Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on May 3, 2006

Registration No. 333

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Tronox Worldwide LLC

and

Tronox Finance Corp.

(Exact name of registrant as specified in its charter)*

| Delaware | 2810 | 11-3663540 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) | ||

| Delaware | 2810 | 20-3611122 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) | ||

c/o Tronox Incorporated 123 Robert S. Kerr Avenue Oklahoma City, Oklahoma 73102 (405) 775-5000 | Roger G. Addison, Esq. 123 Robert S. Kerr Avenue Oklahoma City, Oklahoma 73102 (405) 775-5000 | |

(Address, including Zip Code, and telephone number, including area code, of registrant’s principal executive offices) | (Name, address, including Zip Code, and telephone number, including area code, of agent for service) |

Copies to:

W. Chris Coleman

McAfee & Taft A Professional Corporation

Tenth Floor, Two Leadership Square

211 North Robinson

Oklahoma City, Oklahoma 73102

(405) 235-9621

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement under the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be | Proposed Maximum Offering Price Per Unit(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||

9 1/2% Senior Notes due 2012 | $350,000,000 | 100% | $350,000,000 | $37,450(1) | ||||

Guarantees 9 1/2% Senior Notes due 2012(2) | — | — | — | — |

| (1) | Estimated solely for the purpose of computing the registration fee in accordance with Rule 457(f)(2). |

| (2) | The 9 1/2% Senior Notes due 2012 are guaranteed by the Additional Registrants. No separate consideration will be paid in respect of the guarantees. Pursuant to Rule 457(n) of the Securities Act, no filing fee is required. |

| * | Tronox Incorporated, the parent of the Registrants, and the additional subsidiaries of Tronox Incorporated listed in the attached table are Additional Registrants to this Registration Statement. |

Each registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8 of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8, may determine.

Table of Contents

Index to Financial Statements

TABLE OF ADDITIONAL REGISTRANTS

Name(1) | State of Incorporation/ Formation | Primary Standard Industrial Classification Code Number | IRS Employer Identification No. | |||

Cimarron Corporation | Oklahoma | 2810 | 73-1328735 | |||

Tronox Holdings, Inc. | Delaware | 2810 | 51-0284593 | |||

Triple S Minerals Resources Corporation | Delaware | 2810 | 73-1534515 | |||

Tronox Pigments (Savannah), Inc. | Georgia | 2810 | 58-1622042 | |||

Triple S Refining Corporation | Delaware | 2810 | 73-0974954 | |||

Southwestern Refining Company, Inc. | Delaware | 2810 | 73-0960164 | |||

Transworld Drilling Company | Delaware | 2810 | 73-0755837 | |||

Triangle Refineries, Inc. | Delaware | 2810 | 74-1039180 | |||

Triple S, Inc. | Oklahoma | 2810 | 73-1415116 | |||

Tronox LLC | Delaware | 2810 | 41-2070700 | |||

Tronox Incorporated | Delaware | 2810 | 20-2868245 |

| (1) | The address for each Additional Registrant is 123 Robert S. Kerr Avenue, Oklahoma City, Oklahoma 73102 and the telephone number is (405) 775-5000. |

Table of Contents

Index to Financial Statements

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated May 3, 2006

PROSPECTUS

TRONOX WORLDWIDE LLC

TRONOX FINANCE CORP.

Offer to Exchange up to

$350,000,000 of 9 1/2% Senior Notes due 2012

for up to

$350,000,000 of 9 1/2% Senior Notes due 2012

which have been registered under the Securities Act of 1933

We are offering to exchange up to $350,000,000 of our outstanding 9 1/2% Senior Notes due 2012 for new 9 1/2% Senior Notes due 2012, with substantially identical terms, which have been registered under the Securities Act of 1933 and will generally be freely tradeable. Our exchange offer will expire at 5:00 p.m. New York City time on , 2006 unless we extend the time for expiration.

We will exchange all old notes that you validly tender and do not withdraw before the exchange offer expires for an equal principal amount of new notes. Tenders of outstanding notes may be withdrawn at any time prior to the expiration of the exchange offer.

There is currently no established trading market for the old notes or the new notes. We do not intend to list the new notes on any securities exchange or seek approval for quotation through any automated quotation system.

The exchange offer of the new notes for the old notes will not be a taxable event for U.S. federal income tax purposes.

Investing in the notes involves risks. Please read “Risk Factors” on page 16 for a discussion of factors you should consider before participating in the Exchange Offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the senior notes to be distributed in the exchange offer, nor have any of these organizations determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives new notes for its own account pursuant to this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 90 days from the expiration of this exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

The date of this prospectus is , 2006.

Table of Contents

Index to Financial Statements

| Page | ||

| i | ||

| 1 | ||

| 16 | ||

| 27 | ||

| 27 | ||

| 28 | ||

| 37 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 41 | |

| 64 | ||

| 66 | ||

| 70 | ||

| 83 | ||

| 86 | ||

| 89 | ||

| 91 | ||

| 138 | ||

| 142 | ||

| 143 | ||

| 143 | ||

| 143 | ||

| F-1 |

You should rely only upon the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different information or inconsistent information, you should not rely on it. We are not making an offer to sell these notes in any jurisdiction where the offer or sale is not permitted. You should assume the information appearing in this prospectus is accurate only as of the date of the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

You should contact us with any questions about the exchange offer or if you require additional information to verify the information contained in this prospectus.

You should not consider any information in this prospectus to be legal, business or tax advice. You should consult your own attorney, business advisor and tax advisor for legal, business and tax advice regarding participating in the exchange offer.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this prospectus, which are subject to risks and uncertainties. See “Risk Factors.” These statements are based on the beliefs and assumptions of our management and on the information currently available to our management at the time of such statements. Forward-looking statements include information concerning our possible or assumed future results or otherwise speak to future events and may be preceded by, followed by, or otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions.

Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Future results or performance may differ materially from those expressed or implied in these forward-looking statements. Many of the factors that will determine these results and values are beyond our

i

Table of Contents

Index to Financial Statements

ability to control or predict. Potential investors are cautioned not to put undue reliance on any forward-looking statements. Except as required by the Federal securities laws, we do not have any intention or obligation to update forward-looking statements after we distribute this document, even if new information, future events or other circumstances have made them incorrect or misleading.

You should understand that various factors, in addition to those discussed in “Risk Factors” and elsewhere in this document, could affect our future results and could cause results to differ materially from those expressed in such forward-looking statements, including the following:

| • | adverse changes in general economic conditions or in the markets we serve, including changes in the prices of titanium dioxide pigments and other chemicals; |

| • | changes in our business strategies; |

| • | demand for consumer products for which our businesses supply raw materials; |

| • | availability and pricing of raw materials; |

| • | fluctuations in energy prices; |

| • | technological changes affecting production of our materials; |

| • | developments associated with our environmental remediation efforts; |

| • | hazards associated with chemicals manufacturing; |

| • | risks associated with competition, including the financial resources of competitors and the introduction of new competing products; |

| • | risks associated with international sales and operations; |

| • | changes in laws and regulations, including environmental laws, or changes in the administration of such laws and regulations; |

| • | the quality of future opportunities that may be presented to or pursued by us; |

| • | the ability to generate cash flows or obtain financing to fund growth and the cost of such financing; |

| • | the ability to obtain and maintain regulatory approvals; |

| • | the effect of various litigation that arise from time to time in the ordinary course of business; |

| • | the impact of weather and the occurrence of natural disasters such as fires, floods and other catastrophic events and natural disasters; |

| • | acts of war or terrorist activities; and |

| • | the ability to respond to challenges in international markets, including changes in currency exchange rates, political or economic conditions, and trade and regulatory matters. |

ii

Table of Contents

Index to Financial Statements

The following summary highlights the material information contained elsewhere in this prospectus but may not contain all of the information that is important to you. You should read the entire prospectus carefully, including the consolidated and combined financial statements and related notes and the factors described in “Risk Factors,” before participating in the exchange offer.

