Exhibit (c)(5) Project Navigation Presentation to the Special Committee of the Board of Directors of Navios Maritime Holdings Inc. October 22, 2023 / Confidential Jefferies LLC Member SIPC The information provided in this document, including valuation discussions, represents the views of Jefferies Investment Banking. There is no assurance that the views expressed herein will be consistent with the views expressed by Jefferies Research or its Analysts. Nothing in this document should be understood as a promise or offer of favorable research coverage.

Disclaimer The following pages contain material provided to the Special Committee (the “Committee”) of Navios Maritime Holdings Inc. (NYSE: NM) (“Navios Holdings”) by Jefferies LLC (“Jefferies”) in connection with a proposed transaction involving N Shipmanagement Acquisition Corp. These materials were prepared on a confidential basis in connection with an oral presentation to the Committee and not with a view toward complying with the disclosure standards under state or federal securities laws or otherwise. These materials are solely for use of the Committee in its evaluation of the proposed transaction and may not be used for any other purpose or disclosed to any other party without Jefferies’ prior written consent. No recipient of these materials is permitted to reproduce, summarize or refer to, in whole or in part, the information contained herein or to provide or communicate the materials or the information provided herein to any third party without the prior written consent of Jefferies. No party, other than the Committee (in its capacity as such) may use or rely on these materials and the information contained herein for any purpose without the prior written consent of Jefferies. The information contained in this was solely on public information or information furnished to Jefferies by Navios Holdings. Jefferies has relied, without independent investigation or verification, on the accuracy, completeness and fair presentation of all such information and the conclusions contained herein are conditioned upon such information (whether written or oral) being accurate, complete and fairly presented in all respects. None of Jefferies, its affiliates or its or their respective employees, directors, officers, contractors, advisors, members, successors or agents makes any representation or warranty in respect of the accuracy, completeness or fair presentation of any information or any conclusion contained herein. Jefferies, its affiliates and its and their respective employees, directors, officers, contractors, advisors, members, successors and agents shall have no liability with respect to any information or matter contained herein, or any oral information provided herewith or data any of them generates. Jefferies undertakes no obligation to update these materials. All estimates, budgets and projections with respect to Navios Holdings have been prepared by Navios Holdings management and provided to Jefferies for use in its analysis. Jefferies has assumed that the estimates, budgets and projections contained herein represent the best currently available estimates and judgements of Navios Holdings management as to the matters covered thereby. Such estimates, budgets and projections may or may not be achieved and differences between projected results and those achieved may be material. This presentation does not constitute a fairness opinion of Jefferies as to the value of Navios Holdings, and as such, should not be relied on by Navios Holdings or by any other person as such. Nothing herein shall constitute a recommendation to the committee or any other person with respect to the proposed transaction or any other matter. Neither Jefferies nor any of its affiliates is an advisor as to legal, tax, accounting or regulatory matters in any jurisdiction. Jefferies LLC / October 2023 i

Table of Contents Introduction 1 Preliminary Valuation Analysis 9 Appendix 20 Jefferies LLC / October 2023 ii

Introduction Jefferies LLC / October 2023 1

Overview of N Shipmanagement Proposal ▪ N Shipmanagement Acquisition Corp., a private corporate entity controlled by Angeliki Buyer: Frangou (“Offeror”), the Chairwoman and CEO of Navios Maritime Holdings Inc. Target:▪ Navios Maritime Holdings Inc. (“Navios Holdings”, the “Company”) ▪ Navios Holdings to be merged into an affiliate of Offeror ▪ All of the Company’s outstanding shares of Common Stock not beneficially owned by the Offeror and its affiliates, to be converted into the right to receive $2.28 per share in cash Proposed Transaction (1) ▪ The Offeror and its affiliates beneficially own approximately 64.2% of the Company’s Summary: Common Stock, on an as-converted basis ▪ Offeror states that it will not support in its capacity as Company stockholder any alternative sale, merger, or similar transaction involving the Company ▪ Common shareholders other than Offeror and its affiliates (“Third-Party Shareholders”) Per Share Consideration: will receive $2.28 in cash per share of common stock Implied Transaction ▪ $44.2 million in aggregate cash consideration to Third-Party Shareholders for their (1) Value: 35.8% ownership in the Company ▪ Due Diligence: Offeror will not need to conduct any due diligence of any kind prior to negotiating and executing a mutually acceptable definitive agreement ▪ No Binding Commitment: Proposal is a preliminary expression of interest, with the Offeror Other: reserving the right to withdraw or modify their proposal ▪ Prior Offers: Offeror previously proposed per share considerations of $1.84 on September 13, $2.05 on October 16 and $2.15 on October 19 Source: N Shipmanagement Acquisition Corp. offer letter to the Company’s Board of Directors dated September 13, 2023, and further adjusted to reflect latest N Shipmanagement Corp. proposal. (1) Based on 54.167 million fully diluted shares outstanding including vested options to purchase shares of Common Stock and shares issuable upon conversion of Convertible Debenture as of September 26, 2023 per Navios Holdings Management. See calculation on page 21. Jefferies LLC / October 2023 2

