UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21759

Name of Fund: BlackRock Long-Horizon Equity Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Long-Horizon Equity Fund, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 10/31/2014

Date of reporting period: 10/31/2014

Item 1 – Report to Stockholders

OCTOBER 31, 2014

| | | | |

ANNUAL REPORT | | | |  |

BlackRock Long-Horizon Equity Fund

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| | | | | | |

| | | | | | | |

| 2 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

Dear Shareholder,

The final months of 2013 were generally positive for most risk assets such as equities and high yield bonds even as investors were grappling with uncertainty as to when and by how much the U.S. Federal Reserve would begin to gradually reduce (or “taper”) its asset purchase programs. Higher quality bonds and emerging market investments, however, struggled as Fed tapering became increasingly imminent. When the central bank ultimately announced its tapering plans in mid-December, equity investors reacted positively, as this action signaled the Fed’s perception of real improvement in the economy.

Most asset classes moved higher in the first half of 2014 despite the pull back in Fed stimulus. The year got off to a rocky start, however, as a number of developing economies showed signs of stress and U.S. economic data weakened. Equities declined in January while bond markets found renewed strength from investors seeking relatively safer assets. Although these headwinds persisted, equities were back on the rise in February as investors were assuaged by increasing evidence that the soft patch in U.S. data was temporary and weather-related, and forecasts pointed to growth picking up later in the year.

In the months that followed, interest rates trended lower and bond prices climbed higher in the modest growth environment. Financial markets exhibited a remarkably low level of volatility despite rising tensions in Russia and Ukraine and signs of decelerating growth in China. Equity markets were resilient as investors focused on signs of improvement in the U.S. recovery, stronger corporate earnings, increased merger-and-acquisition activity and, perhaps most importantly, reassurance from the Fed that no changes to short-term interest rates were on the horizon.

In the ongoing low-yield environment, income-seeking investors moved into equities, pushing major indices to record levels. However, as stock prices continued to rise, investors became wary of high valuations and began shedding the stocks that had experienced significant price appreciation in 2013, particularly growth and momentum names. The broad rotation into cheaper valuations resulted in the strongest performers of 2013 struggling most in 2014, and vice versa. Especially hard hit were U.S. small cap and European stocks, where earnings growth had not kept pace with market gains. In contrast, emerging markets benefited from the trend after having suffered heavy selling pressure in early 2014.

Volatility ticked up in the middle of the summer. Markets came under pressure in July as geopolitical turmoil intensified in Gaza, Iraq and Ukraine and financial troubles boiled over in Argentina and Portugal. Investors regained some confidence in August, allowing markets to rebound briefly amid renewed comfort that the Fed would continue to keep rates low and hopes that the European Central Bank would increase stimulus. However, markets swiftly reversed in September as improving U.S. economic indicators raised concerns that the Fed would increase short-term interest rates sooner than previously anticipated. Global credit markets tightened as the U.S. dollar strengthened, ultimately putting a strain on investor flows. High valuations combined with impending rate hikes stoked increasing volatility in financial markets. Escalating geopolitical risks further fueled the fire. The U.S. renewed its involvement in Iraq and the European Union imposed additional sanctions against Russia, while Scottish voters contemplated separating from the United Kingdom.

U.S. risk assets made a comeback in October while other developed markets continued their descent. This divergence in market performance moved in tandem with economic momentum and central bank policy. As the U.S. economy continued to strengthen, the need for monetary policy accommodation diminished. Meanwhile, economies in other parts of the developed world decelerated and central banks in Europe and Japan implemented aggressive measures to stimulate growth.

U.S. large cap stocks were the strongest performers for the six- and 12-month periods ended October 31, 2014. U.S. small caps experienced significantly higher volatility than large caps, but nonetheless generated positive returns. International developed market equities broadly declined while emerging markets posted modest gains. Most fixed income assets produced positive results as rates generally fell. Tax-exempt municipal bonds benefited from a favorable supply-and-demand environment. Short-term interest rates remained near zero, keeping yields on money market securities close to historic lows.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

U.S. financial markets generally outperformed other parts of the world given stronger economic growth and corporate earnings, the continuation of low interest rates and the appeal of relative stability amid rising geopolitical uncertainty.

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of October 31, 2014 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | 8.22 | % | | | 17.27 | % |

U.S. small cap equities

(Russell 2000® Index) | | | 4.83 | | | | 8.06 | |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | (4.83 | ) | | | (0.60 | ) |

Emerging market equities

(MSCI Emerging

Markets Index) | | | 3.74 | | | | 0.64 | |

3-month Treasury bills

(BofA Merrill Lynch 3-Month

U.S. Treasury Bill Index) | | | 0.02 | | | | 0.05 | |

U.S. Treasury securities

(BofA Merrill Lynch 10-Year

U.S. Treasury Index) | | | 4.29 | | | | 5.21 | |

U.S. investment-grade

bonds (Barclays

U.S. Aggregate Bond Index) | | | 2.35 | | | | 4.14 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | 3.54 | | | | 7.94 | |

U.S. high yield bonds

(Barclays U.S.

Corporate High Yield 2%

Issuer Capped Index) | | | 1.05 | | | | 5.82 | |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | | | | | |

| | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | |

| Fund Summary as of October 31, 2014 | | |

BlackRock Long-Horizon Equity Fund’s (the “Fund”) investment objective is to provide high total investment return.

| | |

| Portfolio Management Commentary | | |

How did the Fund perform?

| Ÿ | | For the 12-month period ended October 31, 2014, the Fund outperformed its benchmark, the Morgan Stanley Capital International (“MSCI”) All Country World Index. |

What factors influenced performance?

| Ÿ | | The Fund’s outperformance was driven by stock selection in financials and an overweight in health care. The Fund’s focus on large banks within the financial sector and the overall strong performance of the health care sector benefited the portfolio. |

| Ÿ | | Relative to the benchmark index, a significant overweight in the consumer discretionary sector along with stock selection in industrials represented the largest detractors from performance. Within consumer discretionary, holdings in the luxury goods maker Coach, Inc. and the global watchmaker The Swatch Group AG both negatively impacted relative performance. |

Describe recent portfolio activity.

| Ÿ | | The Fund’s most significant purchases during the period reflected conviction in the global recovery and resulted in a shift toward cyclical value opportunities. In this vein, the Fund purchased Sands China Ltd., AXA SA and ING Groep NV CVA. The largest sales were of DIRECTV, Nestlé SA and Roche Holding AG. The Fund also reduced positions in Imperial Tobacco Group PLC and Newell Rubbermaid, Inc. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Fund’s largest industries were consumer durables, apparel & luxury goods, tobacco and pharmaceuticals. The Fund was generally invested in companies that fund management believes generate recurring cash flows and tend to have the pricing power necessary to sustainably grow earnings over the medium and long term. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of

