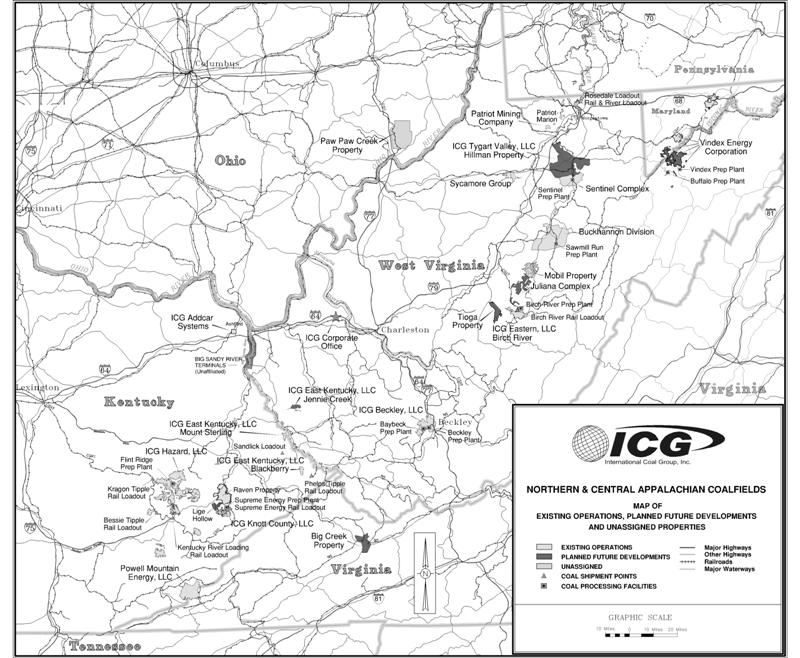

Our Northern and Central Appalachian mining facilities and reserves are strategically located across West Virginia, Kentucky, Maryland and Virginia and are used to produce and ship coal to our customers located primarily in the eastern half of the United States. All of our Northern and Central Appalachian mining operations are union free.

Our mines in Central Appalachia produced 11.6 million tons of coal in 2008 and our mines in Northern Appalachia produced 3.9 million tons of coal in 2008. The coal produced in 2008 from our Northern and Central Appalachian mining operations was, on average, 12,214 Btu/lb., 1.3% sulfur and 12.6% ash by content. Shipments bound for electric utilities accounted for approximately 91% of the coal shipped by these mines in 2008 compared to 93% of shipments in 2007. Within each mining complex, mines have been developed at strategic locations in proximity to our preparation plants and rail shipping facilities. The mines located in Central Appalachia ship the majority of their coal by the Norfolk Southern and CSX rail lines, although production may also be delivered by truck or barge, depending on the customer.

As of December 31, 2008, these mines had 2,166 employees.

Eastern

Eastern operates the Birch River surface mine, located 60 miles east of Charleston, near Cowen in Webster County, West Virginia. Birch River is extracting coal from the Freeport, Upper Kittanning, Middle Kittanning, Upper Clarion and Lower Clarion coalbeds. We estimate that Birch River controls 5.0 million tons of coal reserves. Additional potential reserves have been identified in the immediate vicinity of the Birch River mine and exploration activities are currently being conducted in order to add those potential reserves to the reserve base.

Approximately 36% of the coal reserves are leased, while approximately 64% are owned in fee. Most of the leased reserves are held by four lessors. The leases are retained by annual minimum payments and by tonnage-based royalty payments. Most leases can be renewed until all mineable and merchantable coal has been exhausted.

Overburden is removed by a dragline, excavator, front-end loaders, end dumps and bulldozers. Approximately one-third of the total coal sales are run-of-mine, while the other two-thirds are washed at Birch River’s preparation plant. Coal is transported by conveyor belt from the preparation plant to Birch River’s rail loadout, which is served by CSX via the A&O Railroad, a short-line carrier that is partially owned by CSX.

Hazard

Hazard currently operates seven surface mines, a unit train loadout (Kentucky River Loading) and other support facilities in eastern Kentucky, near Hazard. The coal reserves and operations were acquired in late-1997 and 1998 by AEI Resources.

Hazard’s seven surface mines include East Mac & Nellie, Vicco, Rowdy Gap, County Line, Sam Campbell, Thunder Ridge and Middle Fork. The coal from these mines is being extracted from the Hazard 10, Hazard 9, Hazard 8, Hazard 7 and Hazard 5A seams. Nearly all of the coal is marketed as a blend of run-of-mine product with the remainder being washed. Overburden is removed by front-end loaders, end dumps, bulldozers and blast casting. East Mac & Nellie also utilizes a large capacity hydraulic shovel. Coal is transported by on-highway trucks from the mines to the Kentucky River Loading rail loadout, which is served by CSX. Some coal is direct shipped to the customer by truck from the mine pits.

We estimate that Hazard controls 61.9 million tons of coal reserves, plus 6.4 million tons of coal that is classified as non-reserve coal deposits. Most of the property has been adequately explored, but additional core drilling will be conducted within specified locations to better define the reserves.

Approximately 58% of Hazard’s reserves are leased. Most of the leased reserves are held by seven lessors. In several cases, Hazard has multiple leases with each lessor. The leases are retained by annual minimum payments and by tonnage-based royalty payments. Most leases can be renewed until all mineable and merchantable coal has been exhausted.

Flint Ridge

As of year end, Flint Ridge, located near Breathitt County, Kentucky, was currently operating three underground mines and one preparation plant. Two underground mines operate in the Hazard 8 seam, while the third underground mine operates in the Hazard 5A seam.

Flint Ridge’s three underground mines are room-and-pillar operations, utilizing continuous miners and both battery powered ram cars and shuttle cars. All of the run-of-mine coal is processed at the Flint Ridge preparation plant, which is an existing preparation plant structure that was extensively upgraded in early 2005. Since July 2005, it has been processing coal from the Hazard and Flint Ridge mining complexes.

The majority of the processed coal is trucked to the Kentucky River Loading rail loadout. Some processed coal is trucked directly to the customer from the preparation facility.

We estimate that Flint Ridge controls 24.2 million tons of coal reserves, plus 0.9 million tons of non-reserve coal deposits. Approximately 97% of Flint Ridge’s reserves are leased, while 3% are owned in fee. The leases are retained by annual minimum payments and by tonnage-based royalty payments. Most leases can be renewed until all mineable and merchantable coal has been exhausted.

10

Knott County

Knott County operates three underground mines, the Supreme Energy preparation plant and rail loadout and other facilities necessary to support the mining operations in eastern Kentucky, near Kite. Knott County was acquired by AEI Resources from Zeigler in 1998 with reserves acquired through a lease from Penn Virginia.

Knott County is producing coal from the Hazard 4 and Elkhorn 3 coalbeds. Two mines are operating in the Hazard 4 coalbed: Calvary and Clean Energy. The Classic mine is operating in the Elkhorn 3 coalbed. Three additional properties are in the process of being permitted for underground mine development. We estimate this property contains 15.2 million tons of coal reserves. A significant portion of the property has been explored, but additional core drilling will be conducted within specified locations to better define the reserves.

Approximately 25% of Knott County’s reserves are owned in fee, while approximately 75% are leased. The leases are retained by annual minimum payments and by tonnage-based royalty payments. The leases can be renewed until all mineable and merchantable coal has been exhausted.

Knott County’s three underground mines are room-and-pillar operations, utilizing continuous miners and shuttle cars. Nearly all of the run-of-mine coal is processed at the Supreme Energy preparation plant; some of the Hazard 4 run-of-mine coal is blended with the washed coal. All of Knott County’s coal is transported by rail from loadouts served by CSX.

Raven

Raven, located in Knott County, Kentucky, operates two underground mines and the Raven preparation plant. Raven’s two underground mines are producing coal from the Elkhorn 2 coalbed. We estimate this property contains 12.2 million tons of coal reserves. Most of the property has been extensively explored, but additional core drilling will be conducted within specified locations to better define the reserves.

Raven’s reserves are 100% leased from one lessor. The leases are retained by annual minimum payments and by tonnage-based royalty payments. The leases can be renewed until all mineable and merchantable coal has been exhausted.