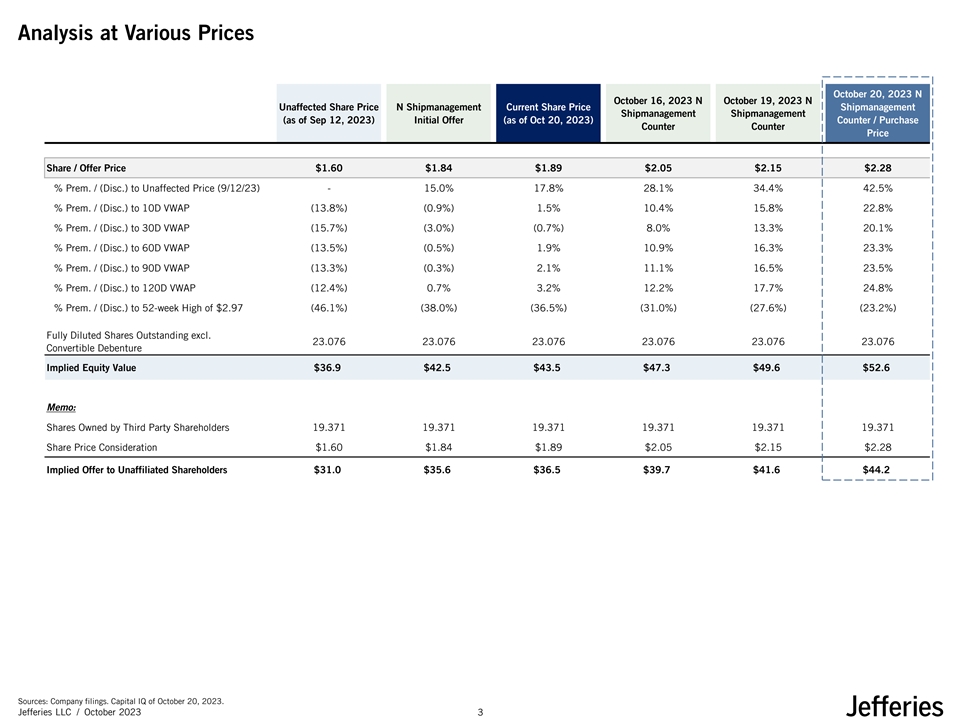

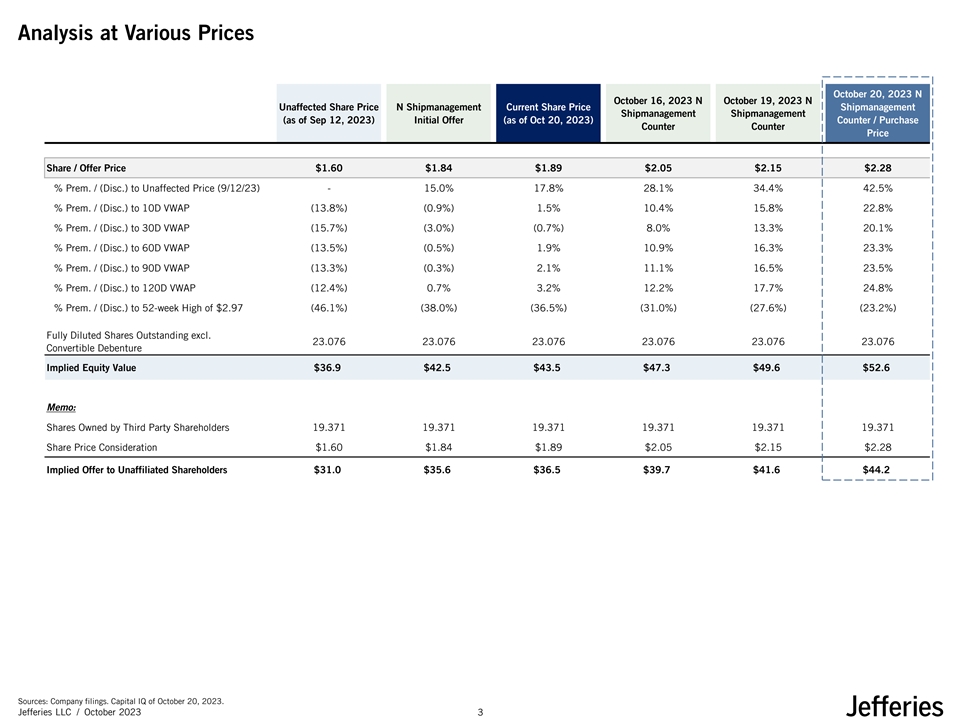

Analysis at Various Prices October 20, 2023 N October 16, 2023 N October 19, 2023 N Unaffected Share Price N Shipmanagement Current Share Price Shipmanagement Shipmanagement Shipmanagement (as of Sep 12, 2023) Initial Offer (as of Oct 20, 2023) Counter / Purchase Counter Counter Price Share / Offer Price $1.60 $1.84 $1.89 $2.05 $2.15 $2.28 % Prem. / (Disc.) to Unaffected Price (9/12/23) - 15.0% 17.8% 28.1% 34.4% 42.5% % Prem. / (Disc.) to 10D VWAP (13.8%) (0.9%) 1.5% 10.4% 15.8% 22.8% % Prem. / (Disc.) to 30D VWAP (15.7%) (3.0%) (0.7%) 8.0% 13.3% 20.1% % Prem. / (Disc.) to 60D VWAP (13.5%) (0.5%) 1.9% 10.9% 16.3% 23.3% % Prem. / (Disc.) to 90D VWAP (13.3%) (0.3%) 2.1% 11.1% 16.5% 23.5% % Prem. / (Disc.) to 120D VWAP (12.4%) 0.7% 3.2% 12.2% 17.7% 24.8% % Prem. / (Disc.) to 52-week High of $2.97 (46.1%) (38.0%) (36.5%) (31.0%) (27.6%) (23.2%) Fully Diluted Shares Outstanding excl. 23.076 23.076 23.076 23.076 23.076 23.076 Convertible Debenture Implied Equity Value $36.9 $42.5 $43.5 $47.3 $49.6 $52.6 Memo: Shares Owned by Third Party Shareholders 19.371 19.371 19.371 19.371 19.371 19.371 Share Price Consideration $1.60 $1.84 $1.89 $2.05 $2.15 $2.28 Implied Offer to Unaffiliated Shareholders $31.0 $35.6 $36.5 $39.7 $41.6 $44.2 Sources: Company filings. Capital IQ of October 20, 2023. Jefferies LLC / October 2023 3

Current Organization Structure (1) (2) (1) (2) 16.1% / 64.2% 83.9% / 35.8% Angeliki Frangou and Third-party shareholders affiliated entities Navios Maritime Holdings Inc. (NYSE: NM) (1) Market Cap: $43.5 million 63.8% ownership 100% ownership 10.3% ownership Navios Maritime Partners L.P. Navios South American Logistics Navios GP L.L.C. (NYSE: NMM) Inc. Market Cap: $684.5 million • Owner of Incentive Distribution • Privately held • Owners of 81 dry bulk, 47 Rights (“IDR”) of Navios Maritime • Infrastructure & logistics service containerships and 47 tankers Partners L.P. provider in South America vessels Sources: Publicly available materials. Company filings. Capital IQ of October 20, 2023. (1) Does not include shares issuable upon conversion of the Convertible Debenture. (2) Inclusive of shares issuable upon conversion of the Convertible Debenture. Jefferies LLC / October 2023 4

Navios Holding’s Shareholder Base % of Total Shares Basic # of Shares for Voting Shareholder # of Shares (mm) Market Value % of Total Voting Rights Outstanding Purposes Top-15 Navios Maritime Holdings Shareholders Angeliki Frangou (Chairwoman & CEO) 3.71 $7.0 16.1% 3.71 6.8% Convertible Debenture owned by Angeliki Frangou - - - 31.09 57.4% Total Shares Owned by Angeliki Frangou 3.71 $7.0 16.1% 34.80 64.2% HighTower Advisors, LLC 0.78 1.5 3.4% 0.78 1.4% Renaissance Technologies LLC 0.45 0.8 1.9% 0.45 0.8% Gratia Capital, LLC 0.32 0.6 1.4% 0.32 0.6% GlobeFlex Capital LP 0.17 0.3 0.7% 0.17 0.3% Morgan Stanley 0.07 0.1 0.3% 0.07 0.1% Citadel Advisors LLC 0.06 0.1 0.3% 0.06 0.1% BlackRock, Inc. 0.05 0.1 0.2% 0.05 0.1% Susquehanna International Group, LLP 0.05 0.1 0.2% 0.05 0.1% MBE Wealth Management, LLC 0.03 0.1 0.1% 0.03 0.1% Vanguard Capital Wealth Advisors, LLC 0.03 0.0 0.1% 0.03 0.0% Pinnacle Holdings, LLC 0.02 0.0 0.1% 0.02 0.0% Kestra Advisory Services, LLC 0.02 0.0 0.1% 0.02 0.0% Stephens Capital Management 0.01 0.0 0.1% 0.01 0.0% Group One Trading LP 0.01 0.0 0.1% 0.01 0.0% Total Top-15 Shareholders 5.77 $10.9 25.0% 36.86 68.1% Total Other Shareholders 17.30 $32.6 75.0% 17.30 31.9% (1) (2) Total Fully Diluted Shares Outstanding 23.08 $43.5 100.0% 54.17 100.0% Sources: Publicly available materials. Company filings. Capital IQ of October 20, 2023. (1) Does not include shares issuable upon conversion of the Convertible Debenture. (2) Inclusive of shares issuable upon conversion of the Convertible Debenture. Jefferies LLC / October 2023 5

Public Market Overview and Capitalization (NYSE: NM) 24-Mo Share Price Performance: 12-Mo Share Price Performance: Share Price as of October 20, 2023: (69.9%) (1.8%) $1.89 Two-Year Historical Share Price Performance Volume Price ($) (mm shares) Navios Holdings Trading Statistics as of Final Unaffected Date (September 12, 2023) Trading since offer announcement 9/12/2023 $2.50 1.2 $7.00 2.0 Closing Share Price $ 1 .60 Offer price: $2.28 per share 1.0 $2.30 % of 52-Week High 53.9% 0.8 $2.10 52-Week High (3/1/23) $ 2 .97 1.8 0.6 $1.90 52-Week Low (9/6/23) $ 1 .47 0.4 $6.00 90-Day Avg. Daily Trading (000s shares) 41 $1.70 0.2 90-Day Avg. Daily Trading (000s USD) $ 70 1.6 $1.50 0.0 12-Mo. Avg. Daily Trading (000s shares) 77 12-Sep 18-Sep 24-Sep 30-Sep 6-Oct 12-Oct 18-Oct 12-Mo. Avg. Daily Trading (000s USD) $ 152 $5.00 1.4 1.2 $4.00 1.0 September 13, 2023: Announced an offer by N Shipmanagement to purchase all $3.00 shares not owned by the offeror 0.8 for $1.84 per share in cash Offer price: $2.28 per share 0.6 $2.00 0.4 $1.00 0.2 $0.00 0.0 Volume Share Price Proposed Transaction Share Price Source: FactSet, Capital IQ, and publicly available materials. Market data as of October 20, 2023. Jefferies LLC / October 2023 6

Current NM Capitalization Current Capitalization 6/30/2023 Cash & Cash Equivalents $ 23.0 Total Debt (1) 121.2 Convertible Debenture due January 2027 9.75% Unsecured Notes due April 2024 8.6 Total Debt $ 129.9 Net Debt $ 106.9 Liquidation Value of Perpetual Preferred Equity 42.5 Common Equity (Market cap as of October 20, 2023) 43.5 Total Shareholders' Equity $ 86.0 (2) $ 192.8 Total Capitalization Sources: Company materials and filings. Capital IQ of October 20, 2023. Note: NM capitalization presented on a deconsolidated basis. (1) Convertible Debenture owned by Offeror and its affiliates. (2) Excludes accrued dividends on perpetual preferred equity of $29.0 million. Jefferies LLC / October 2023 7

NSAL Bond Trading – Yield Yield Since Issuance 12.5% 12.0% October 20, 2023: 11.0% 11.5% 11.0% 10.5% 10.0% 9.5% 9.0% 8.5% Yield YTD 2023 11.6% October 20, 2023: 11.0% 11.3% 11.1% 10.8% 10.6% 10.3% Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Source: Bloomberg as of October 20, 2023. Jefferies LLC / October 2023 8 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23

Preliminary Valuation Analysis Jefferies LLC / October 2023 9

Methodologies Overview ◼ A Sum-of-the-Parts analysis reflecting the two holdings of Navios Holdings: a 63.8% stake of Navios South American Logistics (“NSAL”) and a ~10.3% minority stake in Navios Maritime Partners (NYSE: NMM) (“NMM”) ◼ NSAL valuation utilizing the following methodologies: ─ Select Publicly Traded Companies Analysis, a methodology based on a review of selected publicly traded companies generally considered relevant for comparative purposes ─ Select Precedent Transactions Analysis, a methodology based on a review of selected mergers and acquisitions (“M&A”) transactions generally considered relevant for comparative purposes ─ Discounted Cash Flow ( DCF ) Analysis, a methodology based on an entity’s unlevered free cash flows generated over a forecast period ◼ NMM valuation utilizing the following methodology: ─ Select Precedent Transactions Analysis, a methodology based on a review of selected M&A transactions generally considered relevant for comparative purposes ◼ Jefferies does not attribute any particular weight to any analysis, methodology or factor considered by it, but rather makes qualitative judgments as to the significance and relevance of each analysis and factor. Accordingly, Jefferies’ analyses must be considered as a whole. Considering any portion of such analyses and of the factors considered, without considering all analyses and factors, could create a misleading or incomplete view of the process underlying the conclusions expressed herein Jefferies LLC / October 2023 10

Preliminary Valuation Analysis for Navios Maritime Holdings ($ per share except where otherwise noted) Methodology Implied Equity Value per Share Selected Metrics October 20, 2023: N Shipmanagement Counter / Purchase Price: $2.28 NSAL: Select Publicly Traded NSAL: 5.5x to 6.0x CY2024E Companies EBITDA of $130.8mm $0.61 $2.56 NMM: Select Minority Interest NMM: +/- 1% from median Precedent Transactions premium to 30-day VWAP NSAL: Select Precedent NSAL: 8.0x to 9.0x June 30, Transactions 2023 LTM EBITDA of $98.3mm $2.42 $5.27 NMM: Select Minority Interest NMM: +/- 1% from median Precedent Transactions premium to 30-day VWAP NSAL: 13.0% to 14.0% Weighted Average Cost of Capital, Terminal NSAL: Discounted Cash Flow Multiple of 5.5x to 6.0x CY2027E EBITDA of $145.2mm $1.81 $2.35 NMM: Select Minority Interest Precedent Transactions NMM: +/- 1% from median premium to 30-day VWAP $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 Sources: Projections prepared by Navios Holdings Management and provided to Jefferies on September 26, 2023 for use in its analysis, public filings, Capital IQ, Mergermarket. Market data as of October 20, 2023. Jefferies LLC / October 2023 11

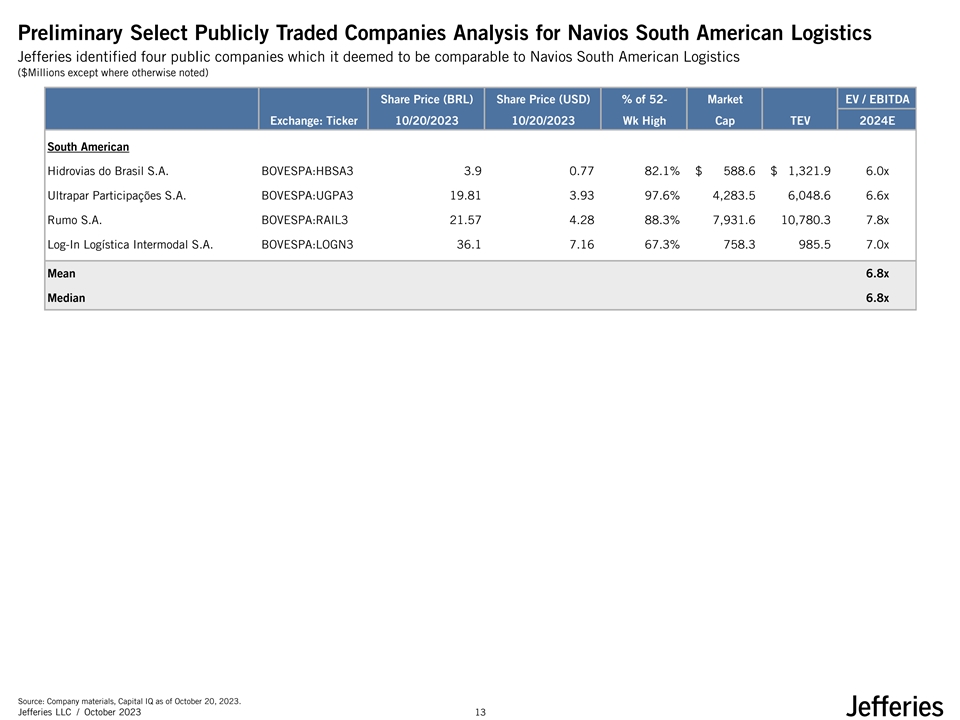

Preliminary Navios South American Logistics Selected Companies Analysis ($Millions except where otherwise noted) Valuation Methodology for Sum-of-the-Parts Low-End High-End NSAL: Select Publicly Traded Companies Forward EBITDA Multiple 5.5x 6.0x 2024E EBITDA $130.8 $130.8 NSAL Enterprise Value - 100% Basis $720.7 $786.1 NSAL Net Debt ($509.4) ($509.4) NSAL Equity Value - 100% Basis $211.3 $276.7 NMM: Non-Controlling Privately Negotiated Transactions in Shipping Share Price Premium / (Discount) - Range Reflects Median Premium of 1.9% 0.9% 2.9% NMM 30D VWAP as of October 20, 2023 $22.90 $22.90 NMM Value per Unit $23.11 $23.57 Going-Concern G&A Net of NMM Distributions Weighted Average Cost of Capital 9.60% 10.60% Growth Assumption 1.00% 1.00% (1) 2025E G&A Expenses Less Annual Distribution Income ($1.4) ($1.4) Discounted Going-Concern Net G&A Utilizing Perpetual Growth Rate ($15.9) ($14.2) Navios Maritime Holdings Sum-of-the-Parts Build-Up Proportionate Value of NSAL (63.8%) $134.8 $176.5 Plus: Equity Stake in NMM (3,183,199 common units) 73.6 75.0 (2) Plus: Value attributable to NMM Incentive Distribution Rights - - Total Assets $208.3 $251.5 (2) Plus: Cash 23.0 23.0 (3) Less: Convertible Debenture due 2027 (121.2) (121.2) (3) Less: 9.75% Unsecured Notes due 2024 (8.6) (8.6) (3) Less: Liquidation Value of Perpetual Preferred Equity (42.5) (42.5) (3) Less: Accrued Distributions on Perpetual Preferred Equity (29.0) (29.0) Less: Going Concern G&A Deduction (15.9) (14.2) Implied Equity Value $14.2 $59.0 (4) Fully Diluted Shares Outstanding 23.076 23.076 Implied Equity Value Per Share $0.61 $2.56 Source: Company management, Capital IQ as of October 20, 2023. (1) Refers to run-rate G&A expenses of $2.0 million less NMM distributions attributable to Navios Holdings of $0.6 million. (2) Financial Forecast provided by Navios Holdings Management to Jefferies on September 26, 2023 does not contemplate distribution levels within thresholds of the IDRs. Lower end of the IDR threshold is at $5.25 quarterly per unit, while projected distribution is at $0.05 quarterly per unit. (3) As of June 30, 2023 per company financial statements provided by Navios Holdings Management to Jefferies on September 26, 2023 (4) Does not include shares issuable upon conversion of the Convertible Debenture. Jefferies LLC / October 2023 12

