July 15, 2014

Via EDGAR

Division of Corporation Finance

Securities and Exchange Commission

Washington, D.C. 20549

| Re: | Gold Standard Ventures Corp. ("GSV") Registration Statement on Form F-3 Filed on June 13, 2014 File No. 333-196751 |

Ladies and Gentlemen:

This letter responds to the comments in the July 9, 2014 letter (the “SEC July 9 Letter”) from John Reynolds, Assistant Director in the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) relating to the above-captioned registration statement (the "Registration Statement"). The SEC July 9 Letter raised two comments set forth in bold type below. The first comment seeks an expanded response to a prior Staff comment to which we had responded by letter July 2, 2014 (the “GSV July 2 Letter”). The second comment seeks an analysis showing why we determined the actions described in the GSV July 2 Letter and herein are consistent with Section 5 of the Securities Act of 1933, as amended (the “Securities Act”). We do not believe that the comments in the SEC July 9 Letter require an amendment to the Registration Statement.

1. Please provide an expanded response to prior comment 2 that addresses any relationships between you, Peter Epstein, Rockstone Research or The Gold Report (including entities referenced in the reports and any arrangements for investor relations efforts). We note the statement in your response regarding no other relationships with Rockstone and that “[t]o our knowledge, the same is true for our affiliates.” However, it appears that an interview between Peter Epstein and Jonathan Awde occurred and was published online on June 10, 2014; and the interview references the Rockstone Research report as “a bullish independent research article [that] contributed to a huge spike in trading volume.” It also references The Gold Report, which links to your website's June 2014 Fact Sheet and July 2014 Investor Presentation. The interview also links to a May 21, 2014 CEO interview by The Gold Report, which states that you “paid Streetwise Reports to conduct, produce and distribute the interview” and that “Gold Standard Ventures Corp. had final approval of the content and is wholly responsible for the validity of the statements.”

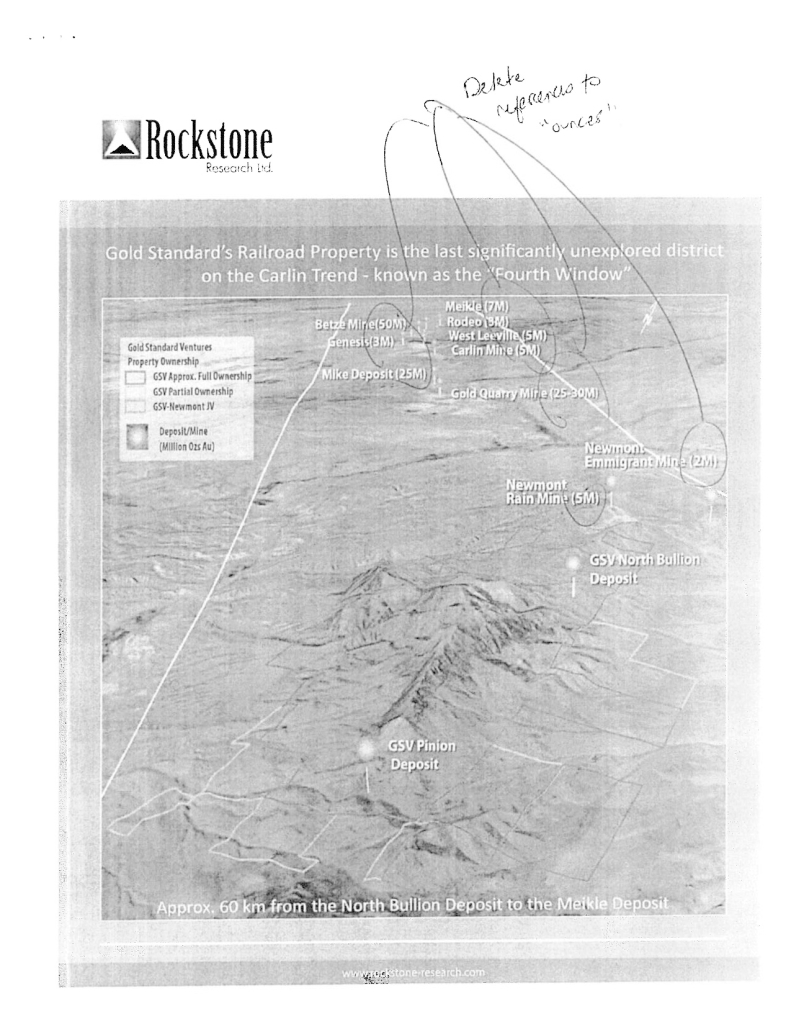

Response: We are classified as a minor mining company engaged in the acquisition, evaluation and exploration of gold-bearing mineral resource properties in the State of Nevada. The Carlin Trend is a predominant area for gold exploration activities in Nevada. The gold mining activities at the Carlin Trend are dominated by a few major companies including Newmont and Barrick Gold.

In 2011, we became subject to reporting under the Securities Exchange Act of 1934, and in June 2012, our Common Shares became listed on the NYSE MKT. Our Common Shares have also been listed on the TSX Venture Exchange in Canada for many years. For the past three years we have regularly issued press releases reporting upon business and financial developments, participated in industry conferences and had contact with many newsletter writers and analysts. However, prior to the spring of 2014, coverage by the investment community was somewhat limited and sporadic due, in large part, to the precipitous drop in the price of gold from US$1,895 in September 2011 to US$1,250 in February 2014 causing the entire gold sector from major producers to junior explorers to contract significantly. Such contraction continues to this day.

