Eagle Bulk Shipping Inc.

September 10, 2007

Wachovia Global Transportation

and Packaging Conference

Forward Looking Statements

This presentation contains certain statements that may be deemed to be “forward-looking statements” within the

meaning of the Securities Acts. Forward-looking statements reflect management’s current views with respect to

future events and financial performance and may include statements concerning plans, objectives, goals,

strategies, future events or performance, and underlying assumptions and other statements, which are other

than statements of historical facts. The forward-looking statements in this presentation are based upon various

assumptions, many of which are based, in turn, upon further assumptions, including without limitation,

management's examination of historical operating trends, data contained in our records and other data available

from third parties. Although Eagle Bulk Shipping Inc. believes that these assumptions were reasonable when

made, because these assumptions are inherently subject to significant uncertainties and contingencies which

are difficult or impossible to predict and are beyond our control, Eagle Bulk Shipping Inc. cannot assure you that

it will achieve or accomplish these expectations, beliefs or projections. Important factors that, in our view, could

cause actual results to differ materially from those discussed in the forward-looking statements include the

strength of world economies and currencies, general market conditions, including changes in charterhire rates

and vessel values, changes in demand that may affect attitudes of time charterers to scheduled and

unscheduled drydocking, changes in our vessel operating expenses, including dry-docking and insurance costs,

or actions taken by regulatory authorities, ability of our counterparties to perform their obligations under sales

agreements and charter contracts on a timely basis, potential liability from future litigation, domestic and

international political conditions, potential disruption of shipping routes due to accidents and political events or

acts by terrorists. Risks and uncertainties are further described in reports filed by Eagle Bulk Shipping Inc. with

the US Securities and Exchange Commission.