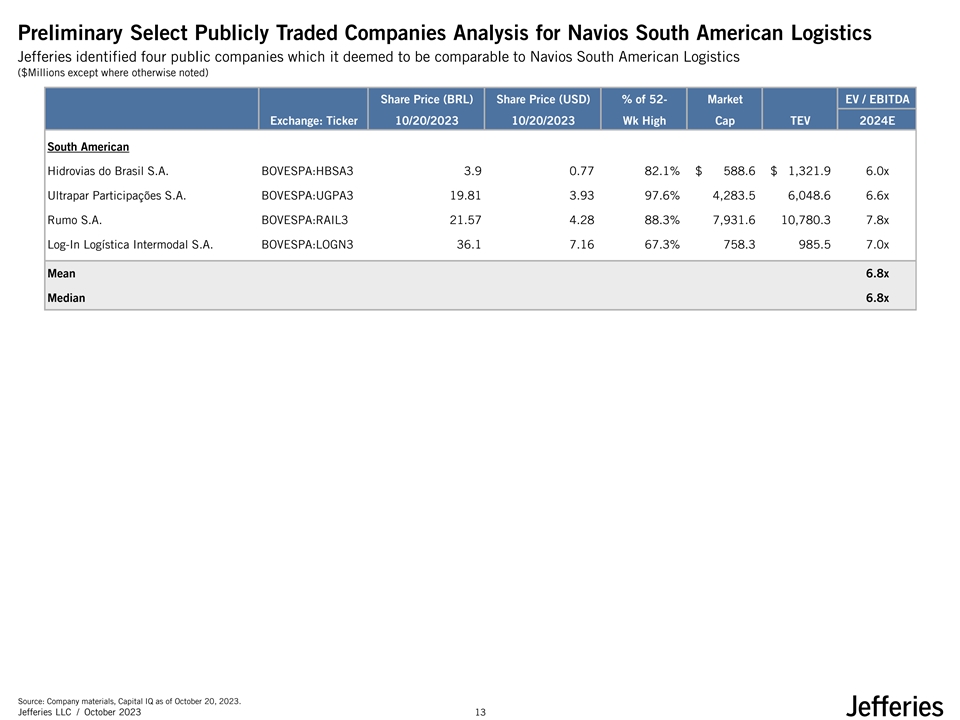

Preliminary Select Publicly Traded Companies Analysis for Navios South American Logistics Jefferies identified four public companies which it deemed to be comparable to Navios South American Logistics ($Millions except where otherwise noted) Share Price (BRL) Share Price (USD) % of 52- Market EV / EBITDA Exchange: Ticker 10/20/2023 10/20/2023 Wk High Cap TEV 2024E South American Hidrovias do Brasil S.A. BOVESPA:HBSA3 3.9 0.77 82.1% $ 588. 6 $ 1,321.9 6.0x Ultrapar Participações S.A. BOVESPA:UGPA3 19.81 3. 93 97.6% 4,283.5 6, 048.6 6.6x Rumo S.A. BOVESPA:RAIL3 21.57 4.28 88.3% 7,931.6 10,780.3 7.8x Log-In Logística Intermodal S.A. BOVESPA:LOGN3 36.1 7. 16 67.3% 758. 3 985. 5 7.0x Mean 6.8x Median 6.8x Source: Company materials, Capital IQ as of October 20, 2023. Jefferies LLC / October 2023 13

Preliminary Select Publicly Traded Companies Analysis for Navios South American Logistics (Cont’d) ($Millions except where otherwise noted) Ticker / Exchange Privately held BOVESPA:HBSA3 BOVESPA:UGPA3 BOVESPA:RAIL3 BOVESPA:LOGN3 One of the largest providers of Integrated logistics solutions Group of four asset-light Largest independent railway Offers cargo movement solutions integrated logistics solutions in the focused on waterway transport, logistics businesses covering logistics operator in Brazil, through an asset-light model of Hidrovia region of South America, terminal operations and cabotage, sales and distribution of fuels connecting the country’s three cabotage and road transportation, serving storage and marine operating on 4 strategic logistics and lubricants, LPG distribution main ports to an inland with an integrated network transportation customers through routes in Brazil with a large and liquid bulk storage, the logistics network by providing facilitating port movement as well Description port terminal, river barge and presence Brazil's North and South latter being active in six of solutions for transportation, as door-to-door logistics costal cabotage operations Corridors Brazil’s major ports handling, storage and shipping in an asset-light model Argentina, Brazil, Country Exposure Brazil Brazil Brazil Brazil Paraguay, and Uruguay $352.7 $464.2 $25,987.4 $2,570.4 $522.6 2024E Revenue 17.8% 14.0% 2.1% 17.2% 12.0% '23-'24 Rev Growth $299.5 $407.1 $25,441.7 $2,194.0 $466.5 2023E Revenue 17.8% 21.7% (6.4%) 17.9% 19.3% '22-'23 Rev Growth $130.8 $220.0 $919.3 $1,384.7 $141.7 2024E EBITDA 16.3% 47.4% 3.5% 53.9% 27.1% '23-'24 EBITDA Growth $112.4 $179.7 $866.3 $1,108.2 $127.3 2023E EBITDA 17.9% 57.9% 41.1% 33.7% 31.6% '22-'23 EBITDA Growth ✓ Presence in major Brazilian ✓ Presence in major Brazilian ✓ Presence in major Brazilian ✓ Presence in major ports ports ports Brazilian ports ✓ Shallow water coastwise ✓ Marine focused logistics ✓ Storage service offering✓ Integrated terminal shipping ûû Comparability to NSAL ✓ Primarily operates along river High exposure to product solutions provider Road-focused and intermodal routes marketsû Rail-focused logistics logistics ✓ Similar offering of cabotage û Significant revenue from û Significant revenue from û Significant revenue from non- and port operation services non-logistics operations non-marine operations marine operations Significant overlapping operations with NSAL Source: Company materials, Capital IQ as of October 20, 2023. Jefferies LLC / October 2023 14

Preliminary Navios South American Logistics Selected Precedent Transactions Analysis ($Millions except where otherwise noted) Valuation Methodology for Sum-of-the-Parts Low-End High-End NSAL: Precedent Transactions LTM EBITDA Multiple 8.0x 9.0x LTM EBITDA as of June 30, 2023 $98.3 $98.3 NSAL Enterprise Value - 100% Basis $786.1 $884.3 NSAL Net Debt ($509.4) ($509.4) NSAL Equity Value - 100% Basis $276.6 $374.9 NMM: Non-Controlling Privately Negotiated Transactions in Shipping Share Price Premium / (Discount) - Range Reflects Median Premium of 1.9% 0.9% 2.9% NMM 30D VWAP as of October 20, 2023 $22.90 $22.90 NMM Value per Unit $23.11 $23.57 Going-Concern G&A Net of NMM Distributions Weighted Average Cost of Capital 9.60% 10.60% Growth Assumption 1.00% 1.00% (1) 2025E G&A Expenses Less Annual Distribution Income ($1.4) ($1.4) Discounted Going-Concern Net G&A Utilizing Perpetual Growth Rate ($15.9) ($14.2) Navios Maritime Holdings Sum-of-the-Parts Build-Up Proportionate Value of NSAL (63.8%) $176.5 $239.2 Plus: Equity Stake in NMM (3,183,199 common units) 73.6 75.0 (2) Plus: Value attributable to NMM Incentive Distribution Rights - - Total Assets $250.1 $314.2 (2) Plus: Cash 23.0 23.0 (3) Less: Convertible Debenture due 2027 (121.2) (121.2) (3) Less: 9.75% Unsecured Notes due 2024 (8.6) (8.6) (3) Less: Liquidation Value of Perpetual Preferred Equity (42.5) (42.5) (3) Less: Accrued Distributions on Perpetual Preferred Equity (29.0) (29.0) Less: Going Concern G&A Deduction (15.9) (14.2) Implied Equity Value $55.9 $121.7 (4) Fully Diluted Shares Outstanding 23.076 23.076 Implied Equity Value Per Share $2.42 $5.27 Source: Company management, Capital IQ as of October 20, 2023. (1) Refers to run-rate G&A expenses of $2.0 million less NMM distributions attributable to Navios Holdings of $0.6 million. (2) Financial Forecast provided by Navios Holdings Management to Jefferies on September 26, 2023 does not contemplate distribution levels within thresholds of the IDRs. Lower end of the IDR threshold is at $5.25 quarterly per unit, while projected distribution is at $0.05 quarterly per unit. (3) As of June 30, 2023 per company financial statements provided by Navios Holdings Management to Jefferies on September 26, 2023 (4) Does not include shares issuable upon conversion of the Convertible Debenture. Jefferies LLC / October 2023 15

Preliminary Selected Precedent Transaction Analysis for Navios South American Logistics Jefferies reviewed five precedent transactions from 2017 to the present Transaction Est. Adj. LTM Announced Est. TEV / Adj. Enterprise Value Target / Seller Acquirer (1) Date LTM EBITDA EBITDA (Millions) (1) (Millions) SAAM Ports SA and SAAM Oct-22 Hapag-Lloyd USD 1,137 USD 125 9.1x Logistics SA Log-In Logistica Intermodal SaS Shipping Agencies Sep-21 BRL 3,595 BRL 322 11.2x (BOVESPA: LOGN3) Services Jul-21 Imperial Logistics DP World Limited ZAR 22,389 ZAR 4,973 4.5x Imperial Logistics South Apr-21 Hidrovias do Brasil S.A USD 90 USD 9 9.6x American Operations Grupo Empresas Navieras S.A. Jun-17 Agencias Universales SA CLP 220,731 CLP 32,237 6.8x (SNSE:NAVIERA) Median 9.1x Mean 8.2x Source: Capital IQ, FactSet, publicly available information. (1) Data is reflected in currency of transaction. Jefferies LLC / October 2023 16

