UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4300 Shawnee Mission Pkwy, Suite 100 Fairway, KS | 66205 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Bo J. Howell

FinTech Law, LLC

6224 Turpin Hills Dr.

Cincinnati, Ohio 45244

Registrant’s telephone number, including area code: 877-244-6235

Date of fiscal year end: 09/30/2024

Date of reporting period: 09/30/2024

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the Timber Point Global Allocations Fund (the “Global Fund”) and the Timber Point Alternative Income Fund (the “Income Fund”), each a series of the 360 Funds (the “registrant”) for the year ended September 30, 2024 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

| Timber Point Global Allocations Fund | ANNUAL REPORT |

Institutional Class (CGHIX)

September 30, 2024

This annual report to shareholders contains important information of the Timber Point Global Allocations Fund (the “Global Fund”) for the year ended September 30, 2024. You can find the Global Fund’s prospectus, financial information on Form N-CSR, holdings, proxy voting information and other information at www.timberpointcapital.com. You can also request this information without charge by contacting the Fund at (877) 244-6235.

What were the Fund costs for the year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class shares | $176 | 1.59% |

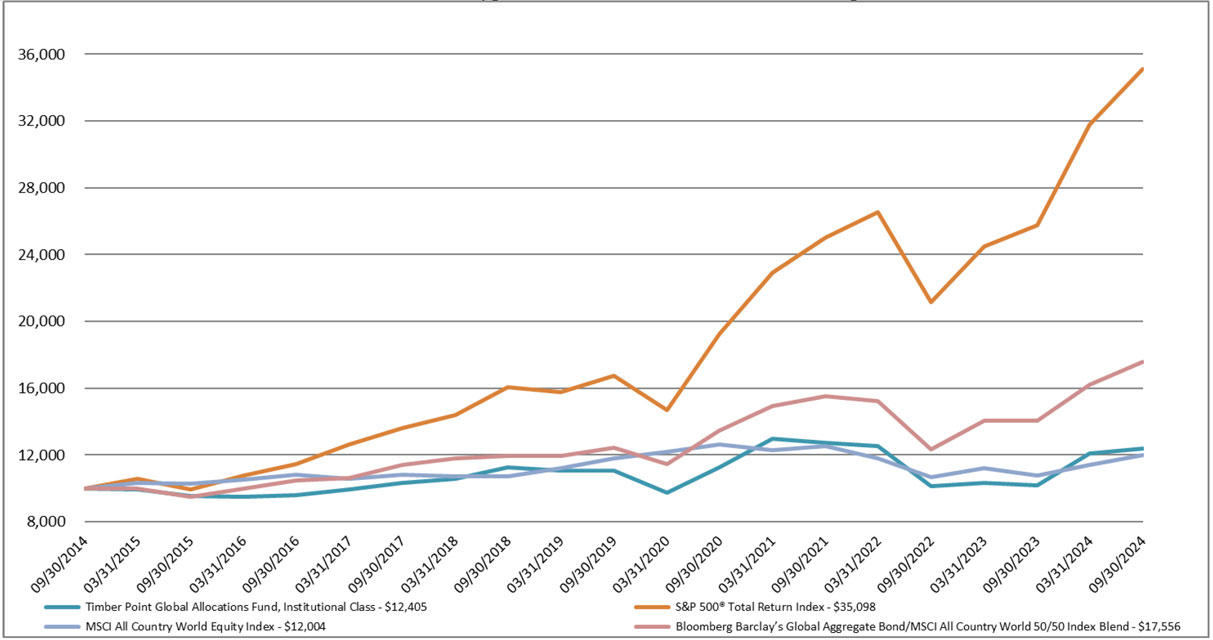

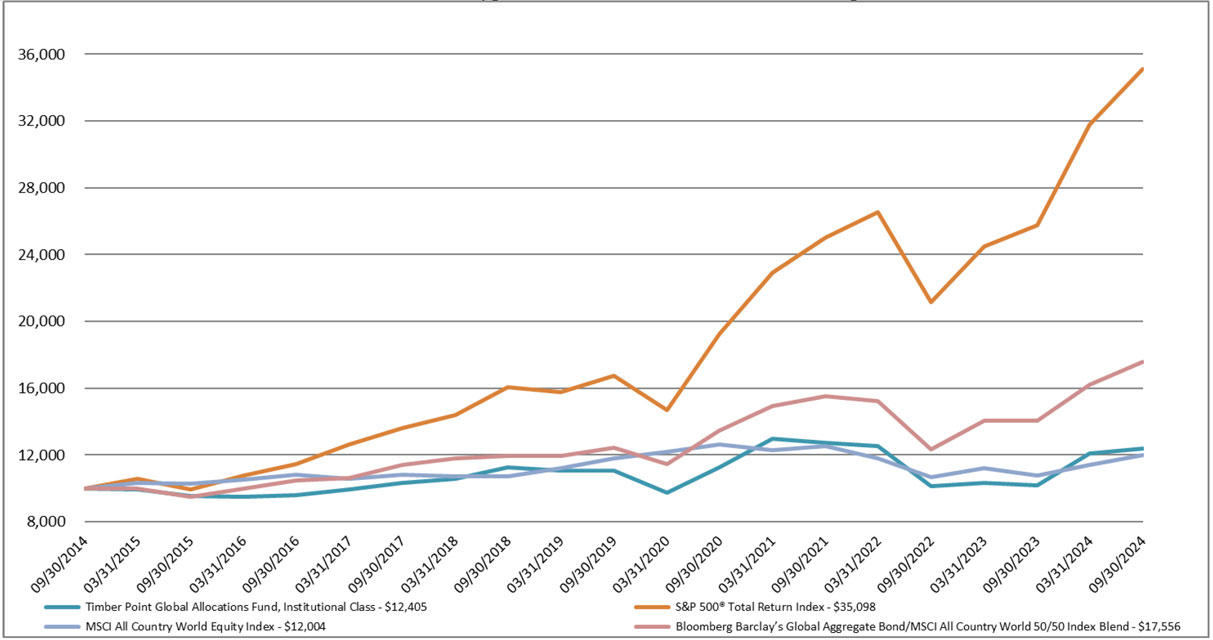

How has the Fund performed during the past 10 years?

| Cumulative Performance of a Hypothetical $10,000 Investment as-of September 30, 2024 |

| | Timber Point Global Allocations Fund, Institutional Class | S&P 500® Total Return Index | MSCI All Country World Equity Index | Bloomberg Barclay’s Global Aggregate Bond/MSCI All Country World 50/50 Index Blend |

| 09/30/2014 | 10,000.00 | 10,000.00 | 10,000.00 | 10,000.00 |

| 03/31/2015 | 9,954.50 | 10,593.01 | 10,342.99 | 9,989.51 |

| 09/30/2015 | 9,538.31 | 9,938.55 | 10,294.08 | 9,503.99 |

| 03/31/2016 | 9,517.53 | 10,781.87 | 10,545.74 | 9,988.37 |

| 09/30/2016 | 9,583.91 | 11,472.11 | 10,828.61 | 10,489.35 |

| 03/31/2017 | 9,925.05 | 12,633.36 | 10,592.20 | 10,630.91 |

| 09/30/2017 | 10,342.57 | 13,606.99 | 10,836.47 | 11,397.52 |

| 03/31/2018 | 10,592.11 | 14,400.99 | 10,719.63 | 11,817.24 |

| 09/30/2018 | 11,234.42 | 16,044.06 | 10,704.69 | 11,935.03 |

| 03/31/2019 | 11,045.05 | 15,768.58 | 11,199.93 | 11,965.83 |

| 09/30/2019 | 11,057.28 | 16,726.55 | 11,806.86 | 12,418.58 |

| 03/31/2020 | 9,729.84 | 14,668.26 | 12,200.51 | 11,438.76 |

| 09/30/2020 | 11,248.58 | 19,260.47 | 12,631.53 | 13,483.31 |

| 03/31/2021 | 12,969.03 | 22,934.07 | 12,287.16 | 14,924.21 |

| 09/30/2021 | 12,733.00 | 25,039.57 | 12,518.46 | 15,520.54 |

| 03/31/2022 | 12,534.24 | 26,522.29 | 11,776.98 | 15,218.94 |

| 09/30/2022 | 10,136.71 | 21,165.43 | 10,690.82 | 12,327.36 |

| 03/31/2023 | 10,336.93 | 24,472.53 | 11,213.65 | 14,052.96 |

| 09/30/2023 | 10,186.21 | 25,740.83 | 10,759.71 | 14,033.71 |

| 03/31/2024 | 12,101.14 | 31,785.20 | 11,404.06 | 16,184.17 |

| 09/30/2024 | 12,404.62 | 35,098.03 | 12,004.45 | 17,555.91 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Institutional Class Shares | 21.78% | 2.33% | 2.18% |

| S&P 500® Total Return Index (“S&P 500”) | 36.35% | 15.96% | 13.37% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

| Bloomberg Barclays Global Aggregate Bond/MSCI ACWI Net Total Return USD 50/50 Index Blend | 21.87% | 6.46% | 5.78% |

The above graphs depict the performance of the Global Fund versus the S&P 500® Total Return Index, the Bloomberg Barclays U.S. Aggregate Bond Index and the Bloomberg Barclays Global Aggregate Bond/MSCI ACWI Net Total Return USD 50/50 Index Blend. The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. Index returns do not include expenses, which are deducted from Fund returns. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling (877) 244-6235.

| Timber Point Global Allocations Fund | ANNUAL REPORT |

Institutional Class (CGHIX)

September 30, 2024 (continued)

How did the Fund perform last year?

