0 Boise Cascade Company Investor Presentation July 2013 Investor Presentation March 10, 2014

1 Forward-Looking Statements / Non-GAAP Financial Measures Forward-Looking Statements During the course of this presentation, we may make forward-looking statements or provide forward- looking information. All statements that address expectations or projections about the future are forward-looking statements. Some of these statements include words such as “expects,” “anticipates,” “believes,” “estimates,” “plans,” “intends,” “projects,” and “indicates.” Although they reflect our current expectations, these statements are not guarantees of future performance, but involve a number of risks, uncertainties, and assumptions which are difficult to predict. Some of the factors that may cause actual outcomes and results to differ materially from those expressed in, or implied by, the forward- looking statements include, but are not necessarily limited to, general economic conditions, competitive pressures, the commodity nature of the Company’s products and their price movements, raw material costs and availability, and the ability to retain key employees. The Company does not undertake to update any forward-looking statements as a result of future developments or new information. Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures, including EBITDA and Adjusted EBITDA, designed to complement the financial information presented in accordance with generally accepted accounting principles in the United States of America because management believes such measures are useful to investors. Our non-GAAP financial measures are not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the metrics of calculation. For a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA and segment income (loss) to segment EBITDA and Adjusted EBITDA, see the Appendix to this presentation.

2 2013 Sales (1) $3,273 million (1) Segment percentages are calculated before intersegment eliminations. (2) Segment percentages exclude Corporate and Other segment expenses. • Large, vertically-integrated building products company operating two businesses: • Wood Products (“Manufacturing”) • Building Materials Distribution (“BMD”) • Leading market positions across portfolio • Broad base of more than 4,500 customers • Focused on new home construction, residential repair and remodel, light commercial construction, and industrial markets • Significant available capacity in EWP and BMD to capitalize on housing recovery 70% 2013 EBITDA (2) $136.4 million Wood Products Wood Products Building Materials Distribution Building Materials Distribution Overview

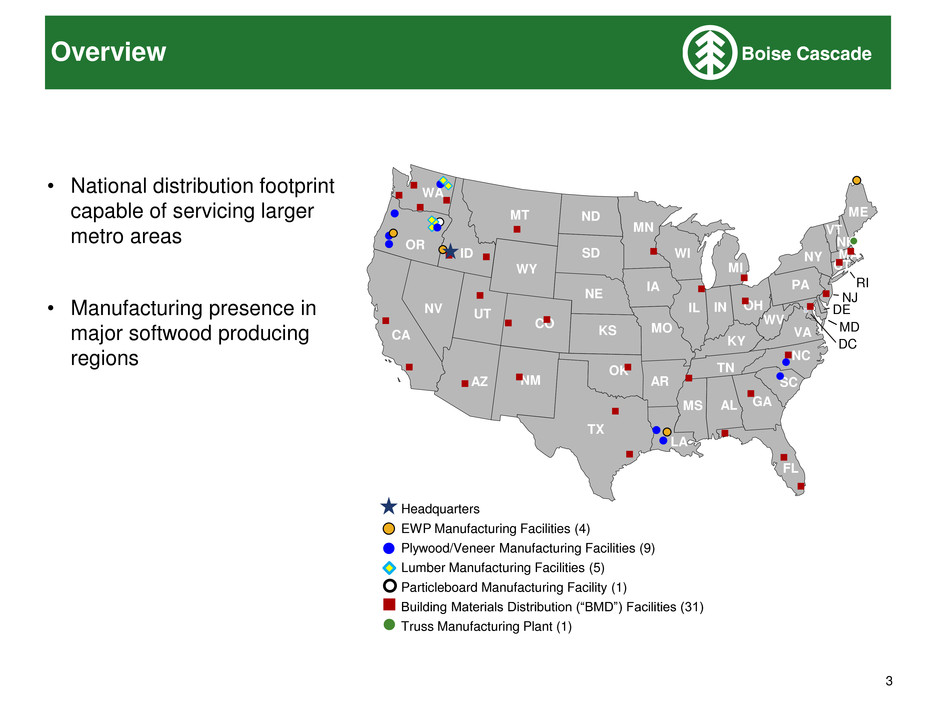

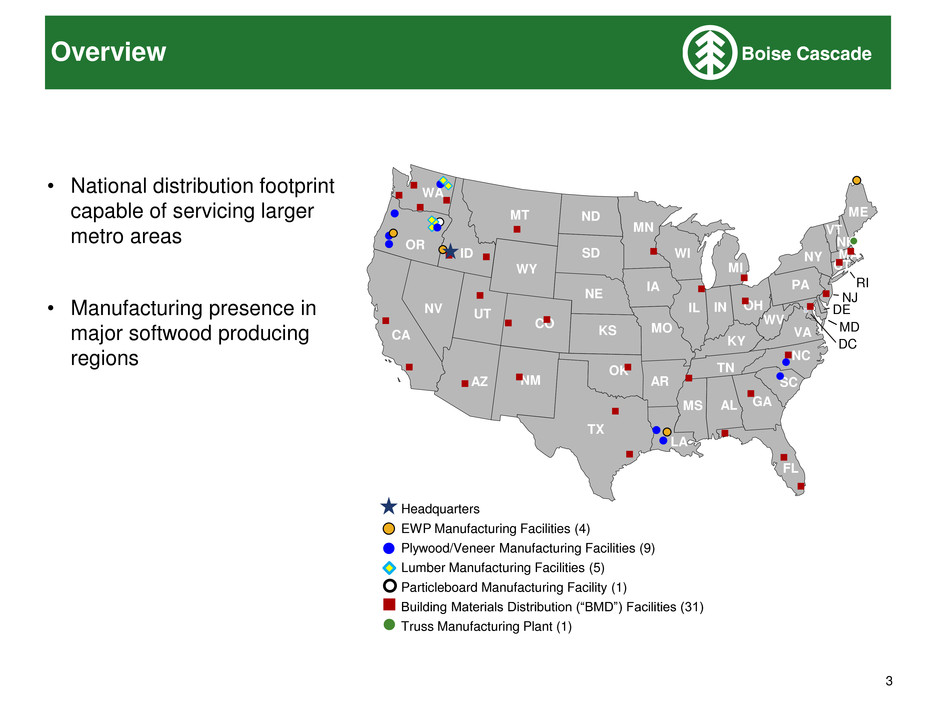

3 ID FL NM DE MD TX OK KS NE SD ND MT WY CO UT AZ NV WA CA OR KY ME NY VT NH MA RI CT WV IN IL NC TN SC AL MS AR LA MO IA MN WI NJ GA DC VA MI OH PA Headquarters EWP Manufacturing Facilities (4) Plywood/Veneer Manufacturing Facilities (9) Lumber Manufacturing Facilities (5) Particleboard Manufacturing Facility (1) Building Materials Distribution (“BMD”) Facilities (31) Truss Manufacturing Plant (1) • National distribution footprint capable of servicing larger metro areas • Manufacturing presence in major softwood producing regions Overview

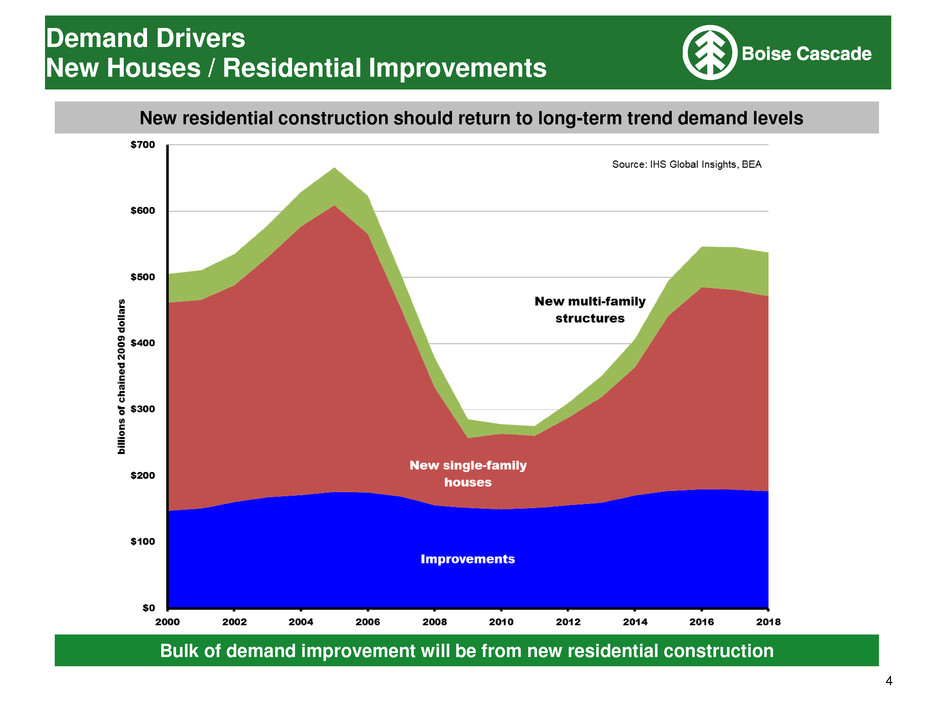

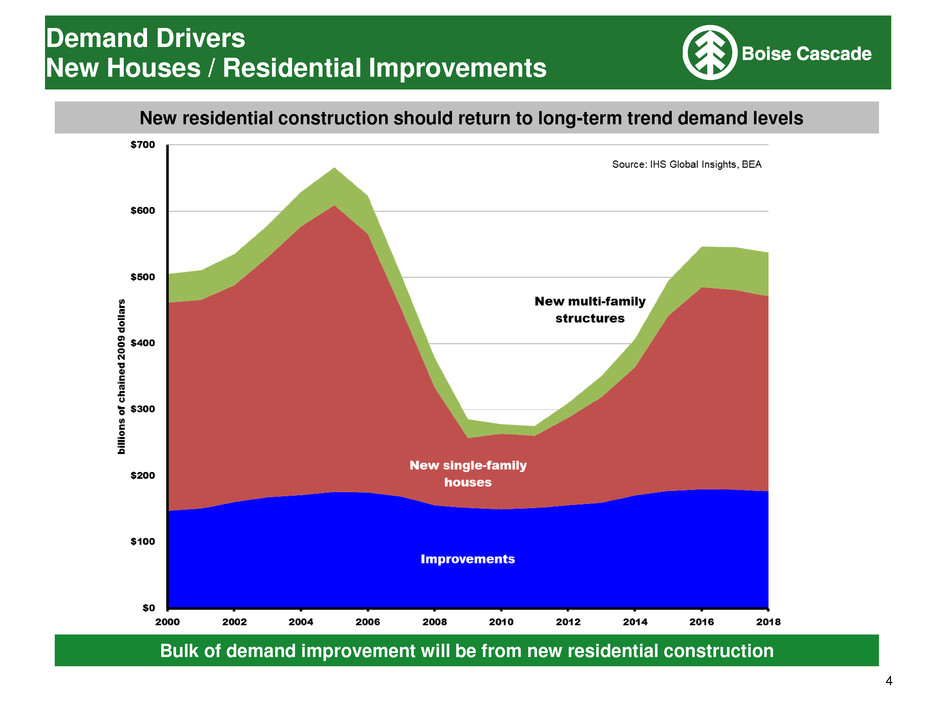

4 Demand Drivers New Houses / Residential Improvements Bulk of demand improvement will be from new residential construction New residential construction should return to long-term trend demand levels

5 Growth Strategies Well Positioned to Grow Distribution • Grow in existing geographic markets/branches • Leverage advantages of national scale • Opportunistically expand into adjacent markets Source: U.S. Census Bureau and Blue Chip Economic Indicators. BMD Sales per U.S. Start and Gross Margin Significant Available Capacity Recent capacity additions provide significant operating leverage opportunity in BMD

6 Wood Products Manufacturing Value Chain Veneer Purchased Logs Plywood I-joist Conversion Costs Conversion Costs Conversion Costs Purchased Veneer / Lumber / OSB Purchased Plywood Maximize total return on raw materials purchased LVL

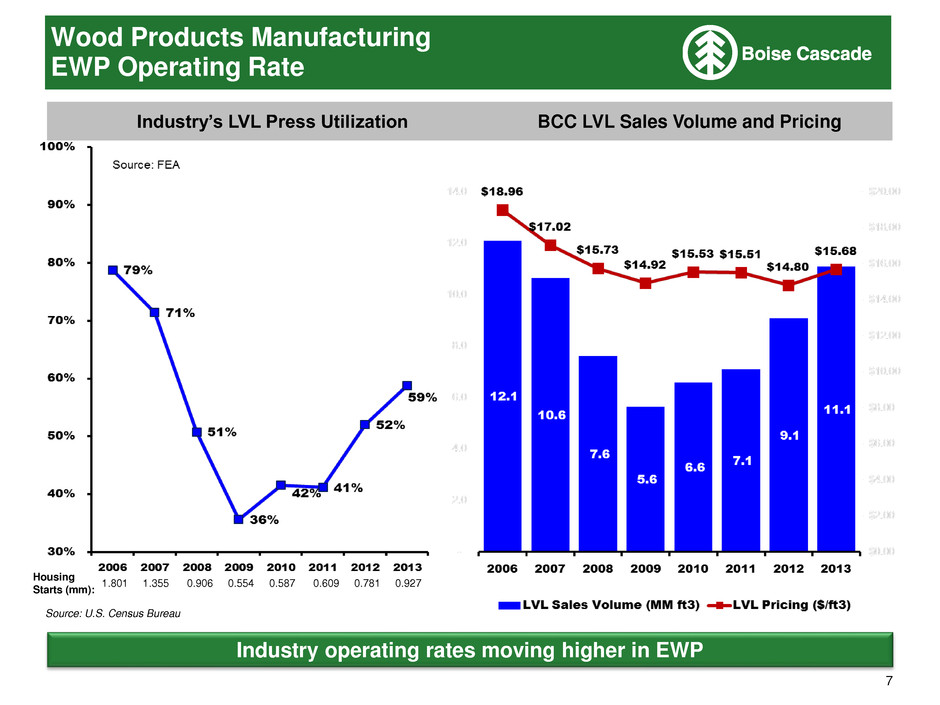

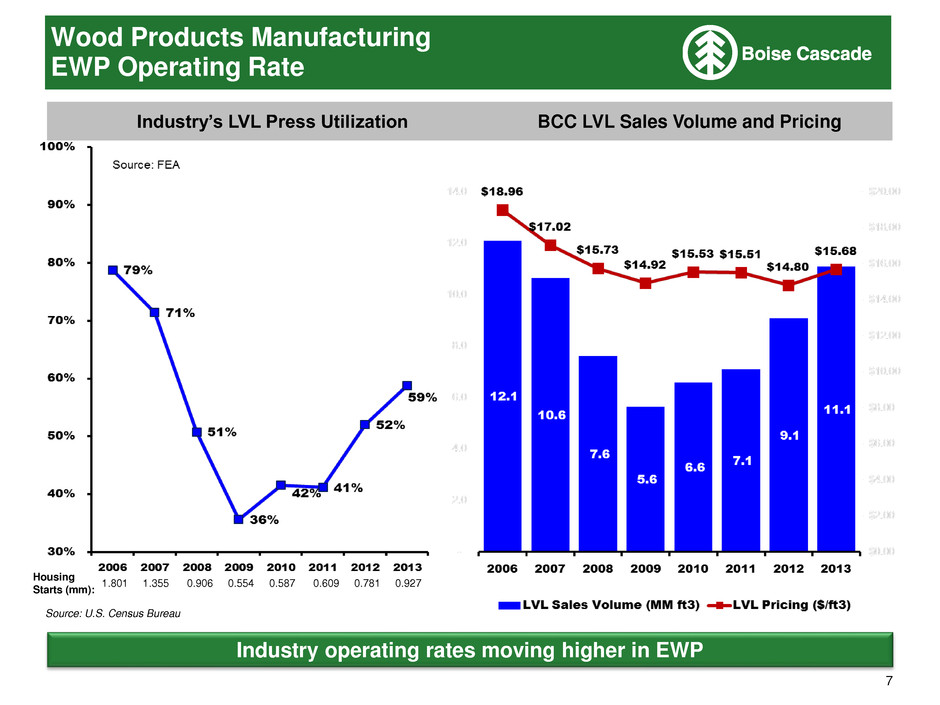

7 Housing Starts (mm): 1.801 1.355 0.906 0.554 0.587 0.609 0.781 0.927 Wood Products Manufacturing EWP Operating Rate Industry’s LVL Press Utilization BCC LVL Sales Volume and Pricing Industry operating rates moving higher in EWP Source: U.S. Census Bureau

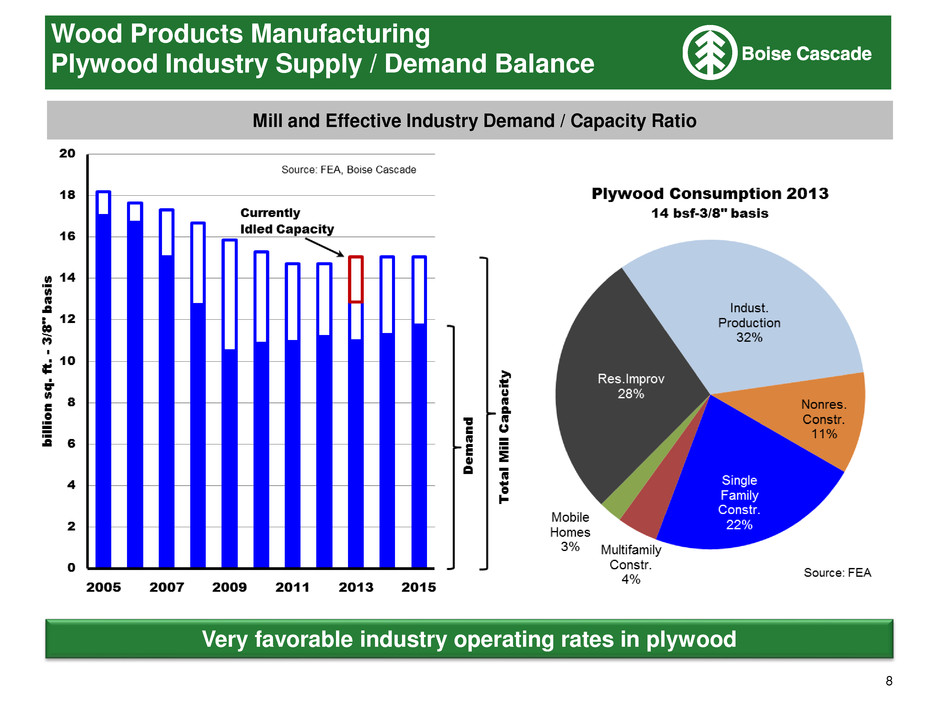

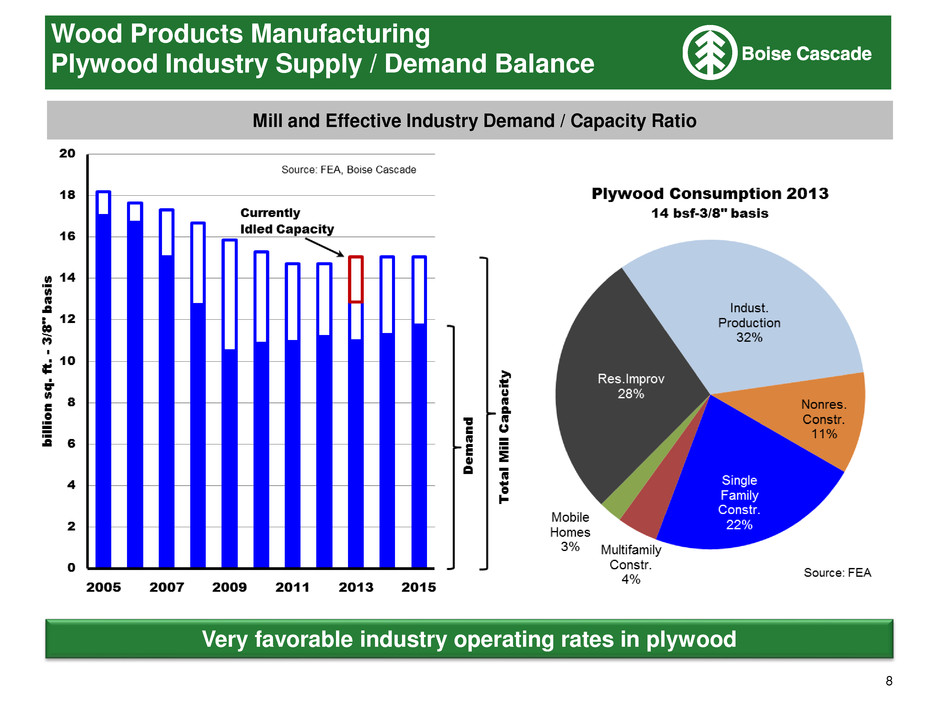

8 Wood Products Manufacturing Plywood Industry Supply / Demand Balance Very favorable industry operating rates in plywood Mill and Effective Industry Demand / Capacity Ratio

