|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act file number 811-21779 |

| |

| JOHN HANCOCK FUNDS II |

| --------------------------------------------------------- |

| (Exact name of registrant as specified in charter) |

| |

| 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------- |

| (Address of principal executive offices) (Zip code) |

| |

| SALVATORE SCHIAVONE, 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------------------------------------ |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (617) 663-4497 |

| -------------- |

| Date of fiscal year end: 12/31 |

| |

| Date of reporting period: 6/30/13 |

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared one semiannual report to shareholders for the period ended June 30, 2013. The report applies to the 5 Lifestyle Portfolios.

Management’s discussion of

Fund performance

By the Portfolio Management Team at John Hancock Asset Management

John Hancock

Lifestyle Portfolios

Market review

The U.S. economy continued along a slow-growth trajectory during the first half of 2013, buoyed by a recovering housing market and slowly improving employment data. Domestic equities posted solid gains for the period. Yet, even as equity prices were rising, many investors were expecting a dramatic pullback during the year’s second quarter. Indeed, for the past few years, second-quarter corrections in the equity market seem to have become a relatively common event. And, as mid-June arrived this year—as if on cue—equity returns again gave up a portion of their earlier gains in the final two weeks.

Unlike last year’s second quarter, however, this year’s second-quarter pullback in equities was not driven by the risks that had previously challenged the markets. In fact, these headwinds — among them, the eurozone debt crisis, a fiscal policy stalemate in the U.S., and an economic hard landing in China — were not of particular concern from a fundamental perspective. Instead, the equity markets’ pullback in June was mainly driven by a statement from Federal Reserve Board (Fed) Chairman Ben Bernanke. He suggested the central bank might begin a gradual tapering of its purchases of bond assets toward the end of this year if economic growth continued to improve. This foreshadowing of an eventual end to the Fed’s quantitative easing (QE) program was at the heart of a lot of the volatility that occurred late in the quarter, with many of the markets’ asset classes — particularly equities, but also interest-rate-sensitive assets such as U.S. Treasuries — suffering losses.

| | |

| | | For the |

| Market index | six months ended |

| total returns | | June 30, 2013 |

|

| U.S. Stocks | | |

|

| S&P 500 Index | | 13.82% |

| Russell Midcap Index | | 15.45% |

| Russell 2000 Index | | 15.86% |

| FTSE NAREIT All Equity REIT Index | 5.80% |

| |

| International Stocks | | |

|

| MSCI EAFE Index | | 4.47% |

| MSCI Emerging Markets Index | –9.40% |

| MSCI EAFE Small Cap Index | 5.93% |

| |

| Fixed Income | | |

|

| Barclays U.S. Aggregate Bond Index | –2.45% |

| Bank of America Merrill Lynch US High |

| Yield Master II Index | | 1.46% |

| JPM Global Government Bonds | |

| Unhedged Index | | –5.80% |

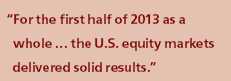

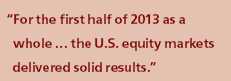

For the first half of 2013 as a whole, however, the U.S. equity markets delivered solid results. Large-capitalization stocks, as represented by the S&P 500 Index, advanced 13.82%, with the more-economically sensitive mid-cap and small-cap stocks moving slightly higher. Meanwhile, returns from foreign equities were far less robust, trailing their U.S. counterparts as Europe continued its attempts to pull out of recession and emerging-market economies saw continued moderation in their growth trends. The MSCI EAFE Index rose only 4.47% through the first six months of the year, while the MSCI Emerging Markets Index ended in negative territory, posting a -9.40% return.

U.S. equities significantly outperformed U.S. bonds in the year-to-date period. The Barclays U.S. Aggregate Bond Index, a proxy for intermediate-term government debt, returned -2.45% as core bonds began to experience heightened selling pressure amid rising interest rates. By comparison, credit-oriented sectors of the bond market fared slightly better, led by bank loans and high-yield bonds.

| |

| 2 | Lifestyle Portfolios | Semiannual report |

Outlook

Despite the second-quarter slowdown in the equity markets, we believe there is surprising resilience in the global economy, with the still-unfolding recovery of the U.S. economy likely to play a lead role in restoring global growth momentum. The U.S. housing market is improving, job creation is gaining traction, and equity markets appear poised to rebound. Given this backdrop, we would anticipate further growth in the U.S. economy during the back half of 2013 and in 2014, as the housing market gains more solid footing, investment accelerates, and consumer spending solidifies. Consumers should be aided by relatively low energy costs, stronger household balance sheets, and still relatively low interest rates.

We believe the main risk to the U.S. expansion is now the tide of enthusiasm for deficit reduction — a long-run necessity but a short-term hurdle. The Fed continues to provide as much support as it can, but its impact is probably diminishing. Chairman Bernanke has highlighted the gradual progress of the recovery and the need for continuing QE for as long as unemployment remains above a presumed threshold and inflation pressure shows no obvious signs of emerging. But his remarks in mid-June, although guarded and without commitments, suggest that the Fed might begin tapering off QE later this year. How the capital markets react to a gradual withdrawal of stimulus will be closely watched.

Meanwhile, the eurozone has been in recession for six quarters, and the continent is still suffering through the trauma of bringing government spending back in line with revenues. For now, the European Central Bank has successfully calmed financial markets with its promise to do “whatever it takes,” but structural reforms are still needed if Europe is to prevent a recurrence of the same problems. Our forecast calls for still-weak but positive growth in the eurozone in 2014. Elsewhere, a new actively engaged government in Japan implies a brighter outlook, as Prime Minister Shinzo Abe is implementing aggressive growth initiatives aimed at ending the deflationary spiral that has plagued Japan’s economy for over 20 years.

In what remains of 2013 and on into 2014, we believe special care should be taken to build a portfolio that can reasonably withstand unexpected shocks that may occur in the economic or geopolitical landscape, consistent with the level of risk investors are comfortable taking on. We wish to stress the importance of maintaining a well-diversified, global portfolio that includes not only traditional equity and fixed-income securities, but also exposure to more nontraditional strategies, such as absolute return funds.

| |

| Semiannual report | Lifestyle Portfolios | 3 |

Lifestyle Aggressive Portfolio

For the six-month period ended June 30, 2013, the portfolio’s Class A shares returned 7.80%, excluding sales charges. In comparison, the portfolio’s benchmark, the S&P 500 Index, returned 13.82% for the same period, and the Morningstar, Inc. large blend fund category returned an average 13.26%.†

The portfolio underperformed its benchmark index over the period. Its relative underperformance was primarily driven by our asset allocation positioning and, to a lesser degree, by the performance of our underlying fund managers. Overseas markets substantially underperformed the broad U.S. stock market, and the portfolio’s exposure to emerging-market and international large-cap stocks was the most significant drag on relative performance. An allocation to global natural resources also detracted, as these stocks underperformed the broader market due to soft commodity prices, slack demand and oversupply.

Although many of the funds in the portfolio posted solid returns over the six months, the performance of our underlying fund managers in aggregate also detracted from relative results. In the large-cap space, several underlying funds underperformed, including Capital Appreciation Fund (Jennison). Among international funds in the portfolio, China Emerging Leaders Fund (Atlantis) and International Value Fund (Templeton) detracted.

We continued to maintain our defensive equity theme, which incorporates a small group of underlying funds whose strategies, when combined, tend to exhibit less volatility than the broader equity market. This defensive theme helped generate competitive risk-adjusted results and mitigate volatility during the period. The portfolio also benefited from its allocation to healthcare. One of the top returns came from the portfolio’s absolute return allocation. In a period when alternative “safe haven” strategies posted very weak positive or even negative returns, the absolute return allocation gained over 5%, led by Currency Strategies Fund (First Quadrant).

The portfolio’s relative performance was also aided by its investments in Alpha Opportunities Fund (Wellington) and Technical Opportunities Fund (Wellington).

Lifestyle Growth Portfolio

For the six-month period ended June 30, 2013, the portfolio’s Class A shares returned 6.80%, excluding sales charges. In comparison, the S&P 500 Index returned 13.82% over the same period, and the Barclays U.S. Aggregate Bond Index returned -2.45%. A blended benchmark comprising 80% S&P 500 Index and 20% Barclays U.S. Aggregate Bond Index returned 10.42%. The Morningstar, Inc. aggressive allocation fund category returned an average 7.20%.†

The portfolio underperformed its blended benchmark index over the period. Its relative underperformance was primarily driven by our asset allocation positioning and, to a lesser extent, by the performance of our underlying fund managers. As overseas markets substantially underperformed the broad U.S. stock market, the portfolio’s exposure to emerging-market and international large-cap stocks was the most significant drag on relative performance. Although many of the funds in the portfolio posted solid returns, the performance of our underlying fund managers in aggregate was slightly negative for the six months. In the large-cap space, several underlying funds underperformed, including Capital Appreciation Fund (Jennison). Among international funds in the portfolio, China Emerging Leaders Fund (Atlantis) and International Value Fund (Templeton) detracted.

