UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS | 66205 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Bo J. Howell

FinTech Law, LLC

6224 Turpin Hills Dr.

Cincinnati, Ohio 45244

Registrant’s telephone number, including area code: 877-244-6235

Date of fiscal year end: 05/31/2024

Date of reporting period: 11/30/2023

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Semi-Annual report to Shareholders of the M3Sixty Small Cap Growth Fund (the “Fund”), a series of the 360 Funds (the “registrant”), for the period ended November 30, 2023 pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1), is filed herewith.

M3Sixty Small Cap Growth Fund

Institutional Class Shares (Ticker Symbol: MCSCX)

A series of the

360 Funds

SEMI-ANNUAL REPORT

NOVEMBER 30, 2023

Investment Adviser:

M3Sixty Capital, LLC

4300 Shawnee Mission Parkway, Suite 100

Fairway, KS 66205

IMPORTANT NOTE: Effective January 24, 2023, the SEC adopted rule and form amendments to require open-end mutual funds and ETFs to transmit concise, visually engaging, and streamlined annual and semi-annual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but will be available online and filed semi-annually on Form N-CSR; you can also request a copy be delivered to you free of charge. The rule and form amendments have a compliance date of July 24, 2024. Prior to this compliance date and as permitted by current SEC regulations, paper copies of the Fund’s shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an e-mail request. Your election to receive reports in paper will apply to all funds held with the Fund complex/your financial intermediary.

TABLE OF CONTENTS

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

November 30, 2023 (Unaudited)

Investment Objective. The investment objective of the M3Sixty Small Cap Growth Fund (the “Fund”) is to seek long-term capital appreciation over a complete market cycle.

Principal Investment Strategy of the Fund. The Fund’s adviser, M3Sixty Capital, LLC (the “Adviser”), delegates the daily management of the Fund’s assets to Bridge City Capital, LLC (the “Sub-Adviser”). The Adviser is responsible for the overall management of the Fund and overseeing the Fund’s Sub-Adviser. Under normal circumstances, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets (plus borrowings for investment purposes) in equity securities of small capitalization companies. The Fund defines small capitalization companies as issuers whose market capitalization is within the same market capitalization range as companies listed in the Russell 2000® Growth Index, which is subject to change over time. As of December 31, 2022, the market capitalization of the companies in the Russell 2000® Growth Index ranged from $3.892 million to $8.050 billion.

The equity securities in which the Fund may invest include common stocks, preferred stocks, convertible securities, real estate investment trusts (“REITs”), sponsored and unsponsored depositary receipts (including American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”)) and U.S. dollar denominated foreign stocks traded on U.S. exchanges. The Fund will invest primarily in U.S. common stocks that the Sub-Adviser believes to have clear indicators of future potential for earnings growth, or that demonstrate other potential for growth of capital. The Fund may also invest in initial public offerings (“IPOs”) in these types of securities. In selecting companies for the Fund’s portfolio, the Sub-Adviser uses a bottom-up approach to select what it believes are quality companies with proven track records, strong financial characteristics, and above average growth prospects at attractive valuations that lead to strong relative returns over a complete market cycle. The Sub Adviser may sell or reduce its position in a security for a variety of reasons when appropriate and consistent with the Fund’s investment objectives and policies, which may include, but are not limited to, when the security: (i) position exceeds the Sub Adviser’s internal position limit of 3% of the Fund’s market value; (ii) exceeds the Sub Adviser’s internal market capitalization limit; or (iii) is no longer considered appropriate for the Fund based on a change in financial condition, management team, or other factor that either reduces the security’s overall score within the Sub-Adviser’s research and screening process or the Sub-Adviser’s conviction in the holding.

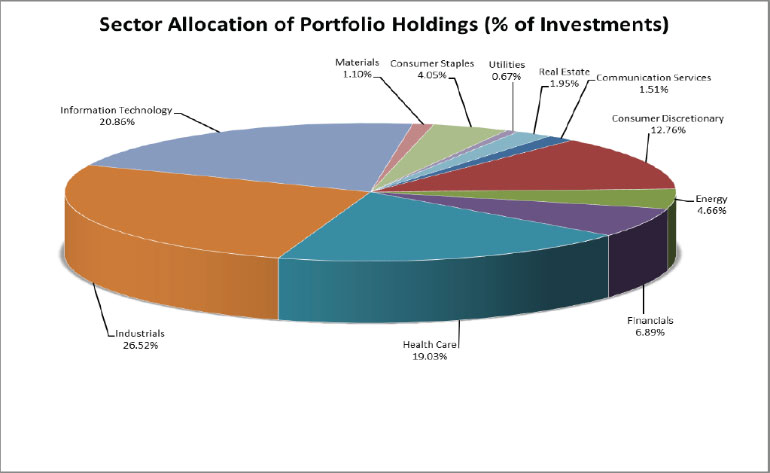

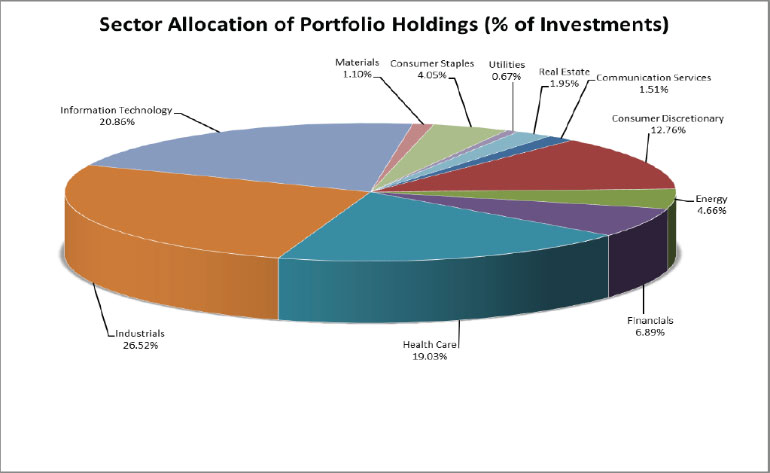

The percentages in the above graph are based on the portfolio holdings of the Fund as of November 30, 2023 and are subject to change.

| M3SIXTY SMALL CAP GROWTH FUND | |

| SCHEDULE OF INVESTMENTS | |

| November 30, 2023 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.92% | | Shares | | | Value | |

