Note 1 — Organization

John Hancock Funds II (the Trust) is an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). It is a series company with multiple investment series (the funds), five of which (collectively, Multimanager Lifestyle Portfolios, or the portfolios, and individually the portfolio) are presented in this report. The Multimanager Lifestyle Portfolios operate as "funds of funds", investing in Class NAV shares of affiliated underlying funds of the Trust, other funds in the John Hancock funds complex and other permitted investments, including other unaffiliated funds.

Effective February 1, 2017, the portfolios changed their names as follows:

| | | |

| Current Portfolio Name | | Former Portfolio Name |

| Multimanager Lifestyle Aggressive Portfolio | | Lifestyle Aggressive Portfolio |

| Multimanager Lifestyle Growth Portfolio | | Lifestyle Growth Portfolio |

| Multimanager Lifestyle Balanced Portfolio | | Lifestyle Balanced Portfolio |

| Multimanager Lifestyle Moderate Portfolio | | Lifestyle Moderate Portfolio |

| Multimanager Lifestyle Conservative Portfolio | | Lifestyle Conservative Portfolio |

The portfolios may offer multiple classes of shares. The shares currently offered by the portfolios are detailed in the Statements of assets and liabilities. Class A and Class C are open to all investors. Class B shares are closed to new investors, subject to exceptions described in the portfolios' prospectus. Class I shares are offered to institutions and certain investors. Class R1, Class R2, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans. Class R6 shares are only available to certain retirement plans, institutions and other investors. Class 1 shares are offered only to certain affiliates of Manulife Financial Corporation (MFC). Class 5 shares are available only to the John Hancock Freedom 529 plans. Class B shares convert to Class A shares eight years after purchase. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, and transfer agent fees for each class may differ.

The investment objectives of the portfolios are as follows:

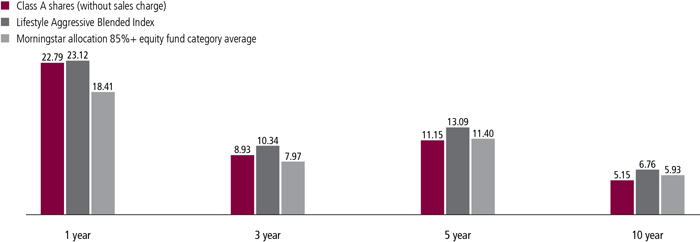

Multimanager Lifestyle Aggressive Portfolio

To seek long-term growth of capital. Current income is not a consideration.

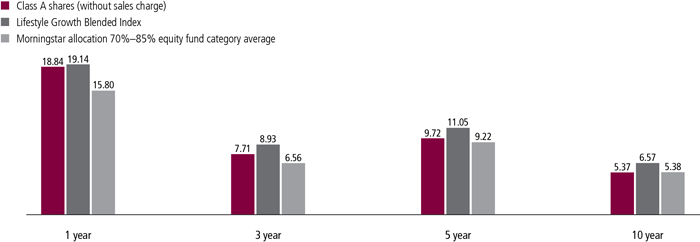

Multimanager Lifestyle Growth Portfolio

To seek long-term growth of capital. Current income is also a consideration.

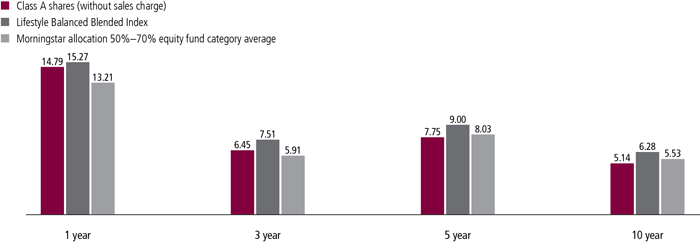

Multimanager Lifestyle Balanced Portfolio

To seek a balance between a high level of current income and growth of capital, with a greater emphasis on growth of capital.

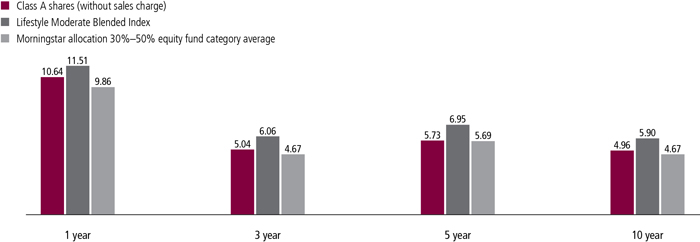

Multimanager Lifestyle Moderate Portfolio

To seek a balance between a high level of current income and growth of capital, with a greater emphasis on income.

Multimanager Lifestyle Conservative Portfolio

To seek a high level of current income with some consideration given to growth of capital.

The accounting policies of the John Hancock underlying funds in which the portfolios invest are outlined in the underlying funds' shareholder reports, which include the underlying funds' financial statements, available without charge by calling 800-344-1029 or visiting jhinvestments.com, on the Securities and Exchange Commission (SEC) website at sec.gov or at the SEC's public reference room in Washington, D.C. The underlying funds are not covered by this report.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. The portfolios qualify as investment companies under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the portfolios:

Security valuation. Investments are stated at value as of the scheduled close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing at a time other than the regularly scheduled close, the net asset value (NAV) may be determined as of the regularly scheduled close of the NYSE pursuant to the portfolios' Valuation Policies and Procedures.

In order to value the securities, the portfolios use the following valuation techniques: Investments by the portfolios in underlying affiliated funds and/or other open-end management investment companies are valued at their respective NAVs each business day.

The portfolios use a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities, including registered investment companies. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the portfolios' own assumptions in