UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4520 Main Street, Suite 1425 Kansas City, MO | 64111 |

| (Address of principal executive offices) | (Zip code) |

Matrix 360 Administration, LLC

4520 Main Street

Suite 1425

Kansas City, MO 64111

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-244-6235

Date of fiscal year end: 02/28/2014

Date of reporting period: 02/28/2014

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the Snow Capital Funds, series of the 360 Funds (the “registrant”) for the period ended February 28, 2014 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

Snow Capital Focused Value Fund Class A Shares (Ticker Symbol: SFOAX) Class I Shares (Ticker Symbol: SFOIX) Snow Capital Hedged Equity Fund Class A Shares (Ticker Symbol: SHEAX) Class I Shares (Ticker Symbol: SHEIX) Snow Capital Market Plus Fund Class A Shares (Ticker Symbol: SPLAX) Class I Shares (Ticker Symbol: SPLIX) Snow Capital Inflation Advantaged Equities Fund Class A Shares (Ticker Symbol: SIAAX) Class I Shares (Ticker Symbol: SIAIX) Snow Capital Dividend Plus Fund Class A Shares (Ticker Symbol: SDPAX) Class I Shares (Ticker Symbol: SDPIX) Snow Capital Mid Cap Value Fund Class A Shares (Ticker Symbol: SNMAX) Class I Shares (Ticker Symbol: SNMIX) each a series of the 360 Funds |

ANNUAL REPORT

February 28, 2014

Investment Adviser

Snow Capital Management L.P.

2000 Georgetowne Drive, Suite 200

Sewickley, Pennsylvania 15143

| LETTER TO SHAREHOLDERS | 2 |

| INVESTMENT HIGHLIGHTS | 16 |

| SCHEDULES OF INVESTMENTS | 25 |

| STATEMENTS OF ASSETS AND LIABILITIES | 38 |

| STATEMENTS OF OPERATIONS | 40 |

| STATEMENTS OF CHANGES IN NET ASSETS | 42 |

| FINANCIAL HIGHLIGHTS | 44 |

| NOTES TO FINANCIAL STATEMENTS | 47 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 58 |

| ADDITIONAL INFORMATION | 59 |

| EXPENSE EXAMPLES | 63 |

Dear Shareholder:

The 25% return for the S&P 500 Total Return Index over the past year was a welcome surprise to most market participants. Only two other times since 2000 has the S&P 500 Total Return Index generated returns of this magnitude on a calendar year basis, i.e., up 32% in 2013, 26% in 2009, and 29% in 2003. Perhaps just as surprisingly, the returns were achieved with minimal volatility. The intra-year drawdown over the 12-month period was only 5.7% versus an average of 14.4% over the last 34 years. There remains plenty to worry about (e.g., China’s economic model, Russian sabre rattling, slow economic growth, government debt, Fed tapering, just to name a few) but those investors that remain in the U.S. domestic stock markets appear to have taken a “What, me worry?” approach.

Few investors have had the wherewithall to remain in the U.S. stock market during the past seven years. Withdrawals from equity mutual funds have totaled more than $600 billion cumulatively since January of 2007. U.S. domestic equity funds saw a modest inflow in calendar year 2013, i.e., less than $20 billion.

After the returns of the past year, one would expect to find evidence of investor euphoria. On the contrary, investors still seem reluctant to jump into the U.S. stock market; we appear to be dealing with a continuation of the malaise from the financial crisis. Investors have more financial options available to them than at any other time in history and they appear to be gravitating toward the vast array of alternative investments in lieu of U.S. domestic stocks.

A return of investors to U.S. stocks is a theme we pinpointed as a catalyst in our last annual letter. While 2013 saw the first year of inflows in the last seven years, we would still look to new inflows as a potential catalyst to push the markets higher.

The companies of the S&P 500 Index trade at about 15 times 2014 estimated earnings, right in the middle of the average range over the past 20 years. Stocks appear to be neither compellingly inexpensive nor are they very rich. Valuation is not likely going to be a driver of future returns. That does not mean that multiples cannot expand from here—as it’s likely they will—but we would not use valuation as the justification for equity investment in general.

The odds are against the returns of the past year being replicated in the next 12 months but we see no reason for the bull market to end right now. The economy continues to chug along at a slow but positive pace while corporations and individuals have the healthiest balance sheets in recent memory. Unemployment is falling and capital expenditures are starting to rise. Given the slack that is still present in the U.S. economy we see plenty of room for growth and little reason for a significant economic decline.

While investment opportunities are not as plentiful as they were in the immediate aftermath of the financial crisis, we are still finding compelling investments. With patient discipline we continue to wade through financial reports and SEC filings to find opportunity where others see only risk.

As of December 2012, in a study entitled "Quantitative Analysis of Investor Behavior" conducted by the research firm DALBAR, Inc., for the trailing 20 years ending December 31, 2011, the average investor** in mutual funds realized a return of just 2.3% annualized. During that same time period, the S&P 500 Index returned 8.2% per annum and inflation as measured by the CPI returned 2.5% per annum. The average investor likely fell short of inflation because of their belief that they could somehow guess the market’s direction. By continually purchasing the most recent best performing asset and selling the asset with the poorest performance, many found themselves selling low and buying high. We believe this phenomenon gives credence to irrational markets and value investing, and more importantly, validates the need for active equity management.

An important tenet of the Snow Capital Management L.P. (“Snow Capital” or the “Firm”) investment process is that we do not time the market. We stay fully invested at all times. Being fully invested when an unexpected market moving event produces short-term losses can be difficult to endure, but one does not realize long-term returns by continually trying to guess the next market move. Real wealth is built over long periods of time by sticking to an investment discipline in good times and bad.

Snow Capital offers mutual funds that provide an investor the opportunity to leverage the Firm’s value investing process, our resources as an institutional investor, and our professional investment discipline. The funds all utilize the same investment process. Your financial professional can help you determine which fund is best suited to you.

Thank you for choosing Snow Capital.

2

Snow Capital Focused Value Fund

How did the Fund perform?

With inception of the Fund being March 28, 2013, all returns for the fiscal year cover an 11-month time frame. For the period ending February 28, 2014, the Class I shares return was 34.80% compared to a return of 19.16% for the Russell 1000 Value Total Return Index. For the six month period ended February 28, 2014, the Class I shares for the Snow Capital Focused Value Fund recorded a return of 23.84% compared to a return of 13.46% for the Russell 1000 Value Total Return Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Focused Value portfolio includes a concentrated group of 18 to 24 stocks that is assembled using a collaborative approach, with weekly input from analysts and portfolio managers. Positions are conviction weighted to reflect potential upside and near-term catalysts.

Comments on the market environment during the period

The year 2013 was filled with negative news stories like any other year: political stalemates, volatility in the Middle East, emerging market concerns, recessions in mature economies, and devastating natural disasters. And yet, the U.S. equity markets climbed the wall of worry and went on to hit a new all-time high, with surprisingly low volatility. Although many focused solely on rising stock prices throughout the period, underlying market fundamentals also improved, in turn, helping support the market’s upward momentum.

Top Positive Contributors to the Fund’s Return

For the time period, Financials, Energy, Industrials, and Consumer Discretionary added the most to overall performance.

The Fund’s top contributor was MetLife (MET), a market leader in the life insurance industry. MET reported strong operating results and hit the low end of its 2016 return-on-equity goals of 12 to 14% through solid underwriting, robust equity markets, and expense control. MET sits with over $4 billion of excess capital while management and investors alike await a regulatory environment favoring returns of capital, most likely through share repurchase. Genworth Financial (GNW), another large multi-line insurance company improved return-on-equity through higher pricing in long-term care and lower losses in the U.S. mortgage insurance business. Hartford Financial Services (HIG) benefited from higher interest rates and favorable pricing in Property & Casualty. A recently announced capital management plan will return $2.7 billion of capital to shareholders in the form of share-repurchases and debt repayment. Royal Caribbean Cruises (RCL) had a strong year with solid booking results in Asia, the EU, and Australia. RCL has done well to manage costs and raise on-board spending, resulting in net yield expansion. The Concordia disaster in Europe and Carnival Cruise issues abroad haven’t tempered the demand for RCL’s cruise experiences as much as some analysts had feared. Finally, Nabors Industries (NBR), an oil and gas driller benefited from improved demand in the U.S. and strong international margins.

