UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21765 | |||||||

| ||||||||

Macquarie Global Infrastructure Total Return Fund Inc. | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

125 West 55th Street, New York, NY |

| 10019 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Craig Fidler | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | (303) 623-2577 |

| ||||||

| ||||||||

Date of fiscal year end: | November 30 |

| ||||||

| ||||||||

Date of reporting period: | November 30, 2007 |

| ||||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

Item 1. Reports to Stockholders.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS AND PAST PERFORMANCE

This Annual Report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of Macquarie Fund Adviser, LLC and its respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would,” or other words that convey uncertainty of future events or outcomes. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Fund’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Past performance is not a reliable indication of future performance. When evaluating the information included in this Annual Report, you are cautioned not to place undue reliance on these forward looking statements, which reflect the judgment of Macquarie Fund Adviser, LLC and its respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Capitalized terms, used but not defined herein, have the meaning assigned to them in the Fund’s prospectus.

The Macquarie Global Infrastructure Total Return Fund (MGU) is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia), and its obligations do not represent deposits with or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (MBL). MBL does not guarantee or otherwise provide assurance in respect of the obligations of the Fund.

1

Shareholder Letter

NOVEMBER 30, 2007 (unaudited)

Introduction

We are pleased to provide the following report to shareholders of Macquarie Global Infrastructure Total Return Fund Inc. (“MGU” or “the Fund”) for the year ended November 30, 2007 (“Period”).

The Net Asset Value (“NAV”) of the Fund increased 22.7% from $28.81 on November 30, 2006, to $35.35 on November 30, 2007. During this Period the Fund also paid four regularly scheduled quarterly distributions, totalling $1.60 per share. The Fund also paid one special distribution of $0.50 per share on December 29, 2006. After including these distributions, MGU’s NAV increased 31.5% on a total return basis over the Period.

MGU’s share price increased by 17.0%, from $26.87 to $31.45 during the Period. Including total distribution payments of $2.10 during the year, MGU’s share price delivered a total return of 25.5%. The share price discount to NAV increased from 6.7% at November 30, 2006, to 11.0% at November 30, 2007. This discount has narrowed to 2.9% at January 3, 2008.

Investment Objective and Strategy

The Fund’s investment objective is to provide investors with a high level of total return consisting of dividends and other income, and capital appreciation. The Fund seeks to achieve its objective by investing at least 80% of its total assets in equity and equity-like securities issued by U.S. and non-U.S. issuers that own or operate infrastructure assets (“Infrastructure Issuers”).

Most of the Infrastructure Issuers in which the Fund has invested, and will continue to invest in, will be public companies listed on national or regional stock exchanges.

In pursuit of its investment objective, MGU will also seek to manage its investments so that at least 25% of its distributions may qualify as tax-advantaged “qualified dividend income” for U.S. federal income tax purposes.

In line with the overall investment strategy of the Fund, Macquarie Fund Adviser, LLC (“MFA” or the “Manager”), investment adviser to the Fund, continues to focus on the securities of infrastructure companies that it believes provide essential services, have strong strategic positions in the businesses in which they are involved, and are able to generate sustainable and growing cash flow streams to equity holders.

2

Shareholder Letter

NOVEMBER 30, 2007 (unaudited)

Fund Commentary

The NAV total return for the Fund and comparative benchmarks for the Period are summarized in the table below:

Total NAV Return: | |||

For the Period Ended | |||

November 30, 2007 | |||

Macquarie Global Infrastructure |

| 31.5 | % |

Total Return Fund (MGU) |

|

|

|

Macquarie Global |

| 26.6 | % |

Infrastructure Index USD (1) |

|

|

|

S&P U.S. Utilities |

| 20.4 | % |

Accumulation Index (2) |

|

|

|

During the Period, MGU and the Macquarie Global Infrastructure Index USD (the “Benchmark”) benefited from favorable equity market conditions, attractive industry fundamentals, solid financial performance and merger and acquisition activity.

MGU continued to benefit from relative weakness in the U.S. Dollar. For example, during the Period, the U.S. Dollar declined on average over 10% against the Australian Dollar and Canadian Dollar, and over 9% against the Euro. These three currencies represented approximately 48% of the portfolio security positions as of November 30, 2007.

Portfolio Composition

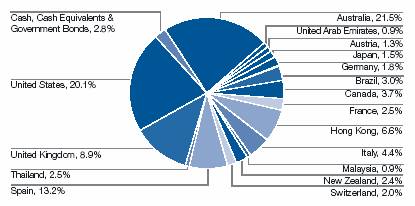

A summary of the geographic and industry diversification of the portfolio as of November 30, 2007. is shown in the following charts:

(1) |

| The Macquarie Global Infrastructure Index consists of over 220 infrastructure/utilities stocks in the FTSE Global All-Cap Index, and has a combined market capitalization of approximately $2.5 trillion as of November 30, 2007. |

|

|

|

(2) |

| The Standard & Poor’s Utilities Index is an unmanaged, capitalization-weighted index representing 31 of the largest utility companies listed on the NYSE. |

3

Portfolio Diversification by Geographic Region (3)

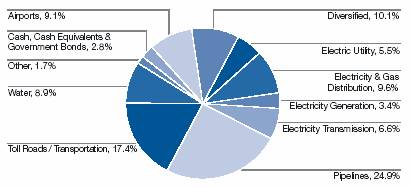

Portfolio Diversification by Industry Sector (3)(4)

The Fund maintained a diversified geographic exposure to take advantage of infrastructure developments around the globe. The two largest holdings by country in MGU as at the end of the Period were in Australia and the United States, together representing 41.6% of the Fund. During the Period, the Fund established positions in a number of countries, including Japan, Austria, Germany, Switzerland, Thailand, and the United Arab Emirates. The Fund also exited its position in South Korea

(3) |

| Based on Total Assets as defined in the Fund’s Prospectus. Total Return Swap positions have been included on a “mark-to-market” basis and they are included on this basis under appropriate country and industry classifications. |

|

|

|

(4) |

| In May 2007, the Industry sector classifications have been updated and therefore, they differ from the classifications presented in the previous annual report. |

4

Shareholder Letter

NOVEMBER 30, 2007 (unaudited)

during the Period. The table below compares the Fund’s geographic diversification on November 30, 2007, with the diversification at the end of the prior corresponding period, on November 30, 2006.

|

| % of Fund on |

| % of Fund on |

| % Change over |

|

Nation |

| Nov. 30, 2006 (3) |

| Nov. 30, 2007 (3) |

| the Year |

|

Australia |

| 16.9 | % | 21.5 | % | 4.6 | % |

United States |

| 19.6 | % | 20.1 | % | 0.5 | % |

Spain |

| 6.3 | % | 13.2 | % | 6.9 | % |

United Kingdom |

| 20.3 | % | 8.9 | % | -11.4 | % |

Hong Kong |

| 6.6 | % | 6.6 | % | 0.0 | % |

Italy |

| 8.6 | % | 4.4 | % | -4.2 | % |

Canada |

| 6.8 | % | 3.7 | % | -3.1 | % |

Thailand, Malaysia and Brazil |

| 1.1 | % | 6.4 | % | 5.3 | % |

France |

| 6.1 | % | 2.5 | % | -3.6 | % |

New Zealand |

| 2.7 | % | 2.4 | % | -0.3 | % |

South Korea |

| 0.8 | % | — |

| -0.8 | % |

Switzerland |

| — |

| 2.0 | % | 2.0 | % |

Germany |

| — |

| 1.8 | % | 1.8 | % |

Japan |

| — |

| 1.5 | % | 1.5 | % |

Austria |

| — |

| 1.3 | % | 1.3 | % |

United Arab Emirates |

| — |

| 0.9 | % | 0.9 | % |

Cash, Cash Equivalents & |

| 4.2 | % | 2.8 | % | -1.4 | % |

The Fund’s investments as at the end of the Period were diversified among 10 industry sectors, with the greatest exposures in Pipelines 24.9% and Toll Roads / Transportation 17.4%. During the Period, the Fund increased its position in Toll Roads / Transportation companies, while it reduced its position in water companies. The table below compares the Fund’s industry sector diversification at the end of the Period to the end of the prior corresponding period, on November 30, 2006.

