UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS | 66205 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Bo J. Howell

FinTech Law, LLC

6224 Turpin Hills Dr.

Cincinnati, Ohio 45244

Registrant’s telephone number, including area code: 877-244-6235

Date of fiscal year end: 05/31/2024

Date of reporting period: 05/31/2024

| ITEM 1. | REPORTS TO SHAREHOLDERS |

M3Sixty Small Cap Growth Fund Institutional Class Shares (Ticker Symbol: MCSCX) A series of the 360 Funds |

ANNUAL REPORT

MAY 31, 2024

Investment Adviser:

M3Sixty Capital, LLC

4300 Shawnee Mission Parkway, Suite 100

Fairway, KS 66205

IMPORTANT NOTE: Effective January 24, 2023, the SEC adopted rule and form amendments to require open-end mutual funds and ETFs to transmit concise, visually engaging, and streamlined annual and semi-annual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but will be available online and filed semi-annually on Form N-CSR; you can also request a copy be delivered to you free of charge. The rule and form amendments have a compliance date of July 24, 2024. Prior to this compliance date and as permitted by current SEC regulations, paper copies of the Fund’s shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an e-mail request. Your election to receive reports in paper will apply to all funds held with the Fund complex/your financial intermediary.

TABLE OF CONTENTS

Dear Fellow Shareholders,

The M3Sixty Small Cap Growth Fund (the “Fund”) ended its fiscal year with solid absolute returns in an uncertain environment. The geopolitical environment continues to present challenges with the Russia/Ukraine war now measured in years and the Israel/Hamas conflict causing a humanitarian crisis as it has laid waste to much of the Gaza Strip.

Domestically, interest rates remain elevated as the U.S. Federal Reserve appears to have stopped raising rates but has yet to begin lowering them despite expectations earlier in the year for rate cuts. Recent advancements in Artificial Intelligence (“AI”) and Machine Learning (“ML”) have energized high tech companies to increase investments in these next generation technologies while investors hoping to participate have gravitated toward large cap stocks. Throughout this macro environment, the Fund remains focused on staying disciplined to our investment process which powers our portfolio decisions.

In this environment, the Fund returned 8.37% (a) through the fiscal year ended May 31, 2024. The Fund’s benchmark, the Russell 2000® Growth Total Return Index (“R2G”) (b), returned 11.39% during the same period. The Fund lagged the benchmark return due to relative underperformance within the Technology sector, primarily attributable to two stocks not owned in the Fund. Specifically Super Micro Computer (SMCI) and MicroStrategy (MSTR), which combined, drove all, and more, of the Fund’s relative underperformance versus the Fund’s benchmark during the period. It is unusual to see individual positions in the R2G drive such meaningful performance challenges.

The Fund’s best performers over the period included Sterling Infrastructure (STRL) +118%, Comfort Systems USA (FIX) +96% and MillerKnoll, Inc. (MLKN) +90%, American Eagle Outfitter (AEO) +87% and Onto Innovation (ONTO) +84%. All of these companies have been owned by the Fund since its inception on June 28, 2023. Three of the five are beneficiaries of increased infrastructure spending driven by high tech company AI/ML investments as STRL and FIX provide engineering/construction and climate-controlled settings for next generation data centers and ONTO provides advanced packaging equipment needed to create electronics for AI/ML.

The Fund’s worst performers were Cambium Networks (CMBM) -80%, Methode Electronics (MEI) -64%, Medifast (MED) -62%, Coherus Biosciences (CHRS) -58% and Omnicell (OMCL) -55%. We no longer own MED, but we believe in the future prospects of the remaining positions.

As the sole subadvisor of the Fund, Bridge City Capital remains committed to its investment philosophy of owning quality companies with proven track records, strong financial characteristics and above average growth prospects at attractive valuations. Our philosophy drives our investment process, which we believe leads us to high quality companies with our process being the definition of high quality. We manage the portfolio in a relatively sector-neutral approach to create excess returns through stock selection. As mentioned earlier, there are many uncertainties in the current market and it is difficult to know what the outlook of the market will be in the near-term. That said, over time we believe investing this way will lead to strong relative returns compared to our benchmark.

|  | |

| |

| Gary DiCenzo | Alex Woodward |

| Chief Executive Officer | President |

| M3Sixty Capital, LLC | Bridge City Capital, LLC |

(a) The performance information quoted assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results and is subject to risks and uncertainties. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information about the Fund can be found in the Fund’s prospectus and annual report. Please read them carefully before investing.

(b) The R2G measures the performance of the small-cap growth segment of the U.S. equity universe. It includes Russell 2000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium-term (2-year) growth, and higher sales per share historical growth (5 years).

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

May 31, 2024 (Unaudited)

Returns as of May 31, 2024 | | | Since Inception of June 28, 2023 through May 31, 2024 |

| M3Sixty Small Cap Growth Fund Institutional Class shares | | | 8.37% |

| Russell 2000® Growth Total Return Index | | | 11.39% |

| Morningstar U.S. Small Cap Broad Growth Extended TR USD Index | | | 12.16% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graphs depict the performance of the M3Sixty Small Cap Growth Fund (the “Fund”) versus the Russell 2000® Growth Total Return Index (the “R2G”) and the Morningstar U.S. Small Cap Broad Growth Extended TR USD Index (the “Morningstar Index”). The R2G measures the performance of the small-cap growth segment of the U.S. equity universe. It includes R2G companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium-term (2-year) growth, and higher sales per share historical growth (5 years). The Morningstar Index measures the performance of U.S. small-cap stocks that fall between the 90th and 99.5th percentile in market capitalization of the investable universe. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the R2G and the Morningstar Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising these indices; so too with the M3Sixty Small Cap Growth Fund, which will generally not invest in all the securities comprising the indices.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

May 31, 2024 (Unaudited)

Investment Objective. The investment objective of the Fund is to seek long-term capital appreciation over a complete market cycle.

Principal Investment Strategy of the Fund. The Fund’s adviser, M3Sixty Capital, LLC (the “Adviser”), delegates the daily management of the Fund’s assets to Bridge City Capital, LLC (the “Sub-Adviser”). The Adviser is responsible for the overall management of the Fund and overseeing the Fund’s Sub-Adviser. Under normal circumstances, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets (plus borrowings for investment purposes) in equity securities of small capitalization companies. The Fund defines small capitalization companies as issuers whose market capitalization is within the same market capitalization range as companies listed in the R2G, which is subject to change over time. As of December 31, 2023, the median market capitalization of the companies in the R2G was $1.268 billion, with the highest market capitalization being $14.993 billion.

The equity securities in which the Fund may invest include common stocks, preferred stocks, convertible securities, real estate investment trusts (“REITs”), sponsored and unsponsored depositary receipts (including American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”)) and U.S. dollar denominated foreign stocks traded on U.S. exchanges. The Fund will invest primarily in U.S. common stocks that the Sub-Adviser believes to have clear indicators of future potential for earnings growth, or that demonstrate other potential for growth of capital. The Fund may also invest in initial public offerings (“IPOs”) in these types of securities.

