Management's Discussion and Analysis of

Results of Operations and Financial Condition

For the three and six months ended

June 30, 2020

August 11, 2020

INTRODUCTION

This Management's Discussion and Analysis ("MD&A") dated August 11, 2020 is intended to supplement Hudbay Minerals Inc.'s unaudited condensed consolidated interim financial statements and related notes for the three and six months ended June 30, 2020 and 2019 (the "consolidated interim financial statements"). The consolidated interim financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS"), including International Accounting Standard 34, Interim Financial Reporting, as issued by the International Accounting Standards Board ("IASB").

References to "Hudbay", the "Company", "we", "us", "our" or similar terms refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries as at June 30, 2020.

Readers should be aware that:

- This MD&A contains certain "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") that are subject to risk factors set out in a cautionary note contained in our MD&A.

- This MD&A includes an updated discussion of the risks associated with the COVID-19 pandemic and its effect on our operations, financial condition, projects and prospects, and supplements the discussion of these risks in our most recent Annual Information Form ("AIF").

- This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to US issuers.

- We use a number of non-IFRS financial performance measures in our MD&A.

- The technical and scientific information in this MD&A has been approved by qualified persons based on a variety of assumptions and estimates.

For a discussion of each of the above matters, readers are urged to review the "Notes to Reader" discussion beginning on page 57 of this MD&A and to carefully review the risks associated with the COVID-19 pandemic that are discussed throughout this MD&A.

Additional information regarding Hudbay, including the risks related to our business and those that are reasonably likely to affect our financial statements in the future, is contained in our continuous disclosure materials, including our most recent AIF, consolidated interim financial statements and Management Information Circular available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

All amounts are in US dollars unless otherwise noted.

OUR BUSINESS

We are a diversified mining company primarily producing copper concentrate (containing copper, gold, and silver) and zinc metal. Directly and through our subsidiaries, we own three polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru), and copper projects in Arizona and Nevada (United States). Our growth strategy is focused on the exploration, development, operation and optimization of properties we already control, as well as other mineral assets we may acquire that fit our strategic criteria. Our vision is to be a responsible, top-tier operator of long-life, low-cost mines in the Americas. We are governed by the Canada Business Corporations Act and our shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima.

SUMMARY

Second Quarter Results Boosted by Strong Manitoba Operations

- Strong production and cost performance from the Manitoba operations during the quarter; an increase in production of all metals over the first quarter and record gold production driven by increasing Lalor gold grades and record gold recoveries at Stall.

- Successfully achieved efficient restart of operations at Constancia in mid-May with increased government-supported COVID-19 health and safety protocols in place.

- Second quarter net loss was $51.9 million or $0.20 per share. Second quarter adjusted net loss1 per share was $0.15 and adjusted EBITDA1 was $49.1 million, after adjusting for the impact of the Peru temporary suspension costs and a partial reversal of the Peru inventory write-down from last quarter.

- Operating cash flow before change in non-cash working capital decreased to $29.5 million in the second quarter of 2020 from $81.3 million in the same quarter of 2019 due to lower production at Constancia and lower realized base metal prices offset by higher realized gold prices and higher gold sales in Manitoba.

- Cash and cash equivalents increased during the second quarter to $391.1 million as at June 30, 2020 as a result of the previously announced $115.0 million gold prepay transaction and cash generated from operations, partially offset by capital investments on the New Britannia refurbishment project.

On Track to Achieve Manitoba Guidance; Updated Peru Guidance

- Owing to the outstanding performance from the Manitoba operations in the first half of 2020, and the ability to achieve safe and continuous operations despite COVID-19 operating challenges, we are on track to meet all Manitoba production and cost guidance for 2020.

- COVID-19 in Peru had a significant impact on our business in the second quarter and continues to be a risk we are actively managing. A government declared state of emergency in mid-March required the suspension of operations at Constancia for a period of eight weeks. The Constancia mill resumed full operation on May 18 processing stockpiled ore, and mining activities returned to normal levels in early July under a successful phased restart plan.

- Updated 2020 Peru production guidance of 65,000 to 75,000 tonnes of copper and 25,000 to 35,000 ounces of precious metals reflects the Constancia suspension period and the expected start of mining at Pampacancha in early 2021.

Executing on Growth Initiatives

- Fully-funded New Britannia gold mill refurbishment project remains on schedule and within budget, with detailed engineering approximately 90% complete and construction activities approximately 25% complete.

- Early mining of the gold zone at Lalor is well-underway, which is expected to result in gold production of 74,000 ounces in 2020 and 102,000 ounces in 2021. This is in preparation for the restart of the New Britannia gold mill, which is expected to increase annual gold production from Lalor to over 150,000 ounces by 2022.

- Successfully advanced Pampacancha with individual land-user agreements in place covering approximately two-thirds of the land, and land clearing activities are underway.

- Filed initial briefs with the U.S. Court of Appeals for the Ninth Circuit in June to advance the appeal of the July 2019 Rosemont court decision, which revoked the U.S. Forest Service's issuance of the Final Record of Decision for Rosemont.

- Restructured revolving credit facilities in the wake of COVID-19 to right-size the facilities and further enhance our financial flexibility during the development of the New Britannia and Pampacancha projects.

- Updated National Instrument ("NI") 43-101 resource estimate for the 1901 deposit near Lalor includes a larger base metal resource estimate and a new gold-rich inferred resource estimate of 500,000 tonnes grading 6.8 grams per tonne of gold.

Summary of Second Quarter Results

Cash generated from operating activities in the second quarter of 2020 decreased to $31.4 million compared to $107.0 million in the same quarter of 2019. Operating cash flow before change in non-cash working capital was $29.5 million during the second quarter of 2020, reflecting a decrease of $51.8 million compared to the same period of 2019. The decrease in operating cash flow is primarily the result of lower realized base metal prices as well as lower Constancia production and sales due to the temporary suspension of mine operations. This decrease was partially offset by higher gold production and sales in Manitoba as well as higher realized gold prices.

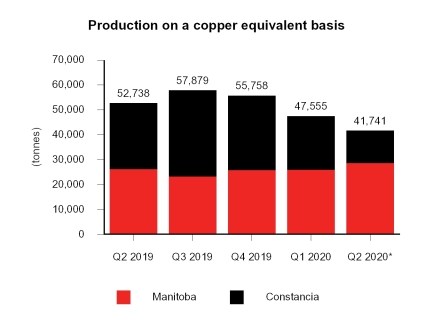

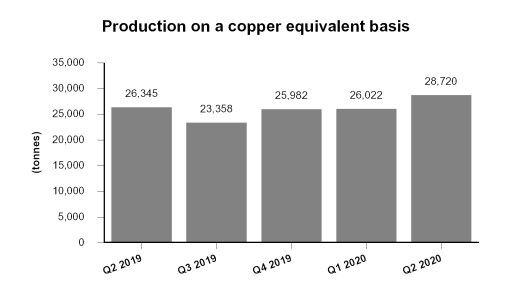

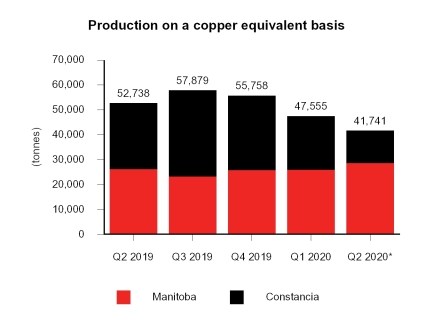

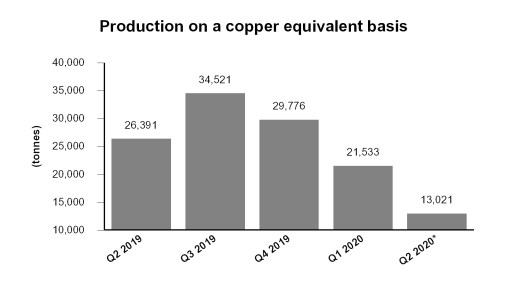

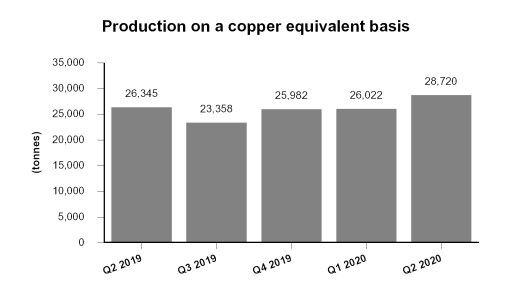

Copper-equivalent production in the second quarter of 2020 decreased by 21% compared to the same period in 2019 primarily as a result of lower ore production from Constancia due to the eight-week suspension of operations commencing mid-March 2020 following a government declared state of emergency as well as lower Constancia copper grades. However, copper-equivalent production in Manitoba increased by 9% in the second quarter over the same quarter in 2019 primarily due to a 25% increase in gold production as sustained results from the Stall mill gold recovery improvement initiatives are achieved.

Net loss and loss per share in the second quarter of 2020 were $51.9 million and $0.20, respectively, compared to a net loss and loss per share of $54.1 million and $0.21, respectively, in the second quarter of 2019. Second quarter earnings were negatively impacted by lower base metal prices, lower sales volumes due to the temporary suspension of Constancia mine operations and lower Constancia grades. In addition, the temporary suspension at Constancia resulted in fixed overhead production costs of $25.6 million during the second quarter and $31.9 million year-to-date that would normally be capitalized to inventories and property, plant, and equipment, to be immediately expensed as part of our cost of sales. This was partially offset by a $8.2 million reversal of a Peru inventory write-down due to rising copper prices in the second quarter. The below table provides a summary of COVID-19 related charges at Constancia and where each item is classified in our consolidated interim financial statements.