Our Parent, Tronox Incorporated, was formed on May 17, 2005, in preparation for the contribution and transfer by Kerr-McGee Corporation (“Kerr-McGee”) of certain entities, including us and other entities comprising substantially all of its chemical business (the “Contribution”). The Contribution was completed in November 2005 along with the recapitalization of Tronox Incorporated, whereby common stock held by Kerr-McGee converted into approximately 22.9 million shares of Class B common stock. An initial public offering (“IPO”) of Tronox Incorporated’s Class A common stock was subsequently completed on November 28, 2005. On March 30, 2006, Kerr-McGee distributed all of the shares of Parent’s Class B common stock that it owned to its stockholders (the “Distribution”).

Unless the context otherwise requires, any references in this prospectus to “we,” “our,” “us” and “Tronox” refer to Tronox Worldwide LLC and all of our subsidiaries , and references to “Tronox Incorporated” and “Parent” refer to Tronox Incorporated and its subsidiaries as in effect on the date of this prospectus, except that all such references in connection with financial information is intended to refer to that of our Parent on a consolidated basis or that of the several entities comprising the Parent’s subsidiaries on a combined basis. Any references in this prospectus to “Tronox Finance” refer to our wholly-owned subsidiary, Tronox Finance Corp., which is a co-issuer of the notes. References to “issuers” mean Tronox and Tronox Finance, as co-issuers of the notes. Any references in this prospectus to “Kerr-McGee” refer to Kerr-McGee Corporation and its consolidated subsidiaries.

The Notes

We completed on November 28, 2005 a private offering of $350.0 million aggregate principal amount of our 9 1/2% Senior Notes due 2012, which we refer to as the “old notes”. We entered into an exchange and registration rights agreement with the initial purchasers of the old notes in which we agreed, among other things, to deliver to you this prospectus and to complete the exchange offer within 240 days of the issuance of the old notes. You are entitled to exchange in the exchange offer your outstanding old notes for registered 9 1/2% Senior Notes due 2012 with substantially identical terms which we refer to as the “new notes”. If (i) we do not file the registration statement for the exchange offer of the new notes for the old notes that this prospectus is a part of (the “Exchange Offer Registration Statement”) by April 27, 2006, (ii) the Exchange Offer Registration Statement is not declared effective (the “Exchange Offer Effective Date”) by the Securities and Exchange Commission (“SEC”) on or prior to June 26, 2006, or (iii) the exchange offer is not completed within thirty (30) days of the Exchange Offer Effective Date, then we will pay liquidated damages in the form of additional interest. We filed this Exchange Offer Registration Statement on May 3, 2006 in violation of clause (i) above. As a result, we are required to pay liquidated damages in the form of special interest in the aggregate amount of $17,500. You should read the discussion under the headings “—Summary Description of the New Notes” and “Description of the Notes” for further information regarding the registered 9 1/2% Senior Notes due 2012. Whenever we use the term “notes,” we are referring to both the old notes and the new notes, unless the context clearly shows a different intent.

We believe that the new notes issued in the exchange offer may be resold by you without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to certain conditions. You should read the discussion under the headings “—Summary of the Terms of the Exchange Offer” and “The Exchange Offer” for further information regarding the exchange offer and resale of the new notes.

1

Table of Contents

Index to Financial Statements

Our Company

Overview

Tronox is one of the leading global producers and marketers of titanium dioxide. Titanium dioxide is a white pigment used in a wide range of products for its exceptional ability to impart whiteness, brightness and opacity. We market titanium dioxide pigment, which represented more than 90% of our net sales in 2005, under the brand name TRONOX®. We are the world’s third-largest producer and marketer of titanium dioxide based on reported industry capacity by the leading titanium dioxide producers, and we have an estimated 13% market share of the $9 billion global market in 2005 based on reported industry sales. Our world-class, high-performance pigment products are critical components of everyday consumer applications, such as coatings, plastics and paper, as well as specialty products, such as inks, foods and cosmetics. In addition to titanium dioxide, we produce electrolytic manganese dioxide, sodium chlorate and boron-based and other specialty chemicals. In 2005, we had net sales of $1.4 billion and adjusted EBITDA of $232.0 million. See pages 13-15 for a reconciliation of adjusted EBITDA to net income for the year ended December 31, 2005. Based on the country of production, the geographic distribution of our net sales was as follows during the last three years:

| 2005 | 2004 | 2003 | |||||||

| (Millions of dollars) | |||||||||

United States | $ | 755.9 | $ | 716.8 | $ | 646.7 | |||

International | 608.1 | 585.0 | 511.0 | ||||||

| $ | 1,364.0 | $ | 1,301.8 | $ | 1,157.7 | ||||

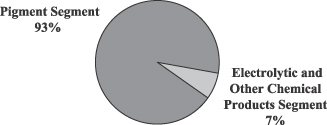

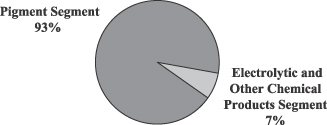

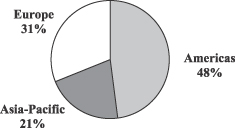

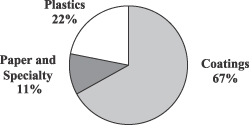

The chart below summarizes our 2005 net sales by business segment:

2005 Net Sales by Business Segment |

|

We have maintained strong relationships with our customers since our current chemical operations began in 1964. We focus on providing our customers with world-class products, end-use market expertise and strong technical service and support. With more than 2,100 employees worldwide, strategically located manufacturing facilities and direct sales and technical service organizations in the United States, Europe and the Asia-Pacific region, we are able to serve our diverse base of more than 1,100 customers in over 100 countries.

Globally, including the production capacity of the facility operated by our Tiwest Joint Venture (see “Business—Manufacturing, Operations and Properties—The Tiwest Joint Venture”), we have 624,000 tonnes of aggregate annual titanium dioxide production capacity. We hold over 200 patents worldwide, as well as other intellectual property. We have a highly skilled and technologically sophisticated workforce.

2

Table of Contents

Index to Financial Statements

Competitive Strengths

We benefit from a number of competitive strengths, including the following:

Leading Market Positions

We are the world’s third-largest producer and marketer of titanium dioxide products based on reported industry capacity by the leading titanium dioxide producers and the world’s second-largest producer and supplier of titanium dioxide manufactured via proprietary chloride technology, which we believe is preferred for many of the largest end-use applications. We estimate that we have a 15% share of the $5.2 billion global market for the use of titanium dioxide in coatings, which industry sources consider the largest end-use market. We believe our leading market positions provide us with a competitive advantage in retaining existing customers and obtaining new business.

Global Presence

We are one of the few titanium dioxide manufacturers with global operations. We have production facilities and a sales and marketing presence in the Americas, Europe and the Asia-Pacific region. In 2005, sales into the Americas accounted for approximately 48% of our total titanium dioxide net sales, followed by approximately 31% into Europe and approximately 21% into the Asia-Pacific region. Our global presence enables us to provide customers in over 100 countries with a reliable source of multiple grades of titanium dioxide. The diversity of the geographic markets we serve also mitigates our exposure to regional economic downturns.

