- DUK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Duke Energy (DUK) DEF 14ADefinitive proxy

Filed: 23 Mar 21, 8:56am

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material under §240.14a-12 | |

DUKE ENERGY CORPORATION | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| | | | | |

| (2) | Aggregate number of securities to which transaction applies: | |||

| | | | | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| | | | | |

| (4) | Proposed maximum aggregate value of transaction: | |||

| | | | | |

| (5) | Total fee paid: | |||

| | | | | |

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| | | | | |

| (2) | Form, Schedule or Registration Statement No.: | |||

| | | | | |

| (3) | Filing Party: | |||

| | | | | |

| (4) | Date Filed: | |||

| | | | | |

Welcome to the Duke Energy

Annual Meeting

of Shareholders

March 23, 2021

Dear Fellow Shareholders:

I am pleased to invite you to Duke Energy's Annual Meeting to be held on Thursday, May 6, 2021, at 12:30 p.m. Eastern time. We look forward to updating you at the Annual Meeting on our strategy and areas of focus and progress in 2020, as well as plans for the future of Duke Energy.

This past year has produced challenges for our Company, customers, and communities unlike any other we have seen. However, I am proud to say that Duke Energy rose to the occasion. We took steps throughout the pandemic to support our customers and communities when they needed us the most – without any layoffs or furloughs of our employees. We also produced exceptional results and continued to work toward our goals.

Our path forward has a clear destination: achieve net-zero carbon emissions from electricity generation by 2050. To meet this target, we are executing a more aggressive clean energy strategy that is transforming how we generate power, improve our energy infrastructure, and support our customers. Foundational to our efforts are safety, operational excellence, and a diverse and inclusive workforce.

This proxy statement contains information about our Board's oversight of Duke Energy's strategy, performance, and risks, as well as our ESG practices. It also describes the outreach we have had in the past year with you – our fellow shareholders – and how that feedback has influenced the work that we are doing at Duke Energy.

Annual Meeting Details

This year's Annual Meeting will once again be held exclusively via live webcast. This will be the fourth year we have held our Annual Meeting via live webcast. The online format has successfully expanded our ability to connect with shareholders from all over the world while still providing you the same opportunities to vote and ask questions that you would have had at an in-person meeting, including by submitting questions in writing in advance of the Annual Meeting on our pre-meeting forum at proxyvote.com. An audio broadcast of the Annual Meeting will also be available by phone toll-free at 866.548.4713, confirmation code 7210509. Details regarding how to participate in the Annual Meeting via live webcast, as well as the items to be voted on, are described in the accompanying Notice of Annual Meeting of Shareholders, "Rules of Conduct for the Annual Meeting" on page 1 of the Proxy Summary, and in the "Frequently Asked Questions and Answers About the Annual Meeting" on page 78 of this proxy statement.

Please review this proxy statement prior to casting your vote as it contains important information relating to the business of the Annual Meeting. Page 79 contains instructions on how you can vote your shares online, by phone, or by mail. We encourage you to vote and share your feedback with us, and hope you can participate in the Annual Meeting.

Thank you for your continued investment in Duke Energy.

Sincerely,

Lynn J. Good

Chair, President and CEO

![]()

Letter from the Board of Directors

Dear Fellow Shareholders:

It is our great honor to serve as independent members of the Board with our Chair, President and CEO, Lynn Good, who has skillfully positioned Duke Energy as a leader while the utility industry navigates rapid changes. We are a diverse, engaged, and experienced group of directors who are deeply committed to sound corporate governance, human capital management, executive compensation, and risk management policies and practices to ensure that Duke Energy operates responsibly and efficiently and achieves long-term sustainable value for our fellow shareholders. The varied perspectives of this Board allow us to actively oversee the most important issues facing Duke Energy.

Since the 2020 Annual Meeting, the world and the Company have faced historic challenges. Throughout these challenges, the Board has focused on the key risk areas for the Company, including safe operations for our employees, customers, and communities; managing regulatory risks; fostering a culture of ethics and compliance, and diversity, equity, and inclusion; and ensuring that cyber and physical security is always top of mind for all employees. The Board has also overseen Duke Energy's continued progress on its clean energy transition, leading to the adoption of a new goal to reach net-zero methane emissions from our natural gas distribution business by 2030 to further bolster the Company's previous commitments to reduce carbon emissions from electricity generation by at least 50% from 2005 levels by 2030 and to reach net-zero carbon emissions from electricity generation by 2050.

In 2020, we also continued our annual shareholder engagement program, reaching out to holders of over one-third of our outstanding common shares in the spring and fall. We held numerous conversations with shareholders and stakeholders outside of our shareholder engagement program, and the feedback we have gathered from these engagements has helped the Board shape our policies, practices, and disclosures.

We look forward to continuing our dialogue with shareholders at the 2021 Annual Meeting, and thank you for your continued support.

Sincerely,

| Michael G. Browning Annette K. Clayton Theodore F. Craver, Jr. Robert M. Davis | Daniel R. DiMicco Nicholas C. Fanandakis John T. Herron William E. Kennard | E. Marie McKee Marya M. Rose Thomas E. Skains William E. Webster, Jr. |

![]()

| Notice of 2021 Annual Meeting of Shareholders |  |

| Items of Business | Board's Voting Recommendation | |||

|---|---|---|---|---|

| 1 | Election of Directors | | ||

| 2 | Ratification of Deloitte & Touche LLP as Duke Energy's independent registered public accounting firm for 2021 | |||

| 3 | Advisory vote to approve Duke Energy's named executive officer compensation | | ||

| 4 | Amendment to the Amended and Restated Certificate of Incorporation of Duke Energy Corporation to eliminate supermajority requirements | |||

| 5 | Two shareholder proposals, if properly presented at the meeting | | ||

| 6 | Any other business that may properly come before the meeting (or any adjournment or postponement of the meeting) | |||

| Vote Now | ||

By Internet | By Mailing Your Proxy Card | |

|  | |

| Visit 24/7 proxyvote.com | Cast your vote, sign your proxy card, and mail free of postage | |

By Phone | Participate in the Annual Meeting | |

| ||

| Call toll free 24/7 at 800.690.6903 or by calling the number provided by your broker, bank, or other nominee if your shares are not registered in your name | You will need the 16-digit control number, which can be found on your Notice, on your proxy card, and on the instructions that accompany your proxy materials | |

Meeting Date: May 6, 2021

Record Date: March 8, 2021

Only holders of record of Duke Energy common stock as of the close of business on the record date are entitled to participate in, vote, and ask questions at the Annual Meeting.

Webcast: duke-energy.onlineshareholdermeeting.com

To participate in the Annual Meeting via live webcast at duke-energy.onlineshareholdermeeting.com, you will need the 16-digit control number, which can be found on your Notice, on your proxy card, and on the instructions that accompany your proxy materials. Those who are not shareholders as of the record date may view the Annual Meeting as guests.

The Annual Meeting will begin promptly at 12:30 p.m. Eastern time. Online check-in will begin at 12:00 p.m. Eastern time.

Audio Broadcast:

Shareholders and guests may also listen to an audio broadcast of the Annual Meeting by phone toll free at 866.548.4713, confirmation code 7210509.

Pre-Meeting Information:

On our pre-meeting forum at proxyvote.com, shareholders of record can submit questions in writing in advance of the Annual Meeting, access copies of proxy materials, and vote. Because we will be providing our proxy materials to our shareholders electronically, most of our shareholders will receive only the Notice containing instructions on how to access the proxy materials electronically and vote online, by phone, or by mail. If you would like to request paper copies of the proxy materials, you may follow the instructions on your Notice.

| Dated: March 23, 2021 | By order of the Board of Directors, | |

| ||

Kodwo Ghartey-Tagoe Executive Vice President, Chief Legal Officer and Corporate Secretary |

| | |

DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

RULES OF CONDUCT FOR THE ANNUAL MEETING

Duke Energy strives to provide our shareholders at the online-only Annual Meeting the same rights that they would have had at an in-person meeting and an enhanced opportunity for participation and discourse.

GLOSSARY OF TERMS

To enhance the readability of this year's proxy statement, we added a Glossary of Terms beginning on page 83, which includes all defined terms in this proxy statement.

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 1 |

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all the information that you should consider. You should read the entire proxy statement carefully before voting. Page references and website addresses are supplied to help you find additional information in this proxy statement and elsewhere. Information provided on websites linked to this proxy statement is not incorporated by reference into this proxy statement.

