| | | | | | | | | | | | | | | |

| | As of 12-31-16 | | | | |

| | | | | Shares | | | | | | Value | |

| | AFFILIATED INVESTMENT COMPANIES (G) - 100.0% | |

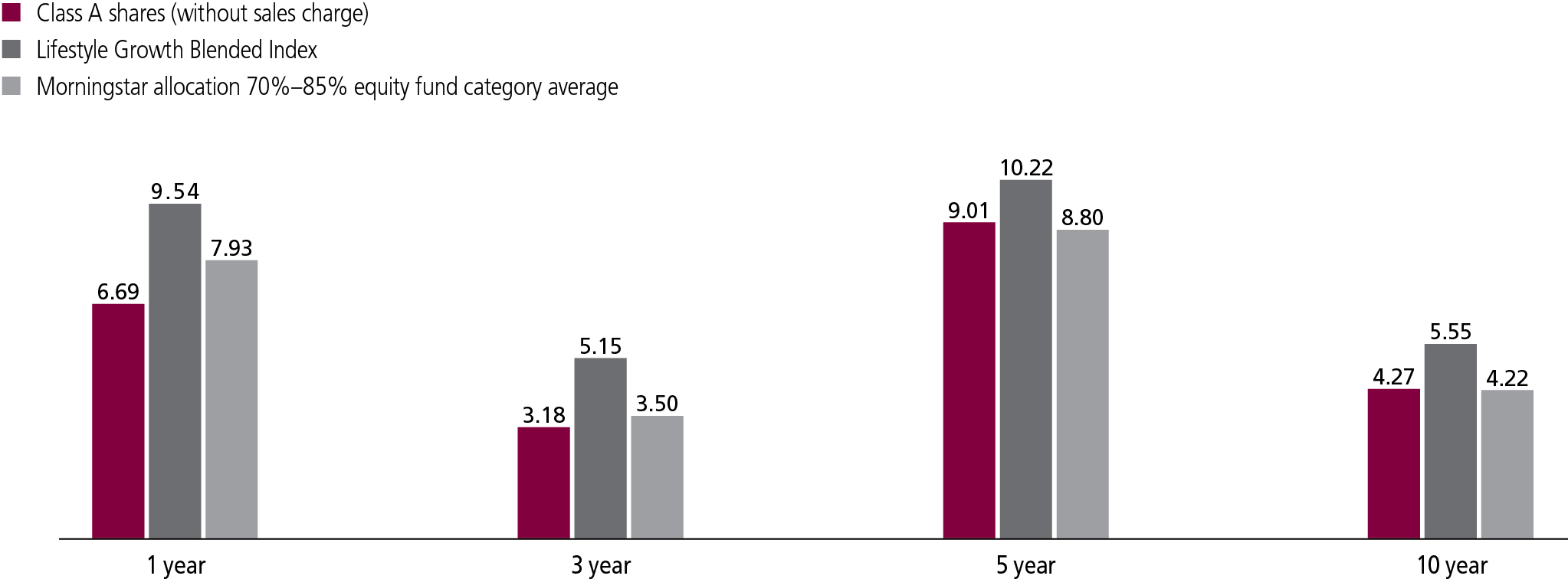

| | Equity - 69.8% | |

| | Alpha Opportunities, Class NAV (Wellington) | | | 8,333,714 | | | | | | $91,170,829 | |

| | Blue Chip Growth, Class NAV (T. Rowe Price) | | | 13,020,653 | | | | | | 401,817,359 | |

| | Capital Appreciation, Class NAV (Jennison) | | | 26,602,036 | | | | | | 389,985,846 | |

| | Capital Appreciation Value, Class NAV (T.Rowe Price) | | | 51,866,727 | | | | | | 573,127,338 | |

| | Disciplined Value, Class NAV (Boston Partners) | | | 18,036,181 | | | | | | 349,721,546 | |

| | Emerging Markets, Class NAV (DFA) | | | 29,787,610 | | | | | | 268,982,122 | |

| | Emerging Markets Equity, Class NAV (JHAM) (A)(1) | | | 30,886,543 | | | | | | 268,095,192 | |

| | Equity Income, Class NAV (T. Rowe Price) | | | 27,712,352 | | | | | | 531,800,027 | |

| | Fundamental Global Franchise, Class NAV (JHAM) (A)(1) | | | 13,698,732 | | | | | | 161,371,060 | |

| | Fundamental Large Cap Core, Class R6 (JHAM) (A)(1) | | | 8,863,786 | | | | | | 407,468,231 | |

| | Global Equity, Class NAV (JHAM) (A)(1) | | | 20,726,572 | | | | | | 225,505,109 | |

| | Global Shareholder Yield, Class NAV (Epoch) | | | 17,028,297 | | | | | | 177,094,290 | |

| | International Growth Opportunities, Class NAV (Baillie Gifford) | | | 12,686,404 | | | | | | 153,759,217 | |

| | International Growth, Class NAV (Wellington) | | | 2,012,317 | | | | | | 40,930,534 | |

| | International Growth Stock, Class NAV (Invesco) | | | 28,222,809 | | | | | | 336,133,654 | |

| | International Small Cap, Class NAV (Franklin Templeton) | | | 11,183,377 | | | | | | 188,887,244 | |

| | International Small Company, Class NAV (DFA) | | | 18,816,519 | | | | | | 191,175,831 | |

| | International Strategic Equity Allocation, Class NAV (JHAM) (A)(1) | | | 71,533,964 | | | | | | 710,332,260 | |

| | International Value, Class NAV (Templeton) | | | 30,225,280 | | | | | | 451,867,939 | |

| | International Value Equity, Class NAV (JHAM) (A)(1) | | | 29,288,671 | | | | | | 219,665,033 | |

| | Mid Cap Stock, Class NAV (Wellington) | | | 22,754,594 | | | | | | 420,049,814 | |

| | Mid Value, Class NAV (T. Rowe Price) | | | 19,690,978 | | | | | | 305,210,153 | |

| | New Opportunities, Class NAV (Brandywine/Invesco/DFA) | | | 2,351,520 | | | | | | 63,067,767 | |

| | Small Cap Core, Class NAV (JHAM) (A)(1) | | | 5,186,494 | | | | | | 63,067,767 | |

| | Small Cap Growth, Class NAV (Wellington) (I) | | | 8,004,156 | | | | | | 64,833,665 | |

| | Small Cap Value, Class NAV (Wellington) | | | 3,633,835 | | | | | | 77,800,398 | |

| | Small Company Growth, Class NAV (Invesco) | | | 3,583,847 | | | | | | 64,509,242 | |

| | Small Company Value, Class NAV (T. Rowe Price) | | | 1,814,798 | | | | | | 51,866,932 | |

| | Strategic Growth, Class NAV (JHAM) (A)(1) | | | 24,999,093 | | | | | | 389,985,846 | |

| | U.S. Strategic Equity Allocation, Class NAV (JHAM) (A)(1) | | | 72,502,178 | | | | | | $763,447,936 | |

| | Value, Class NAV (Invesco) | | | 11,582,045 | | | | | | 130,298,007 | |

| | Value Equity, Class NAV (Barrow Hanley) | | | 21,275,012 | | | | | | 236,365,378 | |

| | Fixed income - 17.0% | |

| | Active Bond, Class NAV (JHAM) (A)(1) | | | 26,224,547 | | | | | | 259,885,266 | |

| | Asia Pacific Total Return Bond, Class NAV (JHAM) (A)(1) | | | 7,820,678 | | | | | | 72,028,442 | |

| | Core Bond, Class NAV (Wells Capital) | | | 6,521,917 | | | | | | 83,350,102 | |

| | Emerging Markets Debt, Class NAV (JHAM) (A)(1) | | | 16,623,278 | | | | | | 151,604,296 | |

| | Floating Rate Income, Class NAV (WAMCO) | | | 29,314,446 | | | | | | 252,104,233 | |

| | Global Bond, Class NAV (PIMCO) | | | 3,061,213 | | | | | | 36,122,313 | |

| | Global Income, Class NAV (Stone Harbor) | | | 7,095,672 | | | | | | 65,493,056 | |

| | Global Short Duration Credit, Class NAV (JHAM) (A)(1) | | | 7,329,214 | | | | | | 66,402,681 | |

| | High Yield, Class NAV (JHAM) (A)(1)* | | | 19,881,633 | | | | | | 68,790,449 | |

| | High Yield, Class NAV (WAMCO) | | | 4,360,509 | | | | | | 35,058,493 | |

| | Real Return Bond, Class NAV (PIMCO) | | | 16,706,696 | | | | | | 183,272,450 | |

| | Short Duration Credit Opportunities, Class NAV (Stone Harbor) | | | 19,715,657 | | | | | | 189,467,468 | |

| | Spectrum Income, Class NAV (T. Rowe Price) | | | 14,704,020 | | | | | | 154,539,251 | |

| | Strategic Income Opportunities, Class NAV (JHAM) (A)(1) | | | 26,631,078 | | | | | | 282,289,430 | |

| | Total Return, Class NAV (PIMCO) | | | 14,546,138 | | | | | | 192,590,861 | |

| | U.S. High Yield Bond, Class NAV (Wells Capital) | | | 4,507,957 | | | | | | 49,903,081 | |

| | Alternative and specialty - 13.2% | |

| | Absolute Return Currency, Class NAV (First Quadrant) (I) | | | 19,101,835 | | | | | | 188,153,071 | |

| | Financial Industries, Class NAV (JHAM) (A)(1) | | | 9,937,148 | | | | | | 189,203,302 | |

| | Global Absolute Return Strategies, Class NAV (Standard Life) (I) | | | 27,985,219 | | | | | | 283,490,264 | |

| | Global Real Estate, Class NAV (Deutsche) | | | 6,999,752 | | | | | | 63,067,767 | |

| | Health Sciences, Class NAV (T. Rowe Price) | | | 19,342,221 | | | | | | 78,722,841 | |

| | Natural Resources, Class NAV (Jennison) | | | 13,952,264 | | | | | | 169,659,531 | |

| | Real Estate Equity, Class NAV (T. Rowe Price) | | | 6,123,240 | | | | | | 62,701,974 | |

| | Redwood, Class NAV (Boston Partners) (I) | | | 9,737,215 | | | | | | 100,682,800 | |

| | Science & Technology, Class NAV (T. Rowe Price/Allianz) | | | 20,701,832 | | | | | | 220,888,548 | |

| | Seaport, Class NAV (Wellington) | | | 3,603,016 | | | | | | 37,903,728 | |

| | Technical Opportunities, Class NAV (Wellington) | | | 24,306,643 | | | | | | 262,754,808 | |

| | TOTAL AFFILIATED INVESTMENT COMPANIES (Cost $11,052,023,798) | | | $12,569,524,072 | |

| | SHORT-TERM INVESTMENTS - 0.0% | |

| | Money market funds - 0.0% | | | | |

| | State Street Institutional U.S. Government Money Market Fund, Premier Class, 0.4218% (Y) | | | 1,001 | | | | | | 1,001 | |

| | TOTAL SHORT-TERM INVESTMENTS (Cost $1,001) | | | $1,001 | |

| | Total Investments (Lifestyle Growth Portfolio) (Cost $11,052,024,799) - 100.0% | | | $12,569,525,073 | |

| | Other assets and liabilities, net - 0.0% | | | (2,975,284) | |

| | TOTAL NET ASSETS - 100.0% | | | $12,566,549,789 | |