- EXPE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Expedia (EXPE) CORRESPCorrespondence with SEC

Filed: 24 Oct 11, 12:00am

Via EDGAR

Maryse Mills-Apenteng, Special Counsel

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | TripAdvisor, Inc. |

Amendment No. 1 to Registration Statement on Form S-4

Filed on September 22, 2011

File No. 333-175828-01

Dear Ms. Mills-Apenteng:

On behalf of Expedia, Inc. (“Expedia”) and TripAdvisor, Inc. (“TripAdvisor” and, with Expedia, the “Companies”), set forth below are responses to the comments of the Staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) that you provided in your letter, dated October 13, 2011, with respect to the filing referenced above. We have included in this letter, where relevant, responses forwarded to us by representatives of the Companies regarding the Staff’s comments relating to the filing referenced above. For the Staff’s convenience, the text of the Staff’s comments is set forth below in bold, followed in each case by the Companies’ response.

Ms. Maryse Mills-Apenteng

U.S. Securities & Exchange Commission

October 24, 2011

Page 2

In connection with this letter, Expedia and TripAdvisor have filed Amendment No. 2 to the referenced Registration Statement on Form S-4 (the “Registration Statement”). We are providing supplementally to the Staff six copies of the Registration Statement blacklined to show the changes to the September 22nd filing. All page references in the responses set forth below are to the pages of this blacklined version of the Registration Statement. All capitalized terms used but not defined herein have the meanings given to them in the Registration Statement.

Risk Factors

Risk Factors Relating to TripAdvisor’s Business Following the Spin-Off, page 32

| 1. | We note that the UK’s Advertising Standards Authority (“ASA”) recently launched an investigation into the authenticity of reviews appearing on your website. Please tell us what consideration you have given to providing risk factor disclosure regarding the ASA’s investigation as well as a discussion of reputational or other risks you may face in connection with allegations being made by KwikChex.com and others that your website includes misleading and fraudulent reviews. |

Response: While TripAdvisor believes that the direct impact of the ASA investigation is likely to be insignificant, in light of the Staff’s comment, TripAdvisor has enhanced its existing discussion of indirect reputational and other risks stemming from allegations of misleading or fraudulent reviews on pages 36-37. The Company also notes that the ASA’s investigation relates to TripAdvisor’s use of certain marketing claims, rather than being an investigation into the authenticity of any particular review on the TripAdvisor website.

Management’s Discussion and Analysis of Financial Condition and Results of Operations of TripAdvisor

Spin-Off, page 91

| 2. | You indicate in your response to prior comment 14 that you revised your disclosures on page 91 to address our comment. However, we do not see such revisions. Please revise to provide a summary of the quantitative impact the agreements to be entered into subsequent to the completion of the spin-off as discussed throughout your registration statement and in Note 14, aside from the anticipated revenue reduction that you disclose on page 93, will have on TripAdvisor’s financial condition and results of operations in future periods. |

Response: The previous comment response in our letter dated September 21, 2011 referenced an inaccurate page number. The responsive revisions were included on page 92 of Amendment No. 1 to the Registration Statement under the caption “Commercial Arrangement

Ms. Maryse Mills-Apenteng

U.S. Securities & Exchange Commission

October 24, 2011

Page 3

with Expedia Businesses.” As disclosed on pages 93 and 95 of Amendment No. 2, TripAdvisor estimates that its revenue may be reduced by approximately 2% to 5% as a result of the new commercial arrangements expected to be entered into with Expedia in connection with the spin-off. With regard to the quantitative impact of the other agreements expected to be entered into in connection with the spin-off, either TripAdvisor cannot quantify an estimate of such impact or, when estimable, it does not expect these other arrangements to have a material impact on TripAdvisor’s liquidity, financial condition or results of operations in future periods. In response to the Staff’s comment, however, the disclosure on pages 93, 94 and 95 has been supplemented to include a reference to the other agreements governing the ongoing relationship between TripAdvisor and Expedia at and after the spin-off as well as clarifying the anticipated quantitative impact of these agreements where possible.

Results of Operations . . . , page 93

| 3. | Please revise to define monthly unique internet protocol (“IP”) addresses and explain how this metric impacts changes in your revenues. |

Response: In response to the Staff’s comment, the Registration Statement has been revised on pages 94 and 95 to describe how the metric is calculated and how it impacts TripAdvisor’s revenue.

TripAdvisor, Inc. Unaudited Pro Forma Condensed Consolidated Financial Statements, page C-1

| 4. | Revise your disclosure in footnote (d) to indicate the adjustment for the costs related to services previously obtained from Expedia is equivalent to those classified as “Related- party shared services fee.” Additionally, revise to disclose the amount of additional expenses associated with being a separately traded public company. |

Response: Footnote (d) on page C-5 and C-6 has been revised in response to the Staff’s comment.

| 5. | We note from your disclosure in footnote (d) and Note 9 that corporate allocations included accounting, legal, tax, corporate development and real estate costs. Please tell us and revise to disclose if your corporate allocations include any allocation of officer and employee salaries pursuant to the guidance of Question 1 of SAB Topic 1.B.1. Additionally, tell us why the shift of stock based compensation explained in footnote (e) and prior comment 26 would not be included in this allocation to the historical financial statements of TripAdvisor. |

Response: The related-party shared services fee within TripAdvisor’s historical financial statements is comprised of allocations from Expedia for accounting, legal, tax, corporate development

Ms. Maryse Mills-Apenteng

U.S. Securities & Exchange Commission

October 24, 2011

Page 4

and real estate functions and includes an allocation of employee compensation, including the related stock-based compensation, within these functions.

In the preparation of the historical financial statements of TripAdvisor and in assessing whether the compensation of Mr. Diller should be allocated on an historical basis, Expedia and TripAdvisor considered the most reasonable allocation methodology to be based on the percentage of time spent directly on behalf of TripAdvisor when determining what costs to reflect within the financial statements. The Companies believed that use of any other allocation methodology would result in costs that were not representative of the costs incurred on behalf of TripAdvisor and thus would make the financial statements less meaningful to users of the financial statements.

As part of this analysis, the Companies reviewed Mr. Diller’s role as Senior Executive and Chairman of the Board of Expedia, a public company, and the amount of time historically expended by him on behalf of TripAdvisor. The factors the Companies considered in performing the analysis included (1) TripAdvisor was not historically a stand-alone, public company, and so no public company type services at the TripAdvisor level were required by Mr. Diller; (2) Mr. Diller’s limited involvement with the operations of the TripAdvisor business unit; and (3) generally speaking his involvement was primarily focused on capital allocation decisions for the broader Expedia group (which then encompassed the capital allocation to TripAdvisor). Based on their analysis, the Companies concluded that the amount of time spent by Mr. Diller on behalf of TripAdvisor was not significant and thus no allocation of his compensation expense was included in the historical financial statements of TripAdvisor.

Following the spin-off, Mr. Diller will take on additional roles, which will be new and significantly different from the role he played at TripAdvisor prior to the spin-off. Mr. Diller will become a Senior Executive and Chairman of the Board of TripAdvisor as well as continue to serve as a Senior Executive and Chairman of the Board of Expedia. In Mr. Diller’s new role, he will oversee TripAdvisor’s Board and shareholder meetings and the creation of Board committees, among other activities. It is expected that he will be much more involved directly in TripAdvisor than he has been historically, including meeting on a more routine basis with the TripAdvisor CEO. As TripAdvisor will be a newly public company, the time and effort that Mr. Diller may be required to devote to TripAdvisor over the coming years could be significant.