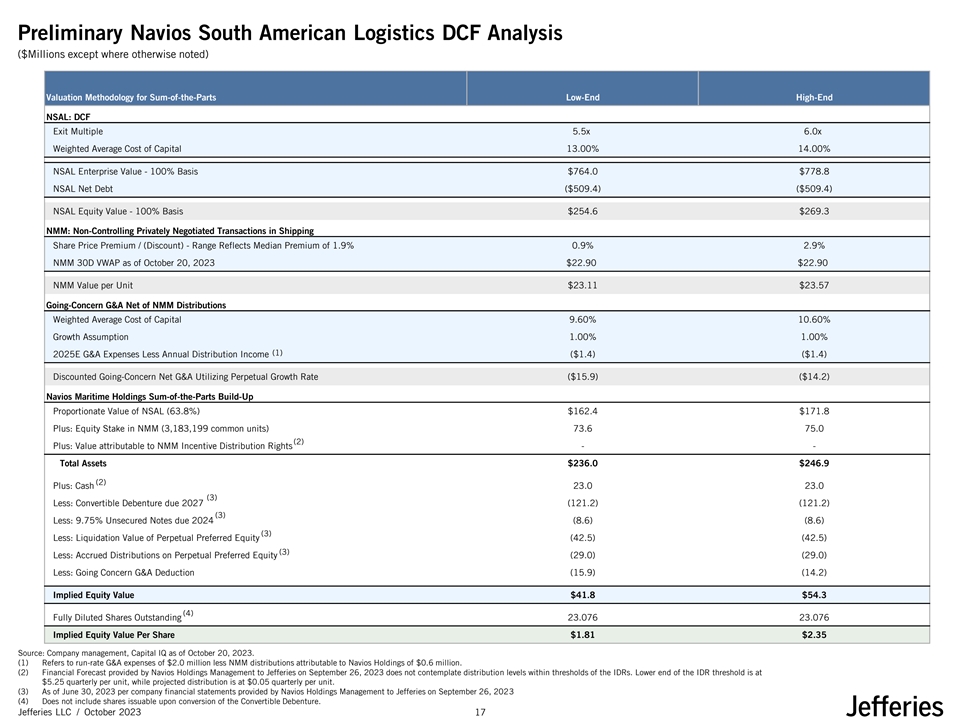

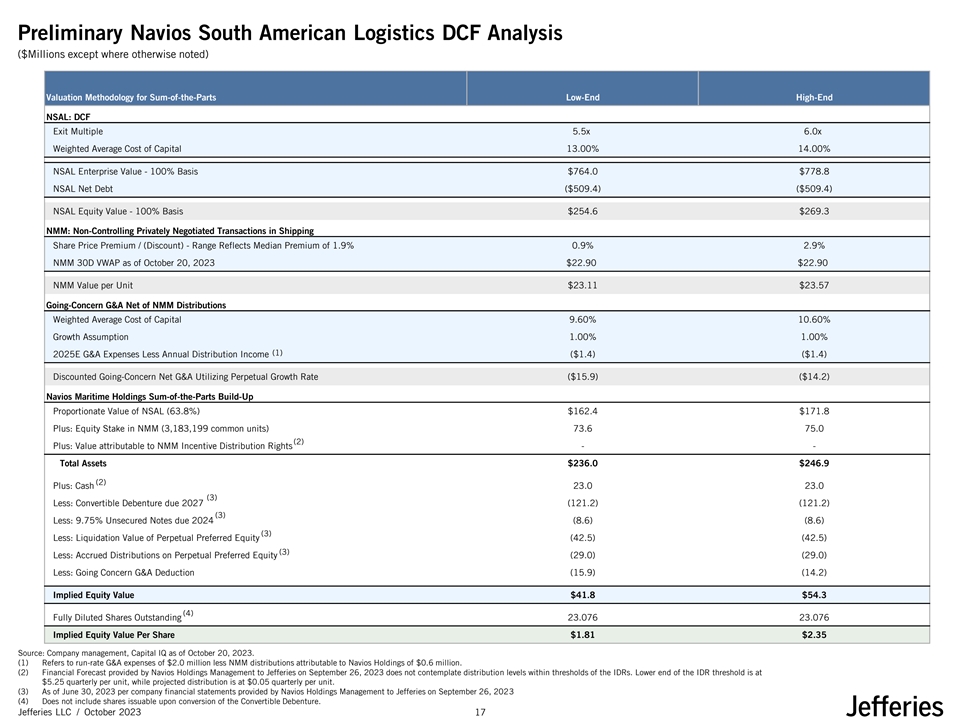

Preliminary Navios South American Logistics DCF Analysis ($Millions except where otherwise noted) Valuation Methodology for Sum-of-the-Parts Low-End High-End NSAL: DCF Exit Multiple 5.5x 6.0x Weighted Average Cost of Capital 13.00% 14.00% NSAL Enterprise Value - 100% Basis $764.0 $778.8 NSAL Net Debt ($509.4) ($509.4) NSAL Equity Value - 100% Basis $254.6 $269.3 NMM: Non-Controlling Privately Negotiated Transactions in Shipping Share Price Premium / (Discount) - Range Reflects Median Premium of 1.9% 0.9% 2.9% NMM 30D VWAP as of October 20, 2023 $22.90 $22.90 NMM Value per Unit $23.11 $23.57 Going-Concern G&A Net of NMM Distributions Weighted Average Cost of Capital 9.60% 10.60% Growth Assumption 1.00% 1.00% (1) 2025E G&A Expenses Less Annual Distribution Income ($1.4) ($1.4) Discounted Going-Concern Net G&A Utilizing Perpetual Growth Rate ($15.9) ($14.2) Navios Maritime Holdings Sum-of-the-Parts Build-Up Proportionate Value of NSAL (63.8%) $162.4 $171.8 Plus: Equity Stake in NMM (3,183,199 common units) 73.6 75.0 (2) Plus: Value attributable to NMM Incentive Distribution Rights - - Total Assets $236.0 $246.9 (2) Plus: Cash 23.0 23.0 (3) Less: Convertible Debenture due 2027 (121.2) (121.2) (3) Less: 9.75% Unsecured Notes due 2024 (8.6) (8.6) (3) Less: Liquidation Value of Perpetual Preferred Equity (42.5) (42.5) (3) Less: Accrued Distributions on Perpetual Preferred Equity (29.0) (29.0) Less: Going Concern G&A Deduction (15.9) (14.2) Implied Equity Value $41.8 $54.3 (4) Fully Diluted Shares Outstanding 23.076 23.076 Implied Equity Value Per Share $1.81 $2.35 Source: Company management, Capital IQ as of October 20, 2023. (1) Refers to run-rate G&A expenses of $2.0 million less NMM distributions attributable to Navios Holdings of $0.6 million. (2) Financial Forecast provided by Navios Holdings Management to Jefferies on September 26, 2023 does not contemplate distribution levels within thresholds of the IDRs. Lower end of the IDR threshold is at $5.25 quarterly per unit, while projected distribution is at $0.05 quarterly per unit. (3) As of June 30, 2023 per company financial statements provided by Navios Holdings Management to Jefferies on September 26, 2023 (4) Does not include shares issuable upon conversion of the Convertible Debenture. Jefferies LLC / October 2023 17

Preliminary Discounted Cash Flow Analysis for Navios South American Logistics ($Millions except where otherwise noted) Discounted Cash Flows Commentary Discounted Cash Flow Analysis Calendar Year Ended Dec 31, ◼ Based on Navios Holdings ($ Millions) H2 2023E 2024E 2025E 2026E 2027E Management forecasts EBITDA $ 53.3 $ 130.8 $ 138.6 $ 142.0 $ 145.2 Less: D&A (17.9) (37.6) (36.8) (36.8) (36.8) ◼ Present value date of June 30, 2023 EBIT $ 35.4 $ 93.2 $ 101.8 $ 105.2 $ 108.4 Less: Taxes (0.8) (1.4) (1.4) (1.4) (1.4) ◼ Mid-year discounting convention NOPAT $ 34.6 $ 91.8 $ 100.4 $ 103.8 $ 107.0 Plus: D&A 17.9 37.6 36.8 36.8 36.8 ◼ Discount rate of 13.0% - 14.0% Less: Increase in NWC (3.0) (1.8) 0.7 0.3 0.2 (see calculation on page 22) (1) (2) (3) (4) (5) Less: Capital Expenditures (37.5) (51.6) (9.1) (34.0) (34.0) ◼ Terminal value utilizes 2025E Unlevered Free Cash Flow $ 12.0 $ 76.0 $ 128.8 $ 106.9 $ 110.0 EBITDA and a 5.5x – 6.0x multiple, based on NSAL trading Terminal Value Implied Enterprise Value Implied Equity Value comparables (see page 13) Exit Multiple 5.8x Terminal Discount Rate Multiple 13.0% 13.5% 14.0% Implied Perpetuity Growth 0.5% 5.5x $764 $751 $739 Terminal Value $ 836.0 5.8x 785 772 759 PV of Terminal Value $ 472.9 6.0x 806 792 779 Total Enterprise Value PV of Unlevered Free Cash Flows $ 298.8 PV of Terminal Value 472.9 Total Enterprise Value $ 771.6 Implied Equity Value 2024E EBITDA $ 130.8 Terminal Discount Rate Implied 2024E EBITDA Multiple 5.9x Multiple 13.0% 13.5% 14.0% 5.5x $255 $242 $229 Equity Value 5.8x 275 262 249 Less: Debt $ (555.1) 6.0x 296 283 269 Plus: Cash 45.7 Equity Value $ 262.2 Source: Public filings, Wall Street research, Duff & Phelps, Navios Holdings Management and Capital IQ as of October 20, 2023. Note: Projections prepared by Navios Holdings Management and provided to Jefferies on September 26, 2023 for use in its analysis. (1) Includes both maintenance and growth capital expenditure of $2.7 million and $34.9 million respectively. (2) Includes both maintenance and growth capital expenditure of $1.7 million and $49.9 million respectively. (3) Includes both maintenance and growth capital expenditure of $3.1 million and $6.0 million respectively. (4) Includes both maintenance and growth capital expenditure of $4.0 million and $30.0 million respectively. (5) Includes both maintenance and growth capital expenditure of $4.0 million and $30.0 million respectively. Jefferies LLC / October 2023 18

