UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

o TRANSITION REPORT PURSUANT TO SECTION 13 OF 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER:

KEYUAN PETROCHEMICALS, INC.

(formerly Silver Pearl Enterprises, Inc.)

(Exact name of registrant as specified in its charter)

| Nevada | 45-0538522 | |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification or Organization No.) |

Qingshi Industrial Park

Ningbo Economic & Technological Development Zone

Ningbo, Zhejiang Province

P.R. China 315803

(86) 574-8623-2955

(Address and telephone number of principal executive offices and principal place of business)

Securities registered under Section 12 (b) of the Exchange Act: NONE

Securities registered under Section 12 (g) of the Exchange Act:

COMMON STOCK WITH $.001 PAR VALUE

(Title of Class)

Indicate by check mark if the Registrant is a well known seasoned issuer as defined in Rule 405 of the securities Act. Yes o No x

Indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated Filer o |

Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the 9,971,301shares of voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $ 48,659,948.88 as of June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $4.88 per share*, as reported on the NASDAQ Capital Market

As of April 10, 2012, the Registrant has 57,695,971 shares of common stock outstanding and 5,333,340 shares of Series B Preferred Stock outstanding.

*For a period from April 1, 2011 to October 6, 2011, trading in our stock was halted by the Nasdaq Capital Market.

KEYUAN PETROCHEMICALS,, INC

TABLE OF CONTENTS

Annual Report on Form 10-K for the Year Ended December 31, 2011

| PART I | Page | |

| Item 1 | 1 | |

| Item 1A | 18 | |

| Item 1B | 31 | |

| Item 2 | 31 | |

| Item 3 | 31 | |

| Item 4 | 31 | |

| PART II | ||

| Item 5 | 32 | |

| Item 6 | 35 | |

| Item 7 | 35 | |

| Item 7A | 42 | |

| Item 8 | 42 | |

| Item 9 | 43 | |

| Item 9A | 44 | |

| Item 9B | 45 | |

| PART III | ||

| Item 10 | 45 | |

| Item 11 | 49 | |

| Item 12 | 50 | |

| Item 13 | 53 | |

| Item 14 | 57 | |

| PART IV | ||

| Item 15 | 58 | |

| 60 |

INTRODUCTORY NOTE

Except as otherwise indicated by the context, references in this Annual Report on Form 10-K (this “Form 10-K”) to the “Company,” “Keyuan” “we,” “us” or “our” are references to the combined business of Keyuan Petrochemicals, Inc. and its consolidated subsidiaries. References to “Keyuan International” are references to our wholly-owned subsidiary, Keyuan International Group Limited”; references to “Keyuan HK” are references to our wholly-owned subsidiary, Keyuan Group Limited; references to “Ningbo Keyuan” are references to our wholly-owned subsidiary, Ningbo Keyuan Plastics Co.,Ltd.; references to “Ningbo Keyuan Petrochemicals” are to our wholly-owned subsidiary, Ningbo Keyuan Petrochemicals Co., Ltd. References to “China” or “PRC” are references to the People’s Republic of China. References to “RMB” are to Renminbi, the legal currency of China, and all references to “$” and dollar are to the U.S. dollar, the legal currency of the United States.

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements and information that are based on the beliefs of our management as well as assumptions made by and information currently available to us. Such statements should not be unduly relied upon. When used in this report, forward-looking statements include, but are not limited to, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as well as statements regarding new and existing products, technologies and opportunities, statements regarding market and industry segment growth and demand and acceptance of new and existing products, any projections of sales, earnings, revenue, margins or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements regarding future economic conditions or performance, uncertainties related to conducting business in China, any statements of belief or intention, and any statements or assumptions underlying any of the foregoing. These statements reflect our current view concerning future events and are subject to risks, uncertainties and assumptions. There are important factors that could cause actual results to vary materially from those described in this report as anticipated, estimated or expected, including, but not limited to: competition in the industry in which we operate and the impact of such competition on pricing, revenues and margins, volatility in the securities market due to the general economic downturn; Securities and Exchange Commission (the “SEC”) regulations which affect trading in the securities of “penny stocks,” and other risks and uncertainties. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward- looking statements, even if new information becomes available in the future. Depending on the market for our stock and other conditional tests, a specific safe harbor under the Private Securities Litigation Reform Act of 1995 may be available. Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) expressly state that the safe harbor for forward-looking statements does not apply to companies that issue penny stock. Because we may from time to time be considered to be an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

PART I

ITEM 1. BUSINESS

GENERAL OVERVIEW

(a) Nature of business

We, through our PRC operating subsidiaries, Ningbo Keyuan and Ningbo Keyuan Petrochemicals, are engaged in the manufacture and sale of petrochemical products in the PRC. Our operations include (i) a production facility with an annual petrochemical production capacity of 720,000 metric tons (MT) of a variety of petrochemical products, (ii) facilities for the storage and loading of raw materials and finished goods and (iii) a manufacturing technology that can support our manufacturing process with relatively low raw material costs and high utilization and yields, all of which are led by a management team consisting of petrochemical experts with proven track records from some of China’s largest state-owned enterprises in the petrochemical industry.

Due to China’s growing demand for refined petrochemical products, we expanded our annual production capacity from 550,000 MT to 720,000 MT in April 2011. We also completed the construction of a Styrene-Butadience-Styrene (the “SBS”) production facility with an annual production capacity of 70,000 MT in September 2011 and began initial trial production in October and November 2011. One SBS production line began commercial production in December 2011. In addition, we plan to complete an additional storage capacity, a raw material pre-treatment facility and an asphalt production facility by the end of 2012.

(b) Organization

Keyuan Petrochemicals, Inc. (“Company” or “the Company”, formerly known as “Silver Pearl Enterprises, Inc.”, together with its subsidiaries, herein referred to as “we” “us” and “our”) was incorporated in the State of Texas on May 4, 2004.

1

On April 22, 2010, the Company entered into a share exchange agreement (the “Exchange Agreement”) with Keyuan International Group Limited (“Keyuan International”), a privately held investment holding company organized on June 11, 2009 under the laws of the British Virgin Islands, Delight Reward Limited (“Delight Reward”), the sole stockholder of Keyuan International and Denise D. Smith (“Smith”), the Company’s former principal stockholder. Pursuant to the terms of the Exchange Agreement, Delight Reward transferred to the Company all of its shares of Keyuan International in exchange for 47,658 shares of the Company’s Series M convertible preferred stock (the “Share Exchange”). On an “as converted” basis, the Series M convertible preferred stock represented approximately 95% of the Company’s outstanding common stock right after the Share Exchange. The Series M convertible preferred stock voted with the common stock on an “as converted basis” and was converted into 47,658,000 shares of the Company’s common stock on December 28, 2010.

As a result of the Share Exchange, Keyuan International became a wholly-owned subsidiary of the Company and Delight Reward became the controlling stockholder of the Company. The Share Exchange was accounted for as a reverse acquisition and recapitalization whereby Keyuan International is deemed to be the accounting acquirer (and the legal acquire). The common stock of the Company continues post the Share Exchange, while the retained deficit of the Company was eliminated as the historical operations are deemed to be those of Keyuan International.

On May 12, 2010, the Company formed a corporation under the laws of the State of Nevada called Keyuan Petrochemicals, Inc. and on the same day, acquired 100% of the entity’s stock for cash. As such, the entity became the Company’s wholly-owned subsidiary (the “Merger Subsidiary”).

Effective as of May 17, 2010, the Merger Subsidiary was merged with and into the Company. As a result of the merger, the Company’s name was changed to “Keyuan Petrochemicals, Inc.”. Prior to the merger, the Merger Subsidiary had no liabilities and nominal assets and, as a result of the merger, the separate existence of the merger subsidiary ceased. The Company is the surviving corporation in the merger and, except for the name change, there was no change in the Company’s directors, officers, capital structure or business.

On August 8, 2010, Keyuan Group Limited (“Keyuan HK) established a wholly owned subsidiary in the People’s Republic of China (“PRC”), Ningbo Keyuan Petrochemicals Co., Ltd (“Ningbo Keyuan Petrochemicals”), which is engaged in the sale of petrochemical products in the PRC.

(c) History of Keyuan International before the Share Exchange

Immediately prior to the date of the Share Exchange, the Company was a shell company with no operations and a nominal amount of cash, and Keyuan International, through Keyuan Group Limited (“Keyuan HK”) and its indirect subsidiary, Ningbo Keyuan, was engaged in the manufacturing and sale of petrochemical products.