Long-Term Investments |

| | | | |

Total SA | | | 7 | % |

AutoZone, Inc. | | | 5 | |

Samsung Electronics Co. Ltd., Preference Shares | | | 5 | |

AstraZeneca PLC | | | 5 | |

Google, Inc. | | | 5 | |

Imperial Tobacco Group PLC | | | 5 | |

Cie Financiere Richemont SA, Registered Shares | | | 5 | |

Newell Rubbermaid, Inc. | | | 5 | |

AXA SA | | | 5 | |

Citigroup, Inc. | | | 5 | |

| | |

| Geographic Allocation1 | | Percent of

Long-Term Investments |

| | | | |

United States | | | 48 | % |

France | | | 11 | |

United Kingdom | | | 11 | |

Netherlands | | | 8 | |

South Korea | | | 5 | |

Switzerland | | | 5 | |

Hong Kong | | | 4 | |

India | | | 4 | |

Denmark | | | 2 | |

Argentina | | | 2 | |

| | 1 | | Includes a less than 1% holding in each of the following countries: China and Taiwan. |

| | | | | | |

| | | | | | | |

| 4 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

| | |

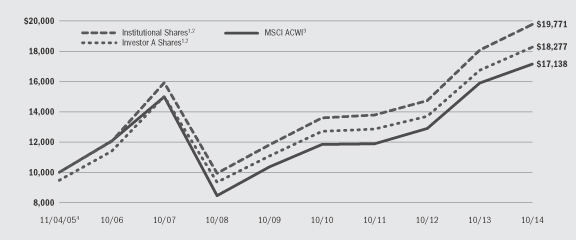

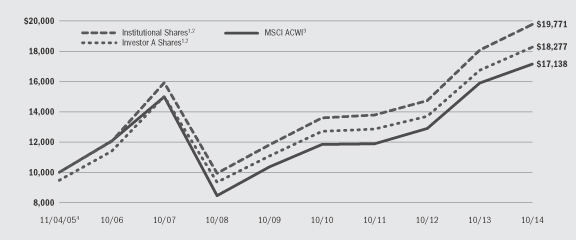

| Total Return Based on a $10,000 Investment | | |

| | 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| | 2 | | The Fund will, under normal circumstances, invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities. The Fund’s total returns prior to October 15, 2012 are the returns of the Fund when it followed a different investment objective and different investment strategies under the name BlackRock Global Dynamic Equity Fund. |

| | 3 | | This unmanaged index is a free float-adjusted, market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI All Country World Index consists of 46 country indexes comprising 23 developed and 23 emerging market country indexes. |

| | 4 | | Commencement of operations. |

| | |

| Performance Summary for the Period Ended October 31, 2014 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | 5 Years | | | Since Inception6 | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | 2.14 | % | | | 9.36 | % | | | N/A | | | | 10.83 | % | | | N/A | | | | 7.88 | % | | | N/A | |

Investor A | | | 2.01 | | | | 9.09 | | | | 3.36 | % | | | 10.52 | | | | 9.33 | % | | | 7.58 | | | | 6.94 | % |

Investor B | | | 1.59 | | | | 8.13 | | | | 3.63 | | | | 9.60 | | | | 9.32 | | | | 6.82 | | | | 6.82 | |

Investor C | | | 1.61 | | | | 8.23 | | | | 7.23 | | | | 9.68 | | | | 9.68 | | | | 6.77 | | | | 6.77 | |

Class R | | | 1.81 | | | | 8.56 | | | | N/A | | | | 10.06 | | | | N/A | | | | 7.18 | | | | N/A | |

MSCI ACWI | | | 2.37 | | | | 7.77 | | | | N/A | | | | 10.57 | | | | N/A | | | | 6.18 | | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 6 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on November 4, 2005. |

| | | | N/A — Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | |

| | | | | | | |

| | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | 5 |

Institutional Shares are not subject to any sales charge or contingent deferred sales charge (“CDSC”). These shares bear no ongoing distribution or service fees and are available only to certain eligible investors.

Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a CDSC where no initial sales charge was paid at the time of purchase.

Investor B Shares are subject to a maximum CDSC of 4.50%, declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic sales conversions.) All returns for periods greater than eight years reflect this conversion. These shares are only available through exchanges and dividend reinvestments by existing shareholders and for purchase by certain employer-sponsored retirement plans.

Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year.

Class R Shares are not subject to any sales charge or CDSC. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans. Prior to March 1, 2007, Class R Shares performance results are those of the Institutional Shares (which have no distribution or service fees) restated to reflect Class R Shares fees.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous page assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Fund’s investment advisor, waived a portion of the Fund’s expenses. Without such waiver, the Fund’s performance would have been lower. The Manager is under no obligation to waive or reimburse or to continue waiving its fees after the applicable termination date. See Note 4 of the Notes to Financial Statements for additional information on waivers and/or reimbursements.

| | | | | | |

| | | | | | | |

| 6 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other Fund expenses. The expense example shown below (which is based on a hypothetical investment of $1,000 invested on May 1, 2014 and held through October 31, 2014) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical2 | | | | |

| | | Beginning

Account Value

May 1, 2014 | | | Ending

Account Value

October 31, 2014 | | | Expenses Paid

During the Period1 | | | Beginning

Account Value

May 1, 2014 | | | Ending

Account Value

October 31, 2014 | | | Expenses Paid

During the Period1 | | | Annualized

Expense Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 1,021.40 | | | $ | 4.89 | | | $ | 1,000.00 | | | $ | 1,020.37 | | | $ | 4.89 | | | | 0.96 | % |

Investor A | | $ | 1,000.00 | | | $ | 1,020.10 | | | $ | 6.21 | | | $ | 1,000.00 | | | $ | 1,019.06 | | | $ | 6.21 | | | | 1.22 | % |

Investor B | | $ | 1,000.00 | | | $ | 1,015.90 | | | $ | 10.72 | | | $ | 1,000.00 | | | $ | 1,014.57 | | | $ | 10.71 | | | | 2.11 | % |

Investor C | | $ | 1,000.00 | | | $ | 1,016.10 | | | $ | 10.06 | | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | % |

Class R | | $ | 1,000.00 | | | $ | 1,018.10 | | | $ | 8.60 | | | $ | 1,000.00 | | | $ | 1,016.69 | | | $ | 8.59 | | | | 1.69 | % |

| | 1 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | 2 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | |

| Derivative Financial Instruments | | |

The Fund may invest in various derivative financial instruments which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a market without owning or taking physical custody of securities or to hedge market, foreign currency exchange rate and/or other risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Fund’s ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require the Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation the Fund can realize on an investment, may result in lower distributions paid to shareholders or may cause the Fund to hold an investment that it might otherwise sell. The Fund’s investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | 7 |

| | |

Schedule of Investments October 31, 2014 | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Argentina — 1.5% | | | | | | | | | | |

MercadoLibre, Inc. | | | | | 59,403 | | | $ | 8,087,718 | |

Denmark — 2.2% | | | | | | | | | | |

Novo Nordisk A/S, Class B | | | | | 259,945 | | | | 11,750,221 | |

France — 11.1% | | | | | | | | | | |

AXA SA | | | | | 1,092,063 | | | | 25,225,043 | |

Total SA | | | | | 584,970 | | | | 34,924,614 | |

| | | | | | | | | | |

| | | | | | | | | | 60,149,657 | |

Hong Kong — 4.1% | | | | | | | | | | |

Chaoda Modern Agriculture Holdings Ltd. (a)(b) | | | | | 3,106,585 | | | | 90,091 | |