Financial statement category | COVID-19 related cost description | Three months ended June 30, 2020 | Six months ended June 30, 2020 |

(in $ thousands) | | | |

Cost of sales | | | |

Mine operating costs | • Fixed overhead production costs • Medical testing • Safety equipment • Additional transportation and accommodation costs for social distancing | 12.4 | | 15.8 | |

Depreciation and amortization | • Straight line equipment depreciation during suspension of operations | 13.2 | | 16.1 | |

Total COVID-19 related costs1 | | 25.6 | | 31.9 | |

1 These charges are not included in our calculation of adjusted net loss and adjusted EBITDA. Adjusted net loss and adjusted EBITDA are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

After adjusting for the temporary suspension costs in Peru and the reversal of the Peru inventory write-down, among other items, adjusted net loss1 and adjusted EBITDA1 in the second quarter of 2020 were $39.7 million, or $0.15 per share, and $49.1 million, respectively. This compares to an adjusted net loss and adjusted EBITDA of $8.1 million, or $0.03 per share, and $95.9 million, respectively, in the same period of 2019. The increase in adjusted net loss and decrease in adjusted EBITDA was primarily due to the same factors noted above.

On a budgeted sales volume basis, if operations at Constancia were maintained during the eight-weeks in which production was suspended, this would have resulted in approximately $108.0 million of incremental revenue and generated approximately $42.4 million of incremental year-to-date pre-tax earnings, assuming closing second quarter commodity prices. These amounts would have improved our current year-to-date reported revenue of $454.0 million and pre-tax loss of $156.1 million.

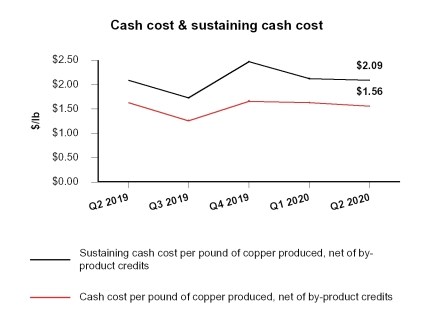

In the second quarter of 2020, consolidated cash cost per pound of copper produced, net of by-product credits1, was $0.64, compared to $1.27 in the same period last year. Given the significant reduction in Constancia production in the second quarter, this measure is more heavily impacted by our Manitoba production which contains meaningful zinc and precious metal by-product revenue components, and this is not indicative of future consolidated cash costs. The overall decrease in this measure was a result of declines in Peru production costs in the second quarter exceeding a more muted decline in by-product credit revenues, due to the significant Manitoba by-product revenue component remaining unchanged compared to the same period in 2019. Incorporating sustaining capital, capitalized exploration, royalties, selling, administrative and regional costs, consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits1, in the second quarter of 2020 was $2.26, which decreased from $2.30 in the same period last year, driven mainly by same factors noted above.

*Reflects Constancia temporary shutdown in April and May.

1 Adjusted net loss and adjusted net loss per share, adjusted EBITDA, cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, and net debt are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A.

KEY FINANCIAL RESULTS

Financial Condition | Jun. 30, 2020 | Dec. 31, 2019 |

(in $ thousands) |

Cash and cash equivalents | 391,136 | 396,146 |

Total long-term debt | 988,418 | 985,255 |

Net debt1 | 597,282 | 589,109 |

Working capital | 260,672 | 271,284 |

Total assets | 4,498,892 | 4,461,057 |

Equity | 1,706,303 | 1,848,123 |

1 Net debt is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

Financial Performance | Three months ended | Six months ended |

(in $ thousands, except per share amounts) | Jun. 30, 2020 | | Jun. 30, 2019 | Jun. 30, 2020 | | Jun. 30, 2019 |

Revenue | 208,913 | | 329,414 | 454,020 | | 621,672 |

Cost of sales | 221,567 | | 286,271 | 488,665 | | 526,718 |

Loss before tax | (74,604 | ) | | (43,931 | ) | (156,056 | ) | | (62,044 | ) |

Loss | (51,901 | ) | | (54,145 | ) | (128,035 | ) | | (67,562 | ) |

Basic and diluted loss per share | (0.20 | ) | | (0.21 | ) | (0.49 | ) | | (0.26 | ) |

Adjusted loss per share1 | (0.15 | ) | | (0.03 | ) | (0.30 | ) | | - | |

Operating cash flow before change in non-cash working capital2 | 29.5 | | 81.3 | 71.4 | | 166.9 |

Adjusted EBITDA1,2 | 49.1 | | | 95.9 | | 104.1 | | | 200.0 | |

1 Adjusted loss per share and adjusted EBITDA are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

2 In millions. |

KEY PRODUCTION RESULTS

| Three months ended | | Three months ended |

Jun. 30, 2020 | | Jun. 30, 2019 |

Peru | Manitoba | Total | | Peru | Manitoba | Total |

Contained metal in concentrate produced 1 | | | | | | |

Copper | | tonnes | 11,504 | 6,522 | 18,026 | | 24,232 | 6,131 | 30,363 | |

Gold | | oz | 2,311 | 30,303 | 32,614 | | 3,794 | 24,305 | 28,099 | |

Silver | | oz | 253,687 | 327,130 | 580,817 | | 551,807 | 260,000 | 811,807 | |

Zinc | | tonnes | - | | 31,222 | 31,222 | | - | | 31,838 | 31,838 | |

Molybdenum | | tonnes | 124 | | - | | 124 | | | 334 | - | | 334 | |

Payable metal sold | | | | | | | |

Copper | | tonnes | 9,023 | 6,928 | 15,951 | | 25,778 | 7,393 | 33,171 | |

Gold | | oz | 1,317 | 29,273 | 30,590 | | 4,056 | 26,482 | 30,538 | |

Silver | | oz | 242,519 | 299,266 | | 541,785 | | 504,259 | 300,042 | 804,301 | |

Zinc 2 | | tonnes | - | | 27,604 | | 27,604 | | | - | | 24,224 | 24,224 | |

Molybdenum | | tonnes | 120 | | - | | 120 | | 419 | | - | | 419 | |

| | | | | | | | | |

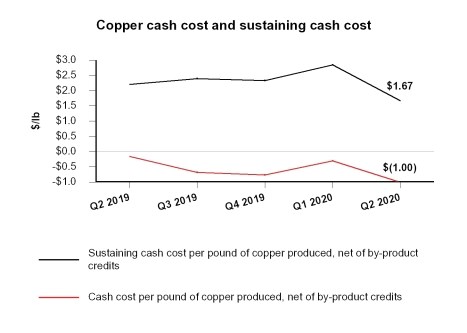

Cash cost 3 | | $/lb | 1.56 | (1.00) | 0.64 | | 1.63 | (0.15) | 1.27 |

Sustaining cash cost 3 | | $/lb | 2.09 | 1.67 | | | 2.11 | 2.19 | |

All-in sustaining cash cost3 | | $/lb | | | 2.26 | | | | 2.30 |

| | | | | | | | | | | | | | | | |

| Six months ended | | Six months ended |

Jun. 30, 2020 | | Jun. 30, 2019 |

Peru | Manitoba | Total | | Peru | Manitoba | Total |

Contained metal in concentrate produced 1 | | | | | | |

Copper | | tonnes | 30,793 | | 11,867 | | 42,660 | | | 56,075 | | 12,260 | | 68,335 | |

Gold | | oz | 5,373 | | 57,596 | | 62,969 | | | 9,151 | | 44,510 | | 53,661 | |

Silver | | oz | 714,989 | | 633,520 | | 1,348,509 | | | 1,186,737 | | 544,265 | | 1,731,002 | |

Zinc | | tonnes | - | | 61,717 | | 61,717 | | | - | | 59,875 | | 59,875 | |

Molybdenum | | tonnes | 478 | | - | | 478 | | | 638 | | - | | 638 | |

Payable metal sold | | | | | | | |

Copper | | tonnes | 28,270 | | 11,753 | | 40,023 | | | 52,440 | | 12,448 | | 64,888 | |

Gold | | oz | 3,936 | | 53,229 | | 57,165 | | | 10,274 | | 42,893 | | 53,167 | |

Silver | | oz | 604,110 | | 513,597 | | 1,117,707 | | | 1,256,518 | | 530,689 | | 1,787,207 | |

Zinc 2 | | tonnes | - | | 54,396 | | 54,396 | | | - | | 47,178 | | 47,178 | |

Molybdenum | | tonnes | 551 | | - | | 551 | | | 653 | | - | | 653 | |

| | | | | | | | | |

Cash cost 3 | | $/lb | 1.61 | | (0.68 | ) | 0.97 | | | 1.38 | | 0.31 | | 1.19 | |

Sustaining cash cost 3 | | $/lb | 2.11 | | 2.21 | | | | 1.71 | | 2.69 | | |

All-in sustaining cash cost3 | | $/lb | | | 2.34 | | | | | 2.07 | |

1 Metal reported in concentrate is prior to deductions associated with smelter contract terms. |

2 Includes refined zinc metal sold. |

3 Cash cost, sustaining cash cost and all-in sustaining cash cost per pound of copper produced, net of by-product credits are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

RECENT DEVELOPMENTS

COVID-19 Business Update

Amidst the COVID-19 pandemic, our business response plan continued to be executed throughout the quarter, building off our crisis response protocols to establish business practices to carry us through this ongoing public health situation. We remain focused on the health and safety of our workforce, their families and the communities in which we operate. Addressing the pandemic is a collective effort and we continue to actively engage with our industry associations to understand developing practices and with local stakeholders and public health authorities to ensure effective implementation of our business response plans. We closely monitor the evolution of the pandemic in each of our regions and are continuously reviewing and adapting our procedures based on the latest local situation.