Keyuan HK was established in Hong Kong in 2009, and is a holding company with no significant assets or operations. On April 26, 2007, Ningbo Keyuan was established as a wholly foreign owned enterprise in Ningbo, PRC by Hong Kong Keyuan PEC Investment Holdings Limited (“Hong Kong Keyuan”, 51%), Hong Kong Development Enterprise Co., Limited (“Hong Kong Development”, 26%) and Wayes International Trading Limited (“Wayes International”, 23%). Hong Kong Keyuan was controlled by Mr. Chunfeng Tao, Hong Kong Development was controlled by Mr. Jicun Wang and Wayes International was controlled by Mr. Peijun Chen. Ningbo Keyuan had an original registered capital of USD $12,000,000. The Ningbo Foreign Trade & Economic Cooperation Bureau approved Ningbo Keyuan’s increase in its registered capital from USD$12,000,000 to USD$20,400,000 on February 27, 2009. The registered capital of Ningbo Keyuan was then increased from USD $20,400,000 to USD$50,400,000 and a new Certificate of Approval was issued by the Ningbo Foreign Trade & Economic Cooperation Bureau on March 22, 2010.

On April 1, 2008 Ningbo Litong Petrochemical (“Ningbo Litong”) acquired 12.75% of the shares of Ningbo Keyuan from Hong Kong Keyuan on behalf of Mr. Chunfeng Tao. On November 25, 2008 Ningbo Kewei Investments Co., Limited (“Ningbo Kewei”), a company controlled by Mr. Tao acquired 12.75% of Ningbo Keyuan from Ningbo Litong. On June 24, 2009, Ningbo Kewei acquired 15.75% of Ningbo Keyuan from Hong Kong Keyuan through a capital increase. On July 17, 2009, Hong Kong Keyuan acquired 28.5% shares from Ningbo Kewei. Through these transactions Mr. Tao’s 51% ownership of Ningbo Keyuan remained unchanged.

In 2009, Apex Smart Limited, Best Castle Investments Limited, Chance Brilliant Holdings Limited, Delight Reward Limited and Keyuan International Group Limited were established in the British Virgin Island (BVI) and Keyuan HK was established in Hong Kong. Delight Reward Limited holds 100% of the equity interests of Keyuan International Group Limited which holds 100% of the equity interests of Keyuan HK. Delight Reward Limited is owned by:

| ● | Apex Smart Limited (45.6132%), which was 100% held by Stewart Shiang Lor, subsequently by Mr. Brian Pak-Lun Mok and subsequently by Mr. Chunfeng Tao exercised his option to acquire ownership from Mr. Mok. The transfer of ownership from Mr. Mok to Mr. Tao is currently being processed and should be completed shortly. |

| ● | Best Castle Investments Limited (23.2523%), which was 100% held by Mr. O. Wing Po and subsequently by Mr. Jicun Wang. |

| ● | Chance Brilliant Holdings Limited (20.5694%), which was 100% held by Mr. Lo Kan Kwan and subsequently by Mr. Peijun Chen. |

2

| ● | Harvest Point Limited (5.3896%), which was 100% held by Mr. Brian Pak-Lun Mok and subsequently by Ms. Muxia Duan. |

| ● | Strategic Synergy Limited (5.1755%), which was 100% held by Mr. Brian Pak-Lun Mok and subsequently Mr. Mok transfered one third of the ownership to Mr. Xin Yue |

On November 16, 2009 Keyuan HK acquired 100% of Ningbo Keyuan from Hong Kong Keyuan, HongKong Development and Wayes International. Mr. Brian Pak-Lun Mok, Mr. O. Wing Po and Mr. Lo Kan Kwan also agreed to support Mr. Chunfeng Tao, Mr. Jicun Wang and Mr. Peijun Chen respectively to retain their controls in Delight Reward Limited and its subsidiaries. The reorganization is considered as restructuring under common control and Mr. Chunfeng Tao, Mr. Jicun Wang and Mr. Peijun Chen remained as the controlling parties.

On April 2, 2010, Mr. Brian Pak-Lun Mok, Mr. O. Wing Po, and Mr. Lo Kan Kwan, who indirectly held 100% of the equity interests in Delight Reward Limited, entered into certain share transfer agreements with Mr. Chunfeng Tao, Mr. Jicun Wang, Mr. Peijun Chen and Mr. Xin Yue, pursuant to which each of these persons agreed to transfer all of its interests in Apex Smart Limited, Best Castle Investments Limited and Chance Brilliant Holdings Limited, Harvest Point Limited and Strategic Synergy Limited (collectively the “BVI Holding Companies”), to Mr. Chunfeng Tao, Mr. Jicun Wang, Mr. Peijun Chen and Mr. Xin Yue respectively, subject to achievement of certain performance targets of Ningbo Keyuan. The performance targets are the Company achieving: at least $39 million of gross revenue for the three months commencing from July 2010 to September 2010; at least $40 million of gross revenue for the three months commencing from October 2010 to December 2010; and, at least $41 million of gross revenue for the three months commencing from January 2011 to March 2011.

Pursuant to the share transfer agreements, (i) Mr. Brian Pak-Lun Mok granted Mr.Chunfeng Tao an option to acquire 100% of the equity of Apex Smart Limited in three installments provided that certain performance targets are met; (ii) Mr. O. Wing Po granted Mr. Jicun Wang an option to acquire 100% of the Best Castle Investments Limited in three installments provided that certain performance targets are met; (iii) Mr. Lo Kan Kwan granted Mr. Peijun Chen an option to acquire 100% of the equity of Chance Brilliant Holdings Limited in three installments provided that certain performance targets are met; (iv) Mr. Brian Pak-Lun Mok granted Mr. Xin Yue an option to acquire 100% of the equity of Harvest Point Limited in three installments provided that certain performance targets are met; and (v) Mr. Brian Pak-Lun Mok granted Mr. Xin Yue an option to acquire 100% of the equity of Strategic Synergy Limited in three installments provided the performance targets are met (the share transfer agreements are herein referred as “Slow Walk Agreement(s)” or “Slow Walk”. Options are herein sometimes referred as “Slow Walk Option(s)”).

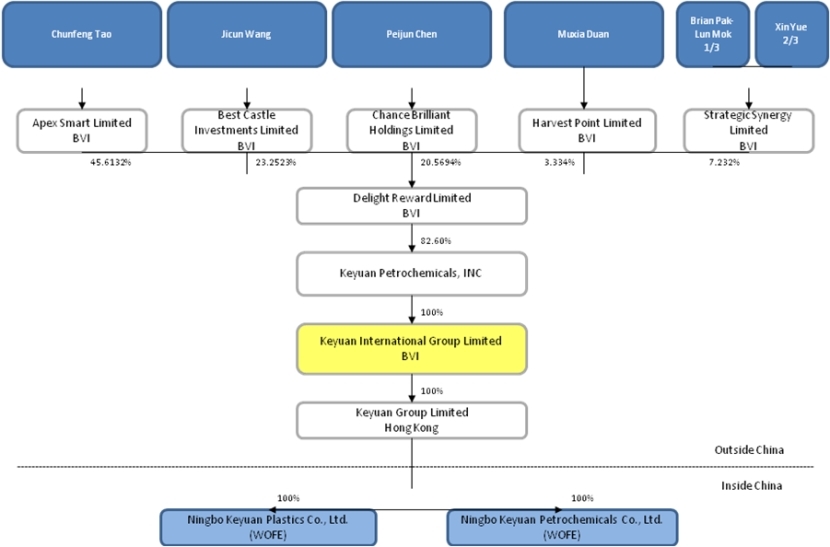

(d) Current Shareholding Structure of the Company

On November 4, 2010, the Company exercised its conversion rights under the terms of the Series A Preferred Stock to convert all of outstanding shares of its Series A 6% Cumulative Convertible Preferred Stock into a total of 6,132,032 shares of Common Stock, $0.001 par value per share. As a result, following the conversion, all 6,132,032 shares of Series A Preferred Stock that had been outstanding were cancelled and were automatically converted, without any delivery of conversion notice required on the part of the holders of Series A preferred stock.

On November 15, 2010, one-third of the Slow Walk Options were exercised after the first performance target was met.

On December 28, 2010, the Company exercised its mandatory conversion rights under the terms of the Series M preferred stock to convert all of outstanding shares of its Series M preferred stock into a total of 47,658,000 shares of Common Stock, $0.001 par value per share, all of which are held by Delight Reward Limited

.

On April 29, 2011, Harvest Point Limited transferred 1,028 shares of Delight Reward Limited’s stock to Strategic Synergy Limited, changing their ownership of Delight Reward Limited’s stock to 3.334% and 7.232% respectively. On the same day, Mr. Brian Pak-Lun Mok and Mr. Xin Yue transferred 33,333 shares and 16,667 shares of Harvest Point Limited, respectively, to Ms. Muxia Duan thus transferred 100% ownership of Harvest Point Limited to Ms. Muxia Duan.

After the second and third performance targets were met, Mr. Peijun Chen and Mr. Jicun Wang exercised their remaining two-thirds of the Slow Walk Options on February 15, 2012. On March 30, 2012, Mr. Chunfeng Tao exercised his remaining two-thirds of the Slow Walk Options and the transfer of the shares of Apex Smart Limited from Mr. Brian Pak-Lun Mok to Mr. Chunfeng Tao is currently being processed. As of the date hereof, Mr. Xin Yue has not exercised his remaining two-thirds of the Slow Walk Options.

3

As a result, the shareholding structure following the restructuring is as follows:

(e) Independent Investigation and Nasdaq Delisting Decision

During the process of preparing the Company’s Annual Report on Form 10-K for the year ending December 31, 2010, on or about March 24, 2011, KPMG, the Company’s former independent auditor, raised certain issues primarily relating to unexplained issues regarding certain cash transactions and recorded sales and requested that the Audit Committee conduct an independent investigation. Based on the issues raised by KPMG, on March 31, 2011, our Audit Committee elected to commence an independent investigation of the issues raised and engaged the services of independent counsel, Pillsbury Winthrop Shaw Pittman LLP (“Pillsbury”), which in turn engaged Deloitte Financial Advisory Services LLP (“Deloitte”), as independent forensic accountants, and King & Wood, as Audit Committee counsel in the People’s Republic of China (Pillsbury, Deloitte and King & Wood are collectively referred herein as “Investigation Team”).

On September 28, 2011, the Investigation Team completed the investigation. On October 3, 2011, the Company provided the Nasdaq Hearings Panel with a copy of the final investigation report along with a comprehensive list of remedial actions the Company has taken and is committed to taking to remediate the accounting and internal control issues. On October 5, 2011, the Company was notified that the Nasdaq Hearings Panel exercised its discretionary authority pursuant to NASDAQ Listing Rule 5101 to delist the Company’s securities from the Nasdaq Stock Market. As a result, the Company’s shares resumed trading in the pink sheets under the ticker symbol KEYP.PK beginning October 7, 2011. The Company’s common stock is currently traded on the Over-the-Counter Bulletin Board under the symbol KEYP.

FINANCINGS

April – May 2010 Private Placement

Following the Share Exchange, we entered into a securities purchase agreement with 122 accredited investors for the issuance and sale of 748,704 Units at a purchase price of $35 per unit, for aggregate gross proceeds of approximately $26,204,640 consisting of, in the aggregate, (a) 6,738,336 shares of Series A convertible preferred stock, par value $0.001 per share convertible into the same number of shares of Common Stock, (b) 748,704 shares of Common Stock, (c) three-year Series A Warrants to purchase up to 748,704 shares of Common Stock, at an exercise price of $4.50 per, and (d) three-year Series B Warrants to purchase up to 748,704 shares of Common Stock, at an exercise price of $5.25 per share (the “April-May 2010 Private Placement”).

4

In connection with the April-May 2010 Private Placement, we also entered into a registration rights agreement with the investors, in which we agreed to file a registration statement with the SEC to register for resale of the Common Stock, the Common Stock issuable upon conversion of the Series A Preferred Stock, the Series A Warrant Shares and the Series B Warrant Shares issued in the financing, within 30 calendar days of April 22, 2010 and to have such registration statement declared effective within 150 calendar days of April 22, 2010 or within 180 calendar days of April 22, 2010 in the event of a full review of the registration statement by the SEC. If we can not comply with the foregoing obligations under the registration rights agreement, we will be required to pay liquidated damages in cash to each investor, at the rate of 1% of the applicable subscription amount for each 30 day period in which we are not in compliance; provided, that such liquidated damages will be capped at 10% of the subscription amount of each investor and will not apply to any registrable securities that may be sold pursuant to Rule 144 under the Securities Act if all of the conditions in Rule 144(i)(2) are satisfied at the time of the proposed sale, or are subject to an SEC comment with respect to Rule 415 promulgated under the Securities Act.

Accordingly, we filed a registration statement on Form S-1 in connection with the April-May 2010 private placement transaction. Amendment No. 4 to such Form S-1 which we filed on October 15, 2010 was declared effective on October 19, 2010. However, because of the delinquency of the Company’s annual report on Form 10-K for fiscal year ended December 31, 2010 and interim reports on Form 10-Q for three months ended March 31, 2011 and June 30, 2011 respectively, as of April 10, 2012, the Amendment No. 4 to such Form S-1 is no longer effective. As a result, we began to accrue penalties pursuant to the terms of the registration rights agreement from April, 2011 to November 1, 2011,the period that the registerable securities were not able to be sold pursuant to Rule 144 under the Securities Act.

Pursuant to the terms of the securities purchase agreement and the terms of the Certificate of Designation of Series A preferred stock, we exercised our conversion rights to convert all of the outstanding Series A preferred stock into a total of 6,132,032 shares of Common Stock. As a result of the conversation, since November 4, 2010, we have no longer incurred the Series A dividends, payable quarterly, at the rate of 6% per annum for each outstanding share.

September 2010 Private Placement

On September 28, 2010, we closed an offering for $20,250,000 consisting of a total of 540,001 units at a purchase price of $37.50 per unit, each unit consisting of, (a) ten (10) shares of Series B convertible preferred stock of the Company, (b) one and a half (1.5) three year Series C warrants to purchase one and a half (1.5) shares of Common Stock, at an exercise price of $4.50 per share, and (c) one and a half (1.5) three year Series D warrants to purchase one and a half (1.5 ) shares of Common Stock, at an exercise price of $5.25 per share (the “ September 2010 Private Placement”) in reliance upon the exemption from securities registration afforded by Regulation S as promulgated under the Securities Act of 1933.

In connection with the September 2010 Private Placement, we also entered into a Registration Rights Agreement with the investors, in which we agreed to file a registration statement with the Commission to register for resale the Common Stock issuable upon conversion of the Series B Preferred Stock, the Series C Warrant Shares and the Series D Warrant Shares, within 30 calendar days of October 19, 2010 and to have the registration statement declared effective within 150 calendar days of October 19, 2010 or within 180 calendar days of October 19, 2010 in the event of a full review of the registration statement by the Commission. If we do not comply with the foregoing obligations under the registration rights agreement, we will be required to pay cash liquidated damages to each Series B Investor, at the rate of 1% of the applicable subscription amount for each 30 day period in which the Company is not in compliance; provided, that such liquidated damages will be capped at 10% of the subscription amount of each investor and will not apply to any registrable securities that may be sold pursuant to Rule 144 under the Securities Act if all of the conditions in Rule 144(i)(2) are satisfied at the time of the proposed sale, or are subject to an SEC comment with respect to Rule 415 promulgated under the Securities Act.

Accordingly, we filed a registration statement on Form S-1 in connection with the September 2010 private placement transaction. Amendment No. 2 to such Form S-1 which we filed on January 14, 2011 was declared effective on January 19, 2011. However, because of the delinquency of the Company’s annual report on Form 10-K for fiscal year ended December 31, 2010 and interim reports on Form 10-Q for three months ended March 31, 2011 and June 30, 2011 respective, as of April 10, 2012, Amendment No. 2 to such Form S-1 is no longer effective. As a result, we began to accrue penalties pursuant to the terms of the registration rights agreement from April 2011to November 2011, the period that the registerable securitiess were not able to be sold pursuant to Rule 144 under the Securities Act.

Mandatory Conversion of Series M Preferred Stock

On December 28, 2010, we exercised our mandatory conversion rights under the terms of the Series M preferred stock to convert all of the outstanding shares of the Series M preferred stock into a total of 47,658,000 shares of Common Stock, $0.001 par value per share. As a result, following the conversion, all 47,658 shares of Series M preferred stock that had been outstanding were cancelled and were automatically converted, without any delivery of conversion notice required on the part of the holders of Series M Preferred Stock.

5

OUR PRODUCTS

We manufacture and supply a variety of petrochemical products, including BenzeneToluene-Xylene Aromatics (BTX Aromatics), propylene, styrene, liquid petroleum gas (LPG), Methyl Tertiary Butyl Ether (MTBE) and other petrochemicals, each of which is described below:

| ● | BTX Aromatics: consists of benzene, toluene, xylene and other chemical components used for further processing into plastics, gasoline and solvent materials widely used in paint, ink, construction coating and pesticide; |

| ● | Propylene: a chemical intermediate which is one of the building blocks for an array of chemical and plastic products that are commonly used to produce polypropylene, acrylonitrile, oxo alcohols, propylene oxide, cumene, isopropyl alcohol, acrylic acid and other chemicals for paints, household detergents, automotive brake fluids, indoor/outdoor carpeting, textile, insulating materials, auto parts and electrical appliances; |

| ● | Styrene: a precursor to polystyrene and several copolymers widely used for packaging materials, construction materials, electronic parts, home appliances, household goods, home furnishings, toys, sporting goods and other products; |

| ● | LPG: a mixture of hydrocarbon gases used as fuel in heating appliances and vehicles. A replacement for chlorofluorocarbons as an aerosol propellant and a refrigerant which reduces damage to the ozone layer; and |

| ● | MTBE & Other Chemicals: MTBE, oil slurry, sulphur and others which are used for a variety of applications including fuel components, refrigeration systems, fertilizers, insecticides and fungicides. |

Production Capacity and Expansion

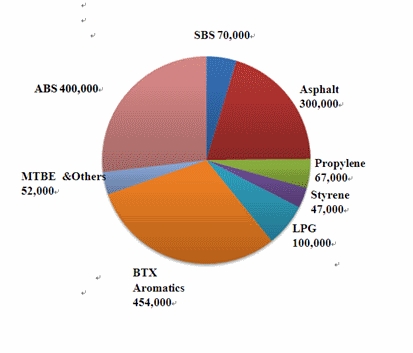

The following chart depicts our production capacity in 2011:

Breakdown of 2011 Capability of 720,000 (MT)

In order to develop our business to meet the increasing customer demands, we have been working to expand our manufacturing capacity by focusing on the following improvements to our infrastructure:

| a) | upgrading the catalytic pyrolysis processing equipment used in production facilities to expand annual design capacity from 550,000 MT to 720,000 MT; |

| b) | an SBS production facility with a design capacity of 70,000 MT per year. The construction was completed in September 2011 and we entered into initial trial production in October and November 2011. One of the SBS production lines began commercial production in December 2011 and the second line is expected to commence commercial production in May 2012 pending the result of current operation. |

| c) | additional storage capacity which will allow us to take better advantage of price variations in our raw materials costs, our finished products sales, as well as to support the storage needs of overall expanded production capacity |

| d) | a raw material pre-treatment facility which will allow us to handle lower grade raw materials thereby helping us to further decrease raw material costs, improve efficiency in current production processes and provide necessary feedstock for asphalt production; |

e) | an asphalt production facility, which will add 300,000 MT annual capacity to our current facility; and |

f) | a production facility in Guangxi Province, which will have annual production capacity of 400,000 metric tons of ABS. The Company began preconstruction activities in February 2012, and the first phase is expected to be completed by the end of 2013. |

6

Our annual designed manufacturing capacity was 550,000 metric tons of a variety of petrochemical products at the end of 2010. We upgraded the catalytic pyrolysis processing equipment used in production facilities to expand the capacity from 550,000 MT to 720,000 MT. This capacity expansion project started in March 2011 and was completed in April 2011.

In September 2011, we completed building a new facility designed for producing Styrene-Butadience-Styrene (the “SBS”), one of the Styreneic Block Copolymers. SBS is a product with higher product margin with major application for footwear, adhesive, polymer modification and modified asphalt industries. The SBS facility was built on part of the 1.2 million square feet of land for which we obtained the right of use in August 2010 The construction started in September, 2010 and was completed as scheduled in September 2011. The project is currently in the stage of equipment optimization and alignment. Trial production is expected to start in late October 2011. The designed capacity of the SBS facility allows for production of up to 70,000 metric tons per year. We expect to generate net profit margins of 10% from our production of SBS once the facility reaches normal production levels. The SBS facility is anticipated to achieve an 80% utilization rate in 2012, the first full year of production, and generate approximately $107 million in sales and $10 million to $11 million in profit in 2012. Market conditions, the volatility of feedstock and SBS product prices can significantly impact the estimated profitability.

In anticipation of the increasing needs for raw materials and the production of finished goods, we are currently working to expand our manufacturing capacity to include:

| a) | additional storage capacity for raw materials and for finished goods to increase our current 100,000 MT of storage capacity to 280,000 MT. The additional storage capacity will allow us to take better advantage of price variations in our raw materials costs and our finished products sales, as well as to support the storage needs of overall expanded production capacity. |

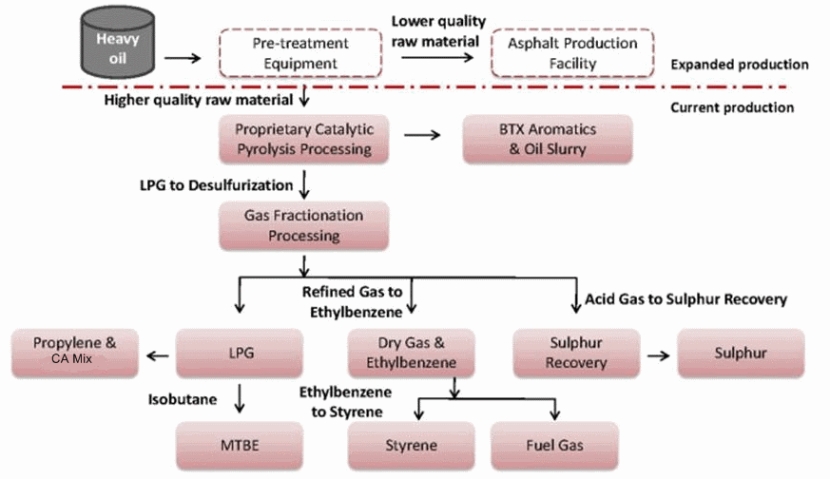

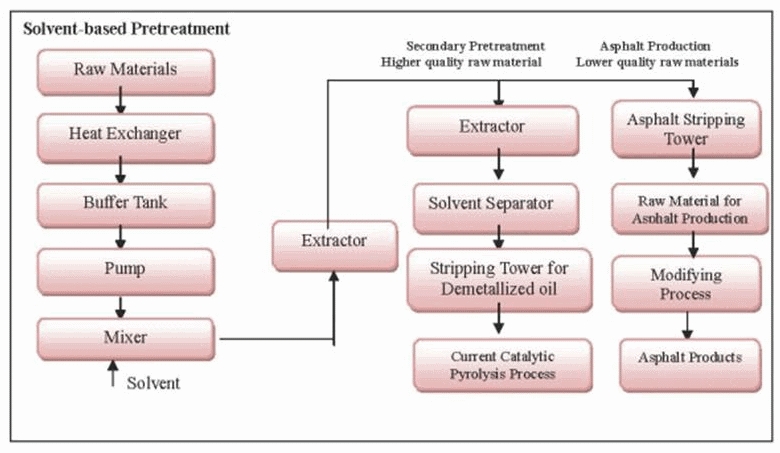

| b) | a raw material pre-treatment facility will enhance our capability to handle tougher raw materials and reduce raw material cost. The pre-treatment equipment will be utilized prior to the catalytic pyrolysis processing. After pre-treatment, the “better” raw materials will go to the catalytic pyrolysis process and the “poorer” raw materials will go to the asphalt production facility. To be more specific, the raw materials coming from storage tanks will go through a heat exchanging process and will be mixed with solvent in the mixer before going to the two level extractors for the separating process. Through different levels of separation, the higher quality raw material will go to the catalytic pyrolysis process and the lower quality raw material will be generated into asphalt products through the modifying process. The raw material pre-treatment facility will allow us to introduce an even lower grade heavy oil which ultimately lowers raw material costs. |

| c) | an asphalt production facility which will add with 300,000 MT annual capacities to our current facility. We plan to produce high-grade pavement asphalt which is the building material for highways and various grades of roads including urban fast roads and trunk roads with heavy traffic flow. High-grade pavement asphalt can also be used as raw materials for emulsified asphalt, diluted asphalt and modified asphalt. We expect the asphalt facility will be completed by the end of June, 2013. We believe that developing an asphalt production capability fits into our overall business. First, there is a large market demand in China due to China’s focus on building infrastructure to support further economic growth and the under-developed domestic supply; Second, asphalt production can provide a better use of our production residuals and lower quality materials. Currently, our production residuals are sold as scrap, however, with our expanded asphalt production, we can use those residuals to produce asphalt which can be sold at a higher price. We expect that the increased revenue and net profit from asphalt production will contribute significantly to our overall success. Third, our management team has in-depth knowledge and expertise in designing, building and managing an asphalt production facility. Our CEO, Mr. Chunfeng Tao successfully built and managed Ningbo Daxie Liwan Petrochemical Co. (later purchased by China National Offshore Oil Company) to an annual production of 500,000 metric tons of high grade asphalt. |

| d) | a production facility in Guangxi Province, which will have annual production capacity of 400,000 metric tons of ABS. ABS ,being the most common thermoplastic resin, is widely used in house hold appliances, electronic components, automotive parts and other fields. Recently, the demand for ABS in China has increased significantly due to domestic growth in the appliances market and the development of the automobile industry. |

The estimated cost of the storage capacity expansion, raw material pre-treatment facility and asphalt facility is approximately $75.8 million including $5.8 million for land, $20 million for facility construction, $40 million for new equipment, and $10 million for working capital. We are currently estimating the cost of the ABS production facility. Upon full completion of our expansion, our total production capacity will reach 1,490,000 MT a year including our current expanded production of 720,000 MT, SBS facility of 70,000 MT, asphalt facility of 300, 000 MT and ABS facility of 400,000 MT. The following chart depicts the breakdown of our new production capacity of 1,490,000 MT.

Now the management are evaluating the effectiveness and feasibility of the whole manufacturing capacity expansion strategy depending on the long-term development and the industry environment , therefore ,the company may carry out adjustment on one or some of projects according to the evaluation results.

7

Capacity Breakdown after expansion projects (1,490,000 MT)

We are currently evaluating the timeline for the expansion projects. Our current estimate is as follows, pending our evaluation:

| Expansion Project | Expected Completion Date |

| Catalytic pyrolysis processing equipment upgrade | Completed in April 2011 |

| SBS Production Facility | Completed in September 2011 |

| Storage Facility | End of Q4, 2012 |

| Raw Materials Pre-treatment Facility | End of Q4, 2012 |

| Asphalt Production Facility | End of Q4, 2012 |

| ABS Production Facility | End of Q4, 2013 |

Petrochemical Manufacturing Process

The following chart illustrates our petrochemical manufacturing process:

8

Petrochemical Market in China

China has the world’s second largest petrochemical market after the U.S. in terms of production and consumption. China’s petrochemical output value grew from RMB 1,240 billion in 2000 to RMB 11,000 billion in 2011 representing a Compound Annual Growth Rate (CAGR) of 21.95%. China Petrol and Chemical Industry Association (CPCIA) expect that the total profits in the petrochemical industry will increase 18% in 2012. (Source: http://www.cinic.org.cn/site951/schj/2012-01-17/529907.shtml)

China’s increasing domestic demand for petrochemical products has exceeded the domestic supply in the past several years:

| ● | China’s benzene supply grew from 2.13 million MT in 2002 to 6.659 million MT in 2011 representing a CAGR of 13.5%. China’s benzene demand increased from 2.08 million MT in 2002 to 5.609 million MT in 2011, representing a CAGR of 11.65%. (data sourcehttp://chem.chem365.net/Web/jckxx_news/47755.htm ) |

| ● | China’s toluene supply grew from 697,000 MT in 2002 to 2.55 million MT in 2011, representing a CAGR of 15.5%. China’s toluene demand increased from 1.56 million MT in 2002 to 2.30 million MT in 2010, representing a CAGR of 5%.(data source: http://info.pcrm.hc360.com/2012/02/020858176690.shtml ) |

| ● | China’s xylene supply grew from 820,000 MT in 2002 to 6.5 million MT in 2010, representing a CAGR of 30%. China’s xylene demand increased from 1.1 million MT in 2002 to 7.5 million MT in 2009 representing a CAGR of 32%.(data source: www.stats.gov.cn ) (www.chem99.com) |

| ● | China’s propylene supply has grown from 3.78 million MT in 2000 to 16.22million MT in 2011, representing a CAGR of14.16%. China’s propylene demand has risen from 4.39 million MT in 2000 to 18.60 million MT in 2010, representing a CAGR of 16%.(data source: http://www.oilchem.net/chemical/5_3_37153.html) |

| ● | China’s styrene supply has grown from 0.89 million MT in 2002 to 3.806 million MT in 2010, representing a CAGR of 20%. China’s Styrene demand has increased from 2.69 million MT in 2002 to 7.3 million MT in 2010, representing a CAGR of 13%.(data http://chem.chem365.net/Web/jckxx_news/30869.htm, http://static.sse.com.cn/cs/zhs/scfw/gg/ssgs/2010-04-29/600481_20100429_3.pdf ) |

| ● | China’s LPG supply has grown from 12.56 million MT in 2003 to 21.811 million MT in 2011 representing a CAGR of 7.14%. China’s LPG demand has increased from 18.77 million MT in 2003 to 23.64 million MT in 2010, representing a CAGR of 3%.(data source: http://www.oilchem.net:88/coalchem/2_1_2991360.html,) |

9

As a result, China has imported petrochemical products to meet the domestic demand, which is expected to continue for a number of years (source: Publication by Business Monitor International Ltd.: China Petrochemicals Report, Includes 5 Year Forecast to 2014; Q2 2010):

| ● | China imported 1.813 million MT of benzene between 2003 and 2011. (data source: http://ie.sci99.com/Product/18) |

| ● | China imported 863,000 MT of toluene in 2002 and 655,100 MT in 2011 (data source: http://info.pcrm.hc360.com/2012/02/020858176690.shtml ;http://chem.chem365.net/Web/jckxx_news/47682.htm) |

| ● | China imported 271,000 MT of xylene in 2002 and 4.98million MT in 2011 (data source: http://ie.sci99.com/Product/167/2011) |

| ● | China’s imports of propylene increased from 210,000 MT in 2004 to 1.95 million MT in 2011 (data source: http://chem.chem99.com/news/1263734.html; http://chem.chem99.com/news/1287660.html)) |

| ● | China’s imports of styrene increased from 1.79 million MT in 2002 to 3.607 million MT in 2011(http://ie.sci99.com/Product/17/2011) |

Asphalt Market in China and Pretreatment & Asphalt Process

In addition to its use as raw materials for emulsified, diluted and modified asphalt-based products, asphalt is widely used for highways, roads and airport pavements. At the end of 2011, the length of China’s highways has reached 85,000 km (52,816 miles) in the aggregate (http://www.ptbtv.com/news.asp?ID=78058), which made China rank the second in the world in terms of the length of its highway system. According to the PRC government plan, the length of China's highways will reach 100,000 km (62,137 miles) by 2020 (http://www.cngaosu.com/a/2010/1109/71783.html). In November 2008, the PRC Ministry of Communication issued a RMB 5 trillion investment plan and according to this plan, the average annual investment for construction of highways in the next five years will be RMB 980 billion, among which 60% will be used for construction of expressways, 20% for provincial highways and 20% for highways in the countryside.

To ensure the high-quality condition of roads and highways, the PRC government requires regular pavement maintenance every five years. In the past five years, the domestic demand for asphalt in China has exceeded supply with total imports of approximately 5.6million MT in 2010.

10

The following chart depicts the pretreatment and asphalt process:

Environmental Protection and Safety Measures

We are committed to environmental protection, facility safety and quality control throughout the design, maintenance and growth of our operation facilities and manufacturing process.

Environmental Protection

We have taken various measures to meet national standards and ensure our environmental compliance. For example, we recycle the water for cooling in our production process and large amounts of water can be saved through recycling. Sulfureted hydrogen generated in production is sent to the facility for sulfur recovery. The waste water and waste gas is treated by our sewage water treatment station and emission control facility to meet the national standards before discharge. The industrial residue and garbage is sent to qualified companies for safe treatment.