Who We Are |

| Headquartered in Charlotte, North Carolina, Duke Energy is one of the largest energy holding companies in the United States, providing electricity to 7.9 million retail electric customers in six states and natural gas distribution services to 1.6 million customers in five states. We have approximately 51,000 megawatts of electric generating capacity in North Carolina, South Carolina, the Midwest, and Florida, and 2,800 megawatts of generating capacity through our commercial renewables business, which owns and operates diverse power generation assets in North America, including a portfolio of renewable wind, solar, energy storage, and microgrid projects. More information about Duke Energy is available on our website at duke-energy.com. |  |

Voting Information |

| | | Broker Non-Votes* | Abstentions | Votes Required for Approval | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| Proposal 1: Election of Directors (page 10) | Do not count | Do not count | Majority of votes cast, with a resignation policy | |||||

| | | | | | | | | |

| Proposal 2: Ratification of Deloitte & Touche LLP as Duke Energy's Independent Registered Public Accounting Firm for 2021 (page 34) | Brokers have discretion to vote | Vote against | Majority of shares represented | |||||

| | | | | | | | | |

| | Proposal 3: Advisory Vote to approve Duke Energy's named executive officer compensation (page 36) The Board recommends you vote FOR this proposal | Do not count | Vote against | Majority of shares represented | ||||

| | | | | | | | | |

| Proposal 4: Amendment to the Amended and Restated Certificate of Incorporation of Duke Energy Corporation to eliminate supermajority requirements (page 71) The Board recommends you vote FOR this proposal | Do not count | Vote against | 80% of shares outstanding | |||||

| | | | | | | | | |

| | Shareholder Proposals 5 - 6: (page 72) The Board recommends you vote AGAINST each shareholder proposal | Do not count | Vote against | Majority of shares represented | ||||

| | | | | | | | | |

| | |

2 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

PROXY SUMMARY

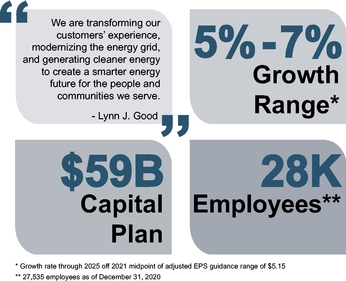

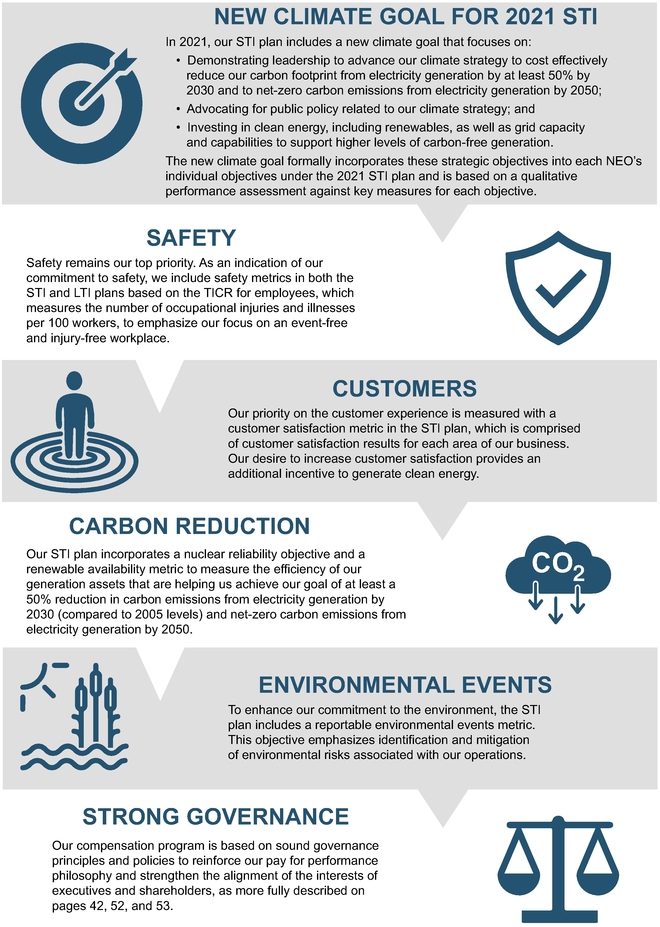

Our Strategy |

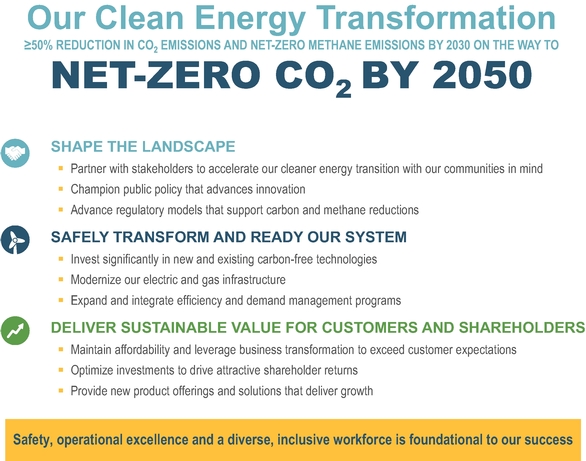

Duke Energy is working to create a smarter energy future for the people and communities it serves. Our business strategy is focused on safely transforming and readying our system by investing in new and existing carbon-free technology, modernizing our gas and electric infrastructure, and expanding and integrating efficiency and demand management programs.

In the past two years, we have set ambitious climate goals that are aligned with this strategy and will help us drive it forward. In 2019, Duke Energy set a goal to reach net-zero carbon emissions from electricity generation by 2050, and in 2020 we set another goal to reach net-zero methane emissions from our natural gas distribution business by 2030. To achieve these major milestones, we are working to shape the landscape by partnering with stakeholders, championing public policy that advances innovation, and advancing regulatory models that support carbon and methane reductions.

As we work to transition our business to clean energy, we are focused on delivering sustainable value for our customers and shareholders, by maintaining affordability and leveraging business transformation to exceed customer expectations, optimizing investments to drive attractive shareholder returns, and providing new product offerings and solutions that deliver growth.

Fundamental to accomplishing this strategy is safety, operational excellence, and a diverse and inclusive workforce.

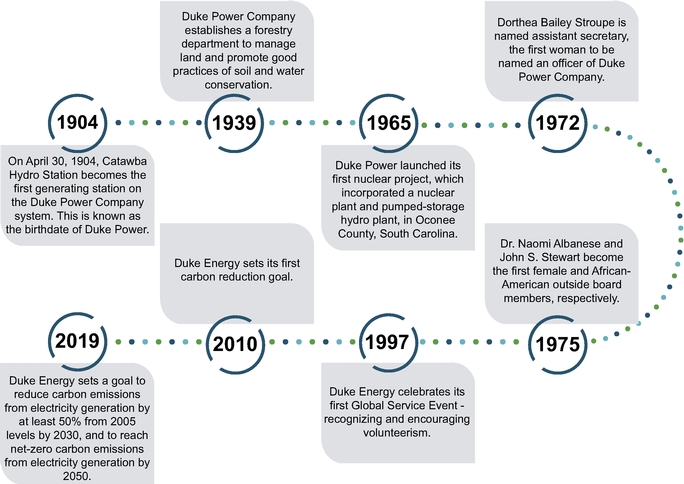

Our History |

Duke Energy has been powering the lives of our customers and communities for more than a century and has been at the forefront of new beginnings. And while we are investing in the future, we will never forget the people and the events that got us where we are today.

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 3 |

PROXY SUMMARY

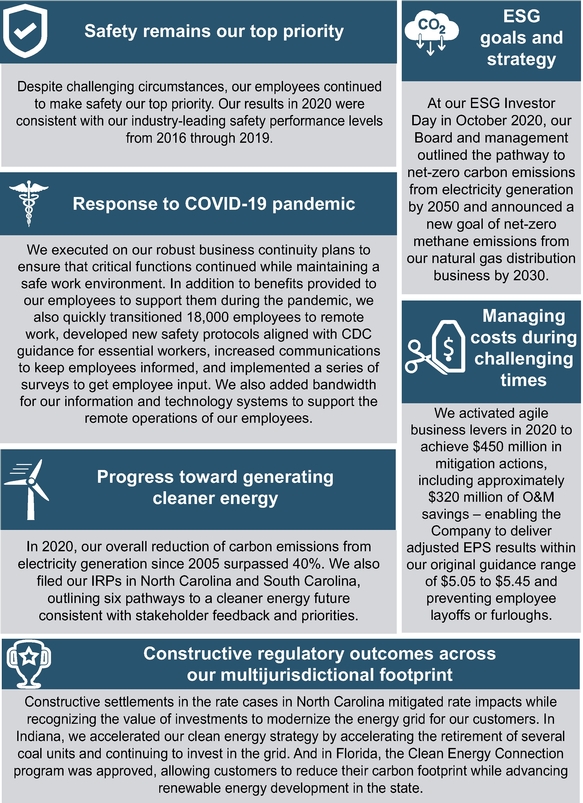

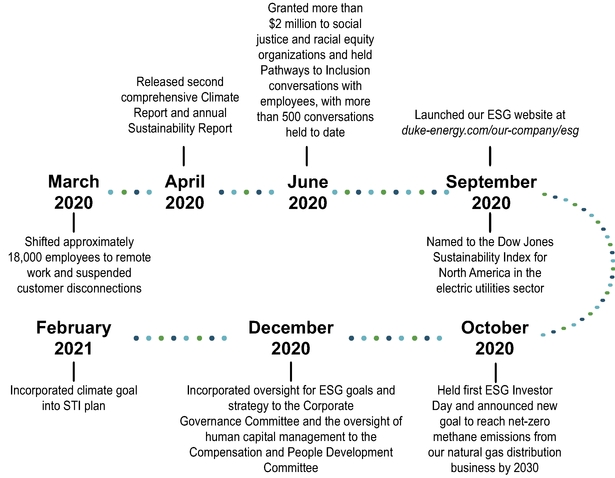

Highlights Since the 2020 Annual Meeting (page 39) |

| | |

4 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

PROXY SUMMARY

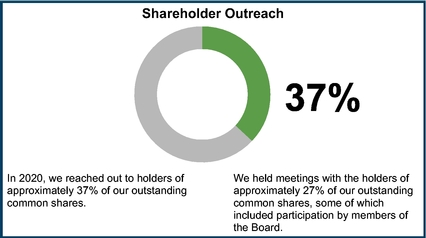

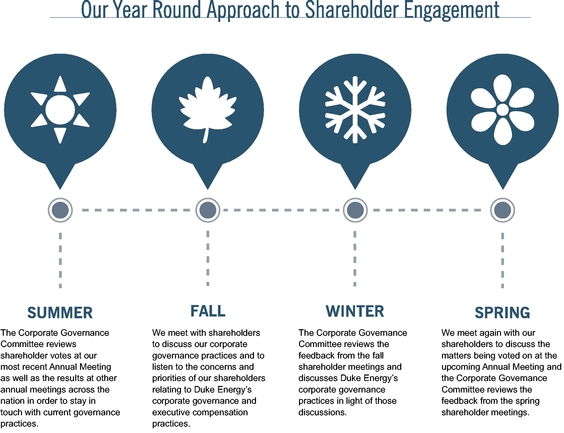

Shareholder Engagement Highlights (pages 22 and 37)

| As part of our commitment to corporate governance, we have a track record of engaging with shareholders year round to discuss and respond to their feedback. |  |

