Exhibit 99.1

ANNUAL INFORMATION FORM

For the Year Ended December 31,2018

(Dated March 28, 2019)

GOLD STANDARD VENTURES CORP.

Suite 610 – 815 West Hastings Street

Vancouver,B.C.

V6C 1B4

TABLE OF CONTENTS

| | | |

| ITEM 1: | | PRELIMINARY NOTES | 3 |

| 1.1 | | Effective Date of Information | 3 |

| 1.2 | | Financial Statements and Management Discussion and Analysis | 3 |

| 1.3 | | Currency | 3 |

| 1.4 | | Imperial and Metric Conversions | 3 |

| ITEM 2: | | CAUTIONARY NOTES | 4 |

| 2.1 | | Cautionary Note Regarding Forward Looking Statements and Forward Looking Information | 4 |

| 2.2 | | Cautionary Notes Regarding Mineral Resource Estimates | 7 |

| ITEM 3: | | CORPORATE STRUCTURE | 8 |

| 3.1 | | Name, Address and Incorporation | 8 |

| 3.2 | | Inter-corporate Relationships | 8 |

| ITEM 4: | | GENERAL DEVELOPMENT OF THE BUSINESS | 9 |

| 4.1 | | Overview | 9 |

| 4.2 | | Three Year History | 11 |

| ITEM 5: | | DESCRIPTION OF THE BUSINESS | 13 |

| ITEM 6: | | MATERIAL MINERAL PROJECT | 14 |

| 6.1 | | Mineral Projects | 14 |

| 6.2 | | Recent Developments | 31 |

| ITEM 7: | | RISK FACTORS | 35 |

| 7.1 | | Risks Relating to the Company | 35 |

| 7.2 | | Risks Relating to the Mining Industry | 41 |

| 7.3 | | Risks Relating to Shares | 45 |

| ITEM 8: | | DIVIDENDS | 48 |

| ITEM 9: | | DESCRIPTION OF CAPITAL STRUCTURE | 48 |

| ITEM 10: | | MARKET FOR SECURITIES | 49 |

| 10.1 | | Trading Price and Volume | 49 |

| 10.2 | | Prior Sales | 50 |

| ITEM 11: | | ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUALRESTRICTION ON TRANSFER | 50 |

| ITEM 12: | | DIRECTORS AND OFFICERS | 50 |

| 12.1 | | Name, Occupation and Security Holding | 50 |

| 12.2 | | Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 56 |

| 12.3 | | Conflicts of Interest | 57 |

| ITEM 13: | | LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 58 |

| 13.1 | | Legal Proceedings | 58 |

| 13.2 | | Regulatory Actions | 58 |

| ITEM 14: | | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 58 |

| ITEM 15: | | TRANSFER AGENT AND REGISTRAR | 59 |

| ITEM 16: | | MATERIAL CONTRACTS | 59 |

| ITEM 17: | | INTERESTS OF EXPERTS | 59 |

| 17.1 | | Names of Experts | 59 |

| 17.2 | | Interests of Experts | 59 |

| ITEM 18: | | AUDIT COMMITTEE | 60 |

| 18.1 | | The Audit Committee Charter | 60 |

| 18.2 | | Composition of Audit Committee | 60 |

| 18.3 | | Relevant Education and Experience | 60 |

| 18.4 | | Reliance on Certain Exemptions | 61 |

| 18.5 | | Reliance on the Exemption in Subsection 3.3 (2) or Section 3.6 | 61 |

| 18.6 | | Reliance on Section 3.8 | 61 |

| 18.7 | | Audit Committee Oversight | 61 |

| 18.8 | | Pre-Approval Policies and Procedures | 61 |

| 18.9 | | External Audit Service Fees (By Category) | 61 |

| ITEM 19: | | ADDITIONAL INFORMATION | 62 |

| SCHEDULE “A” – Audit Committee Charter | |

-2-

| |

| 1.1 | Effective Date of Information |

References to “Gold Standard Ventures”, “Gold Standard”, “GSV”, the “Company”, “its”, “our” and “we”, or related terms in this Annual Information Form (“AIF”), refer to Gold Standard Ventures Corp. and includes, where the context requires, its subsidiaries.

All information contained in this AIF is as at December 31, 2018, unless otherwise stated.

| |

| 1.2 | Financial Statements and Management Discussion and Analysis |

This AIF should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2018 (the “Financial Statements”), and the accompanying Management’s Discussion and Analysis (“MD&A”) for such period. The Financial Statements and MD&A are available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) website atwww.sedar.comunder the Company’s profile.

All references to “$” or “dollars” in this AIF are to lawful currency of Canada unless otherwise expressly stated.

References to “US$” are to United States dollars.

| |

| 1.4 | Imperial and Metric Conversions |

| | |

| To Convert From | To | Multiply By |

| | | |

| Feet (“ft”) | Metres (“m”) | 0.305 |

| Metres (“m”) | Feet (“ft”) | 3.281 |

| Miles (“mi”) | Kilometres (“km”) | 1.609 |

| Kilometres (“km”) | Miles (“mi”) | 0.621 |

| Acres | Hectares | Hectares | 0.405 |

| Hectares | Acres | 2.471 |

-3-

| |

| 2.1 | Cautionary Note Regarding Forward Looking Statements and Forward Looking Information |

Certain statements and information contained in this AIF constitute “forward-looking statements” and “forward looking information” within the meaning of applicable securities legislation. Forward-looking statements and forward looking information include statements concerning the Company’s current expectations, estimates, projections, assumptions and beliefs, and, in certain cases, can be identified by the use of words such as “seeks”, “plans”, “expects”, “is expected”, “budget”, “estimates”, “intends”, “anticipates”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would”, “might” or “will”, “occur” or “be achieved”, or the negative forms of any of these words and other similar expressions.

Examples of forward-looking information in this AIF may pertain to the following, among others:

| 1. | existence and estimates of mineral resources or reserves and timing of development thereof; |

| | |

| 2. | exploration and work programs, including reference to the Company’s plans of operations and notices of intent in place for the Railroad-Pinion Project (as defined below); |

| | |

| 3. | performance characteristics of mineral properties; |

| | |

| 4. | results of various projects, including the expectation that recent drilling results have expanded the Dark Star gold zone beyond the resource block model and are expected to improve the grade of the estimate; |

| | |

| 5. | the expectation that the Dark Star deposit (the “Dark Star Deposit”) may be emerging as a major Carlin gold occurrence where a larger-than-expected ridgeline fault system has played a significant role in concentrating higher grade gold; |

| | |

| 6. | mineral resource or reserve predictions based on recent drilling results, including the expectation that recent drilling results will improve the grade of the current block model in the northern portion of the Dark Star Deposit; |

| | |

| 7. | the anticipation that sales of common shares in the capital of the Company (“Common Shares”) by hedging or arbitrage trading activity may occur; |

| | |

| 8. | the expectation that the correlation between visual logging of oxidized zones containing limonite and/or hematite in drill samples and cyanide (“CN”) soluble gold assays should support efficient mining operation; |

| | |

| 9. | projections of market prices and costs, including estimates of costs and budgeting for potential exploration operations and mining scenarios; |

| | |

| 10. | the expectation that the current working capital surplus will be sufficient to fund the complete work program recommended in the Railroad-Pinion Technical Report (as defined below); |

| | |

| 11. | estimated property holding and maintenance costs for the Railroad-Pinion Project; |

| | |

| 12. | drilling plans and timing of drilling; |

| | |

| 13. | the incorporation of the results of the 2017 and 2018 drill programs into a revised geologic model to potentially convert certain mineral resources previously classified as Inferred to Indicated or Measured; |

| | |

| 14. | the Company working towards a pre-feasibility study; |

-4-

| 15. | treatment under governmental regulatory regimes and tax laws, including the expectation that the Company will be a passive foreign investment company for the taxable year ended December 31, 2018; and |

| | |

| 16. | capital expenditure programs and the timing and method of financing thereof. |

