Exhibit 99.1

ANNUAL INFORMATION FORM

For the Year Ended December 31, 2021

(Dated March 25, 2022)

GOLD STANDARD VENTURES CORP.

Suite 610 – 815 West Hastings Street

Vancouver, B.C.

V6C 1B4

TABLE OF CONTENTS

| ITEM 1: | | PRELIMINARY NOTES | 4 |

| 1.1 | | Effective Date of Information | 4 |

| 1.2 | | Financial Statements and Management Discussion and Analysis | 4 |

| 1.3 | | Currency | 4 |

| 1.4 | | Imperial and Metric Conversions | 4 |

| ITEM 2: | | CAUTIONARY NOTES | 5 |

| 2.1 | | Cautionary Note Regarding Forward Looking Statements and Forward Looking Information | 5 |

| 2.2 | | Cautionary Notes Regarding Mineral Resource Estimates | 8 |

| ITEM 3: | | CORPORATE STRUCTURE | 10 |

| 3.1 | | Name, Address and Incorporation | 10 |

| 3.2 | | Inter-corporate Relationships | 10 |

| ITEM 4: | | GENERAL DEVELOPMENT OF THE BUSINESS | 11 |

| 4.1 | | Overview | 11 |

| 4.2 | | Three Year History | 11 |

| ITEM 5: | | DESCRIPTION OF THE BUSINESS | 18 |

| ITEM 6: | | MATERIAL MINERAL PROJECT | 20 |

| 6.1 | | Mineral Projects | 20 |

| | | Feasibility Study Overview and Principal Findings | 20 |

| | | Property Description and Ownership | 22 |

| | | Exploration and Mining History | 24 |

| | | Geology and Mineralization | 24 |

| | | Data Verification | 25 |

| | | Processing and Metallurgical Testing | 26 |

| | | Recovery Methods | 27 |

| | | Mineral Resource Estimate | 27 |

| | | Mineral Reserve Estimate | 29 |

| | | Mining Methods | 30 |

| | | Infrastructure | 30 |

| | | Environment and Permitting | 31 |

| | | Water Management | 32 |

| | | Capital Cost Summary | 32 |

| | | Operating Cost Summary | 32 |

| | | Conclusions and Recommendations | 33 |

| 6.2 | | Recent Developments | 33 |

| ITEM 7: | | RISK FACTORS | 33 |

| 7.1 | | Risks Relating to the Company | 34 |

| 7.2 | | Risks Relating to the Mining Industry | 41 |

| 7.3 | | Risks Relating to Shares | 45 |

| ITEM 8: | | DIVIDENDS | 49 |

| ITEM 9: | | DESCRIPTION OF CAPITAL STRUCTURE | 49 |

| ITEM 10: | | MARKET FOR SECURITIES | 50 |

| 10.1 | | Trading Price and Volume | 50 |

| 10.2 | | Prior Sales | 50 |

| ITEM 11: | | ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER | 52 |

| ITEM 12: | | DIRECTORS AND OFFICERS | 52 |

| 12.1 | | Name, Occupation and Security Holding | 52 |

| 12.2 | | Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 57 |

| 12.3 | | Conflicts of Interest | 58 |

| ITEM 13: | | LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 60 |

| 13.1 | | Legal Proceedings | 60 |

| 13.2 | | Regulatory Actions | 60 |

| ITEM 14: | | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 60 |

| ITEM 15: | | TRANSFER AGENT AND REGISTRAR | 60 |

| ITEM 16: | | MATERIAL CONTRACTS | 61 |

| ITEM 17: | | INTERESTS OF EXPERTS | 61 |

| 17.1 | | Names of Experts | 61 |

| 17.2 | | Interests of Experts | 62 |

| ITEM 18: | | AUDIT COMMITTEE | 62 |

| 18.1 | | The Audit Committee Charter | 62 |

| 18.2 | | Composition of Audit Committee | 62 |

| 18.3 | | Relevant Education and Experience | 63 |

| 18.4 | | Reliance on Certain Exemptions | 64 |

| 18.5 | | Reliance on the Exemption in Subsection 3.3 (2) or Section 3.6 | 64 |

| 18.6 | | Reliance on Section 3.8 | 64 |

| 18.7 | | Audit Committee Oversight | 64 |

| 18.8 | | Pre-Approval Policies and Procedures | 64 |

| 18.9 | | External Audit Service Fees (By Category) | 64 |

| ITEM 19: | | ADDITIONAL INFORMATION | 65 |

| | |

| SCHEDULE “A” – Audit Committee Charter | |

| 1.1 | Effective Date of Information |

References to “Gold Standard Ventures”, “Gold Standard”, “GSV”, the “Company”, “its”, “our” and “we”, or related terms in this Annual Information Form (“AIF”), refer to Gold Standard Ventures Corp. and includes, where the context requires, its subsidiaries.

All information contained in this AIF is as at December 31, 2021, unless otherwise stated.

| 1.2 | Financial Statements and Management Discussion and Analysis |

This AIF should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2021 (the “Financial Statements”), and the accompanying Management’s Discussion and Analysis (“MD&A”) for such period. The Financial Statements and MD&A are available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) website at www.sedar.com under the Company’s profile.

All references to “$” or “dollars” in this AIF are to lawful currency of Canada unless otherwise expressly stated. References to “US$” are to United States dollars.

| 1.4 | Imperial and Metric Conversions |

To Convert From | To | Multiply By |

| | | |

| Feet (“ft”) | Metres (“m”) | 0.305 |

| Metres (“m”) | Feet (“ft”) | 3.281 |

| Miles (“mi”) | Kilometres (“km”) | 1.609 |

| Kilometres (“km”) | Miles (“mi”) | 0.621 |

| Acres | Hectares | 0.405 |

| Hectares | Acres | 2.471 |

| 2.1 | Cautionary Note Regarding Forward Looking Statements and Forward Looking Information |

Certain statements and information contained in this AIF constitute “forward looking statements” and “forward looking information” within the meaning of applicable securities legislation. Forward looking statements and forward looking information include statements concerning the Company’s current expectations, estimates, projections, assumptions and beliefs, and, in certain cases, can be identified by the use of words such as “seeks”, “plans”, “expects”, “is expected”, “budget”, “estimates”, “intends”, “anticipates”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would”, “might” or “will”, “occur” or “be achieved”, or the negative forms of any of these words and other similar expressions.

Examples of forward looking information in this AIF may pertain to the following, among others:

| 1. | existence and estimates of mineral resources or mineral reserves and timing of development thereof; |

| 2. | exploration and work programs, including reference to the Company’s plans of operations and notices of intent in place for the Railroad-Pinion Project (as defined below); |

| 3. | the need for additional funding to acquire further property interests and maintain and/or carry out exploration work thereon, and for general and administrative and working capital purposes; |

| 4. | plans to pursue minority interests in certain key private land parcels where the Company currently holds less than a 100% interest; |

| 5. | performance characteristics of mineral properties; |

| 6. | results of various projects; |

| 7. | design of mining operations; |

| 8. | estimated production rates, capital expenditures, operating costs, and expected or anticipated economic returns from the Railroad-Pinion Project; |

| 9. | anticipated processing and recovery operations; |

| 10. | the anticipated infrastructure needed to support the Railroad-Pinion Project; |

| 11. | planned environmental, permitting and compliance activities, including the anticipated need for an Environmental Impact Statement and an Individual Section 404 Permit from the United States Army Corps of Engineers; |

| 12. | the anticipated results of required evaluations of social and community issues connected with the Railroad-Pinion Project; |

| 13. | the timing of completion of cultural resource surveys, analysis of sampled mineralized material and hydrogeological evaluation in respect of the SRMP (as defined below); |

| 14. | the timing and content of the TPPC (as defined below) to be submitted in respect of the Railroad-Pinion Project; |

| 15. | mineral resource or mineral reserve predictions based on recent drilling results; |

| 16. | the anticipation that sales of common shares in the capital of the Company (“Common Shares”) by hedging or arbitrage trading activity may occur; |

| 17. | projections of market prices and costs, including estimates of costs and budgeting for potential exploration operations and mining scenarios; |

| 18. | estimated property holding and maintenance costs for the Railroad-Pinion Project; |

| 19. | drilling plans and timing of drilling; |

| 20. | pre-production mining plans and the timing of pre-production mining; |

| 21. | total production cost includes mine operations, process plant operations, general and administration, reclamation and closure, and government fees; |

| 22. | the production of a formal environmental, social and governance report; |

| 23. | the Company’s intention not to declare or pay dividends in the foreseeable future, along with the intention to retain all future earnings, if any, and other cash resources for future operation and development; |

| 24. | treatment under governmental regulatory regimes and tax laws, including the expectation that the Company will be a passive foreign investment company for the taxable year ended December 31, 2021; and |

| 25. | capital expenditure programs and the timing and method of financing thereof. |