Top Detractors from the Fund’s Return

Over the time period, no single sector detracted from the Fund’s overall performance. In order of magnitude, the worst performing stock was Big Lots (BIG), a discount closeout retailer. Shares fell precipitously after announcing plans to exit its underperforming Canadian segment in December. Sluggish holiday sales in the U.S. were also below expectation. The Fund no longer holds this position. Community Health Systems (CYH) experienced lower admissions, higher bad debts and an unfavorable payer mix. A long, drawn-out acquisition of Health Management Associates (HMA) was approved by shareholders in January after initially being announced 6 months prior. Phillips 66 (PSX), an oil refining, marketing, and transportation company, declined due to weaker crack spreads. Bank of America Corp (BAC), a new Fund holding, detracted from performance after an $8.5 billion mortgage bond settlement was upheld by a New York state judge, reigniting fears of further litigation costs.

Were there significant changes to the portfolio?

As of February 28th, 2014, the Fund held an overweight position in the Consumer Discretionary, Energy, Industrials, and Materials sectors compared to the Russell 1000 Value Index. The Fund held below average positions in the Consumer Staples, Financials, Utilities, and Telecomm sectors.

Since the Fund’s inception, we have reduced our exposure to the Information Technology, Financials, Industrials, Health Care, and Consumer Discretionary sectors and increased our investments in the Energy, Utilities, and Materials sectors. We currently hold no positions in the Telecomm or Consumer Staples sectors.

3

Snow Capital Focused Value Fund (Continued)

Comments on the Fund’s Five Largest Holdings

British Petroleum (BP)

A dominant global energy company moving past a crisis, we believe the stock’s valuation reflects the risk and we are confident that the issues will be resolved without threatening the company’s balance sheet. Excellent cash flow has set the stage for higher margin production in the future.

J.P. Morgan Chase (JPM)

After navigating the financial crisis and a slew of negative headlines under the leadership of CEO Jamie Dimon, JPM remains the premier lender in the banking industry. With stable credit trends and a well-capitalized balanced sheet, JPM is positioned to benefit from rising interest rates, further market share gains, and improving investor sentiment.

MetLife (MET)

A market leader in the life insurance industry, MET will continue to benefit from rising interest rates, higher savings rates, and demand for life and variable annuity products. The company is well capitalized and trades at a cheap valuation.

Rio Tinto (RIO)

RIO is an international mining company with interests in iron ore, copper, aluminum, and other metals. The company boasts some of the best iron ore assets and infrastructure in the world and is a low cost producer. With 60% of China’s population living in areas that are still in the early stages of urbanization, RIO is in a position to supply China with iron ore to build out its inner provinces. Management has recently focused on disciplined capital allocation.

Hartford Financial Services (HIG)

Once one of the largest life insurance companies in the United States, Hartford Financial Services Group has transformed itself into a stable property and casualty business focused on personal lines, small business, and middle markets. HIG’s new management team is focused on risk control, expense reduction, improved underwriting, and capital returns for shareholders.

4

Snow Capital Hedged Equity Fund

How did the Fund perform?

With inception of the Fund being March 28, 2013, all returns for the fiscal year cover an 11-month time frame. For the period ending February 28, 2014, the Snow Capital Hedged Equity Fund Class I shares return was 21.18% compared to a return of 21.33% for the S&P 500 Total Return Index, 19.32% for the Russell 3000 Value Total Return Index, and 7.52% for the HFRX Equity Hedge Index. For the six month period ended February 28, 2014, the Snow Capital Hedged Equity Fund Class I shares recorded a return of 16.52% compared to a return of 15.07% for the S&P 500 Total Return Index, 13.68% for the Russell 3000 Value Total Return Index, and 7.32% for the HFRX Equity Hedge Index.

How is the Fund managed?

We employ a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Hedged Equity Fund will invest primarily in equity securities, that Snow Capital believes are undervalued and selling short equity securities the Firm believes are overvalued.

Under normal market conditions, the Fund will invest approximately 80 to 100% of its net assets in long equity securities, or other similar investments. Using a bottom-up approach that seeks to identify companies that the Firm believes are undervalued and are likely to experience a rebound in earnings due to an event or series of events that creates a price to earnings expansion leading to higher stock price valuations. The fund may invest in securities of companies of any size and is not managed toward sector or industry weights.

The Fund will also sell securities short. Under normal market conditions, short sales will typically represent 20 to 40% of net assets. The Fund will employ short positions in an attempt to increase returns and/or to reduce risk. Short sales are placed after performing a bottom-up approach, and it is believed that the price of a particular security is overvalued.

Comments on the market environment during the period

The year 2013 was filled with negative news stories like any other year: political stalemates, volatility in the Middle East, emerging market concerns, recessions in mature economies, and devastating natural disasters. And yet, the U.S. equity markets climbed the wall of worry and went on to hit a new all-time high, with surprisingly low volatility. Although many focused solely on rising stock prices throughout the period, underlying market fundamentals also improved, in turn, helping support the market’s upward momentum.

Top Positive Contributors to the Fund’s Return

For the time period, the Financials, Energy, Consumer Discretionary, and Industrials sectors contributed the most to overall performance.

The Fund’s top contributor was Royal Caribbean Cruises (RCL), which had a strong year with solid booking results in Asia, the EU, and Australia. RCL has done well to manage costs and raise on-board spending, resulting in net yield expansion. The Concordia disaster in Europe and Carnival Cruise issues abroad haven’t tempered the demand for RCL’s cruise experiences as much as some analysts had feared. Genworth Financial (GNW), a diversified multi-line insurance company, was a strong performer. GNW is improving their return on equity through higher pricing in long-term care and lower losses in the U.S. mortgage insurance business. Hewlett-Packard Company (HPQ), led by CEO Meg Whitman, was able to stabilize nearly every line of the business after several quarters of large declines. MetLife (MET) is a market leader in the life insurance industry that benefitted from the improving interest rate environment during 2013. The company reported strong operating results and hit the low end of its 2016 return-on-equity goals of 12 to 14% through solid underwriting, robust equity markets, and expense control. MET sits with over $4 billion of excess capital while management and investors alike await a regulatory environment favoring returns of capital, most likely through share repurchase. Hartford Financial Services (HIG) saw strong pricing trends in their Property & Casualty business with a 2013 return-on-equity of 8.6% and growing into 2014. A recently announced capital management plan will return $2.7 billion of capital to shareholders in the form of share-repurchases and debt repayment.

5

Snow Capital Hedged Equity Fund (Continued)

Top Detractors from the Fund’s Return

For the time period, the selected Consumer Staples detracted from overall performance.

In order of magnitude, Big Lots (BIG) was the Fund’s greatest detractor. Shares fell precipitously after announcing plans to exit its underperforming Canadian segment in December. Sluggish holiday sales results contributed to the detraction. The Fund no longer holds this position. Community Health Systems (CYH) detracted on lower admissions, where weak volumes combined with higher bad debts and an unfavorable payer mix negatively impacted operations. A long, drawn-out acquisition of Health Management Associates (HMA) was approved by shareholders in January after initially being announced 6 months prior. The Industrial Select Sector SPDR (XLI), a short position, underperformed as the Industrial sector rose throughout the year with improved macroeconomic data and rising equity markets. The Consumer Discretionary Select Sector SPDR (XLY), another short position, detracted from performance as the Consumer Discretionary sector increased throughout the year with rising equity markets and an increase in discretionary spending. The Technology Select Sector SPDR (XLK), another short position, detracted from performance as the Technology sector delivered a strong year of returns led by Google (GOOG), Apple (AAPL), and Microsoft (MSFT).

Were there significant changes to the portfolio?