Forward-looking statements and forward looking information reflect the Company’s current expectations and assumptions, and are subject to a number of known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements and forward looking information, including without limitation:

| 1. | the Company’s limited operating history; |

| | |

| 2. | the Company’s history of losses and expectation of future losses; |

| | |

| 3. | uncertainty as to the Company’s ability to continue as a going concern; |

| | |

| 4. | the existence of mineral resources on the Company’s mineral properties; |

| | |

| 5. | the Company’s ability to obtain adequate financing for exploration and development; |

| | |

| 6. | the Company’s ability to attract and retain qualified personnel; |

| | |

| 7. | the Company’s ability to carry out operations in accordance with plans in the face of significant disruptions; |

| | |

| 8. | the Company’s ability to complete a revised geologic model, convert mineral resource estimates previously classified as Inferred to Indicated or Measured and proceeding with economic studies for the Railroad-Pinion Project; |

| | |

| 9. | fluctuations in foreign exchange or interest rates and stock market volatility; |

| | |

| 10. | uncertainty as to the Company’s ability to maintain effective internal controls; |

| | |

| 11. | the involvement by some of the Company’s directors and officers with other natural resource companies; |

| | |

| 12. | the uncertain nature of estimating mineral resources and reserves; |

| | |

| 13. | uncertainty surrounding the Company’s ability to successfully develop its mineral properties; |

| | |

| 14. | exploration, development and mining risks, including risks related to infrastructure, accidents and equipment breakdowns; |

| | |

| 15. | title defects to the Company’s mineral properties; |

| | |

| 16. | the Company’s ability to obtain all necessary permits and other approvals; |

| | |

| 17. | risks related to equipment shortages, access restrictions and inadequate infrastructure; |

| | |

| 18. | increased costs and restrictions on operations due to compliance with environmental legislation and potential lawsuits; |

| | |

| 19. | fluctuations in the market price of gold, other metals and certain other commodities (such as natural gas, fuel, oil, and electricity); |

| | |

| 20. | intense competition in the mining industry; and |

| | |

| 21. | the Company’s ability to comply with applicable regulatory requirements. |

In making the forward-looking statements and developing the forward looking information included in this AIF, the Company has made various material assumptions, including, but not limited to:

| 1. | the results of the Company’s proposed exploration programs on the Railroad-Pinion Project will be consistent with current expectations; |

-5-

| 2. | the Company’s assessment and interpretation of potential geological structures and mineralization at the Railroad-Pinion Project are accurate in all material respects; |

| | |

| 3. | the quantity and grade of mineral resources contained in the Railroad-Pinion Project are accurate in all material respects; |

| | |

| 4. | the sufficiency of the Company’s current working capital to carry out the work programs and drilling on the Railroad-Pinion Project including, but not limited to, its North Bullion deposit (the “North Bullion Deposit”), its Dark Star Deposit and its Pinion deposit (the “Pinion Deposit”), as recommended in the Railroad-Pinion Technical Report on a timely basis; |

| | |

| 5. | the price for gold, other precious metals and commodities will not change significantly from current levels; |

| | |

| 6. | the Company will be able to secure additional financing to continue exploration and, if warranted, development activities on the Railroad-Pinion Project and meet future obligations as required from time to time; |

| | |

| 7. | the Company will be able to obtain regulatory approvals and permits in a timely manner and on terms consistent with current expectations; |

| | |

| 8. | the involvement by some of the Company’s directors and officers with other natural resource companies will not result in a conflict of interest which adversely effects the Company; |

| | |

| 9. | the Company will be able to procure drilling and other mining equipment, energy and supplies in a timely and cost efficient manner to meet the Company’s needs from time to time; |

| | |

| 10. | the Company’s capital and operating costs will not increase significantly from current levels; |

| | |

| 11. | key personnel will continue their employment with the Company and the Company will be able to recruit and retain additional qualified personnel, as needed, in a timely and cost efficient manner; |

| | |

| 12. | there will be no significant adverse changes in the Canada/U.S. currency exchange or interest rates and stock markets; |

| | |

| 13. | there will be no significant changes in the ability of the Company to comply with environmental, safety and other regulatory requirements; and |

| | |

| 14. | the absence of any material adverse effects arising as a result of political instability, terrorism, sabotage, natural disasters, equipment failures or adverse changes in government legislation or the socio-economic conditions in Nevada (“NV”) and the surrounding area with respect to the Railroad-Pinion Project and operations. |

Other assumptions are discussed throughout this AIF and elsewhere in the Company’s public disclosure record.

The Company’s ability to predict the results of its operations or the effects of various events on its operating results is inherently uncertain. Accordingly, readers are cautioned not to place undue reliance on the forward-looking statements and forward looking information or the assumptions on which the Company’s forward-looking statements and forward looking information are based. Investors are advised to carefully review and consider the risk factors identified in this AIF under, among other places, ITEM 7: “Risk Factors” and elsewhere in the Company’s public disclosure record for a discussion of the factors that could cause the Company’s actual results, performance and achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements and forward looking information. Investors are further cautioned that the foregoing list of risks and assumptions is not exhaustive and prospective investors should consult the more complete discussion of the Company’s business, financial condition and prospects that is included in this AIF and elsewhere in the Company’s public disclosure record.

Although the Company believes that the assumptions on which the forward-looking statements are made and forward looking information is provided are reasonable, based on the information available to the Company on the date such statements were made or such information was provided, no assurances can be given as to whether these assumptions will prove to be correct. The forward-looking statements and forward looking information contained in this AIF are expressly qualified in their entirety by the foregoing cautionary statements. Furthermore, the above

-6-

risks are not intended to represent a complete list of the risks that could affect the Company and readers should not place undue reliance on forward-looking statements and forward looking information in this AIF.

Forward-looking statements and forward looking information speak only as of the date the statements are made or such information is provided. The Company assumes no obligation to update publicly or otherwise revise any forward-looking statements or forward looking information to reflect actual results,changes in assumptions or changes in other factors affecting forward-looking statements or forward looking information,except to the extent required by applicable laws. If the Company does update one or more forward-looking statements or forward looking information,no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements or forward looking information.

| |

| 2.2 | Cautionary Notes Regarding Mineral Resource Estimates |

The disclosure in this AIF has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Disclosure, including scientific or technical information, has been made in accordance with Canadian National Instrument 43-101Standards of Disclosure for Mineral Projects(“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by United States standards in documents filed with the SEC. United States investors should also understand that “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. Investors are cautioned not to assume that any part, or all, of the mineral deposits in these categories will ever be converted into mineral reserves. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies. Although it is reasonably expected that the majority of “inferred resources” could be upgraded to “indicated resources” with continued exploration, investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. In addition, the definitions of “proven” and “probable mineral reserves” used in NI 43-101 differ from the definitions in SEC Industry Guide 7 under Regulation S-K of the United States Securities Act of 1933. Disclosure of “contained ounces” is permitted disclosure under Canadian legislation; however, the SEC normally only permits issuers to report mineralization that does not constitute reserves as in place tonnage and grade without reference to unit measures. Accordingly, information contained in this AIF containing descriptions of the Company’s mineral properties may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The forward-looking statements and forward-looking information contained herein are based on information available as of March 22, 2019.

[remainder of page left blank intentionally]

-7-

| |

| ITEM 3: | CORPORATE STRUCTURE |

| |

| 3.1 | Name,Address and Incorporation |

The Company was incorporated on February 6, 2004 under theBusiness Corporations Act(British Columbia) (the “BCBCA”) under the name “TCH Minerals Inc.”. The Company changed its name to “Ripple Lake Minerals Ltd.” on May 13, 2004 and again to “Ripple Lake Diamonds Inc.” on July 26, 2004. On August 16, 2007 the Company consolidated its share capital on a ten for one basis and changed its name to “Devonshire Resources Ltd.”. On November 18, 2009 the Company consolidated its share capital on a further four to one basis and changed its name to its current name “Gold Standard Ventures Corp.”.

The registered and head office of the Company is located at Suite 610 - 815 West Hastings Street, Vancouver, B.C.

V6C 1B4, telephone: (604) 669 - 5702, fax (604) 687 - 3567.

| |

| 3.2 | Inter-corporate Relationships |

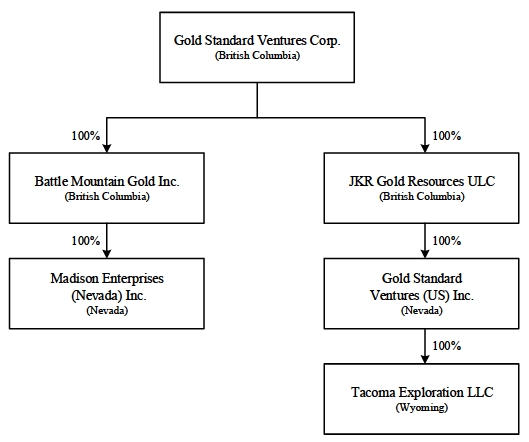

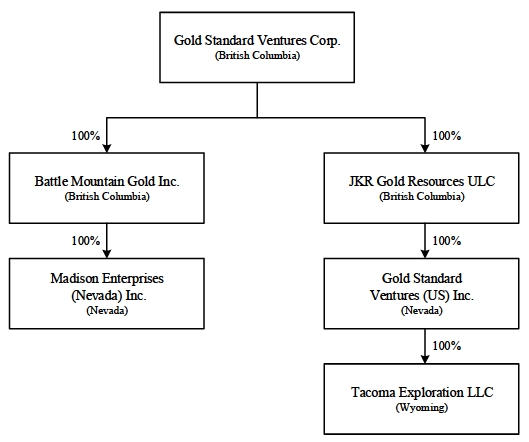

The Company currently has five wholly-owned subsidiaries: JKR Gold Resources ULC (“JKR”), a wholly-owned subsidiary of the Company incorporated under the BCBCA, Gold Standard Ventures (US) Inc. (“GSV US”), a wholly-owned subsidiary of JKR incorporated pursuant to the laws of NV, Tacoma Exploration LLC, a wholly-owned subsidiary of GSV US formed as a limited liability company under the laws of Wyoming, Battle Mountain Gold Inc. (“Battle Mountain”), a wholly-owned subsidiary of the Company incorporated under the BCBCA and Madison Enterprises (Nevada) Inc., a wholly-owned subsidiary of Battle Mountain incorporated pursuant to the laws of NV.