| | | | | | | |

| Auto Parts & Equipment - 3.69% | | | | | | | | |

| Dorman Products, Inc. (a) | | | 618 | | | $ | 44,521 | |

| Gentherm, Inc. (a) | | | 956 | | | | 43,899 | |

| Methode Electronics, Inc. | | | 2,470 | | | | 58,613 | |

| | | | | | | | 147,033 | |

| Banks - 4.96% | | | | | | | | |

| First Financial Bankshares, Inc. | | | 1,513 | | | | 39,716 | |

| Glacier Bancorp, Inc. | | | 1,804 | | | | 60,668 | |

| Hope Bancorp, Inc. | | | 2,901 | | | | 28,430 | |

| Lakeland Financial Corp. | | | 542 | | | | 30,108 | |

| WesBanco, Inc. | | | 1,460 | | | | 38,865 | |

| | | | | | | | 197,787 | |

| Building Materials - 2.56% | | | | | | | | |

| Boise Cascade Co. | | | 315 | | | | 34,429 | |

| UFP Industries, Inc. | | | 617 | | | | 67,642 | |

| | | | | | | | 102,071 | |

| Chemicals - 2.03% | | | | | | | | |

| Quaker Chemical Corp. | | | 236 | | | | 42,194 | |

| Rogers Corp. (a) | | | 298 | | | | 38,561 | |

| | | | | | | | 80,755 | |

| Commercial Services - 4.34% | | | | | | | | |

| AMN Healthcare Services, Inc. (a) | | | 304 | | | | 20,611 | |

| Barrett Business Services, Inc. | | | 217 | | | | 23,859 | |

| CBIZ, Inc. (a) | | | 791 | | | | 45,791 | |

| EVERTEC, Inc. - Puerto Rico | | | 1,011 | | | | 37,377 | |

| Healthcare Services Group, Inc. (a) | | | 2,529 | | | | 24,557 | |

| Medifast, Inc. | | | 312 | | | | 20,710 | |

| | | | | | | | 172,905 | |

| Computers - 3.80% | | | | | | | | |

| ExlService Holdings, Inc. (a) | | | 1,830 | | | | 51,917 | |

| Lumentum Holdings, Inc. (a) | | | 569 | | | | 24,353 | |

| Maximus, Inc. | | | 418 | | | | 34,899 | |

| Qualys, Inc. (a) | | | 219 | | | | 40,480 | |

| | | | | | | | 151,649 | |

| Distribution & Wholesale - 1.38% | | | | | | | | |

| SiteOne Landscape Supply, Inc. (a) | | | 391 | | | | 55,061 | |

| | | | | | | | | |

| Diversified Financial Services - 0.71% | | | | | | | | |

| Evercore, Inc. | | | 191 | | | | 28,182 | |

| | | | | | | | | |

| Electric - 1.04% | | | | | | | | |

| Ameresco, Inc. - Class A (a) | | | 1,380 | | | | 41,345 | |

| | | | | | | | | |

| Electrical Components & Equipment - 1.40% | | | | | | | | |

| Insteel Industries, Inc. | | | 1,641 | | | | 55,827 | |

| M3SIXTY SMALL CAP GROWTH FUND | |

| SCHEDULE OF INVESTMENTS | |

| November 30, 2023 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.92% (continued) | | Shares | | | Value | |

| | | | | | | | | |

| Electronics - 3.48% | | | | | | | | |

| Coherent Corp. (a) | | | 1,498 | | | $ | 55,111 | |

| NVE Corp. | | | 434 | | | | 31,105 | |

| OSI Systems, Inc. (a) | | | 426 | | | | 52,522 | |

| | | | | | | | 138,738 | |

| Engineering & Construction - 5.75% | | | | | | | | |

| Comfort Systems USA, Inc. | | | 566 | | | | 109,566 | |

| Exponent, Inc. | | | 491 | | | | 37,787 | |

| MasTec, Inc. (a) | | | 573 | | | | 34,747 | |

| Sterling Infrastructure, Inc. (a) | | | 739 | | | | 46,934 | |

| | | | | | | | 229,034 | |

| Environmental Control - 2.20% | | | | | | | | |

| Tetra Tech, Inc. | | | 554 | | | | 87,615 | |

| | | | | | | | | |

| Food - 2.74% | | | | | | | | |

| J & J Snack Foods Corp. | | | 243 | | | | 39,986 | |

| Performance Food Group Co. (a) | | | 1,063 | | | | 69,148 | |

| | | | | | | | 109,134 | |

| Hand & Machine Tools - 0.83% | | | | | | | | |

| Franklin Electric Co., Inc. | | | 370 | | | | 32,930 | |

| | | | | | | | | |

| Healthcare - Products - 5.59% | | | | | | | | |

| Globus Medical, Inc. (a) | | | 1,047 | | | | 47,031 | |

| iRadimed Corp. | | | 534 | | | | 23,464 | |

| LeMaitre Vascular, Inc. | | | 1,107 | | | | 58,339 | |

| Neogen Corp. (a) | | | 3,020 | | | | 51,249 | |

| Omnicell, Inc. (a) | | | 591 | | | | 19,716 | |

| Zynex, Inc. (a) | | | 2,535 | | | | 23,221 | |

| | | | | | | | 223,020 | |

| Healthcare - Services - 9.16% | | | | | | | | |

| Addus HomeCare Corp. (a) | | | 368 | | | | 32,090 | |

| Amedisys, Inc. (a) | | | 515 | | | | 48,194 | |

| Ensign Group, Inc. | | | 1,045 | | | | 111,888 | |

| Medpace Holdings, Inc. (a) | | | 380 | | | | 102,874 | |

| Pediatrix Medical Group, Inc. (a) | | | 2,225 | | | | 18,645 | |

| U.S. Physical Therapy, Inc. | | | 607 | | | | 51,613 | |

| | | | | | | | 365,304 | |

| Home Builders - 1.60% | | | | | | | | |

| Century Communities, Inc. | | | 884 | | | | 63,772 | |

| | | | | | | | | |

| Home Furnishings - 1.03% | | | | | | | | |

| MillerKnoll, Inc. | | | 1,588 | | | | 40,970 | |

| | | | | | | | | |

| Household Products & Wares - 0.63% | | | | | | | | |

| WD-40 Co. | | | 104 | | | | 25,155 | |

| M3SIXTY SMALL CAP GROWTH FUND | |

| SCHEDULE OF INVESTMENTS | |

| November 30, 2023 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.92% (continued) | | Shares | | | Value | |

| | | | | | | |

| Internet - 2.13% | | | | | | | | |

| Perficient, Inc. (a) | | | 445 | | | $ | 27,537 | |

| Shutterstock, Inc. | | | 447 | | | | 19,628 | |

| Ziff Davis, Inc. (a) | | | 594 | | | | 37,909 | |

| | | | | | | | 85,074 | |

| Leisure Time - 0.93% | | | | | | | | |

| YETI Holdings, Inc. (a) | | | 872 | | | | 37,182 | |

| | | | | | | | | |

| Machinery - Diversified - 2.52% | | | | | | | | |

| Albany International Corp. | | | 573 | | | | 49,175 | |

| Cactus, Inc. - Class A | | | 1,206 | | | | 51,243 | |

| | | | | | | | 100,418 | |

| Metal Fabricate & Hardware - 1.74% | | | | | | | | |

| RBC Bearings, Inc. (a) | | | 269 | | | | 69,332 | |

| | | | | | | | | |

| Oil & Gas Services - 3.67% | | | | | | | | |

| Aris Water Solutions, Inc. - Class A | | | 2,409 | | | | 19,465 | |

| DMC Global, Inc. (a) | | | 1,473 | | | | 23,494 | |

| Dril-Quip, Inc. (a) | | | 1,949 | | | | 43,307 | |

| RPC, Inc. | | | 4,148 | | | | 30,073 | |

| Select Water Solutions, Inc. | | | 4,034 | | | | 30,094 | |

| | | | | | | | 146,433 | |

| Pharmaceuticals - 2.98% | | | | | | | | |

| Amphastar Pharmaceuticals, Inc. (a) | | | 590 | | | | 33,229 | |

| Coherus Biosciences, Inc. (a) | | | 5,431 | | | | 11,568 | |

| Corcept Therapeutics, Inc. (a) | | | 849 | | | | 21,624 | |

| Phibro Animal Health Corp. - Class A | | | 1,971 | | | | 18,902 | |

| Supernus Pharmaceuticals, Inc. (a) | | | 1,232 | | | | 33,572 | |

| | | | | | | | 118,895 | |

| REITS - 1.87% | | | | | | | | |

| Easterly Government Properties, Inc. | | | 1,429 | | | | 16,662 | |

| Getty Realty Corp. | | | 1,243 | | | | 36,581 | |

| LTC Properties, Inc. | | | 653 | | | | 21,301 | |

| | | | | | | | 74,544 | |

| Retail - 7.49% | | | | | | | | |

| American Eagle Outfitters, Inc. | | | 2,420 | | | | 46,053 | |

| Jack in the Box, Inc. | | | 457 | | | | 33,041 | |

| La-Z-Boy, Inc. | | | 1,405 | | | | 49,442 | |

| Lithia Motors, Inc. | | | 234 | | | | 62,476 | |

| Ollie's Bargain Outlet Holdings, Inc. (a) | | | 541 | | | | 39,639 | |

| Shake Shack, Inc. (a) - Class A | | | 507 | | | | 30,704 | |

| Texas Roadhouse. Inc. | | | 332 | | | | 37,370 | |

| | | | | | | | 298,725 | |

| M3SIXTY SMALL CAP GROWTH FUND | |

| SCHEDULE OF INVESTMENTS | |

| November 30, 2023 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.92% (continued) | | Shares | | | Value | |

