MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

INTRODUCTION

The following discussion of the operating results and financial position of Jaguar Mining Inc. (“Jaguar" or the "Company”) should be read in conjunction with the annual audited consolidated financial statements and the notes thereto of the Company for the years ended 2008 and 2007. The financial statements have been prepared in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”) and the annual audited financial statements have been reconciled to U.S. generally accepted accounting principles (“U.S. GAAP”). The Company reports its financial statements in US dollars (“US$”), however a significant portion of the Company's expenses are incurred in either Canadian dollars (“Cdn.$”) or Brazilian reais (“R$”).

The discussion and analysis contained in this MD&A are as of March 23, 2009.

FORWARD-LOOKING STATEMENTS

Certain statements in this Management’s Discussion and Analysis (“MD&A”) constitute "Forward-Looking Statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Canadian securities legislation. These Forward-Looking Statements include, among others, statements concerning the Company's future objectives, measured and indicated resources and proven and probable reserves, their average grade, the commencement period of production, cash operating costs and completion dates of feasibility studies, gold production and sales targets, capital expenditure costs, future profitability and growth in reserves. Forward-Looking Statements can be identified by the use of words, such as "are expected", "is forecast", “is targeted”, "approximately" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-Looking Statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, or performance to be materially different from any future results or performance expressed or implied by the Forward-Looking Statements.

These factors include the inherent risks involved in the exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating gold prices and monetary exchange rates, the possibility of project cost delays and overruns or unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future, uncertainties related to production rates, timing of production and the cash and total costs of production, changes in applicable laws including laws related to mining development, environmental protection, and the protection of the health and safety of mine workers, the availability of labour and equipment, the possibility of labour strikes and work stoppages and changes in general economic conditions. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward-Looking Statements, there may be other factors that could cause actions, events or results to differ from those anticipated, estimated or intended.

These Forward-Looking Statements represent our views as of the date of this discussion. The Company anticipates that subsequent events and developments may cause the Company's views to change. The Company does not undertake to update any Forward-Looking Statements, either written or oral, that may be made from time to time by, or on behalf of the Company, subsequent to the date of this discussion, other than as required by law. For a discussion of important factors affecting the Company, including fluctuations in the price of gold and exchange rates, uncertainty in the calculation of mineral resources, competition, uncertainty concerning geological conditions and governmental regulations and assumptions underlying the Company's Forward-Looking Statements, see the "CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS" and "RISK FACTORS" as filed in the Company’s Annual Information Form for the year ended December 31, 2008, filed on SEDAR and available at www.sedar.com, and its filings, including the Company's Annual Report on Form 40-F for the year ended December 31, 2008, filed with the U.S. Securities and Exchange Commission, which are available at www.sec.gov on EDGAR. Further information about the Company is available on its corporate website www.jaguarmining.com.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF INFERRED AND MEASURED AND INDICATED RESOURCES

This document includes the term "inferred resources" and "measured and indicated resources". The Company advises U.S. investors that while such terms are recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.U.S. investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into proven or probable reserves.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

"Inferred resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that any part or all of an inferred resource exists or is economically or legally mineable.

SUMMARY DESCRIPTION OF JAGUAR’S BUSINESS

Jaguar is engaged in gold production and in the acquisition, exploration, development and operation of gold producing properties in the Iron Quadrangle region of Brazil, a greenstone belt located near the city of Belo Horizonte in the state of Minas Gerais. Through a joint venture with Xstrata plc (“Xstrata”), the Company is also engaged in gold exploration at a greenfield site in the northeast of Brazil covering 159,000 acres. In addition, the Company may consider the acquisition and subsequent exploration, development and operation of other gold properties in Brazil.

The Company is currently producing gold at its Turmalina, Paciência and Sabará operations. During 2008, the Company finalized NI 43-101 compliant feasibility studies for the Phase I Expansion of the Turmalina operation and the Caeté Project, which were filed on SEDAR on September 11 and September 17, respectively. The Turmalina expansion and the Caeté Project build-out are expected to be completed during the third quarter of 2009 and the second quarter of 2010, respectively.

The Company intends to become a sustainable mid-sized gold producer of between 620,000 ounces and 700,000 ounces of gold in 2014. The Company believes that the development initiatives it has carried out to date, which include over 30 km of underground development at its properties in Minas Gerais, give it a reasonable basis to express confidence that sufficient mineral resources exist and additional resources will be identified to reach and sustain its production targets for the foreseeable future. The Company’s primary properties remain open at depth and along strike. Given the management team's extensive experience operating in the Iron Quadrangle, coupled with the geological characteristics of other gold operations in the same district, management believes the identification of additional gold resources to meet the Company’s production targets will not be a constraining issue.

The Company’s objective is to enhance shareholder value by building, expanding and operating low-cost gold mines and by adding resources and reserves at its existing properties. The Company plans to achieve this objective by completing the development of its Caeté Project and expanding overall production at its three largest properties. The Company continues to aggressively explore and develop its resources in Brazil. The Company has sought to reduce its risk profile and to differentiate itself from other junior mining companies by developing and expanding several mining operations rather than focusing on one operation. This strategy will also allow the Company to rapidly grow the overall business if exploration confirms that mineral resources can be expanded at any of its mines. Management believes that the Company’s well-developed infrastructure, high grade resource base, experienced personnel and its fully developed health, safety and environment program favorably positions the Company to achieve attractive growth at relatively low risk compared with other junior gold developers.

The Company believes it now has and will maintain at various levels of production a cost structure that will ensure its competitiveness. Based on cash on hand and assumptions concerning production costs, foreign currency exchange rates, forward gold prices and limited borrowings, the Company believes it has the required funds to execute on its plans. A sensitivity analysis, which addresses deviations from certain base assumptions for feed grade, costs, and other variables, used in the development of various technical reports the Company has previously filed, is provided in the Company’s Annual Information Form for the year ended December 31, 2008, dated February 11, 2009 and is available on SEDAR at www.sedar.com.

PROJECT DEVELOPMENT REVIEW - OPERATIONS AND EXPLORATION

Production

During the quarter ended December 31, 2008, the Company produced a total of 37,916 ounces of gold at Turmalina, Paciência and Sabará at an average cash operating cost of $396 per ounce compared to 20,463 ounces at an average cash operating cost of $405 per ounce during the same period last year. Gold production for the quarter ended December 31, 2008 increased 85% from the comparable quarter in 2007. Cash operating costs decreased slightly in comparison to the same period last year. The average exchange rate for the quarter ended December 31, 2008 was R$2.28/US$1.00 compared to R$1.78/US$1.00 for the quarter ended December 31, 2007.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

During the year ended December 31, 2008, the Company produced a total of 115,348 ounces of gold at Turmalina, Paciência and Sabará at an average cash operating cost of $429 per ounce compared to 70,113 ounces at an average cash operating cost of $346 per ounce during the year ended December 31, 2007, an increase in ounces produced of 64%.Cash operating costs in 2008 increased by 24% in comparison to 2007 due to the commissioning of the Paciência operation and exchange rates, which were unfavorable on balance. The average exchange rate for the year ended December 31, 2008 was R$1.84/US$1.00 compared to R$1.95/US$1.00 for the year ended December 31, 2007.

The Company’s 2009 production and cash operating cost estimates are as follows:

| Operation | Production (oz) | Cash Operating Cost ($/oz) |

| Turmalina | 80,000-85,000 | $354-387 |

| Paciência | 65,000-70,000 | $362-398 |

| Sabará | 20,000 | $374-411 |

| Total | 165,000-175,000 | $360-394 |

Note: Estimated cash costs are based on R$2.00 to R$2.20 per US$1.00.