Sands China Ltd. (b) | | | | | 3,554,800 | | | | 22,171,666 | |

| | | | | | | | | | |

| | | | | | | | | | 22,261,757 | |

India — 3.7% | | | | | | | | | | |

HDFC Bank Ltd. | | | | | 1,236,712 | | | | 20,022,803 | |

Netherlands — 7.3% | | | | | | | | | | |

Delta Lloyd NV | | | | | 920,196 | | | | 20,974,252 | |

ING Groep NV CVA (a) | | | | | 1,297,838 | | | | 18,585,509 | |

| | | | | | | | | | |

| | | | | | | | | | 39,559,761 | |

South Korea — 5.1% | | | | | | | | | | |

Samsung Electronics Co. Ltd., Preference Shares | | | | | 29,891 | | | | 27,591,275 | |

Switzerland — 4.8% | | | | | | | | | | |

Cie Financiere Richemont SA, Registered Shares | | | | | 308,912 | | | | 26,045,539 | |

Taiwan — 0.0% | | | | | | | | | | |

Chunghwa Telecom Co. Ltd. | | | | | 1 | | | | 3 | |

United Kingdom — 10.1% | | | | | | | | | | |

AstraZeneca PLC | | | | | 374,218 | | | | 27,336,007 | |

Delta Topco Ltd. (g) | | | | | 1,559,597 | | | | 913,924 | |

Imperial Tobacco Group PLC | | | | | 615,314 | | | | 26,730,362 | |

| | | | | | | | | | |

| | | | | | | | | | 54,980,293 | |

United States — 45.1% | | | | | | | | | | |

Allergan, Inc. | | | | | 58,256 | | | | 11,072,135 | |

AMETEK, Inc. | | | | | 355,385 | | | | 18,533,328 | |

AutoZone, Inc. (a) | | | | | 50,958 | | | | 28,206,272 | |

Cerner Corp. (a)(b) | | | | | 293,157 | | | | 18,568,564 | |

Citigroup, Inc. | | | | | 447,264 | | | | 23,942,042 | |

Cognizant Technology Solutions Corp.,

Class A (a)(b) | | | | | 363,235 | | | | 17,744,030 | |

Comcast Corp., Class A | | | | | 405,364 | | | | 22,436,897 | |

Discovery Communications, Inc., Class A (a) | | | | | 276,663 | | | | 9,780,037 | |

Discovery Communications, Inc., Class C (a) | | | | | 276,663 | | | | 9,680,438 | |

Google, Inc., Class C (a) | | | | | 47,918 | | | | 26,789,996 | |

| Common Stocks | | Shares | | | Value | |

United States (concluded) | | | | | | | | | | | | |

JPMorgan Chase & Co. | | | | | | | 355,666 | | | $ | 21,510,680 | |

Newell Rubbermaid, Inc. | | | | | | | 777,903 | | | | 25,927,507 | |

Veeco Instruments, Inc. (a) | | | | | | | 297,726 | | | | 10,715,159 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 244,907,085 | |

| Total Common Stocks — 95.0% | | | | | | | | | | | 515,356,112 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | |

| Corporate Bonds | | Par (000) | | | | |

China — 0.0% | | | | | | | | | | | | |

China Milk Products Group Ltd.,

0.00%, 1/15/2012 (a)(c)(d) | | | USD | | | | 1,000 | | | | 10,000 | |

Hong Kong — 0.0% | | | | | | | | | | | | |

FU JI Food and Catering Services Holdings Ltd., 0.00%, 10/18/2010 (a)(c)(d) | | | CNY | | | | 10,800 | | | | — | |

United Kingdom — 0.2% | | | | | | | | | | | | |

Delta Topco Ltd., 10.00%, 11/24/60 (e)(f)(g) | | | USD | | | | 1,308 | | | | 1,313,006 | |

| Total Corporate Bonds — 0.2% | | | | | | | | | | | 1,323,006 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | |

| Preferred Stocks | | Shares | | | | |

United States — 1.3% | | | | | | | | | | | | |

Proteus Digital Health, 0.00% (g) | | | | | | | 532,725 | | | | 7,000,007 | |

Total Long-Term Investments

(Cost — $449,684,110) — 96.5% | | | | | | | | | | | 523,679,125 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | |

| Short-Term Securities | | | | | | | | | |

Money Market Funds | | | | | | | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.07% (h)(j) | | | | | | | 18,826,796 | | | | 18,826,796 | |

| | | |

| | | | | | Beneficial Interest (000) | | | | |

BlackRock Liquidity Series, LLC, Money Market Series, 0.19% (h)(i)(j) | | | USD | | | | 14,123 | | | | 14,123,480 | |

Total Short-Term Securities

(Cost — $32,950,276) — 6.1% | | | | | | | | | | | 32,950,276 | |

| Total Investments (Cost — $482,634,386) — 102.6% | | | | 556,629,401 | |

| Liabilities in Excess of Other Assets — (2.6)% | | | | (14,194,743 | ) |

| | | | | | | | | | | | |

| Net Assets — 100.0% | | | | | | | | | | $ | 542,434,658 | |

| | | | | | | | | | | | |

| | | | | | | | | | |

| CNY | | Chinese Yuan Renminbi | | | | | | | | |

| USD | | U.S. Dollar | | | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 8 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

| | |

Schedule of Investments (continued) | | |

| | |

| Notes to Schedule of Investments |

| (a) | | Non-income producing security. |

| (b) | | Security, or a portion of security, is on loan. |

| (c) | | Issuer filed for bankruptcy and/or is in default of principal and/or interest payments. |

| (e) | | Convertible security. |

| (f) | | Represents a payment-in-kind security which may pay interest/dividends in additional par/shares and/or in cash. Rates shown are the current rate and possible payment rates. |

| (g) | | Restricted security as to resale. As of report date, the Fund held restricted securities with a current value of $9,226,937 and an original cost of $9,293,143 which is 1.3% of its net assets. |

| (h) | | Investments in issuers considered to be an affiliate of the Fund during the year ended October 31, 2014, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares/Beneficial Interest Held at

October 31,

2013 | | | Net

Activity | | | Shares/Beneficial Interest Held at

October 31,

2014 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 4,318,314 | | | | 14,508,482 | | | | 18,826,796 | | | $ | 1,370 | |

BlackRock Liquidity Series, LLC, Money Market Series | | | 15,441,542 | | | | (1,318,062 | ) | | | 14,123,480 | | | $ | 43,146 | |

| (i) | | Security was purchased with the cash collateral from loaned securities. The Fund may withdraw up to 25% of its investment daily, although the manager of the BlackRock Liquidity Series, LLC, Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. |

| (j) | | Represents the current yield as of report date. |

| Ÿ | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. The three levels of the fair value hierarchy are as follows: |

| | Ÿ | | Level 1 — unadjusted quoted prices in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | Ÿ | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) |

| | Ÿ | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. For information about the Fund’s policy regarding valuation of investments, please refer to Note 2 of the Notes to Financial Statements.