The agenda for these conversations spanned a variety of topics:

| 1 | Board oversight and composition, including diversity and skills | 2 | Our strategic vision, including our goal to reach net-zero carbon emissions from electricity generation by 2050 | 3 | Our operational priorities and response to the pandemic | |||||||||||

| 4 | Our commitment to, and progress on, ESG issues | 5 | Our human capital management and diversity and inclusion initiatives | 6 | Our executive compensation program |

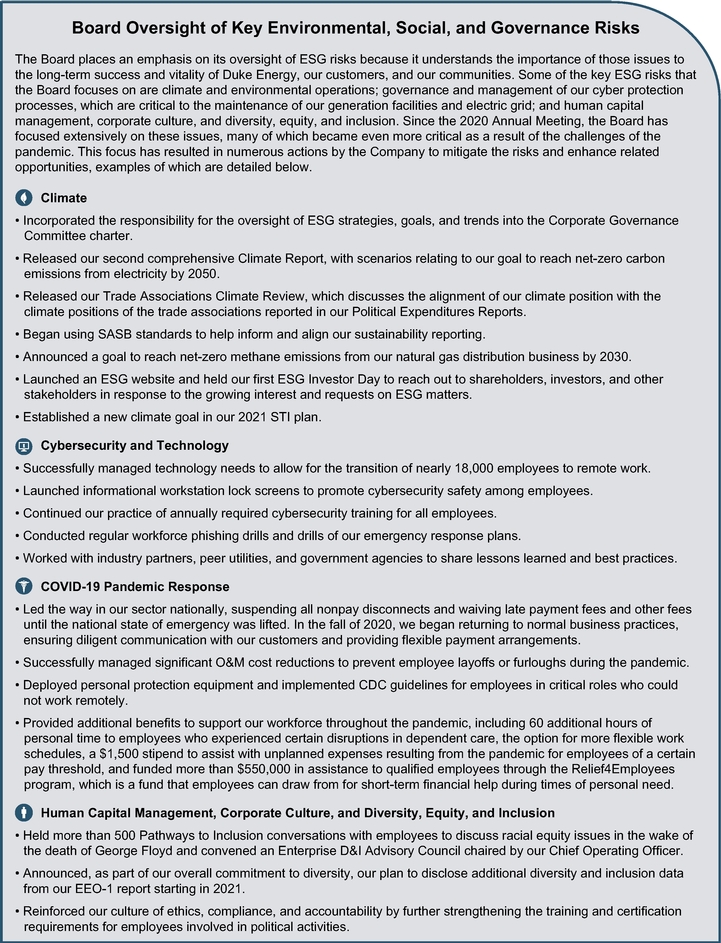

Environmental, Social, and Governance Highlights

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 5 |

PROXY SUMMARY

Corporate Governance Highlights (page 27)

| Independence | | • Independent Lead Director with clearly defined role and responsibilities • Independent Board committees • Independent directors meet in executive session at each regularly scheduled Board meeting | ||

| | | | | |

| Shareholder Rights | | • Ability for shareholders to nominate directors through proxy access • Robust year round shareholder engagement program, including director involvement • Ability for shareholders to take action by less than unanimous written consent • Ability for shareholders to call a special shareholder meeting • Board responsiveness to majority support of shareholder proposals • Each share of common stock is equal to one vote | ||

| | | | | |

| Good Governance Practices | | • Majority voting for directors with mandatory resignation policy and plurality carve out for contested elections • Annual Board, committee, and director assessments • Clearly defined environmental and social initiatives and goals • Annual election of all directors • Policy to prohibit all hedging and pledging of corporate securities • Regular Board refreshment |

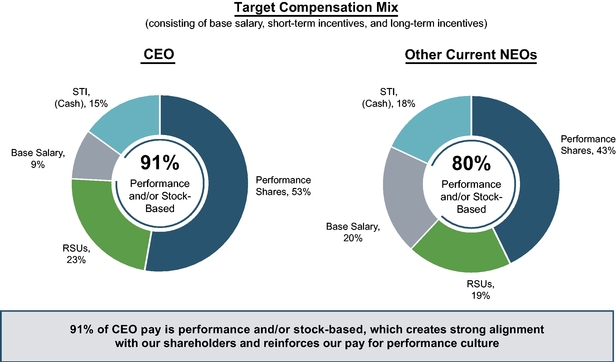

Executive Compensation Highlights (page 37)

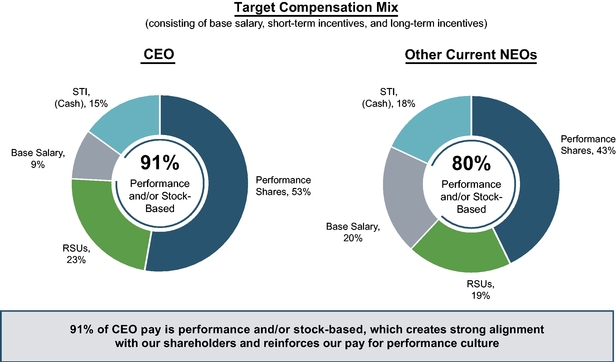

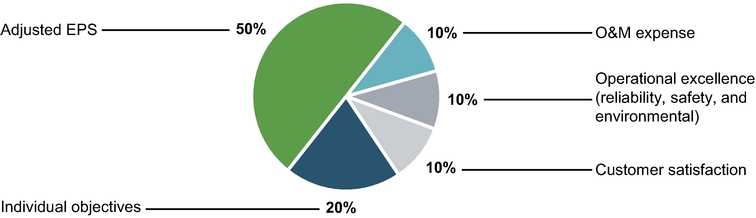

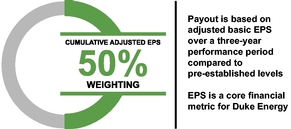

Our executive compensation program is designed to:

| 1 | Link Pay to Performance | 2 | Attract and Retain talented executive officers and key employees | 3 | Emphasize Performance-Based Compensation to motivate executives and key employees |

| | 4 | | Reward Individual Performance | | | 5 | | Encourage Long-Term Commitments to Duke Energy and align the interests of executives with shareholders |

We meet these objectives through the appropriate mix of compensation, including base salary, short-term and long-term incentives, consisting of performance shares and RSUs.

| COMPENSATION COMPONENTS | ||||||

| | | | | | | |

| Base salary | STI | LTI | ||||

| | | | | | | |

| Link pay to performance | | | | |||

| | | | | | | |

| Attract and retain talented executives and key employees | ||||||

| | | | | | | |

| Emphasize performance-based compensation to motivate executives and key employees | | | | |||

| | | | | | | |

| Reward individual performance | ||||||

| | | | | | | |

| Encourage long-term commitment to Duke Energy and align the interests of executives with shareholders | | | | |||

| | | | | | | |

| | |

6 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

PROXY SUMMARY

Key Compensation Features

Following are key features of our executive compensation program:

| | | | | | | |

| AT DUKE ENERGY WE... | | AT DUKE ENERGY WE DO NOT... | ||||

| | | | | | | |

| | Integrate key performance metrics in our incentive plans relating to environmental, climate, safety, human capital management, and customer initiatives | | | | Provide tax gross-ups to NEOs | |

| | Require significant stock ownership, including 6x base salary for our CEO and 3x base salary for other NEOs | | | Permit hedging or pledging of Duke Energy securities | ||

| | | Maintain a stock retention policy | | | | Provide "single trigger" vesting of stock awards upon a change in control |

| | Tie equity and cash-based incentive compensation to a clawback policy | | | Provide employment agreements to a broad group | ||

| | | Use an independent compensation consultant retained by and reporting directly to the Compensation and People Development Committee to advise on compensation matters | | | | Encourage excessive or inappropriate risk-taking through our compensation program |

| | Review tally sheets on an annual basis | | | Provide excessive perquisites | ||

| | | Consider shareholder feedback and the prior year's "say-on-pay" vote | | | | Provide dividend equivalents on unearned performance shares |

| | Require that equity awards must be subject to a one-year minimum vesting period, subject to limited exceptions | | | |||

| | | Disclose performance targets for the performance share cycle granted in the most recent year | | | | |

| | | | | | | |

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 7 |

PROXY SUMMARY

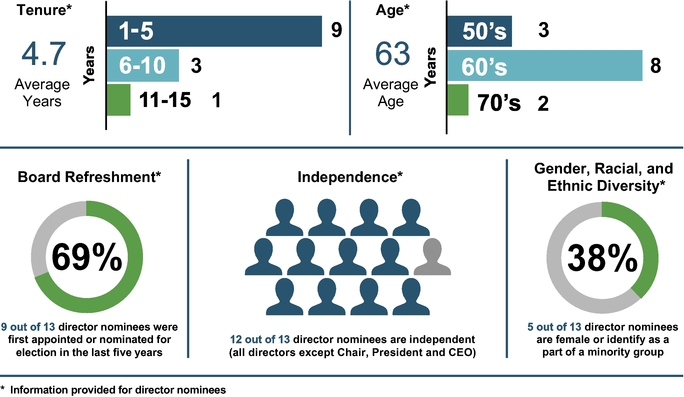

Our Board Nominees (page 10)