Raven’s two underground mines are room-and-pillar operations, utilizing continuous miners and battery powered ram cars. The coal is processed at the Raven preparation plant. Operations at the Raven preparation plant began in 2006 in conjunction with Loadout, LLC, an affiliate of Penn Virginia Resources Partners, L.P. Nearly all of Raven’s coal is transported by rail via CSX.

East Kentucky

East Kentucky is a surface mining operation located in Martin and Pike Counties, Kentucky, near the Tug Fork River. East Kentucky currently operates the Mt. Sterling and Peelpoplar surface mines and the Sandlick loadout. The loadout is serviced by Norfolk Southern railroad. East Kentucky was acquired by AEI Resources in the second quarter of 1999.

Mt. Sterling is an area surface mine that produces coal from the Taylor, Coalburg, Winifrede, Buffalo and Stockton coalbeds. All of the coal is sold run-of-mine. We estimate that the Mt. Sterling mine controls 2.7 million tons of coal reserves, of which 88% are owned. No additional exploration is required. Overburden at the Mt. Sterling mine is removed by front-end loaders, end dumps, bulldozers and blast casting. Coal from the pits is transported by truck to the Sandlick loadout.

Peelpoplar is a surface mine that produces coal using contour mining from the Little Fireclay and Whitesburg Middle coal seams that we estimate to control 0.2 million tons of coal reserves, none of which are owned. Mining is performed using a front-end loader/truck spread and bulldozers. Coal produced is transported by on-highway trucks to the Sandlick loadout. We plan to operate the Peelpoplar mine though 2009.

Although Mt. Sterling and Peelpoplar are mined by East Kentucky, the properties are held by ICG Natural Resources. The leases are retained by annual minimum payments and by tonnage-based royalty payments. Most leases can be renewed until all mineable and merchantable coal has been exhausted.

11

Beckley

The Beckley Pocahontas Mine was placed into production in the fall of 2008. It is located in Central Appalachia in Raleigh County, West Virginia. The Beckley Pocahontas mine accesses a 32.0 million-ton deep reserve of high quality low-volatile metallurgical coal in the Pocahontas No. 3 seam. Most of the 16,800 acre Beckley reserve is leased from three land companies: Western Pocahontas Properties, Crab Orchard Coal Company and Beaver Coal Company.

Construction of the slope portal and a new preparation plant was completed in late 2007 with remaining development completed in 2008. Underground production is by means of the room-and-pillar method with continuous miners and battery haulers. We are marketing the coal produced from the Beckley reserve to domestic steel producers and for export. Additionally, we began marketing metallurgical coal produced from reprocessing a nearby coal refuse pile located at Eccles, West Virginia.

Vindex Energy Corporation

Vindex Energy Corporation operates three surface mines, the Carlos mine, the Island mine and the Jackson Mountain mine, all located in Garrett and Allegany Counties, Maryland. The reserves at Vindex are leased from multiple landowners under leases that expire at varying times and are renewable with annual holding costs. Vindex Energy is a cross-ridge mining operation extracting coal from the Upper Freeport, Bakerstown, Middle Kittanning, Upper Kittanning, Pittsburgh and Redstone seams. All surface mines operated by Vindex Energy are truck-and-shovel/loader mining operations and are conducted with relatively new equipment. Exploration and development is conducted on a continual basis ahead of mining. In 2007, Vindex added the Cabin Run property to its reserve base. The total reserves for the assigned surface operations at Vindex amount to approximately 7.3 million tons.

Most of the surface mine production is shipped directly to the customer as run-of-mine product. Any coal that must be washed is processed at our preparation plant located near Mount Storm, West Virginia, where the product is shipped to the customer by either truck or rail.

Patriot Mining Company

Patriot Mining Company consists of the Guston Run surface mine, located near Morgantown in Monongalia County, West Virginia. The Crown No. 4 surface mine was depleted in the third quarter of 2007 and the Fort Grand surface mine was temporarily idled in the fourth quarter of 2008. The majority of the coal and surface is leased under renewable contracts with small annual minimum holding costs. Coal is extracted from the Waynesburg seam using contour mining methods with dozers, loaders and trucks. As mining progresses, reserves are being acquired and permitted for future operations. The coal is shipped to the customer by rail, truck or barge using our barge loading facility.

We estimate that Patriot Mining Company currently controls approximately 6.2 million tons of coal reserves, of which 1% are owned.

Buckhannon Division

Wolf Run Mining Company’s Buckhannon Division currently consists of two active underground mines: the Imperial mine located in Upshur County, West Virginia, near the town of Buckhannon, and the Sycamore No. 2 mine located in Harrison County, West Virginia, approximately ten miles west of Clarksburg. Nearly all of the reserves in the Buckhannon Division are owned. The Buckhannon Division also owns the Sago mine, which was idled in March 2007. The decision was made in December 2008 to permanently close the Sago mine due to deteriorating conditions and the high cost necessary to reactivate the mine.

The Imperial mine extracts coal from the Middle Kittanning seam. All of the coal extracted from the Imperial mine is processed through the nearby Sawmill Run preparation plant. This coal is primarily shipped by CSX rail with origination by the A&O Railroad, a short-line operator, although some coal is trucked to local industrial customers. The reserves at the Buckhannon Division have characteristics that make it marketable to both steam and export metallurgical coal customers.

The Sycamore No. 2 mine began producing coal from the Pittsburgh seam by the room-and-pillar mining method with continuous miners and shuttle cars in the fourth quarter of 2005. The reserve is primarily leased from one landowner with an annual minimum holding costs and an automatic renewal based on an annual minimum production of 250,000 tons. Unexpected adverse mining conditions forced the idling of the Sycamore No. 2 mine during the third quarter of 2006; however, an independent contractor resumed production at the mine in September 2007. The coal produced from the Sycamore No. 2 mine is sold on a raw basis and shipped to Allegheny Power Service Corporation’s Harrison Power Station by truck.

Powell Mountain

Acquired in 2008, Powell Mountain, located in Lee County, Virginia and Harlan County, Kentucky, currently operates the Darby mine, a room-and-pillar mine operating two sections with both shuttle cars and ram cars. The mine is operating in the Darby seam with all coal being trucked to the Mayflower preparation plant for processing. Coal is shipped by rail through the dual service rail loadout facility with rail service provided by both the Norfolk Southern and CSX railroads. Some purchased coal is brought into the facility for processing and blending. We plan to begin operation of the new Middle Splint mine in 2010.

Sentinel

Wolf Run Mining Company’s Sentinel mine, located in Barbour County, West Virginia, was acquired by Anker in 1990 and has been operating ever since. Historically, coal was extracted from the Upper and Lower Kittanning seams; however, the mine was idled in the second quarter of 2006 to extend the slope and shafts to the underlying Clarion seam. Developmental mining in the Clarion seam began in November 2006 and the current operation now includes three continuous miner sections using the room-and-pillar mining method. Clarion coalbed reserves at the Sentinel mine amount to approximately 15.4 million tons, of which approximately 12% is owned and 88% is leased.

Coal is fed directly from the mine to a preparation plant and loadout facility served by the CSX railroad with origination by the A&O Railroad, as short-line operator. The product can be shipped to steam or metallurgical markets.

12

New Appalachian Mine Developments

Hillman Property

The Hillman property, located in Taylor County, West Virginia, near Grafton, includes approximately 186.0 million tons of deep coal reserves of both steam and metallurgical quality coal in the Lower Kittanning seam covering approximately 65,000 acres. The reserve extends into parts of Barbour, Marion and Harrison Counties as well. ICG owns the Hillman coal reserve in addition to nearly 4,000 acres of surface property to accommodate the development of two projected mining operations. In addition to the Lower Kittanning reserves, we also own significant non-reserve coal deposits in the Kittanning, Freeport, Clarion and Mercer seams on the Hillman property.

The West Virginia Department of Environmental Protection (“WVDEP”) issued a permit on June 5, 2007 for the Tygart No. 1 underground longwall mine and preparation plant complex located on the Hillman Property. On appeal, the WV Surface Mine Board remanded the permit for additional modifications. The modified permit application was approved in April 2008 and mine site development commenced. A subsequent appeal to the WV Surface Mine Board resulted in the suspension of the permit in October 2008 and cessation of construction activity. A modified permit application is awaiting reissuance from WVDEP.