1

Agenda

Investment Thesis

The Fleet

Industry View

Financial Overview

Conclusion

2

Eagle Bulk – A Clear, Focused Investment Story

We are one of the largest

Supramax owners in the world

Quality - Consistency - Transparency

Strong contract coverage at

today’s healthy rates

— $1.2 bn in contracts

— 20 profit-sharing charters

— 15 open vessels

Best long term prospects

Stable and visible cash flows for

sustainable dividends

—Target $0.50 per quarter

$70m acquisition in 3Q-05

$105m acquisition in 2Q-06

$67m acquisition in 4Q-06

$205m acquisition in 1Q-07

$1.1 bn acquisition in 3Q-07

Proven growth strategy

— 39 vessels

— $1.5 billion worth of

acquisitions

4

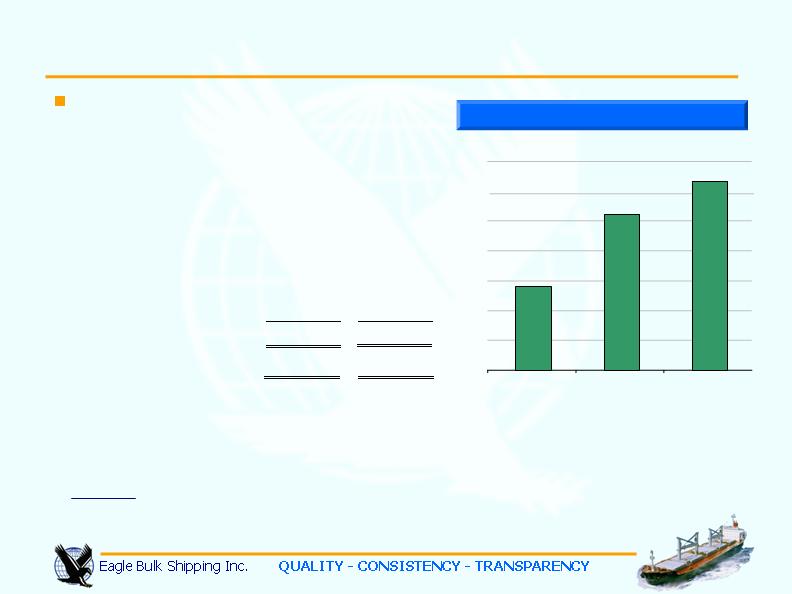

Eagle Bulk – A Growth Story

Sep 07 Financial metrics pro forma for Q3-07 transactions

Target Quarterly Dividend of $0.50 per share

5

Sep 06

Sep 07

Increase

Fleet Size

16 Vessels

49 Vessels

+ 206%

- Supramax

12 Vessels

46 Vessels

+ 283%

- DWT

0.8 million tons

2.7 million tons

+ 238%

Finance

- Enterprise Value

$739 million

$1,618 million

+ 119%

- Market Capitalization

$524 million

$1,095 million

+ 109%

- Dividends Paid to Date

-

$4.10 per share

Acquired a fleet of 26 Supramax vessels for $1.1 billion

Sister-ship fleet consists of 5 vessels of 53,100 dwt each and 21 vessels

of 58,000 dwt each

Vessels to be delivered between 2008 and 2012

21 of 26 vessels secured by long term time charters

Charters until 2018 with average time charter duration of over 10

years from today

Contracted revenue of approximately $1 billion

Uncapped profit sharing on 17 of the charters further enhance

revenue potential

Eagle fleet expands to 49 vessels with contracted revenue of

approximately $1.2 billion

Secured options to build an additional nine 58,000 dwt Supramax sister

vessels

3Q-07 Transformative Acquisition

Eagle Fleet Increases 124% to 2.7 million dwt

6

Modern, High Quality Geared Fleet of Supramax Vessels

Vessel

Year Built

Deadweight

Time Charter Employment Expiration

Base Time

Charter Rate

SUPRAMAX:

Cardinal

2004

55,408

May 2008 to August 2008

$28,000

Condor

2001

50,296

May 2009 to August 2009

$20,500

Falcon

2001

50,296

February 2008 to June 2008

$20,950

December 2009 to May 2010

$39,500

Harrier

2001

50,296

June 2009 to September 2009

$24,000

Hawk I

2001

50,296

April 2009 to June 2009

$22,000

Heron

2001

52,827

December 2007 to February 2008

$24,000

Jaeger

2004

52,248

July 2008 to August 2008

$27,500

Kestrel I

2004

50,326

December 2007 to April 2008

$18,750

Merlin

2001

50,296

October 2007 to December 2007

$24,000

Oct - Dec 2007 to Oct - Dec 2010

$25,000

Osprey I

2002

50,206

July 2008 to November 2008

$21,000

Peregrine

2001

50,913

December 2008 to February 2009

$20,500

Tern

2003

50,200

December 2007 to April 2008

$19,000

Shrike

2003

53,343

April 2009 to August 2009

$24,600

Skua

2003

53,350

May 2009 to August 2009

$24,200

Kittiwake

2002

53,146

May 2008 to August 2008

$30,400

HANDYMAX:

Sparrow

2000

48,225

December 2007 to February 2008

$24,000

Dec 2007 - Feb 2008 to Dec 2009 - Feb 2010

$34,500

Kite

1997

47,195

August 2009 to November 2009

$21,000

Griffon

1995

46,635

March 2009 to May 2009

$20,075

SUPRAMAX NEWBUILDINGS

Crowned Eagle

2008

56,000

Expected to be delivered in November 2008

—

Crested Eagle

2009

56,000

Expected to be delivered in February 2009

—

Stellar Eagle

2009

56,000

Expected to be delivered in April 2009

—

Golden Eagle

2010

56,000

Expected to be delivered in January 2010

—

8

Acquisition Fleet

Vessel

Expected

Delivery

Time Charter Employment

Expiration

Base Time

Charter Rate

Profit Share

53,100 dwt Series

Wren

Aug-08

Feb 2012

$24,750

n.a.

Feb 2012 to Dec 2018/Apr 2019

$18,000

50% over $22,000

Woodstar

Oct-08

Jan 2014

$18,300

n.a.

Jan 2014 to Dec 2018/Apr 2019

$18,000

50% over $22,000

Thrush

Sep-09

Charter Free

-

n.a.

Thrasher

$18,400

n.a.

Feb 2016 to Dec 2018/Apr 2019

$18,000

50% over $22,000

Avocet

Dec-09

Mar 2016

$18,400

n.a.

Mar 2016 to Dec 2018/Apr 2019

$18,000

50% over $22,000

58,000 dwt Series

Bittern

Sep-09

Dec 2014

$18,850

n.a.

Dec 2014 to Dec 2018/Apr 2019

$18,000

50% over $22,000

Canary

Oct-09

Jan 2015

$18,850

n.a.

Jan 2015 to Dec 2018/Apr 2019

$18,000

50% over $22,000

Crane

Nov-09

Feb 2015

$18,850

n.a.