Each of our business units has developed effective site-specific measures to identify and limit COVID-19 exposure and transmission and maintain a safe environment for our workers and our communities. Site-specific measures include testing of incoming workers prior to their travel to site, pre-screening protocols, quarantine periods for incoming workers, workplace physical distancing protocols, and adjustment of work rotation schedules. These measures continue to evolve as the status of the pandemic changes in each of our operating regions and our measures are adapted to the regional health authorities' latest restrictions and guidelines.

We believe the most important way we can support the communities in which we operate is to manage safe operations that provide income for local employees, businesses, and communities. In addition to our efforts to maintain safe operations, we have been supporting public health efforts and providing COVID-19 relief funding, supplies and services to our neighbouring communities. Each region has different emergency needs at this critical time. In Peru, we have donated medical equipment and supplies to the regional hospitals and have delivered food to nearby communities in need. In Manitoba, we have donated to charities that provide various forms of support to families in need.

Resumption of Operations at Constancia

On May 14, following an eight-week suspension of Constancia operations due to a government declared state of emergency, Hudbay received approval of our restart protocols from Peru's Ministry of Energy and Mines. On May 18, 2020, the Constancia processing facilities resumed full production. During the Constancia mine suspension period, a smaller workforce was maintained at the site to oversee critical aspects of the operation and pro-actively prepare detailed mine reopening plans, which helped facilitate the quick and efficient restart of operations. In an effort to ensure a steady ramp-up while minimizing the number of workers at site, the restart plan followed a two-phased approach. The initial phase utilized stockpiled ore to fill the mill for the first six weeks. This was followed by a ramp-up of mining activities, commencing the last week of June with a full ramp up to normal levels in early July.

The situation in Peru, however, remains fluid. The state of emergency, first declared by the government in response to the COVID-19 pandemic on March 15, has since been extended to August 31, 2020 and there remains a risk of further disruptions to mining operations. We are actively monitoring the situation and any potential future impact on Constancia's operations.

Annual Guidance Update

On May 14, 2020, we suspended our previously issued 2020 annual guidance for our Peru operations due to the temporary suspension of operations at Constancia and the ongoing uncertainty surrounding the COVID-19 pandemic. Following a full resumption of Constancia milling activities in mid-May and mining activities in early July, we have reissued updated 2020 annual guidance for our Peru business unit.

Our updated annual production and operating cost guidance, along with our annual capital and exploration expenditure forecasts are presented below. These forecasts incorporate the impact of regularly scheduled maintenance at our operations, including semi-annual mill maintenance at Constancia and planned maintenance on the Lalor hoist facilities during the third quarter. Our updated Peru guidance assumes we are able to continue to safely operate for the remainder of the year while adhering to our existing health protocols and those required by the Peruvian government. Our Manitoba guidance remains unchanged from previously disclosed expectations.

Revised 2020 Guidance Summary | Peru | Manitoba | Total |

| | | |

Contained Metal in Concentrate1 | | | |

Copper | tonnes | 65,000 - 75,000 | 18,000 - 22,000 | 83,000 - 97,000 |

Zinc | tonnes | | 105,000 - 125,000 | 105,000 - 125,000 |

Precious metals2 | oz | 25,000 - 35,000 | 110,000 - 135,000 | 135,000 - 170,000 |

Molybdenum | tonnes | 1,100 - 1,300 | | 1,100 - 1,300 |

| | | |

Combined Unit Operating Cost3 | $/tonne | $8.30 - $10.00 | C$130 - 140 | |

| | | | |

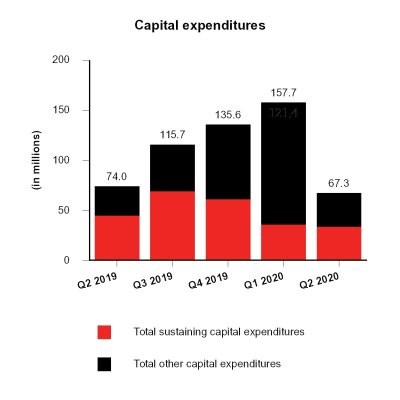

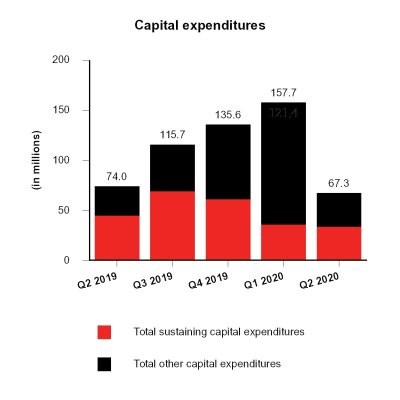

Capital Expenditures4 | | | | |

Sustaining capital | millions | 80.0 | 100.0 | 180.0 |

Growth capital | millions | 70.0 5 | 80.0 | 170.0 6 |

| | | | |

Exploration Expenditures | millions | 15.0 | 10.0 | 25.0 7 |

| | | | |

1 Metal reported in concentrate is prior to refining losses or deductions associated with smelter terms. |

2 Precious metals production includes gold and silver production on a gold-equivalent basis, and silver is converted to gold at a ratio of 89:1. |

3 Reflects combined mine, mill and G&A costs per tonne of milled ore. Peru costs reflect the deduction of expected capitalized stripping costs. Combined unit costs are non-IFRS financial performance measures with no standardized definition under IFRS. For further information, please see the discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

4 Excludes capital costs not considered to be sustaining or growth capital expenditures. |

5 Peru growth capital expenditures include costs associated with project development and acquiring surface rights. Additional costs remain outstanding in recognition of current uses of land and the company is currently entering into agreements to address these matters. |

6 Includes $20.0 million of capitalized Arizona spending associated with the Rosemont and Mason projects. |

7 Includes $15.0 million of capitalized exploration resulting in total exploration expense of $10.0 million. |

The revised production guidance for Peru reflects a reduction of approximately 15,000 to 20,000 tonnes of copper and 20,000 ounces of precious metals compared to the original guidance issued earlier this year, with molybdenum production only modestly affected. This reduction reflects the lost production during the eight-week temporary suspension at Constancia, in addition to revised mine plans for the remainder of the year and the resulting deferral of some higher-grade ore into 2021. The precious metals production guidance also reflects the revised expected Pampacancha production start date of early 2021, compared to the second half of 2020 previously, due to the Peruvian government declared state of emergency and the resulting impact on the Consulta Previa consultation process.

Peru sustaining capital of $80.0 million reflects the deferral of approximately $20.0 million into 2021 due to the resequencing of capital activities, such as tailings and capitalized stripping, as a result of the temporary mine suspension. The revised unit cost guidance in Peru reflects lower mining costs during the gradual ramp-up of mining activities in the second quarter of 2020. There was no change to exploration expenditure guidance.

Peru growth capital of $70.0 million is unchanged from previous guidance and includes initial expenditures for developing the Pampacancha deposit, acquiring surface rights from the local community, but excludes the costs associated with recognizing the current uses of the land by certain community members. We have made significant progress with completing these individual land-user agreements, with agreements covering approximately two-thirds of the property completed to-date and the remaining agreements expected to be completed during the third quarter of 2020. As of June 30, 2020, approximately one-third of the land has been vacated and turned over to Hudbay. We intend to update our Peru growth capital guidance for these remaining costs once all of the individual land-user agreements are completed.

Credit Facility Amendment

In the second quarter of 2020, in the wake of the COVID-19 pandemic, we entered into discussions with the syndicate of banks in our revolving credit facilities (the "Credit Facilities") to restructure the facilities in order to provide Hudbay with enhanced flexibility during the development of the New Britannia and Pampacancha projects. Each of the banks in the syndicate has received credit approval to amend the Credit Facilities on the proposed terms and the transaction is expected to close by the end of August.

As a result of the amendment, total available borrowings under the Credit Facilities will be $400.0 million to reflect our anticipated business requirements until June 2022 when the Credit Facilities mature. The revised covenants include maintaining a net debt to EBITDA ratio of less than 5.25:1 and an interest coverage ratio of greater than 2.50:1 until the end of 2021. Refer to the Liquidity and Capital Resources section for additional information.

Snow Lake Development and Exploration Update

New Britannia Refurbishment Activities Underway

The New Britannia refurbishment project remains on schedule and on budget. In May, we broke ground at the New Britannia site with the start of construction of the foundation for the new copper flotation building. Construction of the pipeline between the New Britannia and Stall mills continues as planned. Detailed engineering is approximately 90% complete and construction activities are approximately 25% complete to-date. Refurbishment activities are on track for completion in August 2021, with plant commissioning and ramp-up expected during the second half of 2021. Through our expertise in project development and the advancement of the detailed engineering work, we have identified the potential to produce gold from the New Britannia mill earlier than expected in 2021. We are exploring this early gold opportunity and expect to provide an update in the third quarter of 2020.

We are continuing with our plan to mine approximately 90,000 tonnes from the gold zone in 2020 as part of stope sequencing in preparation for the restart of the New Britannia gold mill. Gold production from Lalor is expected to be 74,000 ounces in 2020 and 102,000 ounces in 2021, as per the March 30, 2020 mine plan. Upon completion of the New Britannia mill refurbishment, average annual gold production from Lalor is expected to increase to over 150,000 ounces at cash costs and sustaining cash costs, net of by-product credits, of approximately $480 and $655 per ounce, respectively, during the first eight years.

1901 Deposit Updated Resource Estimate

Since its discovery in February 2019, drilling has continued to define the extent and geometry of the 1901 deposit. After announcing an initial inferred resource estimate for the two zinc-rich lenses in August 2019, the focus of the infill drill program conducted during the winter of 2020 was two-fold: to upgrade the classification of a significant portion of the inferred resources reported in August 2019, and to define an initial inferred resource estimate for the gold mineralization that had been intersected around the two zinc-rich lenses.