In conjunction with the spin-off and in recognition of his new role, each of Mr. Diller’s unvested Expedia awards will convert into an unvested Expedia award and an unvested TripAdvisor award, with adjustments to the number of shares subject to the award and, for unvested options, adjustments to the option exercise prices based on (1) the value of Expedia common stock prior to the spin-off and the one-for-two reverse stock split and (2) the value of the applicable company (Expedia or TripAdvisor, as the case may be) after giving effect to the spin-off and the one-for two reverse stock split. As a result, the portion of the stock-based compensation expense attributable to his TripAdvisor awards has been shifted from Expedia to TripAdvisor in the pro forma financial statements as if he had taken over his new role and responsibilities at TripAdvisor as of the beginning of the pro forma period.

Ms. Maryse Mills-Apenteng

U.S. Securities & Exchange Commission

October 24, 2011

Page 5

Footnote (d) on page C-6 and Note 9 on page E-20 have been revised in response to the Staff’s comment to clarify that employee salaries were included as part of the corporate allocation. In addition, footnote (e) on page C-6 has been revised in response to the Staff’s comment to clarify Mr. Diller’s new role and the reasoning of the shift of stock-based compensation expense from Expedia to TripAdvisor on a pro forma basis.

| 6. | We are unable to recalculate the charitable foundation adjustment based on the information you provide in “Contractual Obligations and Commercial Commitments” and in Note 11. Please provide us with your calculation of this amount and consider disclosing how it is calculated in footnote (d). |

Response: The commitment requirement for the charitable foundation specifies a 1.3% annual contribution for 2010. Thus, the charitable foundation contribution was calculated at 1.3% and 1.7% of TripAdvisor’s pro forma Operating Income Before Amortization (“OIBA”) for the year ended December 31, 2010 and the six months ended June 30, 2011, respectively. For example, the contribution for the year ended December 31, 2010 totaling $2,907 was calculated by multiplying 1.3% by the pro forma OIBA before taking into account the charitable contribution, which was calculated as follows:

Pro forma operating income | $ | 195,145 | ||

Plus: charitable contribution | 2,907 | |||

|

| |||

Adjusted operating income | 198,052 | |||

Plus: stock-based compensation | 11,013 | |||

Plus: amortization of intangible assets | 14,609 | |||

|

| |||

OIBA | $ | 223,674 | ||

|

|

Footnote (d) on page C-6 has been revised in response to the Staff’s comment.

TripAdvisor Holdings, LLC Consolidated Financial Statements

Combined Statement of Operations, page E-3

| 7. | We note that in response to prior comment 29 you revised your cost of revenue caption to indicate that it is “exclusive of amortization of intangible assets shown separately below.” We believe you should revise your caption or add a footnote to this line item to indicate that it is exclusive of amortization ofacquired technology and disclose the amount of such costs for the periods presented rather than refer to total amortization of intangible assets since your amortization expense unrelated to acquired technology would not be classified in cost of revenue. Additionally, please ensure the caption on pages C-3 and C-4 is consistent with page E-3. |

Ms. Maryse Mills-Apenteng

U.S. Securities & Exchange Commission

October 24, 2011

Page 6

Response: The Registration Statement has been revised on pages C-3, C-4 and E-3 in response to the Staff’s comment.

| 8. | You indicate in your response to prior comment 30 that there is no direct relationship between your technology and content costs and the amount of revenues generate. However, we note that these costs as a percentage of total revenues are relatively consistent (10% in fiscal 2008 and 11% in fiscal 2009 and 2010). Please explain further as to why you do not believe these costs directly generate revenue when you generate revenue based on your website and its ability to attract users to generate advertising revenue. Additionally, tell us if you gave any consideration to classifying technology and content costs unrelated to research and development type activities in cost of revenues. |

Response: TripAdvisor runs a content rich information website that serves as a travel research resource or ‘travel community’ for its visitors. The TripAdvisor website aggregates user generated reviews, photos, videos and other content about destinations, accommodations, restaurants and activities that visitors to the TripAdvisor website can search, view and contribute to as part of their TripAdvisor experience. None of these activities by visitors (including reading and writing reviews or posting photos or videos) guarantee the generation of revenues for TripAdvisor. Rather, historically over 80% of TripAdvisor’s revenue has been dependent upon visitors to the TripAdvisor website “clicking” on TripAdvisor customers’ advertisements, an activity that a significant majority of visitors to TripAdvisor do not do.