Our Board regularly and diligently reviews its composition to ensure that its collective membership has the skills to meet needs of our business and reflects a diversity of perspectives and experiences. All nominees have the highest level of professional integrity.

| Committee Memberships (C: Chair) | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Name Independence, Age, Tenure Position(1) | Gender (G), Racial or Ethnically (R&E) Diverse | Other Public Boards | Audit | Compensation and People Development | Corporate Governance | Finance and Risk Management | Operations and Nuclear Oversight | Regulatory Policy | ||||||||||

| | | | | | | | | | | | | | | | | | | |

| Michael G. Browning Independent Lead Director, 74, 2006 Chairman, Browning Consolidated | None | | · | C | | | · | |||||||||||

| | | | | | | | | | | | | | | | | | | |

| Annette K. Clayton Independent, 57, 2019 President and CEO, North America Operations, Schneider Electric SA | G | Polaris Industries Incorporated | · | | | | · | | ||||||||||

| | | | | | | | | | | | | | | | | | | |

| Theodore F. Craver, Jr. Independent, 69, 2017 Retired Chairman, President and CEO, Edison International | Wells Fargo & Company | C | | | | | · | |||||||||||

| | | | | | | | | | | | | | | | | | | |

| Robert M. Davis Independent, 54, 2018 CFO and Executive Vice President, Global Services, Merck | None | | · | | · | | | |||||||||||

| | | | | | | | | | | | | | | | | | | |

| Caroline Dorsa Independent, 61, N/A(2) Retired Executive Vice President and CFO, Public Service Enterprise Group Incorporated | G | Biogen Inc., Illumina, Inc. and Intellia Therapeutics, Inc. | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | |

| W. Roy Dunbar Independent, 59, N/A(2) Retired Chairman and CEO of Network Solutions, LLC | R&E | Johnson Controls International, PLC and SiteOne Landscape Supply, Inc. | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | |

| Nicholas C. Fanandakis Independent, 64, 2019 Retired Executive Vice President, DuPont de Nemours, Inc. (fka DowDuPont, Inc.) | FTI Consulting, Inc. and ITT Inc. | · | | | · | | | |||||||||||

| | | | | | | | | | | | | | | | | | | |

| Lynn J. Good Executive Director, 61, 2013 Chair, President and CEO, Duke Energy Corporation | G | The Boeing Company | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | |

| John T. Herron Independent, 67, 2013 Retired President, CEO and Chief Nuclear Officer, Entergy Nuclear | None | | | | · | C | | |||||||||||

| | | | | | | | | | | | | | | | | | | |

| E. Marie McKee Independent, 70, 2012 Retired Senior Vice President, Corning Incorporated | G | None | | C | · | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | |

| Michael J. Pacilio Independent, 60, N/A(2) Retired Executive Vice President and Chief Operating Officer, Exelon Generation, Exelon Corp. | None | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | |

| Thomas E. Skains Independent, 64, 2016 Retired Chairman, President and CEO, Piedmont Natural Gas Company, Inc. | National Fuel Gas Company and Truist Financial Corporation | | | | · | | C | |||||||||||

| | | | | | | | | | | | | | | | | | | |

| William E. Webster, Jr. Independent, 67, 2016 Retired Executive Vice President, Institute of Nuclear Power Operations | None | · | | | | · | | |||||||||||

| | | | | | | | | | | | | | | | | | | |

| | |

8 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

PROXY SUMMARY

Our Board Composition

Diversity of Skills, Qualifications, and Experience

Our Board exhibits a diverse range of skills and experience that collectively creates a well-rounded perspective suitable to protecting the interests of shareholders. The table below denotes the areas of expertise we value and the number of directors with that expertise or experience.

| | | | | |

| Customer Service experience is important as Duke Energy focuses on meeting customer expectations and transforming the customer experience. | 9 | |||

| | | | | |

| Cybersecurity/Technology experience is important in overseeing the security of Duke Energy's business and operational technical systems, including customer experience, financial systems, and internal and grid operations. | 8 | |||

| | | | | |

| Environmental experience is important in analyzing and responding to Duke Energy's risks from climate change and transition to clean energy, as well as in assessing Duke Energy's environmental compliance obligations and operations. | 9 | |||

| | | | | |

| Human Capital Management experience is important in overseeing the needs of our workforce – Duke Energy's most critical resource. | 5 | |||

| | | | | |

| Industry experience is important in understanding the unique technical, regulatory, and financial aspects of the utility industry. | 9 | |||

| | | | | |

| Legal experience is important in understanding Duke Energy's legal risks and obligations. | 2 | |||

| | | | | |

| Regulatory/Government experience is important in understanding the regulated nature of the utility industry. | 10 | |||

| | | | | |

| Risk Management experience is important in overseeing a myriad of risks, including operational, financial, strategic, and reputational risks that affect our business. | 12 | |||

| | | | | |

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 9 |

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors |

The Corporate Governance Committee, comprised of only independent directors, has recommended, and the Board has approved, the individuals discussed on pages 11 through 17 as nominees for election to serve on the Board. The nominees include 10 of our current directors and three new nominees, Caroline Dorsa, W. Roy Dunbar, and Michael J. Pacilio, who the Board recommended because of their diversity, skills, and background, which will aid the Board in overseeing the Company's strategy. Each of the new nominees was identified by an independent search firm.

We have a declassified Board, which means all the directors are voted on every year at the Annual Meeting. If any director is unable to stand for election, the Board may reduce the number of directors or designate a substitute. In that case, shares represented by proxies may be voted for a substitute director. We do not expect that any nominee will be unavailable or unable to serve.

Our Principles for Corporate Governance includes a director tenure policy in addition to a retirement policy, which is described in more detail on page 27 of this proxy statement. Pursuant to this policy, Daniel R. DiMicco will be retiring at the 2021 Annual Meeting. In addition to the retirement of Mr. DiMicco, two other directors, William E. Kennard and Marya M. Rose, each decided not to sit for nomination at the 2021 Annual Meeting due to increased external business and personal commitments. We appreciate the contributions of Mr. DiMicco, Mr. Kennard, and Ms. Rose during their service to Duke Energy.

Majority Voting for the Election of Directors

Under Duke Energy's By-Laws, in an uncontested election at which a quorum is present, a director-nominee will be elected if the number of votes cast "FOR" the nominee's election exceeds the number of votes cast as "WITHHOLD" from that nominee's election. Abstentions and broker non-votes do not count. In addition, Duke Energy has a resignation policy in our Principles for Corporate Governance, which requires an incumbent director who has more votes cast as "WITHHOLD" from that nominee's election than votes cast "FOR" his or her election to tender his or her letter of resignation for consideration by the Corporate Governance Committee.

In contested elections, directors will be elected by plurality vote. For purposes of the By-Laws, a "contested election" is an election in which the number of nominees for director is greater than the number of directors to be elected.

| | |

10 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

PROPOSAL 1: ELECTION OF DIRECTORS

Biographical Information, Skills, and Qualifications of our Board Nominees

| Michael G. Browning | ||||

| | | | | |

| Independent Director Nominee Independent Lead Director | ||||

| Age: 74 Director of Duke Energy since 2006 Principal, Browning Consolidated, LLC | Committees: • Compensation and People Development Committee • Corporate Governance Committee (Chair) • Regulatory Policy Committee Other current public directorships: • None | ||

Mr. Browning currently serves as Chairman of MGB Holdings, Inc. operating as owner, general partner, and managing member of various real estate entities. He is also Principal of Browning Consolidated, a real estate development firm, and was Chairman of the Board of Browning Consolidated from 1981 until November 2019. Mr. Browning is a former director of Standard Management Corporation, Conseco, Inc., and Indiana Financial Corporation. Mr. Browning has served as Independent Lead Director since January 1, 2016. | ||||

Skills and qualifications:

Mr. Browning's qualifications for election include his management experience, as well as his knowledge and understanding of customers' needs in Duke Energy's Midwest service territory gained during his long career as the Chairman of Browning Consolidated, a real estate development firm located in Indiana. Mr. Browning's financial and investment expertise adds a valuable perspective to the Board and its committees.

| Annette K. Clayton | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 57 Director of Duke Energy since 2019 President and CEO, North America Operations, Schneider Electric SA | Committees: • Audit Committee • Operations and Nuclear Oversight Committee Other current public directorships: • Polaris Industries Incorporated | ||

Ms. Clayton has been President and CEO of the North America Operations of Schneider Electric, a global electrical equipment manufacturer, and a member of the Executive Committee since June 2016. She also served as Chief Supply Chain Officer from June 2016 until January 2019. From May 2011 to June 2016, she served as Executive Vice President of Schneider Electric and a Member of the Executive Committee, Hong Kong. Prior to her employment at Schneider Electric, Ms. Clayton served at Dell, Inc. as Vice President of Global Supply Chain Operations and Vice President of Dell Americas operations, and at General Motors as President of their Saturn subsidiary, Corporate Vice President of Global Quality, and a member of their strategy board. | ||||

Skills and qualifications:

Ms. Clayton's qualifications for election include her experience as senior management of Schneider Electric overseeing the strategic direction and financial accountability of the company's North America operations. In her role as President and CEO of Schneider Electric's North America Operations, she has gained experience in customer service through her direct responsibility for the customer call centers, in cybersecurity and technology through Schneider Electric's work with the government on cybersecurity infrastructure, and the digital transformation of their supply chain, and in environmental and regulatory matters through her oversight of Schneider Electric's Safety and Environment function. She also has human capital management experience through her work on talent management initiatives, succession planning, and supply chain workforce planning at Schneider Electric. These skills uniquely fit the skill sets that benefit Duke Energy in our corporate strategy.