The 1901 deposit is located half-way between the former Chisel North mine and the Lalor mine, less than 1,000 metres from an active underground ramp at a depth ranging from 550 to 650 metres and within 15 kilometres trucking distance of both the Stall base metal concentrator and the New Britannia gold mill. The property is 100% owned by the Company, free of any royalties or streams. The mineralization is similar to Lalor with zinc-rich volcanogenic massive sulphide lenses containing high-grade gold zones and indication of a copper-gold rich feeder zone. The mineralization occurs along the hanging wall contact of the stratigraphic horizon hosting the Chisel North deposit.

The updated resource estimates for the 1901 deposit, as of July 20, 2020, are provided in the table below:

1901 Deposit Mineral Resource Estimates1,2,3,4,5 | Tonnes

(millions) | Zn Grade

(%) | Au Grade

(g/t) | Ag Grade

(g/t) | Cu Grade

(%) |

Base Metal Zone | |

Measured | 1.0 | 6.79 | 2.2 | 29.9 | 0.43 |

Indicated | 1.1 | 10.07 | 1.5 | 32.9 | 0.30 |

Total Measured and Indicated | 2.1 | 8.52 | 1.8 | 31.5 | 0.36 |

Inferred | 0.4 | 7.11 | 1.8 | 24.4 | 0.79 |

Gold Zone | |

Inferred | 0.5 | 0.53 | 6.8 | 36.0 | 0.78 |

1 CIM definitions were followed for the estimation of mineral resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

2 Mineral resources are reported within an economic envelope defined by a mineral stope optimization algorithm assuming a selective mining method. |

3 Long-term metal prices of $1,500/oz gold, $18.00/oz silver, $3.00/lb copper and $1.09/lb zinc were used for the estimation of the mineral resources. |

4 Metal recovery estimates are based on the assumption that the base metal mineralization would be processed at the Stall concentrator and would present a similar performance to those experienced historically for the Chisel and Lalor zinc-rich lenses. The gold mineralization is assumed to be processed at the New Britannia concentrator, which is currently being refurbished. |

5 Specific gravity measurements using industry standard techniques were completed on all assayed intervals. |

High resource conversion - The upgraded base metal measured and indicated resource estimates at the 1901 deposit are equivalent to 100% of the initial tonnage of the 2019 base metal inferred resources reported in our most recent AIF, with a 12% lower zinc grade and more than double the gold grade. While the 2020 infill drilling only covered approximately two-thirds of the footprint of the 2019 mineral resource estimates, it has evidenced a larger zinc-rich resource with significant gold, silver and copper content. There remains an additional 400 thousand tonnes of base metal inferred resource estimates with attractive zinc, copper and gold content which has the potential to be upgraded to higher categories with further drilling.

Significant gold content - The 2020 drilling program was also successful in defining a new gold-rich inferred resource estimate of 500 thousand tonnes at a gold grade of 6.8 grams per tonne. Total gold resources have significantly increased with 122 thousand ounces in measured and indicated and 137 thousand ounces in inferred, compared to a total of 58 thousand inferred ounces previously, which continues to demonstrate the gold potential of the Snow Lake camp.

Conservative resource estimation method - The methodology followed to estimate mineral resources at the 1901 deposit is identical to the approach used for the Lalor mine (please refer to the NI 43-101 Technical Report for Lalor dated March 28, 2019 for more details) and constrains the resource within a stope optimization envelope that is expected to lead to a high mineral resource to mineral reserve conversion factor.

1901 Deposit Exploration Potential

There remains further opportunity to convert additional inferred material to the measured and indicated categories and to extend the resource in the northern and eastern parts of the deposit. We expect to complete a drill program in early 2021 with a focus on expanding and upgrading the 1901 resource estimate. We have also identified additional favourable exploration drill targets located between the 1901 deposit and the Lalor mine that remain to be tested.

In addition, recent drilling has identified several high-grade copper-gold zones that have not been included in the current resource estimate due to limited drilling density. Highlights of these copper-gold intersections are summarized in the table below:

Hole ID | From | To | Intercept | True Width1 | Au | Ag | Cu | Zn |

(m) | (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) |

CH1925 | 623.4 | 626.3 | 2.9 | 2.8 | 6.5 | 29.1 | 4.64 | 1.39 |

CH1955 | 655.0 | 658.0 | 3.0 | 2.9 | 2.4 | 10.4 | 2.37 | 0.02 |

CH1956 | 674.0 | 677.0 | 3.0 | 2.9 | 4.0 | 41.5 | 2.17 | 0.76 |

CH1979 | 679.7 | 685.8 | 6.0 | 5.8 | 4.1 | 22.3 | 3.18 | 0.16 |

CH1989 | 696.0 | 699.0 | 3.0 | 2.8 | 7.5 | 24.9 | 3.53 | 1.10 |

CH11012 | 736.0 | 742.2 | 6.2 | - | 0.9 | 19.9 | 4.80 | 0.18 |

CH12012 | 657.0 | 661.0 | 4.0 | - | 1.5 | 7.6 | 1.22 | 0.04 |

CH12032 | 693.5 | 695.0 | 1.5 | - | 6.1 | 21.8 | 5.08 | 0.06 |

Note: all grade values are uncut, and assay results are density and length weighted. |

1 True width is estimated based on drill angle and intercept geometry of mineralization. |

2 Historical drill holes. True widths cannot be estimated at this stage given the uncertainties of the mineralization geometry. |

Hole ID | From (m) | To (m) | Azimuth at Intercept | Dip at Intercept |

Easting | Northing | Elevation | Easting | Northing | Elevation |

CH1925 | 427,188 | 6,078,908 | -294 | 427,188 | 6,078,907 | -297 | 229 | -75 |

CH1955 | 427,128 | 6,078,932 | -322 | 427,127 | 6,078,931 | -325 | 216 | -74 |

CH1956 | 427,095 | 6,078,798 | -339 | 427,095 | 6,078,797 | -342 | 217 | -73 |

CH1979 | 427,118 | 6,078,926 | -346 | 427,116 | 6,078,925 | -352 | 247 | -73 |

CH1989 | 427,087 | 6,078,875 | -349 | 427,086 | 6,078,874 | -351 | 238 | -69 |

CH1101 | 427,471 | 6,078,922 | -399 | 427,471 | 6,078,921 | -402 | 162 | -72 |

CH1201 | 427,266 | 6,078,917 | -312 | 427,265 | 6,078,916 | -316 | 215 | -72 |

CH1203 | 427,201 | 6,079,084 | -365 | 427,200 | 6,079,084 | -367 | 251 | -73 |

Snow Lake Expansion Potential

The updated resource estimate for the 1901 deposit was planned as part of phase three of our Snow Lake gold strategy. There remain opportunities for extension and additional conversion of mineral resource estimates at the 1901 deposit and we are engaged in engineering activities to develop a viable mine plan for the 1901 deposit that could supplement production from Lalor to take advantage of the future processing capacity of our mills in the Snow Lake region.

We are also examining the potential to optimize both the Stall and New Britannia mills, which could create further value for the 1901 deposit and the Snow Lake operations. At the Stall mill, we are initiating studies to increase gold and copper recoveries. We will also be completing studies to potentially expand the New Britannia mill capacity beyond the currently planned 1,500 tonnes per day. We expect to complete these studies in the first half of 2021 as we execute the third phase of our Snow Lake gold strategy.

Constancia Regional Exploration

Our consistent approach to community negotiations has proved successful, demonstrating our strong relationships with the neighbouring communities near Constancia and positioning us well to unlock future value on our other regional growth targets in Peru. After reaching an exploration agreement with the Quehuincha community in early 2019 and subsequently completing the Consulta Previa process, we are on track to commence our planned drill program in the fall of 2020 to test a high-grade skarn target on the Quehuincha North property.

We are also continuing the follow-up drilling program on the previously disclosed Constancia North intersections to test a possible extension of copper porphyry and high-grade skarn mineralization occurring within 300 metres of the edge of the current Constancia pit. We expect to have the results from this drilling program in the third quarter of 2020.

Appointment of Chief Financial Officer

On June 11, 2020, Steve Douglas was appointed as Hudbay's Senior Vice President and Chief Financial Officer effective June 30, 2020. Mr. Douglas is highly regarded and brings over 25 years of resource industry and senior finance leadership experience to our executive team.

Appeal of Unprecedented Rosemont Court Decision

On June 22, 2020 we announced the filing of the Company's initial brief with the U.S. Court of Appeals for the Ninth Circuit in relation to the U.S. District Court for the District of Arizona's ("District Court") decision in July 2019, which revoked the U.S. Forest Service's ("Forest Service") issuance of the Final Record of Decision ("FROD") for the Rosemont project in Arizona. The filing of the Company's brief follows the U.S. federal government's initial brief which was filed on June 15, 2020 by the U.S. Department of Justice on behalf of the federal agencies involved in issuing the FROD. The FROD was issued in June 2017 after a thorough process involving 17 co-operating agencies at various levels of government.

The briefs explain how both the Company and the government believe that the District Court misinterpreted federal mining laws and Forest Service regulations as they apply to Rosemont. Both briefs assert that current law broadly authorizes mining-related activities, such as ore processing and tailings storage, to be conducted on open Forest Service lands. The District Court's determination that the Forest Service's mining regulations do not apply to mining activities unless those activities are conducted entirely on valid mining claims, and hence above ore bodies, is contrary to plain language reading of the general mining law, as well as Forest Service regulations, which explicitly allow for mining-related activity to occur on lands not covered by any mining claim.

On June 29, 2020, further briefs were filed by industry groups in support of Hudbay and the U.S. government's appeal. These industry groups include the National Mining Association, the American Exploration and Mining Association, and the Southern Arizona Business Coalition.

Dividend Declared

A semi-annual dividend of C$0.01 per share was declared on August 11, 2020. The dividend will be paid on September 25, 2020 to shareholders of record as of September 4, 2020.

BlackNorth Initiative

Hudbay's President and Chief Executive Officer, Peter Kukielski, recently joined other senior executives from Canadian public companies in a pledge to take action to end systemic racism and create opportunities for all of those in the underrepresented BIPOC (Black, Indigenous and People of Colour) community. The pledge is part of the BlackNorth Initiative and the recently formed Canadian Council of Business Leaders Against Anti-Black Systemic Racism. The BlackNorth Initiative aligns with our values of dignity and respect, caring, openness and trustworthiness that are inherent in our corporate culture and in our decision-making and actions. Our community engagement efforts are focused around creating opportunities for all members of the communities in which we operate. Through the BlackNorth Initiative, we intend to expand our efforts to help end systemic racism.

CONSTANCIA OPERATIONS REVIEW

| | Three months ended | | Six months ended | | Guidance |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 | | Annual |

| 2020 1 |

Ore mined 2 | tonnes | | 2,775,286 | | 8,211,166 | | 9,760,498 | | 16,845,939 | | |

Copper | % | | 0.34 | | 0.39 | | 0.34 | | 0.43 | | |

Gold | g/tonne | | 0.04 | | 0.04 | | 0.03 | | 0.04 | | |

Silver | g/tonne | | 2.90 | | 3.68 | | 3.04 | | 3.61 | | |

Molybdenum | % | | 0.02 | | 0.01 | | 0.02 | | 0.01 | | |

| | | | | | | | | | | |

Ore milled | tonnes | | 4,355,482 | | 7,679,739 | | 11,074,949 | | 15,672,801 | | |

Copper | % | | 0.34 | | 0.37 | | 0.34 | | 0.42 | | |

Gold | g/tonne | | 0.04 | | 0.04 | | 0.03 | | 0.04 | | |

Silver | g/tonne | | 3.04 | | 3.40 | | 3.09 | | 3.47 | | |

Molybdenum | % | | 0.01 | | 0.02 | | 0.01 | | 0.01 | | |

| | | | | | | | | | | |

Copper concentrate | tonnes | | 51,331 | | 103,796 | | 135,346 | | 238,519 | | |

Concentrate grade | % Cu | | 22.41 | | 23.35 | | 22.75 | | 23.51 | | |

| | | | | | | | | | | |

Copper recovery | % | | 76.6 | | 84.7 | | 81.3 | | 85.6 | | |

Gold recovery | % | | 43.4 | | 41.3 | | 47.0 | | 47.1 | | |

Silver recovery | % | | 59.6 | | 65.7 | | 64.9 | | 67.9 | | |

Molybdenum recovery | % | | 19.9 | | 28.9 | | 29.2 | | 27.9 | | |

| | | | | | | | | | | |

Combined unit operating costs3,4 | $/tonne | | 7.77 | | 10.39 | | 8.70 | | 9.62 | | 8.30 - 10.00 |

1 Updated Peru guidance issued August 11, 2020. |

2 Reported tonnes and grade for ore mined are estimates based on mine plan assumptions and may not reconcile fully to ore milled. |

3 Reflects combined mine, mill and general and administrative ("G&A") costs per tonne of ore milled. Reflects the deduction of expected capitalized stripping costs. |

4 Combined unit costs is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

Following the government-mandated mid-March suspension of operations at Constancia, the mine remained closed for approximately eight weeks and resumed operations in mid-May, achieving normal mill throughput levels on May 18, within 48 hours after restart, and continued at these levels for the remainder of the second quarter. The initial six weeks following restart focused on milling activities while processing stockpile ore. This was followed by a ramp-up of mining activities commencing the last week of June with a full ramp-up to normal levels in early July. Enhanced health and safety measures were implemented upon the re-start of operations and remain in place as we continue to monitor the local impacts of the COVID-19 pandemic.

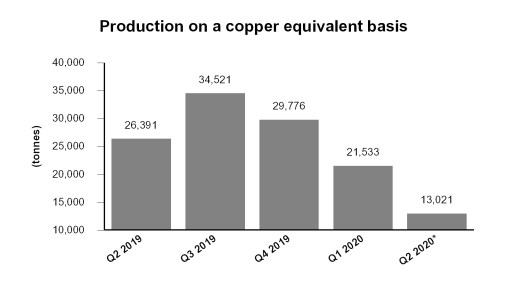

Ore milled at our Constancia mine during the second quarter of 2020 was 43% lower compared to the same period in 2019 due to the temporary shutdown of Constancia. Milled copper grades in the second quarter were approximately 8% lower than the same period in 2019 as mainly lower grade stockpile ore was processed during the quarter. Copper recoveries in the second quarter of 2020 decreased by 10% compared to the same period in 2019 due to processing of mainly lower grade stockpiled ore.

Combined mine, mill and G&A unit operating costs in the second quarter of 2020 were 25% lower than the same period in 2019, primarily due to lower operating costs as a result of constrained activity during the state of emergency, and significantly reduced mining costs during the quarter. We also deferred a second quarter planned plant maintenance shutdown from May to the third quarter, as a result of completing proactive plant maintenance during the eight-week temporary suspension.

Year-to-date production variances were affected by the same factors as the second quarter variances versus prior year.

Contained metal in concentrate produced | Three months ended | | Six months ended | | Guidance |

Jun. 30,

2020 | | Jun. 30,

2019 | | Jun. 30,

2020 | | Jun. 30,

2019 | | Annual |

| 2020 1 |

Copper | tonnes | 11,504 | | 24,232 | | 30,793 | | 56,075 | | 65,000 - 75,000 |

Gold | oz | 2,311 | | 3,794 | | 5,373 | | 9,151 | | |

Silver | oz | 253,687 | | 551,807 | | 714,989 | | 1,186,737 | | |

Molybdenum | tonnes | 124 | | 334 | | 478 | | 638 | | 1,100- 1,300 |

Precious metals2 | oz | 5,161 | | 11,677 | | 13,406 | | 26,104 | | 25,000 - 35,000 |

1 Updated Peru guidance issued August 11, 2020. |

2 Precious metals production includes gold and silver production on a gold-equivalent basis. For 2019, silver is converted to gold at a ratio of 70:1. For 2020, silver is converted to gold at a ratio of 89:1. |

In the second quarter of 2020 production of copper, gold and silver were 53%, 39%, and 54% lower, respectively, than the same period in 2019, as the temporary mine suspension and generally lower grades resulted in reduced production during the quarter. Production in the second half of the quarter, following the resumption of operations, was consistent with volumes from the same period in 2019. For the first half of 2020, production of copper, gold and silver were 45%, 41%, and 40% lower, respectively, compared to the first half of 2019 for the same reasons as the second quarter variances. Molybdenum production was similarly affected.

Peru's updated 2020 production guidance has been revised to reflect the lost production during the eight-week temporary suspension at Constancia, in addition to revised mine plans for the remainder of the year and the resulting deferral of some higher-grade ore into 2021. Our updated guidance assumes we will be able to continue to safely operate for the remainder of the year while adhering to our existing health protocols and those required by the Peruvian government.

*Reflects Constancia temporary shutdown in April and May.

Peru Cash Cost and Sustaining Cash Cost

| | Three months ended | | Six months ended |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

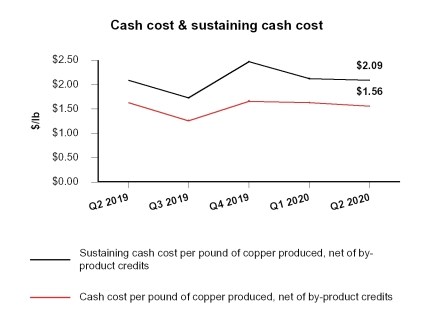

Cash cost per pound of copper produced, net of by-product credits1 | $/lb | | 1.56 | | 1.63 | | 1.61 | | 1.38 |

Sustaining cash cost per pound of copper produced, net of by-product credits1 | $/lb | | 2.09 | | 2.11 | | 2.11 | | 1.71 |

1 Cash cost and sustaining cash costs per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-IFRS financial performance measures, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

Cash cost per pound of copper produced, net of by-product credits, for the three and six months ended June 30, 2020 were $1.56 and $1.61, respectively. Cash cost remained relatively consistent quarter over quarter, however, increased 17% on a year-to-date basis. The overall increase is primarily due to lower copper production as a result of the temporary shutdown and lower copper grades and recoveries, as well as lower by-product credits, partially offset by lower combined operating costs.

Sustaining cash cost per pound of copper produced, net of by-product credits, remained consistent quarter over quarter; however, increased by 23% on a year-to-date basis. The overall increase is primarily due to the same factors noted above affecting cash costs partially offset by lower sustaining capital due to a curtailment of activity during the eight-week shutdown.

Metal Sold

| | Three months ended | | Six months ended |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

Payable metal in concentrate | | | | | | | | | |

Copper | tonnes | | 9,023 | | 25,778 | | | 28,270 | | 52,440 |

Gold | oz | | 1,317 | | 4,056 | | 3,936 | | 10,274 |

Silver | oz | | 242,519 | | 504,259 | | 604,110 | | 1,256,518 |

Molybdenum | tonnes | | 120 | | 419 | | | 551 | | 653 |

Quantities of payable metal sold for the three and six months ended June 30, 2020 were lower than the same period in 2019 primarily for the same reasons that affected contained metal production. In addition, the lag in timing of sales following the restart of operations on May 18 resulted in a marginal increase in concentrate inventory during the current quarter compared to a reduction of concentrate inventory in the same quarter last year.

MANITOBA OPERATIONS REVIEW

Mines

| | Three months ended | | Six months ended |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

Lalor | | | | | | | | | |

Ore | tonnes | | 407,408 | | 411,701 | | 828,926 | | 800,184 |

Copper | % | | 0.77 | | 0.73 | | 0.73 | | 0.75 |

Zinc | % | | 6.05 | | 6.34 | | 5.73 | | 6.51 |

Gold | g/tonne | | 2.64 | | 2.12 | | 2.46 | | 1.90 |

Silver | g/tonne | | 28.40 | | 22.32 | | 27.27 | | 24.09 |

777 | | | | | | | | |

Ore | tonnes | | 281,890 | | 288,599 | | 561,815 | | 567,121 |

Copper | % | | 1.72 | | 1.34 | | 1.45 | | 1.49 |

Zinc | % | | 4.13 | | 3.37 | | 4.12 | | 3.28 |

Gold | g/tonne | | 1.91 | | 1.60 | | 1.87 | | 1.65 |

Silver | g/tonne | | 25.73 | | 18.92 | | 24.80 | | 20.31 |

Total Mines | | | | | | | | | |

Ore | tonnes | | 689,298 | | 700,300 | | 1,390,741 | | 1,367,305 |

Copper | % | | 1.16 | | 0.98 | | 1.02 | | 1.06 |

Zinc | % | | 5.26 | | 5.12 | | 5.08 | | 5.17 |

Gold | g/tonne | | 2.34 | | 1.90 | | 2.22 | | 1.80 |

Silver | g/tonne | | 27.31 | | 20.92 | | 26.27 | | 22.52 |

Unit Operating Costs1,2 | | Three months ended | | Six months ended |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

Mines | | | | | | | | | |

Lalor | C$/tonne | | 96.66 | | 113.18 | | 94.88 | | 107.60 |

777 | C$/tonne | | 80.55 | | 77.12 | | 77.39 | | 76.59 |

Total Mines | C$/tonne | | 90.07 | | 98.32 | | 87.82 | | 94.74 |

1 Reflects costs per tonne of ore mined. | | | | | | | | | |

2 Unit costs is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

The Manitoba business unit had solid operating performance across the mines, mills and zinc plant during the second quarter. In response to the COVID-19 pandemic, we have worked collaboratively with our health and safety committees and the local health units with a focus on keeping our employees and communities safe by implementing a number of layered workplace controls. As a result, the second quarter Manitoba operating results were largely unaffected by the COVID-19 pandemic and are on track to achieve annual production and cost guidance.

Operational performance during the second quarter at both Lalor and 777 was strong, with ore production generally in line and grades largely exceeding the same period in 2019. The enhanced precious metal production from Lalor, driven by improved gold and silver grades is a result of prioritizing resources within the higher value portions of the base metal lenses. Development in the gold rich lenses 25 and 27 advanced ahead of schedule, and production from these areas is expected ahead of the New Britannia mill restart as Lalor transitions to a gold mine. Higher 777 ore grades during the second quarter of 2020 were expected and consistent with the mine plan which included the mining of higher-grade copper stopes during the quarter. As a result, both second quarter and year-to-date gold and silver grades mined in Manitoba increased significantly, while base metal grades were consistent with the same comparative periods in 2019.

Total unit operating costs for the second quarter of 2020 decreased by 8% compared to the same period in 2019 mainly due to lower operating costs at Lalor. Year-to-date total unit operating costs in Manitoba similarly decreased by 7% for the same reason.

Processing Facilities

| | Three months ended | | Six months ended |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

Stall Concentrator | | | | | | | | | |

Ore | tonnes | | 334,601 | | 339,616 | | 704,388 | | 661,139 |

Copper | % | | 0.76 | | 0.71 | | 0.73 | | 0.74 |

Zinc | % | | 6.16 | | 6.36 | | 5.75 | | 6.55 |

Gold | g/tonne | | 2.70 | | 2.08 | | 2.48 | | 1.92 |

Silver | g/tonne | | 28.72 | | 22.03 | | 27.44 | | 24.39 |

| | | | | | | | | |

Copper concentrate | tonnes | | 11,312 | | 9,886 | | 22,950 | | 20,998 |

Concentrate grade | % Cu | | 19.51 | | 20.79 | | 19.41 | | 20.21 |

| | | | | | | | | |

Zinc concentrate | tonnes | | 37,267 | | 38,122 | | 73,397 | | 76,615 |

Concentrate grade | % Zn | | 51.13 | | 51.70 | | 50.72 | | 51.42 |

| | | | | | | | | |

Copper recovery | % | | 86.6 | | 85.6 | | 86.5 | | 86.4 |

Zinc recovery | % | | 92.4 | | 91.2 | | 91.9 | | 91.0 |

Gold recovery | % | | 62.3 | | 52.5 | | 61.6 | | 55.4 |

Silver recovery | % | | 62.1 | | 56.5 | | 61.6 | | 60.6 |

| | | | | | | | | |

Contained metal in concentrate produced | | | | | | |

Copper | tonnes | | 2,208 | | 2,056 | | 4,455 | | 4,242 |

Zinc | tonnes | | 19,057 | | 19,710 | | 37,225 | | 39,393 |

Precious metals1 | oz | | 20,252 | | 13,857 | | 38,928 | | 27,090 |

| | | | | | | | | |

Flin Flon Concentrator | | | | | | | | | |

Ore | tonnes | | 324,906 | | 367,017 | | 657,495 | | 656,261 |

Copper | % | | 1.52 | | 1.26 | | 1.31 | | 1.39 |

Zinc | % | | 4.41 | | 3.84 | | 4.39 | | 3.69 |

Gold | g/tonne | | 1.99 | | 1.71 | | 1.94 | | 1.69 |

Silver | g/tonne | | 25.56 | | 19.82 | | 24.93 | | 20.68 |

| | | | | | | | | |

Copper concentrate | tonnes | | 19,120 | | 18,081 | | 32,642 | | 34,825 |

Concentrate grade | % Cu | | 22.56 | | 22.54 | | 22.70 | | 23.02 |

| | | | | | | | | |

Zinc concentrate | tonnes | | 24,192 | | 23,455 | | 48,564 | | 40,365 |

Concentrate grade | % Zn | | 50.28 | | 51.71 | | 50.43 | | 50.74 |

| | | | | | | | | |

Copper recovery | % | | 87.3 | | 88.0 | | 85.9 | | 88.0 |

Zinc recovery | % | | 84.9 | | 86.0 | | 84.9 | | 84.7 |

Gold recovery | % | | 58.6 | | 61.3 | | 56.1 | | 61.5 |

Silver recovery | % | | 50.7 | | 53.0 | | 47.6 | | 52.7 |

| | | | | | | | | |

Contained metal in concentrate produced | | | | | | |

Copper | tonnes | | 4,314 | | 4,075 | | 7,412 | | 8,016 |

Zinc | tonnes | | 12,165 | | 12,128 | | 24,492 | | 20,482 |

Precious metals1 | oz | | 13,727 | | 14,162 | | 25,786 | | 25,195 |

1 Precious metals production includes gold and silver production on a gold-equivalent basis. For 2019, silver is converted to gold at a ratio of 70:1. For 2020, silver is converted to gold at a ratio of 89:1. |

Unit Operating Costs1 | | Three months ended | | Six months ended | | Guidance |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 | | Annual |

| 2020 |

Concentrators | | | | | | | | | | | |

Stall | C$/tonne | | 24.20 | | 24.61 | | 23.24 | | 25.18 | | |

Flin Flon | C$/tonne | | 23.97 | | 20.67 | | 22.85 | | 22.90 | | |

Combined mine/mill unit operating costs 2,3 | | | | | | | | |

Manitoba | C$/tonne | | 135 | | 135 | | 131 | | 140 | | 130 - 140 |

1 Reflects costs per tonne of milled ore. | |

2 Reflects combined mine, mill and G&A costs per tonne of milled ore. |

3 Combined unit costs is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

At the Stall concentrator, ore processed during the second quarter of 2020 was generally consistent with the same period in 2019, despite a planned two-week outage on one of the grinding lines for capital upgrades. Gold and silver recoveries during the quarter increased by 19% and 10%, respectively, compared to the same period in 2019 due to a combination of improved ore characteristics and numerous operational improvement projects implemented at the Stall mill. Ore processed in the Flin Flon concentrator in the second quarter of 2020 decreased by 11% compared to the same period in 2019 due to less Lalor ore required to be processed in Flin Flon as a result of higher throughput at the Stall mill. Furthermore, operational optimization between the 777 mine and the Flin Flon mill, which provides input feed for paste backfill to the mine, led to lower milling activity and a corresponding increase of the ore stockpile at quarter end. Metal recoveries at the Flin Flon concentrator during the second quarter of 2020 decreased slightly compared with the same period in 2019, which was in line with metallurgical models.

Unit operating costs at Stall decreased slightly in the second quarter of 2020 compared to the same period in 2019, whereas unit operating costs at Flin Flon were 16% higher over the same period because of reduced ore throughput. Manitoba combined mine, mill and G&A unit operating costs in the second quarter of 2020 remained unchanged compared to the same period in 2019.

Year-to-date ore processed at Stall increased by 7% as a result of several continuous improvement initiatives and higher ore availability from the Lalor mine. Year-to-date ore processed at the Flin Flon mill remained largely unchanged from the same period in 2019.

Year-to-date combined mine, mill and G&A unit operating costs were 6% lower as the mines and mills delivered consistent results with less production disruptions.

Manitoba contained metal in concentrate produced1 | Three months ended | | Six months ended | | Guidance |

Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 | | Annual |

| 2020 |

Copper | tonnes | 6,522 | | 6,131 | | 11,867 | | 12,260 | | 18,000 - 22,000 |

Gold | oz | 30,303 | | 24,305 | | 57,596 | | 44,510 | | |

Silver | oz | 327,130 | | 260,000 | | 633,520 | | 544,265 | | |

Zinc | tonnes | 31,222 | | 31,838 | | 61,717 | | 59,875 | | 105,000 - 125,000 |

| | | | | | | | | | |

Precious metals2 | oz | 33,979 | | 28,019 | | 64,714 | | 52,285 | | 110,000 - 135,000 |

1 Metal reported in concentrate is prior to deductions associated with smelter terms. |

3 Precious metals production includes gold and silver production on a gold-equivalent basis. For 2019, silver is converted to gold at a ratio of 70:1. For 2020, silver is converted to gold at a ratio of 89:1. |

In the second quarter of 2020, copper, gold and silver production was 6%, 25%, and 26% higher compared to the same period in 2019 due to higher head grades and higher gold and silver recoveries. Zinc production declined by 2%, in the second quarter of 2020. Year-to-date, gold, silver and zinc production increased by 29%, 16% and 3%, respectively, due to higher throughput and higher gold and silver head grades. Year-to-date copper production decreased by 3% as head grades decreased.