In selecting companies for the Fund’s portfolio, the Sub-Adviser uses a bottom-up approach to select what it believes are quality companies with proven track records, strong financial characteristics, and above average growth prospects at attractive valuations that lead to strong relative returns over a complete market cycle. The Sub-Adviser may sell or reduce its position in a security for a variety of reasons when appropriate and consistent with the Fund’s investment objectives and policies, which may include, but are not limited to, when the security: (i) position exceeds the Sub-Adviser’s internal position limit of 3% of the Fund’s market value; (ii) exceeds the Sub-Adviser’s internal market capitalization limit; or (iii) is no longer considered appropriate for the Fund based on a change in financial condition, management team, or other factor that either reduces the security’s overall score within the Sub-Adviser’s research and screening process or the Sub-Adviser’s conviction in the holding.

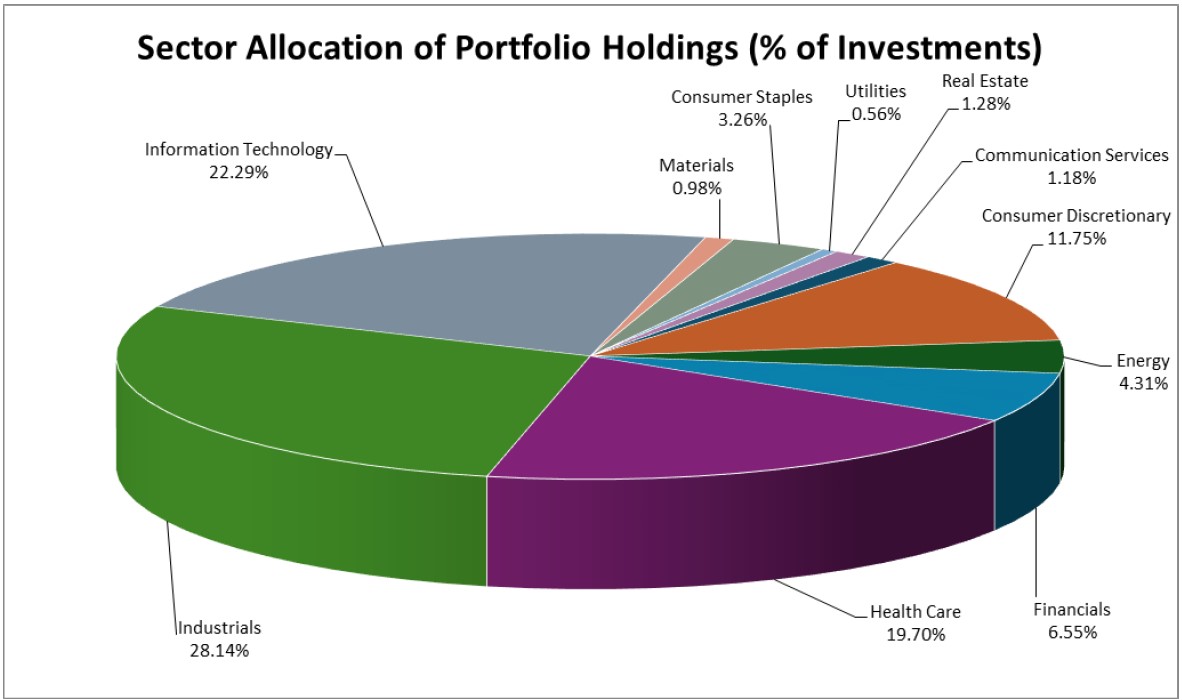

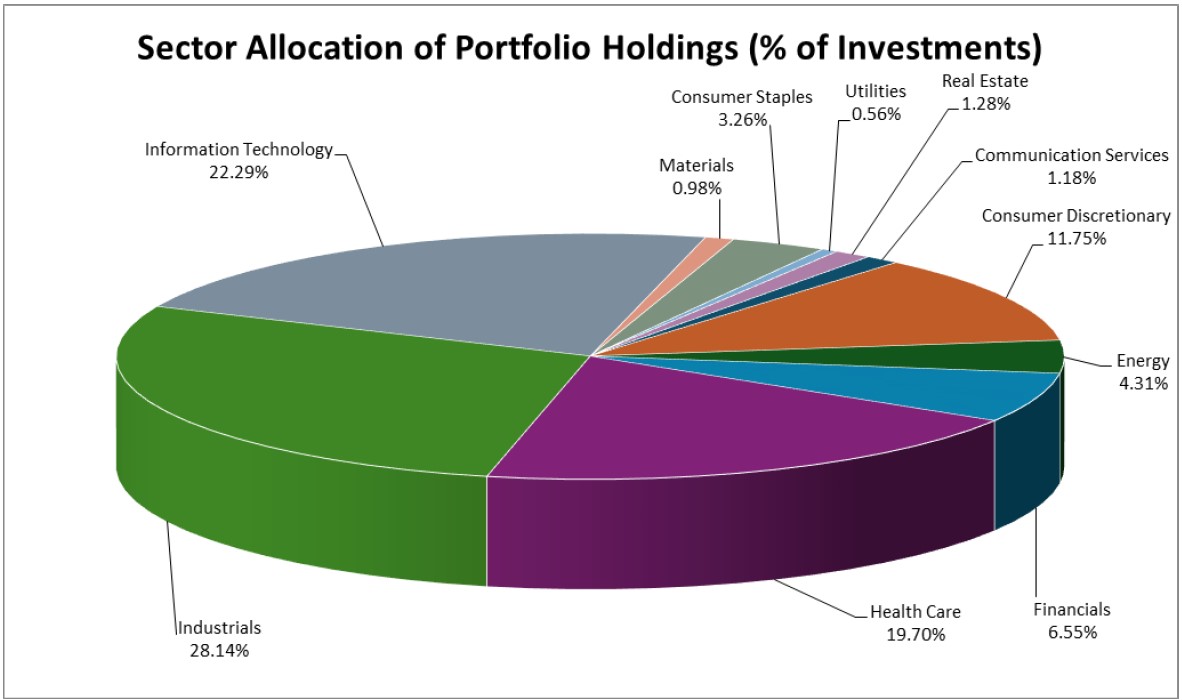

The percentages in the above graph are based on the portfolio holdings of the Fund as of May 31, 2024, and are subject to change.

