A rollfoward of the other intangibles and trade names for 2005 and 2006 is shown below (Dollars in Millions):

On November 30, 2004, in connection with the Acquisition, the Company issued 9.0% senior subordinated notes due 2014 in the principal amount of $300 million. The senior subordinated notes were offered only to qualified institutional buyers and certain persons in offshore transactions. The senior subordinated notes were subsequently registered under the Securities Act of 1933 pursuant to an exchange offer completed on November 2, 2005. Interest is payable semiannually in arrears on May 30 and November 30. The senior subordinated notes do not require principal payments prior to maturity. Affinia Group Intermediate Holdings Inc. and certain of the Company’s current and future subsidiaries guarantee the senior subordinated notes. At its option, Affinia may redeem some or all of the senior subordinated notes prior to November 30, 2009 at a redemption price equal to 100% of the principal amount thereof plus a specified ‘‘make-whole’’ premium plus accrued and unpaid interest, if any. On and after November 30, 2009, the Company may, at its option, redeem all or a portion of the

Table of Contentssenior subordinated notes the redemption prices set forth below (expressed as percentages of principal amount), plus accrued interest, if any, if redeemed during the twelve-month period commencing on November 30 of the years set forth below:

Senior Subordinated Notes

|  |  |  |

| Period |  |  | Redemption Price |

| 2009 |  |  | 104.500% |

| 2010 |  |  | 103.000% |

| 2011 |  |  | 101.500% |

| 2012 and thereafter |  |  | 100.000% |

|

In addition, prior to November 30, 2007, the Company may, at its option, redeem up to 35% of the senior subordinated notes with the proceeds of certain equity offerings at a redemption price of 109% (expressed as a percentage of principal amount), plus accrued and unpaid interest, if any.

On November 30, 2004, in connection with the Acquisition, Affinia established financing arrangements with third-party lenders (the ‘‘banks’’) that provide senior credit facilities consisting of a revolving credit facility and a term loan facility that are unconditionally guaranteed by the Company, and certain domestic subsidiaries of Affinia (collectively, the ‘‘Guarantors’’). The repayment of these facilities is secured by substantially all the assets of the Guarantors, including, but not limited to, a pledge of their capital stock and 65 percent of the capital stock of non-U.S. subsidiaries owned directly by the Guarantors. The revolving credit facility, which expires on November 30, 2010, provides for borrowings of up to $125 million through a syndicate of lenders. The revolving credit facility also includes borrowing capacity available for letters of credit. As of December 31, 2006, the Company had $14 million in outstanding letters of credit, none of which had been drawn against. There were no other amounts outstanding under the revolving credit facility at December 31, 2006. The term loan facility provided for a $350 million term loan with a maturity of seven years, of which $297 million was outstanding at December 31, 2006. On December 12, 2005, in connection with the comprehensive restructuring, certain provisions applicable to the senior credit facilities were amended.

The senior credit facilities, as amended, bear interest at a rate equal to an applicable margin plus, at our option, either (a) a base rate determined by reference to the higher of (1) the bank’s prime rate and (2) the federal funds rate plus one-half of 1% or (b) LIBOR rate determined by reference to the costs of funds for deposits in U.S. dollars for the interest period relevant to such borrowing adjusted for certain additional costs. The applicable margin for borrowings under the term loan facility is 2.00% with respect to base rate borrowings and 3.00% with respect to LIBOR borrowings. The applicable margin for borrowings under the revolving credit facility and the term loan facility may be reduced subject to our attaini ng certain leverage ratios or increased based on certain credit ratings as determined by Moody’s and Standard & Poor’s.

In addition to paying interest on outstanding principal under the senior credit facilities, Affinia is required to pay a commitment fee to the lenders under the revolving credit facility in respect of the unutilized commitments thereunder at a rate equal to 0.50% per annum. The Company also paid customary letter of credit fees.

Principal amounts outstanding under the revolving credit facility are due and payable in full at maturity on November 30, 2010.

At December 31, 2006 the Company had $297 million outstanding under the term loan facility with a weighted-average interest rate during the year of 8.1%. The amounts outstanding, as well as the base rates and margins, at December 31, 2006, were as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Amount |  |  | Base Rate |  |  | Margin |

| Term loan facility |  |  | $297 million |  |  |  |  | 5.36 | |  |  |  |  | 3.00 | |

|

The senior credit facilities contain a number of covenants that, among other things, restrict, subject to certain exceptions, the Company’s ability, and the ability of the Company’s subsidiaries, to

57

Table of Contentssell assets, incur additional indebtedness or issue preferred stock, repay other indebtedness (including the senior subordinated notes), pay certain dividends and distributions or repurchase its capital stock, create liens on assets, make investments, loans or advances, make certain acquisitions, engage in mergers or consolidations, enter into sale and leaseback transactions, engage in certain transactions with affiliates, amend certain material agreements governing Affinia’s indebtedness (including the senior subordinated notes), and change the business conducted by Affinia and its subsidiaries. In addition, the senior credit facilities contain the following financial covenants: a maximum total leverage ratio; a minimum interest coverage ratio; and a maximum capital expenditures limitation. As of December 31, 2006 and 2005 the Company was in compliance with all of these covenants.

The senior subordinated notes limit Affinia’s (and most or all of its subsidiaries’) ability to incur additional indebtedness, pay dividends on or make other distributions or repurchase our capital stock, make certain investments, enter into certain types of transactions with affiliates, use assets as security in other transactions, and sell certain assets or merge with or into other companies. Subject to the aforementioned exceptions, Affinia and its restricted subsidiaries are permitted to incur additional indebtedness, including secured indebtedness, under the terms of the senior subordinated notes. The long term debt matures in 2011 (Term loan) and 2014 (Senior subordinated notes).

|  |

| Note 8. | Securitization of Accounts Receivable |

On November 30, 2004, in connection with the Acquisition, Affinia established a receivables facility that provides up to $100 million in funding, based on availability of eligible receivables and satisfaction of other customary conditions. Under the receivables facility, receivables are sold by certain subsidiaries of Affinia to a wholly owned bankruptcy-remote finance subsidiary of Affinia, which transfers an undivided interest in the purchased receivables to a commercial paper conduit or bank sponsor in exchange for cash.

Affinia, as the receivables collection agent, services, administers and collects the receivables under the receivables purchase agreement for which it receives a monthly servicing fee at a rate of 1.00% per annum of the average daily outstanding balance of receivables. The fees in respect of the receivables facility include a usage fee paid by the finance subsidiaries that varies based upon the Company’s leverage ratio as calculated under the senior credit facilities. Funded amounts under the receivables facility bear interest at a rate equal to the conduit’s pooled commercial paper rate plus the usage fee.

At December 31, 2005 and December 31, 2006, the usage fee margin for the receivables facility was 1.25% per annum of the amount funded. In addition, the finance subsidiary is required to pay a fee on the unused portion of the receivables facility that varies based upon the same ratio. At December 31, 2005 and December 31, 2006, the unused fee was 0.50% per annum of the unused portion of the receivables facility.

Availability of funding under the receivables facility depends primarily upon the outstanding trade accounts receivable balance from time to time. Aggregate availability is determined by using a formula that reduces the gross receivables balance by factors that take into account historical default and dilution rates, obligor concentrations and average days outstanding and the costs of the facility. As of December 31, 2005 and December 31, 2006, approximately $69 million and $71 million, respectively, were available for funding. At December 31, 2005 and December 31, 2006, there were no receivables outstanding under this facility.

The receivables facility contains conditions, representations, warranties and covenants similar to those in the senior credit facilities. We were in compliance with all covenants in both 2006 and 2005. It also contains amortization events similar to the events of default under the senior credit facilities, plus amortization events relating to the quality and performance of the trade receivables. If an amortization event occurs, all of the cash flow from the receivables sold to the finance subsidiary will be allocated to the receivables facility until it is paid in full.

58

Table of Contents |  |

| Note 9. | Stock Option Plans |

Successor Plan

On July 20, 2005, we adopted the Affinia Group Holdings Inc. 2005 Stock Incentive Plan, which we refer to as our stock incentive plan. The stock incentive plan permits the grant of non-qualified stock options, incentive stock options, stock appreciation rights, restricted stock and other stock-based awards to employees, directors or consultants of Affinia Group Holdings Inc. and its affiliates. A maximum of 227,000 shares of common stock may be subject to awards under the stock incentive plan. The number of shares issued or reserved pursuant to the stock incentive plan (or pursuant to outstanding awards) is subject to adjustment on account of mergers, consolidations, reorganizations, stock splits, stock dividends and other diluti ve changes in the common stock. Shares of common stock covered by awards that terminate or lapse and shares delivered by a participant or withheld to pay the minimum statutory withholding rate, in each case, will again be available for grant under the stock incentive plan.