Construction of our Tygart No. 1 mining complex is not expected to resume until market conditions justify the additional production. We will continue to evaluate timing of the development as market conditions evolve, but resumption of work is not currently expected before 2011. At full production, we expect Tygart No. 1 to produce 3.5 million tons annually of high quality coal that is well suited to both the utility market and the high volatile metallurgical market.

Upshur Property

The Upshur Property, located in Northern Appalachia, contains approximately 93.0 million tons of non-reserve coal deposits owned or controlled by us in the Middle and Lower Kittanning seams. Due to unique geologic characteristics and coal quality constraints, Upshur is a potential location for an on-site power plant. Some preliminary research, including air quality monitoring, has been completed as part of conceptual planning for the future construction of a circulating fluidized bed power plant at Upshur.

Big Creek Property

Our Big Creek reserve, located in Central Appalachia, covers 10,000 acres of leased coal lands located north of the town of Richlands in Tazewell County, Virginia. Total recoverable reserves are 25.9 million tons in the Jawbone, Greasy Creek and War Creek seams. The Big Creek reserve is all leased from Southern Regional Industrial Realty. The War Creek mine, which is permitted as a room-and-pillar mining operation, is expected to be developed in the future as market conditions warrant. We receive an overriding royalty on coalbed methane production from this property.

Juliana Complex

The Juliana property, located in Webster County, West Virginia, was extensively mined in the past by a predecessor of ICG. Contour and mountaintop removal surface mining methods were utilized to produce coal from the Kittanning and Upper Freeport seams. In addition, a substantial amount of deep-mined coal was produced from the Middle Kittanning seam.

Currently at Juliana, there are two Kittanning deep mine permits and one surface mine permit in place. Permitted deep and surface non-reserve coal deposits are 1.2 million tons and 1.9 million tons, respectively.

Jennie Creek Property

The Jennie Creek reserve, located in Mingo County, West Virginia, is a 44.9 million ton reserve of surface and deep mineable steam coal. This property contains 14.7 million tons of surface mineable, low sulfur coal reserves. A deep reserve in the high Btu, mid-sulfur Alma seam constitutes the largest block of coal at 30.2 million tons. Permitting is now in progress for a surface mine on this Central Appalachian property. Development of the entire Jennie Creek reserve had been subject to the resolution of certain disputes with lessors arising out of the Horizon bankruptcy proceedings. We resolved our litigation with the lessors of the Jennie Creek coal reserves in 2007. Using the results of an extensive core drilling project completed on the property in 2007 and 2008, the surface mine plan was updated and corresponding changes are being made to the mining permits. The coal will be produced by contouring, highwall mining and area mining.

13

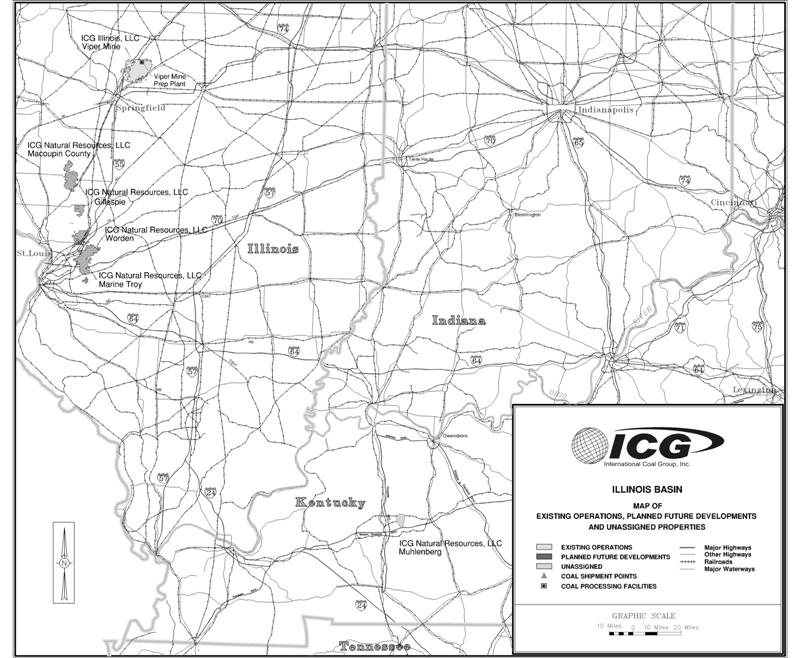

Illinois Basin Mining Operations

Below is a map showing the location and access to our coal operations in the Illinois Basin:

Illinois operates one large underground coal mine, the Viper mine, in central Illinois. Viper commenced mining operations in 1982 as a union free operation for Shell Oil Company. Viper was acquired by Ziegler in 1992 and subsequently acquired by AEI Resources in 1998.

The Viper mine is mining the Illinois No. 5 Seam, also referred to as the Springfield Seam. We estimate that Viper controls approximately 42.6 million tons of coal reserves, plus an additional 38.5 million tons of non-reserve coal deposits.

Approximately 79% of the coal reserves are leased, while 21% are owned in fee. The leases are retained by annual minimum payments and by tonnage-based royalty payments. The leases can be renewed until all mineable and merchantable coal has been exhausted.

The Viper mine is a room-and-pillar operation, utilizing continuous miners and battery coal haulers. Management believes that Illinois is one of the lowest cost and highest productivity mines in the Illinois Basin. All of the raw coal is processed at Viper’s preparation plant. The clean coal is transported to utility and industrial customers located in North Central Illinois by on-highway trucks operated by independent trucking companies. A major rail line is located a short distance from the plant, giving Viper the option of constructing a rail loadout. Shipments to electric utilities account for approximately 64% of coal sales.

The underground equipment, infrastructure and preparation plant are well maintained. Underground equipment is routinely replaced or rebuilt depending on the age and mechanical condition of the equipment. Illinois plans to develop a new portal facility that will allow it to eliminate the need to operate over five miles of underground beltlines and to maintain the extensive previously mined area.

14

Other Operations

Brokered coal sales

In addition to the coal we mine, we purchase and resell coal produced by third parties from their controlled reserves to meet our customers’ specifications.

ADDCAR Systems

In our highwall mining business, we have five systems in operation using our patented ADDCAR highwall mining system and intend to build additional ADDCAR systems as required. ADDCAR(TM) is the registered trademark of ICG. The ADDCAR highwall mining system is an innovative and efficient mining system often deployed at reserves that cannot be economically mined by other methods.

A typical ADDCAR highwall mining system consists of a launch vehicle, continuous miner, conveyor cars, a stacker conveyor, electric generator, water tanker for cooling and dust suppression and a wheel loader with forklift attachment.

A five person crew operates the entire ADDCAR highwall mining system with control of the continuous miner being performed remotely by one person from the climate-controlled cab located at the rear of the launch vehicle. Our system utilizes a navigational package to provide horizontal guidance, which helps to control rib width, and thus roof stability. In addition, the system provides vertical guidance for avoiding or limiting out of seam dilutions. The ADDCAR highwall mining system is equipped with high-quality video monitors to provide the operator with visual displays of the mining process from inside each entry being mined.

The mining cycle begins by aligning the ADDCAR highwall mining system onto the desired heading and starting the entry. As the remotely controlled continuous miner penetrates the coal seam, ADDCAR conveyor cars are added behind it, forming a continuous cascading conveyor train. This continues until the entry is at the planned full depth of up to 1,200 to 1,500 feet. After retraction, the launch vehicle is moved to the next entry, leaving a support pillar of coal between entries. This process recovers as much as 65% of the reserves while keeping all personnel outside the coal seam in a safe working environment. A wide range of seam heights can be mined with high production in seams as low as 3.5 feet and as high as 15 feet in a single pass. If the seam height is greater than 15 feet, then multi-lifts can be mined to create an unlimited entry height. The navigational features on the ADDCAR highwall mining system allow for multi-lift mining while ensuring that the designed pillar width is maintained.