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 11 |

PROPOSAL 1: ELECTION OF DIRECTORS

| Theodore F. Craver, Jr. | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 69 Director of Duke Energy since 2017 Retired Chairman, President and CEO, Edison International | Committees: • Audit Committee (Chair) • Regulatory Policy Committee Other current public directorships: • Wells Fargo & Company | ||

Mr. Craver was Chairman, President and CEO of Edison International, the parent company of a large California utility and various competitive electric businesses, from 2008 until his retirement in 2016. From 2005 to 2007, Mr. Craver served as CEO of Edison Mission Energy, a subsidiary of Edison International. Prior to his appointment as CEO of Edison Mission Energy, Mr. Craver served as CFO of Edison International from 2000 to 2004. He started at Edison International in 1996 after leaving First Interstate Bancorp where he was Executive Vice President and Corporate Treasurer. Mr. Craver is a former member of the ESCC, the organization that is the principal liaison between the federal government and the electric power sector responsible for coordinating efforts to prepare for, and respond to, national-level disasters or threats to critical infrastructure. Mr. Craver currently serves as a Senior Advisor to Blackstone's Global Infrastructure Fund and as a Senior Advisor to Bain & Company. He is also a member of the Economic Advisory Council of the Federal Reserve Bank of San Francisco, on the Board of Advisors of Mobility Impact Partners, and, in 2019, joined the Advisory Board of the Center on Cyber and Technology Innovation, which is a research institute focusing on national security and foreign policy. | ||||

Skills and qualifications:

Mr. Craver's qualifications for election include his experience as CEO of Edison International, which gives him in-depth knowledge of the utility industry and the regulatory arena, including environmental regulations, as well as his financial and risk management experience obtained as a CFO at Edison International, and at First Interstate Bancorp as the Chair of the Asset and Liability Committee, which was responsible for the oversight of risk management within the organization. Mr. Craver's experience in the industry also gives him a keen awareness of the needs of utility customers during this time of industry change. In addition, Mr. Craver's experience with grid cybersecurity as a member of the Steering Committee of the ESCC and as a member of the Advisory Board of the Center on Cyber and Technology Innovation gives him insight into this crucial area for Duke Energy. In 2018, he earned the CERT Certificate in Cybersecurity Oversight from the National Association of Corporate Directors.

| | |

12 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

PROPOSAL 1: ELECTION OF DIRECTORS

| Robert M. Davis | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 54 Director of Duke Energy since 2018 CFO and Executive Vice President, Global Services, Merck | Committees: • Compensation and People Development Committee • Finance and Risk Management Committee Other current public directorships: • None | ||

Mr. Davis has been CFO since April 2014 and CFO and Executive Vice President, Global Services since 2016 for Merck, a global health care company that provides prescription medicines, vaccines, and other health solutions. In February 2021, Merck announced that Mr. Davis would become President of Merck effective April 1, 2021, and CEO and a member of the Merck board of directors effective July 1, 2021. Prior to Merck, Mr. Davis worked for Baxter International, Inc. as Corporate Vice President and President of Medical Products from 2010 to 2014, Corporate Vice President and President of Baxter International's renal business in 2010, Corporate Vice President and CFO from 2006 to 2010, and Treasurer from 2004 to 2006. Mr. Davis previously served on the board of directors of C.R. Bard until its merger with Becton, Dickinson and Company in December 2017. | ||||

Skills and qualifications:

Mr. Davis' qualifications for election include his significant experience in regulatory matters, finance, and risk management obtained during his service as the CFO of Merck, where enterprise risk management and finance are within his areas of responsibility, as well as his prior experience gained in a variety of management and finance roles at Baxter International. Mr. Davis' legal knowledge, obtained when he earned his Doctor of Jurisprudence, adds additional insight to the Board's discussions of legal and risk issues. Mr. Davis also has significant experience with technology and cybersecurity as a result of his direct oversight over those areas during his time as CFO of Merck and at Baxter International. Mr. Davis' experience at Merck provides valuable insight into navigating an industry undergoing rapid transformation.

| Caroline Dorsa | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 61 New Director Nominee Retired Executive Vice President and CFO, Public Service Enterprise Group Incorporated | Committees: Not applicable Other current public directorships: • Biogen Inc. • Illumina, Inc. • Intellia Therapeutics, Inc. | ||

Ms. Dorsa served as the Executive Vice President and CFO of Public Service Enterprise Group, a diversified energy company, from April 2009 until her retirement in October 2015, and served on its board of directors from February 2003 to April 2009. She also served in numerous senior management positions at Merck, Gilead Sciences, and Avaya prior to joining Public Service Enterprise Group. | ||||

Skills and qualifications:

Ms. Dorsa's qualifications for election include her financial acumen, her cybersecurity and technology experience, and her understanding of the regulatory and human capital risks in the energy industry, gained during her time at Public Service Enterprise Group, where she served as a member of the board of directors, Executive Vice President and CFO, head of the finance department, and was directly responsible for the information technology and business development groups.

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 13 |

PROPOSAL 1: ELECTION OF DIRECTORS

| W. Roy Dunbar | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 59 New Director Nominee Retired Chairman and CEO of Network Solutions, LLC | Committees: Not applicable Other current public directorships: • Johnson Controls International, PLC • SiteOne Landscape Supply, Inc. | ||

Mr. Dunbar was Chairman and CEO of Network Solutions, a technology company and web service provider, from January 2008 until October 2009. Following his time at Network Solutions, Mr. Dunbar acted as a developer for solar projects. Mr. Dunbar also served as the President of Global Technology and Operations for MasterCard Incorporated from September 2004 until January 2008. Prior to MasterCard, Mr. Dunbar worked at Eli Lilly and Company for 14 years, serving as President of Intercontinental Operations, and earlier as Chief Information Officer. | ||||

Skills and qualifications:

Mr. Dunbar's qualifications for election include his strong leadership skills, his experience and insight into environmental issues and the energy industry during his time as a solar developer, and his deep experience across a number of functional disciplines, including the application of information technology across different business sectors. The variety of these experiences in these areas which are critical to the success of the Company's strategy will make him a uniquely qualified addition to the Board.

| Nicholas C. Fanandakis | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 64 Director of Duke Energy since 2019 Retired Executive Vice President, DuPont de Nemours, Inc. | Committees: • Audit Committee • Finance and Risk Management Committee Other current public directorships: • FTI Consulting, Inc. • ITT Inc. | ||

Mr. Fanandakis is a retired Executive Vice President of DuPont, a holding company with agriculture, materials science, and specialty products businesses. Mr. Fanandakis served as Executive Vice President and CFO at E.I. du Pont de Nemours and Company from 2009 until January 2019 and as Executive Vice President of DuPont until his retirement in July 2019. Prior to 2009, Mr. Fanandakis served in various plant, marketing, product management, and business director roles in the DuPont organization since 1979. | ||||

Skills and qualifications:

Mr. Fanandakis' qualifications for election include his management experience gained during his career in numerous areas of DuPont. In addition to his management experience, Mr. Fanandakis' expertise in finance, tax, banking, and risk management at a company undergoing transformation is an asset to Duke Energy's Board.

| | |

14 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

PROPOSAL 1: ELECTION OF DIRECTORS

| Lynn J. Good | ||||

| | | | | |

| Non-Independent Director Nominee Chair | ||||

| Age: 61 Director of Duke Energy since 2013 Chair, President and CEO, Duke Energy Corporation | Committees: • None Other current public directorships: • The Boeing Company | ||

Ms. Good has served as Chair, President and CEO of Duke Energy since January 1, 2016, and was Vice Chair, President and CEO of Duke Energy from July 2013 through December 2015. She served as Executive Vice President and CFO of Duke Energy from July 2009 through June 2013. | ||||

Skills and qualifications:

Ms. Good is our Chair, President and CEO and was previously our CFO. Her extensive financial and risk management background, as well as her knowledge of the affairs of Duke Energy and our business make her uniquely suited to lead our Board and Duke Energy. Her many years of experience in the utility industry, her knowledge of the associated regulatory issues, technologies, environmental regulations, and customer focus, provide valuable resources for the Board.

| John T. Herron | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 67 Director of Duke Energy since 2013 Retired President, CEO and Chief Nuclear Officer, Entergy Nuclear | Committees: • Finance and Risk Management Committee • Operations and Nuclear Oversight Committee (Chair) Other current public directorships: • None | ||

Mr. Herron was President, CEO and Chief Nuclear Officer of Entergy Nuclear, the nuclear operations of Entergy Corporation, an electric utility, from 2009 until his retirement in 2013. Mr. Herron joined Entergy Nuclear in 2001 and held a variety of positions. He began his career in nuclear operations in 1979 and, through his career, held positions at a number of nuclear stations across the country. Mr. Herron is a director of Ontario Power Generation and also has served on the board of directors of INPO. | ||||

Skills and qualifications:

Mr. Herron's qualifications for election include his knowledge and extensive insight gained as a senior executive in the utility industry, including his three decades of experience in nuclear energy. In addition to his nuclear expertise, during Mr. Herron's career, and particularly during his time as CEO and Chief Nuclear Officer of Entergy Nuclear, he gained significant financial, regulatory, and environmental expertise, as well as an understanding of utility customers. He also obtained risk management expertise, a required skill for those tasked with overseeing the operation of nuclear power plants. Mr. Herron also had direct responsibility for the management of cybersecurity as CEO and Chief Nuclear Officer of Entergy Nuclear.