The Global Fund performed well over the fiscal year ended September 30, 2024, rising 21.78%. While it modestly underperformed the blended benchmark, it significantly exceeded the target return of U.S. Treasury Bills plus 600 basis points. Due to its diversified investment approach, the Global Fund did lag the S&P 500’s 36.35% return. Throughout the past twelve months, our outlook was generally positive, as we believed that the macroeconomic backdrop, outlined above, would provide a highly favorable investment environment.

What factors influenced performance during the past year?

| ● | The largest contributor to positive returns over the fiscal year was the Global Fund’s exposure to equity market risk, particularly U.S. equities, despite a weak outlook and sentiment from many institutional investors and strategists. Broad U.S. large-cap equity exposure was implemented through several exchange-traded securities, including SPY, RSP, and SPXL. The Global Fund also held significant exposure to U.S. small- and mid-cap stocks through exchange-traded securities like IJR, IJH, and VO. While small- and mid-cap stocks underperformed large caps, they still posted strong absolute returns. |

| ● | Tactical and opportunistic investments that contributed positively included Aerospace and Defense companies, primarily through the exchange-traded fund (“ETF”) PPA. The war in Ukraine and rising hostilities in the Middle East have led to diminished armament stockpiles that need replenishing. Additionally, the Global Fund initiated a position in cryptocurrency through the ETF HODL, which benefited performance as Bitcoin steadily increased throughout the year. An investment in private credit securities through the business development company BXSL also proved highly beneficial. |

| ● | Despite maintaining a broad global viewpoint, the Global Fund held very underweight positions in non-U.S. investments, as we found the prospects for international growth and investing unattractive. Geographically, the Global Fund has been almost entirely allocated to U.S. investment opportunities. |

| ● | Positions that detracted from Global Fund returns were primarily in the biotech sector. Both ETFs and specific companies, such as VKTX and IMMX, were negative contributors over the period. |

| ● | The twelve months ended September 30, 2024, proved very beneficial for investors, as the U.S. economy continued a path of strong growth while inflationary pressures eased significantly. Over this period, the Federal Reserve shifted its monetary policy stance from restrictive to neutral and ultimately reduced the target funds rate to 5% in September. This created an exceptionally favorable macroeconomic environment for investors, spurring a strong rally across most asset classes and investment types. Additionally, alongside this positive macro backdrop, the growing recognition and adoption of artificial intelligence (AI) across businesses and consumer segments ignited another technological breakthrough, leading to increased capital spending, productivity gains, and improved corporate earnings. Many technology stocks, especially those tied to AI, benefited significantly from this secular trend. |

Positioning

The Global Fund is a directional, global multi-asset strategy investing across global equities, debt, commodities, currencies, and market hedging tools. The Global Fund seeks superior risk-adjusted returns with a targeted annualized 5-year net return of 600 basis points over Treasury Bills while maintaining moderate levels of total portfolio volatility.

What are some Fund statistics?

| Fund Statistics |

| Total Net Assets | $19,878,101 | Investment Advisory Fees Paid | $46,054 |

| Number of Portfolio Holdings | 40 | Portfolio Turnover Rate | 187% |

What did the Fund invest in?

| Sector Allocation (as a % of Portfolio) |

| Equity Funds | 57.72% | Consumer, Non-cyclical | 1.57% |

| Asset Allocation Fund | 11.44% | Commodity Fund | 1.06% |

| Debt Funds | 10.85% | Communications | 0.97% |

| Cash and Cash Equivalents | 7.31% | Consumer, Cyclical | 0.62% |

| Financials | 6.29% | Asset-backed and Mortgage-backed securities | 0.01% |

| Asset Allocation Fund | 2.17% | | |

| Timber Point Global Allocations Fund | ANNUAL REPORT |

Institutional Class (CGHIX)

September 30, 2024 (continued)

| Top Ten Holdings (as a % of Net Assets) |

SPDR S&P 500 ETF Trust | 12.99% | iShares Core S&P Mid-Cap ETF | 4.23% |

| Timber Point Alternative Income Fund | 11.43% | iShares 1-3 Year Treasury Bond ETF | 4.18% |

| Federated Hermes Government Obligation Fund | 7.31% | Direxion Daily S&P 500 Bull 3X Shares | 4.12% |

| iShares 7-10 Year Treasury Bond ETF | 5.43% | iShares Core S&P Small-Cap ETF | 4.12% |

| Invesco Aerospace & Defense ETF | 4.77% | Vanguard U.S. Value Factor ETF | 3.94% |

Material Fund Changes

Effective October 22, 2024, the Global Fund added the Bloomberg Barclays Global Aggregate Bond/MSCI ACWI Net Total Return USD 50/50 Index Blend as a new benchmark. Timber Point Capital Management, LLC, the Global Fund’s investment adviser, believes it more representative of the Global Fund’s directional, global, multi-asset strategy approach which incorporates global equities, debt, commodities, currencies and market hedging tools in its portfolio construction.

Change in and Disagreements with Accountants

The Audit Committee of 360 Funds (the “Trust”) has approved and recommended to the Board of Trustees (the “Board”), and the Board has approved Tait, Weller & Baker, LLP (“Tait”) to replace Cohen & Company, Ltd. (“Cohen”) as the Global Fund’s independent registered public accounting firm for the Global Fund’s fiscal year ended September 30, 2024. Through the past fiscal year and through the date of Cohen’s replacement as auditor of the Global Fund, the Global Fund had no disagreements with Cohen on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of Cohen would have caused Cohen to make reference to the disagreement in a Cohen report, and there were no reportable events of the kind described in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934.

With respect to the Global Fund, Cohen’s audit opinions, including for the fiscal year ended September 30, 2023, did not contain either an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the last fiscal year of the Global Fund, neither the Global Fund nor anyone on its behalf has consulted Tait on items concerning the application of accounting principles to a specified transaction (either completed or proposed) or the type of audit opinion that might be rendered on the Global Fund’s financial statements, or concerning the subject of a disagreement of the kind described in Item 304(a)(1)(iv) of Regulation S-K or reportable events of the kind described in Item 304(a)(1)(v) of Regulation S-K.

The Global Fund requested Cohen to furnish it with a letter addressed to the SEC stating whether or not it agrees with the above statements. A copy of such letter will be filed as an Exhibit to the Form N-CSR filing.

Availability of Additional Information

You can find additional information about the Global Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.timberpointcapital.com. You can also request this information by contacting us at (877) 244-6235.

Householding

To reduce Global Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Global Fund documents not be householded, please contact the Global Fund at (877) 244-6235 or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Global Fund.

| Timber Point Alternative Income Fund | ANNUAL REPORT |

Institutional Class (AIIFX)

September 30, 2024

This annual report to shareholders contains important information of the Timber Point Alternative Income Fund (the “Income Fund”) for the year ended September 30, 2024. You can find the Income Fund’s prospectus, financial information on Form N-CSR, holdings, proxy voting information and other information at www.timberpointcapital.com. You can also request this information without charge by contacting the Income Fund at (877) 244-6235.