| M3SIXTY SMALL CAP GROWTH FUND | |

| SCHEDULE OF INVESTMENTS | |

| May 31, 2024 | ANNUAL REPORT |

| COMMON STOCK - 98.24% | | Shares | | | Value | |

| | | | | | | |

| Auto Parts & Equipment - 3.43% | | | | | | | | |

| Dorman Products, Inc. (a) | | | 930 | | | $ | 85,532 | |

| Gentherm, Inc. (a) | | | 1,447 | | | | 78,051 | |

| Methode Electronics, Inc. | | | 5,600 | | | | 65,968 | |

| | | | | | | | 229,551 | |

| Banks - 4.81% | | | | | | | | |

| First Financial Bankshares, Inc. | | | 2,239 | | | | 67,125 | |

| Glacier Bancorp, Inc. | | | 2,678 | | | | 100,104 | |

| Hope Bancorp, Inc. | | | 4,229 | | | | 44,531 | |

| Lakeland Financial Corp. | | | 801 | | | | 49,686 | |

| WesBanco, Inc. | | | 2,175 | | | | 60,030 | |

| | | | | | | | 321,476 | |

| Building Materials - 2.63% | | | | | | | | |

| Boise Cascade Co. | | | 470 | | | | 64,526 | |

| UFP Industries, Inc. | | | 931 | | | | 111,236 | |

| | | | | | | | 175,762 | |

| Chemicals - 1.75% | | | | | | | | |

| Quaker Chemical Corp. | | | 356 | | | | 64,561 | |

| Rogers Corp. (a) | | | 444 | | | | 52,392 | |

| | | | | | | | 116,953 | |

| Commercial Services - 3.74% | | | | | | | | |

| AMN Healthcare Services, Inc. (a) | | | 452 | | | | 25,285 | |

| Barrett Business Services, Inc. | | | 335 | | | | 44,334 | |

| CBIZ, Inc. (a) | | | 1,174 | | | | 89,013 | |

| EVERTEC, Inc. - Puerto Rico | | | 1,469 | | | | 51,371 | |

| Healthcare Services Group, Inc. (a) | | | 3,687 | | | | 39,746 | |

| | | | | | | | 249,749 | |

| Computers - 2.71% | | | | | | | | |

| ExlService Holdings, Inc. (a) | | | 2,753 | | | | 82,205 | |

| Maximus, Inc. | | | 621 | | | | 53,468 | |

| Qualys, Inc. (a) | | | 322 | | | | 45,280 | |

| | | | | | | | 180,953 | |

| Distribution & Wholesale - 1.36% | | | | | | | | |

| SiteOne Landscape Supply, Inc. (a) | | | 586 | | | | 90,725 | |

| | | | | | | | | |

| Diversified Financial Services - 0.85% | | | | | | | | |

| Evercore, Inc. | | | 281 | | | | 57,026 | |

| | | | | | | | | |

| Electric - 0.91% | | | | | | | | |

| Ameresco, Inc. - Class A (a) | | | 1,661 | | | | 60,660 | |

| | | | | | | | | |

| Electrical Components & Equipment - 1.20% | | | | | | | | |

| Insteel Industries, Inc. | | | 2,437 | | | | 80,104 | |

| M3SIXTY SMALL CAP GROWTH FUND | |

| SCHEDULE OF INVESTMENTS | |

| May 31, 2024 | ANNUAL REPORT |

| COMMON STOCK - 98.24% (continued) | | Shares | | | Value | |

| | | | | | | | | |

| Electronics - 6.15% | | | | | | | | |

| Badger Meter, Inc. | | | 397 | | | $ | 76,605 | |

| Coherent Corp. (a) | | | 2,255 | | | | 128,670 | |

| NVE Corp. | | | 644 | | | | 49,929 | |

| OSI Systems, Inc. (a) | | | 633 | | | | 90,987 | |

| Plexus Corp. (a) | | | 588 | | | | 64,762 | |

| | | | | | | | 410,953 | |

| Engineering & Construction - 7.47% | | | | | | | | |

| Comfort Systems USA, Inc. | | | 561 | | | | 183,638 | |

| Exponent, Inc. | | | 906 | | | | 86,179 | |

| MasTec, Inc. (a) | | | 833 | | | | 93,504 | |

| Sterling Infrastructure, Inc. (a) | | | 1,110 | | | | 136,386 | |

| | | | | | | | 499,707 | |

| Environmental Control - 2.56% | | | | | | | | |

| Tetra Tech, Inc. | | | 818 | | | | 171,363 | |

| | | | | | | | | |

| Food - 2.50% | | | | | | | | |

| J & J Snack Foods Corp. | | | 361 | | | | 58,738 | |

| Performance Food Group Co. (a) | | | 1,561 | | | | 108,646 | |

| | | | | | | | 167,384 | |

| Hand & Machine Tools - 0.81% | | | | | | | | |

| Franklin Electric Co., Inc. | | | 547 | | | | 54,416 | |

| | | | | | | | | |

| Healthcare - Products - 7.18% | | | | | | | | |

| Globus Medical, Inc. (a) | | | 1,964 | | | | 131,804 | |

| iRadimed Corp. | | | 1,106 | | | | 46,972 | |

| LeMaitre Vascular, Inc. | | | 1,639 | | | | 129,284 | |

| Neogen Corp. (a) | | | 5,535 | | | | 72,785 | |

| Omnicell, Inc. (a) | | | 876 | | | | 28,549 | |

| UFP Technologies, Inc. (a) | | | 129 | | | | 33,586 | |

| Zynex, Inc. (a) | | | 3,683 | | | | 37,382 | |

| | | | | | | | 480,362 | |

| Healthcare - Services - 8.52% | | | | | | | | |

| Addus HomeCare Corp. (a) | | | 732 | | | | 84,041 | |

| Amedisys, Inc. (a) | | | 766 | | | | 69,821 | |

| Ensign Group, Inc. | | | 1,484 | | | | 179,920 | |

| Medpace Holdings, Inc. (a) | | | 315 | | | | 121,697 | |

| Pediatrix Medical Group, Inc. (a) | | | 3,299 | | | | 24,116 | |

| U.S. Physical Therapy, Inc. | | | 876 | | | | 89,851 | |

| | | | | | | | 569,446 | |

| Home Builders - 1.12% | | | | | | | | |

| Century Communities, Inc. | | | 884 | | | | 74,618 | |

| | | | | | | | | |

| Home Furnishings - 0.96% | | | | | | | | |

| MillerKnoll, Inc. | | | 2,319 | | | | 63,958 | |

| | | | | | | | | |

| Household Products & Wares - 0.70% | | | | | | | | |

| WD-40 Co. | | | 209 | | | | 46,960 | |

| M3SIXTY SMALL CAP GROWTH FUND | |

| SCHEDULE OF INVESTMENTS | |

| May 31, 2024 | ANNUAL REPORT |

| COMMON STOCK - 98.24% (continued) | | Shares | | | Value | |

| | | | | | | | | |

| Internet - 2.83% | | | | | | | | |

| ePlus, Inc. (a) | | | 594 | | | $ | 44,455 | |

| Perficient, Inc. (a) | | | 905 | | | | 67,106 | |

| Shutterstock, Inc. | | | 664 | | | | 26,978 | |

| Ziff Davis, Inc. (a) | | | 876 | | | | 50,466 | |

| | | | | | | | 189,005 | |

| Leisure Time - 0.78% | | | | | | | | |

| YETI Holdings, Inc. (a) | | | 1,286 | | | | 52,392 | |

| | | | | | | | | |

| Machinery - Diversified - 2.73% | | | | | | | | |

| Albany International Corp. | | | 1,047 | | | | 91,843 | |

| Cactus, Inc. - Class A | | | 1,766 | | | | 90,684 | |

| | | | | | | | 182,527 | |

| Metal Fabricate & Hardware - 1.73% | | | | | | | | |

| RBC Bearings, Inc. (a) | | | 392 | | | | 115,750 | |

| | | | | | | | | |

| Miscellaneous Manufacturing 0.98% | | | | | | | | |

| Fabrinet - Thailand (a) | | | 273 | | | | 65,392 | |

| | | | | | | | | |

| Oil & Gas Services - 3.72% | | | | | | | | |

| Aris Water Solutions, Inc. - Class A | | | 3,638 | | | | 55,916 | |

| DMC Global, Inc. (a) | | | 2,206 | | | | 28,656 | |

| Dril-Quip, Inc. (a) | | | 2,869 | | | | 55,486 | |

| RPC, Inc. | | | 6,127 | | | | 41,847 | |

| Select Water Solutions, Inc. | | | 6,090 | | | | 66,564 | |

