UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Quarterly Period Ended September 30, 2009.

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period From to .

Commission File No. 333-128166-10

Affinia Group Intermediate Holdings Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 34-2022081 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

| 1101 Technology Drive, Ann Arbor, Michigan | | 48108 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(734) 827-5400

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

(Note: As a voluntary filer not subject to the filing requirements of Section 13 or 15(d) of the Exchange Act, the registrant has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant would have been required to file such reports) as if it were subject to such filing requirements).

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There were 1,000 shares outstanding of the registrant’s common stock as of November 6, 2009 (all of which are privately owned and not traded on a public market).

Index

Affinia Group Intermediate Holdings Inc.

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements may include comments concerning our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, business trends and other information that is not historical. When used in this report, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” or future or conditional verbs, such as “will,” “should,” “could” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, management’s examination of historical operating trends and data are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there is no assurance that these expectations, beliefs and projections will be achieved. For a discussion of other risks and uncertainties that could materially affect our business financial condition or future results see Part I, “Item 7A Risk Factors” in our Annual Report on form 10-K for the year ended December 31, 2008. With respect to all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this report. Such risks, uncertainties and other important factors include, among others: the impact of the recent turmoil in the financial markets on the availability and cost of credit; financial viability of key customers and key suppliers; our substantial leverage; limitations on flexibility in operating our business contained in our debt agreements; pricing and import pressures; the shift in demand from premium to economy products; our dependence on our largest customers; changing distribution channels; increasing costs for manufactured components, raw materials, crude oil and energy; our ability to achieve cost savings from our restructuring; increased costs in imported products from low cost sources; the consolidation of distributors; risks associated with our non-U.S. operations; product liability and customer warranty and recall claims; changes to environmental and automotive safety regulations; risk of impairment to intangibles and goodwill; non-performance by, or insolvency of, our suppliers or our customers; work stoppages or similar difficulties that could significantly disrupt our operations, and other labor disputes; challenges to our intellectual property portfolio; changes in accounting standards that impact our financial statements; difficulties in developing, maintaining or upgrading information technology systems; the adequacy of our capital resources for future acquisitions; our ability to successfully combine our operations with any businesses we have acquired or may acquire; effective tax rates and timing and amounts of tax payments; and our exposure to a recession. Additionally, there may be other factors that could cause our actual results to differ materially from the forward-looking statements. Forward-looking statements are only as of the date of this report or as of the date they are made and we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

3

PART I

FINANCIAL INFORMATION

| Item 1. | Financial Statements |

Affinia Group Intermediate Holdings Inc.

Unaudited Condensed Consolidated Balance Sheets

(Dollars in Millions)

| | | | | | | | |

| | | December 31,

2008 | | | September 30,

2009 | |

Assets | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 77 | | | $ | 67 | |

Restricted cash | | | 4 | | | | 15 | |

Trade accounts receivable, less allowances of $4 million for 2008 and $3 million for 2009 | | | 312 | | | | 378 | |

Inventories, net | | | 512 | | | | 498 | |

Other current assets | | | 89 | | | | 111 | |

| | | | | | | | |

Total current assets | | | 994 | | | | 1,069 | |

Property, plant, and equipment, net | | | 208 | | | | 214 | |

Goodwill | | | 58 | | | | 54 | |

Other intangible assets, net | | | 163 | | | | 156 | |

Deferred financing costs | | | 11 | | | | 25 | |

Deferred income taxes | | | 59 | | | | 63 | |

Investments and other assets | | | 22 | | | | 28 | |

| | | | | | | | |

Total assets | | $ | 1,515 | | | $ | 1,609 | |

| | | | | | | | |

| | |

Liabilities and equity | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 274 | | | $ | 252 | |

Short-term debt | | | 14 | | | | 27 | |

Other accrued expenses | | | 148 | | | | 158 | |

Accrued payroll and employee benefits | | | 31 | | | | 35 | |

| | | | | | | | |

Total current liabilities | | | 467 | | | | 472 | |

Long-term debt | | | 608 | | | | 618 | |

Deferred employee benefits and other noncurrent liabilities | | | 24 | | | | 35 | |

| | | | | | | | |

Total liabilities | | | 1,099 | | | | 1,125 | |

| | | | | | | | |

Contingencies and commitments | | | | | | | | |

Common stock, $.01 par value, 1,000 shares authorized, issued and outstanding | | | — | | | | — | |

Additional paid-in capital | | | 411 | | | | 434 | |

Accumulated income (deficit) | | | (37 | ) | | | (27 | ) |

Accumulated other comprehensive income (loss) | | | (18 | ) | | | 33 | |

| | | | | | | | |

Total shareholder’s equity of the Company | | | 356 | | | | 440 | |

Noncontrolling interest | | | 60 | | | | 44 | |

| | | | | | | | |

Total equity | | | 416 | | | | 484 | |

| | | | | | | | |

Total liabilities and equity | | $ | 1,515 | | | $ | 1,609 | |

| | | | | | | | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

4

Affinia Group Intermediate Holdings Inc.

Unaudited Condensed Consolidated Statements of Operations

(Dollars in Millions)

| | | | | | | | | | | | | | | | |

| | | Three Months

Ended

September 30,

2008 | | | Three Months

Ended

September 30,

2009 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

Net sales | | $ | 581 | | | $ | 542 | | | $ | 1,713 | | | $ | 1,518 | |

Cost of sales | | | (463 | ) | | | (437 | ) | | | (1,400 | ) | | | (1,232 | ) |

| | | | | | | | | | | | | | | | |

Gross profit | | | 118 | | | | 105 | | | | 313 | | | | 286 | |

Selling, general and administrative expenses | | | (85 | ) | | | (84 | ) | | | (260 | ) | | | (219 | ) |

Loss on disposition of affiliate | | | — | | | | — | | | | (1 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Operating profit | | | 33 | | | | 21 | | | | 52 | | | | 67 | |

Gain on extinguishment of debt | | | — | | | | — | | | | — | | | | 8 | |

Other income, net | | | — | | | | 2 | | | | 1 | | | | 3 | |

Interest expense | | | (13 | ) | | | (24 | ) | | | (41 | ) | | | (52 | ) |

| | | | | | | | | | | | | | | | |

Income (loss) before income tax provision and equity income | | | 20 | | | | (1 | ) | | | 12 | | | | 26 | |

Income tax provision | | | 10 | | | | — | | | | 17 | | | | 11 | |

Equity in income, net of tax | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | | 10 | | | | (1 | ) | | | (5 | ) | | | 15 | |

Less: Net income attributable to noncontrolling interest, net of tax | | | — | | | | (2 | ) | | | — | | | | (5 | ) |

| | | | | | | | | | | | | | | | |

Net income (loss) attributable to the Company | | $ | 10 | | | $ | (3 | ) | | $ | (5 | ) | | $ | 10 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

5

Affinia Group Intermediate Holdings Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(Dollars in Millions)

| | | | | | | | |

| | | Nine Months Ended

September 30, 2008 | | | Nine Months Ended

September 30, 2009 | |

Operating activities | | | | | | | | |

Net income (loss) | | $ | (5 | ) | | $ | 15 | |

Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 27 | | | | 28 | |

Stock-based compensation | | | 1 | | | | 1 | |

Loss on disposition of affiliate | | | 1 | | | | — | |

Provision for deferred income taxes | | | (7 | ) | | | (4 | ) |

Gain on extinguishment of debt | | | — | | | | (8 | ) |

Write-off of unamortized deferred financing costs | | | — | | | | 5 | |

Change in trade accounts receivable | | | (46 | ) | | | (49 | ) |

Change in inventories | | | (34 | ) | | | 39 | |

Change in other current operating assets | | | (33 | ) | | | (20 | ) |

Change in other current operating liabilities | | | 94 | | | | (26 | ) |

Change in other | | | (3 | ) | | | 29 | |

| | | | | | | | |

Net cash (used in) provided by operating activities | | | (5 | ) | | | 10 | |

| | |

Investing activities | | | | | | | | |

Proceeds from sales of assets | | | 1 | | | | — | |

Proceeds from sales of affiliates | | | 6 | | | | — | |

Investment in affiliate | | | (3 | ) | | | (25 | ) |

Change in restricted cash | | | — | | | | (11 | ) |

Additions to property, plant and equipment | | | (17 | ) | | | (22 | ) |

| | | | | | | | |

Net cash used in investing activities | | | (13 | ) | | | (58 | ) |

| | |

Financing activities | | | | | | | | |

Net increase in debt of noncontrolling interest | | | — | | | | 11 | |

Payment of deferred financing costs | | | — | | | | (22 | ) |

Proceeds from Secured Notes | | | — | | | | 222 | |

Proceeds from ABL Revolver | | | — | | | | 260 | |

Payments of ABL Revolver | | | — | | | | (140 | ) |

Repayment of senior term loan facility | | | — | | | | (287 | ) |

Payment of long-term debt | | | — | | | | (10 | ) |

| | | | | | | | |

Net cash provided by financing activities | | | — | | | | 34 | |

Effect of exchange rate changes on cash | | | (1 | ) | | | 4 | |

Change in cash and cash equivalents | | | (19 | ) | | | (10 | ) |

Cash and cash equivalents at beginning of the period | | | 59 | | | | 77 | |

| | | | | | | | |

Cash and cash equivalents at end of the period | | $ | 40 | | | $ | 67 | |

| | | | | | | | |

| | |

Supplemental cash flows information | | | | | | | | |

Cash paid during the period for: | | | | | | | | |

Interest | | $ | 32 | | | $ | 39 | |

Income taxes | | $ | 24 | | | $ | 10 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