[The remainder of this page has been left intentionally blank]

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

Production and Operating Performance

The following tables set forth certain operating data at Turmalina, Paciência and Sabará for the quarter and year ended December 31, 2008 and 2007.

| Quarter Ended December 31, 2008 Operating Data | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Ore Processed (t000) | | | Feed grade (g/t) | | | Plant Recovery rate (%) | | | Production (ounces) | | | Cash Operating cost/t | | | Cash Operating cost/ounce | |

| Sabará | | | 105 | | | | 1.62 | | | | 65 | | | | 4,506 | | | $ | 21.20 | | | $ | 641 | |

| Turmalina | | | 128 | | | | 5.93 | | | | 89 | | | | 19,987 | | | | 52.80 | | | | 330 | |

| Paciência | | | 147 | | | | 3.43 | | | | 92 | | | | 13,423 | | | | 41.20 | | | | 413 | |

| Total | | | 380 | | | | 3.78 | | | | 87 | | | | 37,916 | | | $ | 39.60 | | | $ | 396 | |

| Quarter Ended December 31, 2007 Operating Data | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Ore Processed (t000) | | | Feed grade (g/t) | | | Plant Recovery rate (%) | | | Production (ounces) | | | Cash Operating cost/t | | | Cash Operating cost/ounce | |

| Sabará | | | 140 | | | | 1.76 | | | | 69 | | | | 6,444 | | | $ | 21.90 | | | $ | 534 | |

| Turmalina | | | 96 | | | | 5.51 | | | | 87 | | | | 14,019 | | | | 55.70 | | | | 346 | |

| Paciência | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total | | | 236 | | | | 3.28 | | | | 81 | | | | 20,463 | | | $ | 35.60 | | | $ | 405 | |

| 12 Months Ended December 31, 2008 Operating Data | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Ore Processed (t000) | | | Feed grade (g/t) | | | Plant Recovery rate (%) | | | Production (ounces) | | | Cash Operating cost/t | | | Cash Operating cost/ounce | |

| Sabará | | | 475 | | | | 1.54 | | | | 66 | | | | 18,199 | | | $ | 22.50 | | | $ | 667 | |

| Turmalina | | | 481 | | | | 5.46 | | | | 88 | | | | 72,785 | | | | 55.30 | | | | 364 | |

| Paciência | | | 277 | | | | 3.28 | | | | 92 | | | | 24,364 | | | | 43.00 | | | | 443 | |

| Total | | | 1,233 | | | | 3.46 | | | | 85 | | | | 115,348 | | | $ | 39.90 | | | $ | 429 | |

| 12 Months Ended December 31, 2007 Operating Data | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Ore Processed (t000) | | | Feed grade (g/t) | | | Plant Recovery rate (%) | | | Production (ounces) | | | Cash Operating cost/t | | | Cash Operating cost/ounce | |

| Sabará | | | 504 | | | | 2.07 | | | | 67 | | | | 24,586 | | | $ | 22.70 | | | $ | 462 | |

| Turmalina | | | 347 | | | | 5.1 | | | | 87 | | | | 45,527 | | | | 42.80 | | | | 283 | |

| Paciência | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total | | | 851 | | | | 3.31 | | | | 80 | | | | 70,113 | | | $ | 30.90 | | | $ | 346 | |

The Company’s operations, project development and exploration during the quarter and year ended December 31, 2008 are described below.

Turmalina

Operations

Turmalina is an underground mine utilizing the “sublevel stoping” and the “cut and fill” mining methods with paste fill. Turmalina is currently processing 1,300 tonnes per day (“tpd”) of ore in its carbon-in-pulp (“CIP”) plant, which is the designed operating level.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

During the quarter ended December 31, 2008, Turmalina produced 19,987 ounces of gold at an average cash operating cost of $330 per ounce compared to 14,019 ounces at an average cash operating cost of $346 per ounce during the quarter ended December 31, 2007. Mine production at Turmalina during the quarter totaled 126,777 tonnes at an average ROM grade of 6.01 grams per tonne. The average ROM grade produced during December was 6.75 grams per tonne. For the quarter ended December 31, 2008, the ore processed through the mill totaled 128,438 tonnes at an average feed grade of 5.93 grams per tonne and the average plant recovery rate was 89%, slightly below the design rate of 90%.

During the year ended December 31, 2008, Turmalina produced 72,785 ounces of gold at an average cash operating cost of $364 per ounce compared to 45,527 ounces at an average cash operating cost of $283 per ounce during the year ended December 31, 2007. Steps initiated by management during the second quarter of 2008 to limit mine dilution, which negatively impacted ore grades during the first half of the year, have brought results back on plan during the second half of 2008. Turmalina mine production during the year totaled 497,122 tonnes at an average ROM grade of 5.31 grams per tonne. The ore processed through the mill totaled 480,814 tonnes at an average feed grade of 5.46 grams per tonne. The average plant recovery rate was 88%.

Expansion

On September 11, 2008, the Company filed the NI 43-101 compliant Turmalina Phase I Expansion feasibility study on SEDAR, which added an estimated 1,265,802 tonnes at an average 3.12 grams per tonne containing 127,000 ounces of proven and probable gold reserves to the Turmalina reserve base.

As a result, the Company initiated the first phase of a planned three-phase expansion program at the Turmalina processing plant. In the current expansion, the Company intends to increase gold production by 25% from its present design rate of approximately 80,000 ounces per year to 100,000 ounces per year. Earthwork for the crushing and screening plant, grinding and milling plant and hydrometallurgical plant has been completed. Detailed engineering is nearing completion and civil works began during February 2009. The expansion is expected to be completed during the third quarter of 2009.

Exploration - - Brownfield

Jaguar’s reported mineral resources and reserves for Turmalina are to a depth of approximately 500 meters where the mineralized structure is open at depth and along strike. As part of a recent drill program to prove the continuity of the mineralization at Ore Body A to a depth of over 800 meters, Jaguar drilled four holes to depths ranging from 850 meters to 1,100 meters. Two of these drill holes intersected the mineralized structure in the Ore Body A to a depth of approximately 800 meters. A grade of approximately 7.00 grams per tonne was encountered in a narrow zone at depth thereby confirming the extension of the mineralized structure. Jaguar’s team believes the size of the mineralized structure and mineralization is similar to the existing reserve base in this ore body to the depth of 500 meters. This is also consistent with the characteristics of other gold mines in the Iron Quadrangle, some of which have operated to depths of 2,400 meters. Jaguar intends to update the inferred resources category at Turmalina but does not have any plans to conduct further deep drilling at Turmalina at this time.

As part of the surface exploration to estimate resource potential in a newly discovered oxide zone at Ore Body B, several trenches were opened in the outcropping to expose and sample the mineralized zone. Channel samples revealed two separate mineralized areas with average surface grades ranging from 3.00 grams per tonne to 5.00 grams per tonne. Jaguar’s team intends to update the geological model to incorporate this new data into the overall mine model. The oxide ore from this new zone would be blended with sulfide ore and processed through the Turmalina Plant, providing immediate additional lower cost ore.

At Ore Body C and Zone D, additional gold bearing oxide ore has been identified in the weathered rock above the sulfide zone. During 2008, the Company completed 11,698 meters of drilling in 62 drill holes in the Satinoco structure to estimate oxide and sulfide mineral resources. Jaguar expects to complete the resource estimate by the third quarter of 2009.

Jaguar has also discovered a new target at the Turmalina mining complex, the Fazenda Experimental Target, which management believes has significant potential and is unrelated to the mineralized on-strike zone associated with Ore Bodies A, B and C and Zone D. The Fazenda Experimental Target is located approximately five kilometres from the Turmalina Plant in a structure parallel to the existing ore bodies and zones, where historic mining work at shallow depths can be seen. Jaguar has conducted limited soil sampling, trenching and other geo-chemical work in the area over the past two years.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

During the third quarter of 2008, four drill holes totalling 716 meters were carried out at Fazenda Experimental, which included 200 meters along strike. Three drill holes intercepted mineralized structures. Intersection grades varied from 2.9 grams per tonne to 6.5 grams per tonne at intervals of three meters or less. Additional trenching has provided evidence that the continuity near the surface extends well beyond areas where no drilling has taken place.

During 2009, Jaguar intends to conduct additional underground exploration as part of the forward development of Turmalina’s Ore Bodies A, B and C, as well as in Zone D and at the Fazenda Experimental Target to increase resources and reserves to further expand Turmalina’s annual production beyond the current plan of 100,000 ounces.

Paciência

Operations

Paciência’s Santa Isabel Mine is an underground mine utilizing the cut and fill mining method and a treated tailings backfill system. Ore produced at the Santa Isabel Mine is transported to the new 1,800 tpd CIP processing plant, which was commissioned during the second quarter of 2008. On July 24, 2008, Paciência reported its first gold pour and operations at its processing plant were deemed commercial during the latter part of the quarter ended December 31, 2008 based on throughput rates.