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 15 |

PROPOSAL 1: ELECTION OF DIRECTORS

| E. Marie McKee | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 70 Director of Duke Energy since 2012 Retired Senior Vice President, Corning Incorporated | Committees: • Compensation and People Development Committee (Chair) • Corporate Governance Committee Other current public directorships: • None | ||

Ms. McKee is a retired Senior Vice President of Corning Incorporated, a manufacturer of components for high-technology systems for consumer electronics, mobile emissions controls, telecommunications, and life sciences. Ms. McKee has over 35 years of experience obtained at Corning, where she held a variety of management positions with increasing levels of responsibility, including Senior Vice President of Human Resources from 1996 until 2010, President of Steuben Glass from 1998 until 2008, and President of The Corning Museum of Glass and The Corning Foundation from 1998 until 2014. | ||||

Skills and qualifications:

Ms. McKee's qualifications for election include her senior management experience in human resources, which provides her with a thorough knowledge of human capital management and compensation practices. Her prior experience as a senior executive of Corning Incorporated has also given her excellent operating skills and an understanding of environmental regulations, technology, and risk management with regard to the manufacturing process, which aids the Board in its oversight of environmental and health and safety matters.

| Michael J. Pacilio | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 60 New Director Nominee Retired Executive Vice President and Chief Operating Officer, Exelon Generation, Exelon Corp. | Committees: • Not applicable Other current public directorships: • None | ||

Mr. Pacilio is a retired Executive Vice President and Chief Operating Officer of Exelon Generation, one of the largest competitive U.S. power generators, with the nation's largest nuclear fleet and a balanced portfolio of natural gas, hydro, wind, and solar generation. Mr. Pacilio has almost 40 years of experience at Exelon, where he held a variety of management positions within Exelon Nuclear and Exelon Generation, including President and Chief Nuclear Officer, and has held numerous leadership roles outside of Exelon, including leading the nuclear sector's response to the Fukushima tsunami, helping to develop national industry equipment on digital equipment and cybersecurity, and roles within INPO, the World Nuclear Association and the Nuclear Energy Institute, where he served on the executive committee of the board of directors. | ||||

Skills and qualifications:

Mr. Pacilio's qualifications for election include his extensive knowledge of the nuclear industry, which relies heavily on an understanding and application of risk management and regulatory expertise. His understanding of the financial, operational, and environmental requirements for carbon-free generation, including nuclear, wind, and solar, will provide valuable insight to the Board as the Company navigates our clean energy transition. In addition, Mr. Pacilio's cybersecurity and technology experience within the industry will be valuable as the Company continues to utilize digital innovation to become more efficient.

| | |

16 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

PROPOSAL 1: ELECTION OF DIRECTORS

| Thomas E. Skains | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 65 Director of Duke Energy since 2016 Retired Chairman, President and CEO, Piedmont Natural Gas Company, Inc. | Committees: • Finance and Risk Management Committee • Regulatory Policy Committee (Chair) Other current public directorships: • National Fuel Gas Company • Truist Financial Corporation | ||

Mr. Skains was Chairman, President and CEO of Piedmont, a regional natural gas distributor, until his retirement in 2016. He served as Chairman of Piedmont from December 2003 until October 2016, CEO from February 2003 until October 2016, and as President from February 2002 until October 2016. Prior to his service as President, Mr. Skains served in various roles, including Chief Operating Officer and as Senior Vice President, Marketing and Supply Services where he directed Piedmont's commercial natural gas activities. | ||||

Skills and qualifications:

Mr. Skains' qualifications for election include his financial and risk management expertise and public company governance and strategy gained during his time as Chairman, President and CEO of Piedmont. His time at Piedmont also provided him with in-depth knowledge of the natural gas industry, the environmental regulations related to the industry, and the needs of natural gas customers, which is helpful to Duke Energy as we expand our natural gas business. His prior experience as a corporate energy attorney also gives Mr. Skains insight on legal and regulatory compliance matters.

| William E. Webster, Jr. | ||||

| | | | | |

| Independent Director Nominee | ||||

| Age: 67 Director of Duke Energy since 2016 Retired Executive Vice President, Institute of Nuclear Power Operations | Committees: • Audit Committee • Operations and Nuclear Oversight Committee Other current public directorships: • None | ||

Mr. Webster was Executive Vice President of Industry Strategy for INPO, a nonprofit organization that promotes the highest levels of safety and reliability in the operation of commercial nuclear power plants, until his retirement in June 2016. Mr. Webster has 34 years of experience obtained at INPO where he held a variety of management positions in the Industry Evaluations, Plant Support, Engineering Support, and Plant Analysis and Emergency Preparedness divisions prior to his retirement. Mr. Webster currently serves as the Chairman of the Japan Nuclear Safety Institute. | ||||

Skills and qualifications:

Mr. Webster's qualifications for election include the extensive knowledge he gained during his 34 years in the nuclear industry, including experience with respect to environmental laws and reporting for the nuclear industry, and his regulatory expertise through his interface with the NRC on making new nuclear safety rules after the Fukushima accident in Japan. At INPO, Mr. Webster also was responsible for the development of risk management guidelines for the nuclear industry. These skills, as well as his operational and engineering expertise, are an asset to the Board and its committees as the Company focuses on operational excellence.

The Board of Directors Recommends a Vote "FOR" Each Nominee.

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 17 |

INFORMATION ON THE BOARD OF DIRECTORS

Our Board Leadership Structure

The Board regularly evaluates the leadership structure of Duke Energy and may consider alternative approaches, as appropriate, over time. The Board believes that Duke Energy and our shareholders are best served by the Board retaining discretion to determine the appropriate leadership structure based on what it believes is best for Duke Energy at a particular point in time, including whether the same individual should serve as both Chair and CEO, or whether the roles should be separate.

Lynn Good serves as Duke Energy's Chair, President and CEO. Our Board believes that combining the Chair and CEO roles at this time fosters clear accountability, effective decision-making, and execution of corporate strategy.

Independent Lead Director Responsibilities

The Board recognizes the importance of independent oversight over management as well, and has structured the Board with a robust independent lead director role that is elected by the independent members of the Board. Michael G. Browning serves as our Independent Lead Director and has served in that role since January 2016. Mr. Browning's responsibilities, which meet the latest corporate governance standards set by the National Association of Corporate Directors, include:

In addition to these enumerated responsibilities of the Independent Lead Director in the Principles for Corporate Governance, the Independent Lead Director is in constant contact with management and the Board – acting as a touchpoint to the Chair and CEO, encouraging feedback among the directors, seeking input on and recommending agenda topics, and following up with directors and management on meeting outcomes and deliverables. The Independent Lead Director also leads the discussion on the Board's refreshment efforts by working regularly with the Company's third-party search firm to locate skilled and diverse candidates for the Board. Finally, the Independent Lead Director also leads the Board's oversight of strategy – leading the Board's annual strategy retreat and working with the Chair and CEO to align the Board's committee structures and responsibilities with the Company's long-term strategy, such as consolidating the responsibilities for the oversight of Duke Energy's generation fleet under the Operations and Nuclear Oversight Committee in 2019, and adding the responsibility for the oversight of ESG goals and strategies to the Corporate Governance Committee in 2020.

A complete list of the responsibilities of our Independent Lead Director is included in our Principles for Corporate Governance, a copy of which is posted on our website at duke-energy.com/our-company/investors/corporate-governance/principles-corp-governance.

The Board has determined that none of the directors, other than Ms. Good, has a material relationship with Duke Energy or any of our subsidiaries, and all are, therefore, independent under the listing standards of the NYSE and the rules and regulations of the SEC.

In making the determination regarding each director's independence, the Board considered all transactions and the materiality of any relationship with Duke Energy and any of our subsidiaries in light of all facts and circumstances.