| | | | | | | | 248,469 | |

| Pharmaceuticals - 3.28% | | | | | | | | |

| Amphastar Pharmaceuticals, Inc. (a) | | | 1,239 | | | | 52,447 | |

| Coherus Biosciences, Inc. (a) | | | 8,006 | | | | 14,571 | |

| Corcept Therapeutics, Inc. (a) | | | 1,264 | | | | 38,135 | |

| Pacira BioSciences, Inc. (a) | | | 2,144 | | | | 65,028 | |

| Supernus Pharmaceuticals, Inc. (a) | | | 1,806 | | | | 48,979 | |

| | | | | | | | 219,160 | |

| REITS - 1.25% | | | | | | | | |

| Getty Realty Corp. | | | 1,845 | | | | 50,940 | |

| LTC Properties, Inc. | | | 955 | | | | 32,852 | |

| | | | | | | | 83,792 | |

| Retail - 7.19% | | | | | | | | |

| American Eagle Outfitters, Inc. | | | 3,033 | | | | 66,635 | |

| Jack in the Box, Inc. | | | 684 | | | | 37,866 | |

| La-Z-Boy, Inc. | | | 2,120 | | | | 79,542 | |

| Lithia Motors, Inc. | | | 351 | | | | 88,852 | |

| Ollie’s Bargain Outlet Holdings, Inc. (a) | | | 798 | | | | 65,779 | |

| Shake Shack, Inc. - Class A (a) | | | 601 | | | | 57,029 | |

| Texas Roadhouse. Inc. | | | 494 | | | | 85,299 | |

| | | | | | | | 481,002 | |

| M3SIXTY SMALL CAP GROWTH FUND | |

| SCHEDULE OF INVESTMENTS | |

| May 31, 2024 | ANNUAL REPORT |

| COMMON STOCK - 98.24% (continued) | | Shares | | | Value | |

| | | | | | | | | |

| Semiconductors - 7.66% | | | | | | | | |

| Axcelis Technologies, Inc. (a) | | | 806 | | | $ | 90,667 | |

| Diodes, Inc. (a) | | | 956 | | | | 70,868 | |

| Kulicke & Soffa Industries, Inc. - Singapore | | | 1,461 | | | | 66,724 | |

| MACOM Technology Solutions Holdings, Inc. (a) | | | 1,013 | | | | 102,455 | |

| Onto Innovation, Inc. (a) | | | 174 | | | | 37,706 | |

| Photronics, Inc. (a) | | | 1,678 | | | | 45,893 | |

| Synaptics, Inc. (a) | | | 492 | | | | 46,105 | |

| Vishay Precision Group, Inc. (a) | | | 1,539 | | | | 51,972 | |

| | | | | | | | 512,390 | |

| Software - 0.90% | | | | | | | | |

| ACI Worldwide, Inc. (a) | | | 976 | | | | 35,146 | |

| Consensus Cloud Solutions, Inc. (a) | | | 1,342 | | | | 25,324 | |

| | | | | | | | 60,470 | |

| Telecommunications - 2.09% | | | | | | | | |

| A10 Networks, Inc. | | | 7,979 | | | | 120,882 | |

| Cambium Networks Corp. (a) | | | 5,894 | | | | 18,920 | |

| | | | | | | | 139,802 | |

| Transportation - 1.19% | | | | | | | | |

| Landstar System, Inc. | | | 436 | | | | 79,365 | |

| | | | | | | | | |

| Water - 0.55% | | | | | | | | |

| California Water Service Group | | | 738 | | | | 36,819 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $6,181,460) | | | | | | | 6,568,461 | |

| | | | | | | | | |

| INVESTMENTS AT VALUE (Cost $6,181,460) - 98.24% | | | | | | $ | 6,568,461 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 1.76 % | | | | | | | 117,349 | |

| | | | | | | | | |

| NET ASSETS - 100.00% | | | | | | $ | 6,685,810 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

The following abbreviations are used in this portfolio:

REITS - Real Estate Investment Trusts

The accompanying notes are an integral part of these financial statements.

M3SIXTY SMALL CAP GROWTH FUND

STATEMENT OF ASSETS AND LIABILITIES

| May 31, 2024 | ANNUAL REPORT |

| Assets: | | | |

| Investments, at cost | | $ | 6,181,460 | |

| Investments, at value | | $ | 6,568,461 | |

| Cash and cash equivalents | | | 137,385 | |

| Due from Adviser | | | 5,272 | |

| Receivables: | | | | |

| Interest | | | 776 | |

| Dividends | | | 2,588 | |

| Prepaid expenses | | | 2,832 | |

| Total assets | | | 6,717,314 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Investment securities purchased | | | 12,698 | |

| Due to administrator | | | 6,141 | |

| Accrued Trustee fees | | | 954 | |

| Accrued expenses | | | 11,711 | |

| Total liabilities | | | 31,504 | |

| Commitments and contingencies (a) | | | | |

| Net Assets | | $ | 6,685,810 | |

| | | | | |

| Sources of Net Assets: | | | | |

| Paid-in beneficial interest | | $ | 6,199,346 | |

| Total distributable earnings | | | 486,464 | |

| Total Net Assets (Unlimited $0 par value shares of beneficial interest authorized) | | $ | 6,685,810 | |

| | | | | |

| Institutional Class Shares: | | | | |

| Net assets | | $ | 6,685,810 | |

| Shares Outstanding (Unlimited $0 par value shares of beneficial interest authorized) | | | 619,980 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 10.78 | |

(a) See Note 9 in the Notes to the Financial Statements.

The accompanying notes are an integral part of these financial statements.

M3SIXTY SMALL CAP GROWTH FUND

STATEMENT OF OPERATIONS

| | | For the | |

| | | Period Ended | |

| | | May 31, 2024 (a) | |

| | | | |

| Investment income: | | | | |

| Dividends | | $ | 42,508 | |

| Interest | | | 8,801 | |

| Total investment income | | | 51,309 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees (Note 5) | | | 32,929 | |

| Accounting and transfer agent fees and expenses (Note 5) | | | 63,449 | |

| Organizational fees | | | 23,038 | |

| Pricing fees | | | 16,126 | |

| Trustee fees and expenses | | | 13,351 | |

| Legal fees | | | 10,299 | |

| Custodian fees | | | 9,905 | |

| Audit fees | | | 9,000 | |

| Miscellaneous | | | 8,624 | |

| Compliance officer fees | | | 8,465 | |

| Reports to shareholders | | | 2,784 | |

| Non-12b-1 shareholder servicing expense | | | 1,591 | |

| Registration and filing fees | | | 911 | |

| Insurance | | | 632 | |

| Total expenses | | | 201,104 | |

| Less: fees waived (Note 5) | | | (159,602 | ) |

| Net expenses | | | 41,502 | |

| | | | | |

| Net investment income | | | 9,807 | |

| | | | | |

| Realized and unrealized gain: | | | | |

| Net realized gain on: | | | | |

| Investments | | | 116,050 | |

| Net realized gain on investments | | | 116,050 | |

| | | | | |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | 387,001 | |

| Net change in unrealized appreciation | | | 387,001 | |

| | | | | |

| Net realized and unrealized gain on investments | | | 503,051 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 512,858 | |

(a) The M3Sixty Small Cap Growth Fund commenced operations on June 28, 2023.

The accompanying notes are an integral part of these financial statements.

M3SIXTY SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the | |

| | | Period Ended | |

| | | May 31, 2024 (a) | |

| | | | |

| Increase (decrease) in net assets from: | | | | |

| Operations: | | | | |

| Net investment income | | $ | 9,807 | |

| Net realized gain on investments | | | 116,050 | |

| Net change in unrealized appreciation on investments | | | 387,001 | |

| Net increase in net assets resulting from operations | | | 512,858 | |

| | | | | |

| Distributions to shareholders from: | | | | |

| Distributable earnings - Institutional Class | | | (26,394 | ) |

| Total distributions | | | (26,394 | ) |

| | | | | |

| Beneficial interest transactions (Note 3): | | | | |

| Increase in net assets from beneficial interest transactions | | | 6,199,346 | |

| | | | | |

| Increase in net assets | | | 6,685,810 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | — | |

| | | | | |

| End of period | | $ | 6,685,810 | |

(a) The M3Sixty Small Cap Growth Fund commenced operations on June 28, 2023.

The accompanying notes are an integral part of these financial statements.

M3SIXTY SMALL CAP GROWTH FUND

FINANCIAL HIGHLIGHTS

The following tables set forth the per share operating performance data for a share of beneficial interest outstanding, total return, ratios to average net assets and other supplemental data for the period indicated.

| | | Institutional Class | |

| | | For the | |

| | | Period Ended | |

| | | May 31, 2024 (a) | |

| | | | |

| | | | |

| Net Asset Value, Beginning of Period | | $ | 10.00 | |

| | | | | |

| Investment Operations: | | | | |

| Net investment income (b) | | | 0.02 | |

| Net realized and unrealized gain on investments | | | 0.81 | |

| Total from investment operations | | | 0.83 | |

| | | | | |

| Distributions: | | | | |

| From net investment income | | | (0.02 | ) |

| From net realized capital gains | | | (0.03 | ) |

| Total distributions | | | (0.05 | ) |

| | | | | |

| Net Asset Value, End of Period | | $ | 10.78 | |

| | | | | |

| Total Return (c) | | | 8.37 | %(d) |

| | | | | |

| Ratios/Supplemental Data | | | | |

| Net assets, end of period (in 000’s) | | $ | 6,686 | |

| | | | | |

| Ratio of expenses to average net assets: | | | | |

| Before fees waived and expenses absorbed | | | 4.89 | %(e) |

| After fees waived and expenses absorbed | | | 1.01 | %(e) |

| | | | | |

| Ratio of net investment income (loss): | | | | |

| Before fees waived and expenses absorbed | | | (3.64 | )%(e) |

| After fees waived and expenses absorbed | | | 0.24 | %(e) |

| | | | | |

| Portfolio turnover rate | | | 19 | %(d) |

| (a) | The M3Sixty Small Cap Growth Fund commenced operations on June 28, 2023. |

| (b) | Net investment income per share is based on average shares outstanding for the period ended May 31, 2024. |

| (c) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Had the Adviser not waived fees/reimbursed expenses, total returns would have been lower. |

The accompanying notes are an integral part of these financial statements.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2024

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

The Fund is a series of 360 Funds (the “Trust”) which was organized on February 24, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund is a diversified fund, and its investment objective is to seek long-term capital appreciation over a complete market cycle.

The Fund commenced operations on June 28, 2023.

The Fund offers one class of shares, institutional shares.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company that follows the accounting and reporting guidance of Accounting Standards Codification Topic 946 applicable to investment companies.

a) Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 2.

b) Investments in Small-Cap Companies - The Fund may invest in securities of companies with small market capitalizations. Certain small-cap companies may offer greater potential for capital appreciation than larger companies. However, investors should note that this potential for greater capital appreciation is accompanied by a substantial risk of loss and that, by their very nature, investments in small-cap companies tend to be very volatile and speculative. Small-cap companies may have a small share of the market for their products or services, their businesses may be limited to regional markets, or they may provide goods and services for a limited market. For example, they may be developing or marketing new products or services for markets that are not yet established or may never become established. In addition, small companies may have or will develop only a regional market for products or services and thus be affected by local or regional market conditions. In addition, small-cap companies may lack depth of management, or they may be unable to generate funds necessary for growth or potential development, either internally or through external financing on favorable terms. Such companies may also be insignificant in their industries and be subject to or become subject to intense competition from larger companies. Due to these and other factors, the Fund’s investments in small-cap companies may suffer significant losses. Further, there is typically a smaller market for the securities of a small-cap company than for securities of a large company. Therefore, investments in small-cap companies may be less liquid and subject to significant price declines that result in losses for the Fund.

c) Real Estate Securities - The Fund will not invest in real estate (including mortgage loans and limited partnership interests), but may invest in readily marketable securities issued by companies that invest in real estate or interests therein. The Fund may also invest in readily marketable interests in real estate investment trusts (“REITs”). REITs are generally publicly traded on the national stock exchanges and in the over-the-counter market and have varying degrees of liquidity. Investments in real estate securities are subject to risks inherent in the real estate market, including risk related to changes interest rates.

d) Federal Income Taxes – The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

As of and during the period from June 28, 2023, the commencement of operations, through May 31, 2024, (the “period ended May 31, 2024”), the Fund did not have a liability for any unrecognized tax expenses. The Fund recognizes interest and penalties, if any, related to unrecognized tax liability as income tax expense in the Statement of Operations. During the period ended May 31, 2024, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdictions as U.S. Federal and Delaware State.

e) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in beneficial interest. There were no reclassifications necessary for the period ended May 31, 2024.

f) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2024

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

g) Other – Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Processes and Structure

The Fund’s Board of Trustees (the “Board”) has adopted guidelines for valuing securities including in circumstances in which market quotes are not readily available and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board.

Hierarchy of Fair Value Inputs

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| ● | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| ● | Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| ● | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Value Measurements

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock and REITs) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts and the movement of the certain indexes of securities based on a statistical analysis of the historical relationship and that are categorized in Level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in Level 2.

Money market funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2024

| 2. | SECURITIES VALUATIONS (continued) |

The following table summarizes the inputs used to value the Fund’s assets and liabilities measured at fair value as of May 31, 2024.

| Financial Instruments - Assets | | | | | | | | | |

| Security Classification (1) | | Level 1

(Quoted Prices) | | | Level 2

(Other Significant

Observable Inputs) | | | Totals | |

| Common Stock (2) | | $ | 6,568,461 | | | $ | — | | | $ | 6,568,461 | |

| Totals | | $ | 6,568,461 | | | $ | — | | | $ | 6,568,461 | |

(1) As of and during the period ended May 31, 2024, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

(2) All common stock held in the Fund are Level 1 securities. For a detailed break-out of common stock by industry, please refer to the Schedule of Investments.

During the period ended May 31, 2024, no securities were valued using alternative procedures approved by the Board.

Pursuant to Rule 2a-5, securities for which market quotations are not readily available will have a fair value determined by the Valuation Designee (as defined by Rule 2a-5) in accordance with the fair value policies and procedures adopted by the Board and the Adviser. The Board will oversee the Valuation Designee’s fair value determinations and has assigned the Adviser as the Fund’s Valuation Designee.

Small Capitalization Company Risk

The Fund is subject to the risk that securities of small capitalization companies may underperform other segments of the equity market or the equity market as a whole. Investing in the securities of small capitalization companies involves greater risk and the possibility of greater price volatility than investing in larger capitalization and more established companies. Because smaller companies may have inexperienced management and limited operating history, product lines, market diversification and financial resources, the securities of these companies may be more speculative, volatile and less liquid than securities of larger companies, and they can be particularly sensitive to unexpected changes in interest rates, borrowing costs and earnings or other adverse developments.

Growth Company Risk

Securities of growth companies can be more sensitive to the company’s earnings and more volatile than the market in general. Growth stocks may also fall out of favor and may underperform relative to the overall equity market at times.

| 3. | BENEFICIAL INTEREST TRANSACTIONS |

Transactions in shares of beneficial interest for the Fund for the period ended May 31, 2024 were as follows:

| | | Sold | | | Redeemed | | | Reinvested | | | Net Increase (Decrease) | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Shares | | | 627,690 | | | | (10,113 | ) | | | 2,403 | | | | 619,980 | |

| Value | | $ | 6,278,376 | | | $ | (103,972 | ) | | $ | 24,942 | | | $ | 6,199,346 | |

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2024

| 4. | INVESTMENT TRANSACTIONS |

For the period ended May 31, 2024, aggregate purchases and sales of investment securities (excluding short-term investments) for the Fund were as follows:

| Purchases | | | Sales | |

| $ | 6,873,445 | | | $ | 806,143 | |

There were no government securities purchased or sold during the year.

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

The Fund has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations of the Fund and manages the Fund’s investments in accordance with the stated policies of the Fund. As compensation for the investment advisory services provided to the Fund, the Adviser will receive a monthly management fee equal to an annual rate of 0.80% of the Fund’s net assets.

The Adviser has entered into an Amended Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses (exclusive of interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, expenditures which are capitalized in accordance with generally accepted accounting principles and, other extraordinary expenses not incurred in the ordinary course of the Fund’s business) of the Fund in an amount that limits “Total Annual Fund Operating Expenses” to not more than 0.99% through at least June 30, 2025. Before August 24, 2023, the Adviser had agreed under the Expense Limitation Agreement to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limited the Fund’s annual operating expenses (but excluding interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 Plans, shareholder service fees pursuant to a Shareholder Services Plan, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, expenditures which are capitalized in accordance with generally accepted accounting principles and, other extraordinary expenses not incurred in the ordinary course of such Fund’s business) to not more than 1.20% until and through at least June 30, 2024. These fee waivers and expense reimbursements are subject to recoupment from the Fund within three years of the date on which the waiver or reimbursement occurs, provided that the recoupment payments do not cause Total Annual Fund Operating Expenses (after the repayment is taken into account) to exceed (i) the expense limit then in effect, if any, and (ii) the expense limit in effect at the time the expenses to be repaid were incurred. Before June 30, 2025, this agreement may not be modified or terminated without the approval of the Board. Please see the table below for information regarding the management fees earned, fee waivers and expenses reimbursed during the period ended May 31, 2024, as well as amounts due to (from) the Adviser at May 31, 2024.

| Advisory fees earned | | $ | 32,929 | |

| Fees waived and reimbursed | | | 159,602 | |

| Payable to (Due from) Adviser | | | (5,272 | ) |

The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions, are $159,602 which can be repaid no later than May 31, 2027.

The Fund has entered into an Investment Company Services Agreement (“ICSA”) with M3Sixty Administration, LLC (“M3Sixty”), an affiliate of the Adviser. Pursuant to the ICSA, M3Sixty will provide day-to-day operational services to the Fund including, but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund’s portfolio securities; (d) pricing the Fund’s shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Fund’s legal compliance; and (j) maintaining shareholder account records.

For the period ended May 31, 2024, M3Sixty earned $63,449, including out of pocket expenses, pursuant to the ICSA.

The Fund has also entered into a Chief Compliance Officer Service Agreement (“CCO Agreement”) with M3Sixty. Pursuant to the CCO Agreement, M3Sixty agrees to provide a Chief Compliance Officer (“CCO”), as described in Rule 38a-1 of the 1940 Act, to the Fund for the year and on the terms and conditions set forth in the CCO Agreement.

For the period ended May 31, 2024, M3Sixty earned $8,465 of fees pursuant to the CCO Agreement.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2024

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued) |

Certain officers and a Trustee of the Fund are also employees of M3Sixty and the Adviser.

The Fund has entered into a Distribution Agreement with Matrix 360 Distributors, LLC (“M360D”), an affiliate of the Adviser and M3Sixty. Pursuant to the Distribution Agreement, M360D provides distribution services to the Fund. M360D serves as underwriter/distributor of the Fund. During the period ended May 31, 2024, no commissions were paid to M360D.

For U.S. Federal income tax purposes, the cost of securities owned, gross appreciation, gross depreciation, and net unrealized appreciation/(depreciation) of the Fund’s investments at May 31, 2024 were as follows:

| Cost | | | Gross Appreciation | | | Gross Depreciation | | | Net Appreciation | |

| $ | 6,182,348 | | | $ | 818,582 | | | $ | (432,469 | ) | | $ | 386,113 | |

The difference between book basis unrealized depreciation and tax-basis unrealized depreciation for the Fund is attributable primarily to the tax deferral of losses on wash sales.

The tax character of distributions paid by the Fund during the period ended May 31, 2024 were as follows:

As of May 31, 2024, the components of distributable earnings presented on an income tax basis were as follows:

| Undistributed Ordinary Income | | | Undistributed Long-Term Capital Gains | | | Capital Loss Carryforwards | | | Post-October

Capital Losses & Post-December Ordinary Loss | | | Net Unrealized Appreciation | | | Total Distributable Earnings | |

| $ | 100,089 | | | $ | 262 | | | $ | — | | | $ | — | | | $ | 386,113 | | | $ | 486,464 | |

Under current tax law, net capital losses realized after October 31st and net ordinary losses incurred after December 31st may be deferred and treated as occurring on the first day of the following fiscal year. As of May 31, 2024, the Fund did not elect to defer any post-October or post-December losses.

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized after December 31, 2010, may be carried forward indefinitely, and their character is retained as short-term and/or long-term. As of May 31, 2024, the Fund did not have any capital loss carryforwards for federal income tax purposes available to offset future capital gains.

During the period ended May 31, 2024, the Fund utilized no capital loss carryforwards.

In accordance with accounting pronouncements, the Fund may record reclassifications in the capital accounts. These reclassifications have no impact on the net asset value of the Fund and are designed generally to present distributable earnings on a tax basis which is considered to be more informative to the shareholder. There were no reclassifications necessary for the period ended May 31, 2024.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2024

| 7. | NEW ACCOUNTING PRONOUNCEMENTS AND REGULATORY UPDATES |

In June 2022, the FASB issued Accounting Standards Update 2022-03, which amends Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions (“ASU 2022-03”). ASU 2022-03 clarifies guidance for fair value measurement of an equity security subject to a contractual sale restriction and establishes new disclosure requirements for such equity securities. ASU 2022-03 is effective for fiscal years beginning after December 15, 2023, and for interim periods within those fiscal years, with early adoption permitted. Management is currently evaluating the impact of these amendments on the financial statements.

In December 2022, the FASB issued an Accounting Standards Update, ASU 2022-06, Reference Rate Reform (Topic 848) – Deferral of the Sunset Date of Topic 848 (“ASU 2022-06”). ASU 2022-06 is an amendment to ASU 2020-04, which provided optional guidance to ease the potential accounting burden due to the discontinuation of the LIBOR and other interbank-offered based reference rates and which was effective as of March 12, 2020, through December 31, 2022. ASU 2022-06 extends the effective period through December 31, 2024. Management is currently evaluating the impact, if any, of applying ASU 2022-06.

In October 2022, the Securities and Exchange Commission (the “SEC”) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements. The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendment. Management is currently evaluating the impact of the new rule.

In September 2023, the SEC adopted a final rule relating to “Names Rule” under the 1940 Act. The amendments expanded the rule to require more funds to adopt an 80 percent investment policy, including funds with names suggesting a focus in investments with particular characteristics (e.g., growth or value) or with terms that reference a thematic investment focus (e.g., environmental, social, or governance factors). The amendments will require that a fund review its name for compliance with the rule. If needed, a fund may need to adopt an 80 percent investment policy and review its portfolio assets’ treatment under such policy at least quarterly. The rule also requires additional prospectus disclosure and reporting and record keeping requirements. Depending on the size of the fund, the rule will take effect about 24 to 36 months after its publication date. For funds with less than $1 billion in net assets, such as the Fund, the compliance date is June 11, 2026. Management has evaluated the amendments and determined that they do not require the Fund to make changes to its name or investment strategy.

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of May 31, 2024, Linscott Joint Revocable Trust held 31.36% of the Fund’s shares. National Financial Services, LLC held 48.76% of the Fund’s shares in an omnibus account for the sole benefit of their customers. The Trust does not know whether any of the underlying beneficial shareholders of the omnibus account held by National Financial Services, LLC own more than 25% of the voting securities of the Fund. Shareholders with a controlling interest could affect the outcome of proxy voting or direction of management of the Fund.

| 9. | COMMITMENTS AND CONTINGENCIES |

In the normal course of business, the Trust may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

In accordance with GAAP, Management has evaluated the impact of all subsequent events of the Fund through the date the financial statements were issued, and has determined that there were no events requiring recognition or disclosure in the financial statements.

| taitweller.com |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of

M3Sixty Small Cap Growth Fund and the

Board of Trustees of 360 Funds

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of M3Sixty Small Cap Growth Fund (the “Fund”), a series of 360 Funds (the “Trust”), including the schedule of investments, as of May 31, 2024, the related statement of operations, the statement of changes in net assets and the financial highlights for the period June 28, 2023 (commencement of operations) through May 31, 2024, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2024, the results of its operations, the changes in its net assets and the financial highlights for the period June 28, 2023 (commencement of operations) through May 31, 2024, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the auditor of one or more of the Funds in the Trust since 2018.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of May 31, 2024 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

Philadelphia, Pennsylvania

July 22, 2024

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

May 31, 2024 (Unaudited)

The Fund files its complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Forms N-PORT are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-PORT may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-months ended June 30th is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Shareholder Tax Information - For the period ended May 31, 2024, the Fund distributed $26,394 as ordinary income. Tax information is reported from the Fund’s fiscal year and not calendar year, therefore, shareholders should refer to their Form 1099-DIV or other tax information which will be mailed in 2025 to determine the calendar year amounts to be included on their 2024 tax returns. Shareholders should consult their own tax advisors.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

May 31, 2024

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited)

The Trustees are responsible for the management and supervision of the Fund. The Trustees approve all significant agreements between the Trust, on behalf of the Fund, and those companies that furnish services to the Fund; review performance of the Fund; and oversee activities of the Fund. This section provides information about the persons who serve as Trustees and Officers to the Trust and Fund, respectively, as well as the entities that provide services to the Fund. The Statement of Additional Information of the Trust includes additional information about the Fund’s Trustees and is available upon request, without charge, by calling (877) 244-6235.

Trustees and Officers. Following are the Trustees and Officers of the Trust, their year of birth, their present position with the Trust or the Fund, and their principal occupation during the past five years. Each of the Trustees of the Trust will generally hold office indefinitely. The Officers of the Trust will hold office indefinitely, except that: (1) any Officer may resign or retire and (2) any Officer may be removed any time by written instrument signed by at least two-thirds of the number of Trustees prior to such removal. In case a vacancy or an anticipated vacancy on the Board shall for any reason exist, the vacancy shall be filled by the affirmative vote of a majority of the remaining Trustees, subject to certain restrictions under the 1940 Act. Those Trustees who are “interested persons” (as defined in the 1940 Act) by virtue of their affiliation with either the Trust or the Adviser, are indicated in the table. The address of each trustee and officer is 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS 66205.

| Name and Year of Birth (“YOB”) | Position(s) Held with Trust | Length of Service | Principal Occupation(s) During Past 5 Years | Number of Series Overseen | Other Directorships During Past 5 Years |

| Independent Trustees |

Tom M. Wirtshafter YOB : 1954 | Trustee | Since 2011 | Retired (2024–current); Senior Vice President, American Portfolios Financial Services, (broker-dealer), American Portfolios Advisors (investment adviser) (2009–2024). | Seven | None |

Steven D. Poppen YOB : 1968 | Trustee | Since 2018 | Executive Vice President and Chief Financial Officer, Minnesota Vikings (professional sports organization) (1999–present): Executive Vice President and Chief Financial Officer, MV Ventures, LLC (real estate developer) (2016–present). | Seven | IDX Funds (2015 –2021); FNEX Ventures (2018-2020) |

Thomas J. Schmidt YOB: 1963 | Trustee and Independent Chairman | Since 2018 Since 2021 | Principal, Tom Schmidt & Associates Consulting, LLC (2015–Present) | Seven | Lind Capital Partners Municipal Credit Income Fund (2021–present); FNEX Ventures (2018-2020) |

| Interested Trustee* | | | | | |

Randall K. Linscott YOB: 1971 | President | Since 2013 | Chief Executive Officer, M3Sixty Administration, LLC (2013–present) | Seven | IDX Funds (2015 - 2021) |

* The Interested Trustee is an Interested Trustee because he is an officer and principal owner of the M3Sixty and a principal at the Adviser.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

May 31, 2024

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited) (continued)

| Name and Year of Birth (“YOB”) | Position(s) Held with Trust | Length of Service | Principal Occupation(s) During Past 5 Years | Number of Series Overseen | Other Directorships During Past 5 Years |

Officers | | | | | |

Gary W. DiCenzo YOB: 1962 | Vice President | Since 2023 | Chief Executive Officer, M3Sixty Capital, LLC (2023–Present); Partner, Cognios Capital (investment management firm) (2015–2020), Chief Executive Officer (2015–2019); Founder, IMC Group, LLC (2010–2022) | N/A | 360 Funds Trust (2014–2022); FNEX Ventures (2018–2020); Volt ETF Trust (2021-2022) |

Richard Yates YOB: 1965 | Chief Compliance Officer and Secretary | Since 2021 | Of Counsel, McElroy Deutsch (2020–present); Head of Compliance, M3Sixty Administration, LLC (2021–present); Chief Compliance Officer and Secretary, IDX Funds (2021–2022); Founder, The Yates Law Firm (2018–2020). | N/A | N/A |

Larry E. Beaver, Jr. YOB: 1969 | Treasurer | Since 2021 | Head of Operations, M3Sixty Administration, LLC (2021–present); Fund Accounting, Administration and Tax Officer, M3Sixty Administration, LLC (2017–2021); Treasurer, Tactical Investment Series Trust (2022-present); Assistant Treasurer, 360 Funds Trust (2017–2021); Chief Accounting Officer, Amidex Funds, Inc. (2003–2020); Assistant Treasurer, IDX Funds (2017–2021; Assistant Treasurer, WP Funds Trust (2017–2021). | N/A | N/A |