Well-Established Relationships with a Diverse Customer Base

We sell our products to a diverse portfolio of customers with whom we have well-established relationships. Our customer base consists of more than 1,100 customers in over 100 countries and includes market leaders in each of the major end-use markets for titanium dioxide. We have supplied each of our top ten customers with titanium dioxide pigment for over ten years. We work closely with our customers to optimize their formulations, thereby enhancing the use of titanium dioxide in their production processes. This has enabled us to develop and maintain strong relationships with our customers, resulting in a high customer retention rate.

Innovative, High-Performance Products

We offer innovative, high-performance products for nearly every major titanium dioxide end-use application, including seven grades of titanium dioxide (“TiO2”) for specialty applications such as inks, catalysts and electro-ceramics. We are dedicated to continually developing our titanium dioxide products to better serve our customers and responding to the increasingly stringent demands of their end-use markets. Our recently introduced products, CR-826 and CR-880, offer a combination of optical properties, opacity, ease of dispersion and durability that is valued by customers for a variety of applications. Sales volume of these high-performance products increased at a compounded annual growth rate of 29% from 2001 to 2005.

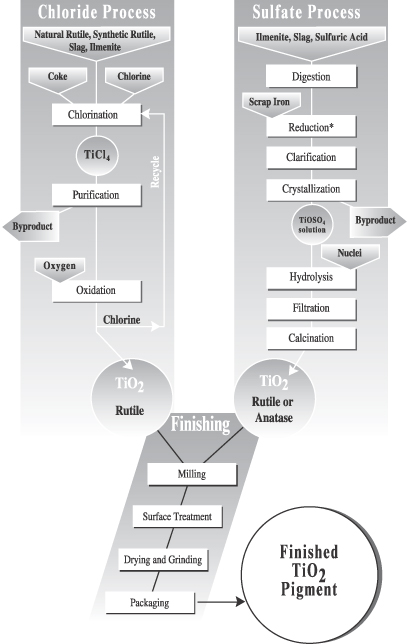

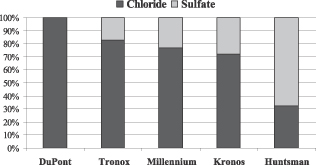

Proprietary Production Technology

We are one of a limited number of producers in the titanium dioxide industry to hold the rights to a proprietary chloride process for the production of titanium dioxide. Approximately 83% of our gross production capacity uses this process technology, which is the subject of numerous patents worldwide and is utilized by our highly skilled and technologically sophisticated work force. Titanium dioxide produced using chloride process technology is preferred for many of the largest end-use applications. The chloride production process generates less waste, uses less energy and is less labor intensive than the sulfate process. The complexity of developing and operating the chloride process technology makes it difficult for others to enter and successfully compete in the chloride process titanium dioxide industry.

3

Table of Contents

Index to Financial Statements

Experienced Management Team

Our management team has an average of 23 years of business experience. The diversity of their business experience provides a broad array of skills that contributes to the successful execution of our business strategy. Our operations team and plant managers, who have an average of 27 years of manufacturing experience, participate in the development and execution of strategies that have resulted in production volume growth, production efficiency improvements and cost reductions. The experience, stability and leadership of our sales organization have been instrumental in growing sales, developing and maintaining customer relationships and increasing our market share.

Business Strategy

We use specific and individualized operating measures throughout our organization to track and evaluate key metrics. This approach serves as a scorecard to ensure alignment with, and accountability for, the execution of our strategy, which includes the following components:

Strong Customer Focus

We target our key markets with innovative, high-performance products that provide enhanced value to our customers at competitive prices. A key component of our business strategy is to continually enhance our product portfolio with high-quality, market-driven product development. We design our titanium dioxide products to satisfy our customers’ specific requirements for their end-use applications and align our business to respond quickly and efficiently to changes in market demands. In this regard, and in order to continue meeting our customers’ needs, we commercialized a new pigment grade for paper coatings and developed a new grade for architectural paints in close cooperation with our customer base. New and enhanced grades for coatings, plastic, paper laminate and specialty applications are in the pipeline for introduction in 2006 and 2007.

Technological Innovation

We employ customer and end-use market feedback, technological expertise and fundamental research to create next-generation products and processes. Our technology development efforts include building value-added properties into our titanium dioxide to enhance its performance in our customers’ end-use applications. Our research and development teams support our future business strategies, and we manage those teams using disciplined project management tools and a team approach to technological development.

Operational Excellence

We achieved record production in 2005 through our currently operating facilities, with fourth-quarter production rates higher than any previous quarter. This is an exceptional achievement because it occurred while our Kwinana plant was shut down approximately two weeks due to force majeure declared by a third-party process gas supplier. This newly demonstrated capability positions us to meet market growth over the short term without investing capital for capacity expansion. While we were not able to offset the rapid increase in energy pricing in 2005 with cost reductions, we continued to improve our energy consumption across plants through Six Sigma projects and other continuous improvement activities. We used a broader spectrum of TiO2ore than ever before, while improving the TiO2 yield through more tightly controlled plant operations.

Maximize Asset Efficiency

We optimize our production plan through strategic use of our global facilities to save on both transportation and warehousing costs. Our production process is designed with multiple production lines. As a result, we can remedy issues with an individual line without shutting down other lines and idling an entire facility. We also

4

Table of Contents

Index to Financial Statements

actively manage production capability across all facilities. For instance, if one plant’s finishing lines are already at full capacity, that plant’s unfinished titanium dioxide can be transferred to another plant for finishing.

Supply Chain Optimization

We improve our supply chain efficiency by focusing on reducing both operating costs and working capital needs. Our supply chain efforts to lower operating costs consist of reducing procurement spending, lowering transportation and warehouse costs and optimizing production scheduling. We actively manage our working capital by increasing inventory turnover and reducing finished goods and raw materials inventory without affecting our ability to deliver titanium dioxide to our customers.

Organizational Alignment

Aligning the efforts of our employees with our business strategies is critical to our success. To achieve that alignment, we evaluate the performance of our employees using a balanced scorecard approach. We also invest in training initiatives that are directly linked to our business strategies. For instance, approximately 120 of our employees have completed the well-regarded supply chain management training program at Michigan State University’s Broad Executive School of Management. We also train our employees in Six Sigma methodology to support our operational excellence and asset efficiency strategic objectives.

5

Table of Contents

Index to Financial Statements

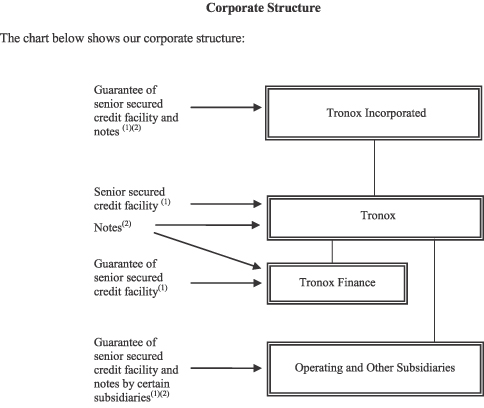

| (1) | The senior secured credit facility consists of a $200 million six-year term loan facility and a $250 million five-year multicurrency revolving credit facility. The senior secured credit facility is guaranteed by Parent and our direct and indirect material domestic subsidiaries. The facility is secured by a first priority security interest in certain domestic assets, including certain real property, of Tronox and the guarantors of the senior secured credit facility. The facility is also secured by pledges of the equity interests in Tronox and our direct and indirect domestic subsidiaries (including Tronox Finance), and up to 65% of our voting and 100% of our non-voting equity interests in our direct foreign subsidiaries and the direct foreign subsidiaries of the guarantors of the senior secured credit facility. Tronox Finance has no significant assets. |

| (2) | Tronox and Tronox Finance, co-issued $350 million in aggregate principal amount of the senior notes, which are guaranteed by Parent and our material direct and indirect domestic wholly-owned subsidiaries. The old notes will be exchanged for the new notes pursuant to this exchange offer. |

6

Table of Contents

Index to Financial Statements

SUMMARY OF THE TERMS OF THE EXCHANGE OFFER

In the exchange offer we are offering to exchange up to $350.0 million principal amount outstanding of our 9 1/2% Senior Notes due 2012, or “old notes”, for an equal principal amount of our 9 1/2% Senior Notes due 2012, or “new notes” and, together with old notes, the “notes”. The form and terms of the new notes are identical in all material respects to the form and terms of the outstanding old notes except that the new notes have been registered under the Securities Act of 1933 and, therefore, are not entitled to the benefits of the registration rights granted under the exchange and registration rights agreement, executed as part of the offering of the outstanding old notes.

