UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21744

Name of Fund: FDP Series, Inc.

FDP BlackRock Capital Appreciation Fund

FDP BlackRock CoreAlpha Bond Fund

FDP BlackRock Equity Dividend Fund

FDP BlackRock International Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, FDP Series, Inc., 55

East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 05/31/2018

Date of reporting period: 05/31/2018

Item 1 – Report to Stockholders

MAY 31, 2018

| | |

ANNUAL REPORT | |  |

FDP Series, Inc.

| Ø | | FDP BlackRock Capital Appreciation Fund |

| Ø | | FDP BlackRock CoreAlpha Bond Fund |

| Ø | | FDP BlackRock Equity Dividend Fund |

| Ø | | FDP BlackRock International Fund |

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

In the 12 months ended May 31, 2018, the strongest corporate profits in seven years drove the equity market higher, while rising interest rates constrained bond returns. Though the market’s appetite for risk remained healthy, risk taking varied by asset class, as bond investors cautiously shifted to higher-quality securities, and stock investors continued to embrace risk by investing abroad.

Strong equity performance worldwide was underpinned by the global economic expansion, driven by synchronized growth across the most influential economies. Emerging markets stocks posted the highest return, as accelerating growth in China, the second-largest economy in the world, improved the outlook for corporate profits in most developing nations.

Short-term U.S. Treasury interest rates rose the fastest, while longer-term rates slightly increased, leading to a substantial flattening of the yield curve. The annual return for the three-month U.S. Treasury bill surpassed 1.0%, but remained well below the annual headline inflation rate of 2.8%. In contrast, the ten-year U.S. Treasury — a bellwether of the bond market — posted a negative return, as rising inflation expectations drove yields higher. Although the fundamentals in credit markets remained relatively solid, investment-grade bonds declined slightly, and high-yield bonds posted modest returns.

Even though it faced rising pressure to boost interest rates in 2017, the U.S. Federal Reserve (the “Fed”) increased short-term interest rates just three times during the reporting period. The Fed also announced plans to reduce its $4.4 trillion balance sheet by $420 billion in 2018, which began the process of gradually reversing its unprecedented stimulus measures after the financial crisis. By contrast, the European Central Bank and the Bank of Japan continued to expand their balance sheets despite nascent signs of sustained economic growth.

The U.S. economy continued to gain momentum despite the Fed’s modest reduction of economic stimulus, as unemployment dipped below 4.0%, wages increased, and the number of job openings reached a record high. Strong economic performance may justify a more rapid pace of rate hikes in 2018, as the headline inflation rate and investors’ expectations for inflation have already surpassed the Fed’s target of 2.0%.

While U.S. monetary policy is seeking to restrain economic growth and inflation, fiscal policy has produced new sources of growth that could nourish the economy for the next few years. Corporate tax cuts and repatriation of capital held abroad could encourage a virtuous cycle of business spending, while lower individual tax rates coupled with the robust job market may refresh consumer spending. Proposed infrastructure spending would deliver growth from the government sector, generate demand, and improve economic activity in other sectors.

We continue to believe the primary risks to economic expansion are trade protectionism, rapidly rising interest rates, and geopolitical tension. Given the deflationary forces of technology and globalization, a substantial increase in inflation is unlikely to materialize as long as the unemployment rate remains above 3.0%. However, we are closely monitoring trade protectionism and the rise of populism in Western nations. In particular, the outcome of trade negotiations between the United States and China is likely to influence the global growth trajectory and set the tone for free trade in many other nations.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of May 31, 2018 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 3.16% | | 14.38% |

U.S. small cap equities

(Russell 2000® Index) | | 6.47 | | 20.76 |

International equities

(MSCI Europe, Australasia, Far East Index) | | 0.03 | | 7.97 |

Emerging market equities

(MSCI Emerging Markets Index) | | 0.89 | | 14.03 |

3-month Treasury bills

(ICE BofAML 3-Month U.S. Treasury Bill Index) | | 0.75 | | 1.28 |

U.S. Treasury securities

(ICE BofAML 10-Year U.S. Treasury Index) | | (2.42) | | (3.40) |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | (1.04) | | (0.37) |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 0.80 | | 1.26 |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 0.06 | | 2.35 |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGEISNOT PARTOF YOUR FUND REPORT |

Table of Contents

FDP Series, Inc. is part of the Funds Diversified PortfoliosSM (“FDP”) Service. You may receive separate shareholder reports for other funds available through the Service.

| | |

| Fund Summary as of May 31, 2018 | | FDP BlackRock Capital Appreciation Fund |

Investment Objective

FDP BlackRock Capital Appreciation Fund’s (the “Fund”) investment objective is to seek long-term growth of capital.

On September 12, 2017, the Board of Directors approved a proposal to change the name of the Fund from “FDP BlackRock Janus Growth Fund” and certain changes to the Fund’s investment objective and strategies. The Board also approved the termination of the Fund’s sub-advisory agreement with Janus Capital Management LLC. In addition, the Fund’s Manager determined to change the benchmark index against which the Fund compares its performance. All of these changes became effective on November 28, 2017.

Portfolio Management Commentary

How did the Fund perform?

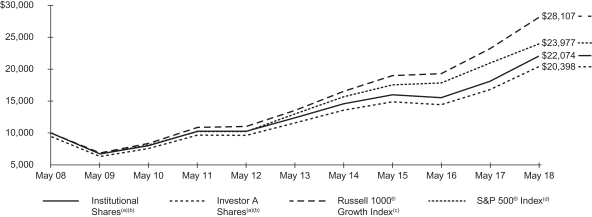

For the 12-month period ended May 31, 2018, the Fund’s Institutional and Investor A Shares outperformed its primary benchmark, the Russell 1000® Growth Index, while the Fund’s Investor C Shares underperformed. For the same period, the Fund outperformed its secondary benchmark, the S&P 500® Index. The following discussion of relative performance pertains to the Russell 1000® Growth Index for the period, since the new portfolio management team assumed responsibility on November 28, 2017.

What factors influenced performance?

Consumer discretionary was the largest contributor to performance on a sector basis, and within the sector internet & direct marketing retail holdings had the most positive impact. Selection within hotels, restaurants & leisure and an underweight to media also added value within the sector. Health care and consumer staples were additional sources of strength. An underweight to biotechnology and positioning in pharmaceuticals proved advantageous within health care, while stock selection in the beverage sub-sector benefited performance within consumer staples. The top individual contributors were Netflix, Inc. and Amazon.com, Inc. Netflix outperformed based on strong financial results throughout the period, while Amazon posted favorable results as continued underperformance among traditional retailers focused investors on Amazon’s opportunities to gain market share. Additional contributions to Fund performance came from positions in Domino’s Pizza, Inc. and the software firm Adobe Systems, Inc.

Conversely, the Fund’s positioning within information technology (“IT”) detracted from performance during the period, with internet software & services holdings having the most negative impact within the sector. Additionally, an underweight to technology hardware, storage & peripherals weighed on performance. The Fund’s materials positioning also hindered results, though to a much lesser degree. The largest individual detractor was the Chinese internet product and services firm Tencent Holdings Ltd., which pulled back amid fears of a slowdown in PC gaming and margin contraction. The Fund maintained an overweight in Tencent in view of the company’s growth opportunities, especially in payments, mobile gaming and advertising. Elsewhere, an underweight to Apple Inc. detracted during the period. The Fund maintained its underweight position based on a mature smartphone market, increasingly challenging competitive dynamics and a lack of innovative products. In addition, a lack of a Fund holding in aircraft manufacturer Boeing Co. and a position in the flooring company Mohawk Industries, Inc. weighed on results.

Describe recent portfolio activity.

Due to a combination of trading activity and market movements during the period from November 28, 2017 through May 31, 2018, the Fund’s weighting increased most notably in the industrials sector, specifically road & rail and professional services. IT exposure also was increased, particularly within the software and internet software & services industries. The Fund’s weighting in the health care sector decreased, especially in biotechnology. Holdings in the chemicals sub-sector of materials also declined.

Describe portfolio positioning at period end.

