- DUK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Duke Energy Corporation 5.625% (DUK) DEF 14ADefinitive proxy

Filed: 26 Mar 20, 4:40pm

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material under §240.14a-12 | |

DUKE ENERGY CORPORATION | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| | | | | |

| (2) | Aggregate number of securities to which transaction applies: | |||

| | | | | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| | | | | |

| (4) | Proposed maximum aggregate value of transaction: | |||

| | | | | |

| (5) | Total fee paid: | |||

| | | | | |

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| | | | | |

| (2) | Form, Schedule or Registration Statement No.: | |||

| | | | | |

| (3) | Filing Party: | |||

| | | | | |

| (4) | Date Filed: | |||

| | | | | |

Welcome to the Duke Energy

Annual Meeting

of Shareholders

March 26, 2020

Dear Fellow Shareholders:

I am pleased to invite you to Duke Energy's Annual Meeting to be held on Thursday, May 7, 2020, at 12:30 p.m. Eastern time. We look forward to updating you at the Annual Meeting on our strategy and areas of focus and progress in 2019, as well as plans for the future of Duke Energy.

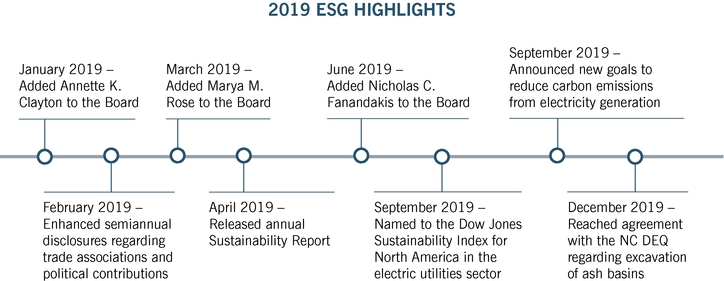

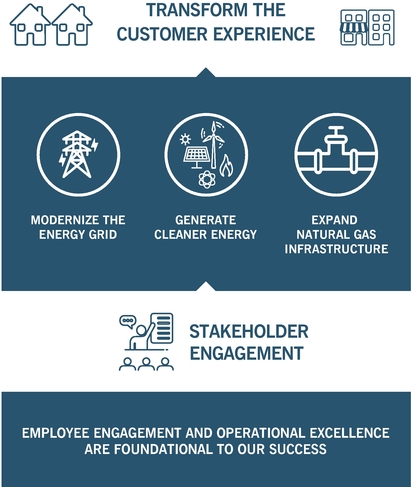

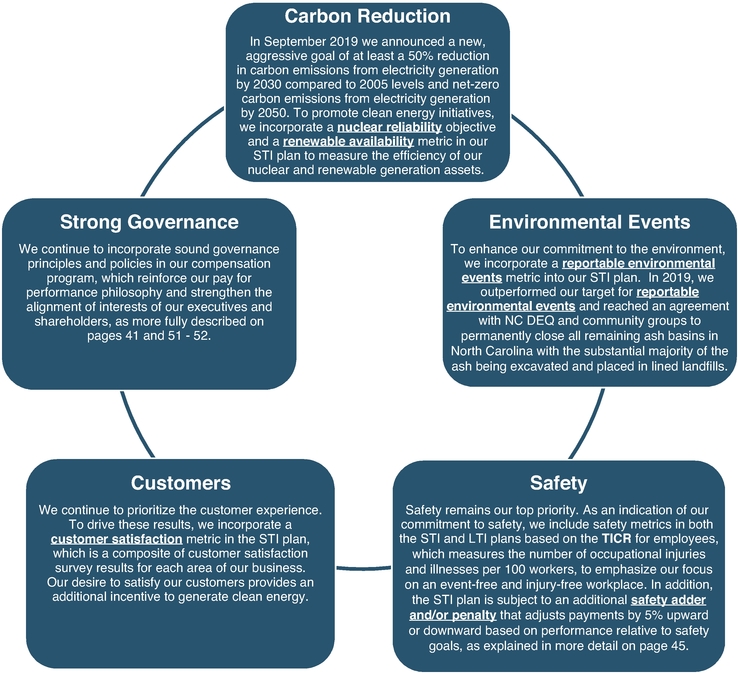

2019 Developments

In 2019, Duke Energy executed on our strategy to transform the customer experience by modernizing the energy grid, generating cleaner energy, and expanding natural gas infrastructure. We announced an updated 2030 goal to reduce carbon emissions from electricity generation by at least 50% from 2005 levels and set a new goal to reach net-zero emissions from electricity generation by 2050. This is an aggressive goal, and one we are committed to strive to attain. We also reached a very important agreement with the NC DEQ and community groups to permanently close all remaining ash basins in North Carolina, with the substantial majority of the ash being excavated and placed in lined landfills. These developments are just a small portion of the progress made on implementing Duke Energy's long-term strategy in 2019, which is further detailed in the 2019 Annual Report that accompanies this proxy statement.

This proxy statement contains information about our Board's oversight of Duke Energy's strategy, performance, risks, governance, executive compensation, and sustainability practices. It also talks about the outreach we have had in the past year with fellow shareholders and how that feedback has influenced the work that we are doing at Duke Energy.

Annual Meeting Details

This year's Annual Meeting will once again be held exclusively via live webcast. As a result of the online format, we are able to connect with more shareholders and answer more questions than we were able to do at previous in-person meetings, all while providing our shareholders the same opportunities to vote and ask questions that they would have had at an in-person meeting.

As we have done in previous years, you will be able to submit questions in writing in advance of the Annual Meeting on our pre-meeting forum atproxyvote.com. An audio broadcast of the Annual Meeting will also be available by phone toll-free at 1.800.289.0438, confirmation code 1802740. Details regarding how to participate in the Annual Meeting via live webcast, as well as the items to be voted on, are more fully described in the accompanying Notice of Annual Meeting of Shareholders and in the "Frequently Asked Questions and Answers About the Annual Meeting" on page 79 of this proxy statement.

Please review this proxy statement prior to casting your vote as it contains important information relating to the business of the Annual Meeting. Page 1 contains instructions on how you can vote your shares online, by phone, or by mail. We hope you can participate in the Annual Meeting. It is important that all of our shareholders, regardless of the number of shares owned, participate in the affairs of Duke Energy. We encourage you to vote promptly, even if you plan to participate in the Annual Meeting.

Thank you for your continued investment in Duke Energy.

Sincerely,

Lynn J. Good

Chair, President and CEO

Letter from the Independent

Lead Director

Dear Fellow Shareholders:

It is a great honor to serve as Duke Energy's Independent Lead Director and to work closely with our Chair, President and CEO, Lynn Good, who has skillfully positioned Duke Energy as a leader as the utility industry navigates rapid changes. I am fortunate to have the privilege of working with a diverse, engaged, and experienced group of directors at Duke Energy. In 2019, we added three new directors, Annette K. Clayton, Marya M. Rose, and Nicholas C. Fanandakis, to the Board. The varied opinions and perspectives of the Board allow us to actively oversee the most important issues facing Duke Energy.

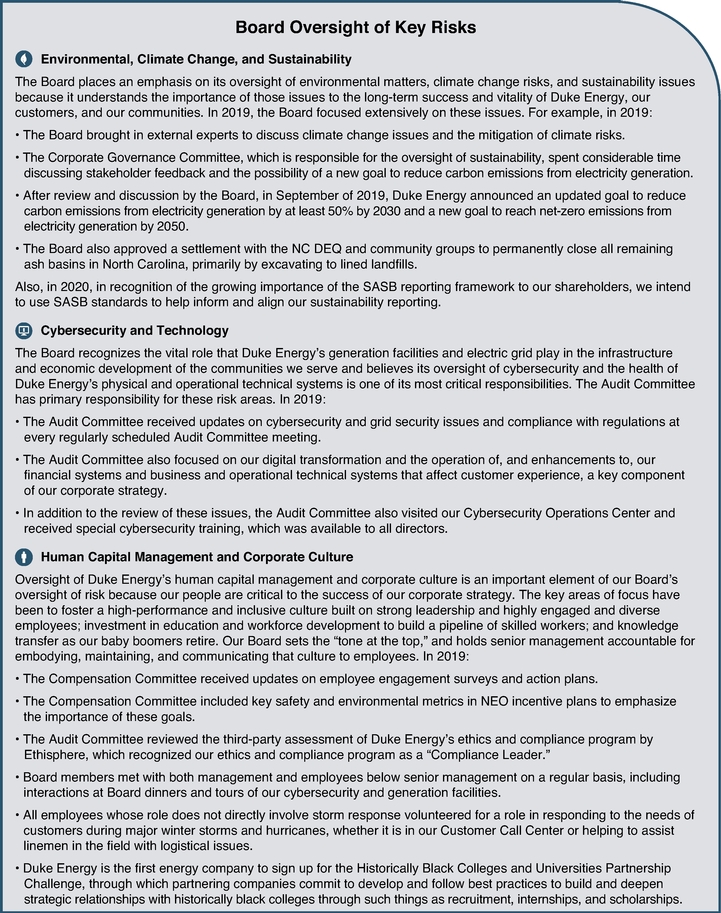

Our Board is deeply committed to sound corporate governance, executive compensation, and risk management policies and practices to ensure that Duke Energy operates responsibly and efficiently and achieves long-term sustainable value for our fellow shareholders. In 2019, the Board focused on the oversight of certain key risk areas for the Company, including operations and regulatory risks, cyber and physical security risks, sustainability and climate change risks, and the Board's oversight of the investments being made toward our strategy to transform the customer experience, modernize the energy grid, generate cleaner energy, and expand natural gas infrastructure. The Board was actively involved in the development of our updated goal to reduce carbon emissions from electricity generation by at least 50% from 2005 levels by 2030 and set a new goal to reach net-zero emissions from electricity generation by 2050. The Board was also instrumental in the addition of over 1,500 megawatts of new commercial renewables projects and additional renewables on our regulated system. Finally, the Board focused on the resolution of the Company's ash basin closure plans and was pleased that the Company reached an agreement with the NC DEQ and community groups to permanently close all remaining ash basins in North Carolina, primarily by excavating to lined landfills.

In 2019, we also continued our annual shareholder engagement program, reaching out to holders of approximately one-third of our outstanding common shares twice a year as well as numerous conversations we have every year with shareholders and stakeholders outside of our shareholder engagement program. The feedback we have gathered both in 2019 and in previous years from this program has helped the Board shape our policies, practices, and disclosures.

We look forward to continuing our dialogue with shareholders at the 2020 Annual Meeting, and, on behalf of the entire Board, thank you for your continued support.

Sincerely,

Michael G. Browning

Independent Lead Director

| Notice of Annual Meeting of Shareholders |

May 7, 2020

12:30 p.m. Eastern time

Via live webcast atduke-energy.onlineshareholdermeeting.com

We will convene Duke Energy's Annual Meeting on Thursday, May 7, 2020, at 12:30 p.m. Eastern time via live webcast atduke-energy.onlineshareholdermeeting.com.Though we plan to hold the Annual Meeting live via webcast on May 7, 2020, we recognize that the challenging and rapidly changing environment caused by the COVID-19 pandemic may necessitate that we re-evaluate our plans for the Annual Meeting at some point in the future. Should the time or date of the Annual Meeting change, we will announce the change by issuing a press release and filing additional proxy materials with the SEC.

The purpose of the Annual Meeting is to consider and take action on the following:

Holders of Duke Energy's common stock as of the close of business on the record date of March 9, 2020, are entitled to vote at the Annual Meeting by visitingduke-energy.onlineshareholdermeeting.com. To participate in the Annual Meeting via live webcast, you will need the 16-digit control number, which can be found on your Notice, on your proxy card, and on the instructions that accompany your proxy materials. The Annual Meeting will begin promptly at 12:30 p.m. Eastern time. Online check-in will begin at 12:00 p.m. Eastern time. Please allow ample time for the online check-in process. An audio broadcast of the Annual Meeting will be available by phone toll-free at 1.800.289.0438, confirmation code 1802740.

Holding the Annual Meeting via live webcast allows us to communicate more effectively with more of our shareholders. On our pre-meeting forum atproxyvote.com, you can submit questions in writing in advance of the Annual Meeting, access copies of proxy materials, and vote.

This year we once again plan to provide our proxy materials to our shareholders electronically. By doing so, most of our shareholders will only receive the Notice containing instructions on how to access the proxy materials electronically and vote online, by phone, or by mail. If you would like to request paper copies of the proxy materials, you may follow the instructions on the Notice. If you receive paper copies of the proxy materials, we ask you to consider signing up to receive these materials electronically in the future by following the instructions contained in this proxy statement. By delivering proxy materials electronically, we can reduce the consumption of natural resources and the cost of printing and mailing our proxy materials.

Please take time to vote now. If you choose to vote by mail, you may do so by marking, dating, and signing the proxy card, and returning it to us. Please follow the voting instructions, which can be found on your proxy card. Regardless of the manner in which you vote, we urge and greatly appreciate your prompt response.

Dated: March 26, 2020 | By order of the Board of Directors,  David B. Fountain Senior Vice President, Legal, Chief Ethics and Compliance Officer and Corporate Secretary |

DUKE ENERGY – 2020 Proxy Statement

DUKE ENERGY – 2020 Proxy Statement

GLOSSARY OF TERMS

To enhance the readability of this year's proxy statement, we added a Glossary of Terms beginning on page 84, which includes all defined terms in this proxy statement.

PARTICIPATE IN THE FUTURE OF DUKE ENERGY; CAST YOUR VOTE NOW

Vote Now

It is very important that you vote to participate in the future of Duke Energy. NYSE rules state that if your shares are held through a broker, bank, or other nominee, they cannot vote on nondiscretionary matters without your instruction. Even if you plan to participate in this year's Annual Meeting, it is a good idea to vote your shares before the Annual Meeting in the event your plans change. Whether you vote online, by phone, or by mail, please have your Notice, proxy card, or instructions that accompanied your proxy materials available and follow the instructions.

Eligibility to Vote

You can vote if you were a holder of Duke Energy's common stock as of the close of business on the record date of March 9, 2020.

By internet | By phone | By mailing your proxy card | ||

|  |  | ||

| Visit 24/7 proxyvote.com | Call toll-free 24/7 1.800.690.6903 or by calling the number provided by your broker, bank, or other nominee if your shares are not registered in your name | Cast your vote, sign your proxy card, and send free of postage |

Participate in the Annual Meeting

This year's Annual Meeting will be held exclusively via live webcast enabling shareholders from around the world to participate, submit questions in writing, and vote. Holders of record of Duke Energy's common stock as of the close of business on the record date of March 9, 2020, are entitled to participate in and vote at the Annual Meeting by visitingduke-energy.onlineshareholdermeeting.com. To participate in the Annual Meeting via live webcast, you will need the 16-digit control number, which can be found on your Notice, on your proxy card, and on the instructions that accompanied your proxy materials. The Annual Meeting will begin promptly at 12:30 p.m. Eastern time. Online check-in will begin at 12:00 p.m. Eastern time. Please allow ample time for the online check-in process. Shareholders may also listen to an audio broadcast of the Annual Meeting by phone toll-free at 1.800.289.0438, confirmation code 1802740. For more details on participating in the Annual Meeting, see "Frequently Asked Questions and Answers About the Annual Meeting" beginning on page 79 of this proxy statement.

Rules of Conduct for the Annual Meeting

Duke Energy has strived to ensure that shareholders at the online only Annual Meeting have the same rights that they would have had at an in-person meeting and an enhanced opportunity for participation and discourse.

DUKE ENERGY – 2020 Proxy Statement 1

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all the information that you should consider. You should read the entire proxy statement carefully before voting. Page references and website addresses are supplied to help you find additional information in this proxy statement and elsewhere. Information provided on websites linked to this proxy statement is not incorporated by reference into this proxy statement.

Voting Matters

| | | More information | Board recommendation | Broker non-votes | Abstentions | Votes required for approval | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| PROPOSAL 1 | Election of directors | Page 9 | FOR each nominee | Do not count | Do not count | Majority of votes cast, with a resignation policy | ||||||

| | | | | | | | | | | | | |

| PROPOSAL 2 | Ratification of Deloitte & Touche LLP as Duke Energy's independent registered public accounting firm for 2020 | Page 33 | FOR | Brokers have discretion to vote | Vote against | Majority of shares represented | ||||||

| | | | | | | | | | | | | |

| PROPOSAL 3 | Advisory vote to approve Duke Energy's named executive officer compensation | Page 35 | FOR | Do not count | Vote against | Majority of shares represented | ||||||

| | | | | | | | | | | | | |

| PROPOSAL 4 | Shareholder proposal regarding independent board chair | Page 70 | AGAINST | Do not count | Vote against | Majority of shares represented | ||||||

| | | | | | | | | | | | | |

| PROPOSAL 5 | Shareholder proposal regarding elimination of supermajority voting provisions in Duke Energy's Certificate of Incorporation | Page 73 | NO RECOMMENDATION | Do not count | Vote against | Majority of shares represented | ||||||

| | | | | | | | | | | | | |

| PROPOSAL 6 | Shareholder proposal regarding providing a semiannual report on Duke Energy's political contributions and expenditures | Page 75 | AGAINST | Do not count | Vote against | Majority of shares represented | ||||||

| | | | | | | | | | | | | |

| PROPOSAL 7 | Shareholder proposal regarding providing an annual report on Duke Energy's lobbying payments | Page 77 | AGAINST | Do not count | Vote against | Majority of shares represented | ||||||

| | | | | | | | | | | | | |

2 DUKE ENERGY – 2020 Proxy Statement

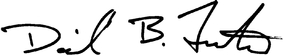

Duke Energy Overview

Headquartered in Charlotte, North Carolina, Duke Energy is one of the largest energy holding companies in the United States. Our Electric Utilities and Infrastructure business serves approximately 7.8 million customers located in six states in the Southeast and Midwest. Our Gas Utilities and Infrastructure business distributes natural gas to approximately 1.6 million customers in the Carolinas, Ohio, Kentucky, and Tennessee. Our Commercial Renewables business operates a growing renewable energy portfolio across the United States. More information about Duke Energy is available atduke-energy.com.

2019 Business Highlights

2019 was an outstanding year for Duke Energy as we met our near-term financial commitments and positioned the Company for sustainable long-term growth. We exceeded the midpoint of our 2019 earnings guidance, resulting in a 5% CAGR in adjusted diluted EPS since 2017, the first year after the completion of our portfolio transformation. We took proactive steps to strengthen our balance sheet, paving the way for a substantial increase in our five-year capital plan, significantly increasing our earnings potential to the benefit of our communities and shareholders. We also continued to advance a growth strategy focused on investments to modernize our energy grid, generate cleaner energy, and expand our natural gas infrastructure – all built on a foundation of customer service, operational excellence, and stakeholder engagement. In 2019:

DUKE ENERGY – 2020 Proxy Statement 3

Board Nominees (page 9)

| Name | Age | Gender, Racial or Ethnically Diverse | Director since | Occupation | Independent | Committee Memberships | Other Public Company Boards | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | |

Michael G. Browning | 73 | | 2006 | Chairman, Browning Consolidated, LLC | ü | • Compensation • Corporate Governance (C) • Regulatory Policy | • None | |||||||

| | | | | | | | | | | | | | | |

Annette K. Clayton | 56 | ü | 2019 | President and CEO, North America Operations, Schneider Electric SA | ü | • Audit • Operations and Nuclear Oversight | • Polaris Industries Incorporated | |||||||

| | | | | | | | | | | | | | | |

| | | | | | | | ||||||||

Theodore F. Craver, Jr. | 68 | | 2017 | Retired Chairman, President and CEO, Edison International | ü | • Audit (C) • Regulatory Policy | • Wells Fargo & Company | |||||||

| | | | | | | | | | | | | | | |

Robert M. Davis | 53 | 2018 | CFO and Executive Vice President, Global Services, Merck | ü | • Compensation • Finance and Risk Management | • None | ||||||||

| | | | | | | | | | | | | | | |

| | | | | | | | ||||||||

Daniel R. DiMicco | 69 | | 2007 | Chairman Emeritus, Retired President and CEO, Nucor Corporation | ü | • Corporate Governance • Regulatory Policy | • Hennessy | |||||||

| | | | | | | | | | | | | | | |

Nicholas C. Fanandakis | 63 | 2019 | Retired Executive Vice President, DuPont de Nemours, Inc. (formerly known as DowDuPont, Inc.) | ü | • Audit • Finance and Risk Management | • ITT Inc. • FTI Consulting, Inc. | ||||||||

| | | | | | | | | | | | | | | |

| | | | | | | | ||||||||

Lynn J. Good | 60 | ü | 2013 | Chair, President and CEO, Duke Energy Corporation | | • None | • The Boeing Company | |||||||

| | | | | | | | | | | | | | | |

John T. Herron | 66 | 2013 | Retired President, CEO and Chief Nuclear Officer, Entergy Nuclear | ü | • Finance and Risk Management • Operations and Nuclear Oversight (C) | • None | ||||||||

| | | | | | | | | | | | | | | |

| | | | | | | | ||||||||

William E. Kennard | 63 | ü | 2014 | Co-Founder and Non-Executive Chairman, Velocitas Partners, LLC | ü | • Corporate Governance • Finance and Risk Management (C) | • AT&T Inc. • Ford Motor Company • MetLife, Inc. | |||||||

| | | | | | | | | | | | | | | |

E. Marie McKee | 69 | ü | 2012 | Retired Senior Vice President, Corning Incorporated | ü | • Compensation (C) • Corporate Governance | • None | |||||||

| | | | | | | | | | | | | | | |

| | | | | | | | ||||||||

Marya M. Rose | 57 | ü | 2019 | Vice President and Chief Administrative Officer, Cummins Inc. | ü | • Compensation • Regulatory Policy | • None | |||||||

| | | | | | | | | | | | | | | |

Thomas E. Skains | 63 | 2016 | Retired Chairman, President and CEO, Piedmont Natural Gas Company, Inc. | ü | • Finance and Risk Management • Regulatory Policy (C) | • Truist Financial Corporation • National Fuel Gas Company | ||||||||

| | | | | | | | | | | | | | | |

| | | | | | | | ||||||||

William E. Webster, Jr. | 66 | | 2016 | Retired Executive Vice President, Institute of Nuclear Power Operations | ü | • Audit • Operations and Nuclear Oversight | • None | |||||||

| | | | | | | | | | | | | | | |

4 DUKE ENERGY – 2020 Proxy Statement

DUKE ENERGY – 2020 Proxy Statement 5

Shareholder Engagement (pages 21 and 36)

As part of our commitment to corporate governance, we have a track record of engaging with shareholders year-round to discuss and respond to their feedback on our corporate governance practices as well as executive compensation, environmental, and social matters of interest to shareholders. In 2019, we reached out to holders of approximately one-third of our outstanding common shares and held meetings with the holders of approximately 25% of our outstanding common shares, some of which included participation by members of the Board. The agenda for these conversations spanned a variety of topics, including our strategic vision, our operational priorities, the strength of our Board and leadership team, our commitment to ESG issues, our human capital management, and our executive compensation program. We also discussed and received positive feedback on our goals to reduce carbon emissions from electricity generation by at least 50% from 2005 levels by 2030 and to reach net-zero emissions from electricity generation by 2050.

6 DUKE ENERGY – 2020 Proxy Statement

Corporate Governance Highlights (page 26)

| | | |

| ü | Ability for shareholders to nominate directors through proxy access | |

| | | |

| ü | Independent Lead Director with clearly defined role and responsibilities | |

| | | |

| ü | Majority voting for directors with mandatory resignation policy and plurality carve-out for contested elections | |

| | | |

| ü | Robust year-round shareholder engagement program, including director involvement | |

| | | |

| ü | Annual Board, committee, and director assessments | |

| | | |

| ü | Ability for shareholders to take action by less than unanimous written consent | |

| | | |

| ü | Ability for shareholders to call a special shareholder meeting | |

| | | |

| ü | Clearly defined environmental and social initiatives and goals | |

| | | |

| ü | Annual election of all directors | |

| | | |

| ü | Independent Board committees | |

| | | |

| ü | Policy to prohibit all hedging and pledging of corporate securities | |

| | | |

| ü | Independent directors meet in executive session at each regularly scheduled Board meeting | |

| | | |

| ü | Regular Board refreshment | |

| | | |

| ü | Board responsiveness to majority support of shareholder proposals | |

| | | |

| ü | Each share of common stock is equal to one vote | |

| | | |

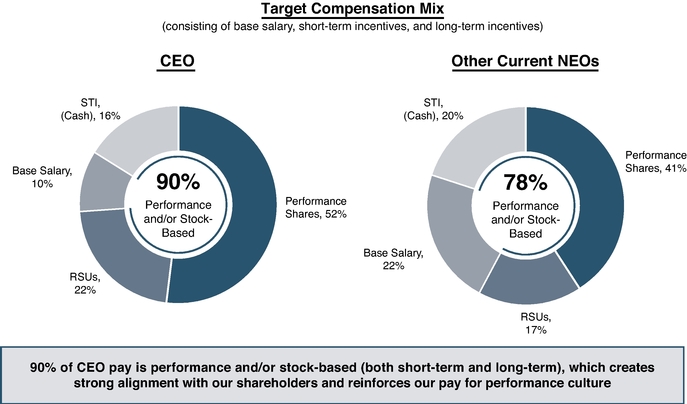

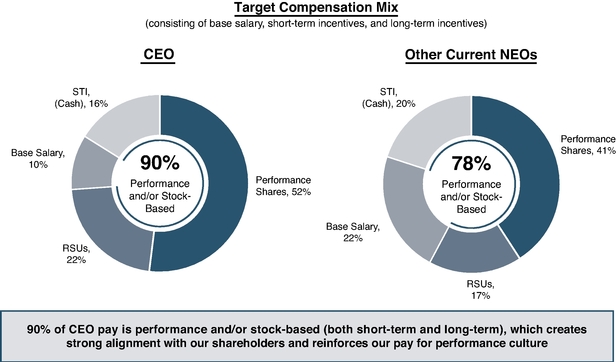

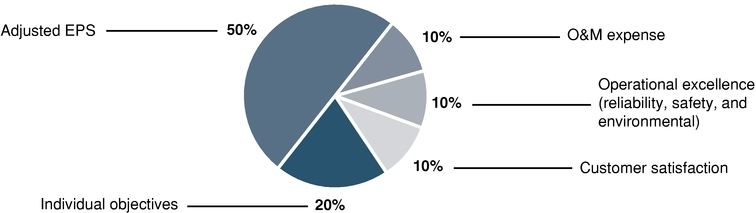

Executive Compensation Highlights (page 36)

Principles and Objectives

Our executive compensation program is designed to:

We meet these objectives through the appropriate mix of compensation, including:

DUKE ENERGY – 2020 Proxy Statement 7

Key Executive Compensation Features (page 41)

| | | |

ü | Significant stock ownership requirements (6x base salary for the CEO) | |

| | | |

ü | Stock holding policy | |

| | | |

ü | Incentive compensation tied to a clawback policy | |

| | | |

ü | Consistent level of severance protection | |

| | | |

ü | Shareholder approval policy for severance agreements | |

| | | |

ü | Equity award granting policy | |

| | | |

ü | Independent compensation consultant | |

| | | |

ü | Annual tally sheets for executive officers | |

| | | |

ü | Review and consideration of prior year's "say-on-pay" vote | |

| | | |

ü | Do not encourage excessive or inappropriate risk-taking | |

| | | |

ü | No tax gross-ups | |

| | | |

ü | No "single trigger" vesting of stock awards upon a change in control | |

| | | |

ü | No employment agreements except for the CEO | |

| | | |

ü | No excessive perquisites | |

| | | |

ü | Enhanced disclosure of performance goals | |

| | | |

ü | Minimum vesting requirement of one year for stock awards, subject to limited exceptions | |

| | | |

8 DUKE ENERGY – 2020 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors |

The Corporate Governance Committee, comprised of only independent directors, has recommended the following current directors as nominees for director, and the Board has approved their nomination for election to serve on the Board. We have a declassified Board, which means all the directors are voted on every year at the Annual Meeting.

If any director is unable to stand for election, the Board may reduce the number of directors or designate a substitute. In that case, shares represented by proxies may be voted for a substitute director. We do not expect that any nominee will be unavailable or unable to serve.

Our Principles for Corporate Governance includes a director tenure policy in addition to a retirement policy. The Board believes that it is very important to monitor the Board's composition, skills, and needs in the context of Duke Energy's overall strategy, and, therefore, our Principles for Corporate Governance includes a range for the Board to consider retirement. Pursuant to this policy, the Board may determine not to nominate a director who has reached the age of 70 or 15 years of service on the Board if, after examining the Board composition and impending Board retirements in light of the Company's strategy, the Board determines it is in the best interest of Duke Energy and our shareholders. Similarly, the Board may determine that it is in the best interest of Duke Energy and our shareholders for a director to remain on the Board. However, the Board will not nominate a director for election at the Annual Meeting in the calendar year following the year of his or her 75th birthday without a waiver of this policy from the Board.

Majority Voting for the Election of Directors

Under Duke Energy's By-Laws, in an uncontested election at which a quorum is present, a director-nominee will be elected if the number of votes cast "FOR" the nominee's election exceeds the number of votes cast as "WITHHOLD" from that nominee's election. Abstentions and broker non-votes do not count. In addition, Duke Energy has a resignation policy in our Principles for Corporate Governance, which requires an incumbent director who has more votes cast as "WITHHOLD" from that nominee's election than votes cast "FOR" his or her election to tender his or her letter of resignation for consideration by the Corporate Governance Committee.

In contested elections, directors will be elected by plurality vote. For purposes of the By-Laws, a "contested election" is an election in which the number of nominees for director is greater than the number of directors to be elected.

DUKE ENERGY – 2020 Proxy Statement 9

PROPOSAL 1: ELECTION OF DIRECTORS

Board Biographical Information, Skills, and Qualifications

| Michael G. Browning | ||||

| | | | | |

| Independent Director Nominee Independent Lead Director | ||||

| Age: 73 Director of Duke Energy since 2006 Chairman, Browning Consolidated, LLC | Committees: • Compensation Committee • Corporate Governance Committee (Chair) • Regulatory Policy Committee Other current public directorships: • None | ||

Mr. Browning has been Chairman of Browning Consolidated, LLC (and its predecessor), a real estate development firm, since 1981 and served as President from 1981 until 2013. He also serves as owner, general partner, or managing member of various real estate entities. Mr. Browning is a former director of Standard Management Corporation, Conseco, Inc., and Indiana Financial Corporation. Mr. Browning has served as Independent Lead Director since January 1, 2016. | ||||

Skills and qualifications:

Mr. Browning's qualifications for election include his management experience as well as his knowledge and understanding of customers' needs in Duke Energy's Midwest service territory gained during his long career as the Chairman of Browning Consolidated, a real estate development firm located in Indiana. Mr. Browning's financial and investment expertise adds a valuable perspective to the Board and its committees.

| Annette K. Clayton | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 56 Director of Duke Energy since 2019 President and CEO, North America Operations, Schneider Electric SA | Committees: • Audit Committee • Operations and Nuclear Oversight Committee Other current public directorships: • Polaris Industries Incorporated | ||

Ms. Clayton has been President and CEO of the North America Operations of Schneider Electric, a global electrical equipment manufacturer, and a member of the Executive Committee since June 2016. She also served as Chief Supply Chain Officer from June 2016 until January 2019. From May 2011 to June 2016, she served as Executive Vice President of Schneider Electric and a Member of the Executive Committee, Hong Kong. Prior to her employment at Schneider Electric, Ms. Clayton served at Dell, Inc. as Vice President of Global Supply Chain Operations and Vice President of Dell Americas operations, and at General Motors as President of their Saturn subsidiary, Corporate Vice President of Global Quality, and a member of their strategy board. | ||||

Skills and qualifications:

Ms. Clayton's qualifications for election include her experience as senior management of Schneider Electric overseeing the strategic direction and financial accountability of the North America operations. In her role as President and CEO of Schneider Electric's North America Operations, she has gained experience in customer service through her direct responsibility for the customer call centers, in cybersecurity and technology through Schneider Electric's work with the government on cybersecurity infrastructure, and the digital transformation of their supply chain, and in environmental and regulatory matters through her oversight of Schneider Electric's Safety and Environment function. She also has human capital management experience through her work on talent management initiatives, succession planning, and supply chain workforce planning at Schneider Electric. These skills uniquely fit the skill sets that benefit Duke Energy in our corporate strategy.

10 DUKE ENERGY – 2020 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

| Theodore F. Craver, Jr. | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 68 Director of Duke Energy since 2017 Retired Chairman, President and CEO, Edison International | Committees: • Audit Committee (Chair) • Regulatory Policy Committee Other current public directorships: • Wells Fargo & Company | ||

Mr. Craver was Chairman, President and CEO of Edison International, the parent company of a large California utility and various competitive electric businesses, from 2008 until his retirement in 2016. From 2005 to 2007, Mr. Craver served as CEO of Edison Mission Energy, a subsidiary of Edison International. Prior to his appointment as CEO of Edison Mission Energy, Mr. Craver served as CFO of Edison International from 2000 to 2004. He started at Edison International in 1996 after leaving First Interstate Bancorp where he was Executive Vice President and Corporate Treasurer. Mr. Craver is a former member of the ESCC, the organization that is the principal liaison between the federal government and the electric power sector responsible for coordinating efforts to prepare for, and respond to, national-level disasters or threats to critical infrastructure. Mr. Craver currently serves as a Senior Advisor to Blackstone's Global Infrastructure Fund and as a Senior Advisor to Bain & Company. He is also a member of the Economic Advisory Council of the Federal Reserve Bank of San Francisco, on the Board of Advisors of Mobility Impact Partners, and, in 2019, joined the Advisory Board of the Center on Cyber and Technology Innovation, which is a research institute focusing on national security and foreign policy. Mr. Craver is also a member of the Board of Trustees of the California Chapter of The Nature Conservancy. | ||||

Skills and qualifications:

Mr. Craver's qualifications for election include his experience as CEO of Edison International, which gives him in-depth knowledge of the utility industry and the regulatory arena, including environmental regulations, as well as his financial and risk management experience obtained as a CFO at Edison International, and at First Interstate Bancorp as the Chair of the Asset and Liability Committee, which was responsible for the oversight of risk management within the organization. Mr. Craver's experience in the industry also gives him a keen awareness of the needs of utility customers during this time of industry change. In addition, Mr. Craver's experience with grid cybersecurity as a member of the Steering Committee of the ESCC and as a member of the Advisory Board of the Center on Cyber and Technology Innovation gives him insight into this crucial area for Duke Energy. In 2018, he earned the CERT Certificate in Cybersecurity Oversight from the National Association of Corporate Directors.

DUKE ENERGY – 2020 Proxy Statement 11

PROPOSAL 1: ELECTION OF DIRECTORS

| Robert M. Davis | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 53 Director of Duke Energy since 2018 CFO and Executive Vice President, Global Services, Merck | Committees: • Compensation Committee • Finance and Risk Management Committee Other current public directorships: • None | ||

Mr. Davis has been CFO since April 2014 and CFO and Executive Vice President, Global Services since 2016 for Merck, a global healthcare company that provides prescription medicines, vaccines, and other health solutions. Prior to Merck, Mr. Davis worked for Baxter International, Inc. as Corporate Vice President and President of Medical Products from 2010 to 2014, Corporate Vice President and President of Baxter International's renal business in 2010, Corporate Vice President and CFO from 2006 to 2010, and Treasurer from 2004 to 2006. Mr. Davis previously served on the board of directors of C.R. Bard until its merger with Becton, Dickinson and Company in December 2017. | ||||

Skills and qualifications:

Mr. Davis' qualifications for election include his significant experience in regulatory matters, finance, and risk management obtained during his service as the CFO of Merck, where enterprise risk management and finance are within his areas of responsibility, as well as his prior experience gained in a variety of management and finance roles at Baxter International. Mr. Davis' legal knowledge, obtained when he earned his Doctor of Jurisprudence, adds additional insight to the Board's discussions of legal and risk issues. Mr. Davis also has significant experience with technology and cybersecurity as a result of his direct oversight over those areas during his time as CFO of Merck and at Baxter International. Mr. Davis' experience at Merck provides valuable insight into navigating an industry undergoing rapid transformation.

| Daniel R. DiMicco | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 69 Director of Duke Energy since 2007 Chairman Emeritus, Retired President and CEO, Nucor Corporation | Committees: • Corporate Governance Committee • Regulatory Policy Committee Other current public directorships: • Hennessy Capital Acquisition Corp. III | ||

Mr. DiMicco has served as Chairman Emeritus of Nucor, a steel company, since December 2013. He served as Executive Chairman of Nucor from January 2013 until December 2013 and as Chairman from May 2006 until December 2012. He served as CEO from September 2000 until December 2012 and President from September 2000 until December 2010. Mr. DiMicco was a member of the Nucor board of directors from 2000 until 2013 and is the former Chairman of the American Iron and Steel Institute. | ||||

Skills and qualifications:

Mr. DiMicco's qualifications for election include his management, finance, and risk management experience gained during his time as CEO of a Fortune 500 company, which served many constituencies. In addition, his experience as CEO of Nucor, a large industrial company headquartered in North Carolina and with operations in the Midwest, provides a valuable perspective on Duke Energy's industrial customer class as well as extensive knowledge of regulatory issues and environmental regulations in Duke Energy's Carolinas and Midwest service territories.

12 DUKE ENERGY – 2020 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

| Nicholas C. Fanandakis | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 63 Director of Duke Energy since 2019 Retired Executive Vice President, DuPont de Nemours, Inc. (formerly known as DowDuPont, Inc.) | Committees: • Audit Committee • Finance and Risk Management Committee Other current public directorships: • ITT Inc. • FTI Consulting, Inc. | ||

Mr. Fanandakis is a retired Executive Vice President of DuPont, a holding company with agriculture, materials science, and specialty products businesses. Mr. Fanandakis served as Executive Vice President and CFO at E.I. du Pont de Nemours and Company from 2009 until January 2019 and as Executive Vice President of DuPont until his retirement in July 2019. Prior to 2009, Mr. Fanandakis served in various plant, marketing, product management, and business director roles in the DuPont organization since 1979. | ||||

Skills and qualifications:

Mr. Fanandakis' qualifications for election include his management experience gained during his career in numerous areas of DuPont. In addition to his management experience, Mr. Fanandakis' expertise in finance, tax, banking, and risk management at a company undergoing transformation is an asset to Duke Energy's Board.

| Lynn J. Good | ||||

| | | | | |

| Non-Independent Director Nominee Chair | ||||

| Age: 60 Director of Duke Energy since 2013 Chair, President and CEO, Duke Energy Corporation | Committees: • None Other current public directorships: • The Boeing Company | ||

Ms. Good has served as Chair, President and CEO of Duke Energy since January 1, 2016, and was Vice Chair, President and CEO of Duke Energy from July 2013 through December 2015. She served as Executive Vice President and CFO of Duke Energy from July 2009 through June 2013. She is a former director of Hubbell Incorporated. | ||||

Skills and qualifications:

Ms. Good is our Chair, President and CEO and was previously our CFO. Her extensive financial and risk management background as well as her knowledge of the affairs of Duke Energy and our business make her uniquely suited to lead our Board and Duke Energy. Her many years of experience in the utility industry, her knowledge of the associated regulatory issues, technologies, environmental regulations, and customer focus, provide valuable resources for the Board.

DUKE ENERGY – 2020 Proxy Statement 13

PROPOSAL 1: ELECTION OF DIRECTORS

| John T. Herron | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 66 Director of Duke Energy since 2013 Retired President, CEO and Chief Nuclear Officer, Entergy Nuclear | Committees: • Finance and Risk Management Committee • Operations and Nuclear Oversight Committee (Chair) Other current public directorships: • None | ||

Mr. Herron was President, CEO and Chief Nuclear Officer of Entergy Nuclear, the nuclear operations of Entergy Corporation, an electric utility, from 2009 until his retirement in 2013. Mr. Herron joined Entergy Nuclear in 2001 and held a variety of positions. He began his career in nuclear operations in 1979 and, through his career, held positions at a number of nuclear stations across the country. Mr. Herron is a director of Ontario Power Generation and also has served on the board of directors of INPO. | ||||

Skills and qualifications:

Mr. Herron's qualifications for election include his knowledge and extensive insight gained as a senior executive in the utility industry, including his three decades of experience in nuclear energy. In addition to his nuclear expertise, during Mr. Herron's career, and particularly during his time as CEO and Chief Nuclear Officer of Entergy Nuclear, he gained significant financial, regulatory, and environmental expertise, as well as an understanding of utility customers. He also obtained risk management expertise, a required skill for those tasked with overseeing the operation of nuclear power plants. Mr. Herron also had direct responsibility for the management of cybersecurity as CEO and Chief Nuclear Officer of Entergy Nuclear.

| William E. Kennard | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 63 Director of Duke Energy since 2014 Co-Founder and Non-Executive Chairman, Velocitas Partners, LLC | Committees: • Corporate Governance Committee • Finance and Risk Management Committee (Chair) Other current public directorships: • AT&T Inc. • Ford Motor Company • MetLife, Inc. | ||

Mr. Kennard has been Co-Founder and Non-Executive Chairman of Velocitas Partners, an asset management firm, since November 2014. He also serves as an advisor to Staple Street Capital and Astra Capital Management, both private equity firms. Prior to joining Velocitas Partners, Mr. Kennard served as Senior Advisor to Grain Management from October 2013 until November 2014, United States Ambassador to the European Union from 2009 until August 2013, Managing Director of The Carlyle Group from 2001 until 2009, and Chairman of the FCC from 1997 until 2001. | ||||

Skills and qualifications:

Mr. Kennard's qualifications for election include his considerable experience and knowledge of the regulatory arena from his service as Chairman of the FCC and United States Ambassador, as well as his legal, financial, and risk management knowledge obtained during his career as a lawyer, policymaker, and investor in the technology and telecommunications sector.

14 DUKE ENERGY – 2020 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

| E. Marie McKee | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 69 Director of Duke Energy since 2012 Retired Senior Vice President, Corning Incorporated | Committees: • Compensation Committee (Chair) • Corporate Governance Committee Other current public directorships: • None | ||

Ms. McKee is a retired Senior Vice President of Corning Incorporated, a manufacturer of components for high-technology systems for consumer electronics, mobile emissions controls, telecommunications, and life sciences. Ms. McKee has over 35 years of experience obtained at Corning, where she held a variety of management positions with increasing levels of responsibility, including Senior Vice President of Human Resources from 1996 until 2010, President of Steuben Glass from 1998 until 2008, and President of The Corning Museum of Glass and The Corning Foundation from 1998 until 2014. | ||||

Skills and qualifications:

Ms. McKee's qualifications for election include her senior management experience in human resources, which provides her with a thorough knowledge of human capital management and compensation practices. Her prior experience as a senior executive of Corning Incorporated has also given her excellent operating skills and an understanding of environmental regulations, technology, and risk management with regard to the manufacturing process, which aids the Board in its oversight of environmental and health and safety matters.

| Marya M. Rose | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 57 Director of Duke Energy since 2019 Vice President and Chief Administrative Officer, Cummins Inc. | Committees: • Compensation Committee • Regulatory Policy Committee Other current public directorships: • None | ||

Ms. Rose has been the Vice President and Chief Administrative Officer of Cummins, a global manufacturer of engines, filtration, and power generation equipment, since August 2011, and is responsible for the communications, marketing, government relations, ethics and compliance, enterprise risk management, facilities, security, corporate responsibility, shared services organization and, until January 2018, the legal function. From 2001 until August 2011, Ms. Rose served as Vice President – General Counsel and Corporate Secretary of Cummins. Prior to her employment at Cummins, Ms. Rose was an attorney with Bose McKinney & Evans and a senior aide to two Indiana Governors. | ||||

Skills and qualifications:

Ms. Rose's qualifications for election include her experience in the role of Chief Administrative Officer, and previously as General Counsel of Cummins, which has given her a background in a number of key areas that are critical to the future success of Duke Energy. In her role as Chief Administrative Officer, she has had direct responsibility for the regulatory, environmental, technology, risk management, and customer service areas. In addition, her legal background, including her time as General Counsel and Corporate Secretary of Cummins, will enable her to have unique insights, which she can lend to the Board on legal and corporate governance issues.

DUKE ENERGY – 2020 Proxy Statement 15

PROPOSAL 1: ELECTION OF DIRECTORS

Thomas E. Skains | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 63 Director of Duke Energy since 2016 Retired Chairman, President and CEO, Piedmont Natural Gas Company, Inc. | Committees: • Finance and Risk Management Committee • Regulatory Policy Committee (Chair) Other current public directorships: • Truist Financial Corporation • National Fuel Gas Company | ||

Mr. Skains was Chairman, President and CEO of Piedmont, a regional natural gas distributor, until his retirement in 2016. He served as Chairman of Piedmont from December 2003 until October 2016, CEO from February 2003 until October 2016, and as President from February 2002 until October 2016. Prior to his service as President, Ms. Skains served in various roles, including Chief Operating Officer and as Senior Vice President, Marketing and Supply Services where he directed Piedmont's commercial natural gas activities. | ||||

Skills and qualifications:

Mr. Skains' qualifications for election include his financial and risk management expertise and public company governance and strategy gained during his time as Chairman, President and CEO of Piedmont. His time at Piedmont also provided him with in-depth knowledge of the natural gas industry, the environmental regulations related to the industry, and the needs of natural gas customers, which is helpful to Duke Energy as it expands into the natural gas arena since the acquisition of Piedmont. His prior experience as a corporate energy attorney also gives Mr. Skains insight on legal and regulatory compliance matters.

| William E. Webster, Jr. | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 66 Director of Duke Energy since 2016 Retired Executive Vice President, Institute of Nuclear Power Operations | Committees: • Audit Committee • Operations and Nuclear Oversight Committee Other current public directorships: • None | ||

Mr. Webster was Executive Vice President of Industry Strategy for INPO, a non-profit organization that promotes the highest levels of safety and reliability in the operation of commercial nuclear power plants, until his retirement in June 2016. Mr. Webster has 34 years of experience obtained at INPO where he held a variety of management positions in the Industry Evaluations, Plant Support, Engineering Support, and Plant Analysis and Emergency Preparedness divisions prior to his retirement. Mr. Webster currently serves as the Chairman of the Japan Nuclear Safety Institute. | ||||

Skills and qualifications:

Mr. Webster's qualifications for election include the extensive knowledge he gained during his 34 years in the nuclear industry, including experience with respect to environmental laws and reporting for the nuclear industry, and his regulatory expertise through his interface with the NRC on making new nuclear safety rules after the Fukushima accident in Japan. At INPO, Mr. Webster also was responsible for the development of risk management guidelines for the nuclear industry. These skills, as well as his operational and engineering expertise, are an asset to the Board and its committees as the Company focuses on operational excellence.

The Board of Directors Recommends a Vote "FOR" Each Nominee.

16 DUKE ENERGY – 2020 Proxy Statement

INFORMATION ON THE BOARD OF DIRECTORS

Our Board Leadership Structure

The Board regularly evaluates the leadership structure of Duke Energy and may consider alternative approaches, as appropriate, over time. The Board believes that Duke Energy and our shareholders are best served by the Board retaining discretion to determine the appropriate leadership structure based on what it believes is best for Duke Energy at a particular point in time, including whether the same individual should serve as both Chair and CEO, or whether the roles should be separate.

Lynn J. Good serves as Duke Energy's Chair, President and CEO. Our Board believes that combining the Chair and CEO roles fosters clear accountability, effective decision-making, and execution of corporate strategy.

Michael G. Browning serves as our Independent Lead Director and has served in that role since January 2016. Mr. Browning's responsibilities, which meet the latest corporate governance standards set by the National Association of Corporate Directors, include:

Our Independent Lead Director is elected by the independent members of the Board.

A complete list of the responsibilities of our Independent Lead Director is included in our Principles for Corporate Governance, a copy of which is posted on our website atduke-energy.com/our-company/investors/corporate-governance/principles-corp-governance.

The Board has determined that none of the directors, other than Ms. Good, has a material relationship with Duke Energy or any of our subsidiaries, and all are, therefore, independent under the listing standards of the NYSE and the rules and regulations of the SEC.

In making the determination regarding each director's independence, the Board considered all transactions and the materiality of any relationship with Duke Energy and any of our subsidiaries in light of all facts and circumstances.

The Board may determine a director to be independent if it has affirmatively determined that the director has no material relationship with Duke Energy or our subsidiaries, either directly or as a shareholder, director, officer, or employee of an organization that has a relationship with Duke Energy or our subsidiaries. Independence determinations are generally made when a director joins the Board and on an annual basis at the time the Board approves director-nominees for inclusion in the proxy statement.

The Board also considers its Standards for Assessing Director Independence, which set forth certain relationships between Duke Energy and our directors and their immediate family members, or affiliated entities, that the Board, in its judgment, has deemed to be immaterial for purposes of assessing a director's independence. Duke Energy's Standards for Assessing Director Independence are on our website atduke-energy.com/our-company/investors/corporate-governance/board. In the event a director has a relationship with Duke Energy that is not addressed in the Standards for Assessing Director Independence, the Corporate Governance Committee, which is composed entirely of independent members of the Board, reviews the relationship and makes a recommendation to the nonconflicted, independent members of the Board who determine whether such relationship is material.

DUKE ENERGY – 2020 Proxy Statement 17

INFORMATION ON THE BOARD OF DIRECTORS

The Board met nine times during 2019 and has met once so far in 2020. During 2019 Board meetings, our Board held five executive sessions with independent directors only.

Directors are expected to attend at least 75% of Board meetings and the meetings of the committees upon which he or she serves. The overall attendance percentage for our directors was approximately 97% in 2019, and all directors attended more than 75% of the Board meetings and the meetings of the committees upon which he or she served in 2019. Directors are also encouraged to attend the Annual Meeting. All directors who were directors at the time of last year's Annual Meeting on May 2, 2019, attended the 2019 Annual Meeting.

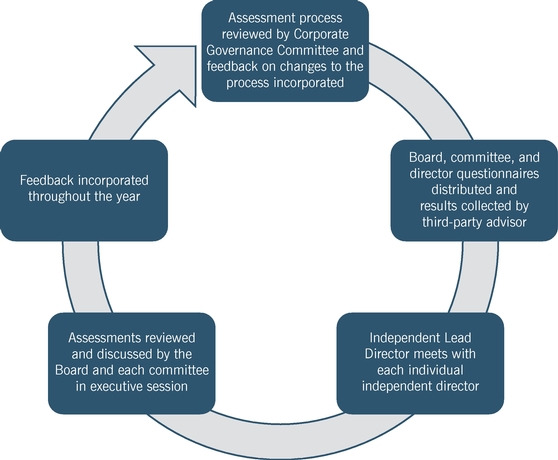

Board and Committee Assessments

Each year the Board, with the assistance of the Corporate Governance Committee, conducts an assessment of the Board, each of its committees, and the directors. The assessment process is facilitated by a third-party advisor, which allows directors to provide anonymous feedback and promotes candidness among the directors. The results of the feedback are presented to the Board and committees and discussed.

In addition to the written assessments, the Independent Lead Director annually takes the opportunity to meet with each of the directors separately to discuss the performance of the Board and to obtain advice on areas of improvement for the Board and the individual directors. Our Board is committed to effective board succession planning and refreshment, including having honest and difficult conversations, as may be deemed necessary, with individual directors.

Management and the Board then incorporate the feedback received in both the written assessments and the discussions throughout the year. For example, over the course of 2019, we incorporated feedback to make changes to the presentation of the materials provided to our directors in advance of their meetings. We also increased Board education opportunities and provided special information sessions on topics of interest to our Board members.

This annual review process and discussion provides continuous improvement in the overall effectiveness of the directors, committees, and Board, and provides an opportunity for directors to express any concerns they may have. This process also allows the Board to identify opportunities for Board succession and skills.

18 DUKE ENERGY – 2020 Proxy Statement

INFORMATION ON THE BOARD OF DIRECTORS

Board Role in Management Succession

The independent directors of the Board are actively involved in our management succession planning process. Among the Corporate Governance Committee's responsibilities described in its charter is to oversee continuity and succession planning. At least annually, the Corporate Governance Committee or full Board reviews the CEO succession plan and makes recommendations to the Board for the successor to the CEO. The Corporate Governance Committee also reports to the Board any concerns or issues that might indicate that organizational strengths are not equal to the requirements of long-range goals and oversees the evaluation of the CEO.

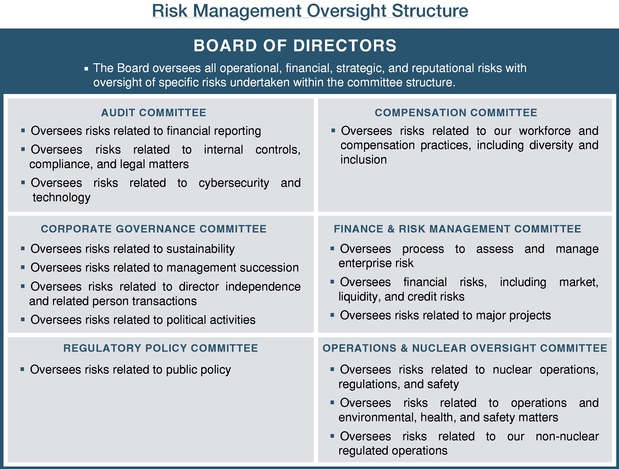

As is true with other large public companies, Duke Energy faces a myriad of risks, including operational, financial, strategic, and reputational risks that affect every segment of our business. The Board is actively involved in the oversight of these risks in several ways. This oversight is conducted primarily through the Finance and Risk Management Committee of the Board but also through the other committees of the Board, as appropriate. The Finance and Risk Management Committee reviews Duke Energy's enterprise risk program with management, including the Chief Risk Officer, on a regular basis at its committee meetings. The enterprise risk program includes the identification of a broad range of risks that affect Duke Energy, their probabilities and severity, and incorporates a review of our approach to managing and prioritizing those risks based on input from the officers responsible for the management of those risks.