The Board may determine a director to be independent if it has affirmatively determined that the director has no material relationship with Duke Energy or our subsidiaries, either directly or as a shareholder, director, officer, or employee of an organization that has a relationship with Duke Energy or our subsidiaries. Independence determinations are generally made when a director joins the Board and on an annual basis at the time the Board approves director-nominees for inclusion in the proxy statement.

| | |

18 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

INFORMATION ON THE BOARD OF DIRECTORS

The Board also considers its Standards for Assessing Director Independence, which sets forth certain relationships between Duke Energy and our directors and their immediate family members, or affiliated entities, that the Board, in its judgment, has deemed to be immaterial for purposes of assessing a director's independence. Duke Energy's Standards for Assessing Director Independence are on our website at duke-energy.com/our-company/investors/corporate-governance/board. In the event a director has a relationship with Duke Energy that is not addressed in the Standards for Assessing Director Independence, the Corporate Governance Committee, which is composed entirely of independent members of the Board, reviews the relationship and makes a recommendation to the nonconflicted, independent members of the Board who determine whether such relationship is material.

The Board met nine times during 2020 and has met three times so far in 2021. During 2020 Board meetings, our Board held five executive sessions with independent directors only.

Directors are expected to attend at least 75% of Board meetings and the meetings of the committees upon which he or she serves. The overall attendance percentage for our directors was approximately 99% in 2020, and all directors attended more than 75% of the Board meetings and the meetings of the committees upon which he or she served in 2020. Directors are also encouraged to attend the Annual Meeting. All directors who were directors at the time of last year's Annual Meeting on May 7, 2020, attended the 2020 Annual Meeting.

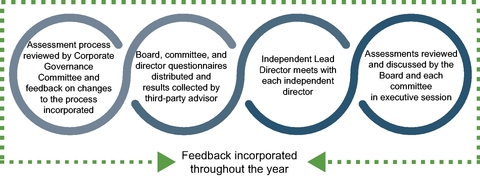

Board and Committee Assessments

Each year the Board, with the assistance of the Corporate Governance Committee, conducts an assessment of the Board, each of its committees, and the directors. The assessment process is overseen by a third-party advisor, which allows directors to provide anonymous feedback and promotes candidness among the directors. The third-party advisor aggregates and provides analysis of all results, which is then presented to the Board and committees and discussed.

In addition to the written assessments, the Independent Lead Director annually takes the opportunity to meet with each of the directors separately to discuss the performance of the Board and to obtain advice on areas of improvement for the Board and the individual directors. Our Board is committed to effective board succession planning and refreshment, including having honest and difficult conversations, as may be deemed necessary, with individual directors.

Management and the Board then incorporate the feedback received in both the written assessments and the discussions throughout the year.

This annual review process and discussion provides continuous improvement in the overall effectiveness of the directors, committees, and Board, and provides an opportunity for directors to express any concerns they may have. This process also allows the Board to identify opportunities for Board succession and skills.

In 2020, in direct response to feedback from last year's assessment process, the Corporate Governance Committee took the opportunity to have a third-party advisor review and update the assessments, streamline the process, and make it more data-driven. In response to other feedback from 2020, we expressly added the responsibility for ESG goals and strategy to the Corporate Governance Committee and incorporated human capital management and diversity and inclusion oversight responsibilities to the Compensation and People Development Committee.

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 19 |

INFORMATION ON THE BOARD OF DIRECTORS

Board Role in Management Succession

The independent directors of the Board are actively involved in our management succession planning process. Among the Corporate Governance Committee's responsibilities described in its charter is to oversee continuity and succession planning. At least annually, the Corporate Governance Committee or full Board reviews the CEO succession plan and makes recommendations to the Board for the successor to the CEO. The Corporate Governance Committee also oversees the evaluation of the CEO. In addition, the Corporation Governance Committee reports to the Board any concerns or issues that might indicate that organizational strengths are not sufficient to meet the requirements of long-range goals.

As is true with other large public companies, Duke Energy faces a myriad of risks, including operational, financial, strategic, and reputational risks that affect every segment of our business. The Board is actively involved in the oversight of these risks in several ways. This oversight is conducted primarily through the Finance and Risk Management Committee of the Board but also through the other committees of the Board, as appropriate. The Finance and Risk Management Committee reviews Duke Energy's enterprise risk program with management, including the Chief Risk Officer, on a regular basis at its committee meetings. The enterprise risk program includes the identification of a broad range of risks that affect Duke Energy, their probabilities and severity, and incorporates a review of our approach to managing and prioritizing those risks based on input from the officers responsible for the management of those risks.

In addition to the oversight of enterprise risk that is conducted through the Finance and Risk Management Committee, each committee of the Board is responsible for the oversight of certain individual areas of risk that pertain to that committee's area of focus. Each committee regularly receives updates from the business units in that committee's area of focus to review the risks in those areas. Throughout the year, each committee chair reports to the full Board regarding the committee's considerations and actions related to the risks within its area of focus.

| | |

20 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

INFORMATION ON THE BOARD OF DIRECTORS

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 21 |

INFORMATION ON THE BOARD OF DIRECTORS

We conduct extensive governance reviews and investor outreach so that management and the Board understand and consider the issues that matter most to our shareholders and address them effectively. In 2020, we reached out to holders of approximately 37% of Duke Energy's outstanding common shares, and members of our Board and management met with holders of approximately 27% of Duke Energy's outstanding common shares. We engaged with every shareholder who accepted our offer to meet as well as every shareholder who requested to meet with us.

During 2020, Duke Energy engaged with shareholders on numerous topics, including sustainability, governance, and executive compensation matters. Shareholder feedback has been invaluable to us in enhancing our practices, policies, and related disclosures. During 2020, we focused our engagements with shareholders on the following topics:

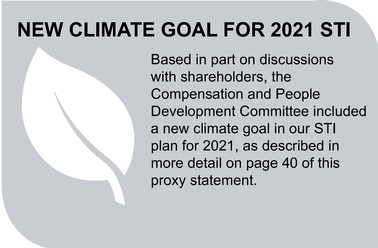

The Corporate Governance Committee reviewed the feedback from all discussions and the feedback informed the decisions discussed herein, including updates to our political expenditures disclosures and the preparation of a report to describe the alignment of our lobbying activities with our climate position, as well as the adoption of a climate metric in our STI plan. Additional information on our discussions with shareholders regarding executive compensation matters is provided on page 37 of this proxy statement.

| | |

22 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

INFORMATION ON THE BOARD OF DIRECTORS

The Board has six standing, permanent committees described below. Each committee operates under a written charter adopted by the Board. The charters are posted on our website at duke-energy.com/our-company/investors/corporate-governance/board-committee-charters.

BOARD COMMITTEE MEMBERSHIP ROSTER(1)

| Name | Audit | Compensation and People Development | Corporate Governance | Finance and Risk Management | Operations and Nuclear Oversight | Regulatory Policy | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

Michael G. Browning | | ✔ | C | | | ✔ | ||||||

Annette K. Clayton | ✔ | ✔ | ||||||||||

Theodore F. Craver, Jr. | C | | | | | ✔ | ||||||

Robert M. Davis | ✔ | ✔ | ||||||||||

Daniel R. DiMicco(2) | | | ✔ | | ✔ | | ||||||

Nicholas C. Fanandakis | ✔ | ✔ | ||||||||||

Lynn J. Good | | | | | | | ||||||

John T. Herron | ✔ | C | ||||||||||

William E. Kennard(2) | | | ✔ | C | | | ||||||

E. Marie McKee | C | ✔ | ||||||||||

Marya M. Rose(2) | | ✔ | | | | ✔ | ||||||

Thomas E. Skains | ✔ | C | ||||||||||

William E. Webster, Jr. | ✔ | | | | ✔ | | ||||||

| | | | | | | | | | | | | |

Audit Committee

| Meetings in 2020: 8 | ||||

Theodore F. Craver, Jr. Chair | Committee Members Theodore F. Craver, Jr., Chair* Annette K. Clayton* Nicholas C. Fanandakis* William E. Webster, Jr.* * Designated as an Audit Committee |  |

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 23 |

INFORMATION ON THE BOARD OF DIRECTORS

officers that could lead to significant reputational damage to the Company. Information regarding how to report concerns to the Audit Committee is posted on our website at duke-energy.com/our-company/investors/corporate-governance/report-concerns-to-the-audit-committee.

Compensation and People Development Committee

| Meetings in 2020: 6 | ||||

E. Marie McKee Chair | Committee Members E. Marie McKee, Chair Michael G. Browning Robert M. Davis Marya M. Rose |  |

| | |

24 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

INFORMATION ON THE BOARD OF DIRECTORS

Corporate Governance Committee

| Meetings in 2020: 5 | ||||

Michael G. Browning Chair | Committee Members Michael G. Browning, Chair Daniel R. DiMicco William E. Kennard E. Marie McKee |  |

Finance and Risk Management Committee

| Meetings in 2020: 5 | ||||

William E. Kennard Chair | Committee Members William E. Kennard, Chair Robert M. Davis Nicholas C. Fanandakis John T. Herron Thomas E. Skains |  |

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 25 |

INFORMATION ON THE BOARD OF DIRECTORS

Operations and Nuclear Oversight Committee

| Meetings in 2020: 4 | ||||

John T. Herron Chair | Committee Members John T. Herron, Chair Annette K. Clayton Daniel R. DiMicco William E. Webster, Jr. |  |

Regulatory Policy Committee

| Meetings in 2020: 4 | ||||

Thomas E. Skains Chair | Committee Members Thomas E. Skains, Chair Michael G. Browning Theodore F. Craver, Jr. Marya M. Rose |  |

| | |

26 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

REPORT OF THE CORPORATE GOVERNANCE COMMITTEE

The following is the report of the Corporate Governance Committee with respect to its philosophy, responsibilities, and initiatives. The Corporate Governance Committee's charter is available on our website at duke-energy.com/our-company/investors/corporate-governance/board-committee-charters/corporate-governance and is summarized below. Additional information about the Corporate Governance Committee and its members is detailed on page 25 of this proxy statement.