Feb 2015 to Dec 2018/Apr 2019

$18,000

50% over $22,000

Egret

Dec-09

Sep 2012 to Jan 2013

$17,650

50% over $20,000

Gannet

Jan-10

Oct 2012 to Feb 2013

$17,650

50% over $20,000

Grebe

Feb-10

Nov 2012 to Mar 2013

$17,650

50% over $20,000

Ibis

Mar-10

Dec 2012 to Apr 2013

$17,650

50% over $20,000

Jay

Apr-10

Sep 2015

$18,500

50% over $21,500

Sep 2015 to Dec 2018/Apr 2019

$18,000

50% over $22,000

Kingfisher

May-10

Oct 2015

$18,500

50% over $21,500

Oct 2015 to Dec 2018/Apr 2019

$18,000

50% over $22,000

Martin

Jun-10

Dec 2016 to Dec 2017

$18,400

n.a.

Nighthawk

Mar-11

Sep 2017 to Sep 2018

$18,400

n.a.

Oriole

Jul-11

Jan 2018 to Jan 2019

$18,400

n.a.

Owl

Aug-11

Feb 2018 to Feb 2019

$18,400

n.a.

Petrel

Sep-11

Jun 2014 to Oct 2014

$17,650

50% over $20,000

Puffin

Oct-11

Jul 2014 to Nov 2014

$17,650

50% over $20,000

Roadrunner

Nov-11

Aug 2014 to Dec 2014

$17,650

50% over $20,000

Sandpiper

Dec-11

Sep 2014 to Jan 2015

$17,650

50% over $20,000

Snipe

Jan-12

Charter Free

n.a.

n.a.

Swift

Feb-12

Charter Free

n.a.

n.a.

Raptor

Mar-12

Charter Free

n.a.

n.a.

Saker

Apr-12

Charter Free

n.a.

n.a.

* Please refer to our press release of July 25, 2007

9

Eagle Captures Today’s Drybulk Values for Extended Periods

Minimum Contracted Revenue on Acquisition Fleet secured at approx. $1 billion

Charter revenue stream insured for three years up to July 2010 with A rated credit

risk underwriter

10

Charter renewals at today’s healthy rates extends high cashflow generation

Period cover extends revenue visibility and predictability and limits spot volatility

SecureCash Flows Provide Stable Dividends

* The new charterer of the FALCON has an option to extend the charter by 11-13onths at a daily rate of $41,000 per day.

New Charters bring in $10.6 million in additional annual revenue:

Vessel

Current Daily

Charter Rate

Current Charter

Ends / New Charter

Commences

New Charter

Daily Rate

Charter Period

(Months)

% Rate

Increase

Increase

in Annual

Revenue

Sparrow

$24,000

Mar-Jun 2008

$34,500

24 - 26 mo.

43.8%

$3.8 m

Falcon *

$20,950

Apr-Jun 2008

$39,500

21 - 23 mo.

