On September 24, 2018, the Company filed a Current Report on Form8-K (the “Original Form8-K”) to report the closing of the Reorganization and related matters in Items 1.01, 1.02, 2.01, 2.03, 3.02, 3.03, 4.01, 5.01 and 9.01 of Form8-K. Due to the large number of events to be reported under the specified items of Form8-K, this Form8-K/A is being filed to amend the Original Form8-K to include additional matters related to the closing of the Business Combination under Items 5.02, 5.03, 5.07 and 8.01.

Capitalized terms used herein but not defined herein shall have the meanings ascribed to such terms in the Original Form8-K.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

To the extent required, the information set forth under Item 2.01 of this Current Report under “Directors and Executive Officers,” “Director and Executive Officer Compensation” and “Certain Relationships and Related Party Transactions” is incorporated herein by reference.

Management Incentive Plan

In connection with the Reorganization, our Board adopted the Amended and Restated Plan to reflect the Reorganization and attract, retain and motivate qualified persons as employees, directors and consultants, thereby enhancing the profitable growth of us and our affiliates. The Amended and Restated Plan provides for the grant, from time to time, at the discretion of our Board or a committee thereof, of stock options, stock appreciation rights, restricted stock, restricted stock units, stock awards, dividend equivalents, other stock-based awards, cash awards and substitute awards. The Amended and Restated Plan will be administered by our Board or a committee thereof.

Subject to adjustment in the event of certain transactions or changes of capitalization in accordance with the Amended and Restated Plan, 15,253,954 shares of our Common Stock have been reserved for issuance pursuant to awards under the Amended and Restated Plan, including with respect to the outstanding performance share unit awards. Common Stock subject to an award that expires or is canceled, forfeited, exchanged, settled in cash or otherwise terminated without delivery of shares and shares withheld to pay the exercise price of, or to satisfy the withholding obligations with respect to, an award will again be available for delivery pursuant to other awards under the Amended and Restated Plan.

The foregoing description is qualified in its entirety by reference to the full text of the Amended and Restated Plan, which is attached as Exhibit 10.4 to this Current Report and is incorporated in this Item 5.02 by reference.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

The information set forth under Item 2.01 of this Current Report under “Description of the Company’s Securities” is incorporated in this Item 5.03 by reference.

| Item 5.07 | Submissions of Matters to a Vote of Security Holders. |

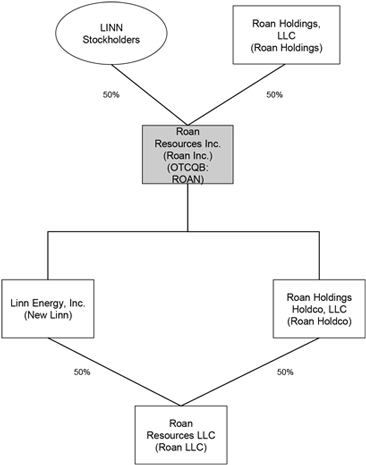

On the Effective Date, immediately following the consummation of the Linn Merger, and prior to the consummation of the Holdco Merger, the holders of approximately 51.1% of the then-issued and outstanding Common Stock of Roan Inc. executed and delivered a written consent adopting and approving (a) our amended and restated certificate of incorporation and amended and restated bylaws and (b) the Holdco Merger.

The information set forth under “Introductory Note” and Item 2.01 of this Current Report under “Description of the Company’s Securities” is incorporated in this Item 5.07 by reference.

On the Effective Date, the Company issued a press release announcing the consummation of the Reorganization, which is included in this Current Report as Exhibit 99.6.

| Item 9.01. | Financial Statements and Exhibits. |

(a)Financial Statements of Businesses Acquired

The historical financial statements of Roan Resources LLC as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015 and as of June 30, 2018 and for the six months ended June 30, 2018 and 2017 are attached hereto as Exhibits 99.1 and 99.2.

5