Relative to the Russell 1000® Growth Index, the Fund’s largest overweights were in the financials, consumer discretionary, and IT sectors. Industrials and consumer staples were the Fund’s largest sector underweights.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

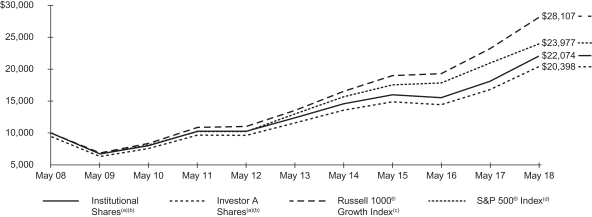

| Fund Summary as of May 31, 2018 (continued) | | FDP BlackRock Capital Appreciation Fund |

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| (b) | The Fund pursues its investment objective by investing primarily in a diversified portfolio consisting primarily of common stocks of U.S. companies that Fund management believes have exhibited above-average growth rates in earnings over the long term. The Fund’s total returns from January 30, 2016 to November 27, 2017 are the returns of the fund when it followed a different investment objective and different investment strategies under the name FDP BlackRock Janus Growth Fund. The Fund’s total returns prior to January 30, 2016 are the returns of the Fund when it followed different investment strategies under the name Marsico Growth FDP Fund. |

| (c) | A float-adjusted, market capitalization–weighted index measures the performance of the large cap growth segment of the U.S. equity universe and consists of those Russell 1000® securities with higher price-to-book ratios and higher forecasted growth values. |

| (d) | An unmanaged index that covers 500 leading companies and captures approximately 80% coverage of available market capitalization. |

Performance Summary for the Period Ended May 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns (b)(e) | |

| | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | 6-Month

Total Returns | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | 12.88 | % | | | | | | | 21.93 | % | | | N/A | | | | | | | | 12.22 | % | | | N/A | | | | | | | | 8.24 | % | | | N/A | |

Investor A | | | 12.69 | | | | | | | | 21.56 | | | | 15.18 | % | | | | | | | 11.94 | | | | 10.74 | % | | | | | | | 7.97 | | | | 7.39 | % |

Investor C | | | 12.33 | | | | | | | | 20.66 | | | | 19.66 | | | | | | | | 11.09 | | | | 11.09 | | | | | | | | 7.15 | | | | 7.15 | |

Russell 1000® Growth Index | | | 7.06 | | | | | | | | 21.02 | | | | N/A | | | | | | | | 15.69 | | | | N/A | | | | | | | | 10.89 | | | | N/A | |

S&P 500® Index | | | 3.16 | | | | | | | | 14.38 | | | | N/A | | | | | | | | 12.98 | | | | N/A | | | | | | | | 9.14 | | | | N/A | |

| | (e) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (g) | | | | |

| | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (f) | | | | | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value (05/31/18) | | | Expenses

Paid During

the Period (f) | | | Annualized

Expense

Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 1,128.80 | | | $ | 5.63 | | | | | | | $ | 1,000.00 | | | $ | 1,019.65 | | | $ | 5.34 | | | | 1.06 | % |

Investor A | | | 1,000.00 | | | | 1,126.90 | | | | 7.00 | | | | | | | | 1,000.00 | | | | 1,018.35 | | | | 6.64 | | | | 1.32 | |

Investor C | | | 1,000.00 | | | | 1,123.30 | | | | 10.80 | | | | | | | | 1,000.00 | | | | 1,014.76 | | | | 10.25 | | | | 2.04 | |

| | (f) | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). | |

| | (g) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | |

| Fund Summary as of May 31, 2018 | | FDP BlackRock CoreAlpha Bond Fund |

Investment Objective

FDP BlackRock CoreAlpha Bond Fund’s (the “Fund”) investment objective is to seek to provide a combination of income and capital growth.

Portfolio Management Commentary

How did the Fund perform?

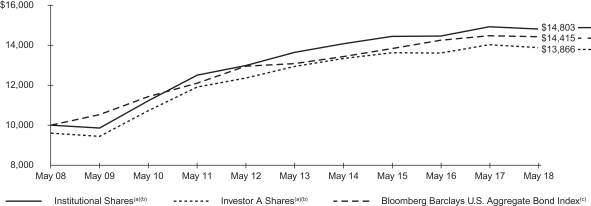

For the 12-month period ended May 31, 2018, the Fund underperformed the benchmark, its Bloomberg Barclays U.S. Aggregate Bond Index.

What factors influenced performance?

During the period, the Fund’s positioning with respect to residential mortgage-backed securities (“MBS”) was the largest detractor from performance relative to the benchmark. Specifically, the Fund’s pool selection within 30-year MBS and a preference for higher coupons constrained performance as the yield curve flattened.

Selection within corporate credit contributed positively to performance due principally to the Fund’s positioning within consumer non-cyclicals. In particular, an overweight position in health care and security selection within pharmaceuticals added to relative returns. Asset allocation also contributed as the Fund was overweight in securitized sectors including MBS, asset-backed securities (“ABS”) and commercial mortgage-backed securities for most of the period. This positioning benefited performance as these sectors experienced continued spread tightening and provided incremental income.

During the period, the Fund employed derivatives as part of its investment strategy. The Fund used futures contracts as a means to manage certain risks and free up capital to purchase corporate bonds. While the Fund’s use of futures contracts detracted from Fund performance, the negative impact was offset by the positive contribution from the asset allocation to corporates.

Describe recent portfolio activity.

During the 12-month period, the Fund maintained an overweight position in industrials while increasing its overweights to consumer cyclicals and technology. The Fund decreased its overweight in non-cyclicals. Within basic materials, the Fund shifted from a slight underweight to metals to an overweight. Lastly, an overweight to the energy sector was reduced by moving to a slight underweight to the independent energy segment.

Describe portfolio positioning at period end.

Relative to the Bloomberg Barclays U.S. Aggregate Bond Index, the Fund was underweight in U.S. Treasury securities. Within spread sectors, the Fund was overweight in investment-grade corporate credit, agency MBS and ABS, with underweights in transportation and real estate investment trusts. The Fund held an out-of-benchmark allocation in high yield corporate credit. Within investment grade credit, the portfolio was overweight in the consumer sectors, banking names and select issues within communications.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 6 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

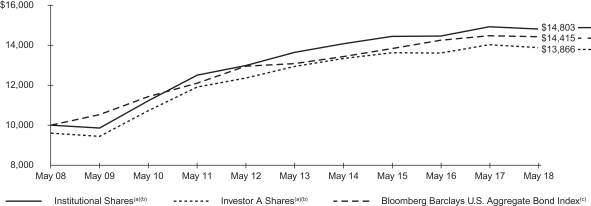

| Fund Summary as of May 31, 2018 (continued) | | FDP BlackRock CoreAlpha Bond Fund |

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| (b) | The Fund invests, under normal circumstances, at least 80% of its assets in bonds and futures and other instruments that have economic characteristics similar to bonds. For the purposes of this strategy, “bonds” include the following: obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities; mortgage-backed securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities, including U.S. agency mortgage pass-through securities; commercial mortgage-backed securities; debt obligations of U.S. issuers; municipal securities; asset-backed securities; and U.S.-registered dollar-denominated debt obligations of foreign issuers. The Fund’s total return prior to March 10, 2017 are the returns of the Fund when it followed a different investment objective and investment strategies under the name FDP BlackRock Franklin Templeton Total Return Fund. |

| (c) | A market-weighted index, comprised of investment-grade U.S. Treasury bonds, government-related bonds, corporate bonds, mortgage-backed pass-through securities, commercial mortgage-backed securities and asset-backed securities (“ABS”) that are publicly offered for sale in the United States with $250 million or more of outstanding face value and at least one year to maturity. |

Performance Summary for the Period Ended May 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Average Annual Total Returns (b)(d) | |

| | | | | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | Standardized

30-Day Yields | | | 6-Month

Total Returns | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | 3.04 | % | | | (1.47 | )% | | | | | | | (0.79 | )% | | | N/A | | | | | | | | 1.66 | % | | | N/A | | | | | | | | 4.00 | % | | | N/A | |

Investor A | | | 2.67 | | | | (1.60 | ) | | | | | | | (1.13 | ) | | | (5.09 | )% | | | | | | | 1.41 | | | | 0.58 | % | | | | | | | 3.74 | | | | 3.32 | % |

Investor C | | | 2.25 | | | | (1.86 | ) | | | | | | | (1.68 | ) | | | (2.64 | ) | | | | | | | 0.84 | | | | 0.84 | | | | | | | | 3.17 | | | | 3.17 | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | — | | | | (1.04 | ) | | | | | | | (0.37 | ) | | | N/A | | | | | | | | 1.98 | | | | N/A | | | | | | | | 3.72 | | | | N/A | |

| | (d) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (f) | | | | |

| | | Beginning

Account Value (12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (e) | | | | | | Beginning

Account Value (12/01/17) | | | Ending

Account Value (05/31/18) | | | Expenses

Paid During

the Period (e) | | | Annualized

Expense

Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 985.30 | | | $ | 3.81 | | | | | | | $ | 1,000.00 | | | $ | 1,021.09 | | | $ | 3.88 | | | | 0.77 | % |

Investor A | | | 1,000.00 | | | | 984.00 | | | | 5.05 | | | | | | | | 1,000.00 | | | | 1,019.85 | | | | 5.14 | | | | 1.02 | |

Investor C | | | 1,000.00 | | | | 981.40 | | | | 7.71 | | | | | | | | 1,000.00 | | | | 1,017.15 | | | | 7.85 | | | | 1.56 | |

| | (e) | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). | |

| | (f) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | |

| Fund Summary as of May 31, 2018 | | FDP BlackRock Equity Dividend Fund |

Investment Objective

FDP BlackRock Equity Dividend Fund’s (the “Fund”) investment objective is to seek long-term total return and current income.

On September 12, 2017, the Board of Directors approved a proposal to change the name of the Fund from “FDP BlackRock Invesco Value Fund” and certain changes to the Fund’s investment objective and strategies. The Board also approved the termination of the Fund’s sub-advisory agreement with Invesco Advisers, Inc. All of these changes became effective on November 28, 2017.

Portfolio Management Commentary

How did the Fund perform?

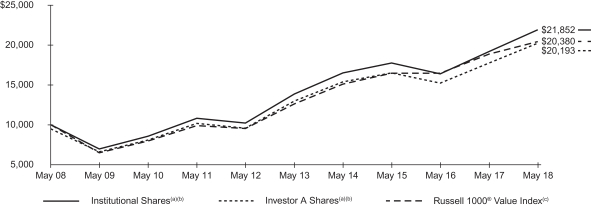

For the 12-month period ended May 31, 2018, the Fund outperformed its benchmark, the Russell 1000® Value Index.

What factors influenced performance?

During the period, stock selection in the health care sector made the largest contribution to relative performance, and was strongest within the pharmaceuticals and health care providers & services industries. An underweight stance and stock selection in consumer staples also contributed and was especially notable within the beverages industry. Additionally, stock selection in the energy sector was positive for returns, particularly within the oil, gas & consumable fuels industry. Stock selection in the industrials and telecommunication services sectors also helped performance.

Stock selection in financials detracted from returns. This was most evident within the insurance industry, where a small overweight negatively impacted returns. Selection in the consumer discretionary sector also was subtractive, principally within the media segment. In addition, stock selection in materials and an underweight to the semiconductor industry weighed on performance.

Describe recent portfolio activity.

Through a combination of portfolio trading and market activity, the Fund gradually increased its overweight in the health care sector during the period, especially within pharmaceuticals. The Fund also gradually increased exposure to consumer staples. Additionally, the Fund moved from an overweight position to an underweight in the industrials sector, mainly by trimming exposure within aerospace & defense as well as air freight & logistics. Finally, the Fund maintained its underweights to real estate and consumer discretionary.

Describe portfolio positioning at period end.

Relative to the Russell 1000® Value Index, the Fund ended the period with its largest overweights in health care and information technology, and also maintained a strong overweight to the banking industry. The Fund had substantial underweights in real estate, consumer discretionary, industrials, utilities and materials.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 8 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of May 31, 2018 (continued) | | FDP BlackRock Equity Dividend Fund |

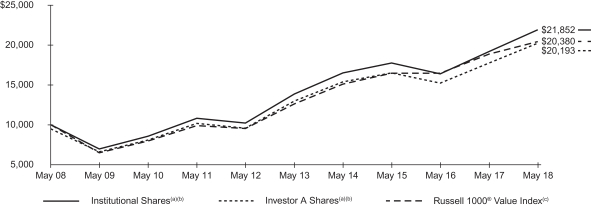

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| (b) | The Fund pursues its investment objective by investing under normal circumstances, at least 80% of its assets in equity securities and at least 80% of its assets in dividend paying securities. The Fund’s total returns prior to November 28, 2017 are the returns of the Fund when it followed a different investment objective and different investment strategies under the name FDP BlackRock Invesco Value Fund. |

| (c) | A float-adjusted, market capitalization–weighted index that is a subset of the Russell 1000® Index that consists of those Russell 1000® securities with lower price-to-book ratios and lower expected growth values |

Performance Summary for the Period Ended May 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns (b)(d) | |

| | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | 6-Month

Total Returns | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | 0.27 | % | | | | | | | 14.13 | % | | | N/A | | | | | | | | 9.56 | % | | | N/A | | | | | | | | 8.13 | % | | | N/A | |

Investor A | | | 0.18 | | | | | | | | 13.89 | | | | 7.91 | % | | | | | | | 9.28 | | | | 8.11 | % | | | | | | | 7.86 | | | | 7.28 | % |

Investor C | | | (0.16 | ) | | | | | | | 13.03 | | | | 12.07 | | | | | | | | 8.47 | | | | 8.47 | | | | | | | | 7.05 | | | | 7.05 | |

Russell 1000® Value Index | | | (0.50 | ) | | | | | | | 8.25 | | | | N/A | | | | | | | | 10.09 | | | | N/A | | | | | | | | 7.38 | | | | N/A | |

| | (d) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (f) | | | | |

| | | Beginning

Account Value

(12/07/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (e) | | | | | | Beginning

Account Value

(12/07/17) | | | Ending

Account Value (05/31/18) | | | Expenses

Paid During

the Period (e) | | | Annualized

Expense

Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 1,002.70 | | | $ | 4.79 | | | | | | | $ | 1,000.00 | | | $ | 1,002.14 | | | $ | 4.84 | | | | 0.96 | % |

Investor A | | | 1,000.00 | | | | 1,001.80 | | | | 6.09 | | | | | | | | 1,000.00 | | | | 1,018.85 | | | | 6.14 | | | | 1.22 | |

Investor C | | | 1,000.00 | | | | 998.40 | | | | 9.67 | | | | | | | | 1,000.00 | | | | 1,015.26 | | | | 9.75 | | | | 1.94 | |

| | (e) | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). | |

| | (f) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| | |

| Fund Summary as of May 31, 2018 | | FDP BlackRock International Fund |

Investment Objective

FDP BlackRock International Fund’s (the “Fund”) investment objective is to seek long-term capital growth.

On September 12, 2017, the Board of Directors approved a proposal to change the name of the Fund from “FDP BlackRock MFS Research International Fund” and certain changes to the Fund’s investment objective and strategies. The Board also approved the termination of the Fund’s sub-advisory agreement with Massachusetts Financial Services Company and the entering into of a sub-advisory agreement with BlackRock International Limited. In addition, the Fund’s Manager determined to remove the MSCI EAFE Index as a benchmark index against which the Fund compares its performance. All of these changes became effective on November 28, 2017.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2018, the Fund underperformed its benchmark, the MSCI All Country World ex USA Index, and its former primary benchmark, the MSCI EAFE Index. The following discussion of relative performance pertains to the MSCI All Country World ex USA Index for the period, since the new portfolio management team assumed responsibility on November 28, 2017.

What factors influenced performance?

Stock selection within information technology (“IT”) was the largest detractor from performance since the Fund’s new strategy was put in place. Stock selection in consumer staples and financials also detracted. The largest individual detractors were the Chinese internet IT company NetEase, Inc., the multinational Spanish banking group Banco Bilbao Vizcaya SA and British American Tobacco PLC. NetEase’s share price came under pressure on concerns surrounding rising first quarter marketing expenses for new video games and pressure on margins.

Conversely, positive stock selection within the consumer discretionary sector was the largest contributor to performance since the Fund’s current management team and strategy were put in place on November 28, 2017. Positive stock selection within energy and materials also contributed. The largest individual contributors to performance were the Brazilian bank Itau Unibanco Holding SA, the British luxury fashion firm Burberry Group PLC, and the Brazilian metals and mining company Vale SA. Shares of Itau Unibanco posted good performance based on more favorable fee income, accelerating loan growth, stable costs and lower taxes.

Describe recent portfolio activity.

On November 28, 2017, the Fund was transitioned to its current management team and strategy, driving a meaningful change in portfolio positioning. Since then, the team reduced the Fund’s consumer staples exposure from a meaningful overweight to a neutral weight. By contrast, the Fund’s consumer discretionary exposure was increased from a neutral weight to a meaningful overweight. From a geographic perspective, these changes resulted in a significant reduction in exposure to the United Kingdom, along with modestly increased exposure to Europe ex-U.K. and the Pacific Basin.

Describe portfolio positioning at period end.

At period end, the Fund’s largest sector overweight positions were in consumer discretionary and financials, while the largest underweights were to industrials and telecommunications. In country terms, the largest overweight exposures were to Spain, the United Kingdom and China, while the largest underweights were in Canada, Australia and South Korea.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 10 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

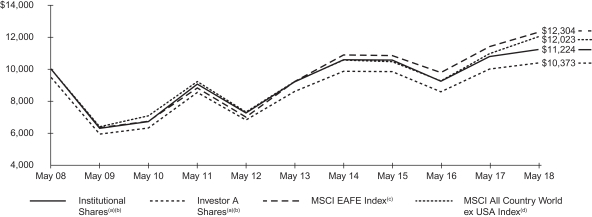

| Fund Summary as of May 31, 2018 (continued) | | FDP BlackRock International Fund |

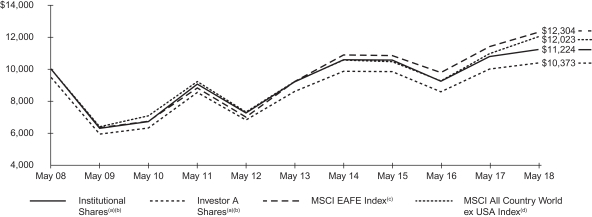

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| (b) | The Fund pursues its investment objective by investing at least 75% of its total assets in global equity securities of any market capitalization, selected for their above-average return potential. The Fund’s total returns prior to November 28, 2017 are the returns of the Fund when it followed a different investment objective and different investment strategies under the name FDP BlackRock MFS Research International Fund. |

| (c) | A free-float adjusted market capitalization index designed to measure equity performance of developed markets, excluding the United States and Canada. Effective November 28, 2017, the Fund no longer measures its performance against the MSCI EAFE Index. |

| (d) | A free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging market countries, excluding the United States. |

Performance Summary for the Period Ended May 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns (b)(e) | |

| | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | 6-Month

Total Returns | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | (3.06 | )% | | | | | | | 4.02 | % | | | N/A | | | | | | | | 4.04 | % | | | N/A | | | | | | | | 1.16 | % | | | N/A | |

Investor A | | | (3.15 | ) | | | | | | | 3.71 | | | | (1.73 | )% | | | | | | | 3.80 | | | | 2.69 | % | | | | | | | 0.91 | | | | 0.37 | % |

Investor C | | | (3.53 | ) | | | | | | | 2.90 | | | | 1.90 | | | | | | | | 3.00 | | | | 3.00 | | | | | | | | 0.15 | | | | 0.15 | |

MSCI All Country World ex USA Index | | | 0.27 | | | | | | |

| 9.67

|

| | | N/A | | | | | | | | 5.46 | | | | N/A | | | | | | | | 1.86 | | | | N/A | |

MSCI EAFE Index | | | 0.03 | | | | | | | | 7.97 | | | | N/A | | | | | | | | 5.93 | | | | N/A | | | | | | | | 2.09 | | | | N/A | |

| | (e) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (g) | | | | |

| | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (f) | | | | | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (f) | | | Annualized

Expense

Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 969.40 | | | $ | 6.09 | | | | | | | $ | 1,000.00 | | | $ | 1,018.75 | | | $ | 6.24 | | | | 1.24 | % |

Investor A | | | 1,000.00 | | | | 968.50 | | | | 7.36 | | | | | | | | 1,000.00 | | | | 1,017.45 | | | | 7.54 | | | | 1.50 | |

Investor C | | | 1,000.00 | | | | 964.70 | | | | 10.92 | | | | | | | | 1,000.00 | | | | 1,013.81 | | | | 11.20 | | | | 2.23 | |

| | (f) | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). | |

| | (g) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

About Fund Performance

Shares are only available for purchase through the FDP Service.

Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors.

Investor A Shares (for all Funds except FDP BlackRock CoreAlpha Bond Fund) are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Investor A Shares for FDP BlackRock CoreAlpha Bond Fund are subject to a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase.

Investor C Shares (for all Funds except FDP BlackRock CoreAlpha Bond Fund) are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. Investor C Shares for FDP BlackRock CoreAlpha Bond Fund are subject to a distribution fee of 0.55% per year and a service fee of 0.25% per year. In addition, these shares for all Funds are subject to a 1.00% CDSC if redeemed within one year of purchase.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend/payable date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment adviser, has contractually agreed to waive and/or reimburse a portion of the Funds’ expenses. Without such waiver and/or reimbursement, the Funds’ performance would have been lower. The Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. Effective November 28, 2017, the Manager agreed to contractually waive a portion of its investment advisory fee of its management fee payable by FDP BlackRock Capital Appreciation Fund, FDP BlackRock Equity Dividend Fund and FDP BlackRock International Fund, so that the management fee is 0.65%, 0.60% and 0.75% of average daily net assets, respectively, through September 30, 2019. Also, effective March 10, 2017, the Manager has agreed to contractually waive its management fee payable by FDP BlackRock CoreAlpha Bond Fund so that the management fee is 0.32% of average daily net assets through September 30, 2018. These contractual waiver agreements may be terminated upon 90 days’ notice by a majority of the non-interested directors of FDP Series, Inc. or by a vote of a majority of the outstanding voting securities of the relevant Fund. Regarding the voluntary waivers, the Manager is under no obligation to waive or to continue waiving its fees and such waivers may be reduced or discontinued at any time. Without such contractual or voluntary waivers, the performance of the Funds would have been lower. See Note 6 of the Notes to Financial Statements for additional information on waivers and reimbursements.

Disclosure of Expenses

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other fund expenses. The expense examples on previous pages (which are based on a hypothetical investment of $1,000 invested on December 1, 2017 and held through May 31, 2018) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

| 12 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

Portfolio Information as of May 31, 2018

FDP BlackRock Capital Appreciation Fund

TEN LARGEST HOLDINGS

| | | | |

| Holding | | Percent of

Net Assets | |

Amazon.com, Inc. | | | 9 | % |

Microsoft Corp. | | | 6 | |

Alphabet, Inc. | | | 5 | |

Visa, Inc. | | | 5 | |

UnitedHealth Group, Inc. | | | 5 | |

Netflix, Inc. | | | 3 | |

Booking Holdings, Inc. | | | 3 | |

Facebook, Inc. | | | 3 | |

Tencent Holdings Ltd. | | | 3 | |

Adobe Systems, Inc. | | | 2 | |

SECTOR ALLOCATION

| | | | |

| Sector | | Percent of

Net Assets | |

Information Technology | | | 42 | % |

Consumer Discretionary | | | 23 | |

Health Care | | | 11 | |

Financials | | | 8 | |

Industrials | | | 8 | |

Consumer Staples | | | 3 | |

Materials | | | 3 | |

Short Term Securities | | | 1 | |

Energy | | | 1 | |

Real Estate | | | 1 | |

Liabilities in Excess of Other Assets | | | (1 | ) |

FDP BlackRock CoreAlpha Bond Fund

PORTFOLIO COMPOSITION

| | | | |

| Asset Type | | Percent of

Total Investments (a) | |

Corporate Bonds | | | 47 | % |

U.S. Government Sponsored Agency Securities | | | 38 | |

Asset-Backed Securities | | | 13 | |

Non-Agency Mortgage-Backed Securities | | | 2 | |

Foreign Agency Obligations | | | 1 | |

Municipal Bonds | | | 1 | |

Floating Rate Loan Interests | | | — | (b) |

TBA Sale Commitments | | | (2 | ) |

| | (a) | Total investments exclude short-term securities. | |

| | (b) | Represents less than 1% of total investments. | |

Portfolio Information as of May 31, 2018 (continued)

FDP BlackRock Equity Dividend Fund

TEN LARGEST HOLDINGS

| | | | |

| Holding | | Percent of

Net Assets | |

JPMorgan Chase & Co. | | | 4 | % |

Bank of America Corp. | | | 4 | |

Pfizer, Inc. | | | 4 | |

Citigroup, Inc. | | | 3 | |

Wells Fargo & Co. | | | 3 | |

Oracle Corp. | | | 3 | |

Microsoft Corp. | | | 3 | |

Suncor Energy, Inc. | | | 2 | |

Anthem, Inc. | | | 2 | |

Verizon Communications, Inc. | | | 2 | |

SECTOR ALLOCATION

| | | | |

| Sector | | Percent of

Net Assets | |

Financials | | | 27 | % |

Health Care | | | 19 | |

Energy | | | 12 | |

Information Technology | | | 11 | |

Consumer Staples | | | 7 | |

Industrials | | | 6 | |

Utilities | | | 5 | |

Consumer Discretionary | | | 4 | |

Short Term Securities | | | 4 | |

Materials | | | 2 | |

Telecommunication Services | | | 3 | |

FDP BlackRock International Fund

TEN LARGEST HOLDINGS

| | | | |

| Holding | | Percent of

Net Assets | |

Sony Corp. | | | 5 | % |

Bayer AG, Registered Shares | | | 4 | |

Banco Bilbao Vizcaya Argentaria SA | | | 4 | |

Ping An Insurance Group Co of China LTD | | | 4 | |

ITV PLC | | | 4 | |

Engie SA | | | 4 | |

ICICI Bank Ltd. | | | 4 | |

BioMarin Pharmaceutical, Inc. | | | 3 | |

Net Ease, Inc. — ADR | | | 3 | |

Bank of China LTD., Class H | | | 3 | |

GEOGRAPHIC ALLOCATION

| | | | |

| Country | | Percent of

Net Assets | |

United Kingdom | | | 17 | % |

Japan | | | 14 | |

China | | | 14 | |

Spain | | | 10 | |

United States | | | 10 | |

Germany | | | 7 | |

France | | | 9 | |

India | | | 4 | |

Netherlands | | | 3 | |

Mexico | | | 2 | |

Italy | | | 2 | |

Switzerland | | | 2 | |

Portugal | | | 2 | |

Hong Kong | | | 2 | |

Singapore | | | 2 | |

| | |

| 14 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments May 31, 2018 | | FDP BlackRock Capital Appreciation Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| Common Stocks — 100.0% | |

|

| Aerospace & Defense — 1.0% | |

TransDigm Group, Inc. | | | 2,468 | | | $ | 824,584 | |

| | | | | | | | |

| Automobiles — 0.9% | |

Tesla, Inc.(a) | | | 2,388 | | | | 679,935 | |

| | | | | | | | |

| Banks — 3.0% | |

Bank of America Corp. | | | 54,773 | | | | 1,590,608 | |

First Republic Bank | | | 7,866 | | | | 783,454 | |

| | | | | | | | |

| | | | 2,374,062 | |

| Beverages — 2.8% | |

Constellation Brands, Inc., Class A | | | 7,064 | | | | 1,575,837 | |

Dr. Pepper Snapple Group, Inc. | | | 5,879 | | | | 701,365 | |

| | | | | | | | |

| | | | 2,277,202 | |

| Biotechnology — 0.8% | |

Vertex Pharmaceuticals, Inc.(a) | | | 4,414 | | | | 679,756 | |

| | | | | | | | |

| Capital Markets — 3.1% | |

E*Trade Financial Corp.(a) | | | 20,740 | | | | 1,313,879 | |

S&P Global, Inc. | | | 6,031 | | | | 1,191,122 | |

| | | | | | | | |

| | | | 2,505,001 | |

| Chemicals — 1.7% | |

DowDuPont, Inc. | | | 7,166 | | | | 459,412 | |

Sherwin-Williams Co. | | | 2,438 | | | | 924,612 | |

| | | | | | | | |

| | | | 1,384,024 | |

| Construction Materials — 1.2% | |

Vulcan Materials Co. | | | 7,366 | | | | 940,933 | |

| | | | | | | | |

| Diversified Financial Services — 1.5% | |

Berkshire Hathaway, Inc., Class B(a) | | | 6,456 | | | | 1,236,518 | |

| | | | | | | | |

| Diversified Telecommunication Services — 0.4% | |

Zayo Group Holdings, Inc.(a) | | | 9,052 | | | | 315,010 | |

| | | | | | | | |

| Electrical Equipment — 0.5% | |

Rockwell Automation, Inc. | | | 2,188 | | | | 383,797 | |

| | | | | | | | |

| Equity Real Estate Investment Trusts (REITs) — 1.1% | |

SBA Communications Corp.(a) | | | 5,734 | | | | 906,373 | |

| | | | | | | | |

| Food Products — 0.5% | |

Bunge Ltd. | | | 5,467 | | | | 380,230 | |

| | | | | | | | |

| Health Care Equipment & Supplies — 3.2% | |

Becton Dickinson & Co. | | | 5,116 | | | | 1,133,654 | |

Boston Scientific Corp.(a) | | | 47,297 | | | | 1,437,356 | |

| | | | | | | | |

| | | | 2,571,010 | |

| Health Care Providers & Services — 4.6% | |

UnitedHealth Group, Inc. | | | 15,210 | | | | 3,673,367 | |

| | | | | | | | |

| Hotels, Restaurants & Leisure — 1.0% | |

Domino’s Pizza, Inc. | | | 3,317 | | | | 834,159 | |

| | | | | | | | |

| Household Durables — 0.7% | |

Mohawk Industries, Inc.(a) | | | 2,861 | | | | 583,758 | |

| | | | | | | | |

| Industrial Conglomerates — 1.9% | |

Honeywell International, Inc. | | | 4,948 | | | | 731,859 | |

Roper Technologies, Inc. | | | 2,778 | | | | 766,144 | |

| | | | | | | | |

| | | | 1,498,003 | |

| Internet & Direct Marketing Retail — 15.4% | |

Amazon.com, Inc.(a) | | | 4,353 | | | | 7,093,736 | |

Booking Holdings, Inc.(a) | | | 1,235 | | | | 2,604,516 | |

Netflix, Inc.(a) | | | 7,629 | | | | 2,682,356 | |

| | | | | | | | |

| | | | 12,380,608 | |

| Internet Software & Services — 13.4% | |

Alibaba Group Holding Ltd. — ADR(a) | | | 3,092 | | | | 612,247 | |

Alphabet, Inc., Class A(a) | | | 3,653 | | | | 4,018,300 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| Internet Software & Services (continued) | |

Facebook, Inc., Class A(a) | | | 13,492 | | | $ | 2,587,496 | |

MercadoLibre, Inc. | | | 3,612 | | | | 1,050,478 | |

Tencent Holdings Ltd. | | | 49,600 | | | | 2,532,185 | |

| | | | | | | | |

| | | | 10,800,706 | |

| IT Services — 8.5% | |

Mastercard, Inc., Class A | | | 9,003 | | | | 1,711,650 | |

PayPal Holdings, Inc.(a) | | | 16,006 | | | | 1,313,613 | |

Visa, Inc., Class A | | | 29,378 | | | | 3,840,292 | |

| | | | | | | | |

| | | | 6,865,555 | |

| Life Sciences Tools & Services — 1.6% | |

Illumina, Inc.(a) | | | 4,709 | | | | 1,282,920 | |

| | | | | | | | |

| Machinery — 0.5% | |

Caterpillar, Inc. | | | 2,759 | | | | 419,120 | |

| | | | | | | | |

| Oil, Gas & Consumable Fuels — 0.5% | |

Pioneer Natural Resources Co. | | | 2,147 | | | | 414,586 | |

| | | | | | | | |

| Pharmaceuticals — 1.0% | |

Zoetis, Inc. | | | 9,119 | | | | 763,260 | |

| | | | | | | | |

| Professional Services — 2.7% | |

CoStar Group, Inc.(a) | | | 3,115 | | | | 1,187,500 | |

Equifax, Inc. | | | 8,304 | | | | 946,324 | |

| | | | | | | | |

| | | | 2,133,824 | |

| Road & Rail — 1.8% | |

Union Pacific Corp. | | | 10,317 | | | | 1,472,855 | |

| | | | | | | | |

| Semiconductors & Semiconductor Equipment — 5.3% | |

Applied Materials, Inc. | | | 15,007 | | | | 762,055 | |

ASML Holding NV — NY Shares | | | 6,091 | | | | 1,197,795 | |

Broadcom Inc. | | | 3,811 | | | | 960,639 | |

NVIDIA Corp. | | | 5,441 | | | | 1,372,166 | |

| | | | | | | | |

| | | | 4,292,655 | |

| Software — 14.6% | |

Activision Blizzard, Inc. | | | 9,196 | | | | 652,088 | |

Adobe Systems, Inc.(a) | | | 7,746 | | | | 1,930,923 | |

Autodesk, Inc.(a) | | | 9,338 | | | | 1,205,536 | |

Electronic Arts, Inc.(a) | | | 11,006 | | | | 1,440,795 | |

Microsoft Corp. | | | 51,165 | | | | 5,057,149 | |

salesforce.com, Inc.(a) | | | 7,634 | | | | 987,305 | |

Workday, Inc., Class A(a) | | | 3,459 | | | | 452,991 | |

| | | | | | | | |

| | | | 11,726,787 | |

| Specialty Retail — 3.5% | |

Home Depot, Inc. | | | 6,335 | | | | 1,181,794 | |

Ulta Salon Cosmetics & Fragrance, Inc.(a) | | | 6,693 | | | | 1,652,569 | |

| | | | | | | | |

| | | | 2,834,363 | |

| Textiles, Apparel & Luxury Goods — 1.3% | |

NIKE, Inc., Class B | | | 14,698 | | | | 1,055,316 | |

| | | | | | | | |

Total Long-Term Investments — 100.0%

(Cost — $61,210,695) | | | | 80,490,277 | |

| | | | | | | | |

|

| Short-Term Securities — 0.7% | |

BlackRock Liquidity Funds, T-Fund,

Institutional Class, 1.61%(b)(c) | | | 562,638 | | | | 562,638 | |

| | | | | | | | |

Total Short-Term Securities — 0.7%

(Cost — $562,638) | | | | 562,638 | |

| | | | | | | | |

| |

Total Investments — 100.7%

(Cost — $61,773,333) | | | | 81,052,915 | |

Liabilities in Excess of Other Assets — (0.7)% | | | | (571,741 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | $ | 80,481,174 | |

| | | | | | | | |

| | | | |

| SCHEDULES OF INVESTMENTS | | | 15 | |

| | |

Schedule of Investments (continued) May 31, 2018 | | FDP BlackRock Capital Appreciation Fund |

| (a) | Non-income producing security. |

| (b) | Annualized 7-day yield as of period end. |

| (c) | During the year ended May 31, 2018, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliated | | Shares

Held at

05/31/17 | | | Net

Activity | | | Shares

Held at

05/31/18 | | | Value at

05/31/18 | | | Income | | | Net

Realized

Gain (Loss) (a) | | | Change in

Unrealized

Appreciation

(Depreciation) | |

BlackRock Liquidity Funds, T-Fund, Institutional Class | | | — | | | | 562,638 | | | | 562,638 | | | $ | 562,638 | | | $ | 3,982 | | | $ | 4 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Includes net capital gain distributions, if applicable. | |

For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of investments. For information about the Fund’s policy regarding valuation of investments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Aerospace & Defense | | $ | 824,584 | | | $ | — | | | $ | — | | | $ | 824,584 | |

Automobiles | | | 679,935 | | | | — | | | | — | | | | 679,935 | |

Banks | | | 2,374,062 | | | | — | | | | — | | | | 2,374,062 | |

Beverages | | | 2,277,202 | | | | — | | | | — | | | | 2,277,202 | |

Biotechnology | | | 679,756 | | | | — | | | | — | | | | 679,756 | |

Capital Markets | | | 2,505,001 | | | | — | | | | — | | | | 2,505,001 | |

Chemicals | | | 1,384,024 | | | | — | | | | — | | | | 1,384,024 | |

Construction Materials | | | 940,933 | | | | — | | | | — | | | | 940,933 | |

Diversified Financial Services | | | 1,236,518 | | | | — | | | | — | | | | 1,236,518 | |

Diversified Telecommunication Services | | | 315,010 | | | | — | | | | — | | | | 315,010 | |

Electrical Equipment | | | 383,797 | | | | — | | | | — | | | | 383,797 | |

Equity Real Estate Investment Trusts (REITs) | | | 906,373 | | | | — | | | | — | | | | 906,373 | |

Food Products | | | 380,230 | | | | — | | | | — | | | | 380,230 | |

Health Care Equipment & Supplies | | | 2,571,010 | | | | — | | | | — | | | | 2,571,010 | |

Health Care Providers & Services | | | 3,673,367 | | | | — | | | | — | | | | 3,673,367 | |

Hotels, Restaurants & Leisure | | | 834,159 | | | | — | | | | — | | | | 834,159 | |

Household Durables | | | 583,758 | | | | — | | | | — | | | | 583,758 | |

Industrial Conglomerates | | | 1,498,003 | | | | — | | | | — | | | | 1,498,003 | |

Internet & Direct Marketing Retail | | | 12,380,608 | | | | — | | | | — | | | | 12,380,608 | |

Internet Software & Services | | | 8,268,521 | | | | 2,532,185 | | | | — | | | | 10,800,706 | |

IT Services | | | 6,865,555 | | | | — | | | | — | | | | 6,865,555 | |

Life Sciences Tools & Services | | | 1,282,920 | | | | — | | | | — | | | | 1,282,920 | |

Machinery | | | 419,120 | | | | — | | | | — | | | | 419,120 | |

Oil, Gas & Consumable Fuels | | | 414,586 | | | | — | | | | — | | | | 414,586 | |

Pharmaceuticals | | | 763,260 | | | | — | | | | — | | | | 763,260 | |

Professional Services | | | 2,133,824 | | | | — | | | | — | | | | 2,133,824 | |

Road & Rail | | | 1,472,855 | | | | — | | | | — | | | | 1,472,855 | |

Semiconductors & Semiconductor Equipment | | | 4,292,655 | | | | — | | | | — | | | | 4,292,655 | |

Software | | | 11,726,787 | | | | — | | | | — | | | | 11,726,787 | |

Specialty Retail | | | 2,834,363 | | | | — | | | | — | | | | 2,834,363 | |

Textiles, Apparel & Luxury Goods | | | 1,055,316 | | | | — | | | | — | | | | 1,055,316 | |

Short-Term Securities: | | | | | | | | | | | | | | | | |

Money Market Funds | | | 562,638 | | | | — | | | | — | | | | 562,638 | |

| | | | | | | | | | | | | | | | |

| | $ | 78,520,730 | | | $ | 2,532,185 | | | $ | — | | | $ | 81,052,915 | |

| | | | | | | | | | | | | | | | |

During the year ended May 31, 2018, there were no transfers between levels.

See notes to financial statements.

| | |

| 16 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments May 31, 2018 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

Security | | Shares | | | Value | |

Common Stocks — 0.0% | |

| | |

| Diversified Financial Services — 0.0% | | | | | | | |

HoldCo 2 NPV, Class A(a)(b) | | | | | | | 1,643,590 | | | $ | — | |

HoldCo 2 NPV, Class B(a)(b) | | | | | | | 163,560 | | | | — | |

| | | | | | | | |

Total Common Stocks — 0.0%

(Cost $—) | | | | — | |

| | | | | | | | |

| | |

| | | Par

(000) | | | | |

| Asset-Backed Securities — 14.2% | |

AmeriCredit Automobile Receivables Trust, Series 2017-3, Class C, 2.69%, 06/19/23 | | | USD | | | | 450 | | | | 443,588 | |

Ameriquest Mortgage Securities, Inc., Series 2004-R4, Class M1, (1 mo. LIBOR US + 0.83%), 2.78%, 06/25/34(c) | | | | | | | 119 | | | | 119,506 | |

Argent Securities, Inc., Series 2005-W2, Class A2C, (1 mo. LIBOR US + 0.36%), 2.32%, 10/25/35(c) | | | | | | | 94 | | | | 93,654 | |

AVANT Loans Funding Trust(d): | | | | | | | | | | | | |

Series 2016-B, Class B, 7.80%, 09/15/20 | | | | | | | 40 | | | | 40,084 | |

Series 2018-A, Class A, 3.09%, 06/15/21 | | | | | | | 190 | | | | 189,995 | |

Chase Funding Mortgage Loan Asset-Backed Certificates, Series 2004-2, Class 2A2, (1 mo. LIBOR US + 0.50%), 2.46%, 02/26/35(c) | | | | | | | 119 | | | | 115,991 | |

Chase Issuance Trust, Series 2013-A6, Class A6, (1 mo. LIBOR + 0.42%), 2.34%, 07/15/20(c) | | | | | | | 880 | | | | 880,429 | |

Citibank Credit Card Issuance Trust, Series 2013-A7, Class A7, (1 mo. LIBOR + 0.43%), 2.36%, 09/10/20(c) | | | | | | | 560 | | | | 560,560 | |

CLUB Credit Trust, Series 2018-NP1, Class A, 2.99%, 05/15/24(d) | | | | | | | 338 | | | | 337,983 | |

Conseco Financial Corp., Series 1996-9, Class M1, 7.63%, 08/15/27(e) | | | | | | | 70 | | | | 74,870 | |

Countrywide Asset-Backed Certificates: | | | | | | | | | | | | |

Series 2004-1, Class M1, (1 mo. LIBOR US + 0.75%), 2.71%, 03/25/34(c) | | | | | | | 43 | | | | 43,602 | |

Series 2005-11, Class AF4, 4.48%, 03/25/34(e) | | | | | | | 700 | | | | 705,942 | |

Drive Auto Receivables Trust: | | | | | | | | | | | | |

Series 2016-CA, Class C, 3.02%, 11/15/21(d) | | | | | | | 800 | | | | 801,265 | |

Series 2017-1, Class C, 2.84%, 04/15/22 | | | | | | | 800 | | | | 799,323 | |

Series 2017-2, Class C, 2.75%, 09/15/23 | | | | | | | 590 | | | | 588,628 | |

Series 2017-3, Class C, 2.80%, 07/15/22 | | | | | | | 400 | | | | 399,018 | |

Series 2017-3, Class D, 3.53%, 12/15/23 | | | | | | | 500 | | | | 499,278 | |

Exeter Automobile Receivables Trust(d): | | | | | | | | | | | | |

Series 2015-1A, Class C, 4.10%, 12/15/20 | | | | | | | 300 | | | | 301,955 | |

Series 2017-2A, Class A, 2.11%, 06/15/21 | | | | | | | 251 | | | | 250,305 | |

GSAA Home Equity Trust, Series 2005-5, Class M3, (1 mo. LIBOR US + 0.95%), 2.90%, 02/25/35(c) | | | | | | | 134 | | | | 134,361 | |

Home Equity Mortgage Trust, Series 2004-4, Class M3, (1 mo. LIBOR US + 0.98%), 2.93%, 12/25/34(c) | | | | | | | 77 | | | | 76,974 | |

Invitation Homes Trust, Series 2015-SFR3, Class C, (1 mo. LIBOR + 2.00%), 3.92%, 08/17/32(c)(d) | | | | | | | 500 | | | | 500,651 | |

Marlette Funding Trust, Class A(d): | | | | | | | | | | | | |

Series 2017-1A, 2.83%, 03/15/24 | | | | | | | 225 | | | | 225,298 | |

Series 2017-2A, 2.39%, 07/15/24 | | | | | | | 340 | | | | 339,061 | |

Morgan Stanley ABS Capital I Trust, Inc., Series 2005-WMC1, Class M2, (1 mo. LIBOR US + 0.74%), 2.69%, 01/25/35(c) | | | | | | | 20 | | | | 20,106 | |

National Collegiate Student Loan Trust(c): | | | | | | | | | | | | |

Series 2006-2, Class A3, (1 mo. LIBOR US + 0.21%), 2.17%, 11/25/27 | | | | | | | 311 | | | | 309,231 | |

Series 2006-3, Class A4, (1 mo. LIBOR US + 0.27%), 2.23%, 03/26/29 | | | | | | | 528 | | | | 520,333 | |

Series 2007-1, Class A3, (1 mo. LIBOR US + 0.24%), 2.20%, 07/25/30 | | | | | | | 576 | | | | 566,330 | |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

| Asset-Backed Securities (continued) | |

Santander Drive Auto Receivables Trust: | | | | | | | | | | | | |

Series 2016-1, Class C, 3.09%, 04/15/22 | | | USD | | | | 750 | | | $ | 751,643 | |

Series 2017-2, Class B, 2.21%, 10/15/21 | | | | | | | 1,300 | | | | 1,293,336 | |

Series 2017-2, Class C, 2.79%, 08/15/22 | | | | | | | 730 | | | | 726,885 | |

SLM Private Education Loan Trust, Series 2011-B, Class A2, 3.74%, 02/15/29(d) | | | | | | | 192 | | | | 192,645 | |

SoFi Consumer Loan Program LLC, Class A(d): | | | | | | | | | | | | |

Series 2017-3, 2.77%, 05/25/26 | | | | | | | 371 | | | | 368,664 | |

Series 2017-4, 2.50%, 05/26/26 | | | | | | | 491 | | | | 484,460 | |

Trafigura Securitisation Finance PLC, Series 2017-1A, Class A1, (1 mo. LIBOR US + 0.85%), 2.77%, 12/15/20(c)(d) | | | | | | | 750 | | | | 753,758 | |

| | | | | | | | |

Total Asset-Backed Securities — 14.2%

(Cost — $14,502,834) | | | | 14,509,712 | |

| | | | | | | | |

|

Corporate Bonds — 50.8% | |

|

| Aerospace & Defense — 1.5% | |

General Dynamics Corp., 2.63%, 11/15/27 | | | | | | | 200 | | | | 184,919 | |

L-3 Communications Corp., 4.75%, 07/15/20 | | | | | | | 500 | | | | 517,330 | |

L3 Technologies, Inc., 3.85%, 06/15/23 | | | | | | | 195 | | | | 195,114 | |

Northrop Grumman Corp., 2.93%, 01/15/25 | | | | | | | 205 | | | | 195,320 | |

Rockwell Collins, Inc., 2.80%, 03/15/22 | | | | | | | 290 | | | | 283,595 | |

Spirit AeroSystems, Inc., 3.95%, 06/15/23 | | | | | | | 125 | | | | 126,260 | |

| | | | | | | | |

| | | | | | | | | | | 1,502,538 | |

| Auto Components — 0.7% | |

Fiat Chrysler Automobiles NV, 4.50%, 04/15/20 | | | | | | | 200 | | | | 201,060 | |

Ford Motor Credit Co. LLC, 4.14%, 02/15/23 | | | | | | | 200 | | | | 201,509 | |

Lear Corp., 3.80%, 09/15/27 | | | | | | | 300 | | | | 286,821 | |

| | | | | | | | |

| | | | | | | | | | | 689,390 | |

| Banks — 5.1% | |

Banco Santander SA, 3.50%, 04/11/22 | | | | | | | 400 | | | | 391,994 | |

Barclays Bank PLC, 2.65%, 01/11/21 | | | | | | | 200 | | | | 196,161 | |

Barclays PLC: | | | | | | | | | | | | |

4.34%, 05/16/24(e) | | | | | | | 200 | | | | 200,048 | |

4.34%, 01/10/28 | | | | | | | 200 | | | | 191,298 | |

Capital One Financial Corp.: | | | | | | | | | | | | |

2.50%, 05/12/20 | | | | | | | 125 | | | | 123,462 | |

2.40%, 10/30/20 | | | | | | | 175 | | | | 171,425 | |

3.45%, 04/30/21 | | | | | | | 106 | | | | 106,065 | |

Capital One NA/Mclean VA, 2.65%, 08/08/22 | | | | | | | 300 | | | | 288,608 | |

Discover Bank, 3.10%, 06/04/20 | | | | | | | 1,000 | | | | 996,495 | |

HSBC Bank USA NA, 4.88%, 08/24/20 | | | | | | | 400 | | | | 414,810 | |

HSBC Holdings PLC: | | | | | | | | | | | | |

3.60%, 05/25/23 | | | | | | | 800 | | | | 797,482 | |

4.30%, 03/08/26 | | | | | | | 400 | | | | 404,279 | |

Santander Holdings USA, Inc.: | | | | | | | | | | | | |

3.40%, 01/18/23 | | | | | | | 75 | | | | 72,880 | |

4.40%, 07/13/27 | | | | | | | 43 | | | | 41,522 | |

Synchrony Bank, 3.65%, 05/24/21 | | | | | | | 250 | | | | 250,773 | |

Westpac Banking Corp., 2.25%, 11/09/20(d) | | | | | | | 600 | | | | 590,298 | |

| | | | | | | | |

| | | | | | | | | | | 5,237,600 | |

| Beverages — 0.5% | |

Anheuser-Busch InBev Worldwide, Inc., 3.50%, 01/12/24 | | | | | | | 45 | | | | 44,992 | |

Constellation Brands, Inc., 3.70%, 12/06/26 | | | | | | | 300 | | | | 292,564 | |

Maple Escrow Subsidiary, Inc.(d): | | | | | | | | | | | | |

3.55%, 05/25/21 | | | | | | | 110 | | | | 110,499 | |

4.60%, 05/25/28 | | | | | | | 65 | | | | 65,521 | |

| | | | | | | | |

| | | | | | | | | | | 513,576 | |

| | | | |

| SCHEDULES OF INVESTMENTS | | | 17 | |

| | |

Schedule of Investments (continued) May 31, 2018 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

| Biotechnology — 0.8% | |

Baxalta, Inc., 3.60%, 06/23/22 | | | USD | | | | 400 | | | $ | 398,008 | |

Celgene Corp., 2.25%, 08/15/21 | | | | | | | 400 | | | | 386,773 | |

| | | | | | | | |

| | | | | | | | | | | 784,781 | |

| Capital Markets — 2.4% | |

Goldman Sachs Group, Inc.: | | | | | | | | | | | | |

3.75%, 05/22/25 | | | | | | | 300 | | | | 294,243 | |

3.27%, 09/29/25(e) | | | | | | | 200 | | | | 190,991 | |

3.75%, 02/25/26 | | | | | | | 700 | | | | 678,857 | |

Jefferies Group LLC, 4.85%, 01/15/27 | | | | | | | 329 | | | | 325,940 | |

Morgan Stanley: | | | | | | | | | | | | |

2.75%, 05/19/22 | | | | | | | 200 | | | | 195,008 | |

3.88%, 01/27/26 | | | | | | | 600 | | | | 594,423 | |

4.30%, 01/27/45 | | | | | | | 200 | | | | 192,420 | |

| | | | | | | | |

| | | | | | | | | | | 2,471,882 | |

| Chemicals — 1.0% | |

LYB International Finance BV, 4.00%, 07/15/23 | | | | | | | 700 | | | | 707,636 | |

Westlake Chemical Corp., 3.60%, 08/15/26 | | | | | | | 300 | | | | 287,526 | |

| | | | | | | | |

| | | | | | | | | | | 995,162 | |

| Commercial Services & Supplies — 0.5% | |

Aviation Capital Group Corp., 6.75%, 04/06/21(d) | | | | | | | 300 | | | | 327,093 | |

Park Aerospace Holdings Ltd., 5.50%, 02/15/24(d) | | | | | | | 200 | | | | 196,250 | |

| | | | | | | | |

| | | | | | | | | | | 523,343 | |

| Communications Equipment — 0.4% | |

CommScope Technologies LLC, 5.00%, 03/15/27(d) | | | | | | | 400 | | | | 374,000 | |

| | | | | | | | |

| Construction Materials — 0.2% | |

Allegion US Holding Co., Inc., 3.55%, 10/01/27 | | | | | | | 225 | | | | 209,498 | |

| | | | | | | | |

| Consumer Discretionary — 0.1% | |

Royal Caribbean Cruises Ltd., 2.65%, 11/28/20 | | | | | | | 65 | | | | 64,034 | |

| | | | | | | | |

| Consumer Finance — 3.1% | |

American Express Co., 2.50%, 08/01/22 | | | | | | | 250 | | | | 240,401 | |

Autodesk, Inc., 3.50%, 06/15/27 | | | | | | | 230 | | | | 217,814 | |

Ford Motor Credit Co. LLC: | | | | | | | | | | | | |

2.43%, 06/12/20 | | | | | | | 245 | | | | 241,102 | |

3.16%, 08/04/20 | | | | | | | 1,000 | | | | 996,240 | |

Synchrony Financial, 2.70%, 02/03/20 | | | | | | | 900 | | | | 893,123 | |

Total System Services, Inc., 4.00%, 06/01/23 | | | | | | | 200 | | | | 201,561 | |

Visa, Inc., 4.15%, 12/14/35 | | | | | | | 400 | | | | 419,624 | |

| | | | | | | | |

| | | | | | | | | | | 3,209,865 | |

| Containers & Packaging — 0.2% | |

Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer Lu(d): | | | | | | | | | | | | |

5.13%, 07/15/23 | | | | | | | 100 | | | | 98,250 | |

7.00%, 07/15/24 | | | | | | | 100 | | | | 102,620 | |

| | | | | | | | |

| | | | | | | | | | | 200,870 | |

| Diversified Financial Services — 6.5% | |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 3.30%, 01/23/23 | | | | | | | 200 | | | | 193,822 | |

AerCap Ireland Capital Ltd./AerCap Global Aviation Trust, 4.25%, 07/01/20 | | | | | | | 250 | | | | 254,329 | |

Bank of America Corp.(e): | | | | | | | | | | | | |

3.50%, 05/17/22 | | | | | | | 200 | | | | 200,504 | |

3.00%, 12/20/23 | | | | | | | 542 | | | | 527,154 | |

3.42%, 12/20/28 | | | | | | | 315 | | | | 297,599 | |

Citigroup, Inc., 4.08%, 04/23/29(e) | | | | | | | 300 | | | | 295,043 | |

Credit Suisse Group AG, 4.28%, 01/09/28(d) | | | | | | | 400 | | | | 389,783 | |

Deutsche Bank AG: | | | | | | | | | | | | |

3.15%, 01/22/21 | | | | | | | 200 | | | | 195,647 | |

3.30%, 11/16/22 | | | | | | | 300 | | | | 285,456 | |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

| Diversified Financial Services (continued) | |

General Motors Financial Co., Inc.: | | | | | | | | | | | | |

2.65%, 04/13/20 | | | USD | | | | 400 | | | $ | 396,074 | |

3.20%, 07/13/20 | | | | | | | 400 | | | | 399,145 | |

5.25%, 03/01/26 | | | | | | | 1,000 | | | | 1,047,484 | |

HSBC Holdings PLC, 3.03%, 11/22/23(e) | | | | | | | 200 | | | | 194,662 | |

JPMorgan Chase & Co.: | | | | | | | | | | | | |

(3 mo. LIBOR US + 1.16%), 3.22%, 03/01/25(f) | | | | | | | 300 | | | | 290,709 | |

3.30%, 04/01/26 | | | | | | | 1,300 | | | | 1,246,028 | |

Lloyds Banking Group PLC, 4.45%, 05/08/25 | | | | | | | 200 | | | | 202,486 | |

Mitsubishi UFJ Financial Group, Inc., 3.46%, 03/02/23 | | | | | | | 200 | | | | 199,008 | |

ORIX Corp., 2.90%, 07/18/22 | | | | | | | 80 | | | | 77,868 | |

| | | | | | | | |

| | | | | | | | | | | 6,692,801 | |

| Diversified Telecommunication Services — 0.7% | |

AT&T, Inc., 3.95%, 01/15/25 | | | | | | | 400 | | | | 394,648 | |

Verizon Communications, Inc., 4.50%, 08/10/33 | | | | | | | 300 | | | | 294,311 | |

| | | | | | | | |

| | | | | | | | | | | 688,959 | |

| Electric Utilities — 1.7% | |

Dominion Resources, Inc., 3.90%, 10/01/25 | | | | | | | 600 | | | | 593,429 | |

Eversource Energy, Series L, 2.90%, 10/01/24 | | | | | | | 170 | | | | 161,738 | |

Public Service Electric & Gas Co., 3.00%, 05/15/27 | | | | | | | 500 | | | | 478,139 | |

Southern Co., 3.25%, 07/01/26 | | | | | | | 500 | | | | 472,952 | |

Virginia Electric & Power Co., Series C, 2.75%, 03/15/23 | | | | | | | 60 | | | | 58,203 | |

| | | | | | | | |

| | | | | | | | | | | 1,764,461 | |

| Electronic Equipment, Instruments & Components — 0.1% | |

Arrow Electronics, Inc., 3.25%, 09/08/24 | | | | | | | 85 | | | | 79,940 | |

Tyco Electronics Group SA, 3.13%, 08/15/27 | | | | | | | 40 | | | | 37,612 | |

| | | | | | | | |

| | | | | | | | | | | 117,552 | |

| Energy Equipment & Services — 0.5% | |

CNOOC Finance 2013 Ltd., 3.00%, 05/09/23 | | | | | | | 500 | | | | 483,150 | |

| | | | | | | | |

| Food & Staples Retailing — 0.4% | |

Lamb Weston Holdings, Inc.(d): | | | | | | | | | | | | |

4.63%, 11/01/24 | | | | | | | 100 | | | | 98,250 | |

4.88%, 11/01/26 | | | | | | | 100 | | | | 99,125 | |

McCormick & Co., Inc., 2.70%, 08/15/22 | | | | | | | 180 | | | | 174,187 | |

| | | | | | | | |

| | | | | | | | | | | 371,562 | |

| Food Products — 0.5% | |

Kraft Heinz Foods Co., 3.50%, 07/15/22 | | | | | | | 500 | | | | 497,422 | |

| | | | | | | | |

| Health Care Equipment & Supplies — 1.7% | |

Baxter International, Inc., 2.60%, 08/15/26 | | | | | | | 250 | | | | 228,827 | |

Becton Dickinson & Co.: | | | | | | | | | | | | |

2.40%, 06/05/20 | | | | | | | 110 | | | | 108,127 | |

2.89%, 06/06/22 | | | | | | | 105 | | | | 102,060 | |

3.36%, 06/06/24 | | | | | | | 667 | | | | 644,671 | |

Boston Scientific Corp., 6.00%, 01/15/20 | | | | | | | 500 | | | | 522,306 | |

Stryker Corp., 3.50%, 03/15/26 | | | | | | | 100 | | | | 98,593 | |

Zimmer Biomet Holdings, Inc., 3.70%, 03/19/23 | | | | | | | 55 | | | | 54,816 | |

| | | | | | | | |

| | | | | | | | | | | 1,759,400 | |

| Health Care Providers & Services — 1.4% | |

Anthem, Inc.: | | | | | | | | | | | | |

3.35%, 12/01/24 | | | | | | | 285 | | | | 277,015 | |

4.10%, 03/01/28 | | | | | | | 75 | | | | 73,854 | |

HCA, Inc., 5.88%, 05/01/23 | | | | | | | 200 | | | | 208,000 | |

Humana, Inc., 2.90%, 12/15/22 | | | | | | | 155 | | | | 151,477 | |

MPH Acquisition Holdings LLC, 7.13%, 06/01/24(d) | | | | | | | 100 | | | | 103,750 | |

UnitedHealth Group, Inc., 3.10%, 03/15/26 | | | | | | | 600 | | | | 578,211 | |

| | | | | | | | |

| | | | | | | | | | | 1,392,307 | |

| | |

| 18 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments (continued) May 31, 2018 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

| Hotels, Restaurants & Leisure — 2.1% | |

KFC Holding Co./Pizza Hut Holdings LLC/Taco Bell of America LLC, 5.00%, 06/01/24(d) | | | USD | | | | 200 | | | $ | 197,500 | |

McDonald’s Corp., 2.63%, 01/15/22 | | | | | | | 2,000 | | | | 1,975,137 | |