As of February 28th, 2014, the Fund held an overweight position in the Consumer Discretionary, Information Technology, and Healthcare sectors compared to the Russell 3000 Value. The Fund held below average positions in the Financials, Telecommunications, Energy, and Consumer Staples sectors.

Comments on the Fund’s Five Largest Holdings

Community Health Systems (CYH)

CYH is an excellent hospital operator who will benefit from integration synergies and increased access to health insurance. Long-term demographic are favorable, and healthcare reform should facilitate the reimbursement process and reduce exposure to bad debt.

Kennametal Inc (KMT)

A provider of custom and standard wear-resistant solutions for industrial and infrastructure applications, KMT has customers in a broad array of end markets. Significant exposure to the growing aerospace, oil & gas, and construction industries provides solid future growth drivers.

British Petroleum (BP)

A dominant global energy company moving past a crisis, we believe the stock’s valuation reflects the risk and we are confident that the issues will be resolved without threatening the company’s balance sheet. Excellent cash flow has set the stage for higher margin production in the future.

Target Corp (TGT)

Target operates general merchandise and food discount stores in the United States along with a fully integrated online business. Brand awareness is among the best-in-class, and TGT has an opportunity to build momentum internationally after recently expanding into Canada.

Spirit AeroSystems (SPR)

A designer and manufacturer of aero structures, SPR is well positioned as the global airline fleet ages, emerging market orders increase, and airline traffic continues to grow.

6

Snow Capital Market Plus Fund

How did the Fund perform?

With inception of the Fund being March 28, 2013, all returns for the fiscal year cover an 11-month time frame. For the period ending February 28, 2014, the return for Class I shares was 27.05% compared to a return of 19.32% for the Russell 3000 Value Total Return Index. For the six month period ended February 28, 2014, the Snow Capital Market Plus Fund Class I shares recorded a return of 18.19% compared to a return of 13.68% for the Russell 3000 Value Total Return Index.

How is the Fund managed?

The Snow Capital Market Plus Fund typically maintains a portfolio of 50 to 80 U.S.-listed securities. The Fund invests approximately 50% of its net assets in equity securities of companies that are among the top 300 securities by weighting in the Russell 3000 Value Index. The Fund invests in each of the top 20 securities by weighting in the Russell 3000 Value Index. We use fundamental analysis and valuation techniques to determine an optimum weight for each position.

With respect to its remaining 50% of assets, the Fund mirrors the Snow Capital Focused Value strategy. Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Focused Value strategy’s portfolio includes a concentrated group of 18 to 24 stocks that is assembled using a collaborative approach, with weekly input from analysts and portfolio managers. Positions are conviction weighted to reflect potential upside and near-term catalysts.

Comments on the market environment during the period

The year 2013 was filled with negative news stories like any other year: political stalemates, volatility in the Middle East, emerging market concerns, recessions in mature economies, and devastating natural disasters. And yet, the U.S. equity markets climbed the wall of worry and went on to hit a new all-time high, with surprisingly low volatility. Although many focused solely on rising stock prices throughout the period, underlying market fundamentals also improved, in turn, helping support the market’s upward momentum.

Top Positive Contributors to the Fund’s Return

For the time period, Financials, Energy, Industrials, and Health Care sectors added the most to overall performance.

The Fund’s top contributor was Nabors Industries (NBR), the largest land driller in the world, which benefitted from improved U.S. rig demand and record international margins. Genworth Financial (GNW), a large multi-line insurance company, positively contributed as they improved their return-on-equity through higher pricing in long-term care and lower losses in the U.S. mortgage insurance business. GNW also benefitted from improving interest rates throughout much of 2013. MetLife (MET), another insurance company that benefitted from the improving interest rate environment during 2013, reported strong operating results and hit the low end of its 2016 return-on-equity goals of 12 to 14% through solid underwriting, robust equity markets, and expense control. MET sits with over $4 billion of excess capital while management and investors alike await a regulatory environment favoring returns of capital, most likely through share repurchase. Hartford Financial Services (HIG) saw strong pricing trends in their Property & Casualty business with a 2013 return-on-equity of 8.6% and growing into 2014. A recently announced capital management plan will return $2.7 billion of capital to shareholders in the form of share repurchases and debt repayment. J.P. Morgan Chase (JPM) outperformed after navigating a slew of negative headlines while maintaining sufficient capital ratios.

Top Detractors from the Fund’s Return

For the time period, Telecommunications was the only sector that detracted from overall performance. The top detractor for the time period was Big Lots (BIG), a discount closeout retailer. Shares fell precipitously after announcing plans to exit its underperforming Canadian segment in December. Sluggish holiday sales results contributed to the detraction. The Fund no longer holds this position. Community Health Systems (CYH) detracted on lower admissions, where weak volumes combined with higher bad debts and an unfavorable payer mix negatively impacted operations. A long, drawn-out acquisition of Health Management Associates (HMA) was approved by shareholders in January after initially being announced six months prior. Phillips 66 (PSX), an oil refining, marketing, and transportation company, reported poor fourth quarter performance in the Atlantic Basin along with increased operating costs from a major turnaround at the Bayway refinery. PSX is a new holding in the Fund. AT&T Inc (T) tracked the Telecommunications sector, detracting slightly, and also saw shares fall as T-Mobile (TMUS) gained market share. The Southern Company (SO), a public utility holding company, has underperformed the utility segment due to cost overruns at their Kemper Country IGCC project and a sustained trend of soft power demand in the summer of 2013.

7

Snow Capital Market Plus Fund (Continued)

Were there significant changes to the portfolio?

As of February 28th, 2014, the Fund held an overweight position in the Energy, Health Care, and Information Technology sectors compared to the Russell 3000 Value Index. The Fund held below average positions in the Financials, Consumer Staples, and Utilities sectors.

Since the Fund’s inception, we have reduced our exposure to the Consumer Staples, Consumer Discretionary, Financials, Industrials, Telecommunications, and Information Technology sectors and increased our investments in the Energy, Health Care, Utilities, and Materials sectors.

Comments on the Fund’s Five Largest Holdings

J.P. Morgan Chase (JPM)

After navigating the financial crisis and a slew of negative headlines under the leadership of CEO Jamie Dimon, JPM remains the premier lender in the banking industry. With credit trends stabilized and a well-capitalized balanced sheet, JPM should benefit from rising interest rates. We believe much of JPM’s legal woes are behind the firm and that investor sentiment will improve over time.

British Petroleum (BP)

A dominant global energy company moving past a crisis, we believe the stock’s valuation reflects the risk and we are confident that the issues will be resolved without threatening the company’s balance sheet. Excellent cash flow has set the stage for higher margin production in the future.

Bank of America Corp (BAC)

One of the largest financial institutions in the United States, BAC has recently bolstered capital levels and simplified its business model. Currently with one of the strongest consumer franchises in the country, BAC has a significant opportunity to grow internationally.

MetLife (MET)

A market leader in the life insurance industry, MET will continue to benefit from rising interest rates, higher savings rates, and demand for life and variable annuity products. The company is well-capitalized and trades at a cheap valuation.

Rio Tinto (RIO)

RIO is an international mining company with interests in iron ore, copper, aluminum, and other metals. The company boasts some of the best iron ore assets and infrastructure in the world and is a low cost producer. With 60% of China’s population living in areas that are still in the early stages of urbanization, RIO is in a position to supply China with iron ore to build out its inner provinces. Management has recently focused on disciplined capital allocation.

8

Snow Capital Inflation Advantaged Fund

How did the Fund perform?

