- EXPE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Expedia (EXPE) CORRESPCorrespondence with SEC

Filed: 21 Sep 11, 12:00am

September 21, 2011

Via EDGAR

Maryse Mills-Apenteng, Special Counsel

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | TripAdvisor, Inc. |

| Registration Statement on Form S-4 |

| Filed on July 27, 2011 |

| File No. 333-175828 |

Dear Ms. Mills-Apenteng:

On behalf of Expedia, Inc. (“Expedia”) and TripAdvisor, Inc. (“TripAdvisor” and, with Expedia, the “Companies”), set forth below are responses to the comments of the Staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) that you provided in your letter, dated August 23, 2011, with respect to the filing referenced above. We have included in this letter, where relevant, responses forwarded to us by representatives of the Companies regarding the Staff’s comments relating to the filing referenced above. For the Staff’s convenience, the text of the Staff’s comments is set forth below in bold, followed in each case by the Companies’ response. We are also providing certain supplemental materials requested by the Staff.

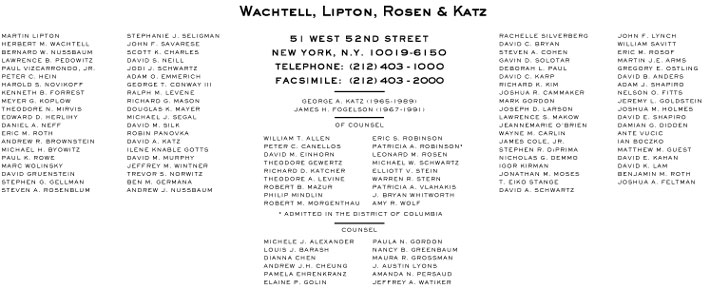

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 2

In connection with this letter, Expedia and TripAdvisor have filed Amendment No. 1 to the referenced Registration Statement on Form S-4 (the “Registration Statement”). We are providing supplementally to the Staff four copies of the Registration Statement blacklined to show the changes to the initial July 27th filing. All page references in the responses set forth below are to the pages of this blacklined version of the Registration Statement. All capitalized terms used but not defined herein have the meanings given to them in the Registration Statement.

Cover Page

| 1. | Please include a cover page immediately following the Calculation of Registration Fee table and footnotes thereto that complies with Item 501 of Regulation S-K. Refer to Item 1 of Form S-4. Please ensure that the cover page includes the title and amount of the securities being registered and also identifies the market for Expedia’s common stock and the trading symbol for those securities. |

Response: The Registration Statement has been revised on the page immediately following the Calculation of Registration Fee table and footnotes thereto in response to the Staff’s comment.

Question and Answers about the Annual Meeting and the Spin-Off

The Spin-Off Proposal, page 5

| 2. | Please balance your discussion in this section of the anticipated benefits of the spin-off with a discussion of the risks of the spin-off for both Expedia and TripAdvisor. |

Response: The Registration Statement has been revised on pages 5-6 in response to the Staff’s comment.

Q. What will I own after the Reverse Stock Split and the Trip Advisor Spin-off?, page 6

| 3. | To the extent possible, please quantify the costs associated with the proposed transactions. As an example, please disclose here, consistent with your disclosure elsewhere, that you expect the total consideration to be paid to holders of preferred stock in the merger, based on the assumptions you have made, to be approximately $17,000. |

Response: The Registration Statement has been revised on page 6 in response to the Staff’s comment.

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 3

Summary, page 9

| 4. | This section should be revised significantly to include a materially complete summary of the material terms of the spin-off, including the fact that the spin-off is contingent upon approval of the preferred stock merger. Your reference to the amendments to your amended and restated certificate of incorporation on page 10 without describing them does not appear to satisfy this requirement. Please revise or advise. |

Response: The Registration Statement has been revised on pages 10-14 in response to the Staff’s comment.