|

| % of Fund on |

| % of Fund on |

| % Change over |

|

Industry Sector |

| Nov. 30, 2006 (3) |

| Nov. 30, 2007 (3)(4) |

| the Year |

|

Pipelines |

| 20.4 | % | 24.9 | % | 4.5 | % |

Toll Roads / Transportation |

| 6.0 | % | 17.4 | % | 11.4 | % |

Diversified |

| 5.7 | % | 10.1 | % | 4.4 | % |

Electricity & Gas Distribution |

| 11.3 | % | 9.6 | % | -1.7 | % |

Airports |

| 7.0 | % | 9.1 | % | 2.1 | % |

Water |

| 16.6 | % | 8.9 | % | -7.7 | % |

Electricity Transmission |

| 7.4 | % | 6.6 | % | -0.8 | % |

Electric Utility |

| 12.3 | % | 5.5 | % | -6.8 | % |

Electricity Generation |

| 2.3 | % | 3.4 | % | 1.1 | % |

Other |

| 6.8 | % | 1.7 | % | -5.1 | % |

Cash, Cash Equivalents & |

| 4.2 | % | 2.8 | % | -1.4 | % |

5

Top Ten Holdings

A summary of the top ten holdings as of November 30, 2007 is shown in the following table:

|

|

|

|

|

| % of Total |

|

Company |

| Country |

| Sector |

| Assets |

|

Cintra Concesiones de Infraestructuras de Transporte SA |

| Spain |

| Toll Roads / |

| 4.5 | % |

Red Electrica de Espana |

| Spain |

| Transmission |

| 4.5 | % |

Spark Infrastructure Group |

| Australia |

| Electricity & Gas Distribution |

| 4.4 | % |

Babcock & Brown Infrastructure Group |

| Australia |

| Diversified |

| 4.3 | % |

Transurban Group |

| Australia |

| Toll Roads / |

|

|

|

|

|

|

| Transportation |

| 4.3 | % |

Enagas |

| Spain |

| Pipelines |

| 4.2 | % |

Enbridge Energy Partners LP |

| United States |

| Pipelines |

| 3.7 | % |

Magellan Midstream Partners LP |

| United States |

| Pipelines |

| 3.6 | % |

Energy Transfer Partners LP |

| United States |

| Pipelines |

| 3.6 | % |

SP AusNet |

| Australia |

| Electricity & |

| 3.5 | % |

The Fund’s investments in the United States continue to focus on Master Limited Partnerships that own pipeline and associated infrastructure assets. The Manager continues to believe that these investments offer relatively predictable and defensive cashflows, attractive yields and good growth prospects. Examples include Enbridge Energy Partners L.P., Magellan Midstream Partners L.P., and Energy Transfer Partners L.P. During the year the Fund participated in the initial public offering of Duncan Energy Partners L.P., and also established positions in NuStar Energy L.P. and Energy Transfer Partners L.P.

In Canada, the Fund exited its position in UE Waterheater Income Fund, a water heater company, following the acquisition by Alinda Capital Partners L.L.C.

In Australia, the Fund has investments in a range of infrastructure companies, including a toll road company, energy infrastructure companies, and also diversified infrastructure companies. During the year, the Fund established a position in Challenger Infrastructure Fund, which is listed in Australia and has a diversified portfolio of global infrastructure and utility assets. In New Zealand, the Fund continues to have a position in Auckland International Airport Limited. In July 2007, Dubai Aerospace Enterprise

6

Shareholder Letter

NOVEMBER 30, 2007 (unaudited)

(DAE) announced a proposal to acquire a majority interest in Auckland International Airport. Later in the year, DAE withdrew this proposal; however in November 2007, the Canada Pension Plan Investment Board announced its intention to make an all-cash partial takeover offer of NZD $3.65 per share for 40% of Auckland International Airport.

The Fund’s investments in the United Kingdom continue to be concentrated on the water utilities sector. During the year, the Fund exited its position in AWG, which was de-listed from the stock exchange in December 2006, following its acquisition by a private consortium called Osprey, which comprised of the Canada Pension Plan Investment Board, Colonial First State Global Asset Management, Industry Funds Management and 3i Group Plc. The Fund also benefited from its holding in UK water company Kelda, which in November 2007 received a takeover bid from a consortium that included Citigroup and HSBC Group.

The Fund continues to hold positions across a number of countries in Europe, including Spain, Italy and France. The Fund increased its holdings in Spain during the year, establishing a position in toll road company Cintra Concesiones de Infraestructuras de Transporte SA, which is now the largest holding in the MGU Fund as at the end of the Period. During the Period, the Fund reduced its position in Aeroports De Paris (ADP), which operates airports such as Charles-de-Gaulle Airport in Paris. The ADP share price has performed strongly since ADP listed in June 2006. ADP was the largest holding in MGU as of May 31, 2007, but as at the end of the Period represents approximately 1.0% of the Fund. Also during the Period, the Fund established positions in other European airports companies, such as Vienna Airport and Zurich Airport, and participated in the initial public offering for Hamburger Hafen und Logistik AG in Germany. The City of Hamburg sold down a 30% interest in Hamburger Hafen und Logistik AG, which is a port operations and logistics group that has the majority of its operations in the Port of Hamburg.

The Fund exited its position in Beijing Capital International Airport during the Period following strong share price performance. As at the end of the Period, the Fund continued to hold Zhejiang Expressway, another Chinese infrastructure company listed on the Hong Kong Stock Exchange, and the share price of Zhejiang Expressway increased approximately 110% during the Period. The Fund also continues to hold Hong Kong companies such as CLP and Hong Kong Electric, which are both Hong Kong power companies, as well as Cheung Kong Infrastructure which is the largest publicly listed diversified infrastructure company in Hong Kong and has investments in countries such as Australia, United Kingdom, Hong Kong, and Mainland China.

During the Period, the Fund established a position in East Japan Railway, which was the Fund’s first investment in Japan. East Japan Railway operates both in the Greater Tokyo metropolitan region and the

7

eastern portion of Japan’s main island of Honshu and is the largest passenger railway company in the world, serving approximately 16 million passengers each day. The Fund also established a position in Airports of Thailand, which manages and operates the 6 leading airports in Thailand, and which account for more than 90% of Thailand’s air traffic.

The Fund added to its investment in Brazil during the Period by establishing a position in Companhia de Concessoes Rodoviarias, which is a tollroad company in Brazil.

The Fund established a position in the United Arab Emirates in November 2007 after participating in the IPO of DP World, which was the largest ever IPO in the Middle East, raising almost USD $5bn. At the time of IPO, DP World was the fourth largest container

terminal operator in the world, with a portfolio of 42 container terminals spanning 22 countries.

Leverage and Swaps

As at the end of the Period, the Fund had drawn down $150 million of its $200 million commercial paper conduit which possesses a renewal date of September 28, 2008. While there has been uneasiness in the credit markets over the past six months, the Manager currently believes this will not have a material adverse effect on the Fund’s ability to renew the credit facility.