With inception of the Fund being March 28, 2013, all returns for the fiscal year cover an 11-month time frame. For the period ending February 28, 2014, the Snow Capital Inflation Advantage Fund Class I shares return was 19.10%% compared to a return of 22.46% for the Russell 3000 Total Return Index. For the six month period ended February 28, 2014, the Snow Capital Inflation Advantage Fund Class I shares recorded a return of 15.63% compared to a return of 15.84% for the Russell 3000 Total Return Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance, seeking to yield a portfolio that is amply diversified across a wide spectrum of economic classifications and sectors. The Snow Capital Inflation Advantage Fund typically maintains a portfolio between 30 and 50 securities with a focus on companies who may prosper from inflation, evidenced by growing revenues, expanding margins, or other drivers of income. Inflation may be driven by macroeconomic factors, but it can also be company or sector specific, enabling a broad array of investment candidates in any economic environment. Under normal market conditions, at least 80% of the Fund’s net assets are invested in equity securities of companies with market capitalizations greater than $1 billion, and up to 15% of its net assets may be invested in U.S. Government or U.S agency obligations.

Comments on the market environment during the period

The year 2013 was filled with negative news stories like any other year: political stalemates, volatility in the Middle East, emerging market concerns, recessions in mature economies, and devastating natural disasters. And yet, the U.S. equity markets climbed the wall of worry and went on to hit a new all-time high, with surprisingly low volatility. Although many focused solely on rising stock prices throughout the period, underlying market fundamentals also improved, in turn, helping support the market’s upward momentum.

Top Positive Contributors to the Fund’s Return

For the time period, the Financials, Energy, Health Care, and Materials added the most to overall performance.

Hartford Financial Services (HIG), a multi-line insurance company, benefited from higher interest rates and favorable pricing trends in their Property & Casualty business with a 2013 return-on-equity of 8.6% and growing into 2014. A recently announced capital management plan will return $2.7 billion of capital to shareholders in the form of share-repurchases and debt repayment. MetLife (MET), another insurance company that benefitted from the improving interest rate environment during 2013, reported strong operating results and hit the low end of its 2016 return-on-equity goals of 12-14% through solid underwriting, robust equity markets, and expense control. MET sits with over $4 billion of excess capital while management and investors alike await a regulatory environment favoring returns of capital, most likely through share repurchase. Johnson Controls (JCI) outperformed on the strength of the automotive markets in 2013 combined with management execution on past restructuring efforts. A sizeable unexpected share repurchase announcement in November also added value to the Fund. Nabors Industrials (NBR) and oil and gas driller, benefited from improved demand in the U.S. and strong international margins. Baker Hughes (BHI), a leading integrated oil servicing company, saw accelerated growth internationally after restricting actions in Brazil. Pressure pumping improvements in North America bolstered sales and margin expansion.

Top Detractors from the Fund’s Return

Over the time period, no single sector detracted from overall performance. In order of magnitude, the worst performing stock was Newmont Mining Corp (NEM), a gold producer that detracted as the price of gold fell along with increases in production costs. Noble Corporation (NE) disappointed after concerns over the near-term demand for off-shore drilling rigs following a period of high growth. Patterson-UTI Energy (PTEN) traded lower on weaker rates for rigs and a fundamental oversupply of the pressure pumping market, which led to price decreases. The Mosaic Company detracted from performance after the international potash market was disrupted during the summer, 2013, which led to a fall in global prices. Community Health Systems (CYH) detracted on lower admissions, where weak volumes combined with higher bad debts and an unfavorable payer mix negatively impacted operations. A long, drawn-out acquisition of Health Management Associates (HMA) was approved by shareholders in January after initially being announced six months prior.

9

Snow Capital Inflation Advantaged Fund (Continued)

Were there significant changes to the portfolio?

As of February 28th, 2014, the Fund held an overweight in the Materials, Energy, Financials, and Consumer Staples sectors compared to the Russell 3000 Index. The Fund held below average positions in the Information Technology, Consumer Discretionary, Telecommunications, and Industrials sectors.

Since the Fund’s inception, we have reduced our exposure to the Materials, Information Technology, Financials, and Consumer Discretionary sectors and increased our investments in the Telecommunications, Health Care, Consumer Staples, and Energy sectors. We currently hold no position within the Telecommunications and Information Technology sectors.

Comments on the Fund’s Five Largest Holdings

Hartford Financial Services (HIG)

Once one of the largest life insurance companies in the United States, Hartford Financial Services Group has transformed itself into a stable property and casualty business focused on personal lines, small business, and middle markets. HIG’s new management team is focused on risk control, expense reduction, improved underwriting, and capital returns for shareholders.

MetLife (MET)

A market leader in the life insurance industry, MET will continue to benefit from rising interest rates, higher savings rates, and demand for life and variable annuity products. The company is well capitalized and trades at a cheap valuation.

Nabors Industries (NBR)

The largest land drilling contractor in the world and one of the largest well-servicing and workover contractors in North America, NBR is involved in every phase of the life of an oil or gas well.

British Petroleum (BP)

A dominant global energy company moving past a crisis, we believe the stock’s valuation reflects the risk and we are confident that the issues will be resolved without threatening the company’s balance sheet. Excellent cash flow has set the stage for higher margin production in the future.

Rio Tinto (RIO)

RIO is an international mining company with interests in iron ore, copper, aluminum, and other metals. The company boasts some of the best iron ore assets and infrastructure in the world and is a low cost producer. With 60% of China’s population living in areas that are still in the early stages of urbanization, RIO is in a position to supply China with iron ore to build out its inner provinces. Management has recently focused on disciplined capital allocation.

10

Snow Capital Dividend Plus Fund

How did the Fund perform?

With inception of the Fund being March 28, 2013, all returns for the fiscal year cover an 11-month time frame. For the period ending February 28, 2014, the Class I shares return was 22.61% compared to a return of 19.16% for the Russell 1000 Value Total Return Index. For the six month period ended February 28, 2014, the Snow Capital Dividend Plus Fund Class I shares recorded a return of 16.22% compared to a return of 13.46% for the Russell 1000 Value Total Return Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Dividend Plus Fund builds on our bottom-up value process with an emphasis on both income and capital appreciation. The portfolio consists of 40-70 investments that are weighted according to total expected return with up to 25% invested in foreign equity or fixed income.

Comments on the market environment during the period

2013 was filled with negative news stories like any other year: political stalemates, volatility in the Middle East, emerging market concerns, recessions in mature economies, and devastating natural disasters. And yet, the U.S. equity markets climbed the wall of worry and went on to hit a new all-time high, with surprisingly low volatility. Although many focused solely on rising stock prices throughout the period, underlying market fundamentals also improved, in turn, helping support the market’s upward momentum.

Top Positive Contributors to the Fund’s Return

For the time period, the Financials, Energy, Health Care, and Information Technology added the most to overall performance.

The Fund’s top contributor was Royal Caribbean Cruises (RCL), which had a strong year with solid booking results in Asia, the EU, and Australia. RCL has done well to manage costs and raise on-board spending, resulting in net yield expansion. The Concordia disaster in Europe and Carnival Cruise issues abroad haven’t tempered the demand for RCL’s cruise experiences as much as some analysts had feared. Microsoft (MSFT) has been able to navigate the poor PC environment better than its peers, and posted three quarters of earnings above analyst expectations for the year. The announced departure of CEO Steve Ballmer also boosted shares. MetLife (MET), a market leader in the life insurance industry, reported strong operating results and hit the low end of its 2016 return-on-equity goals of 12-14% through solid underwriting, robust equity markets, and expense control. MET sits with over $4 billion of excess capital while management and investors alike await a regulatory environment favoring returns of capital, most likely through share repurchase. MET was also a beneficiary of the improving interest rate environment during 2013. Teva Pharmaceuticals (TEVA) recently appointed a new CEO and pledged to overhaul their board of directors. The company continues to deliver on their $2B cost improvement goal, which should help offset increased competition for Copaxone, their market leading multiple sclerosis drug. WellPoint (WLP), a diversified managed care company, saw steady gains throughout the year as lower utilization led to lower medical costs. A new management team has been a positive for the stock, and WLP’s $20 billion fixed income portfolio benefitted from rising interest rates throughout much of 2013.