Administration. The stock incentive plan is administered by the compensation committee of our Board of Directors. The committee has full power and authority to make, and establish the terms and conditions of any award, and to waive any such terms and conditions at any time (including, without limitation, accelerating or waiving any vesting conditions or payment dates). The committee is authorized to interpret the plan, to establish, amend and rescind any rules and regulations relating to the plan and to make any other determinations that it, in good faith, deems necessary or desirable for the administration of the plan and may delegate such authority as it deems appropriate. The committee may correct any defect or supply an omission or reconcile any inconsistency in the plan in the manner and to the extent the committee deems necessary or desirable and any decision of the committee in the interpretation and administration of the plan shall lie within its sole and absolute good faith discretion and shall be final, conclusive and binding on all parties concerned.

Options. The committee determines the option price for each option; however, the stock options must have an exercise price that is at least equal to the fair market value of the common stock on the date the option is granted. An option holder may exercise an option by written notice and payment of the option price (i) in cash or its equivalent, (ii) by the surrender of a number of shares of common stock already owned by the option holder for at least six months (or such other period established by the committee) with a fair market value equal to the exercise price, (iii) if there is a public market for the shares, subject to rules established by the committee, through the delivery of irrevocable instructions to a broker to sell shares obtained upon the exercise of the option and to deliver to Affinia Group Holdings Inc. an amount out of the proceeds of the sale equal to the aggregate option price for the shares being purchase d or (iv) by another method approved by the committee.

Stock Appreciation Rights. The committee may grant stock appreciation rights independent of or in connection with an option. The exercise price per share of a stock appreciation right shall be an amount determined by the committee. Generally, each stock appreciation right shall entitle a participant upon exercise to an amount equal to (i) the excess of (1) the fair market value on the exercise date of one share of common stock over (2) the exercise price, multiplied by (ii) the number of shares of common stock covered by the stock appreciation right. Payment shall be made in common stock or in cash, or partly in common stock and partly in cash, all as shall be determined by the committee.

Other Stock-Based Awards. The committee may grant awards of restricted stock units, rights to purchase stock, restricted stock and other awards that are valued in whole or in part by reference to, or are otherwise based on the fair market value of, shares of common stock. The other stock-based awards will be subject to the terms and conditions established by the committee.

Transferability. Unless otherwise determined by the committee, awards granted under the stock incentive plan are not transferable other than by will or by the laws of descent and distribution.

Change of Control. In the event of a change of control (as defined in the stock incentive plan), the committee may provide for (i) the termination of an award upon the consummation of the change

59

Table of Contentsof control, but only if the award has vested and been paid out or the participant has been permitted to exercise an option in full for a period of not less than 30 days prior to the change of control, (ii) the acceleration of all or any portion of an award, (iii) payment in exchange for the cancellation of an award and/or (iv) the issuance of substitute awards that would substantially preserve the terms of any awards.

Amendment and Termination. Our Board of Directors may amend, alter or discontinue the stock incentive plan in any respect at any time, but no amendment may diminish any of the rights of a participant under any awards previously granted, without his or her consent.

Management Stockholders Agreement. All shares issued under the plan will be subject to a management stockholders agreement or a director stockholders agreement, as applicable.

Restrictive Covenant Agreement. Unless otherwise determined by our Board of Directors, all award recipients will be obligated to sign the standard Confidentiality, Non-Competition and Proprietary Information Agreement which includes restrictive covenants regarding confidentiality, proprietary information and a one year period restricting competition and solicitation of our clients, customers or employees. In the event a participant breaches these restrictive covenants, any exercise of, or payment or delivery pursuant to, an award may be rescinded by the committee in its discretion in which event the participant may be required to pay to us the amount of any gain realized in connection with, or as a result of, the rescinded exercise, payment or delivery.

Amendment. On November 14, 2006, the Compensation Committee of Affinia Group Holdings Inc. revised the vesting terms applicable to options previously awarded by the Committee to its named executive officers, as well as all other employees, under the Plan. One-half of these options vest in equal portions at the end of each year beginning with the year of the grant and ending December 31, 2009 (the ‘‘Vesting Period’’), 40% are eligible for vesting in equal portions upon the Company’s achievement of certain specified annual EBITDA performance targets over the Vesting Period and 10% are eligible for vesting in equal portions upon the Company’s achievement of certain net working capital performance targets over the Vesting Period. The Committee has not modified the time-vesting options or the working capital performance options. The Committee has elected to modify the vesting terms for the EBI TDA performance options so that these options will be eligible for vesting in equal portions at the end of each of the years 2007, 2008 and 2009. The Committee also modified the performance targets for those years. The fair value of the modified award was slightly higher than the grant date fair value. As a result the incremental compensation cost for the modification of the options was less than $0.1 million for 2006.

Method of Accounting and Our Assumptions

On July 20, 2005, we adopted the stock incentive plan with a maximum of 227 thousand shares of common stock subject to awards. As of December 31, 2006 there were 32 thousand vested shares and 117 thousand unvested shares. Additionally, at year-end 78 thousand shares were available for future stock option grants. Each option expires August 1, 2015. One-half of the options vest based on the performance of the Company and the remaining portion vests at the end of each year ratably over the period from the year of the grant until December 31, 2009. The exercise price is $100 per option.

We adopted SFAS 123(R), Share-Based Payment, during the fourth quarter of 2005 and account for our employee stock options under the fair value method of accounting using a Black-Scholes model to measure stock-based compensation expense at the date of grant. Our weighted-average Black-Scholes fair value assumptions for 2005 and 2006 include the following: effective term of six years, risk free interest rate of 4% and expected volatility of 40%. Dividend yields were not a factor because there were no cash dividends issued during 2005 and 2006.

The weighted fair value of the options granted was approximately $2 million as of December 31, 2006. The fair value of the stock option grants is amortized to expense over the vesting period. The Company reduces the overall compensation expense by a turnover rate consistent with historical trends. Stock-based compensation expense, which was recorded in selling, general and administrative expenses, and tax related income tax benefits were less than $1 million for 2005 and 2006.

60

Table of Contents

|  |  |  |  |  |  |

| |  |  | Options |

| Outstanding at January 1, 2005 |  |  |  |  | — | |

| Granted |  |  |  |  | 140,700 | |

| Forfeited/expired |  |  |  |  | — | |

| Outstanding at January 1, 2006 |  |  |  |  | 140,700 | |

| Granted |  |  |  |  | 14,060 | |

| Forfeited/expired |  |  |  |  | (5,500 | |

| Outstanding at December 31, 2006 |  |  |  |  | 149,260 | |

|

Predecessor Plan

Under the Predecessor’s Stock Incentive Plan, which was approved by shareholders in 2003 and amended and restated the 1997 Stock Option Plan of the Predecessor, the Compensation Committee of the board of directors could grant stock options to employees, including selected employees of the Company. Options outstanding, including options granted under a 1992 Stock Option Plan, were granted at option prices not less than the market price of the stock at the date of grant. Generally, one-fourth of the options granted become exercisable at each of the first four anniversary dates of the grant and all options expire ten years from the date of grant. Stock appreciation rights could be granted separately or in conjunction with the o ptions.

Stock options are cancelled upon an optionee’s termination of employment. Retirees have up to five years after retirement to exercise their stock options, so long as the options are at least six months old at the date of retirement and remain outstanding under their original ten-year term. In connection with the divestiture of the Company, the Predecessor agreed to pay optionees the excess of market value over the option value for any ‘‘in the money’’ stock options that had not vested when the divestiture closed. The Predecessor paid approximately $1 million in connection with this agreement, which has been included in the results of operations for the eleven months ended November 30, 2004. These s tock options, along with the stock options with option prices exceeding the market price at closing, are reported as expired in the table below.

The following table is a summary of transactions under these plans related to the Company’s employees in the period January 1, 2004 through November 30, 2004:

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Number of

Shares |  |  | Weighted

Average

Exercise

Price |

| Outstanding at |  |  |  |  | | |  |  |  |  | | |

| December 31, 2003 |  |  |  |  | 1,997,939 | |  |  |  | $ | 23.97 | |

| Exercised – 2004 |  |  |  |  | (137,771 | |  |  |  |  | 13.22 | |

| Cancelled – 2004 |  |  |  |  | (1,860,168 | |  |  |  |  | 24.77 | |

| Outstanding at |  |  |  |  | | |  |  |  |  | | |

| November 30, 2004 |  |  |  |  | — | |  |  |  |  | — | |

|

|  |

| Note 10. | Pension and Other Postretirement Benefits |

The Company provides defined contribution and defined benefit, qualified and nonqualified, pension plans for certain employees.