Forward looking statements and forward looking information reflect the Company’s current expectations and assumptions, and are subject to a number of known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward looking statements and forward looking information, including without limitation:

| 1. | the Company’s limited operating history; |

| 2. | the Company’s history of losses and expectation of future losses; |

| 3. | uncertainty as to the Company’s ability to continue as a going concern; |

| 4. | the existence of mineral resources and mineral reserves on the Company’s mineral properties; |

| 5. | the Company’s ability to obtain adequate financing for exploration and development; |

| 6. | the Company’s ability to attract and retain qualified personnel; |

| 7. | the Company’s ability to carry out operations in accordance with plans in the face of significant disruptions; |

| 8. | the Company’s ability to convert mineral resource estimates previously classified as Inferred to Indicated or Measured; |

| 9. | fluctuations in foreign exchange or interest rates and stock market volatility; |

| 10. | uncertainty as to the Company’s ability to maintain effective internal controls; |

| 11. | the involvement by some of the Company’s directors and officers with other natural resource companies; |

| 12. | the uncertain nature of estimating mineral resources and mineral reserves; |

| 13. | uncertainty surrounding the Company’s ability to successfully develop its mineral properties; |

| 14. | exploration, development and mining risks, including risks related to infrastructure, accidents and equipment breakdowns; |

| 15. | risks related to natural disasters, climate change, terrorism, civil unrest, public health concerns (including health epidemics or outbreaks of communicable diseases such as the coronavirus) and other geopolitical uncertainties; |

| 16. | title defects to the Company’s mineral properties; |

| 17. | the Company’s ability to obtain all necessary permits and other approvals; |

| 18. | risks related to equipment shortages, access restrictions and inadequate infrastructure; |

| 19. | increased costs and restrictions on operations due to compliance with environmental legislation and potential lawsuits; |

| 20. | fluctuations in the market price of gold, other metals and certain other commodities (such as natural gas, fuel, oil, and electricity); |

| 21. | the Company’s ability to secure additional financing to continue exploration and development activities on the Railroad-Pinion Project and meet future obligations as required from time to time; |

| 22. | intense competition in the mining industry; and |

| 23. | the Company’s ability to comply with applicable regulatory requirements. |

In making the forward looking statements and developing the forward looking information included in this AIF, the Company has made various material assumptions, including, but not limited to:

| 1. | the results of the Company’s proposed exploration programs on the Railroad-Pinion Project will be consistent with current expectations; |

| 2. | the Company’s assessment and interpretation of potential geological structures and mineralization at the Railroad-Pinion Project are accurate in all material respects; |

| 3. | the quantity and grade of mineral resources contained in the Railroad-Pinion Project are accurate in all material respects; |

| 4. | further financing being required to fund construction and operating costs on the Railroad-Pinion Project as recommended in the Feasibility Study (as defined below); |

| 5. | the price for gold, other precious metals and commodities will not change significantly from current levels; |

| 6. | the Company will be able to secure additional financing to continue exploration and, if warranted, development activities on the Railroad-Pinion Project and meet future obligations as required from time to time; |

| 7. | the Company will be able to obtain regulatory approvals and permits in a timely manner and on terms consistent with current expectations; |

| 8. | the involvement by some of the Company’s directors and officers with other natural resource companies will not result in a conflict of interest which adversely effects the Company; |

| 9. | the Company will be able to procure drilling and other mining equipment, energy and supplies in a timely and cost efficient manner to meet the Company’s needs from time to time; |

| 10. | the Company’s capital and operating costs will not increase significantly from current levels or as outlined in the Feasibility Study; |

| 11. | key personnel will continue their employment with the Company and the Company will be able to recruit and retain additional qualified personnel, as needed, in a timely and cost efficient manner; |

| 12. | there will be no significant adverse changes in the Canada/U.S. currency exchange or interest rates and stock markets; |

| 13. | there will be no significant changes in the ability of the Company to comply with environmental, safety and other regulatory requirements; and |

| 14. | the absence of any material adverse effects arising as a result of political instability, terrorism, sabotage, natural disasters, public health concerns, equipment failures or adverse changes in government legislation or the socio-economic conditions in Nevada (“NV”) and the surrounding area with respect to the Railroad-Pinion Project and operations. |

Other assumptions are discussed throughout this AIF and elsewhere in the Company’s public disclosure record.

The Company’s ability to predict the results of its operations or the effects of various events on its operating results is inherently uncertain. Accordingly, readers are cautioned not to place undue reliance on the forward looking statements and forward looking information or the assumptions on which the Company’s forward looking statements and forward looking information are based. Investors are advised to carefully review and consider the risk factors identified in this AIF under, among other places, ITEM 7: “Risk Factors” and elsewhere in the Company’s public disclosure record for a discussion of the factors that could cause the Company’s actual results, performance and achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward looking statements and forward looking information. Investors are further cautioned that the foregoing list of risks and assumptions is not exhaustive and prospective investors should consult the more complete discussion of the Company’s business, financial condition and prospects that is included in this AIF and elsewhere in the Company’s public disclosure record.

Although the Company believes that the assumptions on which the forward looking statements are made and forward looking information is provided are reasonable, based on the information available to the Company on the date such statements were made or such information was provided, no assurances can be given as to whether these assumptions will prove to be correct. The forward looking statements and forward looking information contained in this AIF are expressly qualified in their entirety by the foregoing cautionary statements. Furthermore, the above risks are not intended to represent a complete list of the risks that could affect the Company and readers should not place undue reliance on forward looking statements and forward looking information in this AIF.

Forward looking statements and forward looking information speak only as of the date the statements are made or such information is provided. The Company assumes no obligation to update publicly or otherwise revise any forward looking statements or forward looking information to reflect actual results, changes in assumptions or changes in other factors affecting forward looking statements or forward looking information, except to the extent required by applicable laws. If the Company does update one or more forward looking statements or forward looking information, no inference should be drawn that the Company will make additional updates with respect to those or other forward looking statements or forward looking information.

| 2.2 | Cautionary Notes Regarding Mineral Resource Estimates |

The disclosure in this AIF has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Disclosure, including scientific or technical information, has been made in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (“SEC”). In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by United States standards in documents filed with the SEC. United States investors should also understand that “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. Investors are cautioned not to assume that any part, or all, of the mineral deposits in these categories will ever be converted into mineral reserves. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies. Although it is reasonably expected that the majority of “inferred resources”

could be upgraded to “indicated resources” with continued exploration, investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. In addition, the definitions of “proven” and “probable mineral reserves” used in NI 43-101 differ from the definitions in SEC Industry Guide 7 under Regulation S-K of the United States Securities Act of 1933. Disclosure of “contained ounces” is permitted disclosure under Canadian legislation; however, the SEC normally only permits issuers to report mineralization that does not constitute reserves as in place tonnage and grade without reference to unit measures. Accordingly, information contained in this AIF containing descriptions of the Company’s mineral properties may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The forward looking statements and forward looking information contained herein are based on information available as of March 25, 2022.

[remainder of page left blank intentionally]

| ITEM 3: | CORPORATE STRUCTURE |

| 3.1 | Name, Address and Incorporation |

The Company was incorporated on February 6, 2004 under the Business Corporations Act (British Columbia) (the “BCBCA”) under the name “TCH Minerals Inc.”. The Company changed its name to “Ripple Lake Minerals Ltd.” on May 13, 2004 and again to “Ripple Lake Diamonds Inc.” on July 26, 2004. On August 16, 2007 the Company consolidated its share capital on a ten for one basis and changed its name to “Devonshire Resources Ltd.”. On November 18, 2009 the Company consolidated its share capital on a further four to one basis and changed its name to its current name “Gold Standard Ventures Corp.”.

The registered and head office of the Company is located at Suite 610 - 815 West Hastings Street, Vancouver, B.C. V6C 1B4, telephone: (604) 669 - 5702.

| 3.2 | Inter-corporate Relationships |

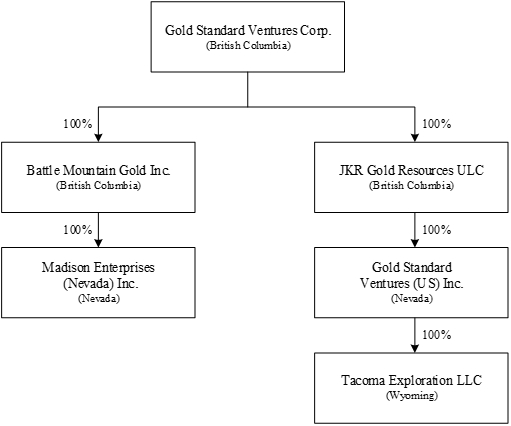

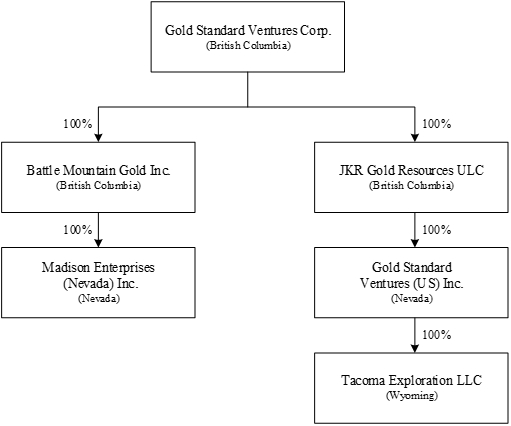

The Company currently has five wholly-owned subsidiaries: JKR Gold Resources ULC (“JKR”), a wholly-owned subsidiary of the Company incorporated under the BCBCA, Gold Standard Ventures (US) Inc. (“GSV US”), a wholly-owned subsidiary of JKR incorporated pursuant to the laws of NV, Tacoma Exploration LLC, a wholly-owned subsidiary of GSV US formed as a limited liability company under the laws of Wyoming, Battle Mountain Gold Inc. (“Battle Mountain”), a wholly-owned subsidiary of the Company incorporated under the BCBCA and Madison Enterprises (Nevada) Inc., a wholly-owned subsidiary of Battle Mountain incorporated pursuant to the laws of NV.

| ITEM 4: | GENERAL DEVELOPMENT OF THE BUSINESS |

The Company is a British Columbia company focused on the development of district-scale and other gold-bearing mineral resource properties exclusively in the State of Nevada, United States and the permitting, exploration and derisking of such properties. None of the Company’s properties are currently in production.