| | | | | | | | | |

| Semiconductors - 8.74% | | | | | | | | |

| Axcelis Technologies, Inc. (a) | | | 460 | | | $ | 57,169 | |

| Diodes, Inc. (a) | | | 648 | | | | 43,040 | |

| Kulicke & Soffa Industries, Inc. - Singapore | | | 750 | | | | 38,640 | |

| MACOM Technology Solutions Holdings, Inc. (a) | | | 679 | | | | 57,022 | |

| Onto Innovation, Inc. (a) | | | 417 | | | | 58,801 | |

| Photronics, Inc. (a) | | | 1,375 | | | | 29,054 | |

| Synaptics, Inc. (a) | | | 328 | | | | 33,207 | |

| Vishay Precision Group, Inc. (a) | | | 1,038 | | | | 31,649 | |

| | | | | | | | 348,582 | |

| Software - 0.87% | | | | | | | | |

| ACI Worldwide, Inc. (a) | | | 677 | | | | 18,103 | |

| Consensus Cloud Solutions, Inc. (a) | | | 896 | | | | 16,504 | |

| | | | | | | | 34,607 | |

| Telecommunications - 2.16% | | | | | | | | |

| A10 Networks, Inc. | | | 5,395 | | | | 67,383 | |

| Cambium Networks Corp. (a) | | | 4,006 | | | | 18,708 | |

| | | | | | | | 86,091 | |

| Transportation - 1.26% | | | | | | | | |

| Landstar System, Inc. | | | 292 | | | | 50,414 | |

| | | | | | | | | |

| Water - 0.64% | | | | | | | | |

| California Water Service Group | | | 508 | | | | 25,690 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $4,042,799) | | | | | | | 3,824,274 | |

| | | | | | | | | |

| INVESTMENTS AT VALUE (Cost $4,042,799) - 95.92% | | | | | | $ | 3,824,274 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 4.08% | | | | | | | 162,645 | |

| | | | | | | | | |

| NET ASSETS - 100.00% | | | | | | $ | 3,986,919 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

The following abbreviations are used in this portfolio:

REITS - Real Estate Investment Trusts

The accompanying notes are an integral part of these financial statements.

M3SIXTY SMALL CAP GROWTH FUND

STATEMENT OF ASSETS AND LIABILITIES

| November 30, 2023 (Unaudited) | SEMI-ANNUAL REPORT |

| Assets: | | | |

| Investments, at cost | | $ | 4,042,799 | |

| Investments, at value | | $ | 3,824,274 | |

| Cash and cash equivalents | | | 120,201 | |

| Due from Adviser | | | 24,890 | |

| Receivables: | | | | |

| Interest | | | 549 | |

| Dividends | | | 3,953 | |

| Investment securities sold | | | 28,520 | |

| Fund shares sold | | | 21,120 | |

| Prepaid expenses | | | 5,253 | |

| Total assets | | | 4,028,760 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Investment securities purchased | | | 23,774 | |

| Due to administrator | | | 4,621 | |

| Accrued Trustee fees | | | 2,246 | |

| Accrued expenses | | | 11,200 | |

| Total liabilities | | | 41,841 | |

| Commitments and contingencies (a) | | | | |

| Net Assets | | $ | 3,986,919 | |

| | | | | |

| Sources of Net Assets: | | | | |

| Paid-in beneficial interest | | $ | 4,187,825 | |

| Total accumulated deficit | | | (200,906 | ) |

| Total Net Assets (Unlimited $0 par value shares of beneficial interest authorized) | | $ | 3,986,919 | |

| | | | | |

| Institutional Class Shares: | | | | |

| Net assets | | $ | 3,986,919 | |

| Shares Outstanding (Unlimited $0 par value shares of beneficial interest authorized) | | | 422,509 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 9.44 | |

(a) See Note 9 in the Notes to the Financial Statements.

The accompanying notes are an integral part of these financial statements.

M3SIXTY SMALL CAP GROWTH FUND

STATEMENT OF OPERATIONS

SEMI-ANNUAL REPORT

| | | For the Period Ended November 30, 2023(a) | |

| | | (Unaudited) | |

| Investment income: | | | | |

| Dividends | | $ | 14,182 | |

| Interest | | | 3,295 | |

| Total investment income | | | 17,477 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees (Note 5) | | | 9,953 | |

| Accounting and transfer agent fees and expenses (Note 5) | | | 26,480 | |

| Organizational fees | | | 18,510 | |

| Trustee fees and expenses | | | 6,986 | |

| Pricing fees | | | 6,733 | |

| Reports to shareholders | | | 5,259 | |

| Legal fees | | | 5,131 | |

| Miscellaneous | | | 2,504 | |

| Custodian fees | | | 4,529 | |

| Audit fees | | | 4,101 | |

| Compliance officer fees | | | 3,156 | |

| Shareholder network fees | | | 2,500 | |

| Registration and filing fees | | | 229 | |

| Non-12b-1 shareholder servicing expense | | | 32 | |

| Total expenses | | | 96,103 | |

| Less: fees waived (Note 5) | | | (83,034 | ) |

| Net expenses | | | 13,069 | |

| | | | | |

| Net investment income | | | 4,408 | |

| | | | | |

| Realized and unrealized (gain) loss: | | | | |

| Net realized gain on: | | | | |

| Investments | | | 13,211 | |

| Net realized gain on investments | | | 13,211 | |

| | | | | |

| Net change in unrealized depreciation on: | | | | |

| Investments | | | (218,525 | ) |

| Net change in unrealized depreciation | | | (218,525 | ) |

| | | | | |

| Net realized and unrealized loss on investments | | | (205,314 | ) |

| | | | | |

| Net decrease in net assets resulting from operations | | $ | (200,906 | ) |

(a) The M3Sixty Small Cap Growth Fund commenced opertations on June 28, 2023.

The accompanying notes are an integral part of these financial statements.

M3SIXTY SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

SEMI-ANNUAL REPORT

| | | For the Period Ended November 30, 2023(a) | |

| | | (Unaudited) | |

| Increase (decrease) in net assets from: | | | | |

| Operations: | | | | |

| Net investment income | | $ | 4,408 | |

| Net realized gain on investments | | | 13,211 | |

| Net change in unrealized depreciation on investments | | | (218,525 | ) |

| Net decrease in net assets resulting from operations | | | (200,906 | ) |

| | | | | |

| Distributions to shareholders from: | | | | |

| Distributable earnings - Institutional Class | | | — | |

| Total distributions | | | — | |

| | | | | |

| Beneficial interest transactions (Note 3): | | | | |

| Increase in net assets from beneficial interest transactions | | | 4,187,825 | |

| | | | | |

| Increase in net assets | | | 3,986,919 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | — | |

| | | | | |

| End of period | | $ | 3,986,919 | |

(a) The M3Sixty Small Cap Growth Fund commenced opertations on June 28, 2023.

The accompanying notes are an integral part of these financial statements.

