During the escrow period, the holders of these escrowed shares will not be able to sell or transfer their securities, except to their spouses and children or trusts established for their benefit, but will retain all other rights as Navios stockholders, including, without limitation, the right to vote their shares of common stock and the right to receive cash dividends, if declared. If dividends are declared and payable in shares of common stock, such dividends will also be placed in escrow.

In September 2004, ISE, our legal predecessor, issued 4,250,000 shares of ISE common stock, which, by virtue of the acquisition of Navios by ISE and reincorporation through the merger of ISE with and into Navios, became Navios common stock, to the individuals set forth below for $25,000 in cash, at an average purchase price of approximately $0.006 per share, as follows:

On January 2, 2006, Navios Corporation and Navios Shipmanagement Inc., two wholly owned subsidiaries of Navios, entered into two lease agreements with Goldland Ktimatiki – Ikodomiki – Touristiki and Xenodohiaki Anonimos Eteria, a Greek corporation which is partially owned by relatives of Angeliki Frangou, our Chairman and Chief Executive Officer. The lease agreements provide for the leasing of two facilities located in Piraeus, Greece, of approximately 2,034.3 square meters and will house the operations of Navios' subsidiaries. The total annual lease payments due under these leases is EUR 420,000 (approximately $500,000) and the lease agreements expire in 2017. Navios believes the terms and provisions of the lease agreements were similar to those that would have been available with a non-related third party. The lease payments are subject to annual adjustments starting form the third year and are based on the inflation rate prevailing in Greece as reported by the Greek State at the end of each year. Navios believes the terms and provisions of the lease agreements were the same as could have been expected in an arm's length transaction.

On December 19, 2004 Navios concluded an agreement to purchase four Panamax vessels from Maritime Enterprises Management S.A., a company affiliated with the Angeliki Frangou family the Company’s Chairman and Chief Executive Officer. On December 22, 2005, Navios took delivery of the first two vessels, the Navios Libra II and the Navios Alegria built in 1995 and 2004 respectively. The third vessel, the Navios Felicity built in 1997, was delivered on December 27, 2005 and the fourth vessel, the Navios Gemini S built in 1994, was delivered on January 5, 2006. The total acquisition cost for the four new vessels including backlogs was $119.8 million and was funded (i) with $13.0 million of Navios’ available cash; (ii) with $80.3 million from bank financing and (iii) through the issuance of 5,500,854 shares of Navios authorized common stock at $4.96 per share for Navios Alegria (1,840,923 shares) and Navios Libra II (1,227,282 shares), $4.82 per share for Navios Felicity (1,271,114 shares) and $4.42 for Navios Gemini S. (1,161,535 shares). Navios believes the terms and provisions of the purchase agreements for these vessels were the same as could have been expected in an arm's length transaction.

On November 29, 2004, ISE's board of directors authorized a stock dividend of approximately 0.676 shares of common stock for each outstanding share of common stock, effectively lowering the purchase price to approximately $0.004 per share.

Table of ContentsThe holders of the majority of these shares will be entitled to make up to two demands that Navios register these shares pursuant to a registration rights agreement previously entered into. The holders of the majority of these shares may elect to exercise these registration rights at any time after the date on which these shares of common stock are released from escrow, which, except in limited circumstances, is not before December 2007. In addition, these stockholders have certain ‘‘piggy-back’’ registration rights on registration statements filed subsequent to the date on which these shares of common stock are released from escrow. Navios will bear the expenses incurred in connection with the filing of any such registration statements.

As of December 16, 2004, Ms. Frangou had advanced a total of approximately $350,000 to ISE, on a non-interest bearing basis, for payment of offering expenses on ISE's behalf. These loans were paid without interest on December 21, 2004. In addition, Ms. Frangou agreed to loan ISE funds to cover its transaction expenses, including bank commitment fees and deposits, in connection with the acquisition of Navios that exceed the amount of funds held outside of ISE's trust, which loan in the aggregate amount of approximately $8.6 million was repaid, without interest, at the closing of the acquisition of Navios.

Navios owns fifty percent of the common stock of Acropolis Chartering and Shipping Inc., (‘‘Acropolis’’). Navios also uses Acropolis as a broker and paid commissions to Acropolis during the three month period ended March 31, 2006, the period from August 26, 2005 to December 31, 2005, the three month period ended March 31, 2005, the period form January 1, 2005 to August 25, 2005 and during the years ended December 31, 2004 and 2003 of $0, $455,000, $188,000, $157,000, $877,000 and $597,000, respectively. During the three month period ended March 31, 2006 the period from August 25, 2005 to December 31, 2005, the three month period ended March 31, 2005, the period from January 1, 2005 to August 25, 2005 and the years ended December 31, 2004 and 2003, Navios received dividends from Acropolis of $455,000, $0, $482,000, $972,000, $699,000 and $78,000, respectively. An amount of $160,000 and $90,000 representing commissions due to Acropolis is included in accounts payable as at March 31, 2006 and December 31, 2005, respectively.

During 2003 and 2002, prior to Navios becoming a public company, Navios used Levant Maritime Company Ltd., or Levant, as an agent. Agency fees paid to Levant amounted to $1,003,000 and $846,000 respectively. Levant was managed by a former director and shareholder of Navios, and Navios ceased using Levant's services as of December 31, 2003.

In November 2002, prior to Navios becoming a public company, a predecessor company to Navios issued a promissory note for $367,000 to Kastella Trading, Inc., or Kastella, a Marshall Islands Corporation. Interest accrued at 4.6% per year and was payable at the note's due date. Kastella was wholly-owned by one of the predecessor company's executives. This loan was repaid in full in 2004.

In August 2004, prior to Navios becoming a public company, Navios advanced to one of its shareholders and executive officers the amount of $50,000. The loan was repaid in full during the year. No interest was calculated for the duration of this loan.

All ongoing and future transactions between Navios and any of its officers and directors or their respective affiliates, including loans by Navios' officers and directors, if any, will be on terms believed by Navios to be no less favorable than are available from unaffiliated third parties, and such transactions or loans, including any forgiveness of loans, will require prior approval, in each instance by a majority of Navios' uninterested ‘‘independent’’ directors or the members of Navios' board who do not have an interest in the transaction, in either case who had access, at Navios' expense, to its attorneys or independent legal counsel.

92

Table of ContentsDESCRIPTION OF SECURITIES

Set forth below is a summary of certain in formation relating to our securities and of certain provisions of our Articles of Incorporation and the laws of the Marshall Islands law. This summary does not purport to be complete. It is qualified in its entirety by reference to the Articles of Incorporation and the laws of the Marshall Islands in effect at the date of this prospectus.

General

On August 25, 2005, ISE, a publicly traded shell company, acquired Navios, a then privately held company, which caused Navios to become a wholly-owned subsidiary of a publicly traded company. Immediately following the acquisition, ISE reincorporated from the State of Delaware to the Republic of Marshall Islands by merging with and into Navios, its wholly owned subsidiary, and as a result of such merger, Navios became a publicly traded operating entity. As a result of the acquisition and reincorporation, and in accordance with its Third Amended and restated Articles of Incorporation, dated August 25, 2005, Navios is authorized to issue 120,000,000 shares of common stock, par value $.0001, and 1,000,000 shares of preferred stock, par value $.0001. As of July 27, 2006, 61,379,134 shares of common stock are outstanding, held by 26 record holders, 16 of which are located in the United States. No shares of preferred stock are currently outstanding. Of Navios' outstanding securities, the common stock, warrants and units, the portions held by investors in the United States are approximately 61%, 89% and 82%, respectively.

Units

Each unit is publicly traded and consists of one share of common stock and two warrants, which warrants started trading separately as of the opening of trading on January 5, 2005. Each warrant entitles the holder to purchase one share of common stock at an exercise price of $5.00 per share.

Common stock

Navios' common stock is publicly traded and stockholders are entitled to one vote for each share held of record on all matters to be voted on by stockholders.

Navios' board of directors is divided into three classes, each of which will generally serve for a term of three years with only one class of directors being elected in each year. There is no cumulative voting with respect to the election of directors, with the result that the holders of more than 50% of the shares voted for the election of directors can elect all of the directors.

Navios' stockholders have no conversion, preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to the common stock.

Holders of 7,125,000 shares of common stock are entitled to registration rights. The holders of the majority of these shares are entitled to make up to two demands that Navios register the resale of these shares. The holders of the majority of these shares can elect to exercise these registration rights at any time after December 10, 2007. In addition, these stockholders have certain ‘‘piggy-back’’ registration rights on registration statements filed subsequent to December 10, 2007. Navios will bear the expenses incurred in connection with the filing of any such registration statements.