We continued to maintain our defensive equity theme, which incorporates a small group of underlying funds whose strategies, when combined, tend to exhibit less volatility than the broader equity market. This defensive theme helped generate competitive risk-adjusted results. The portfolio also benefited from its allocation to healthcare.

One of the top returns came from the portfolio’s absolute return allocation. In a period when alternative “safe haven” strategies posted very weak positive or even negative returns, the absolute return allocation gained over 5%, led by Currency Strategies Fund (First Quadrant). In the fixed-income space, our allocation to high-yield bonds and bank loans made positive contributions to the portfolio’s performance versus its blended benchmark. Strategic Income Opportunities Fund (John Hancock) was a standout within our allocation to multi-sector bonds.

| |

| 4 | Lifestyle Portfolios | Semiannual report |

Lifestyle Balanced Portfolio

For the six-month period ended June 30, 2013, the portfolio’s Class A shares returned 4.53%, excluding sales charges. In comparison, the S&P 500 Index returned 13.82% over the same period, and the Barclays U.S. Aggregate Bond Index returned -2.45%. A blended benchmark comprising 60% S&P 500 Index and 40% Barclays U.S. Aggregate Bond Index returned 7.10%. The Morningstar, Inc. moderate allocation fund category returned an average 5.92%.†

The portfolio underperformed its blended benchmark over the six months. Its underperformance during the period was primarily driven by our asset class positioning and, to a lesser extent, by the performance of our underlying fund managers. As overseas markets substantially underperformed the broad U.S. stock market, the portfolio’s exposure to emerging-market and international large-cap stocks was the most significant drag on relative performance. Although many of the funds in the portfolio posted solid returns, the performance of our underlying fund managers in aggregate was slightly negative for the six months. In the large-cap space, several underlying funds underperformed, including Capital Appreciation Fund (Jennison). Among international funds in the portfolio, China Emerging Leaders Fund (Atlantis) and International Value Fund (Templeton) detracted.

We continued to maintain our defensive equity theme, which incorporates a small group of underlying funds whose strategies, when combined, tend to exhibit less volatility than the broader equity market. This defensive theme helped generate competitive risk-adjusted results and mitigate volatility during the period. The portfolio also benefited from its allocation to healthcare.

One of the top returns came from the portfolio’s absolute return allocation. In a period when alternative “safe haven” strategies posted very weak positive or even negative returns, the absolute return allocation gained over 5%, led by Currency Strategies Fund (First Quadrant). In the fixed-income space, our allocation to bank loans and high-yield bonds made positive contributions to the portfolio’s performance versus the blended benchmark. Strategic Income Opportunities Fund (John Hancock) was a standout within our allocation to multi-sector bonds.

Lifestyle Moderate Portfolio

For the six-month period ended June 30, 2013, the portfolio’s Class A shares returned 2.58%, excluding sales charges. In comparison, the S&P 500 Index returned 13.82% over the same period, and the Barclays U.S. Aggregate Bond Index returned -2.45%. A blended benchmark comprising 40% S&P 500 Index and 60% Barclays U.S. Aggregate Bond Index returned 3.84%. The Morningstar, Inc. conservative allocation fund category returned an average 1.50%.†

The portfolio underperformed its blended benchmark over the six months. Its underperformance during the period was primarily driven by our asset class positioning and, to a lesser extent, by the performance of our underlying fund managers. As overseas markets substantially underperformed the broad U.S. stock market, the portfolio’s exposure to emerging-market and international large-cap stocks was the most significant drag on relative performance. An allocation to global natural resources also detracted, as these stocks underperformed the broader market due to soft commodity prices, slack demand and oversupply. Although many of the funds in the portfolio posted solid returns, the performance of our underlying fund managers in aggregate was slightly negative for the six months. Detractors included international funds International Value Fund (Templeton) and International Growth Opportunities Fund (Baillie Gifford).

We continued to maintain our defensive equity theme, which incorporates a small group of underlying funds whose strategies, when combined, tend to exhibit less volatility than the broader equity market. This defensive theme helped generate competitive risk-adjusted results and mitigate volatility during the period.

One of the top returns came from the portfolio’s absolute return allocation. In a period when alternative “safe haven” strategies posted very weak positive or even negative returns, the absolute return allocation gained over 5%, led by Currency Strategies Fund (First Quadrant). In the fixed-income space, our allocation to bank loans and high-yield bonds made positive contributions to the portfolio’s performance versus the blended benchmark. Strategic Income Opportunities Fund (John Hancock) was a standout within our allocation to multi-sector bonds.

| |

| Semiannual report | Lifestyle Portfolios | 5 |

Lifestyle Conservative Portfolio

For the six-month period ended June 30, 2013, the portfolio’s Class A shares returned 0.48%, excluding sales charges. In comparison, the S&P 500 Index returned 13.82% over the same period, and the Barclays U.S. Aggregate Bond Index returned -2.45%. A blended benchmark comprising 20% S&P 500 Index and 80% Barclays U.S. Aggregate Bond Index returned 0.66%. The Morningstar, Inc. conservative allocation fund category returned an average 1.50%.†

The portfolio slightly underperformed its blended benchmark over the period. Its relative results were helped by our asset class positioning, while the performance of our underlying fund managers was a slight detractor. The portfolio’s allocation to international equities detracted, particularly in its investments in emerging-market and international large-cap stocks. Although many of the funds in the portfolio posted solid returns, the performance of our underlying fund managers in aggregate was slightly negative. Detractors included overseas holding International Value Fund (Templeton).

The portfolio’s allocations to banks loans and high-yield bonds were the biggest contributing factors to our performance, with our multi-sector bond allocation also providing a lift. Within the equity space, we continued to maintain a defensive theme, which incorporates a small group of underlying equity funds whose strategies, when combined, tend to exhibit less volatility than the broader equity market. This defensive theme helped generate competitive risk-adjusted results and mitigate volatility during the period.

The portfolio also enjoyed positive contributions from Currency Strategies Fund (First Quadrant) within its absolute return allocation, as well as from Strategic Income Opportunities Fund (John Hancock) within its allocation to multi-sector bonds.

This commentary reflects the views of the portfolio managers through the end of the period discussed in this report. As such, they are in no way a guarantee of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

The portfolios’ performance depends on the subadvisors’ skill in determining the strategic asset class allocations, the mix of underlying funds and the performance of those underlying funds. The underlying funds’ performance may be lower than the performance of the asset class that they were selected to represent. The portfolios are subject to the same risks as the underlying funds in which they invest, which include the following: stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; and the securities of small-capitalization companies are subject to higher volatility than larger, more established companies; and high-yield bonds are subject to additional risks, such as increased risk of default. For additional information on these and other risk considerations, please see the portfolios’ prospectuses.

† Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower.

| |

| 6 | Lifestyle Portfolios | Semiannual report |

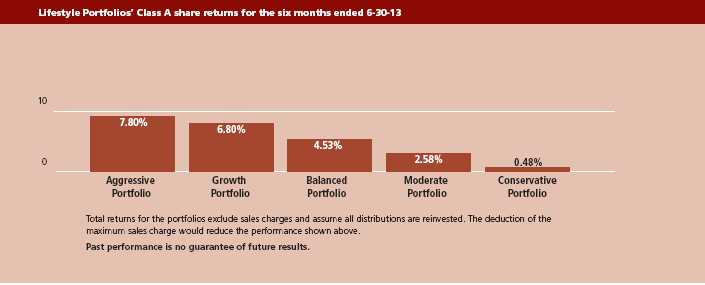

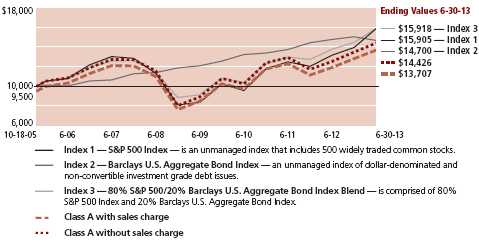

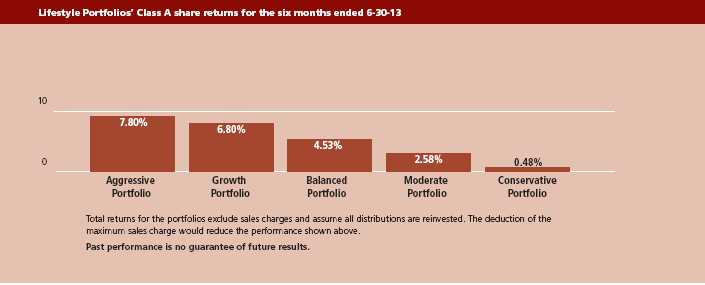

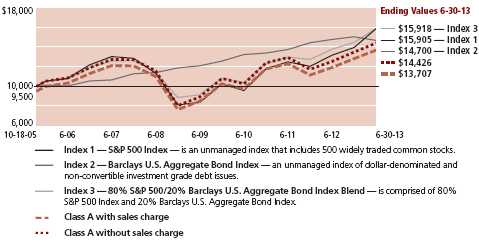

John Hancock Lifestyle Aggressive Portfolio

Growth of $10,000

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Lifestyle Aggressive Portfolio for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we’ve shown the same investment in two separate indexes.

| | |

| Asset Allocation* | |

| | |

| EQUITY | 96.9% OF TOTAL |

|

| U.S. Large Cap | | 44.5% |

|

| International Large Cap | | 13.0% |

|

| Emerging Markets | | 9.3% |

|

| Large Blend | | 7.1% |

|

| U.S. Mid Cap | | 6.9% |

|

| International Small Cap | | 4.8% |

|

| U.S. Small Cap | | 4.1% |

|

| Natural Resources | | 1.9% |

|

| Global Large Cap | | 1.8% |

|

| Health Sciences | | 1.8% |

|

| Real Estate | | 1.2% |

|

| Small Cap Growth | | 0.5% |

|

| ALTERNATIVE | 3.1% OF TOTAL |

|

| Currency | | 2.1% |

|

| Global Absolute Return Strategies | 1.0% |

|

| * As a percentage of net assets on 6-30-13. | |

| | |

Performance chart

Total returns with maximum sales charge for the period ended 6-30-13

| | | | | | | | | | | | |

| | Class A | Class B | Class C | Class R11 | Class R21,2 | Class R31 | Class R41 | Class R51 | Class R61,2 | Class 11 | Index 1 | Index 2 |

| | |

| Start date | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 10-15-05 | 10-15-05 | 10-15-05 |

|

| Average annual total returns | | | | | | | | | | | |

|

| 1 year | 10.92% | 10.87% | 15.02% | 16.23% | 16.75% | 16.43% | 16.83% | 17.08% | 17.37% | 17.28% | 20.60% | 19.14% |

|

| 5 years | 2.22% | 2.14% | 2.55% | 2.88% | 2.38% | 2.99% | 3.31% | 3.62% | 2.42% | 3.78% | 7.01% | –0.16% |

|

| Since inception | 3.66% | 3.57% | 3.62% | 2.89% | 3.33% | 4.10% | 4.40% | 4.70% | 3.18% | 4.84% | 6.24% | 3.93% |

|

| Cumulative returns | | | | | | | | | | | | |

|

| 6 months | 2.42% | 2.40% | 6.47% | 7.55% | 7.76% | 7.66% | 7.82% | 7.89% | 8.07% | 7.99% | 13.82% | 4.47% |

|

| 5 years | 11.58% | 11.16% | 13.41% | 15.27% | 12.46% | 15.85% | 17.65% | 19.46% | 12.71% | 20.39% | 40.33% | –0.77% |

|

| Since inception | 31.85% | 31.05% | 31.50% | 21.31% | 28.71% | 36.31% | 39.28% | 42.41% | 27.30% | 43.95% | 59.52% | 34.58% |

|

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values if they did. Index since inception returns are from 10-15-05, the start date of the oldest share class (Class 1).

Performance figures assume all distributions have been reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charges will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class 1, and Class 5 shares.

Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

The expense ratios of the portfolio, both net (including any fee waivers, expense limitations or recoupments) and gross (excluding any fee waivers, expense limitations or recoupments), are set forth according to the most recent publicly available prospectuses for the portfolio and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 4-30-14 for Class R2 and R6 shares. Had the fee waivers, expense limitations and recoupments not been in place gross expenses would apply. For all other classes the net expenses equal the gross expenses. The expense ratios are as follows:

| | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R2 | Class R3 | Class R4* | Class R5 | Class R6 | Class 1 |

| Net (%) | 1.50 | 2.28 | 2.20 | 1.93 | 1.54 | 1.80 | 1.42 | 1.19 | 1.04 | 1.04 |

| Gross (%) | 1.50 | 2.28 | 2.20 | 1.93 | 17.46 | 1.80 | 1.52 | 1.19 | 3.49 | 1.04 |

* The portfolio’s distributor has contractually agreed to waive 0.10% of Rule 12b-1 fees for Class R4 shares. The current waiver agreement will remain in effect through 4-30-14.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctu-ate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the portfolio’s Website at www.jhfunds.com.

This performance information does not reflect the deduction of taxes that a shareholder may pay on portfolio distributions or the redemption of portfolio shares. The portfolio’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

1 For certain types of investors as described in the portfolio’s prospectuses.

2 Class R6 shares were first offered on 9-1-11. The returns prior to this date are those of Class 1 shares that have been recalculated to apply the gross fees and expenses of Class R6 shares. Class R2 shares were first offered on 3-1-12. The returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class R2 shares.

| |

| Semiannual report | Lifestyle Portfolios | 7 |

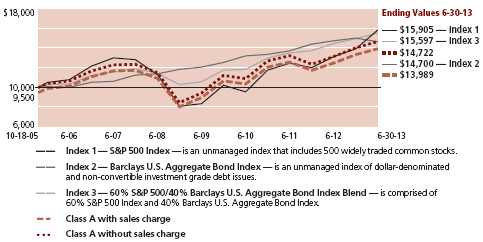

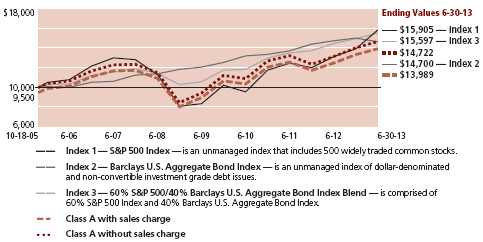

John Hancock Lifestyle Growth Portfolio

Growth of $10,000

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Lifestyle Growth Portfolio for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we’ve shown the same investment in a blended index and two separate indexes

| | |

| Asset Allocation* | |

| |

| EQUITY | 81.7% OF TOTAL |

|

| U.S. Large Cap | | 40.3% |

|

| International Large Cap | | 10.2% |

|

| Emerging Markets | | 7.0% |

|

| U.S. Mid Cap | | 5.7% |

|

| Large Blend | | 5.6% |

|

| International Small Cap | | 3.7% |

|

| U.S. Small Cap | | 2.8% |

|

| Global Large Cap | | 1.8% |

|

| Health Sciences | | 1.5% |

|

| Natural Resources | | 1.5% |

|

| Real Estate | | 1.3% |

|

| Small Cap Growth | | 0.3% |

|

| |

| FIXED INCOME | 15.2% OF TOTAL |

|

| Multi-Sector Bond | | 4.2% |

|

| High Yield Bond | | 3.7% |

|

| Intermediate Bond | | 2.9% |

|

| Bank Loan | | 2.8% |

|

| Global Bond | | 1.1% |

|

| Treasury Inflation-Protected Securities | 0.5% |

|

| |

| ALTERNATIVE | 3.1% OF TOTAL |

|

| Currency | | 2.1% |

|

| Global Absolute Return Strategies | 1.0% |

|

| * As a percentage of net assets on 6-30-13. | |

Performance chart

Total returns with maximum sales charge for the period ended 6-30-13

| | | | | | | | | | | | | | |

| | Class A | Class B | Class C | Class R11 | Class R21,2 | Class R31 | Class R41 | Class R51 | Class R61,2 | Class 11 | Class 51 | Index 1 | Index 2 | Index 3 |

| | |

| Start date | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 10-15-05 | 7-3-06 | 10-15-05 | 10-15-05 | 10-15-05 |

|

| Average annual total returns | | | | | | | | | | | | | |

|

| 1 year | 9.22% | 9.10% | 13.12% | 14.56% | 14.91% | 14.65% | 15.06% | 15.34% | 15.51% | 15.42% | 15.49% | 20.60% | –0.69% | 16.08% |

|

| 5 years | 3.42% | 3.37% | 3.75% | 4.15% | 3.67% | 4.23% | 4.57% | 4.87% | 4.15% | 4.97% | 5.03% | 7.01% | 5.19% | 6.94% |

|

| Since inception | 4.18% | 4.10% | 4.14% | 3.71% | 3.98% | 4.63% | 4.95% | 5.24% | 4.35% | 5.34% | 4.67% | 6.24% | 5.13% | 6.25% |

|

| Cumulative returns | | | | | | | | | | | | | | |

|

| 6 months | 1.47% | 1.34% | 5.34% | 6.55% | 6.68% | 6.58% | 6.81% | 6.95% | 6.98% | 6.98% | 6.98% | 13.82% | –2.45% | 10.42% |

|

| 5 years | 18.31% | 18.00% | 20.23% | 22.53% | 19.77% | 23.02% | 25.06% | 26.82% | 22.57% | 27.42% | 27.78% | 40.33% | 28.78% | 39.85% |

|

| Since inception | 37.07% | 36.32% | 36.69% | 28.06% | 35.10% | 41.70% | 45.03% | 48.22% | 38.86% | 49.36% | 37.66% | 59.52% | 47.05% | 59.57% |

|

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values if they did. Index since inception returns are from 10-15-05, the start date of the oldest share class (Class 1).

Performance figures assume all distributions have been reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charges will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class 1, and Class 5 shares.

Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

The expense ratios of the portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the portfolio and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 4-30-14 for Class R2 and Class R6 shares. Had the fee waivers and expense limitations not been in place gross expenses would apply. For all other classes the net expenses equal the gross expenses. The following expense ratios include expenses of the underlying affiliated funds in which the portfolio invests. The expense ratios are as follows:

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R2 | Class R3 | Class R4* | Class R5 | Class R6 | Class 1 | Class 5 |

| Net (%) | 1.45 | 2.16 | 2.15 | 1.81 | 1.50 | 1.69 | 1.29 | 1.07 | 0.99 | 0.99 | 0.94 |

| Gross (%) | 1.45 | 2.16 | 2.15 | 1.81 | 17.33 | 1.69 | 1.39 | 1.07 | 3.11 | 0.99 | 0.94 |

* The portfolio’s distributor has contractually agreed to waive 0.10% of Rule 12b-1 fees for Class R4 shares. The current waiver agreement expires on 4-30-14.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctu-ate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the portfolio’s Website at www.jhfunds.com.

This performance information does not reflect the deduction of taxes that a shareholder may pay on portfolio distributions or the redemption of portfolio shares. The portfolio’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

1 For certain types of investors as described in the portfolio’s prospectuses.

2 Class R6 shares were first offered on 9-1-11. The returns prior to this date are those of Class 1 shares that have been recalculated to apply the gross fees and expenses of Class R6 shares. Class R2 shares were first offered on 3-1-12. The returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class R2 shares.

| |

| 8 | Lifestyle Portfolios | Semiannual report |

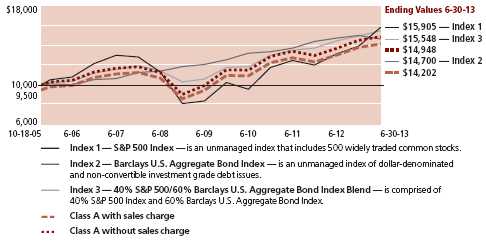

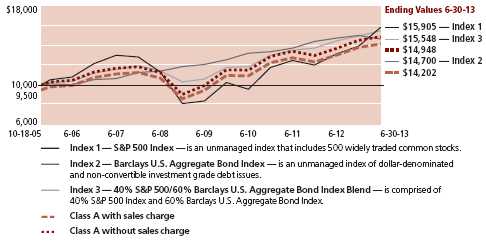

John Hancock Lifestyle Balanced Portfolio

Growth of $10,000

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Lifestyle Balanced Portfolio for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we’ve shown the same investment in a blended index and two separate indexes.

| | |

| Asset Allocation* | |

| |

| EQUITY | 60.6% OF TOTAL |

|

| U.S. Large Cap | | 30.5% |

|

| International Large Cap | | 7.6% |

|

| Emerging Markets | | 4.7% |

|

| U.S. Mid Cap | | 3.7% |

|

| Large Blend | | 3.5% |

|

| International Small Cap | | 2.6% |

|

| U.S. Small Cap | | 2.1% |

|

| Global Large Cap | | 1.6% |

|

| Natural Resources | | 1.4% |

|

| Health Sciences | | 1.3% |

|

| Real Estate | | 1.3% |

|

| Small Cap Growth | | 0.3% |

|

| |

| FIXED INCOME | 35.9% OF TOTAL |

|

| Intermediate Bond | | 10.2% |

|

| Multi-Sector Bond | | 9.9% |

|

| High Yield Bond | | 6.0% |

|

| Bank Loan | | 5.9% |

|

| Global Bond | | 2.7% |

|

| Treasury Inflation-Protected Securities | 1.2% |

|

| |

| ALTERNATIVE | 3.5% OF TOTAL |

|

| Currency | | 2.3% |

|

| Global Absolute Return Strategies | 1.2% |

|

| * As a percentage of net assets on 6-30-13. | |

| | |

Performance chart

Total returns with maximum sales charge for the period ended 6-30-13

| | | | | | | | | | | | | | |

| | Class A | Class B | Class C | Class R11 | Class R21,2 | Class R31 | Class R41 | Class R51 | Class R61,2 | Class 11 | Class 51 | Index 1 | Index 2 | Index 3 |

| | |

| Start date | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 10-15-05 | 7-3-06 | 10-15-05 | 10-15-05 | 10-15-05 |

|

| Average annual total returns | | | | | | | | | | | | | |

|

| 1 year | 6.11% | 5.81% | 9.90% | 11.29% | 11.66% | 11.45% | 11.89% | 12.11% | 12.23% | 12.15% | 12.29% | 20.60% | –0.69% | 11.69% |

|

| 5 years | 3.94% | 3.88% | 4.28% | 4.59% | 4.20% | 4.77% | 5.11% | 5.40% | 4.68% | 5.49% | 5.55% | 7.01% | 5.19% | 6.72% |

|

| Since inception | 4.45% | 4.36% | 4.43% | 4.07% | 4.25% | 4.91% | 5.23% | 5.52% | 4.61% | 5.60% | 5.20% | 6.24% | 5.13% | 6.14% |

|

| Cumulative returns | | | | | | | | | | | | | | |

|

| 6 months | –0.72% | –0.91% | 3.16% | 4.29% | 4.52% | 4.35% | 4.55% | 4.73% | 4.79% | 4.71% | 4.81% | 13.82% | –2.45% | 7.10% |

|

| 5 years | 21.34% | 20.96% | 23.31% | 25.13% | 22.83% | 26.21% | 28.31% | 30.08% | 25.70% | 30.65% | 30.98% | 40.33% | 28.78% | 38.41% |

|

| Since inception | 39.89% | 38.88% | 39.62% | 31.11% | 37.80% | 44.67% | 48.06% | 51.28% | 41.58% | 52.22% | 42.62% | 59.52% | 47.05% | 58.28% |

|

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values if they did. Index since inception returns are from 10-15-05, the start date of the oldest share class (Class 1).

Performance figures assume all distributions have been reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charges will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class 1, and Class 5 shares.

Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

The expense ratios of the portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the portfolio and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 4-30-14 for Class R2 and Class R6 shares. Had the fee waivers and expense limitations not been in place gross expenses would apply. For all other classes the net expenses equal the gross expenses. The following expense ratios include expenses of the underlying affiliated funds in which the portfolio invests. The expense ratios are as follows:

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R2 | Class R3 | Class R4* | Class R5 | Class R6 | Class 1 | Class 5 |

| Net (%) | 1.41 | 2.14 | 2.11 | 1.77 | 1.46 | 1.63 | 1.22 | 1.02 | 0.96 | 0.96 | 0.91 |

| Gross (%) | 1.41 | 2.14 | 2.11 | 1.77 | 17.43 | 1.63 | 1.32 | 1.02 | 2.00 | 0.96 | 0.91 |

* The portfolio’s distributor has contractually agreed to waive 0.10% of Rule 12b-1 fees for Class R4 shares. The current waiver agreement will remain in effect through 4-30-14.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctu-ate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the portfolio’s Website at www.jhfunds.com.

This performance information does not reflect the deduction of taxes that a shareholder may pay on portfolio distributions or the redemption of portfolio shares. The portfolio’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

1 For certain types of investors as described in the portfolio’s prospectuses.

2 Class R6 shares were first offered on 9-1-11. The returns prior to this date are those of Class 1 shares that have been recalculated to apply the gross fees and expenses of Class R6 shares. Class R2 shares were first offered on 3-1-12. The returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class R2 shares.

| |

| Semiannual report | Lifestyle Portfolios | 9 |

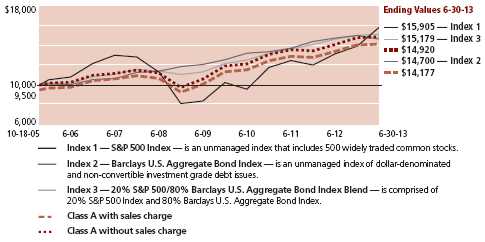

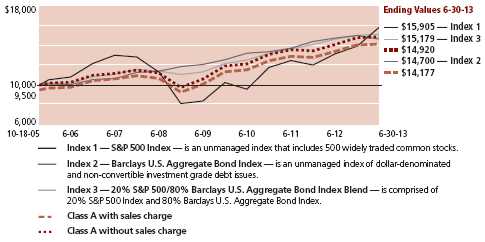

John Hancock Lifestyle Moderate Portfolio

Growth of $10,000

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Lifestyle Moderate Portfolio for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we’ve shown the same investment in a blended index and two separate indexes.

| | |

| Asset Allocation* | |

| |

| EQUITY | 40.1% OF TOTAL |

|

| U.S. Large Cap | | 22.7% |

|

| International Large Cap | | 4.2% |

|

| Large Blend | | 2.5% |

|

| Emerging Markets | | 2.4% |

|

| U.S. Mid Cap | | 2.4% |

|

| Global Large Cap | | 1.3% |

|

| Real Estate | | 1.2% |

|

| International Small Cap | | 1.1% |

|

| U.S. Small Cap | | 1.1% |

|

| Natural Resources | | 1.0% |

|

| Small Cap Growth | | 0.2% |

|

| |

| FIXED INCOME | 55.7% OF TOTAL |

|

| Intermediate Bond | | 21.0% |

|

| Multi-Sector Bond | | 12.4% |

|

| Bank Loan | | 8.8% |

|

| High Yield Bond | | 7.9% |

|

| Global Bond | | 4.1% |

|

| Treasury Inflation-Protected Securities | 1.5% |

|

| |

| ALTERNATIVE | 4.2% OF TOTAL |

|

| Currency | | 2.5% |

|

| Global Absolute Return Strategies | 1.7% |

|

| * As a percentage of net assets on 6-30-13. | |

Performance chart

Total returns with maximum sales charge for the period ended 6-30-13

| | | | | | | | | | | | | | |

| | Class A | Class B | Class C | Class R11 | Class R21,2 | Class R31 | Class R41 | Class R51 | Class R61,2 | Class 11 | Class 51 | Index 1 | Index 2 | Index 3 |

| | |

| Start date | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 10-15-05 | 7-3-06 | 10-15-05 | 10-15-05 | 10-15-05 |

|

| Average annual total returns | | | | | | | | | | | | | |

|

| 1 year | 3.28% | 2.95% | 6.98% | 8.27% | 8.63% | 8.35% | 8.83% | 8.95% | 9.19% | 9.19% | 9.25% | 20.60% | –0.69% | 7.44% |

|

| 5 years | 4.72% | 4.66% | 5.05% | 5.34% | 4.95% | 5.44% | 5.76% | 6.09% | 4.81% | 6.25% | 6.31% | 7.01% | 5.19% | 6.35% |

|

| Since inception | 4.66% | 4.55% | 4.62% | 4.61% | 4.45% | 5.06% | 5.35% | 5.68% | 4.07% | 5.80% | 5.72% | 6.24% | 5.13% | 5.91% |

|

| Cumulative returns | | | | | | | | | | | | | | |

|

| 6 months | –2.53% | –2.79% | 1.22% | 2.32% | 2.49% | 2.36% | 2.63% | 2.68% | 2.76% | 2.75% | 2.78% | 13.82% | –2.45% | 3.84% |

|

| 5 years | 25.95% | 25.57% | 27.92% | 29.70% | 27.35% | 30.34% | 32.30% | 34.39% | 26.45% | 35.39% | 35.78% | 40.33% | 28.78% | 36.04% |

|

| Since inception | 42.02% | 40.85% | 41.60% | 35.78% | 39.84% | 46.29% | 49.43% | 52.98% | 36.05% | 54.47% | 47.56% | 59.52% | 47.05% | 55.71% |

|

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values if they did. Index since inception returns are from 10-15-05, the start date of the oldest share class (Class 1).

Performance figures assume all distributions have been reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charges will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class 1, and Class 5 shares.

Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

The expense ratios of the portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the portfolio and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 4-30-14 for Class R2 and Class R6 shares. Had the fee waivers and expense limitations not been in place gross expenses would apply. For all other classes the net expenses equal the gross expenses. The expense ratios are as follows:

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R2 | Class R3 | Class R4* | Class R5 | Class R6 | Class 1 | Class 5 |

| Net (%) | 1.37 | 2.10 | 2.08 | 1.80 | 1.42 | 1.68 | 1.28 | 1.07 | 0.91 | 0.91 | 0.86 |

| Gross (%) | 1.37 | 2.10 | 2.08 | 1.80 | 17.08 | 1.68 | 1.38 | 1.07 | 5.59 | 0.91 | 0.86 |

* The portfolio’s distributor has contractually agreed to waive 0.10% of the Rule 12b-1 fees for Class R4 shares. The current waiver agreement will remain in effect through 4-30-14.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctu-ate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the portfolio’s Website at www.jhfunds.com.

This performance information does not reflect the deduction of taxes that a shareholder may pay on portfolio distributions or the redemption of portfolio shares. The portfolio’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

1 For certain types of investors as described in the portfolio’s prospectuses.

2 Class R6 shares were first offered on 9-1-11. The returns prior to this date are those of Class 1 shares that have been recalculated to apply the gross fees and expenses of Class R6 shares. Class R2 shares were first offered on 3-1-12. The returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class R2 shares.

| |

| 10 | Lifestyle Portfolios | Semiannual report |

John Hancock Lifestyle Conservative Portfolio

Growth of $10,000

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Lifestyle Conservative Portfolio for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we’ve shown the same investment in a blended index and two separate indexes.

| | |

| Asset Allocation* | |

| |

| EQUITY | 20.0% OF TOTAL |

|

| U.S. Large Cap | | 12.7% |

|

| International Large Cap | | 2.5% |

|

| Real Estate | | 1.1% |

|

| Emerging Markets | | 1.0% |

|

| Global Large Cap | | 0.9% |

|

| U.S. Mid Cap | | 0.8% |

|

| U.S. Small Cap | | 0.5% |

|

| Natural Resources | | 0.5% |

|

| |

| FIXED INCOME | 75.3% OF TOTAL |

|

| Intermediate Bond | | 30.0% |

|

| Multi-Sector Bond | | 14.5% |

|

| Bank Loan | | 10.5% |

|

| High Yield Bond | | 8.3% |

|

| Global Bond | | 5.2% |

|

| Short-Term Bond | | 4.0% |

|

| Treasury Inflation-Protected Securities | 2.8% |

|

| |

| ALTERNATIVE | 4.7% OF TOTAL |

|

| Currency | | 2.5% |

|

| Global Absolute Return Strategies | 2.2% |

|

| * As a percentage of net assets on 6-30-13. | |

Performance chart

Total returns with maximum sales charge for the period ended 6-30-13

| | | | | | | | | | | | | |

| | Class A | Class B | Class C | Class R11 | Class R21,2 | Class R31 | Class R41 | Class R51 | Class R61,2 | Class 11 | Index 1 | Index 2 | Index 3 |

| | |

| Start date | 10-18-05 | 10-18-05 | 10-18-05 | 9-18-06 | 10-18-05 | 10-18-05 | 10-18-05 | 10-18-05 | 10-15-05 | 10-15-05 | 10-15-05 | 10-15-05 | 10-15-05 |

|

| Average annual total returns | | | | | | | | | | | | |

|

| 1 year | 0.22% | –0.26% | 3.78% | 5.04% | 5.55% | 5.11% | 5.57% | 5.84% | 6.01% | 6.00% | 20.60% | –0.69% | 3.31% |

|

| 5 years | 4.74% | 4.69% | 5.08% | 5.34% | 4.99% | 5.46% | 5.76% | 6.12% | 4.60% | 6.28% | 7.01% | 5.19% | 5.84% |

|

| Since inception | 4.64% | 4.55% | 4.58% | 4.82% | 4.43% | 5.05% | 5.31% | 5.66% | 3.78% | 5.79% | 6.24% | 5.13% | 5.58% |

|

| Cumulative returns | | | | | | | | | | | | | |

|

| 6 months | –4.56% | –4.87% | –0.87% | 0.35% | 0.53% | 0.33% | 0.51% | 0.66% | 0.64% | 0.71% | 13.82% | –2.45% | 0.66% |

|

| 5 years | 26.07% | 25.74% | 28.11% | 29.73% | 27.58% | 30.43% | 32.31% | 34.59% | 25.21% | 35.62% | 40.33% | 28.78% | 32.80% |

|

| Since inception | 41.77% | 40.83% | 41.21% | 37.61% | 39.64% | 46.10% | 48.97% | 52.79% | 33.12% | 54.33% | 59.52% | 47.05% | 51.93% |

|

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values if they did. Index since inception returns are from 10-15-05, the start date of the oldest share class (Class 1).

Performance figures assume all distributions have been reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charges will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class 1, and Class 5 shares.

Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

The expense ratios of the portfolio, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the portfolio and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 4-30-14 for Class R2 and Class R6 shares. Had the fee waivers and expense limitations not been in place gross expenses would apply. For all other classes the net expenses equal the gross expenses. The following expense ratios include expenses of the underlying affiliated funds in which the portfolio invests. The expense ratios are as follows:

| | | | | | | | | | |

| | Class A | Class B | Class C | Class R1 | Class R2 | Class R3 | Class R4* | Class R5 | Class R6 | Class 1 |

| Net (%) | 1.32 | 2.06 | 2.02 | 1.84 | 1.37 | 1.73 | 1.26 | 1.07 | 0.87 | 0.87 |

| Gross (%) | 1.32 | 2.06 | 2.02 | 1.84 | 11.40 | 1.73 | 1.36 | 1.07 | 3.26 | 0.87 |

* The portfolio’s distributor has contractually agreed to waive 0.10% of the Rule 12b-1 fees for Class R4. The current waiver agreement will remain in effect through 4-30-14.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctu-ate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the portfolio’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the portfolio’s Website at www.jhfunds.com.

This performance information does not reflect the deduction of taxes that a shareholder may pay on portfolio distributions or the redemption of portfolio shares. The portfolio’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

1 For certain types of investors as described in the portfolio’s prospectuses.

2 Class R6 shares were first offered on 9-1-11. The returns prior to this date are those of Class 1 shares that have been recalculated to apply the gross fees and expenses of Class R6 shares. Class R2 shares were first offered on 3-1-12. The returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class R2 shares.

| |

| Semiannual report | Lifestyle Portfolios | 11 |

Your expenses

As a shareholder of a John Hancock Fund II Lifestyle Portfolio, you incur ongoing costs, such as management fees, distribution and service (12b-1) fees and other expenses. In addition to the operating expenses which the portfolio bears directly, the portfolio indirectly bears a pro rata share of the operating expenses of the affiliated underlying funds in which the portfolio invests. Because the affiliated underlying funds have varied operating expenses and transaction costs and the portfolio may own different proportions of the underlying funds at different times, the amount of expenses incurred indirectly by the portfolio will vary. Had these indirect expenses been reflected in the following analysis, total expenses would have been higher than the amounts shown.

This example is intended to help you understand your ongoing costs (in dollars) of investing in the portfolio so you can compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the period and held for the entire period (January 1, 2013 through June 30, 2013).

Actual expenses:

The first line of each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes:

The second line of each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio for the share class and an assumed annualized rate of return of 5% per year before expenses, which is not the actual return of the share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs and insurance-related charges. Therefore, the second line of each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| |

| 12 | Lifestyle Portfolios | Semiannual report |

Shareholder expense example chart

| | | | | |

| | | Beginning | Ending | Expenses Paid | |

| | | Account Value | Account Value | During Period1 | Annualized |

| | | 1-1-13 | 6-30-13 | 1-1-13–6-30-13 | Expense Ratio2 |

| Lifestyle Aggressive Portfolio | | | | |

|

| Class A | Actual | $1,000.00 | $1,078.00 | $2.83 | 0.55% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.10 | 2.76 | 0.55% |

|

| Class B | Actual | 1,000.00 | 1,074.00 | 6.94 | 1.35% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.10 | 6.76 | 1.35% |

|

| Class C | Actual | 1,000.00 | 1,074.70 | 6.48 | 1.26% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.50 | 6.31 | 1.26% |

|

| Class R1 | Actual | 1,000.00 | 1,075.50 | 5.09 | 0.99% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,019.90 | 4.96 | 0.99% |

|

| Class R2 | Actual | 1,000.00 | 1,077.60 | 3.19 | 0.62% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.70 | 3.11 | 0.62% |

|

| Class R3 | Actual | 1,000.00 | 1,076.60 | 4.48 | 0.87% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.50 | 4.36 | 0.87% |

|

| Class R4 | Actual | 1,000.00 | 1,078.20 | 2.58 | 0.50% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.30 | 2.51 | 0.50% |

|

| Class R5 | Actual | 1,000.00 | 1,078.90 | 1.44 | 0.28% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,023.40 | 1.40 | 0.28% |

|

| Class R6 | Actual | 1,000.00 | 1,080.70 | 0.57 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Class 1 | Actual | 1,000.00 | 1,079.90 | 0.57 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Lifestyle Growth Portfolio | | | | |

| Class A | Actual | $1,000.00 | $1,068.00 | $2.77 | 0.54% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.10 | 2.71 | 0.54% |

|

| Class B | Actual | 1,000.00 | 1,063.40 | 6.45 | 1.26% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.50 | 6.31 | 1.26% |

|

| Class C | Actual | 1,000.00 | 1,063.40 | 6.34 | 1.24% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.60 | 6.21 | 1.24% |

|

| Class R1 | Actual | 1,000.00 | 1,065.50 | 4.56 | 0.89% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.40 | 4.46 | 0.89% |

|

| Class R2 | Actual | 1,000.00 | 1,066.80 | 3.18 | 0.62% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.70 | 3.11 | 0.62% |

|

| Class R3 | Actual | 1,000.00 | 1,065.80 | 4.15 | 0.81% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.80 | 4.06 | 0.81% |

|

| Class R4 | Actual | 1,000.00 | 1,068.10 | 2.00 | 0.39% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.90 | 1.96 | 0.39% |

|

| Class R5 | Actual | 1,000.00 | 1,069.50 | 0.87 | 0.17% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.00 | 0.85 | 0.17% |

|

| Class R6 | Actual | 1,000.00 | 1,069.80 | 0.56 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Class 1 | Actual | 1,000.00 | 1,069.80 | 0.56 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Class 5 | Actual | 1,000.00 | 1,069.80 | 0.31 | 0.06% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.50 | 0.30 | 0.06% |

|

| |

| Semiannual report | Lifestyle Portfolios | 13 |

Shareholder expense example chart, continued

| | | | | |

| | | Beginning | Ending | Expenses Paid | |

| | | Account Value | Account Value | During Period1 | Annualized |

| | | 1-1-13 | 6-30-13 | 1-1-13–6-30-13 | Expense Ratio2 |

| Lifestyle Balanced Portfolio | | | | |

|

| Class A | Actual | $1,000.00 | $1,045.30 | $2.74 | 0.54% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.10 | 2.71 | 0.54% |

|

| Class B | Actual | 1,000.00 | 1,040.90 | 6.58 | 1.30% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.30 | 6.51 | 1.30% |

|

| Class C | Actual | 1,000.00 | 1,041.60 | 6.28 | 1.24% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.60 | 6.21 | 1.24% |

|

| Class R1 | Actual | 1,000.00 | 1,042.90 | 4.51 | 0.89% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.40 | 4.46 | 0.89% |

|

| Class R2 | Actual | 1,000.00 | 1,045.20 | 3.14 | 0.62% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.70 | 3.11 | 0.62% |

|

| Class R3 | Actual | 1,000.00 | 1,043.50 | 3.95 | 0.78% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.90 | 3.91 | 0.78% |

|

| Class R4 | Actual | 1,000.00 | 1,045.50 | 1.83 | 0.36% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,023.00 | 1.81 | 0.36% |

|

| Class R5 | Actual | 1,000.00 | 1,047.30 | 0.91 | 0.18% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,023.90 | 0.90 | 0.18% |

|

| Class R6 | Actual | 1,000.00 | 1,047.90 | 0.56 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Class 1 | Actual | 1,000.00 | 1,047.10 | 0.56 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Class 5 | Actual | 1,000.00 | 1,048.10 | 0.30 | 0.06% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.50 | 0.30 | 0.06% |

|

| Lifestyle Moderate Portfolio | | | | |

| Class A | Actual | $1,000.00 | $1,025.80 | $2.76 | 0.55% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.10 | 2.76 | 0.55% |

|

| Class B | Actual | 1,000.00 | 1,022.10 | 6.42 | 1.28% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.40 | 6.41 | 1.28% |

|

| Class C | Actual | 1,000.00 | 1,022.20 | 6.27 | 1.25% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.60 | 6.26 | 1.25% |

|

| Class R1 | Actual | 1,000.00 | 1,023.20 | 4.72 | 0.94% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.10 | 4.71 | 0.94% |

|

| Class R2 | Actual | 1,000.00 | 1,024.90 | 3.11 | 0.62% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.70 | 3.11 | 0.62% |

|

| Class R3 | Actual | 1,000.00 | 1,023.60 | 4.37 | 0.87% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.50 | 4.36 | 0.87% |

|

| Class R4 | Actual | 1,000.00 | 1,026.30 | 2.16 | 0.43% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.70 | 2.16 | 0.43% |

|

| Class R5 | Actual | 1,000.00 | 1,026.80 | 1.46 | 0.29% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,023.40 | 1.45 | 0.29% |

|

| Class R6 | Actual | 1,000.00 | 1,027.60 | 0.55 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Class 1 | Actual | 1,000.00 | 1,027.50 | 0.55 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Class 5 | Actual | 1,000.00 | 1,027.80 | 0.30 | 0.06% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.50 | 0.30 | 0.06% |

|

| |

| 14 | Lifestyle Portfolios | Semiannual report |

Shareholder expense example chart, continued

| | | | | |

| | | Beginning | Ending | Expenses Paid | |

| | | Account Value | Account Value | During Period1 | Annualized |

| | | 1-1-13 | 6-30-13 | 1-1-13–6-30-13 | Expense Ratio2 |

| Lifestyle Conservative Portfolio | | | | |

|

| Class A | Actual | $1,000.00 | $1,004.80 | $2.73 | 0.55% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.10 | 2.76 | 0.55% |

|

| Class B | Actual | 1,000.00 | 1,001.10 | 6.30 | 1.27% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.50 | 6.36 | 1.27% |

|

| Class C | Actual | 1,000.00 | 1,001.30 | 6.20 | 1.25% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,018.60 | 6.26 | 1.25% |

|

| Class R1 | Actual | 1,000.00 | 1,003.50 | 4.57 | 0.92% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,020.20 | 4.61 | 0.92% |

|

| Class R2 | Actual | 1,000.00 | 1,005.30 | 3.08 | 0.62% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.70 | 3.11 | 0.62% |

|

| Class R3 | Actual | 1,000.00 | 1,003.30 | 3.82 | 0.77% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,021.00 | 3.86 | 0.77% |

|

| Class R4 | Actual | 1,000.00 | 1,005.10 | 2.34 | 0.47% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,022.50 | 2.36 | 0.47% |

|

| Class R5 | Actual | 1,000.00 | 1,006.60 | 0.80 | 0.16% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.00 | 0.80 | 0.16% |

|

| Class R6 | Actual | 1,000.00 | 1,006.40 | 0.55 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

| Class 1 | Actual | 1,000.00 | 1,007.10 | 0.55 | 0.11% |

| | Hypothetical (5% annualized return before expenses) | 1,000.00 | 1,024.20 | 0.55 | 0.11% |

|

1 Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period (181) and divided by 365 (to reflect the one-half year period).

2 The portfolios’ expense ratios do not include fees and expenses indirectly incurred by the underlying funds whose expense ratios can vary based on the mix of underlying funds held by portfolios. The range of expense ratios of the underlying funds held by the portfolios was as follows:

| | | | | |

| | Lifestyle | Lifestyle | Lifestyle | Lifestyle | Lifestyle |

| Period ended | Aggressive | Growth | Balanced | Moderate | Conservative |

| 6-30-13 | 0.70%–1.29% | 0.63%–1.29% | 0.62%–1.29% | 0.62%–1.29% | 0.62%–1.29% |

| |

| Semiannual report | Lifestyle Portfolios | 15 |

Portfolios’ investments

| |

| Investment companies | |

| | |

| Underlying Funds’ Subadvisors | |

| | |

| American Century Investment | |

| Management, Inc. | (American Century) |

| | |

| Atlantis Investment Management | |

| (Hong Kong) Ltd. | (Atlantis) |

| | |

| Baillie Gifford Overseas Ltd. | (Baillie Gifford) |

| |

| Columbia Management Investment | |

| Advisers, LLC | (Columbia) |

| | |

| Davis Selected Advisers, L.P. | (Davis) |

| | |

| Declaration Management & Research, LLC | (Declaration) |

| | |

| Deutsche Asset Management | (Deutsche) |

| | |

| Dimensional Fund Advisors LP | (DFA) |

| | |

| Epoch Investment Partners, Inc. | (Epoch) |

| | |

| First Quadrant, L.P. | (First Quadrant) |

| | |

| Franklin Mutual Advisers | (Franklin) |

| | |

| Franklin Templeton Investments Corp. | (Franklin Templeton) |

| | |

| Templeton Investment Counsel, LLC | (Templeton) |

| | |

| Frontier Capital Management Company, LLC | (Frontier) |

| | |

| Grantham, Mayo, Van Otterloo & Co. LLC | (GMO) |

| | |

| Invesco Advisers, Inc. | (Invesco) |

| | |

| Jennison Associates LLC | (Jennison) |

| | |

| John Hancock Asset Management* | (John Hancock) |

| | |

| Lord, Abbett & Co. LLC | (Lord Abbett) |

| |

| Pacific Investment Management | |

| Company LLC | (PIMCO) |

| | |

| Perimeter Capital Management | (Perimeter) |

| | |

| QS Investors Inc. | (QS Investors) |

| | |

| Rainier Investment Management, Inc. | (Rainier) |

| | |

| RCM Capital Management LLC | (RCM) |

| | |

| Robeco Investment Management, Inc. | (Robeco) |

| | |

| RS Investment Management Co. LLC | (RS Investments) |

| |

| Standard Life Investments | |

| (Corporate Funds) Limited | (Standard Life) |

| | |

| Stone Harbor Investment Partners LP | (Stone Harbor) |

| | |

| T. Rowe Price Associates, Inc. | (T. Rowe Price) |

| | |

| Wellington Management Company, LLP | (Wellington) |

| | |

| Wells Capital Management, Incorporated | (Wells Capital) |

| | |

| Western Asset Management Company | (WAMCO) |

* Manulife Asset Management (US) LLC and Manulife Asset Management (North America) Limited are doing business as John Hancock Asset Management.

Lifestyle Aggressive Portfolio

Securities owned by the portfolio on 6-30-13

| | |

| | Shares | Value |

| AFFILIATED INVESTMENT COMPANIES — 100.00% | |

|

| EQUITY 96.9% | | |

| | | |

| John Hancock Funds II (G) 83.5% | | |

|

| All Cap Core, Class NAV (QS Investors) | 10,513,707 | $119,961,403 |

|

| All Cap Value, Class NAV (Lord Abbett) | 7,125,519 | 93,985,602 |

|

| Alpha Opportunities, Class NAV (Wellington) | 18,967,125 | 232,347,279 |

|

| Blue Chip Growth, Class NAV (T. Rowe Price) | 7,919,450 | 216,517,754 |

|

| Capital Appreciation, Class NAV (Jennison) | 12,780,325 | 182,247,433 |

|

| Capital Appreciation Value, Class NAV | | |

| (T. Rowe Price) | 13,318,336 | 161,817,780 |

|

| China Emerging Leaders, Class NAV (Atlantis) | 6,016,783 | 50,781,649 |

|

| Emerging Markets, Class NAV (DFA) | 33,569,183 | 327,299,537 |

|

| Equity-Income, Class NAV (T. Rowe Price) | 9,329,089 | 170,069,289 |

|

| Fundamental Global Franchise, Class NAV | | |

| (John Hancock1) (A) | 3,088,983 | 36,450,004 |

|

| Fundamental Large Cap Value, Class NAV | | |

| (John Hancock1) (A) | 9,681,832 | 121,603,810 |

|

| Fundamental Value, Class NAV (Davis) | 8,357,794 | 153,114,787 |

|

| Global Equity, Class NAV (John Hancock1) (A)(I) | 3,780,268 | 36,744,200 |

|

| Global Real Estate, Class NAV (Deutsche) | 3,518,137 | 29,693,080 |

|

| Health Sciences, Class NAV (T. Rowe Price) | 4,452,464 | 71,684,667 |

|

| Heritage, Class NAV (American Century) | 3,203,596 | 25,372,480 |

|

| International Growth Opportunities Fund, | | |

| Class NAV (Baillie Gifford) | 5,159,112 | 58,659,107 |

|

| International Growth Stock, Class NAV (Invesco) | 7,790,670 | 90,995,030 |

|

| International Small Cap, Class NAV | | |

| (Franklin Templeton) | 4,115,725 | 66,592,435 |

|

| International Small Company, Class NAV (DFA) | 7,959,012 | 68,447,507 |

|

| International Value, Class NAV (Templeton) | 12,232,017 | 177,364,246 |

|

| Mid Cap Stock, Class NAV (Wellington) | 5,746,200 | 117,394,859 |

|

| Mid Cap Value Equity, Class NAV (Columbia) | 1,705,971 | 15,916,707 |

|

| Mid Value, Class NAV (T. Rowe Price) | 6,733,026 | 98,908,157 |

|

| Mutual Shares, Class NAV (Franklin) | 4,803,521 | 62,830,059 |

|

| Natural Resources, Class NAV | | |

| (RS Investments/Wellington) | 4,954,959 | 77,891,963 |

|

| Real Estate Equity, Class NAV (T. Rowe Price) | 1,969,784 | 19,559,953 |

|

| Redwood, Class NAV (RCM) | 3,010,033 | 33,260,870 |

|

| Science and Technology, Class NAV | | |

| (T. Rowe Price/RCM) (I) | 9,379,234 | 99,044,714 |

|

| Small Cap Growth, Class NAV (Wellington) | 2,437,022 | 23,785,336 |

|

| Small Cap Opportunities, Class NAV (Invesco/DFA) | 855,987 | 23,565,321 |

|

| Small Cap Value, Class NAV (Wellington) | 1,384,136 | 25,135,913 |

|

| Small Company Growth, Class NAV (Invesco) | 1,191,004 | 20,663,913 |

|

| Small Company Value, Class NAV (T. Rowe Price) | 1,163,566 | 37,606,453 |

|

| Smaller Company Growth, Class NAV | | |

| (Frontier/John Hancock2(A)/Perimeter) | 2,037,198 | 20,657,186 |

|

| Technical Opportunities, Class NAV (Wellington) (I) | 7,920,569 | 97,739,821 |

|

| U.S. Equity, Class NAV (GMO) | 8,777,927 | 113,674,152 |

|

| Value, Class NAV (Invesco) | 2,383,480 | 25,741,583 |

| | | |

| John Hancock Funds III (G) 12.5% | | |

|

| Disciplined Value, Class NAV (Robeco) | 5,006,370 | 82,354,784 |

|

| Global Shareholder Yield, Class NAV (Epoch) | 4,606,912 | 49,432,165 |

|

| International Core, Class NAV (GMO) | 3,552,599 | 104,552,996 |

|

| International Value Equity, Class NAV | | |

(John Hancock1) (A) | 6,922,240 | 58,562,149 |

|

| Rainier Growth, Class NAV (Rainier) | 2,789,464 | 69,457,653 |

|

| Strategic Growth, Class NAV (John Hancock1) (A) | 11,362,924 | 147,377,127 |

| | |

| 16 | Lifestyle Portfolios | Semiannual report | |

| | | See notes to financial statements |

| | |

| Lifestyle Aggressive Portfolio (continued) |

| | Shares | Value |

| John Hancock Investment Trust (G) 0.9% | |

|

| Small Cap Intrinsic Value, Class NAV | | |

| (John Hancock1) (A) | 3,064,577 | $38,429,798 |

| | | |

| ALTERNATIVE 3.1% | | |

| | | |

| John Hancock Funds II (G) 3.1% | | |

|

| Currency Strategies, Class NAV (First Quadrant) | 8,176,534 | 84,463,600 |

|

| Global Absolute Return Strategies, Class NAV | | |

| (Standard Life) | 3,741,203 | 40,629,461 |

| | | |

| Total Investments (Lifestyle Aggressive Portfolio) |

| (Cost $3,183,420,584) 100.0% | | $4,080,385,772 |

| | | |

| Other assets and liabilities, net 0.0% | | (3,051) |

|

| TOTAL NET ASSETS 100.0% | | $4,080,382,721 |

| | | |

| Percentages are based upon net assets. | | |

|

| |

| |

| |

| Lifestyle Growth Portfolio | |

| Securities owned by the portfolio on 6-30-13 | |

| | Shares | Value |

| AFFILIATED INVESTMENT COMPANIES — 100.00% |

|

| EQUITY 81.7% | | |

| | | |

| John Hancock Funds II (G) 70.1% | | |

|

| All Cap Core, Class NAV (QS Investors) | 25,162,059 | $287,099,096 |

|

| All Cap Value, Class NAV (Lord Abbett) | 18,721,350 | 246,934,613 |

|

| Alpha Opportunities, Class NAV (Wellington) | 46,365,388 | 567,976,004 |

|

| Blue Chip Growth, Class NAV (T. Rowe Price) | 21,238,957 | 580,673,089 |

|

| Capital Appreciation, Class NAV (Jennison) | 34,234,423 | 488,182,878 |

|

| Capital Appreciation Value, Class NAV | | |

| (T. Rowe Price) | 49,031,607 | 595,734,022 |

|

| China Emerging Leaders, Class NAV (Atlantis) | 14,347,924 | 121,096,480 |

|

| Emerging Markets, Class NAV (DFA) | 78,622,133 | 766,565,796 |

|

| Equity-Income, Class NAV (T. Rowe Price) | 24,941,685 | 454,686,925 |

|

| Fundamental Global Franchise, Class NAV | | |

| (John Hancock1) (A) | 10,939,866 | 129,090,423 |

|

| Fundamental Large Cap Value, Class NAV | | |

| (John Hancock1) (A) | 26,309,401 | 330,446,073 |

|

| Fundamental Value, Class NAV (Davis) | 19,649,436 | 359,977,673 |

|

| Global Equity, Class NAV (John Hancock1) (A)(I) | 9,914,028 | 96,364,354 |

|

| Global Real Estate, Class NAV (Deutsche) | 11,816,896 | 99,734,606 |

|

| Health Sciences, Class NAV (T. Rowe Price) | 11,970,412 | 192,723,630 |

|

| Heritage, Class NAV (American Century) | 8,157,801 | 64,609,784 |

|

| International Growth Opportunities, Class NAV | | |

| (Baillie Gifford) | 12,234,167 | 139,102,484 |

|

| International Growth Stock, Class NAV (Invesco) | 18,500,225 | 216,082,631 |

|

| International Small Cap, Class NAV | | |

| (Franklin Templeton) | 9,134,909 | 147,802,833 |

|

| International Small Company, Class NAV (DFA) | 17,728,799 | 152,467,676 |

|

| International Value, Class NAV (Templeton) | 29,078,009 | 421,631,127 |

|

| Mid Cap Stock, Class NAV (Wellington) | 14,661,486 | 299,534,151 |

|

| Mid Cap Value Equity, Class NAV (Columbia) | 4,265,524 | 39,797,343 |

|

| Mid Value, Class NAV (T. Rowe Price) | 17,047,297 | 250,424,798 |

|

| Mutual Shares, Class NAV (Franklin) | 12,832,719 | 167,851,965 |

|

| Natural Resources, Class NAV | | |

| (RS Investments/Wellington) | 11,993,795 | 188,542,454 |

|

| Real Estate Equity, Class NAV (T. Rowe Price) | 6,050,790 | 60,084,340 |

|

| Redwood, Class NAV (RCM) | 9,219,858 | 101,879,426 |

|

| Science and Technology, Class NAV | | |

| (T. Rowe Price/RCM) (I) | 24,902,826 | 262,973,839 |

|

| Small Cap Growth, Class NAV (Wellington) | 5,047,308 | 49,261,722 |

|

| Small Cap Opportunities, Class NAV (Invesco/DFA) | 1,785,644 | 49,158,766 |

|

| Small Cap Value, Class NAV (Wellington) | 2,879,045 | 52,283,454 |

|

| Small Company Growth, Class NAV (Invesco) | 2,446,336 | 42,443,930 |

|

| Small Company Value, Class NAV (T. Rowe Price) | 2,400,122 | 77,571,941 |

|

| Smaller Company Growth, Class NAV | | |

| (Frontier/John Hancock2(A)/Perimeter) | 4,223,730 | 42,828,623 |

|

| Technical Opportunities, Class NAV (Wellington) (I) | 20,972,368 | 258,799,016 |

|

| U.S. Equity, Class NAV (GMO) | 32,222,009 | 417,275,020 |

|

| Value, Class NAV (Invesco) | 6,061,071 | 65,459,568 |

| | |

| Lifestyle Growth Portfolio (continued) |

| | Shares | Value |

| John Hancock Funds III (G) 11.0% | | |

|

| Disciplined Value, Class NAV (Robeco) | 13,355,140 | $219,692,049 |

|

| Global Shareholder Yield, Class NAV (Epoch) | 19,099,587 | 204,938,567 |

|

| International Core, Class NAV (GMO) | 8,384,842 | 246,765,912 |

|

| International Value Equity, Class NAV | | |

| (John Hancock1)(A) | 16,668,241 | 141,013,315 |

|