-8-

| |

| ITEM 4: | GENERAL DEVELOPMENT OF THE BUSINESS |

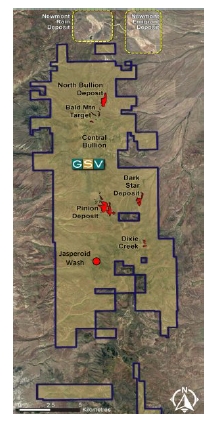

Headquartered in Vancouver, B.C., the Company is an advanced stage gold exploration company focused on district scale discoveries on the Railroad-Pinion Project, located within the Carlin Trend, NV, USA. Within the Railroad-Pinion Project, the Company has three deposits supported by the Railroad-Pinion Technical Report.

The Company has identified its North Bullion Deposit, Dark Star Deposit and Pinion Deposit, which form the Railroad-Pinion Project, as its material mineral projects for purposes of NI 43-101.

Scientific or technical disclosure for the Railroad-Pinion Project is supported by the amended and restated technical report with an effective date of September 15, 2017 on the Railroad-Pinion Project in Elko County, NV, USA, entitled “Technical Report Maiden Resource Estimate North Bullion and Railroad Project, Elko County, Nevada, USA – Amended and Restated” and prepared by Michael B. Dufresne, M.Sc., P.Geol., P.Geo. and Steven J. Nicholls, BA.Sc., MAIG of APEX Geoscience Ltd., qualified persons for the purposes of NI 43-101 (the “Railroad-Pinion Technical Report”). This report was amended and restated to clarify certain of its contents and has been filed on SEDAR on February 19, 2018 under the Company’s profile at www.sedar.com. The Railroad-Pinion Technical Report is the Company’s current technical report for the Railroad-Pinion Project.

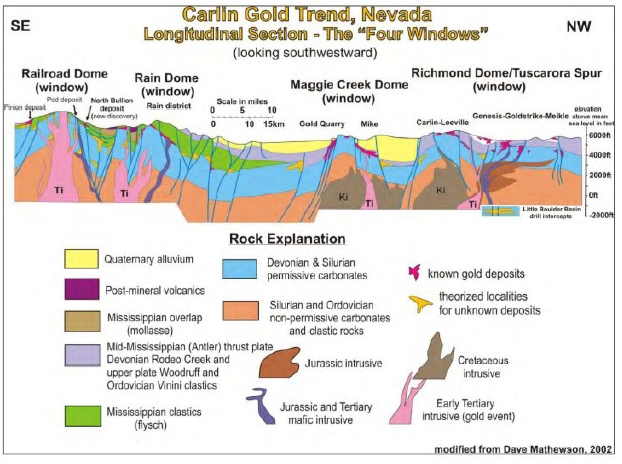

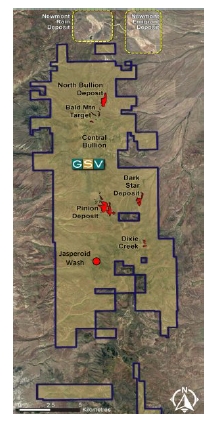

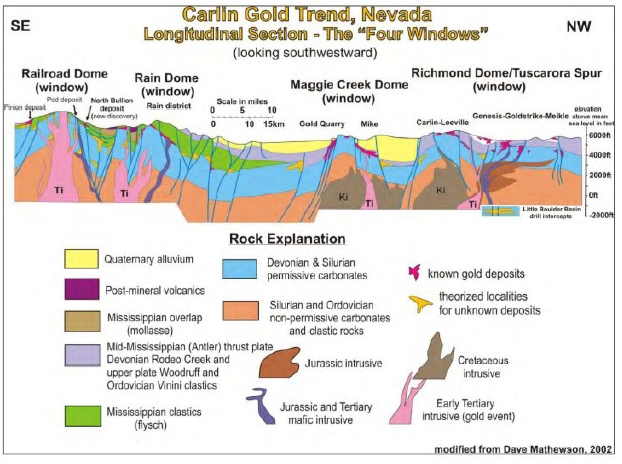

The Railroad-Pinion Project is located at the southeast end of the Carlin (Gold) Trend, a northwest alignment of sedimentary rock-hosted gold deposits in northeastern NV. The Carlin Trend, so named for the city of Carlin, NV comprises more than 40 separate gold deposits that have produced more than 80 million ounces of gold to date. The Railroad-Pinion Project is considered to be an intermediate to advanced stage exploration project centered on the fourth and southernmost dome-shaped window along the Carlin Trend in the Pinon Range. The domes are cored by igneous intrusions that uplift and expose Paleozoic rocks and certain stratigraphic contacts that are favorable for the formation of Carlin-style gold deposits. The Railroad-Pinion Project area covers a significant portion of the southernmost structural window within the Carlin Trend that exposes prospective Upper Paleozoic units that host gold mineralization often associated with multilithic collapse breccias and comprises a number of gold target areas.

-9-

The following is an interpretive illustration of a longitudinal section of the “Four Windows” on the Carlin Trend.

The Railroad-Pinion Project comprises two significant gold target areas, the Railroad district (which includes the North Bullion Deposit) and the Pinion district (which includes the Pinion Deposit and the Dark Star Deposit). Historic work and exploration conducted by the Company since 2010 has identified several significant zones of gold and base metal mineralization at the Railroad-Pinion Project.

In 2010, the Company acquired its initial interest in the Railroad district comprising 480 unpatented lode mining claims and 25 patented lode claims covering approximately 9,064 acres (14.2 square miles) pursuant to a statutory plan of arrangement with JKR in which the Company acquired all of issued and outstanding securities of JKR in exchange for like securities of the Company on a one for one basis. Since that time, the Company has worked to expand and consolidate, by way of staking, purchase and lease, the Railroad-Pinion Project.

As of March 22, 2019:

| 1. | the Railroad-Pinion Project consists of a significant and largely contiguous land position totaling about 53,769 gross acres (21,760 gross hectares) and 50,798 net acres (20,577 net hectares) of land in Elko County, NV; |

| | |

| 2. | the Company owns or has an option on the ownership of approximately 30,141 gross acres (12,198 hectares) of subsurface mineral rights in the form of patented or unpatented mineral lode (claims), and a further approximately 23,628 gross acres (9,562 hectares) of subsurface mineral rights secured or controlled by a contractual interest in private surface and mineral property in the form of various surface use agreements and mining/mineral leases; and |

| | |

| 3. | private land ownership ranges from 49.2% to 100% yielding a net interest of approximately 20,657 acres (8,360 hectares) of subsurface mineral rights for the private lands within the Railroad-Pinion Project. The Company is pursuing the minority interest in key private land parcels where it holds less than a 100% interest. |

-10-

As of March 22, 2019, there were (i) 260,042,886 Common shares, (ii) 11,018,720 stock options to purchase up to an aggregate of 11,018,720 Common Shares at a weighted average exercise price of $1.75 per Common Share expiring from September 12, 2019 to March 15, 2024, (iii) 1,118,632 restricted share units convertible to 1,118,632 Common Shares, and (iv) no warrants, outstanding.

Financings

On February 9 and 12, 2016, the Company completed a private placement of 29,931,931 Common Shares at a price of $1.00 per Common Share for gross proceeds of $29,931,931 (the “February 2016 Private Placement”) with Goldcorp Inc. (TSX/NYSE:G) (“Goldcorp”) and Oceana Gold Corporation (TSX/ASX/NZX:OCG) (“Oceana”). Goldcorp purchased a total of 16,100,000 Common Shares for an aggregate purchase price of $16,100,000 and Oceana exercised its participation right to increase its equity ownership interest to 19.9% by purchasing an additional 13,831,931 Common Shares for an aggregate price of $13,831,931.