What were the Fund costs for the year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class shares | $194 | 1.82% |

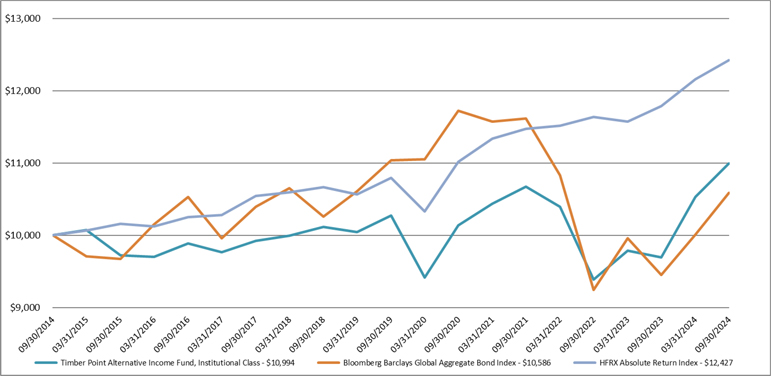

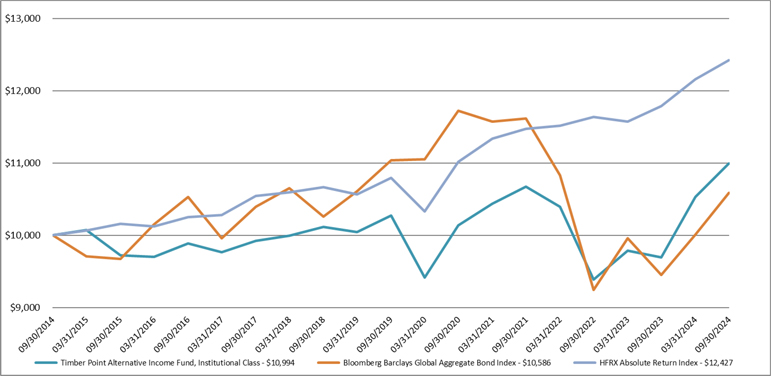

How has the Fund performed during the past 10 years?

| Cumulative Performance of a Hypothetical $10,000 Investment as-of September 30, 2024 |

| | Timber Point Alternative Income Fund, Institutional Class | Bloomberg Barclays Global Aggregate Bond Index | HFRX Absolute Return Index |

| 09/30/2014 | 10,000.00 | 10,000.00 | 10,000.00 |

| 03/31/2015 | 10,076.52 | 9,706.13 | 10,066.65 |

| 09/30/2015 | 9,719.48 | 9,673.51 | 10,161.50 |

| 03/31/2016 | 9,702.91 | 10,149.49 | 10,125.35 |

| 09/30/2016 | 9,890.40 | 10,528.08 | 10,251.10 |

| 03/31/2017 | 9,763.96 | 9,956.37 | 10,281.79 |

| 09/30/2017 | 9,922.09 | 10,395.60 | 10,547.98 |

| 03/31/2018 | 9,993.45 | 10,650.60 | 10,592.88 |

| 09/30/2018 | 10,113.28 | 10,258.62 | 10,666.98 |

| 03/31/2019 | 10,041.64 | 10,610.06 | 10,568.45 |

| 09/30/2019 | 10,269.86 | 11,037.98 | 10,798.49 |

| 03/31/2020 | 9,418.81 | 11,055.28 | 10,331.95 |

| 09/30/2020 | 10,137.71 | 11,726.37 | 11,019.59 |

| 03/31/2021 | 10,438.02 | 11,571.26 | 11,339.52 |

| 09/30/2021 | 10,674.96 | 11,619.58 | 11,471.92 |

| 03/31/2022 | 10,392.87 | 10,830.38 | 11,516.02 |

| 09/30/2022 | 9,390.38 | 9,245.62 | 11,636.60 |

| 03/31/2023 | 9,784.03 | 9,956.77 | 11,577.80 |

| 09/30/2023 | 9,692.95 | 9,452.83 | 11,785.99 |

| 03/31/2024 | 10,527.77 | 10,005.70 | 12,163.80 |

| 09/30/2024 | 10,993.60 | 10,586.07 | 12,426.55 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Institutional Class shares | 13.42% | 1.37% | 0.95% |

| Bloomberg Barclay’s Global Aggregate Bond Index | 11.99% | (0.83)% | 0.57% |

| HFRX Absolute Return Index | 5.43% | 2.86% | 2.20% |

The above graphs depict the performance of the Income Fund versus the the Bloomberg Barclays Global Aggregate Bond Index and the and the HFRX Absolute Return Index. The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. Index returns do not include expenses, which are deducted from Fund returns. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling (877) 244-6235.

How did the Fund perform last year?

The Income Fund delivered strong absolute and relative returns over the fiscal year ended September 30, 2024, rising 13.42% compared to index returns of 11.99%. Sharply falling inflation and the shift in monetary policy expectations from restrictive to accommodative drove bond returns higher.

| Timber Point Alternative Income Fund | ANNUAL REPORT |

Institutional Class (AIIFX)

September 30, 2024 (continued)

What factors influenced performance during the past year?

| ● | The Income Fund focused on corporate credit investments over the past year, particularly high-yield bonds across various maturities. Specifically, it held exchange-traded funds JNK and SJNK. Credit markets in general, and high-yield bonds specifically, posted strong excess returns, significantly contributing to the portfolio's performance. Additionally, the Income Fund invested in private credit through the business development company BXSL, which proved beneficial. The positive economic backdrop led us to favor credit over pure interest rate risk. |

| ● | Given our positive economic outlook, the Income Fund held a small allocation to broad U.S. equity investments, which contributed positively to performance. This included broad market exposure via exchange-traded funds (“ETFs”) such as RSP and SPXL, as well as dividend and income-oriented equities like Real Estate Investment Trusts, utilities, and other higher-yielding equity types. |

| ● | In the third quarter, the Income Fund increased its exposure to more interest rate-sensitive investments as the market began pricing in a shift in monetary policy, causing a sharp decline in interest rates. The Income Fund held exchange-traded positions such as AGG, BND, TLT, and IEF. |

| ● | The Income Fund also initiated a position in cryptocurrency through the ETF HODL, which added to performance as Bitcoin rose steadily throughout the year. |

| ● | Despite holding a diverse range of investments, the Income Fund’s overall realized volatility remained lower than that of its benchmarks. |

| ● | The twelve months ended September 30, 2024, proved very beneficial for investors, as the U.S. economy continued a path of strong growth while inflationary pressures eased significantly. Over this period, the Federal Reserve shifted its monetary policy stance from restrictive to neutral and ultimately reduced the target funds rate to 5% in September. This created an exceptionally favorable macroeconomic environment for investors, spurring a strong rally across most asset classes and investment types. Additionally, alongside this positive macro backdrop, the growing recognition and adoption of artificial intelligence (AI) across businesses and consumer segments ignited another technological breakthrough, leading to increased capital spending, productivity gains, and improved corporate earnings. Many technology stocks, especially those tied to AI, benefited significantly from this secular trend. |

Positioning

The Income Fund is a fixed income diversification strategy which seeks higher yields and returns by allocating to non-traditional sectors of the bond market, particularly sectors where interest rate risk is not the primary source of return. The Income Fund targets an annualized 5-year net return of 150 basis points over the Bloomberg Barclays U.S. Aggregate Bond Index while maintaining low levels of portfolio volatility, consistent with that of bond investments.

What are some Fund statistics?

| Fund Statistics |

| Total Net Assets | $18,829,919 | Investment Advisory Fees Paid | $42,170 |

| Number of Portfolio Holdings | 27 | Portfolio Turnover Rate | 122% |

What did the Fund invest in?

| Sector Allocation (as a % of Portfolio) |

| Debt Funds | 79.35% | Cash and Cash Equivalents | 4.66% |

| Equity Funds | 8.60% | Alternative Fund | 1.26% |

| Financials | 6.07% | Asset-backed and Mortgage-backed securities | 0.06% |

| Top Ten Holdings (as a % of Net Assets) |

| SPDR Portfolio Aggregate Bond ETF | 14.51% | iShares 7-10 Year Treasury Bond ETF | 4.69% |

| SPDR Doubleline Total Return Tactical ETF | 12.99% | iShares 20+ Yr Treasury Bond ETF | 4.69% |

| SPDR Bloomberg Short Term High Yield Bond ETF | 10.11% | Federated Hermes Government Obligations Fund | 4.65% |

| SPDR Portfolio Corporate Bond ETF | 9.31% | iShares Core U.S. Aggregate Bond ETF | 4.57% |

| SPDR Bloomberg High Yield Bond ETF | 6.65% | Vanguard Total Bond Market ETF | 4.55% |

| | | | |

| Timber Point Alternative Income Fund | ANNUAL REPORT |

Institutional Class (AIIFX)

September 30, 2024 (continued)

Material Fund Changes

The Fund did not have any material changes that occurred since the beginning of the reporting period.

Change in and Disagreements with Accountants

The Audit Committee of 360 Funds (the “Trust”) has approved and recommended to the Board of Trustees (the “Board”), and the Board has approved Tait, Weller & Baker, LLP (“Tait”) to replace Cohen & Company, Ltd. (“Cohen”) as the Income Fund’s independent registered public accounting firm for the Income Fund’s fiscal year ended September 30, 2024. Through the past fiscal year and through the date of Cohen’s replacement as auditor of the Income Fund, the Income Fund had no disagreements with Cohen on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of Cohen would have caused Cohen to make reference to the disagreement in a Cohen report, and there were no reportable events of the kind described in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934.