The Company’s flagship property is the Railroad-Pinion project located along the Piñon mountain range approximately 15 miles (24 kilometers) south-southeast of Carlin, NV, in the Railroad mining district (the “Railroad-Pinion Project” or “Railroad-Pinion”). The Railroad-Pinion Project has two adjacent parts: the North Railroad portion (“North Railroad”), which includes the POD, Sweet Hollow and North Bullion deposits (collectively, the “North Bullion Deposit”) and the South Railroad portion (“South Railroad”), which includes the Dark Star deposit (the “Dark Star Deposit”), the Pinion deposit (the “Pinion Deposit”) and the Jasperoid Wash deposit (the “Jasperoid Wash Deposit”). The Railroad-Pinion Project is an intermediate to advanced stage gold development project with a favorable structural, geological and stratigraphic setting situated at the southeast end of the Carlin Trend of north-central Nevada, adjacent to and south of Nevada Gold Mines’ Rain Mining District. The Carlin Trend is a northwest alignment of sedimentary rock-hosted gold deposits where more than 40 separate gold deposits have been delineated in domed geological complexes with past production exceeding 80,000,000 ounces of gold. Each dome or “window” is cored by igneous intrusions that uplift and expose Paleozoic rocks and certain stratigraphic contacts that are favorable for the formation of Carlin-style gold deposits. The Railroad-Pinion Project is centered on the fourth and southernmost dome-shaped window on the Carlin Trend.

Scientific and technical disclosure for the Railroad-Pinion Project is supported by the technical report with an effective date of February 23, 2022, entitled “South Railroad Project Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada” (the “Feasibility Study”), prepared by M3 Engineering & Technology Corporation (“M3”). The Feasibility Study can be accessed at www.sedar.com under the Company’s profile. The Feasibility Study is the Company’s current technical report for the Railroad-Pinion Project and replaces the technical report entitled “South Railroad Project NI 43-101 Technical Report, Updated Preliminary Feasibility Study, Carlin Trend, Nevada, USA”, with an effective date of February 13, 2020 (the “Updated PFS”).

As of March 25, 2022, there were (i) 358,735,368 Common Shares, (ii) 18,397,523 stock options to purchase up to an aggregate of 18,397,523 Common Shares at a weighted average exercise price of $1.08 per Common Share expiring from June 1, 2022 to January 10, 2027, (iii) 4,245,580 restricted share units convertible to 4,245,580 Common Shares, and (iv) no warrants, outstanding.

Financings

On July 31, 2019, the Company completed a short form prospectus offering of 17,250,000 Common Shares at a price of $1.22 per Common Share to the public in certain provinces of Canada and the United States for gross proceeds of $21,045,000 (the “2019 Public Offering”) through a syndicate of underwriters led by BMO Capital Markets.

On April 17, 2020, the Company entered into an at-the-market equity distribution agreement with BMO Capital Markets to establish an at-the-market equity program in the United States, with the intention of issuing up to $14,875,000 of Common Shares. The Common Shares issued under the at-the-market equity program will be issued from treasury to the public from time to time, and will be sold at the prevailing market price at the time of sale through the NYSE American LLC or any other existing trading market for the Common Shares in the United States. The Company sold 15,097,478 Common Shares for this at-the-market equity program for gross proceeds of $14,871,337.

On July 16, 2020, the Company announced a strategic partnership with Orion Mine Finance (“Orion”). As part of the partnership, Orion purchased approximately US$20.5 million of Common Shares, entered into a silver streaming agreement to purchase 100% of the silver production from the South Railroad portion of the Railroad-Pinion Project at a price of 15% of the prevailing market price for silver in exchange for a US$2.0 million payment to the Company

and agreed to provide the Company with a term sheet up to US$200 million to help finance construction of the South Railroad portion of the Railroad-Pinion Project.

On August 14, 2020, the Company entered into an at-the-market equity distribution agreement with BMO Capital Markets to establish an at-the-market equity program in the United States, with the intention of issuing up to $25,000,000 of Common Shares. The Common Shares issued under the at-the-market equity program will be issued from treasury to the public from time to time, and will be sold at the prevailing market price at the time of sale through the NYSE American LLC or any other existing trading market for the Common Shares in the United States. The Company issued 15,000,000 common shares for aggregate gross proceeds of $15,678,000. The Company terminated the August program in September 2020.

On February 17, 2021, the Company completed a bought deal financing with a syndicate of underwriters led by BMO Capital Markets and including Canaccord Genuity Corp., National Bank Financial Inc., PI Financial Corp., Haywood Securities Inc., Paradigm Capital Inc., Stifel Nicolaus Canada Inc., and TD Securities Inc. (collectively, the “Underwriters”) pursuant to which it issued 39,215,000 Common Shares, including the full exercise of the over-allotment option by the Underwriters, at a price of $0.88 per Common Shares for an aggregate gross proceeds of $34,509,200.

U.S. Registration

The Company is also a reporting issuer in the United States and required to file disclosure reports with the SEC under the United States Securities Exchange Act of 1934 (the “U.S. Exchange Act”) to provide information to public investors in the United States (in addition to the Company’s continuous disclosure obligations in Canada).

Stock Exchange Listings

The Common Shares are listed for trading on the Toronto Stock Exchange (the “TSX”) and the NYSE American under the symbol “GSV”.

Plan of Operations

On November 6, 2020, the Company submitted its Plan of Operations to the Bureau of Land Management Nevada (“BLM”), outlining the plans to build and operate the proposed South Railroad portion of the Railroad-Pinion Project. On February 1, 2021, the Company announced its Plan of Operations had been ruled complete by the BLM. Having the Plan of Operations ruled complete by the BLM allows the company to commence the Environmental Impact Statement (“EIS”) process pursuant to the National Environmental Policy Act.

On November 10, 2021, the Company announced that SWCA Environmental Consultants (“SWCA”) has been engaged to manage the EIS process on behalf of the BLM. Preparation of the Notice of Intent has commenced and is anticipated to be submitted to the BLM in Washington, DC, around Q1 2022. Once the Notice of Intent is published in the Federal Register, public scoping meetings can commence. Based on the EIS timeline developed amongst the Company, SWCA, and the BLM, the timing of the Record of Decision permit is anticipated to be in Q1 2023. In conjunction with the permitting process, work is advancing to secure site access and water rights.

Pre-Feasibility and Feasibility Studies

On February 18, 2020, the Company announced the results from the Updated PFS. The initial South Railroad pre-feasibility technical report entitled “South Railroad Project NI 43-101 Technical Report, Preliminary Feasibility Study, Carlin Trend, Nevada, USA”, with an effective date of September 9, 2019, recommended a series of trade-off and optimization studies which were completed by the Company and incorporated into the Updated PFS.

On February 23, 2022, the Company announced the results of the Feasibility Study on the South Railroad portion of its 100%-owned Railroad-Pinion Project located in Elko, Nevada. Please see “Material Mineral Project” for a fulsome discussion of the Feasibility Study and the Company’s Railroad Pinion Project.

Exploration

Virgin Deposit

On May 5, 2020, the Company announced an initial mineral resources estimate (“MRE”) for the Virgin gold and silver deposit (the “Virgin Deposit”) on its 100% owned/controlled Lewis Project. The Lewis Project is located approximately 100 km west of the South Railroad portion of the Railroad-Pinion Project.

The MRE reports an Inferred Mineral Resource of 205,827 troy ounces of gold and 3,537,268 troy ounces of silver contained in 7.74 million tonnes at a grade of 0.83 g Au/t and at a grade of 14.22 g Ag/t , yielding a combined total of 248,300 troy ounces of gold equivalent (“AuEq”) at a combined grade of 1.0 g/t AuEq (using a ratio of 80 to 1 silver to gold). On June 19, 2020, the Company subsequently filed a technical report for the Lewis Project entitled “Technical Report and Mineral Resource Estimate for the Lewis Project, Lander County, Nevada USA” with an effective date of May 1, 2020.