During the quarter ended December 31, 2008, Paciência produced 13,423 ounces of gold at an average cash operating cost of $413 per ounce. Mine production at Paciência totaled 114,785 tonnes at an average ROM grade of 3.29 grams per tonne, which includes 7,014 tonnes at an average grade of 5.43 grams per tonne from the Pilar Mine. The ore processed through the mill totaled 146,666 tonnes at an average feed grade of 3.43 grams per tonne. The average plant recovery was on plan at 92%.

During the year ended December 31, 2008, Paciência produced 24,364 ounces of gold at an average cash operating cost of $443 per ounce. Mine production, primarily at Paciência’s Santa Isabel Mine and a small portion from the Pilar Mine, totaled 283,245 tonnes at an average ROM grade of 3.29 grams per tonne. The ore processed through the mill totaled 277,431 tonnes at an average feed grade of 3.28 grams per tonne. Management expects the ROM grade for the Santa Isabel Mine will continue to rise during 2009. The average plant recovery was 92% for the year ended December 31, 2008.

As of March 23, 2009, mining rates at the Santa Isabel Mine are at design levels required to feed the processing plant.

Exploration - - Brownfield

During the year ended December 31, 2008, the Company conducted extensive underground development and exploration activities at the NW01 Target (Marzagão), the Conglomerates Target (Palmital) and other targets in the area to add additional tonnes of ore both vertically and horizontally in an effort to increase the resource base for the Paciência operation. As part of the exploration program, a total of 12,814 meters totaling 64 drill holes were carried out during 2008.

Grades observed at the NW01 Target are similar to those measured at the Santa Isabel Mine.The new access ramp, which is 5 meters x 5 meters in size, was completed early in 2008. A total of 1,191 meters of ramp and drifts have been developed toward the Santa Isabel Mine located two kilometers to the south of the NW01 portal. This cross cut will eventually intersect the second level of the Santa Isabel Mine. During this development, two new mineralized zones were encountered. Channel samples were taken and the Company decided to develop a drift across the zone. Management believes blind ore shoots likely exist along the contiguous 20-kilometer concession base. By extending the ramp to the second level of the Santa Isabel Mine, the Company’s management expects to increase the tonnes of ore per vertical meter that can be mined and processed along strike.

The mineralized zones are partially exposed, with approximately 30 meters in length and 1 meter to 3 meters in width. Channel sampling in this area confirms grades ranging from 1 gram per tonne to 10 grams per tonne. The extension is open to the North West and the North East. Drill holes from the surface indicate additional mineralized zone. A drill hole from the area had high amounts of “free” gold and a grade of 595 grams per tonne over 0.7 meters. The shape and other characteristics of this structure suggest that other mineralized zones might be located in the vicinity of the NW01 Target. Two surface rigs are presently drilling in the South East extension of the drift with the objective of intercepting these new zones.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

A second zone of mineralization at Paciência, not related to the São Vicente lineament where the Company has a resource and reserve base, is referred to as the Conglomerates Target.The zone entails several concessions, which are located approximately 12 kilometers east of the Paciência processing plant.The property’s previous owners, the Anschutz Group and Western Mining, carried out exploration campaigns between 1985 and 1990, which included underground development and channel sampling, surface and underground diamond drilling and geological mapping. Based on their efforts, a pre NI 43-101 gold resource of approximately 110,000 ounces was estimated.

In order to estimate the Conglomerates Target resources consistent with NI 43-101 standards, the Company conducted a 7,191 meter in-fill drilling program inside this target zone that consisted of 30 drill holes. The Company also opened a portal into the host rock and developed 60 meters of a 4 meter x 5 meter ramp, which was concrete lined. During 2008, Jaguar carried out 1,306 meters of ramp and drifts to reach levels one and two.

At level one, the conglomerate layer was identified to extend over 100 meters, confirming the grades and widths obtained through surface drilling. At the exposed section, the mineralized conglomerate shows thicknesses that vary from less than 1 meter to 2.5 meters and grades of up to 200 grams per tonne. Partial channel results in the drift already defined a mineralized zone with an average grade of 6.8 grams per tonne over a 150 m2 conglomerate layer area.

The development of exploration drifts in level one will continue to laterally expose the conglomerate layer. Through additional drilling, the Company expects to estimate the resource potential in one known 300-meter section and trace the geometry of the conglomerate reef to depth. At level two, further underground development is being carried out to provide access to the mineralized zone for further in-fill drilling. The Company is currently developing a new resource estimate and views this new structure as a potential significant resource that will provide additional feed for the Paciência processing plant.

Sabará

Operations

Sabará is an above ground mine from which oxide ore is processed at a 1,500 tpd carbon-in-column (“CIC”) plant.

During the quarter ended December 31, 2008, Sabará produced 4,506 ounces of gold at an average cash operating cost of $641 per ounce compared to 6,444 ounces at an average cash operating cost of $534 per ounce during the quarter ended December 31, 2007. Cash operating costs in the quarter were primarily impacted by lower ore grades. As planned, leaching operations were suspended during 2008 due to seasonal impact and will resume in April 2009.

During the year ended December 31, 2008, Sabará produced 18,199 ounces of gold at an average cash operating cost of $667 per ounce compared to 24,586 ounces at an average cash operating cost of $462 per ounce during the year ended December 31, 2007. Cash operating costs during the year were primarily impacted by lower ore grades and unfavorable exchange rates.

During the second half of 2008, the Company initiated stripping operations at the Serra Paraíso mineralized zone and its ore accounted for approximately 19% of the tonnage processed at the Sabará Plant during the quarter. Management plans to further reduce mining operations in Zone A at Sabará in early 2009 in favor of higher grade ore from the Serra Paraíso mineralized zone. Production from the Sabará Plant is expected to account for only approximately 10% of Jaguar’s total 2009 production. During 2008, due to its higher average operating cost, Sabará production increased the Company’s overall average cash operating cost by $45/oz. By blending the lower grade ore from Zone A with the higher grade ore from Serra Paraíso, the Company expects to significantly reduce average cash operating costs in 2009.

Exploration - - Brownfield

In order to add oxide resources to feed the Sabará Plant and thereby increase its mine life, the Company developed an exploration program at Sabará and Caeté in a 15,000 hectare area. In addition to the Serra Paraíso Target, which was mentioned above, the Company is conducting channel sampling, soil geochemistry and trenching at three different targets near the Sabará operations. Preliminary results of such exploration identified new targets, which have given rise to a drill program that began in the first quarter of 2009.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

Caeté Project

Development

In September 2008, the Company completed its NI 43-101 compliant feasibility study on the Caeté Project, which includes the Roça Grande and Pilar Mines. Based on the feasibility study, the Caeté Project processing facilities will include crushing and grinding circuits followed by a gravity separation circuit along with a leaching and CIP-ADR (carbon-in-pulp adsorption/desorption/recovery) plant, which will process the sulfide ore from Pilar and Roça Grande Mines and other nearby targets. This new plant is expected to utilize much of the existing infrastructure of the Company’s previously closed Caeté heap leach and CIC facility.The Company intends to use a combination of "cut and fill" and "selective stoping" methods at both mines, which contemplates a treated tailings backfill system.

By the end of the third quarter in 2008 all necessary permits and licenses for the construction and commissioning phase had been received and Jaguar initiated civil works for the milling and treatment circuits.However, in November 2008, due to the retraction in gold prices, deteriorating financial markets and declining equity values worldwide, including the gold sector, the Company temporarily suspended development of the Caeté Project pending an assessment of market conditions and the availability of capital to move the project forward.

Consistent with the decision to suspend the development of the Caeté Project, underground work at the Roça Grande Mine was temporarily suspended; however, development at the Pilar Mine continued. Beginning in December 2008, the Company began transporting ore by truck from the Pilar Mine to the Paciência processing plant to supplement the ore being supplied from Paciência’s Santa Isabel Mine. The Company expects to continue this practice until such time as the ore from the Pilar Mine can be processed at the future Caeté processing plant.

In March 2009, the Company raised Cdn.$86.3 million through a common share offering and announced its decision to retake the Caeté Project. During March 2009, work to complete the Caeté Project was initiated. Earthwork for the crushing and screening plant, grinding and milling plant and hydrometallurgical plant has been completed. Detailed engineering is underway and civil works are expected to begin in April 2009. The Company plans to begin commissioning of the Caeté Plant during the third quarter of 2010.

