UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 333-124793 | |||||||

| ||||||||

Macquarie Global Infrastructure Total Return Fund Inc. | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

125 West 55th Street, New York, NY |

| 10019 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Tane T. Tyler ALPS Mutual Fund Services, Inc. 1625 Broadway, Suite 2200 Denver, Colorado 80202 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | (303) 623-2577 |

| ||||||

| ||||||||

Date of fiscal year end: | November 30 |

| ||||||

| ||||||||

Date of reporting period: | November 30, 2005 |

| ||||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

Item 1. Reports to Stockholders.

MACQUARIE GLOBAL INFRASTRUCTURE TOTAL RETURN FUND, INC. (MGU)

ANNUAL REPORT 2005

MGU/05

MACQUARIE

Shareholder Letter

November 30, 2005

INTRODUCTION

We are pleased to provide the following report to shareholders of the Macquarie Global Infrastructure Total Return Fund Inc. (“MGU” or “the Fund”) for the period from the Fund’s inception on August 26, 2005 to November 30, 2005.

In summary, while the Fund’s invest-up phase has progressed according to plan and the Fund has been able to declare a first distribution in line with expectations, unfavorable equity market conditions have seen the Fund underperform its relevant benchmarks during the invest-up period. This report will provide shareholders with an overview of factors contributing to the Fund’s performance during the period and why Macquarie Infrastructure Fund Adviser, LLC (“MIFA” or the “Manager”) remains committed to the investment strategy of the Fund and is positive about the outlook for the sector going forward.

INVESTMENT OBJECTIVE AND STRATEGY

The Fund’s investment objective is to provide investors with a high level of total return consisting of dividends and other income, and capital appreciation. The Fund seeks to achieve its objective by investing at least 80% of its total assets in equity and equity-like securities issued by U.S. and non-U.S. issuers that own or operate infrastructure assets (“Infrastructure Issuers”).

It is anticipated that most of the Infrastructure Issuers in which the Fund will invest will be public companies listed on national or regional stock exchanges.

In pursuit of its investment objective, MGU will also seek to manage its investments so that at least 25% of its distributions may qualify as tax-advantaged “qualified dividend income” for U.S. federal income tax purposes.

We believe that infrastructure assets have a number of features that make this an appealing asset class for investors:

Essential Services: Many infrastructure issuers are the sole providers of an essential product or service to a segment of the population;

Monopolistic or Near-Monopolistic in Nature: Often these businesses have a strategic competitive advantage;

Inelastic Demand: Demand for infrastructure-related products or services is often linked to underlying economic

1

or demographic growth, which makes demand for infrastructure products or services more stable, and less sensitive to changes when compared to other products or services;

Long-Life, Inflation-Linked Assets: Typically infrastructure assets are long-life assets and may operate under long-term concessions/agreements. The underlying revenue of infrastructure assets may be linked to inflation, sometimes directly through a regulatory framework or through contracts/concession agreements linking price/tariff growth to inflation.

Leverage on Fixed-Cost Basis: Once developed, on-going operational costs for many infrastructure assets are relatively low and stable. Increases in revenue generated by such infrastructure assets may not result in a proportionate increase in operating costs, thereby increasing cash flow.

FUND COMMENTARY

The NAV total return for the Fund and comparative benchmarks from inception to November 30, 2005 are summarized in the Table below:

Total NAV Return: August 26, 2005 - November 30, 2005

Macquarie Global Infrastructure Total Return Fund (MGU) |

| -3.96 | % |

Macquarie Global Infrastructure Index (1) |

| 0.80 | % |

S&P U.S. Utilities Accumulation Index (2) |

| -1.50 | % |

The Manager belives that the NAV movements for the portfolio over the period were largely driven by broad market concerns with respect to the impact of increasing interest rates on stock fundamentals. Over the period from the Fund’s inception to November 30, 2005, the benchmark Macquarie Global Infrastructure Index was up 0.8% on a U.S. dollar total return basis. Weakness in this index was particularly pronounced in the first half of October, where the index fell by 5.2%. The NAV of the MGU portfolio over the period from inception to November 30, 2005, was down by 4.0%.

Relative to the performance of the Macquarie Global Infrastructure Index

(1) The Macquarie Global Infrastructure Index covers 48 markets broken down into five regional indices and eight industry/sector indices. It consists of 258 infrastructure/utilities stocks in the FTSE Global All-Cap Index, and has a combined market cap of approximately $1.2 trillion as of June 15, 2005.

(2) The Standard & Poor’s Utilities Index is an unmanaged, capitalization-weighted index representing 32 of the largest utility companies listed on the NYSE.

2

(the “Benchmark”) (+0.8%), MGU’s performance can be attributed to unfavorable equity market conditions during the invest-up period. The Benchmark rallied 3.9% in the month of September while a significant portion of MGU was being invested into various markets. In other words, MGU was acquiring stocks at September prices which, were higher than those at the end of August. Consequently, the subsequent sell off in the first half of October caused a disproportionate fall in the Fund’s NAV.

Adverse currency movement also contributed to negative returns to the Fund’s NAV due to a large portion of investments outside the U.S. U.S. dollar appreciation against both the British pound and the Euro (approximately 42% of the Fund’s investments at the end of November were in these two currencies) was particularly strong with the U.S. dollar up in excess of 4% against each currency.

Despite the general weakness resulting from the factors discussed above, the MGU portfolio team remains happy with respect to the invest-up of the Fund. The Manager has been able to establish a well diversified portfolio of investments that meet the Fund’s investment criteria and the portfolio has been able to generate returns that have enabled the Fund to declare an initial distribution, in line with the Manager’s expectation, at the beginning of November 2005.

A difficult balancing act in the initial phase of any closed end fund is the need to optimize cash flow from underlying investments against prudent entry points into stocks. We believe that this has been achieved. While some of the portfolio was exposed to general market weakness over the first part of October, this weakness also provided the opportunity for the portfolio team to deploy retained cash into attractive investment opportunities over this period.

Share price performance for MGU has been weak over the period from the Fund’s date of inception to November 30, 2005. The market value of MGU shares declined 17.2% from the initial IPO price of $25.00 to $20.69. Management believes that general price weakness within the Closed-End Fund sector combined with the short investment history of the Fund have contributed to this weakness. As of November 30, the share price of the Fund was at a 10.0% discount to NAV.

3

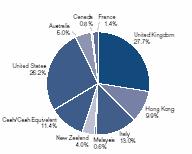

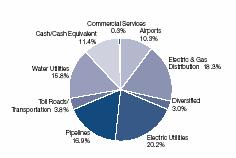

As of November 30, 2005, 91% of proceeds the Fund received from its IPO had been invested in the securities of infrastructure issuers. A summary of the geographic and sector diversification of the portfolio as of November 30, 2005, is illustrated in the charts below:

Portfolio Diversification by Geographic Region (1) | Portfolio Diversification by Industry Sector (1) |

|

|

|

|

(1) Diversification of the Fund based on Total Net Assets

In-line with the overall investment strategy of the Fund, the manager has focused on the securities of infrastructure companies that have strong strategic positions in the businesses in which they are involved, and which the manager believes are able to generate sustainable and growing cash flow streams to equity holders. As indicated in the charts above, this has resulted in strong weightings to investments in the U.K. (28%), U.S. (26%) and Italy (13%). Within the U.K., investments have reflected a combination of airport, port, energy infrastructure (i.e. gas/electricity transmission and distribution networks) and to a lesser extent water utilities. In the U.S., MGU has focused on pipeline infrastructure with a high component of fee-based income and utilities with predominately regulated earnings. In Italy, the Fund has invested in a combination of energy transmission infrastructure companies and the dominant incumbent integrated electric utility. Going forward, the Manager expects that overall exposure to the U.S. will remain at under 30%, with additional funds being invested into infrastructure opportunities outside of the U.S. A summary of the Top 10 holdings as of November 30, 2005, including a brief description of each business, is included in the following table.