During February and the first half of March, 2016, the Company issued an additional 7,468,804 Common Shares at a price of $1.00 per Common Share for gross proceeds of $7,468,804 pursuant to the exercise of share purchase warrants and 795,000 Common Shares at a weighted average price of $0.70 per Common Share for gross proceeds of $558,850 upon the exercise of stock options.

On October 28, 2016, the Company completed a private placement of 12,036,436 Common Shares at a price of $3.17 per Common Share for gross proceeds of $38,155,502 (the “October 2016 Private Placement” and, together with the February 2016 Private Placement, the “2016 Private Placements”) with, among others, Goldcorp. Goldcorp acquired an additional 4,731,862 Common Shares pursuant to the exercise of its participation right granted under the February 2016 Private Placement for an aggregate purchase price of $15,000,003, thereby increasing its equity ownership interest in the Company to 22,903,362 Common Shares.

On February 22, 2018, the Company completed a short form prospectus offering of 13,750,440 Common Shares at a price of $2.05 per Common Share to the public in certain provinces of Canada and the United States for gross proceeds of $28,188,402 (the “2018 Public Offering”) through a syndicate of underwriters co-led by Macquarie Capital Markets Canada Ltd. and BMO Nesbitt Burns Inc., including Cormark Securities Inc. and PI Financial Corp.

Concurrent with the 2018 Public Offering, Oceana subscribed for 2,680,900 Common Shares and Goldcorp subscribed for 2,195,100 Common Shares, both at a price of $2.05 per Common Share for gross proceeds of $9,995,800 (the “February 2018 Private Placement”).

It is a term of Oceana’s subscription agreement from the February 2018 Private Placement that as long as Oceana owns not less than 9.9% of the issued and outstanding Common Shares, Oceana will be entitled to:

| 1. | request the formation of a technical committee of the Company consisting of at least four members with the appointment of one representative by Oceana; |

| | |

| 2. | participate in any future equity financings of the Company in order to (i) maintain its then equity ownership interest in the Company; and/or (ii) increase its equity ownership interest to a maximum of 19.9% of the then issued and outstanding Common Shares; and |

| | |

| 3. | a right of first refusal to match any third party offers regarding a tolling arrangement or a non-equity financing for the purpose of funding the future exploration and development of any assets of the Company. |

It is a term of Goldcorp’s subscription agreement from the February 2018 Private Placement that as long as Goldcorp owns not less than 7.5% of the issued and outstanding Common Shares Goldcorp shall be entitled to:

-11-

| 1. | receive monthly exploration reports updating the status of the Company’s work programs on its mineral properties including, but not limited to, reasonable access to the Company’s scientific and technical data, work plans and programs, permitting information, results of operations and technical personnel from time to time; and |

| | |

| 2. | participate in any future equity financings of the Company in order to: |

| | |

| i. | maintain its then equity ownership interest in the Company; and/or |

| | |

| ii. | increase its equity ownership interest to a maximum of 19.9% of the then issued and outstanding Common Shares, provided that the purchase price per Common Share under such equity financing (a “Subsequent Financing”) shall be equal to the volume weighted average price of the Common Shares on the Toronto Stock Exchange (“TSX”) for the 20 trading days immediately preceding the date of the Company’s public announcement of such financing plus 4%, rounded up or down to the nearest whole cent. |

For so long as Goldcorp beneficially owns not less than 7.5% of the issued and outstanding Common Shares (on an undiluted basis), Goldcorp must give the Company prior written notice of its intention to sell more than one (1%) percent of the then issued and outstanding Common Shares in any 30 day period and, upon receipt of such notice, the Company shall have five business days to purchase or designate the purchasers of all or any part of such shares, failing which Goldcorp may thereafter sell any remaining shares for an additional 30 days.

Goldcorp and Oceana are subject to standstill restrictions which include prohibiting Goldcorp and Oceana, subject to certain terminating events, from making a takeover bid or a tender an offer or participating as, or act in concert with, a bidder in any takeover bid or tender offer for any or all of the issued and outstanding Common Shares for a period of one year from the closing of the February 2018 Private Placement or, in the event of a Subsequent Financing, one year from the closing of the Subsequent Financing.

On September 5, 2018, the Company completed a private placement of 5,230,901 Common Shares at a price of $2.05 per share for aggregate proceeds of $10,723,347 (the “September 2018 Private Placement”, and together with the February 2018 Private Placement, the “2018 Private Placements”). As part of the September 2018 Private Placement, Goldcorp and Oceana exercised their participation rights and purchased 2,926,829 and 975,609 Common Shares, respectively, which represented approximately 13.6% and 15.57% of the issued and outstanding Common Shares, respectively, on a non-diluted basis immediately following the September 2018 Private Placement.

U.S. Registration

The Company is also a reporting issuer in the United States and required to file disclosure reports with the SEC under the United StatesSecurities Exchange Act of 1934(the “U.S. Exchange Act”) to provide information to public investors in the United States (in addition to the Company’s continuous disclosure obligations in Canada).

Stock Exchange Listings

The Common Shares are listed for trading on the TSX and the NYSE American under the symbol “GSV”. Prior to October 11, 2017, the Common Shares traded on the TSX Venture Exchange (“TSXV”).

Land Expansion

The Company has expanded the Railroad-Pinion Project by entering into various mining leases and options to purchase agreements. Between February 2016 and July 2016, the Dark Star Deposit was included, which expanded the Railroad-Pinion Project by approximately 3,880 gross acres (2,540 net acres). The Company paid US$279,000 upon execution of these agreements and is required to make combined annual lease payments of approximately US$16,500 on the first anniversary; the annual lease payments increase to approximately US$31,000 in years six to nine. The leases are for a primary period of 10 years and the Company has the option to purchase certain of the lands

-12-

and claims for US$800,000 prior to commencing production. Certain leases are also subject to a 3% Net Smelter Return (“NSR”) with buy-down options of 1% for US$1,100,000. The Company has the option to extend the leases for an additional 10 years with annual lease payments of approximately US$31,000 per year, with provisions for further extension after that. If the Company exercises the purchase option, all applicable initial lease payments will be credited against future NSR payments.

On March 23, 2017 the Company announced the acquisition of a further 17,061.81 gross acres (17,237.21 net acres) to its land holdings’ at the south end of the Carlin Trend and control over certain additional key gold exploration targets contiguous with, and to the south of, the Dark Star Deposit and the Pinion Deposit. The acquisitions include cost-effective lease agreements with private mineral interest owners and newly staked claims. The total cost of these acquisitions was approximately US$222,121 with annual holding costs of approximately US$272,500 per annum.

Exploration

A discussion of exploration of the Railroad-Pinion Project is included under ITEM 6.1: “Material Mineral Project -Mineral Projects - Exploration” and ITEM 6.2: “Material Mineral Project - Recent Developments”.

Acquisitions

Strategic Investment in and Acquisition of Battle Mountain Gold Inc.

On May 6, 2016, the Company acquired, by way of private placement, a total of 10,481,435 common shares of Battle Mountain (“Battle Mountain Shares”) and 5,240,717 Battle Mountain Share purchase warrants, together representing 19.9% of Battle Mountain at a price of $0.35 per Battle Mountain Share for a total subscription price of $3,668,502.25.

After a Battle Mountain shareholders’ meeting, on June 14, 2017, the Company and Battle Mountain completed a plan of arrangement (the “Arrangement”) under theBusiness Corporations Act(British Columbia) whereby the Company acquired all of the issued and outstanding Battle Mountain Shares. Under the terms of the Arrangement, former Battle Mountain shareholders (other than the Company) received 0.1891 Common Shares plus $0.08 in cash for each Battle Mountain Share held. In addition, other than certain options to acquire Battle Mountain Shares that were cancelled, options and warrants to acquire Battle Mountain Shares became exercisable for Common Shares, all in accordance with the terms of the Arrangement.

Battle Mountain was a reporting issuer listed for trading on the TSXV under the symbol “BMG”, and effective June 14, 2017, Battle Mountain Shares were de-listed from the TSXV. Battle Mountain owns a 100% interest in the 5,500 acres Lewis gold project located in Lander County, NV within the Battle Mountain trend (the “Lewis Gold Project”).

Dispositions

No significant dispositions have been completed by the Company since the commencement of its financial year ended December 31, 2018.

| |

| ITEM 5: | DESCRIPTION OF THE BUSINESS |

Summary

Gold Standard is an advanced stage gold exploration company focused on district scale discoveries on its Railroad-Pinion Project, located within the Carlin Trend, NV, USA. The Company is a mineral exploration company engaged, indirectly through its subsidiaries, in the acquisition and exploration of mineral properties in NV, USA. None of the Company’s properties are currently in production.

