Ladies and Gentlemen:

This letter responds to the comment set forth below in bold in the July 24, 2014 letter (the “SEC Comment Letter”) from John Reynolds, Assistant Director in the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”), relating to the above-captioned registration statement (the "Registration Statement").

| 1. | We note your response to prior comments 1 and 2 and your analysis under Rule 168 of the 1933 Act. Please advise us why you believe your recent investor presentations, interviews, reports and similar publications meet the requirements of Rule 168(d). Additionally, with respect to the statement that the disclosures relate to factual business information, please address the last question and answer from the May 21, 2014 interview, in which the CEO refers to “the best exploration and mining jurisdictions in the world,” “phenomenal world-class exploration team” and “rare and unique opportunity” when discussing why “an investor should take a look at Gold Standard Ventures.” |

Response: We believe that our various investor presentations, interviews, reports and similar publications (collectively, the “Publications”) over the years, including our recent Publications, consisted of factual information and were disseminated in the ordinary course of business consistent with past practice. Moreover, the timing, manner and form of information in our recent Publications is consistent, in all material respects, with similar past Publications. To complete the Rule 168(d) analysis, we are neither an investment company nor a business development company, as defined in the Investment Company Act of 1940.

Our Publications consist of our public filings, press releases and presentations and other investor information regularly publicly disseminated and posted on our website. The investor presentation and fact sheet on our website are updated monthly, and more frequently if a material event has occurred. We began maintaining the investor portion of our website in 2011 at or about the time we became an Exchange Act reporting “foreign private issuer” and we update it regularly. We are subject to, and comply with, the disclosure rules of the NYSE MKT and the TSX Venture Exchange with respect to material information, in addition to the mandatory filings with the SEC and Canadian securities regulatory authorities. Company representatives also attend industry conferences on a regular basis and have, on occasion, presented at such conferences.

However, the Company does not issue separate investment reports about itself. For at least the past 18 months, several analysts have followed us, contacting management periodically, usually after the issuance of particular press releases or the filing of certain periodic reports on EDGAR or SEDAR. As described in our prior response letters, during the spring of 2014 we had two significant events. First, our March acquisition of the Pinion gold deposit and then in May our agreement to sell our non-core exploration assets. Following customary practices and regulatory requirements, we reported these event in our Form 20-F and Form 6-Ks filed with the SEC and in press releases and Canadian material change reports, and posted those filings on our website. The events generated increased analyst interest in the Company resulting in several newsletters about us being published. We had no control over the timing or the content of the newsletters other than as expressed in our July 15 response letter. We also expressed in that letter that the third party newsletters should not be deemed “by or on behalf of” us as an issuer.

The comment in the SEC Comment Letter also asks us to relate the disclosures attributable to the undersigned in the last question in the May 21, 2014 article of The Gold Report on the Company to factual business information on the Company. That question, as well as the three quoted statements in the SEC Comment Letter taken from the article, have to be put in their context. The article was a five page Q&A with all questions other than the last one seeking factual explanations about our properties and drilling program. None of the answers covered our securities, the trading markets or future securities offerings by us. The last question sought three reasons why an investor should take a look at us. I felt the question was seeking a personal summary statement and conclusion to the interview, based upon what I had previously expressed. Again, there were no predictions or estimates, no non-public information, but simply what the CEO of a public company would say in concluding a presentation on his company. It would be a rare situation when a CEO would express that his company may not be an “opportunity” to some investor.