Each committee of the Board is responsible for the oversight of certain areas of risk that pertain to that committee's area of focus. Throughout the year, each committee chair reports to the full Board regarding the committee's considerations and actions related to the risks within its area of focus. Each committee regularly receives updates from the business units in that committee's area of focus to review the risks in those areas.

DUKE ENERGY – 2020 Proxy Statement 19

INFORMATION ON THE BOARD OF DIRECTORS

20 DUKE ENERGY – 2020 Proxy Statement

INFORMATION ON THE BOARD OF DIRECTORS

We conduct extensive governance reviews and investor outreach so that management and the Board understand and consider the issues that matter most to our shareholders and address them effectively. In 2019, we reached out to holders of approximately one-third of Duke Energy's outstanding common shares, and members of our Board and management met with holders of approximately 25% of Duke Energy's outstanding common shares. We engaged with every shareholder who accepted our offer to meet as well as every shareholder who requested to meet with us.

During 2019, Duke Energy engaged with shareholders on numerous topics, including sustainability, governance, and executive compensation matters. Shareholder feedback has been invaluable to us in enhancing our practices, policies, and related disclosures. During 2019, we focused our engagements with shareholders on the following topics:

In the fall, we also extensively discussed our goal to reduce carbon emissions from electricity generation by at least 50% from 2005 levels by 2030 and our new goal to reach net-zero emissions from electricity generation by 2050, as well as the steps Duke Energy is taking to mitigate the risks of climate change on our operations, which was well-received by shareholders. The Corporate Governance Committee reviewed the feedback from all discussions and the feedback informed the decisions discussed herein, including updates to our political expenditures disclosures, updates to the ash management section of our website, and our intention to begin using SASB standards in 2020 to help inform and align our sustainability reporting. Additional information on our discussions with shareholders regarding executive compensation matters is provided on page 36 of this proxy statement.

DUKE ENERGY – 2020 Proxy Statement 21

INFORMATION ON THE BOARD OF DIRECTORS

BOARD COMMITTEE MEMBERSHIP ROSTER(1)

| Name | Audit | Compensation | Corporate Governance | Finance and Risk Management | Operations and Nuclear Oversight | Regulatory Policy | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

Michael G. Browning | | ✔ | C | | | ✔ | ||||||

Annette K. Clayton | ✔ | ✔ | ||||||||||

Theodore F. Craver, Jr. | C | | | | | ✔ | ||||||

Robert M. Davis | ✔ | ✔ | ||||||||||

Daniel R. DiMicco | | | ✔ | | | ✔ | ||||||

Nicholas C. Fanandakis | ✔ | ✔ | ||||||||||

Lynn J. Good | | | | | | | ||||||

John T. Herron | ✔ | C | ||||||||||

William E. Kennard | | | ✔ | C | | | ||||||

E. Marie McKee | C | ✔ | ||||||||||

Charles W. Moorman IV | | | | | ✔ | ✔ | ||||||

Marya M. Rose | ✔ | ✔ | ||||||||||

Carlos A. Saladrigas | ✔ | ✔ | | | | | ||||||

Thomas E. Skains | ✔ | C | ||||||||||

William E. Webster, Jr. | ✔ | | | | ✔ | | ||||||

| | | | | | | | | | | | | |

The Board has the six standing, permanent committees described below. Each committee operates under a written charter adopted by the Board. The charters are posted on our website atduke-energy.com/our-company/investors/corporate-governance/board-committee-charters.

Audit Committee

Eight meetings held in 2019

| Committee Members | ||||

| Theodore F. Craver, Jr., Chair* Annette K. Clayton* Nicholas C. Fanandakis* Carlos A. Saladrigas* William E. Webster, Jr.* * Designated as an Audit Committee | |||

Theodore F. Craver, Jr.

22 DUKE ENERGY – 2020 Proxy Statement

INFORMATION ON THE BOARD OF DIRECTORS

Compensation Committee

Six meetings held in 2019

| Committee Members | ||||

| E. Marie McKee, Chair Michael G. Browning Robert M. Davis Marya M. Rose Carlos A. Saladrigas |

E. Marie McKee

DUKE ENERGY – 2020 Proxy Statement 23

INFORMATION ON THE BOARD OF DIRECTORS

Corporate Governance Committee

Six meetings held in 2019

| Committee Members | ||||

| Michael G. Browning, Chair Daniel R. DiMicco William E. Kennard E. Marie McKee |

Michael G. Browning

Finance and Risk Management Committee

Eight meetings held in 2019

| Committee Members | ||||

| William E. Kennard, Chair Robert M. Davis Nicholas C. Fanandakis John T. Herron Thomas E. Skains |

William E. Kennard

24 DUKE ENERGY – 2020 Proxy Statement

INFORMATION ON THE BOARD OF DIRECTORS

Operations and Nuclear Oversight Committee

Four meetings held in 2019

| Committee Members | ||||

| John T. Herron, Chair Annette K. Clayton Charles W. Moorman IV William E. Webster, Jr. |

John T. Herron

Regulatory Policy Committee

Five meetings held in 2019

| Committee Members | ||||

| Thomas E. Skains, Chair Michael G. Browning Theodore F. Craver, Jr. Daniel R. DiMicco Charles W. Moorman IV Marya M. Rose |

Thomas E. Skains

DUKE ENERGY – 2020 Proxy Statement 25

REPORT OF THE CORPORATE GOVERNANCE COMMITTEE

The following is the report of the Corporate Governance Committee with respect to its philosophy, responsibilities, and initiatives.

Philosophy and Responsibilities

We believe that sound corporate governance has three components: (i) Board independence; (ii) processes and practices that foster sound decision-making by both management and the Board; and (iii) balancing the interests of all of our stakeholders – our investors, customers, employees, the communities we serve, and the environment. The Corporate Governance Committee's charter is available on our website atduke-energy.com/our-company/investors/corporate-governance/board-committee-charters/corporate-governance and is summarized below. Additional information about the Corporate Governance Committee and its members is detailed on page 24 of this proxy statement.

Membership. The committee must be comprised of three or more members, all of whom must qualify as independent directors under the listing standards of the NYSE and other applicable rules and regulations.

Responsibilities. The committee's responsibilities include, among other things: (i) implementing policies regarding corporate governance matters; (ii) assessing the Board's membership needs and recommending nominees; (iii) recommending to the Board those directors to be selected for membership on, or removal from, the various Board committees and those directors to be designated as chairs of Board committees; (iv) sponsoring and overseeing annual performance evaluations for the various Board committees, including the Corporate Governance Committee, the Board and the CEO; (v) overseeing Duke Energy's political expenditures and activities pursuant to the Political Expenditures Policy; (vi) reviewing our charitable contributions and community service policies and practices; and (vii) reviewing Duke Energy's policies, programs, and practices with regard to sustainability. The committee may also conduct or authorize investigations into or studies of matters within the scope of the committee's duties and responsibilities, and may retain, at Duke Energy's expense, and in the committee's sole discretion, consultants to assist in such work as the committee deems necessary.

All of the Board committee charters, as well as our Principles for Corporate Governance, Code of Business Ethics for Employees, and Code of Business Conduct & Ethics for Directors, are available onour website at duke-energy.com/our-company/investors/corporate-governance.

Any amendments to or waivers from our Code of Business Ethics for Employees with respect to executive officers or Code of Business Conduct & Ethics for Directors must be approved by the Board and will be posted on our website. In addition, information regarding how to report actual or suspected violations of our Code of Business Ethics, either through our anonymous EthicsLine or otherwise, is provided on the Ethics section of our websiteat duke-energy.com/our-company/about-us/ethics in the Code of Business Ethics.

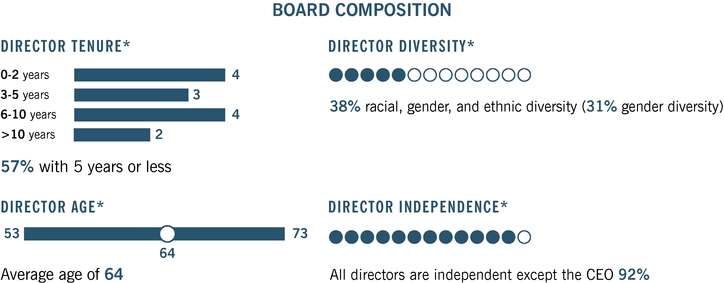

Director Qualifications and Diversity. The Board recognizes that a diverse Board, management, and workforce is key to Duke Energy's success and believes that diversity of background, skill sets, experience, thought, ethnicity, race, gender, age, and nationality, are important considerations in selecting candidates. This commitment to diversity is evidenced in the backgrounds, skills, and qualifications of the directors who have been nominated, as well as the diversity of Duke Energy's executives and workforce, starting with our Chair, President and CEO, Lynn J. Good, who was selected by the Board to lead Duke Energy in 2013, and the diverse senior management team that reports to her.

The Board strives to have a diverse Board representing a range of experiences and qualifications in areas that are relevant to Duke Energy's business and strategy. As part of the search process, the committee looks for the most qualified candidates, including women and minorities, with the following characteristics:

26 DUKE ENERGY – 2020 Proxy Statement

REPORT OF THE CORPORATE GOVERNANCE COMMITTEE

Director Candidate Recommendations. The committee may engage a third party from time to time to assist it in identifying and evaluating director-nominee candidates, in addition to current members of the Board standing for re-election. The committee will provide the third party, based on the profile described above, the characteristics, skills, and experiences that may complement those of our existing members. The third party will then provide recommendations for nominees with such attributes. The committee considers nominees recommended by shareholders on a similar basis, taking into account, among other things, the profile criteria described above and the nominee's experiences and skills. In addition, the committee considers the shareholder-nominee's independence with respect to both Duke Energy and the recommending shareholder. All of the nominees on the proxy card are current members of our Board and were recommended by the committee.

Shareholders interested in submitting nominees as candidates for election as directors must provide timely written notice to the Corporate Governance Committee, c/o David B. Fountain, Senior Vice President, Legal, Chief Ethics and Compliance Officer and Corporate Secretary, Duke Energy Corporation, DEC 48H, P.O. Box 1414, Charlotte, NC 28201-1414. The written notice must set forth, as to each person whom the shareholder proposes to nominate for election as director:

Director Candidate Nominations through Proxy Access. In order to nominate a director pursuant to our proxy access provision for the 2021 Annual Meeting, shareholders who meet the eligibility and other requirements set forth in Section 3.04 of the Company's By-Laws must send a written notice to the Corporate Governance Committee, c/o David B. Fountain, Senior Vice President, Legal, Chief Ethics and Compliance Officer and Corporate Secretary, Duke Energy Corporation, DEC 48H, P.O. Box 1414, Charlotte, NC 28201-1414. The written notice must be provided no earlier than October 27, 2020, and no later than November 25, 2020, and must provide the information set forth above, as well as the other detailed requirements set forth in Section 3.04 of the Company's By-Laws, which can be located on our website atduke-energy.com/our-company/investors/corporate-governance.

DUKE ENERGY – 2020 Proxy Statement 27

REPORT OF THE CORPORATE GOVERNANCE COMMITTEE

New Director Since the 2019 Annual Meeting

Following the 2019 Annual Meeting, and in consideration of the retirement of several members of the Board with extensive expertise in finance, the Corporate Governance Committee sought to recruit an additional Board member. The committee worked extensively in 2019 on identifying a candidate with a deep background in finance and whose qualifications align with the desired qualifications discussed earlier and the needs of the Board considering the priorities and issues facing Duke Energy, our long-term strategy, and our Board refreshment goals. As a result, after working with an independent search firm, the committee identified a candidate with the desired experience, diversity, skills, and other qualifications, to make for a well-balanced Board. In June 2019, the committee recommended that Nicholas C. Fanandakis be appointed to the Board effective June 26, 2019. Mr. Fanandakis brings extensive management experience and expertise in finance, tax, banking, and risk management gained during his tenure as an executive officer at DuPont de Nemours, Inc. and its predecessors. For more information on Mr. Fanandakis' skills and expertise, see page 13.

Director Onboarding. Over half of our Board members have joined the Board in the last five years. In order to help those new directors quickly transition into their roles on the Board, the director onboarding process has become increasingly important. Immediately following their appointment, each new director meets individually with the senior executives responsible for our major lines of business and operations so that they may better understand the issues involved in all aspects of Duke Energy's business. In addition to discussing Duke Energy's businesses and operations, the new directors learn about our corporate governance practices and policies; the financial and technical aspects of our electric utility, natural gas, and commercial renewables businesses; the enterprise's significant risks; our long-term strategy; and Duke Energy's long-standing mission to provide clean, reliable, and affordable energy for our customers. Finally, new members to our Audit and Compensation Committees have a separate orientation to learn more about each committee's responsibilities, policies, and practices, and the matters regularly coming before the committee.

Communications and Engagements with Directors

Interested parties can communicate with any of our directors by writing to our Corporate Secretary at the following address:

Corporate Secretary

David B. Fountain

Senior Vice President, Legal, Chief Ethics and Compliance

Officer and Corporate Secretary

Duke Energy Corporation

DEC 48H

P.O. Box 1414

Charlotte, NC 28201-1414

Interested parties can communicate with our Independent Lead Director by writing to the following address:

Independent Lead Director

c/o David B. Fountain

Senior Vice President, Legal, Chief Ethics and Compliance

Officer and Corporate Secretary

Duke Energy Corporation

DEC 48H

P.O. Box 1414

Charlotte, NC 28201-1414

Our Corporate Secretary will distribute communications to the Board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, the Board has requested that certain items that are unrelated to the duties and responsibilities of the Board be excluded, such as spam, junk mail and mass mailings, service complaints, resumes, and other forms of job inquiries, surveys, and business solicitations or advertisements. In addition, material that is unduly hostile, threatening, obscene or similarly unsuitable will be excluded. However, any communication that is so excluded remains available to any director upon request.

Corporate Governance Committee

Michael G. Browning, Chair

Daniel R. DiMicco

William E. Kennard

E. Marie McKee

28 DUKE ENERGY – 2020 Proxy Statement

DIRECTOR COMPENSATION

Our director compensation program is designed to attract and retain highly qualified directors and align their interests with those of our shareholders. We compensate directors who are not employed by Duke Energy with a combination of cash and equity awards, along with certain other benefits as described below. Ms. Good receives no compensation for her service on the Board.

The Compensation Committee annually reviews the director compensation program and recommends proposed changes for approval by the Board. As part of this review, the Compensation Committee considers the significant amount of time expended, and the skill level required, by each director not employed by Duke Energy in fulfilling his or her duties on the Board, each director's role and involvement on the Board and its committees, and the market compensation practices and levels of our peer companies.

During its annual review of the director compensation program in 2019, the Compensation Committee considered an analysis prepared by its independent consultant, FW Cook, which summarized director compensation trends for independent directors and pay levels at the same peer companies used to evaluate the compensation of our NEOs. Following this review, and after considering the advice of FW Cook about market practices and pay levels, the Compensation Committee did not recommend any changes to our director compensation program.

For 2019, our director compensation program consisted of the following:

| Type of Fee | | Amount ($) | | |

|---|---|---|---|---|

| | | | | |

Annual Board Retainer (cash) | | 125,000 | | |

Annual Board Retainer (stock) | | 160,000 | | |

Annual Board Chair Retainer (if applicable) | | 100,000 | | |

Annual Lead Director Retainer (if applicable) | | 40,000 | | |

Annual Audit Committee Chair Retainer | | 25,000 | | |

Annual Compensation Committee and Operations and Nuclear Oversight Committee Chair Retainers | | 20,000 | | |

Annual Chair Retainer (other committees) | | 15,000 | | |

Additional Cash Retainer Opportunity* | | 10,000 | | |

Board Meeting Fees | | n/a | | |

| | | | | |

Annual Board Stock Retainer for 2019. In 2019, each eligible director received the portion of his or her annual retainer that was payable in stock in the form of fully vested shares. The stock retainer was granted under the Duke Energy Corporation 2015 Long-Term Incentive Plan that was approved by our shareholders and contains an annual limit on equity awards of $400,000 to any director not employed by Duke Energy.

Deferral Plan and Stock Purchases. Directors may elect to receive all or a portion of their annual cash compensation on a current basis or defer such compensation under the Directors' Savings Plan. Deferred amounts are credited to an unfunded account, the balance of which is adjusted for the performance of phantom investment options, including the Duke Energy common stock fund, as elected by the director, and generally are paid when the director terminates his or her service from the Board.

Charitable Giving Program. The Duke Energy Foundation, independent of Duke Energy, maintains the Duke Energy Foundation Matching Gifts Program under which directors and employees generally are eligible to request matching contributions of up to $5,000 per director or employee per calendar year to qualifying institutions. In addition, Duke Energy made a $2,500 donation to designated charities on behalf of the independent directors who retired from the Board of Directors during 2019, as well as a $1,000 donation to the American Red Cross in November 2019 on behalf of each of the directors not employed by Duke Energy who were actively serving at that time.

Expense Reimbursement and Insurance. Duke Energy provides travel insurance to directors and reimburses directors for expenses reasonably incurred in connection with attendance and participation at Board and committee meetings and special functions.

Stock Ownership Guidelines. Directors are subject to stock ownership guidelines, which establish a minimum level of ownership of Duke Energy common stock (or common stock equivalents). Currently, each director not employed by Duke Energy is required to own shares with a value equal to at least five times the annual Board cash retainer (i.e., an ownership level of $625,000) or retain 50% of his or her vested annual equity retainer. All directors were in compliance with the guidelines as of December 31, 2019.

DUKE ENERGY – 2020 Proxy Statement 29

DIRECTOR COMPENSATION

The following table describes the compensation earned during 2019 by each individual, other than Ms. Good, who served as a director during 2019.