-13-

Specialized Skill and Knowledge

Management is comprised of a team of individuals who have extensive expertise and experience in the mineral exploration industry and exploration finance and are complemented by an experienced board of directors. See ITEM 12: “Directors And Officers”.

Competitive Conditions

The Company competes with other mineral exploration and mining companies for mineral properties, joint venture partners, equipment and supplies, qualified personnel and exploration and development capital. See ITEM 7: “Risk Factors” below.

Cycles

Given the general weather conditions and exploration season in north central NV, the Company’s exploration and evaluation assets expenditures tend to be greater from April to December than in the rest of the year.

Environmental Protection

The current and future operations of the Company, including potential development activities on its Railroad-Pinion Project or areas in which it has an interest, are subject to laws and regulations governing exploration, development, tenure, production, taxes, labour standard, occupational health, wastes disposal, greenhouse gas emissions, protection and remediation of environment, reclamation, mine safety, toxic substances and other matters. Compliance with such laws and regulations increases the costs of and delays planning, designing, drilling and developing the Company’s properties. The Company attempts to diligently apply technically proven and economically feasible measures to advance protection of the environment throughout the exploration and development process. Current costs associated with compliance are considered to be normal.

Employees and Consultants

The Company maintains a head office in Vancouver, B.C. and a branch office in Elko County, NV.

As of March 22, 2019, the Company engaged the full time services of 8 geologists and engineers, 1 general manager, 1 warehouse manager and 1 office administrator based in the Company’s NV office (December 31, 2018 – 10 geologists, 1 warehouse manager and 1 office administrator) and 7 persons at its Vancouver head office (December 31, 2018 – 7 persons). As operations require, the Company also retains geologists, engineers, and other consultants on a short term or per diem basis in Vancouver and NV, and in the field at its Railroad-Pinion Project.

Foreign Operations

The Railroad-Pinion Project is located in NV and the Company maintains a branch office in Elko County, NV.

Reorganizations

In December 2017, the Company completed a series of transactions undertaken to simplify the holding and funding structure of GSV and its subsidiaries. Under the reorganization, JKR Gold Resources (USA) Inc. and JMD Exploration Corp. were wound-up to simplify the corporate structure. Battle Mountain Gold (USA) Inc. and Madison Enterprises (Nevada) Inc. merged, with Madison Enterprises (Nevada) Inc. as the surviving entity, to simply the ownership of the Lewis Gold Project.

| |

| ITEM 6: | MATERIAL MINERAL PROJECT |

The Company considers the Railroad-Pinion Project comprised of its North Bullion Deposit, Dark Star Deposit and Pinion Deposit, the material mineral project for purposes of NI 43-101. Set forth below is certain mining and

-14-

technical information in relation to those deposits. The Railroad-Pinion Technical Report is the Company’s current technical report for the Railroad-Pinion Project.

The technical information included in this section is a summary of the technical information disclosed in the Railroad-Pinion Technical Report. Any additional drilling or metallurgical results disclosed subsequent to the date of the Railroad-Pinion Technical Report are included in ITEM 6.2: “Material Mineral Project - Mineral Projects – Recent Developments”.

Project Description,Location and Access

The Company controls a significant and largely contiguous land position of approximately 53,769 gross acres (21,760 gross hectares) in Elko County, NV, referred to as the “Railroad-Pinion Project” or “Railroad-Pinion”.

The Company has been actively exploring the Railroad-Pinion Project since the acquisition of its original position in 2010, including its subsequent strategic acquisitions, through systematic geological model-driven and aggressive exploration programs, including geological mapping, geochemical and geophysical surveying and drilling. To date, the Company has identified three major deposits within the Railroad-Pinion Project: the Dark Star Deposit, the North Bullion Deposit and the Pinion Deposit. Exploration in 2016 and 2017 yielded positive drilling results at all three deposits, which led to the definition of additional resource potential. Mining and technical information regarding the Pinion Deposit can be found in the Annual Information Form. Mining and technical information for the North Bullion Deposit and Dark Star Deposit is set out below.

Railroad-Pinion is located along the Piñon mountain range at the southeast end of the Carlin Trend, approximately 442km west of Salt Lake City, Utah, and 467km east of Reno, NV. It is between 13 and 29km south of Interstate 80, which is a four lane, east-west, transcontinental highway that serves as the primary highway in northern NV.

Primary access to Railroad-Pinion is by a series of paved and gravel roads from Elko, NV (population 18,300). The Railroad-Pinion Project can be reached by travelling westbound from Elko for 32km on Interstate 80 to the town of Carlin (population 2,400), and then south on State Highway 278 for 24km. At Ferdelford Canyon, an all-weather, 24km-long gravel road leads east to the North Bullion Deposit. The Dark Star Deposit is similarly accessed east from Highway 278 along a gravel road located immediately north of Trout Creek. The Railroad-Pinion Project area may also be reached during the summer and autumn months by traveling 48km southwestward from Elko, NV on the Bullion Road, a dirt/gravel road. At both the North Bullion Deposit and Dark Star Deposit, historic and/or recently created exploration roads combined with four-wheel drive tracks allow for access to many of the known target and prospect areas.

Railroad-Pinion’s 53,769 gross acres of subsurface mineral rights are comprised of 30,141 gross acres (12,198 gross hectares) that are owned 100% as patented and unpatented lode mining claims and a further 23,628 gross acres (9,562 hectares) in subsurface mineral rights on private lands. The private land ownership ranges from 49.2% to 100% yielding a net position of 20,657 gross acres (8,360 gross hectares) of subsurface mineral rights for the private lands within the Railroad-Pinion Project area. The Company is pursuing minority interests in the key private land parcels. The subsurface mineral rights for the private lands are held under contractual arrangement via ‘Surface Use Agreement with Conditional Purchase Option’, ‘Mining Lease and Agreement’, and ‘Mineral Lease Agreement’ contracts. Patented claims, private surface and private mineral property are wholly-owned and subject to lease agreement payments and property taxes (paid on an annual basis) as determined by Elko County. The estimated holding cost for the patented mineral claims, private lands, and leased unpatented claims controlled by the Company is US$1,023,649 per annum. Unpatented lode mining claims grant the mineral rights and access to the surface for exploration activities which cause insignificant surface disturbance. The mineral right is maintained by paying a maintenance fee of US$155 per claim to the Department of Interior, Bureau of Land Management (“BLM”) prior to the end of the business day on August 31 every year. A notice of intent to hold must also be filed with the Elko County Recorder on or before November 1 annually along with a filing fee of US$12 per claim plus a US$4 fee document charge. The Company’s estimated maintenance cost for the current package of unpatented lode claims is an additional US$249,723 per annum. Thus, the total cost for maintaining the current Railroad-Pinion Project on an annual basis is US$1,273,372.

The Company controls sufficient ground and has sufficient permitting to access the Railroad-Pinion Project and continue future exploration programs. The Company currently has three plans of operations and two notices of intent

-15-

in place for the Railroad-Pinion Project. It has drafted a Historic Properties Treatment Plan (“HPTP”) for archaeological sites within the Railroad Exploration Project Plan of Operations. The draft HPTP is currently being evaluated by the BLM. The Company has received a Reclamation Permit for the southern portion of the Railroad-Pinion Project that includes the Pinion Deposit and the Dark Star Deposit. This Reclamation Permit covers both private land and public land disturbances. Previously approved reclamation plans associated with these project areas will be closed by the respective permitting agency. No significant factors or risks were found which would limit the Company’s right or ability to perform work on the property.

Portions of the patented, unpatented and private lands are encumbered with production royalties predominantly in the form of standard Net (or Gross) Smelter Return agreements or Net Profit Interest agreements, with various buy down provisions, with the addition of a 3.5% NSR (relative to mineral interest) to Dominek Pieretti and Tusca Sullivan on Sections 3, 5, 7, 8, 9, 10, 15, 17, 19, 21, 29, 31, and 33, Township 29N, Range 53E, and Section 33, Township 30N, Range 53E. There is no current mineral production at the Railroad-Pinion Project. For further information, see ITEM 4.2: “General Development of the Business – Three Year History–Land Expansion”.

History

The Railroad Mining District was intermittently active as a copper, lead, silver, zinc and gold district from 1869 until the early 1960s, when modern exploration began. Since 1967, 15 companies have explored in the Railroad-Pinion Project area as a whole, conducting rock and soil sampling, surveying and drilling programs throughout the property. As the work progressed in the Railroad District new geologic interpretations plus base- and precious-metal surface sample results were combined with favorable drill results; expanding the target types being explored for and widening the range of commodities being explored for.

Pinion and Dark Star

Exploration activity at the southern portion of Railroad-Pinion dates back to the discovery of the Pinion Prospect in 1980 by Newmont Mining Corporation (“Newmont”) with the majority of the historic work being conducted in the late 1980s and early to mid-1990s. The historical work completed identified a significant zone of Carlin-type gold mineralization at the Pinion Prospect (section 22 and 27, T30N, R53E). In 1990, rock and soil sampling identified anomalous surface geochemistry in the area of the Dark Star Deposit. Follow-up drilling in 1991 resulted in the confirmation of bedrock hosted mineralization at the Dark Star Deposit (section 25, T30N, R53E).

Historic drilling identified an approximately north-south trending mineralized zone at the Dark Star Deposit, the Dark Star Corridor (“DSC”). The 1992 drilling defined a 90m thick zone of generally lower grade (<0.025 opt[0.85ppm]Au), somewhat bedding conformable mineralization. The mineralization remained open in three directions (north, east and west). Anomalous gold mineralization at the Dark Star Deposit was intersected over an area 610m along a north-south trend by up to 490m in width and to a depth of 690f. (210m) below surface. Highlight historic intersections at the Dark Star Deposit include 0.044 opt (1.58 g/t) gold (or “Au”) over 28.96 m in hole CDS-001 and 0.061 opt (2.1 g/t) over 76.20 m in hole CDS-053.

Several historic mineral resource estimates have been completed by a variety of companies for the Dark Star Deposit. A review of the historical data within the existing drill hole database did not identify any significant issues with these estimates. Where issues were found, original data was reviewed and the database was corrected. As a result, the historic drill data provides sufficient reliability to warrant the disclosure of the following historic mineral resource estimates. However, the historic estimates summarized below were calculated prior to the introduction of the standards set forth in NI 43-101 and current Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) standards for mineral resource estimation. The authors of the Railroad-Pinion Technical Report have referred to these estimates as “historic resources” and the reader is cautioned not to treat them, or any part of them, as current mineral resources. There is insufficient information available to properly assess data quality, estimation parameters and standards by which the estimates were categorized. The historic resource estimate described below should not be relied upon and has only been included to demonstrate the mineral potential of the Dark Star Deposit. It has been superseded by a NI 43-101 mineral resource estimate for the Dark Star Deposit, which is included in the section entitled “Mineral Projects – Mineral Resource and Mineral Reserve Estimates – Dark Star”.

The historic mineral resource estimate calculated for the Dark Star Deposit, which also encompassed the Pinion Deposit, was completed in 1995 by Cyprus Metals. It comprises a polygonal estimate and a Multiple Indicator

-16-

Kriging estimate using Mintec’s MEDSystem software. The polygonal estimate incorporated both high density and low density drilling at, and surrounding, the zones of mineralization. Polygons were constructed using cross-sectional drill hole information and were classified as “proven” in areas where drill density was high (< 100ft, where polygons were projected <50ft on either side of a section). Polygons with drill hole spacing between 100ft and 200ft were classified as “probable” and those with relatively wide spacing >200ft were classified as “inferred”. The resource was calculated by summing all polygons with an average grade above a cutoff of 0.01opt Au. The original classification of the 1995 polygonal Pinion resource is not consistent with either NI 43-101 of CIM definition standards.

North Bullion

Historic exploration data has not been compiled for the North Bullion Deposit separately from that of the Railroad-Pinion Project as a whole. The North Bullion Deposit was a blind gold discovery in 2010, when a process of vectoring from surface gravity surveys, combined with geological models and geological drill hole data, led to favorable intercepts in the area and subsequent extensive exploration by the Company. The gold system remains open in all directions and spans an area of 400m by 1,200m. Historic resource estimates exist for the nearby POD and East Jasperoid deposits (as shown in the adjacent figure), but not for the North Bullion Deposit itself. For a discussion on the history of the Railroad-Pinion Project as a whole, see ITEM 6.1: “Material Mineral Project - Mineral Projects –History”, above.

Geological Setting,Mineralization and Deposit Types

Regional and Local Geology

Exploration work by the Company at the Railroad-Pinion Project is ongoing and the prospect-scale understanding of the geology and mineralization thus far encountered is evolving as result of the Company’s systematic approach to exploration and data analysis. However, the regional and local scale geological setting is relatively well understood and the below applies to both the Dark Star Deposit and North Bullion Deposit.

The Railroad-Pinion Project is located within the Carlin Trend, a northwest-southeast alignment of sedimentary rock-hosted gold deposits and mineralization, comprised of more than 40 separate gold deposits that have produced more than 80 million ounces of gold to date. Railroad-Pinion is centered on the fourth and southernmost dome-shaped window on the Carlin Trend in the Piñon Range. The domes are cored by igneous intrusions that uplift and expose Paleozoic rocks and certain stratigraphic contacts that are favorable for the formation of Carlin-style gold deposits. The Railroad-Pinion Project area covers a significant portion of the southernmost structural window within the Carlin Trend that exposes prospective Upper Paleozoic (Devonian – Pennsylvanian/Permian) units that host gold mineralization often associated with multilithic collapse breccias elsewhere in the district. The core of the Piñon Range is comprised of an allochthonous and autochthonous sequence of Ordovician through Mississippian marine sedimentary rocks. Folds are present, but horst and graben structure developed within a framework of high-angle faults dominates the structure of the range. Tertiary sedimentary rocks deposited in shallow, fresh water lakes and overlying intermediate to felsic tertiary volcanic rocks are present on the flanks of the range and within surrounding grabens.

Several aspects of the geologic setting complicate gold exploration in northern NV. The largest gold deposits are hosted in the carbonate-rich eastern facies of lower to middle Paleozoic rocks, with much less mineralization found in the allochthonous, western facies siliciclastic rocks. Because of this, most gold mineralization has been discovered where “windows” through the western facies rocks above the Roberts Mountain Thrust expose eastern facies rocks. Miocene volcanic rocks also obscure the underlying geology, almost certainly concealing numerous, to-be-discovered deposits. The extensional faulting distorts and dismembers pre-existing features (including ore deposits), making the projection of mineralized trends beneath younger cover rocks especially difficult.

Pinion

The geological setting including the stratigraphic units and the overall tectonic history of the Pinion Deposit is the same as that described below for the North Bullion Deposit. The Carlin-style gold mineralization of the Pinion Deposit is similar in setting and style to the mineralization of the North Bullion Deposit.

-17-

The Pinion Deposit lies at the southeastern end of the Carlin gold trend and is hosted by a sequence of Paleozoic sedimentary rocks exposed within large structural horst blocks in which the sedimentary rocks have been broadly folded into a southward plunging asymmetric anticline. The apparent dip of the western fold limb ranges from 10 to 25 degrees and the steeper eastern limb dips 35 to 50 degrees. Carlin-type mineralization at the Pinion Deposit is hosted in dissolution collapse breccia developed along the contact between the underlying Devonian Devils Gate Limestone Formation and the overlying Mississippian Webb Formation fine grained clastic sediments and Tripon Pass Formation silty micrite. The Pinion thrust occurs beneath or along the base of the deposit and emplaced Devonian Devils Gate Limestone on top of Mississippian Chainman sandstone. An additional zone of mineralization has been identified at the Pinion Deposit hosted within the Sentinel Mountain dolomite and the top of the underlying Oxyoke sandstone below the Devils Gate Limestone. Gold deposition is thought to have occurred contemporaneous with breccia development and with late silica flooding and quartz veining. Barite-rich breccias can also be observed associated with jasperoid bodies at surface.

Gold deposition is thought to have occurred during the Eocene at the same time as formation of the dissolution collapse breccia. Significant control on the distribution of gold appears to have been exerted by folding/horst development in that the highest grades and thickest mineralization occurs in the apical hinge portion of the coincident Pinion anticline and main horst block. Breccias and gold zones thicken noticeably towards high angle faults, which likely acted as conduits for the gold-bearing hydrothermal fluids.

Dark Star

The Dark Star Deposit lies along the DSC, a north-south zone of gold mineralization and alteration that has affected the Mississippian Chainman, and Pennsylvanian-Permian carbonate rocks. Gold mineralization at the Dark Star Deposit has been identified within a decalcified and silicified Pennsylvanian-Permian carbonate unit, consisting of debris flow conglomerate, bioclastic limestone, calcarenite, calcisiltite and minor silty mudstone. These carbonate host rocks were mapped by the United States Geological Survey as undifferentiated Tomera and Moleen Formations. The Dark Star Deposit is hosted in relatively younger, Pennsylvanian-Permian rocks compared to the rest of the Railroad-Pinion Project, however, its overall tectonic history is similar to other parts of Railroad-Pinion. Thus, the Dark Star Deposit lies stratigraphically up section relative to the remainder of the Railroad-Pinion Project.

Exploration at the Dark Star Deposit area has demonstrated the presence of Carlin-style gold mineralization. The gold mineralization is hosted along contacts with and within a west-dipping conglomerate and bioclastic limestone bearing unit sandwiched between overlying and underlying calcarenite and calcisiltite units. These sedimentary rocks are cut by thin rhyolite dikes along the DSC. Dark Star Deposit gold mineralization occurs in a 400 to 600m wide, 6km long, linear, north trending horst that is part of a structural zone defined as the DSC, which exposes altered and silicified Pennsylvanian siliciclastic and carbonate rocks. North-south trending gold mineralization at the Dark Star Deposit has been intersected over an area approximately 610m long, up to 490m wide and up to a depth of 210m below surface.

The detailed deposit models utilized by the Company are based on direct exploration and mine development experiences on the Carlin and Battle Mountain-Eureka gold trends by Company geologists and include the following elements; uplifted siliciclastic and carbonate rocks favorable for development of Carlin-style sedimentary rock-hosted gold deposits; similar geologic patterns of Paleozoic host rocks; similar geologic patterns of alteration and mineralization at Railroad-Pinion to well-documented disseminated gold deposits on the Carlin Trend; the presence of collapse style breccias at Railroad-Pinion that host gold mineralization; close proximity to a multi-phase igneous stock; dike/sill-filled fault corridors; and the presence of west-northwest, north-south, northeast and northwest striking faults and folds. The identification of these geologic patterns at the Railroad-Pinion Project lends credence to the mineralization models that are being used at the Dark Star Deposit.

North Bullion

The North Bullion horst is bounded to the east and west by younger, generally flat lying, dacitic to rhyolitic tuffs of the Indian Well formation which become more felsic upwards. The Indian Well formation contains phenocrysts of quartz, sanidine, hornblende and biotite within a pink to grey groundmass, and rests on top of an angular unconformity above the underlying Eocene Elko Formation in the eastern hanging wall of the North Bullion Fault Zone (“NBFZ”). The Eocene Elko Formation is found within the eastern hanging wall of the NBFZ and consists of

-18-

thick to thinly bedded mudstone, sandstone, chert pebble conglomerate, fresh water limestone, and tuffaceous sediments.

The North Bullion horst itself consists of thick bedded, coarsening upward mudstone, sandstone and minor conglomerate of the Mississippian Chainman Formation which contains 1 to 7m thick dacite sills from 100 to 200m below the surface. Dacite dikes occur along steeply dipping faults within the NBFZ. In between the upper and lower

Chainman Formation is a sequence of mixed carbonate and siliciclastic rocks which are interpreted to belong to the Mississippian Tripon Pass Formation. Two layers within the Tripon Pass Formation act as informal marker units. Limestone 1 is a dark grey, laminated to thinly bedded micrite located at the top of the Tripon Pass Formation, and Limestone 2 is a grey, medium to thick bedded calcisiltite to calcarenite located approximately 55m below Limestone 1. The Tripon Pass Formation hosts the upper gold zone at the North Bullion Deposit and locally contains >6 g/t Au. The Tripon Pass Formation is underlain by the variably bedded sandstone, conglomerate and silty mudstones of the Mississippian Chainman Formation.

Underlying the Chainman Formation, in low angle fault contact is the Devonian Devils Gate Limestone, composed of grey, thick bedded calcarenite and minor micrite, between 60 to 150m thick. Dissolution collapse breccia developed at the top of the Devils Gate Limestone is host to high-grade gold within the lower zone at the North Bullion Deposit. In the northern portion of the deposit, silty mudstone of the Mississippian Webb Formation and silty micrite of the Mississippian Tripon Pass Formation, are important hosts to gold, and are preserved along the low angle fault contact between the Chainman Formation and the Devils Gate Limestone. Beneath the Devils Gate Limestone, there is a transitional contact into the Sentinel Mountain Dolomite that has an average thickness of 150m and is in transitional contact with calcareous sandstone of the underlying Oxyoke Formation. The Oxyoke Formation consists of cross bedded, well rounded quartz grains which are either matrix or grain supported, and is approximately 120m thick. Located between the Massif and West Strand faults there is tectonic and dissolution collapse breccia that extends from the lower contact of Limestone 1 to the top of the Devils Gate Limestone. Finally, the deepest drill holes at the North Bullion Deposit bottomed in thin to thick bedded dolomite of the Devonian Beacon Peak Dolomite.

Mineralization at the North Bullion Deposit occurs as Carlin-style disseminated gold that is focused in the footwall of the NBFZ. The footwall is a horst of Paleozoic siliciclastic and carbonate rocks, whereas the hanging wall is a deep graben filled with Tertiary volcanic rocks. In the footwall north-south-, northwest-, west-northwest- and northeast-striking faults appear to be important controls on mineralization.

In general, gold is hosted in two zones, a gently to moderately dipping upper zone of strongly sheared siliciclastic and carbonate rocks (a mixed composite of Mississippian Webb and Tripon Pass formations) and a flat lying, lower zone of dissolution collapse breccia developed above and within silty micrite of the Mississippian Tripon Pass Formation and calcarenite of the Devonian Devils Gate Limestone. Between strands of the NBFZ, breccia with both collapse and tectonic features propagated upwards through the Mississippian section incorporating Webb Formation silty mudstone, Tripon Pass Formation silty micrite and Chainman Formation sandstone.

Gold zones range from 105 to 400m in depth, and steepen from flat (10 degrees) to moderate (45 degrees) dips to the east, as they approach the eastern strand of the NBFZ. Gold is associated with sooty sulphides, silica, carbon, clay, barite, realgar and orpiment in addition to elevated As, Hg, Sb and Tl. High-grade (> 6 g/t Au) gold has been intercepted in both the upper and lower gold zones.

Intrusive relationships and tilting of units indicate the deposit formed during an Eocene event with synchronous intrusion, hydrothermal activity and extensional movement on graben-bounding faults. Dacite sills, dated at 38.2-38.8 Ma, intruded steeply dipping faults within the NBFZ and low angle, bedding parallel faults, capping the gold system. The margins of dacite dikes and sills are commonly sheared and some dacite occurs as clasts within mineralized dissolution collapse breccia, indicating continued movement along faults and hydrothermal activity after emplacement of the dacite. In fault steps within the NBFZ, the Eocene Elko Formation has the same moderate eastward dip as the underlying Paleozoic rocks. All of this evidence supports the formation of the North Bullion Deposit during a very dynamic, focused Eocene event with synchronous extension, intrusion and Carlin-style mineralization.

The detailed deposit models utilized by the Company are based on direct exploration and mine development experiences on the Carlin and Battle Mountain-Eureka gold trends by Company geologists and include the following

-19-

elements; uplifted siliciclastic and carbonate rocks favorable for development of Carlin-style sedimentary rock-hosted gold deposits; similar geologic patterns of Paleozoic host rocks; similar geologic patterns of alteration and mineralization at Railroad-Pinion to well-documented disseminated gold deposits on the Carlin Trend; the presence of collapse style breccias at Railroad-Pinion that host gold mineralization; close proximity to a multi-phase igneous stock; dike/sill-filled fault corridors; and the presence of west-northwest, north-south, northeast and northwest striking faults and folds. The identification of these geologic patterns lends credence to the mineralization models that are being used.

Exploration

The Company has been exploring the Railroad-Pinion Project as a whole since 2010, discovering new exploration targets and advancing known prospects and deposits by executing systematic, geological model-driven and aggressive exploration. The Dark Star Deposit was acquired by the Company in 2014 as part of a larger land acquisition, and exploration work largely focused on this newly acquired property in 2015. Work completed in 2016 focused primarily on the Dark Star Deposit area, which included exploration at the Dark Star Main Zone, the Dark Star North Zone and the DSC. Exploration work has consisted of geological mapping, geochemical and geophysical surveys, soil and rock sampling, and drilling (discussed under the heading “Material Mineral Project – Mineral Projects – Drilling – Dark Star”, below).

To improve and standardize historical data, Company geologists have implemented a factual-based format of geological mapping (Anaconda Style) using multiple map layers to record, illustrate and synthesize geological data at a common scale. There is a significant and growing database of geophysical information for the Railroad-Pinion Project, including the Dark Star Deposit, which includes gravity, Controlled-Source Audio Magneto-Telluric (“CSAMT”) and ground magnetic surveys. These surveys have been employed to aid in identifying geological structures, key lithologies and zones of hydrothermal alteration related to mineralization. Additionally, the geophysical surveys have aided in drill hole targeting and have identified multiple exploration targets.