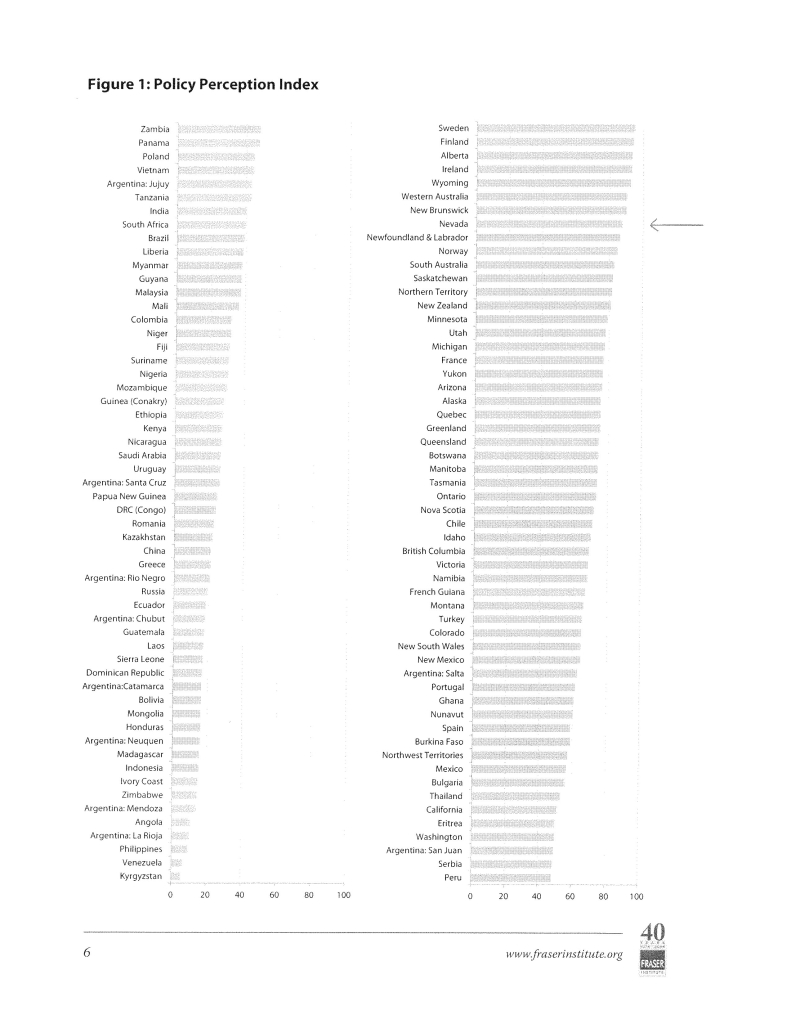

Moreover, the three quoted statements in the SEC Comment Letter are selectively cited, and when read in full convey a different impression to a reader. The first quote from the SEC Comment Letter is “the best exploration and mining jurisdictions in the world,”. However, the full quote is “It's [Nevada] one of the best exploration and mining jurisdictions in the world.”. The quote then briefly outlines various advantages of mining in Nevada. As independent support for the factual nature of this statement, we refer you to the 2013 Annual Survey of Mining Companies published by The Fraser Institute wherein Nevada is ranked as the 8th best mining jurisdiction in the world (Nevada has achieved a top ten ranking in each of the last five surveys), and stated to produce approximately 75% of the annual total U.S gold mining production, see Exhibits A and B attached hereto.

The second quoted statement “phenomenal world-class exploration team” comes from the sentence reading “Last, we have a phenomenal world-class exploration team you typically would not find in a junior.” We are contrasting our exploration team to the type of team common to junior exploration companies, and not to every mining company. Moreover, we truly believe that our geologists, mining engineers and consultants possess extensive exploration mining knowledge and experience (particularly as it relates to Nevada and Carlin type mineral deposits) and have provided high level service to us. Our public reports highlight their backgrounds as we want to show their considerable education and work experience.

The third quoted statement “rare and unique opportunity” is part of the concluding sentence of “Putting all of those characteristics into a junior is a rare and unique opportunity.” That sentence was predicated upon my prior answers in The Gold Report article and simply states that, considering all of our characteristic as a whole, Gold Standard is unique amongst junior exploration companies. In answering the questions my primary intention was to provide factual answers to items we previously publicly disclosed.

Over the past few weeks we have expeditiously responded to the SEC staff comments relating to the Registration Statement, particularly our activities and reports about us during the 30 days prior to filing the Registration Statement. We believe that the background facts described in all of our response letters clearly exhibit that we did not take steps to “condition the market” or “gun jump” the filing of the Registration Statement nor engage in any offering related activities. Our reports and communications were of factual business information and consistent with our prior reporting practice. We should not be faulted or penalized because our business steps in early 2014 attracted analyst attention to us. At no time did we mention to the analysts or others outside of the Company and its advisers the intention to file the Registration Statement. As a mineral exploration company with need for working capital for exploration and drilling and without operating revenues, we obtain funds through periodic public and private financings. This fact of need for funds and the risk of future financings is prominently set forth in our public filings. We had closed a private placement in early March 2014. The next financing would be in the summer, either private or public. The Registration Statement was a shelf, for unspecified number of common shares, warrants, share purchase contracts, subscription receipts and/or units. Nothing specific was being offered to investors.

We request that the SEC staff permit us to file an acceleration request permitting the Registration Statement to be declared effective at the earliest practical date. Even assuming the analyst reports had some effect in conditioning the market for the Company’s securities, whatever that effect may have been, it has undoubtedly dissipated during the more than 40 days since we initially filed the Registration Statement.

Our U.S. securities counsel Bruce A. Rich and I are available to discuss with the Commission staff any questions to our responses in this letter and also what steps can be taken to continue the processing of the Registration Statement toward an effective date.