Annual Information Form

for the year ended December 31, 2010

Dated March 21, 2011

TABLE OF CONTENTS

| CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS | | | 3 | |

| CORPORATE STRUCTURE | | | 3 | |

| GENERAL DEVELOPMENT OF THE BUSINESS | | | 4 | |

Overview of Business | | | 4 | |

Recent History | | | 4 | |

| DESCRIPTION OF THE BUSINESS | | | 9 | |

General | | | 9 | |

Gold Production and Sales | | | 10 | |

Specialized Skill and Knowledge | | | 10 | |

Conpetitive Conditions | | | 10 | |

Employees | | | 10 | |

Foreign Operations | | | 10 | |

Health, Safety and Environmental | | | 11 | |

Technical Information | | | 11 | |

Cautionary Note to United State Investors | | | 12 | |

Mineral Projects | | | 12 | |

Mineral Resource and Mineral Reserve Estimates | | | 12 | |

Mining Concessions and Operational Licenses | | | 14 | |

Material Mineral Properties | | | 15 | |

Turmalina Mining Complex | | | 15 | |

Paciência Mining Complex | | | 23 | |

Caeté Mining Complex | | | 32 | |

Gurupi Project | | | 39 | |

| RISK FACTORS | | | 47 | |

| DIVIDENDS | | | 57 | |

| DESCRIPTION OF CAPITAL STRUCTURE | | | 57 | |

| MARKET FOR SECURITIES | | | 58 | |

| DIRECTORS AND EXECUTIVE OFFICERS | | | 59 | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | | 64 | |

| TRANSFER AGENTS AND REGISTRAR | | | 64 | |

| MATERIAL CONTRACTS | | | 64 | |

| INTERESTS OF EXPERTS | | | 65 | |

| ADDITIONAL INFORMATION | | | 65 | |

| APPENDIX A CHARTER OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | | | 66 | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual information form contains forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended and Section 21E of the United States Exchange Act of 1934, as amended and forward-looking information as defined under applicable Canadian securities legislation (collectively, "forward-looking statements"). These forward-looking statements relate to, among other things, Jaguar Mining Inc.'s ("Jaguar") objectives, goals, strategies, beliefs, intentions, plans, estimates and outlook.

Forward-looking statements can generally be identified by the use of words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “goal,” “will,” “may,” “target,” “potential” and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Forward-looking statements are necessarily based on estimates and assumptions made by Jaguar in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors Jaguar believes are appropriate in the circumstances. These estimates and assumptions are inherently subject to significant business, economic, competitive and other uncertainties and contingencies, many of which, with respect to future events, are subject to change. Although Jaguar believes that the expectations reflected in such forward-looking statements are reasonable, undue reliance should not be placed on such statements.

In making the forward-looking statements in this annual information form, Jaguar has made several assumptions, including, but not limited to assumptions concerning: production costs; the geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis that are involved in the calculation of mineral reserves and resources; that there is no material deterioration in general business and economic conditions; that there is no unanticipated fluctuation of interest rates and foreign currency exchange rates; that the supply and demand for, deliveries of, and the level and volatility of prices of gold as well as oil and petroleum products develop as expected; that Jaguar receives regulatory and governmental approvals for its development projects and other operations on a timely basis; that Jaguar is able to obtain financing for its development projects on reasonable terms; that there is no unforeseen deterioration in Jaguar’s costs of production or Jaguar’s production and productivity levels; that Jaguar is able to procure mining equipment and operating supplies in sufficient quantities and on a timely basis; that engineering and construction timetables and capital costs for Jaguar’s development and expansion projects are not incorrectly estimated or affected by unforeseen circumstances; that costs of closure of various operations are accurately estimated; that unforeseen changes to the political stability or government regulation in the country in which Jaguar operates do not occur; that there are no unanticipated changes to market competition, that Jaguar’s reserve estimates are within reasonable bounds of accuracy (including with respect to size, grade and recoverability) and that the geological, operational and price assumptions on which these are based are reasonable; that Jaguar realizes expected premiums over London Metal Exchange cash and other benchmark prices; and that Jaguar maintains its ongoing relations with its employees and business partners and joint venturers

Actual results may differ materially from those expressed or implied in the forward-looking statements contained in this annual information form. Important factors that could cause actual results to differ materially from these expectations are discussed in greater detail under the heading “Risk Factors” in this annual information form. When relying on forward-looking statements to make decisions with respect to Jaguar, carefully consider these risk factors and other uncertainties and potential events. Jaguar undertakes no obligation to update or revise any forward-looking statement, except as required by law.

CORPORATE STRUCTURE

Jaguar was incorporated on March 1, 2002 pursuant to the Business Corporations Act (New Brunswick). On March 30, 2002, Jaguar issued initial common shares to Brazilian Resources, Inc. (“Brazilian”) and IMS Empreendimentos Ltda. (“IMS”) in exchange for property. In that transaction, Brazilian contributed to Jaguar all of the issued and outstanding shares in Mineração Serras do Oeste Ltda. (“MSOL”), a Brazilian mining company that controlled the mineral rights, concessions and licenses to certain property located near the community of Sabará, east of Belo Horizonte in the state of Minas Gerais, Brazil (the “Sabará Property”), and IMS contributed to Jaguar a 1,000-tonne per day production facility also located east of Belo Horizonte near the community of Caeté (the “Caeté Plant”) and the mineral rights to a nearby property related to National Department of Mineral Production (“DNPM”) Mineral Exploration Request no. 831.264/87 and DNPM Mineral Exploration Request nos. 830.590/83 and 830.592/83 (the “Rio de Peixe Property”). Jaguar was continued into Ontario in October 2003 pursuant to the Business Corporations Act (Ontario) and is currently a corporation existing under the laws of Ontario.

On October 9, 2003, pursuant to an amalgamation agreement dated July 16, 2003, Jaguar amalgamated with Rainbow Gold Ltd. (“Rainbow”), a New Brunswick corporation and a then inactive reporting issuer listed on the TSX Venture Exchange (the “TSX-V”), through a reverse take-over. The amalgamated entity adopted the name “Jaguar Mining Inc.” Jaguar was approved for listing on the TSX-V on October 14, 2003 and began trading on October 16, 2003. Jaguar subsequently graduated from the TSX-V to the Toronto Stock Exchange (the “TSX”) and began trading on the TSX on February 17, 2004 under the symbol “JAG”. On July 23, 2007, trading of Jaguar’s common shares commenced on the NYSE Arca Exchange (“NYSE Arca”) under the symbol “JAG”. In July 2009, Jaguar received approval from the New York Stock Exchange (“NYSE”) to transfer the trading of its common shares from the NYSE Arca to the NYSE. Trading on the NYSE began on July 6, 2009 also under the symbol “JAG”.

Jaguar’s head office is located at 125 North State Street, Concord, New Hampshire, 03301, USA and its registered office is located at 100 King Street West, Suite 4400, 1 First Canadian Place, Toronto, Ontario M5X 1B1, Canada.

Jaguar has three wholly-owned direct subsidiaries, MSOL, Mineração Turmalina Ltda. (“MTL”) and MCT Mineração Ltda. (“MCT”), all incorporated under the laws of the Republic of Brazil. The registered and head office of each of MSOL, MTL and MCT is located at Rua Levindo Lopes 323, Funcionários, Belo Horizonte, Minas Gerais, CEP 30.140-070, Brazil.

GENERAL DEVELOPMENT OF THE BUSINESS

Overview of Business

Jaguar is a gold mining company currently engaged in gold production and in the acquisition, exploration, development and operation of gold mineral properties in Brazil. Jaguar plans to grow organically through the expansion of its existing operations and advancement of its exploration properties. In addition, Jaguar may consider the acquisition and subsequent exploration, development and operation of other gold properties.

Jaguar’s three producing properties, Turmalina, Paciência and Caeté, are located in or adjacent to the Iron Quadrangle region of Brazil, a greenstone belt located east of the city of Belo Horizonte in the state of Minas Gerais. Jaguar’s portfolio also includes the Gurupi Project in the state of Maranhão and the Pedra Branca Project in the state of Ceará, which is part of a joint venture agreement with Xstrata plc. (“Xstrata”).