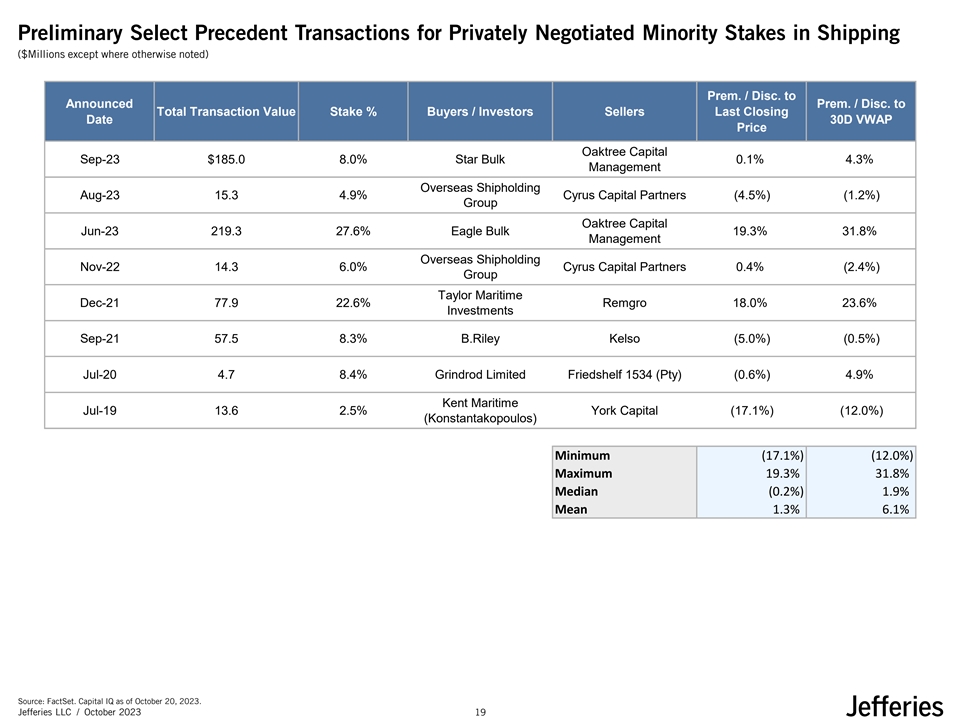

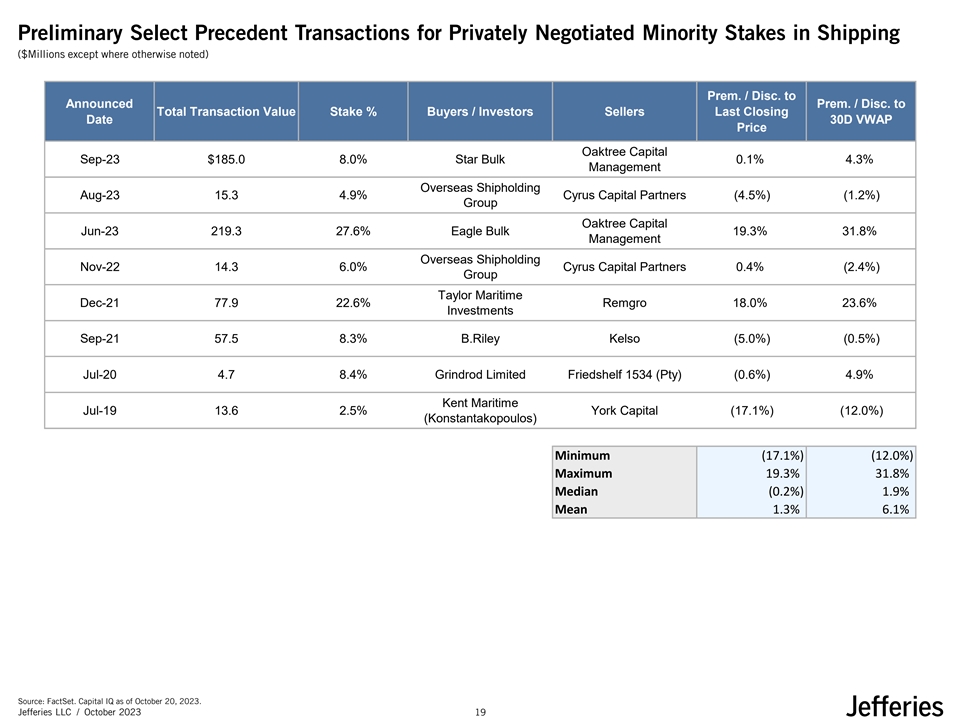

Preliminary Select Precedent Transactions for Privately Negotiated Minority Stakes in Shipping ($Millions except where otherwise noted) Prem. / Disc. to Announced Prem. / Disc. to Total Transaction Value Stake % Buyers / Investors Sellers Last Closing Date 30D VWAP Price Oaktree Capital Sep-23 $185.0 8.0% Star Bulk 0.1% 4.3% Management Overseas Shipholding Aug-23 15.3 4.9% Cyrus Capital Partners (4.5%) (1.2%) Group Oaktree Capital Jun-23 219.3 27.6% Eagle Bulk 19.3% 31.8% Management Overseas Shipholding Nov-22 14.3 6.0% Cyrus Capital Partners 0.4% (2.4%) Group Taylor Maritime Dec-21 77.9 22.6% Remgro 18.0% 23.6% Investments Sep-21 57.5 8.3% B.Riley Kelso (5.0%) (0.5%) Jul-20 4.7 8.4% Grindrod Limited Friedshelf 1534 (Pty) (0.6%) 4.9% Kent Maritime Jul-19 13.6 2.5% York Capital (17.1%) (12.0%) (Konstantakopoulos) Minimum (17.1%) (12.0%) Maximum 19.3% 31.8% Median (0.2%) 1.9% Mean 1.3% 6.1% Source: FactSet. Capital IQ as of October 20, 2023. Jefferies LLC / October 2023 19

Appendix Jefferies LLC / October 2023 20

Navios Holdings Fully Diluted Shares Outstanding Calculation Shares (millions) Basic Shares Outstanding 22.744 Restricted Stock Units Outstanding 0.082 Vested Options 0.250 Fully Diluted Shares Outstanding 23.076 Shares Issuable Upon Conversion of Convertible Debenture 31.090 Fully Diluted Shares Outstanding incl. Convertible Debenture 54.167 Source: Information provided by Navios Holdings Management to Jefferies on September 26, 2023. Jefferies LLC / October 2023 21