With respect to the Income Fund, Cohen’s audit opinions, including for the fiscal year ended September 30, 2023, did not contain either an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the last fiscal year of the Income Fund, neither the Income Fund nor anyone on its behalf has consulted Tait on items concerning the application of accounting principles to a specified transaction (either completed or proposed) or the type of audit opinion that might be rendered on the Income Fund’s financial statements, or concerning the subject of a disagreement of the kind described in Item 304(a)(1)(iv) of Regulation S-K or reportable events of the kind described in Item 304(a)(1)(v) of Regulation S-K.

The Income Fund requested Cohen to furnish it with a letter addressed to the SEC stating whether or not it agrees with the above statements. A copy of such letter will be filed as an Exhibit to the Form N-CSR filing.

Availability of Additional Information

You can find additional information about the Income Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.timberpointcapital.com. You can also request this information by contacting us at (877) 244-6235.

Householding

To reduce Income Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Income Fund documents not be householded, please contact the Income Fund at (877) 244-6235 or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Income Fund.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (b) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| (c) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (d) | The registrant’s Code of Ethics is filed herewith. |

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

| | The registrant’s Board of Trustees has determined that Tom Wirtshafter serves on its audit committee as the “audit committee financial expert” as defined in Item 3. |

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

(a) | Audit Fees. The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $20,000 and $28,800 with respect to the registrant’s fiscal years ended September 30, 2024 and September 30, 2023, respectively. The September 30, 2024 fees were paid to Tait Weller & Baker, LLP and the September 30, 2023 fees were paid to Cohen and Company, Ltd.. |

| | |

| (b) | Audit-Related Fees. There were no fees billed during the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item. |

| (c) | Tax Fees. The aggregate fees billed in the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $3,000 and $6,800 with respect to the registrant’s fiscal years ended September 30, 2024 and September 30, 2023, respectively. The services comprising these fees are the preparation of the registrant’s 2024 federal income and excise tax returns. The September 30, 2024 fees were paid to Tait Weller & Baker, LLP and the September 30, 2023 fees were paid to Cohen & Company, Ltd. |

| | |

| (d) | All Other Fees. The aggregate fees billed in last fiscal year for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 for the fiscal year ended September 30, 2024 and $0 for the fiscal year ended September 30, 2023 for the Global Fund and the Income Fund. |

| | |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time permanent employees was zero percent (0%). |

| | |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the last two fiscal years ended September 30, 2024 and September 30, 2023 are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

| | |

| (h) | There were no non-audit services rendered to the registrant’s investment adviser. |

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable

| ITEM 6. | SCHEDULES OF INVESTMENTS |

Included in annual financial statements and other information filed under item 7 of this form.

| ITEMS 7-11. | FINANCIAL STATEMENTS AND OTHER INFORMATION FILES |

Timber Point Global Allocations Fund

Institutional Class Shares (Ticker Symbol: CGHIX)

Timber Point Alternative Income Fund

Institutional Class Shares (Ticker Symbol: AIIFX)

Series of the

360 Funds

ANNUAL FINANCIAL STATEMENTS AND OTHER INFORMATION

September 30, 2024

Investment Adviser:

Timber Point Capital Management, LLC

555 Pleasantville Road, Suite N202

Briarcliff Manor, NY 10510

1-877-244-6235

www.timberpointcapital.com

Distributed by Matrix 360 Distributors, LLC

Member FINRA

This report is authorized for distribution only to shareholders and to others who have received a copy of the Funds’ prospectus.

IMPORTANT NOTE: The Securities and Exchange Commission (the “SEC”) adopted rule and form amendments which have resulted in changes to the design and delivery of annual and semi-annual reports (the “Reports”). The Reports are now streamlined to highlight key information about the Funds. Certain information previously included in the Reports, including the Funds' financial statements, will no longer appear in the Reports, but will be available online within the Annual and Semi-Annual Financial Statements and Other Information, delivered free of charge, and filed with the SEC.

TABLE OF CONTENTS

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies:

| TIMBER POINT GLOBAL ALLOCATIONS FUND | |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 | ANNUAL REPORT |

| COMMON STOCK 7.66% | | Shares | | | Value | |

| | | | | | | |

| Banks - 3.18% | | | | | | | | |

| JPMorgan Chase & Co. | | | 3,000 | | | $ | 632,580 | |

| | | | | | | | | |

| Biotechnology - 1.50% | | | | | | | | |

| Immix Biopharma, Inc. (a) | | | 30,000 | | | | 44,700 | |

| Viking Therapeutics, Inc. (a) | | | 4,000 | | | | 253,240 | |

| | | | | | | | 297,940 | |

| Diversified Financial Services - 1.79% | | | | | | | | |

| Charles Schwab Corp. | | | 5,500 | | | | 356,455 | |

| | | | | | | | | |

| Media - 0.97% | | | | | | | | |

| Walt Disney Co. | | | 2,000 | | | | 192,380 | |

| | | | | | | | | |

| Pharmaceuticals - 0.07% | | | | | | | | |

| Inhibikase Therapeutics, Inc. (a) | | | 11,000 | | | | 14,300 | |

| | | | | | | | | |

| Real Estate - 0.00% | | | | | | | | |

| Harbor Custom Development, Inc. (a) (f) | | | 7,500 | | | | — | |

| | | | | | | | | |

| Retail - 0.15% | | | | | | | | |

| FAT Brands, Inc. - Class A | | | 6,000 | | | | 29,520 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $1,923,243) | | | | | | | 1,523,175 | |

| | | | | | | | | |

| PREFERRED STOCK - 0.47% | | | | | | | | |

| | | | | | | | | |

| Real Estate - 0.00% | | | | | | | | |

| Harbor Custom Development, Inc. - Series A, 8.00% (a) (f) | | | 5,714 | | | | — | |

| | | | | | | | | |

| Retail - 0.47% | | | | | | | | |

| FAT Brands, Inc. - Series B, 8.25% | | | 9,451 | | | | 92,903 | |

| | | | | | | | | |

| TOTAL PREFERRED STOCK (Cost $326,906) | | | | | | | 92,903 | |

| | | | | | | | | |

| CLOSED-END FUND - 1.32% | | | | | | | | |

| | | | | | | | | |

| Equity Fund - 1.32% | | | | | | | | |

| Royce Small-Cap Trust, Inc. | | | 16,668 | | | | 261,688 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUND (Cost $249,972) | | | | | | | 261,688 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS - 68.61% | | | | | | | | |

| | | | | | | | | |

| Alternative Fund - 2.17% | | | | | | | | |

| VanEck Bitcoin ETF/U.S. (a) | | | 6,000 | | | | 430,980 | |

| | | | | | | | | |

| Commodity Fund - 1.05% | | | | | | | | |

| United States Oil Fund LP (a) | | | 3,000 | | | | 209,760 | |

| | | | | | | | | |

| Debt Funds - 10.85% | | | | | | | | |

| iShares 1-3 Year Treasury Bond ETF | | | 10,000 | | | | 831,500 | |

| iShares 20+ Year Treasury Bond ETF | | | 2,500 | | | | 245,250 | |

| iShares 7-10 Year Treasury Bond ETF | | | 11,000 | | | | 1,079,320 | |

| | | | | | | | 2,156,070 | |

| TIMBER POINT GLOBAL ALLOCATIONS FUND | |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 | ANNUAL REPORT |

| EXCHANGE-TRADED FUNDS - 68.61% (continued) | | Shares | | | Value | |

| | | | | | | |

| Equity Funds - 54.54% | | | | | | | | |

| Dimensional U.S. Small Cap ETF | | | 5,000 | | | $ | 324,300 | |

| Direxion Daily FTSE Europe Bull 3x Shares | | | 9,848 | | | | 287,934 | |

| Direxion Daily S&P 500 Bull 3X Shares | | | 5,000 | | | | 819,750 | |

| Direxion Daily Small Cap Bull 3X Shares | | | 15,000 | | | | 665,100 | |

| Invesco Aerospace & Defense ETF | | | 8,250 | | | | 948,503 | |

| Invesco S&P 500 Equal Weight ETF | | | 2,500 | | | | 447,900 | |

| iShares Biotechnology ETF | | | 1,750 | | | | 254,800 | |

| iShares Core S&P Mid-Cap ETF | | | 13,500 | | | | 841,320 | |

| iShares Core S&P Small-Cap ETF | | | 7,000 | | | | 818,720 | |

| SPDR S&P 500 ETF Trust | | | 4,500 | | | | 2,581,920 | |

| SPDR S&P 600 Small Cap Growth ETF | | | 5,000 | | | | 465,550 | |

| SPDR S&P Biotech ETF | | | 3,500 | | | | 345,800 | |

| SPDR S&P Regional Banking ETF | | | 6,000 | | | | 339,600 | |

| Vanguard Mid-Cap ETF | | | 2,000 | | | | 527,660 | |

| Vanguard Real Estate ETF | | | 4,000 | | | | 389,680 | |

| Vanguard U.S. Value Factor ETF | | | 6,500 | | | | 783,510 | |

| | | | | | | | 10,842,047 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $12,352,982) | | | | | | | 13,638,857 | |