4

TOP TEN HOLDINGS

Company |

| Description of Business |

| % of TNA |

|

BAA Plc |

| Airports Owner (U.K.) |

| 4.82 | % |

TERNA S.p.A. |

| Electricity Transmission (Italy) |

| 4.75 | % |

United Utilities Plc |

| Water Utilities (U.K.) |

| 4.73 | % |

National Grid Plc |

| Electricity and Gas transmission and distribution networks (U.K.) |

| 4.72 | % |

Ameren Corp. |

| Predominantly regulated utility operating in the states of Missouri and Illinois (USA) |

| 4.67 | % |

Enel S.p.A. |

| Integrated electric utility (Italy) |

| 4.64 | % |

Kinder Morgan Energy Partners LP |

| Pipeline infrastructure and bulk storage (USA) |

| 4.57 | % |

Severn Trent Plc |

| Water and Wastewater Utility Services (U.K.) |

| 4.56 | % |

Consolidated Edison, Inc. |

| Predominantly regulated utility in the state of NY (USA) |

| 4.55 | % |

Magellan Midstream Partners LP |

| Pipeline infrastructure and bulk storage (USA) |

| 4.48 | % |

The top performer within the portfolio has been Associated British Ports, the share price of which has appreciated 24% over the period from fund inception to November 30th. This strong performance can be attributed to a combination of takeover activity in the U.K. ports sector, solid earnings results released during the period and a continuation of its share buyback program. The fund established a major position in this stock early in the invest-up phase, with a portion of the position sold towards the end of November. Good performance was also seen from other investments in the U.K. and in Asia. Capital initiatives in the form of share buyback programs and/or special dividends is a theme that the Manager has seen emerge across a number of U.K. and European investments during the quarter and is a trend that the Manager expects will continue into 2006.

5

Weakness in the portfolio can be largely attributed to stock weakness associated with interest rate concerns (as discussed above). This in particular has affected investments in the U.S. across the range of Master Limited Partnership (“MLP”) and utility investments and a range of investments in Australia/New Zealand.

With respect to interest rate concerns, the manager believes that while the portfolio will not be immune to broader market uncertainties, two factors should give investors comfort with respect to the underlying MGU portfolio. First, the MGU portfolio is diversified across both a number of countries (reducing the exposure of the portfolio to the interest rate environment of any one particular country) and a number of different types of infrastructure businesses (providing exposure to businesses exposed to different dynamics and growth rates). Second, the investment process followed by the manager specifically examines the sustainability of a company’s cash flow stream including the impact of higher interest rates on underlying fundamentals.

An important point to remember for many infrastructure companies, particularly those outside of the U.S., is that there is often an explicit linkage between inflation and the underlying tariff/price setting. Therefore, to the extent that increases in interest rates are being driven by increasing inflationary expectations, there is an ability to pass through the increase in interest rate in underlying tariff pricing. In summary, while the portfolio will not be immune to shifts in market sentiment, underlying fundamentals for many infrastructure companies are protected against increasing nominal interest rates.

LEVERAGE

As of November 30, 2005, the Fund had no leverage in place. However, subsequent to fiscal year-end, the Fund entered into a $150 million revolving credit facility. As of the end of December 2005, a significant portion of this credit facility had been drawn down and invested.

The Manager believes that MGU’s credit facility provides an attractive combination of both pricing and flexibility for the Fund. In addition, the overall level of leverage (28% of gross assets) is well within the limit outlined in the Fund’s prospectus. Management believes that the prudent application of leverage can assist in optimizing total returns generated by the Fund.

To limit exposure to potentially adverse interest rate movements,

6

management has locked in interest rates on this borrowing through a number of swaps which will lock in rates for 3-5 years.

DISTRIBUTIONS

With respect to distributions, the Fund’s first regularly scheduled quarterly distribution payment of $0.375 per share was declared on the 2nd of November 2005 with an ex-date of December 7, 2005 and payable December 20, 2005. On an annualized basis, this represents a yield of 7.2% based on the November 30 share price and 6.5% yield based on the November 30 NAV. It represents a 6.0% yield based on the initial IPO price of $25.00.

MARKET OUTLOOK

While interest rate uncertainties are likely to prevail in the short term, a number of interesting themes are emerging within the infrastructure sector globally, providing what Management believes will be an attractive investment environment for the Fund in 2006.

In the U.S., legislative changes that affect the energy and utilities sectors are likely to lead to increased sector consolidation and increased private investment in gas and electricity transmission infrastructure. In Canada, widespread upstream energy developments (especially in Alberta) are acting as a catalyst for the widespread development of essential energy infrastructure, in particular oil and gas pipelines.

In the U.K. and Europe, regulatory reform in a number of countries (e.g., Spain and Germany), new asset privatizations and capital management initiatives (e.g., share buybacks and special dividends) are key themes.

The Australian and New Zealand markets have experienced a number of new offerings in 2005. This trend is expected to continue in 2006.

With respect to non-OECD/emerging market investments, the Fund expects to continue to explore opportunities in countries such as China and India, where strong economic growth combined with increasing prosperity has lead to a significant increase in demand for basic infrastructure services. In keeping with portfolio allocations as of the end of November, this part of the portfolio is likely to continue to represent less than 15% of total investments during 2006.

7

CONCLUSION

The manager remains optimistic about the growth potential for the infrastructure sector and the range of current and potential investment opportunities that the sector presents. There are a number of global trends that make the current environment attractive for the Fund to invest in infrastructure stocks and assist the Fund in delivering a high level of total return consisting of dividends and other income and capital appreciation. The Manager believes that MGU continues to provide U.S. investors with an attractive vehicle to access the expanding global universe of infrastructure securities.

We appreciate your investment in the Fund. For any questions or comments you may have, please call on 1-800-910-1434, e-mail us at MGU-Questions@macquarie.com, or visit us at www.macquarie.com/mgu.

Yours sincerely

Jon Fitch

President

Portfolio Manager

8

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of Macquarie Infrastructure Fund Adviser, LLC and its respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would,” or other words that convey uncertainty of future events or outcomes. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Fund’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this Annual Report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of Macquarie Infrastructure Fund Adviser, LLC and its respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Capitalized terms, used but not defined herein, have the meaning assigned to them in the Fund’s prospectus.

Investments in the fund are not deposits with or other liabilities of Macquarie Bank Limited ABN 46 008 583 542, or any entity in the Macquarie group, and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. None of Macquarie Bank Limited, Macquarie Infrastructure Fund Adviser, LLC, or any member company of the Macquarie group guarantees any particular rate of return or the performance of the Fund, nor do they guarantee the repayment of capital from the Fund or any tax treatment of any distribution by the Fund.

9

Statement of Investments

November 30, 2005

|

| Shares |

| Value $ |

| |

|

|

|

|

|

| |

COMMON STOCK - 87.80% |

|

|

|

|

| |

Airports - 10.32% |

|

|

|

|

| |

Auckland International Airport, Ltd. |

| 11,614,694 |

| $ | 15,445,072 |

|

BAA Plc |

| 1,710,000 |

| 18,796,247 |

| |

Beijing Capital International Airport, Ltd. |

| 13,964,000 |

| 5,987,221 |

| |

|

|

|

| 40,228,540 |

| |

|

|

|

|

|

| |

Diversified - 2.95% |

|

|

|

|

| |

Australian Infrastructure Fund |

| 3,038,064 |

| 5,274,417 |

| |

Babcock & Brown Infrastructure Group |

| 3,820,538 |

| 4,346,652 |

| |

Hastings Diversified Utilities Fund |

| 1,059,005 |

| 1,901,139 |

| |

|

|

|

| 11,522,208 |

| |

|

|

|

|

|

| |

Electric & Gas Distribution - 18.26% |

|

|

|

|

| |

AmeriGas Partners, LP |

| 556,500 |

| 15,793,470 |

| |

Cheung Kong Infrastructure Holdings Ltd. |

| 1,861,000 |

| 6,023,430 |

| |

China Light & Power Holdings Ltd. |

| 1,500,000 |

| 8,839,572 |

| |

Envestra Ltd. |

| 9,386,212 |

| 8,009,067 |

| |

HongKong Electric Holdings Ltd. |

| 2,894,500 |

| 14,127,432 |

| |

National Grid Plc. |

| 1,985,000 |

| 18,402,837 |

| |

|

|

|

| 71,195,808 |

| |

|

|

|

|

|

| |

Electric Utilities - 19.98% |

|

|

|

|

| |

Ameren Corp. |

| 347,300 |

| 18,219,358 |

| |

Consolidated Edison, Inc. |

| 390,000 |

| 17,760,600 |

| |

Electricite de France* |

| 145,520 |

| 5,318,149 |

| |

Enel S.p.A |

| 2,300,000 |

| 18,112,585 |

| |

Terna S.p.A |

| 7,625,000 |

| 18,517,536 |

| |

|

|

|

| 77,928,228 |

| |

|

|

|

|

|

| |

Pipelines - 16.66% |

|

|

|

|

| |

Enbridge Energy Partners LP** |

| 335,600 |

| 15,437,600 |

| |

Kinder Morgan Energy Partners LP |

| 357,500 |

| 17,817,800 |

| |

Magellan Midstream Partners LP |

| 543,500 |

| 17,473,525 |

| |

Snam Rete Gas S.p.A |

| 3,361,954 |

| 14,218,697 |

| |

|

|

|

| 64,947,622 |

| |

10

11

|

|

|

| Value $ |

| |

|

|

|

|

|

| |

SHORT TERM INVESTMENTS (CONTINUED) |

|

|

|

|

| |

Repurchase Agreements - 19.62% |

|

|

|

|

| |

Agreement with Deutsche Bank , 3.97%, dated 11/30/05 and maturing 12/1/05, with a repurchase amount of $76,508,436 collateralized by Federal National Mortgage Association, 3.25% due 7/31/06 with a value of $76,585,906. |

|

|

| $ | 76,500,000 |

|

Total Repurchase Agreements |

|

|

| 76,500,000 |

| |

|

|

|

|

|

| |

Total Short Term Investments (Cost $76,629,856) |

|

|

| 76,629,856 |

| |

Total Investments (Cost $446,450,740) |

| 108.25 | % | 422,128,932 |

| |

Liabilities in Excess of Other Assets |

| -8.25 | % | (32,177,372 | ) | |

Net Assets |

| 100.00 | % | $ | 389,951,560 |

|

* Non-Income producing securities

** Security, or portion of security, is segregated as collateral for the Interest Rate Swap

OUTSTANDING FORWARD CURRENCY EXCHANGE CONTRACT: (1)

Type |

| Expiration |

| Contracts |

| Units Per |

| Value |

| Unrealized |

| ||

Bank of New York Australian Dollar FX Contract |

| 12/01/2005 |

| 1 |

| 8,475,000 | AUD | $ | 6,264,720 |

| $ | (3,638 | ) |

(1) The Fund entered into a currency exchange contract which relates to the purchase of securities in Australia.

See Notes to Financial Statements.

12

SWAP AGREEMENT:

As of November 30, 2005, the Fund had entered into the following interest rate swap agreement:

Swap |

| Notional |

| Fixed |

| Floating |

| Floating |

| Termination |

| Unrealized |

| |

Citibank, N.A. |

| 60,000,000 |

| 4.426 | % | U.S. 1mt |

| USD LIBOR |

| Nov 17 2008 |

| $ | 599,701 |

|

INVESTMENTS BY COUNTRY:

United Kingdom |

| 27.7 | % |

United States |

| 26.2 | % |

Italy |

| 13.0 | % |

Cash/Cash Equivalent |

| 11.4 | % |

Hong Kong |

| 9.9 | % |

Australia |

| 5.0 | % |

New Zealand |

| 4.0 | % |

France |

| 1.4 | % |

Canada |

| 0.8 | % |

Malaysia |

| 0.6 | % |

See Notes to Financial Statements.

13

Statement of Assets & Liabilities

November 30, 2005

ASSETS: |

|

|

| |

Investments, at value (Cost - $446,450,740) |

| $ | 422,128,932 |

|

Unrealized appreciation on interest rate swap contract |

| 599,701 |

| |

Dividends receivable |

| 2,206,527 |

| |

Interest receivable |

| 9,676 |

| |

Other assets |

| 168,300 |

| |

Total Assets |

| 425,113,136 |

| |

|

|

|

| |

LIABILITIES: |

|

|

| |

Payable for investments purchased |

| 33,581,778 |

| |

Accrued investment advisory fee |

| 1,017,914 |

| |

Accrued administration fee |

| 41,802 |

| |

Accrued trustees fee |

| 26,575 |

| |

Accrued offering costs |

| 334,978 |

| |

Unrealized depreciation on foreign currency contract |

| 3,638 |

| |

Other payables and accrued expenses |

| 154,891 |

| |

Total Liabilities |

| 35,161,576 |

| |

|

|

|

| |

Net Assets |

| $ | 389,951,560 |

|

|

|

|

| |

COMPOSITION OF NET ASSETS: |

|

|

| |

Paid in capital |

| 405,125,012 |

| |

Undistributed net investment income |

| 6,634,884 |

| |

Accumulated net realized gain on investments |

| 1,853,558 |

| |

Net unrealized depreciation on investments and foreign currency translation |

| (23,661,894 | ) | |

Net Assets |

| $ | 389,951,560 |

|

|

|

|

| |

Shares of common stock outstanding of $.001 par value, 100,000,000 shares authorized |

| 17,004,189 |

| |

Net asset value per share |

| $ | 22.93 |

|

See Notes to Financial Statements.

14

Statement of Operations

For the Period August 26, 2005 (Inception) to November 30, 2005

INVESTMENT INCOME: |

|

|

| |

Dividends (Net of foreign withholding of $682,395) |

| $ | 7,692,930 |

|

Interest |

| 1,606,973 |

| |

Total Income |

| 9,299,903 |

| |

|

|

|

| |

EXPENSES: |

|

|

| |

Investment advisory expenses |

| 1,017,914 |

| |

Administration expenses |

| 135,635 |

| |

Printing expenses |

| 21,481 |

| |

Transfer agent expenses |

| 7,562 |

| |

Legal expenses |

| 39,863 |

| |

Audit expenses |

| 57,594 |

| |

Trustees expenses |

| 26,575 |

| |

Custody expenses |

| 25,108 |

| |

Insurance expenses |

| 58,200 |

| |

Miscellaneous expenses |

| 23,918 |

| |

Total Expenses |

| 1,413,850 |

| |

|

|

|

| |

Net Investment Income |

| 7,886,053 |

| |

|

|

|

| |

Net realized gain (loss) on: |

|

|

| |

Investment securities |

| 609,405 |

| |

Foreign currency transactions |

| (7,016 | ) | |

Net change in unrealized depreciation on investments and foreign currency translation |

| (23,661,894 | ) | |

Net realized and unrealized loss on investments |

| (23,059,505 | ) | |

Net Decrease in Net Assets Resulting from Operations |

| (15,173,452 | ) | |

See Notes to Financial Statements.

15

Statement of Changes in Net Assets

For the Period August 26, 2005 (Inception) to November 30, 2005

FROM OPERATIONS: |

|

|

| |

Net investment income |

| $ | 7,886,053 |

|

Net realized gain (loss) from: |

|

|

| |

Investment securities |

| 609,405 |

| |

Foreign currency transactions |

| (7,016 | ) | |

Net change in unrealized depreciation on investments and foreign currency translation |

| (23,661,894 | ) | |

Net decrease in net assets from operations |

| (15,173,452 | ) | |

|

|

|

| |

CAPITAL SHARE TRANSACTIONS: |

|

|

| |

Proceeds from sales of common shares, net of offering costs |

| 405,025,000 |

| |

Net increase in net assets from capital share transactions |

| 405,025,000 |

| |

Net Increase in Net Assets |

| 389,851,548 |

| |

Net Assets |

|

|

| |

Beginning of period |

| 100,012 |

| |

End of period |

| $ | 389,951,560 |

|

See Notes to Financial Statements.

16

Financial Highlights

For the Period August 26, 2005 (Inception) to November 30, 2005

PER COMMON SHARE OPERATING PERFORMANCE |

|

|

| ||

Net asset value - beginning of period |

| $ | 23.88 |

| |

Income from investment operations: |

|

|

| ||

Net investment income |

| 0.46 |

| ||

Net realized and unrealized gain (loss) on investments |

| (1.36 | ) | ||

Total from investment operations |

| (0.90 | ) | ||

|

|

|

| ||

CAPITAL SHARE TRANSACTIONS: |

|

|

| ||

Common share offering costs charged to paid in capital |

| (0.05 | ) | ||

Total capital share transactions |

| (0.05 | ) | ||

Net asset value - end of period |

| $ | 22.93 |

| |

Market price - end of period |

| $ | 20.69 |

| |

|

|

|

| ||

Total Investment Return - Net Asset Value (1): |

| (3.96 | )% | ||

Total Investment Return - Market Price (1): |

| (17.24 | )% | ||

|

|

|

| ||

RATIOS AND SUPPLEMENTAL DATA |

|

|

| ||

Net assets attributable to common shares, end of period (000s) |

| $ | 389,952 |

| |

Ratios to average net assets attributable to common shareholders: |

|

|

| ||

Expenses |

| 1.34 | %(2) | ||

Net investment income |

| 7.48 | %(2) | ||

Portfolio turnover rate |

| 3.47 | %(3) | ||

(1) Total investment return is calculated assuming a purchase of a common share at the opening on the first day and a sale at closing on the last day of each period reported. Total investment return on net asset value excludes the sales load of $1.125 per share. Total investment returns do not reflect brokerage commissions that the investors may incur. Total investment returns for less than a full year are not annualized. Past performance is not a guarantee of future results.

(2) Annualized

(3) Not Annualized

See Notes to Financial Statements.

17

Notes to Financial Statements

November 30, 2005

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Macquarie Global Infrastructure Total Return Fund Inc (the “Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940 and organized under the laws of the State of Maryland. The Fund’s investment objective is to provide to its common stockholders a high level of total return consisting of dividends and other income, and capital appreciation. The Fund commenced operations on August 26, 2005. The Fund had no operation prior to August 26 except for the sale of shares to Macquarie Infrastructure Fund Adviser, LLC (“MIFA” or the “Adviser”). The Fund’s Common Shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “MGU”.

The Fund has elements of risk, including the risk of loss of principal. There is no assurance that the investment process will consistently lead to successful results. An investment concentrated in sectors and industries may involve greater risk and volatility than a more diversified investment.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America. This requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

The following summarizes the significant accounting policies of the Fund.

Security Valuation: The net asset value (“NAV”) of the CommonShares will be computed based upon the value of the securities and other assets and liabilities held by the Fund. The NAV is be determined as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern Standard Time) on each day the NYSE is open for trading. U.S. debt securities and non-U.S. securities will normally be priced using data reflecting the earlier closing of the principal markets for those securities (subject to the fair value policies described below).

Readily marketable portfolio securities listed on any U.S. exchange other than the NASDAQ National Market are valued, except as indicated below, at the last sale price on

18

the business day as of which such value is being determined, or if no sale price, at the mean of the most recent bid and asked prices on such day. Securities admitted to trade on the NASDAQ National Market are valued at the NASDAQ Official Closing Price as determined by NASDAQ. Securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. U.S. equity securities traded in the over-the-counter market, but excluding securities admitted to trading on the NASDAQ National Market, are valued at the closing bid prices.

Non-U.S. exchange-listed securities will generally be valued using information provided by an independent third party pricing service. The official non-U.S. security price is determined using the last sale price at the official close of the security’s respective non-U.S. market. Non-U.S. securities, currencies and other assets denominated in non-U.S. currencies are translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar as provided by a pricing service. When price quotes are not available, fair market value is based on prices of comparable securities.

In the event that the pricing service cannot or does not provide a valuation for a particular non-U.S. listed security or such valuation is deemed unreliable, especially with unlisted securities or instruments, fair value is determined by the Board or a committee of the Board or a designee of the Board. In fair valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following:

• the projected cash flows for the issuer;

• the fundamental business data relating to the issuer;

• an evaluation of the forces that influence the market in which these securities are purchased and sold;

• the type, size and cost of holding;

• the financial statements of the issuer;

• the credit quality and cash flow of issuer, based on the Adviser’s or external analysis;

• the information as to any transactions in or offers for the holding;

• the price and extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies;

• the business prospects of the issuer/borrower, including any ability to obtain money or resources from a parent or affiliate and an assessment of the issuer’s or borrower’s management;

19

• the prospects for the issuer’s or borrower’s industry, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry

Foreign Securities: The accounting records of the Fund are maintained in U.S. dollars. Prices of securities and other assets and liabilities denominated in non-U.S. currencies are translated into U.S. dollars using the exchange rate at 12:00 p.m., Eastern Standard Time. Amounts related to the purchases and sales of securities, investment income and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions.

Net realized gain or loss on foreign currency transactions represents net foreign exchange gains or losses from the closure of forward currency contracts, disposition of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions and the difference between the amount of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amount actually received or paid. Net unrealized currency gains and losses arising from valuing foreign currency denominated assets and liabilities, other than security investments, at the current exchange rate are reflected as part of unrealized appreciation/depreciation on foreign currency translation.

Forward currency exchange contracts which are traded in the U.S. on regulated exchanges are valued by calculating the mean between the last bid and asked quotation supplied to a pricing service by certain independentdealers in such contracts. Non-U.S. traded forward currency contracts are valued using the same method as the U.S. traded contracts. Exchange traded options and futures contracts are valued at the closing price in the market where such contractsare principally traded. These contracts may involve market risk in excess of the unrealized gain or loss reflected in the Fund’s Statement of Assets & Liabilities. In addition, theFund could be exposed to risk if thecounterparties are unable to meet theterms of the contract or if the value ofthe currencies change unfavorably tothe U.S. dollar.

The Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in the market prices of securities held at periods end. The Fund does not isolate the effect of changes in foreign exchange rates from changes in market prices of

20

equity securities sold during the year. The Fund may invest in foreign securities and foreign currency transactions that may involve risks not associated with domestic investments as a result of the level of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability, among others.

Distributions to Shareholders: The Fund intends to distribute to holders of its Common Shares quarterly dividends of all or a portion of its net income and/or realized short-term gains after payment of dividends and interest in connection with any leverage used by the Fund. Distributions to shareholders are recorded by the Fund on the ex-dividend date.

Income Taxes: The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies.

Securities Transactions and Investment Income: Investment security transactions are accounted for as of trade date. Dividend income is recorded on the ex-dividend date. Interest income, which includes amortization of premium and accretion of discount, is accrued as earned. Realized gains and losses from securities transactions are determined on basis of identified cost for both financial reporting and income tax purposes.

Repurchase Agreements: Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. In the event of default by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

21

2. INCOME TAXES

There were no distributions paid by the Fund during the period August 26, 2005 (Commencement of Operations) to November 30, 2005.

Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from composition of net assets reported under accounting principles generally accepted in the United States. Accordingly, for the year ended November 30, 2005, the effects of certain differences were reclassified. The fund decreased accumulated net investment income by $1,251,169 and increased accumulated net realized gain by $1,251,169. These differences were primarily due to the differing tax treatment of foreign currency, investments in partnerships and certain other investments. Net assets of the portfolio were unaffected by the reclassifications and the calculation of net investment income per share in the Financial Highlights excludes these adjustments.

As of November 30, 2005, the components of distributable earnings on a tax basis were as follows:

Ordinary income |

| 7,233,001 |

|

Accumulated net realized gain |

| 0 |

|

Unrealized depreciation |

| (22,406,453 | ) |

Total |

| (15,173,452 | ) |

Net unrealized appreciation/(depreciation) of investments based on federal tax costs was as follows:

Gross appreciation on investments (excess of value over tax cost) |

| $ | 1,291,977 |

|

Gross depreciation on investments (excess of tax cost over value) |

| (24,369,632 | ) | |

Gross appreciation on foreign currency and other derivatives |

| 671,202 |

| |

Net unrealized depreciation |

| (22,406,453 | ) | |

Total cost for federal income tax purposes |

| $ | 445,206,587 |

|

The differences between book and tax net unrealized depreciation and cost were primarily due to the differing tax treatment of foreign currency, investments in partnerships, and certain other investments.

22

3. CAPITAL TRANSACTIONS

The Fund’s authorized stock consists of 100,000,000 shares of common stock, par value $.001 per share. Of the 17,004,189 common shares outstanding on November 30, 2005, MIFA owned 4,189 shares. The Fund issued 17,000,000 common shares in its initial public offering on August 26, 2005. These common shares were issued at $25.00 per share before the underwriting discount of $1.125 per share. MIFA has agreed to pay all organizational expenses of approximately $55,000 as well as the offering expenses of the Fund (other than the sales load) that exceed $0.05 per common share.

4. PORTFOLIO SECURITIES

Purchases and sales of investment securities, other than short-term securities, for the period ended November 30, 2005 aggregated $376,953,524 and $7,817,049, respectively.

5. INVESTMENT ADVISORY AGREEMENT

MIFA serves as the Fund’s investment adviser pursuant to an Investment Management Agreement with the Fund and is responsible for determining the Fund’s overall investment strategy and implementation through day-to-day portfolio management, subject to the general supervision of the Fund’s Board of Directors. MIFA is also responsible for managing the Fund’s business affairs, overseeing other service providers and providing management services. As compensation for its services to the Fund, MIFA receives an annual management fee, payable on a quarterly basis, equal to the annualrate of 1.00% of the Fund’s TotalAssets (as defined below) up to andincluding $300 million, 0.90% of the Fund’s Total Assets over $300 million up to and including $500 million, and 0.65% of the Fund’s Total Assets over $500 million. Total Assets of the Fund, for the purpose of this calculation, includes the aggregate of the Fund’s average daily net assets plus proceeds from any outstanding borrowings used for leverage.

6. INTEREST RATE SWAP CONTRACTS

The Fund entered into an interest rate swap agreement in anticipation of the leverage facility described in Note 9. In this interest rate swap, the fund agrees to pay the other party to the interest rate swap (which is known as the counterparty) a fixed rate payment in exchange for the counterparty agreeing to pay the fund a variable rate payment that is intended to approximate the fund’s

23

variable rate payment obligation on the leverage facility. The payment obligation is based on the notional amount of the swap. Depending on the state of interest rates in general, the use of interest rate swaps could enhance or harm the overall performance of the common shares. The market value of interest rate swaps is based on pricing models that consider the time value of money, volatility, the current market and contractual prices of the underlying financial instrument. Unrealized gains are reported as an asset and unrealized losses are reported as a liability on the Statement of Assets & Liabilities. The change in value of swaps, including the accrual of periodic amounts of interest to be paid or received on swaps is reported as unrealized gains or losses in the Statement of Operations. A realized gain or loss is recorded upon payment or receipt of a periodic payment or termination of swap agreements. Swap agreements involve, to varying degrees, elements or market and counterparty risk, and exposures to loss in excess of the related amounts reflected in the Statement of Assets & Liabilities.

7. OTHER

Compensation of Directors: The Independent Directors of the Fund receive a quarterly retainer of $5,000 and an additional $2,500 for each meeting attended.

8. INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

24

9. SUBSEQUENT EVENTS

Distribution: The Fund paid a distribution of $6,376,570.88 or $0.375 per common share on December 20, 2005 to common shareholders of record on December 10, 2005.

Excise Tax: As of December 31, 2005, the Fund expects it will incur excise tax of approximately $100,000.

Leverage: On December 5, 2005, the Fund entered into a 364-day senior secured revolving credit facilityin the amount of $150,000,000 (the “Revolving Credit Facility”) with National Australia Bank, New York Branch (“NAB”). The Fund may draw down a loan utilizing a reference rate that may be either Fed Funds, LIBOR, or Eurodollar rate. The loans comprising each borrowing bear interest at a rate of 40 basis points per annum above the reference rate. On December 5, 2005 the Fund drew down $125,000,000, and on January 4, 2006 the Fund drew down the remaining $25,000,000 from the Revolving Credit Facility. The current borrowings use one month LIBOR as the reference rate.

Swap Agreements: The Fund uses interest rate swaps in connection with the Revolving Credit Facility to reduce or eliminate the risk that an increase in short-term interest rates could have on the performance of the fund’s common shares. On December 7, 2005, the Fund entered into a swap agreement with National Australia Bank.

On January 4, 2006 the Fund entered into a swap agreement with Citibank N.A.

On January 13, 2006, the Fund entered into a swap agreement with Citibank, N.A.

Subsequent swap agreements after November 30, 2005:

Swap |

| Notional |

| Fixed |

| Floating |

| Floating |

| Termination |

| ||

National |

|

|

|

|

| U.S. 1mt |

| USD LIBOR |

|

|

| ||

Australia Bank |

| 40,000,000 |

|

| 4.865% |

|

| Libor |

| BBA 1MT |

| Dec 9 2010 |

|

|

| 30,000,000 | USD |

|

|

|

| U.S. 1mt |

| USD LIBOR |

|

|

|

Citibank, N.A. |

| 34,572,000 | CAD |

| 4.15% | CAD |

| Libor |

| BBA 1MT |

| Jan 6 2009 |

|

|

| 20,000,000 | USD |

|

|

|

| U.S. 1mt |

| USD LIBOR |

|

|

|

Citibank, N.A. |

| 23,242,000 | CAD |

| 4.15% | CAD |

| Libor |

| BBA 1MT |

| Jan 6 2009 |

|

25

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of

Macquarie Global Infrastructure Total Return Fund Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Macquarie Global Infrastructure Total Return Fund Inc. (the “Fund”) at November 30, 2005, and the results of its operations, the changes in its net assets and the financial highlights for the period August 26, 2005 (commencement of operations) through November 30, 2005, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at November 30, 2005 by correspondence with the custodian and brokers, provides a reasonable basis for our opinion.

PricewaterhouseCoopers, LLP

January 17, 2006

26

Additional Information

November 30, 2005 (Unaudited)

Dividend Reinvestment Plan

Unless a stockholder of MGU (“Stockholder”) elects to receive cash distributions, all dividends, including any capital gain dividends, on the Stockholder’s Common Shares will be automatically reinvestedby the Plan Agent, The Bank of New York, in additional Common Shares under the Dividend Reinvestment Plan. If a Stockholder elects to receive cash distributions, the Stockholder will receive all distribution in cash paid by check mailed directly to the Stockholder by The Bank of New York, as dividend paying agent.

If a Stockholder decides to participate in the Plan, the number of Common Shares the Stockholder will receive will be determined as follows:

• If the Common Shares are trading at or above NAV at the time of valuation, the Fund will issue new shares at a price equal to the greater of (i) NAV per Common Share on that date or (ii) 95% of the market price on that date.

• If Common Shares are trading below NAV at the time of valuation, the Plan Agent will receive the dividend or distribution in cash and will purchase Common Shares in the open market, on the NYSE or elsewhere, for the participants’ accounts. It is possible that the market price for the Common Shares may increase before the Plan Agent has completed its purchases. Therefore, the average purchase price per share paid by the Plan Agent may exceed the market price at the time of valuation, resulting in the purchase of fewer shares than if the dividend or distribution had been paid in Common Shares issued by the Fund. The Plan Agent will use all dividends and distribu tions received in cash to purchase Common Shares in the open market within 30 days of the valuation date except where temporary curtailment or suspension of purchases is necessary to comply with federal securities laws. Interest will not be paid on any uninvested cash payments.

A Stockholder may withdraw from the Plan at any time by giving written notice to the Plan Agent, or by telephone in accordance with such reasonable requirements as the Plan Agent and Fund may agree upon. If a Stockholder withdraws or the Plan is terminated, the Stockholder will receive a certificate for each whole share in its account under the Plan and the Stockholder will receive a

27

cash payment for any fraction of a share in its account. If the Stockholder wishes, the Plan Agent will sell the Stockholder’s shares and send the proceeds, minus brokerage commissions, to the Stockholder.

The Plan Agent maintains all Stockholders’ accounts in the Plan and gives written confirmation of all transactions in the accounts, including information a Stockholder may need for tax records. Common Shares in an account will be held by the Plan Agent in non-certificated form. The Plan Agent will forward to each participant any proxy solicitation material and will vote any shares so held only in accordance with proxies returned to the Fund. Any proxy a Stockholder receives will include all Common Shares received under the Plan.

There is no brokerage charge for reinvestment of a Stockholder’s dividends or distributions in Common Shares. However, all participants will pay a pro rata share of brokerage commissions incurred by the Plan Agent when it makes open market purchases.

Automatically reinvesting dividends and distributions does not mean that a Stockholder does not have to pay income taxes due upon receiving dividends and distributions. If a Stockholder holds Common Shares with a brokerage firm that does not participate in the Plan, the Stockholder will not be able to participate in the Plan and any dividend reinvestmentmay be effected on different terms than those described above. Stockholders should consult their financial advisor for more information.

The Fund reserves the right to amend or terminate the Plan if in the judgment of the Board the change is warranted. There is no direct service charge to participants in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants.

All correspondence or questions concerning the Plan should be directed to the Plan Administrator, The Bank of New York, 101 Barclay Street, New York, NY 10286, 20th Floor, Transfer Agent Services, 1-800-433-8191.

Consideration of Approval of the Investment Advisory and Management Agreement

At a Board meeting held on July 13, 2005, all of the Directors, including the non-interested Directors, approved the Investment Management Agreement for an initial two-year

28

term. In their consideration, the Directors took into account: (i) a presentation about the services to be rendered to the Fund by the Adviser, the experience of the person expected to serve as principal portfolio manager, the experience of the Adviser’s affiliates in advising funds and other accounts that invest in Infrastructure Assets and Infrastructure Issuers, and the fees proposed to be paid by the Fund to the Adviser; and (ii) a memorandum describing the legal duties of the Directors under the 1940 Act. The Directors also received information prepared by Lipper, Inc. (“Lipper”) comparing the Fund’s fee rate for advisory and administrative services to those of other funds selected by Lipper and information prepared by Citigroup Global Markets Inc. and MIFA concerning adviser fees, administrative fees and total expenses for 66 closed-end funds generally investing in equity securities. In particular, the Directors considered the following:

(a) The nature, extent and quality of services to be provided by the Adviser. The Directors reviewed the services that the Adviser would provide to the Fund. The Directors discussed in detail with representatives of the Adviser the proposed management of the Fund’s investments in accordance with the Fund’s stated investment objective and policies and the types of transactions that would be entered into on behalf of the Fund. In addition to the investment advisory services to be provided to the Fund, the Directors considered that the Adviser also will oversee Fund service providers. The Directors discussed the Adviser’s compliance framework and considered a presentation by the Chief Compliance Officer of the Adviser and the Fund. The Directors also considered presentations by representativesof the Adviser containing an overview of the Fund and its investment strategy, and the experienceof the Adviser and its affiliates,and global reputation for infrastructureinvesting, their track record andtheir organization. Based on thispresentation, the Directors concludedthat the services to be provided to the Fund by the Adviser under the Investment Management Agreement were likely to be of a high quality andwould benefit the Fund.

(b) Investment performance of the Fund and the Adviser. Because the Fund is newly formed, the Directors did not consider its investment performance. However, Directors reviewed the performance of another closed-end fund for which the Adviser serves as subadviser, and

29

discussed information provided by the Adviser with respect to the exposure of the Adviser and its affiliates to investments in Infrastructure Issuers, including through non-U.S. funds advised by affiliates of the Adviser. The Directors, recognizing that past performance does not assure future results, believed that this information demonstrated the considerable experience and expertise of the Adviser in managing investments in Infrastructure Issuers. Based on their review, the Directors determined that the Adviser would be an appropriate investment adviser for the Fund.

(c) Cost of the services to be provided and profits to be realized by the Adviser from the relationship with the Fund. The Directors also considered the anticipated cost of the services to be provided by the Adviser. Because the Fund is newly formed, had not commenced operations as of July 13, 2005, and the eventual aggregate amount of Fund assets was uncertain, the Adviser was not able to provide the Directors with specific information concerning the cost of services to be provided to the Fund and the profits to be realized by the Adviser from its relationship with the Fund. The Directors, however, did discuss with the Adviser the general level of its anticipated profitability and noted that the Adviser would provide the Directors with profitability information from time to time after the Fund commences operations. The Directors concluded that the Adviser’s anticipated profitability for managing the Fund was expected to be within the range determined by appropriate court cases to be reasonable.

(d) The extent to which economies of scale would be realized as the Fund grows and whether fee levels would reflect such economies of scale. Because the Fund is newly formed, had not commenced operations as of July 13, 2005, and the eventual aggregate amount of Fund assets was uncertain, the Adviser was not able to provide the Directors with specific information concerning the extent to which economies of scale would be realized. However, the Directors noted that the proposed advisory fee schedule contained breakpoints at three levels of assets. The Directors determined that the breakpoints permitted the Fund to share in the potential benefits of economies of scale as the Fund’s assets increased. The Directors also discussed the renewal requirements for investment advisory agreements, and determined that they would revisit this issue no later than when they next review the investment advisory fee after the initial two-year term of the Investment Management Agreement.

30

(e) Comparison of services to be rendered and fees to be paid to those under other investment advisory contracts, such as contracts of the same and other investment advisers or other clients. The Directors compared both the services to be rendered and the fees to be paid under the Investment Management Agreement to the services that the Adviser provides as subadviser to another registered closed-end fund and to contracts of other investment advisers with respect to other generally similar closed-end registered investment companies. When comparing the fee to be charged to the Fund by the Adviser to the fee charged to the other closed-end fund for providing sub-advisory services, the Directors considered the difference in the nature and extent of the services to be provided by the Adviser to the Fund compared to nature and extent of the sub-advisory services, and concluded that the fee differential is justified by the additional services provided to the Fund and related additional costs to the Adviser of servicing the Fund.

In reviewing the advisory fee proposed to be paid by the Fund,the Board also considered that the Fund’s use of leverage would increase the base of assets subject to the advisory fee and so would increase the advisory fee payable to the Adviser. The Board discussed in detail with the Adviser the circumstances under which the Adviser would leverage the Fund’s assets and accepted the Adviser’s explanation that the Adviser would only leverage the Fund’s assets in an attempt to enhance the Fund’s overall returns (that is, produce excess returns after the deduction of advisory fees paid on leveraged assets).

In addition, the Directors evaluated the Fund’s proposed fee schedule for advisory services as compared to the fee rate and expense ratios of the funds enumerated in the materials prepared by Lipper, MIFA and Citigroup Global Markets Inc. and concluded that the Fund’s proposed fee schedule and anticipated expense ratio were within the respective ranges borne by those other funds.

Conclusion. No single factor was determinative to the decision of the Directors. Based on the foregoing and such other matters as were deemed relevant, all of the Directors, including the non-interested Directors, concluded that the proposed advisory fee and projected total expense ratio are reasonable in relation to the services to be provided by the Adviser to the Fund, as well

31

as the costs to be incurred and benefits to be gained by the Adviser in providing such services. As a result, all of the Directors, including the non-interested Directors, approved the Investment Management Agreement. The non-interested Directors were represented by independent counsel who assisted them in their deliberations.

Fund Proxy Voting Policies & Procedures

Policies and procedures used in determining how to vote proxies relating to portfolio securities and a summary of proxies voted by the Fund are available without a charge, upon request, by contacting the Fund at 1-800-910-1434 and on the Commission’s web site at http://www.sec.gov.

Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q within 60 days after the end of the period. Copies of the Fund’s Forms N-Q are available without a charge, upon request, by contacting the Fund at 1-800-910-1434 and on the Commission’s web site at http://www.sec.gov. You may also review and copy Form N-Q at the Commission’s Public Reference Room in Washington, D.C. For more information about the operation of the Public Reference Room, please call the Commission at 1-800-SEC-0330.

Designation Requirements

The Fund designates the following for federal income tax purposes for the year ended November 30, 2005:

Foreign Taxes Paid and Foreign Source Income

Foreign Taxes Paid |

| $ | 595,677 |

|

Foreign Source Income |

| $ | 5,935,706 |

|

Notice

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that the Fund may purchase at market prices from time to time shares of its common stock in the open market.

32

This Page Intentionally Left Blank

33

Directors & Officers

November 30, 2005 (Unaudited)

Certain biographical and other information relating to the non-interested Directors of the Fund is set out below, including their ages, their principal occupations for at least the last five years, the length of time served, the total number of portfolios overseen in the complex of funds advised by the Adviser (“MIFA-Affiliate Advised Funds”), and other public directorships

Biographical Information of the Non-Interested Directors of the Fund

Name, Age and |

| Position(s) Held with |

| Term of Office and |

|

|

|

|

|

Gordon A. Baird, 37 |

| Director |

| Since – July 22, 2005 |

|

|

|

|

|

Thomas W. Hunersen, 47 |

| Director |

| Since – July 12, 2005 |

|

|

|

|

|

Chris LaVictoire Mahai, 50 |

| Director |

| Since – July 12, 2005 |

(1) Each non interested Director may be contacted by writing to the Director, c/o Macquarie Global Infrastructure Total Return Fund, 1625 Broadway, Suite 2200, Denver, CO 80202.

34

Principal Occupation(s) During Past |

| Number of MIFA-Affiliate |

| Public |

|

|

|

|

|

Mr. Baird has been Chief Executive Officer, partner and member of the Board of Paramax Capital Group (investment management firm) since 2003. He was Director, Fixed Income and Structured Finance Group, Citigroup Global Markets Inc. (formerly Salomon Smith Barney Inc.) (2002-2003); President and member of the Board of Directors, IBEX Capital Markets Inc. (1996-2001). |

| 1 |

| None |

|

|

|

|

|

Mr. Hunersen has been a consultant since 2005. He was Head of Strategy Projects—North America, Global Wholesale Banking—Bank of Ireland, Greenwich, Connecticut (2004), Chief Executive Officer, Slingshot Game Technology Incorporated, Natick, Massachusetts (2002-2003), and Executive Vice President, General Manager, Global Head of Energy & Utilities—Global Wholesale Banking—National Australia Bank Limited (1987-2001). |

| 1 |

| None |

|

|

|

|

|

Ms. Mahai has been Owner/Managing Member/Partner of Avenus, LLC (general management consulting) since 1999. |

| 1 |

| None |

35

Biographical Information of the Interested Directors of the Fund

Name, Age and |

| Position(s) Held with |

| Term of Office and |

Oliver Yates, 40 |

| Director |

| Since – May 4, 2005 |

Biographical Information of the Executive Officers of the Fund

Name Address and |

| Position(s) Held with |

| Term of Office and |

Jon Fitch, 40 |

| Chief Executive Officer |

| Since – July 13, 2005 |

|

|

|

|

|

John Mullin, 44 |

| Treasurer, Chief Financial Officer and Secretary |

| Since – July 13, 2005 |

|

|

|

|

|

Rose Barry, 40 |

| Chief Compliance Officer |

| Since – July 13, 2005 |

(1) Each officer serves an indefinite term.

36

| Number of MIFA-Affiliate |

| Public | |

|

|

|

|

|

Co-head of the Macquarie Group’s Financial Products group and an Executive Director of Macquarie Bank Limited (July 2004—present); President of Macquarie Holdings USA (2000—July 2004). |

| 1 |

| None |

Principal Occupation(s) During Past |

|

|

|

|

|

|

|

|

|

CEO, Macquarie Infrastructure Fund Adviser, LLC (February 2004—present); Equity Analyst, Macquarie Equities Limited (2001—2003: established Hong Kong-based research team; 1997—2000: led coverage of the Australian infrastructure and utility sector) |

|

|

|

|

|

|

|

|

|

CFO & Head of CAG, Macquarie Holdings (USA) Inc (September 2004—present); Executive Vice President & Chief Financial Officer, Blaylock & Partners, LP (May 2002 to August 2004); Chief Financial Officer Tucker Anthony Inc (September 1997 to April 2002) |

|

|

|

|

|

|

|

|

|

Macquarie Holdings (USA) Inc, (May 2003—present), Associate Director and Compliance Manager; Macquarie Infrastructure Fund Adviser, LLC (February 2004—present), Chief Compliance Officer; J.P. Morgan Chase & Co. (May 2000—2003), Associate, Legal Department, Private Banking, (June 1996—2000), Compliance Dept. |

|

|

|

|

37

| 1-800-910-1434 |

|

|

| Macquarie Global Infrastructure Total Return Fund |

|

|

| MGU-Questions@macquarie.com |

|

|

| www.macquarie.com/mgu |

38

Item 2. Code of Ethics.

(a) The Registrant, as of the end of the period covered by the report, has adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) Not applicable.

(c) There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics described in Item 2(a) above.

(d) The Registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party, that relates to any element of the code of ethics described in 2(a) above.

(e) Not applicable.

(f) The Registrant's Code of Ethics is attached as Exhibit 12.(A)(1). hereto.

Item 3. Audit Committee Financial Expert.

The Board of Directors of the Registrant has determined that the Registrant has at least one audit committee financial expert serving on its audit committee. The Board of Directors has determined that each of the independent directors is an audit committee financial expert. Gordon A. Baird, Chris LaVictoire Mahai and Thomas W. Hunersen are “independent” as defined in paragraph (a)(2) of Item 3 to Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees: The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for fiscal year 2005 was $76,145.

(b) Audit-Related Fees: The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item was $0 in 2005.

(c) Tax Fees: The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning was $0 in 2005.

(d) All Other Fees: The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item is $0 in 2005.

(e)(1) Audit Committee Pre-Approval Policies and Procedures: All services to be performed by the Registrant’s principal auditors must be pre-approved by the Registrant’s audit committee, which may include the approval of certain services up to an amount determined by the audit committee. Any services that would exceed that amount would require additional approval of the audit committee.

(e)(2) No services described in paragraphs (b) through (d) were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(e) Not applicable.

(f) Not applicable.

(g) Not applicable.

(h) Not applicable

Item 5. Audit Committee of Listed Registrants.

The registrant has a separately designated standing audit committee established in accordance with Section 3 (a)(58)(A) of the Exchange Act and is comprised of the following members:

Gordon A. Baird

Chris LaVictoire Mahai

Thomas W. Hunersen

Item 6. Schedule of Investments.

The Schedule of Investments is included as part of the Report to Stockholders filed under Item 1 of this form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The following is a copy of the registrant’s policies and procedures.

Proxy Voting Guidelines

The Registrant has adopted a proxy voting policy that seeks to ensure that proxies for securities that it holds are voted consistently and solely in the best economic interests of the Registrant.

The Board of Directors is responsible for oversight of the Fund’s proxy voting process. The Board has delegated day-to-day proxy voting responsibility to the Adviser. The Adviser has engaged the services of Institutional Shareholder Services, Inc. (“ISS”) to make recommendations to the Adviser on the voting of proxies relating to securities held by the Fund. ISS provides voting recommendations based upon established guidelines and practices. The Adviser reviews ISS recommendations and frequently will follow the ISS recommendations. However, on selected issues, the Adviser may not vote in accordance with the ISS recommendations when it believes that specific ISS recommendations are not in the best economic interest of the Registrant. If the Adviser manages the assets of a company or its pension plan and any of the Adviser’s clients hold any securities in that company, the Adviser will vote proxies relating to that company’s securities in accordance with the ISS recommendations to avoid any conflict of interest. If the Registrant requests the Adviser to follow specific voting guidelines or additional guidelines, the Adviser will review the request and inform the Registrant only if the Adviser is not able to follow the Registrant’s request.

The Adviser has also adopted the ISS Proxy Voting Guidelines, a current copy of which is attached as Appendix B. While these guidelines are not intended to be all-inclusive, they do provide guidance on the Adviser’s general voting policies.

Information about how the Fund will vote proxies relating to portfolio securities will be available without charge by calling

1-800-910-1434 or by accessing the SEC’s website at http://www.sec.gov.

2005 ISS Proxy Voting Guidelines Summary

1. Auditors

Vote CASE-BY-CASE on shareholder proposals on auditor rotation, taking into account these factors:

• Tenure of the audit firm

• Establishment and disclosure of a renewal process whereby the auditor is regularly evaluated for both audit quality and competitive price

• Length of the rotation period advocated in the proposal

• Significant audit-related issues

• Number of audit committee meetings held each year

• Number of financial experts serving on the committee

2. Board of Directors

Voting on Director Nominees in Uncontested Elections

Generally, vote CASE-BY-CASE. But WITHHOLD votes from:

• Insiders and affiliated outsiders on boards that are not at least majority independent

• Directors who sit on more than six boards, or on more than two public boards in addition to

their own if they are CEOs of public companies

• Directors who adopt a poison pill without shareholder approval since the company’s last annual meeting and there is no requirement to put the pill to shareholder vote within 12 months of its adoption

• Directors who serve on the compensation committee when there is a negative correlation between chief executive pay and company performance (fiscal year end basis)

• Directors who have failed to address the issue(s) that resulted in any of the directors receiving more than 50% withhold votes out of those cast at the previous board election

Classification/Declassification of the Board

Vote AGAINST proposals to classify the board.

Vote FOR proposals to repeal classified boards and to elect all directors annually.

Independent Chairman (Separate Chairman/CEO)