Risk Factors

“Risk Factors Relating to Expedia’s and TripAdvisor’s Businesses Following the Spin-Off,” page 19

| 5. | We note the disclosure on page 141 that Expedia is relying on the exemption for controlled companies from certain NASDAQ requirements. We also note your disclosure on page 85 that you expect that TripAdvisor will qualify as a controlled company under NASDAQ rules. Please include appropriate risk factor disclosure regarding both companies’ use of the rules governing “controlled companies” and the impact of these rules on their corporate governance, or advise. |

Response: The Registration Statement has been revised on page 32 in response to the Staff’s comment.

“Expedia’s and TripAdvisor’s international operations involve additional risks...,” page 21

| 6. | We note your statement in this risk factor that the laws and regulations of China restrict foreign investment in industries in which TripAdvisor operates and that the company has established effective control over its Chinese businesses through a series of agreements. Please advise us if TripAdvisor’s businesses in China are material to its financial condition and results of operations. If they are, please include additional disclosure in this section and in the section discussing TripAdvisor after the spin-off regarding the PRC regulations to which TripAdvisor’s Chinese operations are subject and the contractual arrangements through which it controls its Chinese businesses. Also, file the related agreements as exhibits to the registration statement. |

Response: TripAdvisor supplementally advises the Staff that TripAdvisor’s businesses in China are not material to its financial condition and results of operations. In that regard, we note the information regarding total assets, net assets, revenues, operating income and net income for TripAdvisor’s Chinese operations provided in response to Staff comment No. 32.

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 4

Proposal 1—The Spin-Off Proposal

Background and Reasons for the Spin-Off, page 40

| 7. | Please discuss whether the board considered alternatives to the spin-off of TripAdvisor and, if so, why they were rejected. In addition, please expand your background disclosure to explain the circumstances leading the board to consider a spin-off and how the board made the determination to undertake the spin-off at this particular time. |

Response: The Registration Statement has been revised on page 45 in response to the Staff’s comment.

Benefits of the Spin-Off, page 40

| 8. | Please define the term “pure-play currencies” used in this section. |

Response: The Registration Statement has been revised on page 46 in response to the Staff’s comment.

Risk Factors, page 40

| 9. | You disclose in this section that the board determined that the benefits of the spin-off outweighed the risks. Although we note that the board did not assign relative weights to factors and that different board members may have had different reasons, please expand your disclosure to provide additional insights into how the board reached its conclusion and identify the most material reasons that the board decided to proceed with the spin-off. |

Response: The Registration Statement has been revised on pages 45-46 in response to the Staff’s comment.

Post Spin-Off Expedia Financing Arrangements, page 60

| 10. | You indicate in this section that certain covenants in your outstanding notes could restrict implementation of the proposed spin-off. Please disclose this information in the Q&A or summary section at the beginning of the registration statement and provide updated information on the actions you are taking with respect to the outstanding notes. |

Response: The Registration Statement has been revised on pages 15 and 66 in response to the Staff’s comment.

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 5

Commercial Agreements, page 64

| 11. | Please explain and disclose the basis for your belief that the commercial agreements between Expedia and TripAdvisor were negotiated “at arm’s length” or remove this reference. |

Response:The noted reference has been removed from page 71 of the Registration Statement in response to the Staff’s comment.

Information about Expedia After the Spin-Off, page 64

| 12. | Please advise what consideration you have given to including in this section a discussion of the expected impact of the spin-off of TripAdvisor on Expedia’s financial condition and operating performance. |

Response: Recognizing the Expedia, Inc. Pro Forma Financial Statements in Annex B reflect on an historical basis the impact of the spin-off on Expedia’s financial condition and interim and annual operating performance, Expedia’s disclosure highlighted the more pronounced seasonal impact to Expedia’s operating performance, particularly as it relates to the first quarter. As disclosed in “Expedia’s Seasonality” section on page 71 of the initial Form S-4 filed on July 27, 2011 (emphasis added):