6

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Description of Business

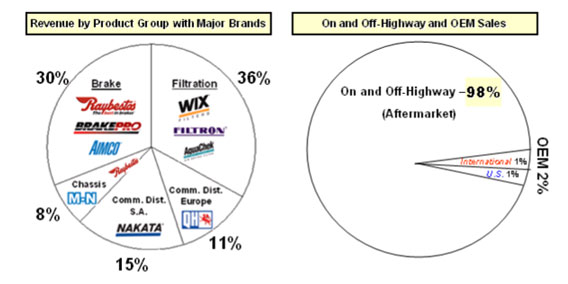

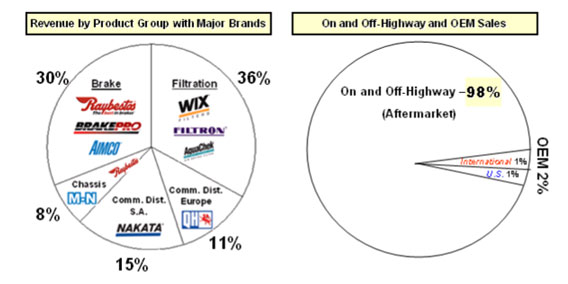

Affinia Group Inc. (“Affinia”) is a global leader in the on and off-highway replacement products and services industry. We derive approximately 98% of our sales from this industry and, as a result, are not directly affected by the market cyclicality of the automotive original equipment manufacturers. Our broad range of brake, filtration, chassis and other products are sold globally. Our brands include WIX®, Raybestos®, McQuay-Norris®, Nakata®, Filtron®, BrakePro® and Quinton Hazell®. Additionally, we provide private label offerings for NAPA®, CARQUEST®, ACDelco®, and other customers; together with co-branded offerings for Federated Auto Parts and Automotive Distribution Network. Affinia is wholly-owned by Affinia Group Intermediate Holdings Inc., which, in turn, is wholly-owned by Affinia Group Holdings Inc., a company controlled by affiliates of The Cypress Group L.L.C. (“Cypress”).

Affinia, a Delaware corporation formed on June 28, 2004, entered into a stock and asset purchase agreement, as amended (the “Purchase Agreement”), with Dana Corporation (“Dana”). The Purchase Agreement provided for the acquisition by Affinia of substantially all of Dana’s aftermarket business operations (the “Acquisition”).

Note 2. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements include the accounts of Affinia Group Intermediate Holdings Inc. and its subsidiaries. In these notes to the condensed consolidated financial statements, the terms “the Company,” “we,” “our” and “us” refer to Affinia Group Intermediate Holdings Inc. and its subsidiaries on a consolidated basis.

The interim financial information is prepared in conformity with accounting principles generally accepted in the United States of America and such principles are applied on a basis consistent with information reflected in our Form 10-K for the year ended December 31, 2008 filed with the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to the rules and regulations promulgated by the SEC. In the opinion of management, the interim financial information includes all adjustments and accruals, consisting only of normal recurring adjustments, which are necessary for a fair presentation of results for the respective interim period. We have evaluated all subsequent events through November 6, 2009, the date the financial statements were issued.

Effective January 1, 2009, we implemented Accounting Standards Codification (“ASC”) Topic 810-10 (ASC Topic 810-10, originally issued as Statement of Financial Accounting Standards (“SFAS”) No. 160, “Noncontrolling Interests in Consolidated Financial Statements, an amendment of ARB No. 51”). This standard changed the accounting for and reporting of minority interest (now called noncontrolling interest) in our consolidated financial statements. Upon adoption, certain prior period amounts have been retrospectively changed to conform to the current period financial statement presentation.

Note 3. Debt and Refinancing

On August 13, 2009 we refinanced our former term loan facility, revolving credit facility and accounts receivable facility. The refinancing consists of a new four-year $315 million asset-based revolving credit facility (the “ABL Revolver”) and $225 million of new 10.75% senior secured notes (“Secured Notes”), the proceeds of which were used to repay outstanding borrowings under our former term loan facility, revolving credit facility and accounts receivable facility, as well as to settle interest rate derivatives and to pay fees and expenses related to the refinancing. The ABL Revolver and the Secured Notes replaced our revolving credit facility, which would have otherwise matured on November 30, 2010, our former term loan facility, which would have otherwise matured on November 30, 2011, and our accounts receivables facility, which would have otherwise matured on November 30, 2009.

During the quarter we recorded a write-off of $5 million to interest expense for unamortized deferred financing costs associated with the term loan facility, revolving credit facility and the accounts receivable facility. Additionally, we recorded $22 million in total deferred financing costs related to the new ABL Revolver and the issuance of the Secured Notes. The unamortized deferred financing will be charged to interest expense over the next four years for the ABL Revolver and seven years for the Secured Notes. The following table summarizes the deferred financing activity from December 31, 2008 to September 30, 2009 (Dollars in Millions).

| | | | |

As of December 31, 2008 | | $ | 11 | |

Amortization | | | (3 | ) |

Write-off of unamortized deferred financing costs | | | (5 | ) |

Deferred financing costs | | | 22 | |

| | | | |

Balance at September 30, 2009 | | | 25 | |

| | | | |

7

The following table summarizes the debt activity from December 31, 2008 to September 30, 2009 (Dollars in Millions).

| | | | | | | | | | | |

| | | Short-

term debt | | Long-

term debt | | | Total debt | |

As of December 31, 2008 | | $ | 14 | | $ | 608 | | | $ | 622 | |

Long-term debt payment | | | — | | | (10 | ) | | | (10 | ) |

Extinguishment of debt(1) | | | — | | | (33 | ) | | | (33 | ) |

Payment of term loan | | | — | | | (287 | ) | | | (287 | ) |

Proceeds from ABL Revolver(2) | | | — | | | 260 | | | | 260 | |

Payment of ABL Revolver(2) | | | — | | | (140 | ) | | | (140 | ) |

Proceeds from Secured Notes(3) | | | — | | | 222 | | | | 222 | |

Increase (decrease) in Haimeng debt(4) | | | 13 | | | (2 | ) | | | 11 | |

| | | | | | | | | | | |

As of September 30, 2009 | | $ | 27 | | $ | 618 | | | $ | 645 | |

| | | | | | | | | | | |

| (1) | In June of 2009, Affinia Group Holdings Inc. purchased in the open market approximately $33 million principal amount of the 9% senior subordinated notes (“Subordinated Notes”) due 2014 and thereafter contributed such notes to Affinia Group Intermediate Holdings Inc. (the “Company”), who contributed such notes to Affinia Group Inc. Affinia Group Inc. promptly surrendered such purchased notes for cancellation, which resulted in a pre-tax gain on the extinguishment of debt of $8 million in the second quarter of 2009. |

| (2) | The Company and certain of its subsidiaries (“the Guarantors”) entered into a new four-year $315 million asset-based revolving credit line, which replaced the Existing Facilities and includes (i) a revolving credit facility (the “U.S. Facility”) of up to $295 million for borrowings solely to the U.S. domestic borrowers, including (a) a $40 million sub-limit for letters of credit and (b) a $30 million swingline facility, and (ii) a revolving credit facility (the “Canadian Facility”) of up to $20 million for Canadian Dollar denominated revolving loans solely to a Canadian borrower. Availability under the ABL Revolver will be based upon monthly (or more frequent under certain circumstances) borrowing base valuations of the Company’s eligible inventory and accounts receivable and will be reduced by certain reserves in effect from time to time. |

| (3) | Consists of $225 million aggregate principal amount of Secured Notes. The notes were offered at a price of 98.799% of their face value, resulting in approximately $222 million of net proceeds. The approximately $3 million discount will be amortized and included in interest expense until the notes mature. |

| (4) | During the second quarter Haimeng restructured its debt facilities and as a result short-term debt increased while long-term debt decreased. |

Note 4. Variable Interest Entity

Effective October 31, 2008, Affinia Acquisition LLC completed the purchase of 85% of the equity interests (the “Acquired Shares”) in HBM Investment Limited (“HBM”). HBM is the sole owner of Longkou Haimeng Machinery Company Limited (“Haimeng”), a drum and rotor manufacturing company located in Longkou City, China.