Exploration - - Brownfield

As part of the Company’s effort to identify and add to its gold resource base at the Caeté Project, 75,000 meters of additional drilling are planned over the next five years in the mineral properties identified to supply the Caeté Plant. During 2008, Jaguar completed 31,500 meters of drilling for a total of 92 drill holes in the exploration concessions that are part of the Caeté Project, in support of completing feasibility studies during the year as well as expanding the overall resource base.

Pedra Branca Project

Exploration - - Greenfield

In March 2007, Jaguar entered into a joint venture agreement with Xstrata to explore the Pedra Branca Project in the State of Ceará in northeastern Brazil. The Pedra Branca Project has mineral rights to 37 concessions totaling approximately 159,000 acres in a 65-kilometer shear zone. The concessions are located in and around municipal areas with good infrastructure.

Xstrata carried out a preliminary exploration program that covered only 25 kilometers of the shear zone. The program identified 10 kilometers of soil anomalies, including two large anomalies referred to as Coelho and Mirador Targets. For the most part, the mineralized formations uncovered by Xstrata’s preliminary efforts are open along the extremity and lead both companies’ geologists to believe the area has significant potential for gold mineralization, which could include the presence of both oxide and sulfide formations in large structures.

Jaguar is currently conducting a comprehensive exploration program at the Pedra Branca Project, including extensive geological mapping, drainage and soil geochemistry, detailing of zones with anomalies, trenching and diamond drilling. During the third quarter of 2007, Jaguar began a diamond drill program to test the continuity of the mineralization at depth. To date, 93 drill holes totaling 8,974 meters have been completed.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

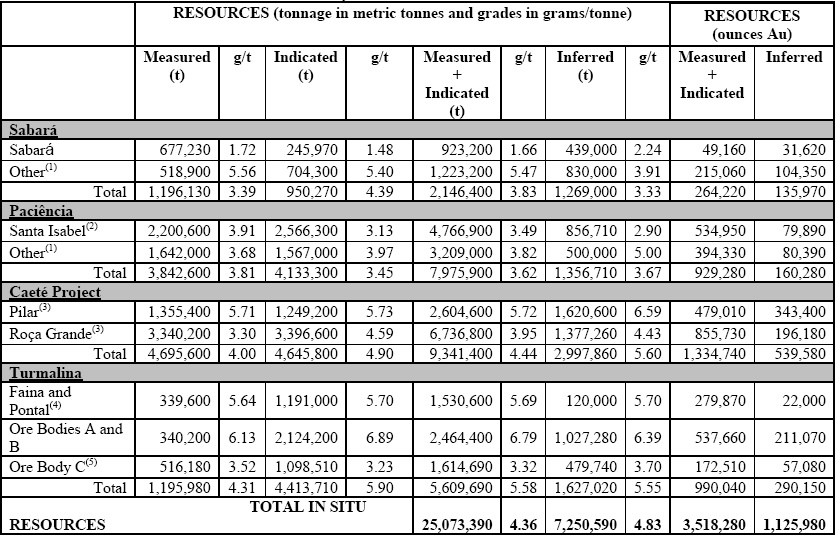

Mineral Resources and Reserves

During 2008, the Company retained TechnoMine to prepare feasibility studies for its Caeté Project and expansion of the Turmalina operation. TechnoMine completed the NI 43-101 compliant feasibility study technical reports on September 9, 2008 and September 15, 2008, respectively.

TechnoMine completed the feasibility studies and in concert with the Company reviewed the information and prepared a table of mineral resources and reserves (the “September 2008 Review”). Ivan C. Machado, M.Sc., P.E., P.Eng. audited the September 2008 Review. Mr. Machado is a Qualified Person as such term is defined in NI 43-101.

Based on the September 2008 Review, the Company reported (i) measured and indicated resources of 23,095,210 tonnes with an average grade of 4.74 grams per tonne containing 3,517,860 ounces of gold and (ii) 6,704,750 tonnes of inferred resources with an average grade of 5.15 grams per tonne containing 1,109,030 ounces of gold. The Company’s proven and probable mineral reserves, which are included in the measured and indicated mineral resource figure above, were 13,510,470 tonnes with an average grade of 4.69 grams per tonne containing 2,033,620 ounces of gold. The figures reported in the September 2008 Review did not consider 2007 and 2008 production from the Turmalina operations and a small test mining production at Paciência in 2006.

In consideration of the significant improvement in global gold prices, the Company and TechnoMine redefined the design criteria to reflect stronger gold markets and completed a review of resources and reserves during the first quarter of 2009. Based on the review Jaguar’s mineral resources are the following as of December 31, 2008 (i) measured and indicated resources of 25,073,390 tonnes with an average grade of 4.36 grams per tonne containing 3,518,280 ounces of gold and (ii) 7,250,590 tonnes of inferred resources with an average grade of 4.83 grams per tonne containing 1,125,980 ounces of gold. Jaguar’s proven and probable mineral reserves, which are included in the measured and indicated mineral resource figure above, are 14,904,840 tonnes with an average grade of 4.16 grams per tonne containing 1,993,550 ounces of gold.

See below detailed tables of Jaguar’s mineral resources and reserves as at December 31, 2008.

Table 1 - Summary of Estimated Mineral Resources*

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

Table 2 - Summary of Estimated Mineral Reserves*

*Mineral resources listed in Table 1 include mineral reserves listed in Table 2. Totals reflect depletion from production through December 31, 2008. Some columns and rows may not total due to rounding.

(1) TechnoMine NI 43-101 Technical Report on the Quadrilátero Gold Project filed on SEDAR on December 20, 2004.

(2) TechnoMine NI 43-101 Technical Report on the Paciência Gold Project Sta. Isabel Mine filed on SEDAR on August 9, 2007. |

(3) TechnoMine NI 43-101 Technical Report on the Caeté Gold Project filed on SEDAR on September 17, 2008.

(4) TechnoMine NI 43-101 Technical Report on the Turmalina Gold Project filed on SEDAR on December 20, 2004.

(5) TechnoMine NI 43-101 Technical Report on the Turmalina Expansion filed on SEDAR on September 11, 2008.

Although the Company has carefully prepared and verified the mineral resource and reserve figures presented herein, such figures are estimates, which are, in part, based on forward-looking information, and no assurance can be given that the indicated level of gold will be produced. Estimated reserves may have to be recalculated based on actual production experience. Market price fluctuations of gold as well as increased production costs or reduced recovery rates, and other factors may render the present proven and probable reserves unprofitable to develop at a particular site or sites for periods of time. See the "CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS" and "RISK FACTORS" as filed in the Company’s Annual Information Form for the year ended December 31, 2008 filed on SEDAR and available at www.sedar.com, and its filings, including the Company's Annual Report on Form 40-F for the year ended December 31, 2008, filed with the U.S. Securities and Exchange Commission, which are available at www.sec.gov on EDGAR.

During the quarter ended December 31, 2008, the market price of gold (London PM fix) traded in a range of $713 to $904, and averaged $795. This was approximately 1% higher than the average price for the quarter ended December 31, 2007. The average market price of gold for the year ended December 31, 2008 was $872, which is 25% higher than the average price for the same period in 2007. The price performance of gold was marked with high levels of volatility. Gold has continued to be influenced by interest rate cuts, volatility in the credit and financial markets, investment demand and inflation expectations. A 10% change in the average market price of gold during the quarter ended and year ended December 31, 2008 would have changed income before income taxes by approximately $3.0 million and $10.1 million respectively.

The Company reports its financial statements in US dollars (“US$”), however a significant portion of the Company's expenses are incurred in either Canadian dollars (“Cdn.$”) or Brazilian reais (“R$”). The strengthening in the average rates of exchange for the US$ caused the Company’s costs reported in US$ to decrease for the quarter ended December 31, 2008. The average rates of exchange for the Cdn.$ per US$1.00 for the quarter ended December 31, 2008 and the quarter ended December 31, 2007 were 1.21 and 0.98 respectively. The average rates of exchange for the R$ per US$1.00 for the quarter ended December 31, 2008 and the quarter ended December 31, 2007 were 2.28 and 1.78 respectively. The impact of a weaker R$ during the fourth quarter of 2008 was not fully reflected in the Company’s cash operating costs during the period, however, the Company expects 2009 cash operating costs will be impacted as the R$ has remained weak compared to the US$. A 10%change in the average rates of exchange during the quarter ended December 31, 2008 would have changed operating income by approximately $4.0 million.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

Summary of Quarterly Results

The following chart summarizes the Company’s quarterly results of operations for the previous eight quarters:

| | | | |

| | | Three Months Ended | |

| (unaudited) | | 31-Dec | | | 30-Sep | | | 30-Jun | | | 31-Mar | | | 31-Dec | | | 30-Sep | | | 30-Jun | | | 31-Mar | |

| ($ in 000s, except per share amounts) | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2007 | | | 2007 | | | 2007 | | | 2007 | |

| Net sales | | $ | 27,874 | | | $ | 25,799 | | | $ | 21,187 | | | $ | 18,797 | | | $ | 14,915 | | | $ | 14,962 | | | $ | 11,415 | | | $ | 6,542 | |

| Net income (loss) | | | (3,443 | ) | | | (1,301 | ) | | | (351 | ) | | | 839 | | | | (14,825 | ) | | | (8,654 | ) | | | (3,685 | ) | | | (496 | ) |

| Basic and diluted income (loss) per share | | | (0.05 | ) | | | (0.02 | ) | | | (0.01 | ) | | | 0.01 | | | | (0.28 | ) | | | (0.16 | ) | | | (0.07 | ) | | | (0.01 | ) |

Net sales over the periods shown above generally trended higher due to both an increase in ounces of gold sold and an increase in the average realized gold price.

Summary of Key Operating Results

| | | | | | | |

| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| (unaudited) | | | | | | | | | | | | |

| ($ in 000s, except per share amounts and shares outstanding) | | | | | | | | | | |

| Gold sales | | | 27,874 | | | | 14,915 | | | | 93,657 | | | | 47,834 | |

| Ounces sold | | | 35,138 | | | | 18,742 | | | | 108,944 | | | | 67,350 | |

| Average sales price $ / ounce | | | 793 | | | | 796 | | | | 860 | | | | 710 | |

| Gross profit | | | 7,103 | | | | 4,007 | | | | 27,354 | | | | 14,289 | |

| Net income (loss) | | | (3,443 | ) | | | (14,825 | ) | | | (4,256 | ) | | | (27,660 | ) |

| Basic and diluted earnings (loss) per share | | | (0.05 | ) | | | (0.28 | ) | | | (0.07 | ) | | | (0.52 | ) |

| Weighted avg. # of shares outstanding - basic | | | 63,982,281 | | | | 55,494,155 | | | | 62,908,676 | | | | 53,613,175 | |

| Weighted avg. # of shares outstanding - diluted | | | 63,982,281 | | | | 55,494,155 | | | | 62,908,676 | | | | 53,613,175 | |

Quarter and Year to Date ended December 31, 2008 compared to December 31, 2007

Sales in the quarter ended December 31, 2008 increased $13.0 million or 87% from the quarter ended December 31, 2007, due to an increase in ounces of gold sold. The number of ounces of gold sold increased 87% to 35,138 ounces in the quarter ended December 31, 2008 compared to 18,742 ounces in the quarter ended December 31, 2007. The average realized gold price decreased to $793 per ounce from $796 per ounce in the same quarter last year.

Sales for the year ended December 31, 2008 increased $45.8 million or 96% compared to the year ended December 31, 2007 due to both an increase of ounces of gold sold and an increase in the average realized gold price. The number of ounces of gold sold increased 62% to 108,944 in the year ended December 31, 2008 compared to 67,350 ounces in the year ended December 31, 2007. The average realized gold price increased to $860 in the year ended December 31, 2008 per ounce from $710 per ounce in the year ended December 31, 2007.

Gross profit for the quarter ended December 31, 2008 increased to $7.1 million from $4.0 million for the quarter ended December 31, 2007. For the year ended December 31, 2008 gross profit increased to $27.4 million from $14.3 million for the same period in 2007 due primarily to the increase in sales. The Company recognized net losses of $3.4 million and $14.8 million for the quarters ended December 31, 2008 and 2007 respectively. For the year ended December 31, 2008 the Company recognized net losses $4.3 million versus a net loss of $27.7 million for the same period in 2007.

[The remainder of this page has been left intentionally blank]

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

Review of Certain Operating Expenses and Other Income and Expenses

| | | | | | | |

| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| (unaudited) | | | | | | | | | | | | |

| ($ in 000s) | | | | | | | | | | | | |

| Stock based compensation | | | 564 | | | | 5,899 | | | | 1,262 | | | | 10,750 | |

| Administration | | | 3,249 | | | | 2,657 | | | | 12,571 | | | | 9,617 | |

| Forward derivative loss | | | - | | | | 3,820 | | | | 318 | | | | 9,908 | |

| Forward fx derivative loss (gain) | | | 2,718 | | | | (966 | ) | | | 2,623 | | | | (3,690 | ) |

| Foreign exchange loss (gain) | | | 272 | | | | (130 | ) | | | (2,477 | ) | | | (2,280 | ) |

| Interest expense | | | 1,493 | | | | 3,523 | | | | 11,584 | | | | 11,170 | |

| Interest income | | | (391 | ) | | | (1,373 | ) | | | (3,850 | ) | | | (4,601 | ) |

Stock based compensation expense varies depending upon when stock options, deferred share units, restricted share units, and stock appreciation rights vest.

Administration costs increased from $2.7 million during the quarter ended December 31, 2007 to $3.2 million during the quarter ended December 31, 2008 and increased from $9.6 million during the year ended December 31, 2007 to $12.6 million for the same period in 2008. The annual increase was mainly due to costs for legal and accounting including those associated with first time compliance with the Sarbanes Oxley Act. In addition, costs increased due to the strengthening of the R$ against the US$. The average exchange rate for the year ended December 31, 2008 was R$1.84 per US$1.00 compared to R$1.95 per US$1.00 for the year ended December 31, 2007. The Company’s administration costs are generally in-line with other South American gold producers on a unit of production basis and are viewed by management as appropriate to achieve the Company’s growth targets.

During the quarter ended December 31, 2007, the Company recognized a loss of $3.8 million on forward derivative contracts the Company purchased as required by the lender for the Turmalina loan facility to manage the commodity price exposure on gold sales. Losses of $318,000 and $9.9 million were recognized in the year ended December 31, 2008 and 2007 respectively associated with increases in the price of gold. During the quarter ended March 31, 2008, the Company closed the forward sales and forward purchase contracts. (See Risk Management Policies - Hedging).

The Company recognized an unrealized loss of $1.6 million for the quarter ended December 31, 2008 versus an unrealized loss of $472,000 for the quarter ended December 31, 2007 on forward foreign exchange contracts used to manage currency exposure on the R$. The Company also recognized a realized loss of $1.1 million for the quarter ended December 31, 2008 versus a realized gain $1.4 million for the quarter ended December 31, 2007 on forward foreign exchange contracts. For the year ended December 31, 2008 the Company recognized an unrealized loss of $4.1 million and a realized gain of $1.5 million compared to an unrealized gain of $1.0 million and a realized gain of $2.7 million for the year ended December 31, 2007. (See Risk Management Policies - Hedging).

Foreign exchange loss of $272,000 was recognized during the quarter ended December 31, 2008 (gain of $2.5 million for the year ended December 31, 2008) versus a gain of $130,000 during the quarter ended December 31, 2007 (gain of $2.3 million for the year ended December 31, 2007) primarily due to volatility of the R$ and Cdn.$. During the quarter ended December 31, 2008, foreign exchange losses were incurred in Cdn.$ cash on hand held in Canada and R$ taxes which are recoverable from the Brazilian tax authorities. These are offset by foreign exchange gains incurred by the Cdn.$ private placement notes and R$ based notes payable in Brazil. The foreign exchange gains and losses are due to changes in the R$ and Cdn.$ versus the US$.

Interest expense decreased from $3.5 million during the quarter ended December 31, 2007 to $1.5 million during the quarter ended December 31, 2008. The change was due to a decrease in debt. The Company repaid the loan facility held by the lender on March 13, 2008. (See Note 10(e) to our 2008 annual financial statements.) For the year ended December 31, 2008 interest expense increased to $11.6 million from $11.2 million for the same period in 2007 primarily due to the write-off of debt issuance costs relating to the repayment of the loan facility held by the lender on March 13, 2008 and the interest incurred on the private placement notes issued on March 22, 2007.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

Interest income decreased from $1.4 million during the quarter ended December 31, 2007 to $391,000 during the quarter ended December 31, 2008. Interest income decreased from $4.6 million for the year ended December 31, 2007 to $3.9 million for the year ended December 31, 2008. Interest income was earned on deposits held in banks in Canada, the U.S. and Brazil.

FINANCIAL CONDITION, CASH FLOW, LIQUIDITY AND CAPITAL RESOURCES

Cash Flow Highlights

($ in 000s)

| | | | | | | |

| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| Operating activities | | | (5,537 | ) | | | 3,913 | | | | (1,410 | ) | | | 1,457 | |

| Financing activities | | | (1,701 | ) | | | 61 | | | | 70,112 | | | | 89,492 | |

| Investing activities | | | (13,906 | ) | | | (23,134 | ) | | | (89,297 | ) | | | (63,092 | ) |

| Effect of foreign exchange on non-U.S. dollar denominated cash and cash equivalents | | | 608 | | | | (2,175 | ) | | | (4,556 | ) | | | 3,095 | |

| Increase (decrease) in cash for the period | | | (20,536 | ) | | | (21,335 | ) | | | (25,151 | ) | | | 30,952 | |

| Beginning cash balance | | | 41,096 | | | | 67,046 | | | | 45,711 | | | | 14,759 | |

Ending cash balance1 | | | 20,560 | | | | 45,711 | | | | 20,560 | | | | 45,711 | |

1Cash balance excludes $3.1 million of restricted cash on December 31, 2008 and $3.1 million on December 31, 2007.

At December 31, 2008 and December 31, 2007, the Company had cash and cash equivalents of $20.6 million and $45.7 million, respectively.

Cash flow from operating activities consumed $5.5 million of cash during the quarter ended December 31, 2008 versus cash generated of $3.9 million during the quarter ended December 31, 2007. Cash flow from operations consumed $1.4 million of cash during the year ended December 31, 2008 versus cash generated of $1.5 million for the same period in 2007.

Financing activities consumed $1.7 million of cash during the quarter ended December 31, 2008 primarily for $1.6 million repayment of debt; and generated $61,000 during the same period in 2007. During the year ended December 31, 2008 financing activities generated $70.1 million, primarily as a result of an equity financing in February 2008 that generated gross proceeds of Cdn$110.6 million ($109.6 million). During the year ended December 31, 2007 financing activities generated $89.5 million. During March 2007 an early exercise program for listed warrants generated $18.8 million and a private placement of units generated gross proceeds of Cdn.$ 86.3 million ($74.5 million). (See Notes 10(g) and 13(b) to the 2008 annual financial statements)

Investing activities consumed $13.9 million of cash during the quarter ended December 31, 2008 ($89.3 million for the year ended December 31, 2008) versus $23.1 million for the quarter ended December 31, 2007 ($63.1 million for the year ended December 31, 2007). The funds were used for mineral exploration, projects under development and the purchase of property, plant and equipment.

The effect of foreign exchange on non-US$ denominated cash and cash equivalents was a $0.6 million gain during the quarter ended December 31, 2008 (quarter ended December 31, 2007 - $2.2 million loss). For the year ended December 31, 2008 the effect of foreign exchange on the non-US$ denominated cash and cash equivalents was a $4.6 million loss versus a $3.1 million gain for the same period in 2007. This reflects the changes of the R$ and Cdn.$ versus the US$.

[The remainder of this page has been left intentionally blank]

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

Cash Requirements - 2008 Capital Spending Program

($ in 000s)

| | | | | | | | | | |

| | | Three Months Ended December 31, 2008 | | | Year Ended December 31, 2008 | | | Estimate for 2009 | |

| Sabará | | $ | 343 | | | $ | 808 | | | $ | 407 | |

| Caeté Project | | | 2,307 | | | | 26,140 | | | | 24,574 | |

| Turmalina | | | 3,790 | | | | 18,530 | | | | 21,122 | |

| Paciência | | | 4,329 | | | | 36,774 | | | | 17,416 | |

Other Spending 1 | | | 3,137 | | | | 14,802 | | | | 7,997 | |

| Total capital spending | | $ | 13,906 | | | $ | 97,054 | | | $ | 71,516 | |

1Includes construction of the central spare parts room, purchase of maintenance equipment, other improvements, replacements and head office spending. |

The Company believes that its cash held in accounts and cash flow generated by operations will be sufficient to finance existing operations and fund other cash requirements for 2009.

Total Capital Spending during the Period

($ in 000s)

| | | | | | | |

| | | Three Months Ended December 31, 2008 | | | Year Ended December 31, 2008 | |

| Capital spending - excluding exploration | | $ | 8,069 | | | $ | 60,984 | |

| Capital spending - exploration | | | 5,837 | | | | 36,070 | |

| Total capital spending | | $ | 13,906 | | | $ | 97,054 | |

| | | | | | | | | |

| Amount paid in cash | | $ | 13,906 | | | $ | 89,297 | |

| Amount financed | | | - | | | | 7,757 | |

| Total capital spending | | $ | 13,906 | | | $ | 97,054 | |

The Company has identified four primary uses of capital during 2009. These include:

(a) mine development and processing capacity for the Caeté Project

(b) expansion at the Turmalina operation

(c) exploration at brownfield properties in the Iron Quadrangle

(d) sustaining capital to maintain existing operations

[The remainder of this page has been left intentionally blank]

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

Contractual Obligations

The Company’s contractual obligations as at December 31, 2008 are summarized as follows ($ in 000s):

| | | | | | | | | | | | | | | | |

| | | Less than 1 year | | | 1 -3 years | | | 3 - 5 years | | | More than 5 years | | | Total | |

| Contractual Obligations | | | | | | | | | | | | | | | |

| Notes Payable | | | | | | | | | | | | | | | |

Principal | | $ | 4,680 | | | $ | 10,588 | | | $ | 70,431 | | | | - | | | | 85,699 | |

Interest | | | 7,528 | | | | 14,842 | | | | 1,682 | | | | - | | | | 24,052 | |

| Capital Lease | | | - | | | | - | | | | - | | | | - | | | | - | |

| Operating Lease Agreements | | | 191 | | | | 180 | | | | - | | | | - | | | | 371 | |

Management Agreements1 | | | | | | | | | | | | | | | | | | | | |

Operations | | | 1,093 | | | | 398 | | | | - | | | | - | | | | 1,491 | |

| Suppliers Agreements | | | | | | | | | | | | | | | | | | | | |

Mine Operations2 | | | 273 | | | | - | | | | - | | | | - | | | | 273 | |

Drilling3 | | | 94 | | | | - | | | | - | | | | - | | | | 94 | |

Asset Retirement Obligations4 | | | 630 | | | | 565 | | | | 5,402 | | | | 3,497 | | | | 10,094 | |

Joint Venture Agreement5 | | | - | | | | 729 | | | | - | | | | - | | | | 729 | |

| Total | | $ | 14,489 | | | $ | 27,302 | | | $ | 77,515 | | | $ | 3,497 | | | $ | 122,803 | |

1The term of the management agreements are one to two years. (See Note 16(a) to the Company's 2008 annual financial statements.) |

2The Company has the right to cancel the mine operations contract with 60 days advance notice. The amount included in the contractual obligations table represents the amount due within 60 days. |

3The Company has the right to cancel the drilling contract with 30 days advance notice. The amount included in the contractual obligations table represents the amount due within 30 days. |

4T he asset retirement obligations are not adjusted for inflation and are not discounted. |

5The Company entered into a formal agreement with Xstrata for the Company to explore the Pedra Branca Gold Project in Ceará, Brazil (See Note 19(e) to the Company's 2008 annual financial statements). |

($ in 000s)

| | | | |

| | | December 31 | |

| | | 2008 | | | 2007 | |

| Current assets | | $ | 45,857 | | | $ | 71,773 | |

| Long term assets | | | 257,977 | | | | 162,458 | |

| Total assets | | $ | 303,834 | | | $ | 234,231 | |

| | | | | | | | | |

| Current liabilities | | $ | 30,119 | | | $ | 38,324 | |

| Long term liabilities | | | 76,991 | | | | 94,388 | |

| Total liabilities | | $ | 107,110 | | | $ | 132,712 | |

Working capital decreased $17.7 million from $33.4 million at December 31, 2007 to $15.7 million at December 31, 2008 primarily due to a decrease in current assets which is offset with a decrease to current liabilities.