| | | | | | | | | |

| MUTUAL FUNDS - 14.60% | | | | | | | | |

| | | | | | | | | |

| Asset Allocation Fund - 11.43% | | | | | | | | |

| Timber Point Alternative Income Fund - Institutional Class (e) | | | 275,180 | | | | 2,272,984 | |

| | | | | | | | | |

| Equity Fund - 3.17% | | | | | | | | |

| LS Opportunity Fund - Institutional Class (a) | | | 33,212 | | | | 629,694 | |

| | | | | | | | | |

| TOTAL MUTUAL FUNDS (Cost $2,685,178) | | | | | | | 2,902,678 | |

| | | | | | | | | |

| WARRANTS - 0.00% | | | | | | | | |

| | | | | | | | | |

| Harbor Custom Development, Inc., $100.00, 06/10/2026 (a) (f) | | | 22,500 | | | | — | |

| Harbor Custom Development, Inc., $59.40, 10/05/2026 (a) (f) | | | 12,500 | | | | — | |

| | | | | | | | | |

| TOTAL WARRANTS (Cost $350) | | | | | | | — | |

| | | | | | | | | |

| BONDS & NOTES - 0.02% | | | | | | | | |

| ASSET-BACKED SECURITIES - 0.01% | | Principal Amount | | | | |

| Countrywide Asset-Backed Certificates, 3.796%, 10/25/2017 (c) (d) | | $ | 1,088 | | | | 972 | |

| | | | | | | | | |

| Total Asset Backed Securities (Cost $1,088) | | | | | | | 972 | |

| | | | | | | | | |

| MORTGAGE-BACKED SECURITIES - 0.01% | | | | | | | | |

| Banc of America Funding 2006-2 Trust, 5.750%, due 03/25/2036 | | | 742 | | | | 641 | |

Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2006-7 Trust, 4.022%,

09/25/2036 (c) | | | 6,285 | | | | 1,714 | |

| | | | | | | | | |

| Total Mortgage-Backed Securities (Cost $3,974) | | | | | | | 2,355 | |

| | | | | | | | | |

| TOTAL BONDS & NOTES (Cost $5,062) | | | | | | | 3,327 | |

| TIMBER POINT GLOBAL ALLOCATIONS FUND | |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 | ANNUAL REPORT |

| SHORT-TERM INVESTMENT - 7.31% | | Shares | | | Value | |

| | | | | | | |

| Federated Hermes Government Obligations Fund - Institutional Shares, 4.79% (b) | | | 1,452,569 | | | $ | 1,452,569 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENT (Cost $1,452,569) | | | | | | | 1,452,569 | |

| | | | | | | | | |

| INVESTMENTS AT VALUE (Cost $18,996,262) - 99.99% | | | | | | $ | 19,875,197 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 0.01% | | | | | | | 2,904 | |

| | | | | | | | | |

| NET ASSETS - 100.00% | | | | | | $ | 19,878,101 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

(b) Rate shown represents the 7-day effective yield at September 30, 2024, is subject to change and resets daily.

(c) Variable rate security - Interest rate shown represents the rate on September 30, 2024.

(d) Principal payments are still being received, not yet matured.

(e) Affiliated investment company. See Investments in Affiliated Companies section of the accompanying notes.

(f) These securities are currently valued by the Adviser using fair valuation procedures approved by the Board of Trustees under the oversight of the Fair Valuation Committee. These securities have a total value of $0 which is 0.00% of the Fund's net assets.

The following abbreviations are used in this portfolio:

ETF - Exchange-Traded Fund

FTSE - Financial Times Stock Exchange

LP - Limited Partnership

SPDR - Standard & Poor's Depositary Receipts

The accompanying notes are an integral part of these financial statements.

| TIMBER POINT ALTERNATIVE INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 | ANNUAL REPORT |

| COMMON STOCK - 1.95% | | Shares | | | Value | |

| | | | | | | |

| Investment Companies - 1.95% | | | | | | | | |

| Blackstone Secured Lending Fund | | | 12,500 | | | $ | 366,125 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $311,469) | | | | | | | 366,125 | |

| | | | | | | | | |

| PREFERRED STOCK - 0.00% | | | | | | | | |

| | | | | | | | | |

| Real Estate - 0.00% | | | | | | | | |

| Harbor Custom Development, Inc. - Series A, 8.000% (a) (e) | | | 4,286 | | | | — | |

| | | | | | | | | |

| TOTAL PREFERRED STOCK (Cost $60,019) | | | | | | | — | |

| | | | | | | | | |

| CLOSED-END FUNDS - 4.11% | | | | | | | | |

| | | | | | | | | |

| Asset Allocation Fund - 2.03% | | | | | | | | |

| RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. | | | 42,175 | | | | 382,738 | |

| | | | | | | | | |

| Equity Fund - 2.08% | | | | | | | | |

| Royce Small-Cap Trust, Inc. | | | 24,975 | | | | 392,108 | |

| | | | | | | | | |

| TOTAL CLOSED END FUNDS (Cost $714,886) | | | | | | | 774,846 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS - 88.99% | | | | | | | | |

| | | | | | | | | |

| Alternative Fund - 1.26% | | | | | | | | |

| VanEck Bitcoin ETF/U.S.(a) | | | 3,300 | | | | 237,039 | |

| | | | | | | | | |

| Debt Funds - 79.15% | | | | | | | | |

| iShares 1-3 Year Treasury Bond ETF | | | 6,500 | | | | 540,475 | |

| iShares 20+ Year Treasury Bond ETF | | | 9,000 | | | | 882,900 | |

| iShares 7-10 Year Treasury Bond ETF | | | 9,000 | | | | 883,080 | |

| iShares Core U.S. Aggregate Bond ETF | | | 8,500 | | | | 860,795 | |

| SPDR Bloomberg High Yield Bond ETF | | | 12,800 | | | | 1,251,712 | |

| SPDR Bloomberg Short Term High Yield Bond ETF | | | 73,900 | | | | 1,902,925 | |

| SPDR Doubleline Total Return Tactical ETF | | | 59,100 | | | | 2,446,740 | |

| SPDR Portfolio Aggregate Bond ETF | | | 104,500 | | | | 2,731,630 | |

| SPDR Portfolio Corporate Bond ETF | | | 58,400 | | | | 1,753,752 | |

| Vanguard Short-Term Corporate Bond ETF | | | 10,000 | | | | 794,200 | |

| Vanguard Total Bond Market ETF | | | 11,400 | | | | 856,254 | |

| | | | | | | | 14,904,463 | |

| Equity Funds - 8.58% | | | | | | | | |

| Direxion Daily S&P 500 Bull 3X Shares | | | 1,000 | | | | 163,950 | |

| Invesco S&P 500 Equal Weight ETF | | | 4,500 | | | | 806,220 | |

| SPDR S&P Regional Banking ETF | | | 5,700 | | | | 322,620 | |

| Utilities Select Sector SPDR Fund | | | 4,000 | | | | 323,120 | |

| | | | | | | | 1,615,910 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $15,916,693) | | | | | | | 16,757,412 | |

| | | | | | | | | |

| WARRANTS - 0.00% | | | | | | | | |

| | | | | | | | | |

| Harbor Custom Development, Inc., $59.40, 10/05/2026 (a) (e) | | | 37,500 | | | | — | |

| | | | | | | | | |

| TOTAL WARRANTS (Cost $375) | | | | | | | — | |

| TIMBER POINT ALTERNATIVE INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 | ANNUAL REPORT |

BONDS & NOTES - 0.06%

| ASSET-BACKED SECURITIES - -99.98% | | Principal Amount | | | Value | |

Ameriquest Mortgage Securities, Inc. Asset-Backed Pass-Through Certificates

Series 2003-11, 5.427%, due 12/25/2033 (c) | | $ | 57 | | | $ | 93 | |

| Countrywide Asset-Backed Certificates, 3.796%, due 10/25/2017 (c) (d) | | | 3,265 | | | | 2,915 | |