Since February 2014, we have completed two significant transactions which have increased our visibility amongst potential investors and analysts in the gold sector, and led to several writers of industry reports contacting us and issuing reports. Firstly, in March 2014, we acquired the remaining interests in the "Pinion" gold deposit located immediately adjacent to our Railroad project at the southeast end of the Carlin Trend in north-central Nevada (the "Pinion Acquisition") thus completing our consolidation of the entire Railroad Mining District of Elko, Nevada. This consolidation was very significant as it represented the culmination of almost four years work to gain exclusive control over the previously fragmented Railroad Mining District for the first time in history as well as giving us a potential nearer-term development option. Secondly, in late May 2014 we entered into a binding letter of intent to sell all of our non-core early exploration assets to an arm-length third party and restructured our scientific and technical team with a view to concentrating our management and financial resources towards resource delineation and development of the Railroad-Pinion property. We view the Pinion Acquisition and sale of our non-core exploration assets as key "pieces" of the puzzle required to increase our visibility and exposure to a broader audience of investors and mining analysts and the impetus behind the issuance of the three reports by Rockstone Research (referenced in our GSV July 2 Letter), Mr. Epstein’s posting on Myriad Equity and Seeking Alpha, and the article in The Gold Report (collectively, the “Reports”). Each of these Reports focused on our proposed drilling plans for our recently consolidated Railroad-Pinion property and our May 2014 binding letter of intent to sell our non-core exploration assets. Certain of the information in these Reports was extracted or derived from what we had disclosed in our public filings and in our presentations and fact sheet posted on our website. None of these Reports mentioned a proposed public offering or even any contemplated financing because we did not discuss this subject with the authors of the Reports nor with anyone else outside of our management, board of directors and professional advisors.

Our relationship with each of Rockstone Research, Mr. Epstein and The Gold Report is as follows:

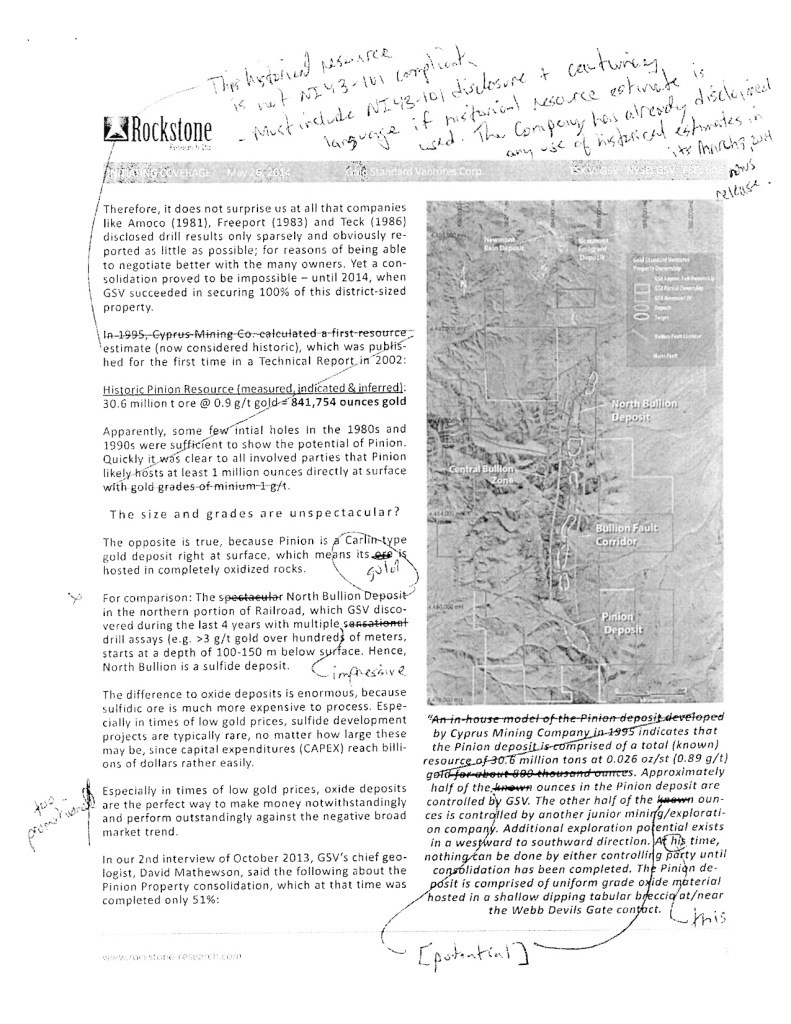

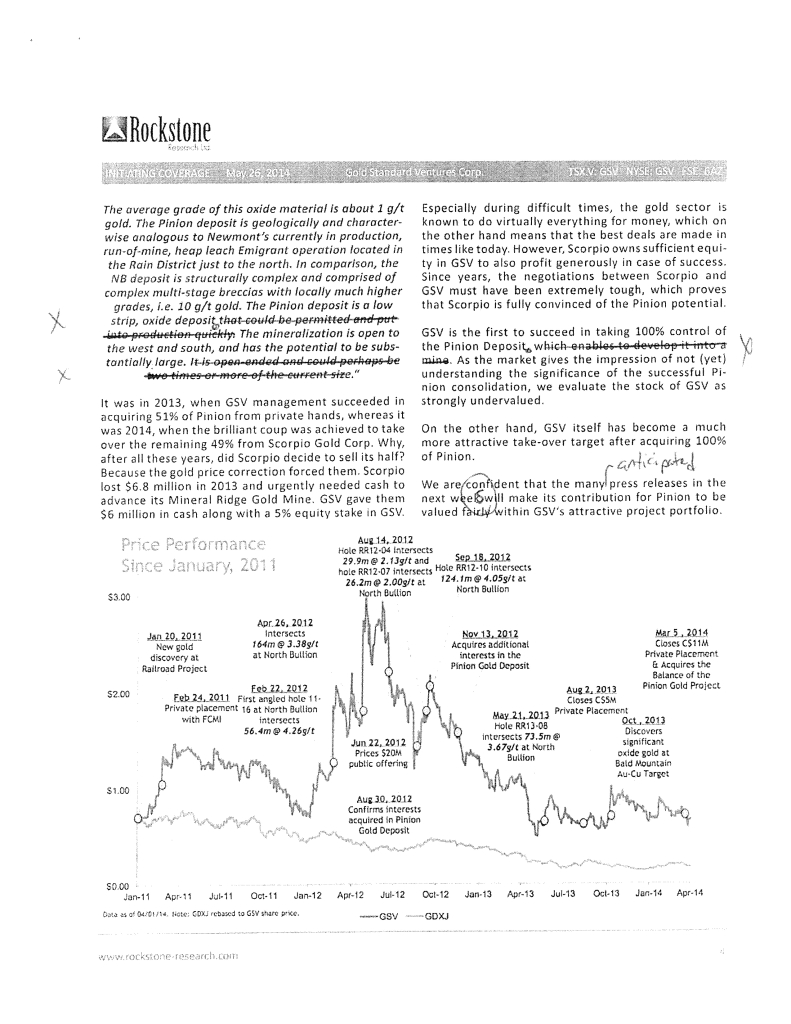

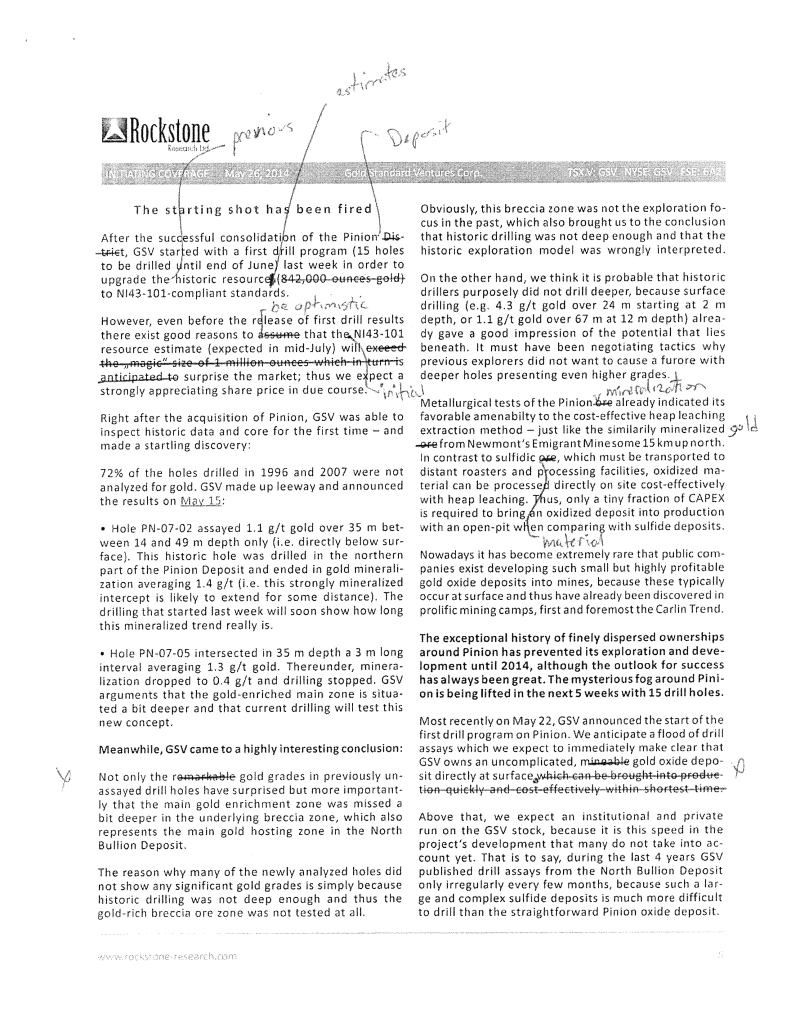

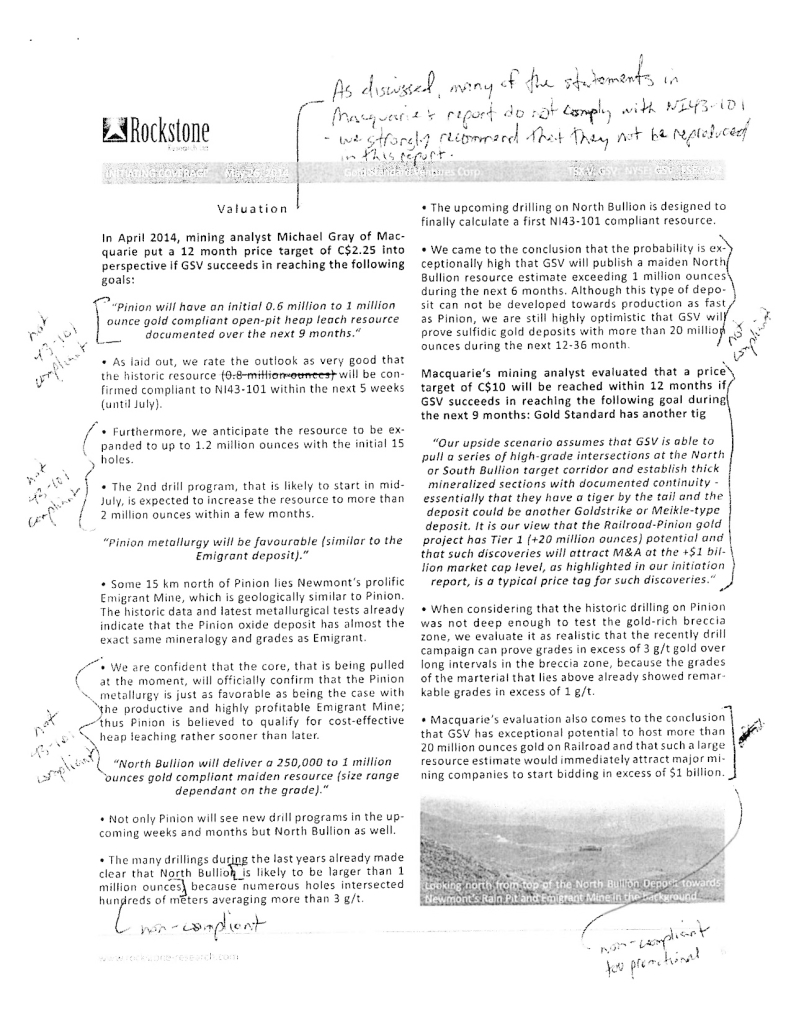

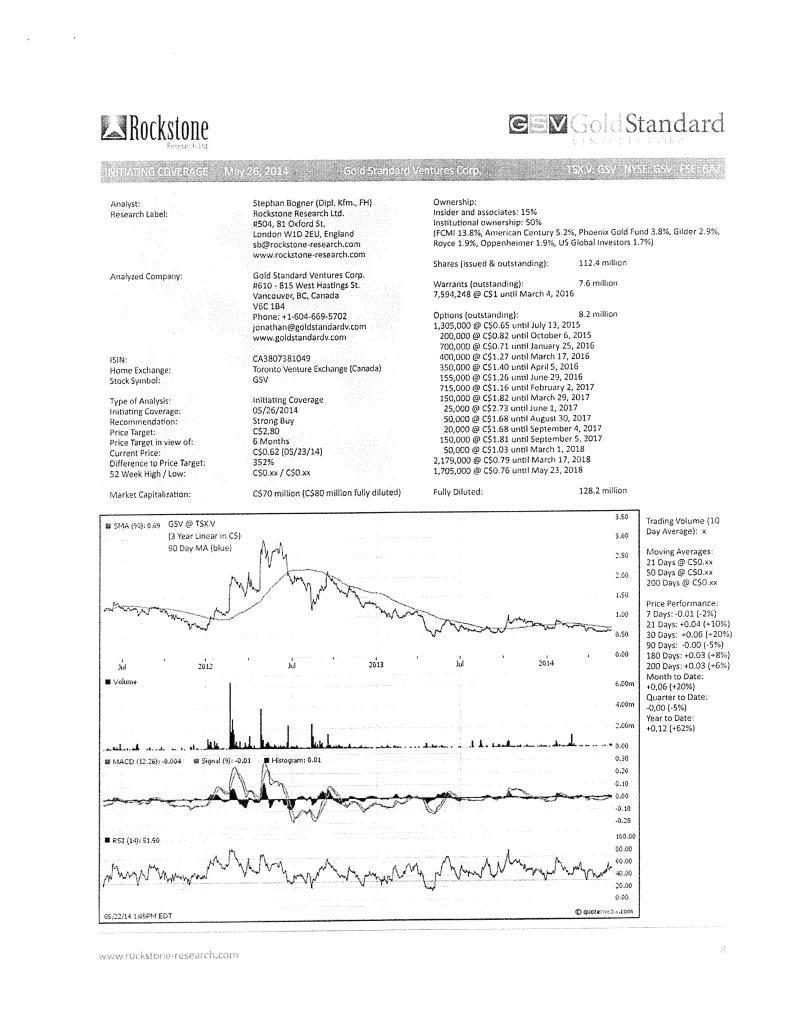

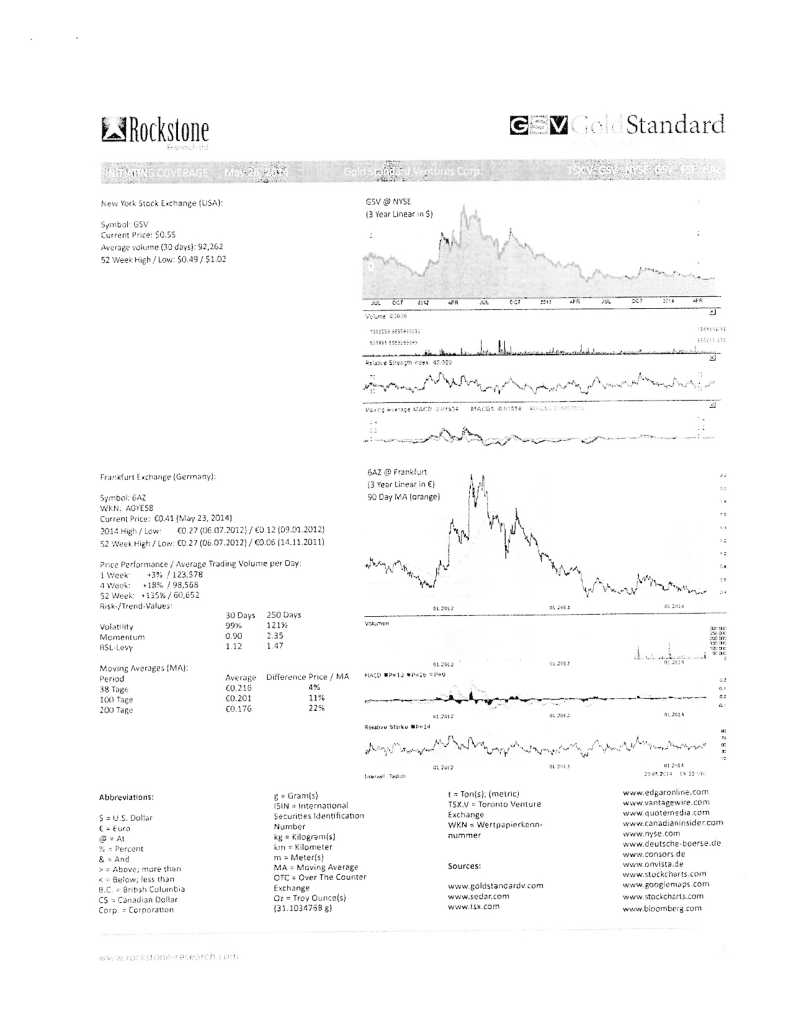

Rockstone Research - we refer to our response to comment 2 in the GSV July 2 Letter for information about our relationship with Rockstone Research and its principal Stephan Bogner. Our U.S. counsel has spoken directly with Peter Epstein and confirmed that he has no relationship with either Rockstone Research or Mr. Bogner and that he became aware of the Rockstone Research reports other than through us. Further, our response noted that our Canadian counsel had reviewed and marked up a draft of the first Rockstone report dated May 26, 2014 (the "May 26 Rockstone Report") which was sent by us to Mr. Bogner, who disregarded the comments. For your information, attached as Exhibit A is a copy of our Canadian counsel’s markup. You will see that his comments go to compliance with Canadian disclosure rules for mineral exploration companies. We note that Rockstone first reported on us in the fall of 2013.

Peter Epstein is an independent analyst who (for at least the last three years) prepares and issues on-line reports on smaller gold companies. He has the right to post his reports on the websites of Myriad Equity and Seeking Alpha, for which he does not receive any payment except for exclusive reports posted on Seeking Alpha. His posting about us on Seeking Alpha was on a non-exclusive, non-fee paying basis. These websites seek persons to contribute articles for posting that can be accessed by readers without a fee. Mr. Epstein submits his articles for posting to establish a following of persons interested in smaller gold companies for some future use.

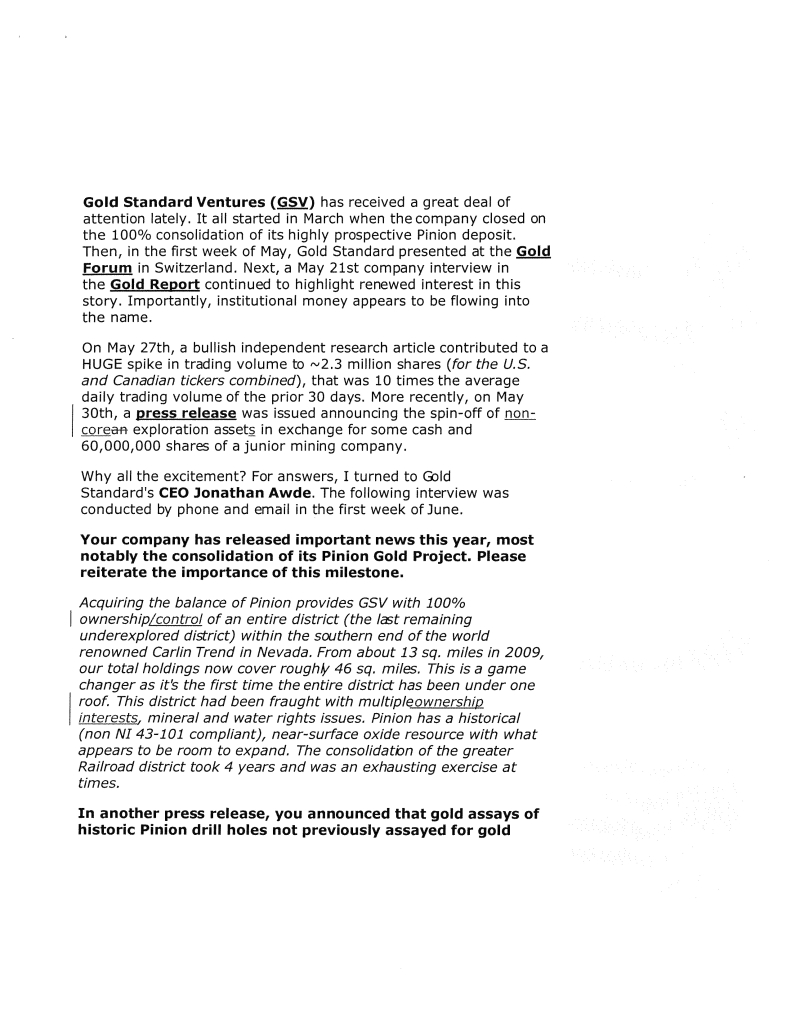

Several months ago, one of our shareholders introduced us to Mr. Epstein. Subsequently Mr. Epstein began following us and maintained contact with Jonathan Awde, our President and Chief Executive Officer, and others at GSV. In early June 2014, after reading other reports on us, Mr. Epstein requested an interview with Mr. Awde for the purposes of preparing a report on GSV. Shortly thereafter, Mr. Epstein conducted a telephone interview with Mr. Awde, and on or about June 9, 2014 prepared his report and sent a draft to us for review. Our Canadian legal counsel reviewed the draft report for compliance with Canadian disclosure guidelines and suggested a number of changes with a view to compliance with Canadian disclosure requirements. A copy of our Canadian counsel's markup of Mr. Epstein's draft report is attached as Exhibit B for your information. To our knowledge, this is the only report Mr. Epstein has written about us.

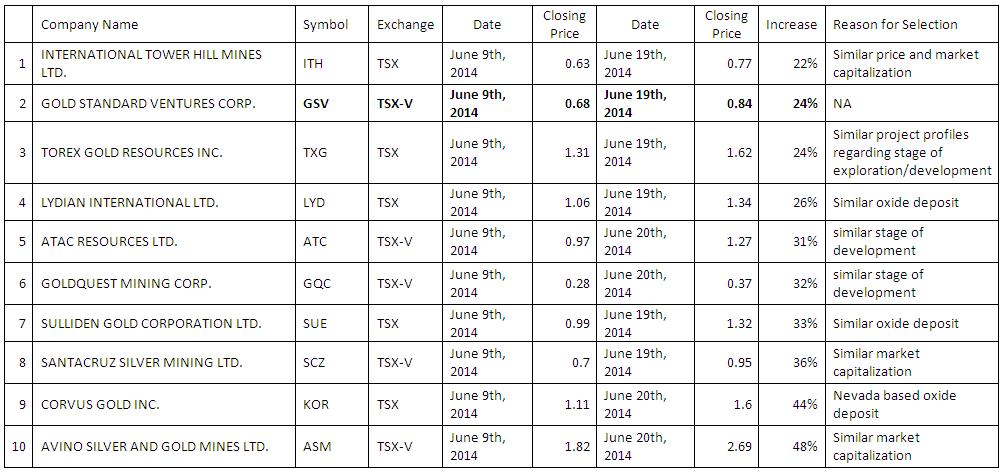

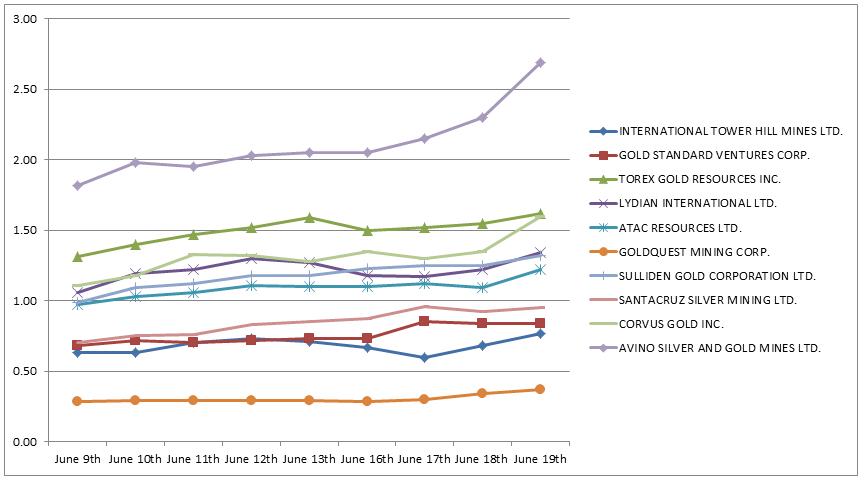

In his report, Mr. Epstein notes a bullish independent research article on us that "… contributed to a HUGE spike in trading volume…". We assume that the referenced report was the May 26 Rockstone Report; however, we confirm that at no time during the interview or otherwise did Mr. Awde discuss the Rockstone Report with Mr. Epstein. Mr. Epstein's characterization of the Rockstone Report and its impact on the trading volume of our shares is entirely his own. However, it is interesting to note that during the period from June 9 to June 19/20, there was also a significant percent increase in the market prices and trading volumes of the shares of numerous gold exploration companies comparable to us listed on the Toronto Stock Exchange and/or TSX Venture Exchange as shown on the chart attached to this letter as Exhibit C. Such increases in market price and trading volume are also consistent with the spike in the price of gold during the same period from US$1,253 on June 9, 2014 to US$1,312 on June 20, 2014 as illustrated in the chart attached hereto as Exhibit D. We note that the price of gold has since retreated to US$1,295.70 as of July 15, 2014 with a corresponding drop in the price of our Common Shares to US$0.632 as of the same date.

We further confirm that Mr. Epstein did not receive any compensation or expense reimbursement from us for his report, nor do we have any agreement or understanding with Mr. Epstein with respect to future reports or services.

The Gold Report is a free website published by Streetwise Reports LLC featuring summaries of articles from major publications, specific recommendations from top worldwide analysts and portfolio managers covering gold stocks and a directory, with samples of precious metals newsletters. Also included are short reports generated by The Gold Report writers on industry companies. Many gold companies, analysts and other market professionals advertise or have sponsorships on The Gold Report. Since May 2011, we have had a sponsorship on The Gold Report paying at the rate of $5,250 per quarter. We also have a similar sponsorship on 321gold. These sponsorships just list our company name in an effort to give us some exposure to the persons who go to these websites.

After the Pinion Acquisition, Streetwise Reports contacted us about preparing a possible story about our proposed Pinion drill program. We agreed to an interview format with Mr. Awde which resulted in the May 21 Special Report on Streetwise Reports. We paid $3,000 to Streetwise Reports for the Management Q&A.

We would like to address two additional points in order to provide some context to certain statements or implications made in the SEC July 9 Letter. First, there is mention of certain of the Reports having links to our website as though we had done something wrong with regard to those links. As a listed public company, under Commission and NYSE regulations, we are required to post certain information and reports on our website for the review and use by the public. Pursuant to those regulations and our investor relations policies, we post our fact sheets and investor presentations on our website. However, our website specifically prohibits, without our prior written approval, the copying, reproduction, modification, uploading, posting, transmitting or distribution of any materials from our website, except for non-commercial, personal or educational purposes where the material is not modified, and while we do not place restrictions on a third party including on its website a hyperlink to something on our website we have never expressly authorized anyone to effect a link to our website. The fact that the Reports in question have links to information on our website cannot infer that we have responsibility for the preparation of those Reports. Moreover, we have never posted on our website a link to a newsletter or analyst report nor any reference to any newsletter or analyst report.

Second, in the spring of 2014, we did not publicly disclose a plan to file the Registration Statement nor take steps to “condition the market” for the Registration Statement. We assume that most investors who follow us are aware that we regularly seek public or private financings. Our public filings clearly state that as an exploration company that does not generate revenue we are in constant need to obtain funds for exploration activities. The Liquidity and Capital Resources section in Item 5B of our Form 20-F for the fiscal year ended December 31, 2013, states “[we] finance our exploration activities by raising capital from equity markets from time to time,” and “[o]ur continuation as a going concern is dependent upon successful results from our exploration and evaluation activities and our ability to attain profitable operations and generate funds therefrom and/or raise equity capital or borrowings sufficient to meet current and future obligations.” In addition, one risk factor in Item 2D of the Form 20-F entitled “We will require additional capital to develop our mineral properties or complete further exploration programs” mentions a private placement in February 2014 and goes on to say that we will require additional capital to complete the Phase 1 program on the Railroad Pinion Project.

2. Please provide an analysis showing how you determined that the interviews and other publications referenced above are consistent with Section 5 of the Securities Act, given the dates of such interviews and other publications and the date you filed the registration statement.

Response - As explained fully below, we have determined that based upon the nature of our Registration Statement filed being a shelf offering, our limited role with the unsolicited Reports, the absence of any mention of a proposed public financing in any of the Reports or even in our discussions with the authors of the Reports, our concern that the Reports be compliant with Canadian disclosure requirements for exploration companies, our not disseminating the Reports or posting/linking them on/to our website or otherwise endorsing or approving them, and the more than 30 day period that has passed since the filing of our Registration Statement, our activities were generally consistent with the Commission’s rules and pronouncements for what a reporting issuer may do during the pre-filing period that does not constitute pre-conditioning the market or “gun jumping.”

The initial question is whether our activities constituted an “offer” as defined in Section 2(a)(3) of the Securities Act. During the pre-filing period, we never discussed with third parties other than our directors, attorneys, accountants and financial advisers the possibility of filing the Registration Statement for a public offering of our securities. The Form F-3 we filed was a shelf registration for US$50,000,000 of an indeterminate number of registered securities consisting of Common Shares, warrants, share purchase contracts, subscription rights and/or units. As you are aware, after the Commission would declare our Registration Statement effective we would still have to file a prospectus supplement specifying the type and number of securities to be offered and the pricing of the securities.

We have been advised that the Commission broadly interprets what is a Section 2(a)(3) offer to include activities which are not within the text book definition of “offer”, including any publicity that may contribute to the conditioning of the public mind or arousing public interest in an offering of securities. In the almost 60 years since the Commission made the foregoing statement expressing concern about “conditioning the market” there have been tremendous changes in the techniques of public offerings and available current information about public companies, coupled with information of the internet websites of both issuers and third parties, including the pervasive third party newsletters. The Commission has sought to keep up with these practices by updating the legal requirements, such as through the 2005 Securities Offering Reform and the rules implementing the 2012 JOBS Act with respect to, among other things, activities by the issuer during the pre-filing period.

We do not believe that our activities during the pre-filing period constituted “conditioning the market” or “gun jumping.” As previously mentioned, we did not publicly disclose the plan to file the Registration Statement. We did express in our Form 20-F for 2013 under “Liquidity and Capital Resources” and in “Risk Factors” that by reason of our lack of operating revenues and our need for funds for exploration activities that we would seek public and private financings, and there be no assurance that any financing would be consummated. Those mandated disclosures, which are common to most small public companies, do not constitute “conditioning the market.” During his interviews with Peter Epstein and the authors of The Gold Report, Mr. Awde never mentioned a contemplated public offering. The Reports were generated by interest developed after our March 2014 disclosure of the Pinion Acquisition, and the information in the Reports focused on the nature of the property acquired; without any mention of financings.