M3SIXTY SMALL CAP GROWTH FUND

FINANCIAL HIGHLIGHTS

SEMI-ANNUAL REPORT

The following tables set forth the per share operating performance data for a share of beneficial interest outstanding, total return, ratios to average net assets and other supplemental data for the period indicated.

| | | Institutional Class | |

| | | For the Period Ended November 30, 2023(a) | |

| | | (Unaudited) | |

| | | | | |

| Net Asset Value, Beginning of Period | | $ | 10.00 | |

| | | | | |

| Investment Operations: | | | | |

| Net investment income (b) | | | 0.01 | |

| Net realized and unrealized gain (loss) on investments | | | (0.57 | ) |

| Total from investment operations | | | (0.56 | ) |

| | | | | |

| Distributions: | | | | |

| From net investment income | | | — | |

| From net realized capital gains | | | — | |

| Total distributions | | | — | |

| | | | | |

| Net Asset Value, End of Period | | $ | 9.44 | |

| | | | | |

| Total Return (c) | | | (5.60 | )%(d) |

| | | | | |

| Ratios/Supplemental Data | | | | |

| Net assets, end of period (in 000's) | | $ | 3,987 | |

| | | | | |

| Ratio of expenses to average net assets: | | | | |

| Before fees waived and expenses absorbed | | | 7.73 | %(e) |

| After fees waived and expenses absorbed | | | 1.05 | %(e) |

| | | | | |

| Ratio of net investment income (loss): | | | | |

| Before fees waived and expenses absorbed | | | (6.32 | )%(e) |

| After fees waived and expenses absorbed | | | 0.35 | %(e) |

| | | | | |

| Portfolio turnover rate | | | 12 | %(d) |

| (a) | The M3Sixty Small Cap Growth Fund commenced operations on June 28, 2023. |

| (b) | Net investment income per share is based on average shares outstanding for the period ended November 30, 2023. |

| (c) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Had the Adviser not waived fees/reimbursed expenses, total returns would have been lower. |

| (d) | Not annualized |

| (e) | Annualized. |

The accompanying notes are an integral part of these financial statements.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2023 (Unaudited)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

The Fund is a series of 360 Funds (the “Trust”). The Trust was organized on February 24, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund is a diversified fund. The Fund’s investment objective is to seek long-term capital appreciation over a complete market cycle.

The Fund commenced operations on June 28, 2023.

The Fund offers one class of shares, institutional shares.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company that follows the accounting and reporting guidance of Accounting Standards Codification Topic 946 applicable to investment companies.

a) Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 2.

b) Investments in Small-Cap Companies - The Fund may invest in securities of companies with small market capitalizations. Certain small-cap companies may offer greater potential for capital appreciation than larger companies. However, investors should note that this potential for greater capital appreciation is accompanied by a substantial risk of loss and that, by their very nature, investments in small-cap companies tend to be very volatile and speculative. Small-cap companies may have a small share of the market for their products or services, their businesses may be limited to regional markets, or they may provide goods and services for a limited market. For example, they may be developing or marketing new products or services for markets that are not yet established or may never become established. In addition, small companies may have or will develop only a regional market for products or services and thus be affected by local or regional market conditions. In addition, small-cap companies may lack depth of management, or they may be unable to generate funds necessary for growth or potential development, either internally or through external financing on favorable terms. Such companies may also be insignificant in their industries and be subject to or become subject to intense competition from larger companies. Due to these and other factors, the Fund’s investments in small-cap companies may suffer significant losses. Further, there is typically a smaller market for the securities of a small-cap company than for securities of a large company. Therefore, investments in small-cap companies may be less liquid and subject to significant price declines that result in losses for the Fund.

c) Real Estate Securities - The Fund will not invest in real estate (including mortgage loans and limited partnership interests), but may invest in readily marketable securities issued by companies that invest in real estate or interests therein. The Fund may also invest in readily marketable interests in real estate investment trusts (“REITs”). REITs are generally publicly traded on the national stock exchanges and in the over-the-counter market and have varying degrees of liquidity. Investments in real estate securities are subject to risks inherent in the real estate market, including risk related to changes interest rates.

d) Federal Income Taxes – The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

As of and during the period from June 28, 2023, the commencement of operations, through November 30, 2023, (the “period ended November 30, 2023”) the Fund did not have a liability for any unrecognized tax expenses. The Fund recognizes interest and penalties, if any, related to unrecognized tax liability as income tax expense in the Statement of Operations. During the period ended November 30, 2023, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdictions as U.S. Federal and Delaware State.

e) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in beneficial interest. There were no reclassifications necessary for the period ended November 30, 2023.

f) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2023 (Unaudited)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

g) Other – Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Processes and Structure

The Fund’s Board of Trustees (the “Board”) has adopted guidelines for valuing securities including in circumstances in which market quotes are not readily available and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board.

Hierarchy of Fair Value Inputs

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| ● | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| ● | Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| ● | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Value Measurements

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock and REITs) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts and the movement of the certain indexes of securities based on a statistical analysis of the historical relationship and that are categorized in Level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in Level 2.

Money market funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2023 (Unaudited)

| 2. | SECURITIES VALUATIONS (continued) |

The following table summarizes the inputs used to value the Fund’s assets and liabilities measured at fair value as of November 30, 2023.

Financial Instruments - Assets

Security Classification (1) | | Level 1 (Quoted

Prices) | | | Level 2 (Other

Significant

Observable

Inputs) | | | Totals | |

| Common Stock (2) | | $ | 3,824,274 | | | $ | — | | | $ | 3,824,274 | |

| Totals | | $ | 3,824,274 | | | $ | — | | | $ | 3,824,274 | |

(1) As of and during the period ended November 30, 2023, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

(2) All common stock held in the Fund are Level 1 securities. For a detailed break-out of common stock by industry, please refer to the Schedule of Investments.

During the period ended November 30, 2023, no securities were valued using alternative procedures approved by the Board of Trustees.

Pursuant to Rule 2a-5, securities for which market quotations are not readily available will have a fair value determined by the Valuation Designee (as defined by Rule 2a-5) in accordance with the fair value policies and procedures adopted by the Board and the Adviser. The Board will oversee the Valuation Designee's fair value determinations and has assigned the Adviser as the Fund's Valuation Designee.

Small Capitalization Company Risk

The Fund is subject to the risk that securities of small capitalization companies may underperform other segments of the equity market or the equity market as a whole. Investing in the securities of small capitalization companies involves greater risk and the possibility of greater price volatility than investing in larger capitalization and more established companies. Because smaller companies may have inexperienced management and limited operating history, product lines, market diversification and financial resources, the securities of these companies may be more speculative, volatile and less liquid than securities of larger companies, and they can be particularly sensitive to unexpected changes in interest rates, borrowing costs and earnings or other adverse developments.

Growth Company Risk

Securities of growth companies can be more sensitive to the company’s earnings and more volatile than the market in general. Growth stocks may also fall out of favor and may underperform relative to the overall equity market at times.

| 3. | BENEFICIAL INTEREST TRANSACTIONS |

Transactions in shares of beneficial interest for the Fund for the period ended November 30, 2023 were as follows:

| | | Sold | | | Redeemed | | | Reinvested | | | Net Increase

(Decrease) | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Shares | | | 422,611 | | | | (102 | ) | | | — | | | | 422,509 | |

| Value | | $ | 4,188,820 | | | $ | (995 | ) | | $ | — | | | $ | 4,187,825 | |

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2023 (Unaudited)

| 4. | INVESTMENT TRANSACTIONS |

For the period ended November 30, 2023, aggregate purchases and sales of investment securities (excluding short-term investments) for the Fund were as follows:

| Purchases | | | Sales | |

| $ | 4,366,370 | | | $ | 336,782 | |

There were no government securities purchased or sold during the period

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

The Fund has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations of the Fund and manages the Fund’s investments in accordance with the stated policies of the Fund. As compensation for the investment advisory services provided to the Fund, the Adviser will receive a monthly management fee equal to an annual rate of 0.80% of the Fund’s net assets.