Under the terms of the defined contribution retirement plans, employee and employer contributions may be directed into a number of diverse investments. None of these defined contribution plans allow direct investment of contributions in Predecessor stock. Expenses related to these defined contribution plans were $2 million for the period January 1, 2004 through November 30, 2004. Additionally, the Successor has established defined contribution plans, under which it incurred under $1 million of expenses for the period December 1, 2004 through December 31, 2004 , $10 million for the year ended December 31, 2005 and $10 million for the year ended December 31, 2006.

61

Table of ContentsThe Successor has retained the Canadian pension plans (the assets of which are referred to as the Fund). The Successor plans are managed in accordance with applicable legal requirements relating to the investment of registered pension plans. The responsibility for the investment of the Fund lies with the Investment Committee of ITT Industries of Canada Ltd. (the ‘‘Committee’’). The Committee is composed of representatives of ITT and of the participating companies, which includes our Company. The investments objectives of the plans are to maximize long-term total investment returns while assuming a prudent level of risk deemed appropriate by the Committee. The Fund may not engage in certain investments that are not permitted for a pension plan pursuant to applicable provincial pension benefits legislation and the Income Tax Act of Canada. Additionally, the Fund may not invest more than 10% of the assets in any single public issue of securities except where the security is issued by or guaranteed by the government of Canada or a Canadian province. This investment policy permits plan assets to be invested in a number of diverse investment categories such as demand or term deposits, short term notes, treasury bills, bankers acceptances, commercial paper, investment certificates issued by banks, insurance companies or trust companies, bonds and non-convertible debentures, mortgages and other asset-backed securities, convertible debentures, real estate, preferred and common stocks that are traded publicly, including both Canadian and foreign stocks, resource properties, venture capital, insured contracts, pooled funds, segregated funds, trusts, closed-end investment companies, limited partnerships and other structur ed vehicles invested directly or indirectly in, or in interests.

The following tables provide a reconciliation of the changes in the Successor’s defined benefit pension plans’ and other postretirement plans’ benefit obligations and the fair value of assets for the years ended December 31, 2005 and December 31, 2006, as well as the statements of the funded status and schedules of the net amounts recognized in the balance sheet at December 31, 2005 and 2006. The measurement date for the amounts in these tables was December 31, of each year presented (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Pension Benefits |

| |  |  | Year Ended

December 31, 2005 |  |  | Year Ended

December 31, 2006 |

| Reconciliation of benefit obligation |  |  |  |  | | |  |  |  |  | | |

| Obligation at beginning of period |  |  |  | $ | 18 | |  |  |  | $ | 23 | |

| Service cost |  |  |  |  | 1 | |  |  |  |  | 1 | |

| Interest cost |  |  |  |  | 1 | |  |  |  |  | 1 | |

| Actuarial (gain) loss |  |  |  |  | 3 | |  |  |  |  | 3 | |

| Benefit payments |  |  |  |  | (1 | |  |  |  |  | (1 | |

| Translation adjustments |  |  |  |  | 1 | |  |  |  |  | — | |

| Obligation at end of period |  |  |  | $ | 23 | |  |  |  | $ | 27 | |

| Accumulated benefit obligation |  |  |  | $ | 23 | |  |  |  | $ | 27 | |

|

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Pension Benefits |

| |  |  | Year Ended

December 31, 2005 |  |  | Year Ended

December 31, 2006 |

| Reconciliation of fair value of plan assets |  |  |  |  | | |  |  |  |  | | |

| Fair value, beginning of period |  |  |  | $ | 17 | |  |  |  | $ | 21 | |

| Actual return on plan assets |  |  |  |  | 2 | |  |  |  |  | 3 | |

| Employer contributions |  |  |  |  | 2 | |  |  |  |  | 3 | |

| Benefit payments |  |  |  |  | (1 | |  |  |  |  | (1 | |

| Translation adjustments |  |  |  |  | 1 | |  |  |  |  | — | |

| Fair value, end of period |  |  |  | $ | 21 | |  |  |  | $ | 26 | |

|

The weighted average asset allocations of the pension plans at December 31, 2005 and December 31, 2006 were as follows:

62

Table of Contents

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31,

2005 |  |  | December 31,

2006 |

| Asset Category |  |  |  |  | | |  |  |  |  | | |

| Equity securities |  |  |  |  | 72 | |  |  |  |  | 66 | |

| Controlled-risk debt securities |  |  |  |  | 26 | |  |  |  |  | 33 | |

| Absolute return strategies investments |  |  |  |  | — | |  |  |  |  | — | |

| Cash and short-term obligations |  |  |  |  | 2 | |  |  |  |  | 1 | |

| Total |  |  |  |  | 100 | |  |  |  |  | 100 | |

|

The target asset allocations of the pension plans for equity securities, controlled-risk debt securities, absolute return strategies investments and cash and other assets at December 31, 2005 and December 31, 2006 were 70%, 30%, 0% and 0%.

The following table presents the funded status of the Successor pension plans and the amounts recognized in the balance sheet as of December 31, 2005 and 2006 (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31,

2005 |  |  | December 31,

2006 |

| Accumulated benefit obligation at beginning of period |  |  |  | $ | 23 | |  |  |  | $ | 23 | |

| Projected benefit obligation |  |  |  |  | 23 | |  |  |  |  | 27 | |

| Fair value of assets |  |  |  |  | 21 | |  |  |  |  | 26 | |

| Accrued cost |  |  |  | $ | (2 | |  |  |  | $ | (1 | |

| Amounts recognized in balance sheet: |  |  |  |  | | |  |  |  |  | | |

| Accrued benefit liability |  |  |  | $ | (1 | |  |  |  | $ | (1 | |

| Intangible asset |  |  |  |  | 1 | |  |  |  |  | — | |

| Accumulated other income |  |  |  |  | — | |  |  |  |  | 2 | |

| Net amount recognized |  |  |  | $ | — | |  |  |  | $ | 1 | |

|

Expected benefit payments by the pension plans retained by the Successor for periods subsequent to December 31, 2006 are expected to be less than $1 million.

Projected contributions to be made to the Company’s defined benefit pension plans are expected to be $1 million and for the next ten years.

63

Table of ContentsComponents of net periodic benefit costs for the Predecessor’s and the Successor’s defined benefit plans for the period January 1, 2004 through November 30, 2004, the period December 1, 2004 through December 31, 2004, the year ended December 31, 2005, and the year ended December 31, 2006 are as follows (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Pension Benefits |

| |  |  | Predecessor |  |  | Successor |

| |  |  | January 1,

2004 through

November 31,

2004 |  |  | December 1,

2004 through

December 31,

2004 |  |  | Year Ended

December 31,

2005 |  |  | Year Ended

December 31,

2006 |

| Service cost |  |  |  | $ | 6 | |  |  |  | $ | — | |  |  |  | $ | 1 | |  |  |  | $ | 1 | |

| Interest cost |  |  |  |  | 12 | |  |  |  |  | — | |  |  |  |  | 1 | |  |  |  |  | 1 | |

| Expected return on plan assets |  |  |  |  | (12 | |  |  |  |  | — | |  |  |  |  | (1 | |  |  |  |  | (1 | |

| Amortization of transition obligation |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Amortization of prior service cost |  |  |  |  | 1 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Recognized net actuarial loss (gain) |  |  |  |  | 2 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Net periodic benefit cost |  |  |  | $ | 9 | |  |  |  | $ | — | |  |  |  | $ | 1 | |  |  |  | $ | 1 | |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Other Benefits |

| |  |  | Predecessor |  |  | Successor |

| |  |  | January 1,

2004 through

November 30,

2004 |  |  | December 1,

2004 through

December 31,

2004 |  |  | Year Ended

December 31,

2005 |  |  | Year Ended

December 31,

2006 |

| Service cost |  |  |  | $ | 1 | |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | — | |

| Interest cost |  |  |  |  | 3 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Net periodic benefit cost |  |  |  | $ | 4 | |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | — | |

|

The Predecessor plans included U.S and Non-U.S. plans. The Successor plans only include Canadian plans.

|  |  |  |  |  |  |

| |  |  | U.S. Plans |

| |  |  | November 30,

2004 |

| Discount rate |  |  |  |  | 6.00 | |

| Expected return on plan assets |  |  |  |  | 8.75 | |

| Rate of compensation increase |  |  |  |  | 5.00 | |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Non-U.S. Plans |

| |  |  | Predecessor |  |  | Successor |

| |  |  | November 30,

2004 |  |  | December 31,

2004 |  |  | December 31,

2005 |  |  | December 31,

2006 |

| Discount rate |  |  |  |  | 5.48 | |  |  |  |  | 6.25 | |  |  |  |  | 6.0 | |  |  |  |  | 5.0 | |

| Expected return on plan assets |  |  |  |  | 6.59 | |  |  |  |  | 7.00 | |  |  |  |  | 7.0 | |  |  |  |  | 6.7 | |

| Rate of compensation increase |  |  |  |  | 3.15 | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

|

The discount rate and expected return on plan assets for the Company plans presented in the tables above are used to determine pension expense for the succeeding year.

The Company selects the expected rate of return on plan assets on the basis of a long-term view of asset portfolio performance of the pension plans. Since the 1981 adoption of the asset/liability management investment policy, the compounded rate of return was 12.7%. However, the two-year, five-year and ten-year compounded rates of return through November 30, 2004 were 16.9%, 4.3% and 11.4%, respectively. The Company assesses the appropriateness of the expected rate of return on an

64

Table of Contentsannual basis and when necessary revises the assumption. The weighted average assumptions used in the measurement of other postretirement benefit obligations for the Predecessor plans are as follows:

|  |  |  |  |  |  |

| |  |  | November 30,

2004 |

| Discount rate |  |  |  |  | 6.09 | |

| Initial weighted health care costs trend rate |  |  |  |  | 9.55 | |

| Ultimate health care costs trend rate |  |  |  |  | 5.00 | |

| Years to ultimate |  |  |  |  | 5.9 | |

|

|  |

| Note 11. | Income Tax |

The Predecessor’s domestic operations were included in Dana’s consolidated U.S. tax return. The domestic income tax provision had been calculated for each period on a method that is generally consistent with a separate return basis as if the Predecessor was a separate entity. The income tax provision of the Company in other countries is generally based on separate returns of the operating units, as adjusted for the effects of applying accounting principles generally accepted in the United States. The components of the income tax provision (benefit) are as follows (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Predecessor |  |  | Successor |

| |  |  | January 1,

2004 through

November 30,

2004 |  |  | December 1,

2004 through

December 31,

2004 |  |  | Year Ended

December 31,

2005 |  |  | Year Ended

December 31,

2006 |

| Current: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| U.S federal |  |  |  | $ | 25 | |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | — | |

| U.S. state and local |  |  |  |  | 1 | |  |  |  |  | — | |  |  |  |  | 1 | |  |  |  |  | — | |

| Non-United States |  |  |  |  | 20 | |  |  |  |  | 3 | |  |  |  |  | 13 | |  |  |  |  | 9 | |

| Total current |  |  |  |  | 46 | |  |  |  |  | 3 | |  |  |  |  | 14 | |  |  |  |  | 9 | |

| Deferred: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| U.S. federal & state |  |  |  |  | (22 | |  |  |  |  | (1 | |  |  |  |  | (21 | |  |  |  |  | (7 | |

| Non-United States |  |  |  |  | (6 | |  |  |  |  | (4 | |  |  |  |  | 3 | |  |  |  |  | (5 | |

| Total deferred |  |  |  |  | (28 | |  |  |  |  | (5 | |  |  |  |  | (18 | |  |  |  |  | (12 | |

| Income tax provision (benefit) |  |  |  | $ | 18 | |  |  |  | $ | (2 | |  |  |  | $ | (4 | |  |  |  |  | (3 | |

|

The income tax provision (benefit) was calculated based upon the following components of earnings (loss) before income taxes and minority interest (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Predecessor |  |  | Successor |

| |  |  | January 1,

2004 through

November 30,

2004 |  |  | December 1,

2004 through

December 31,

2004 |  |  | Year Ended

December 31,

2005 |  |  | Year Ended

December 31,

2006 |

| United States |  |  |  | $ | 9 | |  |  |  | $ | (3 | |  |  |  | $ | (80 | |  |  |  | $ | (27 | |

| Non-United States |  |  |  |  | 36 | |  |  |  |  | (3 | |  |  |  |  | 46 | |  |  |  |  | 19 | |

| Earnings (loss) before income taxes |  |  |  | $ | 45 | |  |  |  | $ | (6 | |  |  |  | $ | (34 | |  |  |  |  | (8 | |

|

65

Table of ContentsDeferred tax assets (liabilities) consisted of the following and are presented in investments and other assets and other current assets (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Successor

At December 31,

2005 |  |  | Successor

At December 31,

2006 |

| Deferred tax assets: |  |  |  |  | | |  |  |  |  | | |

| Net operating loss carryforwards |  |  |  | $ | 27 | |  |  |  | $ | 45 | |

| Inventory reserves |  |  |  |  | 1 | |  |  |  |  | 7 | |

| Fixed assets |  |  |  |  | 6 | |  |  |  |  | — | |

| Expense accruals |  |  |  |  | 32 | |  |  |  |  | 42 | |

| Other |  |  |  |  | 8 | |  |  |  |  | 7 | |

| Subtotal |  |  |  |  | 74 | |  |  |  |  | 101 | |

| Valuation allowance |  |  |  |  | (11 | |  |  |  |  | (15 | |

| Net deferred tax assets |  |  |  |  | 63 | |  |  |  |  | 86 | |

| Current portion |  |  |  |  | 36 | |  |  |  |  | 53 | |

| Long term portion |  |  |  |  | 27 | |  |  |  |  | 33 | |

| Deferred tax liabilities: |  |  |  |  | | |  |  |  |  | | |

| Depreciation & amortization |  |  |  |  | 18 | |  |  |  |  | 24 | |

| Foreign earnings |  |  |  |  | 5 | |  |  |  |  | 14 | |

| Other |  |  |  |  | 7 | |  |  |  |  | — | |

| Deferred tax liabilities (long-term) |  |  |  |  | 30 | |  |  |  |  | 38 | |

| Net deferred tax assets |  |  |  | $ | 33 | |  |  |  | $ | 48 | |

|

Valuation allowances are provided for deferred tax assets whenever the realization of the assets is not deemed to meet a ‘‘more likely than not’’ standard. Accordingly, valuation allowances have been provided for net operating losses in certain non-U.S. countries. To reflect judgments in applying this standard, the Company increased the valuation allowance against deferred tax assets by $4 million in 2006.

The effective income tax rate differs from the U.S. federal income tax rate for the following reasons:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Predecessor |  |  | Successor |

| |  |  | January 1, 2004

through

November 30,

2004 |  |  | December 1,

2004 through

December 31,

2004 |  |  | Year Ended

December 31,

2005 |  |  | Year Ended

December 31,

2006 |

| U.S. federal income tax rate |  |  |  |  | 35.0 | |  |  |  |  | 35.0 | |  |  |  |  | 35.0 | |  |  |  |  | 35.0 | |

| Increases (reductions) resulting from: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| State and local income taxes, net of federal income tax benefit |  |  |  |  | 0.7 | |  |  |  |  | 1.1 | |  |  |  |  | (2.9 | |  |  |  |  | 25.6 | |

| Non-U.S. income |  |  |  |  | 4.3 | |  |  |  |  | (11.3 | |  |  |  |  | (20.6 | |  |  |  |  | (9.7 | |

| Miscellaneous items |  |  |  |  | 0.7 | |  |  |  |  | 2.3 | |  |  |  |  | 0.3 | |  |  |  |  | (8.6 | |

| Effective income tax rate |  |  |  |  | 40.7 | |  |  |  |  | 27.1 | |  |  |  |  | 11.8 | |  |  |  |  | 42.3 | |

|

At the end of 2006, federal domestic net operating loss carryforwards were $70 million. Of these, $8 million expire in 2024, $25 million expire in 2025, and $37 million expire in 2026. At the end of 2006, state domestic net operating loss carryforwards were estimated to be $37 million, the majority of which expire between 2024 and 2026. At the end of 2006, foreign net operating loss carryforwards were $42 million and expire as follows: $1 million in 2007, $1 million in 2008, $1 million in 2009, $1 million in 2010, $2 million in 2011, $1 million in 2012, $2 million in 2013, $3 million in 2014, $1 million in 2015 and $29 million may be carried forward indefinitely.

66

Table of Contents |  |

| Note 12. | Property, Plant and Equipment |

The following table breaks out the property, plant and equipment in further detail (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31, |

| |  |  | 2005 |  |  | 2006 |

| Property, plant and equipment |  |  |  |  | | |  |  |  |  | | |

| Land and improvements to land |  |  |  | $ | 26 | |  |  |  | $ | 25 | |

| Buildings and building fixtures |  |  |  |  | 66 | |  |  |  |  | 74 | |

| Machinery and equipment |  |  |  |  | 119 | |  |  |  |  | 125 | |

| Software |  |  |  |  | 13 | |  |  |  |  | 14 | |

| Other |  |  |  |  | — | |  |  |  |  | 1 | |

| Construction in progress |  |  |  |  | 17 | |  |  |  |  | 17 | |

| |  |  |  |  | 241 | |  |  |  |  | 256 | |

| Less: Accumulated depreciation |  |  |  |  | (43 | |  |  |  |  | (69 | |

| |  |  |  | $ | 198 | |  |  |  | $ | 187 | |

|

|  |

| Note 13. | Other Accrued Expenses |

The following table breaks out the other accrued expenses in further detail (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31, |

| |  |  | 2005 |  |  | 2006 |

| Other accrued expenses |  |  |  |  | | |  |  |  |  | | |

| Return reserve |  |  |  | $ | 19 | |  |  |  | $ | 18 | |

| Accrued rebates and promotions |  |  |  |  | 15 | |  |  |  |  | 15 | |

| Core deposit liability |  |  |  |  | 9 | |  |  |  |  | 10 | |

| Taxes other than income taxes |  |  |  |  | 9 | |  |  |  |  | 8 | |

| Accrued property and casualty |  |  |  |  | 7 | |  |  |  |  | 8 | |

| Accrued restructuring |  |  |  |  | 8 | |  |  |  |  | 13 | |

| Tax deposit payable |  |  |  |  | 30 | |  |  |  |  | 30 | |

| Accrued marketing expense |  |  |  |  | 10 | |  |  |  |  | 9 | |

| Accrued freight |  |  |  |  | 6 | |  |  |  |  | 4 | |

| Other |  |  |  |  | 29 | |  |  |  |  | 28 | |

| |  |  |  | $ | 142 | |  |  |  | $ | 143 | |

|

At December 31, 2005 and December 31, 2006 the Company had other accrued liabilities of $29 million and $28 million, respectively. The other accrued expenses primarily consist of accrued utilities, accrued professional fees and other miscellaneous accruals.

|  |

| Note 14. | Commitments and Contingencies |

At December 31, 2006, the Company had purchase commitments for property, plant and equipment of approximately $4 million.

67

Table of ContentsThe Company had future minimum rental commitments under non-cancelable operating leases of $88 million at December 31, 2006, with future rental payments of:

|  |  |  |  |  |  |

| 2007 |  |  |  |  | 15 | |

| 2008 |  |  |  |  | 12 | |

| 2009 |  |  |  |  | 12 | |

| 2010 |  |  |  |  | 9 | |

| 2011 |  |  |  |  | 8 | |

| Thereafter |  |  |  |  | 32 | |

| Total |  |  |  |  | 88 | |

|

The leases do not contain restrictions on future borrowings. There are no significant lease escalation clauses or purchase options. Rent expense was $26 million for the period January 1, 2004 through November 30, 2004, $3 million for the period December 1, 2004 through December 31, 2004, $27 million in 2005 and $24 million in 2006. We recently entered into a logistics service agreement to provide logistic services for an international location. The logistic contractual fees for the ten year agreement are $64 million.

A reconciliation of the changes in our return reserves is as follows beginning with January 1, 2005 (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | December 31, |

| |  |  | 2005 |  |  | 2006 |

| Beginning balance |  |  |  | $ | 18 | |  |  |  | $ | 19 | |

| Amounts charged to income |  |  |  |  | 49 | |  |  |  |  | 49 | |

| Returns processed |  |  |  |  | (48 | |  |  |  |  | (50 | |

| |  |  |  | $ | 19 | |  |  |  | $ | 18 | |

|

The Company is party to various pending judicial and administrative proceedings arising in the ordinary course of business. These include, among others, proceedings based on product liability claims and alleged violations of environmental laws.

On March 3, 2006, Dana and forty of its domestic subsidiaries (the ‘‘Debtors’’) filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court, Southern District of New York (the ‘‘Court’’) (Case No. 06-10354). The Debtors will continue to operate their businesses as ‘‘debtors-in-possession’’ under the jurisdiction of the Court and in accordance with applicable provisions of the Bankruptcy Code and orders of the Court. Dana is, pursuant to the Purchase Agreement, contractually obligated to indemnify us for specified liabilities, including, among others, (1) liabilities arising out of le gal proceedings commenced prior to the Acquisition and (2) liabilities for death, personal injury or other injury to persons (including, but not limited to, such liabilities that result from human exposure to asbestos) or property damage occurring prior to the Acquisition relating to the use or exposure to any of Dana’s products designed, manufactured, served or sold by Dana. However, in the context of Dana’s bankruptcy, Dana may be discharged entirely from its obligations to indemnify us for future defense settlements or payments in respect of any claim subject to its indemnification obligations and we may recover less than 100% of any indemnification obligations of Dana existing as of March 3, 2006. Further, we do not know whether any insurance that may have been maintained by Dana will cover the costs for which Dana is contractually obligated to indemnify us. We cannot estimate the impact of Dana failing to honor its indemnification obligations but such a failure could adversely affect our fi nancial condition and results of operations.

On January 30, 2006, Parker-Hannifin Corporation (‘‘Parker’’) filed a complaint and request for preliminary injunction against Wix Filtration Corp. (‘‘Wix’’), which is a wholly owned subsidiary of Affinia, alleging patent infringement of four U.S. patents held by Parker. These patents cover an oil filter and fuel filter, designed for the Ford F-150 pickup truck, which Parker was selling to Wix for sale

68

Table of Contentsinto the automotive aftermarket prior to the complaint date. Wix’s response to Parker’s preliminary injunction brief was filed on May 10, 2006 and the preliminary injunction hearing was held on August 23, 2006 in the U.S. District Court for the Eastern District of California. On October 24, 2006, the court denied Parker’s preliminary injunction motion. Wix intends to continue to defend itself vigorously in this suit.

On April 20, 2006, Heritage and Beck Arnley filed suit against Affinia in the Rutherford County Chancery Court for the State of Tennessee. The suit arises out of Affinia’s sale of Beck Arnley to Heritage and damages allegedly arising from a tax election which Affinia was required to make under the Purchase Agreement with Dana. Affinia intends to vigorously defend this matter and does not believe it has any liability. Affinia has moved to dismiss the suit in Tennessee and filed a declaratory judgment action in Illinois. On November 2, 2006, the court dismissed the declaratory judgment action. The parties have begun the discovery process.

The Company has various accruals for contingent product liability costs. At December 31, 2005 and 2006, the Company had $1 million and $3 million accrued, respectively. There are no recoveries expected from third parties. If there is a range of equally probable outcomes, we accrue the lower end of the range.

The Company estimates contingent environmental liabilities based on the most probable method of remediation, current laws and regulations and existing technology. Estimates are made on an undiscounted basis and exclude the effects of inflation. If there is a range of equally probable remediation methods or outcomes, we accrue the lower end of the range. At December 31, 2005 and 2006 the Company had less than $1 million accrued. There are no recoveries expected from third parties.

|  |

| Note 15. | Restructuring of Operations |

In 2005, we announced two restructuring plans: (i) a restructuring plan that we announced at the beginning of 2005 as part of the Acquisition, also referred to herein as the acquisition restructuring and (ii) a restructuring plan that we announced at the end of 2005, also referred to herein as the comprehensive restructuring.

In December 2005, we announced the closure of our Southampton (UK) facility. Additionally, in March 2006 we announced the closure of the Erie (PA), North East (PA) and the McHenry (IL) plants and our intent to sell the Waupaca (WI), Sudbury (Ontario, Canada) and St. Catharines (Ontario, Canada) facilities. In June 2006, we announced our decision to close the St. Catharines foundry, which was closed by the end of 2006. In the third quarter of 2006 we announced the closure of our Cambridge (Ontario, Canada) facility, which is anticipated to close during the first quarter of 2007. In October 2006, we announced the closure of our Cuba (MO) facility, which is anticipated to close during the first quarter of 2007. In November 2006, w e announced and closed our Mississauga (Ontario, Canada) facility.

In connection with the comprehensive restructuring, during 2006, we recorded a charge of $1 million to cost of sales and $39 million to selling, general and administrative expense consisting of employee termination benefits and other exit costs. During 2005, also in connection with the comprehensive restructuring, we recorded a charge of $21 million to cost of sales and $2 million to selling, general and administrative expense, comprised primarily of severance costs and fixed asset impairment. The write-down of fixed assets was accounted for in accordance with SFAS 144, Accounting for the Impairment or Disposal of Long-Lived Assets. Severance costs are being accounte d for in accordance with SFAS 146, Accounting for Costs Associated with Exit or Disposal Activities and SFAS 112, Employers’ Accounting for Postemployment Benefits — an amendment of FASB Statements No. 5 and 43. We currently estimate that we will incur approximately $152 million of cash and non cash restructuring costs.

In the first quarter of 2005, as part of the Acquisition, we announced the acquisition restructuring. The acquisition restructuring was initiated to take advantage of opportunities we identified prior to the Acquisition but were limited in our ability to pursue as part of Dana due to resource constraints.

69

Table of ContentsDuring 2005, acquisition restructuring costs of $21 million were recorded to goodwill as an adjustment to the opening balance sheet, comprised of severance costs, fixed asset impairments and other exit costs. Additionally in 2005, we charged directly to selling, general and administrative expense $2 million relating to current period exit costs.

The following summarizes the restructuring charges and activity for all the Company’s restructuring programs. (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Employee

Termination

Benefits |  |  | Long-Lived

Asset

Impairment |  |  | Exit

Costs |  |  | Total |

| Predecessor |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Balance at December 31, 2003 |  |  |  | $ | 2 | |  |  |  | $ | — | |  |  |  | $ | 2 | |  |  |  | $ | 4 | |

| Activity from January 1, 2004 through November 30, 2004 |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Charges to expense |  |  |  |  | 2 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 2 | |

| Cash payments |  |  |  |  | (2 | |  |  |  |  | — | |  |  |  |  | (2 | |  |  |  |  | (4 | |

| Write-off of assets |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Balance at November 30, 2004 |  |  |  | $ | 2 | |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | 2 | |

| Successor |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Balance at December 1, 2004 |  |  |  | $ | 2 | |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | 2 | |

| Activity from December 1, 2004 through December 31, 2004 |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Charges to expense |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Other |  |  |  |  | 1 | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | 1 | |

| Balance at December 31, 2004 |  |  |  | $ | 3 | |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | 3 | |

| Activity from January 1, 2005 through December 31, 2005 |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Charges to expense |  |  |  | $ | 2 | |  |  |  | $ | 20 | |  |  |  | $ | 3 | |  |  |  | $ | 25 | |

| Write-off of assets |  |  |  |  | — | |  |  |  |  | (20 | |  |  |  |  | — | |  |  |  |  | (20 | |

| Balance at December 31, 2005 |  |  |  | $ | 5 | |  |  |  | $ | — | |  |  |  | $ | 3 | |  |  |  | $ | 8 | |

| Activity from January 1, 2006 through December 31, 2006 |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Charges to expense |  |  |  | $ | 19 | |  |  |  | $ | 1 | |  |  |  | $ | 20 | |  |  |  | $ | 40 | |

| Write-off of assets and other |  |  |  |  | | |  |  |  |  | (1 | |  |  |  |  | (2 | |  |  |  |  | (3 | |

| Cash payments |  |  |  |  | (12 | |  |  |  |  | — | |  |  |  |  | (20 | |  |  |  |  | (32 | |

| Balance at December 31, 2006 |  |  |  | $ | 12 | |  |  |  | $ | — | |  |  |  | $ | 1 | |  |  |  | $ | 13 | |

|

At December 31, 2006, $13 million of restructuring charges remained in accrued liabilities, relating to wage and healthcare continuation for severed employees and other termination costs. These remaining benefits are expected to be paid during 2007.

|  |

| Note 16. | Related Party Transactions |

For purposes of these financial statements, Predecessor sales between the Company and other Dana units have not been eliminated. These transactions between Predecessor and other Dana units were on a cost-plus basis with a mark-up on most transactions of approximately 10%. The Company’s sales to other Dana units totaled $16 million for the period January 1, 2004, through November 30, 2004, and $1 million for the period December 1, 2004 through December 31, 2004. The Predecessor distributed parts produced by Dana for aftermarket customers. The purchases by the Company from Dana were $77 million for the period from January 1, 2004 through November 30, 2004, and $9 million for the period December 1, 2004 through Dece mber 31, 2004.

The following table presents the components of administrative services provided at the Dana corporate level that have been allocated to the Predecessor, plus expenses charged to the aftermarket department within the Dana corporate office, including wages, fringe benefits, travel, employee relocation, charges for internal services such as information technology support and charges for certain

70

Table of Contentsexternal services. These items have been allocated to the Predecessor and included in the selling, general and administrative expenses in the combined statement of income (Dollars in Millions):

|  |  |  |  |  |  |

| |  |  | Predecessor |

| |  |  | January 1,

2004 through

November 30,

2004 |

| Administrative staff wages and fringe benefits |  |  |  | $ | 2 | |

| Treasury services |  |  |  |  | 2 | |

| Accounting, tax and audit services |  |  |  |  | 2 | |

| Legal services |  |  |  |  | 1 | |

| Environmental services |  |  |  |  | 1 | |

| Other services |  |  |  |  | 2 | |

| Allocated corporate expenses |  |  |  |  | 10 | |

| Aftermarket department expenses |  |  |  |  | (1 | |

| Total corporate expenses |  |  |  | $ | 9 | |

|

Affinia and Dana entered into a transition services agreement (the ‘‘TSA’’) effective with the closing of the Acquisition on November 30, 2004. The TSA provided for certain administrative and other services and support to be provided by Dana to the Company, and to be provided by the Company to Dana, in each case after the Acquisition. The Company also leases certain properties, warehouses and office space from Dana for periods up to five years after the Acquisition. Some of these lease terms may be renewed indefinitely by the parties. Dana agreed in the Purchase Agreement to provide the Company with a $16 million credit for payments otherwise due for services under the TSA.

On April 29, 2005, Dana paid the Company $12 million in settlement of the TSA noted above, as well as $11 million for uncollectible receivables covered by the Purchase Agreement, offset by $13 million of original purchase price consideration and $3 million of working capital adjustments, which resulted in a net payment of $7 million to the Company.

Mr. John M. Riess, an Affinia Group Board member, is related to an executive at CARQUEST. In 2006, CARQUEST purchased 7% of our total sales. The related party was the president of CARQUEST Canada in 2005. In 2005, CARQUEST Canada purchased less than 1% of our total sales.

|  |

| Note 17. | Segment Information |

The Company’s operating segments have been aggregated into one reportable business segment, which is the manufacturing and distribution of vehicle aftermarket parts. The products, customer base, distribution channel, manufacturing process, procurement, and economic characteristics are similar throughout all of the Company’s operations.

Net sales by geographic region were as follows (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Predecessor |  |  | Successor |

| |  |  | January 1,

2004 through

November 30,

2004 |  |  | December 1,

2004 through

December 31,

2004 |  |  | January 1,

2005 through

December 31,

2005 |  |  | January 1,

2006 through

December 31,

2006 |

| United States |  |  |  | $ | 1,065 | |  |  |  | $ | 88 | |  |  |  | $ | 1,188 | |  |  |  | $ | 1,198 | |

| Canada |  |  |  |  | 302 | |  |  |  |  | 19 | |  |  |  |  | 282 | |  |  |  |  | 255 | |

| Brazil |  |  |  |  | 163 | |  |  |  |  | 18 | |  |  |  |  | 217 | |  |  |  |  | 242 | |

| Other Countries |  |  |  |  | 404 | |  |  |  |  | 30 | |  |  |  |  | 445 | |  |  |  |  | 465 | |

| |  |  |  | $ | 1,934 | |  |  |  | $ | 155 | |  |  |  | $ | 2,132 | |  |  |  | $ | 2,160 | |

|

71

Table of ContentsLong-lived assets by geographic region were as follows (Dollars in Millions):

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Successor

December 31,

2005 |  |  | Successor

December 31,

2006 |

| United States |  |  |  | $ | 314 | |  |  |  | $ | 310 | |

| Canada |  |  |  |  | 65 | |  |  |  |  | 31 | |

| Brazil |  |  |  |  | 6 | |  |  |  |  | 6 | |

| Other Countries |  |  |  |  | 70 | |  |  |  |  | 73 | |

| |  |  |  | $ | 455 | |  |  |  | $ | 420 | |

|

Net sales by geographic area were determined based on origin of sale. Geographic data on long-lived long-lived assets are comprised of property, plant and equipment, goodwill, other intangible assets and deferred financing costs.

We offer primarily three types of products: brake products, which include brake drums, rotors, pads and shoes and hydraulic brake system components; filtration products, which include oil, fuel, air and other filters; and chassis products, which include steering, suspension and driveline components. Additionally, we have European products and other businesses, which includes our Quinton Hazell European parts operations. Quinton Hazell designs, manufactures, purchases and distributes a wide range of aftermarket replacement motor vehicle components for customers throughout the United Kingdom and Continental Europe, primarily under the Quinton Hazell brand name. The Company’s sales by group of similar products are as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Predecessor |  |  | Successor |

| |  |  | January 1,

2004 through

November 30,

2004 |  |  | December 1,

2004 through

December 31,

2004 |  |  | January 1,

2005 through

December 31,

2005 |  |  | January 1,

2006 through

December 31,

2006 |

| Brake |  |  |  | $ | 969 | |  |  |  | $ | 77 | |  |  |  | $ | 1,052 | |  |  |  | $ | 1,053 | |

| Chassis |  |  |  |  | 153 | |  |  |  |  | 10 | |  |  |  |  | 156 | |  |  |  |  | 156 | |

| Filtration |  |  |  |  | 562 | |  |  |  |  | 46 | |  |  |  |  | 661 | |  |  |  |  | 689 | |

| Europe |  |  |  |  | 241 | |  |  |  |  | 19 | |  |  |  |  | 260 | |  |  |  |  | 268 | |

| Eliminations and other |  |  |  |  | 9 | |  |  |  |  | 3 | |  |  |  |  | 3 | |  |  |  |  | (6 | |

| |  |  |  | $ | 1,934 | |  |  |  | $ | 155 | |  |  |  | $ | 2,132 | |  |  |  | $ | 2,160 | |

|

|  |

| Note 18. | Asset Retirement Obligations |

We adopted FAS 143, ‘‘Accounting for Asset Retirement Obligations’’ and FIN 47, ‘‘Accounting for Conditional Asset Retirement Obligations’’ effective January 1, 2003 and December 31, 2005, respectively. FAS 143 and FIN 47 require that a liability for the fair value of an ARO be recognized in the period in which it is incurred if it can be reasonably estimated, with the offsetting associated asset retirement costs capitalized as part of the carrying amount of the long-lived assets. The asset retirement cost is subsequently allocated to exp ense using a systematic and rational method over its useful life. Changes in the ARO resulting from the passage of time are recognized as an increase in the carrying amount of the liability and as accretion expense, which is included in depreciation and amortization expense in the consolidated statements of income. Changes resulting from revisions to the timing or amount of the original estimate of cash flows are recognized as an increase or a decrease in the asset retirement cost and ARO. The ARO recorded at December 31, 2005 and December 31, 2006 was $3 million. If the provisions of FIN 47 had been in effect on December 31, 2004, the aggregate carrying amount of asset retirement obligations on that date would have been $3 million. If the amortization of asset retirement cost and accretion of asset retirement obligation provisions of FAS 143, as interpreted by FIN 47, had been in effect during 2004, the impact would have been immaterial.

The cumulative effect of a change in accounting principle of adopting FIN 47 was not material to our net income in the period of adoption and had no effect on net income.

72

Table of Contents |  |

| Note 19. | Divestiture of Affiliate and Discontinued Operation |

On March 31, 2005, Affinia completed the legal sale of its subsidiary, Beck Arnley Worldparts Corporation (‘‘Beck Arnley’’), to Heritage Equity Group (‘‘Heritage’’), pursuant to a stock purchase agreement. The contingent purchase price, which was based on future sales of Beck Arnley, for the stock of Beck Arnley was $5 million to be paid starting in 2006. Affinia also made a $3 million five year term loan to Beck Arnley, bearing interest at nine percent per annum. In addition, the stock purchase agreement provided that all of the cash at Beck Arnley, with the exception of $2 million, be retained by the Company. As a result, Affinia retained $17 million of cash that was held on the books of Beck Arnley. In connection with the transaction, Affinia recognized a pre-tax loss on the sale of $21 million, in addition to the $3 million loss from normal operations in the first quarter of 2005.

On April 20, 2006, Heritage and Beck Arnley filed suit against Affinia in the Rutherford County Chancery Court for the State of Tennessee. The suit arises out of Affinia’s sale of Beck Arnley to Heritage and damages allegedly arising from a tax election which Affinia was required to make under the Purchase Agreement with Dana. Affinia intends to vigorously defend this matter and does not believe it has any liability. Affinia has moved to dismiss the suit in Tennessee and filed a declaratory judgment action in Illinois. On November 2, 2006, the court dismissed the declaratory judgment action. The parties have begun the discovery process.

During the third quarter of 2005, we completed the sale of Candados Universales de Mexico, S.A. de C.V. (‘‘Cumsa’’), one of our Mexican operations, and the distribution company for Cumsa (Auto Parts Acquisition LLC) for $7 million in cash. Under the provisions of SFAS 144, Accounting for the Impairment or Disposal of Long-Lived Assets, we classify a business component that has been disposed of as a discontinued operation if the cash flow of the component has been eliminated from our ongoing operations and we will no longer have any significant continuing involvement in the component. The results of operations of our discontinued operations throug h the date of sale, including any gains or losses on disposition, are aggregated and presented on one line in the Consolidated Statement of Operations. The amounts presented in the Consolidated Statement of Operations for 2005 were reclassified to comply with SFAS 144. The after-tax loss recognized on the sale during the third quarter of fiscal 2005 was less than $1 million.

|  |

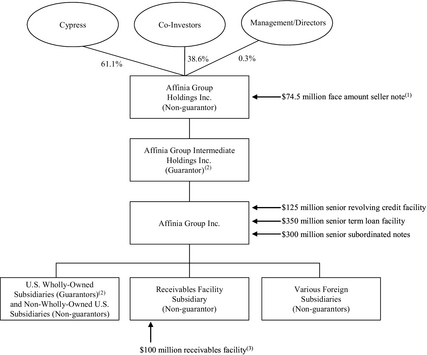

| Note 20. | Financial Information for Guarantors and Non-Guarantors |

Affinia Group Inc. issued $300 million of senior subordinated notes to qualified institutional buyers and certain persons in offshore transactions. The senior subordinated notes were subsequently registered under the Securities Act of 1933 pursuant to an exchange offer completed on November 2, 2005. The senior subordinated notes are general obligations of Affinia Group Inc. and guaranteed by Affinia Group Intermediate Holdings Inc. (‘‘Parent’’) and all of the wholly owned domestic subsidiaries. These guarantors jointly and severally guarantee the Company’s obligations under the senior subordinated notes and the guarantees represent full and unconditional general obligations.

The following information presents combining and consolidating Statements of Operations and Statements of Cash Flows for the period from January 1, 2004 through November 30, 2004, for the period from December 1, 2004, through December 31, 2004, for the year ended December 31, 2005 and for the year ended December 31, 2006 and Consolidated Balance Sheets as of December 31, 2005 and 2006.

73

Table of ContentsAffinia Group Intermediate Holdings Inc.

Notes to combined and consolidated financial statements (continued)

Supplemental Guarantor

Combining Statement of Operations

For the Eleven Months Ended November 30, 2004

(Dollars in Millions)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Parent |  |  | Issuer |  |  | Guarantor |  |  | Non-Guarantor |  |  | Eliminations |  |  | Combined

Total |

| Net sales |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | 1,251 | |  |  |  | $ | 739 | |  |  |  | $ | (56 | |  |  |  | $ | 1,934 | |

| Cost of sales |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (1,102 | |  |  |  |  | (611 | |  |  |  |  | 56 | |  |  |  |  | (1,657 | |

| Gross profit |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 149 | |  |  |  |  | 128 | |  |  |  |  | — | |  |  |  |  | 277 | |

| Selling, general and administrative expenses |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (133 | |  |  |  |  | (101 | |  |  |  |  | — | |  |  |  |  | (234 | |

| Operating profit |  |  |  |  | | |  |  |  |  | | |  |  |  |  | 16 | |  |  |  |  | 27 | |  |  |  |  | — | |  |  |  |  | 43 | |

| Other income, net |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 1 | |  |  |  |  | 3 | |  |  |  |  | — | |  |  |  |  | 4 | |

| Interest expense |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (2 | |  |  |  |  | — | |  |  |  |  | (2 | |

| Income before taxes and minority interest |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 17 | |  |  |  |  | 28 | |  |  |  |  | — | |  |  |  |  | 45 | |

| Income tax provision |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 3 | |  |  |  |  | 15 | |  |  |  |  | — | |  |  |  |  | 18 | |

| Minority interest, net |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Income from continuing operations |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 14 | |  |  |  |  | 13 | |  |  |  |  | — | |  |  |  |  | 27 | |

| Income from discontinued operations |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 1 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 1 | |

| Equity in income |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (26 | |  |  |  |  | 5 | |  |  |  |  | 21 | |  |  |  |  | — | |

| Net (loss) income |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | (11 | |  |  |  | $ | 18 | |  |  |  | $ | 21 | |  |  |  | $ | 28 | |

|

74

Table of ContentsAffinia Group Intermediate Holdings Inc.

Notes to combined and consolidated financial statements (continued)

Supplemental Guarantor

Consolidating Statement of Operations

For the One Month Ended December 31, 2004

(Dollars in Millions)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Parent |  |  | Issuer |  |  | Guarantor |  |  | Non-Guarantor |  |  | Eliminations |  |  | Consolidated

Total |

| Net sales |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | 100 | |  |  |  | $ | 59 | |  |  |  | $ | (4 | |  |  |  | $ | 155 | |

| Cost of sales |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (88 | |  |  |  |  | (53 | |  |  |  |  | 4 | |  |  |  |  | (137 | |

| Gross profit |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 12 | |  |  |  |  | 6 | |  |  |  |  | — | |  |  |  |  | 18 | |

| Selling, general and administrative expenses |  |  |  |  | — | |  |  |  |  | (1 | |  |  |  |  | (10 | |  |  |  |  | (10 | |  |  |  |  | — | |  |  |  |  | (21 | |

| Operating profit |  |  |  |  | | |  |  |  |  | (1 | |  |  |  |  | 2 | |  |  |  |  | (4 | |  |  |  |  | — | |  |  |  |  | (3 | |

| Other income, net |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 2 | |  |  |  |  | — | |  |  |  |  | 2 | |

| Interest expense |  |  |  |  | — | |  |  |  |  | (5 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (5 | |

| Income before taxes and minority interest |  |  |  |  | — | |  |  |  |  | (6 | |  |  |  |  | 2 | |  |  |  |  | (2 | |  |  |  |  | — | |  |  |  |  | (6 | |

| Income tax (benefit) provision |  |  |  |  | — | |  |  |  |  | (2 | |  |  |  |  | 1 | |  |  |  |  | (1 | |  |  |  |  | — | |  |  |  |  | (2 | |

| Minority interest, net |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Income from continuing operations |  |  |  |  | — | |  |  |  |  | (4 | |  |  |  |  | 1 | |  |  |  |  | (1 | |  |  |  |  | — | |  |  |  |  | (4 | |

| Income from discontinued operations |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Equity in income |  |  |  |  | (4 | |  |  |  |  | — | |  |  |  |  | (1 | |  |  |  |  | — | |  |  |  |  | 5 | |  |  |  |  | — | |

| Net (loss) income |  |  |  | $ | (4 | |  |  |  | $ | (4 | |  |  |  | $ | — | |  |  |  | $ | (1 | |  |  |  | $ | 5 | |  |  |  | $ | (4 | |

|

75

Table of ContentsAffinia Group Intermediate Holdings Inc.

Notes to combined and consolidated financial statements (continued)

Supplemental Guarantor

Consolidating Statement of Operations

For the Year Ended December 31, 2005

(Dollars in Millions)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Parent |  |  | Issuer |  |  | Guarantor |  |  | Non-Guarantor |  |  | Eliminations |  |  | Consolidated

Total |

| Net sales |  |  |  | $ | | |  |  |  | $ | — | |  |  |  | $ | 1,266 | |  |  |  | $ | 1,157 | |  |  |  | $ | (291 | |  |  |  | $ | 2,132 | |

| Cost of sales |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (1,065 | |  |  |  |  | (1,063 | |  |  |  |  | 291 | |  |  |  |  | (1,837 | |

| Gross profit |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 201 | |  |  |  |  | 94 | |  |  |  |  | — | |  |  |  |  | 295 | |

| Selling, general and administrative expenses |  |  |  |  | | |  |  |  |  | (46 | |  |  |  |  | (117 | |  |  |  |  | (98 | |  |  |  |  | — | |  |  |  |  | (261 | |

| Loss on disposition of Beck Arnley |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (21 | |  |  |  |  | — | |  |  |  |  | (21 | |

| Operating profit |  |  |  |  | — | |  |  |  |  | (46 | |  |  |  |  | 84 | |  |  |  |  | (25 | |  |  |  |  | — | |  |  |  |  | 13 | |

| Other income, net |  |  |  |  | — | |  |  |  |  | 1 | |  |  |  |  | 1 | |  |  |  |  | 6 | |  |  |  |  | — | |  |  |  |  | 8 | |

| Interest expense |  |  |  |  | — | |  |  |  |  | (55 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (55 | |

| Income before taxes and minority interest |  |  |  |  | — | |  |  |  |  | (100 | |  |  |  |  | 85 | |  |  |  |  | (19 | |  |  |  |  | — | |  |  |  |  | (34 | |

| Income tax (benefit) provision |  |  |  |  | — | |  |  |  |  | (44 | |  |  |  |  | 22 | |  |  |  |  | 18 | |  |  |  |  | — | |  |  |  |  | (4 | |

| Minority interest, net |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Income from continuing operations |  |  |  |  | — | |  |  |  |  | (56 | |  |  |  |  | 63 | |  |  |  |  | (37 | |  |  |  |  | — | |  |  |  |  | (30 | |

| Income from discontinued operations |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Equity interest in income |  |  |  |  | (30 | |  |  |  |  | 56 | |  |  |  |  | 11 | |  |  |  |  | 50 | |  |  |  |  | (87 | |  |  |  |  | — | |

| Net (loss) income |  |  |  | $ | (30 | |  |  |  | $ | — | |  |  |  | $ | 74 | |  |  |  | $ | 13 | |  |  |  | $ | (87 | |  |  |  | $ | (30 | |

|

76

Table of ContentsAffinia Group Intermediate Holdings Inc.

Notes to combined and consolidated financial statements (continued)

Supplemental Guarantor

Consolidating Statement of Operations

For the Year Ended December 31, 2006

(Dollars in Millions)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Parent |  |  | Issuer |  |  | Guarantor |  |  | Non-Guarantor |  |  | Eliminations |  |  | Consolidated

Total |

| Net sales |  |  |  | $ | — | |  |  |  | $ | — | |  |  |  | $ | 1,266 | |  |  |  | $ | 1,235 | |  |  |  | $ | (341 | |  |  |  | $ | 2,160 | |

| Cost of sales |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (992 | |  |  |  |  | (1,133 | |  |  |  |  | 341 | |  |  |  |  | (1,784 | |

| Gross profit |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 274 | |  |  |  |  | 102 | |  |  |  |  | — | |  |  |  |  | 376 | |

| Selling, general, and administrative expenses |  |  |  |  | — | |  |  |  |  | (63 | |  |  |  |  | (144 | |  |  |  |  | (125 | |  |  |  |  | — | |  |  |  |  | (332 | |

| Operating profit |  |  |  |  | — | |  |  |  |  | (63 | |  |  |  |  | 130 | |  |  |  |  | (23 | |  |  |  |  | — | |  |  |  |  | 44 | |

| Other income, net |  |  |  |  | — | |  |  |  |  | 73 | |  |  |  |  | (70 | |  |  |  |  | 4 | |  |  |  |  | — | |  |  |  |  | 7 | |

| Interest expense |  |  |  |  | — | |  |  |  |  | (59 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (59 | |

| Income before taxes and minority interest |  |  |  |  | — | |  |  |  |  | (49 | |  |  |  |  | 60 | |  |  |  |  | (19 | |  |  |  |  | — | |  |  |  |  | (8 | |

| Income tax (benefit) provision |  |  |  |  | — | |  |  |  |  | (9 | |  |  |  |  | — | |  |  |  |  | 6 | |  |  |  |  | — | |  |  |  |  | (3 | |

| Income from continuing operations |  |  |  |  | — | |  |  |  |  | (40 | |  |  |  |  | 60 | |  |  |  |  | (25 | |  |  |  |  | — | |  |  |  |  | (5 | |

| Income from discontinued operations |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Equity interest in income |  |  |  |  | (5 | |  |  |  |  | 40 | |  |  |  |  | 17 | |  |  |  |  | 35 | |  |  |  |  | (87 | |  |  |  |  | — | |

| Net (loss) income |  |  |  | $ | (5 | |  |  |  |  | — | |  |  |  | $ | 77 | |  |  |  | $ | 10 | |  |  |  | $ | (87 | |  |  |  | $ | (5 | |

|

77

Table of ContentsAffinia Group Intermediate Holdings Inc.

Notes to combined and consolidated financial statements (continued)

Supplemental Guarantor

Combining Statement of Cash Flows

For the Eleven Months Ended November 30, 2004

(Dollars in Millions)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Parent |  |  | Issuer |  |  | Guarantor |  |  | Non-Guarantor |  |  | Elimination |  |  | Combined

Total |

| Operating activities |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Net (loss) income |  |  | $ — |  |  | $ — |  |  |  | $ | (11 | |  |  |  | $ | 18 | |  |  |  | $ | 21 | |  |  |  | $ | 28 | |

| Adjustments to reconcile net (loss) income from continuing operations to net cash provided by (used in) operating activities: |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |  |  |  |  | | |

| Depreciation and amortization |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 21 | |  |  |  |  | 20 | |  |  |  |  | — | |  |  |  |  | 41 | |

| Impairment of assets |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 1 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 1 | |

| Deferred income taxes |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 3 | |  |  |  |  | (31 | |  |  |  |  | — | |  |  |  |  | (28 | |

| Losses (gains) on asset sales |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 1 | |  |  |  |  | (3 | |  |  |  |  | — | |  |  |  |  | (2 | |

| Equity in subsidiaries |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 26 | |  |  |  |  | (5 | |  |  |  |  | (21 | |  |  |  |  | — | |

| Change in trade accounts receivable |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 22 | |  |  |  |  | (14 | |  |  |  |  | — | |  |  |  |  | 8 | |