Railroad Pinion

On August 4, 2020, the Company announced its plans for phase 1 of its 2020 development and exploration program on the Railroad Pinion Project, including an estimated 20,410 m of RC and core drilling in 136 holes. The 2020 development and exploration program was subsequently expanded by the Company on September 15, 2020 to include additional RC drilling. The objectives of the 2020 development and exploration program were:

| 1. | to complete the conversion of Pinion Phase 4 to Measured and Indicated confidence level; |

| 2. | drill test additional near surface targets at Dark Star and POD / Sweet Hollow with the goal of expanding the oxide resource; |

| 3. | to further advance the Feasibility Study for the South Railroad portion of the Railroad-Pinion Project; |

| 4. | to file the south Railroad Plan of Operations (see “Plan of Operations” above); and |

| 5. | begin step-out exploration drilling at the LT oxide discovery. |

On October 20, 2020, the Company announced drill results from 24 of 75 holes in the 2020 Pinion deposit development and exploration program. The key highlights of this drilling included:

| ● | Four holes (PR20-14, -15, -19 and -23) from the southern portion of the drill program intersected vertically-continuous zones of oxide mineralization that are thicker- and higher-grade than modeled from existing drilling. These intercepts occurred along an approximate 450m strike length oriented at N60W – an orientation that is parallel to the Pinion Main and South gold zones to the north. Results included: 42.7m of 0.92 g Au/t, including 7.6m of 2.69 g Au/t in hole PR20-14; 38.1m of 0.97 g Au/t in PR20-15; 64.0m of 0.81 g Au/t, including 22.9m of 1.20 g Au/t in hole PR20-19; and 29.0m of 0.77 g Au/t, including 12.2m of 1.28 g Au/t in PR20-23. |

| ● | Drill holes PR20-19, -20, and -27 intersected thick zones of oxide mineralization and all three ended in altered multilithic breccia with oxide gold values ranging from 0.7 g Au/t to 1.37 g Au/t. |

| ● | Three holes (PR20-09, -10 and -11) intersected shallow oxide mineralization in the southeast portion of the drill pattern. |

| ● | Infill drilling and Anaconda-style mapping of new drill site excavations continued to confirm favorable geologic patterns in the Phase 4 area, including: repetition of fault and anticlinal fold orientations, an increase in igneous dikes and sills, and the strength of the gold system in the multilithic breccia host unit. Surface mapping identified the SB Target, which appears to connect with the N60W trend identified above and has 300m of untested strike length to southeast. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance, please see the Company’s press release filed on SEDAR (www.sedar.com) dated October 20, 2020.

On October 29, 2020, the Company reported the results of 10 exploration RC holes drilled at the LT oxide gold discovery which demonstrated the continuity of oxide gold mineralization along a strike length of approximately 200m, with highlights including:

| ● | The down-dip test in drill hole LT20-01 intersected 25.9m of 0.79 g Au/t, including 6.1m of 1.47 g Au/t; a strike test to the northeast in drill hole LT20-08 intersected 30.5m of 0.78 g Au/t, including 7.6m of 1.58 g Au/t; and the up-dip test in drill hole LT20-02 intersected 15.2m of 0.97 g Au/t. |

| ● | LT20-03, an inclined RC hole approximately 77m south of LT19-02, intersected 30.5m of 0.39 g Au/t of near-surface, oxidized mineralization. |

| ● | Continuous channel samples identified two main zones of oxide mineralization: 1) a 24m-wide zone averaging 0.97 g Au/t on the north end of the current drill pattern, and 2) a 12m-wide zone averaging 7.05 g Au/t on the south end which remains untested by drilling. The southern zone is associated with a northeast-striking fault zone. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated October 29, 2020.

On November 12, 2020, the Company announced additional results from the 2020 development and exploration program at the Pinion Deposit resulting from 36 RC holes drilled at the Pinion Deposit. The key highlights from these RC holes included:

| ● | Drill hole PR20-26 intersected 77.7m of 2.24 g Au/t, including 22.9m of 4.21 g Au/t, and PR20-34 intersected 38.1m of 4.37 g Au/t, including 16.8m of 5.41 g Au/t. These drill holes are on the southern margin of the drill pattern and represent the best oxide intercepts ever completed at the Pinion Deposit. |

| ● | Nine holes (PR20-26, -28, -29, -30, -34, -35, -36, -37 and -42) ended in altered multilithic breccia with oxide gold values ranging from 0.31 g Au/t to 2.52 g Au/t. These holes intersected thicker and higher gold grades than predicted by the resource model. |

| ● | Pinion Phase 4 drilling defined a new N60W striking zone of higher than average deposit gold grade, considerable breccia thickness and an increase in igneous sills and dikes. Along this trend, oxide mineralization exhibited vertical and strike continuity over an area approximately 300m (along a NW/SE strike) by approximately 170m wide. Mineralization remains open for another 600m to the southeast of this drilling and at depth. |

| ● | PR20-34 also intersected a reduced gold zone of 10.7m of 2.14 g Au/t (at a 1.0 g Au/t cutoff) in the Tripon Pass Formation, immediately above the oxide intercept of 38.1m of 4.37 g Au/t. This reduced intercept represents a new gold host and style of mineralization at Pinion. |

| ● | In the northern portion of the drill pattern, three holes intersected vertically-continuous zones of +1 g Au/t oxide mineralization, including 32.0m of 1.14 g Au/t, including 10.7m of 2.40 g Au/t in PR20-47; 24.4m of 1.55 g Au/t, including 16.8m of 2.11 g Au/t in PR20-59; and 25.9m of 3.66 g Au/t, including 12.2m of 6.45 g Au/t in PR20-60. These holes intersected higher gold grades than predicted by the resource model. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated November 12, 2020.

On November 18, 2020, the Company reported results from nine RC drill holes at the Dark Star Deposit at the Railroad-Pinion Project. Six of these drill holes targeted and intersected up-dip, near-surface oxide mineralization to the east of the Company’s drilling at Main Dark Star. The key highlights from these drill results included:

| ● | Stepout holes DR20-01 through -06 intersected thick intervals of oxide mineralization to the east of the existing drilling at Main Dark Star. These results expanded mineralization to the east beyond the current block model approximately 60m. |

| ● | DR20-09 intersected 231.7m @ 2.66 g Au/t, with mineralization starting just below surface and being oxide to depth. The hole infilled a gap in drilling to tie surface sample results to vertically-continuous, +1 g Au/t oxide mineralization at North Dark Star. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated November 18, 2020.

On April 15, 2021, the Company reported results from fifteen metallurgical core holes and two additional development holes at the Pinion Deposit. The key highlights from these drill results included:

| ● | PC20-22, a south directed core hole, intersected an oxidized interval of 61.1m of 1.07 g Au/t, including two higher-grade intervals of 14.2m of 1.77 g Au/t and 19.0m of 1.43 g Au/t. |

| ● | These results are on the southern margin of the drill pattern and expand the Pinion deposit approximately 50m to the south. |

| ● | Oxide mineralization remains open to the south and east of this intercept. |

| ● | Currently fifteen drill holes define the Pinion SB Zone (“SB Zone”), a N60W striking zone of higher-than-average deposit gold grade, considerable breccia thickness and an increase in igneous sills and dikes. Along this trend, oxide mineralization exhibits vertical and strike continuity over an area approximately 300m (along a NW/SE strike) by approximately 170m wide. Oxide mineralization remains open for another 600m to the southeast of this drilling and at depth. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated April 15, 2021.

On April 26, 2021, the Company reported drill results from fourteen reverse circulation/sonic holes and five core holes at the Dark Star Deposit. Drill holes DR20-01 through DR20-09 were previously released on November 18, 2020. The key highlights from these drill results included:

| ● | Drill holes DR20-10 through DR20-14 tested for extensions of bedrock mineralization at Dark Star Main. The oxide mineralization results reported in DR20-12 (57.9m @ 0.68 g Au/t) and DR20-14 (29.0m @ 0.56 g Au/t) continue to demonstrate that that mineralization remains open to the east at Dark Star Main. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated April 26, 2021.

On August 3, 2021, the Company announced drill results from reverse circulation holes and core drilling during 2020 at the POD and Sweet Hollow oxide gold deposits and a Central Bullion skarn target. The key highlights from these drill results included:

| ● | 21 drill holes were completed as step outs to the current oxide resources at POD and Sweet Hollow. The oxide mineralization result reported in RR20-04 (12.1m @ 2.07 g Au/t) extends known mineralization by 30 to 60 meters. |

| ● | Elevated silver grades were encountered in the drilling of up to 130 g Ag/t. Currently, silver is not modeled in the resources at POD and Sweet Hollow. |

| ● | Five drill holes were completed at the historical Central Bullion mining district, focused on historical producing zones. Historic records indicate high grade silver, copper, lead, and zinc production, with small amounts of gold, that were processed from this district. Drill hole RRB20-03 intersected 64.2m @ 20 g Ag/t, 0.50% Cu, 0.60% Zn, 0.10% Pb, 0.06g Au/t starting from surface. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated August 3, 2021.

On September 13, 2021, the Company announced drill results from 20 reverse circulation drill holes at the Dark Star gold deposit. The key highlights from these drill results included:

| ● | Drill holes DR21-14 and DR21-15 were completed at Dark Star North to support conversion of certain Inferred resources to Measured and Indicated resources for inclusion in the mine plan. |

| ● | Drill hole DR21-15 intersected an interval of 41.2 meters of 3.06 g Au/t sulphide mineralization directly below the oxide pit boundary. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated September 13, 2021.

On November 8, 2021, the Company announced significant confidence in its new LT discovery from five reverse circulation drill holes at the LT discovery, located three kilometers to the northwest of the South Railroad portion of the Railroad-Pinion Project, as part of its 2021 Exploration and Development Program. The key highlights from these drill results included:

| ● | LT21-02 intersected an interval of 39.6m of 0.76 g Au/t oxidized gold mineralization starting from surface, including 7.6m of 1.96 Au/t. |

| ● | All five of the RC drill holes returned gold assays that started at or near surface. |

| ● | The 2021 program is a follow up of the significant intercepts from the 2020 LT program which included 30.5m of 0.78 g Au/t in hole LT20-08; 24.3m of 0.73 g Au/t in LT20-01; and 15.2m of 0.96 g Au/t in LT20-02. |

| ● | Drilling returned higher gold grades and thickness than adjacent historical drill holes, and suggests mineralization is open to the north and east. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated November 8, 2021.

