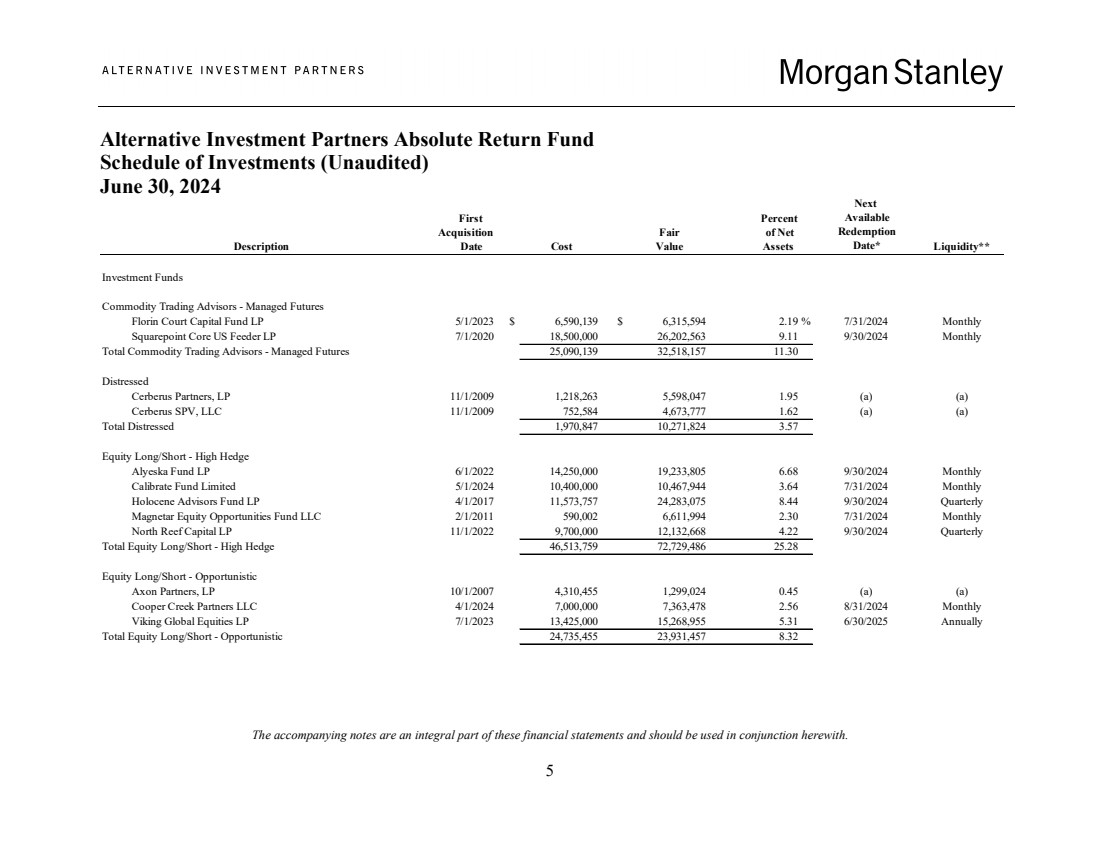

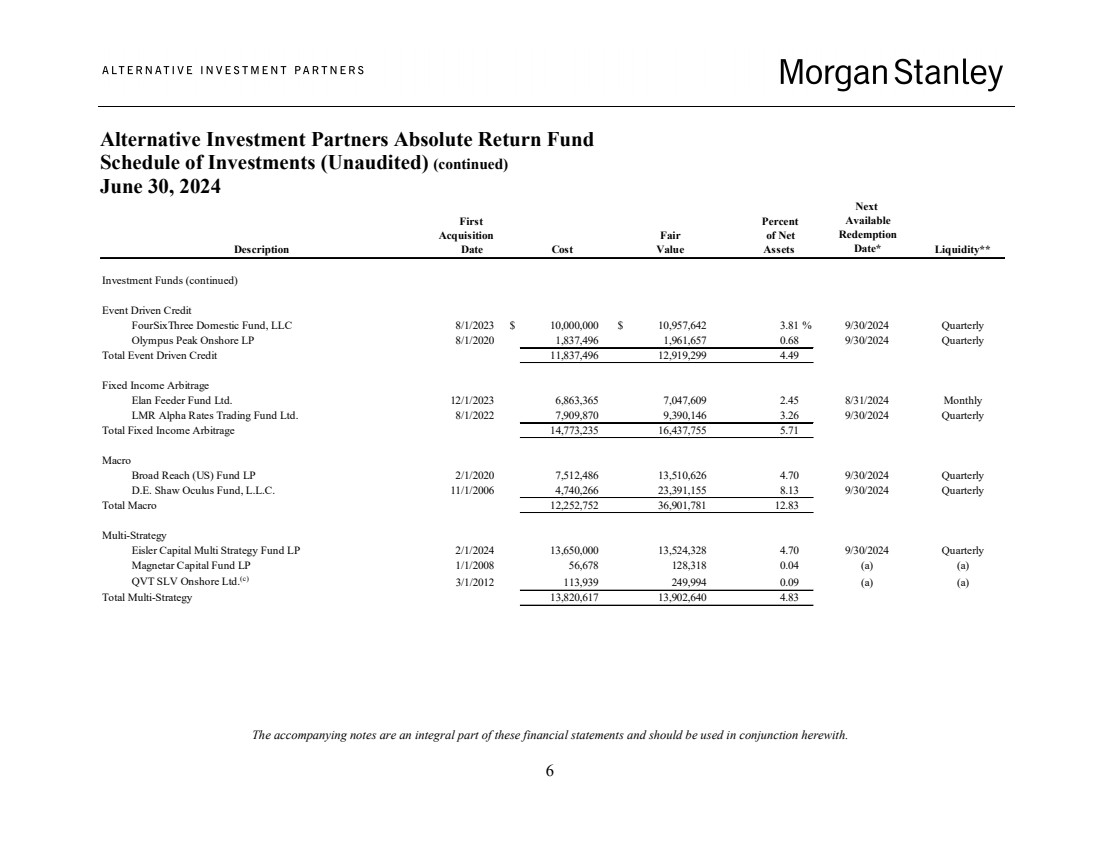

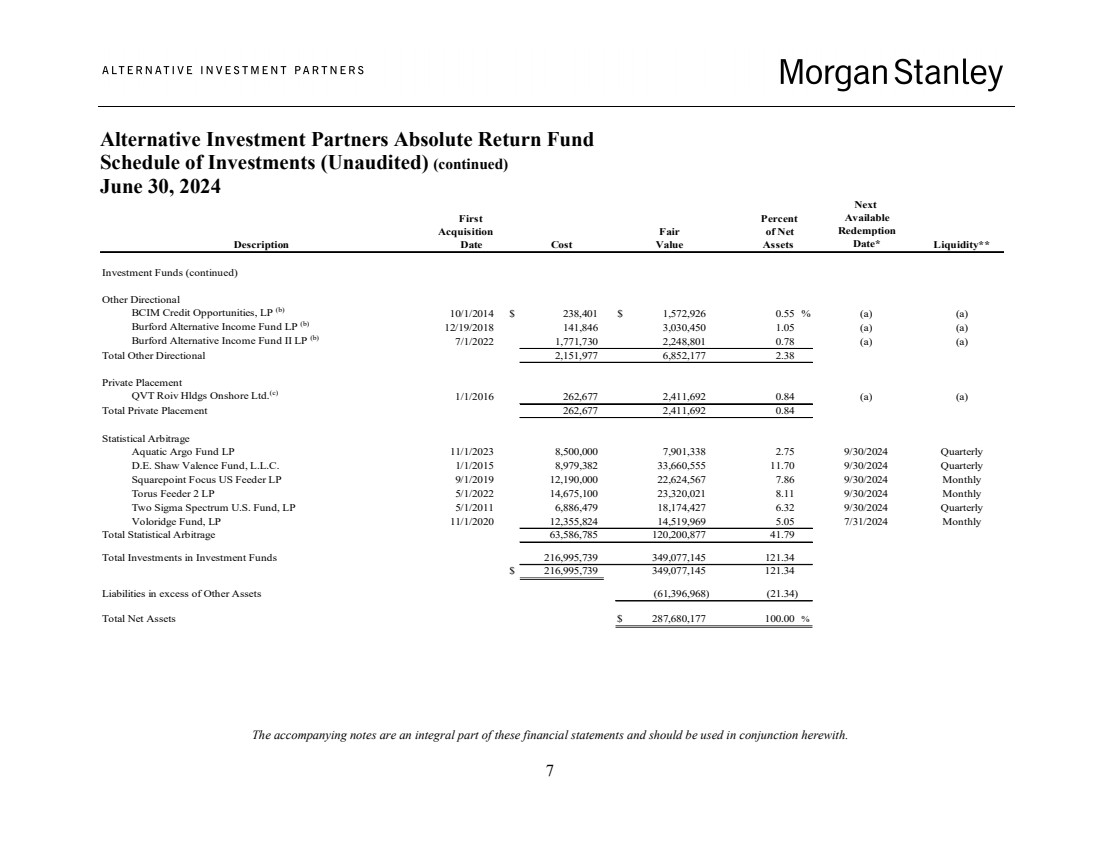

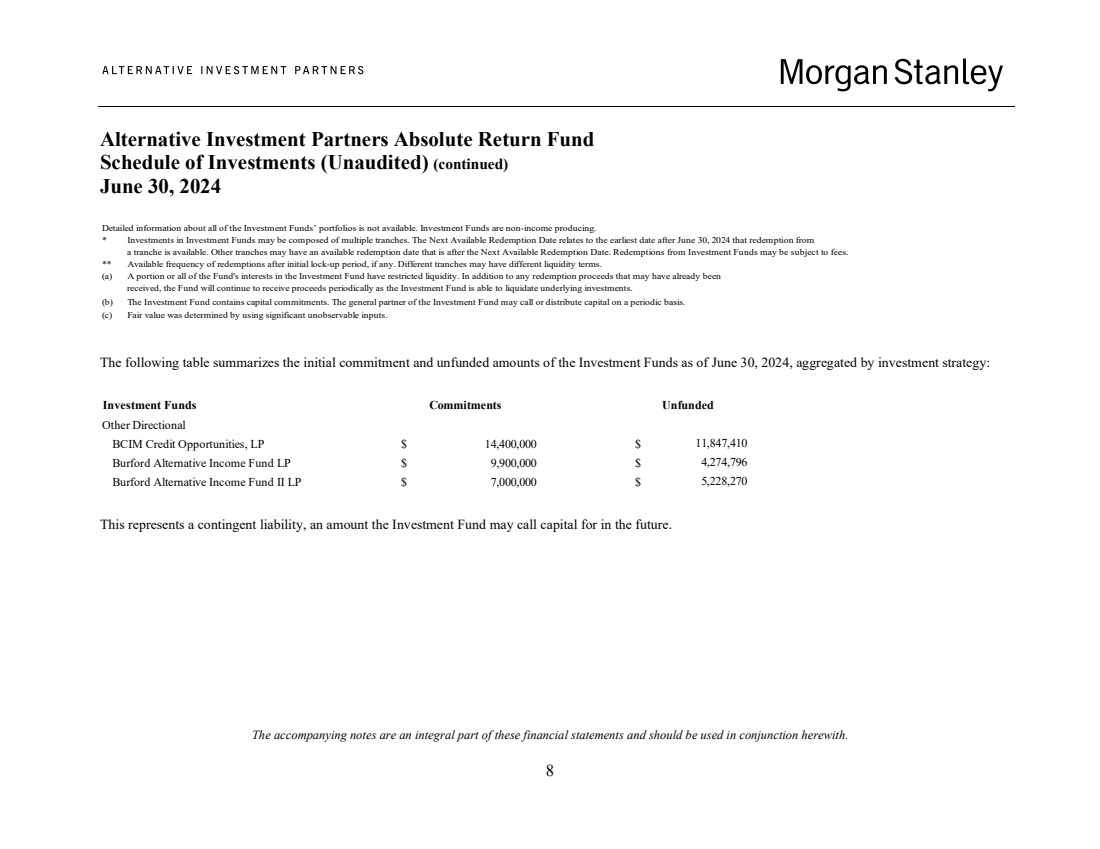

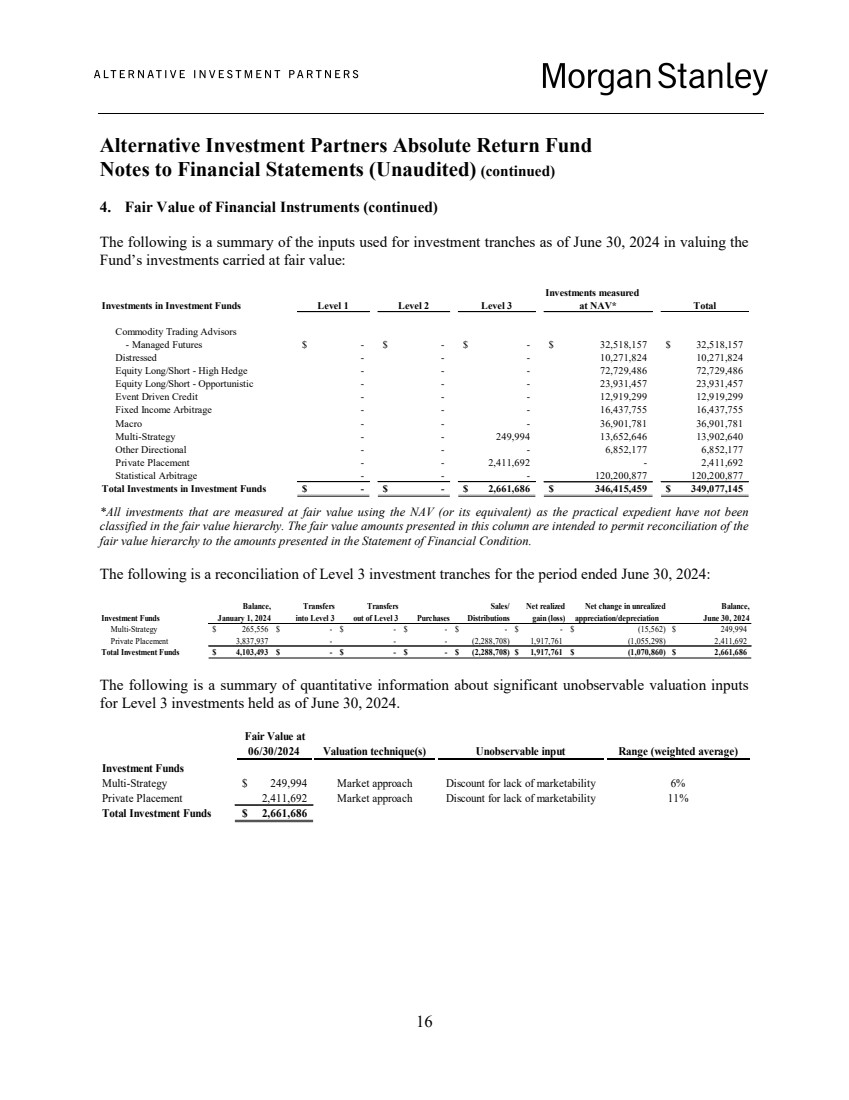

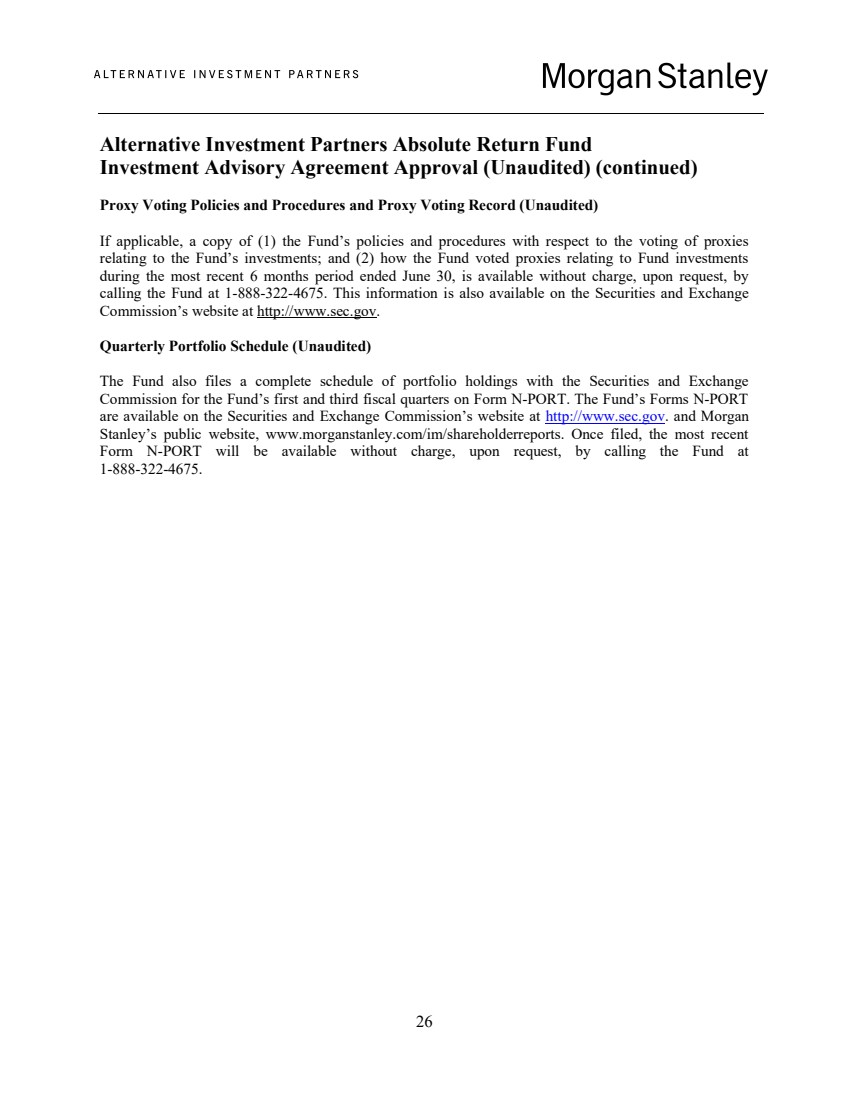

| Alternative Investment Partners Absolute Return Fund Notes to Financial Statements (Unaudited) (continued) 16 4. Fair Value of Financial Instruments (continued) The following is a summary of the inputs used for investment tranches as of June 30, 2024 in valuing the Fund’s investments carried at fair value: Investments measured Investments in Investment Funds Level 1 Level 2 Level 3 at NAV* Total Commodity Trading Advisors - Managed Futures $ - - $ - $ 32,518,157 $ 32,518,157 $ Distressed - - - 10,271,824 10,271,824 Equity Long/Short - High Hedge - - - 72,729,486 72,729,486 Equity Long/Short - Opportunistic - - - 23,931,457 23,931,457 Event Driven Credit - - - 12,919,299 12,919,299 Fixed Income Arbitrage - - - 16,437,755 16,437,755 Macro - - - 36,901,781 36,901,781 Multi-Strategy - - 249,994 13,652,646 13,902,640 Other Directional - - - 6,852,177 6,852,177 Private Placement - - 2,411,692 - 2,411,692 Statistical Arbitrage - - - 120,200,877 120,200,877 Total Investments in Investment Funds - $ - $ 2,661,686 $ 346,415,459 $ 349,077,145 $ *All investments that are measured at fair value using the NAV (or its equivalent) as the practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this column are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Financial Condition. The following is a reconciliation of Level 3 investment tranches for the period ended June 30, 2024: Balance, Transfers Transfers Sales/ Net realized Net change in unrealized Balance, Investment Funds January 1, 2024 into Level 3 out of Level 3 Purchases Distributions gain (loss) appreciation/depreciation June 30, 2024 Multi-Strategy 265,556 $ - $ - $ - $ - $ - $ (15,562) $ 249,994 $ Private Placement 3,837,937 - - - (2,288,708) 1,917,761 (1,055,298) 2,411,692 Total Investment Funds 4,103,493 $ - $ - $ - $ (2,288,708) $ 1,917,761 $ (1,070,860) $ 2,661,686 $ The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 investments held as of June 30, 2024. Fair Value at 06/30/2024 Valuation technique(s) Unobservable input Range (weighted average) Investment Funds Multi-Strategy 249,994 $ Market approach Discount for lack of marketability 6% Private Placement 2,411,692 Market approach Discount for lack of marketability 11% Total Investment Funds 2,661,686 $ |