Safety Measures

Our safety control measures include:

| 1. | Distribution control system; |

| 2. | Emergency shutdown mechanism; |

| 3. | Automatic interlocking system; |

| 4. | Detection & alarm system for flammable and toxic gas; |

| 5. | Fire detection & automatic sprinkler system; and |

| 6. | Real-time system and process monitoring system |

Quality Control

With our commitment to quality control, our petrochemical products have met all applicable national standards for petrochemical products set by the General Administration of Quality Supervision, Inspection and Quarantine of the PRC. For instance, the purity of our Styrene product exceeded the national standard of 99.7%, and the purity and our Propylene product exceeded the national standard of 99.5%.

Our Competitive Strengths

As an independent petrochemical manufacturer and supplier, our competitive strengths include:

11

Technology Advantage

We have proprietary manufacturing technologies that allow for better use of raw materials, higher yield rate and enhanced operational efficiency.

Specifically, we possess the technology to use heavy oil, instead of naphtha which is a commonly used feedstock in the petrochemical production industry. Heavy oil is approximately 15% cheaper per ton and more readily available than naphtha, which provides us with competitive advantage in the selection of raw materials. In addition, we use proprietary catalytic pyrolysis with higher reaction temperatures, which results in a 15% higher Olefin yield rate than that of conventional fluidized catalytic cracking processes. Finally, we use enhanced technologies in our production process that allow for lower capital investment and higher operations efficiency.

Our yield rate in 2010 for our entire production line indicates a yield rate of 87.6% for the finished products. The yield rate in 2011 for our entire line is 87.2% for the finished products. Yield rate represents the percentage of finished product produced from input of raw material and net input of unfinished products and is calculated by dividing the sum of crude oil and net unfinished input into the individual net production of finished products. A yield rate of 87.2% means, for instance, 100 tons of heavy oil can generate approximately 87.2 tons of finished products.

In addition, we use enhanced technologies in our production process that allow for lower capital investment and higher operations efficiency. Our proprietary catalytic pyrolysis process uses a set of dual risers for one precipitator and one regenerator, while the commonly-used fluidized catalytic cracking process uses one riser for one precipitator and one regenerator respectively. The dual riser, one precipitator and one regenerator are integrated into one complete process which provides for ease of operation, higher operation efficiency and higher reaction temperature. It was estimated that the technology generates a 15% higher olefin yield rate than that of the fluidized catalytic cracking process, which allows us to produce more higher-margin olefin products such as styrene and propylene

Finally, a catalytic pyrolysis process with high temperatures can produce more olefin hydrocarbon based products compared with other equipment using low temperatures for the same product. In other words, our cost is reduced while producing the same amount of the product.

Our management considers our manufacturing technologies and manufacturing design critical to our business, and has taken steps to protect these technologies. In January 2011, we received the approval for our patent application for MEP technology (Multiple Ethylene Propylene) from the National Intellectual Property Bureau in China, #ZL-2010-2-0191523.6. In addition to patent protection, we also entered into confidentiality and license agreements with certain employees, customers and others to protect the confidentiality of our technologies.

Elite Workforce

Our management team, composed of seasoned petrochemical experts with proven track records from China’s largest state-owned enterprises, provides us with specialized operating management and technical administration. In addition, we have allied with many industry-renowned technology experts and advisors assisting us to achieve consistent technological improvement.

Ideal Location

Our operation and storage facilities are at the ocean front and in close proximity to suppliers and customers which provides us with an advantage of lower logistics cost and readily available access to raw materials and target customers. In addition, being located in Qingshi Chemical Park in Ningbo provides us with access to skilled labor and industry resources.

Sales and Pricing

Sales

In selling our products, most of our customers pay cash in advance. For core customers with excellent credit history, we may occasionally make an exception by conducting credit sales, which is part of our strategy to maintain customer relationship.

In order to meet customers’ demand, we have improved our manufacturing technologies and streamlined our conversion process to achieve an approximately 30 days’ raw material-to-sales cycle.

In order to facilitate our future growth, Ningbo Keyuan Petrochemicals, Ltd was incorporated in Ningbo, China with a registered capital of $3 million as a wholly-owned subsidiary of Keyuan Group (the BVI entity) on August 27, 2010. Ningbo Keyuan Petrochemicals is responsible for the sales and marketing, raw materials sourcing and market analysis for the Company. Dr. Jingtao Ma was appointed as the General Manager of the new entity. Dr. Ma was the head of the former sales and marketing division of Ningbo Keyuan. This new entity will also serve as the “market thermometer” that can better monitor market conditions and obtain first hand market data through buying and selling activities. Management believes that the consolidation of the sales and marketing and raw material procurement function under one business unit will help efficiently manage the future expansion of the Company.

12

Pricing

Our raw material price fluctuations are primarily attributable to international oil prices and market effects of supply and demand. We set our selling prices based upon benchmark prices published by national petrochemical companies, and/or through individually negotiated prices with customers. Specifically, BTX aromatic prices are influenced by benchmark prices set by National Development and Reform Commission, or NDRC.

Customers

Our main customer base is downstream petrochemicals manufacturers and distributors (trading companies) located in and near the Yangtze River Delta and Pearl River Delta. 14% of our sales are direct sales to petrochemical companies that use our products as raw materials for their own products such as polystyrene, isoprene, dicyclopentadiene, acrylic acid, oil fuel products and other chemical products. 86% of our sales are through the trading companies, i.e., distributors who sell our products to petrochemicals derivative companies and manufacturers. We engage distributors as customers mainly because: (1) distributors customarily pay the entire purchase price prior to shipment, while end-users often request credit payment terms; and (2) it decreases our overhead by allowing for a more streamlined sales force as distributors do not require regular client visits, entertaining or a highly specialized sales team to maintain the relationships.

In order to estimate the total orders for a year, we conduct surveys with our major customers to obtain their preliminary orders for the next one or two years and update the information annually. We enter into purchase contracts with customers on an order-to-order basis. In each contract, price is determined based on market price and the quantity is specified based on (1) the customer demand for a particular order and (2) our capability to satisfy that particular order. Our five largest customers accounted for 44% and 40% of the sales for the years ended December 31, 2011 and 2010, respectively. We anticipate that our overall customer composition and the concentration of our top customers will change as we expand our business and modify our product portfolio to include new products and higher-margin products; however, we can give no assurance that this will be the case.

Intellectual Property

We have a pending trademark application for the Ningbo Keyuan company logo with the State Administration for Industry and Commerce, Trademark Office. On January 25, 2011 we received approval for a patent related to the Company's proprietary production process, called MEP (Multiple Ethylene Propylene). MEP is an exclusive and leading technology used in Keyuan's existing production process. Through the ingenuity of our CEO, Mr. Tao, we have developed this proprietary production process that improves the manufacturing efficiency and flexibility for a wide range of petrochemicals. The utility model patent received, #ZL-2010-2-0191523.6, applies to a processing technology used in the production of ethylene and propylene. This technology allows us to use lower grade feedstock (such as heavy oil) instead of a higher grade feedstock commonly used in other existing petrochemical production processes. It also allow us to improve the yield and utilization rate of its production line, resulting in a 15% cost savings.

Government Regulation

In addition to U.S. securities laws, banking laws and laws applicable to all companies, such as The Foreign Corrupt Practices Act, as a China-based entity, we are subject to various Chinese regulations. This section sets forth a summary of the most significant China regulations or requirements that may affect our business activities operated in China or our shareholders’ right to receive dividends and other distributions of profits from the PRC subsidiary.

Foreign Investment in PRC Operating Companies

The Foreign Investment Industrial Catalogue jointly issued by China's Ministry of Commerce (MOFCOM) and NDRC in 2007 classified various industries/businesses into three different categories: (i) encouraged for foreign investment; (ii) restricted to foreign investment; and (iii) prohibited from foreign investment. For any industry/business not covered by any of these three categories, they will be deemed industries/businesses permitted for foreign investment. Except for those expressly provided with restrictions, encouraged and permitted industries/businesses are usually 100% open to foreign investment and ownership. With regard to those industries/businesses restricted to foreign investment, there is always a limitation on foreign investment and ownership. Foreign investment is prohibited in prohibited industries/business. The PRC subsidiary’s business does not fall under the industry categories that are restricted to, or prohibited from foreign investment and is not subject to limitation on foreign investment and ownership.

13

Regulation of Foreign Currency Exchange

Foreign currency exchange in the PRC is governed by a series of regulations, including the Foreign Currency Administrative Rules (1996), as amended, and the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), as amended. Under these regulations, the Renminbi is freely convertible for trade and service-related foreign exchange transactions, but not for direct investment, loans or investments in securities outside the PRC without the prior approval of State Administration of Foreign Exchange (SAFE). Pursuant to the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), foreign investment enterprises, or FIEs may purchase foreign exchange without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange, subject to a cap approved by SAFE, to satisfy foreign exchange liabilities or to pay dividends. However, the relevant Chinese government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside the PRC are still subject to limitations and require approvals from SAFE.

Regulation of FIEs’ Dividend Distribution

The principal laws and regulations in the PRC governing distribution of dividends by FIEs include:

| (i) | The Sino-foreign Equity Joint Venture Law (1979), as amended, and the Regulations for the Implementation of the Sino-foreign Equity Joint Venture Law (1983), as amended; |

| (ii) | The Sino-foreign Cooperative Enterprise Law (1988), as amended, and the Detailed Rules for the Implementation of the Sino-foreign Cooperative Enterprise Law (1995), as amended; |

| (iii) | The Foreign Investment Enterprise Law (1986), as amended, and the Regulations of Implementation of the Foreign Investment Enterprise Law (1990), as amended. |

Under these regulations, FIEs in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, the wholly-owned foreign enterprises in the PRC are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds unless such reserve funds have reached 50% of their respective registered capital. These reserves are not distributable as cash dividends.

Regulation of a Foreign Currency’s Conversion into RMB and Investment by FIEs

On August 29, 2008, SAFE issued a Notice of the General Affairs Department of the State Administration of Foreign Exchange on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises or Notice 142, to further regulate the foreign exchange of FIEs. According to Notice 142, FIEs shall obtain a verification report from a local accounting firm before converting its registered capital in foreign currency into Renminbi, and the converted Renminbi shall be used for the business within its permitted business scope. Notice 142 explicitly prohibits FIEs from using RMB converted from foreign capital to make equity investments in the PRC, unless the domestic equity investment is within the approved business scope of the FIE and has been approved by SAFE in advance. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Violations of Notice 142 may result in severe penalties, including substantial fines as set forth in the SAFE rules.

Regulation of Foreign Exchange in Certain Onshore and Offshore Transactions

In October 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-raising and Return Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, or SAFE Notice 75, which became effective as of November 1, 2005. SAFE has also issued implemented rules to SAFE Notice 75. SAFE Notice 75 and its implementation rules require PRC residents (including both corporate entities and natural persons) to register with SAFE or its competent local branch in connection with their direct or indirect shareholding in any company outside of China referred to as an “offshore special purpose company” established for the purpose of raising fund from overseas to acquire assets of, or equity interests in, PRC companies. Under SAFE Notice 75, a “special purpose vehicle”, or SPV, refers to an offshore entity established or controlled, directly or indirectly, by PRC residents for the purpose of seeking offshore equity financing using assets or interests owned by such PRC residents in onshore companies. In addition, any PRC resident that is the shareholder of an offshore special purpose company is required to amend his or her SAFE registration with the SAFE or its competent local branch, with respect to that offshore special purpose company in connection with any of its increase or decrease of capital, transfer of shares, merger, division, equity investment or creation of any security interest over any assets located in China. The SAFE regulations require retroactive approval and registration of direct or indirect investments previously made by PRC residents in offshore special purpose companies. PRC subsidiaries of an offshore special purpose company are required to coordinate and supervise the filing of SAFE registrations by the offshore holding company’s shareholders who are PRC residents in a timely manner. In the event that a PRC resident shareholder with a direct or indirect investment in an offshore parent company fails to obtain the required SAFE approval and make the required registration, the PRC subsidiaries of such offshore parent company may be prohibited from making distributions of profit to the offshore parent and from paying the offshore parent proceeds from any reduction in capital, share transfer or liquidation in respect of the PRC subsidiaries. Further, failure to comply with the various SAFE approval and registration requirements described above, as currently drafted, could result in liability under PRC law for foreign exchange evasion.

14

There still remain uncertainties as to how certain procedures and requirements under the aforesaid SAFE regulations will be enforced, and it remains unclear how these existing regulations, and any future legislation concerning offshore or cross-border transactions, will be interpreted, amended and implemented by the relevant government authorities. Although we have requested PRC residents who, to our knowledge, hold direct or indirect interests in our Company to make the necessary applications, filings and amendments as required under the SAFE Notice 75 and other related rules, our PRC resident beneficial holders have not completed such approvals and registrations required by the SAFE regulations. We will attempt to comply, and attempt to ensure that all of our shareholders subject to these rules comply with the relevant requirements. We cannot, however, assure the compliance of all of our China-resident shareholders. Any current or future failure to comply with the relevant requirements could subject us to fines or sanctions imposed by the Chinese government, including restrictions on certain of our subsidiaries’ ability to pay dividends or hinder our investment in those subsidiaries or affect our ownership structure, which could adversely affect our business and prospects.

Regulations on Employee Stock Option Plans

In December 2006, the People’s Bank of China promulgated the Administrative Measures of Foreign Exchange Matters for Individuals, which set forth the respective requirements for foreign exchange transactions by individuals (both PRC or non-PRC citizens) under either the current account or the capital account. In January 2007, SAFE issued implementing rules for the Administrative Measures of Foreign Exchange Matters for Individuals, which, among other things, specified approval requirements for certain capital account transactions such as a PRC citizen’s participation in the employee stock ownership plans or stock option plans of an overseas publicly-listed company. In March 2007, SAFE promulgated the Application Procedures of Foreign Exchange Administration for Domestic Individuals Participating in Employee Stock Ownership Plan or Stock Option Plan of Overseas-Listed Company, or the Stock Option Rules. Under these rules, PRC citizens who participate in an employee stock ownership plan or a stock option plan in an overseas publicly-listed company are required to register with SAFE or its local branch and complete certain other procedures. For participants of an employee stock ownership plan, an overseas custodian bank should be retained by the PRC agent, which could be the PRC subsidiary of such overseas publicly-listed company, to hold on trusteeship all overseas assets held by such participants under the employee share ownership plan. In the case of a stock option plan, the PRC agent is required to retain a financial institution with stock brokerage qualification at the place where the overseas publicly-listed company is listed or a qualified institution designated by the overseas publicly-listed company to handle matters in connection with the exercise or sale of stock options for the stock option plan participants. For participants who had already participated in an employee stock ownership plan or stock option plan before the date of the Stock Option Rules, the Stock Option Rules require their PRC employers or PRC agents to complete the relevant formalities within three months of the date of this rule.

Further, a notice concerning the individual income tax on earnings from employee share options jointly issued by Ministry of Finance, or the MOF, and the State Administration of Taxation, or the SAT, and its implementing rules, provide that domestic companies that implement employee share option programs shall (a) file the employee share option plans and other relevant documents to the local tax authorities having jurisdiction over them before implementing such employee share option plans; (b) file share option exercise notices and other relevant documents with the local tax authorities having jurisdiction over them before exercise by the employees of the share options, and clarify whether the shares issuable under the employee share options mentioned in the notice are the shares of publicly listed companies; and (c) withhold taxes from the PRC employees in connection with the PRC individual income tax.

We and our PRC citizen employees who participate in the employee stock incentive plan, which we adopted in 2010, will be subject to these regulations. We and our PRC option grantees have not completed the registrations under these regulations. We cannot assure you that we and our PRC option grantees will be able to complete the required registrations. Any current or future failure to comply with the relevant requirements could subject us to fines or sanctions imposed by the Chinese government, which could adversely affect our business and prospects.

Government Regulations Relating to Taxation

On March 16, 2007, the National People’s Congress or NPC, approved and promulgated the PRC Enterprise Income Tax Law, which we refer to as the New EIT Law. The New EIT Law took effect on January 1, 2008. Under the New EIT Law, FIEs and domestic companies are subject to a uniform tax rate of 25%. The New EIT Law provides a five-year transition period starting from its effective date for those enterprises which were established before the promulgation date of the New EIT Law and which were entitled to a preferential lower tax rate under the then-effective tax laws or regulations.

On December 26, 2007, the State Council issued a Notice on Implementing Transitional Measures for Enterprise Income Tax, or the Notice, providing that the enterprises that have been approved to enjoy a low tax rate prior to the promulgation of the New EIT Law will be eligible for a five-year transition period beginning January 1, 2008, during which time the tax rate will be increased step by step to the 25% unified tax rate set out in the New EIT Law. From January 1, 2008, for the enterprises whose applicable tax rate was 15% before the promulgation of the New EIT Law, the tax rate will be increased to 18% for 2008, 20% for 2009, 22% for 2010, 24% for 2011, and 25% for 2012. For the enterprises whose applicable tax rate was 24%, the tax rate will be changed to 25% from January 1, 2008.

15

The New EIT Law and Implementation Rules of the New EIT Law provide that an income tax rate of 10% may be applicable to dividends payable to non-PRC investors that are “non-resident enterprises”, which (i) do not have an establishment or place of business in the PRC, or (ii) have such establishment or place of business in the PRC but the relevant income is not effectively connected with the establishment or place of business, to the extent such dividends are derived from sources within the PRC. The income tax for non-resident enterprises shall be subject to withholding at the income source, with the payor acting as the obligatory withholder under the New EIT Law, and therefore such income taxes generally called withholding tax in practice. Such income tax may be exempted or reduced by the State Council of the PRC or pursuant to a tax treaty between the PRC and the jurisdictions in which our non-PRC shareholders reside. For example, the 10% withholding tax is reduced to 5% pursuant to the Double Tax Avoidance Agreement Between Hong Kong and Mainland China if a Hong Kong resident enterprise owns more than 25% of the registered capital in a company in the PRC and is determined by the competent PRC tax authority to have satisfied the other conditions and requirements under such Double Tax Avoidance Agreement Between Hong Kong and Mainland China and other applicable laws. We are a U.S. holding company and substantially all of our income is derived from dividends we receive from our subsidiaries located in the PRC. Thus, if Keyuan HK are considered as a “non-resident enterprise” under the New EIT Law and the dividends paid to Keyuan HK by our subsidiaries in the PRC are considered income sourced within the PRC, such dividends may be subject to a withholding tax at a rate up to 10%.

The new tax law provides only a framework of the enterprise tax provisions, leaving many details on the definitions of numerous terms as well as the interpretation and specific applications of various provisions unclear and unspecified. Any increase in the combined Company’s tax rate in the future could have a material adverse effect on our financial condition and results of operations.

For the years ended December 31, 2011 , 2010 and 2009, the Company was subject to the 25% tax rate. In order to support the growth of certain local enterprises, the local government granted certain credit back to Ningbo Keyuan. In the first two profitable years, the local government will credit back to the Company the entire local portion of the income tax which equals to 40% of the whole Enterprise Income Tax the Company paid applying the 25% tax rate.; in the subsequent three profitable years, the local government will credit back 50% of the local income tax the Company paid under the 25% tax rate. The Company will recognize the subsidy related to income tax at the time the cash is received.

Regulations on Work Safety

On June 29, 2002, the Work Safety Law (“WSL”) of the PRC was adopted by Standing Committee of the 9th National People’s Congress and came into effect on November 1, 2002, as amended on August 27, 2009. The WSL provides general work safety requirements for entities engaging in manufacturing and business activities within the PRC. Additionally, Regulation on Work Safety Licenses (“RWSL”), as adopted by the State Council on January 7, 2004 effective on January 13, 2004, requires enterprises engaging in the manufacture of dangerous chemicals to obtain a work safety license with a term of three years. If a work safety license needs to be extended, the enterprise must go through extension procedures with authorities three months prior to its expiration. In addition, on May 17, 2004, the Measures for Implementation of Work Safety Licenses of Dangerous Chemicals Production was promulgated as implementing measures to the Regulation on Work Safety Licenses which provides that entities producing dangerous chemicals are required to obtain work safety licenses pursuant to specific requirements. Without work safety licenses, no entity may engage in the formal manufacture of dangerous chemicals. The Measures for Implementation of Work Safety Licenses of Dangerous Chemicals Production was amended on August 5, 2011 and the amended regulation will become effective on December 1, 2011. The amended regulation provides for more detailed and comprehensive requirements and conditions for obtaining work safety licenses for dangerous chemicals production.

The Regulations on the Safety Administration of Dangerous Chemicals (“RSADC”) was promulgated by the State Council on January 26, 2002, effective as of March 15, 2002. It sets forth general requirements for manufacturing and storage of dangerous chemicals in China. The RSADC requires that companies manufacturing dangerous chemicals establish and strengthen their internal regulations and rules on safety control and fulfill the national standards and other relevant provisions of the State. In addition, according to the RSADC, companies that manufacture, store, transport or use dangerous chemicals shall be required to obtain corresponding approvals or licenses with the State Administration of Work Safety and its local branches and other proper authorities. Companies that manufacture or store dangerous chemicals without approval or registration with the proper authorities can be shut down, ordered to stop manufacturing or ordered to destroy the dangerous chemicals. Such companies can also be subject to fines. If criminal law is violated, the persons chiefly liable, along with other personnel directly responsible for such impropriety, shall be subject to relevant criminal liability. The RSADC was amended on March 2, 2011 and the amended regulation will become effective on December 1, 2011. The amended regulation strengthens the administration of dangerous chemicals production.

The Company has put work place safety as one of the top priorities for our work. In order to comply with the aforementioned rules and regulations, we have made considerable investment for major equipment with a total estimated amount of RMB 23 million (about USD 3.37 million). We have installed a distribution control system (DCS), emergency shutdown system, electric explosion protection, automatic interlocking system, detecting & alarming system for inflammable and toxic gas, fire fighting and fire detecting system, auto-sprinkling system, pressure release and control system. The Company’s operating subsidiary Ningbo Keyuan has obtained a work safety license effective from March 25, 2011 to March 24, 2014 for producing petrochemical products.

16

Regulations on Environmental Protection

According to the Prevention and Control of Water Pollution Law, as adopted by the Standing Committee of the 10th National People’s Congress on February 28, 2008 and effective on June 1, 2008, China adopted a licensing system for pollutant discharge. Companies directly or indirectly responsible for discharge of industrial waste water or medical sewage to waters are required to obtain a pollutant discharge license. All companies are prohibited from discharging wastewater and sewage to waters without the license or in violation of the terms of the pollutant discharge license. As Ningbo city is currently working on setting up an inspection system of the pollutant discharge, there is no specific pollutant discharge license for our operating subsidiary Ningbo Keyuan. However, Ningbo Keyuan’s facilities have passed inspection with Ningbo city environmental protection authorities which includes an approval for the pollutant discharge.

The Regulations on the Administration of Construction Projects Environmental Protection (“RACPEP”), as adopted by the State Council on November 18, 1998 and effective on November 29, 1998, governs construction projects and the impact such projects will have on the environment. Pursuant to the RACPEP, the governing body is responsible for supervising the implementation of a three tiered system that includes (i) reviewing and approving a construction project, (ii) overseeing the construction project and (iii) inspecting the finished construction project and ensuring that all harmful pollutants are disposed of correctly. Manufacturing companies are required to apply for inspection with environmental protection authorities upon completion of a construction project. Our facilities have passed the inspection by the environmental protection authorities.

In order to meet the above mentioned requirements for environmental protection, we have invested about RMB 28 million (about USD 4.1 million) and built facilities including a sewage treatment facility, a sulphur recovery facility, a sea water desulphurization facility, a flue gas treatment facility and a real-time monitoring system for environmental protection. With these facilities, we believe we are able to meet all the environmental protection standards set by the government.

Research and Development

We consider ourselves as a technology driven innovative Company. Our senior management combined has over one hundred years of industry experience. We continue to enhance our technology through internal and external research and development.

On January 25, 2011 we received approval for a patent related to the Company's proprietary production process, called MEP (Multiple Ethylene Propylene). MEP is an exclusive and leading technology used in Keyuan's existing production process. The utility model patent received, #ZL-2010-2-0191523.6, applies to a processing technology used in the production of ethylene and propylene. This technology allows us to use lower grade feedstock (such as heavy oil) instead of a higher grade feedstock commonly used in other existing petrochemical production processes. It also allows us to improve the yield and utilization rate of its production line.