On January 18, 2022, the Company announced positive drill results from eight reverse circulation drill holes at the SB Zone as part of its 2021 Exploration and Development Program. The SB Zone is the contiguous southeast extension of the Pinion deposit. The key highlights from these drill results included:

| ● | PR21-07 intersected 27.4m of 1.26 g Au/t, one of the highest grade intercepts at the SB Zone to date. |

| ● | PR21-06 intersected 45.7m of 0.52 g Au/t with mineralization beginning closer to surface than previous estimations of the SB Zone; the geological interpretation of this development will inform future SB Zone drill programs. |

| ● | PR21-01 and PR21-02 were two of the most eastern holes ever drilled at SB Zone, and PR21-03 and PR21-04 were two of the most southern holes ever drilled at SB Zone; all four drill holes intersected mineralization and prove the target remains open to the south and to the east. |

| ● | The 2021 program is a follow up of the significant intercepts from the 2020 SB Zone program which included 61.1 of 1.07 g Au/t in hole PC20-22. |

For a complete summary of these exploration results, and the related information regarding data verification, sampling methodology, chain of custody, quality control and quality assurance in respect of drilling, please see the Company’s press release filed on SEDAR (www.sedar.com) dated January 18, 2022.

Acquisitions and Dispositions

No significant acquisitions or dispositions have been completed by the Company since the commencement of its financial year ended December 31, 2021.

Corporate Changes

On December 2, 2020, the Company announced that the CEO succession plan had been finalized. Mr. Jonathan Awde handed over the role of President and CEO to Jason Attew who joined the company on December 2, 2020. On January 5, 2021, the Company announced the departures of Mr. Michael Waldkirch (CFO until March 31, 2021), Mr. Glenn Kumoi (VP, General Counsel and Corporate Secretary until March 16, 2021) and Mr. William Gehlen (former Manager, Corporate Development) and the hiring of Mr. Lawrence Radford, Chief Operating Officer, Mr. Jordan Neeser, Chief Financial Officer and Corporate Secretary, and Mr. Michael McDonald, VP Corporate Development and Investor Relations. On March 7, 2022, the Company announced the departure of Larry Radford (COO until March 20, 2022), with Jeff Fuerstenau, Process Manager, assuming local operational responsibilities in Nevada and Mark Laffoon, Project Director, assuming project planning responsibilities.

| ITEM 5: | DESCRIPTION OF THE BUSINESS |

Summary

The Company is a British Columbia company focused on the development of district-scale and other gold-bearing mineral resource properties exclusively in the State of Nevada, United States and the permitting, exploration and derisking of such properties. None of the Company’s properties are currently in production.

Specialized Skill and Knowledge

Management is comprised of a team of individuals who have extensive expertise and experience in the mineral exploration and mining industry and are complemented by an experienced board of directors. See ITEM 12: “Directors And Officers”.

Competitive Conditions

The Company competes with other mineral exploration and mining companies for mineral properties, joint venture partners, equipment and supplies, qualified personnel and exploration and development capital. See ITEM 7: “Risk Factors” below.

Cycles

Given the general weather conditions and exploration season in north central NV, the Company’s exploration and evaluation assets expenditures tend to be greater from May to December than in the rest of the year.

Environmental Protection

The current and future operations of the Company, including potential development activities on its Railroad-Pinion Project or areas in which it has an interest, are subject to laws and regulations governing exploration, development, tenure, production, taxes, labour standards, occupational health, wastes disposal, greenhouse gas emissions, protection and remediation of environment, reclamation, mine safety, toxic substances and other matters. Compliance with such laws and regulations increases the costs of and delays planning, designing, drilling and developing the Company’s properties. The Company attempts to diligently apply technically proven and economically feasible measures to advance protection of the environment throughout the exploration and development process. Current costs associated with compliance are considered to be normal.

Employees and Consultants

The Company maintains a head office in Vancouver, B.C. and a branch office in Elko County, NV.

As of March 25 2022, the Company had 9 full time employees based in the Company’s Elko, NV office (December 31, 2021 – 14 employees) and 5 persons at its Vancouver head office (December 31, 2021 – 6 persons). As operations require, the Company also retains geologists, engineers, and other consultants on a short term or per diem basis in Vancouver and NV, and in the field at its Railroad-Pinion Project.

Foreign Operations

The Railroad-Pinion Project and the Lewis Gold Project are located in NV and the Company maintains an office in Elko County, NV.

Social or Environmental Policies

The Company has adopted an environmental policy to ensure that it is maintaining sound environmental practices in all activities (the “Environmental Policy”). Pursuant to the Environmental Policy, the Company:

| ● | examines the potential impact to the environment of all proposed activities and takes steps to minimize, or where possible, eliminate the impact; |

| ● | ensures that all activities are in compliance with all environmental permits and regulations; |

| ● | on a routine basis, determines the Company’s impact on the environment and through continuous improvement, strives to attain higher levels of environmental performance; |

| ● | maintains a high-level of environmental protection by applying practices and technology that minimize impacts and enhance environmental quality; |

| ● | maintains open dialogue with local communities, ranchers and other stakeholders within the area of influence of the Company’s project areas; |

| ● | progressively and regularly reclaims disturbed areas in accordance with approved reclamation plans, and incorporates new technology where practical; |

| ● | encourages cooperative research programs with state and federal agencies to better understand and monitor impacts associated with the Company’s project areas; and |

| ● | trains all employees and, contractors as appropriate, to help them better understand their environmental responsibility related to the Company’s project areas. |

The Company has also formed a Technical, Health, Safety and Environmental Committee (the “HSEC”), which, among other things, monitors, on behalf of the board of directors of the Company (the “Board”), the Company’s compliance with its approved environmental policies. The HSEC reviews with management any extraordinary event or condition involving an environmental impact or significant risk, including, where appropriate, reporting and making recommendations to management and the Board.

| ITEM 6: | MATERIAL MINERAL PROJECT |

The Company considers the Railroad-Pinion Project comprised of North Railroad and South Railroad, its material mineral project for purposes of NI 43-101. Set forth below is certain mining and technical information in relation to those deposits.

The technical information included in this section is a summary of the technical information disclosed in the Feasibility Study. Any additional drilling or metallurgical results disclosed subsequent to the effective date of the Feasibility Study are included in “Material Mineral Project - Mineral Projects – Recent Developments”.

The Feasibility Study is the Company’s current technical report for the Railroad-Pinion Project and presents the results of the South Railroad feasibility study, incorporating new design-work, scheduling and projected costs in support of mineral resource and mineral reserve estimates for the Dark Star Deposit and the Pinion Deposit. The following is a summary description of the Railroad-Pinion Project and is a direct extract and reproduction of the summary, without material modification, contained in the Feasibility Study. The Feasibility Study was prepared on behalf of the Company by M3 and each of the following Qualified Persons:

| ● | Benjamin Bermudez and Matthew Sletten of M3; |

| ● | Michael Lindholm, Jordan Anderson and Thomas L. Dyer of Mine Development Associates, Inc. (“MDA”) (a division of RESPEC); |

| ● | Gary L. Simmons of GL Simmons Consulting, LLC (“GL Consulting”); |

| ● | Kevin Lutes of NewFields Mining Design & Technical Services (“NewFields”); |

| ● | Richard DeLong of EM Strategies, Inc. (“EM”); and |

| ● | Art S. Ibrado of Fort Lowell Consulting PLLC (“FLC”). |

Each of the above individuals are independent Qualified Persons in accordance with NI 43-101.

All defined terms used in the summary below have the meaning ascribed to them in the Feasibility Study, and as a result may differ from the defined terms used elsewhere throughout this AIF. The below summary is subject to all the assumptions, qualifications and procedures set out in the Feasibility Study and is qualified in its entirety with reference to the full text of the Feasibility Study, which is incorporated herein by reference, and which was originally filed on March 14, 2022, and is available for review under the Company’s profile at www.sedar.com.

Feasibility Study Overview and Principal Findings

Gold Standard’s Railroad Pinion property is located in the Bullion mining district of the southern Carlin trend in Nevada. The property has two adjacent parts, the North Railroad portion, which includes POD, Sweet Hollow, South Lodes and North Bullion (collectively called the North Bullion deposits, or the North Bullion area), and the South Railroad portion, which includes Dark Star, Pinion, and Jasperoid Wash.

Gold Standard has drilled, or received assays, for 127 new holes since the effective dates of the databases for the respective deposits on the Railroad-Pinion property. In many cases, assay results were delayed significantly past the effective dates due to the COVID-19 pandemic. That drilling was primarily focused on obtaining metallurgy samples, generating geotechnical data, construction of water and monitor wells, infilling within modeled areas, or for exploration of secondary targets. The new drilling in the Dark Star, Pinion, North Bullion and Jasperoid Wash areas were evaluated with respect to the resource models and it was determined there would be minimal to no impact on estimated volumes and grades as reported within optimized pits in the Feasibility Study.

Extensive metallurgical testing has been completed for the Dark Star and Pinion deposits. On the other hand, the North Railroad portion of the property has not been tested comprehensively for metallurgical response.