Tim Easton YOB: 1968 | Anti-Money Laundering (“AML”) Officer | Since 2024 | Chief Operating Officer, M3Sixty Distributors, LLC (2024–present): Head of Transfer Agency, M3Sixty Administration, LLC (2022–present); Self Employed (2020–2022); Head of Sales, M3Sixty Administration, LLC (2019–2020) | N/A | N/A |

Remuneration Paid to Trustees and Officers - Officers of the Trust and Trustees who are “interested persons” of the Trust or the Adviser will receive no salary or fees from the Trust. Officers of the Trust and Interested Trustees do receive compensation directly from certain service providers to the Trust, including M3SixtyD and M3Sixty. Each Trustee who is not an “interested person” (an “Independent Trustee”) receives a $5,000 annual retainer (paid quarterly). In addition, each Independent Trustee receives, on a per fund basis: (i) a fee of $1,500 per fund each year (paid quarterly); (ii) a fee of $200 per Board meeting attended; and (iii) a fee of $200 per committee meeting attended. The Trust will also reimburse each Trustee for travel and other expenses incurred in connection with, and/or related to, the performance of their obligations as a Trustee. Officers of the Trust will also be reimbursed for travel and other expenses relating to their attendance at Board meetings.

| Name of Trustee1 | Aggregate Compensation From the Fund2 | Pension or Retirement Benefits Accrued As Part of Portfolio Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From the Fund Paid to Trustees2 |

| Independent Trustees |

| Tom M. Wirtshafter | $2,661 | None | None | $2,661 |

| Steven D. Poppen | $2,661 | None | None | $2,661 |

| Thomas J. Schmidt | $2,661 | None | None | $2,661 |

| Interested Trustees |

| Randall K. Linscott | None | Not Applicable | Not Applicable | None |

| | | | | | |

1 Each of the Trustees serves as a Trustee to the seven series of the Trust.

2 Figures are for period ended May 31, 2024.

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

May 31, 2024

Information About Your Fund’s Expenses - (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and/or service (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses – The first section of the table provides information about actual account values and actual expenses (relating to the example $1,000 investment made at the beginning of the period). You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second section of the table provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), CDSC fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. For more information on transactional costs, please refer to the Fund’s prospectus.

Expenses and Value of a $1,000 Investment for the period from 11/30/23 through 05/31/24

| | | Beginning Account

Value (11/30/2023) | | | Annualized Expense

Ratio for the Period | | | Ending Account

Value (05/31/2024) | | | Expenses Paid

During Period (a) | |

| Actual Fund Return (in parentheses) | | | | | | | | | |

| Institutional Class (+14.80%) | | $ | 1,000.00 | | | | 0.99 | % | | $ | 1,148.00 | | | $ | 5.32 | |

| Hypothetical 5% Fund Return | | | | | | | | | | | | | | | | |

| Institutional Class | | $ | 1,000.00 | | | | 0.99 | % | | $ | 1,020.10 | | | $ | 5.00 | |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| M3Sixty Small Cap Growth Fund | ANNUAL REPORT |

May 31, 2024

Information About Your Fund’s Expenses - (Unaudited)(continued)

For more information on Fund expenses, please refer to the Fund’s prospectus, which can be obtained from your investment representative or by calling 1-877-244-6235. Please read it carefully before you invest or send money.

Total Fund operating expense ratios as stated in the supplement dated August 25, 2023 to the Fund’s prospectus dated June 28, 2023 were as follows: |

| M3Sixty Small Cap Growth Fund Institutional Class, gross of fee waivers or expense reimbursements | 1.66% |

| M3Sixty Small Cap Growth Fund Institutional Class, after waiver and reimbursement* | 0.99% |

* The Adviser has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses exclusive of interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, expenditures which are capitalized in accordance with generally accepted accounting principles and, other extraordinary expenses not incurred in the ordinary course of such Fund’s business) to not more than 0.99% until and through at least June 30, 2025. Subject to approval by the Fund’s Board, any waiver under the Expense Limitation Agreement is subject to repayment by the Fund within the three fiscal years following the year in which such waiver occurred, if the Fund is able to make the payment without exceeding the 0.99% expense limitation. Before June 30, 2025, this agreement may not be modified or terminated without the approval of the Board. Total Gross Operating Expenses (Annualized) during the period ended May 31, 2024 were 4.89% for the Institutional Class shares. Please see the Information About Your Fund’s Expenses, the Financial Highlights and Notes to Financial Statements (Note 5) sections of this report for gross and net expense related disclosures during the period ended May 31, 2024. |

360 FUNDS

4300 Shawnee Mission Parkway

Suite 100

Fairway, KS 66205

INVESTMENT ADVISER

M3Sixty Capital, LLC

4300 Shawnee Mission Parkway

Suite 100

Fairway, KS 66205

INVESTMENT SUB-ADVISER

Bridge City Capital, LLC

One Centerpointe Drive

Suite 565

Lake Oswego, OR 97035

ADMINISTRATOR & TRANSFER AGENT

M3Sixty Administration, LLC

4300 Shawnee Mission Parkway

Suite 100

Fairway, KS 66205

DISTRIBUTOR

Matrix 360 Distributors, LLC

4300 Shawnee Mission Parkway

Suite 100

Fairway, KS 66205

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Tait, Weller & Baker, LLP

50 South 16th Street

Suite 2900

Philadelphia, PA 19102-2529

LEGAL COUNSEL

FinTech Law, LLC

6224 Turpin Hills Dr.

Cincinnati, Ohio 45244

CUSTODIAN BANK

Huntington National Bank

7 Easton Oval

Columbus, OH 43219

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (b) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| (c) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| (d) | The registrant’s Code of Ethics is filed herewith. |

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

| | The registrant’s Board of Trustees has determined that Tom M. Wirtshafter serves on its audit committee as the “audit committee financial expert” as defined in Item 3 of Form N-CSR. |

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

(a) | Audit Fees. The aggregate fees billed for the last fiscal year for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $7,500 with respect to the registrant’s fiscal year ended May 31, 2024, the Fund’s initial fiscal year. The audit fees were paid to Tait Weller and Baker, LLP. |

| | |

| (b) | Audit-Related Fees. There were no fees billed during the last fiscal year for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item 4 of Form N-CSR. |

| (c) | Tax Fees. The aggregate fees billed in the last fiscal year for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $1,500 with respect to the registrant’s fiscal year ended May 31, 2024. The fees were paid to Tait Weller & Baker, LLP and the services comprising these fees are the preparation of the registrant’s 2024 federal income and excise tax returns. |

| (d) | All Other Fees. The aggregate fees billed in the last fiscal year for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this Item 4 of Form N-CSR were $0 for the fiscal year ended May 31, 2024. |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item 4 of Form N-CSR that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X |

| (f) | Not applicable. |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the last fiscal year ended May 31, 2024 are disclosed in paragraphs (b) through (c) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser during the last fiscal year. |

| (h) | There were no non-audit services rendered to the registrant’s investment adviser. |

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable to the registrant.

Included in the Annual Report to Shareholders filed under Item 1 of this Form N-CSR.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable as the Fund is an open-end management investment company.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES |

Not applicable as the Fund is an open-end management investment company.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable as the Fund is an open-end management investment company.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

Not applicable.

| ITEM 11. | CONTROLS AND PROCEDURES. |

| (a) | The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the 1940 Act, are effective, as of a date within 90 days of the filing date of this report, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act and Rule 15d-15(b) under the Securities Exchange Act of 1934, as amended. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| ITEM 12. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable as the Fund is an open-end management investment company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

360 Funds