Our extensive product offering fits nearly every car and light truck vehicle make and model on the road, allowing us to serve as a full line supplier to our customers for our product categories. These customers primarily include large aftermarket distributors and retailers selling to professional installers. Our customer base also includes certain original equipment service (‘‘OES’’) market participants. Many of our customers are leading aftermarket companies, including NAPA, CARQUEST, Aftermarket Auto Parts Alliance (the ‘‘Alliance’’), Uni-Select, CSK Auto, Inc. (‘‘CSK’’) and Federated. As an active participant in the aftermarket for more than 60 years, we have developed many long-standing customer relationships. Consequently, our top ten customers in 2005 have been doing business with us for an average of 27 years.

We derived approximately 95% of our 2005 net sales from the aftermarket. The growth of the aftermarket has been, and we believe will continue to be, affected by the size, age and use of the population of vehicles in operation. We believe that the aftermarket will continue to grow steadily as a result of increases in (1) the light vehicle population, (2) the average age of light vehicles, (3) the total number of vehicle miles driven per year, and (4) the popularity of SUVs and light trucks and the emergence of cross-over vehicles, which generally have greater service requirements than other passenger vehicles. According to Automotive Aftermarket Industry Association, the U.S. aftermarket grew by 4.9% during 2005.

Table of ContentsBased on 2005 net sales, we believe we had the #1 market position in North America in brake and filtration components and the #2 market position in North America in chassis components. We believe we have achieved our #1 and #2 market positions due to the quality and reputation of our brands and products among professional automotive technicians, who are the primary installers of the types of components we supply to the aftermarket. These professionals prefer to order reliable, well known brands because it is industry practice to replace, free of any labor or service charge, malfunctioning parts. We believe that the quality and reputation of our brands for form, fit, and functional quality creates and maintains significant demand for our products from these technicians and throughout the aftermarket supply chain.

We continue to face factors affecting our competitive position, including significant price increases during 2004 in raw steel and steel-related components (the prices remained at high levels in 2005) and increases in freight and energy costs during 2005. In addition, the aftermarket in which the Company operates continues to experience increased price competition from various manufacturers in countries with lower production costs.

In 2005, we announced two restructuring plans: (i) a restructuring plan that we announced at the beginning of 2005 as part of the Acquisition, also referred to as the acquisition restructuring and (ii) a restructuring plan that we announced at the end of 2005, also referred to as the comprehensive restructuring.

The comprehensive restructuring will affect several facilities over the next two years. In December 2005, we announced the closure of our Southampton facility. Additionally, in March 2006 we announced the closure of the Erie, North East and McHenry plants and the intent to sell our Waupauca, Sudbury and St. Catharines facilities. Additional facility closures will be announced periodically over 2006 and 2007. In 2005, we recorded a charge of $23 million primarily comprised of severance costs, and fixed asset impairment. The write-down of fixed assets was accounted for in accordance with SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. Severance costs are being accounted for in accordance with SFAS No. 146, Accounting for Costs Associated with Exit or Disposal Activities. We currently estimate that we will incur in the aggregate approximately $152 million of cash and non-cash restructuring costs for the comprehensive restructuring.

In the first quarter of 2005, as part of the Acquisition, we announced the acquisition restructuring. The acquisition restructuring plan was initiated to take advantage of opportunities we identified prior to the Acquisition but were, due to resource constraints, limited in our ability to actively pursue as part of Dana. Acquisition restructuring costs of $21 million associated with the acquisition restructuring were recorded to goodwill as an adjustment to the opening balance sheet, comprised of severance costs, fixed asset impairments, and other exit costs. Additionally, we charged directly to operations $2 million relating to current period exit costs. We do not expect any material costs subsequent to December 31, 2005, relating to the acquisition restructuring.

Industry

The statements regarding industry outlook, trends, the future development of certain aftermarket products and other non-historical information contained in this section are forward-looking statements.

Aftermarket products can be classified into three primary groups: (1) routine service parts, such as oil, fuel, air and other filters, lubricants, fluids and tune up parts; (2) wear parts, such as brake and chassis system components (e.g., pads, rotors, shoes, drums, shock absorbers, steering and other suspension components); and (3) components that commonly fail, such as batteries, starters, alternators and rubber products. We primarily compete in the routine service parts and wear parts product categories.

We believe the overall U.S. motor vehicle aftermarket was approximately $132 billion in aggregate wholesale sales in 2005. We estimate that the demand for our primary aftermarket products, which consists of brake system parts, steering and suspension parts and general service parts industry

5

Table of Contentscategories (which mainly includes filtration and battery products), in the U.S. was approximately $9 billion in aggregate wholesale sales. We have significant presence in filtration products and no presence in the battery market. The suppliers to this market consist of a few large participants and many smaller ones. We are one of the largest participants, offering a full line of quality products within these product categories. To facilitate efficient inventory management, many of our customers rely on larger suppliers like us to have full product line offerings, consistent service and timely delivery. There are important advantages to having meaningful size and scale in the aftermarket, including the ability to support significant distribution operations, offer sophisticated supply chain management capabilities and provide broad product line offerings.

In general, aftermarket industry participants can be categorized into three major groups: (1) manufacturers of parts, (2) distributors of replacement parts (without manufacturing capabilities) and (3) installers, both professional and Do-It-Yourself (‘‘DIY’’). Distributors purchase products from manufacturers and sell them to wholesale or retail operations, which in turn sell them to those who install the parts.

The distribution segment is comprised of the (1) traditional, (2) retail and (3) original equipment manufacturers (‘‘OEM’’) and OES channels. Typically, professional installers purchase their products through the traditional channel, and DIY mechanics purchase products through both traditional and retail stores. The traditional channel includes such well-known distributors as NAPA, CARQUEST, Federated, the Alliance, Uni-Select and Automotive Distribution Network (‘‘ADN’’; formerly known as Parts Plus and IAPA). Through a network of distribution centers, these distributors sell primarily to owned or affiliated stores, which in turn supply professional installers. The retail sector includes merchants such as Advance Auto Parts, CSK and Pep Boys. OEM and OES channels consist primarily of new vehicle manufacturers’ service departments at new vehicle dealerships.

We believe that the growth in aftermarket product sales has been driven by the following key factors:

Increasing Light Vehicle Population. U.S. light vehicle population has been increasing steadily in recent years, driven principally by population growth and the increase in average vehicles in service per person. As of 2004, there were over 233 million vehicles in operation in the United States. This figure has risen steadily each year, increasing by a total of 12% from approximately 208 million vehicles in use in 1999.

Increasing Average Age of Vehicles. As of 2004, the average light vehicle age in the United States was approximately 9.4 years, compared to an average of approximately 8.5 years in 1995. As average vehicle age continues to rise, the use of aftermarket parts is expected to continue to increase.

Increasing Total and Average Miles Driven. In the United States, total light vehicle miles driven rose from 2.4 trillion in 1994 to 2.9 trillion in 2004. We believe according to industry sources that average annual miles driven increased by 2% in 2005.

Increasing Prevalence of SUVs, Cross-Over Vehicles and Light Trucks. The Automotive Aftermarket Industry Association estimates that the number of SUVs, light trucks and crossover vehicles currently in operation in the United States has increased 50% from 1995 to 2004. Since larger and heavier vehicles place more wear on brake systems and chassis components, increases in the number of these vehicles are expected to result in corresponding growth in the sale of aftermarket brake and chassis components. Additionally, we expect the increasing prevalence of light trucks to increase the demand for filtration products due to increased use of diesel engines in trucks, which require more complex filtration and more frequent maintenance. Also, the percentage of light vehicles in operation that use disc brakes, rather than drum brakes, continues to grow and is eventually expected to include all light vehicles. Smaller and lighter weight disc brake systems have shorter operational lives than drum brakes, and therefore require more frequent replacement.

6

Table of ContentsProducts

Our principal product areas are described below:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Product |  | 2005 Net

Sales

(Dollars in

Millions) |  | Percent

of 2005

Net Sales |  | Representative Brands |  | Product Description |

| Brake products |  | $ | 1,052 | |  | | 50 | % |  | Raybestos, NAPA, CARQUEST, AIMCO and ACDelco |  | Drums, rotors, calipers, pads and shoes and hydraulic components |

| Filtration products |  | | 661 | |  | | 31 | % |  | WIX, NAPA and CARQUEST |  | Oil, fuel, air and other filters for light-, medium- and heavy-duty vehicle applications |

| Chassis products |  | | 156 | |  | | 7 | % |  | Spicer Chassis, NAPA Chassis, McQuay-Norris, ACDelco and Nakata |  | Steering, suspension and driveline components |

| European products and other |  | | 260 | |  | | 12 | % |  | Quinton Hazell and other |  | Various European and other foreign nameplate aftermarket products |

| Corporate and other |  | | 3 | |  | | | |  | |  | |

| Total net sales |  | $ | 2,132 | |  | | | |  | |  | |

|

We offer primarily three types of products: brake products, which include brake drums and rotors, pads and shoes and hydraulic brake system components; filtration products, which include oil, fuel, air and other filters; and chassis products, which include steering, suspension and driveline components.

Brake Products. We are a leading designer, manufacturer, marketer and distributor of a broad range of brake products for the aftermarket. Based on 2005 net sales, we believe we hold the #1 market position in North America for brake components. Our products include master cylinders, wheel cylinders, hardware and hydraulics, drums, shoes, linings, bonded/riveted segments, rotors, brake pads, calipers and castings. We sell our brake products into the three primary distribution channels — traditional, retail and OEM/OES.

We have an extensive offering of high quality, premium brake products. The brake products are sold under our leading premium brand name, Raybestos, as well as the AIMCO brand name. We believe the Raybestos brand name is the most recognized brake product brand in the aftermarket. In addition to our own brands, we also provide private label offerings for NAPA and CARQUEST.

Our aftermarket and OEM brake customers have differing needs and requirements. Aftermarket customers rely on our expertise for product design and engineering. These customers are highly focused on delivery time for their unpredictable and changing volume requirements, as they prefer to carry lower inventory levels while demanding full product coverage of different makes and models. In contrast, OEM customers provide more predictable sales volumes. However, they require individualized engineering as they are subject to self-imposed quality standards.

This product category has and is expected to continue to have one of the highest growth rates in the aftermarket due to the proliferation of SUVs, cross-over vehicles and other heavy vehicles which tend to generate greater wear of brake system products.

7

Table of ContentsFiltration Products. We are a leading designer, manufacturer, marketer and distributor of a broad range of filtration products for the aftermarket. Based on 2005 net sales, we believe we hold the #1 market position in North America for filtration components. We are one of the few aftermarket suppliers of heavy-duty and light-duty filters, which helps secure our leading market position. Our filtration product lines include oil, fuel, air and other filters for automobiles, trucks and off-road equipment. We sell our filtration products primarily into the traditional channel and, to a lesser extent, into the OES/OEM channel.

Under our well-known WIX brand, we offer automotive, diesel, agricultural, industrial and specialty filter applications. WIX is the #1 filter for cars on the NASCAR circuit and an exclusive NASCAR Performance Product. We also provide a comprehensive private label product offering to our two largest customers, NAPA and CARQUEST. We also sell our filters under the Kralinator brand in Canada and the Filtron brand in Europe.

The heavy-duty filtration segment is expected to continue to grow at a stable rate as demand for heavy-duty oil filters is expected to increase due to newer diesel engines with exhaust gas recirculation technology, which generates more soot particulates compared to older engine designs, thereby increasing engine filtration demands. Overall heavy-duty filter demand is expected to experience stable growth, as there are more filters per engine in newer vehicles. Proprietary filtration designs and increasingly complicated filtration systems are also expected to create additional demand.

Chassis Products. We are a leading designer, manufacturer, marketer and distributor of a broad range of chassis components in the aftermarket. Based on 2005 net sales, we believe we hold the #2 market position in North America for chassis components. Our chassis parts include steering, suspension and driveline components such as ball joints, tie rods, pittman arms, idler arms, drag links, control arms, center links, stabilizers and other related parts. In addition to our own brands, including Nakata and McQuay-Norris, we provide private label products for NAPA and other customers. We also sell our Chassis products under the Spicer brand name, which is a brand we use pursuant to a license agreement with Dana. We sell our chassis products into the three primary distribution channels — traditional, retail and OEM/OES.

Chassis products by their nature wear out and need to be replaced periodically. Frequency of replacement depends on the use of the vehicle. As a result, fleet construction and off-road vehicles typically need to have chassis parts replaced more frequently than other types of vehicles. We believe growth in the replacement of chassis components will be driven by an increase in the proliferation of replaceable chassis components and in the average age of vehicles.

European Products and Other. Our European products and other businesses include our Quinton Hazell European parts supplier. Quinton Hazell designs, manufactures and distributes a wide range of aftermarket replacement motor vehicle components for customers throughout the United Kingdom and Continental Europe, primarily under the Quinton Hazell brand name. It is focused on supplying Europe’s independent aftermarkets as a ‘‘one-stop shop’’ for regional aftermarket suppliers. Its products include cooling, transmission, steering and suspension, brakes, shock absorbers, electrical and filter products. In addition to the Quinton Hazell brand, Quinton Hazell supplies components under nine other subordinate brands targeting specific industry segments and/or geographies.

Corporate and other. Consists of sales of our subsidiary Beck/Arnley World Parts Corp. ("Beck Arnley") and inter company sales eliminations between product grouping. On March 31, 2005, we completed the sale of Beck Arnley to Heritage Equity Group (‘‘Heritage’’). Beck Arnley was our foreign nameplate for light vehicle parts into North America. Its products included brake system components, chassis parts, electrical products, clutch and driveline products, engine and filter parts and cooling systems.

Sales Channels and Customers

We distribute our products across several sales channels, including traditional, retail and OEM and OES channels. Our ten largest customers accounted for approximately 52% of our net sales in 2005, with approximately 21% and 8% derived from our two largest customers, NAPA and

8

Table of ContentsCARQUEST, respectively. During 2005, we derived 59% of our net sales from United States and 41% of our net sales from other countries.

We have maintained long-standing relationships with our customers and, consequently, our top ten customers in 2005 have been doing business with us for an average of 27 years. Some of our most significant customers include NAPA, CARQUEST, ADN, Federated, the Alliance, and CSK each of which is a key player in the aftermarket.

The following table provides a description of the primary sales channels to which we supply our products:

|  |  |  |  |  |  |  |  |  |  |

| Primary Sales Channels |  | Description |  | Customers |

| Traditional |  | Warehouses and distribution centers that supply local distribution outlets, which sell to professional installers. |  | NAPA, CARQUEST, Federated and Uni-Select |

| OEM and OES |  | New vehicle manufacturers and service departments at new vehicle dealerships. |  | GM/GMSPO, Delphi, Robert Bosch, TRW Automotive and DaimlerChrysler |

| Retail and Mass Merchant |  | Retail stores, including national chains that sell replacement parts directly to consumers (the DIY market) and to some professional installers. |  | CSK |

|

The traditional channel is important to us because it is the primary source of products for professional installers. We believe that the quality and reputation of our brands for form, fit, and functional quality promotes significant demand for our products from these installers and throughout the aftermarket supply chain. We have many long-standing relationships with leading distributors in the traditional channel such as NAPA and CARQUEST, for whom we have manufactured products for 38 and 16 years, respectively.

The retail channel has historically provided us with steadily increasing revenue streams. As retailers become increasingly focused on consolidating their supplier base, we believe that our broad product offering, product quality, sales and marketing support and customer service capabilities make us more valuable to these customers.

Recently, many vehicle dealerships have begun providing ‘‘all-makes’’ service whereby dealers will service a vehicle even if they do not sell the make or model being serviced. In these circumstances, OEMs cannot require their dealerships to purchase components exclusively from their suppliers, and therefore dealerships can choose to purchase less expensive components from aftermarket suppliers. We believe the volumes generated by OES customers, especially in brakes, may provide an opportunity for significant increases in our sales and profitability.

Customer Support

We believe that our emphasis on customer support has been a key factor in maintaining our leading market positions. We continuously seek to improve service, order turnaround time, product coverage and order accuracy. As a result of our efforts, we have achieved typical order fill rates of approximately 95%. Our ability to replenish inventory quickly is extremely important to customers as it enables them to maximize their sales while carrying reduced inventory levels. For these reasons, we ship the majority of orders within 24 to 48 hours of receipt.

In order to maintain the competitiveness of our existing customers and maximize new sales opportunities, we have extensive product coverage. In turn, this has allowed our customers to develop

9

Table of Contentsa reputation for carrying the parts their customers need, especially for newer vehicles for which OEM warranties may not have expired and aftermarket parts are not generally available.

In addition, as the aftermarket has become more electronically integrated, customers more often prefer to receive their application information electronically as well as in print form. We provide both printed and electronic catalog media. We also provide products which are problem solvers for professional installers, such as alignment products that allow installers to properly align a vehicle, even though the vehicle was not equipped with adjustment features by the OEM. We provide many other support features, such as technical support hot lines and training and electronic systems which interface with customers and conform to aftermarket industry standards.

Intellectual Property

We own significant intellectual property, including a large number of patents, trademarks, copyrights and trade secrets and are involved in numerous licensing arrangements. Although our intellectual property plays an important role in maintaining our competitive position in a number of the markets that we serve, no single patent, copyright, trade secret or license, or group of related patents, copyrights, trade secrets or licenses is, in our opinion, of such value to us that our business would be materially affected by its expiration or termination. Our general policy is to apply for patents on an ongoing basis in the United States, the United Kingdom and certain other countries to protect our patentable technology developments.

Our patent portfolio of nearly 200 patents and pending patent applications reflects our commitment to invest in technology and covers many aspects of our products and the processes for making those products. In addition, we have developed a substantial body of manufacturing know-how that we believe provides a significant competitive advantage in the marketplace. We have entered into numerous technology license agreements that either strategically exploit our intellectual property rights or provide a conduit for us into third party intellectual property rights useful in our businesses. In many of these agreements, we license technology to our suppliers, joint venture companies and other local manufacturers to support outsourced product manufacturing. In other agreements, we license the technology to other companies to obtain royalty income. Also, as part of the Acquisition, we entered into intellectual property license agreements with Dana.

We also own a number of secondary trade names and marks applicable to certain of our businesses and products that we view as important to such businesses and products.

Raw Materials and Manufactured Components

We use a broad range of manufactured components and raw materials in our products, including raw steel, steel-related components, filtration media, aluminum, brass, iron, rubber, resins, plastics, paper and packaging materials. We purchase raw materials from a wide variety of domestic and international suppliers, and we have not, in recent years, experienced any significant shortages of these items and normally do not carry inventories of these items in excess of those reasonably required to meet our production and shipping schedule. Raw materials comprise the largest component of our costs. We experienced significant price increases in our raw steel and steel-related component purchases in 2004 and the prices have remained at higher levels than historical prices. We were successful in passing through price increases on some products in 2005 in order to partially offset these costs. Additional increases could further materially increase our operating costs and materially adversely affect our profit margins. In addition, there has typically been a delay of up to several months or longer in our ability to increase prices to our customers, which has temporarily impacted profitability. Furthermore, we are subject to freight and energy costs in obtaining the supply of components and products that our customers require and thus are sensitive to increases in those prices as well. Moreover, we have experienced longer than typical lead times in sourcing some of our steel-related components and certain finished products, which caused us to buy from non-preferred vendors at higher costs. In the future, if costs continue to rise rapidly, it may be difficult to pass these costs on to our customers in a timely fashion. We also purchase component parts or finished goods from competitors or other suppliers, a common practice in the aftermarket industry.

10

Table of ContentsCompetition

The brake aftermarket is comprised of several large manufacturers: our Company, Federal Mogul Corp. under the brand name Wagner, Genuine Parts Co. under the brand name Rayloc, Honeywell International Inc. under the brand name Bendix, and Cardone Industries, Inc. under the brand name Cardone. The light-duty filter aftermarket is comprised of several large U.S. manufacturers: our Company, United Components, Inc. under the brand name Champ, Honeywell International Inc. under the FRAM brand and ArvinMeritor Inc. under the Purolator brand, along with several international light-duty filter suppliers. The heavy-duty filter aftermarket is comprised of several manufacturers, including our Company, Cummins, Inc. under the brand name Fleetguard, CLARCOR Inc. under the brand name Baldwin, and Donaldson Company Inc. under the brand name Donaldson. The chassis aftermarket is comprised primarily of two large U.S. manufacturers: Federal Mogul Corp. under the brand name Moog, and our Company, along with some international chassis suppliers. We compete on, among other things, the basis of quality, price, service, brand reputation, delivery, technology and product offerings.

Employees

As of December 31, 2005, we had 11,678 employees, of whom 7,978 were employed in North America, 2,180 were employed in Europe and 1,520 were employed in South America. Approximately 24% of our employees are salaried and the remaining 76% of our employees are paid hourly. As of December 31, 2005, approximately 120 of our U.S. employees and approximately 812 Canadian employees were represented by unions. We consider relations with our employees to be good.

Environmental Matters

We are subject to a variety of federal, state, local and foreign environmental laws and regulations, including those governing the discharge of pollutants into the air or water, the emission of noise and odors, the management and disposal of hazardous substances or wastes, the clean-up of contaminated sites and human health and safety. Some of our operations require environmental permits and controls to prevent and reduce air and water pollution, and these permits are subject to modification, renewal and revocation by issuing authorities. Contamination has been discovered at certain of our owned properties, which is currently being monitored and/or remediated. Although we are not aware of any contaminated sites which we believe will result in material liabilities, the discovery of additional remedial obligations at these sites could result in significant liabilities. In addition, many of our current and former facilities are located on properties with long histories of industrial or commercial operations. Because some environmental laws can impose liability for the entire cost of clean-up upon any of the current or former owners or operators, regardless of fault, we could become liable for investigating or remediating contamination at these properties if contamination requiring such activities is discovered in the future. We anticipate incurring environmental remediation costs and retirement obligations associated with the comprehensive restructuring and the acquisition restructuring plans that were announced in 2005 (Refer to Item 8. Note 18. Restructuring of Operations).

We are also subject to the U.S. Occupational Safety and Health Act and similar state and foreign laws. We believe that we are in substantial compliance with all applicable environmental laws and regulations. Historically, our costs of achieving and maintaining compliance with environmental and health and safety requirements have not been material to our operations.

Internet Availability

Available free of charge through our internet website is a link to our reports on forms 10-K, 10-Q, 8-K and amendments to those reports filed with the Securities and Exchange Commission. These reports can be found through a link on our internet website www.affiniagroup.com as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission.

11

Table of Contents |  |

| Item 1A. | Risk Factors |

If any of the following events discussed in the following risks were to occur, our results of operations, financial conditions, or cash flows could be materially affected. Additional risks and uncertainties not presently known or currently deemed material by us may also constrain our business operations.

We are subject to increasing pricing pressure from import activity, particularly from China.

Price competition from aftermarket manufacturers particularly based in China and other locations with lower production costs have historically played a role and may play an increasing role in the aftermarket sectors in which we compete. Pricing pressures have historically been more prevalent with respect to our brake and chassis products than our other products. While aftermarket manufacturers in these locations have historically competed primarily in markets for less technologically advanced products and manufactured a limited number of products, they are expanding their manufacturing capabilities to produce a broad range of lower cost, higher quality products and provide an expanded product offering. In the future, competitors in Asia may be able to effectively compete in our premium markets and produce a wider range of products which may force us to move additional manufacturing capacity offshore and/or lower our prices, reducing our margins and/or decreasing our net sales.

The shift in demand from premium to economy brands may force us to produce value products at the expense of premium products, forcing us to lower our prices, thereby reducing our margins and decreasing our net sales.

We estimate that a majority of our net sales are currently derived from products we consider to be premium products and this number has been declining. There has been, and may continue to be, a shift in demand from premium products, on which we can generally command premium pricing and generate enhanced margins, to value products. If such a trend continues, we may be forced to expand our production and/or purchases of value products at competitive prices. In addition, we could be forced to further reduce our prices to remain competitive, in which case our margins will decrease unless we make corresponding reductions in our cost structure.

Our substantial leverage could harm our business by limiting our available cash and our access to additional capital and, to the extent of our variable rate indebtedness, exposing us to interest rate risk.

As a result of the Acquisition, we are highly leveraged. This leverage may limit our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions, restructuring and general corporate or other purposes, limit our ability to adjust to changing market conditions and place us at a competitive disadvantage compared to our less leveraged competitors. In addition, a substantial portion of our cash flows from operations must be dedicated to the payment of principal and interest on our indebtedness and is not available for other purposes, including our operations, capital expenditures and future business opportunities. Certain of our borrowings, including borrowings under our senior credit facilities, are at variable rates of interest, exposing us to the risk of increased interest rates. We may be more vulnerable than a less leveraged company to a downturn in general economic conditions or in our business, or we may be unable to carry out capital spending that is important to our growth.

Our business would be materially and adversely affected if we lost any of our largest customers.

For the year ended December 31, 2005, approximately 21% and 8% of our gross sales were to NAPA and CARQUEST, respectively. To compete effectively, we must continue to satisfy these and other customers' pricing, service, technology and increasingly stringent quality and reliability requirements. Additionally, our revenues may be affected by decreases in NAPA's or CARQUEST's business or market share. Consolidation among our customers may also negatively impact our

12

Table of Contentsbusiness. We cannot provide any assurance as to the amount of future business with these or any other customers. While we intend to continue to focus on retaining and winning these and other customers' business, we may not succeed in doing so. Although business with any given customer is typically split among numerous contracts, the loss of, or significant reduction in purchases by, one of those major customers could materially and adversely affect our business, results of operations and financial condition.

During June 2004, AutoZone terminated its relationship with us. We believe the termination was primarily due to our decision not to participate in its consignment inventory program known as pay-on-scan. We have replaced some of this business in 2005 with business from new and existing customers. We have not been able to, and we cannot assure you that we will be able to, replace the balance of the AutoZone business with business from new or existing customers.

Increasing costs for manufactured components, raw materials, crude oil and energy prices may adversely affect our profitability.

We use a broad range of manufactured components and raw materials in our products, including raw steel, steel-related components, filtration media, aluminum, brass, iron, rubber, resins, plastics, paper and packaging materials. Materials comprise the largest component of our costs. We have recently experienced significant price increases in our crude oil, raw steel and steel-related component purchases. Further increases in the price of these items could further materially increase our operating costs and materially adversely affect our profit margins. In addition, in connection with passing through steel and other raw material price increases to our customers, there has typically been a delay of up to several months in our ability to increase prices, which has temporarily impacted profitability. For example, although we began implementing price increases with customers in June 2004 to pass through the increases in steel costs that we began experiencing in the beginning of 2004, delays in implementing these increases resulted in a deterioration of our margins and profitability. In the future, it may be difficult to pass further price increases on to our customers, especially if we experience additional cost increases soon after implementing price increases. In addition, we have experienced longer than typical lead times in sourcing some of our steel-related components and certain finished products, which caused us to buy from non-preferred vendors at higher costs.

We may not be able to achieve the cost savings that we expect from the restructuring of our operations.

Although we expect to realize cost savings as a result of our comprehensive restructuring plan, we may not be able to achieve the level of benefits that we expect to realize or we may not be able to realize these benefits within the timeframes we currently expect. We are currently rationalizing certain manufacturing operations in order to alleviate redundant capacity and reduce our cost basis. This restructuring will involve the movement of U.S. and Canada production to Mexico, South America and Asia. Our ability to achieve these cost savings could be affected by a number of factors. Since our restructuring efforts will focus on increasing our international presence, they will exacerbate the risks described below relating to our non-U.S. operations. Changes in the amount, timing and character of charges related to the restructuring, failure to complete or a substantial delay in completing the restructuring and planned divestitures or the receipt of lower proceeds from such divestitures than currently is anticipated could have a material adverse effect on us.

As a result of the consolidation driven by improved logistics and data management, distributors have reduced their inventory levels, which has reduced and could continue to reduce our sales.

Warehouse distributors have consolidated through acquisition and drained off inventories, while streamlining their own distribution systems through more timely deliveries and better data management. The corresponding reduction in purchases by distributors negatively impacted our sales. Further consolidation could have a similar adverse impact on our sales.

If the aftermarket adopts practices such as pay-on-scan programs and expansion of return policies, our cash flow and results of operations could be harmed.

Some customers in the aftermarket are pursuing ways to shift their costs of working capital. For example, our fourth largest customer in 2003, AutoZone, publicly stated that it is pursuing a

13

Table of Contentsconsignment inventory program known as pay-on-scan whereby suppliers retain title to inventory until the inventory is eventually sold. Under such a program, we would not record a sale until our customer sells our product and our receipt of payment for such sales would typically be delayed for a specified period until after the sale was made. We have declined to participate in this program, even though some of our competitors do so. We believe AutoZone's termination of its relationship with us in 2004 was primarily based on our decision not to participate in this pay-on-scan program. If the pay-on-scan program or a similar program is pursued by other customers, we may be asked to participate in such programs with our customers or extend more favorable terms to them. If this were to occur, we may lose these customers and our net sales and cash flow may be adversely affected.

We are also subject to returns from customers, some of which may manage their excess inventory through returns. Arrangements with customers typically include provisions that permit them to return specified levels of their purchases. Returns have historically represented approximately 2% of our sales. If returns from our customers significantly increase, our profitability may be adversely affected.

We are subject to other risks associated with our non-U.S. operations.

We have significant manufacturing operations outside the United States, including joint ventures and other alliances. We operate 44 manufacturing facilities with 17 locations in the United States, 6 in Canada, 4 in Mexico, 10 in Europe and 7 in South America. In 2005, approximately 41% of our net sales originated outside the United States. Risks are inherent in international operations, including:

|  |  |

| • | exchange controls and currency restrictions; |

|  |  |

| • | currency fluctuations and devaluations; |

|  |  |

| • | changes in local economic conditions; |

|  |  |

| • | changes in laws and regulations; |

|  |  |

| • | exposure to possible expropriation or other government actions; and |

|  |  |

| • | unsettled political conditions and possible terrorist attacks against American interests. |

These and other factors may have a material adverse effect on our international operations or on our business, results of operations and financial condition. We may experience net foreign exchange losses of gains due to currency fluctuations.

We may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against us.

We may be exposed to product liability and warranty claims in the event that our products actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in bodily injury and/or property damage. Accordingly, we could experience material warranty or product liability losses in the future and incur significant costs to defend these claims.

In addition, if any of our products are, or are alleged to be, defective, we may be required to participate in a recall of that product if the defect or the alleged defect relates to automotive safety. Our costs associated with providing product warranties could be material. Product liability, warranty and recall costs may have a material adverse effect on our business, results of operations and financial condition. Our insurance may not be sufficient to cover such costs.

Recently, the U.S. automotive industry has been experiencing financial difficulties, which has led to some companies filing for protection under Chapter 11 of the United States Bankruptcy Code (the "Bankruptcy Code"). Specifically, Dana and Delphi Corporation have filed Chapter 11 cases, with Delphi Corporation filing on October 8, 2005 and Dana filing on March 3, 2006. We do not do sell a significant amount of parts to Delphi and currently the amount recorded in account receivables is insignificant. We have more significant relationships with Dana as discussed in the next paragraph (Refer to Item 8. Note 22. Subsequent Event for details on the Dana Chapter 11 cases).

On March 3, 2006, Dana and forty of its domestic subsidiaries (the "Debtors") filed voluntary petitions for reorganization under the Bankruptcy Code in the United States Bankruptcy Court,

14

Table of ContentsSouthern District of New York (the "Court") (Case No. 06-10354). The Debtors will continue to operate their businesses as ‘‘debtors-in-possession’’ under the jurisdiction of the Court and in accordance with applicable provisions of the Bankruptcy Code and orders of the Court. Dana is, pursuant to the Purchase Agreement, contractually obligated to indemnify us for specified liabilities, including, among others, (1) liabilities arising out of legal proceedings that commenced prior to the Acquisition and (2) liabilities for death, personal injury or other injury to persons (including, but not limited to, such liabilities that result from human exposure to asbestos) or property damage occurring prior to the Acquisition relating to the use or exposure to any of Dana's products designed, manufactured, served or sold by Dana. However, in the context of Dana's bankruptcy, Dana may be discharged entirely from its obligations to indemnify us for future defense, settlements or payments in respect of any claim subject to its indemnity obligations and we may recover less than 100% of any indemnification obligations of Dana existing as of March 3, 2006. Further, we do not know whether any insurance that may have been maintained by Dana will cover the costs for which Dana is contractually obligated to indemnify us. In addition, if Dana is unable or unwilling to pay settlements or judgments, claims may be brought against us that historically have been asserted only against Dana and other current or former manufacturers of automotive products, not including us. The failure of Dana to honor its indemnification obligations could adversely affect our financial condition and results of operations. Our accounts receivable from Dana at April 13, 2006 were insignificant.

We are subject to costly regulation, particularly in relation to environmental, health and safety matters, which could adversely affect our business and results of operations.

We are subject to a substantial number of costly regulations. In particular, we are required to comply with frequently changing and increasingly stringent requirements of federal, state and local environmental and occupational safety and health laws and regulations in the United States and other countries, including those governing emissions to air, discharges to air and water, and the creation and emission of noise and odor; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties and occupational health and safety. We could incur substantial costs, including cleanup costs, fines and civil or criminal sanctions, third party property damage or personal injury claims, or costs to upgrade or replace existing equipment, as a result of violations of or liabilities under environmental, health and safety laws or non-compliance with environmental permits required at our facilities. In addition, many of our current and former facilities are located on properties with long histories of industrial or commercial operations. Because some environmental laws can impose joint and several liability for the entire cost of cleanup upon any of the current or former owners or operators, regardless of fault, we could become liable for investigating and/or remediating contamination at these properties if contamination requiring such activities is discovered in the future. We cannot assure you that we have been, or will at all times be, in complete compliance with all environmental requirements, or that we will not incur material costs or liabilities in connection with these requirements in excess of amounts we have reserved. In addition, environmental requirements are complex, change frequently and have tended to become more stringent over time. These requirements may change in the future in a manner that could have a material adverse effect on our business, results of operations and financial condition. We have made and will continue to make expenditures to comply with environmental requirements. These requirements, responsibilities and associated expenses and expenditures, if they continue to increase, could have a material adverse effect on our business and results of operations. While our costs to defend and settle claims arising under environmental laws in the past have not been material, we cannot assure you that this will remain so in the future. For more information about our environmental compliance and potential environmental liabilities, see ‘‘Item 1. Business — Environmental Matters’’ and ‘‘Item 3. Legal Proceedings.’’

Increased crude oil and energy prices could reduce global demand for and use of automobiles and increase our costs, which could have an adverse effect on our profitability.

Material increases in the price of crude oil have, historically, been a contributing factor to the periodic reduction in the global demand for and use of automobiles. A continued increase in the price of crude oil could reduce global demand for and use of automobiles and continue to shift customer

15

Table of Contentsdemand away from larger cars and light trucks (including SUVs), which we believe have more frequent replacement intervals for our products, which could have an adverse effect on our profitability. Further, as higher gasoline prices result in a reduction in discretionary spending for auto repair by the end users of our products, our results of operations have been, and could continue to be, impacted.

Our operations would be adversely affected if we are unable to purchase raw materials, manufactured components or equipment from our suppliers.

Because we purchase from suppliers various types of raw materials, finished goods, equipment and component parts, we may be materially and adversely affected by the failure of those suppliers to perform as expected. This non-performance may consist of delivery delays or failures caused by production issues or delivery of non-conforming products. The risk of non-performance may also result from the insolvency or bankruptcy of one or more of our suppliers. Our suppliers' ability to supply products to us is also subject to a number of risks, including availability of raw materials, such as steel, destruction of their facilities or work stoppages. In addition, our failure to promptly pay, or order sufficient quantities of inventory from, our suppliers may increase the cost of products we purchase or may lead to suppliers refusing to sell products to us at all. Our efforts to protect against and to minimize these risks may not always be effective.

Work stoppages or similar difficulties could significantly disrupt our operations.

As of December 31, 2005, approximately 120 of our U.S. employees and approximately 812 of our Canadian employees were represented by unions. It is possible that our workforce will become more unionized in the future. We may be subject to work stoppages and may be affected by other labor disputes. A work stoppage at one or more of our plants may have a material adverse effect on our business. Unionization activities could also increase our costs, which could have an adverse effect on our profitability.

Additionally, a work stoppage at one of our suppliers could adversely affect our operations if an alternative source of supply were not readily available. Stoppages by employees of our customers also could result in reduced demand for our products.

Our intellectual property portfolio is subject to legal challenges.

We have developed and actively pursue developing a considerable amount of proprietary technology in the automotive industry and rely on intellectual property laws and a number of patents to protect such technology. In doing so, we incur ongoing costs to enforce and defend our intellectual property. We also face increasing exposure to the claims of others for infringement of intellectual property rights. We cannot assure you that we will not incur material intellectual property claims in the future or that we will not incur significant costs or losses related to such claims. We also cannot assure you that our proprietary rights will not be invalidated or circumvented.

We may not be able to successfully respond to changing distribution channels for aftermarket products.

Major aftermarket retailers, such as AutoZone and Advance Auto Parts, are attempting to increase their commercial sales by selling directly to automotive parts installers in addition to individual consumers. These installers have historically purchased from local warehouse distributors and jobbers, who are our more traditional customers. We cannot assure you that we will be able to maintain or increase aftermarket sales through increasing our sales to retailers.

Our success depends in part on our development of improved products, and our efforts may fail to meet the needs of customers on a timely or cost-effective basis.

Our continued success depends on our ability to maintain advanced technological capabilities, machinery and knowledge necessary to adapt to changing market demands as well as to develop and commercialize innovative products. We cannot assure you that we will be able to develop new

16

Table of Contentsproducts as successfully as in the past or that we will be able to keep pace with technological developments by our competitors and the industry generally. In addition, we may develop specific technologies and capabilities in anticipation of customers' demands for new innovations and technologies. If such demand does not materialize, we may be unable to recover the costs incurred in such programs. If we are unable to recover these costs or if any such programs do not progress as expected, our business, financial condition or results of operations could be materially adversely affected.

The introduction of new and improved products and services may reduce our future sales.

Improvements in technology and product quality may extend the longevity of automotive parts and delay aftermarket sales. In particular, in our oil filter business the introduction of oil change indicators and the use of synthetic motor oils may extend oil filter replacement cycles. The introduction of electric, fuel cell and hybrid automobiles may pose a long-term risk to our business because these vehicles may alter demand for our primary product lines. In addition, the introduction by OEMs of increased warranty and maintenance service initiatives, which are gaining popularity, have the potential to decrease the demand for our products in the traditional and retail sales channels.

Cypress controls us and may have conflicts of interest with us or the holders of our senior subordinated notes in the future.

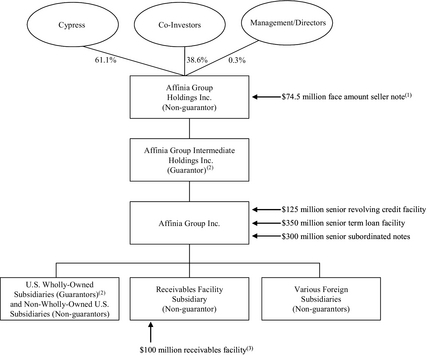

Cypress beneficially owns 61.1% of the outstanding shares of our common stock. As a result, Cypress has control over our decisions to enter into any corporate transaction and has the ability to prevent any transaction that requires the approval of stockholders regardless of whether or not other stockholders or noteholders believe that any such transactions are in their own best interests. For example, Cypress could cause us to make acquisitions that increase the amount of indebtedness that is secured or senior to the senior subordinated notes or sell revenue-generating assets, impairing our ability to make payments under the senior subordinated notes.

Additionally, Cypress is in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. So long as Cypress continues to own a significant amount of the outstanding shares of our common stock, even if such amount is less than 50%, it will continue to be able to strongly influence or effectively control our decisions.

|  |

| Item 1B. | Unresolved Staff Comments. |

None.

|  |

| Item 2. | Properties |

Our principal executive offices are located in Ann Arbor, Michigan; our operations include numerous manufacturing, research and development and warehousing facilities as well as offices. We operate 44 principal manufacturing facilities with 17 locations in the United States, 6 in Canada, 4 in Mexico, 10 in Europe and 7 in South America. In addition, we own or lease 49 principal distribution facilities located throughout the world, including 11 in the United States, 3 in Canada, 3 in Mexico, 10 in Europe and 22 in South America. Approximately 60% of our principal manufacturing domestic facilities are brake production facilities, 30% are filtration production facilities and 10% are chassis production facilities. Of the total number of principal manufacturing facilities operated by us, approximately 64% of such facilities are owned and 36% are leased.

|  |

| Item 3. | Legal Proceedings |

Various claims, lawsuits and administrative proceedings are pending or threatened against us and our subsidiaries, arising from the ordinary course of business with respect to commercial, intellectual property, product liability and environmental matters. We believe that the ultimate resolution of the foregoing matters will not have a material effect on our financial condition or results of operations.

17

Table of ContentsOn March 3, 2006, Dana and forty of its domestic subsidiaries (the "Debtors") filed voluntary petitions for reorganization under the Bankruptcy Code in the United States Bankruptcy Court, Southern District of New York (the "Court") (Case No. 06-10354). The Debtors will continue to operate their businesses as ‘‘debtors-in-possession’’ under the jurisdiction of the Court and in accordance with applicable provisions of the Bankruptcy Code and orders of the Court. Dana is, pursuant to the Purchase Agreement, contractually obligated to indemnify us for specified liabilities, including, among others, (1) liabilities arising out of legal proceedings that commenced prior to the Acquisition and (2) liabilities for death, personal injury or other injury to persons (including, but not limited to, such liabilities that result from human exposure to asbestos) or property damage occurring prior to the Acquisition relating to the use or exposure to any of Dana's products designed, manufactured, served or sold by Dana. However, in the context of Dana's bankruptcy, Dana may be discharged entirely from its obligations to indemnify us for future defense settlements or payments in respect of any claim subject to its indemnity obligations and we may recover less than 100% of any indemnification obligations of Dana existing as of March 3, 2006. Further, we do not know whether any insurance that may have been maintained by Dana will cover the costs for which Dana is contractually obligated to indemnify us. In addition, if Dana is unable or unwilling to pay settlements or judgments, claims may be brought against us that historically have been asserted only against Dana and other current or former manufacturers of automotive products, not including us. The failure of Dana to honor its indemnification obligations could adversely affect our financial condition and results of operations.

|  |

| Item 4. | Submission of Matters to a Vote of Security Holders |

During the fourth quarter of the year covered by this report, no matters were submitted to a vote of security holders.

18

Table of ContentsPART II.

|  |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Shares |

No trading market for our common stock currently exists. As of April 13, 2006, our parent, Affinia Group Holdings Inc., was the sole holder of our common stock. The Company has not declared or paid any cash dividends on its common stock in its two most recent years. We intend to retain all current and foreseeable future earnings to support operations. Our senior credit facilities and our senior subordinated notes indenture restrict our ability to pay cash dividends on our common stock. For information in respect of securities authorized under our equity compensation plan, see Item 11. Executive Compensation.

The following table provides information about Affinia Group Holdings Inc.'s shares of common stock that may be issued upon the exercise of options under its existing equity compensation plans as of December 31, 2005:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Plan Category |  | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights |  | Weighted average

exercise price of

outstanding options,

warrants and rights |  | Number of securities

remaining available for

future issuance |

| Equity compensation plans approved by security holders(1): |  | | 227,000 | |  | $ | 100.00 | |  | | 86,300 | |

| Equity compensation plans not approved by security holders |  | | N/A | |  | | N/A | |  | | N/A | |

| Total |  | | 227,000 | |  | $ | 100.00 | |  | | 86,300 | |

|

|  |

| (1) | This plan consists of the Affinia Group Holdings Inc. 2005 Stock Incentive Plan. See Item 11. Executive Compensation for a description of the plan. |

|  |

| Item 6. | Selected Historical Consolidated and Combined Financial Data |

Affinia Group Intermediate Holdings Inc. was formed in connection with the Acquisition. The financial statements included in this report are the combined financial statements of the aftermarket business of Dana before the Acquisition and the consolidated financial statements of Affinia Group Intermediate Holdings Inc. after the Acquisition. The financial data presented below for periods prior to the Acquisition are referred to as ‘‘Predecessor’’ and the financial data for periods after the Acquisition are referred to as ‘‘Successor.’’ The selected financial data have been derived from our financial statements. The financial data as of December 31, 2004 and 2005 and for the years ended December 31, 2003 and 2005 and for the period from January 1, 2004 through November 30, 2004 and for the period from December 1, 2004 through December 31, 2004 have been derived from the audited financial statements contained under ‘‘Item 8. Financial Statements and Supplementary Data.’’ The selected financial data as of December 31, 2002 and 2003 and for the year ended December 31, 2002 and 2001 have been derived from the audited financial statements of the Predecessor. The selected financial data as of December 31, 2001 have been derived from the internal unaudited accounting records of Predecessor. In the opinion of management, such unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods.

The statement of cash flows for the period December 1, 2004 through December 31, 2004 has been restated (Refer to Note 2. Restatement of Financial Statement).

The data for the periods after the Acquisition are therefore based on an allocation of the Acquisition purchase price, which is based on fair values of the assets acquired and liabilities assumed.

19

Table of ContentsYou should read the following data in conjunction with ‘‘Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations’’ and ‘‘Item 8. Financial Statements and Supplementary Data (Dollars in Millions).’’

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Predecessor |  | Successor |

| |  | Year Ended December 31, |  | January 1 to

November 30, |  | December 1 to

December 31, |  | Year Ended

December 31, |

| |  | 2001 |  | 2002 |  | 2003 |  | 2004 |  | 2004 |  | 2005 |

| Statement of income data: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Net sales |  | $ | 2,038 | |  | $ | 2,035 | |  | $ | 2,025 | |  | $ | 1,934 | |  | $ | 155 | |  | $ | 2,132 | |

| Cost of sales |  | | 1,760 | |  | | 1,634 | |  | | 1,656 | |  | | 1,657 | |  | | 137 | |  | | 1,837 | |

| Gross profit |  | | 278 | |  | | 401 | |  | | 369 | |  | | 277 | |  | | 18 | |  | | 295 | |

| Selling, general and administrative expenses |  | | 276 | |  | | 281 | |  | | 254 | |  | | 234 | |  | | 21 | |  | | 261 | |

| Loss on disposition of Beck Arnley |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | 21 | |

| Operating profit (loss) |  | | 2 | |  | | 120 | |  | | 115 | |  | | 43 | |  | | (3 | ) |  | | 13 | |

| Other income, net |  | | 4 | |  | | 4 | |  | | 5 | |  | | 4 | |  | | 2 | |  | | 8 | |

| Income (loss) before interest expense, taxes and minority interest |  | | 6 | |  | | 124 | |  | | 120 | |  | | 47 | |  | | (1 | ) |  | | 21 | |

| Interest expense |  | | (8 | ) |  | | (5 | ) |  | | (3 | ) |  | | (2 | ) |  | | (5 | ) |  | | (55 | ) |

| (Loss) income before taxes and minority interest |  | | (2 | ) |  | | 119 | |  | | 117 | |  | | 45 | |  | | (6 | ) |  | | (34 | ) |

| Income tax provision (benefit) |  | | 13 | |  | | 56 | |  | | 49 | |  | | 18 | |  | | (2 | ) |  | | (4 | ) |

| Minority interest, net of tax |  | | — | |  | | (1 | ) |  | | (2 | ) |  | | — | |  | | — | |  | | — | |

| (Loss) income before effect of change in accounting |  | | (15 | ) |  | | 62 | |  | | 66 | |  | | 27 | |  | | (4 | ) |  | | (30 | ) |

Effect of change of accounting, net

of tax |  | | — | |  | | (20 | ) |  | | — | |  | | — | |  | | — | |  | | — | |

(Loss) income from continuing

operations |  | | (15 | ) |  | | 42 | |  | | 66 | |  | | 27 | |  | | (4 | ) |  | | (30 | ) |

| (Loss) income from discontinued operations net of tax |  | | (4 | ) |  | | (2 | ) |  | | 1 | |  | | 1 | |  | | — | |  | | — | |

| Net (loss) income |  | $ | (19 | ) |  | $ | 40 | |  | $ | 67 | |  | $ | 28 | |  | $ | (4 | ) |  | $ | (30 | ) |

| Statement of cash flows data: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Net cash from continuing operations: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Operating activities, restated |  | $ | 183 | |  | $ | 155 | |  | $ | 115 | |  | $ | (7 | ) |  | $ | 58 | |  | $ | 103 | |

| Investment activities |  | | (24 | ) |  | | (22 | ) |  | | (37 | ) |  | | (37 | ) |  | | (1,018 | ) |  | | (52 | ) |

| Financing activities, restated |  | | (153 | ) |  | | (120 | ) |  | | (70 | ) |  | | 42 | |  | | 996 | |  | | (49 | ) |

| Other financial data: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Capital expenditures |  | $ | 28 | |  | $ | 26 | |  | $ | 44 | |  | $ | 44 | |  | $ | 3 | |  | $ | 35 | |

| Depreciation |  | | 50 | |  | | 46 | |  | | 46 | |  | | 41 | |  | | 4 | |  | | 46 | |

| Amortization of goodwill (pre-tax)(2) |  | | 5 | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |

| Balance sheet data (end of period):(3) |  | (Unaudited) |  | | | |  | | | |  | | | |  | | | |  | | | |

| Cash and cash equivalents |  | $ | 21 | |  | $ | 38 | |  | $ | 46 | |  | $ | 44 | |  | $ | 80 | |  | $ | 82 | |

| Total current assets |  | | 970 | |  | | 961 | |  | | 985 | |  | | 1,091 | |  | | 988 | |  | | 907 | |

| Total assets |  | | 1,323 | |  | | 1,281 | |  | | 1,313 | |  | | 1,435 | |  | | 1,469 | |  | | 1,440 | |

| Total current liabilities |  | | 346 | |  | | 381 | |  | | 385 | |  | | 366 | |  | | 397 | |  | | 408 | |

| Total non-current liabilities and minority interest in consolidated subsidiaries |  | | 66 | |  | | 104 | |  | | 106 | |  | | 144 | |  | | 668 | |  | | 658 | |

| Shareholders equity |  | | 911 | |  | | 796 | |  | | 822 | |  | | 925 | |  | | 404 | |  | | 374 | |

|

|  |

| (1) | We initiated in 2001 a restructuring plan that we completed in 2003, including a reduction of our workforce, the closure of 13 facilities, the sale of two non-core businesses, a reduction in real estate and improvements in working capital management. The restructuring charges relating to this plan were $38, $35 and $4 million for 2001 through 2003, respectively. Additionally, for the period January 1 to November 30, 2004, we had $2 million in restructuring charges. Restructuring charges related to these efforts included severance, asset writedowns and related exit costs. In 2005, we |

20

Table of Contents |  |

| substantially completed the acquisition restructuring plan and announced the comprehensive restructuring plan that will be completed over the next two years. The comprehensive and acquisition restructuring charges combined were $25 million in 2005. |

|  |

| (2) | SFAS No. 142, ‘‘Goodwill and Other Intangible Assets,’’ which the Predecessor adopted effective January 1, 2002, did not provide for restatement of prior periods. The amounts below present the amount of goodwill amortization, net of the related income tax benefits, included in reported net loss as if SFAS No. 142 had been adopted prior to the earliest year presented. |

|  |  |  |  |  |  |

| |  | Year Ended

December 31, 2001 |

| |  | (Dollars in Millions) |

| Reported net loss |  | $ | (19 | ) |

| Effect of goodwill amortization, net of tax |  | | 4 | |

| Adjusted net loss |  | $ | (15 | ) |

|

|  |

| (3) | For presentation purposes, the various balance sheet line items as of December 31, 2001, 2002, 2003, and November 30, 2004 within the table have not been modified to reflect the 2005 disposition of Candados Universales de Mexico, S.A. de C.V. (‘‘Cumsa’’) as such a presentation would not be materially different. The presentation of the various balance sheet line items as of December 31, 2005 and 2004 within the table does reflect the impact of the 2005 disposition of Cumsa. |

|  |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our financial condition and results of operations covers periods prior and subsequent to the Acquisition. Accordingly, the discussion and analysis of historical operations of the Predecessor during the periods prior to the consummation of the Acquisition do not reflect the impact that the Acquisition has had on us. In addition, the statements in the discussion and analysis regarding industry outlook, our expectations regarding the performance of our business and other non-historical statements in the discussion and analysis are forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the risks and uncertainties described under ‘‘Forward-Looking Statements.’’ Our actual results may differ materially from those contained in or implied by any forward-looking statements. You should read the following discussion together with ‘‘Forward-Looking Statements,’’ ‘‘Item 6. Selected Historical Consolidated and Combined Financial Data’’ and ‘‘Item 8. Financial Statements and Supplementary Data.’’

The consolidated statement of cash flows for the period December 1, 2004 to December 31, 2004 has been restated to correct the presentation of funds received from the receivables facility and used to partially fund the Acquisition. There was no income statement or balance sheet impact as a result of this restatement. Amounts within this Management's Discussion and Analysis of Financial Condition and Results of Operations have been adjusted accordingly.

Company Overview

We are a leading designer, manufacturer and distributor of motor vehicle components for passenger cars, sports utility vehicles, light, medium and heavy trucks and off-highway vehicles in North America, Europe and South America. Our broad range of brake, filtration and chassis products are sold in North America, Europe and South America sold primarily to the aftermarket. In 2005, brake and filtration products which, by their nature, sustain significant wear and must routinely be replaced, represented 50% and 31% of our net sales, respectively. Chassis products, which include steering, suspension and driveline components, represented 7% of our net sales in 2005. The remaining 12% of our 2005 net sales were derived from our European products and other business, which includes our Quinton Hazell European distribution group and our North American Beck Arnley foreign nameplate business, which was sold on March 31, 2005.

The acquisition of Dana’s aftermarket business, which consisted of several operating units, was completed on November 30, 2004. In 2005, the first full year of operations, we sold three of our acquired operating units, Beck Arnley, Candados Universales de Mexico, S.A. de C.V. (‘‘Cumsa’’) and Auto Parts Acquisition LLC (which is part of Cumsa). These companies were not compatible with our strategic plan. Due to Affinia’s $3 million working capital loan to Beck Arnley and the contingent consideration used to pay for the sale, the transaction, under accounting rules, could not be presented as a discontinued operation. The Cumsa disposition qualified for discontinued operations treatment and we accordingly reclassified the amounts presented for prior years as discontinued operations.

21

Table of ContentsWe typically conduct business with our customers pursuant to short-term contracts and purchase orders. However, our business is not characterized by frequent customer turnover due to the critical nature of long-term relationships in our industry. The expectation of quick turnaround times for car repairs and the broad proliferation of available part numbers require a large investment in inventory and strong fulfillment capabilities in order to deliver high fill rates and quick cycle times. Large aftermarket distributors typically source their product lines at a particular price point and product category with one "full-line" supplier, such as our company, which covers substantially all of their product requirements. Switching to a new supplier typically requires that a distributor make a substantial investment to purchase, or "changeover," to the new supplier's products.

In addition, the end user of our products, who is most frequently a professional installer, requires consistently high quality products because it is industry practice to replace, free of any labor or service charge, malfunctioning parts. Despite these factors, our business is becoming more competitive as "value line" and offshore suppliers have tried to penetrate our customer base by targeting the highest volume part numbers in the value category, without offering full product line coverage. In many cases, the presence of these lower priced parts has caused full-line suppliers either to reduce prices in their premium categories or introduce new, intermediate-priced product offerings. In many instances, full-line suppliers have also been required to move more of their sourcing and production of value products to offshore, lower cost locations to offset this trend. We currently estimate that a majority of our net sales are currently derived from products we consider to be premium products and this number has been declining.

We frequently provide various rebates or allowances as a component of our product pricing. Rebates have steadily increased each year as a percentage of net sales due to the creation of new programs intended to maintain and grow our business. Our traditional channel and national retail customers have demanded increasingly competitive, as well as increasingly complex, pricing programs.

Business Environment

Our Markets. We believe that the aftermarket will continue to grow steadily as a result of continuing increases in (1) the light vehicle population, (2) the average age of vehicles, (3) the total number of miles driven, and (4) the prevalence of SUVs and lighter trucks in the fleet mix, since larger vehicles place greater wear on components such as brake systems and chassis components. Growth in sales in the aftermarket does not always have a direct correlation to sales growth for aftermarket suppliers like our company. For example, as automotive parts distributors have consolidated during the past several years, they have reduced purchases from manufacturers as they focused on reducing their combined inventories.

Raw Materials and Manufactured Components. Our variable costs are proportional to sales volume and mix and are comprised primarily of raw materials and labor and certain overhead costs. Our fixed costs are not significantly influenced by volume in the short term and consist principally of selling, general and administrative expenses, depreciation and other facility-related costs.

We use a broad range of manufactured components and raw materials in our products, including raw steel, steel-related components, filtration media, aluminum, brass, iron, rubber, resins, plastics, paper and packaging materials. We purchase raw materials from a wide variety of domestic and international suppliers, and we have not, in recent years, experienced any significant shortages of these items and normally do not carry inventories of these items in excess of those reasonably required to meet our production and shipping schedule.

We experienced significant price increases in our raw steel and steel-related component purchases last year. We have historically been successful in passing through price increases in order to offset these types of cost increases. Further increases in the price of these items could increase our operating costs and materially adversely affect our profit margins. In addition, there has typically been a delay of up to several months or longer in our ability to increase prices to our customers which has impacted profitability. We are also subject to freight and energy costs in obtaining the supply of components and products that our customers require and thus are sensitive to increases in those costs as well. In addition, we have experienced longer than typical lead times in sourcing some of our steel-related

22

Table of Contentscomponents and certain finished products, which caused us to buy from non-preferred vendors at higher costs. In the future, if costs continue to rise rapidly, it may be difficult to pass all of these costs on to our customers in a timely fashion.

We also purchase component parts or finished goods from competitors or other suppliers, a common practice in the automotive aftermarket industry.

Seasonality. Our working capital requirements are significantly impacted by the seasonality of the automotive aftermarket. In a typical year, we build inventory during the first and second quarters to accommodate our peak sales during the second and third quarters. Our working capital requirements therefore tend to be highest from March through August. In periods of weak sales, inventory can increase beyond typical seasonal levels, as our product delivery lead times are less than two days while certain components we purchase from overseas require lead times of up to 90 days.

Global Developments. The aftermarket has also experienced increased price competition from manufacturers based in China and other countries with lower production costs. These manufacturers may continue to play an increasing role in the areas of the aftermarket in which we compete by increasing their product offerings and expanding their manufacturing capabilities to produce lower cost, higher quality products. We are responding to this challenge through restructuring and outsourcing initiatives, as well as through ongoing cost reduction programs.

Restructuring