88.5%

$6.8 m

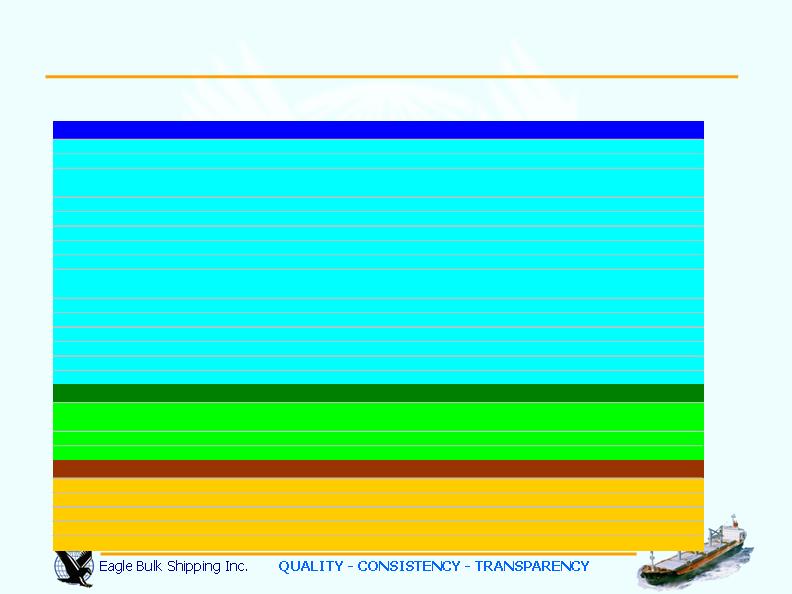

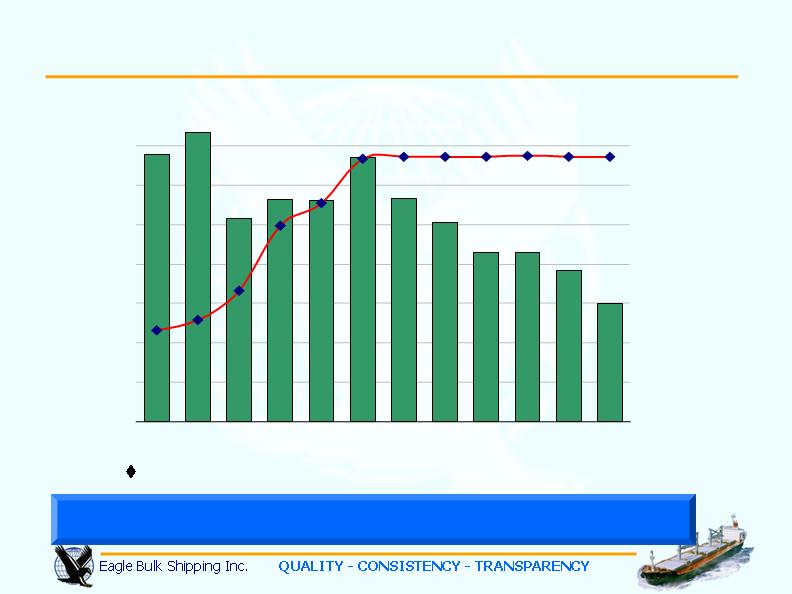

Time Charter Contracts Provide Stable and Visible Cashflows

Contracted gross revenues in excess of $1.2 billion

No. of ships in Fleet

-

20

40

60

80

100

120

140

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

$ m

Owned Days

Contracted Revenues from Fixed Days

18

30

21

38

45

49

49

49

49

49

49

49

11

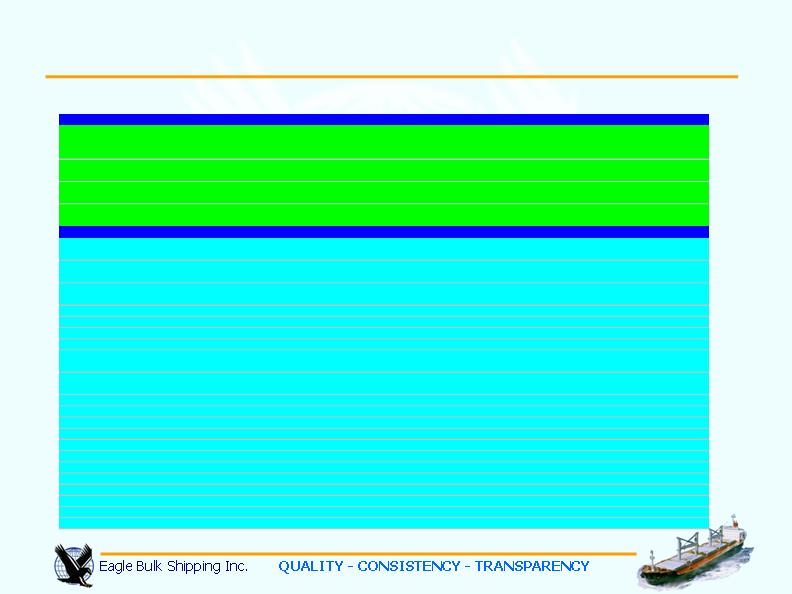

46 of the 49 vessels in the

Company’s fleet are Supramaxes

Smallest segment of the drybulk

market provides opportunities

Aging Handymax Fleet Provides Opportunities

Source: Clarksons as of August 2007

Aging Handymax fleet — 33% of

capacity > 20 years old

Negligible scrapping since 2003

could see surge of ships removed

from market in 2009-11

Orderbook and Fleet Age

13

World Dry Bulk Fleet

33%

23%

18%

41%

30%

63%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

55%

60%

65%

Handymax

Panamax

Capesize

% of Fleet > 20 years

Orderbook as % of Fleet

New Supramax Asset Class Services Growing Global Needs

Imports of sub-Panamax minor bulk cargoes

into China surge – 2007 import rate of 64m

tons double that of 34m tons in 2006.