HBM subsequently changed its name to Affinia Hong Kong Limited. Affinia Group Holdings Inc. owned 95% of Affinia Acquisition LLC and Affinia Group Inc. owned the remaining 5% interest. Effective June 1, 2009, Affinia Group Inc. acquired an additional 35% ownership interest in Affinia Acquisition LLC for a purchase price of $25 million, which increased its ownership to 40%. Financial Accounting Standards Board Interpretation No. (“FIN”) 46R, “Consolidation of Variable Interest Entities an Interpretation of ARB No. 51”(“FIN 46”), requires the “primary beneficiary” of a variable interest entities (“VIE”) to include the VIE’s assets, liabilities and operating results in its consolidated financial statements. Based on the criteria for consolidation of VIEs, we determined that Affinia Group Inc. is deemed the primary beneficiary of Affinia Acquisition LLC. Therefore, the consolidated financial statements of the Company include Affinia Acquisition LLC and its subsidiaries. The net income attributable to the noncontrolling interest owned in Affinia Acquisition LLC was $2 million and $5 million for the third quarter of 2009 and the first nine months of 2009, respectively.

The aforementioned acquisition has been accounted for in accordance with SFAS No. 141,Business Combinations. There was only one significant adjustment, which was for $2 million, based on our valuations and purchase accounting adjustments in the first nine months of 2009. During the remainder of 2009, the Company may make further adjustments to these preliminary allocations, but these adjustments if any, are not expected to be material. Purchase price allocations are subject to adjustment until all pertinent information regarding the acquisition is obtained and fully evaluated.

8

Affinia Hong Kong Limited is reporting its financial results on a one-month reporting lag. There are no arrangements between the primary beneficiary, Affinia Group Inc., and the VIE, Affinia Acquisition LLC, that would require financial support be provided to the VIE. Additionally, the primary beneficiary has not imposed any restrictions on the VIE and there are no recourse provisions in the acquisition agreement.

Noncontrolling interest decreased to $44 million as of September 30, 2009 from $60 million as of December 31, 2008. The noncontrolling interest decreased $21 million due to acquiring an additional 35% ownership interest in Affinia Acquisition LLC offset by a $5 million increase related to the net income attributable to noncontrolling interest.

Note 5. New Accounting Pronouncements

In May 2009, the FASB issued authoritative guidance to establish general standards of accounting for, and disclosures of, events that occur after the balance sheet date but before financial statements are issued or are available to be issued. It requires the disclosure of the date through which an entity has evaluated subsequent events and the basis for that date, that is, whether that date represents the date the financial statements were issued or were available to be issued. See Footnote No. 2, “Basis of Presentation” for the related disclosures. The adoption of the new guidance in the second quarter of 2009 did not have a material affect on our financial condition, results of operations, and disclosures.

In June 2009, the FASB issued authoritative guidance that requires additional information regarding transfers of financial assets, including securitization transactions, and where companies have continuing exposure to the risks related to transferred financial assets. The concept of a “qualifying special-purpose entity,” changes the requirements for derecognizing financial assets, and requires additional disclosures. The new guidance is effective for fiscal years beginning after November 15, 2009 and is effective for us on January 1, 2010. We are currently evaluating the impact that the adoption of the new guidance may have on our financial condition, results of operations, and disclosures.

In June 2009, the FASB issued authoritative guidance that modifies how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The guidance clarifies that the determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design and a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance. The guidance requires an ongoing reassessment of whether a company is the primary beneficiary of a variable interest entity. The guidance also requires additional disclosures about a company’s involvement in variable interest entities and any significant changes in risk exposure due to that involvement. The guidance is effective for fiscal years beginning after November 15, 2009 and is effective for us on January 1, 2010. We are currently evaluating the impact that the adoption may have on our financial condition, results of operations, and disclosures.

In June 2009, the FASB approved the “FASB Accounting Standards Codification” (“Codification”) as the single source of authoritative nongovernmental U.S. GAAP to be launched on July 1, 2009. The Codification does not change current U.S. GAAP, but is intended to simplify user access to all authoritative U.S. GAAP by providing all the authoritative literature related to a particular topic in one place. All existing accounting standard documents will be superseded and all other accounting literature not included in the Codification will be considered nonauthoritative. The Codification is effective for interim and annual periods ending after September 15, 2009. The Codification is effective for us during this quarter and did not have an impact on our financial condition or results of operations, but did result in a revision to our references to generally accepted accounting principles.

9

Note 6. Inventories, net

Inventories are valued at the lower of cost or market. Cost is determined on the FIFO basis for all domestic inventories or average cost basis for non-U.S. inventories. Inventories are reduced by an allowance for slow-moving and obsolete inventories based on management’s review of on-hand inventories compared to historical and estimated future sales and usage. A summary of inventories, net is provided in the table below (Dollars in Millions):

| | | | | | |

| | | At December 31,

2008 | | At September 30,

2009 |

Raw materials | | $ | 115 | | $ | 125 |

Work-in-process | | | 42 | | | 23 |

Finished goods | | | 355 | | | 350 |

| | | | | | |

| | $ | 512 | | $ | 498 |

| | | | | | |

During the first three months of 2009, we had a change in estimate that adjusted the carrying amount of finished goods inventory. The change results from new information as defined in ASC Topic 250-10 (ASC Topic 250-10, originally issued as SFAS No. 154 “Accounting Changes and Error Corrections a replacement of APB Opinion No. 20 and FASB Statement No. 3”). Due to the recent addition of new controls and reporting processes related to certain remanufactured inventory components, we were able to more closely determine the cost of these components. The financial impact of this change in estimate increased inventory and decreased cost of sales by $3 million in the first nine months of 2009.

Note 7. Comprehensive Income

The elements of comprehensive income are presented in the following table (Dollars in Millions):

| | | | | | | | | | | | | | | | |

| | | Three Months

Ended

September 30,

2008 | | | Three Months

Ended

September 30,

2009 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

Net (loss) income | | $ | 10 | | | $ | (1 | ) | | $ | (5 | ) | | $ | 15 | |

Interest rate swap, net of tax | | | — | | | | 3 | | | | — | | | | 4 | |

Change in foreign currency translation adjustments, net of tax | | | (45 | ) | | | 26 | | | | (20 | ) | | | 47 | |

| | | | | | | | | | | | | | | | |

Comprehensive income (loss) | | | (35 | ) | | | 28 | | | | (25 | ) | | | 66 | |

Less: Comprehensive income attributable to noncontrolling interest | | | — | | | | (2 | ) | | | — | | | | (5 | ) |

| | | | | | | | | | | | | | | | |

Comprehensive income (loss) attributable to the Company | | $ | (35 | ) | | $ | 26 | | | $ | (25 | ) | | $ | 61 | |

| | | | | | | | | | | | | | | | |

Note 8. Goodwill

The goodwill relates to the initial acquisition in 2004, as described in Note 1, the acquisition of Affinia Hong Kong Limited, as described in Note 4, in 2008 and a minor acquisition in the second quarter of 2008. For the 2004 acquisition, the tax benefit for the excess of tax-deductible goodwill over the reported amount of goodwill is applied to first reduce the goodwill related to the Acquisition, in accordance with ASC Topic 805-740 (ASC Topic 805-740, originally issued as SFAS No. 109, “Accounting for Income Taxes”). The tax benefit for the excess of tax deductible goodwill reduced reported goodwill by approximately $9 million during 2008 to $26 million at the end of 2008 and $6 million during the first nine months of 2009. We anticipate goodwill being reduced by another $3 million during the fourth quarter of 2009. Once the reported amount of goodwill for the 2004 acquisition is reduced to zero, the remaining tax benefit reduces the basis of intangible assets purchased in the 2004 acquisition. Any remaining tax benefit reduces the income tax provision.