During the mining cycle, in addition to the tramming effort provided by the crawler drive of the continuous miner, the ADDCAR highwall mining system increases the cutting capability of the machine through additional forces provided by hydraulic cylinders which transmit thrust to the back of the miner through blocks mounted on the side of the conveyor cars. This additional energy allows the continuous miner to achieve maximum cutting and loading rates as it moves forward into the seam. The first ADDCAR narrow bench mining system was placed in operation in 2007.

We currently have the exclusive North American distribution rights for the ADDCAR highwall mining system.

15

Coalbed methane

CoalQuest has entered into a lease and joint operating agreement pursuant to which it leases coalbed methane, which is pipeline quality gas that resides in coal seams, and participates in certain coalbed methane wells, from its properties in Barbour, Harrison and Taylor counties in West Virginia. The first production well owned in part by CoalQuest began commercial operations in June 2006 and ten additional wells partially owned by CoalQuest were brought online by the end of 2007. During 2008, the counterparty to the lease and joint operating agreement declared bankruptcy. As a result, we recorded a reserve against related outstanding accounts receivable. The counterparty continues to operate the wells under the protection of the bankruptcy court. Our coalbed methane lessee developed other wells in which CoalQuest is not a partial owner. In the eastern United States, conventional natural gas fields are typically located in various sedimentary formations at depths ranging from 2,000 to 15,000 feet. Exploration companies often put capital at risk by searching for gas in commercially exploitable quantities at these depths. By contrast, the coal seams from which we recover coalbed methane are typically less than 1,000 feet deep and are usually better defined than deeper formations. We believe that this contributes to lower exploration costs than those incurred by producers that operate in deeper, less defined formations. We believe this project is part of the first application of proprietary horizontal drilling technology for coalbed methane in northern West Virginia coalfields. We have not filed reserve estimates with any federal agency.

We receive an overriding royalty on coalbed methane production from the Crab Orchard Coal Company and Beaver Coal Company coal reserves leased by ICG Beckley in Raleigh County, West Virginia and from the leased Big Creek coal reserves in Tazewell County, Virginia. We also lease coalbed methane from certain of our properties in Kentucky and will receive rents and royalties on future production.

Customers and Coal Contracts

Customers

Our primary customers are investment grade electric utility companies primarily in the eastern half of the United States. The majority of our customers purchase coal for terms of one year or longer, but we also supply coal on a spot basis for some of our customers. Our three largest customers for the year ended December 31, 2008 were Progress Energy, Georgia Power Company and Allegheny Energy Supply Company and we derived approximately 32% of our coal revenues from sales to our five largest customers. We did not derive more than 10% of our coal sales revenues from any single customer in 2008.

Long-term coal supply agreements

As is customary in the coal industry, we enter into long-term supply contracts (exceeding one year in duration) with many of our customers when market conditions are appropriate. These contracts allow customers to secure a supply for their future needs and provide us with greater predictability of sales volume and sales price. For the year ended December 31, 2008, approximately 51% of our revenues were derived from long-term supply contracts. We sell the remainder of our coal through short-term contracts and on the spot market. We have also entered into certain brokered transactions to purchase certain amounts of coal to meet our sales commitments. These purchase coal contracts expire between 2009 and 2010 and are expected to provide us a minimum of approximately 1.9 million tons of coal through the remaining lives of the contracts.

We have certain contracts which are below current market rates because they were entered into during periods of suppressed coal prices. As the net costs associated with producing coal have increased due to higher energy, transportation and steel prices, the price adjustment mechanisms within several of our long-term contracts do not reflect current market prices. This has resulted in certain counterparties to these contracts benefiting from below-market prices for our coal.

16

The terms of our coal supply agreements result from competitive bidding and extensive negotiations with customers. Consequently, the terms of these contracts vary significantly by customer, including price adjustment features, price reopener terms, coal quality requirements, quantity adjustment mechanisms, permitted sources of supply, future regulatory changes, extension options, force majeure provisions and termination and assignment provisions.

Some of our long-term contracts provide for a pre-determined adjustment to the stipulated base price at times specified in the agreement or at other periodic intervals to account for changes due to inflation or deflation in prevailing market prices.

In addition, most of our contracts contain provisions to adjust the base price due to new statutes, ordinances or regulations that impact our costs related to performance of the agreement. Also, some of our contracts contain provisions that allow for the recovery of costs impacted by modifications or changes in the interpretations or application of any applicable government statutes.

Price reopener provisions are present in many of our long-term contracts. These price reopener provisions may automatically set a new price based on prevailing market price or, in some instances, require the parties to agree on a new price, sometimes within a specified range of prices. In a limited number of agreements, failure of the parties to agree on a price under a price reopener provision can lead to termination of the contract. Under some of our contracts, we have the right to match lower prices offered to our customers by other suppliers.

Quality and volumes for the coal are stipulated in coal supply agreements and, in some instances, buyers have the option to vary annual or monthly volumes. Most of our coal supply agreements contain provisions requiring us to deliver coal within certain ranges for specific coal characteristics such as heat content, sulfur, ash, hardness and ash fusion temperature. Failure to meet these specifications can result in economic penalties, suspension or cancellation of shipments or termination of the contracts.

Transportation/Logistics

We ship coal to our customers by rail, truck or barge. We typically pay the transportation costs for our coal to be delivered to the barge or rail loadout facility, where the coal is then loaded for final delivery. Once the coal is loaded in the barge or railcar, our customer is typically responsible for the freight costs to the ultimate destination. Transportation costs vary greatly based on the customer’s proximity to the mine and our proximity to the loadout facilities. We use a variety of independent companies for our transportation needs and typically enter into multiple agreements with transportation companies throughout the year.

In 2008, approximately 98% of our coal (both produced and purchased) from our Central Appalachian operations was delivered to our customers by rail generally on either the Norfolk Southern or CSX rail lines, with the remaining 2% delivered by truck. For our Illinois Basin operations, all of our coal was delivered by truck to customers, generally within an 80 mile radius of our Illinois mine.

We believe we enjoy good relationships with rail carriers and barge companies due, in part, to our modern coal-loading facilities and the experience of our transportation and distribution employees.

Suppliers

In 2008, we spent more than $375.6 million to procure goods and services in support of our business activities, excluding capital expenditures. Principal commodities include maintenance and repair parts and services, fuel, roof control and support items, explosives, tires, conveyance structure, ventilation supplies and lubricants. Our outside suppliers perform a significant portion of our equipment rebuilds and repairs both on- and off-site, as well as construction and reclamation activities.

Each of our regional mining operations has developed its own supplier base consistent with local needs. We have a centralized sourcing group for major supplier contract negotiation and administration, for the negotiation and purchase of major capital goods and to support the business units. The supplier base has been relatively stable for many years, but there has been some consolidation. We are not dependent on any one supplier in any region. We promote competition between suppliers and seek to develop relationships with those suppliers whose focus is on lowering our costs. We seek suppliers who identify and concentrate on implementing continuous improvement opportunities within their area of expertise.

17

Competition

The coal industry is intensely competitive. Our main competitors are Massey Energy Company, Arch Coal, Consol Energy, Alpha Natural Resources, Foundation Coal Holdings, James River Coal Company, Patriot Coal Corporation and various other smaller, independent producers. The most important factors on which we compete are coal price at the mine, coal quality and characteristics, transportation costs and the reliability of supply. Demand for coal and the prices that we are able to obtain for our coal are closely linked to coal consumption patterns of the domestic electric generation industry, which accounted for approximately 93% of domestic coal consumption in 2007. These coal consumption patterns are influenced by factors beyond our control, including the demand for electricity which is significantly dependent upon economic activity and summer and winter temperatures in the United States, government regulation, technological developments and the location, availability, quality and price of competing sources of coal, changes in international supply and demand, alternative fuels such as natural gas, oil and nuclear and alternative energy sources, such as hydroelectric power.

Employees

As of December 31, 2008, we had 2,727 employees of which 22% were salaried and 78% were hourly. We believe our relationship with our employees is positive. Our entire workforce is union free.

Reclamation

Reclamation expenses are a significant part of any coal mining operation. Prior to commencing mining operations, a company is required to apply for numerous permits in the state where the mining is to occur. Before a state will approve and issue these permits, it typically requires the mine operator to present a reclamation plan which meets regulatory criteria and to secure a surety bond to guarantee performance of reclamation in an amount determined under state law. Bonding companies also require posting of collateral, typically in the form of letters of credit, to secure the surety bonds. As of December 31, 2008, the Company had $61.1 million in letters of credit supporting its reclamation surety bonds. While bonds are issued against reclamation liability for a particular permit at a particular site, collateral posted in support of the bond is not allocated to a specific bond, but instead is part of a collateral pool supporting all bonds issued by that particular insurer. Bonds are released in phases as reclamation is completed in a particular area.

Environmental, Safety and Other Regulatory Matters

Federal, state and local authorities regulate the U.S. coal mining industry with respect to matters such as permitting and licensing requirements, employee health and safety, air quality standards, water pollution, plant and wildlife protection, the reclamation and restoration of mining properties after mining has been completed, the discharge of materials into the environment, surface subsidence from underground mining and the effects of mining on groundwater quality and availability. These laws and regulations have had, and will continue to have, a significant effect on our costs of production and competitive position. Future legislation, regulations or orders may be adopted or become effective which may adversely affect our mining operations, cost structure or the ability of our customers to use coal. For instance, new legislation, regulations or orders, as well as future interpretations and more rigorous enforcement of existing laws, may require substantial increases in equipment and operating costs to us and delays, interruptions or a termination of operations, the extent of which we cannot predict. Future legislation, regulations or orders may also cause coal to become a less attractive fuel source, resulting in a reduction in coal’s share of the market for fuels used to generate electricity.

We endeavor to conduct our mining operations in compliance with all applicable federal, state and local laws and regulations. However, due in part to the extensive and comprehensive regulatory requirements, violations during mining operations occur from time to time in the industry and at our operations.

18

Mining Permits and Approvals

Numerous governmental permits or approvals are required for mining operations. In connection with obtaining these permits and approvals, we may be required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that any proposed production or processing of coal may have upon the environment. The requirements imposed by any of these authorities may be costly and time consuming and may delay commencement or continuation of mining operations. Applications for permits are subject to public comment and may be subject to litigation from environmental groups or other third parties seeking to deny issuance of a permit, which may also delay commencement or continuation of mining operations. Regulations also provide that a mining permit or modification can be delayed, refused or revoked if an officer, director or a stockholder with a 10% or greater interest in the entity is affiliated with or is in a position to control another entity that has outstanding permit violations. Thus, past or ongoing violations of federal and state mining laws could provide a basis to revoke existing permits and to deny the issuance of additional permits.

In order to obtain mining permits and approvals from state regulatory authorities, mine operators must submit a reclamation plan for restoring, upon the completion of mining operations, the mined property to its prior condition, productive use or other permitted condition. Typically, we submit our necessary mining permit applications for our planned mines promptly upon securing the necessary property rights and required geologic and environmental data. In our experience, mining permit approvals generally require 12 to 18 months after initial submission.

Surface Mining Control and Reclamation Act

The Surface Mining Control and Reclamation Act of 1977 (“SMCRA”), which is administered by the Office of Surface Mining Reclamation and Enforcement (“OSM”), establishes mining, environmental protection and reclamation standards for all aspects of surface mining, as well as many aspects of deep mining. Mine operators must obtain SMCRA permits and permit renewals from the OSM, or the appropriate state regulatory agency, for authorization of certain mining operations that result in a disturbance of the surface. If a state adopts a regulatory program as comprehensive as the federal mining program under SMCRA, the state becomes the regulatory authority. States in which we have active mining operations have achieved primary control of enforcement through federal approval of the state program.

SMCRA permit provisions include requirements for coal prospecting, mine plan development, topsoil removal, storage and replacement, selective handling of overburden materials, mine pit backfilling and grading, protection of the hydrologic balance, subsidence control for underground mines, surface drainage control, mine drainage and mine discharge control and treatment and revegetation. These requirements seek to limit the adverse impacts of coal mining and more restrictive requirements may be adopted from time to time.

The mining permit application process is initiated by collecting baseline data to adequately characterize the pre-mine environmental condition of the permit area. This work includes surveys of cultural resources, soils, vegetation, wildlife, assessment of surface and ground water hydrology, climatology and wetlands. In conducting this work, we collect geologic data to define and model the soil and rock structures and coal that it will mine. We develop mine and reclamation plans by utilizing this geologic data and incorporating elements of the environmental data. The mine and reclamation plan incorporates the provisions of SMCRA, the state programs and the complementary environmental programs that impact coal mining.

Also included in the permit application are documents defining ownership and agreements pertaining to coal, minerals, oil and gas, water rights, rights of way and surface land, and documents required by the OSM’s Applicant Violator System, including the mining and compliance history of officers, directors and principal owners of the entity.

Once a permit application is prepared and submitted to the regulatory agency, it goes through a completeness review and technical review. Public notice and opportunity for public comment on a proposed permit is required before a permit can be issued. Some SMCRA mine permits take over a year to prepare, depending on the size and complexity of the mine and typically take 12 to 18 months, or even longer, to be issued. Regulatory authorities have considerable discretion in the timing of the permit issuance and the public has rights to comment on, and otherwise engage in, the permitting process, including through intervention in the courts.

19

Before a SMCRA permit is issued, a mine operator must submit a bond or otherwise secure the performance of reclamation obligations. The Abandoned Mine Land Fund, which is part of SMCRA, requires a fee on all coal produced. The proceeds are used to reclaim mine lands closed or abandoned prior to 1977. On December 7, 2006, the Abandoned Mine Land Program was extended for 15 years.

SMCRA stipulates compliance with many other major environmental statutes, including: the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act (“RCRA”), and the Comprehensive Environmental Response, Compensation and Liability Act (“Superfund”).

Surety Bonds

Federal and state laws require us to obtain surety bonds to secure payment of certain long-term obligations including mine closure or reclamation costs, federal and state workers’ compensation costs, coal leases and other miscellaneous obligations. Many of these bonds are renewable on a yearly basis.

Surety bond costs have increased in recent years while the market terms of such bonds have generally become more unfavorable. In addition, the number of companies willing to issue surety bonds has decreased. Bonding companies also require posting of collateral, typically in the form of letters of credit, to secure the surety bonds. As of December 31, 2008, the Company had $73.6 million in letters of credit supporting its surety bonds, including reclamation bonds.

Clean Air Act

The federal Clean Air Act, and comparable state laws that regulate air emissions, directly affect coal mining operations, but have a far greater indirect effect. Direct impacts on coal mining and processing operations may occur through permitting requirements and/or emission control requirements relating to particulate matter, such as fugitive dust or fine particulate matter measuring 2.5 micrometers in diameter or smaller. The Clean Air Act indirectly affects coal mining operations by extensively regulating the air emissions of sulfur dioxide, nitrogen oxides, mercury and other compounds emitted by coal-fired electricity generating plants and coke ovens. The general effect of such extensive regulation of emissions from coal-fired power plants could be to reduce demand for coal.

Clean Air Act requirements that may directly or indirectly affect our operations include the following:

Acid Rain

Title IV of the Clean Air Act required a two-phase reduction of sulfur dioxide emissions by electric utilities. Phase II became effective in 2000 and extended the Title IV requirements to all coal-fired power plants with generating capacity greater than 25 megawatts. The affected electricity generators have sought to meet these requirements by, among other compliance methods, switching to lower sulfur fuels, installing pollution control devices, reducing electricity generating levels or purchasing sulfur dioxide emission allowances. We cannot accurately predict the effect of these provisions of the Clean Air Act on us in future years. At this time, we believe that implementation of Phase II has resulted in an upward pressure on the price of lower sulfur coals as coal-fired power plants continue to comply with the more stringent restrictions of Title IV.

Fine Particulate Matter and Ozone

The Clean Air Act requires the U.S. Environmental Protection Agency (the “EPA”) to set standards, referred to as National Ambient Air Quality Standards (“NAAQS”) for certain pollutants. Areas that are not in compliance with these standards (“non-attainment areas”) must take steps to reduce emissions levels. In 1997, the EPA revised the NAAQS for particulate matter and ozone; although previously subject to legal challenge, these revisions were subsequently upheld, but implementation was delayed for several years.

20

For ozone, these changes include replacement of the existing one-hour average standard with a more stringent eight-hour average standard. On April 15, 2004, the EPA announced that counties in 32 states failed to meet the new eight-hour standard for ozone. The EPA is also considering whether to revise the ozone standard. States which fail to meet the new standard had until June 2007 to develop plans for pollution control measures that allow them to come into compliance with the standards. On January 16, 2009, the EPA proposed additional requirements for non-attainment areas that could impose new requirements on power plants.

For particulates, the changes include retaining the existing standard for particulate matter with an aerodynamic diameter less than or equal to 10 microns and adding a new standard for fine particulate matter with an aerodynamic diameter less than or equal to 2.5 microns (“PM2.5”). Following identification of non-attainment areas, each individual state will identify the sources of emissions and develop emission reduction plans. These plans may be state-specific or regional in scope. Under the Clean Air Act, individual states have up to twelve years from the date of designation to secure emissions reductions from sources contributing to the problem. In addition, on April 25, 2005, the EPA issued a finding that states have failed to submit State Implementation Plans that satisfy the requirements of the Clean Air Act with respect to the interstate transport of pollutants relative to the achievement of the 8-hour ozone and the PM2.5 standards. Because of this finding, the EPA must promulgate a Federal Implementation Plan for any state which does not submit its own plan. The EPA issued a more stringent PM2.5 standard which became effective December 18, 2006. On December 22, 2008, the EPA identified portions of 25 states as being in non-attainment with the PM2.5 standard. Meeting the new PM2.5 standard may require reductions of nitrogen oxide and sulfur dioxide emissions. Future regulation and enforcement of these new ozone and PM2.5 standards will affect many power plants, especially coal-fired plants and all plants in non-attainment areas.

Significant additional emissions control expenditures will be required at coal-fired power plants to meet the current NAAQS for ozone. Nitrogen oxides, which are a by-product of coal combustion, can lead to the creation of ozone. Accordingly, emissions control requirements for new and expanded coal-fired power plants and industrial boilers will continue to become more demanding in the years ahead.

NOx SIP Call

The NOx SIP Call program was established by the EPA in October of 1998 to reduce the transport of ozone on prevailing winds from the Midwest and South to states in the Northeast, which said they could not meet federal air quality standards because of migrating pollution. Under Phase I of the program, the EPA requires 900,000 tons of nitrogen oxide reductions from power plants in 22 states east of the Mississippi River and the District of Columbia beginning in May 2004. Phase II of the rule required a further reduction of about 100,000 tons of nitrogen oxides per year by May 1, 2007. Installation of additional control measures required under the final rules, such as selective catalytic reduction devices, will make it more costly to operate coal-fired electricity generating plants, thereby making coal a less attractive fuel.

Interstate Air Quality Rule

On March 10, 2005, the EPA adopted new rules for reducing emissions of sulfur dioxide and nitrogen oxides. This Clean Air Interstate Rule calls for power plants in 29 eastern states and the District of Columbia to reduce emission levels of sulfur dioxide and nitrous oxide. The rule regulates these pollutants under a cap and trade program similar to the system now in effect for acid deposition control. The stringency of the cap may require many coal-fired sources to install additional pollution control equipment, such as wet scrubbers. This increased sulfur emission removal capability pursuant to this rule could result in decreased demand for low sulfur coal, potentially driving down prices for low sulfur coal. Emissions would be permanently capped and could not increase. The rule seeks to cut sulfur dioxide emissions by 45% in 2010 and by 57% in 2015. On December 23, 2008, the United States Court of Appeals for the District of Columbia remanded, without vacating, the Clean Air Interstate Rule to the EPA for further proceedings consistent with the Court’s July 11, 2008 opinion which found numerous fatal flaws in the Rule. The EPA has not determined how to respond to the Court’s decision.

21

Mercury

The EPA has announced that it intends to initiate a rulemaking to adopt technology-based standards for mercury emissions from coal-fired power plants in response to a court order which vacated and remanded its 2005 Clean Air Mercury Rule, which would have reduced mercury emissions from such plants by a nationwide average of nearly 70%. The parties that overturned this rule seek even reductions in mercury emissions uniformly applied to all power plants. Some parties contend that during the pendency of this rulemaking, these plants are subject to mercury emission limitations determined on a case-by-case basis applying maximum achievable control technology.

Other proposals for controlling mercury emissions from coal-fired power plants have been made, such as establishing state or regional emission standards. If these proposals were enacted, the mercury content and variability of our coal would become a factor in future sales. In addition, seven Northeastern states have prepared and submitted to the EPA a Northeast Regional Mercury Total Maximum Daily Load to reduce mercury in waterbodies by reducing air deposition of mercury primarily from coal-fired power plants in the Midwest.

Carbon Dioxide

In February 2003, a number of states notified the EPA that they planned to sue the agency to force it to set new source performance standards for utility emissions of carbon dioxide and to tighten existing standards for sulfur dioxide and particulate matter for utility emissions. In June 2003, three of these states sued the EPA seeking a court order requiring the EPA to designate carbon dioxide as a criteria pollutant and to issue a new NAAQS for carbon dioxide. If these lawsuits result in the issuance of a court order requiring the EPA to set emission limitations for carbon dioxide and/or lower emission limitations for sulfur dioxide and particulate matter, it could reduce the amount of coal our customers would purchase from us.

Regional Haze

The EPA has initiated a regional haze program designed to protect and improve visibility at and around national parks, national wilderness areas and international parks. This program restricts the construction of new coal-fired power plants whose operation may impair visibility at and around federally protected areas. Moreover, this program may require certain existing coal-fired power plants to install additional control measures designed to limit haze-causing emissions, such as sulfur dioxide, nitrogen oxides, volatile organic chemicals and particulate matter. These limitations could affect the future market for coal. On July 6, 2005, the EPA issued regulations revising its regional haze program.

Clean Water Act

The federal Clean Water Act (“CWA”) and corresponding state laws affect coal mining operations by imposing restrictions on the discharge of certain pollutants into water and on dredging and filling wetlands and jurisdictional waters. The CWA establishes in-stream water quality standards and treatment standards for wastewater discharge through the National Pollutant Discharge Elimination System (“NPDES”). Regular monitoring, as well as compliance with reporting requirements and performance standards, are preconditions for the issuance and renewal of NPDES permits that govern the discharge of pollutants into water.

22

Permits under Section 404 of the CWA are required for coal companies to conduct dredging or filling activities in jurisdictional waters for the purpose of conducting any instream activities, including installing culverts, creating water impoundments, constructing refuse areas, creating slurry ponds, placing valley fills or performing other mining activities. Jurisdictional waters typically include intermittent and perennial streams and may, in certain instances, include man-made conveyances that have a hydrologic connection to a stream or wetland. The Army Corps of Engineers (“ACOE”) authorizes in-stream activities under either a general “nationwide” permit or under an individual permit, based on the expected environmental impact. A nationwide permit may be issued for specific categories of filling activity that are determined to have minimal environmental adverse effects; however, the effective term of such permits is limited to no longer than five years. Nationwide Permit 21 authorizes the disposal of dredge-and-fill material from mining activities into the waters of the United States. An individual permit typically requires a more comprehensive application process, including public notice and comment, but an individual permit can be issued for the project life. We have secured nationwide permits and individual permits, depending on the expected duration and timing of the proposed in-stream activity.

Judge Robert C. Chambers of the U.S. District Court for the Southern District of West Virginia ruled in March 2007 in a lawsuit filed by several citizen groups against the ACOE that the ACOE failed to adequately assess the impacts of surface mining on headwaters and approved mitigation that did not appropriately compensate for stream losses. Judge Chambers in June 2007 found that sediment ponds situated within a stream channel violated the prohibition against using the waters of the U.S. for waste treatment and further decided that using the reach of stream between a valley fill and the sediment pond to transport sediment-laden runoff is prohibited by the Clean Water Act. In February 2009, the Fourth Circuit Court of Appeals overturned these decisions and remanded the case for further proceedings.

On December 6, 2007, the Sierra Club and Kentucky Waterways Alliance sued the ACOE in the U.S. District Court for the Western District of Kentucky alleging that the ACOE Louisville District wrongfully issued a Section 404 authorization to ICG Hazard’s Thunder Ridge surface mine in Perry County, Kentucky. The plaintiffs, who are represented by the same counsel as the plaintiffs in the Chambers lawsuit, make essentially the same claims but add the charge that the ACOE violated the National Environmental Policy Act requirement that stream impacts first must be avoided or in the alternative minimized. On December 26, 2007, the ACOE suspended the Section 404 permit to allow it to review and supplement as needed the administrative record on which the permit decision is based. We are cooperating with the ACOE in defending the ACOE’s decision to issue the permit. Our Thunder Ridge surface mine continues to operate on previously permitted areas and, in accordance with an agreement reached among the parties, on certain portions of the newly permitted area.

On October 23, 2003, several citizens groups sued the ACOE in the U.S. District Court for the Southern District of West Virginia seeking to invalidate “nationwide” permits utilized by the ACOE and the coal industry for permitting most in-stream disturbances associated with coal mining, including excess spoil valley fills and refuse impoundments. Although the lower court enjoined the issuance of authorizations under Nationwide Permit 21, that decision was overturned by the Fourth Circuit Court of Appeals, which concluded that the ACOE complied with the Clean Water Act in promulgating Nationwide Permit 21. While this case remained dormant since the appeals court decision, the judge asked the parties to brief the court regarding the effects of the Chambers’ decision on the Nationwide Permit 21 program. The requested briefs were filed in 2008 and the case is pending decision or further directive by the court.

A lawsuit making similar claims regarding the Nationwide Permit 21 filed in the United States Court for the Eastern District of Kentucky by a number of environmental groups is still pending. This suit also seeks, among other things, an injunction preventing the ACOE from authorizing pursuant to Nationwide Permit 21 “further discharges of mining rock, dirt or coal refuse into valley fills or surface impoundments” associated with certain specific mining permits, including permits issued to some of our mines in Kentucky. Granting of such relief would interfere with the further operation of these mines. The judge ordered a briefing schedule for the parties in this litigation.

In September 2008 the Sixth Circuit Court of Appeals partly affirmed and partly rejected a federal district court’s decision that had upheld EPA’s approval of Kentucky’s new anti-degradation regulations. Anti-degradation regulations prohibit diminution of water quality in streams. The circuit court upheld Kentucky’s methodology for designating high quality waters, even though environmental groups claimed the methodology resulted in too few high quality designations. The circuit court also affirmed Kentucky’s designation method on a water body-by-water body approach and rejected environmentalist claims that such designations must be conducted on a parameter by parameter basis. The court also upheld Kentucky’s exclusion of “impaired” waters from anti-degradation review. However, the circuit court struck down the district court’s approval of Kentucky’s alternative anti-degradation implementation procedures for coal mining. See “Legal Proceedings” contained in Item 3 of this Annual Report on Form 10-K.

Mine Safety and Health

Stringent health and safety standards have been in effect since Congress enacted the Coal Mine Health and Safety Act of 1969. The Federal Mine Safety and Health Act of 1977 significantly expanded the enforcement of safety and health standards and imposed safety and health standards on all aspects of mining operations. All of the states in which we operate have state programs for mine safety and health regulation and enforcement. Collectively, federal and state safety and health regulation in the coal mining industry is perhaps the most comprehensive and pervasive system for protection of employee health and safety affecting any segment of U.S. industry. The federal Mine Improvement and New Emergency Response Act of 2006 (the “MINER Act”) was signed into law on June 15, 2006 and implementation of the specific requirements of the MINER Act is currently underway. The Mine Safety and Health Administration (“MSHA”) issued an emergency temporary standard addressing sealing of abandoned areas in underground mines on May 22, 2007 and on September 6, 2007, MSHA published a proposed rule that would implement Section 4 of the MINER Act by addressing composition and certification of mine rescue teams and improving their availability and training. While mine safety and health regulation has a significant effect on our operating costs, our U.S. competitors are subject to the same degree of regulation. However, pending legislation in various states could result in differing operating costs in different states and, therefore, our competitors operating in states with less stringent new legislation may not be subject to the same degree of regulation.

23

Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981, each coal mine operator must secure payment of federal black lung benefits to claimants who are current and former employees and to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to July 1, 1973. The trust fund is funded by an excise tax on production of up to $1.10 per ton for underground coal and up to $0.55 per ton for surface-mined coal, neither amount to exceed 4.4% of the gross sales price. The excise tax does not apply to coal shipped outside the United States. In 2008, we recorded $11.8 million of expense related to this excise tax.

Resource Conservation and Recovery Act

The RCRA affects coal mining operations by establishing requirements for the treatment, storage and disposal of hazardous wastes. Certain coal mine wastes, such as overburden and coal cleaning wastes, are exempted from hazardous waste management.

Subtitle C of the RCRA exempted fossil fuel combustion by-products (“CCBs”) from hazardous waste regulation until the EPA completed a report to Congress and, in 1993, made a determination on whether the CCBs should be regulated as hazardous. In the 1993 regulatory determination, the EPA addressed some high volume-low toxicity coal combustion by-products generated at electric utility and independent power producing facilities, such as coal ash.

In May 2000, the EPA concluded that CCBs do not warrant regulation as hazardous waste under the RCRA and that the hazardous waste exemption applied to these CCBs. However, the EPA has determined that national non-hazardous waste regulations under the RCRA Subtitle D are needed for CCBs disposed in surface impoundments and landfills and used as mine-fill. The agency also concluded beneficial uses of these CCBs, other than for mine-filling, pose no significant risk and no additional national regulations are needed. As long as the exemption remains in effect, it is not anticipated that regulation of CCBs will have any material effect on the amount of coal used by electricity generators. Most state hazardous waste laws also exempt CCBs and instead treat them as either a solid waste or a special waste. Efforts continue by environmental groups and others for the adoption of more stringent disposal requirements for CCBs. Any increased costs associated with handling or disposal of CCBs would increase our customers’ operating costs and potentially reduce their coal purchases. In addition, contamination caused by the past disposal of ash can lead to material liability.

Due to the hazardous waste exemption for CCBs such as ash, some of the CCBs are currently put to beneficial use. For example, at certain mines, the Company sometimes uses ash deposits from the combustion of coal as a beneficial use under its reclamation plan. The alkaline ash used for this purpose serves to help alleviate the potential for acid mine drainage.

Federal and State Superfund Statutes

Superfund and similar state laws affect coal mining and hard rock operations by creating liability for investigation and remediation in response to releases of hazardous substances into the environment and for damages to natural resources caused by such releases. Under Superfund, joint and several liability may be imposed on waste generators, site owners or operators and others regardless of fault. In addition, mining operations may have reporting obligations under these laws.

24

Climate Change

Global climate change has a potentially far-reaching impact upon our business. Concerns over measurements, estimates and projections of global climate change, particularly global warming, have resulted in widespread calls for the reduction, by regulation and voluntary measures, of the emission greenhouse gases, which include carbon dioxide and methane. These measures could impact the market for our coal and coalbed methane, increase our own energy costs and affect the value of our coal reserves. The United States has not ratified the Framework Convention on Global Climate Change, commonly known as the Kyoto Protocol, which would require our nation to reduce greenhouse gas emissions to 93% of 1990 levels by 2012. The United States is participating in international discussions which are underway to develop a treaty to require additional reductions in greenhouse gas emissions after 2012. The United States has yet to adopt a federal program for controlling greenhouse gas emissions. However, Congress is considering a variety of legislative proposals which would restrict and/or tax the emission of carbon dioxide from the combustion of coal and other fuels and which would mandate or encourage the generation of electricity by new facilities that do not use coal. Even without new legislation, the emission of greenhouse gases may be restricted by future regulation, as the U.S. Supreme Court held in 2007 that the EPA has authority under the Clean Air Act to regulate these gases. The EPA is considering the potential mechanisms for regulating greenhouse gas emissions under the Clean Air Act, including whether to impose restrictions on the emission of carbon dioxide. Federal regulation of the emission of carbon dioxide from coal-fired electric generating stations could adversely affect the demand for coal.

While advocating for comprehensive federal legislation, many states have adopted measures, sometimes as part of a regional collaboration, to reduce green house gases generated within their own jurisdiction. These measures include emission regulations, mandates for utilities to generate a portion of its electricity without using coal and incentives or goals for generating electricity using renewable resources. Some municipalities have also adopted similar measures. Even in the absence of mandatory requirements, some entities are electing to purchase electricity generated by renewable resources for a variety of reasons, including participation in programs calling for voluntary reductions in greenhouse gas emissions.

In addition to impacting our markets, regulations enacted due to climate change concerns could affect our operations by increasing our costs. Our energy costs could increase, and we may have to incur higher costs to control emissions of carbon dioxide, methane or other pollutants from our operations.

Coal Industry Retiree Health Benefit Act of 1992

Unlike many companies in the coal business, we do not have significant liabilities under the Coal Industry Retiree Health Benefit Act of 1992 (the “Coal Act”), which requires the payment of substantial sums to provide lifetime health benefits to union-represented miners (and their dependents) who retired before 1992, because liabilities under the Coal Act that had been imposed on our predecessor or acquired companies were retained by the sellers and, if applicable, their parent companies in the applicable acquisition agreements, except for Anker. We should not be liable for these liabilities retained by the sellers unless they and, if applicable, their parent companies fail to satisfy their obligations with respect to Coal Act claims and retained liabilities covered by the acquisition agreements. Upon the consummation of the business combination with Anker, we assumed Anker’s Coal Act liabilities, which were estimated to be $1.3 million at December 31, 2008.

Endangered Species Act

The federal Endangered Species Act and counterpart state legislation protect species threatened with possible extinction. Protection of threatened and endangered species may have the effect of prohibiting or delaying us from obtaining mining permits and may include restrictions on timber harvesting, road building and other mining or agricultural activities in areas containing the affected species or their habitats. A number of species indigenous to our properties are protected under the Endangered Species Act. Based on the species that have been identified to date and the current application of applicable laws and regulations, however, we do not believe there are any species protected under the Endangered Species Act that would materially and adversely affect our ability to mine coal from our properties in accordance with current mining plans.

Emergency Planning and Community Right to Know Act

Some of our subsidiary operations utilize materials and/or store substances that require certain reporting to local and state authorities under the federal Emergency Planning and Community Right to Know Act. If required reporting is missed it can result in the assessment of fines and penalties. We do not believe that any potential fines or penalties that could potentially arise under the federal Emergency Planning and Community Right to Know Act would materially or adversely affect our ability to mine coal.

Other Regulated Substances

Some of our subsidiary operations utilize certain substances, such as ammonia or caustic soda, for managing water quality in discharges from their mine sites. These materials are considered hazardous and require safeguards in handling and use and, if present in sufficient quantities, create emergency planning and response requirements. The storage of petroleum products in certain quantities can also trigger reporting, planning and response requirements. Our subsidiaries are required to maintain careful control over the storage and use of these substances. The subsidiaries attempt to minimize the amount of materials stored at their operations that give rise to such concerns and to maximize the use of less hazardous materials whenever feasible. If quantities are sufficient, utilization of CCBs for reclamation can trigger certain reporting requirements for constituent trace elements contained in CCBs.

25

Additional Information

We file annual, quarterly and current reports, as well as amendments to those reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). You may access and read our SEC filings without charge through our website, www.intlcoal.com, or the SEC’s website, www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1–800–SEC–0330 for further information on the public reference room. You may also request copies of our filings, at no cost, by telephone at (304) 760-2400 or by mail at: International Coal Group, Inc., 300 Corporate Centre Drive, Scott Depot, West Virginia 25560, Attention: Secretary.

GLOSSARY OF SELECTED TERMS

Ash. Impurities consisting of silica, alumina, calcium, iron and other incombustible matter that are contained in coal. Since ash increases the weight of coal, it adds to the cost of handling and can affect the burning characteristics of coal.

Base load. The lowest level of power production needs during a season or year.

Bituminous coal. A middle rank coal (between sub-bituminous and anthracite) formed by additional pressure and heat on lignite. It is the most common type of coal with moisture content less than 20% by weight and heating value of 10,000 to 14,000 Btus per pound. It is dense and black and often has well-defined bands of bright and dull material. It may be referred to as soft coal.

British thermal unit or Btu. A measure of the thermal energy required to raise the temperature of one pound of pure liquid water one degree Fahrenheit at the temperature at which water has its greatest density (39 degrees Fahrenheit). On average, coal contains about 22 million Btu per ton.

By-product. Useful substances made from the gases and liquids left over when coal is changed into coke.

Central Appalachia. Coal producing area in eastern Kentucky, Virginia and southern West Virginia.

Clean coal burning technologies. A number of innovative, new technologies designed to use coal in a more efficient and cost-effective manner while enhancing environmental protection. Several promising technologies include fluidized-bed combustion, integrated gasification combined cycle, limestone injection multi-stage burner, enhanced flue gas desulfurization (or scrubbing), coal liquefaction and coal gasification.

Coal seam. A bed or stratum of coal. Usually applies to a large deposit.

Coke. A hard, dry carbon substance produced by heating coal to a very high temperature in the absence of air. Coke is used in the manufacture of iron and steel. Its production results in a number of useful byproducts.

Compliance coal. Coal which, when burned, emits 1.2 pounds or less of sulfur dioxide per million Btu, as required by Phase II of the Clean Air Act Acid Rain program.

26

Continuous miner. A machine that simultaneously extracts and loads coal. This is distinguished from a conventional, or cyclic, unit, which must stop the extraction process for loading to commence.

Deep mine. An underground coal mine.

Dragline. A large excavating machine used in the surface mining process to remove overburden (see “Overburden” below). The dragline has a large bucket suspended from the end of a huge boom, which may be 275 feet long or larger. The bucket is suspended by cables and capable of scooping up vast amounts of overburden as it is pulled across the excavation area. The dragline, which can “walk” on huge pontoon-like “feet,” is one of the largest land-based machines in the world.

Fluidized bed combustion. A process with a high success rate in removing sulfur from coal during combustion. Crushed coal and limestone are suspended in the bottom of a boiler by an upward stream of hot air. The coal is burned in this bubbling, liquid-like (or fluidized) mixture. Rather than released as emissions, sulfur from combustion gases combines with the limestone to form a solid compound recovered with the ash.

Fossil fuel. Fuel such as coal, crude oil or natural gas formed from the fossil remains of organic material.

High Btu coal. Coal which has an average heat content of 12,500 Btus per pound or greater.

High sulfur coal. Coal which, when burned, emits 2.5 pounds or more of sulfur dioxide per million Btu.

Highwall. The unexcavated face of exposed overburden and coal in a surface mine or in a face or bank on the uphill side of a contour mine excavation.

Illinois Basin. Coal producing area in Illinois, Indiana and western Kentucky.

Longwall mining. The most productive underground mining method in the United States. One of three main underground coal mining methods currently in use. Employs a rotating drum, or less commonly a steel plow, which is pulled mechanically back and forth across a face of coal that is usually about a thousand feet long. The loosened coal falls onto a conveyor for removal from the mine.

Low sulfur coal. Coal which, when burned, emits 1.6 pounds or less of sulfur dioxide per million Btu.

Medium sulfur coal. Coal which, when burned, emits between 1.6 and 2.5 pounds of sulfur dioxide per million Btu.

Metallurgical coal. The various grades of coal suitable for carbonization to make coke for steel manufacture. Also known as “met” coal, its quality depends on four important criteria: volatile matter, which affects coke yield; the level of impurities including sulfur and ash, which affects coke quality; composition, which affects coke strength; and basic characteristics, which affect coke oven safety. Met coal typically has a particularly high Btu, but low ash and sulfur content.

Nitrogen oxide (NOx). A gas formed in high temperature environments such as coal combustion. It is a harmful pollutant that contributes to acid rain.

Non-reserve coal deposits. Non-reserve coal deposits are coal bearing bodies that have been sufficiently sampled and analyzed, but do not qualify as a commercially viable coal reserve as prescribed by SEC rules until a final comprehensive SEC prescribed evaluation is performed.

Northern Appalachia. Coal producing area in Maryland, Ohio, Pennsylvania and northern West Virginia.

Overburden. Layers of earth and rock covering a coal seam. In surface mining operations, overburden is removed prior to coal extraction.

27

Pillar. An area of coal left to support the overlying strata in a mine; sometimes left permanently to support surface structures.