China’s emergence as largest stainless steel

producer results in development of a new trade

– import of Nickel Ore which surges from

almost nothing in 2005 to an annualized 20m

tons in 2007.

Vessel Gear increases flexibility and broadens customer base

Source: J.E. Hyde, Clarksons, Global Trade Information Services. Mining Weekly

Exports of cement and steel out of China

expected to maintain healthy growth rates in

excess of 20%. Chinese steel output in 2007

to increase 18% to reach 500 million tons.

New mining capacities coming on stream in

2007-09 to increase global iron ore output by

375 million tons per annum.

850m ton sub-Panamax market

New Trades

-

5

10

15

20

25

30

1st Half 2006

2nd Half 2006

1st Half 2007

Minor Bulks

Nickel Ore

m tons

Chinese Imports

14

Charterers Attracted by Versatility of Supramax Vessels

Eagle vessels carried 3.5 million tons of cargo in FH-07 MISC. cargoes include Phosrock, Sugar, HBI, and Concentrates

45% of Eagle’s 1H-07 Cargoes were “Capesize and Panamax cargoes”

IRON

ORE

COAL

GRAINS

OTHER

ORES

CEMENT

COKE

STEELS

SCRAP

IRON

AGGREGATES

MISC.

In m tons

560,702

609,376

392,996

668,989

169,930

304,329

206,976

39,060

10,000

502,326

Cardinal

Condor

Falcon

Griffon

Harrier

Hawk I

Heron

Kite

Merlin

Osprey I

Peregrine

Shrike

Sparrow

Kestrel I

Tern

Jaeger

15

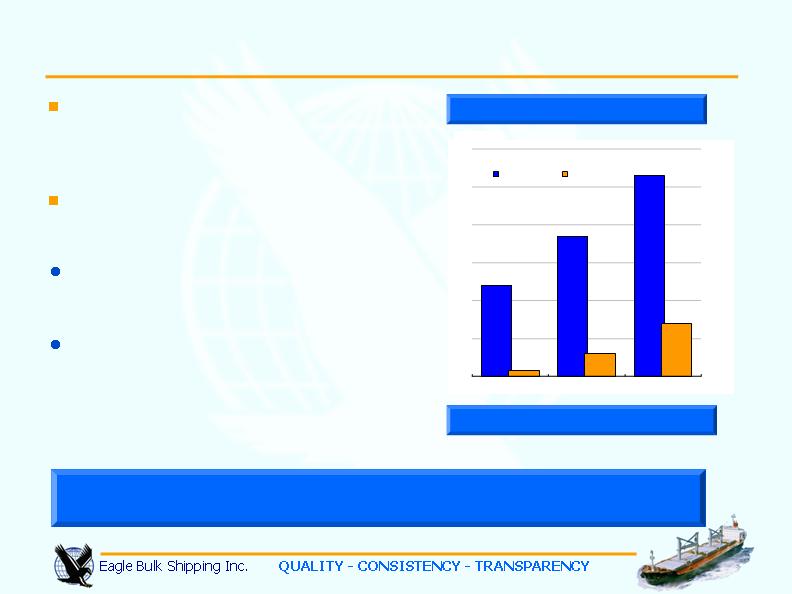

99.5% Fleet Utilization Rate

Revenue Growth

Net revenues include billed time charter revenues, deductions

for brokerage commissions and amortization of net prepaid

and deferred charter revenue. Please refer to our financial

statements for a definition of Ownership days, Available days,

Operating days, and Fleet Utilization.

Operating Expenses include Vessel Depreciation

Net Revenues

$ m

2007 (E)

2006

2005

140

120

100

80

60

40

20

Income Statement

Condensed Income Statement:

($ 000's)

Net Time Charter Revenues

55,247

47,895

Operating Expenses

30,668

24,173

Net Interest Expense

4,166

3,538

NET INCOME

20,412

20,184

Diluted Income per Common Share

$0.51

$0.61

Credit Agreement EBITDA

44,106

38,527

EBITDA Margin (% of revenue)