Preferred stock

Navios' certificate of incorporation authorizes the issuance of 1,000,000 shares of blank check preferred stock with such designation, rights and preferences as may be determined from time to time by Navios' board of directors. Accordingly, Navios' board of directors is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting or other rights which could adversely affect the voting power or other rights of the holders of common stock, although the underwriting agreement prohibits Navios, prior to a business combination, from issuing preferred stock which participates in any manner in the proceeds of the trust fund, or which votes as a class with the common stock on a business combination. Navios may issue some or all of the preferred

93

Table of Contentsstock to effect a business combination. In addition, the preferred stock could be utilized as a method of discouraging, delaying or preventing a change in control of Navios. Although Navios does not currently intend to issue any shares of preferred stock, Navios cannot assure you that it will not do so in the future.

Warrants

On June 7, 2006, Navios announced the exercise of 15,978,280 of its 65,550,000 outstanding warrants resulting in the issuance of 15,978,280 shares of unregistered common stock. Under the agreement with certain qualifying shareholders the exercise price of the previously outstanding warrants was reduced from $5.00 to $4.10 per share. The gross proceeds from the exercise of warrants were approximately $65.5 million. To comply with securities laws, the transaction was limited to certain institutional holders and Navios' Chairman and principal stockholder.

Ms. Angeliki Frangou, Navios chairman and principal stockholder, participated in this transaction and paid approximately $27.3 million to the Company to exercise 6,666,280 warrants. Ms. Angeliki Frangou's unregistered shares will not be registered in the registration statement referred to below.

Navios has agreed to file a registration statement, other than with respect to the share exercised by Ms. Frangou, registering the resale of such common stock by August 25, 2006 and have such registration statement declared effective depending upon certain conditions within 120 days of the filing, subject to certain penalties for failure to meet this deadline.

Giving effect to this transaction and the 1,161,535 shares issued in connection with the acquisition of vessel Gemini S (see notes 17 and 23 to the December 31, 2005 consolidated financial statements), Navios currently has 61,379,134 shares outstanding and 49,571,720 warrants outstanding. The shares outstanding do not include an additional 708,993 shares, which Navios has agreed to issue to Navios' financial advisors. These shares will initially be unregistered. As of the date of this prospectus, none of the shares related to the additional 708,993 shares have been issued.

Navios currently has warrants outstanding to purchase 49,571,720 shares of Navios common stock. Each warrant entitles the registered holder to purchase one share of Navios' common stock at a price of $5.00 per share, subject to adjustment as discussed below, at any time commencing on December 10, 2005.

The warrants will expire on December 9, 2008, at 5:00 p.m., New York City time. Navios may call the warrants for redemption, with Sunrise Securities Corp.'s prior consent, in whole and not in part, at a price of $.01 per warrant at any time after the warrants become exercisable, upon not less than 30 days' prior written notice of redemption to each warrant holder, if, and only if, the last reported sale price of the common stock equals or exceeds $8.50 per share, for any 20 trading days within a 30 trading day period ending on the third business day prior to the notice of redemption to warrant holders and the weekly trading volume of Navios' common stock has been at least 800,000 shares for each of the two calendar weeks prior to the notice of redemption.

The warrants are issued in registered form under a warrant agreement between Continental Stock Transfer & Trust Company, as warrant agent, and Navios.

The exercise price and number of shares of common stock issuable on exercise of the warrants may be adjusted in certain circumstances including in the event of a stock dividend, or Navios' recapitalization, reorganization, merger or consolidation. However, the warrants will not be adjusted for issuances of common stock at a price below their respective exercise prices.

The warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price, by certified check payable to Navios, for the number of warrants being exercised. The warrant holders do not have the rights or privileges of holders of common stock or any voting rights until they exercise their warrants and receive shares of common stock. After the issuance of shares of common stock upon exercise of the warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by stockholders.

94

Table of ContentsNo fractional shares will be issued upon exercise of the warrants. If, upon exercise of the warrants, a holder would be entitled to receive a fractional interest in a share, Navios will, upon exercise, round up to the nearest whole number the number of shares of common stock to be issued to the warrant holder.

Transfer Agent and Warrant Agent

The transfer agent for Navios' securities and warrant agent for Navios' warrants is Continental Stock Transfer & Trust Company, 17 Battery Place, New York, New York 10004.

MARSHALL ISLANDS COMPANY CONSIDERATIONS

Our corporate affairs are governed by our articles of incorporation and bylaws and by the Business Corporation Act of the Republic of the Marshall Islands, or BCA. The provisions of the BCA resemble provisions of the corporation laws of a number of states in the United States. For example, the BCA allows the adoption of various anti-takeover measures such as shareholder ‘‘rights’’ plans. While the BCA also provides that it is to be in interpreted according to the laws of the State of Delaware and other states with substantially similar legislative provisions, there have been few, if any, court cases interpreting the BCA in the Marshall Islands and we can not predict whether Marshall Islands courts would reach the same conclusions as U.S. courts. Thus, you may have more difficulty in protecting your interests in the face of actions by the management, directors or controlling shareholders than would shareholders of a corporation incorporated in a United States jurisdiction which has developed a substantial body of case law. The following table provides a comparison between the statutory provisions of the BCA and the Delaware General Corporation Law relating to shareholders' rights.

|  |  |  |

| Marshall Islands |  |  | Delaware |

| Shareholder Meetings |

| •Held at a time and place as designated in the by-laws |  |  | •May be held at such time or place as designated in the certificate of incorporation or the by-laws, or if not so designated, as determined by the board of directors |

| •May be held within or without the Marshall Islands |  |  | •May be held within or without Delaware |

| •Notice: |  |  | •Notice: |

| •Whenever shareholders are required to take action at a meeting, written notice shall state the place, date and hour of the meeting and indicate that it is being issued by or at the direction of the person calling the meeting |  |  | •Whenever shareholders are required to take any action at a meeting, a written notice of the meeting shall be given which shall state the place, if any, date and hour of the meeting, and the means of remote communication, if any |

| •A copy of the notice of any meeting shall be given personally or sent by mail not less than 15 nor more than 60 days before the meeting |  |  | •Written notice shall be given not less than 10 nor more than 60 days before the meeting |

|

95

Table of Contents

|  |  |  |

| Marshall Islands |  |  | Delaware |

| Shareholder's Voting Rights |

| •Any action required to be taken by meeting of shareholders may be taken without meeting if consent is in writing and is signed by all the shareholders entitled to vote |  |  | •Shareholders may act by written consent to elect directors |

| •Any person authorized to vote may authorize another person or persons to act for him by proxy |  |  | •Any person authorized to vote may authorize another person or persons to act for him by proxy |

| •Unless otherwise provided in the articles of incorporation, a majority of shares entitled to vote constitutes a quorum. In no event shall a quorum consist of fewer than one-third of the shares entitled to vote at a meeting |  |  | •For non-stock companies, certificate of incorporation or by-laws may specify the number of members to constitute a quorum. In the absence of this, one-third of the members shall constitute a quorum |

| •No provision for cumulative voting |  |  | •For stock corporations, certificate of incorporation or by-laws may specify the number to constitute a quorum but in no event shall a quorum consist of less than one-third of shares entitled to vote at a meeting. In the absence of such specifications, a majority of shares entitled to vote shall constitute a quorum |

| |  |  | •The certificate of incorporation may provide for cumulative voting |

| Directors |

| •Board must consist of at least one member |  |  | •Board must consist of at least one member |

| •Number of members can be changed by an amendment to the by-laws, by the shareholders, or by action of the board |  |  | •Number of board members shall be fixed by the by-laws, unless the certificate of incorporation fixes the number of directors, in which case a change in the number shall be made only by amendment of the certificate |

| •If the board is authorized to change the number of directors, it can only do so by an absolute majority (majority of the entire board) |  |  | |

| Dissenter's Rights of Appraisal |

| •Shareholder's have a right to dissent from a merger or sale of all or substantially all assets not made in the usual course of business, and receive payment of the fair value of their shares |  |  | •Appraisal rights shall be available for the shares of any class or series of stock of a corporation in a merger or consolidation |

|

96

Table of Contents

|  |  |  |

| Marshall Islands |  |  | Delaware |

| •A holder of any adversely affected shares who does not vote on or consent in writing to an amendment to the articles of incorporation has the right to dissent and to receive payment for such shares if the amendment: |  |  | |

| •Alters or abolishes any preferential right of any outstanding shares having preference; or |  |  | |

| •Creates, alters, or abolishes any provision or right in respect to the redemption of any outstanding shares; or |  |  | |

| •Alters or abolishes any preemptive right of such holder to acquire shares or other securities; or |  |  | |

| •Excludes or limits the right of such holder to vote on any matter, except as such right may be limited by the voting rights given to new shares then being authorized of any existing or new class |  |  | |

| Shareholder's Derivative Actions |

| •An action may be brought in the right of a corporation to procure a judgement in its favor, by a holder of shares or of voting trust certificates or of a beneficial interest in such shares or certificates. It shall be made to appear that the plaintiff is such a holder at the time of bringing the action and that he was such a holder at the time of the transaction of which he complains, or that his shares or his interest therein devolved upon him by operation of law |  |  | •In any derivative suit instituted by a stockholder or a corporation, it shall be averred in the complaint that the plaintiff was a stockholder of the corporation at the time of the transaction of which he complains or that such stockholder's stock thereafter devolved upon such stockholder by operation of law |

| •Complaint shall set forth with particularity the efforts of the plaintiff to secure the initiation of such action by the board or the reasons for not making such effort |  |  | |

| •Such action shall not be discontinued, compromised or settled, without the approval of the High Court of the Republic |  |  | |

| •Attorney's fees may be awarded if the action is successful |  |  | |

| •Corporation may require a plaintiff bringing a derivative suit to give security for reasonable expenses if the plaintiff owns less than 5% of any class of stock and the shares have a value of less than $50,000 |  |  | |

|

97

Table of ContentsPLAN OF DISTRIBUTION

The shares of Common Stock underlying the publicly traded warrants are being offered directly by the Company, without an underwriter, and the holders of such publicly traded warrants may purchase the shares of Common Stock directly from the Company, by exercising the publicly traded warrants in accordance with the exercise provisions, and pursuant to the terms of the publicly traded warrants, as described in ‘‘Description of Securities.’’

TAXATION

Marshall Islands Tax Considerations

Navios is incorporated in the Marshall Islands. Under current Marshall Islands law, Navios will not be subject to tax on income or capital gains, and no Marshall Islands withholding tax will be imposed upon payments.

Federal Income Tax Consequences

General

The following discussion addresses certain United States federal income tax aspects of our business and to the holders of our warrants and common stock. It does not address other tax aspects (including issues arising under state, local and foreign tax laws other than the Marshall Islands), nor does it attempt to address the specific circumstances of any particular stockholder of Navios.

United States Federal Income Tax Considerations

United States Taxation of Navios' Operating Income: In General

Navios is incorporated under the laws of the Marshall Islands. Accordingly, it will be taxed as a foreign corporation by the United States. If Navios were taxed as a domestic corporation, it could be subject to substantially greater United States income tax than contemplated below.

In general, a foreign corporation is subject to United States tax on income that is treated as derived from US source income or that is effectively connected income. Based on its current plans, however, Navios expects that its income from sources within the United States will be international shipping income that qualifies for exemption from United States federal income taxation under Section 883 of the Code, and that it will have no effectively connected income. Accordingly, Navios does not expect to be subject to federal income tax on any of its income.

If Navios is taxed as a foreign corporation and the benefits of Code Section 883 are unavailable, Navios' United States source shipping income that is not effectively connected income would be subject to a four percent (4%) tax imposed by Section 887 of the Code on a gross basis, without the benefit of deductions. Navios believes that no more than fifty percent (50%) of Navios' shipping income would be treated as United States source shipping income because, under Navios' current business plan, its shipping income will be attributable to transportation which does not both begin and end in the United States. Thus, the maximum effective rate of United States federal income tax on Navios' shipping income would never exceed two percent (2%) under the four percent (4%) gross basis tax regime.

To the extent the benefits of Code Section 883 exemption are unavailable and Navios' international shipping income is considered to be effectively connected income, such income, net of applicable deductions, would be subject to the United States federal corporate income tax. United States corporate income tax would also apply to any other effectively connected income of Navios, and to Navios' worldwide income if it were taxed as a domestic corporation. This could result in the imposition of a tax of up to 35% on Navios' income, except to the extent that Navios were able to take advantage of more favorable rates that may be imposed on shipping income of domestic

98

Table of Contentscorporations or foreign corporations. In addition, as a foreign corporation, Navios could potentially be subject to the thirty percent (30%) branch profits on effectively connected income, as determined after allowance for certain adjustments, and on certain interest paid or deemed paid attributable to the conduct of its United States trade or business. Since Navios does not intend to have any vessel sailing to or from the United States on a regularly scheduled basis, Navios believes that none of its international shipping income will be effectively connected income.

United States Taxation of Gain on Sale of Vessels

Regardless of whether Navios qualifies for exemption under Code Section 883, it will not be subject to United States federal income taxation with respect to gain realized on a sale of a vessel, provided that the sale is considered to occur outside of the United States as defined under United States federal income tax principles. In general, a sale of a vessel will be considered to occur outside of the United States for this purpose if title to the vessel, and risk of loss with respect to the vessel, pass to the buyer outside of the United States. It is expected than any sale of a vessel by Navios will be considered to occur outside of the United States.

United States Federal Income Taxation of US Holders

As used herein, the term ‘‘US Holder’’ means a beneficial owner of warrants and/or common stock that

|  |  |

| • | is an individual United States citizen or resident, a United States corporation or other United States entity taxable as a corporation, an estate of which the income is subject to United States federal income taxation regardless of its source, or a trust if a court within the United States is able to exercise primary jurisdiction over the administration of the trust and one or more United States persons have the authority to control all substantial decisions of the trust; |

|  |  |

| • | owns Navios common stock as a capital asset; and |

|  |  |

| • | owns less than ten percent (10%) of Navios' common stock for United States federal income tax purposes. |

If a partnership holds Navios common stock, the tax treatment of a partner will generally depend upon the status of the partner and upon the activities of the partnership. If you are a partner in a partnership holding Navios common stock, you should consult your tax advisor.

Tax Treatment of the Warrants

A US Holder generally will not recognize gain or loss upon exercise of a warrant, except with respect to any cash received in lieu of a fractional share. The US Holder will have a tax basis in the shares of Navios common stock received on exercise of the warrant equal to the sum of the US Holder's tax basis in the warrant and the exercise price paid in respect of the exercise. The holding period of common stock received upon the exercise of a warrant will begin on the day the warrant is exercised. If a warrant expires without being exercised, a US Holder will recognize a capital loss in an amount equal to the US Holder's tax basis in the warrant.

Generally, a US Holder's tax basis in a warrant will equal the amount paid by the US Holder to acquire the warrant. The warrants were originally issued as part of a unit comprised of one share of Navios common stock and two warrants. If a US Holder acquired a warrant as part of such a unit, the amount paid for the warrant is the portion of the amount paid for the unit allocable to the warrant, based on the relative fair market values of the warrant and the Navios common stock comprising the unit on the date of acquisition. By analogy to other provisions of the Code, Navios' allocation of the value of the warrant may be binding on US Holders who acquired their warrants at original issue, but not on the Internal Revenue Service, unless the US Holder explicitly discloses a contrary position in a statement attached to the US Holder's timely filed United States federal income tax return for the taxable year in which the US Holder acquired the unit.

Adjustments to the exercise price of the warrants, or the failure to make adjustment, may in certain circumstances result in the receipt of taxable constructive dividends by the US Holders, in which event the US Holder's tax basis in the warrants would be increased by an amount equal to the constructive dividend.

99

Table of ContentsSee also discussion under ‘‘United States Federal Income Taxation of US Holders — Sale, Exchange or other Disposition of Common Stock or Warrants’’.

Tax Treatment of Common Stock

Distributions

Subject to the discussion of passive federal foreign investment companies below, distributions made by Navios with respect to Navios common stock to a US Holder will generally constitute dividends to the extent of Navios' current or accumulated earnings and profits, as determined under United States federal income tax principles, and will be included in the US Holder's gross income. Distributions in excess of such earnings and profits will first be treated as a nontaxable return of capital to the extent of the US Holder's tax basis in his common stock on a dollar-for-dollar basis and thereafter as capital gain. Because Navios is not a United States corporation, US Holders that are corporations will not be entitled to claim a dividends received deduction with respect to any distributions it receives from Navios. Dividends paid with respect to Navios' common stock will generally be treated as ‘‘passive income’’ for purposes of computing allowable foreign tax credits for United States foreign tax credit purposes.

Dividends paid on Navios common stock to a US Holder who is an individual, trust or estate, a US Non-Corporate Holder, will, under current law, generally be treated as ‘‘qualified dividend income’’ that is taxable to such US Non-Corporate Holder at preferential tax rates (through 2008), provided that (1) the common stock is readily tradable on an established securities market in the United States (such as the NASDAQ National Market); (2) Navios is not a passive foreign investment company for the taxable year during which the dividend is paid or the immediately preceding taxable year (which Navios does not believe it is or will be); (3) the US Non-Corporate Holder has owned the common stock for more than sixty (60) days in the 121-day period beginning sixty (60) days before the date on which the common stock becomes ex-dividend; and (4) the US Non-Corporate Holder is under no obligation to make related payments with respect to positions in substantially similar or related property. Special rules may apply to any ‘‘extraordinary dividend’’ generally, a dividend in an amount equal to or in excess of ten percent of a stockholder's adjusted basis in a share of common stock paid by Navios. If Navios pays an ‘‘extraordinary dividend’’ on its common stock that is treated as ‘‘qualified dividend income’’, then any loss derived by a US Non-Corporate Holder from the sale or exchange of such common stock will be treated as long-term capital loss to the extent of such dividend.

There is no assurance that any dividends paid on Navios common stock will be eligible for these preferential rates in the hands of a US Non-Corporate Holder, although Navios believes that they will be so eligible. Any dividends out of earnings and profits Navios pays which are not eligible for these preferential rates will be taxed as ordinary income to a US Non-Corporate Holder.

Sale, Exchange or Other Disposition of Common Stock or Warrants

Assuming Navios does not constitute a passive foreign investment company for any taxable year, a US Holder generally will recognize taxable gain or loss upon a sale, exchange or other disposition of Navios common stock or warrants in an amount equal to the difference between the amount realized by the US Holder from such sale, exchange or other disposition and the US Holder's tax basis in such stock. Such gain or loss will be treated as long-term capital gain or loss if the US Holder's holding period is greater than one year at the time of the sale, exchange or other disposition. Such capital gain or loss will generally be treated as United States source income or loss, as applicable, for United States foreign tax credit purposes. Long-term capital gains of US Non-Corporate Holders are eligible for reduced rates of taxation. A US Holder's ability to deduct capital losses is subject to certain limitations. See, ‘‘United States Federal Income Tax Considerations United States Tax Consequences’’ above, for a discussion of certain tax basis and holding period issues related to Navios common stock.

Passive Foreign Investment Company Status and Significant Tax Consequences

Special United States federal income tax rules apply to a US Holder that holds stock or warrants in a foreign corporation classified as a ‘‘passive foreign investment company’’ for United States federal

100

Table of Contentsincome tax purposes. A foreign corporation will be a foreign passive investment company if 75% or more of its gross income for a taxable year is treated as passive income, or if the average percentage of assets held by such corporation during a taxable year which produce or are held to produce passive income is at least 50%. A US Holder of stock or warrants in a passive foreign investment company can be subject to current taxation on undistributed income of such company or to other adverse tax results if it does not elect to be subject to such current taxation.

Navios believes that it will not be a passive foreign investment company because it believes that its shipping income will be active services income and most of its assets will be held for the production of active services income.

Since there is no legal authority directly on point, however, the IRS or a court could disagree with Navios' position and treat its shipping income and/or shipping assets as passive income or as producing or held to produce passive income. In addition, although Navios intends to conduct its affairs in a manner that would avoid Navios being classified as a passive foreign investment company with respect to any taxable year, it cannot ensure that the nature of its operations will not change in the future.

United States Federal Income Taxation of Non-US Holders

A beneficial owner of warrants or common stock (other than a partnership) that is not a US Holder is referred to herein as a Non-US Holder.

Tax Treatments of Warrants

The U.S. federal income tax consequences of the exercise of a warrant by a Non-US Holder generally are the same as described above for a US Holder.

Tax Treatment of Common Stock

Dividends on Common Stock

Non-US Holders generally will not be subject to United States federal income tax or withholding tax on dividends received with respect to Navios common stock, unless that income is effectively connected with the Non- US Holder's conduct of a trade or business in the United States. If the Non-US Holder is entitled to the benefits of a United States income tax treaty with respect to those dividends, that income is taxable only if it is attributable to a permanent establishment maintained by the Non-US Holder in the United States. In the event that Navios were to be taxed as a United States corporation received by Non-US Holders could be subject to United States withholding tax. See discussion above under ‘‘United States Tax Consequences Taxation of Operating Income: In General’’.

Sale, Exchange or other Disposition of Common Stock

Non-US Holders generally will not be subject to United States federal income tax or withholding tax on any gain realized upon the sale, exchange or other disposition of Navios' common stock or warrants, unless:

|  |  |

| • | the gain is effectively connected with the Non-US Holder's conduct of a trade or business in the United States (and, if the Non-US Holder is entitled to the benefits of an income tax treaty with respect to that gain, that gain is attributable to a permanent establishment maintained by the Non-US Holder in the United States); or |

|  |  |

| • | the Non-US Holder is an individual who is present in the United States for 183 days or more during the taxable year of disposition and other conditions are met. |

If the Non-US Holder is engaged in a United States trade or business for United States federal income tax purposes, the income from the common stock, including dividends and the gain from the sale, exchange or other disposition of the stock or warrants, that is effectively connected with the

101

Table of Contentsconduct of that trade or business, will generally be subject to regular United States federal income tax in the same manner as discussed in the previous section relating to the taxation of US Holders. In addition, if the shareholder or warrant holder is a corporate Non-US Holder, the shareholder's earnings and profits that are attributable to the effectively connected income, which are subject to certain adjustments, may be subject to an additional branch profits tax at a rate of thirty percent (30%), or at a lower rate as may be specified by an applicable income tax treaty.

Backup Withholding and Information Reporting

In general, dividend payments or other taxable distributions, made within the United States to the shareholder, will be subject to information reporting requirements if the shareholder is a non-corporate US Holder. Such payments or distributions may also be subject to backup withholding tax if the shareholder is a non-corporate US Holder and:

|  |  |

| • | fails to provide an accurate taxpayer identification number; |

|  |  |

| • | is notified by the IRS that the shareholder failed to report all interest or dividends required to be shown on the shareholder's federal income tax returns; or |

|  |  |

| • | in certain circumstances, fails to comply with applicable certification requirements. |

Non-US Holders may be required to establish their exemption from information reporting and backup withholding by certifying their status on IRS Form W-8ECI or W-81MY, as applicable.

If the shareholder or warrant holder is a Non-US Holder and sells the Non-U.S. Holder's common stock or warrants to or through a United States office of a broker, the payment of the proceeds is subject to both United States backup withholding and information reporting unless the Non-U.S. Holder certifies that the Non-U.S. Holder is a non-United States person, under penalties of perjury, or otherwise establishes an exemption. If the Non-U.S. Holder sells common stock or warrants through a non-United States office of a non-United States broker and the sales proceeds are paid to the Non-U.S. Holder outside the United States, then information reporting and backup withholding generally will not apply to that payment. United States information reporting requirements, but not backup withholding, however, will apply to a payment of sales proceeds, even if that payment is made to the Non-U.S. Holder outside the United States, if the Non-U.S. Holder sells common stock or warrants through a non-United States office of a broker that is a United States person or has some other contacts with the United States. Such information reporting requirements will not apply, however, if the broker has documentary evidence in its records that the shareholder or warrant holder is a non-United States person and certain other conditions are met, or otherwise establishes an exemption.

The conclusions expressed above are based on current United States tax law. Future legislative, administrative or judicial changes or interpretations, which can apply retroactively, could affect the accuracy of those conclusions.

The discussion does not address all of the tax consequences that may be relevant to particular taxpayers in light of their personal circumstances or to taxpayers subject to special treatment under the Code. Such taxpayers include non-US persons, insurance companies, tax-exempt entities, dealers in securities, banks and persons who acquired their shares of capital stock pursuant to the exercise of employee options or otherwise as compensation.

BECAUSE OF THE COMPLEXITY OF THE TAX LAWS, AND BECAUSE THE TAX CONSEQUENCES TO ANY PARTICULAR STOCKHOLDER MAY BE AFFECTED BY MATTERS NOT DISCUSSED ABOVE, EACH NAVIOS WARRANT HOLDER AND STOCKHOLDER IS URGED TO CONSULT A TAX ADVISOR WITH RESPECT TO THE SPECIFIC TAX CONSEQUENCES OF THE OFFERING AND THE EXERCISE OF THE PUBLICLY TRADED WARRANTS, INCLUDING THE APPLICABILITY AND EFFECT OF STATE, LOCAL AND NON-US TAX LAWS, AS WELL AS FEDERAL TAX LAWS.

102

Table of ContentsENFORCEABILITY OF CIVIL LIABILITIES AND

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

We are incorporated under the laws of the Republic of the Marshall Islands. A majority of the directors, officers and the experts named in the prospectus reside outside the United States. In addition, a substantial portion of the assets and the assets of the directors, officers and experts are located outside the United States. As a result, you may have difficulty serving legal process within the United States upon Navios or any of these persons. You may also have difficulty enforcing, both in and outside the United States, judgments you may obtain in United States courts against Navios or these persons in any action, including actions based upon the civil liability provisions of United States federal or state securities laws. Furthermore, there is substantial doubt that the courts of the Marshall Islands would enter judgments in original actions brought in those courts predicated on United States federal or state securities laws.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

We have obtained directors' and officers' liability insurance against any liability asserted against such person incurred in the capacity of director or officer or arising out of such status, whether or not we would have the power to indemnify such person.

LEGAL MATTERS

The validity of the common stock underlying the publicly traded warrants offered in this offering, including the valid issuance of the shares of common stock upon exercise of the warrants and the comparison of stockholders' rights under Marshall Islands law as compared to Delaware law in connection with this offering relating to Marshall Islands law will be passed upon for us by Reeder & Simpson P.C.

EXPERTS

The consolidated financial statements of Navios Maritime Holdings Inc. (successor) as of December 31, 2005 and for the period from August 26, 2005 to December 31, 2005 and the consolidated financial statements of Navios Maritime Holdings, Inc. (predecessor) as of December 31, 2004, and for the period from January 1, 2005 until August 25, 2005 and for the two years in the period ended December 31, 2004 included in this prospectus have been so included in reliance on the reports of PricewaterhouseCoopers S.A., an independent registered public accounting firm, given on the authority of said firm as experts in accounting and auditing.

The financial statements of International Shipping Enterprises, Inc. (a corporation in the development stage) as of December 31, 2004 and for the period from September 17, 2004 to December 31, 2004 included in this prospectus have been so included in reliance on the report of Goldstein Golub Kessler LLP, an independent registered public accounting firm, given on the authority of said firm as experts in accounting and auditing.

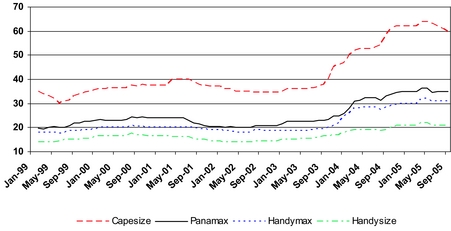

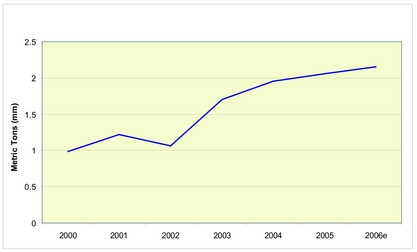

The discussions contained under the sections of this prospectus entitled ‘'The International Dry Bulk Shipping Industry’’ have been reviewed by Drewry Shipping Consultants, Ltd., which has confirmed to Navios that they accurately describe the international dry bulk shipping industry, subject to the reliability of the data supporting the statistical and graphical information presented in this prospectus.

The statistical and graphical information Navios uses in this prospectus has been compiled by Drewry from its database. Drewry compiles and publishes data for the benefit of its clients. Its methodologies for collecting data, and therefore the data collected, may differ from those of other sources, and its data does not reflect all or even necessarily a comprehensive set of the actual transactions occurring in the market.

103

Table of ContentsWHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form F-1, including the exhibits and schedules thereto, with the Securities and Exchange Commission, or SEC, under the Securities Act, and the rules and regulations thereunder, for the registration of the common stock that are being offered by this prospectus. This prospectus does not include all of the information contained in the registration statement. You should refer to the registration statement and its exhibits for additional information. Whenever we make reference in this prospectus to any of our contracts, agreements or other documents, the references are not necessarily complete and you should refer to the exhibits attached to the registration statement for copies of the actual contract, agreements or other document.

We are subject to the informational requirements of the Securities Exchange Act, applicable to foreign private issuers. We, as a ‘‘foreign private issuer’’, are exempt from the rules under the Securities Exchange Act prescribing certain disclosure and procedural requirements for proxy solicitations, and our officers, directors and principal shareholders are exempt from the reporting and ‘‘short-swing’’ profit recovery provisions contained in Section 16 of the Securities Exchange Act, with respect to their purchases and sales of shares. In addition, we are not required to file annual, quarterly and current reports and financial statements with the SEC as frequently or as promptly as United States companies whose securities are registered under the Securities Exchange Act. However, we will file with the SEC, within 180 days after the end of each fiscal year, an annual report on Form 20-F containing financial statements audited by an independent accounting firm. We will also furnish quarterly reports on Form 6-K containing unaudited interim financial information for the first three quarters of each fiscal year, within 60 days after the end of such quarter.

You may read and copy any document we file or furnish with the SEC at reference facilities at 450 Fifth Street, NW, Washington, DC 20549. You may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 450 Fifth Street, NW, Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities. You can review our SEC filings and the registration statement by accessing the SEC's internet site at http://www.sec.gov.

Documents may also be inspected at the National Association of Securities Dealers, Inc., 1735 K Street, N.W., Washington D.C. 20006.

104

Table of ContentsIndex

|  |  |  |  |  |  |

| |  |  | Page |

| NAVIOS MARITIME HOLDINGS INC. |  |  |  |  | | |

| UNAUDITED CONSOLIDATED BALANCE SHEET AT MARCH 31, 2006 (SUCCESSOR) |  |  |  |  | F-2 | |

| UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE MONTH PERIODS ENDED MARCH 31, 2006 (SUCCESSOR) AND MARCH 31, 2005 (PREDECESSOR) |  |  |  |  | F-3 | |

| UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE THREE MONTH PERIODS ENDED MARCH 31, 2006 (SUCCESSOR) AND MARCH 31, 2005 (PREDECESSOR) |  |  |  |  | F-4 | |

| UNAUDITED CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY FOR THE THREE MONTH PERIOD ENDED MARCH 31, 2006 (SUCCESSOR) |  |  |  |  | F-5 | |

| NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS |  |  |  |  | F-6 | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (SUCCESOR) |  |  | F-18 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PREDECESSOR) |  |  | F-19 |

| CONSOLIDATED BALANCE SHEETS AT DECEMBER 31, 2005 (SUCCESSOR) AND DECEMBER 31, 2004 (PREDECESSOR) |  |  | F-20 |

| CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE PERIOD FROM AUGUST 26, 2005 TO DECEMBER 31, 2005 (SUCCESSOR), THE PERIOD FROM JANUARY 1, 2005 TO AUGUST 25, 2005, AND FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003 (PREDECESSOR) |  |  | F-21 |

| CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE PERIOD FROM AUGUST 26, 2005 TO DECEMBER 31, 2005 (SUCCESSOR), THE PERIOD FROM JANUARY 1, 2005 TO AUGUST 25, 2005, AND FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003 (PREDECESSOR) |  |  | F-22 |

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY FOR THE PERIOD FROM AUGUST 26, 2005 TO DECEMBER 31, 2005 (SUCCESSOR), THE PERIOD FROM JANUARY 1, 2005 TO AUGUST 25, 2005 AND FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003 (PREDECESSOR) |  |  | F-24 |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |  |  | F-25 |

| INTERNATIONAL SHIPPING ENTERPRISE, INC. |  |  | |

| UNAUDITED BALANCE SHEET AT JUNE 30, 2005 |  |  | F-63 |

| UNAUDITED STATEMENTS OF OPERATIONS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2005 |  |  | F-64 |

| UNAUDITED STATEMENTS OF STOCKHOLDERS' EQUITY FOR THE SIX MONTHS ENDED JUNE 30, 2005 |  |  | F-65 |

| UNAUDITED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS ENDED JUNE 30, 2005 |  |  | F-66 |

| NOTES TO THE UNAUDITED FINANCIAL STATEMENTS |  |  | F-67 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |  |  | F-70 |

| BALANCE SHEET FOR THE YEAR ENDED DECEMBER 31, 2004 |  |  | F-71 |

| INCOME STATEMENT FOR THE PERIOD FROM SEPTEMBER 17, 2004 (INCEPTION) TO DECEMBER 31, 2004 |  |  | F-72 |

| STATEMENT OF STOCKHOLDER'S EQUITY FOR THE PERIOD FROM SEPTEMBER 17, 2004 (INCEPTION) TO DECEMBER 31, 2004 |  |  | F-73 |

| STATEMENT OF CASH FLOWS FOR THE PERIOD FROM SEPTEMBER 17, 2004 (INCEPTION) TO DECEMBER 31, 2004 |  |  | F-74 |

| NOTES TO FINANCIAL STATEMENTS |  |  | F-75 |

|

F-1

Table of ContentsNAVIOS MARITIME HOLDINGS INC.

CONSOLIDATED BALANCE SHEETS

(Expressed in thousands of US Dollars — except per share data)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Notes |  |  | March 31, 2006 |  |  | December 31, 2005 |

| |  |  | |  |  | (unaudited) |  |  | |

| ASSETS |  |  | |  |  | |  |  | |

| Current Assets |  |  | |  |  |  |  | | |  |  |  |  | | |

| Cash and cash equivalents |  |  | 4, 8 |  |  |  | $ | 31,774 | |  |  |  | $ | 37,737 | |

| Restricted cash |  |  | 8 |  |  |  |  | 6,792 | |  |  |  |  | 4,086 | |

| Accounts receivable, net |  |  | |  |  |  |  | 5,296 | |  |  |  |  | 13,703 | |

| Short term derivative asset |  |  | 8 |  |  |  |  | 31,577 | |  |  |  |  | 45,556 | |

| Short term backlog asset |  |  | 6 |  |  |  |  | 6,320 | |  |  |  |  | 7,019 | |

| Prepaid expenses and other current assets |  |  | |  |  |  |  | 7,207 | |  |  |  |  | 6,438 | |

| Total current assets |  |  | |  |  |  |  | 88,966 | |  |  |  |  | 114,539 | |

| Deposit on exercise of vessels purchase options |  |  | 5 |  |  |  |  | 1,666 | |  |  |  |  | 8,322 | |

| Vessels, port terminal and other fixed assets, net |  |  | 5, 14 |  |  |  |  | 471,686 | |  |  |  |  | 365,997 | |

| Long term derivative assets |  |  | 8 |  |  |  |  | 169 | |  |  |  |  | 28 | |

| Deferred financing costs, net |  |  | |  |  |  |  | 11,024 | |  |  |  |  | 11,677 | |

| Deferred dry dock and special survey costs, net |  |  | |  |  |  |  | 3,317 | |  |  |  |  | 2,448 | |

| Investments in affiliates |  |  | |  |  |  |  | 356 | |  |  |  |  | 657 | |

| Long term backlog asset |  |  | 6 |  |  |  |  | 6,450 | |  |  |  |  | 7,744 | |

| Trade name |  |  | 6 |  |  |  |  | 88,320 | |  |  |  |  | 89,014 | |

| Port terminal operating rights |  |  | 6 |  |  |  |  | 30,538 | |  |  |  |  | 30,728 | |

| Favorable lease terms and purchase options |  |  | 6 |  |  |  |  | 88,384 | |  |  |  |  | 117,440 | |

| Goodwill |  |  | |  |  |  |  | 40,789 | |  |  |  |  | 40,789 | |

| Total non-current assets |  |  | |  |  |  |  | 742,699 | |  |  |  |  | 674,844 | |

| Total Assets |  |  | |  |  |  | $ | 831,665 | |  |  |  | $ | 789,383 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |  |  | |  |  |  |  | | |  |  |  |  | | |

| Current Liabilities |  |  | |  |  |  |  | | |  |  |  |  | | |

| Accounts payable |  |  | |  |  |  | $ | 10,069 | |  |  |  | $ | 13,886 | |

| Accrued expenses |  |  | |  |  |  |  | 6,570 | |  |  |  |  | 11,253 | |

| Deferred voyage revenue |  |  | |  |  |  |  | 5,540 | |  |  |  |  | 6,143 | |

| Short term derivative liability |  |  | 8 |  |  |  |  | 23,825 | |  |  |  |  | 39,992 | |

| Short term backlog liability |  |  | 6 |  |  |  |  | 8,109 | |  |  |  |  | 8,109 | |

| Current portion of long term debt |  |  | 7 |  |  |  |  | 60,086 | |  |  |  |  | 54,221 | |

| Total current liabilities |  |  | |  |  |  |  | 114,199 | |  |  |  |  | 133,604 | |

| Long term debt, net of current portion |  |  | 7 |  |  |  |  | 496,256 | |  |  |  |  | 439,179 | |

| Long term liabilities |  |  | |  |  |  |  | 2,099 | |  |  |  |  | 2,297 | |

| Long term derivative liability |  |  | 8 |  |  |  |  | 313 | |  |  |  |  | 598 | |

| Long term backlog liability |  |  | 6 |  |  |  |  | 3,947 | |  |  |  |  | 5,947 | |

| Total non-current liabilities |  |  | |  |  |  |  | 502,615 | |  |  |  |  | 448,021 | |

| Total liabilities |  |  | |  |  |  |  | 616,814 | |  |  |  |  | 581,625 | |

| Commitments and Contingencies |  |  | |  |  |  |  | | |  |  |  |  | | |

| Stockholders’ Equity |  |  | |  |  |  |  | | |  |  |  |  | | |

| Preferred stock — $0.0001 par value, authorized 1,000,000 shares. None issued |  |  | |  |  |  |  | — | |  |  |  |  | — | |

| Common stock — $ 0.0001 par value, authorized 120,000,000 shares, issued and outstanding 45,400,854 and 44,239,319 as of March 31, 2006 and December 31, 2005 respectively |  |  | |  |  |  |  | 5 | |  |  |  |  | 4 | |

| Additional paid-in capital |  |  | |  |  |  |  | 210,727 | |  |  |  |  | 205,593 | |

| Retained earnings |  |  | |  |  |  |  | 4,119 | |  |  |  |  | 2,161 | |

| Total stockholders’ equity |  |  | |  |  |  |  | 214,851 | |  |  |  |  | 207,758 | |

| Total Liabilities and Stockholders’ Equity |  |  | |  |  |  | $ | 831,665 | |  |  |  | $ | 789,383 | |

|

See notes to consolidated financial statements

F-2

Table of ContentsNAVIOS MARITIME HOLDINGS INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Expressed in thousands of US Dollars — except per share data)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | |  |  | Successor |  |  | Predecessor |

| |  |  | Note |  |  | Three Month Period

ended

March 31, 2006 |  |  | Three Month Period

ended

March 31, 2005 |

| |  |  | |  |  | (unaudited) |  |  | (unaudited) |

| Revenue |  |  | 12 |  |  |  | $ | 49,169 | |  |  |  | $ | 61,365 | |

| Gain (loss) on Forward Freight Agreements |  |  | 8 |  |  |  |  | 1,662 | |  |  |  |  | (4,567 | |

| Time charter, voyage and port terminal expenses |  |  | |  |  |  |  | (20,767 | |  |  |  |  | (37,469 | |

| Direct vessel expenses |  |  | |  |  |  |  | (4,164 | |  |  |  |  | (2,110 | |

| General and administrative expenses |  |  | |  |  |  |  | (3,596 | |  |  |  |  | (3,644 | |

| Depreciation and amortization |  |  | 5, 6 |  |  |  |  | (10,120 | |  |  |  |  | (1,489 | |

| Interest income |  |  | |  |  |  |  | 468 | |  |  |  |  | 302 | |

| Interest expense and finance cost, net |  |  | 7 |  |  |  |  | (9,206 | |  |  |  |  | (475 | |

| Other income |  |  | |  |  |  |  | 1,425 | |  |  |  |  | 971 | |

| Other expense |  |  | |  |  |  |  | (43 | |  |  |  |  | (222 | |

| Income before equity in net earnings of affiliate companies |  |  | |  |  |  |  | 4,828 | |  |  |  |  | 12,662 | |

| Equity in net Earnings of Affiliated Companies |  |  | |  |  |  |  | 154 | |  |  |  |  | 302 | |

| Net income |  |  | |  |  |  | $ | 4,982 | |  |  |  | $ | 12,964 | |

| Earnings per share, basic |  |  | |  |  |  | $ | 0.11 | |  |  |  | $ | 14.82 | |

| Weighted average number of shares, basic |  |  | 13 |  |  |  |  | 45,336,324 | |  |  |  |  | 874,584 | |

| Earnings per share, diluted |  |  | |  |  |  | $ | 0.11 | |  |  |  | $ | 14.82 | |

| Weighted average number of shares, diluted |  |  | 13 |  |  |  |  | 45,336,324 | |  |  |  |  | 874,584 | |

|

See notes to consolidated financial statements.

F-3

Table of ContentsNAVIOS MARITIME HOLDINGS INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in thousands of US Dollars)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | |  |  | Successor |  |  | Predecessor |

| |  |  | Note |  |  | Three Month Period

ended

March 31, 2006 |  |  | Three Month Period

ended

March 31, 2005 |

| |  |  | |  |  | (unaudited) |  |  | (unaudited) |

| OPERATING ACTIVITIES |  |  | |  |  |  |  | | |  |  |  |  | | |

| Net income |  |  | |  |  |  | $ | 4,982 | |  |  |  | $ | 12,964 | |

| Adjustments to reconcile net income to net cash provided by operating activities: |  |  | |  |  |  |  | | |  |  |  |  | | |

| Depreciation and amortization |  |  | 5, 6 |  |  |  |  | 10,120 | |  |  |  |  | 1,489 | |

| Amortization of deferred financing cost |  |  | |  |  |  |  | 653 | |  |  |  |  | 13 | |

| Amortization of deferred dry dock costs |  |  | |  |  |  |  | 263 | |  |  |  |  | 62 | |

| Amortization of backlog |  |  | |  |  |  |  | 493 | |  |  |  |  | — | |

| Provision for losses on accounts receivable |  |  | |  |  |  |  | — | |  |  |  |  | (912 | |

| Unrealized (gain)/loss on FFA derivatives |  |  | |  |  |  |  | (1,877 | |  |  |  |  | 16,905 | |

| Unrealized loss on foreign exchange contracts |  |  | |  |  |  |  | — | |  |  |  |  | 197 | |

| Unrealized (gain)/loss on interest rate swaps |  |  | |  |  |  |  | (926 | |  |  |  |  | (612 | |

| Earnings in affiliates, net of dividends received |  |  | |  |  |  |  | 301 | |  |  |  |  | 180 | |

| Changes in operating assets and liabilities: |  |  | |  |  |  |  | | |  |  |  |  | | |

| Decrease (increase) in restricted cash |  |  | |  |  |  |  | (2,706 | |  |  |  |  | (1,474 | |

| (Increase) decrease in accounts receivable |  |  | |  |  |  |  | 8,407 | |  |  |  |  | (1,565 | |

| Decrease (increase) in prepaid expenses and other |  |  | |  |  |  |  | (769 | |  |  |  |  | (7,300 | |

| (Decrease) increase in accounts payable |  |  | |  |  |  |  | (3,817 | |  |  |  |  | (689 | |

| Increase (decrease) in accrued expenses |  |  | |  |  |  |  | (4,683 | |  |  |  |  | (2,639 | |

| (Decrease) increase in deferred voyage revenue |  |  | |  |  |  |  | (603 | |  |  |  |  | 3,807 | |

| (Decrease) increase in long term liability |  |  | |  |  |  |  | (198 | |  |  |  |  | (235 | |

| Increase (decrease) in derivative accounts |  |  | |  |  |  |  | 189 | |  |  |  |  | (2,014 | |

| Payments for dry dock and special survey costs |  |  | |  |  |  |  | (1,132 | |  |  |  |  | — | |

| Net cash provided by operating activities |  |  | |  |  |  |  | 8,697 | |  |  |  |  | 18,177 | |

| INVESTING ACTIVITIES: |  |  | |  |  |  |  | | |  |  |  |  | | |

| Acquisition of vessels |  |  | 5, 11 |  |  |  |  | (73,652 | |  |  |  |  | — | |

| Purchase of property and equipment |  |  | 5 |  |  |  |  | (927 | |  |  |  |  | (1,656 | |

| Net cash (used in) provided by investing activities |  |  | |  |  |  |  | (74,579 | |  |  |  |  | (1,656 | |

| FINANCING ACTIVITIES: |  |  | |  |  |  |  | | |  |  |  |  | | |

| Proceeds from long term loan |  |  | 7 |  |  |  |  | 77,964 | |  |  |  |  | — | |

| Repayment of long term debt |  |  | 7 |  |  |  |  | (15,021 | |  |  |  |  | (250 | |

| Dividends paid |  |  | |  |  |  |  | (3,024 | |  |  |  |  | — | |

| Net cash provided by (used in) financing activities |  |  | |  |  |  |  | 59,919 | |  |  |  |  | (250 | |

| (Decrease) increase in cash and cash equivalents |  |  | |  |  |  |  | (5,963 | |  |  |  |  | 16,271 | |

| Cash and cash equivalents, beginning of year |  |  | |  |  |  |  | 37,737 | |  |  |  |  | 46,758 | |

| Cash and cash equivalents, end of year |  |  | |  |  |  | $ | 31,774 | |  |  |  | $ | 63,029 | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |  |  | |  |  |  |  | | |  |  |  |  | | |

| Cash paid for interest |  |  | |  |  |  | $ | 8,581 | |  |  |  | $ | 765 | |

|

Non-cash investing and financing activities

|  |

| • | See Notes 5 and 11 for issuance of shares in connection with the acquisition of vessels |

See notes to consolidated financial statements.

F-4

Table of ContentsNAVIOS MARITIME HOLDINGS INC.

CONSOLIDATED STATEMENTS STOCKHOLDERS’ EQUITY

(Expressed in thousands of US Dollars — except per share data)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Number of

Common

Shares |  |  | Common

Stock |  |  | Additional

Paid-in

Capital |  |  | Legal

Reserve

(Restricted) |  |  | Retained

Earnings |  |  | Total

Stockholders’

Equity |

| Balance December 31, 2004 (Predecessor) |  |  |  |  | 874,584 | |  |  |  |  | 87 | |  |  |  |  | 60,570 | |  |  |  |  | 289 | |  |  |  |  | 113,845 | |  |  |  |  | 174,791 | |

Net income – year to

August 25, 2005 |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 51,337 | |  |  |  |  | 51,337 | |

| Movement in legal reserve |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 163 | |  |  |  |  | (163 | |  |  |  |  | — | |

| Balance August 25, 2005 (Predecessor) |  |  |  |  | 874,584 | |  |  |  |  | 87 | |  |  |  |  | 60,570 | |  |  |  |  | 452 | |  |  |  |  | 165,019 | |  |  |  |  | 226,128 | |

| Elimination of historical stockholders’ equity |  |  |  |  | (874,584 | |  |  |  |  | (87 | |  |  |  |  | (60,570 | |  |  |  |  | (452 | |  |  |  |  | (165,019 | |  |  |  |  | (226,128 | |

| Push down of purchase accounting |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 607,967 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 607,967 | |

| Downstream merger |  |  |  |  | 39,900,000 | |  |  |  |  | 4 | |  |  |  |  | (423,719 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (423,715 | |

| Issuance of common stock in connection with the acquisition of vessels (Notes 5 and 11) |  |  |  |  | 4,339,319 | |  |  |  |  | — | |  |  |  |  | 21,345 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 21,345 | |

| Net income August 26, 2005 to December 31, 2005 |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 2,161 | |  |  |  |  | 2,161 | |

| Balance December 31, 2005 (Successor) |  |  |  |  | 44,239,319 | |  |  |  | $ | 4 | |  |  |  | $ | 205,593 | |  |  |  | $ | — | |  |  |  | $ | 2,161 | |  |  |  | $ | 207,758 | |

| Issuance of common stock in connection with the acquisition of vessels (Notes 5 and 11) |  |  |  |  | 1,161,535 | |  |  |  |  | 1 | |  |  |  |  | 5,134 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 5,135 | |

| Net income |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | 4,982 | |  |  |  |  | 4,982 | |

| Dividend paid |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | (3,024 | |  |  |  |  | (3,024 | |

| Balance March 31, 2006 (unaudited) |  |  |  |  | 45,400,854 | |  |  |  |  | 5 | |  |  |  |  | 210,727 | |  |  |  |  | — | |  |  |  |  | 4,119 | |  |  |  |  | 214,851 | |

|

See notes to consolidated financial statements.

F-5

Table of ContentsNAVIOS MARITIME HOLDINGS INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of US Dollars — except per share data)

NOTE 1 — DESCRIPTION OF BUSINESS

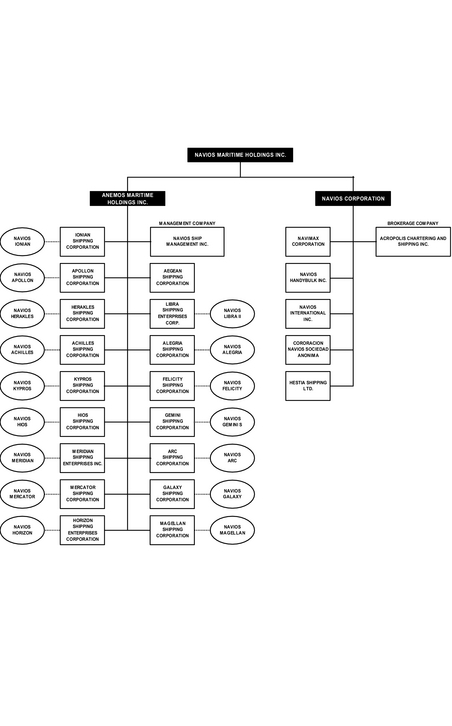

On December 11, 2002, the shareholders of Anemos Maritime Holdings Inc. (‘‘Anemos’’) and Navios Corporation (‘‘Navios’’) each contributed their respective interests for shares of a newly created entity named Nautilus Maritime Holdings, Inc. (‘‘Nautilus’’), a Marshall Islands corporation. For accounting purposes, Anemos was considered the acquirer. During 2003, Nautilus changed its name to Navios Maritime Holdings Inc.

On August 25, 2005, pursuant to a Stock Purchase Agreement dated February 28, 2005, as amended, by and among International Shipping Enterprises, Inc. (‘‘ISE’’), Navios Maritime Holdings Inc. (‘‘Navios’’ or the ‘‘Company’’) and all the shareholders of Navios, ISE acquired Navios through the purchase of all of the outstanding shares of common stock. As a result of this acquisition, Navios became a wholly-owned subsidiary of ISE. In addition, on August 25, 2005, simultaneously with the acquisition of Navios, ISE effected a reincorporation from the State of Delaware to the Republic of the Marshall Islands through a downstream merger with and into its newly acquired wholly-owned subsidiary, whose name was and continued to be Navios Maritime Holdings Inc. (Note 3).

The purpose of the business combination was to create a leading international maritime enterprise focused on the: (i) transportation and handling of bulk cargoes through the ownership, operation and trading of vessels, (ii) forward freight agreements ‘‘FFAs’’ and (iii) ownership and operation of port and transfer station terminals. The Company operates a fleet of owned Ultra Handymax and Panamax vessels and a fleet of time chartered Panamax and Ultra Handymax vessels that are employed to provide worldwide transportation of bulk commodities. The Company actively engages in assessing risk associated with fluctuating future freight rates, fuel prices and foreign exchange and, where appropriate, will actively hedge identified economic risk with appropriate derivative instruments. Such economic hedges do not always qualify for accounting hedge treatment, and, as such, the usage of such derivatives could lead to material fluctuations in the Company's reported results from operations on a period-to-period basis.

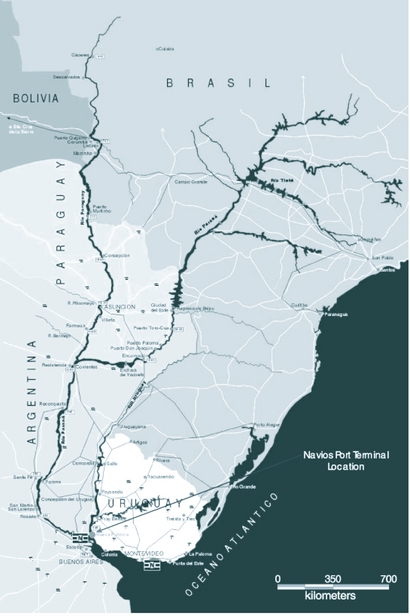

The Company also operates a port and transfer facility located in Nueva Palmira, Uruguay. The facility consists of docks, conveyors and silo storage capacity totaling 270,440 tons.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

|  |

| (a) | Basis of presentation: The accompanying interim consolidated financial statements are unaudited, but, in the opinion of the management, reflect all adjustments for a fair presentation of Navios Maritime Holdings Inc. (Navios or the Company) consolidated financial position, and cash flows for the periods presented. Adjustments consist of normal, recurring entries. The results of operations for the interim periods are not necessarily indicative of results for the full year. The footnotes are condensed as permitted by the requirements for interim financial statements and accordingly, do not include information and disclosures required under United States Generally Accepted Accounting Principles (GAAP) for complete financial statements. These interim financial statements should be read in conjunction with the Company’s consolidated financial statements and notes included elsewhere in this document. |

The consolidated statements of cash flows for all period presented have been reclassified to reflect drydock and special survey costs as operating activities instead of investing activities to conform to the presentation adopted by the Company starting January 1, 2006.

|  |

| (b) | Principles of consolidation: The accompanying interim consolidated financial statements include the accounts of Navios Maritime Holdings Inc., a Marshall Islands corporation, and its majority owned subsidiaries (the ‘‘Company’’ or ‘‘Navios’’). All significant inter-company balances and transactions have been eliminated in the consolidated statements. |

F-6

Table of ContentsNAVIOS MARITIME HOLDINGS INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of US Dollars — except per share data)

Companies included in the consolidation:

|  |  |  |  |  |  |

| Company Name |  |  | Nature/

Vessel Name |  |  | Country of

Incorporation |

| Navios Maritime Holdings Inc. |  |  | Holding Company |  |  | Marshall Is. |

| Navios Corporation |  |  | Sub-Holding Company |  |  | Marshall Is. |

| Navios International Inc. |  |  | Operating Company |  |  | Marshall Is. |

| Navimax Corporation |  |  | Operating Company |  |  | Marshall Is. |

| Navios Handybulk Inc. |  |  | Operating Company |  |  | Marshall Is. |

| Corporation Navios SA |  |  | Operating Company |  |  | Uruguay |

| Hestia Shipping Ltd. |  |  | Operating Company |  |  | Malta |

| Anemos Maritime Holdings |  |  | Sub-Holding Company |  |  | Marshall Is. |

| Navios Shipmanagement Inc. |  |  | Management Company |  |  | Marshall Is. |

| Achilles Shipping Corporation |  |  | Navios Achilles |  |  | Marshall Is. |

| Apollon Shipping Corporation |  |  | Navios Apollon |  |  | Marshall Is. |

| Herakles Shipping Corporation |  |  | Navios Herakles |  |  | Marshall Is. |

| Hios Shipping Corporation |  |  | Navios Hios |  |  | Marshall Is. |

| Ionian Shipping Corporation |  |  | Navios Ionian |  |  | Marshall Is. |

| Kypros Shipping Corporation |  |  | Navios Kypros |  |  | Marshall Is. |

| Meridian Shipping Enterprises Inc. |  |  | Navios Meridian |  |  | Marshall Is. |

| Mercator Shipping Corporation |  |  | Navios Mercator |  |  | Marshall Is. |

| Libra Shipping Enterprises Corp. |  |  | Navios Libra II |  |  | Marshall Is. |

| Alegria Shipping Corporation |  |  | Navios Alegria |  |  | Marshall Is. |

| Felicity Shipping Corporation |  |  | Navios Felicity |  |  | Marshall Is. |

| Gemini Shipping Corporation |  |  | Navios Gemini S |  |  | Marshall Is. |

| Arc Shipping Corporation |  |  | Navios Arc |  |  | Marshall Is. |

| Galaxy Shipping Corporation |  |  | Navios Galaxy I |  |  | Marshall Is. |

| Horizon Shipping Enterprises Corporation |  |  | Navios Horizon (ii) |  |  | Marshall Is. |

| Magellan Shipping Corporation |  |  | Navios Magellan |  |  | Marshall Is. |

| Acropolis Chartering & Shipping Inc. (i) |  |  | Brokerage Company |  |  | Liberia |

|

|  |

| (i) | The company is 50% owned by Navios and is accounted for on the equity basis. |

|  |

| (ii) | Navios Horizon was acquired on April 10, 2006. |

|  |

| (c) | Recent Accounting Pronouncements: |

In February 2006, the Financial Accounting Standard Board issued Statement of Financial Accounting Standards No. 155 (SFAS 155) ‘‘Accounting for Certain Hybrid Instruments — an amendment of FASB Statements No. 133 and 140’’. SFAS 155 amends SFAS 133 to permit fair value measurement for certain hybrid financial instruments that contain an embedded derivative, provides additional guidance on the applicability of SFAS 133 and SFAS 140 to certain financial instruments and subordinated concentrations of credit risk. SFAS 155 is effective for the first fiscal year that begins after September 15, 2006. We are currently evaluating the impact SFAS 155 will have on our consolidated financial statements. This statement will be effective for the Company for the fiscal year beginning on January 1, 2007.

In March 2006, the Financial Accounting Standard Board issued Statement of Financial Accounting Standards No. 156 (SFAS 156) ‘‘Accounting for Servicing of Financial Assets — an amendment of FASB Statements No. 140’’. SFAS 156 amends SFAS 140 requiring that all separately recognized servicing assets and servicing liabilities be measured at fair value, if practicable. SFAS 156 also permits, but does not require, the subsequent measurement of servicing and servicing liabilities. SFAS 156 is effective for the first fiscal year that begins after September 15, 2006. The adoption of this Accounting Standard is not expected to have an effect on our consolidated financial statements. This statement will be effective for the Company for the fiscal year beginning on January 1, 2007.

F-7

Table of ContentsNAVIOS MARITIME HOLDINGS INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of US Dollars — except per share data)

NOTE 3: ACQUISITION/REINCORPORATION

On August 25, 2005, pursuant to a Stock Purchase Agreement dated February 28, 2005, as amended, by and among International Shipping Enterprises, Inc. (‘‘ISE’’), Navios Maritime Holdings Inc. (‘‘Navios’’ or the ‘‘Company’’) and all the shareholders of Navios, ISE acquired Navios through the purchase of all of its outstanding shares of common stock. As a result of this acquisition, Navios became a wholly-owned subsidiary of ISE. In addition, on August 25, 2005, simultaneously with the acquisition of Navios, ISE effected a reincorporation from the State of Delaware to the Republic of the Marshall Islands through a downstream merger with and into its newly acquired wholly-owned subsidiary, whose name was and continued to be Navios Maritime Holdings Inc.

The following table presents the unaudited pro forma results as if the acquisition, downstream merger and related financing had occurred at the beginning of the three month period ended March 31, 2005 (in thousands, except for numbers of and amounts per share):

|  |  |  |  |  |  |

| |  |  | Three month

period ended

March 31, 2005 |

| |  |  | (unaudited) |

| Gross revenues |  |  |  | $ | 61,365 | |

| Net income |  |  |  | $ | 1,669 | |

| Basic earnings per share |  |  |  | $ | 0.04 | |

| Diluted earnings per share |  |  |  | $ | 0.04 | |

| Average shares outstanding during the period presented |  |  |  |  | 39,900,000 | |

| Warrants assumed to be outstanding |  |  |  |  | 65,550,000 | |

| Proceeds to Company on exercise of warrants |  |  |  |  | 327,750,000 | |

| Assumed market price for repurchase of incremental shares |  |  |  |  | 5.00 | |

| Number of shares assumed to be repurchased |  |  |  |  | 65,550,000 | |

| Incremental shares on exercise of warrants |  |  |  |  | — | |

| Total number of shares assumed to be outstanding for dilution purposes |  |  |  |  | 39,900,000 | |

|

The unaudited pro forma results are for comparative purposes only and do not purport to be indicative of the results that would have actually been obtained if the acquisition/reincorporation had occurred at the beginning of the period presented.

NOTE 4 — CASH AND CASH EQUIVALENTS

Cash and cash equivalents consist of the following:

|  |  |  |  |  |  |  |  |  |  |  |  |