Exhibit 99.1

Term Sheet Subject to Revision

$

SLM STUDENT LOAN TRUST 2005-6

Issuer

SLM FUNDING LLC

Depositor

SALLIE MAE, INC.

Servicer and Administrator

STUDENT LOAN-BACKED NOTES

On July , 2005, the trust will issue:

| | | | | | |

Class

| | Principal

| | Interest Rate

| | Maturity

|

Class A-1 Notes | | $ | | 3-month LIBOR minus [ ]% | | |

Class A-2 Notes | | $ | | 3-month LIBOR plus [ ]% | | |

Class A-3 Notes | | $ | | 3-month LIBOR plus [ ]% | | |

Class A-4 Notes | | $ | | 3-month LIBOR plus [ ]% | | |

Class A-5A Notes | | $ | | 3-month LIBOR plus [ ]% | | |

Class A-5B Notes | | $ | | 3-month LIBOR plus [ ]%* | | |

Class A-6 Notes | | $ | | 3-month LIBOR plus [ ]% | | |

Class A-7 Notes | | $ | | 3-month LIBOR plus [ ]% | | |

Class B Notes | | $ | | 3-month LIBOR plus [ ]% | | |

| * | Effective until the initial reset date. |

The information contained in this term sheet is preliminary, limited in nature and may be changed. All the information in this term sheet will be superseded in its entirety by the information appearing in the final prospectus supplement and prospectus relating to the offering of the notes. The information contained herein is intended to address only certain limited aspects of the characteristics of the notes and does not purport to provide a complete assessment thereof. The information contained herein supersedes and replaces certain of the information contained in the preliminary prospectus supplement and prospectus, each dated July 15, 2005 (the “Preliminary Prospectus”, filed with the Securities and Exchange Commission (“SEC”) on July 19, 2005). The information contained herein is not intended to be a complete summary of any class of notes and does not reflect the impact of all structural characteristics of the notes or any changes made to the structure of the notes after the date hereof. To the extent not specifically replaced hereby, all information contained in the Preliminary Prospectus regarding the notes remains unchanged and potential investors are strongly urged to review the Preliminary Prospectus carefully for more detailed information regarding the notes and the pool of trust student loans. Additional information will be contained in the final prospectus supplement and prospectus.

Sales of the notes may not be consummated unless the purchaser has received the final prospectus supplement and prospectus. This term sheet shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the notes in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the applicable laws of any such state or other jurisdiction.

Neither the SEC nor any state securities commission has approved of the notes or determined if this Term Sheet is accurate or complete. Any representation to the contrary is a criminal offense.

Joint Book-Runners

| | | | |

| Lehman Brothers | | Merrill Lynch & Co. | | Morgan Stanley |

| | |

| | | | | |

| | |

| | | Co-Managers | | |

| | |

| Deutsche Bank Securities | | RBS Greenwich Capital | | Wachovia Securities |

| | | | | |

| | | July 19, 2005 | | |

Reset Rate Notes

The class A-5B notes will be the only class of reset rate notes. During their initial reset period, the class A-5B notes will bear interest at a floating rate equal to three-month LIBOR (calculated for all accrual periods in the same manner as the LIBOR-based notes) plusa spread. The spread and the initial reset date for the class A-5B notes will be specified in the final prospectus supplement. During the initial reset period, there will not be any swap agreement for any class of notes. In addition, until at least the initial reset date, there will be no accumulation account, investment premium purchase account, investment reserve account or supplemental interest account relating to such class or any other feature applicable exclusively to the reset rate notes while they bear a fixed rate of interest.

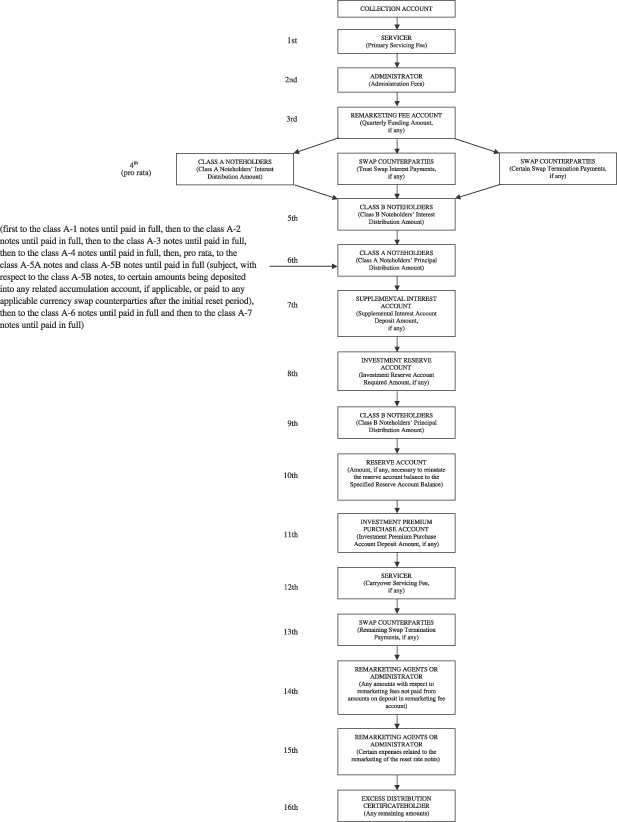

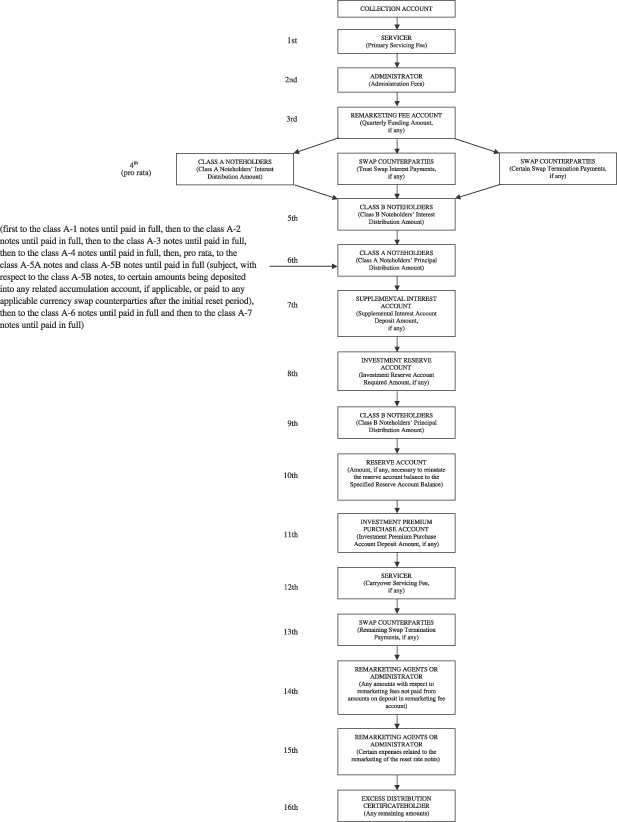

Distributions

The trust will make payments to noteholders quarterly on the 25th day (or the next succeeding business day if such 25th day is not a business day) of each January, April, July and October, beginning on October 25, 2005, primarily from collections on a pool of consolidation student loans. In general, the trust will pay principal allocable to the class A notes sequentially to the class A-1 through class A-4 notes, in that order, until each such class is paid in full; then the class A-5A and class A-5B notes will receive payments (or allocations) of such principal, each on a pro-rata basis until paid in full; and then the class A-6 notes and class A-7 notes, sequentially in that order, will receive payments of principal until each such class is paid in full.

The class B notes will not receive principal until the stepdown date. The stepdown date will be specified in the final prospectus supplement. The class B notes then will receive principal pro rata with the class A notes, as long as a trigger event is not in effect for the related distribution date. Interest on the class B notes will be subordinate to interest on the class A notes and principal on the class B notes will be subordinate to both principal and interest on the class A notes.

The class A-1 through class A-4 notes, the A-5A notes, the class A-6 notes, the class A-7 notes and the class B notes are LIBOR-based notes. The class A-5B notes are reset rate notes and will be LIBOR-based during their initial reset period. During their initial reset period, LIBOR for the reset rate notes will be calculated in the same manner as for the other class A and class B notes (including for the initial accrual period).

The following chart presents a summary of all distributions to be made by the trust with amounts on deposit in the collection account and other applicable accounts on each distribution date.