On February 21, 2008, the Company completed the equity financing referred in the Cash Flow Highlights section for gross proceeds of Cdn.$110.6 million ($109.6 million) (see Note 13(a)(i) to the Company's 2008 annual financial statements December 31, 2008). The proceeds of the offering were used primarily to fund capital expenditures for exploration and expansion at the Company’s three largest projects in Brazil, to close forward sales contracts and repay project financing term debt and for general corporate purposes.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

On March 22, 2007, the Company issued private placement notes for gross proceeds of Cdn.$86.3 million ($74.5 million) bearing a coupon of 10.5%, payable semi-annually in arrears. (See Note 10(g) to the Company's 2008 annual financial statements.)

Risk Management Policies - Hedging

Forward Gold Sales and Purchase Contracts - Derivative Financial Instruments

During the quarter ended March 31, 2008, the Company paid the lender $22.1 million to close the forward sales contracts. At December 31, 2007, forward sales contracts for 48,556 ounces were outstanding, which were to be settled at $527.10 at the end of each quarter over the term of the contracts.

During the quarter ended March 31, 2008, the Company closed the forward purchase contracts, realizing a gain of $7.4 million, effectively reducing the net loss on the forward contracts to $14.8 million, of which $14.5 million was accrued at December 31, 2007. At December 31, 2007 forward purchase contracts for 48,556 ounces were outstanding at an average cost of $823.81 per ounce.

With these transactions the Company has no forward gold production hedged.

Forward Foreign Exchange Contracts - Derivative Financial Instruments

The Company manages its exposure to changes in foreign exchange rates through the use of forward foreign exchange contracts to hedge certain future transactions denominated in foreign currencies. The Company hedges anticipated but not yet committed foreign currency transactions when they are probable and the significant characteristics and expected terms are identified.

As at December 31, 2008, the Company has forward foreign exchange contracts to purchase R$ at a weighted average rate of 1.87 as follows:

| | | |

| Settlement Date | Amount in thousands of US$ | Settlement amount in thousands of R$ |

| 28-Jan-09 | $1,000,000 | R$ 1,882,500 |

| 30-Jan-09 | 1,000,000 | 1,785,000 |

| 25-Feb-09 | 1,000,000 | 1,892,500 |

| 27-Feb-09 | 1,000,000 | 1,795,000 |

| 31-Mar-09 | 1,000,000 | 1,805,200 |

| 31-Mar-09 | 1,000,000 | 1,807,500 |

| 30-Apr-09 | 1,000,000 | 1,842,000 |

| 30-Apr-09 | 1,000,000 | 2,004,000 |

| 29-May-09 | 1,000,000 | 1,860,000 |

| 29-May-09 | 1,000,000 | 2,050,000 |

| 30-Jun-09 | 1,000,000 | 1,880,000 |

| | $ 11,000,000 | R$ 20,603,700 |

The terms of the contract require a percentage of the funds to be held on deposit as collateral to cover the contracts. At December 31, 2008 and 2007, $3.0 million of cash was restricted for this purpose.

The R$ weakened 20% versus the US$ during the three months ended December 31, 2008. At December 31, 2008, current liabilities include $2.4 million of unrealized foreign exchange losses. At December 31, 2007 current assets include $1.7 million of unrealized foreign exchange gains. Included in the statement of operations are the following amounts of unrealized and realized gains or losses on foreign exchange derivatives:

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

| | | | | | | |

| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| Unrealized loss (gain) | | $ | 1,643 | | | $ | 472 | | | $ | 4,099 | | | $ | (972 | ) |

| Realized loss (gain) | | | 1,075 | | | | (1,438 | ) | | | (1,476 | ) | | | (2,718 | ) |

| Total | | $ | 2,718 | | | $ | (966 | ) | | $ | 2,623 | | | $ | (3,690 | ) |

The forward exchange contracts are considered derivative financial instruments and are used for risk management purposes and not for generating trading profits. The Company closely monitors exchange rates and, as deemed appropriate by management, will continue to enter into forward currency contracts with the aim of minimizing adverse changes in the R$ and US$ relationship.

The Company is exposed to credit-related losses in the event of non-performance by the major international financial institution handling the derivative financial instruments, but does not expect this highly rated counterparty to fail to meet its obligations.

This derivative financial instrument is not accounted for as a hedge. The unrealized gains and losses will be recognized in the operating income of the Company and are a result of the difference between the spot price of the R$ and the forward currency contract price as at the balance sheet date.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet investment or debt arrangements.

INCOME TAXES

The Company recorded an income tax expense of $4.5 million for the year. This compares to a tax expense of $5.2 million for 2007 and $0.3 million for 2006. The current year income tax provision reflects a current income tax expense of $6.2 million for 2008 and a future income tax recovery of $1.6 million. This compares to a current income tax expense of $3.5 million for 2007 and $0.6 million for 2006 and a future tax expense of $1.7 million for 2007 and a future tax recovery of $0.3 million for 2006. The income tax expense reflects the current taxes incurred in Brazil. The Company maintains net operating losses (“NOLs”) which can be applied to future periods. The expense is reduced by the recognition of NOL tax losses available to be used against future incomes taxes payable in Brazil and the reversal of the future tax liability on intercompany loans.

The consolidated balance sheet reflects a future tax asset of $nil for 2008 and a future income tax liability of $2.2 million for 2007.

The Company has approximately $17.6 million of tax losses available for carry forward in Canada and $11.5 million of tax losses available for carry forward in Brazil.

The Company is subject to income taxes in both Canada and Brazil. The taxation in these jurisdictions is subject to uncertainty and carries risk of additional taxes being assessed to the Company because of changes in interpretations and application of tax laws, amendments to the tax laws, and the introduction of new taxes. (See Note 12 to the Company's 2008 annual financial statements.)

NORMAL COURSE ISSUER BID

In November 2008, the Company received approval from the TSX for a third normal course issuer bid to purchase up to the lesser of 3,119,114 common shares, being 5% of the issued and outstanding common shares of the Company at that time, or the number of common shares equal to a maximum aggregate purchase price of Cdn.$7.0 million. The normal course issuer bid commenced on November 13, 2008 and will terminate on November 12, 2009, or on such earlier date as the Company may complete its purchases under the bid. No shares were purchased during the fourth quarter of 2008 or through March 23, 2009.

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

In August 2007, the Company received approval from the TSX for a second normal course issuer bid to purchase up to the lesser of 2,760,224 common shares, being 5% of the issued and outstanding common shares of the Company at that time, or the number of common shares equal to a maximum aggregate purchase price of Cdn.$5.25 million. The normal course issuer bid commenced on August 30, 2007 and terminated on August 29, 2008. In June 2008, the Company received approval from the TSX for an amendment to the second normal course issuer bid to purchase additional shares up to the lesser of 2,242,924 common shares, or the number of common shares equal to the maximum aggregate purchase price of Cdn.$10.0 million. During the course of the second normal course issuer bid, the Company purchased a total of 821,300 common shares at an average price of Cdn$9.97. These shares have been cancelled.

The Company decided to engage in a normal course issuer bid because it believes that, from time to time, the market price of its common shares may not reflect fully the underlying value of its business and future business prospects. In such circumstances, the Company believes the outstanding common shares represent an attractive investment, since a portion of the Company’s excess cash can be invested for an attractive risk adjusted return on capital through its bid.

RELATED PARTY TRANSACTIONS

The Company incurred management fees of $719,000 for the year ended December 31, 2008 ($747,000 for the year ended December 31, 2007) from IMS Engenharia Mineral Ltda ("IMS"), a company held by several officers of the Company, which provides operating services to the Company's Brazilian subsidiaries.

The Company incurred occupancy fees of $180,000 for the year ended December 31, 2008 ($120,000 for the year ended December 31, 2007) to Brazilian Resources, Inc. (“BZI”), a corporate shareholder, for use of administrative offices. The Company moved to new administrative office space in December 2007. The term of the agreement is three years beginning on the date of occupancy.