| GE Capital Mortgage Services, Inc. 1999-HE1 Trust, 6.265%, due 04/25/2029 | | | 10 | | | | 10 | |

| | | | | | | | | |

| Total Asset Backed Securities (Cost $3,331) | | | | | | | 3,018 | |

| | | | | | | | | |

| MORTGAGE-BACKED SECURITIES - 0.04% | | | | | | | | |

| Banc of America Funding 2006-2 Trust, 5.750%, due 03/25/2036 | | | 2,227 | | | | 1,922 | |

| Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2006-7 Trust, 4.022%, due 09/25/2036 (c) | | | 18,857 | | | | 5,143 | |

| | | | | | | | | |

| Total Mortgage-Backed Securities (Cost $11,858) | | | | | | | 7,065 | |

| | | | | | | | | |

| TOTAL BONDS & NOTES (Cost $15,189) | | | | | | | 10,083 | |

| SHORT-TERM INVESTMENT - 4.65% | | Shares | | | | |

| | | | | | | |

| Federated Hermes Government Obligations Fund - Institutional Shares, 4.79% (b) | | | 875,553 | | | | 875,553 | |

| | | | | | | | | |

| SHORT TERM INVESTMENT (Cost $875,553) | | | | | | | 875,553 | |

| | | | | | | | | |

| INVESTMENTS AT VALUE (Cost $17,894,184) - 99.76% | | | | | | $ | 18,784,019 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 0.24% | | | | | | | 45,900 | |

| | | | | | | | | |

| NET ASSETS - 100.00% | | | | | | $ | 18,829,919 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

(b) Rate shown represents the 7-day effective yield at September 30, 2024, is subject to change and resets daily.

(c) Variable rate security - Interest rate shown represents the rate on September 30, 2024.

(d) Principal payments are still being received, not yet matured.

(e) These securities are currently valued by the Adviser using fair valuation procedures approved by the Board of Trustees under the oversight of the Fair Valuation Committee. These securities have a total value of $0 which is 0.00% of the Fund's net assets.

The following abbreviations are used in this portfolio:

ETF - Exchange-Traded Fund

SPDR - Standard & Poor's Depositary Receipts

The accompanying notes are an integral part of these financial statements.

| TIMBER POINT FUNDS | |

| STATEMENTS OF ASSETS AND LIABILITIES | |

| | |

| September 30, 2024 | ANNUAL REPORT |

| | | Timber Point Global Allocations Fund | | | Timber Point Alternative Income Fund | |

| Assets: | | | | | | | | |

| Investment securities: | | | | | | | | |

| Unaffiliated Securities at Cost | | $ | 16,876,347 | | | $ | 17,894,184 | |

| Affiliated Securities at Cost | | | 2,119,915 | | | | — | |

| Total Securities at Cost | | | 18,996,262 | | | | 17,894,184 | |

| Unaffiliated Securities at Value | | | 17,602,213 | | | | 18,784,019 | |

| Affiliated Securities at Value | | | 2,272,984 | | | | — | |

| Total Securities at Value | | | 19,875,197 | | | | 18,784,019 | |

| Receivables: | | | | | | | | |

| Interest | | | 7,384 | | | | 3,729 | |

| Dividends | | | 13,561 | | | | 9,818 | |

| Fund shares sold | | | 16 | | | | 52,733 | |

| Prepaid expenses and other assets | | | 3,393 | | | | 3,512 | |

| Total assets | | | 19,899,551 | | | | 18,853,811 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payables: | | | | | | | | |

| Fund shares redeemed | | | — | | | | 743 | |

| Due to adviser | | | 6,783 | | | | 8,808 | |

| Due to administrator | | | 9,743 | | | | 9,440 | |

| Accrued Trustee fees | | | 1,254 | | | | 1,254 | |

| Accrued expenses | | | 3,670 | | | | 3,647 | |

| Total liabilities | | | 21,450 | | | | 23,892 | |

| Net Assets | | $ | 19,878,101 | | | $ | 18,829,919 | |

| | | | | | | | | |

| Sources of Net Assets: | | | | | | | | |

| Paid-in capital | | $ | 24,769,670 | | | $ | 20,988,962 | |

| Total accumulated losses | | | (4,891,569 | ) | | | (2,159,043 | ) |

| Total Net Assets | | $ | 19,878,101 | | | $ | 18,829,919 | |

| | | | | | | | | |

| Institutional Class Shares: | | | | | | | | |

| Net assets | | $ | 19,878,101 | | | $ | 18,829,919 | |

| Shares Outstanding ($0 par value, Unlimited shares of beneficial interest authorized) | | | 2,027,046 | | | | 2,280,714 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 9.81 | | | $ | 8.26 | |

The accompanying notes are an integral part of these financial statements.

| TIMBER POINT FUNDS | |

| STATEMENTS OF OPERATIONS | |

| | |

| September 30, 2024 | ANNUAL REPORT |

| | | Timber Point Global Allocations Fund | | | Timber Point Alternative Income Fund | |

| | | | | | | |

| | | | For the Year Ended September 30, 2024 | | | | For the Year Ended September 30, 2024 | |

| | | | | | | | | |

| Investment income: | | | | | | | | |

| Dividends (net of foreign withholding taxes of $472 and $0, respectively) | | $ | 260,479 | | | $ | 634,343 | |

| Dividends from affiliated funds | | | 48,601 | | | | — | |

| Interest | | | 51,655 | | | | 31,107 | |

| Total investment income | | | 360,735 | | | | 665,450 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Management fees (Note 6) | | | 159,313 | | | | 116,630 | |

| Accounting and transfer agent fees and expenses | | | 98,502 | | | | 90,410 | |

| Legal fees | | | 19,275 | | | | 19,451 | |

| Audit fees | | | 19,100 | | | | 18,500 | |

| Non-12b-1 shareholder servicing expense | | | 16,931 | | | | 17,569 | |

| Trustee fees and expenses | | | 16,661 | | | | 16,661 | |

| Compliance officer fees | | | 16,570 | | | | 16,570 | |

| Reports to shareholders | | | 14,180 | | | | 13,915 | |

| Miscellaneous | | | 8,995 | | | | 9,105 | |

| Pricing fees | | | 7,650 | | | | 7,891 | |

| Custodian fees | | | 6,129 | | | | 5,273 | |

| Insurance | | | 5,780 | | | | 4,905 | |

| Registration and filing fees | | | 5,516 | | | | 2,998 | |

| Total expenses | | | 394,602 | | | | 339,878 | |

| Less: | | | | | | | | |

| Fees waived by Adviser (Note 6) | | | (94,435 | ) | | | (74,460 | ) |

| Fees waived by Adviser for affiliated holdings (Note 6) | | | (18,844 | ) | | | — | |

| Net expenses | | | 281,323 | | | | 265,418 | |

| | | | | | | | | |

| Net investment income | | | 79,412 | | | | 400,032 | |

| | | | | | | | | |

| Realized and unrealized gain: | | | | | | | | |

| Net realized gain on: | | | | | | | | |

| Unaffiliated Investments | | | 1,582,149 | | | | 201,064 | |

| | | | | | | | | |

| Net realized gain on investments | | | 1,582,149 | | | | 201,064 | |

| | | | | | | | | |

| Net change in unrealized appreciation on: | | | | | | | | |

| Unaffiliated Investments | | | 1,518,665 | | | | 1,225,502 | |

| Affiliated Investments | | | 221,856 | | | | — | |

| | | | | | | | | |

| Net change in unrealized appreciation on investments | | | 1,740,521 | | | | 1,225,502 | |

| | | | | | | | | |

| Net realized & unrealized gain on investments | | | 3,322,670 | | | | 1,426,566 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | $ | 3,402,082 | | | $ | 1,826,598 | |

The accompanying notes are an integral part of these financial statements.