Drilling

The Company has conducted drilling on the Railroad-Pinion Project as a whole since 2010 to test the extent of known mineralization, support ongoing geological modelling and resolve current geological models. After the Company’s acquisition of the southern portion of the Railroad-Pinion Project in 2014, efforts focused on the Pinion Deposit and Dark Star Deposit and their surrounding areas.

Pinion

The Company first focused on the North Zone and northern portion of the Main Zone, after which the focus shifted to extending areas of known shallow gold mineralization along strike and at depth and to test newly identified exploration targets. From 2014 to 2015, the Company completed 81 reverse-circulation (“RC”) and diamond drill holes totalling 22,498.5 m. In 2016, the Company completed a total of 25 drill holes in the Pinion Deposit area totalling 8,053.7 m. Drilling at the Pinion Deposit was designed to extend known zones of mineralization, provide additional ‘in-fill’ data for specific zones, provide material for continued metallurgical testing (“met holes”) and included several holes that were intended to test the Irene geological/geochemical target west of the Pinion Deposit and the new Sentinel target to the north of the Pinion Deposit.

Dark Star

In 2015, the Company completed a two-phase drill program in the Dark Star Deposit area, completing 13 RC and diamond drill holes totalling 5,048.1m and identified significant gold mineralization. The drilling intersected a vertically extensive oxide gold zone hosted in variably silicified and quartz veined bioclastic debris flows and conglomerates within Pennsylvanian-Permian units that lie stratigraphically higher than the Devonian Devils Gate–Tripon Pass, host to the Main Pinion Zone of gold mineralization. The final 2015 drill hole at the Dark Star Deposit was a core hole (DS15-13, which twinned RC hole DS15-11) that had identified multiple significant intersections of gold mineralization approximately 500m north of the Dark Star Main Zone.

-20-

The primary focus of the 2016 drill program was the Dark Star Deposit area with 40 drill holes completed totaling 17,850m over the Dark Star Main and North Zone and along the DSC. The drilling at the Dark Star Deposit area extended the known mineralization of the Main Zone to the west and northwest and extended the zone of known mineralization into the new North Zone, joining the two targets, and highlighting the gold potential of the entire DSC. The results from the 2016 drilling at the Dark Star Deposit led to revised geological modelling and an updated NI 43-101 mineral resource estimate.

North Bullion

In 2010, the Company utilized gravity geophysical data and geological models to identify an untested target that lead to intercepts of 32m of 1.39g Au/t and 43.6m of 1.21 g/t Au in drill hole RR10-8 completed at the North Bullion Deposit. This blind discovery of sediment-hosted Carlin-style gold mineralization by the Company lead to more than 50% of drilling conducted from 2010 to 2013 within the North Bullion Deposit area. Additional drilling focused on testing geological, geophysical and/or geochemical targets for gold, silver and/or base metal mineralization.

Drilling conducted during 2012 and 2013 confirmed and expanded a significant Carlin-style, disseminated gold system at the North Bullion Deposit, and identified new mineralized zones at the Bald Mountain and Sylvania (Central Bullion) targets. Drilling at the North Bullion Deposit during 2015 focused on expanding a zone of higher grade gold mineralization within the “lower collapse breccia”. In 2016, the drilling program at the northern portion of the Railroad-Pinion Project was designed to extend known mineralization and to test new targets at the North Bullion Deposit, among other identified targets. Drilling at the North Bullion Deposit extended the zone of known mineralization to the north and northwest. The 2016 North Bullion drilling highlights included:

| 1. | a 65.6m core length interval of 3.17 g/t Au that includes a 8.5m interval of 11.16 g/t Au from drill hole RR16-01; and |

| | |

| 2. | a 19.8m core length interval of 4.4 g/t Au that includes a 5.3m interval of 7.02 g/t Au from drill hole RR16-05. |

Before September 15, 2017, the effective date of the Railroad-Pinion Technical Report, the Company completed a total of 5 RC/core combination drill holes at North Bullion that totaled 2,442.4m as part of its 2017 drill program. The program included step out drilling and testing of new targets at the northern part of the North Bullion area. Results from the drill program extended mineralization some 200m to the north from previous intersections in drill holes RR16-02 and RR16-05. Step-out holes an additional 300m to the north (RR17-04 and RR17-05) returned anomalous gold assays, with the intersections considered low grade and narrow to moderate thickness compared to intervals to the south. The North Bullion Deposit 2017 drilling highlights up to September 15, 2017 included:

| 1. | a 4.6m core length interval of 0.45 g/t Au in drill hole RR17-01; |

| | |

| 2. | a 1.2m core length interval of 2.16 g/t Au in drill hole RR17-03; and |

| | |

| 3. | a 24.4m core length interval of 0.46 g/t Au from drill hole RR17-04. |

Sampling,Analysis and Data Verification

The sample collection, security, transportation, preparation, insertion of geochemical standards and blanks, and analytical procedures have been found to be within industry norms and best practices. The procedures utilized by the Company are considered adequate to insure that the results disclosed are accurate within scientific limitations and are not misleading. Data verification of the analytical results includes a statistical analysis of the duplicates, standards and blanks that must pass certain parameters for acceptance to insure accurate and verifiable results.

Sampling and Analysis

All sampling is conducted under the supervision of the Company’s project geologists and the chain of sample custody from the field to the sample preparation facility is continuously monitored.

-21-

For surface sampling, a blank or certified reference material is inserted approximately every forty samples for soil and rock samples.

Drill core is collected from the drill rig by Company personnel and transported to the Company’s Elko, NV office on a daily basis. At the Elko facility, Company personnel complete the following:

| 1. | A geological log is completed on the whole core. Logs illustrate core recovery, sample intervals, lithologic data, hydrothermal alteration and structural features with respect to the core axis; |

| 2. | The whole core is marked/tagged for sampling, and digitally photographed; |

| | |

| 3. | Core is cut (rock sawed) and sawed core sample intervals are recorded on daily cut core sheets for review each day; |

| | |

| 4. | Samples for geochemical analysis are collected with the remaining core for each retained in their original core boxes; and |

| | |

| 5. | Standard reference materials (standards and blanks) are inserted into the sample sequence at a rate of approximately 1 in every 10 to 15 samples. |

RC drill samples are collected by the drilling contractor using a wet sample splitter on the drill rig. Samples typically range from 5 to 20 pounds. Geochemical standards and/or blanks are inserted by Company geologists every 10 to 15 samples.

All samples are delivered to eitherALS Chemex’s (“ALS”) or Bureau Veritas’ (“BV”) preparation facilities in Elko, NV or Sparks, NV where they are crushed so that +70% passes a 6mm screen, then it is finely crushed so that +70% passes a 2mm screen. A 250g (~0.5 pound) split (original pulp) is then selected and pulverized to better than 85% passing a 75 micron screen. Resulting pulps are shipped to either ALS or BV certified laboratories in Sparks, NV or Vancouver, BC. Pulps are digested and analyzed for gold using fire assay fusion and an atomic absorption spectroscopy (“AAS”) or by ICP-AES finish on a 30g aliquot. All other elements are determined using a 0.5g aliquot of the pulp that is analyzed by wet chemical methods that compriseaqua regiaacid digestion followed by ICP-AES analysis. All samples that assay greater than 0.14ppm gold are follow-up assayed for Au by cyanide leach utilizing a 30g aliquot and a leach time of about an hour. The target areas that yield high levels of geochemical silver (or “Ag”) and greater than 0.14ppm Au are follow-up assayed for total Ag by four acid digestion followed by AAS finish and for Au and Ag by cyanide leach utilizing a 30g aliquot and a leach time of about an hour. The cyanide leach samples are finished using AAS.

All original geochemical analyses are completed by either ALS or BV, both internationally accredited independent analytical companies with ISO9001:2008 certification.

Quality Control and Data Verification

The following section details the Quality Assurance and Quality Control (“QA/QC”) program employed by the Company between 2010 and 2017.

For non-analytical field data, the Company employs a variety of protocols and procedures to insure data integrity. For example, during surface geochemical sampling (rock grab and soil sampling), samplers are required to enter sample locations and descriptive information into computers daily and locations are checked to eliminate data input errors. For non-analytical drill hole information, the Company employs a similar protocol of continuous data checking to insure the accurate recording within the drilling database. This includes both collar and down hole survey information as well as all geological and geotechnical information from both core and RC chip logging. These procedures are considered reasonable and adequate and insure data integrity.

The analytical portion of the QA/QC program employed by the Company aims to insure the overall accuracy and precision of the assaying that is performed on its drilling samples. To this end, Company personnel insert samples of standard reference materials (standards and blanks) into the Company’s sample stream, along with duplicate samples. The standard samples are certified to contain a known concentration of an element (or elements), in this case gold, including blank (pulp) samples that are a type of standard that are certified to contain Au below detectable

-22-