Top Detractors from the Fund’s Return

Over the time period, Telecomm was the only sector to detract from performance. In order of magnitude, the worst performing holding was Annaly Capital Management (NLY), a real estate investment trust. NLY was negatively impacted by the Federal Reserve unwinding QE3, and the company has since diversified away from agency mortgage backed securities and into commercial loans. KBR Inc (KBR), a leading global engineering and construction services company, fell after reporting disappointing fourth quarter results and issuing forward guidance that was below analyst expectations. A delay in closing two LNG projects also negatively affected earnings for KBR. Bank of America Preferred Series L Convertible Preferred (BAC 7.25%) fell as the interest rate environment improved during 2013. FirstEnergy Corp (FE), a diversified energy company operating in the Ohio Valley, detracted after an increase in new proposed plants caused forward electric prices to drop. FE stood to gain from coal plant retirements, but competition from planned natural gas fueled facilities along with imports from neighboring markets reduced market prices. Rogers Communications (RCI) also negatively impacted performance over the time period due to two consecutive quarters of earnings disappointments coupled with lingering concerns about the impact of Verizon (VZ) entering into the Canadian market.

11

Snow Capital Dividend Plus Fund (Continued)

Were there significant changes to the portfolio?

As of February 28th, 2014, the Fund held an overweight position in the Information Technology, Telecom, Materials, and Consumer Discretionary sectors compared to the Russell 1000 Value. The Fund held below average positions in the Industrials, Health Care, Financials, and Consumer Staples sectors.

Since the Fund’s inception, we have reduced our exposure to the Industrials, Consumer Staples, Energy, Consumer Discretionary, and Utilities sectors and increased our investments in the Telecomm, Information Technology, Financials, and Materials sectors.

Comments on the Fund’s Five Largest Holdings

J.P. Morgan Chase (JPM)

After navigating the financial crisis and a slew of negative headlines under the leadership of CEO Jamie Dimon, JPM remains the premier lender in the banking industry. With credit trends stabilized and a well-capitalized balanced sheet, JPM should benefit from rising interest rates. We believe much of JPM’s legal woes are behind it and that investor sentiment will improve over time.

Teva Pharmaceuticals (TEVA)

The world’s largest generic pharmaceuticals company with an expanding specialty drug portfolio, TEVA is poised to benefit from an aging industrialized population in conjunction with governments under pressure to slow rising health care costs.

Annaly Capital Management (NLY)

A real estate investment trust, NLY pays out at least 90% of its taxable income in the form of shareholder dividends. While NLY’s portfolio has been negatively impacted through the unwinding of Quantitative Easing, management has done well to manage exposure to mortgage backed securities in a rising interest rate environment. NLY boasts a stable forward dividend yield of greater than 10%.

Verizon Communications (VZ)

Verizon holds a strong position in the wireless space attributable to their overall network quality, and should see growth driven by 4G smartphones and tablets, wireless video, and machine-to-machine applications. Substantial free cash flow will be directed towards deleveraging the balance sheet and paying the 4.5% dividend.

Microsoft Corp (MSFT)

The world’s most successful software company, MSFT has re-organized their internal structure and now has less profit tied to the struggling PC market. Microsoft Office remains the dominant software platform in the commercial sector and we like the company’s prospects as computing shifts to a cloud-based model.

12

Snow Capital Mid Cap Value Fund

How did the Fund perform?

With inception of the Fund being March 28, 2013, all returns for the fiscal year cover an 11-month time frame. For the period ending February 28, 2014, the Snow Capital Mid Cap Value Fund Class I shares return was 29.89%, compared to a return of 20.58% for the Russell 2500 Value Total Return Index. For the six month period ended February 28, 2014, the Snow Capital Mid Cap Value Fund Class I shares recorded a return of 19.77% compared to a return of 16.79% for the Russell 2500 Value Total Return Index.

How is the Fund managed?

We employ a contrarian value process rooted in the fundamental analysis of individual companies to build a portfolio of investments. The Snow Capital Mid Cap Value Fund typically maintains a portfolio between 30 to 50 U.S.-listed equities. We weight position sizes based upon our assessment of upside potential and near-term catalysts. The Fund draws at least 80% of its investments from companies with market capitalizations between $3 billion and $25 billion.

Comments on the market environment during the period

The year 2013 was filled with negative news stories like any other year: political stalemates, volatility in the Middle East, emerging market concerns, recessions in mature economies, and devastating natural disasters. And yet, the U.S. equity markets climbed the wall of worry and went on to hit a new all-time high, with surprisingly low volatility. Although many focused solely on rising stock prices throughout the period, underlying market fundamentals also improved, in turn, helping support the market’s upward momentum.

Top Positive Contributors to the Fund’s Return

For the year, Financials, Health Care, Industrials, and Consumer Discretionary added the most to overall performance.

In order of magnitude, the best performing stock for the year was Endo International (ENDP). Endo benefited from the acquisition of Paladin Labs, which will enable ENDP to further diversify across products and geographies. ENDP also did well to manage costs ahead of anticipated competition for generic products. Defense contractor General Dynamics (GD) Corporation was the second largest contributor, as it was able to generate positive earnings surprises despite headwinds from U.S. budget cuts and the government shutdown. Genworth Financial (GNW), a diversified multi-line insurance company, was a strong performer. GNW is improving their return on equity through higher pricing in long-term care and lower losses in the U.S. mortgage insurance business. Managed care provider WellPoint Inc. (WLP) was a beneficiary of a new management team, better than expected earnings, and rising investor sentiment related to the implementation of the Affordable Care Act. Rounding out the top five was Hartford Financial Services (HIG), which saw strong pricing trends in their Property & Casualty business with a 2013 return-on-equity of 8.6% and growing into 2014. A recently announced capital management plan will return $2.7 billion of capital to shareholders in the form of share repurchases and debt repayment.

Top Detractors from the Fund’s Return

For the full year, no sector had negative overall performance. In order of magnitude, the worst performing stock over the last year was Big Lots (BIG). Shares fell precipitously after announcing plans to exit its underperforming Canadian segment in December. Sluggish holiday sales results contributed to the detraction. The Fund no longer holds this position. KBR Inc. (KBR), a leading global engineering and construction services company, fell after reporting disappointing fourth quarter results and issuing forward guidance that was below analyst expectations. A delay in closing two LNG projects also negatively affected earnings for KBR. Valero Energy (VLO) underperformed due to shifting sentiment towards the refining industry and we exited our position in the Company’s shares. Community Health Systems (CYH) detracted on lower admissions, where weak volumes combined with higher bad debts and an unfavorable payer mix negatively impacted operations. A long, drawn-out acquisition of Health Management Associates (HMA) was approved by shareholders in January after initially being announced 6 months prior. Newmont Mining (NEM) shares detracted as the price of gold fell along with increases in production costs.

13

Snow Capital Mid Cap Value Fund (Continued)

Were there significant changes to the portfolio?

As of February 28th, 2014, the Fund held an overweight in the Energy, Consumer Discretionary, Health Care and Industrials sectors compared to the Russell 2500 Value Index. The Fund held below average positions in the Financials, Utilities, Information Technology and Telecommunications sectors.

Since the Fund’s inception, we have reduced our exposure to the Health Care, Energy, Information Technology, Financials, Consumer Staples, and Materials sectors and increased our investments in the Industrials, Consumer Discretionary, and Utilities sectors. We currently hold no position within the Telecommunications sector.

Comments on the Fund’s Five Largest Holdings

First Niagara Financial Group (FNFG)

A regional bank with branches throughout the northeast, FNFG boasts stellar credit metrics and a well-diversified balance sheet. With a footprint exposed to energy and manufacturing, FNFG has been able to grow faster than their peers who have focused on real estate lending.

Kohl’s Corporation (KSS)

Kohl’s is a family-focused, value-oriented specialty department store offering moderately priced apparel, shoes, accessories, beauty, and home products. KSS operates 1,158 stores in 49 states. Kohl’s also offers online shopping as well as store credit cards.

Nabors Industries (NBR)

The largest land drilling contractor in the world and one of the largest well-servicing and workover contractors in North America, NBR is involved in every phase of the life of an oil or gas well.

