of Curian Capital, LLC from April 2004 to December 31, 2008. | N/A | N/A |

Brandon Byrd 4520 Main Street Suite 1425 Kansas City, Missouri 64111 Age 34 | Assistant Secretary | Since July 2013 | Mr. Byrd has been the Director of Operations at M3Sixty Administration LLC since 2012. Prior to 2012, Mr. Byrd served as a Division Manager – Client Service Officer for Boston Financial Data Services from 2010 until 2012, and as a Group Manager for Boston Financial Data Services from 2007 until 2010. | N/A | N/A |

Larry Beaver 4520 Main Street Suite 1425 Kansas City, Missouri 64111 Age 45 | Treasurer | Since March 2007 | Mr. Beaver has been the Director of Fund Accounting & Administration for M3Sixty Administration LLC since February 2005. | N/A | N/A |

| * | The Interested Trustee and Officers are Interested because they are officers and/or employees of the Administrator. |

ADDITIONAL INFORMATION

August 31, 2014 (Unaudited)

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited) (continued)

Remuneration Paid to Trustees and Officers - Officers of the Trust and Trustees who are “interested persons” of the Trust or the Adviser will receive no salary or fees from the Trust. Each Trustee who is not an “interested person” receives a fee of $1,000 each year plus $125 per Board or committee meeting attended. The Trust reimburses each Trustee and officer for his or her travel and other expenses relating to attendance at such meetings.

| Name of Trustee1 | Aggregate Compensation From the Fund2 | Pension or Retirement Benefits Accrued As Part of Portfolio Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From the Fund Paid to Trustees2 |

| Independent Trustees |

| Art Falk | $1,125 | None | None | $1,125 |

| Thomas Krausz | $1,125 | None | None | $1,125 |

| Tom M. Wirtshafter | $1,125 | None | None | $1,125 |

| Interested Trustees and Officers |

| Randall K. Linscott | None | Not Applicable | Not Applicable | None |

| Robert S. Driessen | None | Not Applicable | Not Applicable | None |

| Brandon Byrd | None | Not Applicable | Not Applicable | None |

| Larry Beaver | None | Not Applicable | Not Applicable | None |

| 1 | Each of the Trustees serves as a Trustee to each Series of the Trust. The Trust currently offers thirteen (13) series of shares. |

| 2 | Figures are for the period since inception from December 4, 2014 through August 31, 2014. |

| Winning Points Funds | ANNUAL REPORT |

Information About Your Fund’s Expenses - (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as the sales charge (load) imposed on certain subscriptions and the contingent deferred sales charge (“CDSC”) imposed on certain short-term redemptions; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses – The first section of the table provides information about actual account values and actual expenses (relating to the example $1,000 investment made at the beginning of the period). You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second section of the table provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), CDSC fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. For more information on transactional costs, please refer to the Fund’s prospectus.

| Expenses and Value of a $1,000 Investment for the period from 03/01/14 through 08/31/14 |

| |

| | Beginning Account Value (03/01/2014) | Annualized Expense Ratio for the Period | Ending Account Value (08/31/2014) | Expenses Paid During Period (a) |

| Actual Fund Return (in parentheses) | | | |

| Institutional Class (+5.71%) | $1,000.00 | 3.16% | $1,057.06 | $16.38 |

| Expenses and Value of a $1,000 Investment for the period from 03/01/14 through 08/31/14 |

| |

| | Beginning Account Value (03/01/2014) | Annualized Expense Ratio for the Period | Ending Account Value (08/31/2014) | Expenses Paid During Period (a) |

| Hypothetical 5% Fund Return | | | |

| Institutional Class | $1,000.00 | 3.16% | $1,009.30 | $16.00 |