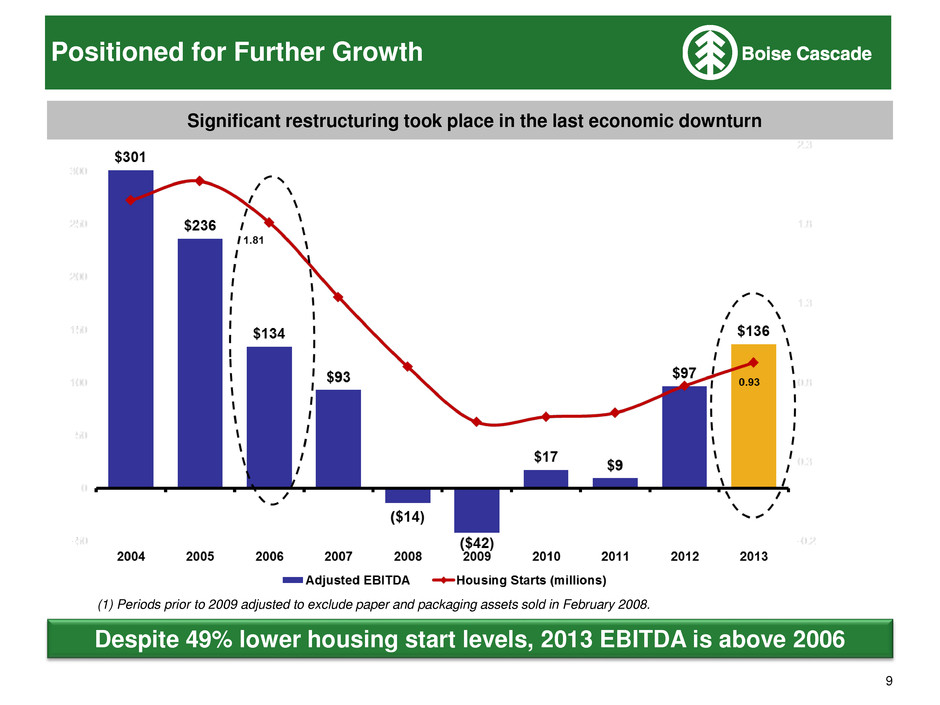

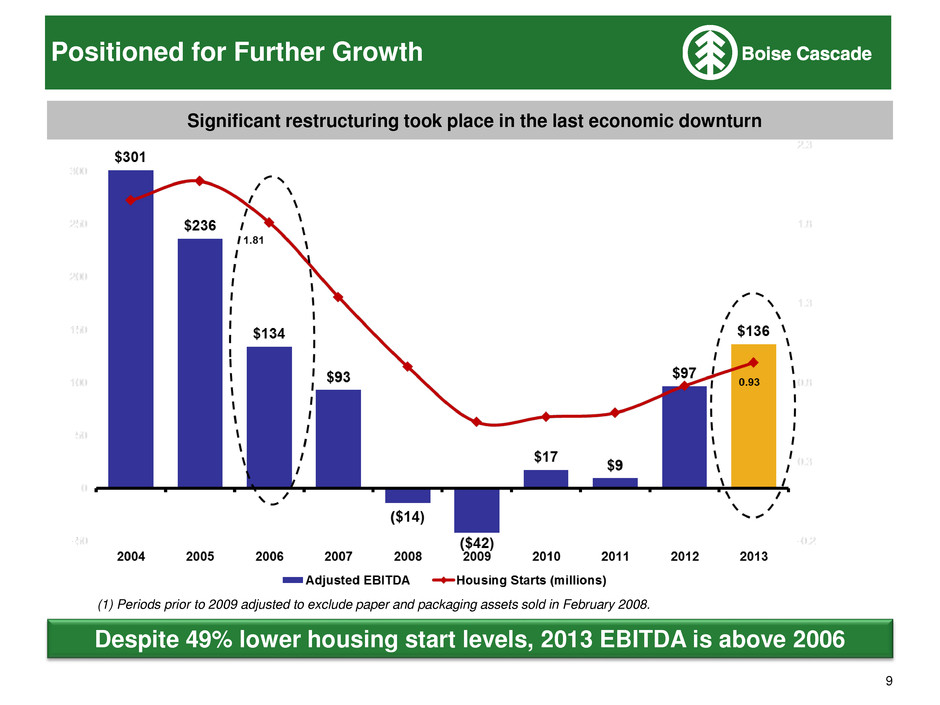

9 Significant restructuring took place in the last economic downturn Despite 49% lower housing start levels, 2013 EBITDA is above 2006 (1) Periods prior to 2009 adjusted to exclude paper and packaging assets sold in February 2008. Positioned for Further Growth

10 • Acquired Pilot Rock, OR sawmill • New dryer Medford, OR • Relocated Atlanta, GA distribution center • Acquired EWP/ truss plant Saco, ME • Expanded distribution yard Minneapolis, MN Company continues to reinvest to add capacity and improve efficiency 2010 2009 2011 2012 2013 • New dryer Medford, OR • Relocated Baltimore, MD distribution center • Expanded distribution yard Detroit, MI • Opened distribution yard Pompano, FL • Rebuilt dryer Oakdale, LA • Acquired glulam plant Homedale, ID • Expanded distribution yards Delanco, NJ, Dallas, TX & Portsmouth, NH • Added door shop (distribution) Milton, FL • Rebuilt dryer Florien, LA • Acquired pine sawmill Arden, WA • Added door shops (distribution) Memphis, TN & Tulsa, OK • Acquired plywood mills in Chester, SC & Moncure, NC • New dryer Oakdale, LA • Expanded distribution yard Minneapolis, MN • $100 million share repurchase Capital Invested

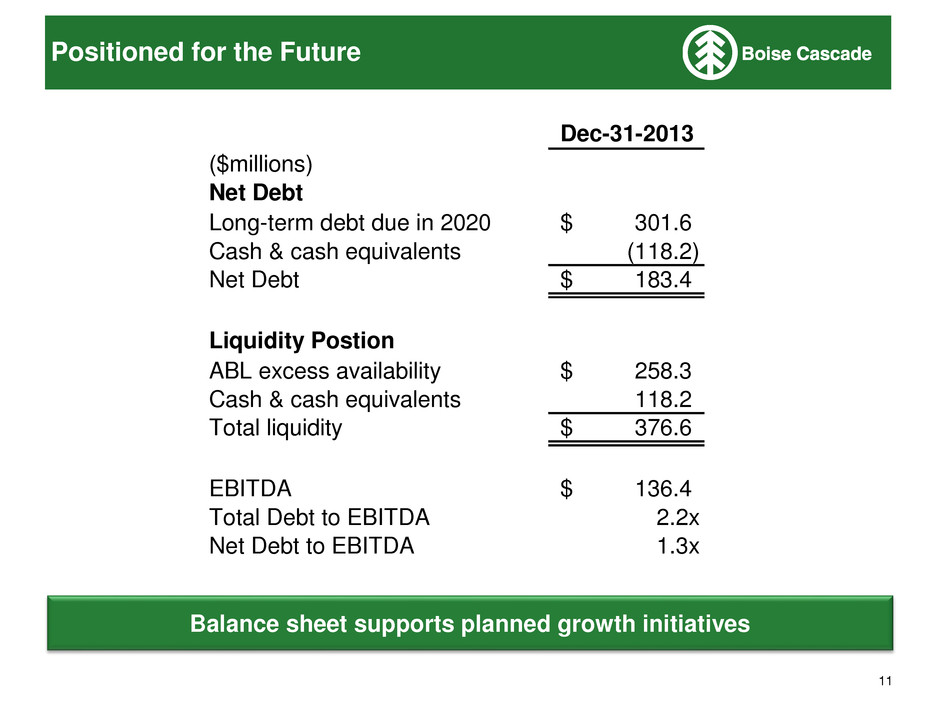

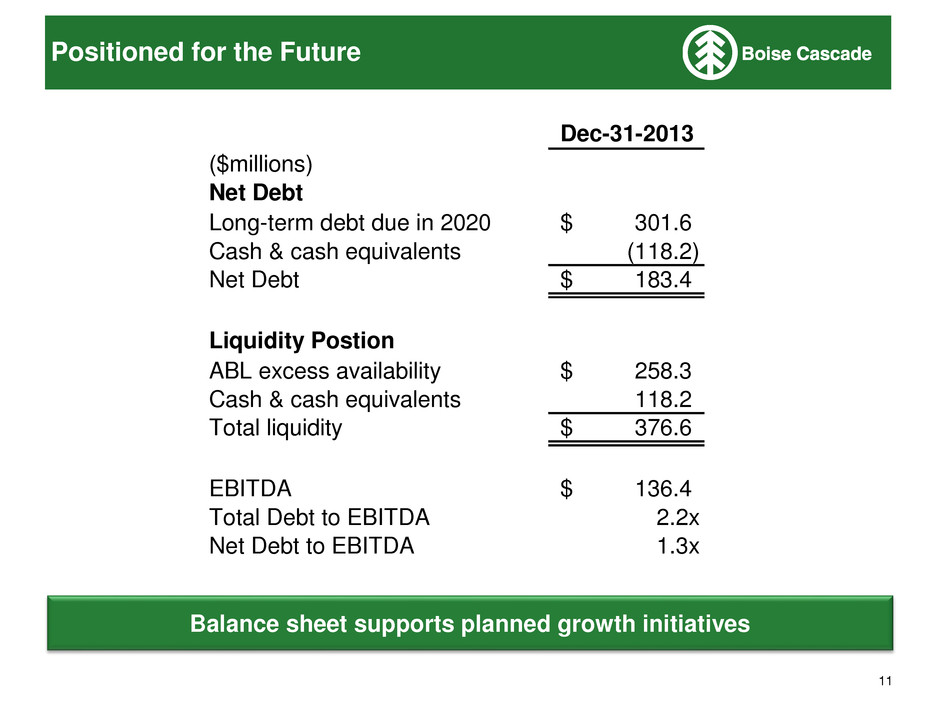

11 Balance sheet supports planned growth initiatives Positioned for the Future Dec-31-2013 ($millions) Net Debt Long-term debt due in 2020 301.6$ Cash & cash equivalents (118.2) Net Debt 183.4$ Liquidity Postion ABL excess availability 258.3$ Cash & cash equivalents 118.2 Total liquidity 376.6$ EBITDA 136.4$ Total Debt to EBITDA 2.2x Net Debt to EBITDA 1.3x

Appendix

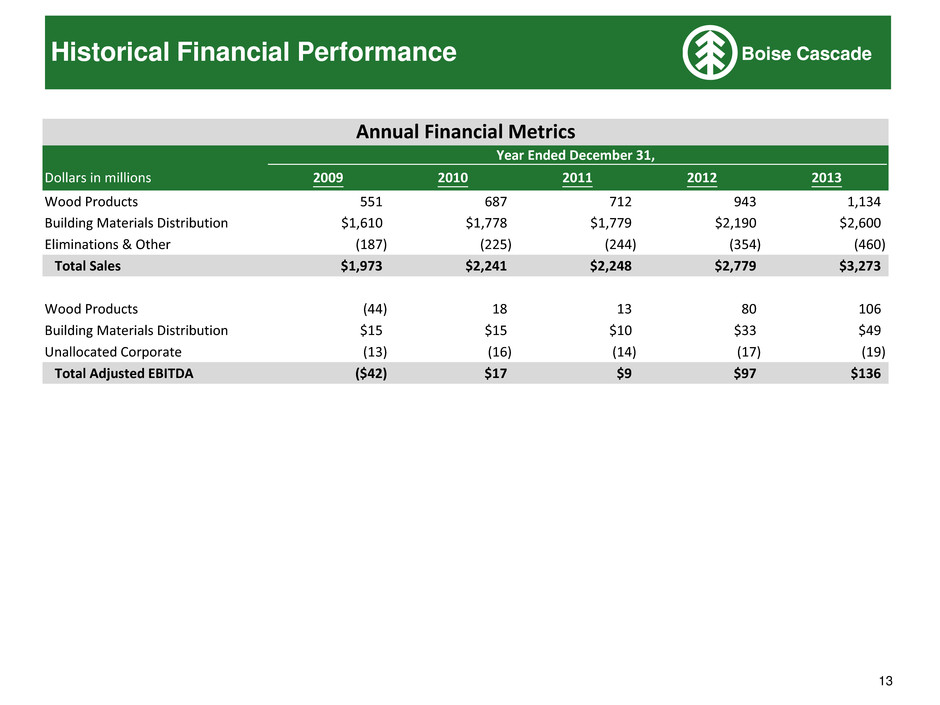

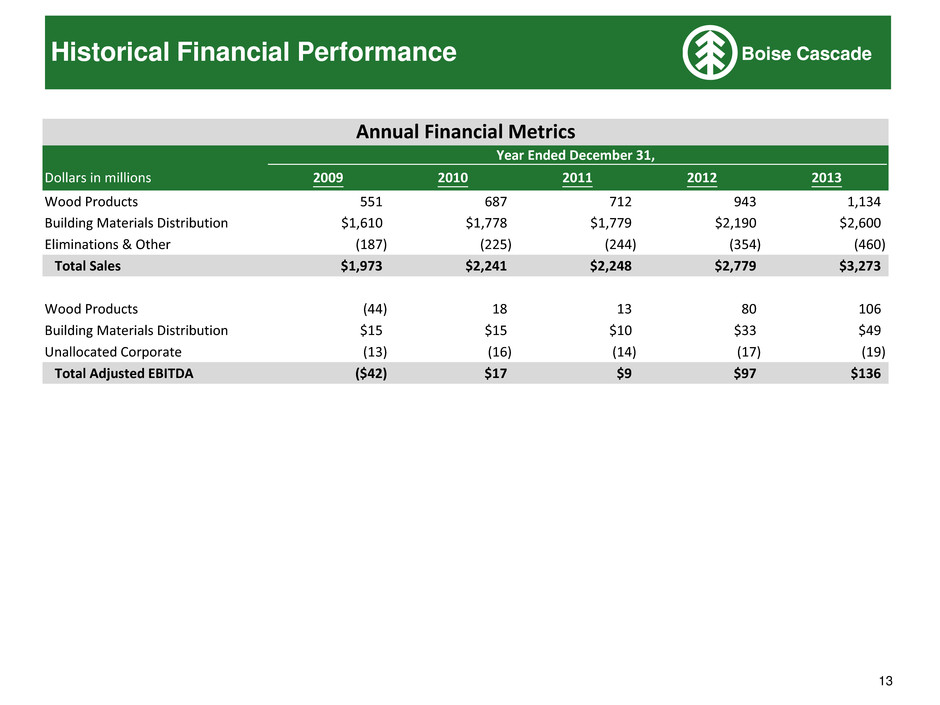

13 Historical Financial Performance Year Ended December 31, Dollars in millions 2009 2010 2011 2012 2013 Wood Products 551 687 712 943 1,134 Building Materials Distribution $1,610 $1,778 $1,779 $2,190 $2,600 Eliminations & Other (187) (225) (244) (354) (460) Total Sales $1,973 $2,241 $2,248 $2,779 $3,273 Wood Products (44) 18 13 80 106 Building Materials Distribution $15 $15 $10 $33 $49 Unallocated Corporate (13) (16) (14) (17) (19) Total Adjusted EBITDA ($42) $17 $9 $97 $136 Annual Financial Metrics

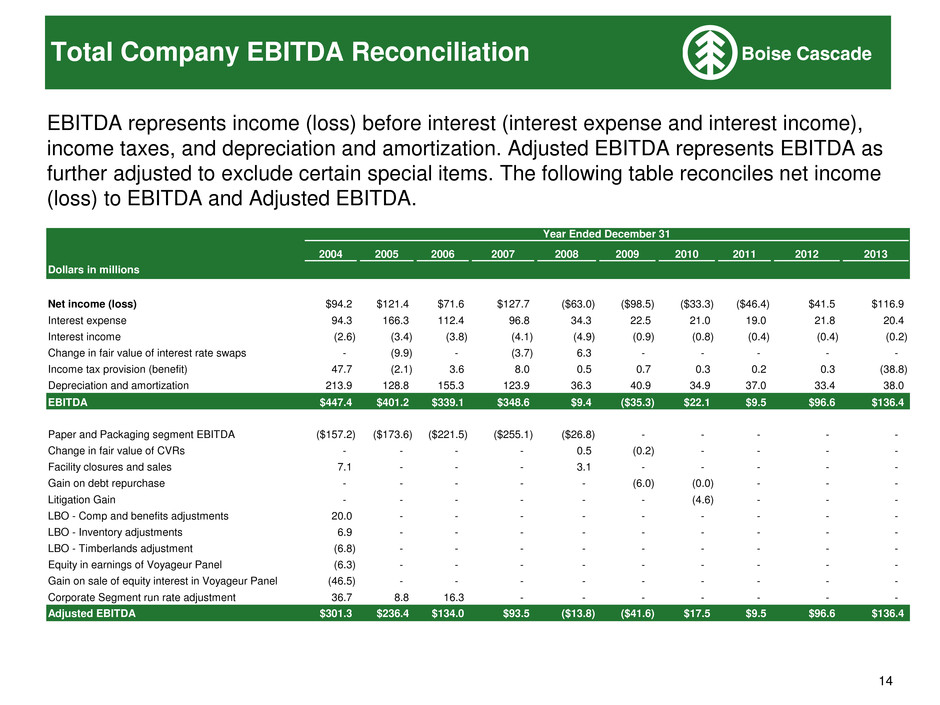

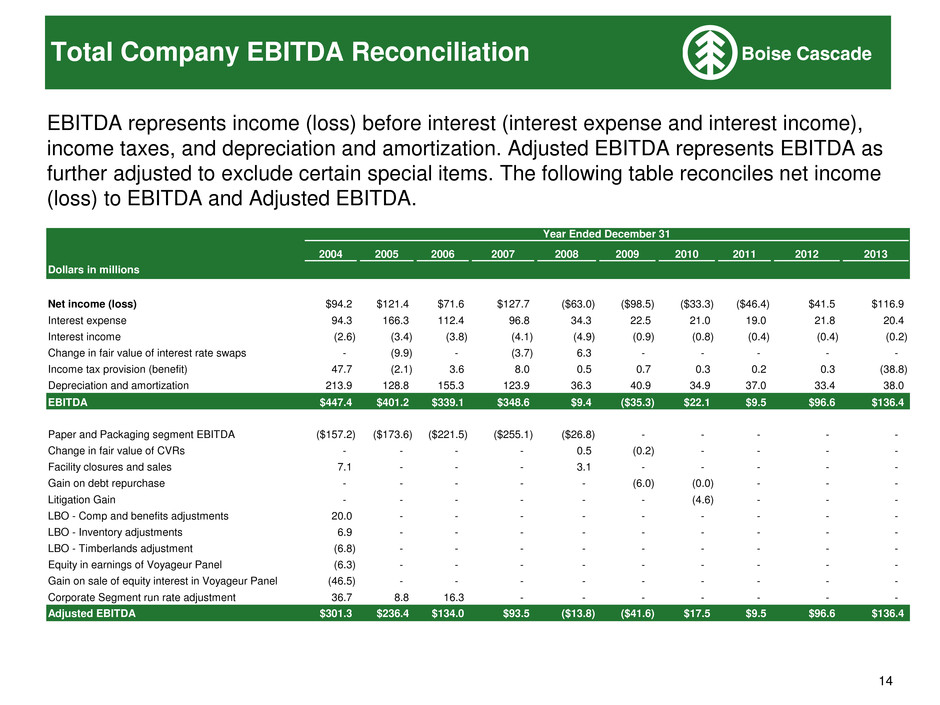

14 EBITDA represents income (loss) before interest (interest expense and interest income), income taxes, and depreciation and amortization. Adjusted EBITDA represents EBITDA as further adjusted to exclude certain special items. The following table reconciles net income (loss) to EBITDA and Adjusted EBITDA. Total Company EBITDA Reconciliation Year Ended December 31 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Dollars in millions Net income (loss) $94.2 $121.4 $71.6 $127.7 ($63.0) ($98.5) ($33.3) ($46.4) $41.5 $116.9 Interest expense 94.3 166.3 112.4 96.8 34.3 22.5 21.0 19.0 21.8 20.4 Interest income (2.6) (3.4) (3.8) (4.1) (4.9) (0.9) (0.8) (0.4) (0.4) (0.2) Change in fair value of interest rate swaps - (9.9) - (3.7) 6.3 - - - - - Income tax provision (benefit) 47.7 (2.1) 3.6 8.0 0.5 0.7 0.3 0.2 0.3 (38.8) Depreciation and amortization 213.9 128.8 155.3 123.9 36.3 40.9 34.9 37.0 33.4 38.0 EBITDA $447.4 $401.2 $339.1 $348.6 $9.4 ($35.3) $22.1 $9.5 $96.6 $136.4 Paper and Packaging segment EBITDA ($157.2) ($173.6) ($221.5) ($255.1) ($26.8) - - - - - Change in fair value of CVRs - - - - 0.5 (0.2) - - - - Facility closures and sales 7.1 - - - 3.1 - - - - - Gain on debt repurchase - - - - - (6.0) (0.0) - - - Litigation Gain - - - - - - (4.6) - - - LBO - Comp and benefits adjustments 20.0 - - - - - - - - - L O - Inventory adjustments 6.9 - - - - - - - - - LBO - Timberlands adjustment (6.8) - - - - - - - - - Equity in earnings of Voyageur Panel (6.3) - - - - - - - - - Gain on sale of equity interest in Voyageur Panel (46.5) - - - - - - - - - Corporate Segment run rate adjustment 36.7 8.8 16.3 - - - - - - - Adjusted EBITDA $301.3 $236.4 $134.0 $93.5 ($13.8) ($41.6) $17.5 $9.5 $96.6 $136.4

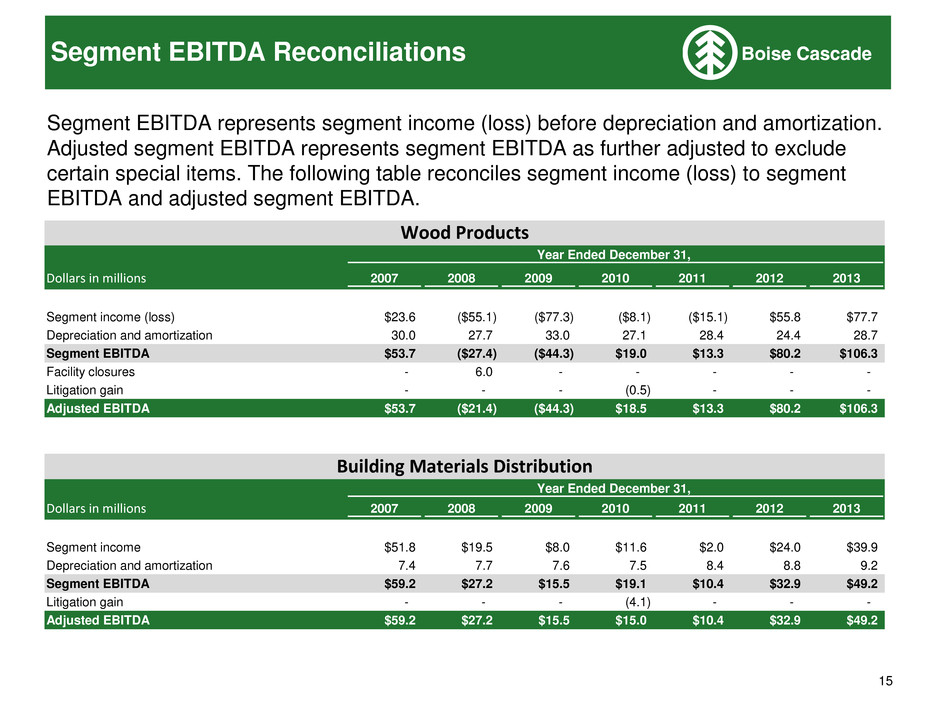

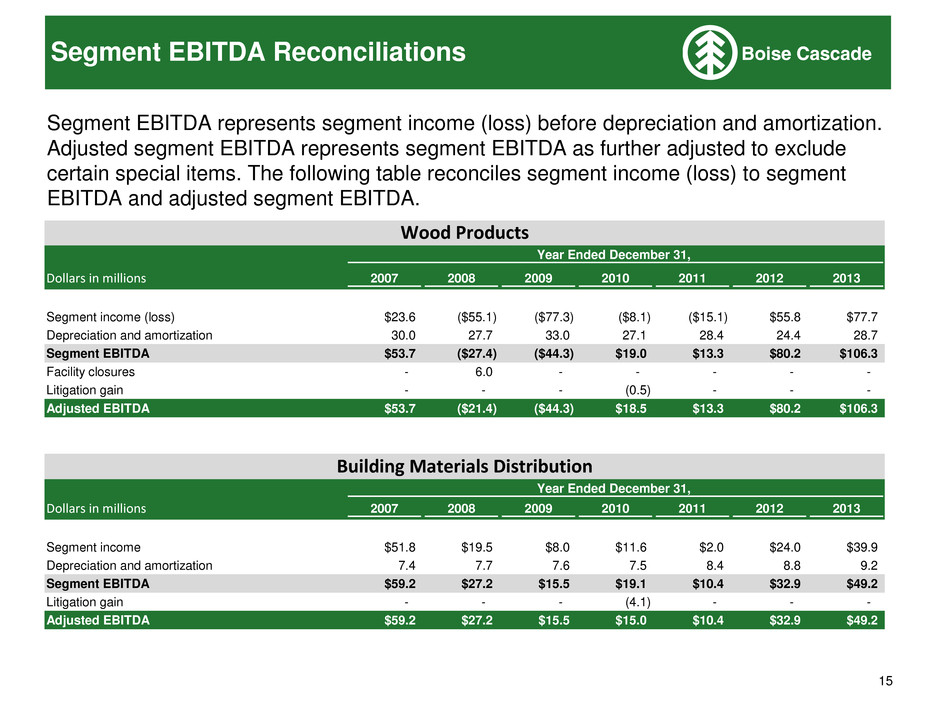

15 Segment EBITDA represents segment income (loss) before depreciation and amortization. Adjusted segment EBITDA represents segment EBITDA as further adjusted to exclude certain special items. The following table reconciles segment income (loss) to segment EBITDA and adjusted segment EBITDA. Segment EBITDA Reconciliations Year Ended December 31, Dollars in millions 2007 2008 2009 2010 2011 2012 2013 Segment income (loss) $23.6 ($55.1) ($77.3) ($8.1) ($15.1) $55.8 $77.7 Depreciation and amortization 30.0 27.7 33.0 27.1 28.4 24.4 28.7 Segment EBITDA $53.7 ($27.4) ($44.3) $19.0 $13.3 $80.2 $106.3 Facility closures - 6.0 - - - - - Litigation gain - - - (0.5) - - - Adjusted EBITDA $53.7 ($21.4) ($44.3) $18.5 $13.3 $80.2 $106.3 Year Ended December 31, Dollars in millions 2007 2008 2009 2010 2011 2012 2013 Segment income $51.8 $19.5 $8.0 $11.6 $2.0 $24.0 $39.9 Depreciation and amortization 7.4 7.7 7.6 7.5 8.4 8.8 9.2 Segment EBITDA $59.2 $27.2 $15.5 $19.1 $10.4 $32.9 $49.2 Litigation gain - - - (4.1) - - - Adjusted EBITDA $59.2 $27.2 $15.5 $15.0 $10.4 $32.9 $49.2 Wood Products Building Materials Distribution