In conjunction with the acquisition of Affinia Hong Kong Limited, we determined the fair value of intangibles, property, plant and equipment, other assets and liabilities. Based on our valuations and purchase accounting adjustments, we recorded $30 million as goodwill at the end of 2008 and we have increased goodwill by $2 million in the first nine months of 2009.

During the second quarter of 2008, we purchased the remaining 40% interest in Wix Helsa Company. The purchase price exceeded the fair value of the assets and the liabilities acquired by approximately $2 million, which was recorded to goodwill.

10

The following table summarizes goodwill activity, which is related to the On and Off-Highway segment for the first nine months of 2009 (Dollars in Millions):

| | | | |

| | | Nine Months

Ended

September 30,

2009 | |

Balance at December 31, 2008 | | $ | 58 | |

Tax benefit reduction | | | (6 | ) |

Other | | | 2 | |

| | | | |

Balance at September 30, 2009 | | $ | 54 | |

| | | | |

Note 9. Commitments and Contingencies

At September 30, 2009, the Company had purchase commitments for property, plant and equipment of approximately $2 million.

A reconciliation of the changes in our return reserves is as follows (Dollars in Millions):

| | | | | | | | |

| | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

Beginning balance | | $ | 20 | | | $ | 18 | |

Amounts charged to expense | | | 48 | | | | 44 | |

Returns processed | | | (47 | ) | | | (43 | ) |

| | | | | | | | |

| | $ | 21 | | | $ | 19 | |

| | | | | | | | |

Note 10. Income Taxes

The total amount of unrecognized tax benefits as of December 31, 2008 and September 30, 2009 was $2 million, and if recognized, would affect the effective tax rate. The Company recognizes interest related to unrecognized tax benefits in interest expense and recognizes penalties as part of the income tax provision. As of September 30, 2009 the Company’s accrual for interest and penalties was less than $1 million. The Company is subject to taxation in the U.S. and various state and foreign jurisdictions. For jurisdictions in which the Company transacts significant business, tax years ended December 31, 2004 and later remain subject to examination by tax authorities. We do not anticipate any material change in the total amount of unrecognized tax benefits to occur within the next twelve months. The effective tax rate was 42% and 142% for the first nine months of 2009 and 2008, respectively. The effective tax rate was much higher in 2008 due to the valuation entity losses in 2008 and a one time reorganization cost in 2008. There are certain entities within our Commercial Distribution Europe segment that cannot utilize net losses so we are unable to recognize a tax benefit related to those entities. The valuation entity losses were significantly higher in 2008 due to the restructuring activities in our Commercial Distribution Europe segment.

Note 11. Legal Proceedings

On March 31, 2008, a class action lawsuit was filed by S&E Quick Lube Distributors, Inc. of Utah against several auto parts manufacturers for allegedly conspiring to fix prices for replacement oil, air, fuel and transmission filters. Several auto parts companies are named as defendants, including Champion Laboratories, Inc., Purolator Filters NA LLC, Honeywell International Inc., Cummins Filtration Inc., Donaldson Company, Baldwin Filters Inc., Bosch USA., Mann + Hummel USA Inc., ArvinMeritor Inc., United Components Inc. and WIX Filtration Corp LLC (“Wix”), a subsidiary of Affinia. The lawsuit was filed in US District Court for the District of Connecticut and seeks damages and injunctive relief on behalf of a nationwide class of direct purchasers of filters. Since this initial complaint was filed, over 56 “tag-along” suits in multiple jurisdictions have been filed on behalf of both direct and indirect purchasers of automotive filtration products. Two suits have also been filed in the Canadian provinces of Ontario and Quebec. As a result, all U.S. lawsuits have been consolidated in a Multi-District Litigation Proceeding in Chicago, IL. Wix, along with other named defendants, filed various motions to dismiss Plaintiffs’ complaints that are under consideration by the court. Affinia believes that Wix did not have significant sales in this particular market at the relevant time periods so we currently expect any potential exposure to be immaterial. Additionally, as of April 2009, the Florida Attorney General’s office had filed a tag along suit also naming Wix as a defendant.

11

The Company has various accruals for civil product liability and other costs. If there is a range of equally probable outcomes, we accrue at the lower end of the range. The Company had $1 million accrued as of December 31, 2008 and September 30, 2009. There are no recoveries expected from third parties.

Note 12. Restructuring of Operations

In 2005, we announced two restructuring plans: (i) a restructuring plan that we announced at the beginning of 2005 as part of the Acquisition, also referred to herein as the acquisition restructuring and (ii) a restructuring plan that we announced at the end of 2005, also referred to herein as the comprehensive restructuring. We have completed the acquisition restructuring and we are continuing the comprehensive restructuring program. We have closed 44 facilities in the last four years. The following chart summarizes the timing of the significant comprehensive restructuring activity to date:

| | | | |

Facility | | Closure

Announcement Date | | Date Closed |

Southampton (UK) | | December 2005 | | 2nd Qtr. 2006 |

Erie (PA) | | March 2006 | | 4th Qtr. 2006 |

North East (PA) | | March 2006 | | 4th Qtr. 2006 |

McHenry (IL) | | March 2006 | | 4th Qtr. 2006 |

Nuneaton (UK) | | May 2006 | | 3rd Qtr. 2007 |

St. Catharines (ON, Canada) | | June 2006 | | 4th Qtr. 2006 |

Cambridge (ON, Canada) | | September 2006 | | 1st Qtr. 2007 |

Cuba (MO) | | October 2006 | | 2nd Qtr. 2007 |

Mississauga (ON, Canada) | | November 2006 | | 4th Qtr. 2006 |

Sudbury (ON, Canada) | | March 2007 | | 2nd Qtr. 2007 |

Mishawaka (IN) | | October 2007 | | 2nd Qtr. 2008 |

El Talar (Argentina) | | April 2008 | | 2nd Qtr. 2008 |

Barcelona (Spain) | | May 2008 | | 4th Qtr. 2008 |

Litchfield (IL) | | June 2008 | | Open |

Dallas (TX) | | June 2008 | | 2nd Qtr. 2009 |

Milton (ON, Canada) | | June 2008 | | Open |

Brownhills (UK) | | May 2008 | | 3rd Qtr. 2008 |

Balatas Plant in Mexico City (Mexico) | | December 2008 | | 2nd Qtr. 2009 |

In connection with the comprehensive restructuring, we recorded $150 million in restructuring costs to date. The restructuring costs were recorded in selling, general and administrative expense and cost of sales and are disclosed by year in the chart below (Dollars in Millions).

| | | | | | | | | |

| | | Selling, General

and

Administrative

Expenses | | Cost of Sales | | Total |

2005 | | $ | 2 | | $ | 21 | | $ | 23 |

2006 | | | 39 | | | 1 | | | 40 |

2007 | | | 35 | | | 3 | | | 38 |

2008 | | | 39 | | | 1 | | | 40 |

First nine months of 2009 | | | 8 | | | 1 | | | 9 |

| | | | | | | | | |

Total | | $ | 123 | | $ | 27 | | $ | 150 |

| | | | | | | | | |

These charges consist of employee termination costs, other exit costs and impairment costs. Severance costs are being accounted for in accordance with ASC Topic 420-10 (ASC Topic 420-10, originally issued as SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities”) and ASC Topic 712-10 (ASC Topic 712-10, originally issued SFAS No. 112, “Employers’ Accounting for Postemployment Benefits —an amendment of FASB Statements No. 5 and 43.”)

As of the end of 2008, we have announced all the expected comprehensive restructuring activity. We forecast that the comprehensive restructuring program will result in approximately $162 million in restructuring costs, which exceeds preliminary expectations of $152 million. We anticipate that we will incur approximately $12 million more in restructuring costs during 2009 and 2010 completing the closure of the previously announced facilities.

The Company also continues to expect that the major components of such costs will be employee severance costs, asset impairment charges, and other costs (i.e. moving costs, environmental remediation, site clearance and repair costs) each of which we expect to represent approximately 44%, 18% and 38% respectively, of the total cost of the comprehensive restructuring program.