Philosophy and Responsibilities

We believe that sound corporate governance has three components:

Membership. The committee must be comprised of three or more members, all of whom must qualify as independent directors under the listing standards of the NYSE and other applicable rules and regulations.

Responsibilities. The committee's responsibilities include, among other things:

The committee may also conduct or authorize investigations into or studies of matters within the scope of the committee's duties and responsibilities, and may retain, at Duke Energy's expense, and in the committee's sole discretion, consultants to assist in such work as the committee deems necessary.

All of the Board committee charters, as well as our Principles for Corporate Governance, Code of Business Ethics for Employees, and Code of Business Conduct & Ethics for Directors, are available on our website at duke-energy.com/our-company/investors/corporate-governance.

Any amendments to or waivers from our Code of Business Ethics for Employees with respect to executive officers or Code of Business Conduct & Ethics for Directors must be approved by the Board and posted on our website.

In addition, information regarding how to report actual or suspected violations of our Code of Business Ethics, either through our anonymous EthicsLine or otherwise, is provided on the Ethics section of our website at duke-energy.com/our-company/about-us/ethics.

Board Refreshment

The Board annually reviews its composition, skills, and needs in the context of Duke Energy's overall strategy. As part of the Board's overall refreshment, the Board has adopted a retirement and tenure policy within our Principles for Corporate Governance, which includes a range for the Board to consider when determining when retirement is appropriate. Pursuant to this policy, the Board may determine, based on the best interest of Duke Energy and our shareholders at the time, not to nominate a director once the director has reached the age of 70 or 15 years of service on the Board though it is not obligated to do so. However, the Board will not nominate a director for election at the Annual Meeting in the calendar year following the year of his or her 75th birthday without a waiver of this policy from the Board.

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 27 |

REPORT OF THE CORPORATE GOVERNANCE COMMITTEE

Director Qualifications and Diversity. The Board recognizes that a diverse Board, management, and workforce is key to Duke Energy's success and believes that diversity of background, skill sets, experience, thought, ethnicity, race, gender, age, and nationality, are important considerations in selecting candidates. This commitment to diversity is evidenced in the backgrounds, skills, and qualifications of the directors who have been nominated, as well as the diversity of Duke Energy's executives and workforce, starting with our Chair, President and CEO, Lynn J. Good, who was selected by the Board to lead Duke Energy in 2013, and the diverse senior management team that reports to her.

The Board strives to have diverse members representing a range of experiences and qualifications in areas that are relevant to Duke Energy's business and strategy. As part of the search process, the committee looks for the most qualified candidates, including women and minorities, with the following characteristics:

Director Candidate Recommendations. The committee may engage a third party from time to time to assist it in identifying and evaluating director-nominee candidates, in addition to current members of the Board standing for re-election. The committee will provide the third party, based on the profile described above, the characteristics, skills, and experiences that may complement those of our existing members. The third party will then provide recommendations for nominees with such attributes. The committee considers nominees recommended by shareholders on a similar basis, taking into account, among other things, the profile criteria described above and the nominee's experiences and skills. In addition, the committee considers the shareholder-nominee's independence with respect to both Duke Energy and the recommending shareholder. All of the nominees on the proxy card were recommended by the committee.

Shareholders interested in submitting nominees as candidates for election as directors must provide timely written notice to the Corporate Governance Committee, c/o Kodwo Ghartey-Tagoe, Executive Vice President, Chief Legal Officer and Corporate Secretary, Duke Energy Corporation, DEC 48H, P.O. Box 1414, Charlotte, NC 28201-1414. The written notice must set forth, as to each person whom the shareholder proposes to nominate for election as director:

| | |

28 DUKE ENERGY 2021 PROXY STATEMENT | | BUILDING A SMARTER ENERGY FUTURE® |

REPORT OF THE CORPORATE GOVERNANCE COMMITTEE

Director Candidate Nominations through Proxy Access. In order to nominate a director pursuant to our proxy access provision for the 2022 Annual Meeting, shareholders who meet the eligibility and other requirements set forth in Section 3.04 of the Company's By-Laws must send a written notice to the Corporate Governance Committee, c/o Kodwo Ghartey-Tagoe, Executive Vice President, Chief Legal Officer and Corporate Secretary, Duke Energy Corporation, DEC 48H, P.O. Box 1414, Charlotte, NC 28201-1414. The written notice must be provided no earlier than October 24, 2021, and no later than November 23, 2021, and must provide the information set forth above, as well as the other detailed requirements set forth in Section 3.04 of the Company's By-Laws, which can be located on our website at duke-energy.com/our-company/investors/corporate-governance.

Director Onboarding. Over half of our Board members have joined the Board in the last five years. In order to help those new directors quickly transition into their roles on the Board, the director onboarding process has become increasingly important. Immediately following their appointment, each new director meets individually with the senior executives responsible for our major lines of business and operations so that they may better understand the issues involved in all aspects of Duke Energy's business. In addition to discussing Duke Energy's businesses and operations, the new directors learn about our corporate governance practices and policies; the financial and technical aspects of our electric utility, natural gas, and commercial renewables businesses; the enterprise's significant risks; our long-term strategy; and Duke Energy's long-standing mission to provide clean, reliable, and affordable energy for our customers. Finally, new members to our Audit and Compensation and People Development Committees have a separate orientation to learn more about each committee's responsibilities, policies, and practices, and the matters regularly coming before the committee.

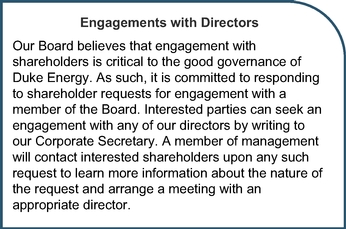

Communications and Engagements with Directors

Interested parties can communicate with any of our directors by writing to our Corporate Secretary at the following address:

Corporate Secretary

Kodwo Ghartey-Tagoe

Executive Vice President, Chief Legal Officer and Corporate Secretary

Duke Energy Corporation

DEC 48H

P.O. Box 1414

Charlotte, NC 28201-1414

Interested parties can communicate with our Independent Lead Director by writing to the following address:

Independent Lead Director

c/o Kodwo Ghartey-Tagoe

Executive Vice President, Chief Legal Officer and Corporate Secretary

Duke Energy Corporation

DEC 48H

P.O. Box 1414

Charlotte, NC 28201-1414

Our Corporate Secretary will distribute communications to the Board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, the Board has requested that certain items that are unrelated to the duties and responsibilities of the Board be excluded, such as spam, junk mail and mass mailings, service complaints, resumes, and other forms of job inquiries, surveys, and business solicitations or advertisements. In addition, material that is unduly hostile, threatening, obscene or similarly unsuitable will be excluded. However, any communication that is so excluded remains available to any director upon request.

Corporate Governance Committee

Michael G. Browning, Chair

Daniel R. DiMicco

William E. Kennard

E. Marie McKee

| | |

BUILDING A SMARTER ENERGY FUTURE® | | DUKE ENERGY 2021 PROXY STATEMENT 29 |

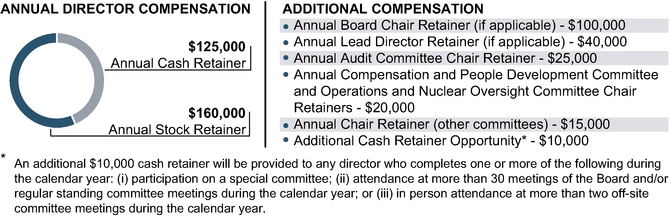

DIRECTOR COMPENSATION

Our director compensation program is designed to attract and retain highly qualified directors and align their interests with those of our shareholders. We compensate directors who are not employed by Duke Energy with a combination of cash and equity awards, along with certain other benefits as described below. Ms. Good receives no compensation for her service on the Board.

The Compensation and People Development Committee annually reviews the director compensation program and recommends proposed changes for approval by the Board. As part of this review, they consider the significant amount of time expended, and the skill level required, by each director not employed by Duke Energy in fulfilling his or her duties on the Board, each director's role and involvement on the Board and its committees, and the market compensation practices and levels of our peer companies.

During its annual review of the director compensation program in 2020, the Compensation and People Development Committee considered an analysis prepared by its independent consultant, FW Cook, which summarized director compensation trends for independent directors and pay levels at the same peer companies used to evaluate the compensation of our NEOs. Following this review, and after considering the advice of FW Cook about market practices and pay levels, the Compensation and People Development Committee did not recommend any changes to our director compensation program.

For 2020, our director compensation program consisted of the following:

Annual Board Stock Retainer for 2020. In 2020, each eligible director received the portion of his or her annual retainer that was payable in stock in the form of fully vested shares. The stock retainer was granted under the Duke Energy Corporation 2015 Long-Term Incentive Plan that was approved by our shareholders and contains an annual limit on equity awards of $400,000 to any director not employed by Duke Energy.

Deferral Plan. Directors may elect to receive all or a portion of their annual compensation on a current basis or defer such compensation under the Directors' Savings Plan. Deferred amounts are credited to an unfunded account, the balance of which is adjusted for the performance of phantom investment options, including the Duke Energy common stock fund, as elected by the director, and generally are paid when the director terminates his or her service from the Board.