The Company also incurred consulting fees and administrative service charges of $344,000 from BZI for the year ended December 31, 2008 ($450,000 for the year ended December 31, 2007). At December 31, 2008 accounts payable and accrued liabilities includes $39,000 for consulting fees. At December 31, 2007 prepaid expenses and sundry assets includes a prepaid expense of $101,000 to BZI. The occupancy costs, consulting fees and administrative service fees are included in the statement of operations.

The Company recognized rental income of $9,000 from Prometálica Mineração Ltda (“PML”) and $34,000 from Prometálica Centro Oeste Mineração Ltda (“PCO”) for the year ended December 31, 2008 ($192,000 from PML and $126,000 from PCO for the year ended December 31, 2007) for providing temporarily idle equipment and use of administrative offices. PML’s controlling shareholders are BZI and IMS, the founding shareholders of the Company. PCO is controlled by IMS, a founding shareholder of the Company. As at December 31, 2008 prepaid expenses and sundry assets includes $nil receivable from PML, and $12,000 from PCO (2007 - $149,000 from PML and $36,000 from PCO). During the year ended December 31, 2008 the Company also received approximately $30,000 ($0.3 million for the same period in 2007) of royalty income relating to the NSR.

On August 11, 2008, PML filed a judicial restructuring in Belo Horizonte, state of Minas Gerais, Brazil. At this time the financial impact of this action is indeterminate. Prior to the filing, the primary shareholders of PML, BZI and IMS, provided a guarantee of PML’s obligation to Mineração Serras do Oeste Ltda (“MSOL”), a 100% owned subsidiary of the Company. This guarantee will ensure the recovery of the Net Smelter Royalty due from PML if PML is unable to pay the Company. As at December 31, 2008 the amount of the obligation is approximately $1.0 million.

The Company’s subsidiaries MSOL and MTL were required to pay an employment claim of a former employee who performed work for MSOL, then owned by BZI, and other BZI companies. BZI has guaranteed the amount owed to the company of R$378,000 ($162,000), which will mature on September 30, 2011. As at December 31, 2008, prepaid expenses and sundry assets includes $162,000 receivable from BW Mineração, a wholly owned subsidiary of BZI. (2007 - $nil).

CRITICAL ACCOUNTING ESTIMATES

The preparation of its consolidated financial statements requires the Company to use estimates and assumptions that affect the reported amounts of assets and liabilities as well as revenues and expenses. The Company’s accounting policies are described in Note 2 to its consolidated annual financial statements. The Company’s accounting policies relating to work-in-progress inventory valuation and amortization of property, plant and equipment, mineral exploration projects,

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

and site reclamation and closure accruals are critical accounting estimates that are subject to assumptions regarding reserves, recoveries, future gold prices and future mining activities.

Gold in process and ore in stockpiles are stated at the lower of average production cost and net realizable value. Production costs include labor, benefits, material and other product costs. These costs are charged to earnings and are included in cost of sales. The assumptions used in the impairment assessment of gold in process inventories include estimates of gold contained in the ore stacked, assumptions of the amount of gold stacked that is expected to be recovered and an assumption of the gold price expected to be realized when the gold is recovered. If these estimates or assumptions prove to be inaccurate, the Company could be required to write-down the recorded value of its work-in-progress inventories, which would reduce the Company’s earnings and working capital.

In addition, GAAP requires the Company to consider, at the end of each accounting period, whether or not there has been an impairment of the capitalized mineral exploration projects, property, plant and equipment. For producing properties, this assessment is based on expected future cash flows to be generated from the location. For non-producing properties, this assessment is based on whether factors that may indicate the need for a write-down are present. If the Company determines there has been an impairment because its prior estimates of future cash flows have proven to be inaccurate, due to reductions in the price of gold, increases in the costs of production, reductions in the amount of reserves expected to be recovered or otherwise, or because the Company has determined that the deferred costs of non-producing properties may not be recovered based on current economics or permitting considerations, the Company would be required to write-down the recorded value of its mineral exploration projects, property, plant and equipment, which would reduce the Company’s earnings and net assets.

The Company’s mining and exploration activities are subject to various laws and regulations governing the protection of the environment. In general, these laws and regulations are continually changing and, over time, becoming more restrictive which impacts the cost of retiring assets at the end of their useful life. The Company recognizes management’s estimate of the fair value of liabilities for asset retirement obligations in the period in which they are incurred. A corresponding increase to the carrying amount of the related asset (where one is identifiable) is recorded and depreciated over the life of the asset. Where a related asset is not easily identifiable with a liability, the change in fair value over the course of the year is expensed. Over time, the liability will be increased each period to reflect the interest element (accretion) reflected in its initial measurement at fair value, and will also be adjusted for changes in the estimate of the amount, timing and cost of the work to be carried out. Additionally, future changes to environmental laws and regulations could increase the extent of reclamation and remediation work required to be performed by the Company.

The Company’s mineral exploration projects and mining properties are depleted and depreciated on a units-of-production basis, which bases its calculations on the expected amount of recoverable reserves. If these estimates of reserves prove to be inaccurate, or if the Company revises its mine plan due to reductions in the price of gold or unexpected production cost increases, and as a result the amount of reserves expected to be recovered are reduced, then the Company would be required to write-down the recorded value of its mineral exploration projects and mining properties and to increase the amount of future depletion and amortization expense, both of which would reduce the Company’s earnings and net assets.

CHANGES IN ACCOUNTING POLICIES INCLUDING INITIAL ADOPTION

The Company’s audited consolidated financial statements for the year ended December 31, 2008 were prepared following accounting policies consistent with the Company’s audited annual consolidated financial statements and notes thereto for the year ended December 31, 2007, except for the following changes in accounting principles. ..

| | (a) | Effective January 1, 2008 the Company adopted the following new CICA Handbook Standards: |

| | (i) | Financial Instruments Disclosure and Presentation: |

In December 2006, the CICA published Section 3862 Financial Instruments- Disclosures and Section 3863, Financial Instruments- Presentation. These standards introduce disclosure and presentation requirements that will enable financial statements’ users to evaluate, and enhance their understanding of, the significance of financial instruments for the entity’s financial position, performance and cash flows, and the nature and extent of risks arising from financial instruments to which the entity is exposed, and how those risks are managed. (See Note 5 to the Company’s 2008 annual financial statements.)

JAGUAR MINING INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(All dollar amounts are expressed in U.S. dollars)

In December 2006, the CICA published Section 1535 of the Handbook, Capital Disclosures, which requires disclosure of (i) an entity’s objectives, policies and processes for managing capital; (ii) quantitative data about what the entity regards as capital; (iii) whether the entity has complied with any capital requirements; and (iv) the consequences of non-compliance in the event the entity has not complied. This information will enable financial statements’ users to evaluate the entity’s objectives, policies and processes for managing capital. (See Note 18 to the Company’s 2008 annual financial statements.)

In January 2007, the CICA published Section 3031 of the Handbook, Inventories, which prescribes the accounting treatment for inventories. Section 3031 provides guidance on determination of costs and its subsequent recognition as an expense, and provides guidance on the cost formulas used to assign costs to inventories. The new standard did not impact the current or prior years financial statements.

| | (b) | Accounting Principles Issued but not yet Implemented: |

| | (i) | Adoption of International Financial Reporting Standards: |

In January 2006, the Accounting Standards Board announced its decision to require all Publicly Accountable Enterprises to report under International Financial Reporting Standards (IFRS) for years beginning on or after January 1, 2011. These changes reflect a global shift to IFRS and they are intended to facilitate capital flows and bring greater clarity and consistency to financial reporting in the global marketplace. (See Note 2(c)(i) to the Company’s 2008 annual financial statements.)

| | (ii) | Goodwill and intangible assets: |

In February 2008, the CICA issued accounting standard Section 3064 Goodwill and Intangible Assets replacing accounting standard Section 3062, Goodwill and Other Intangible Assets, and accounting standard Section 3450, Research and Development Costs. The new Section will be applicable to financial statements relating to fiscal years beginning on or after October 1, 2008. Accordingly, the Company will adopt the new standards for its fiscal year beginning January 1, 2009. Section 3064 establishes standards for the recognition, measurement, presentation and disclosure of goodwill subsequent to its initial recognition and of intangible assets by profit-oriented enterprises. Standards concerning goodwill are unchanged from the standards included in the previous Section 3062. This standard is not expected to have a material impact on the Company’s financial statements.

| | (iii) | Credit risk and fair value of financial assets and financial liabilities: |