TripAdvisor attracts users to its community by a variety of means. The primary marketing activity associated with user attraction is search engine marketing. The costs associated with this activity are contained in, and form the majority of, TripAdvisor’s direct sales and marketing expense. As mentioned above, it is important to note that a significant majority of visitors to the TripAdvisor website do not perform activities that result in revenue to TripAdvisor. TripAdvisor believes it is appropriate to reflect these costs as sales and marketing expense. In reviewing other similar businesses, such as HomeAway and Linkedin, TripAdvisor notes that these companies treated the costs in a similar manner.

Technology and content costs reflect costs incurred to build and maintain the TripAdvisor travel community (i.e. the development and maintenance associated with the TripAdvisor websites). This includes salaries and overhead costs related to web developers, product developers and content management personnel. These costs allow visitors to the TripAdvisor website to participate in TripAdvisor’s travel community, but they do not guarantee TripAdvisor will generate revenue. Therefore, while these costs are relatively consistent as a percentage of revenue, the rate at which they increase or decrease is not necessarily correlated with the rate at which revenue increases or decreases. TripAdvisor therefore classifies these storefront types of costs in technology and content.

Below is a detailed breakout of the types of items TripAdvisor classified within technology and content expenses:

Technology and Content | Description | Six Months Ended June 30, 2011 | Year Ended December 31, 2010 | |||||||

| ($ in millions) | ||||||||||

Personnel and overhead | ||||||||||

Web developers | Salaries and overhead related to engineers working on the websites | $ | 14 | $ | 26 | |||||

Product developers | Salaries and overhead related to product managers. Product managers own the website development projects, develop the specs and liase between the business people and the developers | 4 | 6 | |||||||

Content management | Salaries and overhead related to people who manage the integrity of the content on the site (e.g. checking reviews for fraud, profanity, etc. costs of localization/translation of reviews) | 5 | 8 | |||||||

|

|

|

| |||||||

Total personnel and overhead | 23 | 40 | ||||||||

Depreciation and amortization of technology assets | Depreciation/amortization of hardware and capitalized software costs | 7 | 10 | |||||||

Other direct costs | Third party vendor costs to acquire and translate content as well as consulting and licensing costs related to our technology and content | 3 | 4 | |||||||

|

|

|

| |||||||

Total technology and content | $ | 33 | $ | 54 | ||||||

|

|

|

| |||||||

Costs incurred that are closely correlated or directly related to revenue generating activities on the website are considered costs of revenue. This includes costs such as ad serving fees, flight search fees, credit card fees and data center costs, which include bandwidth costs. TripAdvisor outsources its data center activities and personnel costs related thereto are encompassed in the data center fees TripAdvisor pays. TripAdvisor’s treatment of technology and content expense and cost of revenue is also consistent with other similar businesses, such as Zillow and LinkedIn.

Ms. Maryse Mills-Apenteng

U.S. Securities & Exchange Commission

October 24, 2011

Page 7

Below is a detailed breakout of the types of items TripAdvisor classified within cost of revenue:

Cost of Revenue | Description | Six Months Ended June 30, 2011 | Year Ended December 31, 2010 | |||||||

| ($ in millions) | ||||||||||

Data center costs | Costs related to third party data centers, including bandwidth costs | $ | 2 | $ | 3 | |||||

Ad serving fees | Fees paid for third party ad services | 1 | 1 | |||||||

Flight search service fees | Fees paid to global distribution partners for access to flight data on the website | 1 | 2 | |||||||