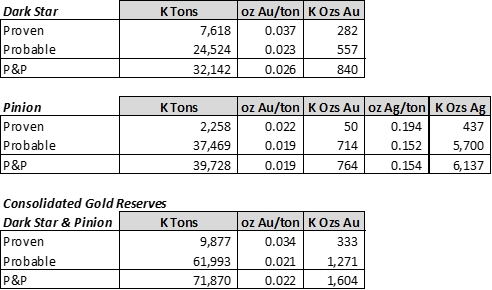

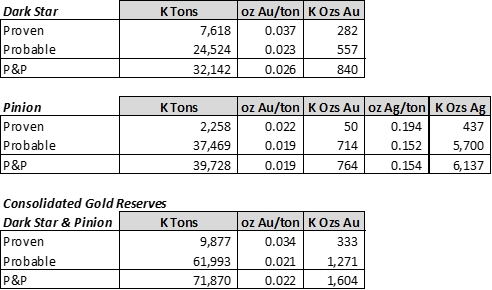

Gold Standard reports mineral reserves for Dark Star and Pinion deposits in the Feasibility Study. The Feasibility Study, which includes the mine schedule, process-plant design, and financial analysis, covers only these two deposits.

The proposed project is an open-pit gold mine operation that will deliver ore to a 71.9 million-ton heap leach facility over 8 years of mine life. The heap leach facility will treat Run-of-Mine (ROM) ore via leaching on a dedicated leach pad with cyanide-bearing solution.

Gold Standard selected M3 and other third-party consultants to prepare mineral resource/reserve estimates, mine plans, process plant design, and to complete environmental studies and cost estimates used for the Feasibility Study. All consultants have the capability to support the project, as required and within the confines of their expertise, from feasibility study to full operation.

The key project parameters and findings are presented in Table 6-1, including a summary of the project size, productions, capital and operating costs, metal prices, and financial indicators.

Table 6-1: Key Project Data

Mine Life | 8 Years + pre-strip (6 months) |

| Mine Type | Open Pit |

| Process Description | ROM heap leach Gold/silver recovery by ADR plant & Refinery, dual carbon column trains |

| Total Mineral Reserve Estimate | 71.9 M Tons |

| Average Grade | 0.022 oz Au/ton; 0.154 oz Ag/ton (Pinion – Representing 39.7 M tons of ore) |

| Contained Gold / Silver Ounces | 1.604 M oz Au; 6.137 M oz Ag (Pinion) |

| Average Recovery | ROM: 64.5% Au, 10.8% Ag |

| Average Annual Tons Moved | 44 Million Tons |

| Annual Mineral Reserve Estimate | 8.8 Million Tons |

| Strip Ratio | 4.10:1 |

| Process (ROM) Throughput (tons/day) | 32,700 (Design); 24,700 (Average) |

| Initial Capital Expenditures | US$190.2 M |

| Sustaining Capital Expenditures | US$186.7 M |

| | |

| Payable Metals | |

| Gold, oz | 1,030,000 |

| Silver, oz | 651,000 |

| | |

| Unit Operating Costs | |

| Average Life of Mine (“LOM”) Mining Costs | US$1.68 / ton mined |

| Average LOM Processing Costs | US$2.05 / ore ton |

| G & A | US$0.53 / ore ton |

| Refining | US$0.07 / ore ton |

| Cash Costs | US$794 / oz Au |

| Cash Costs After By-Product Credit | US$792 / oz Au |

| All in Sustaining Costs (“AISC”) | US$1,021 / oz Au |

Financial Indicators

(in US$ unless otherwise stated) | Spot Price (Au) (Feb 22, 2022) | Base +150 | Base Case | Base -150 | Base -250 |

| Gold Price (per troy oz) | $1,899 | $1,800 | $1,650 | $1,500 | $1,400 |

| Silver Price (per troy oz) | $21.50 | $21.50 | $21.50 | $21.50 | $21.50 |

| Pre-tax Cash Flow, US$M | $753.9 | $651.9 | $497.3 | $342.8 | $239.8 |

| Pre-tax NPV (5%) in US$M | $603.0 | $517.9 | $388.9 | $259.9 | $173.9 |

| Pre-tax Internal Rate of Return (IRR) | 68.2% | 60.8% | 49.2% | 36.5% | 27.2% |

| Pre-tax Payback (Years) | 1.6 | 1.7 | 1.9 | 2.1 | 2.4 |

| After-tax Cash Flow, US$M | $606.3 | $526.1 | $403.2 | $280.9 | $199.0 |

| After-tax NPV (5%) in US$M | $486.4 | $418.7 | $314.8 | $211.2 | $141.6 |

| After-tax IRR | 62.1% | 55.3% | 44.3% | 32.6% | 24.0% |

| After-tax Payback (Years) | 1.6 | 1.7 | 1.9 | 2.2 | 2.4 |

The effective date of this Feasibility Study is February 23, 2022, and the issue date of the Technical Report is March 14, 2022. The effective dates of the Pinion and Dark Star databases on which the mineral resources described in the Feasibility Study are estimated on, are June 2, 2021 and June 15, 2021, respectively. The effective date of the Jasperoid Wash database is October 6, 2018, and the effective date of the North Bullion deposits database is August 21, 2020. New optimized pits and underground shells were generated using current mining costs in 2022, so the effective dates of the reported mineral resource estimates for all deposits is January 31, 2022.

Property Description and Ownership

The primary site access for South Railroad will be from Elko, NV using a 41.7-mile access route. This 41.7-mile route begins from its intersection with 12th Street in Elko, NV and continues approximately 5.5 miles along the existing paved State Route (SR) 227 (i.e., Lamoille Highway) to the intersection with SR 228 (i.e., Jiggs Highway). The route continues south along paved SR 228 for another 5.5 miles to the paved Elko County Road 715 (i.e., South Fork Road). The route follows southward along County Road 715 approximately 5.7 miles to the intersection with County Road 715B (i.e., Lucky Nugget Road/Grant Avenue). From this intersection, the route follows County Road 715B approximately 3.1 miles along the west shore of South Fork Reservoir through a semi-rural residential area to the intersection with BLM Road 1119, which continues southwest approximately 6 miles to its intersection with Elko County Road 720 (i.e., Bullion Road). The route follows the Bullion Road southwest approximately 10 miles to the intersection with the un-improved BLM Road 1053, then continues southward following the approximate alignment of BLM Road 1053 along the eastern flank of the Pinion Range approximately 6 miles to the South Railroad Project). The property is centered approximately at UTM NAD27 Zone 11 coordinates of 585,000E and 4,480,000N.

