Exhibit (c)(2) Project Navigation Presentation to the Special Committee of the Board of Directors of Navios Maritime Holdings Inc. October 4, 2023 / Confidential Jefferies LLC Member SIPC The information provided in this document, including valuation discussions, represents the views of Jefferies Investment Banking. There is no assurance that the views expressed herein will be consistent with the views expressed by Jefferies Research or its Analysts. Nothing in this document should be understood as a promise or offer of favorable research coverage.

Disclaimer The following pages contain material provided to the Special Committee (the “Committee of Navios Maritime Holdings Inc. (NYSE: NM) (“Navios Holdings”) by Jefferies LLC (“Jefferies”) in connection with a proposed transaction involving N Shipmanagement Acquisition Corp. (“N Shipmanagement”) (the “Transaction”). These materials were prepared on a confidential basis in connection with an oral presentation to the Committee and not with a view toward complying with the disclosure standards under state or federal securities laws or otherwise. These materials are solely for use of the Committee and may not be used for any other purpose or disclosed to any other party without Jefferies’ prior written consent. The information contained in this was solely on public information or information furnished to Jefferies. Jefferies has relied, without independent investigation or verification, on the accuracy, completeness and fair presentation of all such information and the conclusions contained herein are conditioned upon such information (whether written or oral) being accurate, complete and fairly presented in all respects. None of Jefferies, its affiliates or its or their respective employees, directors, officers, contractors, advisors, members, successors or agents makes any representation or warranty in respect of the accuracy, completeness or fair presentation of any information or any conclusion contained herein. Jefferies, its affiliates and its and their respective employees, directors, officers, contractors, advisors, members, successors and agents shall have no liability with respect to any information or matter contained herein. Jefferies undertakes no obligation to update these materials. Neither Jefferies nor any of its affiliates is an advisor as to legal, tax, accounting or regulatory matters in any jurisdiction. Jefferies LLC / October 4, 2023 i

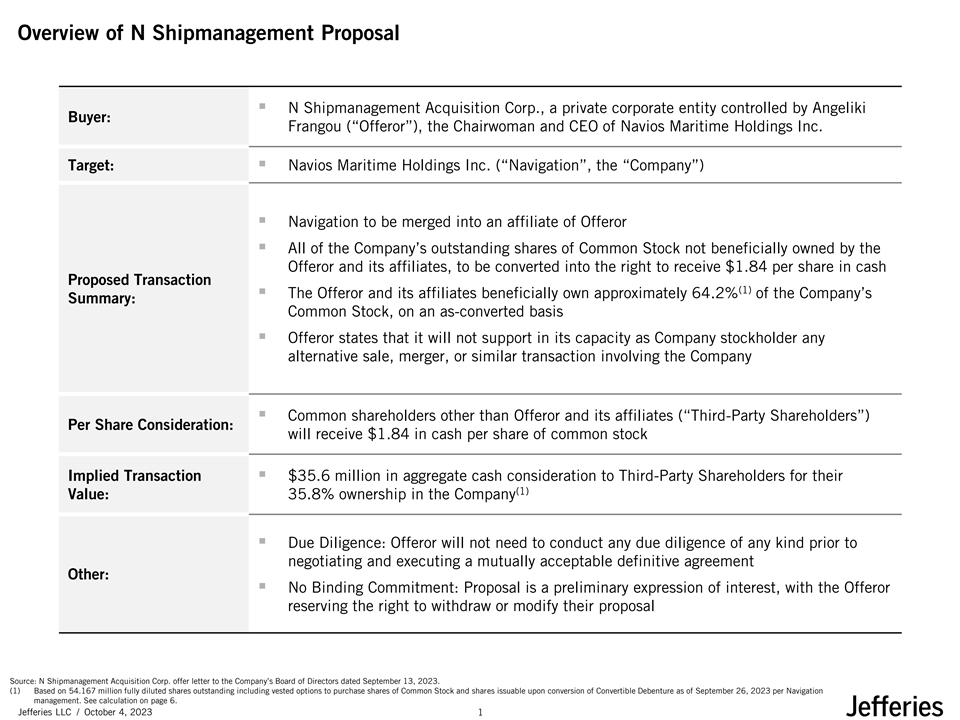

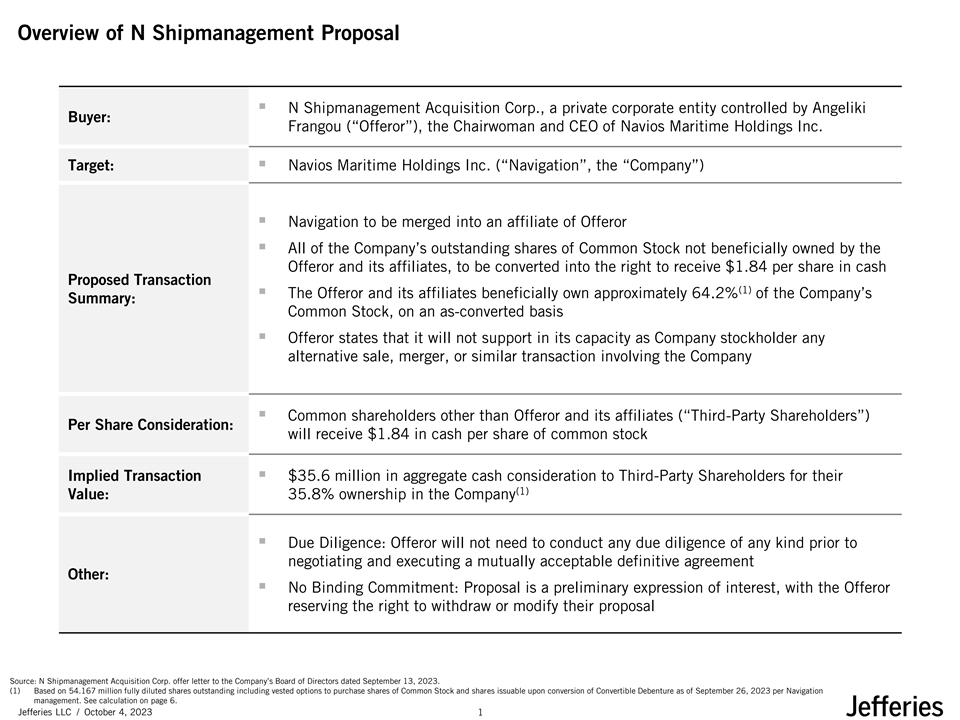

Overview of N Shipmanagement Proposal ▪ N Shipmanagement Acquisition Corp., a private corporate entity controlled by Angeliki Buyer: Frangou (“Offeror”), the Chairwoman and CEO of Navios Maritime Holdings Inc. Target:▪ Navios Maritime Holdings Inc. (“Navigation”, the “Company”) ▪ Navigation to be merged into an affiliate of Offeror ▪ All of the Company’s outstanding shares of Common Stock not beneficially owned by the Offeror and its affiliates, to be converted into the right to receive $1.84 per share in cash Proposed Transaction (1) ▪ The Offeror and its affiliates beneficially own approximately 64.2% of the Company’s Summary: Common Stock, on an as-converted basis ▪ Offeror states that it will not support in its capacity as Company stockholder any alternative sale, merger, or similar transaction involving the Company ▪ Common shareholders other than Offeror and its affiliates (“Third-Party Shareholders”) Per Share Consideration: will receive $1.84 in cash per share of common stock Implied Transaction ▪ $35.6 million in aggregate cash consideration to Third-Party Shareholders for their (1) Value: 35.8% ownership in the Company ▪ Due Diligence: Offeror will not need to conduct any due diligence of any kind prior to negotiating and executing a mutually acceptable definitive agreement Other: ▪ No Binding Commitment: Proposal is a preliminary expression of interest, with the Offeror reserving the right to withdraw or modify their proposal Source: N Shipmanagement Acquisition Corp. offer letter to the Company’s Board of Directors dated September 13, 2023. (1) Based on 54.167 million fully diluted shares outstanding including vested options to purchase shares of Common Stock and shares issuable upon conversion of Convertible Debenture as of September 26, 2023 per Navigation management. See calculation on page 6. Jefferies LLC / October 4, 2023 1

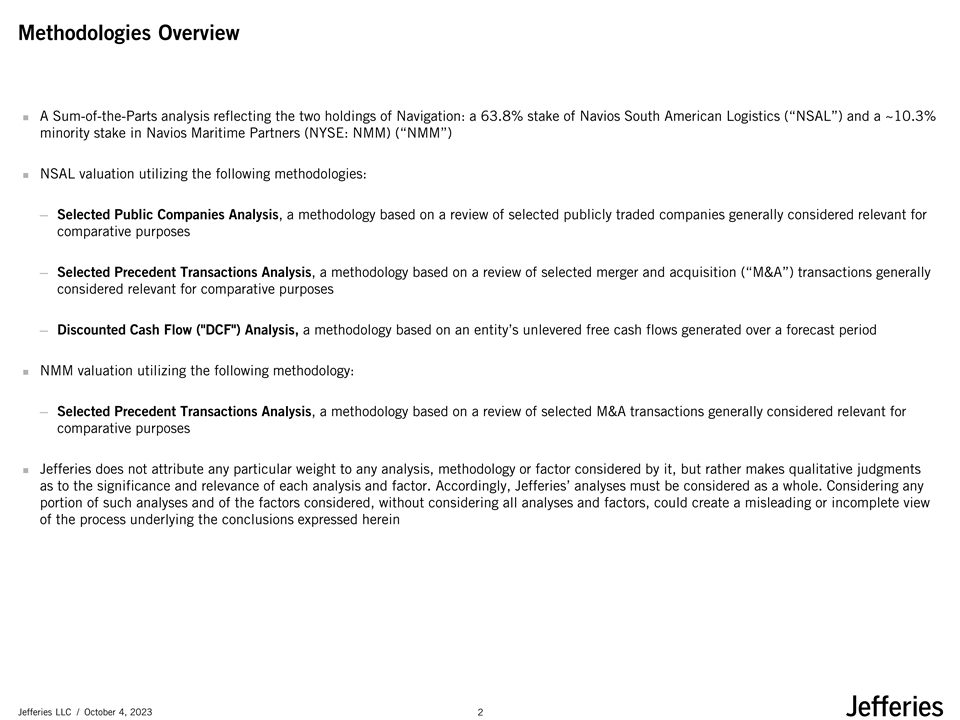

Methodologies Overview ◼ A Sum-of-the-Parts analysis reflecting the two holdings of Navigation: a 63.8% stake of Navios South American Logistics (“NSAL”) and a ~10.3% minority stake in Navios Maritime Partners (NYSE: NMM) (“NMM”) ◼ NSAL valuation utilizing the following methodologies: ─ Selected Public Companies Analysis, a methodology based on a review of selected publicly traded companies generally considered relevant for comparative purposes ─ Selected Precedent Transactions Analysis, a methodology based on a review of selected merger and acquisition (“M&A”) transactions generally considered relevant for comparative purposes ─ Discounted Cash Flow ( DCF ) Analysis, a methodology based on an entity’s unlevered free cash flows generated over a forecast period ◼ NMM valuation utilizing the following methodology: ─ Selected Precedent Transactions Analysis, a methodology based on a review of selected M&A transactions generally considered relevant for comparative purposes ◼ Jefferies does not attribute any particular weight to any analysis, methodology or factor considered by it, but rather makes qualitative judgments as to the significance and relevance of each analysis and factor. Accordingly, Jefferies’ analyses must be considered as a whole. Considering any portion of such analyses and of the factors considered, without considering all analyses and factors, could create a misleading or incomplete view of the process underlying the conclusions expressed herein Jefferies LLC / October 4, 2023 2

Current Organization Structure (1) (2) (1) (2) 16.1% / 64.2% 83.9% / 35.8% Angeliki Frangou and Third-party shareholders affiliated entities Navios Maritime Holdings Inc. (NYSE: NM) (1) Market Cap: $45.5 million 63.8% ownership 100% ownership 10.3% ownership Navios Maritime Partners L.P. Navios South American Logistics Navios GP L.L.C. NYSE: NMM Inc. Market Cap: $698.1 million • Owner of Incentive Distribution • Privately held • Owners of 81 dry bulk, 47 Rights (“IDR”) of Navios Maritime • Infrastructure & logistics service containerships and 47 tankers Partners L.P. provider in South America vessels Sources: Publicly available materials. Company filings. Capital IQ of October 3, 2023. (1) Does not include shares issuable upon conversion of the Convertible Debenture. (2) Inclusive of shares issuable upon conversion of the Convertible Debenture. Jefferies LLC / October 4, 2023 3

Analysis at Various Prices Unaffected Share Price Current Share Price Current Proposal (as of Sep 12, 2023) (as of Oct 03, 2023) Share / Offer Price $1.60 $1.84 $1.97 % Prem. / (Disc.) to Unaffected Price (9/12/23) - 15.0% 23.1% % Prem. / (Disc.) to 10D VWAP 0.8% 15.9% 24.1% % Prem. / (Disc.) to 30D VWAP (0.6%) 14.3% 22.3% % Prem. / (Disc.) to 60D VWAP (6.4%) 7.6% 15.2% % Prem. / (Disc.) to 90D VWAP (5.7%) 8.4% 16.1% % Prem. / (Disc.) to 120D VWAP (5.5%) 8.7% 16.3% % Prem. / (Disc.) to 52-week High of $2.97 (46.1%) (38.0%) (33.7%) Fully Diluted Shares Outstanding exl. Convertible Debenture 23.076 23.076 23.076 Implied Equity Value $36.9 $42.5 $45.5 Memo: Shares Owned by Third Party Shareholders 19.371 19.371 19.371 Share Price Consideration $1.60 $1.84 $1.97 Implied Offer to Unaffiliated Shareholders $31.0 $35.6 $38.2 Sources: Publicly available materials. Company filings. Capital IQ of October 3, 2023. Jefferies LLC / October 4, 2023 4

Appendix Jefferies LLC / October 4, 2023 5

Navios Maritime Holdings Fully Diluted Shares Outstanding Calculation Shares (millions) Basic S/O 22.744 Restricted Stock Units outstanding 0.082 Vested options 0.250 Fully Diluted Shares Outstanding 23.076 Shares issuable upon conversion of Convertible Debenture 31.090 Fully Diluted Shares Outstanding incl. Convertible Debenture 54.167 Source: Information provided by Navigation Management to Jefferies on September 26, 2023. Jefferies LLC / October 4, 2023 6