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | 9 |

| | |

Schedule of Investments (concluded) | | |

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy as of October 31, 2014:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Argentina | | $ | 8,087,718 | | | | — | | | | — | | | $ | 8,087,718 | |

Denmark | | | — | | | $ | 11,750,221 | | | | — | | | | 11,750,221 | |

France | | | — | | | | 60,149,657 | | | | — | | | | 60,149,657 | |

Hong Kong | | | — | | | | 22,261,757 | | | | — | | | | 22,261,757 | |

India | | | — | | | | 20,022,803 | | | | — | | | | 20,022,803 | |

Netherlands | | | — | | | | 39,559,761 | | | | — | | | | 39,559,761 | |

South Korea | | | — | | | | 27,591,275 | | | | — | | | | 27,591,275 | |

Switzerland | | | — | | | | 26,045,539 | | | | — | | | | 26,045,539 | |

Taiwan | | | — | | | | 3 | | | | — | | | | 3 | |

United Kingdom | | | — | | | | 54,066,369 | | | $ | 913,924 | | | | 54,980,293 | |

United States | | | 244,907,085 | | | | — | | | | — | | | | 244,907,085 | |

Corporate Bonds | | | — | | | | — | | | | 1,323,006 | | | | 1,323,006 | |

Preferred Stock | | | — | | | | — | | | | 7,000,007 | | | | 7,000,007 | |

Short-Term Securities: | | | | | | | | | | | | | | | | |

Money Market Funds | | | 18,826,796 | | | | 14,123,480 | | | | — | | | | 32,950,276 | |

| | | | |

Total | | $ | 271,821,599 | | | $ | 275,570,865 | | | $ | 9,236,937 | | | $ | 556,629,401 | |

| | | | |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of October 31, 2014, such assets and/or liabilities are categorized within the disclosure hierarchy as follows:

| | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

Assets: | | | | | | | | | | | | | | |

Foreign currency at value | | $ | 398 | | | | — | | | — | | $ | 398 | |

Liabilities: | | | | | | | | | | | | | | |

Collateral on securities loaned at value | | | — | | | $ | (14,123,480 | ) | | — | | | (14,123,480 | ) |

| | | | |

Total | | $ | 398 | | | $ | (14,123,480 | ) | | — | | $ | (14,123,082 | ) |

| | | | |

There were no transfers between levels during the year ended October 31, 2014.

A reconciliation of Level 3 investments is presented when the Fund had a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used in determining fair value:

| | | | | | | | | | | | | | | | |

| | | Common

Stock | | | Corporate

Bonds | | | Preferred

Stock | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Opening Balance, as of October 31, 2013 | | $ | 1,141,625 | | | $ | 1,406,726 | | | | — | | | $ | 2,548,351 | |

Transfers into Level 3 | | | — | | | | — | | | | — | | | | — | |

Transfers out of Level 3 | | | — | | | | — | | | | — | | | | — | |

Accrued discounts/premiums | | | — | | | | 19 | | | | — | | | | 19 | |

Net realized gain (loss) | | | — | | | | (2,305 | ) | | | — | | | | (2,305 | ) |

Net change in unrealized appreciation/depreciation1,2 | | | (227,701 | ) | | | (99,825 | ) | | | — | | | | (327,526 | ) |

Purchases | | | — | | | | 128,949 | | | $ | 7,000,007 | | | | 7,128,956 | |

Sales | | | — | | | | (110,558 | ) | | | — | | | | (110,558 | ) |

| | | | |

Closing Balance, as of October 31, 2014 | | $ | 913,924 | | | $ | 1,323,006 | | | $ | 7,000,007 | | | $ | 9,236,937 | |

| | | | |

Net change in unrealized appreciation/depreciation on investments held as of October 31, 20141,2 | | $ | (227,701 | ) | | $ | (99,825 | ) | | | — | | | $ | (327,526 | ) |

| | | | |

1 Included in the related net change in unrealized appreciation/depreciation in the Statement of Operations. | |

2 Any difference between Net change in unrealized appreciation/depreciation and Net change in unrealized appreciation/depreciation on investments held as of October 31, 2014 is generally due to investments no longer held or categorized as Level 3 at period end. | |

Certain of the Fund’s investments that are categorized as Level 3 were valued utilizing third party pricing information without adjustment. Such valuations are based on unobservable inputs. A significant change in third party information inputs could result in a significantly lower or higher value of such Level 3 investments.

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 10 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

| | |

| Statement of Assets and Liabilities | | |

| | | | |

| October 31, 2014 | | | |

| | | | |

| Assets | | | | |

Investments at value — unaffiliated (including securities loaned of $13,944,678) (cost — $449,684,110) | | $ | 523,679,125 | |

Investments at value — affiliated (cost — $32,950,276) | | | 32,950,276 | |

Dividends receivable | | | 1,129,999 | |

Capital shares sold receivable | | | 358,937 | |

Interest receivable | | | 108,932 | |

Securities lending income receivable — affiliated | | | 3,528 | |

Foreign currency at value (cost — $401) | | | 398 | |

Prepaid expenses | | | 37,733 | |

| | | | |

Total assets | | | 558,268,928 | |

| | | | |

| | | | |

| Liabilities | | | | |

Collateral on securities loaned at value | | | 14,123,480 | |

Capital shares redeemed payable | | | 890,397 | |

Investment advisory fees payable | | | 355,509 | |

Service and distribution fees payable | | | 172,123 | |

Officer’s and Trustees’ fees payable | | | 5,470 | |

Other affiliates payable | | | 1,615 | |

Other accrued expenses payable | | | 285,676 | |

| | | | |

Total liabilities | | | 15,834,270 | |

| | | | |

Net Assets | | $ | 542,434,658 | |

| | | | |

| | | | |

| Net Assets Consist of | | | | |

Paid-in capital | | $ | 387,661,909 | |

Undistributed net investment income | | | 4,630,352 | |

Accumulated net realized gain | | | 76,203,356 | |

Net unrealized appreciation/depreciation | | | 73,939,041 | |

| | | | |

Net Assets | | $ | 542,434,658 | |

| | | | |

| | | | |

| Net Asset Value | | | | |

Institutional — Based on net assets of $83,466,330 and 5,465,737 shares outstanding, unlimited shares authorized, $0.10 par value | | $ | 15.27 | |

| | | | |

Investor A — Based on net assets of $330,523,903 and 21,696,792 shares outstanding, unlimited shares authorized, $0.10 par value | | $ | 15.23 | |

| | | | |

Investor B — Based on net assets of $2,388,304 and 155,403 shares outstanding, unlimited shares authorized, $0.10 par value | | $ | 15.37 | |

| | | | |

Investor C — Based on net assets of $122,305,064 and 8,075,792 shares outstanding, unlimited shares authorized, $0.10 par value | | $ | 15.14 | |

| | | | |

Class R — Based on net assets of $3,751,057 and 246,636 shares outstanding, unlimited shares authorized shares authorized, $0.10 par value | | $ | 15.21 | |