79.8%

80.4%

Jun. 30, 2007

Jun. 30, 2006

Six-months ended

17

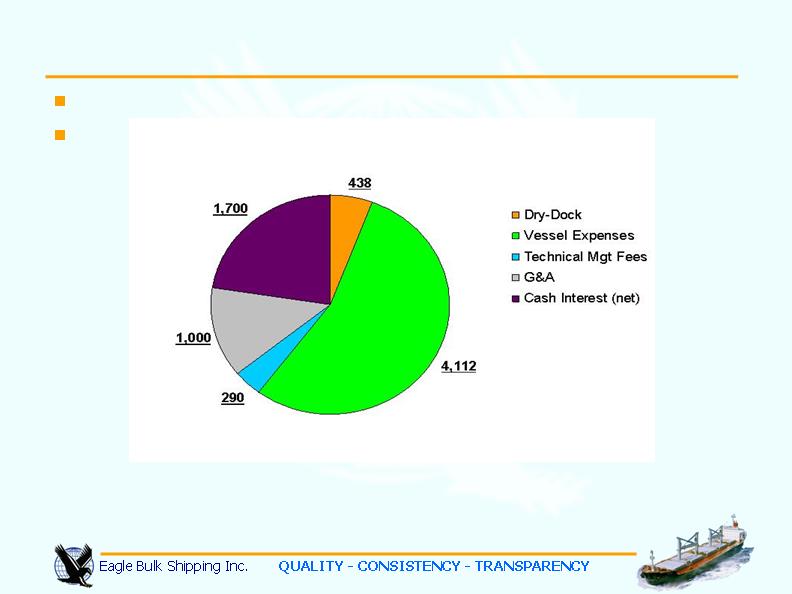

Daily cash breakeven cost of $7,540 per day per vessel (2007E)

No principal repayments until 2012

Low Breakeven Cost Strategy

Vessel expenses include crew wages and related costs, the cost of insurance including credit risk insurance, expenses relating

to repairs and maintenance, the cost of spares and consumable stores and related inventory, tonnage taxes, pre-operating

costs associated with the delivery of acquired vessels including providing the newly acquired vessels with initial provisions and

stores, and other miscellaneous expenses. The Company is anticipating higher crewing costs, higher costs for oil based

supplies including lubes and paints, and increasing drydocking costs due to constraints in global drydocking yard capacity.

18

Strong Balance Sheet

1 Acquisition funding and Initial Construction Progress Payments for the Acquisition vessels.

2 Construction finance costs (interest, deferred finance charges, supervision, etc.) are capitalized

eliminating any impact on current cash flows and income statement.

3 Net Debt is pro forma after taking into effect 2Q-07 Dividend payment of $19.6 million.

Quarterly Dividend Cash Flow Maintained

19

BALANCE SHEET DATA

Jun. 30, 2007

Transactions

1

Pro forma

Jun.30, 2007

(in $ 000's)

(unaudited)

Cash

$22,879

3,000

$25,879

Other Current Assets

3,984

-

3,984

Vessels, net

618,572

-

618,572

Advances for Vessel Construction

2

64,785

316,900

381,685

Restricted Cash

7,325

-

7,325

Other Assets

9,109

-

9,109

TOTAL ASSETS

726,654

1,046,554

Current Liabilities

8,843

-

8,843

Long-term Debt

302,377

319,900

622,277

Other Liabilities

4,693

-

4,693

Stockholders' Equity

410,741

-

410,741

Book Capitalization

1,033,018

Net Debt

3

/ Capitalization

58.9%

20

Liquidity for Growth

* Thereafter semi-annual reduction in availability to Balloon

10-year Revolver Underwritten by The Royal Bank of Scotland

New Facility to Replace Exisiting Facility

$1.6 Billion Commitment at Favorable Terms

Revolver Amount

$1.6 billion

Maturity

July 2017

Interest Only until (at least)

July 2012

Interest Margin

Libor + 80/90

basis points

Commitment Fees on

undrawn revolver

25 basis points

Availability in full until *

July 2012

Balloon (fully drawn)

$850 million

Conclusion - Accretive Growth Strategy

Eagle Bulk – a solid, clear, focused investment story

CLEAR BENEFITS TO SHAREHOLDERS

Secure dividend over long term.

Pay down debt

Paid Dividends of $4.10 per share to date.Intent to grow dividend over time

AFFIRMS EAGLE BULK AS CONSOLIDATOR IN DRYBULK INDUSTRY

Grows fleet to 49 vessels

Increases cargo carrying capacity to 2.7 million dwt

Lowers average age to 2 years

Improves operating efficiencies with 41 sister vessels

HEALTHY DRYBULK MARKET FUNDAMENTALS CONTINUE

Increase contracted revenues with 15 open vessels available to charter

through 2008 and 20 profit sharing charters

22