Cautionary Note Regarding Forward-Looking Statements

Statements in this Current Report on Form8-K that are not historical facts are “forward-looking statements.” These statements are based on certain assumptions and expectations made by the Company, which reflect management’s experience, estimates and perception of historical trends, current conditions and anticipated future developments. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to uncertainties that may delay or negatively impact the Reorganization or cause the Reorganization to be delayed or to not occur at all, uncertainties related to the Company’s and Roan LLC’s ability to realize the anticipated benefits of the Reorganization, the potential negative effects of the Reorganization, financial and operational performance and results of the Company and Roan LLC, continued low or further declining commodity prices and demand for oil, natural gas and natural gas liquids, ability to hedge future production, ability to replace reserves and efficiently develop current reserves, the capacity and utilization of midstream facilities and the regulatory environment. These and other important factors could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Please read “Risk Factors” in the Company’s Annual Reports on Form10-K, Quarterly Reports on Form10-Q and other public filings. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

| Item 3.02 | Unregistered Sales of Equity Securities. |

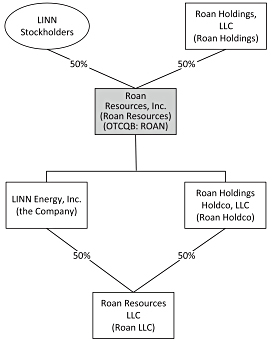

In connection with the Reorganization and as described above in Item 1.01 of this Current Report, on the Effective Date, Roan Resources expects to issue 76,269,766 shares of Roan Common Stock to Roan Holdings pursuant to the Master Reorganization Agreement and the Roan Holdco Merger Agreement. Such issuances of Roan Common Stock will not involve any underwriters, underwriting discounts or commissions or a public offering, and will be made in reliance on the exemption from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

In connection with and effective upon the Reorganization, each of David B. Rottino, President and Chief Executive Officer, James G. Frew, Executive Vice President and Chief Financial Officer, and Darren Schluter, Executive Vice President, Finance, Administration and Chief Accounting Officer, will depart from the Company. Each such officer has indicated to the Board that his or her departure is not due to any disagreement with the Company or its management with respect to any matter relating to the Company’s operations, policies or practices.

On September 18, 2018, the Company issued a press release announcing the entrance into the Reorganization Agreement. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| # | Pursuant to Item 601(b)(2) of RegulationS-K, the registrant agrees to furnish supplementally a copy of any omitted exhibit or schedule to the SEC upon request. |

3