Our June 2014 Fact Sheet and July 2014 Investor Presentation as posted on our web site were updates to prior fact sheets and presentations. We update this information at least monthly to ensure full public access to our current information.

All of the Reports were unsolicited by us. The Commission has advocated companies having an open door to analysts, subject to certain exceptions, such as those expressed in Securities Act Rules 137 to139. On April 29, 2014, we filed our Form 20-F for 2013 with the Commission. The Form 20-F contained complete information about the Pinion Acquisition and our business plan for undertaking drilling activities on the property in order to ascertain the presence of gold and other minerals. Subsequently, as part of our normal business disclosures, we issued press releases about our preliminary exploration activities and updated our website information. We believe that these disclosures, which were consistent with our prior disclosure practice, consisted of factual business information, as defined in Securities Act Rule 168. We never made predictions with regard to possible drilling results nor market prices for our Common Shares.

Rule 168(b)(3) states that the release or dissemination of a communication is by or on behalf of the issuer if the issuer authorizes or approves such release or dissemination before it is made. First, we feel that the Reports are not subject to analysis under Rule 168 as they contained factual business information taken either from company information or management with limited editorial comment of the authors. By definition, newsletters contain some editorial information. We never posted/linked the Reports on/to our website nor referred third parties to read them. The inclusion in the Reports of hyperlinks to our website is not evidence of any “approval or authorization” by us. Under current technology, third parties have the ability to hyperlink to our website without seeking our permission.

The author of the May 26 Rockstone Report and Peter Epstein sent drafts to us which were reviewed by our Canadian securities counsel solely from a standpoint of compliance with applicable Canadian disclosure requirements as Canadian exploration companies are restricted in what they can and cannot say in discussing exploration activities and possible drilling results. Copies of counsel’s reviews are attached as Exhibits A and B to this letter. The author of the May 26 Rockstone Report did not accept our counsel's comments to his initial report, and did not send drafts of his follow-up reports to us. This legal review of the above Reports should not been deemed an “approval or authorization” by us. The Gold Report was not reviewed by our counsel although we did receive an advance copy and paid $3,000 to The Gold Report, the publisher, as reimbursement of the author, who was an independent contractor of The Gold Report. The amount was an administrative payment, extremely modest in amount and not designed to influence the substance of the Report. Furthermore, the statements in The Gold Report that "Gold Standard Ventures Corp. had final approval of the content and is wholly responsible for the validity of the statements" is simply part of The Gold Report's standard disclaimer and our "involvement" in the preparation of such report was limited to providing the author with historical and factual information about GSV.

The Commission and the courts formulated the “entanglement” theory” and the “adoption” theory as the first and second lines of inquiry in examining whether information prepared and distributed by third parties that are not offering participants can be attributed to the offering participant depends upon whether the issuer has involved itself in the preparation of the information or explicitly or implicitly endorsed or approved the information. The “entanglement theory” looks at the issuer’s level of pre-publication involvement in the preparation of the information. In examining the involvement of an issuer one court stated “[M]erely providing analysts with historical information and correcting factual inaccuracies is not sufficient” to apply the “entanglement” theory, and went on to say that “there are sound reasons for a court to construe the entanglement requirements strictly.” See In the Matter of Caere Corp. Sec. Litig., 837 F. Supp. 1054 (N.D. Cal. 1993). The “adoption” theory considers whether after publication of the report the issuer explicitly or implicitly endorses or approves the report. In its 2000 Electronics Release (Release No. 33-7856 April 28, 2000), the Commission, in discussing the “adoption” theory in the context of hyperlinked information, speaks of the issuer doing some act to link, endorse or incorporate the report. We did not explicitly or implicitly endorse the Reports, never posting/linking them on/to our website or making any references to them that could lead to questions of “entanglement” or “adoption.” Moreover, we never intended that the persons or entities responsible for the Reports would have any role in the public offering.

Because of the variety of communication practices by issuers and analysts during the pre-filing period and certain unnecessary and outmoded Commission rules, the Commission adopted various new rules under the 2005 Securities Offering Reform. The new Securities Act rules included the Rule 168 non-exclusive “safe harbor” for communications during the pre-filing period that are part of the issuers’ continued regular release of factual business information. After discussions with our counsel about the Reports and our role as expressed herein with respect to the regulatory issues affecting the Registration Statement, we believe our actions come within the regulatory purpose expressed in Rule 168.

Finally, we have endeavored to explain that the Reports were not designed to be “offers” for a public offering of our securities, nor to stimulate interest in a proposed public offering, even without any reference to a public offering in the Reports. We submit that it would be difficult to demonstrate that a reader of the Reports would have developed a desire to wait for some future public offering of our securities. Moreover, the nature of our review of the draft May 26 Rockstone Report and the Epstein Report and the very limited payment in connection with The Gold Report should not, in our view, deem the Reports attributable to us. The content and distribution of the disclosures by us in our public filings and other communications, and even the Reports, do not suggest that a selling effort was underway with a view toward a public offering.

Our U.S. securities counsel Bruce A. Rich and I are available to discuss with the Commission staff any questions to our responses in this letter and also what steps can be taken to continue the processing of the Registration Statement toward an early effective date.

| | Very truly yours,

GOLD STANDARD VENTURES CORP. | |

| | | | |

| | By: | /s/ Jonathan Awde | |

| | Name: Jonathan Awde | |

| | Title: President and CEO | |

| | | | |