Recent History

The following is a description of Jaguar’s most significant events over the most recent financial years.

Turmalina Mining Complex - Expansion, Geo-Mechanical Issues and Change in Mining Methods

The Turmalina underground mines (Ore Bodies A and B) and the carbon-in-pulp (“CIP”) processing plant (the “Turmalina Plant”) were commissioned in November 2006. The first gold pour was conducted in January 2007 and commercial production was declared in August 2007. During 2008, Jaguar conducted a complementary 12,000 meter in-fill diamond drilling program at Ore Body C as part of an effort to convert resources to reserves to expand the Turmalina operation. In September 2008, Jaguar completed a National Instrument 43-101-Standards of Disclosure for Mineral Projects (“NI 43-101”) compliant feasibility study technical report on the Turmalina Phase I Expansion, which was implemented and completed during the third quarter of 2009, increasing Turmalina’s annual gold production capacity from 80,000 ounces per year to 100,000 ounces per year. As a result, grinding and milling capacity at the Turmalina Plant was increased to 1,800 tonnes per day of ore from its previous designed operating level of 1,500 tonnes per day.

During 2010, Jaguar encountered geo-mechanical issues at level 3 in Ore Body A, which resulted in dilution averaging over 30%, more than double the anticipated level. Jaguar initiated steps to convert the mining method at Turmalina from selective stoping to cut-and-fill in Ore Body A in the second quarter of 2010. As part of this effort, Jaguar elected to deploy additional personnel and equipment to accelerate forward underground development in Ore Body A. The mining team achieved 1.7 km of new development, which represents the highest quarterly rate in the history of the Turmalina operation and was over 25% higher than the rate of development achieved on a quarterly basis during the first half of 2010. Management believes that the conversion of mining methods should be essentially completed during the first quarter of 2011. Actual mining of the panels in Ore Body A has already demonstrated a significant improvement in dilution control, which is now averaging below 15% as compared to much higher rates during 2010 when the selective sublevel stoping method was used.

Production at Turmalina decreased in 2010 by approximately 28% compared to 2009, to 59,481 ounces of gold. This decrease was primarily attributable to the geo-mechanical issues at Ore Body A mentioned above.

As of the date of this annual information form, Turmalina has 14 fully developed stopes and 31 workable faces across all three ore bodies, a 10% increase since the end of 2010. This represents 10 months of developed ore reserves. The Company’s goal is to have 18 months of developed ore reserves at the Turmalina Mine by year-end.

In 2010, underground mine development at Turmalina totaled 5.9 kilometers. Exploration efforts during the year were concentrated on three targets that are part of the Turmalina complex, Zone D, Faina and Pontal. In 2010, Jaguar drilled a total of 20,210 meters in 122 surface drill holes and 557 meters in four underground drill holes. During the second quarter of 2011, Jaguar expects to report the results of these exploration campaigns and provide an updated NI 43-101 resource estimate for the Faina and Pontal targets.

Paciência Mining Complex - Commissioning and Production

The Paciência underground mine (Santa Isabel) and CIP processing plant (the “Paciência Plant”) were commissioned in April 2008. The first gold pour was conducted in July 2008 and commercial production was declared in December 2008. In December of 2008, Jaguar began hauling ore from the Pilar Mine to the Paciência Plant, which is located 130 kilometers away. In July and August of 2009, Jaguar completed the development of the Palmital and Marzagão mines, respectively, and started to process ore from both mines at the Paciência Plant. Currently, the Paciência Plant is processing ore from the Santa Isabel, Palmital and Marzagão mines. In November 2010, Jaguar ceased to process ore from the Pilar Mine at the Paciência Plant as ore haulage was re-directed to the Caeté Mining Complex (defined below).

Production at Paciência decreased in 2010 to 59,287 ounces of gold from 66,671 ounces in 2009. The decrease in production resulted from a slight decrease in feed grades due to dilution as well as Jaguar's decision to re-direct ore from Pilar to the new Caeté processing plant during November 2010.

Jaguar has taken delivery of a fleet of new, smaller mining equipment to access the narrower sections of high grade zones in order to improve selectivity in the Santa Isabel Mine. Additional units are expected to be received and integrated into mining operations during the first half of 2011. Management believes this fleet of new equipment, along with the existing development at Santa Isabel, and the added tonnage from Ouro Fino, should largely offset the shifting of the tonnage from Pilar.

In 2010, underground mine development at the Paciência mining complex totaled nearly seven kilometers. As of the date of this annual information form, there are 13 fully developed stopes and 16 workable faces in the Santa Isabel Mine, an increase of over 25% compared to what was in place at the end of 2010. This represents 10 months of developed ore reserves. The Company’s goal is to have 18 months of developed ore reserves at the Santa Isabel Mine by year- end.

Since 2007, Jaguar has been conducting exploration activities and underground development at Paciência’s mineral concession portfolio, which consists of a contiguous 20-kilometer area adjacent to the São Vicente lineament. In 2010, Jaguar drilled a total of 19,023 meters in 175 surface and underground drill holes at the NW1 and NW3 targets, which are located on the same shear zone and possess similar geological and mineralization characteristics. During the second quarter of 2011, Jaguar expects to report the results of these exploration campaigns.

Caeté Mining Complex - Development, Construction and Production

The Caeté mining complex is composed of the Roça Grande and Pilar mines and a CIP processing plant (the “Caeté Plant”), which were commissioned in June 2010. The first gold pour was conducted in August 2010 and commercial production was declared in the third quarter of 2010. In November 2008, due to the retraction in gold prices, financial markets and worldwide equity values, including the gold sector, Jaguar temporarily suspended development of Caeté. Consequently, underground work at the Roça Grande Mine was suspended; however, development at the Pilar Mine continued. As previously discussed, from December 2008 to November 2010, Jaguar hauled ore from the Pilar Mine to the Paciência Plant to supplement the ore being supplied from Paciência’s Santa Isabel Mine. In March 2009, Jaguar completed a Cdn.$86.3 million equity offering, the proceeds of which were primarily used to restart development and construction at Caeté. During 2009 and 2010, Jaguar spent approximately US$32.5 million and US$66.0 million, respectively, developing Caeté.

Operations at the Caeté Plant were temporarily suspended in October 2010 to replace the tailings discharge pump system, which had failed during commissioning. In 2010, Caeté produced 19,099 ounces of gold. Underground development at the Pilar and Roça Grande mines totaled 5.9 kilometers in 2010. As of the date of this annual information form, the Pilar and Roça Grande mines had a total of 14 open stopes and 16 workable faces, five additional faces since the close of 2010. This represents over 18 months of developed ore reserves at the Roça Grande and Pilar mines.

On the exploration front and as part of Jaguar’s effort to identify and add to its gold resource base at the Caeté mining complex, 75,000 meters of additional drilling are planned over the next few years on targets near the Caeté Plant. In 2010, Jaguar drilled a total of 9,649 meters in 84 surface drill holes at some of these targets.

Gurupi Project - Acquisition and Completion of Feasibility Study

On December 2, 2009, Jaguar acquired 100 percent of MCT, a wholly owned subsidiary of Kinross Gold Corporation ("Kinross") for US$42.5 million, which includes a US$3.5 million adjustment from the US$39 million purchase price to reflect the fair value for accounting purposes. MCT holds all of the mineral licences for the Gurupi Project. In December, 2009, Jaguar filed a NI 43-101 compliant statement of resources technical report on SEDAR that was prepared by Pincock Allen & Holt (“PAH”) and stated measured and indicated gold resources of 70,159,952 tonnes at an average grade of 1.12 grams per tonne totaling 2,516,326 ounces and inferred gold resources of 18,821,168 tonnes at an average grade of 1.02 grams per tonne totaling 618,595 ounces. In May 2010, Jaguar completed and filed a pre-feasibility study, which was prepared by AMEC Americas Limited (“AMEC”). In January 2011, Jaguar completed and filed a NI 43-101 feasibility study, which was prepared by TechnoMine Services, LLC (“TechnoMine”). Assuming a gold price of US$1,066 per ounce, the feasibility study confirmed an estimated 69,887,500 tonnes of indicated mineral resources at an average grade of 1.12 grams per tonne totaling 2,518,170 ounces of gold and 18,676,700 tonnes of inferred mineral resources at an average grade of 1.03 grams per tonne totaling 616,630 ounces of gold. Probable gold reserves, which are included in the reported mineral resource estimate, are estimated at 63,756,700 tonnes at an average grade of 1.14 grams per tonne totaling 2,327,930 ounces. The average stripping ratio is estimated at 3.94.