The Adviser had entered into an Expense Limitation Agreement with the Fund under which it had agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limited the Fund’s annual operating expenses (but excluding interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, expenditures which are capitalized in accordance with generally accepted accounting principles and, other extraordinary expenses not incurred in the ordinary course of such Fund’s business) to not more than 1.20% until and through at least June 30, 2024. Effective August 24, 2023, The Board approved an amendment to the Expense Limitation Agreement between the Trust and the Adviser to reduce the Fund’s maximum operating expenses from 1.20% to 0.99% of its average daily net assets (exclusive of interest, borrowing expenses, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage fees and commissions, dividend expenses on short sales, litigation expenses, expenditures which are capitalized in accordance with generally accepted accounting principles and, other extraordinary expenses not incurred in the ordinary course of the Fund’ business) through June 30, 2025. These fee waivers and expense reimbursements are subject to recoupment from the Fund within three years of the date on which the waiver or reimbursement occurs, provided that the recoupment payments do not cause Total Annual Fund Operating Expenses (after the repayment is taken into account) to exceed (i) the expense limit then in effect, if any, and (ii) the expense limit in effect at the time the expenses to be repaid were incurred. This agreement may be terminated only by the Board upon 60 days’ written notice to the Fund’s Adviser. Please see the table below for information regarding the management fees earned, fee waivers and expenses reimbursed during the period ended November 30, 2023, as well as amounts due to (from) the Adviser at November 30, 2023.

| Advisory fees earned | | $ | 9,953 | |

| Fees waived and reimbursed | | | 83,034 | |

| Payable to (Due from) Adviser | | | (24,890 | ) |

The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions, are $83,034 which can be repaid no later than May 31, 2027.

The Fund has entered into an Investment Company Services Agreement (“ICSA”) with M3Sixty Administration, LLC (“M3Sixty”). Pursuant to the ICSA, M3Sixty will provide day-to-day operational services to the Fund including, but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund’s portfolio securities; (d) pricing the Fund’s shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Fund’s legal compliance; and (j) maintaining shareholder account records.

For the period ended November 30, 2023, M3Sixty earned $26,480, including out of pocket expenses, pursuant to the ICSA.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2023 (Unaudited)

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued) |

The Fund has also entered into a Chief Compliance Officer Service Agreement (“CCO Agreement”) with M3Sixty. Pursuant to the CCO Agreement, M3Sixty agrees to provide a Chief Compliance Officer (“CCO”), as described in Rule 38a-1 of the 1940 Act, to the Fund for the year and on the terms and conditions set forth in the CCO Agreement.

For the period ended November 30, 2023, M3Sixty earned $3,155 of fees pursuant to the CCO Agreement.

Certain officers and a Trustee of the Fund are also employees of M3Sixty.

The Fund has entered into a Distribution Agreement with M3Sixty Distributors, LLC (“M3SixtyD”). Pursuant to the Distribution Agreement, M3SixtyD provides distribution services to the Fund. M3SixtyD serves as underwriter/distributor of the Fund. During the period ended November 30, 2023, no commissions were paid to M3SixtyD. M3SixtyD is an affiliate of M3Sixty.

For U.S. Federal income tax purposes, the cost of securities owned, gross appreciation, gross depreciation, and net unrealized appreciation/(depreciation) of the Fund’s investments at November 30, 2023 were as follows:

| Cost | | | Gross Appreciation | | | Gross Depreciation | | | Net Depreciation | |

| $ | 4,043,132 | | | $ | 205,594 | | | $ | (424,452 | ) | | $ | (218,858 | ) |

The difference between book basis unrealized depreciation and tax-basis unrealized depreciation for the Fund is attributable primarily to the tax deferral of losses on wash sales.

The Fund’s tax basis distributable earnings are determined at the end of each fiscal year and will be provided in the Fund's May 31, 2024 annual report.

The Fund did not pay any distributions during the period ended November 30, 2023.

| 7. | NEW ACCOUNTING PRONOUNCEMENTS AND REGULATORY UPDATES |

In June 2022, the FASB issued Accounting Standards Update 2022-03, which amends Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions (“ASU 2022-03”). ASU 2022- 03 clarifies guidance for fair value measurement of an equity security subject to a contractual sale restriction and establishes new disclosure requirements for such equity securities. ASU 2022-03 is effective for fiscal years beginning after December 15, 2023, and for interim periods within those fiscal years, with early adoption permitted. Management is currently evaluating the impact of these amendments on the financial statements.

In December 2022, the FASB issued an Accounting Standards Update, ASU 2022-06, Reference Rate Reform (Topic 848) – Deferral of the Sunset Date of Topic 848 (“ASU 2022-06”). ASU 2022-06 is an amendment to ASU 2020-04, which provided optional guidance to ease the potential accounting burden due to the discontinuation of the LIBOR and other interbank-offered based reference rates and which was effective as of March 12, 2020, through December 31, 2022. ASU 2022-06 extends the effective period through December 31, 2024. Management is currently evaluating the impact, if any, of applying ASU 2022- 06.

In October 2022, the Securities and Exchange Commission (the “SEC”) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements. The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendment. Management is currently evaluating the impact of the new rule.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

NOTES TO FINANCIAL STATEMENTS

November 30, 2023 (Unaudited)

| 7. | NEW ACCOUNTING PRONOUNCEMENTS AND REGULATORY UPDATES (continued) |

In September 2023, the SEC adopted a final rule relating to “Names Rule” under the 1940 Act. The amendments expanded the rule to require more funds to adopt an 80 percent investment policy, including funds with names suggesting a focus in investments with particular characteristics (e.g., growth or value) or with terms that reference a thematic investment focus (e.g., environmental, social, or governance factors). The amendments will require that a fund review its name for compliance with the rule. If needed, a fund may need to adopt an 80 percent investment policy and review its portfolio assets' treatment under such policy at least quarterly. The rule also requires additional prospectus disclosure and reporting and record keeping requirements. Depending on the size of the fund, the rule will take effect about 24 to 36 months after its publication date.

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of November 30, 2023, Linscott Joint Revocable Trust held 45.78% of the Fund’s shares. National Financial Services, LLC held 25.25% of the Fund’s shares in an omnibus account for the sole benefit of their customers. The Trust does not know whether any of the underlying beneficial shareholders of the omnibus account held by National Financial Services, LLC own more than 25% of the voting securities of the Fund. Shareholders with a controlling interest could affect the outcome of proxy voting or direction of management of the Fund.

| 9. | COMMITMENTS AND CONTINGENCIES |

In the normal course of business, the Trust may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

On December 21, 2023, the Fund paid ordinary income distributions of $26,394, which were payable on December 21, 2023.

In accordance with GAAP, Management has evaluated the impact of all subsequent events of the Fund through the date the financial statements were issued, and has determined that there were no other subsequent events requiring recognition or disclosure in the financial statements.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

ADDITIONAL INFORMATION

November 30, 2023 (Unaudited)

The Fund files its complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Forms N-PORT are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-PORT may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Shareholder Tax Information - For the period ended November 30, 2023, the Fund did not pay any distributions. Tax information is reported from the Fund’s fiscal year and not calendar year, therefore, shareholders should refer to their Form 1099- DIV or other tax information which will be mailed in 2024 to determine the calendar year amounts to be included on their 2023 tax returns. Shareholders should consult their own tax advisors.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

ADDITIONAL INFORMATION

November 30, 2023

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited)

The Trustees are responsible for the management and supervision of the Fund. The Trustees approve all significant agreements between the Trust, on behalf of the Fund, and those companies that furnish services to the Fund; review performance of the Fund; and oversee activities of the Fund. This section provides information about the persons who serve as Trustees and Officers to the Trust and Fund, respectively, as well as the entities that provide services to the Fund. The Statement of Additional Information of the Trust includes additional information about the Fund's Trustees and is available upon request, without charge, by calling (877) 244-6235.

Trustees and Officers. Following are the Trustees and Officers of the Trust, their age and address, their present position with the Trust or the Fund, and their principal occupation during the past five years. Each of the Trustees of the Trust will generally hold office indefinitely. The Officers of the Trust will hold office indefinitely, except that: (1) any Officer may resign or retire and (2) any Officer may be removed any time by written instrument signed by at least two-thirds of the number of Trustees prior to such removal. In case a vacancy or an anticipated vacancy on the Board shall for any reason exist, the vacancy shall be filled by the affirmative vote of a majority of the remaining Trustees, subject to certain restrictions under the 1940 Act. Those Trustees who are “interested persons” (as defined in the 1940 Act) by virtue of their affiliation with either the Trust or the Adviser, are indicated in the table. The address of each trustee and officer is 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS 66205.

* The Interested Trustee is an Interested Trustee because he is Chief Executive Officer and principal owner of M3Sixty Administration, LLC, the Fund's administrator and transfer agent.

Name, Address and Year of

Birth (“YOB”) | Position(s)

Held with

Trust | Length of

Service | Principal Occupation(s)

During Past 5 Years | Number

of Series

Overseen | Other Directorships

During Past

5 Years |

| Independent Trustees |

Tom M. Wirtshafter

YOB : 1954 | Trustee | Since 2011 | Senior Vice President, American Portfolios Financial Services, (broker-dealer), American Portfolios Advisors (investment Advisor) (2009–Present). | Seven | None |

Steven D. Poppen

YOB : 1968 | Trustee | Since 2018 | Executive Vice President and Chief Financial Officer, Minnesota Vikings (professional sports organization) (1999–present): Executive Vice President and Chief Financial Officer, MV Ventures, LLC (real estate developer) (2016 - present). | Seven | IDX Funds (2015 – 2021); FNEX Ventures (2018- 2020) |

Thomas J. Schmidt

YOB: 1963 | Trustee

and

Independent Chairman | Since 2018 Since 2021 | Principal, Tom Schmidt & Associates Consulting, LLC (2015–Present) | Seven | Lind Capital Partners Municipal Credit Income Fund (2021– present); FNEX Ventures (2018-2020) |

| Interested Trustee* |

Randall K. Linscott

YOB: 1971 | President | Since 2013 | Chief Executive Officer, M3Sixty Administration, LLC (2013–present) | Seven | IDX Funds (2015 - 2021) |

* The Interested Trustee is an Interested Trustee because he is an officer and principal owner of the Administrator.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

ADDITIONAL INFORMATION

November 30, 2023

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited) (continued)

Name, Address and Year of

Birth (“YOB”) | Position(s)

Held with

Trust | Length of

Service | Principal Occupation(s)

During Past 5 Years | Number

of Series

Overseen | Other Directorships

During Past

5 Years |

| Officers |

Richard Yates

YOB: 1965 | Chief Compliance Officer and Secretary | Since 2021 | Of Counsel, McElroy Deutsch (2020–present); Head of Compliance, M3Sixty Administration, LLC (2021–present); Chief Compliance Officer and Secretary, IDX Funds (2021–2022); Founder, The Yates Law Firm (2018–2020). | N/A | N/A |

Larry E. Beaver, Jr.

YOB: 1969 | Treasurer | Since 2021 | Head of Operations, M3Sixty Administration, LLC (2021-present); Fund Accounting, Administration and Tax Officer, M3Sixty Administration, LLC (2017–2021) Assistant Treasurer, 360 Funds Trust (2017–2021); Chief Accounting Officer, Amidex Funds, Inc. (2003– 2020); Assistant Treasurer, IDX Funds (2017– 2021; Assistant Treasurer, WP Funds Trust (2017–2021). | N/A | N/A |

Tim Easton

YOB: 1968 | Anti-Money Laundering (“AML”) Officer | Since 2024 | Chief Operating Officer, M3Sixty Distributors, LLC (2024–present): Head of Transfer Agency, M3Sixty Administration, LLC (2022-present); Self Employed (2020-2022); Head of Sales, M3Sixty Administration, LLC (2019 – 2020) | N/A | N/A |

Remuneration Paid to Trustees and Officers - Officers of the Trust and Trustees who are “interested persons” of the Trust or the Adviser will receive no salary or fees from the Trust. Officers of the Trust and Interested Trustees do receive compensation directly from certain service providers to the Trust, including M3SixtyD and M3Sixty. Each Trustee who is not an “interested person” (an “Independent Trustee”) receives a $5,000 annual retainer (paid quarterly). In addition, each Independent Trustee receives, on a per fund basis: (i) a fee of $1,500 per fund each year (paid quarterly); (ii) a fee of $200 per Board meeting attended; and (iii) a fee of $200 per committee meeting attended. The Trust will also reimburse each Trustee for travel and other expenses incurred in connection with, and/or related to, the performance of their obligations as a Trustee. Officers of the Trust will also be reimbursed for travel and other expenses relating to their attendance at Board meetings.

| Name of Trustee1 | Aggregate

Compensation

From the Fund2 | Pension or Retirement

Benefits Accrued As Part

of Portfolio Expenses | Estimated

Annual Benefits

Upon

Retirement | Total Compensation

From the

Fund Paid to Trustees2 |

| | Independent Trustees |

| Tom M. Wirtshafter | $954 | None | None | $954 |

| Steven D. Poppen | $954 | None | None | $954 |

| Thomas J. Schmidt | $954 | None | None | $954 |

| | Interested Trustees |

| Randall K. Linscott | None | Not Applicable | Not Applicable | None |

1 Each of the Trustees serves as a Trustee to the seven series of the Trust.

2 Figures are for period ended November 30, 2023.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

November 30, 2023

Information About Your Fund’s Expenses - (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and/or service (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses – The first section of the table provides information about actual account values and actual expenses (relating to the example $1,000 investment made at the beginning of the period). You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second section of the table provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), CDSC fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. For more information on transactional costs, please refer to the Fund’s prospectus.

Expenses and Value of a $1,000 Investment for the period from 06/30/23 through 11/30/23

| | | Beginning Account

Value (06/30/2023) | | | Annualized Expense

Ratio for the Period | | | Ending Account

Value (11/30/2023) | | | Expenses Paid

During Period(a) | |

| Actual Fund Return (in parentheses) | | | | | | | | | |

| Institutional Class (-5.60%) | | $ | 1,000.00 | | | | 1.05 | % | | $ | 944.00 | | | $ | 4.29 | |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period from 06/30/2023, the date of initial expense accruals, through November 30, 2023, multiplied by 154/366 to reflect the period from June 30, 2023 through November 30, 2023. |

Expenses and Value of a $1,000 Investment for the period from 06/01/23 through 11/30/23

| | | Beginning Account

Value (06/01/2023) | | | Annualized Expense

Ratio for the Period | | | Ending Account

Value (11/30/2023) | | | Expenses Paid

During Period (b) | |

| Hypothetical 5% Fund Return | | | | | | | | | |

| Institutional Class | | $ | 1,000.00 | | | | 1.05 | % | | $ | 1,019.80 | | | $ | 5.30 | |

| (b) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period from June 1, 2023 through November 30, 2023, multiplied by 183/366 to reflect the one-half year period. |