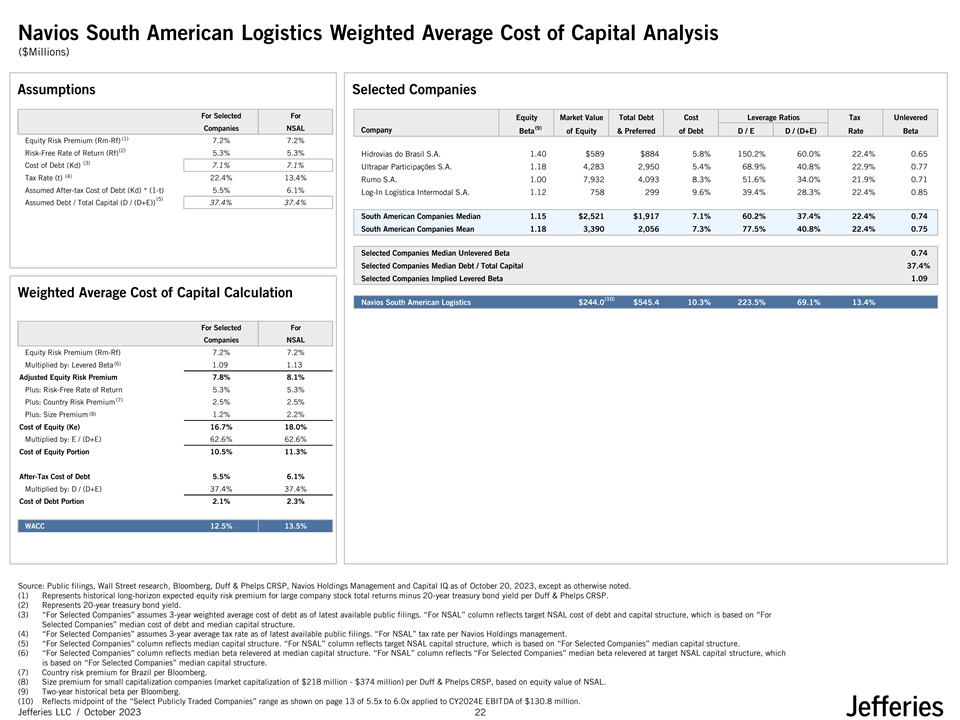

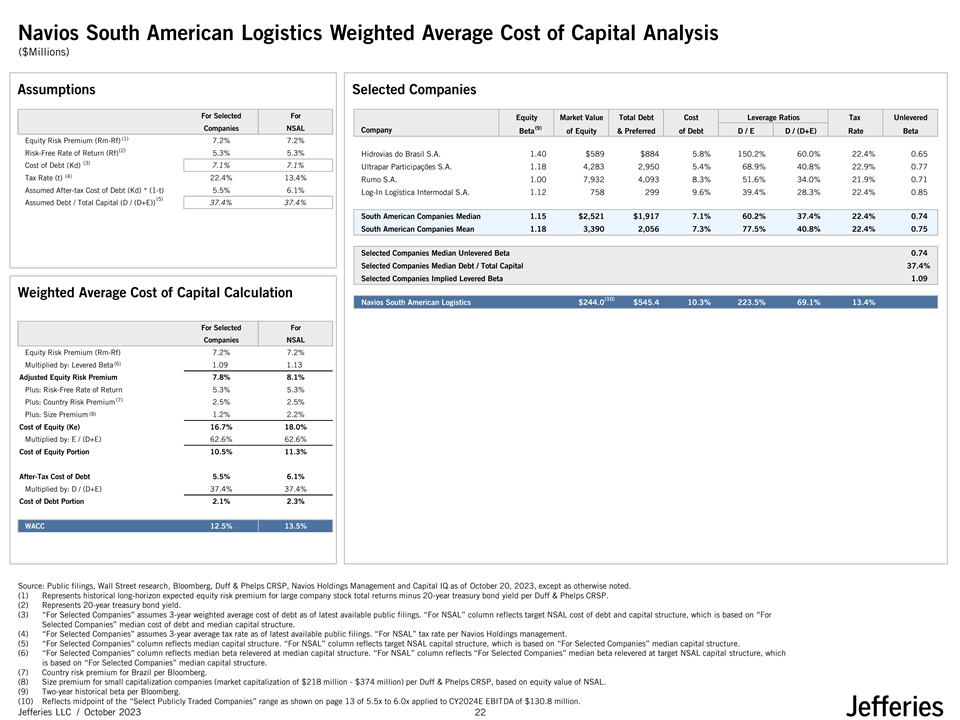

Navios South American Logistics Weighted Average Cost of Capital Analysis ($Millions) Assumptions Selected Companies For Selected For Equity Market Value Total Debt Cost Leverage Ratios Tax Unlevered Companies NSAL (9) Company Beta of Equity & Preferred of Debt D / E D / (D+E) Rate Beta (1) Equity Risk Premium (Rm-Rf) 7.2% 7.2% (2) Risk-Free Rate of Return (Rf) 5.3% 5.3% Hidrovias do Brasil S.A. 1.40 $589 $884 5.8% 150.2% 60.0% 22.4% 0.65 (3) Cost of Debt (Kd) 7.1% 7.1% Ultrapar Participações S.A. 1.18 4,283 2,950 5.4% 68.9% 40.8% 22.9% 0.77 (4) Tax Rate (t) 22.4% 13.4% Rumo S.A. 1.00 7,932 4,093 8.3% 51.6% 34.0% 21.9% 0.71 Assumed After-tax Cost of Debt (Kd) * (1-t) 5.5% 6.1% Log-In Logística Intermodal S.A. 1.12 758 299 9.6% 39.4% 28.3% 22.4% 0.85 (5) Assumed Debt / Total Capital (D / (D+E)) 37.4% 37.4% South American Companies Median 1.15 $2,521 $1,917 7.1% 60.2% 37.4% 22.4% 0.74 South American Companies Mean 1.18 3,390 2,056 7.3% 77.5% 40.8% 22.4% 0.75 Selected Companies Median Unlevered Beta 0.74 Selected Companies Median Debt / Total Capital 37.4% Selected Companies Implied Levered Beta 1.09 Weighted Average Cost of Capital Calculation (10) Navios South American Logistics $244.0 $545.4 10.3% 223.5% 69.1% 13.4% For Selected For Companies NSAL Equity Risk Premium (Rm-Rf) 7.2% 7.2% (6) Multiplied by: Levered Beta 1.09 1.13 Adjusted Equity Risk Premium 7.8% 8.1% Plus: Risk-Free Rate of Return 5.3% 5.3% (7) Plus: Country Risk Premium 2.5% 2.5% (8) Plus: Size Premium 1.2% 2.2% Cost of Equity (Ke) 16.7% 18.0% Multiplied by: E / (D+E) 62.6% 62.6% Cost of Equity Portion 10.5% 11.3% After-Tax Cost of Debt 5.5% 6.1% Multiplied by: D / (D+E) 37.4% 37.4% Cost of Debt Portion 2.1% 2.3% WACC 12.5% 13.5% Source: Public filings, Wall Street research, Bloomberg, Duff & Phelps CRSP, Navios Holdings Management and Capital IQ as of October 20, 2023, except as otherwise noted. (1) Represents historical long-horizon expected equity risk premium for large company stock total returns minus 20-year treasury bond yield per Duff & Phelps CRSP. (2) Represents 20-year treasury bond yield. (3) “For Selected Companies” assumes 3-year weighted average cost of debt as of latest available public filings. “For NSAL” column reflects target NSAL cost of debt and capital structure, which is based on “For Selected Companies” median cost of debt and median capital structure. (4) “For Selected Companies” assumes 3-year average tax rate as of latest available public filings. “For NSAL” tax rate per Navios Holdings management. (5) “For Selected Companies” column reflects median capital structure. “For NSAL” column reflects target NSAL capital structure, which is based on “For Selected Companies” median capital structure. (6) “For Selected Companies” column reflects median beta relevered at median capital structure. “For NSAL” column reflects “For Selected Companies” median beta relevered at target NSAL capital structure, which is based on “For Selected Companies” median capital structure. (7) Country risk premium for Brazil per Bloomberg. (8) Size premium for small capitalization companies (market capitalization of $218 million - $374 million) per Duff & Phelps CRSP, based on equity value of NSAL. (9) Two-year historical beta per Bloomberg. (10) Reflects midpoint of the “Select Publicly Traded Companies” range as shown on page 13 of 5.5x to 6.0x applied to CY2024E EBITDA of $130.8 million. Jefferies LLC / October 2023 22