| TIMBER POINT FUNDS | |

| STATEMENTS OF CHANGES IN NET ASSETS | |

| | ANNUAL REPORT |

| | | Timber Point Global Allocations Fund | |

| | | | | | | | | |

| | | For the Year Ended September 30, 2024 | | | For the Year Ended September 30, 2023 | |

| | | | | | | | | |

| Increase (decrease) in net assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 79,412 | | | $ | 203,789 | |

| Net realized gain (loss) from investments and securities sold short | | | 1,582,149 | | | | (892,894 | ) |

| Net change in unrealized appreciation on investments | | | 1,740,521 | | | | 763,843 | |

| Net increase in net assets resulting from operations | | | 3,402,082 | | | | 74,738 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Total distributable earnings - Institutional Class | | | (115,475 | ) | | | (202,941 | ) |

| Total distributions | | | (115,475 | ) | | | (202,941 | ) |

| | | | | | | | | |

| From shares of beneficial interest: | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Institutional Class | | | 2,085,923 | | | | 3,447,378 | |

| Net asset value of shares issued in reinvestment of distributions: | | | | | | | | |

| Institutional Class | | | 92,843 | | | | 165,586 | |

| Payments for shares redeemed: | | | | | | | | |

| Institutional Class | | | (1,273,193 | ) | | | (9,343,307 | ) |

| Increase (decrease) in net assets from transactions in shares of beneficial interest | | | 905,573 | | | | (5,730,343 | ) |

| | | | | | | | | |

| Increase (decrease) in net assets | | | 4,192,180 | | | | (5,858,546 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 15,685,921 | | | | 21,544,467 | |

| | | | | | | | | |

| End of year | | $ | 19,878,101 | | | $ | 15,685,921 | |

| | | | | | | | | |

| Capital share activity: | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Shares Sold | | | 222,940 | | | | 405,641 | |

| Shares Reinvested | | | 10,443 | | | | 20,570 | |

| Shares Redeemed | | | (139,573 | ) | | | (1,133,390 | ) |

| Net increase (decrease) in shares of beneficial interest outstanding | | | 93,810 | | | | (707,179 | ) |

The accompanying notes are an integral part of these financial statements.

| TIMBER POINT FUNDS | |

| STATEMENTS OF CHANGES IN NET ASSETS | |

| | ANNUAL REPORT |

| | | Timber Point Alternative Income Fund | |

| | | | | | | | | |

| | | For the Year Ended September 30, 2024 | | | For the Year Ended September 30, 2023 | |

| | | | | | | | | |

| Increase (decrease) in net assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 400,032 | | | $ | 394,726 | |

| Net realized gain (loss) from investments and securities sold short | | | 201,064 | | | | (282,601 | ) |

| Net change in unrealized appreciation on investments | | | 1,225,502 | | | | 284,095 | |

| Net increase in net assets resulting from operations | | | 1,826,598 | | | | 396,220 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Total distributable earnings - Institutional Class | | | (309,993 | ) | | | (355,286 | ) |

| Total distributions | | | (309,993 | ) | | | (355,286 | ) |

| | | | | | | | | |

| From shares of beneficial interest: | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Institutional Class | | | 5,612,069 | | | | 4,270,253 | |

| Net asset value of shares issued in reinvestment of distributions: | | | | | | | | |

| Institutional Class | | | 304,799 | | | | 347,896 | |

| Payments for shares redeemed: | | | | | | | | |

| Institutional Class | | | (2,413,472 | ) | | | (3,559,170 | ) |

| | | | | | | | | |

| Increase in net assets from transactions in shares of beneficial interest | | | 3,503,396 | | | | 1,058,979 | |

| | | | | | | | | |

| Increase in net assets | | | 5,020,001 | | | | 1,099,913 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 13,809,918 | | | | 12,710,005 | |

| | | | | | | | | |

| End of year | | $ | 18,829,919 | | | $ | 13,809,918 | |

| | | | | | | | | |

| Capital share activity: | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Shares Sold | | | 704,519 | | | | 564,981 | |

| Shares Reinvested | | | 39,177 | | | | 47,920 | |

| Shares Redeemed | | | (316,190 | ) | | | (476,385 | ) |

| Net increase in shares of beneficial interest outstanding | | | 427,506 | | | | 136,516 | |

The accompanying notes are an integral part of these financial statements.

| TIMBER POINT FUNDS | | |

| FINANCIAL HIGHLIGHTS | | |

| | | |

| | ANNUAL REPORT | |

| | | |

The following tables set forth the per share operating performance data for a share of beneficial interest outstanding, total return, ratios to average net assets and other supplemental data for each of the years indicated.

| | | | | | | | | | | | | | | | |

| | | Timber Point Global Allocations Fund | |

| | | | | | | | | | | | | | | | |

| | | Institutional Class | |

| | | For the

Year Ended

September 30, 2024 | | | For the

Year Ended

September 30, 2023 | | | For the

Year Ended

September 30, 2022 (a) | | | For the

Year Ended

September 30, 2021 (a) | | | For the

Year Ended

September 30, 2020 (a) | |

| Net Asset Value, Beginning of Year | | $ | 8.11 | | | $ | 8.16 | | | $ | 10.25 | | | $ | 9.11 | | | $ | 9.04 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (1) | | | 0.04 | | | | 0.10 | | | | 0.04 | | | | (0.04 | ) | | | 0.03 | |

| Net realized and unrealized gain (loss) on investments | | | 1.72 | | | | (0.06 | ) | | | (2.13 | ) | | | 1.24 | | | | 0.13 | (6) |

| Total from investment operations | | | 1.76 | | | | 0.04 | | | | (2.09 | ) | | | 1.20 | | | | 0.16 | |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.06 | ) | | | (0.09 | ) | | | — | | | | (0.06 | ) | | | (0.09 | ) |

| Total distributions | | | (0.06 | ) | | | (0.09 | ) | | | — | | | | (0.06 | ) | | | (0.09 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 9.81 | | | $ | 8.11 | | | $ | 8.16 | | | $ | 10.25 | | | $ | 9.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (2) | | | 21.78 | % | | | 0.49 | % | | | (20.39 | )% | | | 13.20 | % | | | 1.73 | % (5) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 19,878 | | | $ | 15,686 | | | | 21,544 | | | $ | 35,239 | | | $ | 38,588 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of expenses to average net assets (3): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses reimbursed | | | 2.23 | % | | | 2.32 | % | | | 2.00 | % | | | 1.79 | % | | | 2.23 | % |

| After fees waived and expenses reimbursed | | | 1.59 | % | | | 1.47 | % | | | 1.55 | % | | | 1.58 | % | | | 1.46 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of expenses to average net assets (excluding dividends on securities sold short and interest on margin account) (3): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses reimbursed | | | 2.23 | % | | | 2.32 | % | | | 1.95 | % | | | 1.72 | % | | | 2.13 | % |

| After fees waived and expenses reimbursed | | | 1.59 | % | | | 1.47 | % | | | 1.50 | % | | | 1.50 | % | | | 1.36 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of net investment income (loss) to average net assets (3) (4) | | | 0.45 | % | | | 1.17 | % | | | 0.39 | % | | | (0.42 | )% | | | 0.31 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 187 | % | | | 257 | % | | | 351 | % | | | 374 | % | | | 385 | % |

| (a) | Amounts for the years ended September 30, 2020, September 30, 2021 and September 30, 2022 are consolidated. |

| | |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (2) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends, if any. Total returns shown exclude the effect of applicable redemption fees. |

| (3) | The ratios of expenses and net investment income (loss) to average net assets do not reflect the Fund’s proportionate share of expenses of underlying investment companies in which the Fund invests. |

| (4) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (5) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (6) | The amount of net realized and unrealized gain on investment per share for the year ended September 30, 2020, does not accord with the amounts in the Consolidated Statements of Operations due to the timing of purchases and sales of Fund shares in relation to fluctuating market values. |

The accompanying notes are an integral part of these financial statements.

| TIMBER POINT FUNDS | | |

| FINANCIAL HIGHLIGHTS | | |

| | | |

| | ANNUAL REPORT | |

The following tables set forth the per share operating performance data for a share of beneficial interest outstanding, total return, ratios to average net assets and other supplemental data for the years indicated.