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

November 30, 2023

Information About Your Fund’s Expenses - (Unaudited) (continued)

For more information on Fund expenses, please refer to the Fund’s prospectus, which can be obtained from your investment representative or by calling 1-877-244-6235. Please read it carefully before you invest or send money.

| Total Fund operating expense ratios as stated in the supplement dated August 25, 2023 to the Fund’s prospectus dated June 28, 2023 were as follows: | |

| | | | | |

| M3Sixty SmallCap Growth Fund Institutional Class, gross of fee waivers or expense reimbursements | | | 1.66 | % |

| M3Sixty Small Cap Growth Fund Institutional Class, after waiver and reimbursement* | | | 0.99 | % |

| | | | | |

| * The Adviser has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, other expenditures that are capitalized in accordance with generally accepted accounting principles, acquired funds fees and expenses, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, interest and dividend expense on securities sold short, and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 of the 1940 Act to not more than 0.99% until and through at least June 30, 2024. Subject to approval by the Fund’s Board, any waiver under the Expense Limitation Agreement is subject to repayment by the Fund within the three fiscal years following the year in which such waiver occurred, if the Fund is able to make the payment without exceeding the 0.99% expense limitation. The current contractual agreement cannot be terminated prior to at least one year after the effective date without the Board’s approval. Total Gross Operating Expenses (Annualized) during the period ended November 30, 2023 were 7.73% for the Institutional Class shares. Please see the Information About Your Fund’s Expenses, the Financial Highlights and Notes to Financial Statements (Note 5) sections of this report for gross and net expense related disclosures during the period ended November 30, 2023. | |

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

November 30, 2023

Approval of the Investment Advisory Agreement for the M3Sixty Small Cap Growth Fund (Unaudited)

At a meeting held April 25, 2023, (the “Meeting”) the Board considered the approval of a new Advisory Agreement between the Trust and the Adviser, concerning the Fund. The Board reviewed the information provided by the Adviser, which included: (1) industry data comparing advisory fees and expense ratios of comparable investment companies and other products; (2) comparative performance information; (3) The Adviser’s estimated revenues, costs, and profitability of providing services to the Fund; and (4) information about the Adviser’s personnel. Before voting, the Independent Trustees reviewed the proposed Advisory Agreement with management and legal counsel and received materials from such counsel discussing the legal standards for the Board’s consideration of the agreement.

In approving the Advisory Agreement, the Board considered various factors, among them: (1) the nature, extent, and quality of the Adviser’s proposed services to the Fund, including the personnel providing such services; (2) the Adviser’s compensation and profitability; (3) a comparison of the Fund’s fees and performance relative to their peer group; (4) expected economies of scale; and (5) the terms of the Advisory Agreement and possible conflicts of interest between the Fund and the Adviser.

| (1) | The nature, extent, and quality of the services to be provided by the Adviser. |

The Board considered the Adviser’s experience and knowledge relating to the management of a mutual fund, including the professional experience and qualifications of its senior personnel. In evaluating the quality of services to be provided by the Adviser, the Board considered the Adviser’s operations and compliance policies and procedures. The Board also considered the Adviser’s financial condition, its resources, and any potential conflicts of interest.

The Board considered the Adviser’s process for monitoring the sub-adviser, which includes an examination of both qualitative and quantitative elements of the sub-advisor’s organization, personnel, procedures, investment discipline, infrastructure and performance. The Board considered that the Adviser will conduct periodic due diligence of the sub-adviser, during which the Adviser will examines a wide variety of factors, such as the financial condition of the sub-adviser, the quality of its systems, the effectiveness of its disaster recovery programs, trade allocation and execution procedures, compliance with its policies and procedures, results of regulatory examinations, and any other factors that might affect the quality of services that the sub-adviser will provide to the Fund. The Board noted that the Adviser’s monitoring processes also include quarterly reviews of compliance certifications, and that any issues arising from such reviews and the Advisor’s due diligence review of the sub-advisers are reported to the Board.

The Board, including the Independent Trustees, concluded that it was satisfied with the nature, extent, and quality of the Adviser’s proposed services to the Fund under the Advisory Agreement.

| (2) | The costs of the services to be provided, and profits realized, by the Adviser from the relationship with the Fund. |

The Board considered the Adviser’s financial condition, its expected profitability, and the direct and indirect benefits derived by the Adviser through its relationship with the Fund. The Board considered the financial information provided by the Adviser, including its expected profit margin for managing the Fund and the proposed expense limitation agreement (the “ELA”). The Board noted that the Adviser will pay the sub-advisers’ sub-advisory fees out of the management fees that the Adviser receives from the Fund. The Board also considered whether the Adviser has the financial wherewithal to provide services to the Fund, noting the ongoing commitment of the Adviser under the ELA. The Board noted that the Adviser and its affiliated firms, M3Sixty and M3SixtyD, will derive benefits from its association with the Fund.

The Board recognized that the Adviser would earn a reasonable level of profits in exchange for the level of services it provides to the Fund and the entrepreneurial risk that the Adviser assumes for managing the Fund. Based upon its review, the Board, including the Independent Trustees, concluded that the Adviser’s compensation and profitability from its relationship with the Fund is reasonable and not excessive.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

November 30, 2023

Approval of the Investment Advisory Agreement for the M3Sixty Small Cap Growth Fund (Unaudited) (continued)

| (3) | Investment performance of the Fund and the Adviser. |

The Board noted that the Fund has not yet commenced operations in the Trust, but it considered the historical performance of the Sub-Adviser in managing separate accounts with similar strategies. The Board compared the proposed advisory fee and total expense ratio for the Fund with various comparative data, including the median and average advisory fees and total expense ratios of the Fund’s peer groups, noting that the proposed management fee was equal to the average and slightly above the median of the Fund’s peer group. The Board further considered the Adviser’s plans to increase fund assets, which will have a positive effect on the Fund’s expense ratios. In reviewing the estimated expense ratio of the Fund, the Board also considered the nature, extent, and quality of the Adviser’s proposed services. The Board considered, among other data, the specific factors, and concluded that the advisory fee was reasonable considering the Adviser’s proposed services.

| (4) | The extent to which economies of scale would be realized if the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. |

The Board considered the potential growth of the Fund based on the Adviser’s estimated investor demand and its marketing plans. The Board noted that the advisory fee would stay the same as asset levels increased, although it noted that under the ELA, the Adviser was obligated to pay some of the Fund’s operating expenses, which limited the overall fees and expenses paid by the Fund even at lower asset levels. The Board also noted that if the Fund’s assets increased over time, the Fund might realize other economies of scale if assets increased proportionally more than certain other expenses.

| (5) | Possible conflicts of interest and benefits derived by the Adviser. |

In considering the terms of the Advisory Agreement, the Board noted that the terms were substantially similar to the Trust’s other advisory agreements and are consistent with industry standards. The Board determined that the compensation payable under the Advisory Agreement was fair, reasonable, and reflected an arms-length negotiation considering all the surrounding circumstances.

Regarding the Adviser’s potential conflicts of interest, the Board considered (i) the experience and ability of the advisory and compliance personnel assigned to the Fund; (ii) the proposed oversight of the Sub-Adviser; (iii) the substance and administration of the Adviser’s code of ethics and other relevant policies described in its compliance manual and Form ADV. The Board also noted that the Adviser’s affiliates, M3Sixty and M3SixtyD, would also receive monetary and other benefits from servicing the Fund. The Board, including the Independent Trustees, determined that the Adviser’s compliance policies and operational controls were reasonably designed to eliminate or mitigate these conflicts of interest.