To limit MGU’s exposure to potentially adverse interest rate movements, the Manager entered into swap agreements for three to five years from the establishment date of the swaps. The swap agreements currently mature between November 2008 and December 2010. While the Manager expects to be able to renew these swap agreements, it is unclear as to whether the Fund would be able to lock in interest rates greater or less than the current rates.

In addition, the Fund has entered into a total return swap agreement with the Bank of Nova Scotia. This total return swap agreement provides an alternative, costeffective structure for investing in Canadian securities. As of November 30, 2007, the total return swap agreement had a notional amount of CAD 25,530,085.

The Manager believes MGU’s credit and total return swap facilities provide an attractive combination of pricing and flexibility for the Fund. In addition, the overall level of leverage, being 19.9% of total assets of the Fund, is well within the limit outlined in the Fund’s prospectus. The Manager believes that the prudent application of leverage can assist in increasing total returns generated by the Fund. Subsequent to the year-end, on December 28, 2007, the Fund drew down $25 million from the CP Conduit.

Distributions

The Fund paid four regular quarterly distributions and one special distribution during the Period, totalling $2.10 per share.

Based on the Fund’s NAV of $35.35 and closing share price of $31.45 as at the end of the Period, the $0.40 per share regular quarterly distributions represent

8

Shareholder Letter

NOVEMBER 30, 2007 (unaudited)

an annualized distribution rate of 4.5% on NAV and 5.1% on share price, respectively.

Subsequent to the end of the Period, the Fund declared three distributions: a regular quarterly distribution of $0.40 per common share, a special distribution of $0.085 per common share on December 11, 2007 and a long-term capital gain distribution of $3.895 per common share on December 11, 2007. All three distributions are payable on December 31, 2007 to shareholders of record on December 20, 2007.

Market Outlook

While global equity markets were volatile during the year, the Manager remains positive about the outlook for the infrastructure sector and the investment opportunities it presents for the Fund.

The Manager believes that infrastructure continues to be an attractive sector for investment groups, as they are attracted to typical features of infrastructure assets such as strong strategic positions, relatively predictable cash flows, and the long-life nature of infrastructure assets. Investment groups launched takeovers for a number of listed infrastructure companies during the year, including AWG, UE Waterheater Income Fund, Kelda and Auckland International Airport, and the Manager expects this trend to continue.

The Manager also believes that the privatization of infrastructure assets by governments around the world will continue to provide opportunities for the Fund, as governments seek to reduce their debt levels and improve essential services to their populations. Since inception, MGU has participated in a number of initial public offerings, and the Manager expects that asset divestitures through initial public offerings will continue to provide investment opportunities for the Fund.

Conclusion

The Fund has performed well during the year ending November 30, 2007. The Manager believes that MGU continues to provide U.S. investors with an attractive vehicle to access the global universe of infrastructure securities. The Manager remains committed to the investment strategy of the Fund, and will continue to focus on the securities of infrastructure companies that it believes provide essential services, have strong strategic positions in the businesses in which they are involved, and are able to generate sustainable and growing cash flow streams to equity holders.

We appreciate your investment in the Fund. For any questions or comments you may have, please call on 1-800-910-1434, e-mail us at MGU-Questions@ macquarie.com, or visit us at www.macquarie.com/mgu.

Yours sincerely,

Jon Fitch

President/Portfolio Manager

Justin Lannen

Portfolio Manager

9

Schedule of Investments

NOVEMBER 30, 2007

(Expressed in US Dollars)

Description |

| Shares |

| Value $ |

| |

COMMON STOCKS - 90.58% |

|

|

|

|

| |

Australia - 26.88% |

|

|

|

|

| |

Australian Infrastructure Fund |

| 3,038,065 |

| $ | 8,854,125 |

|

Babcock & Brown Infrastructure Group |

| 22,882,166 |

| 32,333,430 |

| |

Challenger Infrastructure Fund |

| 4,141,103 |

| 13,458,557 |

| |

Envestra, Ltd. |

| 15,056,370 |

| 13,031,098 |

| |

Hastings Diversified Utilities Fund |

| 1,059,005 |

| 3,179,886 |

| |

SP AusNet |

| 25,065,282 |

| 26,342,332 |

| |

Spark Infrastructure Group |

| 19,041,365 |

| 33,212,367 |

| |

Transurban Group (1) |

| 5,060,443 |

| 32,133,060 |

| |

|

|

|

| 162,544,855 |

| |

|

|

|

|

|

| |

Austria - 1.62% |

|

|

|

|

| |

Flughafen Wien AG |

| 86,727 |

| 9,782,242 |

| |

|

|

|

|

|

| |

Brazil - 2.61% |

|

|

|

|

| |

AES Tiete SA |

| 200,100,000 |

| 7,210,610 |

| |

Cia de Concessoes Rodoviarias |

| 489,710 |

| 8,550,189 |

| |

|

|

|

| 15,760,799 |

| |

|

|

|

|

|

| |

France - 3.07% |

|

|

|

|

| |

Aeroports de Paris |

| 65,907 |

| 7,520,658 |

| |

Electricite de France |

| 90,814 |

| 11,040,368 |

| |

|

|

|

| 18,561,026 |

| |

|

|

|

|

|

| |

Germany - 2.28% |

|

|

|

|

| |

Hamburger Hafen und Logistik AG |

| 157,642 |

| 13,791,225 |

| |

|

|

|

|

|

| |

Hong Kong - 8.26% |

|

|

|

|

| |

Cheung Kong Infrastructure Holdings, Ltd. |

| 4,762,170 |

| 18,318,509 |

| |

CLP Holdings, Ltd. |

| 1,500,000 |

| 10,162,536 |

| |

Hong Kong Electric Holdings, Ltd. |

| 839,960 |

| 4,385,383 |

| |

Zhejiang Expressway Co., Ltd. |

| 11,951,000 |

| 17,099,280 |

| |

|

|

|

| 49,965,708 |

| |

|

|

|

|

|

| |

Italy - 5.51% |

|

|

|

|

| |

Enel SpA |

| 1,319,000 |

| 15,803,687 |

| |

Snam Rete Gas SpA |

| 211,954 |

| 1,345,740 |

| |

Terna SpA |

| 4,125,000 |

| 16,142,747 |

| |

|

|

|

| 33,292,174 |

| |

See Notes to Financial Statements.

10

Schedule of Investments

NOVEMBER 30, 2007

(Expressed in US Dollars)

Description |

| Shares |

| Value $ |

| ||

Japan - 1.89% |

|

|

|

|

| ||

East Japan Railway Co. |

| 1,380 |

| $ | 11,401,161 |

| |

|

|

|

|

|

| ||

Malaysia - 1.19% |

|

|

|

|

| ||

PLUS Expressways Berhad |

| 7,269,000 |

| 7,172,858 |

| ||

|

|

|

|

|

| ||

New Zealand - 2.99% |

|

|

|

|

| ||

Auckland International Airport, Ltd. |

| 8,390,858 |

| 18,081,350 |

| ||

|

|

|

|

|

| ||

Spain - 16.43% |

|

|

|

|

| ||

Cintra Concesiones de Infraestructuras de Transporte SA |

| 2,120,635 |

| 33,847,016 |

| ||

Enagas SA |

| 1,055,000 |

| 31,763,441 |

| ||

Red Electrica de Espana SA |

| 547,000 |

| 33,753,873 |

| ||

|

|

|

| 99,364,330 |

| ||

|

|

|

|

|

| ||

Switzerland - 2.44% |

|

|

|

|

| ||

Flughafen Zuerich AG |

| 37,166 |

| 14,767,295 |

| ||

|

|

|

|

|

| ||

Thailand - 3.10% |

|

|

|

|

| ||

Airports of Thailand Plc |

| 11,124,301 |

| 18,733,589 |

| ||

|

|

|

|

|

| ||

United Arab Emirates - 1.19% |

|

|

|

|

| ||

DP World, Ltd. |

| 5,515,000 |

| 7,224,650 |

| ||

|

|

|

|

|

| ||

United Kingdom - 11.12% |

|

|

|

|

| ||

Kelda Group Plc |

| 676,923 |

| 15,002,529 |

| ||

Pennon Group Plc |

| 838,396 |

| 11,634,813 |

| ||

Severn Trent Plc |

| 647,950 |

| 20,874,540 |

| ||

United Utilities Plc |

| 1,280,974 |

| 19,751,861 |

| ||

|

|

|

| 67,263,743 |

| ||

|

|

|

|

|

| ||

Total Common Stocks |

|

|

| $ | 547,707,005 |

| |

See Notes to Financial Statements.

11

Description |

| Shares |

| Value $ |

| |

PREFERRED STOCKS - 1.10% |

|

|

|

|

| |

Brazil - 1.10% |

|

|

|

|

| |

AES Tiete SA |

| 184,000,000 |

| $ | 6,640,709 |

|

|

|

|

|

|

| |

Total Preferred Stocks |

|

|

| 6,640,709 |

| |

|

|

|

|

|

| |

CANADIAN INCOME TRUSTS - 4.55% |

|

|

|

|

| |

Northland Power Income Fund (1) |

| 912,900 |

| 11,868,293 |

| |

Pembina Pipeline Income Fund |

| 879,800 |

| 15,652,425 |

| |

|

|

|

|

|

| |

Total Canadian Income Trusts |

|

|

| 27,520,718 |

| |

|

|

|

|

|

| |

MASTER LIMITED PARTNERSHIPS - 25.06% |

|

|

|

|

| |

Amerigas Partners LP |

| 344,789 |

| 12,153,812 |

| |

Duncan Energy Partners LP |

| 91,520 |

| 2,084,826 |

| |

Enbridge Energy Partners LP - Class A |

| 540,200 |

| 27,652,838 |

| |

Energy Transfer Partners LP |

| 522,168 |

| 26,891,652 |

| |

Enterprise Products Partners LP |

| 798,089 |

| 24,948,262 |

| |

Kinder Morgan Energy Partners LP |

| 515,000 |

| 26,053,850 |

| |

Magellan Midstream Partners LP(2) |

| 625,788 |

| 27,396,999 |

| |

NuStar Energy LP |

| 77,206 |

| 4,369,859 |

| |

|

|

|

|

|

| |

Total Master Limited Partnerships |

|

|

| 151,552,098 |

| |

|

| Interest |

| Maturity |

| Principal |

|

|

| ||

Description |

| Rate |

| Date |

| Amount |

| Value $ |

| ||

|

|

|

|

|

|

|

|

|

| ||

U.S. TREASURY SECURITIES - 1.33% |

|

|

|

|

|

|

|

|

| ||

U.S. Treasury Notes (2) |

| 4.625 | % | 02/29/2008 |

| $ | 4,000,000 |

| 4,014,376 |

| |

U.S. Treasury Notes (2) |

| 4.875 | % | 05/31/2008 |

| 4,000,000 |

| 4,031,564 |

| ||

|

|

|

|

|

|

|

|

|

| ||

Total U.S. Treasury Securities |

|

|

|

|

|

|

| $ | 8,045,940 |

| |

See Notes to Financial Statements.

12

Schedule of Investments

NOVEMBER 30, 2007

(Expressed in US Dollars)

|

| Interest |

| Maturity |

|

|

| ||

Description |

| Rate |

| Date |

| Value $ |

| ||

|

|

|

|

|

|

|

| ||

SHORT TERM INVESTMENTS - 2.17% |

|

|

|

|

|

|

| ||

Repurchase Agreement - 2.17% |

|

|

|

|

|

|

| ||

Agreement with Deutsche Bank, dated |

| 4.450 | % | 12/1/2007 |

| $ | 13,100,000 |

| |

|

|

|

|

|

|

|

| ||

Total Short Term Investments |

|

|

|

|

| 13,100,000 |

| ||

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||

Total Investments - 124.79% |

|

|

|

|

| 754,566,470 |

| ||

|

|

|

|

|

|

|

| ||

Other Assets Less Other Liabilities - 0.02% |

|

|

|

|

| 135,527 |

| ||

|

|

|

|

|

|

|

| ||

Leverage Facility (3)(4) - (24.81)% |

|

|

|

|

| (150,000,000 | ) | ||

|

|

|

|

|

|

|

| ||

Total Net Assets - 100.00% |

|

|

|

|

| $ | 604,701,997 |

| |

See Notes to Financial Statements.

13

Schedule of Investments

NOVEMBER 30, 2007

(Expressed in US Dollars)

SWAP AGREEMENTS: |

|

|

|

|

|

|

Interest |

| Notional |

| Fixed |

| Floating Rate |

| Floating |

| Termination |

| Unrealized |

| % of |

|

Citibank, N.A. |

| 60,000,000 USD |

| 4.426 | % | US 1MT LIBOR |

| USD LIBOR |

| November 17, |

| ($119,878 | ) | (0.02 | )% |

|

|

|

|

|

|

|

| BBA 1MT |

| 2008 |

|

|

|

|

|

Citibank, N.A. |

| 30,000,000 USD |

| 4.150 | % | US 1MT LIBOR |

| USD LIBOR |

| January 6, |

| (4,447,274 | ) | (0.74 | )% |

|

| 34,572,000 CAD |

|

|

|

|

| BBA 1MT |

| 2009 |

|

|

|

|

|

Citibank, N.A. |

| 20,000,000 USD |

| 4.150 | % | US 1MT LIBOR |

| USD LIBOR |

| January 6, |

| (3,158,148 | ) | (0.52 | )% |

|

| 23,242,000 CAD |

|

|

|

|

| BBA 1MT |

| 2009 |

|

|

|

|

|

National |

| 40,000,000 USD |

| 4.865 | % | US 1MT LIBOR |

| USD LIBOR |

| December 9, |

| (1,138,388 | ) | (0.19 | )% |

Australia Bank |

|

|

|

|

|

|

| BBA 1MT |

| 2010 |

|

|

|

|

|

Total |

|

|

|

|

| Floating Rate |

|

|

|

|

|

|

| % of |

| |

Return Swap |

|

|

| Notional |

| Paid by the |

| Floating |

| Termination |

| Unrealized |

| Net |

| |

Counterparty |

| Shares |

| Amount |

| Fund (6) |

| Rate Index |

| Date |

| Appreciation |

| Assets |

| |

Bank of Nova |

|

|

| 25,530,085 |

| CAD 1 MT CDOR |

| CAD BA |

| July 26, 2016 |

| $ | 97,457 |

| 0.02 | % |

Scotia |

|

|

| CAD |

|

|

| CDOR |

|

|

|

|

|

|

| |

PORTFOLIO DIVERSIFICATION BY INDUSTRY SECTOR: (7)(8) |

|

|

|

|

|

|

|

Pipelines |

| 24.9 | % |

Toll Roads / Transportation |

| 17.4 | % |

Diversified |

| 10.1 | % |

Electricity & Gas Distribution |

| 9.6 | % |

Airports |

| 9.1 | % |

Water |

| 8.9 | % |

Electricity Transmission |

| 6.6 | % |

Electric Utility |

| 5.5 | % |

Electricity Generation |

| 3.4 | % |

Other |

| 1.7 | % |

Cash, Cash Equivalents & Government Bonds |

| 2.8 | % |

|

| 100.0 | % |

(1) |

| Securities with the market value of $44,001,353 as of November 30, 2007, are segregated as collateral for Total Return Swap. |

(2) |

| Securities, or a portion of securities, with the total market value of $13,076,900 as of November 30, 2007 are segregated as collateral for Interest Rate Swaps. |

(3) |

| The aggregate market value of collateralized securities totals to $741,466,470 as of November 30, 2007. |

(4) |

| Leverage facility expressed as a percentage of net assets. However, leverage limitations are calculated based on Total Assets as defined in the Fund’s Prospectus. (See Note 8 under Notes to the Financial Statements) |

(5) |

| London-Interbank Offered Rate - British Bankers Association Fixing for US Dollar. The fixing is conducted each day at 11:00 a.m. (London time). The rate is an average derived from the quotations provided by the banks determined by the British Bankers Association. The US IM LIBOR was 5.24% as of November 30, 2007. |

(6) |

| Average rates from nine Canadian Bank/contributors. The CAD IM CDOR was 4.73% as of November 30, 2007. |

(7) |

| Percentages are based upon total assets as defined in the Fund’s Prospectus. Please note that percentages shown on the Schedule of Investments are based on net assets. Total Return Swap positions have been included on a “mark to market” basis and included on this basis under the appropriate sector classifications. |

(8) |

| In May, 2007, the industry sector classifications have been updated, therefore; they differ from classifications in the previous annual report. |

See Notes to Financial Statements.

14

Statement of Assets and Liabilities

NOVEMBER 30, 2007

(Expressed in US Dollars)

ASSETS: |

|

|

| |

Investments, at value (Cost $646,742,216) |

| $ | 754,566,470 |

|

Cash (Restricted) |

| 8,500,000 |

| |

Cash |

| 93,695 |

| |

Foreign Currency, at value (Cost $775,507) |

| 775,512 |

| |

Unrealized appreciation on total return swap contract |

| 97,457 |

| |

Dividends receivable |

| 1,853,022 |

| |

Dividend reclaim receivable |

| 38,812 |

| |

Total return swap payments receivable |

| 195,810 |

| |

Interest receivable |

| 49,983 |

| |

Interest receivable on interest rate swap contract |

| 6,024 |

| |

Other assets |

| 84,746 |

| |

Total Assets |

| 766,261,531 |

| |

|

|

|

| |

LIABILITIES: |

|

|

| |

Unrealized depreciation on interest rate swap contracts |

| 8,863,688 |

| |

Interest payable on interest rate swap contracts |

| 14,595 |

| |

Loan payable |

| 150,000,000 |

| |

Accrued interest on loan payable |

| 718,298 |

| |

Accrued investment advisory expense |

| 1,578,130 |

| |

Accrued legal expense |

| 92,032 |

| |

Accrued administration expense |

| 79,989 |

| |

Accrued directors expense |

| 23,769 |

| |

Other payables and accrued expenses |

| 189,033 |

| |

|

|

|

| |

Total Liabilities |

| 161,559,534 |

| |

Net Assets |

| $ | 604,701,997 |

|

|

|

|

| |

COMPOSITION OF NET ASSETS: |

|

|

| |

Paid-in-capital |

| $ | 407,926,535 |

|

Accumulated net investment loss |

| (7,977,195 | ) | |

Accumulated net realized gain on investments |

| 105,508,552 |

| |

Net unrealized appreciation on investments, swaps, and foreign currency translation |

| 99,244,105 |

| |

Net Assets |

| $ | 604,701,997 |

|

|

|

|

| |

Shares of common stock outstanding of $0.001 par value, 100,000,000 shares authorized |

| 17,104,789 |

| |

Net Asset Value Per Share |

| $ | 35.35 |

|

See Notes to Financial Statements.

15

Statement of Operations

FOR THE YEAR ENDED NOVEMBER 30, 2007

(Expressed in US Dollars)

INVESTMENT INCOME: |

|

|

| |

Dividends (net of foreign withholding tax of $2,208,435) |

| $ | 38,232,876 |

|

Interest |

| 1,468,676 |

| |

Total Investment Income |

| 39,701,552 |

| |

|

|

|

| |

EXPENSES: |

|

|

| |

Interest on loan |

| 8,879,417 |

| |

Investment advisory |

| 6,172,187 |

| |

Administration |

| 924,444 |

| |

Legal |

| 367,363 |

| |

Audit |

| 244,999 |

| |

Insurance |

| 203,224 |

| |

Custody |

| 198,784 |

| |

Printing |

| 138,908 |

| |

Directors |

| 112,810 |

| |

Transfer agent |

| 31,272 |

| |

Miscellaneous |

| 249,704 |

| |

|

|

|

| |

Total Expenses |

| 17,523,112 |

| |

Net Investment Income |

| 22,178,440 |

| |

|

|

|

| |

Net realized gain/loss on: |

|

|

| |

Investment securities |

| 88,757,631 |

| |

Interest rate swaps |

| 1,294,964 |

| |

Total return swap |

| 495,999 |

| |

Foreign currency transactions |

| (972,021 | ) | |

Net change in unrealized appreciation/depreciation on: |

|

|

| |

Investment securities |

| 40,620,980 |

| |

Swap contracts |

| (4,580,237 | ) | |

Translation of assets and liabilities denominated in foreign currencies |

| (9,198 | ) | |

Net Realized and Unrealized Gain on Investments |

| 125,608,118 |

| |

Net Increase in Net Assets From Operations |

| $ | 147,786,558 |

|

See Notes to Financial Statements.

16

Statements of Changes in Net Assets

FOR THE YEARS ENDED NOVEMBER 30

(Expressed in US Dollars)

|

| 2007 |

| 2006 |

| ||

FROM OPERATIONS: |

|

|

|

|

| ||

Net investment income |

| $ | 22,178,440 |

| $ | 21,973,735 |

|

Net realized gain/loss on: |

|

|

|

|

| ||

Investment securities |

| 88,757,631 |

| 16,418,769 |

| ||

Interest rate swaps |

| 1,294,964 |

| 692,631 |

| ||

Total return swap |

| 495,999 |

| 269,866 |

| ||

Foreign currency transactions |

| (972,021 | ) | 19,130 |

| ||

Net change in unrealized appreciation on investments, swap contracts and foreign currency translation |

| 36,031,545 |

| 86,874,454 |

| ||

Net Increase in Net Assets From Operations |

| 147,786,558 |

| 126,248,585 |

| ||

|

|

|

|

|

| ||

DISTRIBUTIONS TO COMMON SHAREHOLDERS: |

|

|

|

|

| ||

Net decrease in net assets from distributions |

| (35,829,518 | ) | (26,356,493 | ) | ||

|

|

|

|

|

| ||

CAPITAL SHARE TRANSACTIONS: |

|

|

|

|

| ||

Net asset value of common stock issued to stockholders from reinvestment of dividends |

| 2,901,305 |

| — |

| ||

Net Increase in Net Assets |

| 114,858,345 |

| 99,892,092 |

| ||

|

|

|

|

|

| ||

NET ASSETS: |

|

|

|

|

| ||

Beginning of period |

| $ | 489,843,652 |

| $ | 389,951,560 |

|

End of period * |

| $ | 604,701,997 |

| $ | 489,843,652 |

|

* Includes Accumulated Net Investment Loss of: |

| $ | (7,977,195 | ) | $ | (455,379 | ) |

See Notes to Financial Statements.

17

Statement of Cash Flows

FOR THE YEAR ENDED NOVEMBER 30, 2007

(Expressed in US Dollars)

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

| |

Net increase in net assets from operations |

| $ | 147,786,558 |

|

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: |

|

|

| |

Increase in restricted cash |

| (8,500,000 | ) | |

Purchase of investment securities |

| (285,554,399 | ) | |

Proceeds from disposition of investment securities |

| 297,038,507 |

| |

Net realized gain from investment securities |

| (88,757,631 | ) | |

Net sale of short-term investment securities |

| 6,906,719 |

| |

Net change in unrealized appreciation on investments |

| (40,620,980 | ) | |

Net change in unrealized appreciation on swap contracts |

| 4,580,237 |

| |

Discount accretion |

| (27,593 | ) | |

Increase in dividends receivable |

| (175,233 | ) | |

Increase in dividend reclaim receivable |

| (38,812 | ) | |

Decrease in interest receivable |

| 1,089 |

| |

Decrease in other assets |

| 106,335 |

| |

Decrease in accrued interest on loan payable |

| (62,105 | ) | |

Increase in accrued investment advisory expense |

| 196,314 |

| |

Increase in accrued administration expense |

| 13,477 |

| |

Increase in accrued directors expense |

| 13,555 |

| |

Increase in other payables and accrued expenses |

| 64,163 |

| |

Net Cash Provided by Operating Activities |

| 32,970,201 |

| |

|

|

|

| |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

| |

Cash distributions paid |

| (32,928,213 | ) | |

Net Cash Used in Financing Activities |

| (32,928,213 | ) | |

|

|

|

| |

Net increase in cash |

| 41,988 |

| |

Cash and foreign currency, beginning balance |

| $ | 827,219 |

|

|

|

|

| |

Cash and foreign currency, ending balance |

| $ | 869,207 |

|

|

|

|

| |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

| |

Cash paid during the period for interest from bank borrowing: |

| $ | 8,941,522 |

|

Noncash financing activities not included herein consist of reinvestment of dividends and distributions of: |

| $ | 2,901,305 |

|

See Notes to Financial Statements.

18

Financial Highlights

(Expressed in US Dollars)

|

| For the Years Ended |

| For the Period |

| |||||

|

| 2007 |

| 2006 |

| 30, 2005 (1) |

| |||

PER COMMON SHARE OPERATING PERFORMANCE: |

|

|

|

|

|

|

| |||

Net asset value - beginning of period Income from investment operations: |

| $ | 28.81 |

| $ | 22.93 |

| $ | 23.88 |

|

Net investment income |

| 1.30 |

| 1.29 |

| 0.46 |

| |||

Net realized and unrealized gain/loss on investments |

| 7.34 |

| 6.14 |

| (1.36 | ) | |||

Total from Investment Operations |

| 8.64 |

| 7.43 |

| (0.90 | ) | |||

|

|

|

|

|

|

|

| |||

DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: |

|

|

|

|

|

|

| |||

Net investment income |

| (2.10 | ) | (1.55 | ) | — |

| |||

Total Distributions |

| (2.10 | ) | (1.55 | ) | — |

| |||

|

|

|

|

|

|

|

| |||

CAPITAL SHARE TRANSACTIONS: |

|

|

|

|

|

|

| |||

Common share offering costs charged to paid-in-capital |

| — |

| — |

| (0.05 | ) | |||

Total Capital Share Transactions |

| — |

| — |

| (0.05 | ) | |||

Net asset value - end of period |

| $ | 35.35 |

| $ | 28.81 |

| $ | 22.93 |

|

Market price - end of period |

| $ | 31.45 |

| $ | 26.87 |

| $ | 20.69 |

|

|

|

|

|

|

|

|

| |||

Total Investment Return - Net Asset Value (2) |

| 31.51 | % | 34.43 | % | (3.96 | )%(3) | |||

Total Investment Return - Market Price (2) |

| 25.45 | % | 38.95 | % | (17.24 | )%(3) | |||

|

|

|

|

|

|

|

| |||

RATIOS AND SUPPLEMENTAL DATA: |

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

| |||

Net assets attributable to common shares, at end of period (000s) |

|

|

|

|

|

|

| |||

Ratios to average net assets attributable to common shareholders: |

| $ | 604,702 |

| $ | 489,844 |

| $ | 389,952 |

|

Expenses |

| 3.12 | %(4) | 3.57 | %(4) | 1.34 | %(5) | |||

Expenses excluding interest expense |

| 1.54 | % | 1.69 | % | N/A |

| |||

Net investment income |

| 3.95 | % | 5.15 | % | 7.48 | %(5) | |||

Portfolio turnover rate |

| 41.22 | % | 25.87 | % | 3.47 | % | |||

(1) |

| The Fund commenced operations on August 26, 2005. |

(2) |

| Total investment return is calculated assuming a purchase of a common share at the opening on the first day and a sale at closing on the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment returns do not reflect brokerage commissions. Total investment returns for less than a full year are not annualized. Past performances is not a guarantee of future results. |

(3) |

| Total investment return on net asset value reflects a sales load of $1.125 per share. |

(4) |

| For the years ended November 30, 2007 and 2006, the annualized ratio to Total Assets was 2.46% and 2.66%, respectively. The prospectus for the Fund defines Total Assets as Total Net Assets plus leverage. |

(5) |

| Annualized. |

See Notes to Financial Statements.

19

Notes to Financial Statements

NOVEMBER 30, 2007

1. Organization and Significant Accountings Policies

Macquarie Global Infrastructure Total Return Fund Inc. (the “Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940 and organized under the laws of the State of Maryland. The Fund’s investment objective is to provide to its common stockholders a high level of total return consisting of dividends and other income, and capital appreciation. The Fund commenced operations on August 26, 2005. The Fund had no operations prior to August 26, 2005 except for the sale of shares to Macquarie Fund Adviser, LLC (“MFA” or the “Manager”). The Fund’s common shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “MGU”.

The Fund has elements of risk, including the risk of loss of principal. There is no assurance that the investment process will consistently lead to successful results. An investment concentrated in sectors and industries may involve greater risk and volatility than a more diversified investment.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America. This requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

The following summarizes the significant accounting policies of the Fund.

Cash and Cash Equivalents: Cash equivalents are funds (proceeds) temporarily invested in original maturities of ninety days or less.

As of November 30, 2007, the Fund had restricted cash in the amount of $8,500,000. The restricted cash represents collateral in relation to interest rate swap agreements between the Fund and Citibank, N.A. The restricted cash is held at the Fund’s custodian, The Bank of New York.

Portfolio Valuation: The net asset value (“NAV”) of the common shares will be computed based upon the value of the securities and other assets and liabilities held by the Fund. The NAV is determined as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern Standard Time) on each day the NYSE is open for trading. U.S. debt securities and non-U.S. securities will normally be priced using data reflecting the earlier closing of the principal markets for those securities (subject to the fair value policies described below).

Readily marketable portfolio securities listed on any U.S.

20

Notes to Financial Statements

NOVEMBER 30, 2007

exchange other than the NASDAQ National Market are valued, except as indicated below, at the last sale price on the business day as of which such value is being determined, or if no sale price, at the mean of the most recent bid and asked prices on such day. Securities admitted to trade on the NASDAQ National Market are valued at the NASDAQ official closing price as determined by NASDAQ. Securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. U.S. equity securities traded in the over-the-counter market, but excluding securities admitted to trading on the NASDAQ National Market, are valued at the closing bid prices.

Non-U.S. exchange-listed securities will generally be valued using information provided by an independent third party pricing service. The official non-U.S. security price is determined using the last sale price at the official close of the security’s respective non-U.S. market. Non-U.S. securities, currencies and other assets denominated in non-U.S. currencies are translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar as provided by a pricing service. When price quotes are not available, fair market value may be based on prices of comparable securities.

Forward currency exchange contracts are valued by calculating the mean between the last bid and asked quotation supplied to a pricing service by certain independent dealers in such contracts. Non-U.S. traded forward currency contracts are valued using the same method as the U.S. traded contracts. Exchange traded options and futures contracts are valued at the closing price in the market where such contracts are principally traded. These contracts may involve market risk in excess of the unrealized gain or loss reflected in the Fund’s Statement of Assets & Liabilities. In addition, the Fund could be exposed to risk if the counterparties are unable to meet the terms of the contract or if the value of the currencies changes unfavorably to the U.S. dollar.

In the event that the pricing service cannot or does not provide a valuation for a particular security, or such valuation is deemed unreliable, especially with unlisted securities or instruments, fair value is determined by the Board of Directors or a committee of the Board of Directors or a designee of the Board. In fair valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following:

· the projected cash flows for the issuer;

· the fundamental business data relating to the issuer;

· an evaluation of the forces that influence the market in which

21

these securities are purchased and sold;

· the type, size and cost of holding;

· the financial statements of the issuer;

· the credit quality and cash flow of the issuer, based on the Manager’s or external analysis;

· the information as to any transactions in or offers for the holding;

· the price and extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies;

· the business prospects of the issuer/borrower, including any ability to obtain money or resources from a parent or affiliate and an assessment of the issuer’s or borrower’s management; and

· the prospects for the issuer’s or borrower’s industry, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry.

Foreign Currency Translation: The accounting records of the Fund are maintained in U.S. dollars. Prices of securities and other assets and liabilities denominated in non-U.S. currencies are translated into U.S. dollars using the exchange rate at 4:00 p.m., Eastern Standard Time. Amounts related to the purchases and sales of securities, investment income and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions.

Net realized gain or loss on foreign currency transactions represents net foreign exchange gains or losses from the closure of forward currency contracts, disposition of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions and the difference between the amount of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amount actually received or paid. Net unrealized currency gains and losses arising from valuing foreign currency denominated assets and liabilities, other than security investments, at the current exchange rate are reflected as part of unrealized appreciation/depreciation on foreign currency translation.

The Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in the market prices of securities held at period end. The Fund does not isolate the effect of changes in foreign exchange rates from changes in market prices of securities sold during the year. The Fund may invest in foreign securities and foreign currency transactions that may involve risks not associated with domestic investments as a result of the level of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability, among others.

22

Notes to Financial Statements

NOVEMBER 30, 2007

Distributions to Shareholders: The Fund intends to distribute to holders of its common shares quarterly dividends of all or a portion of its net income and/or realized short-term gains after payment of interest in connection with any leverage used by the Fund. Distributions to shareholders are recorded by the Fund on the ex-dividend date.

Income Taxes: The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies.

Securities Transactions and Investment Income: Investment security transactions are accounted for as of trade date. Dividend income is recorded on the ex-dividend date. Interest income, which includes amortization of premium and accretion of discount, is accrued as earned. Realized gains and losses from securities transactions are determined on the basis of identified cost for both financial reporting and income tax purposes.

Repurchase Agreements: Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. In the event of default by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

New Accounting Pronouncements: In July 2006, the Financial Accounting Standards Board (“FASB”) issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes – an Interpretation of FASB Statement No. 109” (the “Interpretation”). The Interpretation establishes, for all entities, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. The Interpretation is effective for fiscal years beginning after December 15, 2006, and will also apply to all open tax years as of the date of effectiveness. Management continues to evaluate the application of the Interpretation to the Fund, and is not in a position at this time to estimate the significance of its impact, if any, on the Fund’s financial statements.

In September 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements.” The Statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. The Statement establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from sources independent of the reporting entity

23

(observable inputs) and (2) the reporting entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The Statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and is to be applied prospectively as of the beginning of the fiscal year in which this Statement is initially applied. Management has recently begun to evaluate the application of the Statement to the Fund, and has started to evaluate the significance of its impact, if any, on the Fund’s financial statements.

2. Income Taxes

Classification of Distributions: Net investment income/loss and net realized gain/loss may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes.

The tax character of the distributions paid by the Fund during the year ended November 30, 2007, was as follows:

Distributions paid from:

|

| 2007 |

| 2006 |

| ||

Ordinary income |

| $ | 35,829,518 |

| $ | 26,356,493 |

|

Total |

| $ | 35,829,518 |

| $ | 26,356,493 |

|

Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from composition of net assets reported under accounting principles generally accepted in the United States. Accordingly, for the year ended November 30, 2007, the effects of certain differences were reclassified. The Fund decreased its accumulated net investment loss by $6,129,262, increased paid in capital by $7,484, and decreased accumulated net realized gain by $6,136,746. These differences were primarily due to the differing tax treatment of foreign currency, distributions, investments in partnerships, swaps and certain other investments. Net assets of the portfolio were unaffected by the reclassifications and the calculation of net investment income per share in the Financial Highlights excludes these adjustments.

24

Notes to Financial Statements

NOVEMBER 30, 2007

As of November 30, 2007, the components of distributable earnings on a tax basis were as follows:

Ordinary income |

| $ | 2,855,604 |

|

Accumulated capital gains |

| 77,743,046 |

| |

Unrealized appreciation |

| 122,312,832 |

| |

Cumulative effect of other timing differences |

| (6,136,020 | ) | |

Total |

| $ | 196,775,462 |

|

The other timing differences are due to the partially estimated application of the passive activity loss rules related to the Fund’s investments in master limited partnerships.

As of November 30, 2007, net unrealized appreciation/depreciation of investments based on federal tax costs was as follows:

Gross appreciation on investments (excess of value over tax cost) |

| $ | 143,145,386 |

|

Gross depreciation on investments (excess of tax cost over value) |

| $ | (10,285,942 | ) |

Gross appreciation/depreciation on foreign currency and other derivatives |

| $ | (10,546,612 | ) |

Net unrealized appreciation/depreciation |

| $ | 122,312,832 |

|

Total cost for federal income tax purposes |

| $ | 621,707,026 |

|

The differences between book and tax net unrealized appreciation and cost were primarily due to the differing tax treatment of foreign currency, investments in partnerships, and certain other investments.

3. Capital Transactions

|

| For the Year Ended |

| For the Year Ended |

|

|

| November 30, 2007 |

| November 30, 2006 |

|

Common shares outstanding – beginning of period |

| 17,004,189 |

| 17,004,189 |

|

Common shares issued |

| 100,600 | * | — |

|

Common shares outstanding – end of period |

| 17,104,789 |

| 17,004,189 |

|

4. Portfolio Securities

Purchase and sales of investment securities, other than short-term securities, for the year ended November 30, 2007 aggregated $285,554,399 and $297,038,507, respectively.

Purchases and sales of U.S. government securities for the year ended November 30, 2007 was $0 and $0 respectively.

5. Investment Advisory Agreement

MFA serves as the Fund’s investment adviser pursuant to an Investment Management Agreement with the Fund and is responsible for determining the Fund’s overall investment strategy and implementation through day-to-day portfolio management, subject to the general supervision of the

* | 100,600 common shares were issued on January 5, 2007 in accordance with the Fund’s Dividend Reinvestment Plan. At the time of valuation, January 4, 2007, the Fund was trading at a premium to NAV resulting in the issuance of these shares. |

25

Fund’s Board of Directors. MFA is also responsible for managing the Fund’s business affairs, overseeing other service providers and providing management services. As compensation for its services to the Fund, MFA receives an annual management fee, payable on a quarterly basis, equal to the annual rate of 1.00% of the Fund’s Total Assets (as defined below) up to and including $300 million, 0.90% of the Fund’s Total Assets over $300 million up to and including $500 million, and 0.65% of the Fund’s Total Assets over $500 million. Total Assets of the Fund, for the purpose of this calculation, include the aggregate of the Fund’s average daily net assets plus proceeds from any outstanding borrowings used for leverage.

6. Interest Rate Swap Contracts

The Fund has entered into interest rate swap agreements to hedge its interest rate exposure on its leverage facility described in Note 8. In these interest rate swap agreements, the Fund agrees to pay the other party to the interest rate swap (which is known as the counterparty) a fixed rate payment in exchange for the counterparty agreeing to pay the Fund a variable rate payment that is intended to approximate the Fund’s variable rate payment obligation on the leverage facility. The payment obligation is based on the notional amount of the swap. Depending on the state of interest rates in general, the use of interest rate swaps could enhance or harm the overall performance of the fund shares. The market value of interest rate swaps is based on pricing models that consider the time value of money, volatility, the current market and contractual prices of the underlying financial instrument. Unrealized gains are reported as an asset and unrealized losses are reported as a liability on the Statement of Assets and Liabilities. The change in value of interest rate swaps, including the accrual of periodic amounts of interest to be paid or received on swaps is reported as a change in unrealized appreciation/depreciation on the Statement of Operations. A realized gain or loss is recorded upon payment or receipt of a periodic payment or termination of swap agreements. Swap agreements involve, to varying degrees, elements of market and counterparty risk, and exposures to loss in excess of the related amounts reflected in the Statement of Assets and Liabilities.

7. Total Return Swap Contracts

The Manager believes total return swaps provide an attractive combination of both pricing and flexibility to obtain exposure to certain securities.

The Fund has entered into a total return swap agreement with the Bank of Nova Scotia. The swap agreement is for a period of ten years, but may be terminated earlier by the Fund. Because the principal amount is not exchanged, it represents neither an asset nor

26

Notes to Financial Statements

NOVEMBER 30, 2007

a liability to either counterparty, and is referred to as notional. The unrealized gain/loss related to the daily change in the valuation of the swap, as well as the amount due to (owed by) the Fund at termination or settlement, is combined and separately disclosed as an asset/liability on the Statement of Assets and Liabilities. The Fund also records any periodic payments received from (paid to) the counterparty, including at termination, under such contracts as realized gain/loss on the Statement of Operations. The total return swap is subject to market and counterparty risks, and exposures to loss in excess of the related amounts reflected in the Statement of Assets and Liabilities (if the counterparty fails to meet its obligations).

8. Leverage

The Fund possesses a commercial paper conduit (the “CP Conduit”) with TSL (USA) Inc. (“TSL”) as conduit lender, and National Australia Bank Limited (“NAB”), New York Branch as secondary lender.

The Fund drew down $150 million on September 29, 2006, and the Fund may draw down an additional $50 million up to a total of $200 million. The Fund has pledged all securities in its porfolio (except those securities that are pledged as collateral for other purposes and repurchase agreement) as collateral for the CP Conduit. As of November 30, 2007 the market value of the securities pledged as a collateral for the CP conduit totaled to $684,388,217.

The Fund pays interest at a rate of 40 bps per annum above the cost of funds TSL is able to obtain in the commercial paper market. As of November 30, 2007 the cost of funds was 5.35% and the interest rate payable by the Fund was 5.75%.

The Fund also incurs a commitment fee of 10 bps for the amount of commitment available in excess of the outstanding loan. As of November 30, 2007, the Fund had commitments available of $50 million.

9. Other

Compensation of Directors: The Independent Directors of the Fund approved an increase to their compensation on October 16, 2007. The Independent Directors of the Fund currently receive a quarterly retainer of $8,750, an additional $2,500 for each meeting attended, and $1,500 for each telephonic meeting. Prior to October 16, 2007 the Independent Directors of the Fund received a quarterly retainer of $5,000, and an additional $2,500 for each meeting attended.

10. Indemnifications

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

27

11. Subsequent Events

Distributions: The Fund paid three distributions totaling $4.38 per share: the regular quarterly distribution of $0.40 per common share, a special distribution of $0.085 per common share, and long-term capital gain distribution of $3.895 per common share. All three distributions were paid on December 31, 2007 to shareholders of record on December 20, 2007.

Leverage: On December 28, 2007 the Fund drew down $25 million from the CP Conduit. After the drawdown, the Fund has utilized $175 million of its $200 million facility.

28

Report of Independent Registered Public Accounting Firm

NOVEMBER 30, 2007

To the Board of Directors and Shareholders of Macquarie Global Infrastructure Total Return Fund Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations, of changes in net assets and of cash flows and the financial highlights present fairly, in all material respects, the financial position of Macquarie Global Infrastructure Total Return Fund Inc. (the “Fund”) at November 30, 2007, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for the two years in the period then ended and for the period August 26, 2005 (commencement of operations) through November 30, 2005, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial sta tements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at November 30, 2007 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

![]()

Denver, CO

January 11, 2008

29

Additional Information

NOVEMBER 30, 2007 (unaudited)

Dividend Reinvestment Plan

Unless a stockholder of MGU (“Stockholder”) elects to receive cash distributions, all dividends, including any capital gain dividends, on the Stockholder’s Common Shares will be automatically reinvested by the Plan Agent, The Bank of New York, in additional Common Shares under the Dividend Reinvestment Plan. If a Stockholder elects to receive cash distributions, the Stockholder will receive all distributions in cash paid by check mailed directly to the Stockholder by The Bank of New York, as dividend paying agent.

If a Stockholder decides to participate in the Plan, the number of Common Shares the Stockholder will receive will be determined as follows:

· If Common Shares are trading at or above NAV at the time of valuation, the Fund will issue new shares at a price equal to the greater of (i) NAV per Common Share on that date or (ii) 95% of the market price on that date.

· If Common Shares are trading below NAV at the time of valuation, the Plan Agent will receive the dividend or distribution in cash and will purchase Common Shares in the open market, on the NYSE or elsewhere, for the participants’ accounts. It is possible that the market price for the Common Shares may increase before the Plan Agent has completed its purchases. Therefore, the average purchase price per share paid by the Plan Agent may exceed the market price at the time of valuation, resulting in the purchase of fewer shares than if the dividend or distribution had been paid in Common Shares issued by the Fund. The Plan Agent will use all dividends and distributions received in cash to purchase Common Shares in the open market within 30 days of the valuation date except where temporary curtailment or suspension of purchases is necessary to comply with federal securities laws. Interest will not be paid on any uninvested cash payments.

A Stockholder may withdraw from the Plan at any time by giving written notice to the Plan Agent, or by telephone in accordance with such reasonable requirements as the Plan Agent and Fund may agree upon. If a Stockholder withdraws or the Plan is terminated, the Stockholder will receive a certificate for each whole share in its account under the Plan and the Stockholder will receive a cash payment for any fraction of a share in its account. If the Stockholder wishes, the Plan Agent will sell the Stockholder’s shares and send the proceeds, minus brokerage commissions, to the Stockholder.

The Plan Agent maintains all Stockholders’ accounts in the Plan and gives written confirmation of all transactions in the accounts,

30

Additional Information

NOVEMBER 30, 2007 (unaudited)

including information a Stockholder may need for tax records. Common Shares in an account will be held by the Plan Agent in non-certificated form. The Plan Agent will forward to each participant any proxy solicitation material and will vote any shares so held only in accordance with proxies returned to the Fund. Any proxy a Stockholder receives will include all Common Shares received under the Plan.

There is no brokerage charge for reinvestment of a Stockholder’s dividends or distributions in Common Shares. However, all participants will pay a pro rata share of brokerage commissions incurred by the Plan Agent when it makes open market purchases.