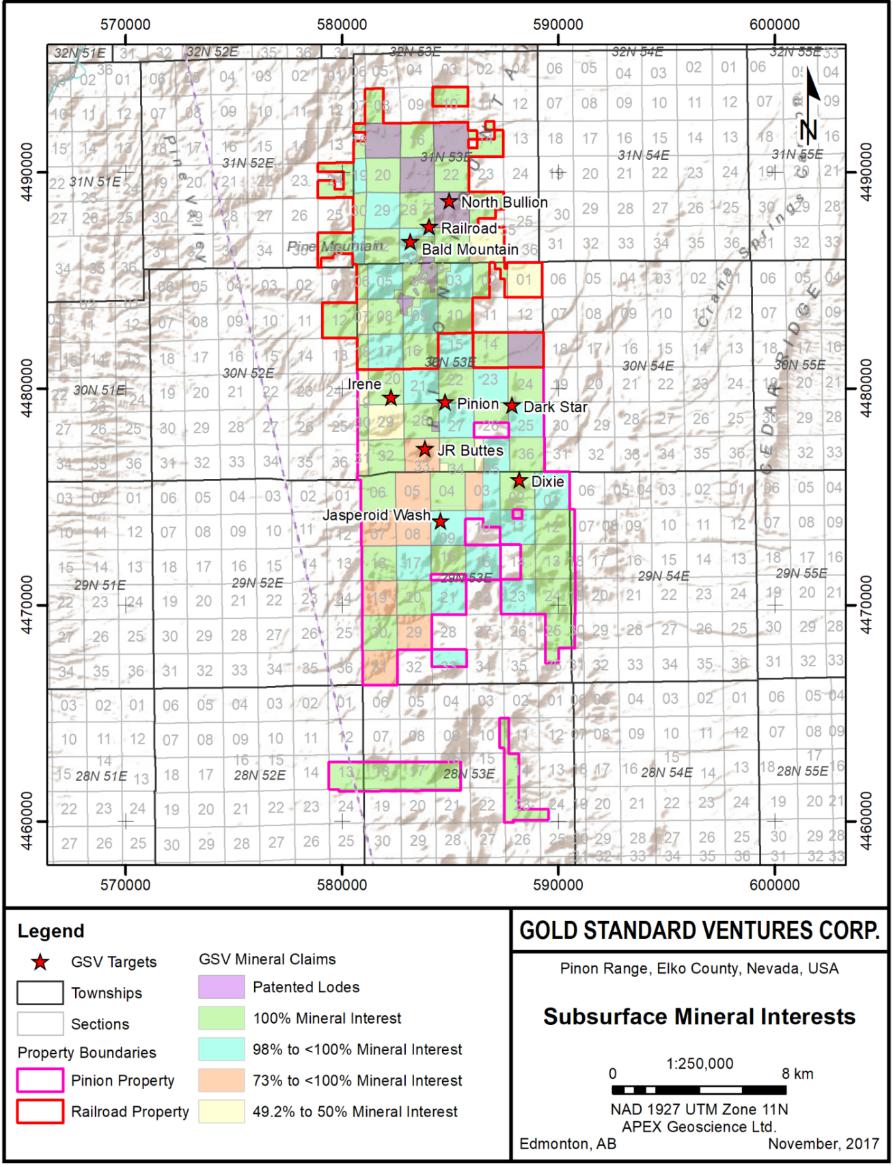

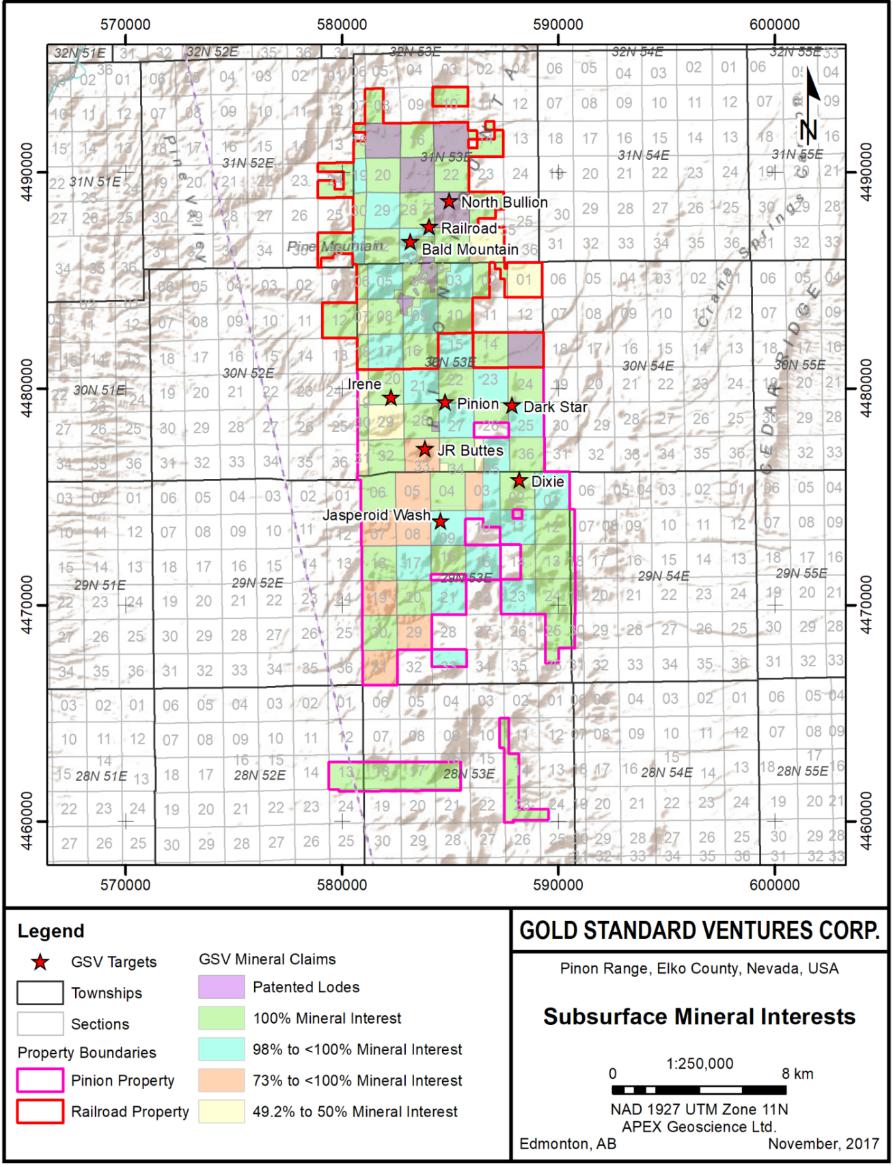

Gold Standard’s contiguous North and South Railroad portions of the Railroad-Pinion property constitute a combined land position totaling 53,570 acres in Elko County, Nevada, centered approximately at UTM NAD27 Zone 11 with coordinates of 585,000E and 4,480,000N. This includes 1,454 claims owned by Gold Standard and 207 claims held under lease, a total of 30 claims are patented. There is also a total of 23,630 gross acres of private lands of which Gold Standard’s ownership of the subsurface mineral rights varies from 49.2% to 100%.

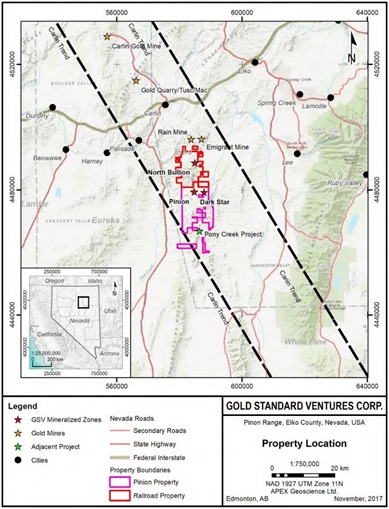

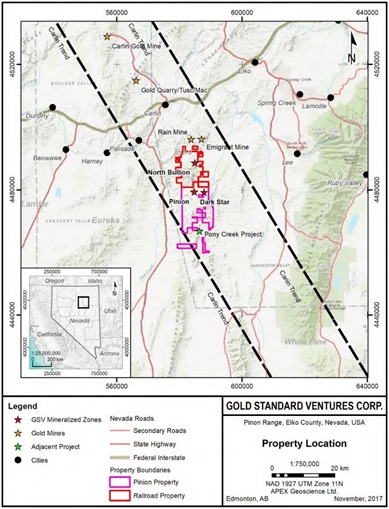

Figure 1-1: Location Map for the Railroad-Pinion Property

(from Dufresne and Nicholls, 2017b)

Figure 1-2: Railroad-Pinion Property with Ownership Percentages, Elko County, Nevada

(from Dufresne and Nicholls, 2017b)

Exploration and Mining History

The Railroad–Pinion property is being explored on an ongoing basis by Gold Standard using geological mapping, geochemical and geophysical surveying, and drilling. Exploration work by Gold Standard commenced in 2010 and has resulted in the identification of 17 prospect areas or zones of mineralization within the property.

Twenty-one different historical operators are known to have drilled 1,084 holes, for a total of 500,544.1 ft, from 1969 through 2008. As of the database effective dates, Gold Standard has drilled 1,121 holes for a total of 953,112 ft. At least 80% of all drilling used RC methods. However, the amount of RC drilling may be understated because the hole-types are not known for a substantial number of holes drilled in the late 1980s and 1990s, when RC drilling was common.

Geology and Mineralization

The Railroad-Pinion property is located in the southern portion of the Carlin trend, centered on the Railroad dome in the Piñon Range, which is comprised of Ordovician through Permian marine sedimentary rocks. Eastern assemblage formations throughout the property include the Pogonip, Hanson Creek, Eureka Quartzite, Lone Mountain Dolomite, Oxyoke, Beacon Peak, Sentinel Mountain Dolomite, and Devils Gate Limestone and Tripon Pass formations. Siliceous

clastic units include those of the Webb, Chainman, and Tonka formations. The north-south-striking Bullion fault corridor separates Tertiary volcanic rocks to the east from the Paleozoic sedimentary units in the range, which have been intruded by a complex of Eocene igneous rocks centered south of Bald Mountain, in the core and east flank of the range.

The gold-silver deposits within the Railroad-Pinion property that are the focus of the Feasibility Study are considered to be Carlin-type, sedimentary-rock-hosted deposits. Precious metal mineralization is generally submicroscopic, disseminated, and hosted principally in sedimentary rocks, with some mineralization in felsic dikes and sills as well.

In the South Railroad portion of the property, the Dark Star Main (“Dark Star Main”) and Dark Star North (“Dark Star North”) zones, which comprise the Dark Star deposit are hosted primarily within Pennsylvanian-Permian rocks, with minor amounts of gold mineralization found in the Chainman Formation and Tertiary conglomerates. The deposits are centered along the roughly north-south Dark Star fault corridor, within which is a horst block and associated silicified zone bounded by the West fault and Dark Star fault. Gold mineralization in the horst block is hosted in the middle, coarse-grained conglomeratic and bioclastic limestone-bearing unit of a Pennsylvanian-Permian undifferentiated sequence interpreted to be equivalent to the Tomera Formation. Mineralization dips steeply to the west near the surface at Dark Star Main and Dark Star North, but dips less steeply at depth at Dark Star Main.

Also, in the South Railroad portion of the property, the Pinion deposit is situated in a sequence of Paleozoic sedimentary rocks exposed within large horst blocks in which the sedimentary rocks have been broadly folded into a south- to southeastward-plunging, asymmetric anticline. The axis of this Pinion anticline trends approximately N50ºW to N60ºW and can be traced for approximately 2.0 mi (3.2 km). The limbs of the anticline dip shallowly at 10° to 25° to the west, and more steeply at 35° to 50° to the east. Disseminated gold and silver mineralization at the Pinion deposit is strongly controlled by a 10 ft to 400 ft-thick (3 m to 120 m-thick) dissolution-collapse breccia at the contact between calcarenite of the Devils Gate Limestone and the overlying silty micrite of the Tripon Pass Formation. Gold deposition was contemporaneous with breccia development, quartz veins formation, silica ± barite replacement and infill of open spaces.

The Jasperoid Wash disseminated gold deposit, also located in the South Railroad portion of the property, is hosted by altered Tertiary feldspar porphyry dikes and their host Pennsylvanian-Permian conglomeratic rocks of a Tomera Formation equivalent. The deposit has approximate extents of 4,600 ft (1,400 m) to the north and a width of about 3,600 ft (1,100 m), and is partially contained within an elongate, north to south, steeply dipping structural corridor. Drilling shows the deposit dips steeply to the west nearby and within Tertiary dikes; east of the dikes, the deposit dips gently to the west. The gold is Inferred to be submicroscopic in grain size, however, petrographic studies have yet to be performed.