In considering the Advisory Agreement, the Board, including the Independent Trustees, did not identify any single factor as controlling, and each Trustee may have attributed different weights to the numerous factors. The Board reached the following conclusions regarding the Advisory Agreement, among others: (a) the Adviser demonstrated that it possesses the capability and resources to perform the duties required of it under the Advisory Agreement; (b) the Adviser maintains an appropriate compliance program; and (c) the Fund’s advisory fee is reasonable considering the Adviser’s proposed services. Based on their conclusions, the Board, including the Independent Trustees, determined that approval of the Advisory Agreement was in the best interests of the Fund and its future shareholders.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

November 30, 2023

Approval of the Sub-Advisory Agreement for the M3Sixty Small Cap Growth Fund (Unaudited)

At a meeting held April 25, 2023, (the “Meeting”) the Board considered the approval of a new Sub-Advisory Agreement (the “Sub-Advisory Agreement”) between the Advisor and the Sub-Adviser, concerning the Fund. The Board reviewed the information provided by the Sub-Adviser, which included: (1) industry data comparing advisory fees and expense ratios of comparable investment companies and other products; (2) comparative performance information; (3) the Sub-Adviser’s estimated revenues, costs, and profitability of providing services to the Fund; and (4) information about the Sub-Adviser’s personnel. Before voting, the Independent Trustees reviewed the proposed Sub-Advisory Agreement with management and legal counsel and received materials from such counsel discussing the legal standards for the Board’s consideration of the agreement.

In approving the Sub-Advisory Agreement, the Board considered various factors, among them: (1) the nature, extent, and quality of the Sub-Adviser’s proposed services to the Fund, including the personnel providing such services; (2) the Sub-Adviser’s compensation and profitability; (3) a comparison of the Fund’s fees and performance relative to their peer group; (4) expected economies of scale; and (5) the terms of the Sub-Advisory Agreement and possible conflicts of interest between the Fund and the Sub-Adviser.

| (1) | The nature, extent, and quality of the services to be provided by the Sub-Adviser. |

The Board considered the Sub-Adviser’s experience and knowledge relating to the management of a mutual fund, including the professional experience and qualifications of its senior personnel. In evaluating the quality of services provided by the Sub-Adviser, the Board considered the Sub-Adviser’s other investment products that use similar strategies. The Board also considered the Sub-Adviser’s operations and compliance policies and procedures, its financial condition, its resources, and any potential conflicts of interest. The Board, including the Independent Trustees, concluded that it was satisfied with the nature, extent, and quality of the Sub-Adviser’s proposed services to the Fund under the Sub-Advisory Agreement.

| (2) | The costs of the services to be provided, and profits to be realized, by the Sub-Adviser from the relationship with the Fund. |

The Board considered the Sub-Adviser’s financial condition, its expected profitability, and the direct and indirect benefits derived by the Sub-Adviser through its relationship with the Adviser and the Fund. The Board considered the financial information provided by the Sub-Adviser, including its expected profit margin as a sub-adviser. The Board noted the undertaking of the Adviser to maintain expense limits for the Fund and also noted that the sub-advisory fees under the Sub-Advisory Agreement are paid by the Adviser out of the management fee that it receives under the Investment Advisory Agreement and negotiated at arm’s-length to the Fund and the proposed expense limitation agreement (the “ELA”). The Board compared the sub-advisory fee paid by the Adviser to the advisory fees charged by the Sub-Adviser to manage comparable separate accounts. The Board also considered whether the Sub-Adviser has the financial wherewithal to provide services to the Fund, noting the ongoing commitment of the Sub-Adviser to support the Adviser’s obligations under the ELA. The Board considered the amount of the management fee retained by the Adviser compared to the sub-advisory fee paid by the Adviser to the Sub-Adviser for the various services it provides. The Board noted that the Sub-Adviser will derive benefits to its reputation and other benefits from its association with the Fund.

The Board recognized that the Sub-Adviser would earn a reasonable level of profits in exchange for the level of services it provides to the Fund and the entrepreneurial risk that the Sub-Adviser assumes for managing the Fund. Based upon its review, the Board, including the Independent Trustees, concluded that the Sub-adviser’s compensation and profitability from its relationship with the Fund is reasonable and not excessive.

| M3Sixty Small Cap Growth Fund | SEMI-ANNUAL REPORT |

November 30, 2023

Approval of the Sub-Advisory Agreement for the M3Sixty Small Cap Growth Fund (Unaudited) (continued)

| (3) | Investment Performance of the Fund and the Sub-Adviser. |

The Board noted that the Fund has not yet commenced operations in the Trust, but it considered the historical performance of the Sub-Adviser in managing separate accounts with similar strategies. The Board considered the Sub-Adviser’s performance in managing such accounts since 2009, noting that the Sub-Adviser’s composite had outperformed its benchmark in 9 of the past 14 years. The Board also considered comparative performance to the Fund’s peer group, noting that the composite had outperformed its peers during the one-, three-, five-, and ten-year periods as of February 28, 2023. Based on these considerations, the Board determined that the information presented regarding the performance of the Sub-Adviser in managing separate accounts using the same strategy as the Fund was satisfactory.

| (4) | The extent to which economies of scale would be realized if the Fund grows and whether sub-advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. |

The Board noted that the Adviser would pay the sub-advisory fee from the management fee that the Adviser receives from the Fund. The Board considered the split of the management fee between the Adviser and the Sub-Adviser and concluded that it was reasonable and the result of an arm’s length negotiation between the two firms. The Board also considered the potential growth of the Fund based on the Sub-Adviser’s estimated investor demand and the Adviser and the Sub-Adviser’s marketing plans. The Board noted that the sub-advisory fee would stay the same as asset levels increased, although it noted that under the ELA, the Fund’s operating expenses would be limited even at lower asset levels. The Board also noted that if the Fund’s assets increased over time, the Fund might realize other economies of scale if assets increased proportionally more than certain other expenses.

In considering the terms of the Sub-Advisory Agreement, the Board noted that the terms were consistent with industry standards. The Board determined that the compensation payable under the Sub-Advisory Agreement was fair, reasonable, and reflected an arms-length negotiation considering all the surrounding circumstances.

| (5) | Possible conflicts of interest and benefits derived by the Sub-Adviser. |

Regarding the Sub-Adviser’s potential conflicts of interest, the Board considered (i) the experience and ability of the advisory and compliance personnel assigned to the Fund; (ii) the investment and trading processes for the funds; (iii) the method for bunching of portfolio securities transactions; (iv) the substance and administration of the Sub-Adviser’s code of ethics and other relevant policies described in its compliance manual and Form ADV. The Board, including the Independent Trustees, determined that the Sub-Adviser’s compliance policies and operational controls were reasonably designed to eliminate or mitigate conflicts of interest.

In considering the Sub-Advisory Agreement, the Board, including the Independent Trustees, did not identify any single factor as controlling, and each trustee may have attributed different weights to the numerous factors. The Board reached the following conclusions regarding the Sub-Advisory Agreement, among others: (a) the Sub-Adviser demonstrated that it possesses the capability and resources to perform the duties required of it under the Sub-Advisory Agreement; (b) the Sub-Adviser maintains an appropriate compliance program; and (c) the sub-advisory fee is reasonable considering the Sub-Advisor’s proposed services. Based on their conclusions, the Board, including the Independent Trustees, determined that approval of the Sub-Advisory Agreement was in the best interests of the Fund and its future shareholders.

360 FUNDS

4300 Shawnee Mission Parkway

Suite 100

Fairway, KS 66205

INVESTMENT ADVISER

M3Sixty Capital, LLC

4300 Shawnee Mission Parkway

Suite 100

Fairway, KS 66205

INVESTMENT SUB-ADVISER

Bridge City Capital, LLC

One Centerpointe Drive