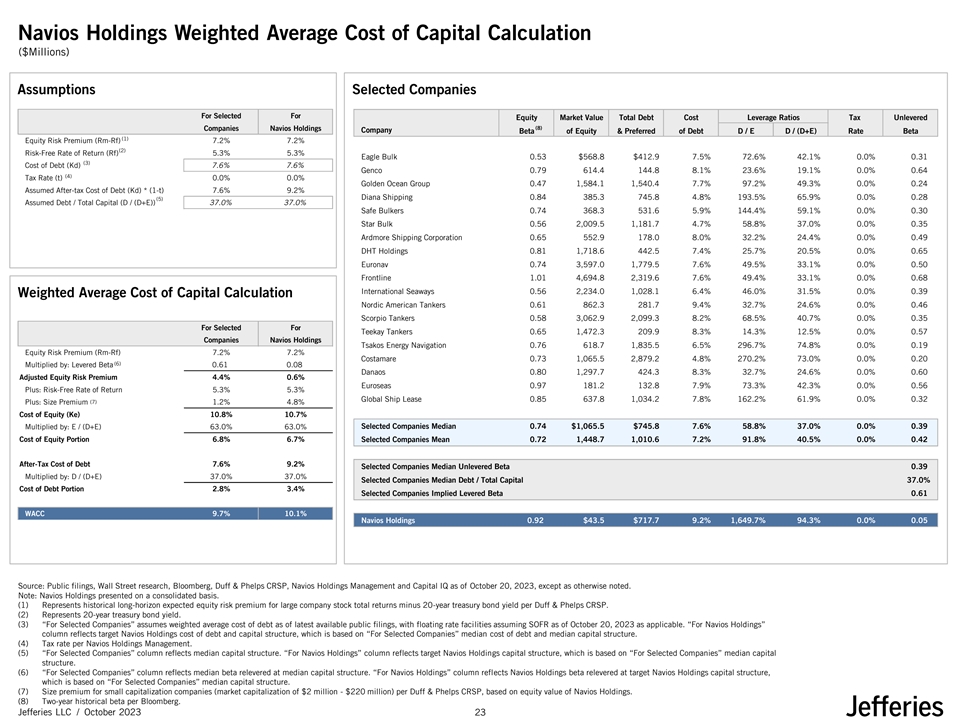

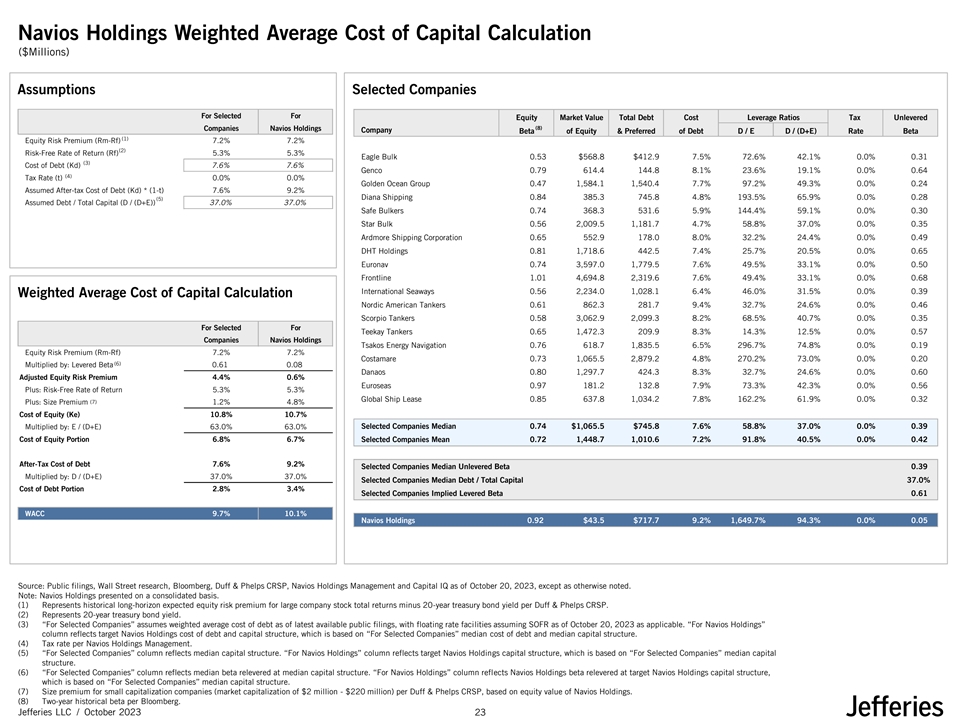

Navios Holdings Weighted Average Cost of Capital Calculation ($Millions) Assumptions Selected Companies For Selected For Equity Market Value Total Debt Cost Leverage Ratios Tax Unlevered Companies Navios Holdings (8) Company Beta of Equity & Preferred of Debt D / E D / (D+E) Rate Beta (1) Equity Risk Premium (Rm-Rf) 7.2% 7.2% (2) Risk-Free Rate of Return (Rf) 5.3% 5.3% Eagle Bulk 0.53 $568.8 $412.9 7.5% 72.6% 42.1% 0.0% 0.31 (3) Cost of Debt (Kd) 7.6% 7.6% Genco 0.79 614.4 144.8 8.1% 23.6% 19.1% 0.0% 0.64 (4) Tax Rate (t) 0.0% 0.0% Golden Ocean Group 0.47 1,584.1 1,540.4 7.7% 97.2% 49.3% 0.0% 0.24 Assumed After-tax Cost of Debt (Kd) * (1-t) 7.6% 9.2% Diana Shipping 0.84 385.3 745.8 4.8% 193.5% 65.9% 0.0% 0.28 (5) Assumed Debt / Total Capital (D / (D+E)) 37.0% 37.0% Safe Bulkers 0.74 368.3 531.6 5.9% 144.4% 59.1% 0.0% 0.30 Star Bulk 0.56 2,009.5 1,181.7 4.7% 58.8% 37.0% 0.0% 0.35 Ardmore Shipping Corporation 0.65 552.9 178.0 8.0% 32.2% 24.4% 0.0% 0.49 DHT Holdings 0.81 1,718.6 442.5 7.4% 25.7% 20.5% 0.0% 0.65 Euronav 0.74 3,597.0 1,779.5 7.6% 49.5% 33.1% 0.0% 0.50 Frontline 1.01 4,694.8 2,319.6 7.6% 49.4% 33.1% 0.0% 0.68 International Seaways 0.56 2,234.0 1,028.1 6.4% 46.0% 31.5% 0.0% 0.39 Weighted Average Cost of Capital Calculation Nordic American Tankers 0.61 862.3 281.7 9.4% 32.7% 24.6% 0.0% 0.46 Scorpio Tankers 0.58 3,062.9 2,099.3 8.2% 68.5% 40.7% 0.0% 0.35 For Selected For Teekay Tankers 0.65 1,472.3 209.9 8.3% 14.3% 12.5% 0.0% 0.57 Companies Navios Holdings Tsakos Energy Navigation 0.76 618.7 1,835.5 6.5% 296.7% 74.8% 0.0% 0.19 Equity Risk Premium (Rm-Rf) 7.2% 7.2% Costamare 0.73 1,065.5 2,879.2 4.8% 270.2% 73.0% 0.0% 0.20 (6) Multiplied by: Levered Beta 0.61 0.08 Danaos 0.80 1,297.7 424.3 8.3% 32.7% 24.6% 0.0% 0.60 Adjusted Equity Risk Premium 4.4% 0.6% Euroseas 0.97 181.2 132.8 7.9% 73.3% 42.3% 0.0% 0.56 Plus: Risk-Free Rate of Return 5.3% 5.3% Global Ship Lease 0.85 637.8 1,034.2 7.8% 162.2% 61.9% 0.0% 0.32 (7) Plus: Size Premium 1.2% 4.8% Cost of Equity (Ke) 10.8% 10.7% Multiplied by: E / (D+E) 63.0% 63.0% Selected Companies Median 0.74 $1,065.5 $745.8 7.6% 58.8% 37.0% 0.0% 0.39 Cost of Equity Portion 6.8% 6.7% Selected Companies Mean 0.72 1,448.7 1,010.6 7.2% 91.8% 40.5% 0.0% 0.42 After-Tax Cost of Debt 7.6% 9.2% Selected Companies Median Unlevered Beta 0.39 Multiplied by: D / (D+E) 37.0% 37.0% Selected Companies Median Debt / Total Capital 37.0% Cost of Debt Portion 2.8% 3.4% Selected Companies Implied Levered Beta 0.61 WACC 9.7% 10.1% Navios Holdings 0.92 $43.5 $717.7 9.2% 1,649.7% 94.3% 0.0% 0.05 Source: Public filings, Wall Street research, Bloomberg, Duff & Phelps CRSP, Navios Holdings Management and Capital IQ as of October 20, 2023, except as otherwise noted. Note: Navios Holdings presented on a consolidated basis. (1) Represents historical long-horizon expected equity risk premium for large company stock total returns minus 20-year treasury bond yield per Duff & Phelps CRSP. (2) Represents 20-year treasury bond yield. (3) “For Selected Companies” assumes weighted average cost of debt as of latest available public filings, with floating rate facilities assuming SOFR as of October 20, 2023 as applicable. “For Navios Holdings” column reflects target Navios Holdings cost of debt and capital structure, which is based on “For Selected Companies” median cost of debt and median capital structure. (4) Tax rate per Navios Holdings Management. (5) “For Selected Companies” column reflects median capital structure. “For Navios Holdings” column reflects target Navios Holdings capital structure, which is based on “For Selected Companies” median capital structure. (6) “For Selected Companies” column reflects median beta relevered at median capital structure. “For Navios Holdings” column reflects Navios Holdings beta relevered at target Navios Holdings capital structure, which is based on “For Selected Companies” median capital structure. (7) Size premium for small capitalization companies (market capitalization of $2 million - $220 million) per Duff & Phelps CRSP, based on equity value of Navios Holdings. (8) Two-year historical beta per Bloomberg. Jefferies LLC / October 2023 23