Cautionary Legends

The attached presentation was filed with the Securities and Exchange Commission (“SEC”) as part of the

Form 8-K filed by Echo Healthcare Acquisition Corporation (“Echo Healthcare�� or “Echo”) on September 11,

2006. Echo is holding presentations for its stockholders regarding its purchase of XLNT Veterinary Care, Inc.

(“Pet DRx”). A copy of the complete presentation is available at the SEC’s website (http://www.sec.gov)

and the Company’s website (http://www.echohealthcare.com) under the “News Releases” tab.

Morgan Joseph & Co. Inc. (“Morgan Joseph”), the managing underwriter of Echo’s initial public offering

(“IPO”) consummated March 2006, is assisting Echo in these efforts and will receive an advisory fee equal to

$750,000. Echo, Pet DRx and their directors, executive officers, affiliates, Morgan Joseph and Roth Capital

Partners, LLC (“Roth”) may be deemed to be participants in the solicitation of proxies for the special meeting

of Echo’s stockholders to be held to approve this transaction.

Stockholders of Echo and other interested persons are advised to read, when available, Echo’s preliminary

proxy statement and definitive proxy statement in connection with Echo’s solicitation of proxies for the

special meeting to approve the acquisition because these proxy statements will contain important

information. Such persons can also read Echo’s final prospectus, dated March 17, 2006, as well as periodic

reports filed with the SEC, for more information about Echo, its officers and directors, Morgan Joseph and

Roth and their interests in the successful consummation of this business combination. Information about the

directors and officers of Pet DRx as well as updated information about Morgan Joseph, Roth and the directors

and officers of Echo and Pet DRx will be included in the definitive proxy statement. Morgan Joseph, Roth, the

directors and officers of Echo and Pet DRx have interests in the merger, some of which may differ from, or may

be in addition to those of the respective stockholders of Echo generally. Those interests will be described in

greater detail in the definitive proxy statement with respect to the merger, which may include potential fees

to Morgan Joseph and Roth, employment relationships, potential membership on the Echo Board of

Directors, option and stock holdings and indemnification. The definitive proxy statement will be mailed to

stockholders as of a record date to be established for the purpose of convening a special meeting to vote on

this transaction. Stockholders and other interested persons will also be able to obtain a copy of the

definitive proxy statement, the final prospectus and other periodic reports filed with the SEC, without charge, by

visiting the SEC’s Internet site at (http://www.sec.gov).

2

Sept. 11, 2006

Safe Harbor

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, about Echo, Pet DRx and their combined business after completion of the proposed transaction. Forward-looking statements are statements that are not historical facts. Such forward-looking statements, based upon the current beliefs and expectations of Echo’s management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: veterinary services trends, including factors affecting supply and demand; Pet DRx’s dependence on acquisitions for growth; labor and personnel relations; credit or currency risks affecting Pet DRx’s revenue and profitability; conditions in financial markets that impact Pet DRx’s ability to obtain capital to finance acquisitions; changing interpretations of generally accepted accounting principles; and general economic conditions, as well as other relevant risks detailed in Echo’s filings with the SEC, including the final prospectus relating to Echo’s IPO dated March 17, 2006. The information set forth herein should be read in light of such risks. Neither Echo nor Pet DRx assumes any obligation to update the information contained in this presentation.

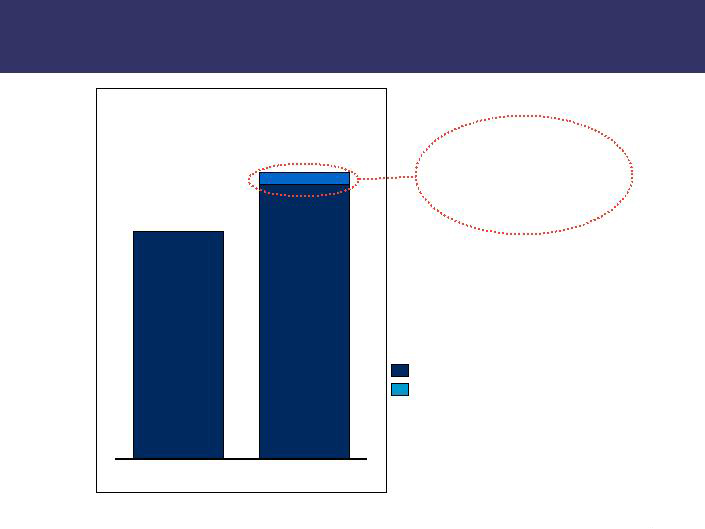

This presentation contains disclosures of EBITDA and hospital EBITDA for certain periods, which may be deemed to be non-GAAP financial measures within the meaning of Regulation G promulgated by the SEC. Management believes that EBITDA, or earnings before interest, taxes, depreciation and amortization, and hospital EBITDA, which is EBITDA before corporate expenses, are appropriate measures of evaluating operating performance and liquidity, because they reflect the resources available for strategic opportunities including, among others, investments in the business and strategic acquisitions. The disclosure of EBITDA and hospital EBITDA may not be comparable to similarly titled measures reported by other companies. EBITDA and hospital EBITDA should be considered in addition to, and not as a substitute for, or superior to, operating income, cash flows, revenue, or other measures of financial performance prepared in accordance with generally accepted accounting principles.

3

Sept. 11, 2006

Transaction Overview