| | | | |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | 11 |

| | | | |

| Year Ended October 31, 2014 | | | |

| | | | |

| Investment Income | | | | |

Dividends — unaffiliated | | $ | 13,697,865 | |

Interest | | | 146,969 | |

Securities lending — affiliated — net | | | 43,146 | |

Dividends — affiliated | | | 1,370 | |

Foreign taxes withheld | | | (689,471 | ) |

| | | | |

Total income | | | 13,199,879 | |

| | | | |

| | | | |

| Expenses | | | | |

Investment advisory | | | 4,808,242 | |

Service — Investor A | | | 869,774 | |

Service and distribution — Investor B | | | 38,762 | |

Service and distribution — Investor C | | | 1,293,356 | |

Service and distribution — Class R | | | 21,347 | |

Transfer agent — Institutional | | | 79,951 | |

Transfer agent — Investor A | | | 314,645 | |

Transfer agent — Investor B | | | 9,637 | |

Transfer agent — Investor C | | | 135,765 | |

Transfer agent — Class R | | | 17,217 | |

Accounting services | | | 169,135 | |

Professional | | | 86,648 | |

Registration | | | 80,659 | |

Custodian | | | 71,878 | |

Printing | | | 32,541 | |

Officer and Trustees | | | 22,556 | |

Miscellaneous | | | 39,265 | |

| | | | |

Total expenses | | | 8,091,378 | |

Less fees waived by Manager | | | (3,046 | ) |

Less transfer agent fees waived and/or reimbursed — class specific | | | (3,908 | ) |

| | | | |

Total expenses after fees waived | | | 8,084,424 | |

| | | | |

Net investment income | | | 5,115,455 | |

| | | | |

| | | | |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) from: | | | | |

Investments | | | 76,470,924 | |

Foreign currency transactions | | | 192,867 | |

| | | | |

| | | 76,663,791 | |

| | | | |

| Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | (29,328,457 | ) |

Foreign currency translations | | | (96,122 | ) |

| | | | |

| | | (29,424,579 | ) |

| | | | |

Net realized and unrealized gain | | | 47,239,212 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 52,354,667 | |

| | | | |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 12 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

| | |

| Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | Year Ended October 31, | |

| Increase (Decrease) in Net Assets: | | 2014 | | | 20131 | |

| | | | | | | | |

| Operations | | | | | | | | |

Net investment income | | $ | 5,115,455 | | | $ | 4,430,490 | |

Net realized gain | | | 76,663,791 | | | | 14,931,161 | |

Net change in unrealized appreciation/depreciation | | | (29,424,579 | ) | | | 107,245,630 | |

| | | | |

Net increase in net assets resulting from operations | | | 52,354,667 | | | | 126,607,281 | |

| | | | |

| | | | | | | | |

| Distributions to Shareholders From2 | | | | | | | | |

| Net investment income: | | | | | | | | |

Institutional | | | (1,657,076 | ) | | | (3,843,222 | ) |

Investor A | | | (3,293,478 | ) | | | (9,405,204 | ) |

Investor B | | | — | | | | (151,608 | ) |

Investor C | | | (75,281 | ) | | | (2,557,789 | ) |

Class R | | | (12,578 | ) | | | (154,591 | ) |

| Net realized gain: | | | | | | | | |

Institutional | | | (2,983,805 | ) | | | (2,998,677 | ) |

Investor A | | | (8,032,408 | ) | | | (7,940,477 | ) |

Investor B | | | (75,966 | ) | | | (196,010 | ) |

Investor C | | | (3,059,226 | ) | | | (2,995,459 | ) |

Class R | | | (112,847 | ) | | | (150,398 | ) |

| | | | |

Decrease in net assets resulting from distributions to shareholders | | | (19,302,665 | ) | | | (30,393,435 | ) |

| | | | |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Net decrease in net assets derived from capital share transactions | | | (121,293,230 | ) | | | (106,846,431 | ) |

| | | | |

| | | | | | | | |

| Net Assets | | | | | | | | |

Total decrease in net assets | | | (88,241,228 | ) | | | (10,632,585 | ) |

Beginning of year | | | 630,675,886 | | | | 641,308,471 | |

| | | | |

End of year | | $ | 542,434,658 | | | $ | 630,675,886 | |

| | | | |

Undistributed net investment income, end of year | | $ | 4,630,352 | | | $ | 4,342,694 | |

| | | | |

| | 1 | | Consolidated Statement of Changes. |

| | 2 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | 13 |

| | | | | | | | | | | | | | | | | | | | |

| | | Institutional | |

| | | Year Ended October 31, | |

| | | 2014 | | | 20131 | | | 20121 | | | 20111 | | | 20101 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 14.48 | | | $ | 12.43 | | | $ | 11.98 | | | $ | 11.93 | | | $ | 10.52 | |

| | | | |

Net investment income2 | | | 0.19 | | | | 0.15 | | | | 0.14 | | | | 0.15 | | | | 0.12 | |

Net realized and unrealized gain | | | 1.11 | | | | 2.56 | | | | 0.64 | | | | 0.02 | 3 | | | 1.44 | 3 |

| | | | |

Net increase (decrease) from investment operations | | | 1.30 | | | | 2.71 | | | | 0.78 | | | | 0.17 | | | | 1.56 | |

| | | | |

Distributions from:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.18 | ) | | | (0.37 | ) | | | (0.33 | ) | | | (0.12 | ) | | | (0.15 | ) |

Net realized gain | | | (0.33 | ) | | | (0.29 | ) | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | (0.51 | ) | | | (0.66 | ) | | | (0.33 | ) | | | (0.12 | ) | | | (0.15 | ) |

| | | | |

Net asset value, end of year | | $ | 15.27 | | | $ | 14.48 | | | $ | 12.43 | | | $ | 11.98 | | | $ | 11.93 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return5 | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 9.36% | | | | 22.71% | | | | 6.93% | | | | 1.41% | | | | 14.92% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 0.95% | | | | 0.98% | | | | 1.01% | | | | 1.00% | | | | 1.01% | |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 0.95% | | | | 0.98% | | | | 1.00% | | | | 1.00% | | | | 1.01% | |

| | | | |

Total expenses after fees waived and/or reimbursed, excluding reorganization expenses and dividend expense | | | 0.95% | | | | 0.98% | | | | 1.00% | | | | 1.00% | 6 | | | 1.01% | |

| | | | |

Net investment income | | | 1.31% | | | | 1.12% | | | | 1.17% | | | | 1.19% | | | | 1.09% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 83,466 | | | $ | 130,942 | | | $ | 138,976 | | | $ | 319,863 | | | $ | 293,944 | |

| | | | |

Portfolio turnover rate | | | 45% | | | | 11% | | | | 112% | | | | 37% | | | | 32% | |

| | | | |

| | 1 | | Consolidated Financial Highlights. |

| | 2 | | Based on average shares outstanding. |

| | 3 | | Includes a redemption fee, which is less than $0.005 per share. |

| | 4 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 5 | | Where applicable, assumes the reinvestment of distributions. |

| | 6 | | Excludes stock loan fees, which had no impact to the ratio. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 14 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

| | |

| Financial Highlights (continued) | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Investor A | |

| | | Year Ended October 31, | |

| | | 2014 | | | 20131 | | | 20121 | | | 20111 | | | 20101 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 14.43 | | | $ | 12.40 | | | $ | 11.95 | | | $ | 11.90 | | | $ | 10.50 | |

| | | | |

Net investment income2 | | | 0.14 | | | | 0.11 | | | | 0.12 | | | | 0.11 | | | | 0.09 | |

Net realized and unrealized gain | | | 1.13 | | | | 2.55 | | | | 0.63 | | | | 0.03 | 3 | | | 1.43 | 3 |

| | | | |

Net increase (decrease) from investment operations | | | 1.27 | | | | 2.66 | | | | 0.75 | | | | 0.14 | | | | 1.52 | |

| | | | |

Distributions from:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.14 | ) | | | (0.34 | ) | | | (0.30 | ) | | | (0.09 | ) | | | (0.12 | ) |