In the North Railroad portion of the property, disseminated gold mineralization has been defined by drilling in the North Bullion, POD, and Sweet Hollow zones. The mineralization is focused in the footwall of the Bullion fault zone. Faults appear to be important controls on mineralization. In general, gold-silver mineralization is localized in gently to moderately dipping, strongly sheared rocks of the Webb and Tripon Pass formations, in dissolution-collapse breccia developed above and within silty micrite of the Tripon Pass Formation, and calcarenite of the Devils Gate Limestone. The top of gold mineralization varies from 350 ft to 1,300 ft (105 m to 400 m) below the surface and varies in dip from 10° to 45° to the east. Gold is associated with “sooty” sulfide minerals, silica, carbon, clay, barite, realgar, and orpiment.

Data Verification

Mr. Lindholm is satisfied that the Pinion, Dark Star, Jasperoid Wash and North Bullion drilling databases are in good condition. Various audits and checks were performed by MDA to verify collar coordinates, down-hole deviation surveys, geology and assay data in the drill-hole database. All Gold Standard gold assay data was verified using digital laboratory certificates. However, about one third of the Pinion assays and one quarter of the Dark Star assays from historical drill campaigns were unsupported with original assay certificates. The same is true at North Bullion, where Gold Standard drilling makes up only 28% of the database, almost all of which is in the North Bullion deposit. The drill-hole data at the POD, Sweet Hollow and South Lodes deposits is almost entirely historical. Drill-hole data lacking

adequate supporting documentation, as well as data from holes observed during sectional modeling to be inconsistent with surrounding holes, were treated as lower confidence, or excluded from use in modeling and estimation.

In 2019, Gold Standard supplemented their Pinion silver database with re-assayed individual samples for which composites of multiple intervals had previously been analyzed. Over 50% of the original certificates were available for all silver data and were used for verification. Quality assurance/quality control (“QA/QC”) data was also evaluated, and the silver data was deemed acceptable for use in estimation of classified mineral resources.

There is no evidence of significant historical QA/QC programs for drilling prior to 2014. For Gold Standard programs at Dark Star, Pinion and Jasperoid Wash, the QA/QC program was minimal in 2014 through 2016 but was more comprehensive in 2017 to 2020. Similarly at North Bullion, over the full-time span of the Gold Standard drilling from 2010 to 2012 there is a reasonable implementation of QA/QC protocols, but during some periods of time it is less substantial. The results and amount of QA/QC data, as well as non-remedied QA/QC “failures,” were considered in mineral resource classification for the Dark Star, Pinion, Jasperoid Wash and North Bullion deposits. Mr. Lindholm concludes that the Dark Star, Pinion, and Jasperoid Wash analytical data are adequate for the purposes used in the Feasibility Study, subject to issues described in Section 12 of the Feasibility Study.

Cyanide-soluble gold assays at Dark Star and Pinion were verified, but no QA/QC data was available for evaluation. Carbon and sulfur species data were audited and determined to be adequate for use in their respective estimates done for waste handling and metallurgical characterization. No QA/QC data was associated with the carbon and sulfur analyses.

Barium was estimated in the Pinion deposit block model for metallurgical characterization. Barium analyses were done using pressed-powder energy-dispersive x-ray fluorescence (“XRF-ED”) and loose-powder NITON XRF analytical methods. These methods were evaluated by running additional analyses on duplicate pulp samples by various methods. After evaluating the reliability and relationship of barium assays produced by the two methods, and verification of the data, the data was used to model and estimate NITON XRF-derived barium grades.

Processing and Metallurgical Testing

The current study of the South Railroad portion of the Railroad-Pinion project focuses on two main sources of ore, for which mineral reserves are declared: The Pinion and Dark Star deposits. These deposits have different geo-metallurgical characteristics, which are briefly summarized as follows:

The Pinion deposit can be characterized as hard and abrasive material, with a steep feed P80 vs. gold recovery response. Much of the gold is contained in the rock ground mass and requires fine crushing (-1/4” inch) to liberate gold for the most efficient cyanide-leach extraction. Gold recovery has proven to be sensitive to high barite/silica content in the mulilithic breccia (mlbx) ore type. Gold recovery from the high-barite/silica materials benefits the most from fine crushing. This deposit can be heap leached without crushing, at low gold recovery, conventionally crushed and leached at modestly higher gold recovery, or HPGR-crushed at higher gold recovery.

The Dark Star deposit can be characterized as hard and moderately abrasive material, with a flat feed P80 vs. gold recovery response. Most of the gold is contained in fractures that have been oxidized and accessible to cyanide solutions that easily pass through the rock matrix. Consequently, high gold extractions are achieved at coarse particle size, requiring no crushing prior to heap leaching.

A large number of variability and master composites (mostly from PQ core) were selected by Gold Standard Ventures for feasibility level testing on the Dark Star and Pinion Deposits. Standard metallurgical testing protocols consisted of bottle roll leach testing at 80 percent passing (P80) size targets of 75 microns (200 mesh) and 1,700 microns (10 mesh), and column leaching testing at various P80sizes ranging from 0.375 inch to 1.0 inch (9.5 mm to 25 mm). Additional composites were crushed using High Pressure Grinding Rolls (HPGR), at medium press force, and subjected to column leaching. The total number of metallurgical tests, by deposit, is presented in Table 1-1 below.

Table 1-1: Summary of Leach Tests Performed

Test Procedure | Number of Tests |

| Dark Star | Pinion |

| Bottle Roll P80 Target = 75 microns (200 mesh) | 121 | 195 |

| Bottle Roll P80 Target = 1,700 microns (10 mesh) | 121 | 207 |

| Conv. Crush Columns P80 Target = 0.375-1.0 inch (9.5-25 mm) | 99 | 90 |

| HPGR Crush Columns P80 Target = 0.20-0.24 inch (5-6 mm) | 11 | 23 |

ROM heap leach head grade vs. gold recovery models were developed for Dark Star and Pinion and silver recovery models were developed for Pinion. Silver recovery was not modelled for Dark Star as silver grades are too low to be of economic significance.

Due to the multiple material types, and the dependence of gold recoveries on head grades and crush size, 71 gold and silver recovery vs head grade equations were developed, along with recovery vs solution-to-ore ratio equations. Of the recovery equations, 28 are for Pinion oxide and transition ROM ores and 16 are for Dark Star oxide and transition ROM ores. The recovery equations can be found in Section 13 of the Feasibility Study.

The gold and silver recovery equations for each ore type were delivered to the mine modelers for incorporation into the block calculations.

The overall life-of-mine ROM average gold recovery for the Dark Star deposit is estimated at 71.9 percent and the Pinion deposit is estimated at 56.3 percent.

The major reagent consumptions for heap leaching of Pinion and Dark Star ore have been taken from available metallurgical test results from column leach tests on crushed material. No test data exists at the ROM particle size, so the selected reagent consumptions have been estimated based on test results on the coarsest samples tests 1.5 inch (37 mm). Cyanide consumptions have been estimated at 0.44 lb/ton (0.22 kg/tonne) for Pinion and 0.46 lb/ton (0.23 kg/tonne) for Dark Star. Lime consumption is estimated at 2.0 lb/ton (1.0 kg/tonne) for both Pinion and Dark Star ores.

Recovery Methods

The process selected for recovery of gold and silver from the Pinion and Dark Star ore is a conventional ROM heap leach. Oxide and transition ore types will be mined by standard open pit mining methods from two separate pits. The ore will be truck-stacked on the heap as ROM ore directly, without crushing, in 30-foot lifts. Lime will be added directly to the haul trucks for pH control.

The stacking rate will be in accordance with the mine plan. The ROM ore placement is equivalent to a LOM average of 24,700 tons per day, with the peak in Year 5 of an average of 32,700 tons per day.

Gold and silver in the stacked ore will be leached with a dilute cyanide solution using a drip irrigation system at application rates in the range of 4,800-6,100 gallons per minute. The leached gold and silver will be recovered from solution using a carbon adsorption circuit. The gold and silver will be stripped from carbon using a desorption process, followed by electrowinning to produce a precipitate sludge. The precipitate sludge will be processed using a retort oven for drying and mercury recovery, and then refined in a melting furnace to produce gold and silver doré bars.

Mineral Resource Estimate

The estimated mineral resources presented in the Feasibility Study were classified in order of increasing geological and quantitative confidence into Inferred, Indicated, and Measured categories to be in accordance with the “CIM Definition Standards - For Mineral Resources and Mineral Reserves” (2014) and therefore Canadian National Instrument 43-101. Mineral resources are reported at cutoffs that are reasonable for deposits of this nature given

anticipated mining methods and plant processing costs, while also considering economic conditions, because of the regulatory requirements that a mineral resource exists “in such form and quantity and of such a grade or quality that it has reasonable prospects for eventual economic extraction.”

MDA modeled geology and metal domains for the Dark Star, Pinion, and Jasperoid Wash deposits, then estimated and classified gold mineral resources. A silver estimate was also produced for the Pinion deposit. Gold Standard provided the geologic modeling for the various deposits and were intimately involved with metal domain modeling. Block sizes were 30 ft x 30 ft x 30 ft for Dark Star and Pinion, and 20 ft x 20 ft x 20 ft for Jasperoid Wash. The block size for modeling and estimation at the North Bullion deposits model was 10 ft x 10 ft x 10 ft for evaluation of underground potential, but reblocked to 30 ft x 30 ft x 30 ft to optimize open pits. Estimation was done using inverse-distance methods with powers ranging from two to four. Multiple models were estimated in order to optimize the estimation parameters.