Manitoba production of all metals and combined unit operating costs are expected to be within guidance ranges for the full year 2020.

Zinc Plant

Zinc Production | | Three months ended | | Six months ended | | Guidance |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 | | Annual |

| 2020 |

Zinc Concentrate Treated | | | | | | | | |

Domestic | tonnes | | 63,350 | | 57,929 | | 124,701 | | 108,023 | | |

Refined Metal Produced | | | | | | | | | | |

Domestic | tonnes | | 27,535 | | 27,486 | | 56,001 | | 51,205 | | 100,000 - 112,000 |

Unit Operating Costs | | Three months ended | | Six months ended | | Guidance |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 | | Annual |

| 2020 |

Zinc Plant 1,2 | C$/lb | | 0.45 | | 0.44 | | 0.47 | | 0.48 | | 0.45 - 0.52 |

1 Zinc unit operating costs include G&A costs. | |

2 Zinc unit costs is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Reporting Measures" section of this MD&A. |

Production of cast zinc in the second quarter of 2020 is comparable to the same period in 2019 while operating costs per pound of zinc metal produced remained consistent over the same periods. Year-to-date refined metal zinc production increased by 9% compared to the first half of 2019.

Full year production of cast zinc and zinc plant unit operating cost are expected to be within guidance ranges for the full year 2020.

Manitoba Cash Cost and Sustaining Cash Cost

| | Three months ended | | Six months ended |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

Cost per pound of copper produced | | | | | | | | | |

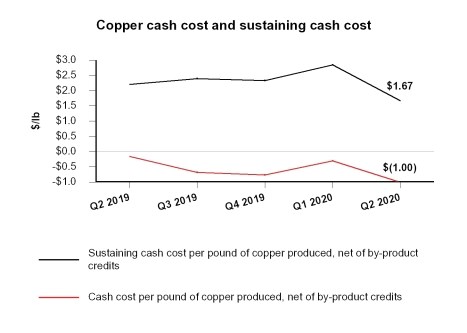

Cash cost per pound of copper produced, net of by-product credits 1 | $/lb | | (1.00 | ) | | (0.15 | ) | | (0.68 | ) | | 0.31 |

Sustaining cash cost per pound of copper produced, net of by-product credits 1 | $/lb | | 1.67 | | | 2.19 | | | 2.21 | | | 2.69 | |

| | | | | | | | | |

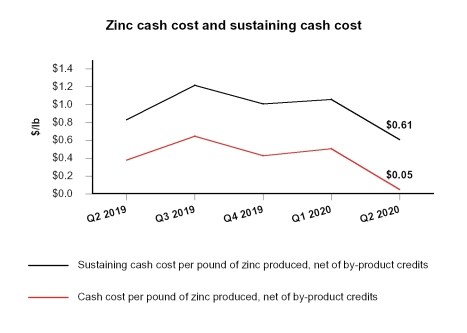

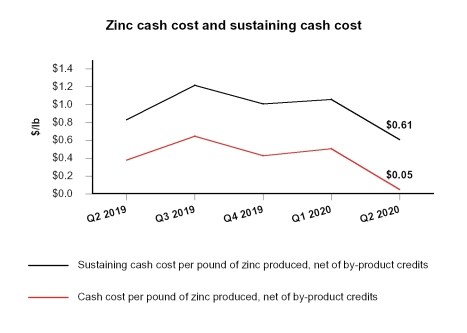

Cost per pound of zinc produced | | | | | | | | | |

Cash cost per pound of zinc produced, net of by-product credits 1 | $/lb | | 0.05 | | | 0.38 | | | 0.28 | | | 0.52 | |

Sustaining cash cost per pound of zinc produced, net of by-product credits 1 | $/lb | | 0.61 | | | 0.83 | | | 0.83 | | | 1.01 | |

1 Cash cost and sustaining cash cost per pound of copper & zinc produced, net of by-product credits, are not recognized under IFRS. For more detail on this non-IFRS financial performance measure, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

Cash cost per pound of copper produced, net of by-product credits, in the second quarter of 2020 was negative $1.00. These costs were lower compared to the same period in 2019, primarily as a result of lower mining costs, higher by-product credits and higher copper production.

Sustaining cash cost per pound of copper produced, net of by-product credits, in the second quarter of 2020 was $1.67. These costs were lower compared to the same period in 2019, primarily due to the reasons listed above slightly offset by increased sustaining capital expenditures.

Cash cost and sustaining cash cost per pound of zinc produced, net of by-product credits, in the second quarter of 2020 were lower than the same period last year as a result of significantly higher by-product credits and lower mining costs, partially offset by lower zinc production and higher sustaining capital expenditures.

Cash cost and sustaining cash cost per pound of zinc produced, net of by-product credits, were lower in the first half of 2020 compared to the same period in 2019 due to increased zinc production, significantly higher by-product credits and lower mining costs, partially offset by higher sustaining capital expenditures.

Metal Sold

| | Three months ended | | Six months ended |

| Jun. 30, 2020 | | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

Payable metal in concentrate | | | | | | | | | |

Copper | tonnes | | 6,928 | | 7,393 | | 11,753 | | 12,448 |

Gold | oz | | 29,273 | | 26,482 | | 53,229 | | 42,893 |

Silver | oz | | 299,266 | | 300,042 | | 513,597 | | 530,689 |

Zinc | tonnes | | - | | | - | | | - | | | - | |

Refined zinc | tonnes | | 27,604 | | 24,224 | | 54,396 | | 47,178 |

OUTLOOK

This outlook includes forward-looking information about the markets for the commodities we produce. For additional information on forward-looking information, refer to the "Forward-Looking Information" section of this MD&A. We may update our outlook depending on changes in metals prices and other factors. In addition to this section, refer to the "Operations Review" and "Financial Review" sections for additional details on our outlook for 2020.

Commodity Markets

In March 2020, the World Health Organization declared the COVID-19 outbreak a global pandemic. The current and future impacts on global commerce are anticipated to be far-reaching. To date, there has been significant volatility in stock markets, commodities and foreign exchange markets, restrictions on the conduct of business in many jurisdictions and the global movement of people and some goods have become restricted. Containment measures have resulted in significantly decreased economic activity in the second quarter of 2020, which has adversely affected the broader global economy.

Our 2020 operational and financial performance will be influenced by a number of factors. At the macro-level, the impact of COVID-19 and the general performance of the Chinese, North American and global economies will influence future demand for our products. The realized prices we achieve in the commodity markets significantly affect our financial performance. To date, we have experienced production below estimated levels and reduced revenue.

Copper and zinc prices declined by 20% or more in response to the COVID-19 pandemic, reaching lows in March of $2.08 per pound and $0.83 per pound, respectively. Since that time, liquidity injections by central banks and government stimulus in all parts of the globe, combined with actual and projected supply disruptions in copper and zinc mining operations, have seen prices of both metals rebound dramatically with copper hitting fresh 2020 highs in the $2.90 range in July. Gold prices have also been very volatile, initially dropping approximately $200 per ounce in response to the global asset sell off in March before fears of future inflation stemming from the response of central banks and governments to COVID-19 drove prices to all-time record levels above $2,000/oz in early August.

We remain confident in the longer-term outlook for the commodities we produce; however, there is significant ongoing short to medium-term uncertainty surrounding COVID-19 and the extent and duration of the impacts that it may have on demand and prices for the commodities we produce, on our suppliers, on our employees and on global financial markets. As a result, our financial results may remain volatile as COVID-19 continues to affect production, operating costs and the prices we receive for our products.

FINANCIAL REVIEW

Financial Results

In the second quarter of 2020, we recorded a net loss of $51.9 million compared to a loss of $54.1 million for the same period in 2019, representing a marginal increase in earnings of $2.2 million. Year-to date in 2020, we recorded a net loss of $128.0 million compared to a loss of $67.5 million in the same period in 2019, a decrease in profit of $60.5 million.

The following table provides further details on these variances:

(in $ millions) | Three months ended

June 30, 2020 | Six months ended

June 30, 2020 | |

|

(Decrease) increase in components of profit or loss: | | | |

Revenues | (120.5 | ) | (167.7 | ) | |

Cost of sales | | | |

Mine operating costs | 54.3 | | 37.0 | | |

Depreciation and amortization | 10.4 | | 1.1 | | |

Selling and administrative expenses | (0.3 | ) | 9.5 | | |

Write down of UCM receivable | 26.0 | | 26.0 | | |

Net finance expense | (8.0 | ) | (13.1 | ) | |

Other | 7.3 | | 13.2 | | |

Tax | 33.0 | | 33.5 | | |

Increase (decrease) in profit for the period | 2.2 | | (60.5 | ) | |

Revenue

Revenue for the second quarter of 2020 was $208.9 million, $120.5 million or 37% lower than the same period in 2019, primarily as a result of significantly lower sales volumes in Peru as a result of an eight-week shutdown at Constancia through to May 18. The lag in concentrate shipments resulted in Peru's first shipment for the quarter occurring in June. Revenues from Manitoba during the quarter were also lower compared to the same period in 2019, due to lower realized base metal prices, partially offset by higher realized gold prices and higher zinc sales volumes.

