KBS REIT I Valuation & Portfolio Update December 11, 2014 1 Exhibit 99.1

Forward-Looking Statements The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Real Estate Investment Trust’s (“KBS REIT I”) Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Commission Exchange (the “SEC”) on March 7, 2014, and in KBS REIT I’s Quarterly Report on Form 10-Q for the period ended September 30, 2014, filed with the SEC on November 13, 2014, including the “Risk Factors” contained in such filings. For a full description of the limitations, methodologies and assumptions used to value KBS REIT I’s assets and liabilities in connection with the calculation of KBS REIT I’s estimated value per share, see KBS REIT I’s Current Report on Form 8-K, filed with the SEC on December 11, 2014. Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. KBS REIT I intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of KBS REIT I and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Further, forward-looking statements speak only as of the date they are made, and KBS REIT I undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Actual results may differ materially from those contemplated by such forward-looking statements. The appraisal methodologies for KBS REIT I’s real estate properties assume the properties realize the projected cash flows and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Though the appraisals and valuation estimates used in calculating the estimated value per share are Duff & Phelps’ best estimates as of September 30, 2014, and/or KBS REIT I’s and KBS Capital Advisors LLC’s (“the Advisor”) best estimates as of December 9, 2014, KBS REIT I can give no assurance in this regard. These statements also depend on factors such as: future economic, competitive and market conditions; KBS REIT I’s ability to maintain occupancy levels and lease rates at its real estate properties; the borrowers under KBS REIT I’s loan investments continuing to make required payments under the loan documents; KBS REIT I’s ability to sell real estate properties at the times and at the prices it expects; the ability of certain borrowers to maintain occupancy levels and lease rates at the properties securing KBS REIT I’s real estate-related investments; KBS REIT I’s ability to successfully negotiate modifications, extensions or refinancings of its debt obligations; the ability of KBS REIT I to make strategic asset sales to make required amortization payments and principal payments on its debt obligations and to fund its short and long-term liquidity needs; KBS REIT I’s ability to successfully operate and sell the GKK properties given current economic conditions and the concentration of the GKK properties in the financial services sector; the significant debt obligations KBS REIT I has assumed with respect to the GKK properties; the Advisor’s limited experience operating and selling bank branch properties; and other risks identified in Part I, Item IA of KBS REIT I’s Annual Report on Form 10-K for the year ended December 31, 2013 and in Part II, Item IA of KBS REIT I’s Quarterly Report on Form 10-Q for the period ended March 31, 2014, each as filed with the SEC. Actual events may cause the value and returns on KBS REIT I’s investments to be less than that used for purposes of KBS REIT I’s estimated value per share. 2

Overview Valuation History – Offering Price $10.00 – November 20091 $7.17 – December 20102 $7.32 – March 20123 $5.16 – December 20124 $5.18 – December 20135 $4.45 after $0.395/share distribution paid 12/5/13 – December 20146 $4.52 Distribution History (Record Dates) – 7/18/06 – 6/30/09 (36 Payments): $0.70/share on an annualized basis – 7/1/09 – 2/28/12 (32 Payments): $0.525/share on an annualized basis – 11/8/13 (1 Payment): $0.395/share as a one-time distribution paid 12/5/13, as a return of capital – 9/30/14 (1 Payment): $0.025/share as a quarterly distribution paid 10/30/14 3 1Data as of 9/30/09. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on November 23, 2009. 2Data as of 9/30/10. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on December 10, 2010. 3Data as of 12/31/11. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on March 26, 2012. 4Data as of 9/30/12. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on December 19, 2012. 5Data as of 9/30/13, with the exception of real estate appraised as of November 30, 2013. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on December 19, 2013. 6 Data as of 9/30/14. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on December 11, 2014.

• KBS REIT I followed the IPA Valuation Guidelines, which included independent third-party appraisals of 15 of its historical real estate properties and 387 GKK properties. Property values for properties held, and not under contract to sell, as of December 9, 2014 are equal to their appraised values as of September 30, 2014, and property values for properties sold from October 1, 2014 to December 9, 2014, or under contract to sell as of December 9, 2014, are equal to the contractual sales prices less actual or estimated disposition costs and fees. • Real estate-related investments, cash, other assets, mortgage debt and other liabilities were valued by the Advisor, similar to prior valuations. The estimated values of the real estate-related investments and mortgage debt are equal to the GAAP fair values as disclosed in the footnotes to KBS REIT I’s 10-Q for the period ended September 30, 2014, though $0.2 million has been added to the mortgage debt GAAP fair value disclosed in the 10-Q to account for slight changes in the assumed market interest rate, based on the appraised value of two real estate properties which were finalized subsequent to the filing of the 10-Q. • The estimated value per share as of December 9, 2014 is based on the estimated value of the REIT’s assets less the estimated value of the REIT’s liabilities divided by the number of shares outstanding, as of September 30, 2014. • Duff & Phelps primarily used a 10-year discounted cash flow (“DCF”) valuation method for historical properties, and direct capitalization, DCF and present value of cash flow valuation methods for the GKK properties. • KBS REIT I currently expects to update the estimated value per share in December 2015, in accordance with the IPA Valuation Guidelines, but is not required to update the estimated value per share more frequently than every 18 months. It expects to utilize an independent valuation firm or the Advisor for such valuation. Valuation Information 4 Third Party Valuation

KBS REIT I Valuation Summary Estimated Value of Portfolio 12/9/141 12/18/132 Assets: $1.625 Billion3 $1.977 Billion4 GKK Properties $730.8 Million (45%) $769 Million (39%) 394 Assets 417 Assets Historical Real Estate5 $683.2 Million (42%) $836.7 Million (42%) 15 Assets 23 Assets Historical Real Estate-Related $25.3 Million (2%) $25.5 Million (1%) Investments 4 Assets 4 Assets Real Estate Securities None $19.3 Million (1%) Other Assets6 $185.8 Million (11%) $326.4 Million (17%) Liabilities: $773.9 Million $1.056 Billion Mortgage and other debt: $726.0 Million $982 Million Other Liabilities7: $47.9 Million $74.0 Million Net Equity at Estimated Value: $851.2 Million $921.2 Million Distributions Paid December 5, 2013 ($75.0 Million) Net Equity at Estimated Value After Distribution $846.2 Million 5 1Based on data as of September 30, 2014. 2 Based on data as of September 30, 2013, with the exception of real estate appraised as of November 30, 2013. 3Includes properties held as of September 30, 2014, some of which were sold or transferred prior to December 9, 2014. 4Includes properties held for sale and non-sale disposition as of September 30, 2013, some of which were sold or transferred prior to December 18, 2013. 5Includes unconsolidated joint venture participation and Tribeca. 6Includes cash and cash equivalents, restricted cash, rents and other receivables, deposits and prepaid expenses as applicable. 7Includes accounts payable, accrued liabilities, security deposits, contingent liabilities and prepaid rent.

On December 9, 2014, KBS REIT I’s Board of Directors approved an estimated value per share of $4.52 The change in the estimated value per share from the December 2013 valuation of $4.45 was due to the following:* Valuation Information 6 * The changes are not equal to the change in values of each asset and liability group due to asset sales, loan payments, and other factors, which caused the value of certain asset or liability groups to change with no impact to KBS REIT I’s fair value of equity or the overall estimated value per share. For more information, see the Current Report on Form 8-K filed with the SEC on December 9, 2014. Change in Estimated Value (in thousands) December 18, 2013 est. value per share before December 5, 2013 distribution payment $ 4.85 Distribution paid on December 5, 2013 (0.40) December 18, 2013 estimated value per share $ 4.45 Real Estate Properties held as of September 30, 2014 – historical $ 0.04 Properties held as of September 30, 2014 – GKK properties 0.12 Properties sold through September 30, 2014 (0.03) Capital expenditures on real estate (0.14) Total changes related to real estate (0.01) Mortgage debt (0.05) Real estate securities 0.02 Undistributed operating cash flows 0.09 Other changes, net 0.02 Total changes $ 0.07 2014 estimated value per share $ 4.52

2014 Portfolio Highlights Bridgeway Technology Loan Discounted Payoff • The loan had an outstanding principal balance of $26.8 million plus accrued and unpaid interest of $2.1 million. Negotiated a discounted payoff of $25.6 million in April 2014. • Resulted in estimated annual interest savings of approximately $1.7 million. • Since the payoff, the REIT has fully leased the building from 60% occupancy to 100% occupancy and the appraised value increased by approximately $10.7 million. BBD2 Mortgage Loan Modification • Negotiated a $52.0 million paydown of this loan in April 2014, of which $7.0 million was drawn from a reserve fund. As of September 30, 2014, the outstanding principal balance for the BBD2 loan was $138.9 million. • Resulted in estimated annual interest savings of approximately $3.1 million. • Also negotiated a removal of the limitation on the number of times an event causing the imposition of a cash trap could be cured by KBS REIT I, as the lender had imposed a cash trap restricting certain distributions otherwise payable to KBS REIT I. • As a result of the negotiations and paydown, the REIT is now in compliance with the related covenants and the $7.6 million balance in the cash trap has been released to the REIT. Citizens JV Loan Refinance • The REIT made a $22.8 million paydown on the Citizens JV loan and refinanced the remaining $40 million in May 2014 with a new $40 million loan with an interest rate of LIBOR plus 3%. • Prior loan had an outstanding principal balance as of the date of the refinance of $63.1 million and an interest rate of 8.24%. • Estimated annual interest savings from the refinance is approximately $3.9 million. 7

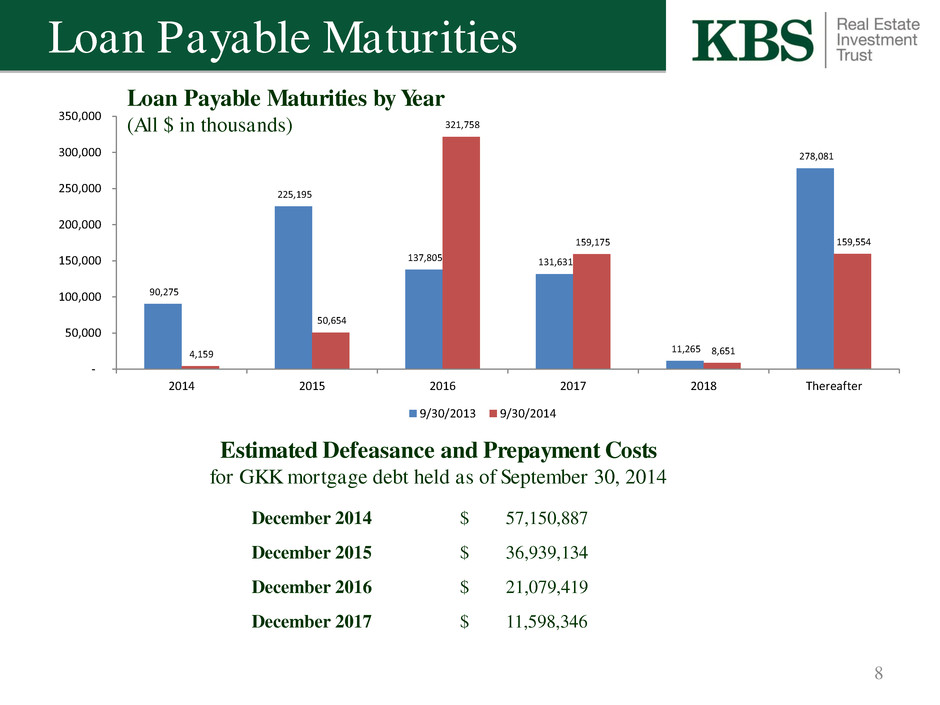

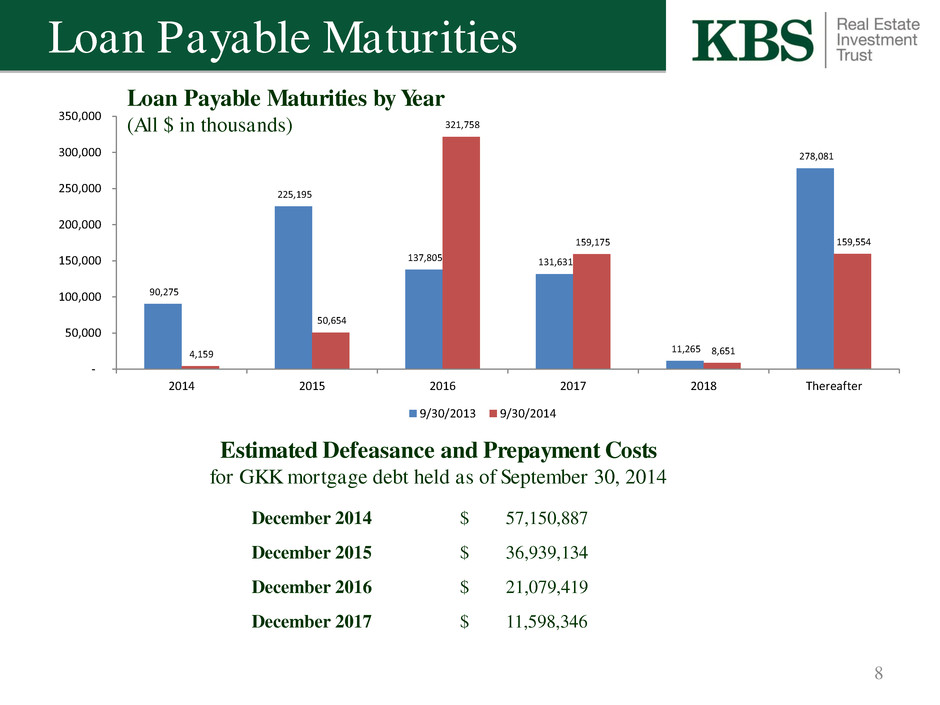

90,275 225,195 137,805 131,631 11,265 278,081 4,159 50,654 321,758 159,175 8,651 159,554 - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 2014 2015 2016 2017 2018 Thereafter 9/30/2013 9/30/2014 8 Loan Payable Maturities December 2014 $ 57,150,887 December 2015 $ 36,939,134 December 2016 $ 21,079,419 December 2017 $ 11,598,346 Estimated Defeasance and Prepayment Costs for GKK mortgage debt held as of September 30, 2014 Loan Payable Maturities by Year (All $ in thousands)

Stockholder Performance 9 KBS REIT I is providing this estimated value per share to assist broker-dealers that participated in its initial public offering in meeting their FINRA customer account statement reporting obligations. The valuation was performed in accordance with the provisions of and also to comply with the IPA Valuation Guidelines. As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different estimated value per share and these differences could be significant. KBS REIT I can give no assurance that: • a stockholder would be able to resell his or her shares at this estimated value; • a stockholder would ultimately realize distributions per share equal to the estimated value per share upon liquidation of KBS REIT I’s assets and settlement of its liabilities or a sale of KBS REIT I; • KBS REIT I’s shares of common stock would trade at the estimated value per share on a national securities exchange; • another independent third-party appraiser or third-party valuation firm would agree with KBS REIT I’s estimated value per share; or • the methodology used to calculate KBS REIT I’s estimated value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements. Further, the estimated value per share as of December 9, 2014 is based on the estimated value of KBS REIT I’s assets less the estimated value of KBS REIT I’s liabilities divided by the number of shares outstanding, all as of September 30, 2014. The value of KBS REIT I’s shares will fluctuate over time in response to developments related to individual assets in KBS REIT I’s portfolio and the management of those assets and in response to the real estate and finance markets. The estimated value per share does not reflect a discount for the fact that KBS REIT I is externally managed, nor does it reflect a real estate portfolio premium/discount versus the sum of the individual property values. The estimated value per share does not take into account estimated disposition costs and fees for real estate properties that are not under contract to sell, debt prepayment penalties or defeasance costs that could apply upon the prepayment of certain of KBS REIT I’s debt obligations or the impact of restrictions on the assumption of debt. KBS REIT I currently expects to utilize the Advisor and/or an independent valuation firm to update the estimated value per share in December 2015, in accordance with the IPA Valuation Guidelines, but is not required to update the estimated value per share more frequently than every 18 months.

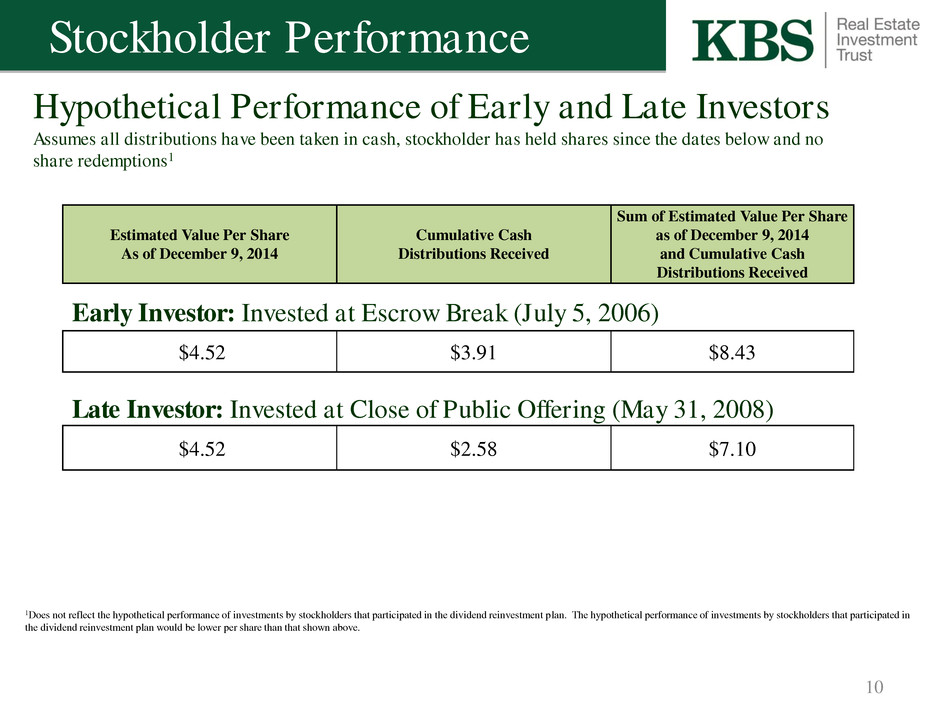

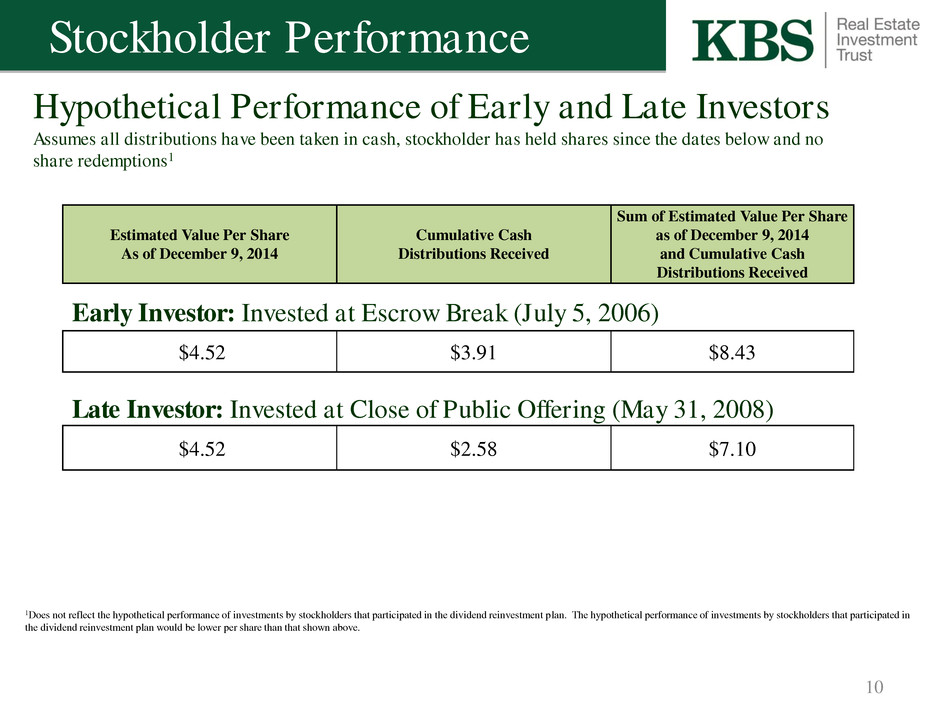

Stockholder Performance 10 $4.52 $3.91 $8.43 Hypothetical Performance of Early and Late Investors Assumes all distributions have been taken in cash, stockholder has held shares since the dates below and no share redemptions1 Estimated Value Per Share As of December 9, 2014 Cumulative Cash Distributions Received Sum of Estimated Value Per Share as of December 9, 2014 and Cumulative Cash Distributions Received Late Investor: Invested at Close of Public Offering (May 31, 2008) Early Investor: Invested at Escrow Break (July 5, 2006) $4.52 $2.58 $7.10 1Does not reflect the hypothetical performance of investments by stockholders that participated in the dividend reinvestment plan. The hypothetical performance of investments by stockholders that participated in the dividend reinvestment plan would be lower per share than that shown above.

2015 Focus & Objectives 1) Strategically selling assets 2) Exploring value-add opportunities for existing assets, primarily in the GKK portfolio 3) Refinancing upcoming maturities and paying down debt 4) Distributing available cash to stockholders 11

Examples of Challenges and Risks • Lower net operating income and cash flow from operations due to asset sales • Appropriately deploying capital to maintain and/or increase the value of the assets in the portfolio • Successful execution of strategic dispositions at times that maximize value returned to investors • Successful continued operations of the GKK properties given current economic conditions • Attracting tenants to vacant space in suburban markets at acceptable capital costs • Ability of tenants and borrowers to make future payments to the REIT • Susceptibility to disruptions in the banking industry due to a significant portion of GKK properties being leased to financial institutions 12

Thank You Q&A 13