The exchange offer | We are offering to exchange $1,000 principal amount of one new note for each $1,000 principal amount of old notes accepted in the exchange offer. We will accept for exchange all outstanding old notes that are validly tendered and not validly withdrawn. In order to be accepted, an outstanding old note must be properly tendered and accepted. After consummation of the exchange offer, holders of old notes which are not exchanged will continue to be subject to the existing restrictions upon the transfer of old notes and we will have no further obligation to such holders to provide for the registration of the old notes under the Securities Act. |

The expiration date | The exchange offer will expire at 5:00 p.m., New York City time, , 2006 unless we decide to extend the expiration date. |

Accrued interest on the new notes and the outstanding old notes | Interest on the new notes will accrue from November 28, 2005. If we accept your old notes you will not receive any payment of interest on such outstanding old notes accrued from November 28, 2005 to the date of the issuance of the new notes. Consequently, holders who exchange their outstanding old notes for new notes will receive the same interest payment on June 1, 2006, that they would have received had they not accepted the exchange offer, which is the first interest payment date with respect to the outstanding old notes and the new notes to be issued in the exchange offer. |

Termination of the exchange offer | We may terminate the exchange offer at any time prior to the expiration date if we determine that our ability to proceed with the exchange offer could be materially impaired due to any legal or governmental action, new law, statute, rule or regulation or any interpretation of the staff of the Securities and Exchange Commission of any existing law, statute, rule or regulation. We do not expect any of the foregoing conditions to occur, although there can be no assurance that such conditions will not occur. Holders of outstanding old notes will have certain rights under the exchange and registration rights agreement executed as part of the offering of the outstanding old notes should we fail to consummate the exchange offer. |

Conditions to the exchange offer | The exchange offer is subject to certain conditions, which may be waived by us. See “The Exchange Offer—Conditions of the Exchange Offer.” The exchange offer is not conditioned upon any minimum number of old notes being tendered. |

7

Table of Contents

Index to Financial Statements

Special procedures for beneficial owners | If you are the beneficial owner of old notes and your name does not appear on a security position listing of the Depository Trust Company as the holder of such old notes or if you are a beneficial owner of old notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender such old notes in the exchange offer, you should contact the person in whose name your old notes are registered promptly and instruct that person to tender on your behalf. If such beneficial holder wishes to tender on his own behalf such beneficial holder must, prior to completing and executing the letter of transmittal and delivering his outstanding old notes, either make appropriate arrangements to register ownership of the outstanding old notes in such holder’s name or obtain a properly completed bond power from the registered holder. The transfer of record ownership may take considerable time. |

Guaranteed delivery procedures | If you wish to tender your old notes and time will not permit your required documents to reach the exchange agent by the expiration date, or the procedure for book-entry transfer cannot be completed on time or certificates for registered old notes cannot be delivered on time, you may tender your old notes pursuant to the procedures described in this prospectus under the heading “The Exchange Offer—Terms of the Exchange Offer—Guaranteed Delivery Procedures.” |

Withdrawal rights | You may withdraw the tender of your old notes at any time prior to 5:00 p.m., New York City time, on , 2006, unless we decide to extend the expiration date or your old notes were previously accepted for exchange. |

Acceptance of outstanding old notes and delivery of new notes | Subject to certain conditions as described more fully under “The Exchange Offer—Conditions of the Exchange Offer”, we will accept for exchange any and all outstanding old notes which are properly tendered in the exchange offer prior to 5:00 p.m., New York City time, on the expiration date. The new notes issued pursuant to the exchange offer will be delivered promptly to you following the expiration date. |

Federal income tax considerations | The exchange of the old notes will not be a taxable exchange for United States federal income tax purposes. We believe you will not recognize any taxable gain or loss or any income as a result of such exchange. |

Use of proceeds | We will not receive any proceeds from the issuance of new notes pursuant to the exchange offer. We will pay all expenses incident to the exchange offer. |

Exchange agent | Citibank, N.A. is serving as the exchange agent in connection with the exchange offer. The exchange agent can be reached at 111 Wall Street, 15th Floor, New York, New York 10043. For more information with respect to the exchange offer, the telephone number for the exchange agent is 1-800-422-2066 and the facsimile number for the exchange agent is (212) 657-1020. |

8

Table of Contents

Index to Financial Statements

Summary Description of the New Notes

Issuers | Tronox Worldwide LLC and Tronox Finance Corp. |

Notes offered | $350.0 million aggregate principal amount of 9 1/2% Senior Notes due 2012. |

Maturity date | December 1, 2012. |

Interest Payment dates | June 1 and December 1 of each year, commencing on June 1, 2006. |

Guarantees | Our obligations with respect to the notes will be fully and unconditionally guaranteed by Parent and all of our direct and indirect material domestic subsidiaries. Our foreign subsidiaries will not guarantee the notes. See “—Ranking.” |

Ranking | The notes and guarantees are unsecured senior obligations. Accordingly, the notes and guarantees will rank: |

| • | senior in right of payment to all of our and our guarantors’ existing and future subordinated debt; |

| • | equal in right of payment with all of our and our guarantors’ existing and future senior indebtedness; and |

| • | effectively subordinated to any of our and our guarantors’ secured indebtedness to the extent of the value of the collateral securing that indebtedness, including borrowings under the senior secured credit facility, as well as all obligations of our non-guarantor subsidiaries. |

The senior notes we issued on November 28, 2005 and those being issued in this exchange offer will be treated as a single class for all purposes of the indenture. |

As of March 31, 2006, the aggregate amount of our secured indebtedness was $199.5 million, and approximately $173.4 million was available under our senior secured credit facility. |

Optional redemption | On or after December 1, 2009, we may, at our option, redeem some or all of the notes at the redemption prices set forth under “Description of Notes—Optional Redemption,” plus accrued and unpaid interest up to but not including the date of redemption. |

In addition, prior to December 1, 2008, we may, at our option, redeem up to 35% of the notes issued under the indenture at a redemption price of 109.500% of the principal amount, plus accrued and unpaid interest up to but not including the date of redemption, with the proceeds of certain equity offerings. See “Description of Notes—Optional Redemption.” |

9

Table of Contents

Index to Financial Statements

Offer to purchase | If we experience a change of control, or we or any of our restricted subsidiaries sell certain assets, we may be required to offer to purchase the notes at the prices set forth under “Description of Notes—Repurchase at the Option of Holders—Change of Control” and “Description of Notes—Repurchase at the Option of Holders—Asset Sales.” |

Covenants | We will issue the new notes under an indenture between us and the trustee. The indenture will, among other things, limit our ability and the ability of our restricted subsidiaries (as defined under “Description of Notes”) to: |

| • | incur additional indebtedness and issue preferred stock; |

| • | pay dividends or distributions on our capital stock or purchase, redeem or retire our capital stock; |

| • | issue or sell stock of subsidiaries; |

| • | make certain investments; |

| • | create liens on our assets; |

| • | enter into transactions with affiliates; |

| • | merge or consolidate with another company; and |

| • | transfer and sell assets. |

Each of these covenants is subject to a number of important limitations and exceptions. See “Description of Notes—Certain Covenants.” |