| | | Timber Point Alternative Income Fund | |

| | | | | | | | | | | | | | | | |

| | | Institutional Class | |

| | | For the

Year Ended

September 30, 2024 | | | For the

Year Ended

September 30, 2023 | | | For the

Year Ended

September 30, 2022 | | | For the

Year Ended

September 30, 2021 | | | For the

Year Ended

September 30, 2020 | |

| Net Asset Value, Beginning of Year | | $ | 7.45 | | | $ | 7.40 | | | $ | 8.56 | | | $ | 8.32 | | | $ | 8.54 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.21 | | | | 0.21 | | | | 0.14 | | | | 0.18 | | | | 0.09 | |

| Net realized and unrealized gain (loss) on investments | | | 0.78 | | | | 0.02 | | | | (1.15 | ) | | | 0.26 | | | | (0.19 | ) |

| Total from investment operations | | | 0.99 | | | | 0.23 | | | | (1.01 | ) | | | 0.44 | | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.18 | ) | | | (0.18 | ) | | | (0.15 | ) | | | (0.20 | ) | | | (0.12 | ) |

| Total distributions | | | (0.18 | ) | | | (0.18 | ) | | | (0.15 | ) | | | (0.20 | ) | | | (0.12 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 8.26 | | | $ | 7.45 | | | $ | 7.40 | | | $ | 8.56 | | | $ | 8.32 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (2) | | | 13.42 | % | | | 3.22 | % | | | (12.03 | )% | | | 5.30 | % | | | (1.17 | )% (5) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 18,830 | | | $ | 13,810 | | | $ | 12,710 | | | $ | 17,419 | | | $ | 16,801 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of expenses to average net assets (3): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses reimbursed | | | 2.33 | % | | | 2.40 | % | | | 2.33 | % | | | 2.28 | % | | | 2.97 | % |

| After fees waived and expenses reimbursed | | | 1.82 | % | | | 1.70 | % | | | 1.73 | % | | | 1.78 | % | | | 2.04 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of expenses to average net assets (excluding dividends on securities sold short and interest on margin account) (3): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses reimbursed | | | 2.33 | % | | | 2.40 | % | | | 2.30 | % | | | 2.25 | % | | | 2.79 | % |

| After fees waived and expenses reimbursed | | | 1.82 | % | | | 1.70 | % | | | 1.70 | % | | | 1.75 | % | | | 1.86 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of net investment income to average net assets (3) (4) | | | 2.74 | % | | | 2.75 | % | | | 1.75 | % | | | 2.09 | % | | | 1.11 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 122 | % | | | 130 | % | | | 348 | % | | | 194 | % | | | 287 | % |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (2) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (3) | The ratios of expenses to average net assets and net investment income to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests. |

| (4) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (5) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

The accompanying notes are an integral part of these financial statements.

| Timber Point Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2024

The Timber Point Global Allocations Fund (the “Global Fund”) and the Timber Point Alternative Income Fund (the “Income Fund”) (collectively, the “Funds”) were organized on October 6, 2017 as separate diversified series of 360 Funds (the “Trust”) and are successors by merger to the respective series of Northern Lights Fund Trust II. The Trust was organized on February 24, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Global Fund’s investment objective is to seek superior risk adjusted total returns by investing across a wide variety of global assets. The Income Fund’s investment objective is to seek superior risk adjusted returns by investing in income oriented securities.

Each Fund offers one class of shares, Institutional Class.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of the significant accounting policies followed by the Funds in the preparation of their financial statements and are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Funds are investment companies that follow the accounting and reporting guidance of Accounting Standards Codification Topic 946 applicable to investment companies.

a) Security Valuation – All investments in securities are recorded at their estimated fair value, as described in note 3.

b) Short Sales – The Funds may sell securities short. A short sale is a transaction in which a Fund sells a security it does not own or have the right to acquire (or that it owns but does not wish to deliver) in anticipation that the market price of that security will decline.

When Funds make a short sale, the broker-dealer through which the short sale is made must borrow the security sold short and deliver it to the party purchasing the security. Funds are required to make a margin deposit in connection with such short sales; the Funds may have to pay a fee to borrow particular securities and will often be obligated to pay over any dividends and accrued interest on borrowed securities.

If the price of the security sold short increases between the time of the short sale and the time the Funds cover their short positions, the Funds will incur a loss; conversely, if the price declines, the Funds will realize a capital gain. Any gain will be decreased, and any loss increased, by the transaction costs described above. The successful use of short selling may be adversely affected by imperfect correlation between movements in the price of the security sold short and the securities being hedged.

To the extent the Funds sell securities short, they will provide collateral to the broker-dealer and (except in the case of short sales “against the box”) will maintain additional asset coverage in the form of cash, U.S. government securities or other liquid securities with its custodian in a segregated account in an amount at least equal to the difference between the current market value of the securities sold short and any amounts required to be deposited as collateral with the selling broker (not including the proceeds of the short sale).

c) Investment Companies – The Funds may invest in investment companies such as open-end funds (mutual funds), exchange-traded funds (“ETFs”) and closed-end funds (“CEFs”) (also referred to as “Underlying Funds”) subject to limitations as defined in the 1940 Act. Your cost of investing in the Funds will generally be higher than the cost of investing directly in the Underlying Funds. By investing in the Funds, you will indirectly bear fees and expenses charged by the Underlying Funds in which the Funds invest in addition to the Funds’ direct fees and expenses. Also, with respect to dividends paid by the Underlying Funds, it is possible for these dividends to exceed the underlying investments’ taxable earnings and profits resulting in the excess portion of such dividends being designated as a return of capital. Distributions received from investments in securities that represent a return of capital or capital gains are recorded as a reduction of the cost of investments or as a realized gain, respectively.

d) Federal Income Taxes – The Funds have qualified and intend to continue to qualify as regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Funds to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of their net investment company taxable income and net capital gains. The Funds also intend to distribute sufficient net investment income and net capital gains, if any, so that they will not be subject to excise tax on undistributed income and gains. Therefore, no federal income tax or excise tax provision is required.

| Timber Point Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2024

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

As of and during the year ended September 30, 2024, the Funds did not have a liability for any unrecognized tax expenses. The Funds recognize interest and penalties, if any, related to unrecognized tax liability as income tax expense in the statements of operations. During the year ended September 30, 2024, the Funds did not incur any interest or penalties. The Funds identify their major tax jurisdictions as U.S. Federal and Delaware state.

In addition, GAAP requires management of the Funds to analyze all open tax years, as defined by Internal Revenue Service statute of limitations for all major jurisdictions, including federal tax jurisdictions and certain state tax jurisdictions. As of and during the years ended September 30, 2021 through September 30, 2024, the Funds did not have a liability for any unrecognized tax benefits. The Funds have no examinations in progress and are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

e) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains. There were no reclassifications necessary during the year ended September 30, 2024.

f) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates.

g) Other – Investment and shareholder transactions are recorded on trade date. The Funds determine the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income and expenses are recognized on the ex-dividend date or as soon as information is available to the Funds and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

| 3. | SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS |

Processes and Structure

The Funds’ Board of Trustees (the “Board”) has adopted guidelines for valuing securities and other derivative instruments including in circumstances in which market quotes are not readily available, and has delegated authority to the Valuation Designee (as described below) to apply those guidelines in determining fair value prices, subject to review by the Board.

Hierarchy of Fair Value Inputs

The Funds utilize various methods to measure the fair value of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| ● | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| ● | Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| ● | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

| Timber Point Funds | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2024

| 3. | SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS (continued) |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Value Measurements

Securities and assets for which representative market quotations are not readily available or that cannot be accurately valued using a fund’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Board. Fair value pricing may be used, for example, in situations where (i) a portfolio security, such as a small-cap stock, is so thinly traded that there have been no transactions for that stock over an extended period of time or the validity of a market quotation received is questionable; (ii) the exchange on which the portfolio security is principally traded closes early; (iii) trading of the particular portfolio security is halted; (iv) the security is a restricted security not registered under federal securities laws purchased through a private placement not eligible for resale; or (v) the security is purchased on a foreign exchange.

A description of the valuation techniques applied to the Trust’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock, preferred stock, warrants, ETFs and CEFs) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts, financial futures, ETFs, and the movement of the certain indexes of securities based on a statistical analysis of the historical relationship and are categorized in level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in level 2.

Money market funds and mutual funds – Money market funds and mutual funds are valued at their net asset value per share and are categorized as level 1.

Fixed income securities (asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”) - Securities valued using market quotations in an active market, will be categorized as Level 2 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Adviser believes such prices more accurately reflect the fair value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. These securities will generally be categorized as Level 2 securities. If the Adviser decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when certain restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review of the Board and the Fair Valuation Committee. These securities will be categorized as Level 3 securities. The Adviser may use inputs such as evaluated broker quotes in inactive markets, actual trade prices in inactive markets, present value of expected future cash flows, terms of expected bond restructurings, and yields on similar securities in determining the fair value of such Level 3 securities.

The SEC adopted Rule 2a-5 under the 1940 Act, which established an updated regulatory framework for registered investment company fair valuation practices. Under the new rule a greater number of the Funds’ securities may be subject to fair value pricing. The Funds’ fair value policies and procedures and valuation practices were updated to comply with Rule 2a-5. Specifically, the Board designated Timber Point Capital Management, LLC (the “Adviser”) as the Funds’ “Valuation Designee” to make fair value determinations. The Adviser acts through its Rule 2a-5 Committee (the “Valuation Committee”) in accordance with the Trust’s and the Adviser’s policies and procedures (collectively, the “Valuation Procedures”). While fair value determinations will be based upon all available factors that the Valuation Designee deems relevant at the time of the determination, fair value represents only a good faith approximation of the value of an asset or liability.