12

The following summarizes the restructuring charges and activity for all the Company’s restructuring programs (Dollars in Millions):

| | | | | | | |

Balance at December 31, 2008 | | | | | $ | 11 | |

Charges to expense: | | | | | | | |

Asset write-offs expense | | 1 | | | | | |

Other expenses | | 8 | | | | | |

| | | | | | | |

Total restructuring expenses | | 9 | | | | | |

Cash payments and asset write-offs: | | | | | | | |

Cash payments | | (11 | ) | | | | |

Asset retirements and other | | (1 | ) | | | | |

| | | | | | | |

Total cash payments and asset write-offs | | (12 | ) | | | | |

Total activity for the first nine months of 2009 | | | | | | (3 | ) |

| | | | | | | |

Balance at September 30, 2009 | | | | | $ | 8 | |

| | | | | | | |

At September 30, 2009, $8 million of restructuring charges remained in other accrued expenses, relating to wage and healthcare continuation for severed employees and other termination costs. These remaining benefits are expected to be paid during 2009 and 2010. The following table shows the restructuring expenses by segment (Dollars in Millions):

| | | | | | | | | | | | |

| | | Three Months

Ended

September 30,

2008 | | Three Months

Ended

September 30,

2009 | | Nine Months

Ended

September 30,

2008 | | Nine Months

Ended

September 30,

2009 |

On and Off-highway segment | | $ | 2 | | $ | 3 | | $ | 14 | | $ | 4 |

Commercial Distribution European segment | | | — | | | — | | | 11 | | | 1 |

Brake South America segment | | | 1 | | | 1 | | | 6 | | | 1 |

Corporate, eliminations and other | | | — | | | 2 | | | 1 | | | 3 |

| | | | | | | | | | | | |

| | $ | 3 | | $ | 6 | | $ | 32 | | $ | 9 |

| | | | | | | | | | | | |

Note 13. Segment and Geographic Information

The products, customer base, distribution channel, manufacturing process, and procurement are similar throughout all of the Company’s operations. However, due to different economic characteristics in the Company’s operations we have a Commercial Distribution European Segment, a Brake South America Segment and a third segment that includes multiple operating segments aggregated into one reportable business segment. All three segments are in the On and Off-highway industry but for segment reporting purposes we refer to the third segment as the On and Off-highway Segment. Segment net sales, operating profit, total assets, depreciation and capital expenditures were as follows (Dollars in Millions):

| | | | | | | | | | | | | | | | |

| | | Net Sales | |

| | | Three Months

Ended

September 30,

2008 | | | Three Months

Ended

September 30,

2009 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

On and Off-Highway segment | | $ | 514 | | | $ | 479 | | | $ | 1,496 | | | $ | 1,340 | |

Commercial Distribution European segment | | | 65 | | | | 63 | | | | 211 | | | | 176 | |

Brake South America segment | | | 6 | | | | 5 | | | | 22 | | | | 16 | |

Corporate, eliminations and other | | | (4 | ) | | | (5 | ) | | | (16 | ) | | | (14 | ) |

| | | | | | | | | | | | | | | | |

| | $ | 581 | | | $ | 542 | | | $ | 1,713 | | | $ | 1,518 | |

| | | | | | | | | | | | | | | | |

13

| | | | | | | | | | | | | | | | |

| | | Operating Profit | |

| | | Three Months

Ended

September 30,

2008 | | | Three Months

Ended

September 30,

2009 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

On and Off-Highway segment | | $ | 50 | | | $ | 36 | | | $ | 104 | | | $ | 100 | |

Commercial Distribution European segment | | | (2 | ) | | | (2 | ) | | | (15 | ) | | | (3 | ) |

Brake South America segment | | | (2 | ) | | | (1 | ) | | | (9 | ) | | | (2 | ) |

Corporate, eliminations and other | | | (13 | ) | | | (12 | ) | | | (28 | ) | | | (28 | ) |

| | | | | | | | | | | | | | | | |

| | $ | 33 | | | $ | 21 | | | $ | 52 | | | $ | 67 | |

| | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | Total Assets | |

| | | | | | | | | December 31,

2008 | | | September 30,

2009 | |

On and Off-Highway segment | | | | | | | | | | $ | 1,327 | | | $ | 1,474 | |

Commercial Distribution European segment | | | | | | | | | | | 120 | | | | 103 | |

Brake South America segment | | | | | | | | | | | 6 | | | | 3 | |

Corporate, eliminations and other | | | | | | | | | | | 62 | | | | 29 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | $ | 1,515 | | | $ | 1,609 | |

| | | | | | | | | | | | | | | | |

| |

| | | Depreciation and Amortization | |

| | | Three Months

Ended

September 30,

2008 | | | Three Months

Ended

September 30,

2009 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

On and Off-Highway segment | | $ | 5 | | | $ | 7 | | | $ | 15 | | | $ | 18 | |

Commercial Distribution European segment | | | 1 | | | | — | | | | 2 | | | | 1 | |

Brake South America segment | | | 1 | | | | 1 | | | | 1 | | | | 1 | |

Corporate, eliminations and other | | | 3 | | | | 2 | | | | 9 | | | | 8 | |

| | | | | | | | | | | | | | | | |

| | $ | 10 | | | $ | 10 | | | $ | 27 | | | $ | 28 | |

| | | | | | | | | | | | | | | | |

| |

| | | Capital Expenditures | |

| | | Three Months

Ended

September 30,

2008 | | | Three Months

Ended

September 30,

2009 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

On and Off-Highway segment | | $ | 5 | | | $ | 9 | | | $ | 14 | | | $ | 19 | |

Commercial Distribution European segment | | | — | | | | — | | | | 1 | | | | 2 | |

Brake South America segment | | | — | | | | — | | | | 1 | | | | 1 | |

Corporate, eliminations and other | | | — | | | | — | | | | 1 | | | | — | |

| | | | | | | | | | | | | | | | |

| | $ | 5 | | | $ | 9 | | | $ | 17 | | | $ | 22 | |

| | | | | | | | | | | | | | | | |

|

| Net sales by geographic region were as follows (Dollars in Millions): | |

| | | | |

| | | Three Months

Ended

September 30,

2008 | | | Three Months

Ended

September 30,

2009 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

United States | | $ | 295 | | | $ | 260 | | | $ | 887 | | | $ | 764 | |

Canada | | | 41 | | | | 27 | | | | 117 | | | | 79 | |

Brazil | | | 107 | | | | 91 | | | | 286 | | | | 224 | |

Other Countries | | | 138 | | | | 164 | | | | 423 | | | | 451 | |

| | | | | | | | | | | | | | | | |

| | $ | 581 | | | $ | 542 | | | $ | 1,713 | | | $ | 1,518 | |

| | | | | | | | | | | | | | | | |

14

Long-lived assets by geographic region were as follows (Dollars in Millions):

| | | | | | |

| | | December 31,

2008 | | September 30,

2009 |

United States | | $ | 284 | | $ | 288 |

Canada | | | 14 | | | 12 |

Brazil | | | 6 | | | 8 |

China | | | 78 | | | 80 |

Other Countries | | | 58 | | | 61 |

| | | | | | |

| | $ | 440 | | $ | 449 |

| | | | | | |

Net sales by geographic region were determined based on origin of sale. Geographic data on long-lived assets are comprised of property, plant and equipment, goodwill, other intangible assets and deferred financing costs.