As part of the process of completing the feasibility study, Jaguar also incorporated additional work to the AMEC pre-feasibility as summarized below.

| | • | The option for a 230-kV power line from the Encruzo Substation to the Project Main Substation (40 km), instead of the 69-kV that was considered in the AMEC pre-feasibility; |

| | • | The inclusion of secondary crushing and a High Pressure Grinding Roll (“HPGR”) replacing a SAG Mill; |

| | • | The inclusion of vertical mills replacing ball mills; and |

| | • | The utilization of intensive concentration technology. |

Jaguar is continuing with the work necessary to receive the appropriate environmental licenses for the Gurupi Project. A public hearing in connection with the Previous License (“LP”) was held on March 16, 2011 and the outcome was positive. As a result of this meeting, Jaguar expects to receive the LP in mid-April 2011. After the LP is granted, Jaguar will start the process of obtaining the Installation License.

In April 2011, the Jaguar intends to initiate a 30,000-meter drilling program on targets in close proximity to the main ore bodies identified in the feasibility study. Based on existing drilling results from these nearby targets, management believes the mineral resource base for the Gurupi Project could increase. Management estimates the cost of this additional program will total approximately $12 million, including infrastructure, development, drilling, metallurgical testing and technical analysis.

At the conclusion of the drilling program, and prior to the construction commitment, Jaguar will determine whether to proceed with the development as outlined in the recently completed feasibility study, or if warranted, to increase the scope and scale of the project based on the additional drilling results and other assessments. This decision could include a two-phase approach, which allows the project to proceed as planned and subsequently expand the processing circuit to accommodate additional ore from the nearby targets.

Pedra Branca Project

In March 2007, Jaguar entered into a joint venture agreement with Xstrata to explore the Pedra Branca Project. The Pedra Branca Project has mineral rights to 24 concessions totaling approximately 51,568 hectares in a 65-kilometer shear zone. The concessions are located in and around municipal areas with good infrastructure. Xstrata carried out a preliminary exploration program that covered only 25 kilometers of the shear zone. The program identified ten kilometers of soil anomalies, including two large anomalies referred to as the Coelho and Mirador targets. For the most part, the mineralized structures discovered by Xstrata’s preliminary efforts are open along the strike and led Jaguar's geologist to believe the area has significant potential for gold mineralization, which could include the presence of both oxide and sulfide mineralization in large structures. During 2007 and 2008, Jaguar completed an exploration drilling program to test the continuity of the mineralization laterally and at depth. During 2009, Jaguar carried out geological reconnaissance in the concession area, trenching and soil geochemistry. In 2010, Jaguar continued with the exploration program, including extensive geological mapping, drainage and soil geochemistry, detailing of anomalous zones and trenching.

Sabará

The Sabará operation produced gold from December 2005 to December 2009. This operation included the Sabará Zone A and Serra Paraíso open pit mines from which oxide ore was processed at a 1,500 tonnes per day carbon-in-column (“CIC”) plant (the “Sabará Plant”) located adjacent to the Zone A Mine. In early-2010, Jaguar deemed this operation to be a non-core facility and recorded a charge against earnings of approximately $3.5 million for the fourth quarter of 2009. The charge represented the current book value of the assets less an estimate of the equipment salvage value. During 2010, Sabará remained on care and maintenance. Jaguar continues to evaluate the strategic alternatives for this idled operation and will likely dispose of the assets during the next 12 months. During the fourth quarter of 2010, Jaguar recorded a $0.3 million charge to further reduce the estimated fair value of the Sabará facility to zero.

Jaguar continues to assess the alternatives with respect to the Sabará facility. These alternatives include seeking a buyer for the equipment or relocating the Sabará Plant to a new site with sufficient oxide resources.

Corporate Transactions

On February 21, 2008, Jaguar closed a public offering of 8,250,000 common shares at a price of Cdn.$13.40 per share for proceeds of Cdn.$110,550,000. The offering was underwritten by a syndicate of underwriters led by RBC Dominion Securities Inc. (“RBC”) and included TD Securities Inc. (“TD Securities”), Blackmont Capital Inc. (“BCI”), BMO Nesbitt Burns Inc. and Raymond James Ltd.

On November 10, 2008, Jaguar received approval from the TSX for a normal course issuer bid (“NCIB”) to purchase up to the lesser of 3,110,114 common shares, being 5% of the issued and outstanding common shares at that time, or the number of common shares equal to a maximum aggregate purchase price of Cdn.$7,000,000. The NCIB commenced on November 13, 2008 and terminated on November 12, 2009. Jaguar did not purchase any common shares under the NCIB.

On March 2, 2009, Jaguar closed a public offering of 13,915,000 common shares at a price of Cdn$6.20 per share for gross proceeds of Cdn.$86,273,000. The offering was underwritten by a syndicate of underwriters led by RBC and BCI and included TD Securities and M Partners Inc.

On July 6, 2009, trading of Jaguar common shares was transferred from the NYSE Arca to the NYSE under the symbol “JAG”.

On September 15, 2009, Jaguar closed a private offering of US$150,000,000 aggregate principal amount of 4.50% senior convertible notes due 2014 (the"2009 Notes"). J.P. Morgan Securities Inc. acted as sole book-running manager and Jefferies & Company, Inc. acted as co-manager for the offering. Jaguar granted the initial purchasers in the offering a 30-day option to purchase up to an additional US$15,000,000 aggregate principal amount of notes to cover over-allotments, if any. On September 21, 2009, Jaguar closed the issuance of the additional US$15,000,000 of notes following the exercise in full of the over-allotment option. The net proceeds of approximately US$14,500,000 million from the exercise of the over-allotment option brought the total net proceeds received from the offering to approximately US$159,100,000.

The 2009 Notes were issued pursuant to an indenture (the "2009 Indenture") dated September 15, 2009, between Jaguar and The Bank of New York Mellon and BNY Trust Company of Canada, as trustees (the "Trustees"). The 2009 Notes are unsecured, senior obligations of Jaguar. The 2009 Notes bear interest at a rate of 4.5% per year, payable semi-annually in arrears on May 1 and November 1 of each year, beginning on May 1, 2010, and will mature on November 1, 2014. The 2009 Notes have an initial conversion rate of 78.4314 Jaguar common shares per US$1,000 principal amount of converted notes, representing an initial conversion price of approximately US$12.75 per common share, which represented a premium of approximately 26.24% to the closing price of Jaguar common shares on the NYSE on September 10, 2009. The conversion rate is subject to certain anti-dilution adjustments. The 2009 Notes are convertible at any time prior to maturity. Upon conversion, Jaguar may, in lieu of delivering its common shares, elect to pay or deliver, as the case may be, cash or a combination of cash and common shares, in respect of the converted notes. Jaguar will be required to make an offer to repurchase the 2009 Notes for cash upon the occurrence of certain fundamental changes.

On December 2, 2009, Jaguar completed its purchase of 100 percent of MCT from Kinross in connection with the Gurupi Project acquisition. Jaguar satisfied the US$39 million purchase price (recorded as US$42.5 million, including a US$3.5 million adjustment from the US$39 million purchase price to reflect the fair value for accounting purposes) for MCT (and an associated right of first refusal provided to Jaguar by Kinross in connection with certain properties adjacent the those held by MCT) by issuing 3,377,354 common shares to a subsidiary of Kinross representing approximately 4.07 percent of Jaguar’s outstanding common shares (on a non-diluted basis) as at December 2, 2009 after giving effect to the issuance of such common shares.

On February 9, 2011, Jaguar closed a private offering of US$103.5 million aggregate principal amount of 5.5% senior unsecured convertible notes (the "2011 Notes"). Merrill Lynch, Pierce, Fenner and Smith Incorporated acted as sole book-runner and RBC Capital Markets, LLC acted as co-manager for the offering. The 2011 Notes were issued pursuant to an indenture (the "2011 Indenture") dated February 9, 2011 between Jaguar and the Trustees. The 2011 Notes are unsecured, senior obligations of Jaguar. Jaguar received net proceeds from the offering of approximately US$99.3 million. The 2011 Notes bear interest at a rate of 5.5% per annum, payable semi-annually in arrears on March 31 and September 30 each year, beginning on September 30, 2011 and will mature on March 31, 2016. The 2011 Notes will have an initial conversion rate of 132.4723 Jaguar common shares per $1,000 principal amount of converted notes, representing an initial conversion price of approximately US$7.55 per common share, which was approximately 137.5% of the closing price of Jaguar common shares on the NYSE on February 3, 2011. The conversion rate is subject to certain anti-dilution adjustments and adjustments in connection with specified corporate events. The 2011 Notes will be convertible any time prior to maturity. Upon conversion, Jaguar may, in lieu of delivering its common shares, elect to pay or deliver, as the case may be, cash or a combination of cash and common shares, in respect of the converted notes. Jaguar will be required to make an offer to repurchase the 2011 Notes for cash upon the occurrence of certain fundamental changes.

Contracts with AngloGold Ashanti

On November 21, 2003, Jaguar acquired its Paciência - Santa Isabel, Catita, Juca Vieira (Catita II), Bahú, Marzagão (NW1 Target), Camará and Morro do Adão properties in the Iron Quadrangle region from AngloGold Ashanti Ltd (“Anglogold Ashanti”). Under the terms of this transaction, AngloGold Ashanti has the right, following exhaustion of the reserves developed from the known resources at the Paciência - Santa Isabel, Juca Vieira, Catita, Bahú, Marzagão, Camará and Morro do Adão properties, to develop a full valuation of any of such properties, including drilling works. If the valuation identifies the existence, in one or more areas, of measured and indicated resources of a minimum of 750,000 ounces per concession, AngloGold Ashanti will have the right to reacquire up to 70% of any of such concessions at an ascribed value of US$10.50 per ounce of the new measured and indicated resources.

AngloGold Ashanti’s rights pertain to only three of the fourteen concessions at Jaguar’s Paciência property (Paciência-Santa Isabel, Bahú and Marzagão) and four concessions at the Sabará property (Catita, Catita II, Camará and Morro do Adão). The mineralization potential at Sabará is not considered substantial. These seven concessions represent 13.8% of the hectares of Jaguar’s concession base in Minas Gerais. At this time, none of Jaguar’s resources, operations and projections for the next five years are impacted by this provision nor are they expected to be impacted in the next several years. Moreover, any improvements made to the properties, such as the costs of underground development or above-ground processing plants Jaguar has made, are not included under the agreements signed with AngloGold Ashanti. Given these substantial costs, management believes the likelihood of AngloGold Ashanti exercising their right to reacquire any of the properties which Jaguar is actively mining from today, is minimal.

Refining Services

In July 2010, Jaguar’s subsidiaries MSOL and MTL executed a contract with a São Paulo-based precious metals refiner for pre-treatment, foundry, sampling, testing and refining of the gold produced at Jaguar’s Turmalina, Paciência and Caeté operations. The refining company is a global materials technology group with industrial operations on all continents and employs approximately 14,400 people. Prior to July 2010, refining services were provided to Jaguar by AngloGold Ashanti. Jaguar is realizing significant savings in gold refining costs as a result of its contract with this refiner.

Contracts for Sale of Products

Jaguar sells its refined gold through reputable international banks and metals traders at prevailing world spot prices on a bi-monthly basis. The gold is transferred from the refining facility in armored car services to these international banks and metals traders at the time of shipment.

DESCRIPTION OF THE BUSINESS

General

Jaguar is a gold mining company engaged in gold production and in the acquisition, exploration, development and operation of gold mineral properties in Brazil. Jaguar plans to grow organically through the expansion of its existing operations and advancement of its exploration properties. In addition, Jaguar may consider the acquisition and subsequent exploration, development and operation of other gold properties.

Jaguar’s three producing properties, Turmalina, Paciência and Caeté, are located in or adjacent to the Iron Quadrangle region of Brazil, a greenstone belt located east of the city of Belo Horizonte in the state of Minas Gerais. Jaguar’s portfolio also includes the Gurupi Project in the state of Maranhão and the Pedra Branca Project in the state of Ceará, which is part of a joint venture agreement with Xstrata.

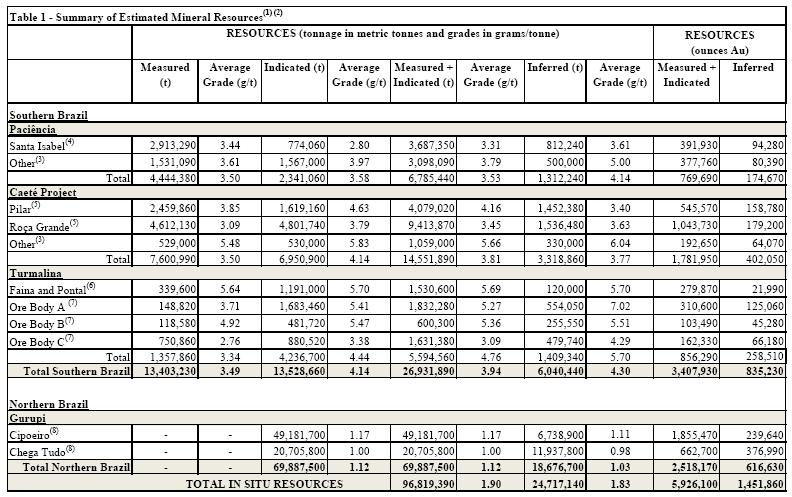

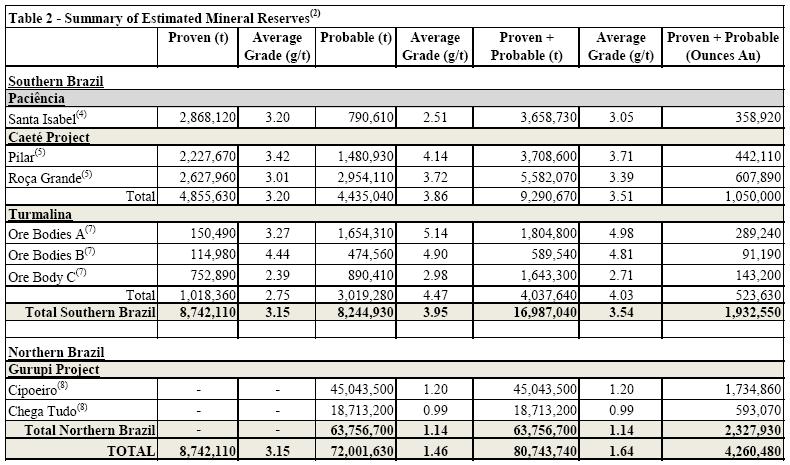

Through its wholly-owned subsidiaries, MSOL, MTL and MCT, Jaguar has interests in, and controls the mineral rights, concessions and licenses to the mineral resources and reserves presented in Tables 1 and 2 under the section entitled “Mineral Resources and Reserves”.

All of Jaguar’s production facilities are, or will be, near Jaguar’s mineral concessions and are accessible via existing roads. Jaguar believes it has an advantage over other gold mine operators due to the clustered nature of its resource concessions and the proximity of its concessions to its processing facilities and existing infrastructure.

Gold Production and Sales

During 2010, Jaguar produced a total of 137,867 ounces of gold at Turmalina, Paciência and Caeté at an average cash operating cost of US$732 per ounce compared to 148,742 ounces at an average cash operating cost of US$462 per ounce (exclusive of Sabará 2009 gold production of 6,360 ounces at an average cash operating costs of $680 per ounce) during 2009.

The decrease in gold production compared to the previous year largely stemmed from geo-mechanical problems at Turmalina and increased dilution, which is described below under Turmalina. Average cash operating costs were higher than those recorded in 2009 due to several factors: (i) lower gold production, (ii) significantly stronger Brazilian Real against the US dollar, (iii) geo-mechanical issues encountered in Ore Body A at the Turmalina operation, which elevated dilution and significantly reduced feed grades into the processing plant, and (iv) start-up issues at Jaguar’s new Caeté operation, where lower grade ore was utilized during the commissioning phase.

Gold sales in 2010 totaled 140,530 ounces at an average price of US$1,215 per ounce compared to 143,698 ounces sold at an average price of US$979 per ounce in 2009.

Specialized Skill and Knowledge

Jaguar is staffed by an experienced senior management team with extensive experience exploring, developing and operating gold mines in Brazil. Jaguar’s Chief Executive Officer and President, Daniel R. Titcomb, has been involved in continuous mining exploration and development in Brazil since 1993. Jaguar’s Chief Operating Officer, Lúcio Cardoso, was formerly superintendent of AngloGold’s Brazilian gold division (currently AngloGold Ashanti) and has over 35 years experience in the Brazilian mining sector. Jaguar’s Vice President of Exploration and Engineering, Adriano L. Nascimento, has approximately 30 years experience in the Brazilian mining industry and held the position of senior engineer at AngloGold’s Brazilian gold division for 11 years, where he was responsible for the production department of several mines, including Mina Grande, the deepest and one of the oldest mines in Brazil.

Competitive Conditions

The gold exploration and mining business is a competitive business. Jaguar competes with numerous other companies and individuals in the search for, and the acquisition of, mineral licenses, permits and other mineral interests, as well as for acquisition of equipment and the recruitment and retention of qualified employees. There is also significant competition for the limited number of gold property acquisition opportunities. The ability of Jaguar to acquire gold mineral properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for gold development or mineral exploration.

Jaguar has built its base upon the acquisition of mature gold exploration properties in the Iron Quadrangle region of Brazil at relatively depressed prices. Jaguar believes that its asset acquisition costs combined with the clustered nature of its mineral assets and production facilities gives it an advantage over other similarly-sized competitors.

Employees

Jaguar had 1,788 employees as at December 31, 2010, 1,778 of which are based in Brazil. The remaining 10 employees are based at Jaguar's corporate office in New Hampshire, USA.

Foreign Operations

All of Jaguar’s mineral projects are owned and operated though its wholly-owned Brazilian subsidiaries, MSOL, MTL and MCT. Jaguar’s wholly-owned properties are located in the states of Minas Gerais and Maranhão in Brazil. Jaguar is entirely dependent on its foreign operations for the exploration and development of gold properties and for production of gold.

Health, Safety and Environmental

Jaguar places high priority on the safety and welfare of its employees. Jaguar recognizes employees are its most valuable asset. In the past few years, Jaguar has expanded its health and safety department significantly to meet the needs of its growing work force and expanding operations. Jaguar's training program for new employees includes the participation of experienced professionals that act as mentors, providing hands-on guidance and conducting periodical reviews. Jaguar wants its employees to grow with the company, so it encourages them to further their education and provide them with tools to understand Jaguar's corporate culture and objectives.

While Jaguar's accident rate is low, it strives for improving it. Jaguar has an integrated management system in place that promotes open communication at all levels. This system includes tools such as the "Daily Safety Dialogue" to go over health and safety procedures before every shift, "Easy Talk" to encourage employees to report inadequate conditions or behavior, and the "Accident Analysis and Prevention" tool, which reviews every accident and allows employees to propose new safety measures to avoid future occurrences.

Jaguar promotes the concept of environmental stewardship in the communities where it operates and supports programs such as a program in support of the concepts of sustainable development, environmental stewardship and social responsibility.

Technical Information

The estimated mineral reserves and mineral resources for Jaguar's mines and mineral projects set forth in this annual information form have been calculated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Council -Definitions adopted by the CIM Council on November 27, 2010 (the “CIM Standards”). The following definitions are reproduced from the CIM Standards:

The term "Mineral Resource" means a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

The term "Inferred Mineral Resource" means that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

The term "Indicated Mineral Resources" means that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

The term "Measured Mineral Resource" means that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

The term "Mineral Reserve" means the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

The term "Probable Mineral Reserve" means the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

The term "Proven Mineral Reserve" means the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

Cautionary Note to United States Investors

U.S. investors should be aware that Jaguar is a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare its disclosure documents in accordance with Canadian disclosure standards. Such requirements are different from those of the United States.

Unless otherwise indicated, all reserve and resource estimates included in this annual information form have been prepared in accordance with NI 43-101 and the CIM classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators (“CSA”) that establishes standards for all public disclosure a Canadian issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission (the "SEC"), and reserve and resource information contained in this annual information form may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this annual information form uses the terms “measured resources,” “indicated resources” and “inferred resources.” U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the SEC does not recognize them. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that any part of the “measured resource” or “indicated resource” will ever be converted into a “reserve.” U.S. investors should also understand that “inferred resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of “inferred resources” exist, are economically or legally mineable or will ever be upgraded to a higher category. Under Canadian securities laws, estimated “inferred resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Disclosure of “contained ounces” in a mineral resource is also permitted disclosure under Canadian securities laws. However, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade, without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth may not be comparable with information made public by companies that report in accordance with U.S. standards.

Mineral Projects

Mineral Resource and Mineral Reserve Estimates

In March 2011, Jaguar completed an internal reconciliation of its mineral resources and reserves. Ivan C. Machado, M.Sc., P.E., P.Eng., audited the internal reconciliation. Mr. Machado is an independent Qualified Person as such term is defined in NI 43-101.

Based on the reconciliation, Jaguar’s mineral resources are (i) measured and indicated resources of 96,819,390 tonnes with an average grade of 1.90 grams per tonne containing 5,926,100 ounces of gold and (ii) inferred resources of 24,717,140 tonnes with an average grade of 1.83 grams per tonne containing 1,451,860 ounces of gold. Jaguar’s proven and probable mineral reserves, which are included in the measured and indicated mineral resource figure above, are 80,743,740 tonnes with an average grade of 1.64 grams per tonne containing 4,260,480 ounces of gold.

The tables below set forth mineral resource and reserve estimates for the Turmalina, Paciência and Caeté operations as of December 31, 2010 and mineral resource and reserve estimates for the Gurupi Project as of January 31, 2011.

Notes

(1)Mineral resources listed include mineral reserves.

(2)Some columns and rows may not total due to rounding.

(3) TechnoMine NI 43-101 Technical Report on the Quadrilátero Gold Project dated Dec 20, 2004.

(4) TechnoMine NI 43-101 Technical Report on the Paciência Gold Project Feasibility Study dated Aug 7, 2007.

(5) TechnoMine NI 43-101 Technical Report on the Caeté Project Amended Feasibility Study dated Oct 29, 2010.

(6) TechnoMine NI 43-101 Technical Report on the Turmalina Gold Project dated Dec 20, 2004.

(7) TechnoMine NI 43-101 Technical Report on the Turmalina Expansion Feasibility Study dated Sept 9, 2008.

(8) TechnoMine NI 43-101 Technical Report on the Gurupi Project Feasibility Study dated Jan 31, 2011.

Although Jaguar has carefully prepared and verified the mineral resource and reserve figures presented herein, such figures are estimates, which are, in part, based on forward-looking information and no assurance can be given that the indicated level of gold will be produced. Estimated reserves may have to be recalculated based on actual production experience. Market price fluctuations of gold as well as increased production costs or reduced recovery rates and other factors may render the present proven and probable reserves unprofitable to develop at a particular site or sites for periods of time. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements”.

Mining Concessions and Operational Licenses

In Brazil, mining activity requires the grant of concessions from the DNPM, an agency of the Brazilian federal government responsible for controlling and applying the Brazilian Mining Code. Government concessions consist of exploration awards, exploration licenses, and mining permits. Exploration awards permit the holder to begin exploration of the property, exploration licenses allow the holder to proceed with exploration to determine feasibility of mining the property, and mining permits allow the holder to mine the property.

Applications for mining concessions must include an independently-prepared environmental plan that deals with water treatment, soil erosion, air quality control, re-vegetation and reforestation (where necessary) and reclamation. Mining concessions will not be granted unless the mining plan, including the environmental plan, is approved by the state authorities.

The following table lists the status of Jaguar’s mining permits and operational licenses.

| Property | Permits |

| License | Status |

| Turmalina Mining Complex |

| Turmalina Mine and Plant | Operation License | Received June 2008 |

| Turmalina Mine and Plant Expansion I | Operation License | Received December 2009 |

| Turmalina Tailing Dam Expansion I | Operation License | Received December 2009 |

| Paciência Mining Complex |

| Santa Isabel Mine and Plant | Operation License | Received October 2008 |

| Palmital Mine | Mining Permit* | Received July 2007 |

| NW1 Mine | Mining Permit* | Received August 2007 |

| Ouro Fino Mine | Mining Permit* | Received December 2009 |

| Bahú Mine | Mining Permit* | Received February 2010 |

| Caeté Mining Complex |

| Caeté Plant | Operation License | Received May 2010 |

| Caeté Tailing Dam (MOITA) | Operation License | Received May 2010 |

| Caeté Tailing Dam (RG) | Operation License | Received August 2010 |

| Roça Grande Mine | Operation License | Received April 2008 |

| Pilar Mine | Operation License | Received October 2009 |

*A Mining Permit, which is known in Brazil as the “AAF - Autorização Ambiental de Funcionamento”, allows mining production of up to 100,000 tonnes per year for underground mines and 50,000 tonnes per year for open pit mines. |

All of Jaguar’s mineral rights and mining concessions in connection with its operations in the state of Minas Gerais and mineral rights in connection with its Gurupi Project in the state of Maranhão are in good standing. Through its wholly-owned subsidiaries, Jaguar has all the necessary environmental licenses that are material to the operation of its mines and processing plants.

Material Mineral Properties

Turmalina Mining Complex

Property Description and Location

The Turmalina mining complex is located in the state of Minas Gerais, Brazil, approximately 120 kilometers northwest of the city of Belo Horizonte. Belo Horizonte, the commercial center for Brazil's mining industries, has a population of 5.4 million, outstanding infrastructure and skilled mining professionals. The Turmalina mining complex is comprised of 4,787 hectares of mining and exploration concessions.

Jaguar acquired the Turmalina property and associated mining concessions from AngloGold Ashanti on September 30, 2004. The property is owned through Jaguar’s wholly-owned subsidiary, MTL.

The mining concessions related to Turmalina’s Ore Bodies A, B and C are in good standing and Jaguar has all the necessary environmental licenses that are material to the operation of the mining complex.

The Turmalina mining concessions are subject to annual royalties paid to five individuals collectively as follows: five percent of the first US$10 million of annual net revenue and three percent of annual net revenue over US$10 million.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Turmalina mining complex is accessed from Belo Horizonte by 120 kilometers of paved highways to the town of Pitangui. The Turmalina deposits are located six kilometers south of Pitangui and less than one kilometer from a state highway.

This mining region has historically produced significant quantities of gold and iron from open pit and large-scale underground mining operations operated by AngloGold Ashanti, Vale and CSN. The city is a well-developed urban metropolis with substantial infrastructure including two airports, an extensive network of paved highways, a fully-developed and reliable power grid and ready access to processed and potable water.

Pitangui is a town of approximately 25,000 people. The local economy is based on agriculture, cattle breeding and a small pig iron plant. Manpower, energy, and water are readily available.

The Turmalina mining complex lies approximately 700 meters above sea level. The Pitangui area terrain is rugged, with numerous rolling hills. The area experiences six months of warm dry weather (April to November) with the mean temperature slightly above 20ºC, followed by six months of tropical rainfall. Annual precipitation ranges from 1,300 millimeters to 2,500 millimeters and is most intense in December and January.

History

Gold was first discovered in the Turmalina area in the 17th century and through the 19th century, intermittent small-scale production took place from alluvial terraces and outcropping quartz veins. Gold production exploited alluvium or weathered material, including saprolite and saprolite-hosted quartz veins. Records from this historical period are few and incomplete. At the end of the 19th century numerous international companies started underground activities in the district, including AngloGold Ashanti, which operated the Morro Velho Mine, the deepest mine in Brazil. The Morro Velho Mine is reported to have produced more than 16 million ounces of gold with continuous operations for more than 180 years.

AngloGold Ashanti controlled the Turmalina mineral rights from 1978 to 2004 through a number of Brazilian subsidiaries, including MTL.

AngloGold Ashanti explored the Turmalina area extensively between 1979 and 1988 using geochemistry, ground geophysics, and trenching, which led to the discovery of the Turmalina Ore Bodies A, B and C, Faina, Pontal and other mineralized zones. Exploration work at these mineralized bodies included 22 diamond drill holes totaling 5,439 meters drilled from the surface to test the downward extension of the sulfide mineralized body.

In 1992 and 1993, AngloGold Ashanti mined 373,000 tonnes of oxide ore from open pits at the Ore Bodies A, B and C, Pontal, and Faina zones. It recovered 35,500 ounces of gold using heap leach technology. Subsequently, AngloGold Ashanti explored a possible downward sulfide extension of the Turmalina Ore Body A deposit by driving a ramp beneath the pit and drifting on two levels in the mineralized zone at approximately 50 meters and 75 meters below the pit floor.

Detailed underground works included collecting approximately 2,000 samples from channels with 3-meter spacing along all the length of the drifts. About 17,000 tonnes of ore were mined (trial mine) by AngloGold Ashanti. The ore was transported and treated at their plant located in the town of Nova Lima, near Belo Horizonte.

Jaguar acquired MTL from AngloGold Ashanti in September 2004. In November 2006, the Turmalina underground mines (Ore Bodies A and B) and the Turmalina Plant were commissioned. The first gold pour was conducted in January 2007 and commercial production was declared in August 2007.

During 2008, Jaguar conducted a complementary 12,000 meter in-fill diamond drilling program at Ore Body C as part of an effort to convert resources to reserves to expand the Turmalina operation. In September 2008, Jaguar completed an NI 43-101 compliant feasibility study technical report on the Turmalina Phase I Expansion, which was implemented and completed during the third quarter of 2009, increasing Turmalina’s annual gold production capacity from 80,000 ounces per year to 100,000 ounces per year. As a result, milling capacity at the Turmalina Plant was increased to 1,800 tonnes per day of ore from its previous designed operating level of 1,500 tonnes per day.

During 2009 and 2010, exploration efforts were concentrated on three targets that are part of the Turmalina mining complex, Zone D, Faina and Pontal. During 2009, a total of 17,319 meters of drilling in 72 drill holes were completed. In 2010, Jaguar drilled a total of 20,210 meters in 122 surface drill holes and 557 meters in four underground drill holes. During the second quarter of 2011, Jaguar expects to report the results of these exploration campaigns and provide an updated NI 43-101 resource estimate for the Faina and Pontal targets.

During 2010, Jaguar encountered geo-mechanical issues at level 3 in Ore Body A, which resulted in dilution averaging over 30%, more than double the level expected. Jaguar initiated steps to convert the mining method at Turmalina from selective stoping to cut-and-fill in Ore Body A in the second quarter of 2010. As part of this effort, Jaguar elected to deploy additional personnel and equipment to accelerate forward underground development in Ore Body A at the expense of producing and processing higher tonnage during the fourth quarter of 2010. The mining team achieved 1.7 km of new development, which represents the highest quarterly rate in the history of the Turmalina operation and was over 25% higher than the rate of development achieved on a quarterly basis during the first half of 2010. Management believes that the conversion of mining methods should be essentially completed during the first quarter of 2011. Actual mining of the panels in Ore Body A has already demonstrated a significant improvement in dilution control, which is now averaging below 15%.

Geological Setting

The Turmalina deposit is hosted by rocks of the Archean Rio das Velhas Supergroup greenstone belt in the Iron Quadrangle region. The Rio das Velhas Supergroup is further subdivided into the Nova Lima and Maquiné Groups. The Nova Lima Group, which hosts most of the gold deposits in the region, is comprised of clastic sediments, pyroclastics, volcanic flows, chemical sediments, and banded iron formations (“BIF”). There is no widely accepted stratigraphy for the Nova Lima Group, due to intense deformation, hydrothermal alteration, and weathering.

The Rio das Velhas Supergroup unconformably overlies a tonalite, trondjemite basement. The Proterozoic Minas Supergroup overlies the Rio das Velhas Supergroup and consists of clastic and chemical sediments, including rich hematite mineralization and minor metavolcanics.

Gold mineralization in the Iron Quadrangle is most commonly associated with the BIF, cherts and quartz veins in schists of the Nova Lima Group, which are located along regional structural lineaments. The most important structures are NW and NE striking, thrust-related, oblique ramps or EW-striking transcurrent faults, the latter being the most favored location for gold deposition.

The Turmalina area is underlain by rocks of Archaean and Proterozoic ages. Archaean units include a granitic basement, overlain by the Pitangui Group, a sequence of ultramafic to intermediate volcanic flows and pyroclastics, and associated sediments.

Proterozioc units include the Minas Supergroup and the Bambui Group. The former includes basal quartzites and conglomerates as well as phyllites. Some phyllites, stratigraphically higher in the sequence, are hematitic. The Bambui is composed of calcareous sediments.

The Turmalina deposit is hosted by a sequence of rocks within the intermediate unit of the Pitangui Group. Sheared pelitic schists are the dominant rock hosting Ore Bodies A and B. A sequence of sheared, banded, sulfide iron formation intercalated with amphibolites and chert, lying stratigraphically below Ore Bodies A and B, hosts the Satinoco Structure. Gold mineralization is associated with higher levels of sericite, quartz, chlorite, biotite, and pink garnet with disseminated arsenopyrite. Fine banding is likely associated with shearing.

The Satinoco Structure lies in or close to the banded iron formation/chert horizon. Both the banded iron formation/chert and the mineralized zones are located within a shear zone more than one kilometer long that strikes approximately Az 135º and dips to 60o - 70o NE.

Exploration

Jaguar’s initial exploration efforts started in 2004 and focused on the re-interpretation of the AngloGold Ashanti data (trenches, soil geochemistry, and drilling) to better understand the local geology. These efforts were concentrated on the targets previously identified by AngloGold Ashanti, Ore Bodies A, B, and C (formerly known as Main, Northeast and Satinoco targets, respectively).

An exploration program was carried out at Ore Body C from March 2006 to April 2008 in order to estimate resources in accordance with NI 43-101. This program included the opening of about 700 meters of trenches and the collection of 146 channel samples crossing the mineralized zone and a complementary diamond drilling program, which consisted of three phases carried out as follows:

Phase I: 5,501 meters drilled in 35 drill holes to test the continuity of the mineralized bodies between the weathered zone and up to 200 meters below the surface.

Phase II: 3,338 meters drilled in 24 complementary infill-holes to create a 25 x 60 meter grid between the surface and 100 meters below and to test the lateral continuity of the mineralized bodies.

Phase III: An additional drill-hole campaign was carried out in 2007, which consisted of 12,763 meters drilled in 48 holes to estimate gold mineral resources.

Jaguar initially completed Phases I and II at the Ore Body C Target and commissioned TechnoMine to prepare a resource estimate technical report. A technical report was issued in October 2007, based on exploration data achieved until July 2007. Jaguar completed Phase III of the exploration campaign in December 2007. The results generated during Phase III were integrated with the previous exploration database and gave rise to a re-evaluation of the resource base. In February 2008, Jaguar filed a technical report in accordance with NI 43-101 in connection with the upgrade of inferred to measured and indicated resources at the Ore Body C Target.

During the fourth quarter of 2007, Jaguar completed an underground crosscut to access Ore Body C mineralization through the existing ramp developed to mine Ore Bodies A and B at Turmalina. The crosscut is utilized to transport ore from Ore Body C through the Turmalina Mine adit. During the excavation process of the crosscut, economic grades of gold were discovered in channel samples. During 2008, Jaguar conducted a complementary 12,000 meter in-fill diamond drilling program as part of the feasibility work in an effort to convert resources to reserves to expand Turmalina’s operations.

In September 2008, TechnoMine completed the NI 43-101 compliant feasibility study technical report on the Turmalina Phase I Expansion, which converted the Ore Body C mineral resources to reserves. The expansion was completed during the third quarter of 2009.

Jaguar’s reported mineral resources for Turmalina extend to a depth of approximately 500 meters where the mineralized structure is open at depth and along strike. As part of a drilling program to prove the continuity of the mineralization at Ore Body A, Jaguar drilled four holes to depths ranging from 850 meters to 1,100 meters. Two of these drill holes intersected the mineralized structure of Ore Body A to a depth of approximately 800 meters. A grade of approximately seven grams per tonne was encountered in a narrow zone at depth thereby confirming the extension of the mineralized structure. Jaguar’s team believes the size of the mineralized structure and mineralization is similar to the existing reserve base in this ore body to a depth of 500 meters. This is also consistent with the characteristics of other gold mines in the Iron Quadrangle, some of which have operated to depths of 2,400 meters.

As part of the surface exploration program to estimate resource potential in a newly discovered oxide zone at Ore Body B, several trenches were excavated to expose and sample the mineralized zone. Channel samples revealed two separate mineralized areas with average surface grades ranging from 3 grams per tonne to 5 grams per tonne.

At Ore Body C and Zone D, which is an extension of Ore Body C, additional gold bearing oxide ore has been identified in the weathered rock overlying the sulfide zone. During 2008, 11,698 meters of drilling for a total of 62 drill holes were drilled in this structure to estimate oxide and sulfide mineral resources.

During 2009, Jaguar continued drilling in the Satinoco structure Ore Bode C to estimate oxide and sulfide mineral resources. A total of 5,017 meters of drilling in 31 drill holes were completed. Mining of these oxide resources commenced in the fourth quarter of 2009.

Jaguar has also discovered a new target at the Turmalina mining complex, the Fazenda Experimental Target. This new structure is unrelated to the mineralized on-strike zone associated with Ore Bodies A, B and C and Zone D. The Fazenda Experimental Target is located approximately five kilometers from the Turmalina Plant in a structure parallel to the existing ore bodies and zones. Some limited historical mining at this target had been carried out at shallow depths but this was determined to be insignificant. Over the past two years, Jaguar has conducted work in the area, including soil sampling, trenching and 668 meters of drilling in four drill holes. Drilling results confirmed continuity of the mineralization along strike.

During 2009, drilling activity was also focused on the Faina and Pontal targets. A total of 17,319 meters of drilling in 72 drill holes were completed, with very encouraging preliminary assay results.

During 2010, exploration activities at the Turmalina mining complex consisted of geological detailing and in-fill drilling at the Faina, Pontal and Zone D targets. Jaguar also conducted surface and underground drilling at Ore Bodies A, B and C to assist with mining activities as well as to test the continuity of the ore bodies at depth. A total of 20,210 meters in 122 surface drill holes and 557 meters in four underground drill holes were completed in 2010 at these targets.

During the second quarter of 2011, Jaguar expects to report the results of these exploration campaigns and provide an updated NI 43-101 resource estimate for the Faina and Pontal targets.

Mineralization

Gold mineralization in the Turmalina deposits occurs in fine grains associated with sulfides in sheared schists and BIF sequences. Gold particles found within the ore, averaging 10 to 20 mm, are mostly associated with arsenopyrite, quartz, and micas (sericite and biotite), as presented in the table below:

| Gold - Mode of Occurrence |

| Associated to | % of gold content | Notes |

| Arsenopyrite | 61 | Occurring both inside and at the borders of the mineral |

| Quartz | 26 | Occurring both inside and at the borders of the mineral |

| Micas | 9 | Occurring both inside and at the borders of the mineral |

| Pyrite + Pyrrhotite | 4 | Occurring only at the borders of the mineral |

Coarse gold, on a millimeter scale, is found locally with discrete quartz veins. Overall, this type of occurrence is minor. Typically, these mineralized bodies show a yellowish color produced by weathering in outcrops within the weathered rock zone.

Drilling

During the survey, three different mineralized sectors were defined in Ore Body C by trenches and drilling. These sectors were named Central, NW, and SE and were drilled in exploratory and locally detailed grids. Drill-hole lengths ranged from 32 meters to 453 meters. Core diameters were consistently HQ from surface through the weathered rock to bedrock. At about three meters into bedrock, the holes were reduced to NQ diameter to the final depth.

Collar locations for the holes were established by theodolite surveys. All holes were drilled within three meters of the planned location. Azimuth and inclination for angle holes were set by brunton compass, deemed accurate to within 2o azimuth and <1o inclination.

Following completion of the drill holes, the collars were resurveyed with theodolite and cement markers emplaced. Downhole surveys were completed in all holes with length greater than 100 meters, using Sperry-Sun or Maxibore equipment.

The average core recovery was greater than 90%. Core samples were collected during these phases and sent to laboratories for gold assay. A total of 2,338 core samples from holes FSN 10 to 113 were collected. The drilling program was carried out by Mata Nativa Comércio e Serviços Ltda. (“Mata Nativa”), a local drilling company, using Longyear drill rigs.

Drilling results have confirmed both lateral and depth continuity and the configuration of the mineralized bodies. Ore Body C is still open at depth and in the NW directions.

Sampling Method and Approach

The drill core logging was done by one of Jaguar’s senior geologists at its Caeté facilities, where an exploration office, chemical laboratory, core preparation, and sampling and storage units are located. Diamond drill cores were logged based on lithology, weathering, hydrothermal alteration, and mineralization.

The core sampling intervals were determined according to lithology, mineralization type, and visually anticipated grade. A total of 2,338 intervals were selected for sampling. The sample length varied between 0.8 to 1.2 meters, with 1.0 meter on average. A few samples in barren or poorly mineralized section were slightly larger (maximum 1.5 meters). One or two samples in barren core on the margins of the mineralized zones were systematically collected for the assurance of the complete sampling process.

The cores selected for sampling were halved with a diamond saw. One half was placed in a plastic bag and the other half was returned to the original wooden core box. The samples were transported to the laboratories using a local courier. The assays were made in Belo Horizonte by SGS do Brasil and Lakefield/Geosol assay laboratories and by Jaguar’s laboratory in Caeté. In 2006, Lakefield/Geosol was bought by SGS. Collar and down-hole survey data, major lithologies, and assay results were entered into a database using a digital spreadsheet format.

Sample Preparation, Analysis and Security

Between 1979 and 1988, trenching, drilling and sampling were performed in accordance with AngloGold Ashanti’s controls and standard industry practices at that time (pre NI 43-101).

The following channel sampling procedures were used in trenches used by AngloGold Ashanti. First, sites were cleaned with a hoe, exposing the material by scraping. Next, structures were mapped, lithologic contacts were defined, and samples were marked so that no sample had more than one lithology. Samples had a maximum length of one meter and weighed between one and two kilograms. Channel samples were collected from outcrops, trenches, and drift walls. This consisted of manually opening the channels with lengths ranging from 50 centimeters to one meter, average widths between 5 to 10 centimeters, and about 3 centimeters deep, using a hammer and a chisel. Either an aluminum tray or a plastic canvas was used to collect the material. The samples were then stored in a plastic bag and identified by a numbered label, which was protected by a plastic cover and placed with the sample. At the sampling site, samples were identified by aluminum plates, labels, or wooden poles. Next, sketches were drawn with lithological and structural information. The sample locations were surveyed by theodolite.

The following diamond drill core sampling procedures were adopted by AngloGold Ashanti. Drilling was carried out by their drill operators using their own drill rigs in HQ and NQ diameters. The cores were stored in wooden boxes of one meter length, with three meters of core per box (HQ diameter) or four meters of core per box (NQ diameter). Hole number, depth, and location were identified on the boxes by an aluminum plate on the front of the box. The drilling interval and core recovery were identified inside the boxes by small wooden or aluminum plates.

During logging of the hole, geological information was collected, the interval and recovery were verified, and samples for chemical analyses were defined. Samples were identified in the boxes by highlighting their side or by labels. Samples were cut in the middle with a diamond saw or a hammer, at right angles to the structure direction that controls the mineralization. If the samples were of weathered oxide mineralization, either a spatula or a spoon was used to divide and collect the sample. One half was stored in a heavy duty plastic bag, identified by a laminated label, and the other half was kept in the proper box at the core shed. The standard procedure was to cut the core parallel to the long axis. Sampling intervals were generally defined in accordance with the key geological control parameters, as lithologic contacts and structures, marked inside each unit, maintaining the dimensions specified above.

Assays were carried out by AngloGold Ashanti’s laboratory in Nova Lima, Minas Gerais, which has international certification. The fire assay/atomic absorption ("AA") method was used. At that time, AngloGold Ashanti’s laboratory standard procedure was to re-assay all samples which returned grades greater than three grams per tonne. One duplicate was assayed for every 20 samples.

Channel sampling carried out by Jaguar was restricted to the walls of trenches and underground development. First, sites were cleaned with a hoe, exposing the material by scraping surface trenches or by water if underground. Next, structures were mapped, lithologic contacts were defined, and samples were marked so that no sample had more than one lithology. Usually, the samples had a maximum length of one meter and weighed between one to two kilograms. Channel samples were taken manually, using a hammer and chisel. The channels had lengths ranging from 50 centimeters to one meter, with averaging width ranging from five to six centimeters and about three centimeters deep. In the drift, samples were collected in channels starting at the floor level on one side and going over the drift section to the floor on the opposite side.

An aluminum tray or a plastic canvas was used to collect the material. The samples were then stored in plastic bags and identified by numbered labels, which were protected by a plastic cover and placed with the sample. Samples were identified at the sampling site by number sequence painted in the drift walls. Sample locations were surveyed by theodolite.

Surface diamond drilling was carried out by Mata Nativa using HQ and NQ tools. The diamond drill core sampling procedures adopted by Jaguar are described below.

Only drill holes with more than 90% core recovery from the mineralized zone were accepted. Drill-hole deviations were surveyed by Sperry Sun or DDI/Maxibore equipment. The cores were stored in wooden boxes of one meter length with three meters of core per box (HQ diameter) or four meters of core per box (NQ diameter). The hole’s number, depth, and location were identified in the boxes by an aluminum plate on the front of the box and by a water-resistant ink mark on its side. The progress interval and core recovery are identified inside the boxes by small wooden or aluminum plates.

During logging of the geological information, progress and recovery measures were verified and chemical analyses samples were defined. Samples are identified in the boxes by highlighting their side or by labels. Samples were cut in the middle with the help of a diamond saw and a hammer. One half was stored in a heavy duty plastic bag, identified by a laminated label, and the other half is kept in the proper box at the core shed.

SGS laboratories in Belo Horizonte prepared and assayed the core samples during Phase I drilling. During Phases II and III, Jaguar used its own laboratory. After Jaguar received the assays results, the mineralized sections were identified in the drill core and sent to SGS for re-assay and inter-laboratories check-control. About 43% of these core samples were submitted for re-assay. Rock Labs standards, blanks, and duplicates were used. No significant assay variations were detected. The SGS laboratory has been assessed by ABS Quality Evaluations, in Houston, Texas, and found to be in compliance with ISO 9001.

Samples were prepared by drying, crushing to 90% minus two millimeters, quartering with a Jones splitter to produce a 250 gram sample, and pulverizing to 95% minus 150 mesh. Gold assay was by standard fire assay procedures, using a 30 gram sample with an AA finish. Analytical results were forwarded to Jaguar’s exploration department by email, followed by a hard copy. SGS and Jaguar laboratories used identical sample preparation and analyses methodologies.

Mineral Resource and Reserve Estimates

Turmalina has an estimated 5,594,560 tonnes of measured and indicated mineral resources at an average grade of 4.76 grams per tonne totaling 856,290 ounces of gold and 1,409,340 tonnes of inferred mineral resources at an average grade of 5.70 grams per tonne totaling 258,510 ounces of gold.

Proven and probable gold reserves, which are included in the reported mineral resource estimate, are estimated at 4,037,640 tonnes at an average grade of 4.03 grams per tonne totaling 523,630 ounces.

Mining Operations and Metallurgical Process