Macy’s Inc. (M)

One of the nation’s premier retailers, operating 840 department stores in 45 states under than names Macy’s and Bloomingdale’s. Macy’s stores sell a wide range of merchandise, including men’s, women’s, and children’s apparel and accessories, cosmetics, home furnishings and other consumer goods. The Company also operates direct mail catalog and electronic commerce subsidiaries.

Hartford Financial Services (HIG)

Once one of the largest life insurance companies in the United States, Hartford Financial Services Group has transformed itself into a stable property and casualty business focused on personal lines, small business, and middle markets. HIG’s new management team is focused on risk control, expense reduction, improved underwriting, and capital returns for shareholders.

** The DALBAR, Inc. study defines the "Average Investor" as follows: The average investor refers to the universe of all mutual fund investors whose actions and financial results are restated to represent a single investor. This approach allows the entire universe of mutual fund investors to be used as the statistical sample, ensuring ultimate reliability.

Past performance is not a guarantee of future results.

The views expressed herein are solely the opinions of Snow Capital Management L.P. We make no representations as to their accuracy. This communication is intended for informational purposes only and does not constitute a solicitation to invest money nor a recommendation to buy or sell certain securities. Equity investments are not appropriate for all investors. Individual investment decisions should be discussed with a financial advisor.

14

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in foreign securities involve political, economic, and currency risks, greater volatility and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Snow Capital Market Plus Fund, Snow Capital Mid Cap Value Fund, Snow Capital Hedged Equity Fund, Snow Capital Inflation Advantaged Fund, Snow Capital Dividend Plus Fund, and Snow Capital Focused Value Fund may use options or futures contracts which have the risks of unlimited losses and the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of the securities prices, interest rates, and currency exchange rates. These investments may not be suitable for all investors.

Please see the Total Return Tables on the following pages for performance information on the Funds’ Class A and Class I shares. The performance information quoted assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235. Investors should consider the investment objectives, risks, charges and expenses carefully before investing or sending money. This and other important information about the Fund can be found in the Fund’s prospectus. Please read it carefully before investing.

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of fund holdings.

The S&P 500 Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Russell 3000 Value Index is an unmanaged index of those Russell 3000 companies chosen for their value orientation. The Russell 3000 Index is an unmanaged index of those Russell 3000 companies based on total market capitalization which represents approximately 98% of the investable U.S. equity market.

The Russell 2000 Value Index is an unmanaged index of those Russell 2000 companies chosen for their value orientation.

The Russell 2500 Value Index is an unmanaged index of those Russell 2500 companies chosen for their value orientation.

The HFRX Equity Hedge Index uses quantitative techniques to maximize representation of the Hedge Fund Universe.

You cannot invest directly in an index.

The Price-to-Earnings (P/E) ratio is calculated as the current price of a stock divided by its trailing twelve month operating earnings per diluted share of equity.

The Price/Book ratio is calculated as the current share price of a stock divided by its book value per diluted share of equity.

The CPI or Consumer price index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services as defined by the Bureau of Labor Statistics.

Cash flow is calculated as the most recent four quarters of income before extraordinary and discontinued items plus accumulated depreciation and amortization.

Return on Equity or ROE is calculated as net income divided by common stockholders’ equity.

15

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

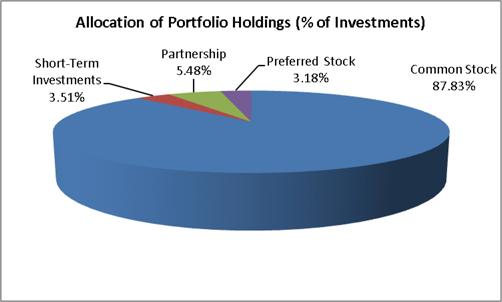

Snow Capital Focused Value Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and exchange-traded funds (“ETFs”) that invest in equity securities, fixed income securities, or other similar investments. Under normal market conditions the Fund will invest at least 80% of its net assets in equity securities of companies with market capitalizations greater than $1 billion.

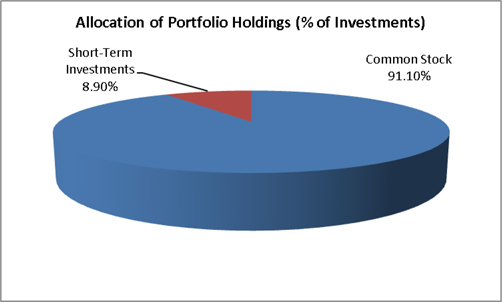

Snow Capital Hedged Equity Fund

The investment objective of the Fund is long-term growth of capital and protection of investment principal with lower volatility than the U.S. equity market. The Fund’s principal investment strategy is to invest at least 80% of long net assets in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and exchange-traded funds (“ETFs”) that invest in equity securities. The Adviser will utilize short equity positions in individual equity securities and ETFs to reduce the portfolio’s overall market exposure. The Fund may borrow money from banks or other financial institutions to purchase securities, commonly known as “leveraging,” in an amount not to exceed one-third of its total assets, as permitted by the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund may invest in equity and/or fixed income securities of companies of any size. In addition to domestic securities, the Fund may also directly or indirectly invest in foreign equity, including investments in emerging markets.

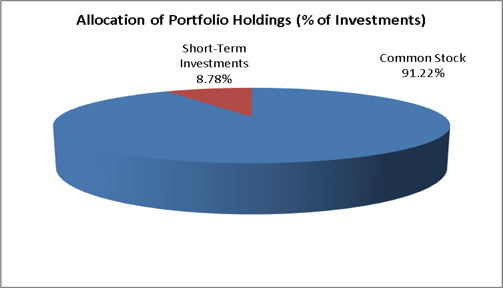

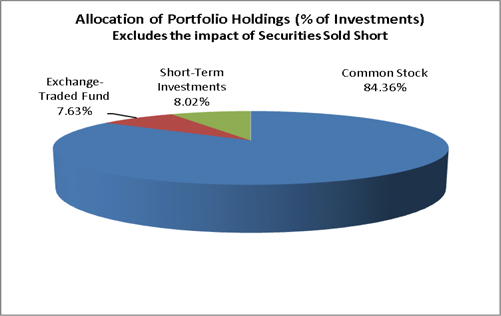

The percentages in the above graphs are based on the portfolio holdings of the Fund as of February 28, 2014 and are subject to change.

For a detailed break-out of holdings by industry and exchange traded funds by investment type, please refer to the Schedules of Investments.

16

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 28, 2014 (Unaudited)

Snow Capital Market Plus Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities. Under normal market conditions, the Fund will invest approximately 80% of its net assets in equity securities of companies that are among the top 300 securities by weighting in the Russell 3000 Value Index. The Fund will invest in each of the top 20 securities by weighting in the Russell 3000 Value Index. The Adviser will use fundamental analysis and valuation techniques to determine an appropriate weight for each position.

Snow Capital Inflation Advantaged Equities Fund

The investment objective of the Fund is long-term growth of capital and protection of investment principal. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities.

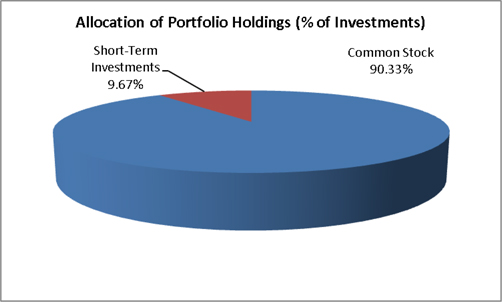

The percentages in the above graphs are based on the portfolio holdings of the Fund as of February 28, 2014 and are subject to change.

For a detailed break-out of holdings by industry and exchange traded funds by investment type, please refer to the Schedules of Investments.

17

| Snow Family of Funds | ANNUAL REPORT |

February 28, 2014 (Unaudited)

Snow Capital Dividend Plus Fund

The investment objective of the Fund is long-term growth of capital and income. The Fund’s principal investment strategy is to invest in a diversified portfolio of equities, bonds, preferred stock, and options. Under normal market conditions, the Fund will invest at least 80% of its net assets in equity securities that pay a dividend and are within the market capitalization range of the Russell 1000 Value Index. With respect to its remaining assets, the Fund may invest in corporate bonds, sovereign bonds, convertible bonds, preferred stocks, or other securities or instruments whose prices are linked to the value of the underlying common stock of the issuer of the securities. The Fund may have up to 25% of its net assets invested directly or indirectly in foreign equity securities, including investments in emerging markets.

Snow Capital Mid Cap Value Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest at least 80% of its net assets in equity securities of companies within the market capitalizations range of the Russell Mid Cap Value Index (“mid-cap securities”). The Fund’s investments in equity securities may include common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities of mid-cap companies. In addition to equity securities, the Fund may also invest up to 15% of its net assets in U.S. Government or U.S. agency obligations. The Fund may have up to 20% of its net assets invested directly or indirectly in foreign equity securities, including investments in emerging markets.

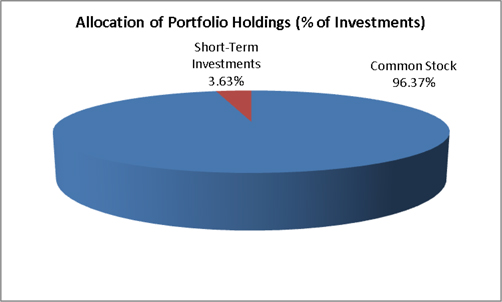

The percentages in the above graphs are based on the portfolio holdings of the Fund as of February 28, 2014 and are subject to change.

For a detailed break-out of holdings by industry and exchange traded funds by investment type, please refer to the Schedules of Investments.

18

| Snow Family of Funds | ANNUAL REPORT |

February 28, 2014 (Unaudited)

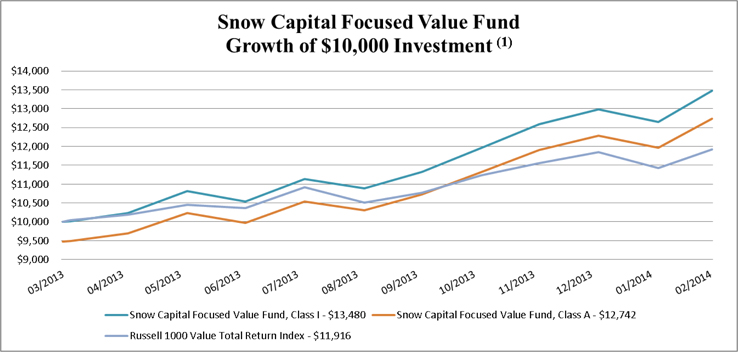

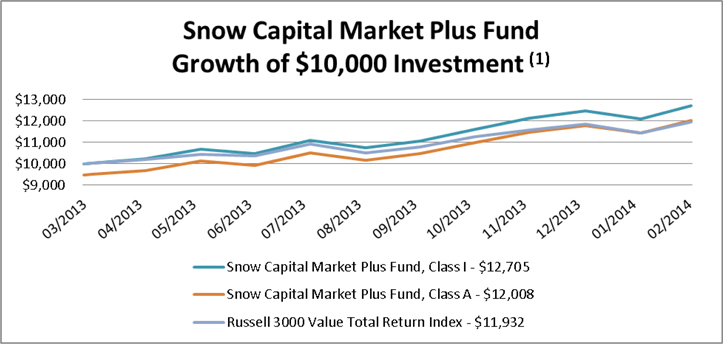

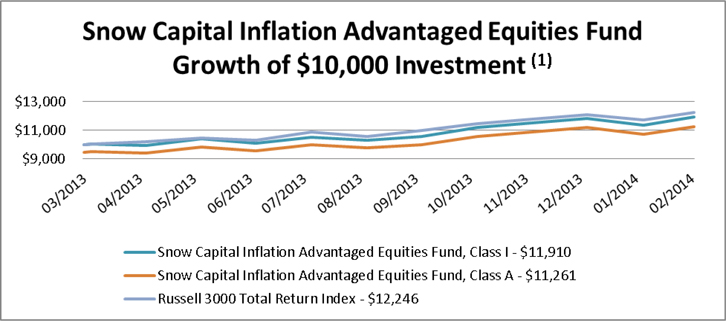

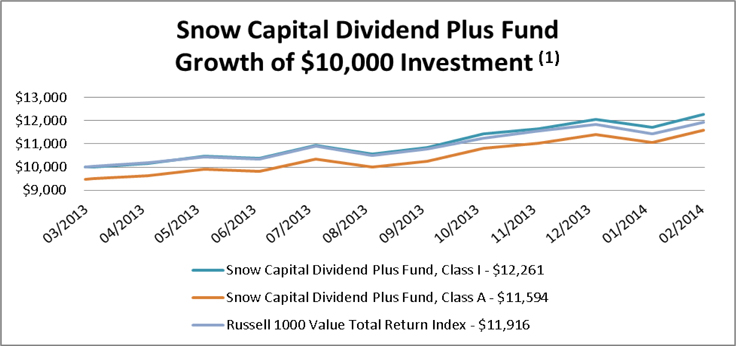

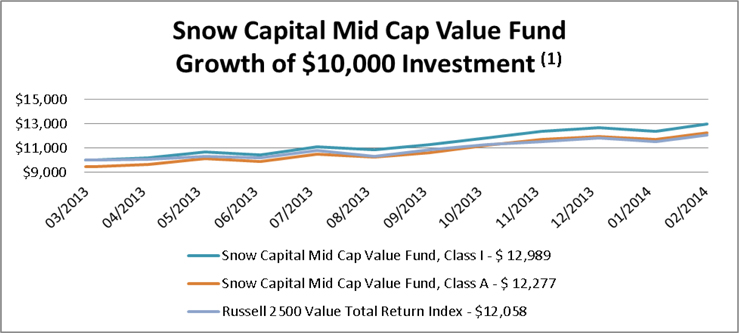

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2014 | Since Inception of March 27, 2013 through February 28, 2014 (2) |

| Snow Capital Focused Value Fund Class A without sales charge | 34.48% |

| Snow Capital Focused Value Fund Class A with sales charge | 27.42% |

| Snow Capital Focused Value Fund Class I | 34.80% |

| Russell 1000 Value Total Return Index | 19.16% |

| (2) | Not Annualized. With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Focused Value Fund versus the Russell 1000 Value Total Return Index. The Russell 1000 Value Index is an unmanaged index of those Russell 1000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 1000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Focused Value Fund, which will generally not invest in all the securities comprising the index.

19

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 28, 2014 (Unaudited)

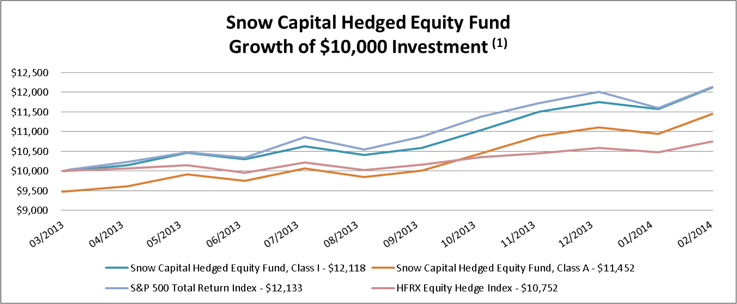

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2014 | Since Inception of March 27, 2013 through February 28, 2014 (2) |

| Snow Capital Hedged Equity Fund Class A without sales charge | 20.87% |

| Snow Capital Hedged Equity Fund Class A with sales charge | 14.52% |

| Snow Capital Hedged Equity Fund Class I | 21.18% |

| S&P 500 Total Return Index | 21.33% |

| HFRX Equity Hedge Index | 7.52% |

| (2) | Not Annualized. With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Hedged Equity Fund versus the S&P 500 Total Return Index and the HFRX Equity Hedge Index. The S&P 500 Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The HFRX Equity Hedge Index uses quantitative techniques to maximize representation of the Hedge Fund Universe. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Total Return Index and the HFRX Equity Hedge Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Snow Hedged Equity Fund, which will generally not invest in all the securities comprising the indices.

20

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 28, 2014 (Unaudited)

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2014 | Since Inception of March 27, 2013 through February 28, 2014 (2) |

| Snow Capital Market Plus Fund Class A without sales load | 26.73% |

| Snow Capital Market Plus Fund Class A with sales load | 20.08% |

| Snow Capital Market Plus Fund Class I | 27.05% |

| Russell 3000 Value Total Return Index | 19.32% |

| (2) | Not Annualized. With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Market Plus Fund versus the Russell 3000 Value Total Return Index. The Russell 3000 Value Index is an unmanaged index of those Russell 3000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 3000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Market Plus Fund, which will generally not invest in all the securities comprising the index.

21

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 28, 2014 (Unaudited)

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2014 | Since Inception of March 27, 2013 through February 28, 2014 (2) |

| Snow Capital Inflation Advantaged Equities Fund Class A without sales charge | 18.85% |

| Snow Capital Inflation Advantaged Equities Fund Class A with sales charge | 12.61% |

| Snow Capital Inflation Advantaged Equities Fund Class I | 19.10% |

| Russell 3000 Total Return Index | 22.46% |

| (2) | Not Annualized. With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Inflation Advantaged Equities Fund versus the Russell 3000 Total Return Index. The Russell 3000 Index is an unmanaged index of those Russell 3000 companies based on total market capitalization which represents approximately 98% of the investable U.S. equity market. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 3000 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Inflation Advantaged Equities Fund, which will generally not invest in all the securities comprising the index.

22

| Snow Family of Funds | ANNUAL REPORT |

February 28, 2014 (Unaudited)

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2014 | Since Inception of March 27, 2013 through February 28, 2014 (2) |

| Snow Capital Dividend Plus Fund Class A without sales charge | 22.36% |

| Snow Capital Dividend Plus Fund Class A with sales charge | 15.94% |

| Snow Capital Dividend Plus Fund Class I | 22.61% |

| Russell 1000 Value Total Return Index | 19.16% |

| (2) | Not Annualized. With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Dividend Plus Fund versus the Russell 1000 Value Total Return Index. The Russell 1000 Value Index is an unmanaged index of those Russell 1000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 1000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Dividend Plus Fund, which will generally not invest in all the securities comprising the index.

23

| Snow Family of Funds | ANNUAL REPORT |

February 28, 2014 (Unaudited)

| (1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 28, 2014 | Since Inception of March 27, 2013 through February 28, 2014 (2) |

| Snow Capital Mid Cap Value Fund Class A without sales charge | 29.57% |

| Snow Capital Mid Cap Value Fund Class A with sales charge | 22.77% |

| Snow Capital Mid Cap Value Fund Class I | 29.89% |

| Russell 2500 Value Total Return Index | 20.58% |

| (2) | Not Annualized. With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Mid Cap Value Fund versus the Russell 2500 Value Total Return Index. The Russell 2500 Value Index is an unmanaged index of those Russell 2500 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 2500 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Mid Cap Value Fund, which will generally not invest in all the securities comprising the index.

24

| SNOW FAMILY OF FUNDS | ANNUAL REPORT |

Snow Capital Focused Value Fund

SCHEDULE OF INVESTMENTS

February 28, 2014

| COMMON STOCK - 96.78% | Shares | Fair Value | ||||||

| Aerospace & Defense - 4.15% | ||||||||

| Spirit Aerosystems Holdings, Inc. - Class A (a) | 485 | $ | 13,983 | |||||

| Banks - 8.91% | ||||||||

| Bank of America Corp. | 595 | 9,835 | ||||||

| JPMorgan Chase & Co. | 355 | 20,171 | ||||||

| 30,006 | ||||||||

| Computers - 3.37% | ||||||||

| Hewlett-Packard Co. | 380 | 11,354 | ||||||

| Electric - 3.29% | ||||||||

| Exelon Corp. | 365 | 11,100 | ||||||

| Hand & Machine Tools - 4.67% | ||||||||

| Kennametal, Inc. | 360 | 15,746 | ||||||

| Healthcare - Services - 9.18% | ||||||||

| Community Health Systems, Inc. (a) | 405 | 16,812 | ||||||

| Health Net, Inc./CA (a) | 415 | 14,131 | ||||||

| 30,943 | ||||||||

| Insurance - 14.60% | ||||||||

| Genworth Financial, Inc. (a) | 790 | 12,277 | ||||||

| Hartford Financial Services Group, Inc./The | 495 | 17,419 | ||||||

| MetLife, Inc. | 385 | 19,508 | ||||||

| 49,204 | ||||||||

| Leisure Time - 3.14% | ||||||||

| Royal Caribbean Cruises Ltd. | 200 | 10,586 | ||||||

| Machinery - Construction & Mining - 2.18% | ||||||||

| Terex Corp. | 165 | 7,347 | ||||||

| Mining - 5.53% | ||||||||

| Rio Tinto PLC - ADR | 325 | 18,622 | ||||||

| Miscellaneous Manufacturing - 2.06% | ||||||||

| Textron, Inc. | 175 | 6,948 | ||||||

| Oil & Gas - 15.18% | ||||||||

| BP PLC - ADR | 455 | 23,028 | ||||||

| Nabors Industries Ltd. | 625 | 14,387 | ||||||

| PBF Energy, Inc. | 545 | 13,734 | ||||||

| 51,149 | ||||||||

| Oil & Gas Services - 3.10% | ||||||||

| Baker Hughes, Inc. | 165 | 10,441 | ||||||

| Pharmaceuticals - 3.92% | ||||||||

| Teva Pharmaceutical Industries Ltd. - ADR | 265 | 13,221 | ||||||

| Retail - 7.63% | ||||||||

| Macy's, Inc. | 190 | 10,993 | ||||||

| Target Corp. | 235 | 14,697 | ||||||

| 25,690 | ||||||||

25

| SNOW FAMILY OF FUNDS | ANNUAL REPORT |

SCHEDULE OF INVESTMENTS

February 28, 2014

| COMMON STOCK - 96.78% (continued) | Shares | Fair Value | ||||||

| Semiconductors - 5.87% | ||||||||

| Broadcom Corp. | 340 | $ | 10,105 | |||||

| Intel Corp. | 390 | 9,656 | ||||||

| 19,761 | ||||||||

| TOTAL COMMON STOCK (Cost $275,971) | 326,101 | |||||||

| SHORT-TERM INVESTMENTS - 9.31% | ||||||||

Fidelity Institutional Money Market Funds - Money Market Portfolio, 0.03%(b) (Cost $31,376) | 31,376 | 31,376 | ||||||

| TOTAL INVESTMENTS (Cost $307,347) - 106.09% | $ | 357,477 | ||||||

| LIABILITIES IN EXCESS OTHER ASSETS, NET - (6.09)% | (20,534 | ) | ||||||

| NET ASSETS - 100% | $ | 336,943 | ||||||

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the rate at February 28, 2014, is subject to change and resets daily. |

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

26

| SNOW FAMILY OF FUNDS | ANNUAL REPORT |

Snow Capital Hedged Equity Fund

SCHEDULE OF INVESTMENTS

February 28, 2014

| COMMON STOCK - 86.54% | Shares | Fair Value | ||||||

| Aerospace & Defense - 5.00% | ||||||||

| Spirit Aerosystems Holdings, Inc. - Class A (a) | 1,050 | $ | 30,272 | |||||

| Banks - 5.68% | ||||||||

| Bank of America Corp. | 500 | 8,265 | ||||||

| JPMorgan Chase & Co. | 460 | 26,137 | ||||||

| 34,402 | ||||||||

| Computers - 4.39% | ||||||||

| Hewlett-Packard Co. | 890 | 26,593 | ||||||

| Electric - 1.56% | ||||||||

| Exelon Corp. | 310 | 9,427 | ||||||

| Hand & Machine Tools - 5.56% | ||||||||