Credit card fees, merchant fees and chargebacks | Fees related to credit card receipts | 1 | 1 | |||||||

|

|

|

| |||||||

| $ | 5 | $ | 7 | |||||||

|

|

|

| |||||||

In light of the Staff’s comment, TripAdvisor has revised its descriptions of its cost of revenue, sales and marketing expense and technology and content expense on pages 95, 96 and 97 of the Registration Statement to further clarify the nature of these costs as follows:

Cost of Revenue: TripAdvisor’s cost of revenue consist of expenses that are closely correlated or directly related to revenue generation, including ad serving fees, flight search fees, credit card fees and data center costs.

Sales and Marketing: TripAdvisor’s sales and marketing expenses primarily consist of direct costs, including traffic acquisition costs from search engines and affiliate program commissions, brand advertising and public relations. In addition, TripAdvisor’s indirect sales and marketing expense consists of personnel and overhead expenses, including salaries, commissions, benefits, share-based compensation expense and bonuses for sales, sales support, customer support and marketing employees.

Technology and Content: TripAdvisor’s technology and content expenses consist of personnel and overhead expenses, including salaries and benefits, share-based compensation expense and bonuses for salaried employees and contractors engaged in the design, development, testing and maintenance of TripAdvisor’s website. Technology and content expenses also include depreciation of and amortization costs of technology assets including web servers, and purchased and capitalized website and development activities as well as licensing expenses.

Additionally, as noted in our response to comment No. 7 above, the Statement of Operations captions have been revised on pages C-3, C-4 and E-3 of the Registration Statement.

Exhibit 5.1

| 9. | Counsel must opine that the warrants being registered are legal, binding obligations of the registrants under the state law governing the warrant agreements. Please revise accordingly. |

Response: Exhibit 5.1 to the Registration Statement has been revised in response to the Staff’s comment.

Exhibit 8.1

| 10. | We note the statement in the first sentence of the last paragraph of the opinion that it is not to be used or relied upon “by any other party” without your prior written consent. Disclaimers of responsibility that in any way state or imply that investors |

Ms. Maryse Mills-Apenteng

U.S. Securities & Exchange Commission

October 24, 2011

Page 8

| are not entitled to rely on the opinion, or other limitations on who may rely on the opinion, are inappropriate. Please have counsel revise its opinion to delete this provision. |

Response: Exhibit 8.1 to the Registration Statement has been revised in response to the Staff’s comment.

* * * *

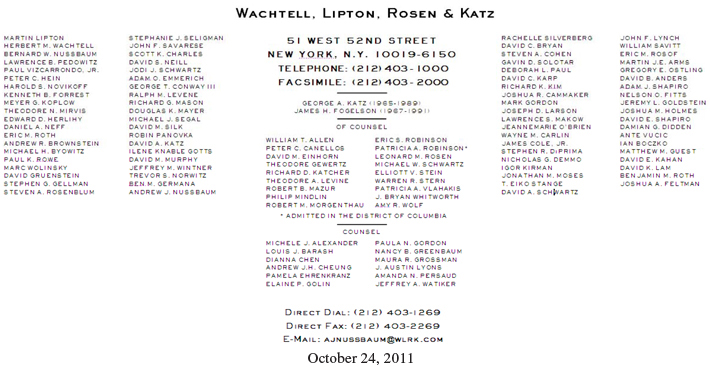

If you have any questions, please do not hesitate to contact the undersigned at (212) 403-1269 or Nancy B. Greenbaum at (212) 403-1339.

| Very truly yours, |

/s/ Andrew J. Nussbaum

Andrew J. Nussbaum |

| cc: | Mr. Burke F. Norton, Esq., Executive Vice President, General Counsel and Secretary of Expedia, Inc. |

Mr. Matthew Crispino, Staff Attorney of the U.S. Securities and Exchange Commission