Resale of new notes | Based on interpretations by the staff of the Securities and Exchange Commission set forth in no-action letters issued to third parties, including “Exxon Holdings Corporation” (available May 13, 1998) and “Morgan Stanley & Co. Incorporated” (available June 5, 1991), we believe that you may offer the new notes for resale, resell the new notes and otherwise transfer the new notes without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| • | you acquire the new notes in the exchange offer in the ordinary course of business; |

| • | you have no arrangement or understanding with any person to participate in the distribution of the new notes that you obtain in the exchange offer; |

| • | you are not a broker-dealer who purchased old notes directly from us for resale pursuant to Rule 144A or any other available exemption under the Securities Act; and |

| • | you are not an “affiliate”. |

We intend to rely on the existing no-action letters and we do not intend to seek a no-action letter from the SEC with respect to the resale of the new notes. |

10

Table of Contents

Index to Financial Statements

Risk Factors

Investing in the notes involves risk. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” beginning on page 16 in deciding whether to participate in the exchange offer.

Company Information

Tronox Worldwide LLC is a Delaware limited liability company initially organized as a corporation in Delaware. On September 12, 2005, its name was changed from Kerr-McGee Chemical Worldwide LLC to Tronox Worldwide LLC. Our website address iswww.tronox.com. The information on our website is not incorporated by reference into this prospectus and you should not consider information on our website a part of this prospectus. Our principal executive offices are located at 123 Robert S. Kerr Avenue, Oklahoma City, Oklahoma 73102. Our telephone number is (405) 775-5000.

11

Table of Contents

Index to Financial Statements

Selected Financial Data

The following table sets forth selected financial data of Parent as of the dates and for the years indicated in such table. The selected statement of operations data for the years ended December 31, 2005, 2004, 2003 and 2002, and the balance sheet data as of December 31, 2005, 2004 and 2003, have been derived from our Parent’s audited consolidated and combined financial statements. The selected statement of operations data for the year ended December 31, 2001, and the balance sheet data as of December 31, 2002 and 2001, have been derived from Kerr-McGee’s accounting records and are unaudited.

The selected financial data presented below should be read together with “Use of Proceeds,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated and combined financial statements of Parent and the notes to those statements, in each case, included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||||||||||

| (Millions of dollars, except per share) | ||||||||||||||||||||

Consolidated and Combined Statement of Operations Data: | ||||||||||||||||||||

Net sales | $ | 1,364.0 | $ | 1,301.8 | $ | 1,157.7 | $ | 1,064.3 | $ | 1,022.6 | ||||||||||

Cost of goods sold | 1,143.8 | 1,168.9 | 1,024.7 | 949.0 | 972.5 | |||||||||||||||

Gross margin | 220.2 | 132.9 | 133.0 | 115.3 | 50.1 | |||||||||||||||

Selling, general and administrative expenses | 115.2 | 110.1 | 98.9 | 84.0 | 92.2 | |||||||||||||||

Restructuring charges(1) | — | 113.0 | 61.4 | 11.8 | — | |||||||||||||||

Provision for environmental remediation and restoration, net of reimbursements | 17.1 | 4.6 | 14.9 | 14.3 | 7.7 | |||||||||||||||

| 87.9 | (94.8 | ) | (42.2 | ) | 5.2 | (49.8 | ) | |||||||||||||

Interest and debt expense | (4.5 | ) | (0.1 | ) | (0.1 | ) | (0.1 | ) | (0.1 | ) | ||||||||||

Other income (expense)(2) | (15.2 | ) | (25.2 | ) | (20.5 | ) | (13.1 | ) | (39.9 | ) | ||||||||||

Income (loss) from continuing operations before income taxes | 68.2 | (120.1 | ) | (62.8 | ) | (8.0 | ) | (89.8 | ) | |||||||||||

Income tax benefit (provision) | (21.8 | ) | 38.3 | 15.1 | (8.3 | ) | 30.7 | |||||||||||||

Income (loss) from continuing operations before cumulative effect of change in accounting principle | 46.4 | (81.8 | ) | (47.7 | ) | (16.3 | ) | (59.1 | ) | |||||||||||

Loss from discontinued operations, net of income tax benefit | (27.6 | ) | (45.8 | ) | (35.8 | ) | (81.0 | ) | (49.0 | ) | ||||||||||

Income (loss) before cumulative effect of change in accounting principle | 18.8 | (127.6 | ) | (83.5 | ) | (97.3 | ) | (108.1 | ) | |||||||||||

Cumulative effect of change in accounting principle, net of income tax | — | — | (9.2 | ) | — | 0.7 | ||||||||||||||

Net income (loss) | $ | 18.8 | $ | (127.6 | ) | $ | (92.7 | ) | $ | (97.3 | ) | $ | (107.4 | ) | ||||||

Income (loss) from continuing operations per common share, basic and diluted | $ | 1.89 | $ | (3.57 | ) | $ | (2.08 | ) | $ | (0.71 | ) | $ | (2.58 | ) | ||||||

Dividends declared per common share | 0.05 | — | — | — | — | |||||||||||||||

12

Table of Contents

Index to Financial Statements

| Year Ended December 31, | |||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||

| (Millions of dollars, except per share) | |||||||||||||||

Consolidated and Combined Balance Sheet Data: | |||||||||||||||

Working capital(3) | $ | 404.4 | $ | 240.2 | $ | 304.5 | $ | 243.6 | $ | 264.5 | |||||

Property, plant and equipment, net | 839.7 | 883.0 | 961.6 | 944.9 | 948.9 | ||||||||||

Total assets(4) | 1,758.3 | 1,595.9 | 1,809.1 | 1,733.6 | 1,628.1 | ||||||||||

Noncurrent liabilities: | |||||||||||||||

Long-term debt(5) | 548.0 | — | — | — | — | ||||||||||

Environmental remediation and/or restoration | 145.9 | 130.8 | 135.9 | 131.4 | 40.0 | ||||||||||

All other noncurrent liabilities(4) | 200.4 | 215.9 | 312.2 | 192.4 | 209.6 | ||||||||||

Total liabilities(5) | 1,269.3 | 706.0 | 797.9 | 671.2 | 556.7 | ||||||||||

Total business/stockholders’ equity(5) | 489.0 | 889.9 | 1,011.2 | 1,062.4 | 1,071.4 | ||||||||||

Supplemental Information: | |||||||||||||||

Depreciation and amortization expense | 103.1 | 104.6 | 106.5 | 105.7 | 119.9 | ||||||||||

Capital expenditures | 87.6 | 92.5 | 99.4 | 86.7 | 153.3 | ||||||||||

Adjusted EBITDA(6) | 232.0 | 162.2 | 160.3 | 134.5 | N/A | ||||||||||

| (1) | Restructuring charges in 2004 include costs associated with the shutdown of our titanium dioxide pigment sulfate production at our Savannah, Georgia, facility. Restructuring charges in 2003 include costs associated with the shutdown of our synthetic rutile plant in Mobile, Alabama, and charges in connection with a work force reduction program consisting of both voluntary retirements and involuntary terminations. Restructuring charges in 2002 represent a write-down of fixed assets for abandoned engineering projects. |

| (2) | Includes interest expense allocated by Kerr-McGee based on specifically identified borrowings from Kerr-McGee at Kerr-McGee’s average borrowing rates. Also includes net foreign currency transaction gain (loss), equity in net earnings of equity method investees, loss on accounts receivable sales and other expenses. See Note 21 to the Consolidated and Combined Financial Statements included in this prospectus. |

| (3) | Working capital is defined as the excess of current assets over current liabilities. |

| (4) | Total assets and all other noncurrent liabilities do not include the effects of certain employee benefit obligations and associated plan assets that will be assumed upon completion of the Distribution. See“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies.” |

| (5) | In the fourth quarter of 2005, Parent completed a recapitalization, whereby Parent’s common stock held by Kerr-McGee converted into approximately 22.9 million shares of Class B common stock. Also in the fourth quarter of 2005, Parent completed an IPO, whereby approximately 17.5 million shares of its Class A common stock were issued. All of the net proceeds from the IPO were distributed to Kerr-McGee. Concurrent with the IPO, we issued $350.0 million of senior notes and borrowed $200.0 million under a senior secured credit facility. |

| (6) | EBITDA represents net income (loss) before net interest expense, income tax benefit (provision), and depreciation and amortization expense. Adjusted EBITDA represents EBITDA as further adjusted to reflect the items set forth in the table below, all of which are required in determining our compliance with financial covenants under our senior secured credit facility. See“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition and Liquidity.” |

We have included EBITDA and adjusted EBITDA to provide investors with a supplemental measure of our operating performance and information about the calculation of some of the financial covenants that are contained in our senior secured credit facility. We believe EBITDA is an important supplemental measure of operating performance because it eliminates items that have less bearing on our operating performance and thus highlights trends in our core business that may not otherwise be apparent when relying solely on generally accepted accounting principles (“GAAP”) financial measures. We also believe that securities analysts, investors and other interested parties frequently use EBITDA in the evaluation of issuers, many of |

13

Table of Contents

Index to Financial Statements

which present EBITDA when reporting their results. Adjusted EBITDA is a material component of the covenants imposed on us by the senior secured credit facility. Under the senior secured credit facility, we are subject to financial covenant ratios that are calculated by reference to adjusted EBITDA. Non-compliance with the financial covenants contained in the senior secured credit facility could result in a default, an acceleration in the repayment of amounts outstanding, and a termination of the lending commitments under the senior secured credit facility. Any acceleration in the repayment of amounts outstanding under the senior secured credit facility would result in a default under the indenture governing the notes. While an event of default under the senior secured credit facility or the indenture governing the notes is continuing, we would be precluded from, among other things, paying dividends on our common stock or borrowing under the revolving credit facility. For a description of required financial covenant levels, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition and Liquidity.” Our management also uses EBITDA and adjusted EBITDA in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets and assess our ability to meet our future debt service, capital expenditure and working capital requirements and our ability to pay dividends on our common stock. |

| EBITDA and adjusted EBITDA are not presentations made in accordance with GAAP. As discussed above, we believe that the presentation of EBITDA and adjusted EBITDA in this prospectus is appropriate. However, when evaluating our results, you should not consider EBITDA and adjusted EBITDA in isolation of, or as a substitute for, measures of our financial performance as determined in accordance with GAAP, such as net income (loss). EBITDA and adjusted EBITDA have material limitations as performance measures because they exclude items that are necessary elements of our costs and operations. Because other companies may calculate EBITDA and adjusted EBITDA differently than we do, EBITDA may not be, and adjusted EBITDA as presented in this prospectus is not, comparable to similarly titled measures reported by other companies. |

| The following table reconciles net income (loss) to EBITDA and adjusted EBITDA for the periods presented: |

| Year Ended December 31, | ||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | |||||||||||||

| (Millions of dollars) | ||||||||||||||||

Net income (loss)(a) | $ | 18.8 | $ | (127.6 | ) | $ | (92.7 | ) | $ | (97.3 | ) | |||||

Interest and debt expense | 4.5 | 0.1 | 0.1 | 0.1 | ||||||||||||

Net interest expense on borrowings with affiliates and interest income(b) | 11.9 | 9.5 | 8.8 | 11.1 | ||||||||||||

Income tax provision (benefit) | 7.0 | (63.0 | ) | (39.3 | ) | (35.3 | ) | |||||||||

Depreciation and amortization expense | 103.1 | 104.6 | 106.5 | 105.7 | ||||||||||||

EBITDA | 145.3 | (76.4 | ) | (16.6 | ) | (15.7 | ) | |||||||||

Savannah sulfate facility shutdown costs | — | 29.0 | — | — | ||||||||||||

Loss from discontinued operations(c) | 42.4 | 69.7 | 51.9 | 120.1 | ||||||||||||

Provision for environmental remediation and restoration, net of reimbursements | 17.1 | 4.6 | 14.9 | 14.3 | ||||||||||||

Extraordinary, unusual or non-recurring expenses or losses(d) | — | (0.3 | ) | 47.0 | — | |||||||||||

Noncash changes constituting: | ||||||||||||||||

(Gain) loss on sales of accounts receivable(e) | (0.1 | ) | 8.2 | 4.8 | 4.7 | |||||||||||

Write-downs of property, plant and equipment and other assets(f) | 9.3 | 104.8 | 29.3 | 18.5 | ||||||||||||

Impairment of intangible assets | — | 7.4 | — | — | ||||||||||||

Cumulative effect of change in accounting principle | — | — | 14.1 | — | ||||||||||||

Provision for asset retirement obligations | 1.4 | — | — | — | ||||||||||||

Other items(g) | 16.6 | 15.2 | 14.9 | (7.4 | ) | |||||||||||

Adjusted EBITDA | $ | 232.0 | $ | 162.2 | $ | 160.3 | $ | 134.5 | ||||||||

14

Table of Contents

Index to Financial Statements

| (a) | Net income (loss) includes pre-tax operating losses associated with our Savannah sulfate facility, which was closed in September 2004, of $2.6 million, $17.8 million, $18.6 million and $9.6 million for the years ended December 31, 2005, 2004, 2003 and 2002, respectively. |

| (b) | Included as a component of Other income (expense) in the Consolidated and Combined Statement of Operations. Net interest expense on borrowings with affiliates was $14.6 million, $12.1 million, $10.1 million and $12.9 million for the years ended December 31, 2005, 2004, 2003 and 2002, respectively. |

| (c) | Includes provisions for environmental remediation and restoration, net of reimbursements, related to our former forest products operations, thorium compounds manufacturing, uranium and refining operations of $17.6 million, $61.5 million, $41.1 million and $61.1 million for the years ended December 31, 2005, 2004, 2003 and 2002, respectively. |

| (d) | Represents extraordinary, unusual or non-recurring expenses or losses as defined within our credit agreement. Includes $25.8 million associated with the closure of our Mobile, Alabama, facility in 2003 for charges not reflected elsewhere and $21.2 million for a work force reduction program for continuing operations in 2003. See Note 16 to the Consolidated and Combined Financial Statements included in this prospectus. |

| (e) | Loss on the sales of accounts receivable under an asset monetization program, or a factoring program, comparable to interest expense. |

| (f) | The 2004 amount includes $86.6 million associated with the shutdown of our Savannah sulfate facility. |

| (g) | Includes noncash stock-based compensation, noncash pension and postretirement cost and accretion expense. |

15

Table of Contents

Index to Financial Statements

In addition to the other information contained in this prospectus, the following factors related to our company, the exchange offer and the new notes should be considered carefully in deciding to participate in the exchange offer.

Risks Related to Our Indebtedness and the Notes

We may need additional capital in the future and may not be able to obtain it on favorable terms, if at all.

Our industry is highly capital intensive and our success depends to a significant degree on our ability to develop and market innovative products and to update our facilities and process technology. We may require additional capital in the future to finance our future growth and development, implement further marketing and sales activities, fund our ongoing research and development activities and meet our general working capital needs. Our capital requirements will depend on many factors, including acceptance of and demand for our products, the extent to which we invest in new technology and research and development projects, and the status and timing of competitive developments. Additional financing may not be available when needed on terms favorable to us or at all. Further, the terms of the senior secured credit facility and the indenture governing the notes, may limit our ability to incur additional indebtedness or Parent’s ability to issue additional shares of common stock. If we are unable to obtain adequate funds on acceptable terms, we may be unable to develop or enhance our products, take advantage of future opportunities or respond to competitive pressures, which could harm our business.

Your right to receive payments on the notes could be adversely affected if any of our non-guarantor subsidiaries declare bankruptcy, liquidate or reorganize.

We conduct domestic and international business through our operating subsidiaries. Portions of our international business are conducted through operating subsidiaries that are organized outside the United States, none of which guarantee the notes. Therefore, the notes are effectively subordinated to the prior payment of debts and other liabilities (including trade payables) of our non-U.S. operating subsidiaries. In the event of a bankruptcy, liquidation or reorganization of any of our non-guarantor subsidiaries, holders of their indebtedness and their trade creditors will generally be entitled to payment of their claims from the assets of those subsidiaries before any assets are made available for distribution to us. Our non-guarantor subsidiaries had net sales (after intercompany eliminations) for the year ended December 31, 2005 of approximately $680.6 million, which represented 50% of consolidated net sales. At December 31, 2005 (i) our non-guarantor subsidiaries held approximately 43% of accounts receivable (excluding intercompany receivables), inventory and net property, plant and equipment, and (ii) our foreign non-guarantor subsidiaries had current and noncurrent liabilities (excluding intercompany liabilities and liabilities related to income taxes) which aggregated approximately $226.5 million. Our domestic non-guarantor subsidiaries are immaterial.

Your right to receive payments on these notes is effectively subordinated to the rights of our existing and future secured creditors.

Holders of our secured indebtedness will have claims that are prior to your claims as holders of the notes to the extent of the value of the assets securing that other indebtedness. Notably, we, certain of our subsidiaries and Parent are parties to our senior secured credit facility, which is secured by (1) a pledge of the capital stock of our domestic subsidiaries, (2) a pledge of 65% of the voting capital stock and 100% of the non-voting stock of our direct foreign subsidiaries and (3) a first priority security interest in certain domestic assets, including certain real property, of Tronox and the guarantors of the senior secured credit facility. The notes are effectively subordinated to that secured indebtedness to the extent of the value of the pledged collateral. In the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation, reorganization, or other bankruptcy proceeding, holders of secured indebtedness will have a claim on those of our assets that constitute their collateral that is senior to the claims of the holders of the notes and the guarantees. Holders of the notes will participate ratably with all holders of our unsecured indebtedness that is deemed to be of the same

16

Table of Contents

Index to Financial Statements

class as the notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the notes. As a result, holders of notes may receive less, ratably, than holders of secured indebtedness. As of December 31, 2005, the aggregate amount of our secured indebtedness was $200.0 million, and approximately $216.2 million was available for borrowing under our senior secured credit facility. We will be permitted to incur substantial additional indebtedness, including senior debt, in the future under the terms of our senior secured credit facility. See “Description of Other Indebtedness.”

If we are required by the indenture to offer to repurchase the notes upon a change of control, we may not have the necessary funds to do so.

Upon the occurrence of certain specific kinds of change of control events, we will be required to offer to repurchase all outstanding notes at 101% of the principal amount thereof plus accrued and unpaid interest to the date of repurchase. Any future agreements relating to indebtedness to which we become a party may contain similar provisions. However, it is possible that we will not have sufficient funds at the time of any change of control transaction to make the required repurchase of notes or that restrictions in our credit facility will not allow such repurchases. See “Description of Notes—Repurchase at the Option of Holders—Change of Control.”

The indebtedness represented by the notes and the guarantees may be unenforceable due to fraudulent conveyance statutes.

Under federal bankruptcy law and/or state fraudulent transfer laws, if a court of competent jurisdiction in a suit by an unpaid creditor or representative of creditors (such as a trustee in bankruptcy or a debtor-in-possession) were to find that we or our guarantors did not receive fair consideration (or reasonably equivalent value) for issuing the notes or the guarantees or any indebtedness refinanced by the notes and at the time of the issuance of the notes or the guarantees, that we or our guarantors were insolvent, were rendered insolvent by reason of that incurrence, were engaged in a business or transaction for which our remaining assets constituted unreasonably small capital, intended to incur, or believed that we would incur, debts beyond our ability to pay such debts as they became due, or that we intended to hinder, delay or defraud our creditors, then that court could, among other things,

| • | void all or a portion of our obligations to the holders of the notes or our guarantors’ obligations under the guarantees, |

| • | recover all or a portion of the payments made to holders of the notes, and/or |

| • | subordinate our or our guarantors’ obligations to the holders of the notes to our other existing and future indebtedness to a greater extent than would otherwise be the case, the effect of which would be to entitle those other creditors to be paid in full before any payment could be made on the notes. |

The measure of insolvency for purposes of the foregoing will vary depending upon the law of the relevant jurisdiction. Generally, however, a company would be considered insolvent for purposes of the foregoing if the sum of that company’s debts was greater than all of that company’s assets at a fair valuation, or if the present fair saleable value of that company’s assets was less than the amount that would be required to pay the probable liability on its existing debts as they become absolute and due. There can be no assurance as to what standards a court would apply to determine whether we or our guarantor were solvent at the relevant time, or whether, whatever standard was applied, the notes would not be voided on another of the grounds set forth above.

A financial failure by us or our subsidiaries may result in the assets of any or all of those entities becoming subject to the claims of all creditors of those entities.

A financial failure by us or our subsidiaries could affect payment of the notes if a bankruptcy court were to substantively consolidate us and our subsidiaries. If a bankruptcy court substantively consolidated us and our subsidiaries, the assets of each entity would become subject to the claims of creditors of all entities. This would expose holders of notes not only to the usual impairments arising from bankruptcy, but also to potential dilution

17

Table of Contents

Index to Financial Statements

of the amount ultimately recoverable because of the larger creditor base. Furthermore, forced restructuring of the notes could occur through the “cram-down” provisions of the bankruptcy code. Under these provisions, the notes could be restructured over your objections as to their general terms, primarily interest rate and maturity.

We may issue additional notes ranking equal to your notes.

The indenture governing the notes will permit us to issue additional notes, subject to satisfaction of certain covenants. If we issue any such additional notes, the holders of those notes will be entitled to share ratably with the holders of the notes in any proceeds distributed in connection with any foreclosure upon the collateral or an insolvency, liquidation, reorganization, dissolution or other winding-up. This may have the effect of reducing the amount of proceeds paid to you. See “Description of Notes.”

The notes may be affected by fluctuations in the market for non-investment-grade securities.

Historically, the market for non-investment-grade, or high-yield, debt securities has been subject to disruptions that have caused substantial volatility in their prices. To the extent that a trading market for the notes does develop, the liquidity of, and trading market for, the notes may be materially adversely affected by declines in the market for high-yield debt securities generally. These declines may materially adversely affect the price and trading of the notes, and the price at which they can be sold, independently of our financial performance and prospects.

Risks Related to Our Business and Industry

We are subject to significant liabilities that are in addition to those associated with our primary business. These liabilities could adversely affect our financial condition and results of operations and we could suffer losses as a result of these liabilities even if our primary business performs well.

We, our subsidiaries and their predecessors have operated a number of businesses in addition to the current chemical business, including businesses involving the treatment of forest products, the production of ammonium perchlorate, the refining and marketing of petroleum products, offshore contract drilling, coal mining and the mining, milling and processing of nuclear materials. As a result, we are subject to significant liabilities that are in addition to those associated with our primary business, including legal, regulatory and environmental liabilities. For example, we have liabilities relating to the remediation of various sites at which chemicals such as creosote, perchlorate, low-level radioactive substances, asbestos and other materials have been used or disposed. Our financial condition and results of operations could be adversely affected by these liabilities. We also could suffer losses as a result of these liabilities even if our primary business performs well. See Note 22 to the Consolidated and Combined Financial Statements included in this prospectus for a discussion of contingencies.

The costs of compliance with the extensive environmental, health and safety laws and regulations to which we are subject or the inability to obtain, update or renew permits required for the operation of our business could reduce our profitability or otherwise adversely affect us.

Our current and former operations involve the generation and management of regulated materials that are subject to various environmental laws and regulations and are dependent on the periodic renewal of permits from various governmental agencies. The inability to obtain, update or renew permits related to the operation of our businesses, or the costs required in order to comply with permit standards, could have a material adverse affect on us. For example, we currently are updating permits related to water and air emissions for our facility in Botlek, Netherlands. Although we do not anticipate any significant difficulties in obtaining such permits or that any material expenditures will be required, the failure to update such permits could have a material adverse effect on our ability to produce our products and on our results of operations.

In addition, changes in the laws and regulations to which we are subject, or their interpretation, or the enactment of new laws and regulations, could result in materially increased and unanticipated capital expenditures and compliance costs. For example, the proposed REACH (Registration, Evaluation and Authorization of Chemicals) regulatory scheme in the European Union, if implemented as currently proposed,

18

Table of Contents

Index to Financial Statements

could adversely affect our European operations by imposing on us a testing, evaluation and registration program for some of the chemicals that we use or produce. At the present time, we are not able to predict the ultimate cost of compliance with these requirements or their effect on our business.

Environmental laws and regulations obligate us to remediate various sites at which chemicals such as creosote, perchlorate, low-level radioactive substances, asbestos and other materials have been disposed of or released. Some of these sites have been designated Superfund sites by the U.S. Environmental Protection Agency (“EPA”) under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (“CERCLA”). See Note 22 to the Consolidated and Combined Financial Statements included in this prospectus for a discussion of these matters. The discovery of contamination arising from historical industrial operations at some of our properties has exposed us, and in the future may continue to expose us, to significant remediation obligations and other damages.

The actual costs of environmental remediation and restoration could exceed estimates.

As of December 31, 2005, we had reserves in the amount of $223.7 million for environmental remediation and restoration. We reserve for costs related to environmental remediation and restoration only when a loss is probable and the amount is reasonably estimable. In estimating our environmental liabilities, including the cost of investigation and remediation at a particular site, we consider a variety of matters, including, but not limited to, the stage of the investigation at the site, the stage of remedial design for the site, the availability of existing remediation technologies, presently-enacted laws and regulations and the state of any related legal or administrative investigation or proceedings. For example, at certain sites we are in the preliminary stages of our environmental investigation and therefore have reserved for such sites amounts equal only to the cost of our environmental investigation. The findings of these site investigations could result in an increase in our reserves for environmental remediation. While we believe we have established appropriate reserves for environmental remediation based on the information we currently know, additions to the reserves may be required as we obtain additional information that enables us to better estimate our liabilities.

Our estimates of environmental liabilities at a particular site could increase significantly as a result of, among other things, changes in laws and regulations, revisions to the site’s remedial design, unanticipated construction problems, identification of additional areas or volumes of contamination, increases in labor, equipment and technology costs, changes in the financial condition of other potentially responsible parties and the outcome of any related legal and administrative proceedings to which we are or may become a party. For example, in 2004, remediation efforts required by the Nuclear Regulatory Commission (“NRC”) at our site in Cushing, Oklahoma, identified additional soil and groundwater impacts that would require assessment and possible remediation. As a result, in that year we increased our reserves for environmental remediation with respect to the Cushing site by $10.3 million, which was part of a total increase in our 2004 environmental reserves of $81.4 million. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Environmental Matters—Environmental Costs” and Note 22 to the Consolidated and Combined Financial Statements included in this prospectus.

In addition to the sites for which we have established reserves, there may be other sites where we have potential liability for environmental matters but for which we do not have sufficient information to determine that a liability is probable and reasonably estimable. As we obtain additional information about those sites, we may determine that reserves for such sites should be established. New environmental claims also may arise as a result of changes in environmental laws and regulations or for other reasons. If new claims arise and losses associated with those claims become probable and reasonably estimable, we will need to increase our reserves to reflect those new claims.

As a result of the factors described above, it is not possible for us to reliably estimate the amount and timing of all future expenditures related to environmental or other contingent matters, and our actual costs related to such matters could exceed our current reserves at December 31, 2005. See “Business—Government Regulations and Environmental Matters” and “Legal Proceedings.”

19

Table of Contents

Index to Financial Statements

Hazards associated with chemical manufacturing could adversely affect our results of operations.

Due to the nature of our business, we are exposed to the hazards associated with chemical manufacturing and the related storage and transportation of raw materials, products and wastes. These hazards could lead to an interruption or suspension of operations and have an adverse effect on the productivity and profitability of a particular manufacturing facility or on us as a whole. Potential hazards include the following:

| • | Piping and storage tank leaks and ruptures |

| • | Mechanical failure |

| • | Employee exposure to hazardous substances |

| • | Chemical spills and other discharges or releases of toxic or hazardous substances or gases |

There is also a risk that one or more of our key raw materials or one or more of our products may be found to have currently unrecognized toxicological or health-related impact on the environment or on our customers or employees. Such hazards may cause personal injury and loss of life, damage to property and contamination of the environment, which could lead to government fines or work stoppage injunctions and lawsuits by injured persons. If such actions are determined adversely to us, we may have inadequate insurance to cover such claims, or we may have insufficient cash flow to pay for such claims. Such outcomes could adversely affect our financial condition and results of operations.

Violations or noncompliance with the extensive environmental, health and safety laws and regulations to which we are subject could result in unanticipated loss or liability.

Our operations and production facilities are subject to extensive environmental and health and safety laws and regulations at national, international and local levels in numerous jurisdictions relating to pollution, protection of the environment, transporting and storing raw materials and finished products and storing and disposing of hazardous wastes. We may incur substantial costs, including fines, damages, criminal or civil sanctions and remediation costs, or experience interruptions in our operations, for violations arising under these laws and regulations. In the event of a catastrophic incident involving any of the raw materials we use or chemicals we produce, we could incur material costs as a result of addressing the consequences of such event.

We are party to a number of legal and administrative proceedings involving environmental and other matters pending in various courts and before various agencies. These include proceedings associated with facilities currently or previously owned, operated or used by us or our predecessors, and include claims for personal injuries, property damages, injury to the environment, including natural resource damages, and non-compliance with permits. Any determination that one or more of our key raw materials or products, or the materials or products associated with facilities previously owned, operated or used by us or our predecessors, has, or is characterized as having, a toxicological or health-related impact on our environment, customers or employees could subject us to additional legal claims. These proceedings and any such additional claims may be costly and may require a substantial amount of management attention, which may have an adverse affect on our financial condition and results of operations. See “Business—Government Regulations and Environmental Matters” and “Legal Proceedings.”

The amount of our debt could adversely affect our financial condition, limit our ability to pursue business opportunities, reduce our operating flexibility or put us at a competitive disadvantage.

As of December 31, 2005, we had $548.0 million of long-term debt. Our debt could have important consequences for us. For instance, it could: