Exhibit 10.120

CONFIDENTIAL

NIP JV, LLC

A Delaware Limited Liability Company

LIMITED LIABILITY COMPANY AGREEMENT

Dated as of December 23, 2011

MEMBERSHIP INTERESTS IN NIP JV, LLC, A DELAWARE LIMITED LIABILITY COMPANY, HAVE NOT BEEN REGISTERED WITH OR QUALIFIED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE. THE INTERESTS ARE BEING SOLD IN RELIANCE UPON EXEMPTIONS FROM SUCH REGISTRATION OR QUALIFICATION REQUIREMENTS. THE INTERESTS CANNOT BE SOLD, TRANSFERRED, ASSIGNED OR OTHERWISE DISPOSED OF EXCEPT IN COMPLIANCE WITH THE RESTRICTIONS ON TRANSFERABILITY CONTAINED IN THE COMPANY’S LIMITED LIABILITY COMPANY AGREEMENT AND APPLICABLE FEDERAL AND STATE SECURITIES LAWS.

________________________________________________________________________________________________________________________

|

| | | |

| | | |

| TABLE OF CONTENTS |

| | | Page |

| | |

| ARTICLE I DEFINITIONS AND USAGE | 1 |

|

| | | |

| Section 1.1 | Definitions | 1 |

|

| Section 1.2 | Terms and Usage Generally | 17 |

|

| | |

| ARTICLE II THE COMPANY | 17 |

|

| | | |

| Section 2.1 | Formation | 17 |

|

| Section 2.2 | Name | 17 |

|

|

| | | |

| Section 2.3 | Term | 17 |

|

| Section 2.4 | Registered Office; Registered Agent; Principal Office; Other Offices | 18 |

|

| Section 2.5 | Purposes | 18 |

|

| Section 2.6 | Powers of the Company | 18 |

|

| Section 2.7 | Partnership Status | 18 |

|

| Section 2.8 | Ownership of Property | 18 |

|

| | |

| ARTICLE III MEMBERS; REPORTS | 19 |

|

| | | |

| Section 3.1 | Admission of Members | 19 |

|

| Section 3.2 | Substitute Members and Additional Members | 19 |

|

| Section 3.3 | Tax and Accounting Information | 20 |

|

| Section 3.4 | Certification of Membership Interests | 21 |

|

| | |

| ARTICLE IV CAPITAL CONTRIBUTIONS AND REFINANCING | 21 |

|

| | | |

| Section 4.1 | General | 21 |

|

| Section 4.2 | Initial Oaktree Contribution | 21 |

|

| Section 4.3 | Capital Contributions through HC-KBS Funding Date | 22 |

|

| Section 4.4 | Refinancing | 22 |

|

| Section 4.5 | Additional HC-KBS Contribution | 23 |

|

| Section 4.6 | Additional Contributions | 23 |

|

| Section 4.7 | Failures to Make Additional Contributions | 23 |

|

| Section 4.8 | No Additional Rights | 24 |

|

| | |

| ARTICLE V CAPITAL ACCOUNTS; DISTRIBUTIONS; ALLOCATIONS | 24 |

|

| | | |

| Section 5.1 | Capital Accounts | 24 |

|

| Section 5.2 | Amounts and Priority of Distributions | 25 |

|

| Section 5.3 | Allocations | 28 |

|

| Section 5.4 | Other Allocation Rules | 30 |

|

| Section 5.5 | Tax Withholding; Withholding Advances | 31 |

|

| | |

|

| | | |

| ARTICLE VI CERTAIN TAX MATTERS | 32 |

|

| | | |

| Section 6.1 | Tax Matters Partner | 32 |

|

i

________________________________________________________________________________________________________________________

|

| | | |

| | | |

| Section 6.2 | Section 754 Election | 33 |

|

| | |

| ARTICLE VII VOTING RIGHTS AND MANAGEMENT OF THE COMPANY | 33 |

|

| | | |

| Section 7.1 | Management by the Board of Representatives | 33 |

|

| Section 7.2 | Board of Representatives | 34 |

|

| Section 7.3 | Participation in Management by Members; Major Decisions | 36 |

|

| Section 7.4 | Day-to-Day Management; Asset Management | 39 |

|

| | |

| ARTICLE VIII TRANSFERS OF INTERESTS | 40 |

|

| | | |

| Section 8.1 | Restrictions on Transfers | 40 |

|

| Section 8.2 | Right of First Refusal | 42 |

|

| Section 8.3 | Tag-Along Right | 43 |

|

| Section 8.4 | Drag-Along Right | 45 |

|

| Section 8.5 | Effect of Repurchase; Transfers and Replacement Certificates | 46 |

|

| | |

| ARTICLE IX UNWINDING | 46 |

|

| | | |

| Section 9.1 | Unwinding | 46 |

|

| | |

| ARTICLE X LIMITATION ON LIABILITY; EXCULPATION AND INDEMNIFICATION; REPRESENTATIONS AND WARRANTIES | 47 |

|

| | | |

| Section 10.1 | Limitation on Liability | 47 |

|

| Section 10.2 | Exculpation and Indemnification | 47 |

|

| Section 10.3 | Representations and Warranties | 48 |

|

| | |

| ARTICLE XI DISSOLUTION AND TERMINATION | 51 |

|

| | | |

| Section 11.1 | Dissolution | 51 |

|

| Section 11.2 | Winding Up of the Company | 52 |

|

| Section 11.3 | Distribution of Property | 53 |

|

| Section 11.4 | Termination | 53 |

|

| Section 11.5 | Survival | 53 |

|

| | |

| ARTICLE XII MISCELLANEOUS | 53 |

|

| | | |

| Section 12.1 | Expenses | 53 |

|

| Section 12.2 | Further Assurances | 53 |

|

|

| | | |

| Section 12.3 | Notices | 53 |

|

| Section 12.4 | No Third Party Beneficiaries | 54 |

|

| Section 12.5 | Waiver | 54 |

|

| Section 12.6 | Consent to Jurisdiction | 54 |

|

| Section 12.7 | Integration | 55 |

|

| Section 12.8 | Rules of Construction | 55 |

|

| Section 12.9 | Membership Interests Legend | 55 |

|

| Section 12.10 | Headings | 55 |

|

| Section 12.11 | Sale Transaction | 56 |

|

ii

________________________________________________________________________________________________________________________

|

| | | |

| | | |

| Section 12.12 | Confidentiality | 56 |

|

| Section 12.13 | Severability | 57 |

|

| Section 12.14 | Governing Law | 57 |

|

| Section 12.15 | Amendment | 57 |

|

| Section 12.16 | Counterparts | 57 |

|

|

| | | | | | |

| | | | | | | |

| | | | |

| SCHEDULE A | | | | Members and Capital Contributions | | |

| SCHEDULE B | | | | NIP Properties | | |

| SCHEDULE C | | | | Board Representatives | | |

| SCHEDULE D | | | | REIT Prohibited Transactions | | |

| SCHEDULE E | | | | Exempt Properties | | |

| SCHEDULE F | | | | Board Decisions | | |

| SCHEDULE G | | | | Lawsuits against Borrowers or NIP Properties | | |

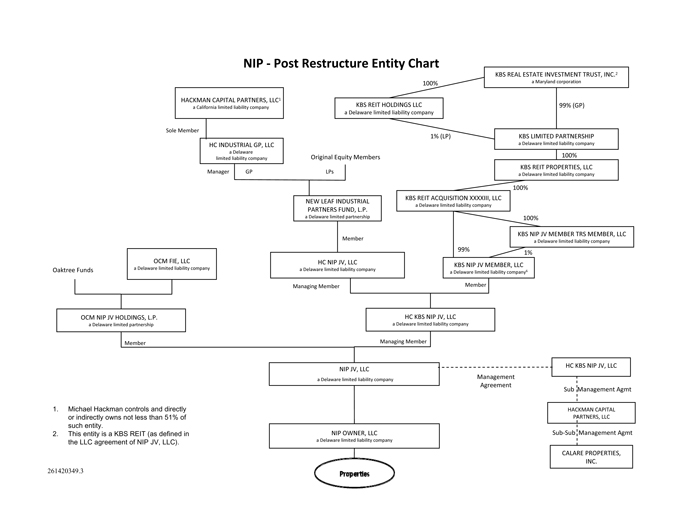

| SCHEDULE H | | | | Structure Chart | | |

iii

________________________________________________________________________________________________________________________

LIMITED LIABILITY COMPANY AGREEMENT of NIP JV, LLC, a Delaware limited liability company (the “Company”), dated as of December 23, 2011 (the “Effective Date”), by and between HC KBS NIP JV, LLC, a Delaware limited liability company (“HC-KBS”), and OCM NIP JV HOLDINGS, L.P., a Delaware limited partnership (“Oaktree”). Capitalized terms used but not elsewhere defined herein shall have the respective meanings ascribed to such terms in Section 1.1(a).

Preliminary Statement

WHEREAS, the Company (i) was formed as a limited partnership under the Delaware Revised Uniform Partnership Act, 6 Del. C. §§ 15-101 et seq., under the name OCM Industrial Holdings, L.P., pursuant to a certificate of partnership which was executed and filed with the Secretary of State of the State of Delaware on June 25, 2010, and (ii) was converted to, and reorganized under the name of the Company as, a limited liability company under the Delaware Limited Liability Company Act, 6 Del. C. §§ 18-101 et seq. (the “Act”) pursuant to a certificate of conversion and a certificate of formation (the “Certificate”), both of which were executed and filed with the Secretary of State of the State of Delaware on December 15, 2011;

WHEREAS, the original members of the Company (within the meaning of Section 18-101(7) of the Act), certain affiliates of Oaktee, assigned their membership interests in the Company to Oaktree prior to the Effective Date;

WHEREAS, HC-KBS is being admitted to the Company as a member (within the meaning of Section 18-101(7) of the Act) as of the Effective Date; and

WHEREAS, the HC-KBS Member and the Oaktree Member wish to adopt this Agreement as the Company’s limited liability company agreement (within the meaning of Section 18-101(7) of the Act) and to set forth herein, among other things, their respective rights, duties and obligations with respect to the Company and each other.

NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Members hereby agree as follows:

ARTICLE I

DEFINITIONS AND USAGE

Section 1.1 Definitions.

(a) The following terms shall have the following meanings for the purposes of this Agreement:

________________________________________________________________________________________________________________________

“Additional Member” means any Person admitted as a member of the Company pursuant to Section 3.2 in connection with the new issuance of Membership Interests to such Person.

“Adjusted Capital Account Deficit” means, with respect to any Member, the deficit balance, if any, in such Member’s Capital Account as of the end of the relevant Allocation Year, after giving effect to the following adjustments:

(i) Credit to such Capital Account any amounts that such Member is deemed to be obligated to restore pursuant to the penultimate sentence in Treasury Regulations Sections 1.704-2(g)(1) and 1.704-2(i)(5); and

(ii) Debit to such Capital Account the items described in Treasury Regulations Sections 1.704-1(b)(2)(ii)(d)(4), 1.704-1(b)(2)(ii)(d)(5) and 1.704-1(b)(2)(ii)(d)(6).

The foregoing definition of Adjusted Capital Account Deficit is intended to comply with the provisions of Treasury Regulations Section 1.704-1(b)(2)(ii)(d) and shall be interpreted consistently therewith.

“Affiliate” of any specified Person means (i) with respect to any Person that is not a natural Person, any other Person that, directly or indirectly, Controls, is Controlled by or is under common Control with such specified Person and (ii) with respect to any Person that is a natural Person, (A) the spouse, siblings, ancestors or lineal descendants (including by adoption) of such Person, (B) the estate or legal representative of, or any trust established for the benefit of, such Person or any of the Persons described in clause (A) above, (C) any entity which such Person and/or one or more of the Persons described in clause (A) and/or (B) Controls or in which any one or more of such Persons hold a majority interest. For purposes of this Agreement, none of the Company or its Subsidiaries shall be deemed an Affiliate of any of the Members or any of their Affiliates.

“Affiliate Contract” means any agreement or transaction between the Company or any of its Subsidiaries, on the one hand, and any Member, Hackman Capital Partners, LLC, Calare Properties, Inc., a KBS REIT, or any of their respective Affiliates, or any directors, officers, managers or general partners of, or Persons holding similar positions in, any of the foregoing, or any Affiliates of any such directors, officers, managers, general partners or other Persons, on the other hand. No issuance, purchase or sale of Membership Interests by the Company shall constitute an Affiliate Contract.

“Agreement” means this Limited Liability Company Agreement.

“Allocation Year” means (i) the period commencing on the Effective Date and ending on December 31, 2011, (ii) any subsequent twelve (12) month period commencing on January 1 and ending on December 31 or (iii) any portion of the period described in clauses (i) or (ii) for which the Company is required to allocate Net Income, Net Loss, and other items of Company income, gain, loss, or deduction pursuant to ARTICLE V.

2

________________________________________________________________________________________________________________________

“Borrower” means the borrower under any of the Loans.

“Business” means, collectively, the acquisition, ownership, operation, holding, development, leasing, management, maintenance, sale, transfer, servicing, conveyance, disposition, pledge, assignment, financing and refinancing of, and otherwise dealing with, either directly or indirectly through one or more Persons, the NIP Properties and other properties acquired in accordance with the provisions hereof and used or to be used primarily for industrial and/or warehouse and related purposes (and any Property relating thereto), and any other businesses ancillary or complementary thereto.

“Business Day” means any day excluding Saturday, Sunday or any day which is a legal holiday under the laws of the State of California or is a day on which banking institutions in the State of California are authorized or required by law or other governmental action to close.

“Capital Account” means the capital account established and maintained for each Member pursuant to Section 5.1.

“Capital Contribution” means, (i) with respect to the Oaktree Member, the Initial Oaktree Contribution, any Subsequent Oaktree Contributions, and any other capital contribution made by the Oaktree Member to the Company in accordance with Section 4.6, and (ii) with respect to the HC-KBS Member, the HC-KBS Contribution (if any), the Additional HC-KBS Contribution (if any) and any other capital contribution made by the HC-KBS Member to the Company in accordance with Section 4.6.

“Carrying Value” means, with respect to any Property (other than money), such Property’s adjusted basis for Federal income tax purposes, except as follows:

(i) The initial Carrying Value of any such Property contributed by a Member to the Company shall be the gross fair market value of such Property, as specified herein or as determined by the Board;

(ii) The Carrying Values of all such Properties shall be adjusted to equal their respective gross fair market values (taking Section 7701(g) of the Code into account), as determined by the Board, at the time of any Revaluation pursuant to Section 5.1(c);

(iii) The Carrying Value of any item of such Properties distributed to any Member shall be adjusted to equal the gross fair market value (taking Section 7701(g) of the Code into account) of such Property on the date of distribution as determined by the Board; and

(iv) The Carrying Values of such Properties shall be increased (or decreased) to reflect any adjustments to the adjusted basis of such Properties pursuant to Code Section 734(b) or Code Section 743(b), but only to the extent that such adjustments are taken into account in determining Capital Accounts pursuant to Treasury Regulations Section 1.704-1(b)(2)(iv)(m) and subparagraph (vi) of the definition of “Net

3

________________________________________________________________________________________________________________________

Income” and “Net Loss” or Section 5.3(b)(vi); provided, however, that Carrying Values shall not be adjusted pursuant to this subparagraph (iv) to the extent that an adjustment pursuant to subparagraph (ii) is required in connection with a transaction that would otherwise result in an adjustment pursuant to this subparagraph (iv). If the Carrying Value of such Property has been determined or adjusted pursuant to subparagraph (i), (ii), or (iv), such Carrying Value shall thereafter be adjusted by the Depreciation taken into account with respect to such Property, for purposes of computing Net Income and Net Loss.

The respective Carrying Values of the NIP Properties as of the Effective Date shall be determined by the Oaktree Member, after reasonable consultation with the HC-KBS Member, as soon as practicable following the Effective Date but in no event later than June 30, 2012.

“Code” means the Internal Revenue Code of 1986.

“Company Liabilities” any and all liabilities of the Company (including (i) all bills and accounts payable, (ii) all accrued and unpaid expenses, (iii) all contractual obligations for the payment of money or Property, (iv) funds set aside or amounts allocated to reserves, including reserves for operating costs and expenses and working capital reserves, in amounts determined by the Board, and (v) all other liabilities owed by the Company of whatsoever kind and nature) other than any Additional Equity Loans.

“Company Minimum Gain” means “partnership minimum gain,” as defined in Treasury Regulations Sections 1.704-2(b)(2) and 1.704-2(d).

“Confidential Information” means any confidential, proprietary or non-public information with regard to the Company or any of its Subsidiaries disclosed or communicated by the Company or any of its Subsidiaries to any Member, whether oral or written, and regardless of the manner or form in which it is furnished and including, for the avoidance of doubt, the existence and terms of this Agreement and any information provided pursuant to Section 3.3.

“Control” (including the terms “Controls” and “Controlled”), with respect to the relationship between or among two or more Persons, means the possession, directly or indirectly, of the power to direct or cause the direction of the affairs or management of the Person or Persons subject to such “Control”, whether through the ownership of voting securities, as trustee or executor, by contract or otherwise.

“Covered Person” means (i) each Member or any Affiliate of a Member (including any such Member in its capacity as the Tax Matters Partner), (ii) each officer, director, shareholder, member, partner, employee, representative, agent or trustee, or spouse, of a Member or an Affiliate thereof, (iii) each officer or authorized agent of the Company or of any of its Subsidiaries, and (iv) each Representative on the Board.

“Depreciation” means, for each Allocation Year, an amount equal to the depreciation, amortization, or other cost recovery deduction allowable for Federal income

4

________________________________________________________________________________________________________________________

tax purposes with respect to an asset for such Allocation Year, except that if the Carrying Value of an asset differs from its adjusted basis for Federal income tax purposes at the beginning of such Allocation Year, Depreciation shall be an amount that bears the same ratio to such beginning Carrying Value as the Federal income tax depreciation, amortization, or other cost recovery deduction for such Allocation Year bears to such beginning adjusted tax basis; provided, however, that, if the adjusted basis for Federal income tax purposes of an asset at the beginning of such Allocation Year is zero, Depreciation shall be determined with reference to such beginning Carrying Value using any reasonable method selected by the Board.

“Distributable Cash” means, as of the time of determination, the excess of (i) the balance of cash (including cash equivalents) then held by the Company at such time, including from distributions by the Company’s Subsidiaries with respect to the Equity Securities in such Subsidiaries held by the Company, over (ii) all Company Liabilities as of such time, in each case, as determined by the Board.

“Equity Security” means (i) with respect to any corporation, shares, interests, participations or other equivalents in the capital stock of such corporation, however designated, and (ii) with respect to any partnership or limited liability company, partnership or limited liability company interests, or units, participations or equivalents of partnership or limited liability company interests, in such partnership or limited liability company, however designated.

“Fair Market Value” means, as to any Property, the price at which a willing seller would sell, and a willing buyer would buy, such Property having full knowledge of the relevant facts, in an arm’s-length transaction without either party having time constraints, and without either party being under any compulsion to buy or sell, as determined by the Board.

“Final Determination” means the final resolution of any tax matter contested by the IRS or any state, local or foreign taxing authority, including a closing agreement with the IRS or the relevant state, local or foreign taxing authority, a claim for refund that has been allowed, a deficiency notice with respect to which the period for filing a petition with the United States Tax Court or the relevant state, local or foreign tribunal has expired, or a decision of competent jurisdiction that is not subject to appeal or as to which the time for appeal has expired.

“Fiscal Year” means the fiscal year and taxable year of the Company. The initial Fiscal Year shall commence on the Effective Date and end on December 31, 2011, and each Fiscal Year thereafter shall commence on January 1 and end on December 31 of the next succeeding calendar year; provided that, subject to the requirements of Section 706 of the Code, the Fiscal Year of the Company may (without the consent of any Member) be changed by the Board.

“HC Entity” means an entity Controlled by either or both of Michael Hackman and William Manley.

5

________________________________________________________________________________________________________________________

“HC-KBS Funding Date” means March 15, 2012 or, if the Equity Member shall have made the First HC-KBS Contribution in the amount set forth in clause (ii) or (iii) of the first sentence of Section 4.3(a) in accordance with the

provisions thereof, May 15, 2012.

“HC-KBS Member” means HC-KBS and/or any direct or indirect Permitted Transferee thereof to whom Membership Interests are Transferred in accordance with Section 8.1(a) of this Agreement.

“HC-KBS Party” means HC-KBS and any Person that owns a direct or indirect interest in HC-KBS and has the right to approve any of the transactions, activities or matters contemplated in this Agreement.

“IRR” means an internal rate of return, compounded monthly, as determined using the Microsoft Excel Function XIRR (or, if such software is no longer available, any comparable software selected by the Board), and shall include a return of, as well as a return on, the relevant capital.

“IRS” means the Internal Revenue Service of the United States.

“JV Member Transfer” means any transfer of an equity interest in the HC-KBS Member (whether pursuant to the exercise of a buy-sell right under the operating agreement of the HC-KBS Member or otherwise) between the KBS JV Member and any member of the HC-KBS Member which is an HC Entity.

“KBS JV Member” has the meaning set forth in the definition of “Qualified HC-KBS Entity”.

“KBS REIT” means any real estate investment trust or institutional investor for which KBS Capital Advisors LLC, a Delaware limited liability company, acts as the investment advisor from time to time, in which capacity KBS Capital Advisors LLC is responsible for conducting or overseeing the day-to-day operation of the business of such trust or the investments of such investor which are the subject of such advisory arrangement (including such investor’s investment in the HC-KBS Member) and for making recommendations to the independent board Controlling such trust, or to such investor, regarding material actions and decisions. The term “KBS REIT” includes, as of the Effective Date, KBS Real Estate Investment Trust, Inc., a Maryland corporation, KBS Real Estate Investment Trust II, Inc., a Maryland corporation, KBS Real Estate Investment Trust III, Inc., a Maryland corporation, and KBS Strategic Opportunity REIT, Inc., a Maryland corporation.

“Leveraged Equity” has the meaning set forth in the definition of “Pro Rata”.

“Lien” means any pledge, encumbrance, security interest, purchase option, call or similar right.

6

________________________________________________________________________________________________________________________

“Loans” means (i) a mortgage loan in the original principal amount of $300,000,000 made pursuant to that certain Second Amended and Restated Loan Agreement dated as of May 8, 2008, effective as of April 15, 2008, by and between OCM Investment Holdings, LLC (“OCMIH”), as successor (by assignment) to Citigroup Global Markets Realty Corp. (“CGMRC”), as lender (in such capacity, “Mortgage Lender”), and National Industrial Portfolio, LLC (f/k/a National Industrial Portfolio Borrower, LLC), as borrower (“Mortgage Borrower”), as amended by that certain First Amendment to Second Amended and Restated Loan Agreement dated as of November 19, 2008, by and between Mortgage Lender and Mortgage Borrower, that certain Second Amendment to Second Amended and Restated Loan Agreement dated as of July 9, 2010, by and between Mortgage Lender and Mortgage Borrower, and that certain Omnibus Amendment to Loan Documents, dated as of August 9, 2011, by and between Mezzanine A Lender and Mezzanine A Borrower, Mezzanine B Lender and Mezzanine B Borrower, Mezzanine C Lender and Mezzanine C Borrower, Mezzanine D Lender and Mezzanine D Borrower, Mezzanine E Lender and Mezzanine E Borrower (as such terms are hereinafter defined), and Mortgage Borrower and Mortgage Lender, and acknowledged and consented and agreed to by Guarantors (as defined therein) (the “Omnibus Amendment”), (ii) a mezzanine loan in the original principal amount of $40,200,000 made pursuant to that certain Second Amended and Restated Mezzanine A Loan Agreement dated as of May 8, 2008, effective as of April 15, 2008, between OCMIH, as successor (by assignment) to CGMRC, as lender (in such capacity, “Mezzanine A Lender”), and National Industrial Mezz A, LLC, as borrower (“Mezzanine A Borrower”), as amended by that certain First Amendment to Second Amended and Restated Mezzanine A Loan Agreement dated as of November 19, 2008, by and between Mezzanine A Lender and Mezzanine A Borrower, that certain Second Amendment to Second Amended and Restated Mezzanine A Loan Agreement dated as of July 9, 2010, by and between Mezzanine A Lender and Mezzanine A Borrower, and the Omnibus Amendment to Loan Documents, (iii) a mezzanine loan in the original principal amount of $32,300,000 made pursuant to that certain Mezzanine B Loan Agreement dated as of May 8, 2008, effective as of April 15, 2008, by and between OCMIH, as successor (by assignment) to Normandy NIP Holdings, LLC, as lender (in such capacity, “Mezzanine B Lender”), and NIPB Mezz B, LLC, as borrower (“Mezzanine B Borrower”), as amended by that certain First Amendment to Mezzanine B Loan Agreement dated as of November 19, 2008, by and between Mezzanine B Lender and Mezzanine B Borrower, that certain Second Amendment to Mezzanine B Loan Agreement dated as of

July 9, 2010, by and between Mezzanine B Lender and Mezzanine B Borrower, and the Omnibus Amendment to Loan Documents, (iv) a mezzanine loan in the original principal amount of $32,300,000 made pursuant to that certain Mezzanine C Loan Agreement dated as of May 8, 2008, effective as of April 15, 2008, by and between OCMIH, as successor (by assignment) to CGMRC, as lender (in such capacity, “Mezzanine C Lender”), and NIPB Mezz C, LLC, as borrower (“Mezzanine C Borrower”), as amended by that certain First Amendment to Mezzanine C Loan Agreement dated as of November 19, 2008, by and between Mezzanine C Lender and Mezzanine C Borrower, that certain Second Amendment to Mezzanine C Loan Agreement dated as of July 9, 2010, by and between Mezzanine C Lender and Mezzanine C Borrower, and the Omnibus Amendment to Loan Documents, (v) a mezzanine loan in the original principal amount of $26,200,000 made pursuant to that certain Mezzanine D Loan Agreement dated as of May 8, 2008, effective as of April 15, 2008, by and between OCMIH, as successor (by assignment) to CGMRC, as

7

________________________________________________________________________________________________________________________

lender (in such capacity, “Mezzanine D Lender”), and NIPB Mezz D, LLC, as borrower (“Mezzanine D Borrower”), as amended by that certain First Amendment to Mezzanine D Loan Agreement dated as of November 19, 2008, by and between Mezzanine D Lender and Mezzanine D Borrower, that certain Second Amendment to Mezzanine D Loan Agreement dated as of July 9, 2010, by and between Mezzanine D Lender and Mezzanine D Borrower, and the Omnibus Amendment to Loan Documents, and (vi) a mezzanine loan in the original maximum principal amount of $20,000,000 made pursuant to that certain Mezzanine E Loan Agreement dated as of May 8, 2008, effective as of April 15, 2008, by and between OCM Industrial E-Investments, L.P., as successor (by assignment) to CGMRC, as lender (in such capacity, “Mezzanine E Lender”), and NIPB Mezz E, LLC, as borrower (“Mezzanine E Borrower”), as amended by that certain First Amendment to Mezzanine E Loan Agreement dated as of November 19, 2008, by and between Mezzanine E Lender and Mezzanine E Borrower, that certain Second Amendment to Mezzanine E Loan Agreement dated as of July 9, 2010, by and between Mezzanine E Lender and Mezzanine E Borrower, and the Omnibus Amendment to Loan Documents. All of the Loans have, prior to the Effective Date, been assigned to the Company.

“Member” means any Person named as a member of the Company on Schedule A and on the books and records of the Company as the same may be amended from time to time to reflect any Person admitted as an Additional Member or a Substitute Member, for so long as such Person continues to be a member of the Company.

“Member Nonrecourse Debt” has the same meaning as the term “partner nonrecourse debt” in Treasury Regulations Section 1.704-2(b)(4).

“Member Nonrecourse Debt Minimum Gain” means an amount with respect to each “partner nonrecourse debt” (as defined in Treasury Regulation Section 1.704-2(b)(4)) equal to the Company Minimum Gain that would result if such partner nonrecourse debt were treated as a nonrecourse liability (as defined in Treasury Regulations Section 1.752-1(a)(2)) determined in accordance with Treasury Regulations Section 1.704-2(i)(3).

“Member Nonrecourse Deductions” has the same meaning as the term “partner nonrecourse deductions” in Treasury Regulations Sections 1.704-2(i)(1) and 1.704-2(i)(2).

“Membership Interest” means the interest of a Member in the Company, including such Member’s right (i) to a distributive share of the Net Income, Net Losses, and other items of income, gain, loss, deduction and credits of the Company, (ii) to a distributive share of the assets of the Company and (iii) to vote on, consent to or otherwise participate in any decision of the Members to the extent provided in this Agreement.

“Net Income” and “Net Loss” mean, for each Allocation Year, an amount equal to the Company’s taxable income or loss for such Allocation Year, determined in accordance with Section 703(a) of the Code (for this purpose, all items of income, gain, loss, or deduction required to be stated separately pursuant to Section 703(a)(1) of the

8

________________________________________________________________________________________________________________________

Code shall be included in taxable income or loss), with the following adjustments (without duplication):

(i) Any income of the Company that is exempt from Federal income tax and not otherwise taken into account in computing Net Income or Net Loss pursuant to this definition of “Net Income” and “Net Loss” shall be added to such taxable income or loss;

(ii) Any expenditures of the Company described in Section 705(a)(2)(B) of the Code or treated as Section 705(a)(2)(B) of the Code expenditures pursuant to Treasury Regulations Section 1.704-1(b)(2)(iv)(i), and not otherwise taken into account in computing Net Income and Net Loss pursuant to this definition of “Net Income” and “Net Loss,” shall be subtracted from such taxable income or loss;

(iii) In the event the Carrying Value of any Company asset is adjusted pursuant to subparagraphs (ii) or (iii) of the definition of “Carrying Value,” the amount of such adjustment shall be treated as an item of gain (if the adjustment increases the Carrying Value of the asset) or an item of loss (if the adjustment decreases the Carrying Value of the asset) from the disposition of such asset and shall be taken into account for purposes of computing Net Income and Net Loss;

(iv) Gain or loss resulting from any disposition of Property with respect to which gain or loss is recognized for Federal income tax purposes shall be computed by reference to the Carrying Value of the Property disposed of, notwithstanding that the adjusted tax basis of such Property differs from its Carrying Value;

(v) In lieu of the depreciation, amortization, and other cost recovery deductions taken into account in computing such taxable income or loss, there shall be taken into account Depreciation for such Allocation Year, computed in accordance with the definition of Depreciation;

(vi) To the extent an adjustment to the adjusted tax basis of any Company asset pursuant to Section 734(b) of the Code is required, pursuant to Treasury Regulations Section 1.704-(b)(2)(iv)(m)(4), to be taken into account in determining Capital Accounts as a result of a distribution other than in liquidation of a Member’s interest in the Company, the amount of such adjustment shall be treated as an item of gain (if the adjustment increases the basis of the asset) or loss (if the adjustment decreases such basis) from the disposition of such asset and shall be taken into account for purposes of computing Net Income or Net Loss; and

(vii) Notwithstanding any other provision of this definition, any items that are specially allocated pursuant to Section 5.3(b) or Section 5.3(c) shall not be taken into account in computing Net Income and Net Loss.

9

________________________________________________________________________________________________________________________

The amounts of the items of Company income, gain, loss, or deduction available to be specially allocated pursuant to Section 5.3(b) or Section 5.3(c) shall be determined by applying rules analogous to those set forth in subparagraphs (i) through (vi) above.

“NIP Properties” means the properties described on Schedule B.

“Nonrecourse Deductions” has the meaning set forth in Treasury Regulations Sections 1.704-2(b)(1) and 1.704-2(c).

“Oaktree Affiliate” means Oaktree Capital Management, L.P. or one or more funds, separate accounts or other Persons directly or indirectly managed or Controlled by Oaktree Capital Management, L.P.

“Oaktree Member” means Oaktree and/or any direct or indirect Permitted Transferee thereof to whom Membership Interests are Transferred in accordance with Section 8.1(b).

“Oaktree Party” means Oaktree and any Person that owns a direct or indirect interest in Oaktree and has the right to approve any of the transactions, activities or matters contemplated in this Agreement.

“Oaktree Pro Forma Equity” means, as of any date, the sum of (i) the Initial Oaktree Contribution plus a twelve percent (12%) annual return thereon, compounded monthly from the Effective Date, and (ii) the aggregate amount of the Subsequent Capital Contributions made by Oaktree in accordance with Section 4.3(c), if any, plus, in the case of each Subsequent Capital Contribution, a twelve percent (12%) annual return thereon, compounded monthly from the date on which such Subsequent Capital Contribution was made.

“Permitted Transferee” means (i) with respect to the HC-KBS Member, any Qualified HC-KBS Entity and (ii) with respect to the Oaktree Member, any of its Affiliates and any of the Oaktree Affiliates.

“Person” means any natural person or any corporation, partnership (whether general or limited), limited liability company, association, custodian, nominee, trust, estate, joint venture, governmental authority or other entity.

“Portfolio Property” means, as of any date, any NIP Property or other industrial and/or warehouse property acquired in accordance with the provisions hereof, in each case in which the Company then owns (directly or indirectly through a Subsidiary) an interest.

“Pre-Leveraged Equity” means the sum described in subclause (A)(y) of clause (ii) of the definition of the term “Pro Rata” or, if the HC-KBS Member makes the Second HC-KBS Contribution in accordance with Section 4.3(b), the sum described in subclause (A)(y) of clause (iii) of the definition of the term “Pro Rata”.

10

________________________________________________________________________________________________________________________

“Prime Rate” means the rate of interest from time to time identified by JPMorgan Chase Bank, N.A. as being its “prime” or “reference” rate.

“Pro Rata” means:

(i) if the HC-KBS Member does not make the HC-KBS Contribution in accordance with Section 4.3, (A) in the case of the Oaktree Member, one hundred percent (100%), and (B) in the case of the HC-KBS Member, zero percent (0%);

(ii) if the HC-KBS Member makes the First HC-KBS Contribution in accordance with Section 4.3(a), then, upon the making of the First HC-KBS Contribution and at all times prior to the making of the Second HC-KBS Contribution in accordance with Section 4.3(b) or (if the Second HC-KBS Contribution is not made in accordance therewith) the Refinancing, (A) in the case of the Oaktree Member, a fraction (expressed as a percentage), (x) the numerator of which is the Oaktree Pro Forma Equity on the date of the First HC-KBS Contribution and (y) the denominator of which is the sum of such Oaktree Pro Forma Equity and the First HC-KBS Contribution, and (B) in the case of the HC-KBS Member, a fraction (expressed as a percentage), the numerator of which is the First HC-KBS Contribution and the denominator of which is the sum described in subclause (A)(y) of this clause (ii);

(iii) if the HC-KBS Member makes the Second HC-KBS Contribution in accordance with Section 4.3(b), then, upon the making of the Second HC-KBS Contribution and at all times prior to the Refinancing, (A) in the case of the Oaktree Member, a fraction (expressed as a percentage), (x) the numerator of which is the Oaktree Pro Forma Equity on the date of the Second HC-KBS Contribution and (y) the denominator of which is the sum of such Oaktree Pro Forma Equity and the HC-KBS Contribution, and (B) in the case of the HC-KBS Member, a fraction (expressed as a percentage), the numerator of which is the HC-KBS Contribution and the denominator of which is the sum described in subclause (A)(y) of this clause (iii);

(iv) if the HC-KBS Member makes the HC-KBS Contribution in accordance with Section 4.3, then, upon the Refinancing and at all times thereafter, (A) in the case of the Oaktree Member, a fraction (expressed as a percentage), the numerator of which is the Oaktree Pro Forma Equity at the time of the Refinancing less the amount of Leveraged Equity Distributions distributed to the Oaktree Member, and the denominator of which is the sum of (x) the Pre-Leveraged Equity plus any Additional HC-KBS Contribution less the aggregate Leveraged Equity Distributions made to the Oaktree Member and the Equity Member (the amount of this subclause (x), the “Leveraged Equity”), (y) the 12% annual return described in subclause (B)(x)(I)(1) of this clause (iv), and (z) if applicable, the 12% annual return described in subclause (B)(x)(I)(2) of this clause (iv), and (B) in the case of the HC-KBS Member, a fraction (expressed as a percentage), (x) the numerator of which is (I) the sum of (1) the First HC-KBS Contribution, plus a 12% annual return thereon, compounded monthly, from the date the First HC-KBS Contribution was made through the date of the Refinancing, (2) the Second HC-KBS Contribution, if any, plus a 12% annual return thereon, compounded monthly, from the date the Second HC-KBS Contribution was made through the date of

11

________________________________________________________________________________________________________________________

the Refinancing, and (3) the Additional HC-KBS Contribution, if any, less (II) the amount the amount of Leveraged Equity Distributions distributed to the Equity Member and (y) the denominator of which is the sum of (I) the Leveraged Equity, (II) the 12% annual return described in subclause (B)(x)(I)(1) of this clause (iv) and (III) if applicable, the 12% annual return described in subclause (B)(x)(I)(2) of this clause (iv).

“Profits Interest” means an interest in the future profits of the Company satisfying the requirements for a partnership profits interest transferred in connection with the performance of services, as set forth in IRS Revenue Procedures

93-27 and 2001-43, or any future IRS guidance or other authority that supplements or supersedes the foregoing Revenue Procedures, provided that all Members, whether parties hereto as of the Effective Date or admitted after the Effective Date, consent that the Company may take all actions, including amending this Agreement, necessary or appropriate to cause the interests of the Promote Member to be treated as a Profits Interest for all Federal income tax purposes.

“Property” means an interest of any kind in any real or personal (or mixed) property, including cash, and shall include both tangible and intangible property.

“Qualified HC-KBS Entity” means an entity meeting each of the following requirements: (i) such entity is Controlled by a KBS REIT (or an entity comprised exclusively of one or more KBS REITs (a “KBS Entity”)) and/or an HC Entity, (ii) at least 20% of the equity interests in such entity are owned by an HC Entity, provided that, if such HC Entity then owns less than 20% of the equity interests in the HC-KBS Member as a result of a JV Member Transfer, the foregoing requirement in this clause (ii) shall be deemed to be satisfied if such HC Entity owns a percentage interest in such entity which is not less than the percentage interest owned by such HC Entity in the HC-KBS Member immediately following such JV Member Transfer, (iii) so long as a KBS REIT or a KBS Entity indirectly owns an interest in the HC-KBS Member, such KBS REIT or KBS Entity Controls, and owns, directly or indirectly, at least 50% of the equity interests in, the member of the HC-KBS Member through which such KBS REIT or KBS Entity owns such interest (the “KBS JV Member”), except to the extent that any failure of such KBS REIT or KBS Entity to Control, or to own, directly or indirectly, at least 50% of the equity interests in, such Person shall have been caused by a pledge, assignment or conveyance described in the last sentence of Section 8.1(a), and (iv) more than 50% of the equity interests in such entity are owned, directly or indirectly, by (x) a KBS REIT or KBS Entity and/or (y) an HC Entity.

“Qualified Transferee” means (i) a savings bank, savings and loan association, investment bank, insurance company, real estate investment trust, commercial bank or trust company, commercial credit corporation, pension plan, pension fund or pension advisory firm, mutual fund or governmental authority that satisfies the Eligibility Requirements (as hereinafter defined), (ii) an investment company, money management firm or “qualified institutional buyer” within the meaning of Rule 144A under the Securities Act that satisfies the Eligibility Requirements, (iii) an institution substantially similar to any of the entities described in clauses (i) and (ii) of this

12

________________________________________________________________________________________________________________________

definition that satisfies the Eligibility Requirements, or (iv) a Qualified Trustee (as hereinafter defined) in connection with a securitization of, the creation of collateralized debt obligations (“CDO”) secured by, or a financing through an “owner trust” of, any interest of a KBS REIT in the HC-KBS Member (any of the foregoing, a “Securitization Vehicle”), provided that (a) one or more classes of Securities issued by such Securitization Vehicle is initially rated at least investment grade by Standard & Poor’s Ratings Services (“S&P”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”), (b) the special servicer or manager of such Securitization Vehicle at the time of the Transfer has (and the operative documents for such Securitization Vehicle require that any successor has) the Required Special Servicer Rating (as hereinafter defined), and (c) the owners of the “equity interest” in any Securitization Vehicle that is a CDO, and the owners of the “controlling class” of Securities issued by any Securitization Vehicle that is not a CDO, are (and are required by the operative documents for the applicable Securitization Vehicle to be) entities which are Qualified Transferees described in any of clauses (i), (ii) or (iii) of this definition. For purposes of this definition, (x) “Eligibility Requirements” means, with respect to any Person, that such Person (I) has total assets (in name or under management) in excess of $600,000,000 and (except with respect to a pension advisory firm or similar fiduciary) capital/statutory surplus or shareholder’s equity of $250,000,000 and (II) is regularly engaged in the business of (A) making, owning or acquiring for investment, directly or indirectly, commercial real estate loans or (B) owning and/or operating commercial real estate, (y) “Qualified Trustee” means (I) a corporation, national bank, national banking association or trust company, in each case organized and doing business under the laws of any state or the United States of America, authorized under such laws to exercise corporate trust powers and to accept the trust conferred, having a combined capital and surplus of at least $100,000,000 and subject to supervision or examination by federal or state authority, (II) an institution insured by the Federal Deposit Insurance Corporation or (III) an institution whose long-term senior unsecured debt is rated in either of the top two rating categories then in use by S&P, Moody’s or Fitch, and (z) “Required Special Servicer Rating” means (I) in the case of Fitch, a rating of “CSSI”, (II) in the case of S&P, being on the list of approved special servicers and (III) in the case of Moody’s, acting as special servicer in a commercial mortgage loan securitization that was rated within the 12-month period prior to the date of determination, provided that Moody’s has not downgraded or withdrawn the then-current rating on any class of commercial mortgage securities or placed any class of commercial mortgage securities on watch citing the continuation of such special servicer as special servicer of such commercial mortgage securities.

“Sale Transaction” means the sale of all of the Membership Interests or the sale of all or substantially all of the

Company’s assets (including by means of merger, consolidation, reorganization, capitalization, sale of stock, sale of assets, or any combination thereof) to one or more third parties.

“SEC” means the United States Securities and Exchange Commission.

“Securities” means any stock, shares, partnership interests, voting trust certificates, certificates of interest or participation in any profit-sharing agreement or

13

________________________________________________________________________________________________________________________

arrangement, options, warrants, bonds, debentures, notes, or other evidences of indebtedness, secured or unsecured, convertible, subordinated or otherwise, or in general any instruments commonly known as “securities” or any certificates of interest, shares or participations in temporary or interim certificates for purchase or acquisition of, or any right to subscribe to, purchase or acquire, any of the foregoing.

“Securities Act” means the United States Securities Act of 1933.

“Special Promote Base” means the amount of $21,039,000.

“Subsidiary” means, with respect to any Person, any corporation, partnership, limited liability company, association, joint venture or other business entity of which more than 50% of the total voting power of shares of stock or other ownership interests entitled (without regard to the occurrence of any contingency) to vote in the election of the Person or Persons (whether directors, managers, trustees or other Persons performing similar functions) having the power to direct or cause the direction of the management and policies thereof (or, in the case of a partnership, limited liability company or other similar entity managed by its general partner, managing member or like Person, the general partnership, managing member or like interests) is at the time owned or Controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof.

“Substitute Member” means any Person admitted as a member of the Company pursuant to Section 3.2 in connection with the Transfer of Membership Interests to such Person.

“Transaction Documents” means this Agreement and any agreements or documents ancillary hereto, including for this purpose that certain Agreement in Lieu of Foreclosure dated as of the Effective Date by and between the Company, the Borrowers and the Guarantors (as defined therein) (pursuant to which the NIP Properties were conveyed to Subsidiaries of the Company), and all agreements and instruments executed pursuant thereto or in connection therewith.

“Transfer” means any sale, assignment, transfer, exchange, gift, bequest, pledge, hypothecation or other disposition or encumbrance, direct or indirect, in whole or in part, by operation of law or otherwise, and shall include all matters deemed to constitute a Transfer under ARTICLE VIII. An Upper Tier Transfer shall be deemed a Transfer for the purposes hereof. The terms “Transferred”, “Transferring”, “Transferor”, “Transferee” and “Transferable” have meanings correlative to the foregoing.

“Treasury Regulations” mean the regulations promulgated under the Code.

“Unreturned Capital Percentage” means (i) with respect to the Oaktree Member, a fraction (expressed as a percentage), the numerator of which is the Unreturned Oaktree Capital and the denominator of which is the sum of the Unreturned Oaktree Capital and the Unreturned HC-KBS Capital, and (ii) with respect to the HC-KBS Member, a fraction (expressed as a percentage), the numerator of which is the Unreturned

14

________________________________________________________________________________________________________________________

HC-KBS Capital and the denominator of which is the sum of the Unreturned Oaktree Capital and the Unreturned HC-KBS Capital.

“Unreturned Oaktree Capital” means, with respect to the Oaktree Member at any time, the Initial Oaktree Contribution plus the aggregate amount of any Subsequent Oaktree Contributions theretofore made by the Oaktree Member plus the aggregate amount of any additional Capital Contributions theretofore made by the Oaktree Member less the cumulative distributions (including distributions of Refinancing Proceeds) theretofore made by the Company to the Oaktree Member pursuant to Section 5.2(a)(iii).

“Unreturned HC-KBS Capital” means, with respect to the HC-KBS Member at any time, the HC-KBS Contribution, if any, plus the Additional HC-KBS Contribution, if any, plus the aggregate amount of any additional Capital Contributions theretofore made by the HC-KBS Member less the cumulative distributions (including distributions of Refinancing Proceeds) theretofore made by the Company to the Equity Member pursuant to Section 5.2(a)(iii).

“Upper Tier Transfer” means any event (including a Transfer of Securities, an issuance of Securities or the amendment of the organizational documents of any Person) which results in the HC-KBS Member no longer being a Qualified HC-KBS Entity.

(b) The following additional terms shall have the meanings specified in the indicated Section of this Agreement:

|

| | |

| | | |

| Term | | Section |

| Accounting Firm | | Section 3.3(b) |

| Act | | Recitals |

| Additional Equity Loan | | Section 4.7 |

| Additional HC-KBS Contribution | | Section 4.5 |

| Board | | Section 7.1 |

| Call Amounts | | Section 4.6 |

| Call Notice | | Section 4.6 |

| Certificate | | Recitals |

| Company | | Preamble |

| Damages | | Section 10.2(c) |

| Dissolution Event | | Section 11.1(c) |

| Drag-Along Closing Date | | Section 8.4(b) |

| Drag-Along Notice | | Section 8.4(b) |

| Drag-Along Price | | Section 8.4(b) |

| Drag-Along Purchaser | | Section 8.4(a) |

| Drag-Along Right | | Section 8.4(a) |

| Drag-Along Sale | | Section 8.4(a) |

| Drag-Along Terms | | Section 8.4(b) |

| Effective Date | | Preamble |

| Equity Member | | Section 5.2(a) |

| Exempt Properties | | Section 7.3(b)(viii)(1) |

15

________________________________________________________________________________________________________________________

|

| | |

| | | |

| Term | | Section |

| Exercise Notice | | Section 8.2(b) |

| Final Distribution | | Section 11.2(b) |

| First HC-KBS Contribution | | Section 4.3(a) |

| Funding Dates | | Section 4.6 |

| HC-KBS | | Preamble |

| HC-KBS Contribution | | Section 4.3(b) |

| HC-KBS Representatives | | Section 7.2(a) |

| Initial Oaktree Contribution | | Section 4.2 |

| KBS REIT Entity | | Section 7.3(b)(vii) |

| Leveraged Equity Distributions | | Section 4.4 |

| Liquidator | | Section 11.2(a) |

| Noncontributing Member | | Section 4.7 |

| Notice | | Section 12.3 |

| Oaktree | | Preamble |

| Oaktree Representatives | | Section 7.2(a) |

| Promote Member | | Section 5.2(a) |

| Proposed Purchaser | | Section 8.3(a) |

| Refinancing | | Section 4.4 |

| Refinancing Proceeds | | Section 4.4 |

| Regulatory Allocations | | Section 5.3(c) |

| REIT | | Schedule D |

| Representatives | | Section 7.2(a) |

| Required Contributions | | Section 4.6 |

| Revaluation | | Section 5.1(c) |

| ROFR Interest | | Section 8.2(a) |

| ROFR Notice | | Section 8.2(a) |

| ROFR Option Period | | Section 8.2(b) |

| ROFR Price | | Section 8.2(a) |

| ROFR Terms | | Section 8.2(a) |

| Sale Distribution Amount | | Section 7.3(b)(viii)(1) |

| Second HC-KBS Contribution | | Section 4.3(b) |

| Section 754 Election | | Section 6.2 |

| Subsequent Oaktree Contribution | | Section 4.3(c) |

| Tag-Along Closing Date | | Section 8.3(b) |

| Tag-Along Exercise Notice | | Section 8.3(c) |

| Tag-Along Notice | | Section 8.3(b) |

| Tag-Along Price | | Section 8.3(b) |

| Tag-Along Right | | Section 8.3(a) |

| Tag-Along Sale | | Section 8.3(a) |

| Tag-Along Terms | | Section 8.3(b) |

| Tax Matters Partner | | Section 6.1 |

| Third Party Purchaser | | Section 8.2(a) |

| Threshold Amount | | Section 4.4 |

| Uncontributed Amount | | Section 4.7 |

| Withholding Advances | | Section 5.5(b) |

16

________________________________________________________________________________________________________________________

Section 1.2 Terms and Usage Generally. The definitions in Section 1.1 shall apply equally to both the singular and plural forms of the terms defined. Whenever the context may require, any pronoun shall include the corresponding masculine, feminine and neuter forms. All references herein to Articles, Sections and Schedules shall be deemed to be references to Articles and Sections of, and Schedules to, this Agreement unless the context shall otherwise require. All Schedules attached hereto shall be deemed incorporated herein as if set forth in full herein. The words “include”, “includes” and “including” shall be deemed to be followed by the phrase “without limitation”. All accounting terms not defined in this Agreement shall have the meanings determined by United States generally accepted accounting principles as in effect from time to time. The words “hereof”, “herein” and “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. Unless otherwise expressly provided herein, any agreement, instrument or statute defined or referred to herein or in any agreement or instrument that is referred to herein means such agreement, instrument or statute as from time to time amended, modified, supplemented or restated, including (in the case of agreements or instruments) by waiver or consent and (in the case of statutes) by succession of comparable successor statutes, and all attachments thereto and instruments incorporated therein and (in the case of statutes) also any rules and regulations promulgated thereunder.

ARTICLE II

THE COMPANY

Section 2.1 Formation. The Company was initially formed as a Delaware limited partnership, and has been reorganized as a Delaware limited liability company by the execution and filing of the Certificate by an authorized person (within the meaning of the Act) under and pursuant to the Act. The Board may cause to be executed and filed any duly authorized amendments to the Certificate from time to time in a form prescribed by the Act. The rights, powers, duties, obligations and liabilities of the Members shall be determined pursuant to the Act and this Agreement. To the extent that the rights, powers, duties, obligations and liabilities of any Member are different by reason of any provision of this Agreement than they would be in the absence of such provision, this Agreement shall, to the extent permitted by the Act, control.

Section 2.2 Name. The name of the Company shall be NIP JV, LLC. The Board in its sole discretion may change the name of the Company at any time and from time to time. Written notification of any such change shall be given to all Members. The Company’s business may be conducted under its name and/or any other name or names deemed advisable by the Board.

Section 2.3 Term. The term of the Company, as reorganized as described in Section 2.1, began on December 15, 2011, the date the Certificate was filed with the Secretary of State of the State of Delaware, and the Company shall have

17

________________________________________________________________________________________________________________________

perpetual existence unless sooner dissolved and its affairs wound up as provided in ARTICLE XI.

Section 2.4 Registered Office; Registered Agent; Principal Office; Other Offices. The registered office of the Company required by the Act to be maintained in the State of Delaware shall be the office of the initial registered agent named in the Certificate or such other office (which need not be a place of business of the Company) as the Board may designate from time to time in the manner provided by law. The registered agent of the Company in the State of Delaware shall be the initial registered agent named in the Certificate or such other Person or Persons as the Board may designate from time to time in the manner provided by law. The principal office of the Company shall be at 11111 Santa Monica Blvd., Suite 750, Los Angeles, California 90025, or at such other place as the Board may designate from time to time, which need not be in the State of Delaware, and the Company shall maintain records there. The Company may have such other offices as the Board may designate from time to time.

Section 2.5 Purposes. The Company has been reorganized (as described in Section 2.1) for the object and purpose of, and the nature of the business to be conducted and promoted by the Company is, engaging in the Business and activities incident thereto, as determined by the Board. The Company shall have the power to do and perform all things necessary for, connected with or arising out of such purposes and shall have the power to take such actions as may be necessary or appropriate to accomplish such purposes and conduct such purposes, including forming one or more Subsidiaries to accomplish such purposes and conduct such purposes. Nothing set forth herein shall be construed as authorizing the Company to possess any purpose or power, or to do any act or thing, forbidden by the Act to a limited liability company organized under the laws of the State of Delaware.

Section 2.6 Powers of the Company. The Company shall have the power and authority to take any and all actions necessary, appropriate or advisable to or for the furtherance of the purposes set forth in Section 2.5.

Section 2.7 Partnership Status. The Members intend that the Company shall be treated as a partnership for Federal, state and local tax purposes to the extent such treatment is available and as a continuation of OCM Industrial Holdings, L.P. for such purposes, and agree to take (or refrain from taking) such actions as may be necessary to receive and maintain such treatment and refrain from taking any actions inconsistent therewith.

Section 2.8 Ownership of Property. Legal title to all Property conveyed to or held by the Company or its Subsidiaries shall reside in the Company or its Subsidiaries and shall be conveyed only in the name of the Company or its Subsidiaries, and no Member or any other Person, individually, shall have any ownership of such Property.

18

________________________________________________________________________________________________________________________

ARTICLE III

MEMBERS; REPORTS

Section 3.1 Admission of Members.

(a) Generally. The name and address of each Member and its Capital Contribution as of the Effective Date are set forth on Schedule A. When any Capital Contribution is made or any Membership Interests are Transferred in accordance with this Agreement, Schedule A shall be amended to reflect such Capital Contribution or such Transfer (and the admission of any Substitute Member), as the case may be.

(b) Additional Members. Additional Members may be admitted to the Company only with the approval of the Board and subject to the provisions of Section 3.2(a).

Section 3.2 Substitute Members and Additional Members.

(a) No Transferee of any Membership Interests or Person to whom any Membership Interests are issued pursuant to this Agreement shall be admitted as a Member hereunder or acquire any rights hereunder, including the right to receive distributions and allocations in respect of the Transferred or issued Membership Interests, as applicable, unless (i) such Membership Interests are Transferred or issued in compliance with the provisions of this Agreement (including ARTICLE VIII), (ii) such Transferee or recipient shall have executed and delivered to the Company such instruments as the Board deems necessary or desirable, in its sole discretion, to effectuate the admission of such Transferee or recipient as a Member and to confirm the agreement of such Transferee or recipient to be bound by all the terms and provisions of this Agreement, and (iii) in the case of the issuance of new Membership Interests, the Members shall have executed and delivered an amendment to this Agreement reflecting the admission of such Additional Member. If the immediately preceding sentence is complied with, the applicable Transferee or recipient shall, without the need for any further action of any Person, be deemed admitted to the Company as a Member. Unless otherwise expressly set forth in this Agreement, a Substitute Member shall enjoy the same rights, and be subject to the same obligations, as the Transferor; provided that such Transferor shall not be relieved of any obligation or liability hereunder arising prior to the consummation of such Transfer but shall be relieved of all future obligations with respect to the Membership Interests so Transferred. In the event of any admission of a Substitute Member pursuant to this Section 3.2(a), this Agreement shall be deemed amended to reflect such admission, and any formal amendment of this Agreement (including Schedule A) in connection therewith shall only require execution by the Company and such Substitute Member to be effective. As promptly as practicable after the admission of any Person as a Member, the books and records of the Company shall be changed to reflect such admission of a Substitute Member or Additional Member.

19

________________________________________________________________________________________________________________________

(b) If a Member shall Transfer all (but not less than all) of its Membership Interests, such Member shall (subject to the proviso in the third sentence of Section 3.2(a)) thereupon cease to be a Member of the Company.

Section 3.3 Tax and Accounting Information.

(a) Accounting Method. For financial reporting purposes, the books and records of the Company shall be kept on the accrual method of accounting applied in a consistent manner and shall reflect all Company transactions.

(b) Financial Reports. The books and records of the Company shall be audited as of the end of each Fiscal Year by Ernst &Young or such other accounting firm as may be selected by the Board (in either case, the “Accounting Firm”). The Company will use its reasonable efforts to provide to each Member:

(i) on an annual basis, within 120 days after the end of each Fiscal Year, (A) an audited balance sheet, statement of operations and statement of cash flow of the Company and its Subsidiaries, audited by the Accounting Firm, and (B) a statement of such Member’s Capital Account, including such Member’s allocation and share of Net Income and Net Loss and special allocations pursuant to Section 5.3, for such Fiscal Year;

(ii) on a quarterly basis, within 30 days after the end of each calendar quarter (provided that the period beginning on the Effective Date and ending on March 31, 2012, shall be deemed to constitute the first calendar quarter for purposes of this Section 3.3(b)(ii)), (A) an unaudited balance sheet and related statement of operations and statement of cash flow of the Company and its Subsidiaries and (B) a statement of such Member’s Capital Account, including such Member’s allocation of and share of Net Income and Net Loss and special allocations pursuant to Section 5.3, for such quarter;

(iii) within 30 days after each calendar month (provided that the period beginning on the Effective Date and ending on January 31, 2012, shall be deemed to constitute the first calendar month for purposes of this Section 3.3(b)(iii)), (A) a monthly report of net income for the Company and its Subsidiaries (derived from an unaudited income statement) and (B) a monthly unaudited balance sheet of the Company and its Subsidiaries.

Such annual, quarterly and monthly financial information referred to in clauses (i), (ii) and (iii) above will be prepared in all material respects in accordance with United States generally accepted accounting principles as in effect from time to time, subject to year-end audit adjustments and the absence of notes in the case of such quarterly and monthly financial information. The Company shall also provide to the Members (x) such supporting schedules, reports and backup information with respect to such financial information as may be reasonably requested by the Members and (y) copies of such additional reports and statements as may be received by the Company or any of its

20

________________________________________________________________________________________________________________________

Subsidiaries from any asset manager or property manager with respect to any of the Portfolio Properties or otherwise in connection with the Business.

(c) Tax Returns.

(i) The Company shall timely cause to be prepared all Federal, state, local and foreign tax returns (including information returns) of the Company and its Subsidiaries, which may be required by a jurisdiction in which the Company and its Subsidiaries operate or conduct business for each year or period for which such returns are required to be filed and shall cause such returns to be timely filed. The Company shall (x) upon a timely request by a Member, provide a draft of any such tax return to such Member and consult with such Member prior to finalizing and filing such tax return and (y) upon a request by a Member at any time, furnish to such Member a copy of any such tax return.

(ii) Within 90 days after the end of each Fiscal Year, the Company shall furnish to each Member all information required to be reported in the tax returns of the Members for tax jurisdictions in which the Company is doing business, including a report (including Schedule K-1) indicating each Member’s share in the Company’s taxable income, gain, credits, losses and deductions for such year, in sufficient detail to enable such Member to prepare its Federal, state and other tax returns.

(d) Inconsistent Positions. No Member shall take a position on its income tax return with respect to any item of Company income, gain, deduction, loss or credit that is different from the position taken on the Company’s income tax return with respect to such item.

Section 3.4 Certification of Membership Interests. The Board may in its discretion cause the Company to issue certificates to the Members representing their respective Membership Interests.

ARTICLE IV

CAPITAL CONTRIBUTIONS AND REFINANCING

Section 4.1 General. Except as provided in this ARTICLE IV, no Member shall be required or, without the approval of the Board, permitted to make or commit to make a Capital Contribution, loan or advance to the Company or any of

its Subsidiaries or guarantee or make any other financial commitment with respect to any debt or other obligation of the Company or its Subsidiaries, including to fund operations of the Company or its Subsidiaries.

Section 4.2 Initial Oaktree Contribution. The Oaktree Member shall be deemed to have made Capital Contributions as of the Effective Date in the aggregate amount set forth opposite its name on Schedule A under the column “Initial Capital Contribution” (the “Initial Oaktree Contribution”).

21

________________________________________________________________________________________________________________________

Section 4.3 Capital Contributions until HC-KBS Funding Date.

(a) The Equity Member shall have the right, without the approval of the Board, to contribute capital to the Company (the “First HC-KBS Contribution”) at any time prior to March 15, 2012, in an amount of up to (i) the lesser of (x) 15% of the Pre-Leveraged Equity after giving effect to the First HC-KBS Contribution and (y) $20,000,000, (ii) the portion of the amount described in clause (i) above required or permitted under the operating agreement of the HC-KBS Member to be funded by the KBS Member (out of cash so funded) or (iii) the portion of the amount described in clause (i) above required or permitted under the operating agreement of the HC-KBS Member to be funded by the member of the HC-KBS Member which is an HC Entity (out of cash so funded). The Equity Member shall give the Oaktree Member and the Company written notice of the First HC-KBS Contribution (specifying the amount thereof) not less than 15 days prior to the making of the First HC-KBS Contribution.

(b) In the event that the Equity Member makes the First HC-KBS Contribution in the amount set forth in clause (ii) or (iii) of the first sentence of Section 4.3(a) in accordance with the provisions of Section 4.3(a), then the Equity Member shall have the further right, without the approval of the Board, to contribute (out of cash funded by the same member of the HC-KBS Member which funded the First HC-KBS Contribution) capital to the Company (the “Second HC-KBS Contribution” and, together with the First HC-KBS Contribution, the “HC-KBS Contribution”) at any time prior to May 15, 2012, in an amount of up to (i) the lesser of (x) 15% of the Pre-Leveraged Equity after giving effect to the Second HC-KBS Contribution and (y) $20,000,000, minus (ii) the amount of the First HC-KBS Contribution. The Equity Member shall give the Oaktree Member and the Company written notice of the Second HC-KBS Contribution (specifying the amount thereof) not less than 15 days prior to the making of the Second HC-KBS Contribution.

(c) The Oaktree Member shall have the right, without the approval of the Board, to contribute capital to the Company (any such contribution, a “Subsequent Oaktree Contribution”) from time to time during the period commencing on the Effective Date and ending on the HC-KBS Funding Date, if the Oaktree Member believes, at the time such contribution is made, that such contribution will need to be deployed by the Company for Company purposes within 30 days after such contribution is made.

Section 4.4 Refinancing. The Members shall use commercially reasonable efforts to obtain refinancing for all of the Portfolio Properties within 180 days after the Effective Date. Upon the initial refinancing of all or any material portion of the Property (the “Refinancing”), the proceeds of the Refinancing (the “Refinancing Proceeds”) shall be distributed to the Equity Member and the Oaktree Member as provided in Section 5.2 (any such distributions made to the Equity Member or the Oaktree Member pursuant to Section 5.2(a)(iii), the “Leveraged Equity Distributions”), provided that, if the Equity Member made the HC-KBS Contribution in accordance with Section 4.3 and the HC-KBS Contribution was less than 15% of the Pre-Leveraged Equity (after giving effect to the HC-KBS Contribution), then, notwithstanding anything

22

________________________________________________________________________________________________________________________

to the contrary in Section 5.2, distributions (if any) of the Refinancing Proceeds to the Equity Member shall be limited to the extent necessary to have the Unreturned HC-KBS Capital be equal to the product of (a) a percentage expressed as a fraction whose numerator is the amount of the HC-KBS Contribution and whose denominator is $20,000,000 and (b) 15% of the sum of the Unreturned HC-KBS Capital and the Unreturned Oaktree Capital after giving effect to such distributions (such product, the “Threshold Amount”).

Section 4.5 Additional HC-KBS Contribution. If (a) the Equity Member made the HC-KBS Contribution in accordance with Section 4.3 and (b) following the Refinancing and the distribution of the Refinancing Proceeds pursuant to Section 4.4, the Unreturned HC-KBS Capital would constitute less than the Threshold Amount, then the Equity Member shall have the right to contribute, concurrently with the distribution of the Refinancing Proceeds, additional capital to the Company

(the “Additional HC-KBS Contribution”) in an amount that will cause the Unreturned HC-KBS Capital to be equal to the product of (i) a percentage expressed as a fraction whose numerator is the amount of the HC-KBS Contribution and whose denominator is $20,000,000 and (ii) 15% of the sum of the Unreturned Oaktree Capital and the Unreturned HC-KBS Capital after giving effect to the Additional HC-KBS Contribution.

Section 4.6 Additional Contributions. After the HC-KBS Funding Date, each Member shall contribute to the Company the amounts required by the Company (the “Required Contributions”) from time to time, in such amounts (the “Call Amounts”) and on such dates (“Funding Dates”) as shall be specified by the Company upon not less than 21 days’ written notice (the “Call Notice”) by the Company. No Member shall be permitted to contribute less than the full amount of any Required Contribution which it is obligated under this Section 4.6 to make.

Section 4.7 Failures to Make Additional Contributions. If either Member shall fail to contribute the applicable Call Amount set forth in a Call Notice on or before the Funding Date therefor (such Member being herein referred to as a “Noncontributing Member”, and the applicable Call Amount, the “Uncontributed Amount”), then (i) the Company shall give notice to the other Member of such failure and the Uncontributed Amount in respect thereof, (ii) the other Member shall have the right, but not the obligation, to contribute to the Company all or any portion of the Uncontributed Amount and (iii) the total amount funded by such other Member with respect to such Call Notice both pursuant to Section 4.6 and this Section 4.7 shall, notwithstanding anything the contrary contained in Section 4.6 and this Section 4.7, be treated as a loan (and not as a Capital Contribution) to the Company by such other Member (an “Additional Equity Loan”) which shall accrue interest at a rate equal to 18% per annum, compounded monthly. Additional Equity Loans shall be repaid by the Company out of Distributable Cash as provided in Section 5.2. Notwithstanding anything to the contrary contained in this Agreement, no failure by a Member to make a Required Contribution shall constitute a default under this Agreement.

23

________________________________________________________________________________________________________________________

Section 4.8 No Additional Rights. No Member, in its capacity as a Member, shall have the right to receive any cash or any other Property of the Company, and no Member shall be entitled to withdraw any part of its (or its predecessor’s) Capital Contribution or Capital Account or to receive any distribution from the Company, except as provided in Section 5.2 and ARTICLE XI. No interest shall be paid by the Company on Capital Contributions or on balances in Member’s Capital Accounts.

ARTICLE V

CAPITAL ACCOUNTS;

DISTRIBUTIONS; ALLOCATIONS

Section 5.1 Capital Accounts.

(a) Maintenance of Capital Accounts. The Company shall maintain a Capital Account for each Member on the books of the Company in accordance with the following provisions:

(i) As of the Effective Date, the Capital Account of each Member is as set forth on Schedule A.