“Expedia generally experiences seasonal fluctuations in the demand for its travel products and services. For example, traditional leisure travel bookings are generally the highest in the first three quarters as travelers plan and book their spring, summer and holiday travel. The number of bookings typically decreases in the fourth quarter. Because revenue in the merchant business is generally recognized when the travel takes place rather than when it is booked, revenue typically lags bookings by several weeks or longer. As a result, revenue and income are typically the lowest in the first quarter and highest in the third quarter.Similarly, TripAdvisor typically comprises a larger portion of Expedia revenue and income during the first quarter. Thus, following the spin-off the seasonal impact on Expedia’s business will likely be more pronounced, particularly in the first quarter, as the bookings versus recognition of revenue time lag under the merchant hotel business will represent a larger portion of Expedia’s operating results without TripAdvisor. The continued growth of Expedia’s international operations or a change in its product mix may influence the typical trend of the seasonality in the future.”

Expedia believes the disclosure noted above emphasizes to financial statement readers that the most meaningful impact the spin-off will have on operating results will occur during the first quarter. However, in light of the Staff’s comment, Expedia has expanded the above disclosure to include additional information under the section “Impact of the Spin-Off on Expedia’s Operating Performance and Seasonality” on pages 78-79 of the Registration Statement.

Expedia also considered the impact of the spin-off on Expedia’s financial condition and, based on Expedia’s expected current assets after the spin-off, Expedia does not believe the spin-off will have a material effect on its financial condition and thus no further disclosure was made.

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 6

Information about TripAdvisor After the Spin-Off, page 73

| 13. | With respect to third-party statements in the prospectus, such as the data attributed to comScore, PhoCusWright’s Global Online Travel Overview and International Data Corporation in this section, please supplementally provide us with support for such statements. To expedite our review, please clearly mark each report to highlight the applicable portion or section containing the information and cross-reference it to the appropriate location in the prospectus. |

Response: The requested materials are being supplementally provided to the Staff.

Management’s Discussion and Analysis of Financial Condition and Results of Operations of TripAdvisor

Spin-Off, page 83

| 14. | Revise to address the impact that the agreements to be entered into subsequent to the completion of the spin-off, as discussed throughout your registration statement and in Note 14, will have on TripAdvisor’s financial condition and results of operations in future periods. Please refer to Section III.B.3 of SEC Release 33-8350. |

Response: The Registration Statement has been revised on page 91 in response to the Staff’s comment.

TripAdvisor also notes that on page 93 of the Registration Statement in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations of TripAdvisor—Results of Operations for the Three and Six Months Ended June 30, 2011 and 2010 and the Years Ended December 31, 2010, 2009 and 2008—Revenue” section, TripAdvisor discloses its estimate of the annual net revenue reduction expected to result from Expedia’s anticipated reduction in marketing spend with TripAdvisor as being approximately 2% to 5%.

Results of Operations . . . , page 84

| 15. | In your discussions of the results of operations, there are some instances where two or more sources of a material change have been identified, but the dollar amounts for each source that contributed to the change were not disclosed. Revise your disclosure to provide quantification for each source that contributed to a material change in your MD&A discussion pursuant to Item 303(a)(3)(iii) of Regulation S-K and Section III.D of SEC Release 33-6835. Additionally, tell us your consideration to quantify site traffic since that appears to be a primary driver of increases in your revenues. |

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 7

Response: The Registration Statement has been revised starting on page 93 in response to the Staff’s comment to include additional tables and information to quantify the material sources of changes within the disclosures as well as enhanced disclosure in the revenue discussion to quantify the percentage increase of monthly unique internet protocol (“IP”) addresses for the TripAdvisor-branded websites, which is the primary source of TripAdvisor’s increase in revenue. The term “site traffic” has been replaced in the results of operations with the more specific term “monthly unique IP addresses.”

Financial Position, Liquidity and Capital Resources, page 89

| 16. | You indicate on page D-19 that you have not provided for deferred U.S. income taxes on undistributed earnings of certain foreign subsidiaries that you intend to reinvest permanently outside the U.S. Revise to disclose the amount of cash and investments that are currently held in subsidiaries where earnings are indefinitely reinvested. To the extent that this tax strategy relates to certain countries, then disclose the names of such countries. We refer you to Section IV of SEC Release 33-8350. |

Response: The Registration Statement has been revised on pages 98-99 in response to the Staff’s comment.

Contractual Obligations and Commercial Commitments, page 90

| 17. | Revise to include a footnote to the contractual obligations table to disclose TripAdvisor’s obligation to enter into a $400 million term loan and a $200 million revolving credit facility subsequent to the spin-off and the related interest terms of these instruments. |

Response: The Registration Statement has been revised on page 100 in response to the Staff’s comment.

TripAdvisor Management

Directors, page 93

| 18. | For each director, briefly discuss the specific experience, qualifications, attributes, or skills that led to the conclusion that the person should serve as a director of TripAdvisor. Refer to Item 401(e) of Regulation S-K. |

Response: The Registration Statement has been revised on pages 104-106 in response to the Staff’s comment.

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 8

Proposal 2—Reverse Stock Split Proposal

Principal Effects of the Reverse Stock Split, page 123

| 19. | You indicate that the reverse stock split will not affect the number of shares of your common stock, Class B common stock and preferred stock that you are authorized to issue. Please disclose in this section the number of shares of your common stock, class B common stock and preferred stock authorized. Also, disclose in this section whether you presently have any plans, proposals or arrangements to issue any of the newly available authorized shares of stock for any purpose, including future acquisitions and/or financings. Finally, discuss the possible anti-takeover effects of the effective increase in your authorized shares. Refer to Release No. 34-15230. |

Response: The Registration Statement has been revised on pages 135 and 137 in response to the Staff’s comment.

Proposal 3—Preferred Stock Merger Proposal

The Merger, page 127

| 20. | You indicate that Expedia’s board of directors has determined that the terms of the merger agreement are fair to, and in the best interests of, Expedia and its stockholders. Please briefly discuss the factors your board considered in reaching this conclusion. |

Response: The Registration Statement has been revised on pages 139-140 in response to the Staff’s comment.

Expedia Executive Compensation

Cash Bonuses, page 160

| 21. | Disclose the specific performance goals set for stock performance and worldwide hotel bookings for 2010, and explain how achievement of these goals factored into the amount of the bonus awarded to each named executive officer. Refer to Item 402(b)(2) of Regulation S-K. Also, disclose whether the cash bonus received by Mr. Kaufer for fiscal 2010, disclosed on page 98, was subject to achievement of these performance goals. |

Response: The Registration Statement has been revised on pages 109, 175 and 179 in response to the Staff’s comment.

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 9

Where You Can Find More Information and Incorporation By Reference, page 182

| 22. | Please update this section to incorporate the applicable Exchange Act reports filed subsequent to the filing of the Form S-4. Refer to Item 11 of Form S-4. |

Response: The Registration Statement has been revised on page 198 in response to the Staff’s comment.

Item 22. Undertakings

| 23. | Please include the Rule 415 undertakings required by Item 512(a) of Regulation S-K. Refer to Section II.F of Release 33-6578. |

Response: The Registration Statement has been revised on pages II-2 to II-3 in response to the Staff’s comment.

TripAdvisor, Inc. Unaudited Pro Forma Condensed Consolidated Financial Statements, page C-1

| 24. | Please provide us with your calculation of the adjustment to additional paid-in capital (“APIC”). In your response, please tell us how you determined the fair value of TripAdvisor common stock that will be issued with the spin-off. Additionally, please tell us if the adjustment to APIC includes the warrants discussed in footnote (9) to the table of the calculation of registration fee. Finally, please consider revising your disclosure to allow investors to more easily determine how you calculated the APIC adjustment. |

Response: The Registration Statement has been revised on page C-5 in response to the Staff’s comment. As the spin-off will be effected by means of a reclassification of Expedia’s capital stock, a conversion of Expedia warrants into TripAdvisor warrants and a transfer of net assets to TripAdvisor from Expedia, the adjustment to additional paid-in capital (“APIC”) in TripAdvisor’s pro forma balance sheet represents Expedia’s basis in the historical TripAdvisor net assets (invested equity), adjusted for (i) certain assets that will remain with Expedia after the transfer and (ii) the allocation of amounts to common stock and Class B common stock based on the par value of those securities, and thus no adjustment related to the conversion of the warrants. In response to the Staff’s comment, the disclosure in note (a) to the TripAdvisor pro forma financial statements has been revised to include a table supporting the pro forma APIC-related adjustments as follows (italicized text indicates additional disclosure):

| (a) | To reflect the formation of TripAdvisor, Inc. and the transfer to TripAdvisor by Expedia of the post-spin-off net assets of TripAdvisor after giving effect to the terms provided for in the separation agreements and the accounting treatment related thereto: |

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 10

Invested equity | $ | 648,283 | ||

Cash distributed to Expedia (1) | (364,641 | ) | ||

Receivable from Expedia extinguished (2) | (75,032 | ) | ||

Common shares issued (3) | (124 | ) | ||

Class B shares issued (3) | (13 | ) | ||

|

| |||

Addition to APIC | $ | 208,473 | ||

|

|

| (1) | The transfer of approximately $365 million in cash to Expedia, prior to TripAdvisor’s separation from Expedia, which was raised from the financing referred to in note (b) below. TripAdvisor will retain $165 million in cash and short-term investments upon the separation, inclusive of cash on hand; |

| (2) | The extinguishment of the receivables from Expedia; |

| (3) | Thereclassification of 124.2 million shares of Expedia’s common stock and 12.8 million shares of Expedia Class B common stock into,in part, shares of Expedia mandatory exchangeable preferred stock that will automatically, immediately following the reclassification, exchange into 124.2 million shares of TripAdvisor common stock and 12.8 million shares of TripAdvisor Class B common stock to effect the transfer of ownership of TripAdvisor from Expedia to Expedia’s shareholders based upon an expected ratio of one share ofthe respective class of TripAdvisorcommon stock for each share ofthe respective class of Expediacommon stock based on the number of Expedia common and Class B common stock outstanding as of June 30, 2011 after giving effect to the one-for-two reverse stock split of Expedia shares that is expected to be effected in connection with, and immediately prior to, the spin-off. |

| 25. | Please quantify and explain to us in further detail the nature of additional estimated costs associated with being a publicly traded company as discussed in adjustment (d). Also, your disclosures in note (d) indicate that these expenses include the costs related to services previously obtained from Expedia, such as accounting, legal, tax, corporate development and real estate costs. Please clarify whether this adjustment includes any additional accounting, legal, tax, corporate development or real estate costs, other than those associated with being a public company, and if so, please explain why such costs are not reflected in the company’s audited financial statements. Additionally, please quantify the costs related to Expedia’s obligation to fund a charitable foundation that will be assumed by TripAdvisor in connection with the spin-off. For the charitable contribution adjustment, please clarify these costs were not included in the company’s historical financial statements. We refer you to SAB Topic 1.B.1. |

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 11

Response: Included within TripAdvisor’s pro forma general and administrative adjustment for the year ended December 31, 2010 was the following (in thousands):

Expenses allocated by Expedia included in historical financial statements | $ | 7,900 | ||

Additional expenses associated with being a separately traded public company | 9,918 | |||

Charitable foundation adjustment | 2,907 | |||

|

| |||

| $ | 20,725 | |||

|

|

As required by SAB Topic 1.B.1, TripAdvisor believes the TripAdvisor audited financial statements reflect all of its costs of doing business, including those that Expedia incurred on TripAdvisor’s behalf, which totaled $7.9 million for the year ended December 31, 2010. Please refer to the response to the Staff’s comment No. 31 for a detailed description of the costs allocated as well as the related allocation methodology. The pro forma increase of $9.9 million represents the additional expenses TripAdvisor expects to incur as a result of its being a separately traded public company, such as board of director fees, director and officer insurance and higher accounting, legal, financial software license and other fees.

With regards to the charitable contribution adjustment, page 100 of the Registration Statement under the caption “Contractual Obligations and Commercial Commitments” details the criteria surrounding the contribution calculation. Prior to the spin-off, Expedia was contractually obligated to make such payments and thus the expense remained within Expedia’s historical financial statements.

| 26. | Quantify and further explain your adjustment (e) for the shift of stock based compensation from Expedia to TripAdvisor for certain of these unvested awards and clarify why this expense was not included in historical stock based compensation expense pursuant to SAB Topic 1.B.1. |

Response: The adjustment to shift stock-based compensation from Expedia to TripAdvisor relates to the unvested awards held by Mr. Diller at the date of the spin-off and totaled $3.1 million and $0.5 million for the periods ended December 31, 2010 and June 30, 2011. Historically, Mr. Diller was a Senior Executive and Chairman of the Board of Expedia. As such, he was an employee of Expedia, Inc. and his stock-based compensation was therefore included in the historical stock-based compensation of Expedia. Following the spin-off, Mr. Diller will take on a new role and will also become a Senior Executive and Chairman of the Board of TripAdvisor as well as continue to serve as Senior Executive and Chairman of the Board of Expedia. In conjunction with the spin-off and in recognition of his new role, each of his unvested Expedia awards will convert into an unvested Expedia award and an unvested TripAdvisor award. Mr. Diller will then be a Senior Executive and Chairman of TripAdvisor and he will take on the duties and responsibilities of those roles as an employee of TripAdvisor following the spin-off. As a result, the portion of the stock-based compensation expense attributable to his TripAdvisor awards was shifted from Expedia to TripAdvisor in the pro forma financial statements as if he had taken over his new role and responsibilities at TripAdvisor as of the beginning of the pro forma period.

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 12

TripAdvisor, Inc. Consolidated Financial Statements

General

| 27. | Please update your financial statements pursuant to Rule 3-12 of Regulation S-X. |

Response: The Registration Statement has been revised to include updates to TripAdvisor’s financial statements pursuant to Rule 3-12 of Regulation S-X.

Consolidated Statement of Operations, page D-3

| 28. | We note your additional disclosure of share-based compensation on the face of the Consolidated Statements of Operations, which includes a total of share-based compensation. Pursuant to paragraph F of SAB 107, the Staff believes that disclosure regarding the amount of expense related to share-based payment arrangements might be appropriate in a parenthetical note to the appropriate income statement line items, on the cash flow statement, in the footnotes to the financial statements, or within MD&A. The guidance in SAB 107, however, does not provide for a reconciliation of the share-based compensation expense on the face of the income statement that includes a total of the share-based compensation. Please revise to remove the subtotal of stock-based compensation expense. In addition, see the Division of Corporation Finance’s “Current Accounting and Disclosure Issues” (Updated 11/30/06), Section I.B.2 located athttp://www.sec.gov/divisions/corpfin/cfacctdisclosureissues.pdf. |

Response: The consolidated statements of operations have been revised in response to the Staff’s comment to remove the subtotal of stock-based compensation expense.

| 29. | We note from your disclosures on page 88 that some of your amortization expense appears to be related to acquired technology. Tell us your consideration to include amortization expense in cost of revenues. We refer you, by analogy, to ASC 985-20-45-1 (FASB Staff Implementation Guide, SFAS 86, Question 17). If you intend to continue classifying amortization related to cost of revenue in your amortization expense line item, disclosure of the exclusion and the amount should be made as a footnote to the cost of revenue line caption in accordance with SAB Topic 11B. |

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 13

Response: While evaluating the classification of amortization expense related to acquired technology, TripAdvisor considered a variety of factors including the trends in the amortization expense in correlation to TripAdvisor’s revenue trends, what information would be most useful to investors, the materiality of the amounts involved as well as the classification of these amounts by other internet/technology companies. Based on these considerations, TripAdvisor determined its classification of amortization expense related to acquired technology within amortization of intangible assets on the consolidated statements of operations to be the most appropriate presentation. The amortization of acquired technology included within amortization expense was $1 million in 2010, $4 million in 2009 and $5 million in 2008, which is less than 3% of operating income for all periods. This is immaterial to TripAdvisor’s financial results and is becoming increasingly less material. In response to the Staff’s comment, additional disclosure of the exclusion to the cost of revenue caption in the statement of operations in accordance with the guidance cited in SAB Topic 11B has been included on page E-3 of the Registration Statement.

| 30. | We note your line item titled, Technology and Content, includes product development, website engineering and content expense, as well as the operation of your information technology costs to support your infrastructure, back-office applications and overall monitoring and security of networks. Please tell us how you considered allocating each of these expenses between other expense line items in your Consolidated Statements of Operations (i.e., cost of revenue, general and administrative, or additionally into research and development). In your response, tell us why you believe your current presentation complies with Rule 5-03 of Regulation S-X. |

Response: In considering how best to present the technology costs associated with operating TripAdvisor’s business, TripAdvisor considered a variety of factors including the nature of the expenses incurred, their relationship or lack thereof to other costs included in the various other income statement classifications in TripAdvisor’s statement of operations, how similar amounts are presented by peer companies with similar operations and what information would be most useful to investors. TripAdvisor believes its current statement of operations classifications are in compliance with Rule 5-03 of Regulation S-X and provide investors with the most meaningful information by which to evaluate TripAdvisor’s business. In reaching this conclusion TripAdvisor considered the following:

| • | TripAdvisor reviewed several businesses within the Internet industry and noted a lack of consistent classification within the statement of operations across the surveyed businesses. TripAdvisor noted that technology and content costs are classified by its peer companies in the following similar expense categories as TripAdvisor’s: product development, technology and development, or technology and content. TripAdvisor’s analysis included amongst others, Amazon.com, Inc., HomeAway, Inc., Zillow, Inc., and Netflix, Inc. |

| • | Costs currently classified as technology and content within TripAdvisor’s statement of operations generally do not vary with revenues but rather are more a function of decisions related to the types of software and hardware the company pursues and implements to operate its business and the efforts required to support those efforts. While TripAdvisor believes these decisions will lead to growth in its business, there is no direct relationship between these decisions and the amount of revenues generated in a given period. |

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 14

| • | Having technology and content classified separately within the statement of operations is the most useful presentation to readers of the financial statements as technology innovation, investment and management are key to TripAdvisor’s success as a business. Having all of the technology and content expense in a single category highlights these key investments better than spreading the costs across several other expense categories. TripAdvisor further notes that Rule 5-03 indicates that items not normally included within selling, general and administrative expenses that are material should be stated separately. |

Based on these considerations, TripAdvisor believes that the current classification, which summarizes the technology and development costs within one location on the statement of operations, is appropriate and consistent with the presentation used by others in the industry and Rule 5-03.

Note 1. Organization and Basis of Presentation

Basis of Presentation, page D-7

| 31. | You indicate that you allocated certain Expedia corporate expenses to TripAdvisor. Revise to disclose your methodology to allocate these expenses along with management’s assertion that the method used was reasonable pursuant to SAB Topic 1.B.2. You should also disclose, if practicable, management’s estimate of what the expenses would have been on a stand-alone basis (i.e., the cost that would have been incurred if TripAdvisor had operated as an unaffiliated entity for each year presented), if such costs are materially different from your allocation. |

Response: In response to the Staff’s comment, the disclosure on page E-7 of the Registration Statement has been revised to include a reference to Note 9 for further information on the allocation of these expenses. On page E-20 of the Registration Statement within Note 9: Related Party Transactions with Expedia, TripAdvisor included the disclosures requested in relation to the allocation of Expedia’s corporate expenses to TripAdvisor. That disclosure reads as follows:

“Our operating expenses include a related-party shared services fee, which is comprised of allocations from Expedia for accounting, legal, tax, corporate development and real estate functions. These allocations were determined on a basis that Expedia and TripAdvisor considered to be a reasonable reflection of the cost of services provided or the benefit received by TripAdvisor. These expenses were allocated based on a number of factors including headcount, estimated time spent and operating expenses. It is not practicable to determine the amounts of these expenses that would have been incurred had TripAdvisor operated as an unaffiliated entity. In the opinion of management of TripAdvisor, the allocation method is reasonable.”

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 15

Note 2. Significant Accounting Polices

Consolidation, page D-8

| 32. | You indicate that certain of your subsidiaries operate in China and have variable interests in affiliated entities, which are consolidated. Please tell us the amount of total assets, net assets, revenues, operating income, and net income for your Chinese operations for each period presented. |

Response: The total assets, net assets, revenues, operating income and net income for TripAdvisor’s Chinese operations for each period presented are as follows (in thousands):

| Chinese operations | Years Ended December 31, | Six Months Ended June 30, | ||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

Total Assets | - | 574 | 4,964 | 4,865 | 6,748 | |||||||||||||||

Net Assets | - | 570 | 3,225 | 3,250 | (33 | ) | ||||||||||||||

Revenue | - | - | 4,285 | 1,656 | 4,420 | |||||||||||||||

Operating Income/(Loss) | - | (3,072 | ) | (11,052 | ) | (6,787 | ) | (6,882 | ) | |||||||||||

Net Income/(Loss) | - | (3,072 | ) | (11,124 | ) | (6,758 | ) | (7,093 | ) | |||||||||||

| % of Consolidated | Years Ended December 31, | Six Months Ended June 30, | ||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

Total Assets | - | 0.1 | % | 0.7 | % | 0.7 | % | 0.8 | % | |||||||||||

Net Assets | - | 0.1 | % | 0.6 | % | 0.7 | % | 0.0 | % | |||||||||||

Revenue | - | 0.0 | % | 0.9 | % | 0.7 | % | 1.4 | % | |||||||||||

Operating Income/(Loss) | - | 1.8 | % | 4.9 | % | 5.4 | % | 4.4 | % | |||||||||||

Net Income/(Loss) | - | 3.0 | % | 8.0 | % | 8.7 | % | 7.0 | % | |||||||||||

Subsequent Events, page D-8

| 33. | Revise to disclose that the date through which you evaluated subsequent events, July 26, 2011, represents the date non-SEC filers should disclose if it is based on the date the financial statements were issued or were available to be issued pursuant to ASC 855-10-50-1. |

Response: In response to the Staff’s comment, TripAdvisor has revised the disclosure on page E-8 of the Registration Statement to include the date through which it evaluated subsequent events and to disclose that the date represents the date the financial statements were available to be issued.

WACHTELL, LIPTON, ROSEN & KATZ

Ms. Maryse Mills-Apenteng

U.S. Securities and Exchange Commission

September 21, 2011

Page 16

Property and Equipment, Including Website and Software Development Costs, page D-9

| 34. | You disclose that you capitalize internal and extern costs for website development and internal use software. Please explain the nature of the capitalized costs in further detail. In addition, please confirm if these costs include any capitalized content costs. If so, then please tell us the amount of capitalized content costs recorded in each period presented. We may have further comments. |

Response: The majority of TripAdvisor’s capitalized website development and internal use software costs are internal personnel costs with a small amount of external consulting costs which are capitalized (approximately $1 million per year). As TripAdvisor’s content is primarily user-generated, TripAdvisor has minimal paid content costs (approximately $2 million per year) which it expenses as incurred.

Note 5. Goodwill and Intangible Assets, Net, page D-14

| 35. | Revise to disclose the information in the table on page D-15 for intangible assets with definite lives to be by major intangible asset class pursuant to ASC 350-30-50-1. |

Response: In response to the Staff’s comment, TripAdvisor revised its intangible assets with definite lives disclosure on page E-15 of the Registration Statement to include the information required by major intangible asset class.

* * * *

If you have any questions, please do not hesitate to contact the undersigned at (212) 403-1269 or Nancy B. Greenbaum at (212) 403-1339.

Very truly yours,

/s/ Andrew J. Nussbaum

Andrew J. Nussbaum

| cc: | Mr. Burke F. Norton, Esq., Executive Vice President, General Counsel and Secretary of Expedia, Inc. |

| Mr. | Matthew Crispino, Staff Attorney of the U.S. Securities and Exchange Commission |