Net realized gain | | | (0.33 | ) | | | (0.29 | ) | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | (0.47 | ) | | | (0.63 | ) | | | (0.30 | ) | | | (0.09 | ) | | | (0.12 | ) |

| | | | |

Net asset value, end of year | | $ | 15.23 | | | $ | 14.43 | | | $ | 12.40 | | | $ | 11.95 | | | $ | 11.90 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return5 | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 9.09% | | | | 22.32% | | | | 6.62% | | | | 1.14% | | | | 14.57% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.22% | | | | 1.27% | | | | 1.28% | | | | 1.26% | | | | 1.28% | |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1.22% | | | | 1.27% | | | | 1.28% | | | | 1.26% | | | | 1.28% | |

| | | | |

Total expenses after fees waived and/or reimbursed, excluding reorganization expenses and dividend expense | | | 1.22% | | | | 1.27% | | | | 1.28% | | | | 1.26% | 6 | | | 1.27% | |

| | | | |

Net investment income | | | 0.96% | | | | 0.82% | | | | 1.04% | | | | 0.91% | | | | 0.82% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 330,524 | | | $ | 354,562 | | | $ | 353,237 | | | $ | 381,311 | | | $ | 411,573 | |

| | | | |

Portfolio turnover rate | | | 45% | | | | 11% | | | | 112% | | | | 37% | | | | 32% | |

| | | | |

| | 1 | | Consolidated Financial Highlights. |

| | 2 | | Based on average shares outstanding. |

| | 3 | | Includes a redemption fee, which is less than $0.005 per share. |

| | 4 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 5 | | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| | 6 | | Excludes stock loan fees, which had no impact to the ratio. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | 15 |

| | |

| Financial Highlights (continued) | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Investor B | |

| | | Year Ended October 31, | |

| | | 2014 | | | 20131 | | | 20121 | | | 20111 | | | 20101 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 14.43 | | | $ | 12.39 | | | $ | 11.90 | | | $ | 11.86 | | | $ | 10.45 | |

| | | | |

Net investment income2 | | | 0.02 | | | | 0.00 | 3 | | | 0.02 | | | | (0.06 | ) | | | (0.00 | )4 |

Net realized and unrealized gain | | | 1.14 | | | | 2.55 | | | | 0.64 | | | | 0.10 | 5 | | | 1.43 | 5 |

| | | | |

Net increase (decrease) from investment operations | | | 1.16 | | | | 2.55 | | | | 0.66 | | | | 0.04 | | | | 1.43 | |

| | | | |

Distributions from:6 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.22 | ) | | | (0.17 | ) | | | — | | | | (0.02 | ) |

Net realized gain | | | (0.22 | ) | | | (0.29 | ) | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | (0.22 | ) | | | (0.51 | ) | | | (0.17 | ) | | | — | | | | (0.02 | ) |

| | | | |

Net asset value, end of year | | $ | 15.37 | | | $ | 14.43 | | | $ | 12.39 | | | $ | 11.90 | | | $ | 11.86 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return7 | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 8.13% | | | | 21.26% | | | | 5.76% | | | | 0.34% | | | | 13.66% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 2.14% | | | | 2.11% | | | | 2.12% | | | | 2.08% | | | | 2.11% | |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 2.13% | | | | 2.11% | | | | 2.12% | | | | 2.08% | | | | 2.11% | |

| | | | |

Total expenses after fees waived and/or reimbursed, excluding reorganization expenses and dividend expense | | | 2.13% | | | | 2.11% | | | | 2.12% | | | | 2.08% | 8 | | | 2.10% | |

| | | | |

Net investment income | | | 0.13% | | | | 0.01% | | | | 0.18% | | | | (0.50)% | | | | (0.01)% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 2,388 | | | $ | 6,200 | | | $ | 8,868 | | | $ | 13,819 | | | $ | 18,321 | |

| | | | |

Portfolio turnover rate | | | 45% | | | | 11% | | | | 112% | | | | 37% | | | | 32% | |

| | | | |

| | 1 | | Consolidated Financial Highlights. |

| | 2 | | Based on average shares outstanding. |

| | 3 | | Amount is less than $0.005 per share. |

| | 4 | | Amount is greater than $(0.005) per share. |

| | 5 | | Includes a redemption fee, which is less than $0.005 per share. |

| | 6 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 7 | | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| | 8 | | Excludes stock loan fees, which had no impact to the ratio. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 16 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

| | |

| Financial Highlights (continued) | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Investor C | |

| | | Year Ended October 31, | |

| | | 2014 | | | 20131 | | | 20121 | | | 20111 | | | 20101 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 14.33 | | | $ | 12.32 | | | $ | 11.85 | | | $ | 11.81 | | | $ | 10.42 | |

| | | | |

Net investment income2 | | | 0.03 | | | | 0.01 | | | | 0.03 | | | | 0.02 | | | | 0.01 | |

Net realized and unrealized gain | | | 1.12 | | | | 2.53 | | | | 0.64 | | | | 0.02 | 3 | | | 1.42 | 3 |

| | | | |

Net increase (decrease) from investment operations | | | 1.15 | | | | 2.54 | | | | 0.67 | | | | 0.04 | | | | 1.43 | |

| | | | |

Distributions from:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.01 | ) | | | (0.24 | ) | | | (0.20 | ) | | | — | | | | (0.04 | ) |

Net realized gain | | | (0.33 | ) | | | (0.29 | ) | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | (0.34 | ) | | | (0.53 | ) | | | (0.20 | ) | | | — | | | | (0.04 | ) |

| | | | |

Net asset value, end of year | | $ | 15.14 | | | $ | 14.33 | | | $ | 12.32 | | | $ | 11.85 | | | $ | 11.81 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return5 | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 8.23% | | | | 21.36% | | | | 5.85% | | | | 0.34% | | | | 13.75% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.99% | | | | 2.04% | | | | 2.05% | | | | 2.02% | | | | 2.04% | |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1.99% | | | | 2.03% | | | | 2.05% | | | | 2.02% | | | | 2.04% | |

| | | | |

Total expenses after fees waived and/or reimbursed, excluding reorganization expenses and dividend expense | | | 1.99% | | | | 2.03% | | | | 2.05% | | | | 2.02% | 6 | | | 2.04% | |

| | | | |

Net investment income | | | 0.19% | | | | 0.05% | | | | 0.26% | | | | 0.13% | | | | 0.06% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 122,305 | | | $ | 134,124 | | | $ | 133,374 | | | $ | 165,823 | | | $ | 182,756 | |

| | | | |

Portfolio turnover rate | | | 45% | | | | 11% | | | | 112% | | | | 37% | | | | 32% | |

| | | | |

| | 1 | | Consolidated Financial Highlights. |

| | 2 | | Based on average shares outstanding. |

| | 3 | | Includes a redemption fee, which is less than $0.005 per share. |

| | 4 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 5 | | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| | 6 | | Excludes stock loan fees, which had no impact to the ratio. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | 17 |

| | |

| Financial Highlights (concluded) | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Class R | |

| | | Year Ended October 31, | |

| | | 2014 | | | 20131 | | | 20121 | | | 20111 | | | 20101 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 14.38 | | | $ | 12.36 | | | $ | 11.89 | | | $ | 11.85 | | | $ | 10.46 | |

| | | | |

Net investment income2 | | | 0.07 | | | | 0.06 | | | | 0.07 | | | | 0.06 | | | | 0.04 | |

Net realized and unrealized gain | | | 1.13 | | | | 2.54 | | | | 0.63 | | | | 0.02 | 3 | | | 1.44 | 3 |

| | | | |

Net increase from investment operations | | | 1.20 | | | | 2.60 | | | | 0.70 | | | | 0.08 | | | | 1.48 | |

| | | | |

Distributions from:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.04 | ) | | | (0.29 | ) | | | (0.23 | ) | | | (0.04 | ) | | | (0.09 | ) |

Net realized gain | | | (0.33 | ) | | | (0.29 | ) | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | (0.37 | ) | | | (0.58 | ) | | | (0.23 | ) | | | (0.04 | ) | | | (0.09 | ) |

| | | | |

Net asset value, end of year | | $ | 15.21 | | | $ | 14.38 | | | $ | 12.36 | | | $ | 11.89 | | | $ | 11.85 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return5 | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 8.56% | | | | 21.87% | | | | 6.17% | | | | 0.68% | | | | 14.20% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.79% | | | | 1.86% | | | | 1.82% | | | | 1.77% | | | | 1.78% | |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1.70% | | | | 1.69% | | | | 1.69% | | | | 1.70% | | | | 1.70% | |

| | | | |

Total expenses after fees waived and/or reimbursed, excluding reorganization expenses and dividend expense | | | 1.70% | | | | 1.69% | | | | 1.69% | | | | 1.70% | 6 | | | 1.69% | |

| | | | |

Net investment income | | | 0.51% | | | | 0.45% | | | | 0.62% | | | | 0.48% | | | | 0.40% | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 3,751 | | | $ | 4,848 | | | $ | 6,853 | | | $ | 6,895 | | | $ | 9,072 | |

| | | | |

Portfolio turnover rate | | | 45% | | | | 11% | | | | 112% | | | | 37% | | | | 32% | |

| | | | |

| | 1 | | Consolidated Financial Highlights. |

| | 2 | | Based on average shares outstanding. |

| | 3 | | Includes a redemption fee, which is less than $0.005 per share. |

| | 4 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 5 | | Where applicable, assumes the reinvestment of distributions. |

| | 6 | | Excludes stock loan fees, which had no impact to the ratio. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 18 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

| | | | |

| Notes to Financial Statements | | |

1. Organization:

BlackRock Long-Horizon Equity Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified, open-end management investment company. The Fund is organized as a Delaware statutory trust. The Fund offers multiple classes of shares. Institutional Shares are sold without a sales charge and only to certain eligible investors. Investor A Shares are generally sold with an initial sales charge. Investor B and Investor C Shares may be subject to a CDSC. Class R Shares are sold without a sales charge and only to certain employer-sponsored retirement plans. All classes of shares have identical voting, dividend, liquidation and other rights and the same terms and conditions, except that Investor A, Investor B, Investor C and Class R Shares bear certain expenses related to the shareholder servicing of such shares, and Investor B, Investor C and Class R Shares also bear certain expenses related to the distribution of such shares. Investor B Shares automatically convert to Investor A Shares after approximately eight years. Investor B Shares are only available through exchanges and distribution reinvestment by current holders and for purchase by certain employer-sponsored retirement plans. Each class has exclusive voting rights with respect to matters relating to its shareholder servicing and distribution expenditures (except that Investor B shareholders may vote on material changes to the Investor A distribution and service plan).

The Fund, together with certain other registered investment companies advised by BlackRock Advisors, LLC (the “Manager”) or its affiliates, is included in a complex of open-end funds referred to as the Equity-Bond Complex.

Basis of Consolidation: The accompanying consolidated statements of changes in net assets and financial highlights include the accounts of BlackRock Cayman Global Dynamic Equity Fund I, Ltd. (the “Subsidiary”), a wholly owned subsidiary of the Fund, which primarily invested in commodity-related instruments. During the year ended October 31, 2013, the subsidiary was dissolved. The Subsidiary enabled the Fund to hold these commodity-related instruments and satisfy Regulated Investment Company (“RIC”) tax requirements. Intercompany accounts and transactions, if any, have been eliminated.

2. Significant Accounting Policies:

The Fund’s financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund:

Valuation: The Fund’s investments are valued at fair value as of the close of trading on the New York Stock Exchange (“NYSE”) (generally 4:00 p.m., Eastern time). U.S. GAAP defines fair value as the price the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund determines the fair values of its financial instruments at market value using independent dealers or pricing services under policies approved by the Board of Trustees of the Fund (the “Board”). The BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) is the committee formed by management to develop global pricing policies and procedures and to provide oversight of the pricing function for the Fund for all financial instruments.

Equity investments traded on a recognized securities exchange are valued at the official close each day, if available. For equity investments traded on more than one exchange, the official close price on the exchange where the stock is primarily traded is used. Equity investments traded on a recognized exchange for which there were no sales on that day may be valued at the last available bid (long positions) or ask (short positions) price.

Bond investments are valued on the basis of last available bid prices or current market quotations provided by dealers or pricing services. Floating rate loan interests are valued at the mean of the bid prices from one or more brokers or dealers as obtained from a pricing service. In determining the value of a particular investment, pricing services may use certain information with respect to transactions in such investments, quotations from dealers, pricing matrixes, market transactions in comparable investments, various relationships observed in the market between investments and calculated yield measures. Asset-backed and mortgage-backed securities are valued by independent pricing services using models that consider estimated cash flows of each tranche of the security, establish a benchmark yield and develop an estimated tranche-specific spread to the benchmark yield based on the unique attributes of the tranche. Investments in open-end registered investment companies are valued at NAV each business day. Short-term securities with remaining maturities of 60 days or less may be valued at amortized cost, which approximates fair value.

The Fund values its investment in BlackRock Liquidity Series, LLC, Money Market Series (the “Money Market Series”) at fair value, which is ordinarily based upon its pro rata ownership in the underlying fund’s net assets. The Money Market Series seeks current income consistent with maintaining

| | | | | | |

| | | | | | | |

| | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | 19 |

| | |

| Notes to Financial Statements (continued) | | |

liquidity and preserving capital. Although the Money Market Series is not registered under the 1940 Act, its investments will follow the parameters of investments by a money market fund that is subject to Rule 2a-7 under the 1940 Act. The Fund may withdraw up to 25% of its investment daily, although the manager of the Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day.

Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates determined as of the close of business on the NYSE. Forward foreign currency exchange contracts are valued at the mean between the bid and ask prices and are determined as of the close of business on the NYSE. Interpolated values are derived when the settlement date of the contract is an interim date for which quotations are not available.

In the event that the application of these methods of valuation results in a price for an investment that is deemed not to be representative of the market value of such investment, or if a price is not available, the investment will be valued by the Global Valuation Committee, or its delegate, in accordance with a policy approved by the Board as reflecting fair value (“Fair Value Investments”). When determining the price for Fair Value Investments, the Global Valuation Committee, or its delegate, seeks to determine the price that the Fund might reasonably expect to receive or pay from the current sale or purchase of that asset or liability in an arm’s-length transaction. Fair value determinations shall be based upon all available factors that the Global Valuation Committee, or its delegate, deems relevant consistent with the principles of fair value measurement, which include the market approach, income approach and/or in the case of recent investments, the cost approach, as appropriate. The market approach generally consists of using comparable market transactions. The income approach generally is used to discount future cash flows to present value and is adjusted for liquidity as appropriate. These factors include but are not limited to: (i) attributes specific to the investment or asset; (ii) the principal market for the investment or asset; (iii) the customary participants in the principal market for the investment or asset; (iv) data assumptions by market participants for the investment or asset, if reasonably available; (v) quoted prices for similar investments or assets in active markets; and (vi) other factors, such as future cash flows, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, recovery rates, liquidation amounts and/or default rates. Due to the inherent uncertainty of valuations of such investments, the fair values may differ from the values that would have been used had an active market existed. The Global Valuation Committee, or its delegate, employs various methods for calibrating valuation approaches for investments where an active market does not exist, including regular due diligence of the Fund’s pricing vendors, regular reviews of key inputs and assumptions, transactional back-testing or disposition analysis to compare unrealized gains and losses to realized gains and losses, reviews of missing or stale prices and large movements in market values and reviews of any market related activity. The pricing of all Fair Value Investments is subsequently reported to the Board or a committee thereof on a quarterly basis.

Generally, trading in foreign instruments is substantially completed each day at various times prior to the close of business on the NYSE. Occasionally, events affecting the values of such instruments may occur between the foreign market close and the close of business on the NYSE that may not be reflected in the computation of the Fund’s net assets. If events (e.g., a company announcement, market volatility or a natural disaster) occur during such periods that are expected to materially affect the value of such instruments, those instruments may be Fair Value Investments and be valued at their fair value, as determined in good faith by the Global Valuation Committee, or its delegate, using a pricing service and/or policies approved by the Board. Each business day, the Fund uses a pricing service to assist with the valuation of certain foreign exchange-traded equity securities and foreign exchange-traded and OTC options (the “Systematic Fair Value Price”). Using current market factors, the Systematic Fair Value Price is designed to value such foreign securities and foreign options at fair value as of the close of business on the NYSE, which follows the close of the local markets.

Foreign Currency: The Fund’s books and records are maintained in U.S. dollars. Purchases and sales of investment securities are recorded at the rates of exchange prevailing on the respective date of such transactions. Generally, when the U.S. dollar rises in value against a foreign currency, the Fund’s investments denominated in that currency will lose value because that currency is worth fewer U.S. dollars; the opposite effect occurs if the U.S. dollar falls in relative value.

The Fund does not isolate the portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in the market prices of investments held or sold for financial reporting purposes. Accordingly, the effects of changes in foreign currency exchange rates on investments are not segregated in the Statement of Operations from the effects of changes in market prices of those investments but are included as a component of net realized and unrealized gain (loss) from investments. The Fund reports realized currency gains (losses) on foreign currency related transactions as components of net realized gain (loss) for financial reporting purposes, whereas such components are generally treated as ordinary income for federal income tax purposes.

Investment Transactions and Investment Income: For financial reporting purposes, investment transactions are recorded on the dates the transactions are entered into (the trade dates). Realized gains and losses on investment transactions are determined on the identified cost basis. Dividend income is recorded on the ex-dividend date. Dividends from foreign securities where the ex-dividend date may have passed are subsequently recorded when

| | | | | | |

| | | | | | | |

| 20 | | BLACKROCK LONG-HORIZON EQUITY FUND | | OCTOBER 31, 2014 | | |

| | | | |

| Notes to Financial Statements (continued) | | |

the Fund is informed of the ex-dividend date. Under the applicable foreign tax laws, a withholding tax at various rates may be imposed on capital gains, dividends and interest. Interest income, including amortization and accretion of premiums and discounts on debt securities, is recognized on the accrual basis. Income, expenses and realized and unrealized gains and losses are allocated daily to each class based on its relative net assets.

Distributions: Distributions paid by the Fund are recorded on the ex-dividend date. Distributions of capital gains are recorded on the ex-dividend date. The character and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

Recent Accounting Standard: In June 2014, the Financial Accounting Standards Board issued guidance to improve the financial reporting of reverse repurchase agreements and other similar transactions. The guidance will require expanded disclosure for entities that enter into reverse repurchase agreements and similar transactions accounted for as secured borrowings. It is effective for financial statements with fiscal years beginning on or after December 15, 2014 and interim periods within those fiscal years. Management is evaluating the impact, if any, of this guidance on the Fund’s financial statement disclosures.

Other: Expenses directly related to the Fund or its classes are charged to the Fund or the applicable class. Other operating expenses shared by several funds are prorated among those funds on the basis of relative net assets or other appropriate methods. Expenses directly related to the Fund and other shared expenses prorated to the Fund are allocated daily to each class based on its relative net assets or other appropriate methods.

The Fund has an arrangement with the custodian whereby fees may be reduced by credits earned on uninvested cash balances, which, if applicable, are shown as fees paid indirectly in the Statement of Operations. The custodian imposes fees on overdrawn cash balances, which can be offset by accumulated credits earned or may result in additional custody charges.

3. Securities and Other Investments:

Zero-Coupon Bonds: The Fund may invest in zero-coupon bonds, which are normally issued at a significant discount from face value and do not provide for periodic interest payments. Zero-coupon bonds may experience greater volatility in market value than similar maturity debt obligations which provide for regular interest payments.

Securities Lending: The Fund may lend its securities to approved borrowers, such as brokers, dealers and other financial institutions. The borrower pledges and maintains with the Fund collateral consisting of cash, an irrevocable letter of credit issued by a bank, or securities issued or guaranteed by the U.S. government. The initial collateral received by the Fund is required to have a value of at least 102% of the current value of the loaned securities for securities traded on U.S. exchanges and a value of at least 105% for all other securities. The collateral is maintained thereafter, at a value equal to at least 100% of the current market value of the securities on loan. The market value of the loaned securities is determined at the close of each business day of the Fund and any additional required collateral is delivered to the Fund on the next business day. During the term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities. Loans of securities are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for settlement of securities transactions.

The market value of securities on loan and the value of the related collateral are shown separately in the Statement of Assets and Liabilities as a component of investments at value — unaffiliated, and collateral on securities loaned at value, respectively. As of October 31, 2014, any securities on loan were collateralized by cash. The cash collateral invested by the securities lending agent, BlackRock Investment Management, LLC (“BIM”), if any, is disclosed in the Schedule of Investments.

Securities lending transactions are entered into by the Fund under Master Securities Lending Agreements (each, an “MSLA”), which provide the right, in the event of default (including bankruptcy or insolvency), for the non-defaulting party to liquidate the collateral and calculate a net exposure to the defaulting party or request additional collateral. In the event that a borrower defaults, the Fund, as lender, would offset the market value of the collateral received against the market value of the securities loaned. When the value of the collateral is greater than that of the market value of the securities loaned, the lender is left with a net amount payable to the defaulting party. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of an MSLA counterparty’s bankruptcy or insolvency. Under the MSLA, the borrower can resell or re-pledge the loaned securities, and the Fund can reinvest cash collateral, or, upon an event of default, resell or re-pledge the collateral.