We offer primarily three types of products: brake products, which include brake drums, rotors, pads and shoes and hydraulic brake system components; filtration products, which include oil, fuel, air and other filters; and chassis products, which include steering, suspension and driveline components. Additionally, we have our Commercial Distribution South America products and Commercial Distribution European products, which offer brake, chassis, filtration and other products. The Commercial Distribution European products include our Quinton Hazell European parts operation. Quinton Hazell designs, manufactures, purchases and distributes a wide range of aftermarket replacement motor vehicle components for customers throughout Europe, primarily under the Quinton Hazell brand name. Brake products are segregated below into Brake North America and Asia products and Brake South America products. The Company’s sales by group of similar products are as follows:

| | | | | | | | | | | | | | | | |

| | | Three Months

Ended

September 30,

2008 | | | Three Months

Ended

September 30,

2009 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

Filtration products | | $ | 192 | | | $ | 186 | | | $ | 572 | | | $ | 541 | |

Brake North America and Asia products | | | 172 | | | | 160 | | | | 512 | | | | 451 | |

Commercial Distribution South America products | | | 110 | | | | 94 | | | | 294 | | | | 232 | |

Commercial Distribution European products | | | 65 | | | | 63 | | | | 211 | | | | 176 | |

Chassis products | | | 40 | | | | 39 | | | | 118 | | | | 116 | |

Brake South America products | | | 6 | | | | 5 | | | | 22 | | | | 16 | |

Corporate, eliminations and other | | | (4 | ) | | | (5 | ) | | | (16 | ) | | | (14 | ) |

| | | | | | | | | | | | | | | | |

| | $ | 581 | | | $ | 542 | | | $ | 1,713 | | | $ | 1,518 | |

| | | | | | | | | | | | | | | | |

Note 14. Stock Option Plans

On July 20, 2005, we adopted a stock incentive plan with a maximum of 227,000 shares of common stock subject to awards. As of September 30, 2009, 176,613 shares had been awarded, which included vested shares of 77,956 and 98,657 unvested shares. Additionally, at September 30, 2009, there were 50,387 shares available for future stock option grants. Pursuant to the terms of the stock incentive plan, each option expires August 1, 2015. One-half of the options vest based on the performance of the Company and the remaining portion vests at the end of each year ratably over the period from the year of the grant until December 31, 2009. The exercise price is $100 per option.

We account for our employee stock options under the fair value method of accounting using a Black-Scholes model to measure stock-based compensation expense at the date of grant. Dividend yields were not a factor because there were no cash dividends declared during 2008 and the first nine months of 2009. Our weighted-average Black-Scholes fair value assumptions include:

| | | | | | | | |

| | | 2008 | | | 2009 | |

Weighted-average effective term | | | 5.2 years | | | | 5.2 years | |

Weighted-average risk free interest rate | | | 4.35 | % | | | 4.33 | % |

Weighted-average expected volatility | | | 40.1 | % | | | 40.8 | % |

Weighted-average fair value of options (Dollars in millions) | | $ | 7 | | | $ | 7 | |

15

The fair value of the stock option grants is amortized to expense over the vesting period. The Company reduces the overall compensation expense by a turnover rate consistent with historical trends. Stock-based compensation expense, which was recorded in selling, general and administrative expenses, and related income tax benefits were less than $1 million for each of the nine month periods ending September 30, 2008 and 2009. A summary of our stock-based compensation activity for the year ended December 31, 2008 and the nine months ended September 30, 2009 is presented below:

| | | |

Outstanding at December 31, 2007 | | 217,510 | |

Granted | | 9,500 | |

Forfeited/expired | | (45,225 | ) |

| | | |

Outstanding at December 31, 2008 | | 181,785 | |

Granted | | 1,500 | |

Forfeited/expired | | (6,672 | ) |

| | | |

Balance at September 30, 2009 | | 176,613 | |

| | | |

We also have a Deferred Compensation and Stock Award Plan (“Stock Plan”), which commenced with its first activity in the third quarter of 2009. The Stock Plan provides executives and certain employees with a deferred incentive compensation opportunity and a 25% company match. The matching contributions vest in full on the last day of the second calendar year following the calendar year in which such hypothetical shares are first credited to the Participant’s Share Account. We recorded less than $1 million related to this plan in the current quarter. Participant’s Share Accounts were credited with 7,153 of hypothetical shares in the third quarter of 2009.

Note 15. Derivatives

The Company’s financial derivative assets and liabilities consist of standard currency forward contracts and “plain-vanilla” interest rate swaps. The fair value framework requires the categorization of assets and liabilities into three levels based upon the assumptions (inputs) used to price the assets or liabilities. Level 1 provides the most reliable measure of fair value, whereas Level 3 generally requires significant management judgment. The three levels are defined as follows:

| | • | | Level 1: Unadjusted quoted prices in active markets for identical assets and liabilities. |

| | • | | Level 2: Observable inputs other than those included in Level 1. For example, quoted prices for similar assets or liabilities in active markets or quoted prices for identical assets or liabilities in inactive markets. |

| | • | | Level 3: Unobservable inputs reflecting management’s own assumptions about the inputs used in pricing the asset or liability. |

The fair value measurements of the Company’s interest rate and the currency derivatives are based upon Level 2 inputs consisting of observable current market data pertaining to relevant interest and currency exchange rates, as reported by a recognized independent third-party financial information provider. Based upon the Company’s periodic assessment of the creditworthiness of its derivative transactions counterparties, neither the currency nor the interest rate derivative instruments’ fair value measurements are adjusted for incremental counterparty credit risk.

Currency Rate Derivatives

The Company transacts business in multiple currencies in various international markets. Therefore, our reported results from operations and financial position are vulnerable to several forms of risk related to currency exchange rate volatility. The Company’s use of currency rate derivatives (currency forward contracts) is limited to transactions intended to mitigate reported currency gains and losses arising from the periodic re-measurement of monetary assets and liabilities denominated in a non-local currency. Our policy does not require hedging each individual exposure that may give rise to currency gain or loss. However, our practice has been to execute hedge transactions in notional amounts that would be reasonably expected to result in gains and losses that approximately offset expected gains and losses arising from specific underlying net currency exposures. Our policy strictly prohibits the use of currency rate derivatives to generate trading profits or to otherwise speculate on currency rate movements.

Our currency forward transactions are undesignated hedges and are, therefore, not eligible for hedge accounting treatment. The Company’s outstanding currency forward contracts are recorded in the Consolidated Balance Sheets as “Other current assets” or “Other accrued expenses”, accordingly. Currency derivative gains and losses are recognized in “Other income, net” in the Consolidated Statements of Operations in the reporting period of occurrence. The Company has not recorded currency derivative gains (losses) to other comprehensive income (loss) nor has it reclassified prior period currency derivative results from other comprehensive income to earning during the last twelve months. The Company does not anticipate that it will record any currency derivative gains or losses to other comprehensive income (loss) or that it will reclassify prior period currency derivative results from other comprehensive income (loss) to earnings in the next twelve months.

16

The notional amount and fair value of our outstanding currency forward contracts were as follows (Dollars in millions):

| | | | | | | | | |

| | | Notional Amount | | Asset Derivative | | Liability Derivative |

As of September 30, 2009 | | $ | 132 | | $ | 2 | | $ | 1 |

As of December 31, 2008 | | $ | 146 | | $ | 3 | | $ | 2 |

Interest Rate Derivatives

Concurrent with its recent debt refinancing, the Company terminated its previously reported interest rate swap transactions on August 17, 2009. In accordance with hedge accounting requirements set forth in ASC Topic 815 (ASC Topic 815, originally issued as SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities”), the Company recognized a $4 million loss upon settlement of these transactions that had been previously deferred in other comprehensive income (loss). As of September 30, 2009, the Company had no outstanding interest rate derivative balances nor was there any gains (losses) deferred in other comprehensive income associated with terminated interest rate derivative transactions.

The notional amount and fair value of interest rate swaps outstanding are as follows (Dollars in millions):

| | | | | | |

| | | Notional Amount | | Fair Value |

As of September 30, 2009 | | $ | — | | $ | — |

As of December 31, 2008 | | $ | 150 | | $ | 7 Liability |

Note 16. Related Party Transaction

Affinia Group Inc. is wholly-owned by Affinia Group Intermediate Holdings Inc., which, in turn, is wholly-owned by Affinia Group Holdings Inc., a company controlled by affiliates of Cypress. Cypress charged Affinia Group Inc. $3 million in the third quarter of 2009, which consisted of a management fee for services related to the refinancing and other advisory services. This amount was included in selling, general, and administrative expenses.

Note 17. Financial Information for Guarantors and Non-Guarantors

Affinia Group Intermediate Holdings Inc. (presented as Parent in the following schedules), through its 100%-owned subsidiary, Affinia Group Inc. (presented as Issuer in the following schedules), issued the Secured Notes on August 13, 2009 in the principal amount of $225 million and Subordinated Notes on November 30, 2004 in the principal amount of $300 million. As of September 30, 2009 there were $267 million and $225 million of Subordinated Notes and Secured Notes outstanding, respectively. The notes were offered only to qualified institutional buyers and certain persons in offshore transactions.