Year-to-date revenue in 2020 was $454.0 million, $167.7 million or 27% lower than the same period in 2019 largely due to the same reasons as the quarterly variance, partially offset by a variable consideration adjustment on our stream revenue.

(in $ millions) | Three months ended

June 30, 2020 | Six months ended

June 30, 2020 |

| | |

Metals prices1 | | |

Lower copper prices | (7.4) | (23.7) |

Lower zinc prices | (24.0) | (38.6) |

Higher gold prices | 10.0 | 20.1 |

Lower silver prices | (0.1) | (1.0) |

Sales volumes | | |

Lower copper sales volumes | (105.5) | (154.0) |

Higher zinc sales volumes | 10.1 | 21.2 |

Higher gold sales volumes | 0.1 | 5.6 |

Lower silver sales volumes | (6.5) | (16.7) |

Other | | |

Change in derivative mark-to-market on zinc | 2.4 | (0.7) |

Molybdenum and other volume and pricing differences | (10.0) | (8.3) |

Variable consideration adjustments | - | | 13.5 |

Effect of lower treatment and refining charges | 10.4 | 14.9 |

Decrease in revenue in 2020 compared to 2019 | (120.5) | (167.7) |

1 See discussion below for further information regarding metals prices. | | |

Our revenue by significant product type is summarized below:

| Three months ended | | Six months ended |

(in $ millions) | Jun. 30, 2020 | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

Copper | 88.2 | | 205.3 | | | 227.4 | | | 407.6 | |

Zinc | 59.0 | | 71.6 | | | 122.6 | | | 138.8 | |

Gold | 44.0 | | 33.8 | | | 86.8 | | | 54.8 | |

Silver | 5.0 | | 7.0 | | | 11.0 | | | 15.3 | |

Molybdenum | 2.3 | | 11.2 | | | 11.5 | | | 17.6 | |

Other metals | 1.0 | | 1.4 | | | 1.8 | | | 2.5 | |

Revenue from contracts | 199.5 | 330.3 | | 461.1 | | 636.6 |

Amortization of deferred revenue - gold | 6.3 | | 8.5 | | | 10.5 | | | 16.0 |

Amortization of deferred revenue - silver | 7.6 | | 12.8 | | | 16.0 | | | 31.1 |

Amortization of deferred revenue - variable consideration adjustments - prior periods | - | | - | | | (2.8 | ) | | (16.3) |

Pricing and volume adjustments1 | 7.0 | | (0.3) | | (3.6 | ) | | (3.6) |

Treatment and refining charges | (11.5 | ) | (21.9) | | (27.2 | ) | | (42.1) |

Revenue | 208.9 | 329.4 | | 454.0 | | 621.7 |

1 Pricing and volume adjustments represents mark-to-market adjustments on provisionally prices sales, realized and unrealized changes to fair value for non-hedge derivative contracts and adjustments to originally invoiced weights and assays. |

For further detail on variable consideration adjustments, refer to note 15 of our consolidated interim financial statements.

Realized sales prices

This measure is intended to enable management and investors to understand the average realized price of metals sold to third parties in each reporting period. The average realized price per unit sold does not have any standardized meaning prescribed by IFRS, is unlikely to be comparable to similar measures presented by other issuers and should not be considered in isolation or a substitute for measures of performance prepared in accordance with IFRS.

For sales of copper, gold and silver we may enter into non-hedge derivatives ("QP hedges") which are intended to manage the provisional pricing risk arising from quotational period terms in concentrate sales agreements. The QP hedges are not removed from the calculation of realized prices. We expect that gains and losses on QP hedges will offset provisional pricing adjustments on concentrate sales contracts.

Our realized prices for the second quarter in 2020 and 2019, respectively, are summarized below:

| Realized prices1 for the | LME YTD 20202 | | Realized prices1 for the |

Three months ended | | Six months ended |

| LME QTD 20202 | Jun. 30, 2020 | Jun. 30, 2019 | | Jun. 30, 2020 | | Jun. 30, 2019 |

Prices | | | | | | | | | |

Copper | $/lb | 2.42 | 2.57 | | 2.78 | 2.49 | | 2.54 | | | 2.81 |

Zinc3 | $/lb | 0.89 | 0.96 | | 1.35 | 0.93 | | 1.01 | | | 1.33 |

Gold4 | $/oz | | 1,771 | | 1,441 | | | 1,752 | | | 1,401 |

Silver4 | $/oz | | 24.19 | | 24.60 | | | | 24.21 | | | 25.00 | |

1 Realized prices exclude refining and treatment charges and are on the sale of finished metal or metal in concentrate. Realized prices include the effect of provisional pricing adjustments on prior period sales. |

2 London Metal Exchange average for copper and zinc prices. |

3 All sales for the three and six months ended June 30, 2020 and 2019 were cast zinc metal. Zinc realized prices include premiums paid by customers for delivery of refined zinc metal, but exclude unrealized gains and losses related to non-hedge derivative contracts that are included in zinc revenues. |

4 Sales of gold and silver from our 777 and Constancia mines are subject to our precious metals stream agreement with Wheaton Precious Metals, pursuant to which we recognize deferred revenue for precious metals deliveries and also receive cash payments. Stream sales are included within realized prices and their respective deferred revenue and cash payment rates can be found on page 30. |

The following table provides a reconciliation of average realized price per unit sold, by metal, to revenues as shown in the consolidated interim financial statements.

Three months ended June 30, 2020 |

(in $ millions) 1 | Copper | Zinc | Gold | Silver | Molybdenum | Other | Total |

Revenue per financial statements2 | 88.2 | | 59.0 | | 50.3 | | 12.6 | | 2.3 | | 1.0 | | 213.4 | |

Pricing and volume adjustments3 | 2.1 | | 1.1 | | 3.8 | | 0.6 | | (0.6 | ) | - | | 7.0 | |

Derivative mark-to-market4 | - | | (1.8 | ) | - | | - | | - | | - | | (1.8 | ) |

Revenue, excluding mark-to-market on non-QP hedges | 90.3 | | 58.3 | | 54.1 | | 13.2 | | 1.7 | | 1.0 | | 218.6 | |

Payable metal in concentrate sold 5 | 15,951 | | 27,604 | | 30,590 | | 541,785 | | 120 | | - | | - | |

Realized price 6 | 5,670 | | 2,111 | | 1,771 | | 24.19 | | - | | - | | - | |

Realized price 7 | 2.57 | | 0.96 | | - | | - | | - | | - | | - | |

Six months ended June 30, 2020 |

(in $ millions) 1 | Copper | Zinc | Gold | Silver | Molybdenum | Other | Total |

Revenue per financial statements2 | 227.4 | | 122.6 | | 97.3 | | 27.0 | | 11.5 | | 1.8 | | 487.6 | |

Pricing and volume adjustments3 | (3.2 | ) | (2.0 | ) | 2.9 | | - | | (1.3 | ) | - | | (3.6 | ) |

Derivative mark-to-market4 | - | | 0.4 | | - | | - | | - | | - | | 0.4 | |

Revenue, excluding mark-to-market on non-QP hedges | 224.2 | | 121.0 | | 100.2 | | 27.0 | | 10.2 | | 1.8 | | 484.4 | |

Payable metal in concentrate sold 5 | 40,023 | | 54,396 | | 57,165 | | 1,117,707 | | 551 | | - | | - | |

Realized price 6 | 5,601 | | 2,225 | | 1,752 | | 24.21 | | - | | - | | - | |

Realized price 7 | 2.54 | | 1.01 | | - | | - | | - | | - | | - | |

Three months ended June 30, 2019 |

(in $ millions) 1 | Copper | Zinc | Gold | Silver | Molybdenum | Other | Total |

Revenue per financial statements2 | 205.3 | | 71.6 | | 42.3 | | 19.8 | | 11.2 | | 1.4 | | 351.6 | |

Pricing and volume adjustments3 | (2.1 | ) | - | | 1.7 | | - | | 0.1 | | - | | (0.3 | ) |

Derivative mark-to-market4 | - | | 0.6 | | - | | - | | - | | - | | 0.6 | |

Revenue, excluding mark-to-market on non-QP hedges | 203.2 | | 72.2 | | 44.0 | | 19.8 | | 11.3 | | 1.4 | | 351.9 | |

Payable metal in concentrate sold 5 | 33,171 | | 24,224 | | 30,538 | | 804,301 | | 419 | | - | | - | |

Realized price 6 | 6,128 | | 2,981 | | 1,441 | | 24.60 | | - | | - | | - | |

Realized price 7 | 2.78 | | 1.35 | | - | | - | | - | | - | | - | |

Six months ended June 30, 2019 |

(in $ millions) 1 | Copper | Zinc | Gold | Silver | Molybdenum | Other | Total |

Revenue per financial statements2 | 407.6 | | 138.8 | | 70.8 | | 46.4 | | 17.6 | | 2.5 | | 683.7 | |

Pricing and volume adjustments3 | (5.7 | ) | (0.1 | ) | 3.7 | | (1.7 | ) | 0.2 | | - | | (3.6 | ) |

Derivative mark-to-market4 | - | | (0.3 | ) | - | | - | | - | | - | | (0.3 | ) |

Revenue, excluding mark-to-market on non-QP hedges | 401.9 | | 138.4 | | 74.5 | | 44.7 | | 17.8 | | 2.5 | | 679.8 | |

Payable metal in concentrate sold 5 | 64,888 | | 47,178 | | 53,167 | | 1,787,207 | | 653 | | - | | - | |

Realized price 6 | 6,194 | | 2,933 | | 1,401 | | 25.00 | | - | | - | | - | |

Realized price 7 | 2.81 | | 1.33 | | - | | - | | - | | - | | - | |

1 Average realized price per unit sold may not calculate based on amounts presented in this table due to rounding. |

2 Gold and silver includes amortization of deferred revenue. |