The Secured Notes are fully, unconditionally and jointly and severally guaranteed on a senior secured basis and the Subordinated Notes are fully, unconditionally and jointly and severally guaranteed on an unsecured senior subordinated basis. The Subordinated Notes are general obligations of the Issuer and guaranteed by the Parent and all of the Issuer’s wholly owned current and future domestic subsidiaries (the “Guarantors”). The Issuer’s obligations under the Secured Notes are guaranteed by the Guarantors and are secured by first-priority liens, subject to permitted liens and exceptions for excluded assets, on substantially all of the Issuers and the Guarantors’ tangible and intangible assets (excluding the ABL Collateral as defined below), including real property, fixtures and equipment owned or acquired in the future by the Issuer and the Guarantors (the “Non-ABL Collateral”) and are secured by second-priority liens on all accounts receivable, inventory, cash, deposit accounts, securities accounts and proceeds of the foregoing and certain assets related thereto held by the Issuer and the Guarantors, which constitute collateral under the ABL Revolver on a first-priority basis (the “ABL Collateral”).

The following unaudited information presents Condensed Consolidating Statements of Operations for the three and nine months ended September 30, 2008 and 2009, Condensed Consolidating Statements of Cash Flows for the nine months ended September 30, 2008 and 2009 and Condensed Consolidating Balance Sheets as of December 31, 2008 and September 30, 2009 of (1) the Parent, (2) the Issuer, (3) the Guarantors, (4) the Non-Guarantors, and (5) eliminations to arrive at the information for the Company on a consolidated basis. Other separate financial statements and other disclosures concerning the Parent and the Guarantors are not presented because management does not believe that such information is material to investors.

17

Affinia Group Intermediate Holdings Inc.

Supplemental Guarantor

Condensed Consolidating Balance Sheet

December 31, 2008

(Dollars in Millions)

| | | | | | | | | | | | | | | | | | | | |

| | | Parent | | Issuer | | | Guarantor | | Non-Guarantor | | Eliminations | | | Consolidated

Total |

Assets | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | — | | $ | 59 | | | $ | — | | $ | 18 | | $ | — | | | $ | 77 |

Restricted cash | | | — | | | — | | | | — | | | 4 | | | — | | | | 4 |

Trade accounts receivable | | | — | | | 31 | | | | 155 | | | 126 | | | — | | | | 312 |

Inventories, net | | | — | | | — | | | | 314 | | | 198 | | | — | | | | 512 |

Other current assets | | | — | | | 47 | | | | 1 | | | 41 | | | — | | | | 89 |

| | | | | | | | | | | | | | | | | | | | |

Total current assets | | | — | | | 137 | | | | 470 | | | 387 | | | — | | | | 994 |

Investments and other assets | | | — | | | 218 | | | | 76 | | | 19 | | | — | | | | 313 |

Intercompany investments | | | 356 | | | 1,068 | | | | 347 | | | — | | | (1,771 | ) | | | — |

Intercompany receivables | | | — | | | (332 | ) | | | 275 | | | 57 | | | — | | | | — |

Property, plant and equipment, net | | | — | | | 9 | | | | 95 | | | 104 | | | — | | | | 208 |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 356 | | $ | 1,100 | | | $ | 1,263 | | $ | 567 | | $ | (1,771 | ) | | $ | 1,515 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Liabilities and Equity | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | — | | $ | 13 | | | $ | 156 | | $ | 105 | | $ | — | | | $ | 274 |

Short-term debt | | | — | | | — | | | | — | | | 14 | | | — | | | | 14 |

Accrued payroll and employee benefits | | | — | | | 6 | | | | 4 | | | 21 | | | — | | | | 31 |

Other accrued expenses | | | — | | | 59 | | | | 31 | | | 58 | | | — | | | | 148 |

| | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | — | | | 78 | | | | 191 | | | 198 | | | — | | | | 467 |

Deferred employee benefits and noncurrent liabilities | | | — | | | 14 | | | | — | | | 10 | | | — | | | | 24 |

Long-term debt | | | — | | | 597 | | | | — | | | 11 | | | — | | | | 608 |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | — | | | 689 | | | | 191 | | | 219 | | | — | | | | 1,099 |

Total shareholder’s equity of the company | | | 356 | | | 356 | | | | 1,067 | | | 348 | | | (1,771 | ) | | | 356 |

Noncontrolling interest | | | — | | | 55 | | | | 5 | | | — | | | — | | | | 60 |

| | | | | | | | | | | | | | | | | | | | |

Total equity | | | 356 | | | 411 | | | | 1,072 | | | 348 | | | (1,771 | ) | | | 416 |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and equity | | $ | 356 | | $ | 1,100 | | | $ | 1,263 | | $ | 567 | | $ | (1,771 | ) | | $ | 1,515 |

| | | | | | | | | | | | | | | | | | | | |

18

Affinia Group Intermediate Holdings Inc.

Supplemental Guarantor

Condensed Consolidating Balance Sheet

September 30, 2009

(Dollars in Millions)

| | | | | | | | | | | | | | | | | | | | |

| | | Parent | | Issuer | | | Guarantor | | Non-Guarantor | | Eliminations | | | Consolidated

Total |

Assets | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | — | | $ | 10 | | | $ | — | | $ | 57 | | $ | — | | | $ | 67 |

Restricted cash | | | — | | | — | | | | — | | | 15 | | | — | | | | 15 |

Trade accounts receivable | | | — | | | 28 | | | | 187 | | | 163 | | | — | | | | 378 |

Inventories, net | | | — | | | — | | | | 266 | | | 232 | | | — | | | | 498 |

Other current assets | | | — | | | 47 | | | | 3 | | | 61 | | | — | | | | 111 |

| | | | | | | | | | | | | | | | | | | | |

Total current assets | | | — | | | 85 | | | | 456 | | | 528 | | | — | | | | 1,069 |

Investments and other assets | | | — | | | 230 | | | | 16 | | | 80 | | | — | | | | 326 |

Intercompany investments | | | 440 | | | 1,172 | | | | 484 | | | — | | | (2,096 | ) | | | — |

Intercompany receivables | | | — | | | (316 | ) | | | 286 | | | 30 | | | — | | | | — |

Property, plant and equipment, net | | | — | | | 5 | | | | 99 | | | 110 | | | — | | | | 214 |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 440 | | $ | 1,176 | | | $ | 1,341 | | $ | 748 | | $ | (2,096 | ) | | $ | 1,609 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Liabilities and Equity | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | — | | $ | 15 | | | $ | 124 | | $ | 113 | | $ | — | | | $ | 252 |

Short-term debt | | | — | | | — | | | | — | | | 27 | | | — | | | | 27 |

Accrued payroll and employee benefits | | | — | | | 9 | | | | 10 | | | 16 | | | — | | | | 35 |

Other accrued expenses | | | — | | | 45 | | | | 35 | | | 78 | | | — | | | | 158 |

| | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | — | | | 69 | | | | 169 | | | 234 | | | — | | | | 472 |

Deferred employee benefits and noncurrent liabilities | | | — | | | 14 | | | | — | | | 21 | | | — | | | | 35 |

Long-term debt | | | — | | | 609 | | | | — | | | 9 | | | — | | | | 618 |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | — | | | 692 | | | | 169 | | | 264 | | | — | | | | 1,125 |

Total shareholder’s equity of the company | | | 440 | | | 446 | | | | 1,166 | | | 484 | | | (2,096 | ) | | | 440 |

Noncontrolling interest | | | — | | | 38 | | | | 6 | | | — | | | — | | | | 44 |

| | | | | | | | | | | | | | | | | | | | |

Total equity | | | 440 | | | 484 | | | | 1,172 | | | 484 | | | (2,096 | ) | | | 484 |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and equity | | $ | 440 | | $ | 1,176 | | | $ | 1,341 | | $ | 748 | | $ | (2,096 | ) | | $ | 1,609 |

| | | | | | | | | | | | | | | | | | | | |

19

Affinia Group Intermediate Holdings Inc.

Supplemental Guarantor

Condensed Consolidating Statement of Operations

For the Three Months Ended September 30, 2008

(Dollars in Millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Parent | | Issuer | | | Guarantor | | | Non-Guarantor | | | Eliminations | | | Consolidated

Total | |

Net sales | | $ | — | | $ | (1 | ) | | $ | 301 | | | $ | 358 | | | $ | (77 | ) | | $ | 581 | |

Cost of sales | | | — | | | — | | | | (220 | ) | | | (320 | ) | | | 77 | | | | (463 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | — | | | (1 | ) | | | 81 | | | | 38 | | | | — | | | | 118 | |

Selling, general and administrative expenses | | | — | | | (11 | ) | | | (37 | ) | | | (37 | ) | | | — | | | | (85 | ) |

Loss on disposition of affiliate | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) profit | | | — | | | (12 | ) | | | 44 | | | | 1 | | | | — | | | | 33 | |

Other income (loss), net | | | — | | | 5 | | | | (6 | ) | | | 1 | | | | — | | | | — | |

Interest expense | | | — | | | (13 | ) | | | — | | | | — | | | | — | | | | (13 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income before taxes and equity income | | | — | | | (20 | ) | | | 38 | | | | 2 | | | | — | | | | 20 | |

Income tax provision | | | — | | | — | | | | — | | | | 10 | | | | — | | | | 10 | |

Equity interest in income, net of tax | | | 10 | | | 30 | | | | 25 | | | | 16 | | | | (81 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income | | | 10 | | | 10 | | | | 63 | | | | 8 | | | | (81 | ) | | | 10 | |

Less: Net income attributable to noncontrolling interest, net of tax | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to the company | | $ | 10 | | $ | 10 | | | $ | 63 | | | $ | 8 | | | $ | (81 | ) | | $ | 10 | |

| | | | | | | | | | | | | | | | | | | | | | | |

20

Affinia Group Intermediate Holdings Inc.

Supplemental Guarantor

Condensed Consolidating Statement of Operations

For the Nine Months Ended September 30, 2008

(Dollars in Millions)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Parent | | | Issuer | | | Guarantor | | | Non-Guarantor | | | Eliminations | | | Consolidated

Total | |

Net sales | | $ | — | | | $ | (1 | ) | | $ | 892 | | | $ | 1,053 | | | $ | (231 | ) | | $ | 1,713 | |

Cost of sales | | | — | | | | — | | | | (689 | ) | | | (942 | ) | | | 231 | | | | (1,400 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | — | | | | (1 | ) | | | 203 | | | | 111 | | | | — | | | | 313 | |

Selling, general and administrative expenses | | | — | | | | (22 | ) | | | (120 | ) | | | (118 | ) | | | — | | | | (260 | ) |

Loss on disposition of affiliate | | | — | | | | — | | | | — | | | | (1 | ) | | | — | | | | (1 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) profit | | | — | | | | (23 | ) | | | 83 | | | | (8 | ) | | | — | | | | 52 | |

Other income (loss), net | | | — | | | | 19 | | | | (20 | ) | | | 2 | | | | — | | | | 1 | |

Interest expense | | | — | | | | (41 | ) | | | — | | | | — | | | | — | | | | (41 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income before taxes and equity income | | | — | | | | (45 | ) | | | 63 | | | | (6 | ) | | | — | | | | 12 | |

Income tax (benefit) provision | | | — | | | | (5 | ) | | | — | | | | 22 | | | | — | | | | 17 | |

Equity interest in income, net of tax | | | (5 | ) | | | 48 | | | | 24 | | | | 51 | | | | (118 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income | | | (5 | ) | | | 8 | | | | 87 | | | | 23 | | | | (118 | ) | | | (5 | ) |

Less: Net income attributable to noncontrolling interest, net of tax | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to the company | | $ | (5 | ) | | $ | 8 | | | $ | 87 | | | $ | 23 | | | $ | (118 | ) | | $ | (5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

21

Affinia Group Intermediate Holdings Inc.

Supplemental Guarantor

Condensed Consolidating Statement of Operations

For the Three Months Ended September 30, 2009

(Dollars in Millions)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Parent | | | Issuer | | | Guarantor | | | Non-Guarantor | | | Eliminations | | | Consolidated

Total | |

Net sales | | $ | — | | | $ | — | | | $ | 308 | | | $ | 319 | | | $ | (85 | ) | | $ | 542 | |

Cost of sales | | | — | | | | — | | | | (257 | ) | | | (265 | ) | | | 85 | | | | (437 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | — | | | | — | | | | 51 | | | | 54 | | | | — | | | | 105 | |

Selling, general and administrative expenses | | | — | | | | (13 | ) | | | (36 | ) | | | (35 | ) | | | — | | | | (84 | ) |

Income from settlement | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) profit | | | — | | | | (13 | ) | | | 15 | | | | 19 | | | | — �� | | | | 21 | |

Other income (loss), net | | | — | | | | 5 | | | | (4 | ) | | | 1 | | | | — | | | | 2 | |

Interest expense | | | — | | | | (24 | ) | | | — | | | | — | | | | — | | | | (24 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income before income tax provision and equity income | | | — | | | | (32 | ) | | | 11 | | | | 20 | | | | — | | | | (1 | ) |

Income tax (benefit) provision | | | — | | | | (6 | ) | | | — | | | | 6 | | | | — | | | | — | |

Equity interest in income, net of tax | | | (3 | ) | | | 25 | | | | 14 | | | | — | | | | (36 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income | | | (3 | ) | | | (1 | ) | | | 25 | | | | 14 | | | | (36 | ) | | | (1 | ) |

Less: Net income attributable to noncontrolling interest, net of tax | | | — | | | | (2 | ) | | | — | | | | — | | | | — | | | | (2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to the company | | $ | (3 | ) | | $ | (3 | ) | | $ | 25 | | | $ | 14 | | | $ | (36 | ) | | $ | (3 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

22

Affinia Group Intermediate Holdings Inc.

Supplemental Guarantor

Condensed Consolidating Statement of Operations

For the Nine Months Ended September 30, 2009

(Dollars in Millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Parent | | Issuer | | | Guarantor | | | Non-Guarantor | | | Eliminations | | | Consolidated

Total | |

Net sales | | $ | — | | $ | — | | | $ | 902 | | | $ | 862 | | | $ | (246 | ) | | $ | 1,518 | |

Cost of sales | | | — | | | — | | | | (763 | ) | | | (715 | ) | | | 246 | | | | (1,232 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | — | | | — | | | | 139 | | | | 147 | | | | — | | | | 286 | |

Selling, general and administrative expenses | | | — | | | (25 | ) | | | (104 | ) | | | (90 | ) | | | — | | | | (219 | ) |

Income from settlement | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) profit | | | — | | | (25 | ) | | | 35 | | | | 57 | | | | — | | | | 67 | |

Gain on extinguishment of debt | | | — | | | 8 | | | | — | | | | — | | | | — | | | | 8 | |

Other income (loss), net | | | — | | | 13 | | | | (12 | ) | | | 2 | | | | — | | | | 3 | |

Interest expense | | | — | | | (51 | ) | | | — | | | | (1 | ) | | | — | | | | (52 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income before income tax provision and equity income | | | — | | | (55 | ) | | | 23 | | | | 58 | | | | — | | | | 26 | |

Income tax (benefit) provision | | | — | | | (5 | ) | | | — | | | | 16 | | | | — | | | | 11 | |

Equity interest in income, net of tax | | | 10 | | | 64 | | | | 42 | | | | — | | | | (116 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income | | | 10 | | | 14 | | | | 65 | | | | 42 | | | | (116 | ) | | | 15 | |

Less: Net income attributable to noncontrolling interest, net of tax | | | — | | | (4 | ) | | | (1 | ) | | | — | | | | — | | | | (5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to the company | | $ | 10 | | $ | 10 | | | $ | 64 | | | $ | 42 | | | $ | (116 | ) | | $ | 10 | |

| | | | | | | | | | | | | | | | | | | | | | | |

23

Affinia Group Intermediate Holdings Inc.

Supplemental Guarantor

Condensed Consolidating Statement of Cash Flows

For the Nine Months Ended September 30, 2008

(Dollars in Millions)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Parent | | Issuer | | | Guarantor | | | Non-Guarantor | | | Elimination | | Consolidated

Total | |

Operating activities | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | $ | — | | $ | 5 | | | $ | 10 | | | $ | (20 | ) | | $ | — | | $ | (5 | ) |

Investing activities | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from sale of assets | | | — | | | — | | | | — | | | | 1 | | | | — | | | 1 | |

Proceeds from sale of affiliates | | | — | | | 3 | | | | — | | | | 3 | | | | — | | | 6 | |

Investment in affiliate | | | — | | | — | | | | (3 | ) | | | — | | | | — | | | (3 | ) |

Additions to property, plant, and equipment, net | | | — | | | (1 | ) | | | (8 | ) | | | (8 | ) | | | — | | | (17 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) investing activities | | | — | | | 2 | | | | (11 | ) | | | (4 | ) | | | — | | | (13 | ) |

Financing activities | | | | | | | | | | | | | | | | | | | | | | |

Short-term debt, net | | | — | | | — | | | | — | | | | — | | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | |