UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended:September 30, 2013

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission File Number:001-34649

CHINA GENGSHENG MINERALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| NEVADA | 91-0541437 |

| (State or Other jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | |

| CHINA GENGSHENG MINERALS, INC. | |

| No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan Province P.R. China | 451271 |

| | |

| (Address of Principal Executive Offices) | (Zip Code) |

(86) 371-64059863

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] | Smaller Reporting Company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

As of November 19, 2013, there were 26,803,044 shares of Common Stock of the Company, $0.001 par value,outstanding.

Table of Contents

China GengSheng Minerals, Inc.

Consolidated Balance Sheets

| | | September 30, | | | | |

| | | 2013 | | | December 31, | |

| | | (Unaudited) | | | 2012 | |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | $ | 2,124,877 | | $ | 5,408,309 | |

| Restricted cash | | 36,553,484 | | | 20,113,452 | |

| Trade receivables, net | | 48,304,537 | | | 55,811,468 | |

| Bills receivable | | 4,153,097 | | | 9,913,668 | |

| Other receivables and prepayments, including related parties, net | | 16,059,702 | | | 16,466,252 | |

| Advances to senior management | | 32,560 | | | 9,005 | |

| Inventories, net | | 14,092,132 | | | 12,971,168 | |

| Deferred tax assets, net of valuation allowance | | 216,256 | | | 210,544 | |

| | | | | | | |

| Total current assets | | 121,536,645 | | | 120,903,866 | |

| | | | | | | |

| Investment in a non-consolidated entity | | 993,174 | | | 1,040,492 | |

| Property, plant and equipment, net | | 36,124,888 | | | 36,425,004 | |

| Land use rights, net | | 4,012,193 | | | 4,035,948 | |

| | | | | | | |

| TOTAL ASSETS | $ | 162,666,900 | | $ | 162,405,310 | |

| | | | | | | |

| LIABILITIES AND EQUITY | | | | | | |

| | | | | | | |

| Current liabilities: | | | | | | |

| Trade payables | $ | 26,187,317 | | $ | 23,808,926 | |

| Bills payable | | 13,426,930 | | | 13,995,550 | |

| Other payables and accrued expenses, including related parties | | 7,213,423 | | | 7,561,146 | |

| Deferred revenue - Government grants | | 1,212,616 | | | 649,612 | |

| Provision of warranty | | 76,981 | | | 100,570 | |

| Income taxes payable | | 169,396 | | | 166,719 | |

| Non-interest-bearing loans, including related parties | | 9,440,944 | | | 6,760,465 | |

| Collateralized short-term bank loans | | 66,888,008 | | | 65,196,883 | |

| Loans from a third party | | 5,698,000 | | | 3,170,000 | |

| Deferred tax liabilities | | 525,910 | | | 513,524 | |

| | | | | | | |

| TOTAL LIABILITIES | | 130,839,525 | | | 121,923,395 | |

| | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | |

1

China GengSheng Minerals, Inc.

Consolidated Balance Sheets (Cont’d)

| | | September 30, | | | | |

| | | 2013 | | | December 31, | |

| | | (Unaudited) | | | 2012 | |

| EQUITY | | | | | | |

| CHGS STOCKHOLDERS' EQUITY | | | | | | |

Preferred stock par value - $0.001 per share; authorized 50,000,000 shares, none

issued and outstanding | | - | | | - | |

Common stock par value - $0.001 per share; authorized 100,000,000 shares, 26,803,044

shares issued and outstanding | | 26,803 | | | 26,803 | |

| Additional paid-in capital | | 28,197,310 | | | 28,197,310 | |

| Statutory and other reserves | | 8,110,972 | | | 8,110,972 | |

| Accumulated other comprehensive income | | 8,749,981 | | | 7,994,358 | |

| Accumulated deficit | | (13,385,356 | ) | | (3,997,894 | ) |

| | | | | | | |

| Total China GengSheng Minerals, Inc. stockholders' equity | | 31,699,710 | | | 40,331,549 | |

| NONCONTROLLING INTEREST | | 127,665 | | | 150,366 | |

| | | | | | | |

| TOTAL EQUITY | | 31,827,375 | | | 40,481,915 | |

| | | | | | | |

| TOTAL LIABILITIES AND EQUITY | $ | 162,666,900 | | $ | 162,405,310 | |

See accompanying notes to the consolidated financial statements.

2

China GengSheng Minerals, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

| | | Three months ended | | | Nine months ended | |

| | | September 30, | | | September 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | |

| Sales | $ | 14,599,946 | | $ | 23,626,721 | | $ | 41,009,314 | | $ | 56,957,599 | |

| | | | | | | | | | | | | |

| Cost of goods sold | | (11,721,181 | ) | | (18,503,171 | ) | | (33,513,372 | ) | | (46,063,149 | ) |

| | | | | | | | | | | | | |

| Gross profit | | 2,878,765 | | | 5,123,550 | | | 7,495,942 | | | 10,894,450 | |

| | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | |

| General and administrative expenses | | 1,788,216 | | | 1,692,502 | | | 5,253,506 | | | 5,358,592 | |

| Research and development expenses | | 402,179 | | | 307,632 | | | 1,049,550 | | | 706,911 | |

| Selling expenses | | 2,091,967 | | | 3,598,525 | | | 5,801,084 | | | 8,869,668 | |

| | | | | | | | | | | | | |

| Total operating expenses | | 4,282,362 | | | 5,598,659 | | | 12,104,140 | | | 14,935,171 | |

| | | | | | | | | | | | | |

| Loss from operations | | (1,403,597 | ) | | (475,109 | ) | | (4,608,198 | ) | | (4,040,721 | ) |

| | | | | | | | | | | | | |

| Other (expenses) income | | | | | | | | | | | | |

| Government grant income | | 57,276 | | | 163,597 | | | 131,382 | | | 548,911 | |

| Guarantee income | | 80,670 | | | 141,765 | | | 273,115 | | | 443,051 | |

| Guarantee expenses | | (1,045 | ) | | (136,940 | ) | | (154,090 | ) | | (373,748 | ) |

| CHGS’s share of net loss of a non-consolidated entity | | (25,078 | ) | | (24,293 | ) | | (75,267 | ) | | (32,860 | ) |

| Interest income | | 345,426 | | | 185,982 | | | 868,286 | | | 424,931 | |

| Other income (expenses) | | (27,046 | ) | | 1,153 | | | (81,801 | ) | | 44,997 | |

| Finance costs | | (2,065,795 | ) | | (1,989,431 | ) | | (5,258,766 | ) | | (5,689,561 | ) |

| | | | | | | | | | | | | |

| Total other expenses | | (1,635,592 | ) | | (1,658,167 | ) | | (4,297,141 | ) | | (4,634,279 | ) |

| | | | | | | | | | | | | |

| Loss before income taxes and noncontrolling interest | | (3,039,189 | ) | | (2,133,276 | ) | | (8,905,339 | ) | | (8,675,000 | ) |

| | | | | | | | | | | | | |

| Income taxes | | (37,499 | ) | | (59,170 | ) | | (516,633 | ) | | (273,536 | ) |

| | | | | | | | | | | | | |

| Net loss before noncontrolling interest | | (3,076,688 | ) | | (2,192,446 | ) | | (9,421,972 | ) | | (8,948,536 | ) |

| Net (income) loss attributable to noncontrolling interest | | 3,587 | | | (8,047 | ) | | 34,510 | | | 41,441 | |

| | | | | | | | | | | | | |

| Net loss attributable to Company’s common stockholders | $ | (3,073,101 | ) | $ | (2,200,493 | ) | $ | (9,387,462 | ) | $ | (8,907,095 | ) |

| | | | | | | | | | | | | |

| Net loss before noncontrolling interest | $ | (3,076,688 | ) | $ | (2,192,446 | ) | $ | (9,421,972 | ) | $ | (8,948,536 | ) |

| Other comprehensive income | | | | | | | | | | | | |

| Foreign currency translation adjustments | | 223,244 | | | (86,017 | ) | | 755,623 | | | 174,425 | |

| | | | | | | | | | | | | |

| Comprehensive loss | | (2,853,444 | ) | | (2,278,463 | ) | | (8,666,349 | ) | | (8,774,111 | ) |

| Comprehensive loss attributable to noncontrolling Interest | | (7,174 | ) | | (7,964 | ) | | (57,211 | ) | | (15,914 | ) |

Comprehensive loss attributable to Company’s

common Stockholders | $ | (2,860,618 | ) | $ | (2,286,427 | ) | $ | (8,723,560 | ) | $ | (8,790,025 | ) |

| | | | | | | | | | | | | |

Net loss per share - Basic and diluted

attributable to Company’s common stockholders | $ | (0.11 | ) | $ | (0.08 | ) | $ | (0.33 | ) | $ | (0.33 | ) |

| | | | | | | | | | | | | |

Weighted average common shares outstanding -

Basic and diluted | | 26,803,044 | | | 26,803,044 | | | 26,803,044 | | | 26,803,044 | |

See accompanying notes to the consolidated financial statements.

3

China GengSheng Minerals, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

| | | Nine Months Ended September 30, | |

| | | 2013 | | | 2012 | |

| Cash flows from operating activities | | | | | | |

| Net loss before noncontrolling interest | $ | (9,421,972 | ) | $ | (8,948,536 | ) |

| Adjustments to reconcile net loss before noncontrolling interest to net cash provided by operating activities: | | | | | | |

| Depreciation | | 2,373,327 | | | 2,235,742 | |

| Amortization of land use rights | | 82,789 | | | 55,020 | |

| CHGS’s share of net loss of a non-consolidated entity | | 75,267 | | | 32,860 | |

| Deferred taxes | | (620 | ) | | 12,133 | |

| (Gain) loss on disposal of property, plant and equipment | | (25,197 | ) | | 115,523 | |

| Guarantee expenses | | 154,090 | | | 373,748 | |

| Guarantee income | | (273,115 | ) | | (443,051 | ) |

| Allowance for doubtful accounts | | 738,667 | | | 767,839 | |

| Exchange gain | | (235,176 | ) | | (57,580 | ) |

| Changes in operating assets and liabilities: | | | | | | |

| Restricted cash | | (4,708,666 | ) | | 11,197,678 | |

| Trade receivables | | 7,787,429 | | | (11,233,245 | ) |

| Bills receivable | | 6,643,539 | | | (276,043 | ) |

| Other receivables and prepayments | | 2,256,417 | | | (2,875,714 | ) |

| Advances to senior management | | (23,225 | ) | | 361,764 | |

| Inventories | | (765,836 | ) | | 2,064,488 | |

| Trade payables | | 1,841,020 | | | 6,981,173 | |

| Provision of warranty | | (26,220 | ) | | (112,409 | ) |

| Bills payable | | (1,581,054 | ) | | 515,417 | |

| Other payables and accrued expenses | | 305,961 | | | (132,397 | ) |

| Income taxes payable | | (1,839 | ) | | (147,482 | ) |

| Net cash provided by operating activities | | 5,195,586 | | | 486,928 | |

| Cash flows from investing activities | | | | | | |

| Payments for acquisition of an investment | | - | | | (790,500 | ) |

| Payments for acquisition of property, plant and equipment | | (1,228,963 | ) | | (1,776,235 | ) |

| Net cash used in investing activities | | (1,228,963 | ) | | (2,566,735 | ) |

| Cash flows from financing activities | | | | | | |

| Government grant received | | 543,370 | | | 357,306 | |

| Restricted cash | | (11,127,123 | ) | | (31,866,636 | ) |

| Proceeds from bank loans | | 99,004,642 | | | 52,199,687 | |

| Repayment of bank loans | | (99,081,979 | ) | | (22,654,149 | ) |

| Proceeds from non-interest-bearing loans | | 11,743,811 | | | 1,153,235 | |

| Repayment of non-interest-bearing loans | | (10,861,722 | ) | | (1,247,110 | ) |

| Proceeds from third party loans | | 5,677,000 | | | 3,162,000 | |

| Repayment of third party loans | | (3,244,000 | ) | | - | |

| Net cash provided by (used in) financing activities | | (7,346,001 | ) | | 1,104,333 | |

4

China GengSheng Minerals, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

| | | Nine Months Ended September 30, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Effect of foreign currency translation on cash and cash equivalents | | 95,946 | | | 10,350 | |

| | | | | | | |

| Net change in cash and cash equivalents | | (3,283,432 | ) | | (965,124 | ) |

| Cash and cash equivalents - beginning of period | | 5,408,309 | | | 3,594,361 | |

| | | | | | | |

| Cash and cash equivalents - end of period | $ | 2,124,877 | | $ | 2,629,237 | |

| | | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | |

| Interest paid | $ | 4,913,863 | | $ | 4,203,589 | |

| Income taxes paid | $ | 519,416 | | $ | 345,896 | |

| | | | | | | |

| Non-cash investing and financing activities: | | | | | | |

| | | | | | | |

| Proceeds from disposal of property, plant and equipment settled by offsetting trade payables | $ | 121,286 | | $ | 88,538 | |

| Acquisition of Yili YiQiang Silicon Limited by offsetting deposit for acquisition of a non-consolidated entity | $ | - | | $ | 1,096,898 | |

See accompanying notes to the consolidated financial statements.

5

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 1. | Basis of presentation |

| | |

| Basis of presentation |

| | |

| The unaudited consolidated financial statements and related notes of the Company and its subsidiaries have been prepared in accordance accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information, and with the rules and regulations of the Securities and Exchange Commission (the “SEC”) including the instructions to Form 10-Q and Regulation S-X. Accordingly, they do not include all the information and notes required by U.S. GAAP for complete financial statements. In the opinion of the management of the Company, all adjustments, which are of a normal recurring nature, necessary for a fair statement of the results for the interim period have been made. Interim results presented are not necessarily indicative of the results that might be expected for the full fiscal year. These unaudited interim consolidated financial statements should be read in conjunction with our audited consolidated financial statements for the year ended December 31, 2012, included in our Annual Report on Form 10-K for the year ended December 31, 2012 as filed with the Securities and Exchange Commission on April 15, 2013. |

| | |

| Certain reclassifications have been made to prior period financial statements to conform with current period’s presentation. |

| | |

| 2. | Corporate information |

| | |

| The Company was originally incorporated on November 13, 1947, in accordance with the laws of the State of Washington as Silver Mountain Mining Company. On August 20, 1979, the Articles of Incorporation were amended to change the corporate name of the Company to Leadpoint Consolidated Mines Company. On August 15, 2006, the Company changed its state of incorporation from Washington to Nevada by means of a merger with and into a Nevada corporation formed on May 23, 2006, solely for the purpose of effectuating the reincorporation and changed its name to Point Acquisition Corporation. On June 11, 2007, the Company changed its name to China Minerals Technologies, Inc. and on July 26, 2007, the Company changed its name to China GengSheng Minerals, Inc. On March 4, 2010, the Company’s common stock began trading on the NYSE MKT LLC (formerly the American Stock Exchange) under the symbol CHGS. Prior to March 4, 2010, the Company’s common stock traded on the Over-the-Counter Bulletin Board under the symbol CHGS.OB. |

| | |

| Currently the Company has the following eight subsidiaries: |

| Company name | Place/date of incorporation or establishment | The Company's effective ownership interest | Common stock/ registered capital | | Principal activities |

| | | | | | |

GengSheng

International Corporation

( “GengSheng International” ) | The British Virgin Islands (the “BVI”)/

November 3, 2004

| 100% | Ordinary shares :- Authorized: 50,000 shares of $1 each Paid up: 100 shares of $1 each | | Investment holding |

| | | | | | |

Henan GengSheng

Refractories Co., Ltd.

( “Refractories” ) | The People's Republic of

China (the “PRC”)/

December 20, 1996 | 100% | Registered capital of $12,089,879 fully paid up | | Manufacturing and selling of refractory products |

| | | | | | |

Henan GengSheng

High-Temperature Materials Co., Ltd.

( “High-Temperature” ) | PRC/

September 4, 2002

| 89.33% | Registered capital of $1,246,300 fully paid up | | Manufacturing and selling of functional ceramic products |

6

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 2. | Corporate information (Cont’d) |

| Company name | Place/date of incorporation or establishment | The Company's effective ownership interest | Common stock/ registered capital | | Principal activities |

| | | | | | |

Smarthigh Holdings Limited

( “Smarthigh” ) | BVI/

November 5, 2004 | 100% | Ordinary shares :- Authorized: 50,000 shares of $1 each Paid up: 100 shares of $1 each | | Investment holding |

| | | | | | |

Zhengzhou Duesail

Fracture Proppant Co., Ltd.

( “Duesail” ) | PRC/

August 14, 2006 | 100% | Registered capital of $2,800,000 fully paid up | | Manufacturing and selling of fracture proppant products |

| | | | | | |

Henan GengSheng

Micronized Powder Materials Co., Ltd.

( “Micronized” ) | PRC/

March 31, 2008 | 100% | Registered capital of $5,823,000 fully paid up | | Manufacturing and selling of fine precision abrasives |

| | | | | | |

Guizhou Southeast

Prefecture GengSheng New Materials Co., Ltd.

( “Prefecture” ) | PRC/

April 13, 2004 | 100% | Registered capital of $141,840 fully paid up | | Manufacturing and selling of corundum materials |

| | | | | | |

Henan Yuxing Proppant Co., Ltd.

(“Yuxing”) | PRC/

June 3, 2011 | 100% | Registered capital of $3,086,000 fully paid up | | Manufacturing and selling of fracture proppant products |

| 3. | Description of business |

| | |

| The Company is a holding company whose primary business operations are conducted through its subsidiaries located in the PRC’s Henan Province. Through its operating subsidiaries, the Company produces and markets a broad range of monolithic refractory, functional ceramics, fracture proppants, fine precision abrasives, and corundum materials. |

| | |

| The principal raw materials used in the products are several forms of aluminum oxide, including bauxite, processed AI2O3and calcium aluminates cement, and other materials, such as corundum, magnesia, resin and silica, which are primarily sourced from suppliers located in the PRC. The production facilities of the Company, other than the Prefecture’s sub-processing factory located in Guizhou, are also located in Henan Province. |

| | |

| Refractories products allow steel makers and other customers to improve the productivity and longevity of their equipment and machinery. Functional ceramic products mainly include abrasive balls and tiles, valves, electronic ceramics and structural ceramics. Fracture proppant products are used to reach trapped pockets of oil and natural gas deposits, which lead to higher productivities of oil and natural gas wells. Due to their heat-resistant qualities and ability to function under thermal stress, refractories serve as components in industrial furnaces and other heavy industrial machinery. Corundum materials are a major raw material for producing monolithic refractory. Fine precision abrasive is used for slicing the solar-silicon bar and polishing the equipment surface. The Company’s customers include some of the largest steel and iron producers located in 25 provinces in the PRC, as well as other countries in Asia and Europe. |

7

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 4. | Summary of significant accounting policies |

| | |

| Basis of consolidation |

| | |

| The Company applies the guidance of Topic 810“Consolidation”of the FASB Accounting Standards Codification to determine whether and how to consolidate another entity. Pursuant to ASC Paragraph 810-10-15-10 all majority-owned subsidiaries—all entities in which a parent has a controlling financial interest—shall be consolidated except (1) when control does not rest with the parent, the majority owner; (2) if the parent is a broker-dealer within the scope of Topic 940 and control is likely to be temporary; (3) consolidation by an investment company within the scope of Topic 946 of a non-investment-company investee. Pursuant to ASC Paragraph 810-10-15-8 the usual condition for a controlling financial interest is ownership of a majority voting interest, and, therefore, as a general rule ownership by one reporting entity, directly or indirectly, of more than 50 percent of the outstanding voting shares of another entity is a condition pointing toward consolidation. The power to control may also exist with a lesser percentage of ownership, for example, by contract, lease, agreement with other stockholders, or by court decree. The Company consolidates all less-than-majority-owned subsidiaries, if any, in which the parent’s power to control exists. |

| | |

| The consolidated financial statements include the accounts of the Company and its subsidiaries. All inter-company accounts and transactions have been eliminated in consolidation. |

| | |

| Concentrations and credit risk |

| | |

| Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, trade, bills and other receivables. As of September 30, 2013 and December 31, 2012, substantially all of the Company’s cash and cash equivalents and restricted cash were held by major financial institutions located in the PRC and Hong Kong, which management believes are of high credit quality. With respect to trade and other receivables, the Company extends credit based on an evaluation of the customer’s financial condition. The Company generally does not require collateral for trade and other receivables and maintains an allowance for doubtful accounts of trade and other receivables. |

| | |

| Regarding bills receivable, they are undertaken by the banks to honor the payments at maturity and the customers are required to place deposits with the banks equivalent to a certain percentage of the bills amount as collateral. These bills receivable can be sold to any third party at a discount before maturity. The Company does not maintain allowance for bills receivable in the absence of bad debt experience and the payments are undertaken by the banks. |

| | |

| During the reporting periods, sales to the following customers represented 10% or more of the Company’s consolidated sales: |

| | | | Three months ended | | | Nine months ended | |

| | | | September 30, | | | September 30, | |

| | | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | |

| | CNPC Changqing Oilfield | $ | 3,632,893 | | $ | - | | $ | 6,328,214 | | $ | - | |

| | Shangdong Steel Co., Ltd. Rizhao Subsidiary | | 1,236,493 | | | 3,059,573 | | | 5,634,290 | | | 7,504,693 | |

| | Fushun New Steel Co., Ltd. | | 1,229,836 | | | 1,831,414 | | | 4,249,864 | | | 4,817,575 | |

| | Jilin Petroleum Group Company Ltd. | | 235,065 | | | 6,271,021 | | | 572,343 | | | 7,579,405 | |

| | | | | | | | | | | | | | |

| | | $ | 6,334,287 | | $ | 11,162,008 | | $ | 16,784,711 | | $ | 19,901,673 | |

During the reporting periods, no customer represented 10% or more of the Company’s trade receivables.

Fair value of financial instruments

ASC 820 requires the disclosure of the estimated fair value of financial instruments including those financial instruments for which fair value option was not elected. The fair value of collateralized borrowings are estimated using discounted cash flow analysis, based on the Company’s current incremental borrowing rates for similar types of borrowing arrangement. The carrying amount of financial assets and liabilities approximate their fair value due to short maturities.

8

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 4. | Summary of significant accounting policies (Cont’d) |

| | |

| Recently issued accounting pronouncements |

| | |

| Management does not believe that any other recently issued, but not yet effective accounting pronouncements, if adopted, would have a material effect on the consolidated financial statements. |

| | |

| 5. | Restricted cash and bills payable |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Bank deposits held as collateral for bills payable (Note 5a) | $ | 4,726,084 | | $ | 2,168,082 | |

| | Bank deposits held as collateral for bank loans (Note 14) | | 31,827,400 | | | 17,945,370 | |

| | | | | | | | |

| | | $ | 36,553,484 | | $ | 20,113,452 | |

Notes:

| | a) | The Company is requested by certain suppliers to settle amounts owed to such suppliers by the issuance of bills through banks for which the banks undertake to guarantee the Company’s settlement of these amounts at maturity. These bills are interest free and usually mature within six months from the date of issuance. As collateral security for the banks’ undertakings, the Company is required to pay the bank charges as well as maintain deposits with such banks in amounts equal to 20%, 50% or 100% of the bills’ amounts issued. |

| | | |

| | b) | Bills payable amounted to $13,426,930 and $13,995,550 as of September 30, 2013 and December 31, 2012, respectively. |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Trade receivables | $ | 51,851,486 | | $ | 58,542,915 | |

| | Allowance for doubtful accounts | | (3,546,949 | ) | | (2,731,447 | ) |

| | | | | | | | |

| | | $ | 48,304,537 | | $ | 55,811,468 | |

An analysis of the allowance for doubtful accounts for the interim period ended September 30, 2013 and 2012 is as follows:

| | | | Nine months Ended | |

| | | | September 30, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Balance at beginning of period | $ | 2,731,447 | | $ | 2,046,820 | |

| | Addition of doubtful accounts expense, net | | 738,667 | | | 456,892 | |

| | Translation adjustments | | 76,835 | | | 9,103 | |

| | | | | | | | |

| | Balance at end of period | $ | 3,546,949 | | $ | 2,512,815 | |

9

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 7. | Bills receivables |

| | |

| Bills receivable represents bank undertakings that essentially guarantee the payment of amounts owed by our customers to us. The undertakings are provided by banks upon receipt of collateral deposits from the customers. Bills receivable can be sold by us at a discount before maturity. |

| | |

| As of September 30, 2013, the balance of bills receivable was $4,153,097 with maturities ranging from 15 days to 6 months. As of December 31, 2012, the balance of bills receivable was $9,913,668. |

| | |

| 8. | Other receivables and prepayments, net and advances to senior management |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Government grant receivables (Note 8a) | $ | 409,735 | | $ | 398,913 | |

| | Loans to third parties (Note 8b) | | 1,505,769 | | | 1,532,455 | |

| | Value added tax and other tax recoverable | | 403,974 | | | 569,886 | |

| | Deposits for purchase of raw materials | | 2,392,688 | | | 2,145,583 | |

| | Other deposit | | 1,427,658 | | | 1,140,410 | |

| | Prepayment | | 3,799,479 | | | 874,873 | |

| | Other receivables | | 698,999 | | | 489,653 | |

| | Related party advances (Note 8c) | | 7,295,001 | | | 11,138,593 | |

| | | | | | | | |

| | | | 17,933,303 | | | 18,290,366 | |

| | Allowance for doubtful accounts | | (1,873,601 | ) | | (1,824,114 | ) |

| | | | | | | | |

| | | $ | 16,059,702 | | $ | 16,466,252 | |

| | | | | | | | |

| | Advances to senior management (Note 8b) | $ | 32,560 | | $ | 9,005 | |

An analysis of the allowance for doubtful accounts for the interim period ended September 30, 2013 and 2012 is as follows:

| | | | Nine months Ended | |

| | | | September 30, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Balance at beginning of period | $ | 1,824,114 | | $ | 757,217 | |

| | Addition of doubtful debt expenses, net | | - | | | 310,947 | |

| | Translation adjustments | | 49,487 | | | 3,367 | |

| | | | | | | | |

| | Balance at end of period | $ | 1,873,601 | | $ | 1,071,531 | |

10

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 8. | Other receivables and prepayments, net and advances to senior management (Cont’d) |

| | | |

| Notes : |

| | | |

| a) | As of September 30, 2013, government grant receivables represented incentive bonus of $409,735 from the local government for good performance by Refractories. The Company is currently evaluating the collectability and timing of the receipt of the grants. |

| | | |

| b) | The loans to third parties represent the loans to third party entities which have business connections with the Company. The amounts are interest-free, unsecured and repayable on demand. |

| | | |

| | The advances to senior management were mainly for travel and other expenses in the ordinary course of business. |

| | | |

| c) | The amounts represent staff drawings for handling sourcing and logistic activities for the Company in the ordinary course of business and staff advances of $1,302,400 and $6,355,850 used as collateral for the Company’s loans and bills payable related to financing activities as of September 30, 2013 and December 31, 2012, respectively. |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Raw materials | $ | 4,740,247 | | $ | 4,327,856 | |

| | Work-in-progress | | 8,267,717 | | | 2,249,471 | |

| | Finished goods | | 1,238,359 | | | 6,543,959 | |

| | | | | | | | |

| | | | 14,246,323 | | | 13,121,286 | |

| | Allowance for obsolete inventories | | (154,191 | ) | | (150,118 | ) |

| | | | | | | | |

| | | $ | 14,092,132 | | $ | 12,971,168 | |

| No allowance for obsolete inventories was recognized in the cost of goods sold during the three months and nine months ended September 30, 2013 and 2012. |

| | |

| 10. | Investment in a non-consolidated entity |

| | |

| The Company paid RMB 15 million (equivalent to $2.37 million) in August 2010 to acquire 24.5% equity interest in Yili YiQiang Silicon Limited ("Yili"), a company established in the PRC and engaged in manufacturing and trading of silicon carbide. The acquisition was completed on May 28, 2012. |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Investment in a non-consolidated entity, beginning balance | $ | 1,040,492 | | $ | 1,092,041 | |

| | Less: CHGS’s share of net loss of a non-consolidated entity | | (75,267 | ) | | (59,143 | ) |

| | Translation adjustments | | 27,949 | | | 7,594 | |

| | | | | | | | |

| | Investment in a non-consolidated entity, ending balance | $ | 993,174 | | $ | 1,040,492 | |

11

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 11. | Property, plant and equipment |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | Costs: | | | | | | |

| | Buildings | $ | 26,160,572 | | $ | 25,669,609 | |

| | Plant and machinery | | 16,519,804 | | | 15,289,765 | |

| | Furniture, fixture and equipment | | 1,878,732 | | | 1,670,067 | |

| | Motor vehicles | | 2,773,365 | | | 2,369,478 | |

| | | | | | | | |

| | | | 47,332,473 | | | 44,998,919 | |

| | Accumulated depreciation | | (13,496,723 | ) | | (10,848,175 | ) |

| | Impairment charge | | - | | | (223,539 | ) |

| | Construction in progress | | 2,289,138 | | | 2,497,799 | |

| | | | | | | | |

| | Property, plant and equipment, net | $ | 36,124,888 | | $ | 36,425,004 | |

| | (i) | During the reporting periods, depreciation is included in: |

| | | | Nine months Ended | |

| | | | September 30, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Cost of goods sold and overhead of inventories | $ | 1,727,179 | | $ | 1,659,864 | |

| | General and administrative expenses | | 646,148 | | | 575,878 | |

| | | | | | | | |

| | | $ | 2,373,327 | | $ | 2,235,742 | |

| | | During the nine months ended September 30, 2013, property, plant and equipment with carrying amounts of $95,996 were disposed for consideration of $121,193 to offset trade payable balances, resulting in a gain of $25,197. During the nine months ended September 30, 2012, property, plant and equipment with carrying amounts of $204,061 were disposed for consideration of $88,538 to offset a trade payable balance, resulting in a loss of $115,523. |

| | | |

| | (ii) | Construction in progress |

| | | |

| | | Construction in progress mainly comprises capital expenditure for construction of the Company’s new offices and factories. |

| | | |

| | (iii) | Impairment charge |

| | | |

| | | The management believed that there was an indication of impairment related to the buildings, machinery and equipment, and construction in progress at Prefecture as of December 31, 2012. Based on the impairment review performed by the management, an impairment loss was recognized in the consolidated statements of operations and comprehensive loss for the year ended December 31, 2012. |

12

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 12. | Other payables and accrued expenses, including related parties |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | Accrued audit fee | $ | - | | $ | 90,135 | |

| | Other accrued expenses | | 198,701 | | | 216,273 | |

| | Value added tax and other tax payables | | 2,361,270 | | | 2,979,263 | |

| | Sales receipts in advance | | 1,290,115 | | | 392,898 | |

| | Salaries payable | | 1,355,462 | | | 1,360,136 | |

| | Staff welfare payable (Note 12a) | | 161,718 | | | 196,048 | |

| | Advances from staff, including related parties | | 383,847 | | | 869,196 | |

| | Freight charges payable | | - | | | 3,833 | |

| | Guarantee liability (Note 19b) | | 96,940 | | | 210,690 | |

| | Other payables | | 1,365,370 | | | 1,242,674 | |

| | | | | | | | |

| | | $ | 7,213,423 | | $ | 7,561,146 | |

Note:

| | a) | Staff welfare payable represents accrued staff medical, industry injury claims, labor and unemployment insurances. All of which are third parties insurance and the insurance premiums are based on certain percentages of salaries. The obligations of the Company are limited to those premiums contributed by the Company. |

| 13. | Non-interest-bearing loans, including related parties |

| | |

| The loans represent interest-free and unsecured loans from the Company’s associates and are repayable on demand. The balance of non-interest-bearing loans as of September 30, 2013 and December 31, 2012 included loans from related parties. Details of non-interest-bearing loans as of September 30, 2013 and December 31, 2012 are as follow. |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Loans from third parties | $ | 7,210,558 | | $ | 3,827,141 | |

| | Loans from employees | | 2,212,471 | | | 2,774,824 | |

| | Loan from Mr. Shunqing Zhang, the Chairman and CEO | | 17,915 | | | 158,500 | |

| | | | | | | | |

| | Total non-interest-bearing loans | $ | 9,440,944 | | $ | 6,760,465 | |

13

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 14. | Collateralized short-term bank loans |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Bank loans repayable within 1 year | $ | 66,888,008 | | $ | 65,196,883 | |

The above bank loans are denominated in RMB and carry average interest rates at 6.40% (2012: 6.11%) per annum with maturity dates ranging from 8 days to twelve months.

The bank loans as of September 30, 2013 were secured by the following:

| | (a) | Guarantees executed by business associates up to the amount of $21,978,000; |

| | | |

| | (b) | Land use rights with carrying amount of $4,012,193; |

| | | |

| | (c) | Bank deposits of $31,827,400 (Note 5); and |

| | | |

| | (d) | Bills issued by banks. |

| 15. | Loans from a third party |

| | |

| The loans are interest-bearing at 24% per annum from an unrelated company. They were guaranteed by Mr. Shunqing Zhang, the Chairman and CEO of the Company and another employee of the Company. These loans are payable no later than November 15, 2013 and November 30, 2013. |

| | |

| 16. | Finance costs |

| | | | Three months ended | | | Nine months ended | |

| | | | September 30, | | | September 30, | |

| | | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | |

| | Interest expenses | $ | 1,142,500 | | $ | 825,010 | | $ | 3,073,728 | | $ | 2,568,233 | |

| | Bills discounting charges | | 923,295 | | | 1,164,421 | | | 2,185,038 | | | 3,121,328 | |

| | | | | | | | | | | | | | |

| | | $ | 2,065,795 | | $ | 1,989,431 | | $ | 5,258,766 | | $ | 5,689,561 | |

| 17. | Income taxes |

| | |

| UNITED STATES |

| | |

| The Company is incorporated in the United States of America (“U.S.”) and is subject to U.S. tax law. No provisions for income taxes have been made as the Company has no U.S. taxable income for reporting periods. The applicable income tax rate for the reporting periods is 34%. The Company has not provided deferred tax on undistributed earnings of its non-U.S. subsidiaries as of September 30, 2013, as it is the Company's current policy to reinvest these earnings in non-U.S. operations. |

| | |

| BVI |

| | |

| GengSheng International and Smarthigh were incorporated in the BVI and are not subject to income taxes under the current laws of the BVI. |

14

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 17. | Income taxes (Cont’d) |

| | |

| PRC |

| | |

| The PRC’s legislative body, the National People’s Congress, adopted the unified Corporate Income Tax Law (“CIT Law”) on March 16, 2007. This new tax law replaces the then separate income tax laws for domestic enterprises and foreign-invested enterprises and became effective on January 1, 2008. Under the new tax law, a unified income tax rate is set at 25% for both domestic enterprises and foreign-invested enterprises. However, there will be a transition period for enterprises, whether foreign-invested or domestic, that are currently receiving preferential tax treatments granted by relevant tax authorities. Enterprises that are subject to an enterprise income tax rate lower than 25% may continue to enjoy the lower rate and will transit into the new tax rate over a five year period beginning on the effective date of the CIT Law. Enterprises that are currently entitled to exemptions for a fixed term will continue to enjoy such treatment until the exemption term expires. Preferential tax treatment will continue to be granted to industries and projects that qualify for such preferential treatments under the new tax law. |

| | |

| Pursuant to the income tax rules and regulations of the PRC, provision for PRC income tax of the PRC subsidiaries is calculated based on the following rates: |

| | | | | | | | |

| | | | | | | Period ended September 30, | |

| | | | Note | | | 2013 | | | 2012 | |

| | | | | | | | | | | |

| | Refractories | | (a) | | | 15.0% | | | 15.0% | |

| | High-Temperature | | (a) | | | 15.0% | | | 15.0% | |

| | Duesail | | (a) | | | 15.0% | | | 12.5% | |

| | Prefecture | | | | | 25.0% | | | 25.0% | |

| | Micronized | | | | | 25.0% | | | 25.0% | |

| | Yuxing | | | | | 25.0% | | | 25.0% | |

Note:

| | (a) | Entities entitled to a tax holiday in which they are fully exempted from the PRC enterprise income tax for 2 years starting from their first profit-making year after netting off accumulated tax losses, followed by a 50% reduction in the PRC enterprise income tax for the next 3 years (“tax holidays”). Any unutilized tax holidays will continue until expiry while tax holidays were deemed to start from January 1, 2008, even if the entity was not yet making profit after netting off its accumulated tax losses. Duesail is in the fifth year of tax holidays in 2013. Refractories was in the third year of tax holidays in 2009 and starting from the fiscal year 2011, Refractories is subject to enterprise income tax at unified rate of 15% for three years due to its engagement in an advanced technology industry and has passed the inspection of the provincial high-tech item. The relevant authority granted it a certificate during 2011. Starting from the fiscal year 2011, High-Temperature is subject to enterprise income tax at unified rate of 15% for three years due to its engagement in an advanced technology industry. The relevant authority granted it a certificate during 2011. |

In July 2006, the FASB issued ASC 740-10-25. This interpretation requires recognition and measurement of uncertain income tax positions using a “more-likely-than-not” approach. The Company adopted this ASC 740-10-25 on January 1, 2007. Under the new CIT Law which became effective on January 1, 2008, the Company may be deemed to be a resident enterprise by the PRC tax authorities. If the Company was deemed to be resident enterprise, the Company may be subject to the CIT at 25% on the worldwide taxable income and dividends paid from the PRC subsidiaries to their overseas holding companies may be exempted from 10% PRC withholding tax. Except for certain immaterial interest income from bank deposits placed with financial institutions outside the PRC, all of the Company’s income is generated from the PRC operations. Given the immaterial amount of income generated from outside the PRC and the PRC subsidiaries do not intend to pay dividends for the foreseeable future, the management considers that the impact arising from resident enterprise on the Company’s financial position is not significant. The management evaluated the Company's tax positions and considered no provision for uncertainty in income taxes is necessary as of September 30, 2013 and December 31, 2012.

15

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 18. | Net loss per common share |

| | | |

| During the reporting periods, all the potential dilutive shares were not included in the computation of diluted net loss per common share because they were anti-dilutive. Accordingly, the basic and diluted net loss per common share are the same. |

| | | |

| 19. | Commitments and contingencies |

| | | |

| (a) | The Company’s operations are subject to the laws and regulations in the PRC relating to the generation, storage, handling, emission, transportation and discharge of certain materials, substances and waste into the environment, and various other health and safety matters. Governmental authorities have the power to enforce compliance with their regulations, and violators may be subject to fines, injunctions or both. The Company must devote substantial financial resources to ensure compliance and believes that it is in substantial compliance with all the applicable laws and regulations. |

| | | |

| | The Company is currently not involved in any environmental remediation and has not accrued any amounts for environmental remediation relating to its operations. Under existing legislation, management believes that there are no probable liabilities that will have a material adverse effect on the financial position, operating results or cash flows of the Company. |

| | | |

| (b) | The Company guaranteed the following debts of third parties, which is summarized as follows: |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Guaranteed amount | $ | 20,350,000 | | $ | 30,939,200 | |

In accordance with ASC 460, the Company recognized a liability arising from guarantees given for the debts granted to third parties by financial institutions.

An analysis of the guarantee liability is as follows:

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | | | | | | | |

| | Balance at beginning of period/year | $ | 210,690 | | $ | 309,858 | |

| | Recognized as expenses for the period/year | | 154,090 | | | 461,578 | |

| | Recognized as income for the period/year | | (273,115 | ) | | (562,847 | ) |

| | Translation adjustments | | 5,275 | | | 2,101 | |

| | | | | | | | |

| | Balance at end of period/year | $ | 96,940 | | $ | 210,690 | |

The fair value of such guarantees is determined by reference to fees charged in an arm’s length transaction for similar services.

16

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 19. | Commitments and contingencies (Cont’d) |

| | |

| Guarantees as of September 30, 2013 are further analyzed as below: |

| | | | Term loan | | | | | | Interest | | | | | | | | | | | | | | | Estimated | |

| | | | draw down | | | Expiration | | | rate (per | | | | | | Principal | | | | | | Outstanding | | | maximum | |

| | Guarantee | | date | | | date | | | annum) | | | Loan principal | | | repaid | | | Outstanding | | | interest | | | exposure | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Business associates | | 8/27/2012 | | | 8/26/2015 | | | 11.664% | | | 1,628,000 | | | - | | | 1,628,000 | | | 366,774 | | | 1,994,774 | |

| | | | 10/26/2012 | | | 10/25/2013 | | | 6.160% | | | 3,256,000 | | | - | | | 3,256,000 | | | 18,683 | | | 3,274,683 | |

| | | | 11/23/2012 | | | 11/22//2013 | | | 6.160% | | | 3,256,000 | | | - | | | 3,256,000 | | | 34,069 | | | 3,290,069 | |

| | | | 1/12/2013 | | | 1/11/2014 | | | 8.640% | | | 8,140,000 | | | - | | | 8,140,000 | | | 215,806 | | | 8,355,806 | |

| | | | 6/8/2013 | | | 6/6/2014 | | | 6.000% | | | 3,256,000 | | | - | | | 3,256,000 | | | 138,090 | | | 3,394,090 | |

| | | | 6/29/2013 | | | 6/25/2014 | | | 11.520% | | | 814,000 | | | - | | | 814,000 | | | 69,366 | | | 883,366 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 20,350,000 | | $ | - | | $ | 20,350,000 | | $ | 842,788 | | $ | 21,192,788 | |

| | | Notes: |

| | | |

| | | During the period, the Company has acted as guarantor for bank loans granted to certain business associates. Certain of these associates also provided guarantees for bank loans to the Company (Note 14). None of our directors, director nominees or executive officers is involved in normal operation or investing in the business of the guaranteed business associates. All the business associates have a healthy record to pay back loans in a timely manner, in the People’s Bank of China’s (Central Bank of China) credit rating system. |

| | | |

| | | All the above guarantees have no recourse provision that would enable the Company to recover from third parties of any amounts paid under the guarantees and any assets held either as collateral or by third parties that the Company can obtain or liquidate to recover all or a portion of the amounts paid under the guarantees. |

| | | |

| | | If the third parties fail to perform under their contractual obligation, the Company will make future payments including the contractual principal amounts, related interest and penalties. |

| | | |

| | (c) | As of September 30, 2013, the Company had capital commitments of $1,222,286 in connection with the construction of new office buildings and workshops; and $307,338 in connection with the purchase of machinery, which were not contracted for and provided in these financial statements. |

| | | |

| | (d) | In accordance with the PRC tax regulations, the Company’s sales are subject to value added tax (“VAT”) at 17% upon the issuance of VAT invoices to its customers. When preparing these consolidated financial statements, the Company recognized revenue when the significant risks and rewards of ownership have been transferred to the buyer at the time when the products are delivered to and accepted by customers, and made full tax provision in accordance with relevant national and local laws and regulations of the PRC. |

| | | |

| | | The Company follows the practice of reporting its revenue for PRC tax purposes when invoices are issued. In the local statutory financial statements prepared under PRC GAAP, the Company recognized revenue on an “invoice basis” instead of when the significant risks and rewards of ownership have been transferred to the buyer at the time when the products are delivered to and accepted by customers. Accordingly, despite the fact that the Company has made full tax provision in the consolidated financial statements, the Company may be subject to a penalty for the deferred reporting of tax obligations. The exact amount of penalty cannot be estimated with any reasonable degree of certainty. The management considers it is very unlikely that the tax penalty will be imposed. |

17

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 20. | Defined contribution plan |

| | |

| The Company has a defined contribution plan for all qualified employees in the PRC. The employer and its employees are each required to make contributions to the plan at the rates specified in the plan. The only obligation of the Company with respect to the retirement plan is to make the required contributions under the plan. No forfeited contribution is available to reduce the contribution payable in the future years. The defined contribution plan contributions were charged to the consolidated statements of operations and comprehensive loss. The Company contributed $483,073 and $345,910 for the nine months ended September 30, 2013 and 2012, respectively. |

| | |

| 21. | Segment information |

| | |

| The Company uses the “management approach” in determining reportable operating segments. The management approach considers the internal organization and reporting used by the Company's chief operating decision maker for making operating decisions and assessing performance as the source for determining the Company's reportable segments. Management, including the chief operating decision maker, reviews operating results solely by the revenue of monolithic refractory products, industrial ceramic products, fracture proppant products, fine precision abrasives and operating results of the Company. As such, the Company has determined that it has four operating segments as defined by ASC 280, “Segment Reporting”: refractories, industrial ceramic, fracture proppant and fine precision abrasives. |

| | |

| Adjustments and eliminations of inter-company transactions were not included in determining segment (loss) profit, as they are not used by the chief operating decision maker. |

| | Three months ended September 30, | | | | | | | | | | | | | | | | | | | | | | |

| | (unaudited) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Refractories | | | Industrial ceramic | | | Fracture proppant | | | Fine precision abrasives | | | Total | |

| | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue from external customers | $ | 8,173,820 | | $ | 9,251,050 | | $ | 268,647 | | $ | 573,505 | | $ | 5,201,077 | | $ | 12,839,151 | | $ | 956,402 | | $ | 963,015 | | $ | 14,599,946 | | $ | 23,626,721 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Segment (loss) profit | $ | (1,617,227 | ) | $ | (2,495,736 | ) | $ | (33,622 | ) | $ | 75,420 | | $ | (157,580 | ) | $ | 1,798,780 | | $ | (1,151,470 | ) | $ | (1,459,580 | ) | $ | (2,959,899 | ) | $ | (2,081,116 | ) |

| | Nine months ended September 30, | | | | | | | | | | | | | | | | | | | | | | |

| | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Refractories | | | Industrial ceramic | | | Fracture proppant | | | Fine precision abrasives | | | Total | |

| | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue from external customers | $ | 25,676,665 | | $ | 30,808,842 | | $ | 814,054 | | $ | 1,434,303 | | $ | 12,877,459 | | $ | 18,058,353 | | $ | 1,641,136 | | $ | 6,656,101 | | $ | 41,009,314 | | $ | 56,957,599 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Segment (loss) profit | $ | (4,527,902 | ) | $ | (5,129,084 | ) | $ | (323,442 | ) | $ | (388,385 | ) | $ | (535,551 | ) | $ | 1,154,927 | | $ | (3,072,168 | ) | $ | (3,978,550 | ) | $ | (8,459,063 | ) | $ | (8,341,092 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | September | | | December | | | September | | | December | | | September | | | December | | | September | | | December | | | September | | | December | |

| | | | 30, 2013 | | | 31, 2012 | | | 30, 2013 | | | 31, 2012 | | | 30, 2013 | | | 31, 2012 | | | 30, 2013 | | | 31, 2012 | | | 30, 2013 | | | 31, 2012 | |

| | Segment assets | $ | 79,068,041 | | | 80,170,355 | | $ | 3,750,556 | | $ | 3,778,461 | | $ | 45,723,080 | | $ | 44,524,087 | | $ | 32,595,425 | | $ | 31,709,484 | | $ | 161,137,102 | | $ | 160,182,387 | |

18

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 21. | Segment information (Cont'd) |

| | |

| Segment information by products for the three months ended September 30, 2013 and 2012 |

| | | | | | | | | | | | | | | | | | | | | | | | | Fine | | | | |

| | | | Monolithic | | | | | | Pre-cast | | | Ceramic | | | Ceramic | | | Wearable | | | Fracture | | | precision | | | | |

| | | | materials1 | | | Mortar | | | roofs | | | tubes2 | | | cylinders3 | | | ceramic valves | | | proppant | | | abrasives | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, 2013 (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue | $ | 4,884,612 | | $ | 454,522 | | $ | 2,834,686 | | $ | 238,203 | | $ | 12,969 | | $ | 17,475 | | $ | 5,201,077 | | $ | 956,402 | | $ | 14,599,946 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, 2012 (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue | $ | 5,475,652 | | $ | 415,939 | | $ | 3,359,459 | | $ | 464,637 | | $ | 100,362 | | $ | 8,506 | | $ | 12,839,151 | | $ | 963,015 | | $ | 23,626,721 | |

Segment information by products for the nine months ended September 30, 2013 and 2012

| | | | | | | | | | | | | | | | | | | | | | | | | Fine | | | | |

| | | | Monolithic | | | | | | Pre-cast | | | Ceramic | | | Ceramic | | | Wearable | | | Fracture | | | precision | | | | |

| | | | materials1 | | | Mortar | | | roofs | | | tubes2 | | | cylinders3 | | | ceramic valves | | | proppant | | | abrasives | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine months ended September 30, 2013 (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue | $ | 15,786,225 | | $ | 1,416,656 | | $ | 8,473,784 | | $ | 700,573 | | $ | 77,267 | | $ | 36,214 | | $ | 12,877,459 | | $ | 1,641,136 | | $ | 41,009,314 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine months ended September 30, 2012 (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue | $ | 18,249,483 | | $ | 452,167 | | $ | 12,107,192 | | $ | 1,158,810 | | $ | 256,011 | | $ | 19,482 | | $ | 18,058,353 | | $ | 6,656,101 | | $ | 56,957,599 | |

1Castable, coating, and dry mix materials & low-cement and non-cement castables generally refer as Monolithic materials.

2Ceramic plates, tubes, elbows, and rollers generally refer as Ceramic tubes.

3Ceramic cylindsers and plugs comprehensively refer to Ceramic cylinders.

Reconciliation is provided for unallocated amounts relating to corporate operations which are not included in the segment information.

| | | | Three months ended | | | Nine months ended | |

| | | | September 30, | | | September 30, | |

| | | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | |

| | Total consolidated revenue | $ | 14,599,946 | | $ | 23,626,721 | | $ | 41,009,314 | | $ | 56,957,599 | |

| | | | | | | | | | | | | | |

| | Total loss for reportable segments | $ | (2,959,899 | ) | $ | (2,081,116 | ) | $ | (8,459,063 | ) | $ | (8,341,092 | ) |

| | Unallocated amounts relating to operations: | | | | | | | | | | | | |

| | General and administrative expenses | | (79,351 | ) | | (52,136 | ) | | (446,337 | ) | | (302,237 | ) |

| | Other income/ (expenses) | | 61 | | | (24 | ) | | 61 | | | (31,671 | ) |

| | | | | | | | | | | �� | | | |

| | Loss before income taxes and noncontrolling interest | $ | (3,039,189 | ) | $ | (2,133,276 | ) | $ | (8,905,339 | ) | $ | (8,675,000 | ) |

19

China GengSheng Minerals, Inc.

September 30, 2013 and 2012

Notes to Consolidated Financial Statements

(Unaudited)

| 21. | Segment information (Cont'd) |

| | | | September 30, | | | December 31, | |

| | | | 2013 | | | 2012 | |

| | Assets | | | | | | |

| | | | | | | | |

| | Total assets for reportable segments | $ | 161,137,102 | | $ | 160,182,387 | |

| | Other receivables | | 733,140 | | | 737,866 | |

| | Cash and cash equivalents | | 796,658 | | | 1,485,057 | |

| | | | | | | | |

| | | $ | 162,666,900 | | $ | 162,405,310 | |

All of the Company's long-lived assets are located in the PRC. Geographic information about the revenues, which are classified based on customers, is set out as follows:

| | | | Three months ended | | | Nine months ended | |

| | | | September 30, | | | September 30, | |

| | | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | |

| | PRC | $ | 14,210,795 | | $ | 23,174,222 | | $ | 39,763,489 | | $ | 55,707,865 | |

| | United States | | - | | | - | | | - | | | 82,671 | |

| | Others | | 389,151 | | | 452,499 | | | 1,245,825 | | | 1,167,063 | |

| | | | | | | | | | | | | | |

| | Total | $ | 14,599,946 | | $ | 23,626,721 | | $ | 41,009,314 | | $ | 56,957,599 | |

| 22. | Subsequent events |

| | |

| The Company evaluated all events or transactions that occurred after the balance sheet date through the date when the consolidated financial statements were issued to determine if they must be reported. The Management of the Company determined that there were no material recognizable or subsequent events or transactions to be disclosed. |

20

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Forward-Looking Statements:

The following discussion of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and related notes thereto. The following discussion contains forward-looking statements. Unless the context requires otherwise, references to “we”, “us”, “our”, “the Registrant”, or the “Company” refer to China GengSheng Minerals, Inc. and its subsidiaries. The words or phrases “would be,” “will allow,” “expect to,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” or similar expressions are intended to identify forward-looking statements. Such statements include those concerning our expected financial performance, our corporate strategy and operational plans. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including: (a) those risks and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions; (b) whether we are able to manage our planned growth efficiently and operate profitable operations, including whether our management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able to successfully manage and exploit existing and potential market opportunities; (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations; and (d) whether we are able to successfully fulfill our primary requirements for cash which are explained below under “Liquidity and Capital Resources.” Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

Conventions

In this Form 10-Q, unless indicated otherwise, references to:

“China GengSheng Minerals”, “we”, “us”, “our”, the “Registrant” or the “Company” refer to the combined business of China GengSheng Minerals, Inc., a Nevada corporation (formerly, China Minerals Technologies, Inc.) and its wholly-owned BVI subsidiary, GengSheng International Corporation, or GengSheng International, GengSheng International’s wholly-owned BVI subsidiary, Smarthigh Holding Limited, or Smarthigh and GengSheng International’s wholly-owned Chinese subsidiary, Zhengzhou Duesail Fracture Proppant Co. Ltd., or Duesail, and Duesail’s wholly-owned subsidiary, Henan Yuxing Proppant Co., Ltd., or Yuxing and GengSheng International’s wholly-owned Chinese subsidiary, Henan GengSheng Refractories Co., Ltd., or Refractories, and Refractories’s majority-owned subsidiary, Henan GengSheng High-Temperature Materials Co., Ltd., or High Temperature, and Refractories’s wholly-owned subsidiary, Henan GengSheng Micronized Powder Materials Co., Ltd., or Micronized, and Henan GengSheng's wholly-owned subsidiary, Guizhou Southeast Prefecture GengSheng New Materials Co., Ltd, or Prefecture;

“Powersmart” or “GengSheng International” refer to GengSheng International Corporation, a BVI company (formerly, Powersmart Holdings Limited) that is wholly-owned by China GengSheng Minerals;

“Securities Act” refers to the Securities Act of 1933, as amended, and “Exchange Act” refer to Securities Exchange Act of 1934, as amended;

“China” and “PRC” refer to the People's Republic of China, and “BVI” refers to the British Virgin Islands;

“RMB” refers to Renminbi, the legal currency of China; and

“U.S. dollar,” “$” and “US$” refers to the legal currency of the United States. For all U.S. dollar amounts reported, the dollar amount has been calculated on the basis that RMB1 = $0.1585 for its December 31, 2012 audited balance sheet, and RMB1 = $0.1628 for its September 30, 2013 unaudited balance sheet, which were determined based on the currency conversion rate at the end of each respective period. The conversion rates of RMB1 = $0.1622 is used for the consolidated statement of income and comprehensive income and consolidated statement of cash flows for the third quarter of 2013, and RMB1 = $0.1581 is used for the consolidated statement of income and comprehensive income and consolidated statement of cash flows for the third quarter of 2012; both of which were based on the average currency conversion rate for each respective quarter.

Overview of Company

We are a Nevada holding company operating in the materials technology industry through our subsidiaries in China. We develop, manufacture and sell a broad range of mineral-based, heat-resistant products capable of withstanding high temperatures, saving energy and boosting productivity in industries such as steel and oil. Our products include refractory products, industrial ceramics, fracture proppants and fine precision abrasives.

Currently, we conduct our operations in China through our wholly owned subsidiaries, Henan GengSheng Refractories Co., Ltd. (“Refractories”), Zhengzhou Duesail Fracture Proppant Co., Ltd. (“Duesail”), Henan GengSheng Micronized Powder Materials Co., Ltd. (“Micronized”), Guizhou Southeast Prefecture GengSheng New Materials Co., Ltd. (“Prefecture”) and Henan Yuxing Proppant Co., Ltd., 21 (“Yuxing”), and through our majority owned subsidiary, Henan GengSheng High-Temperature Materials Co., Ltd. (“High-Temperature”). Through our wholly owned BVI subsidiary, GengSheng International, and its wholly owned Chinese subsidiary, Refractories, which has an annual production capacity of approximately 127,000 tons, we manufacture refractories products. We manufacture fracture proppant products through Duesail, which has an annual production capacity of approximately 66,000 tons, and Yuxing, which has designed annual production capacity of approximately 60,000 tons. We manufacture fine precision abrasives products through Micronized, which has designed annual production capacity of approximately 22,000 tons. Through our majority owned subsidiary, High-Temperature, which has an annual production capacity of approximately 150,000 units, we manufacture industrial and functional ceramic products.

21

We sell our products to over 300 customers in the iron, steel, oil, glass, cement, aluminum, chemical and solar industries located in China and other countries in Asia, Europe and North America. Our refractory customers are companies in the steel, iron, petroleum, chemical, coal, glass and mining industries. Our fracture proppant products are sold to oil and gas companies. Our industrial ceramics are used in the utilities and petrochemical industries. Our fine precision abrasives are marketed to solar companies and optical equipment manufacturers. Our largest customers, measured by percentage of our revenue, mainly operate in the steel industry and oil industry. Currently, most of our revenues are derived from the sale of our monolithic refractory products and fracture proppants products to customers in China.

Our principal executive offices are located at No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271 and our telephone number is (86) 371-6405-9863.

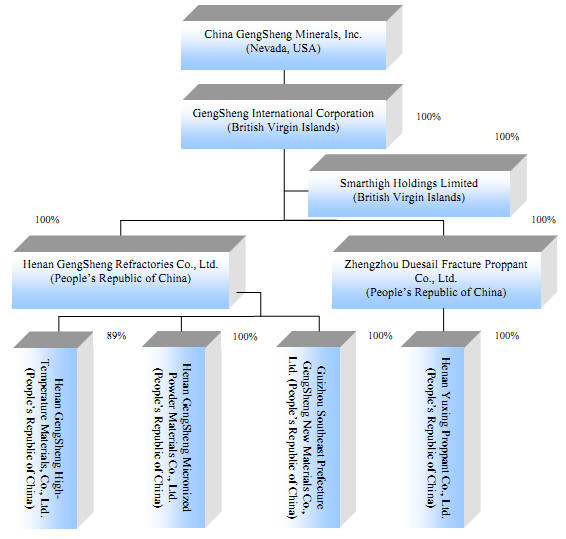

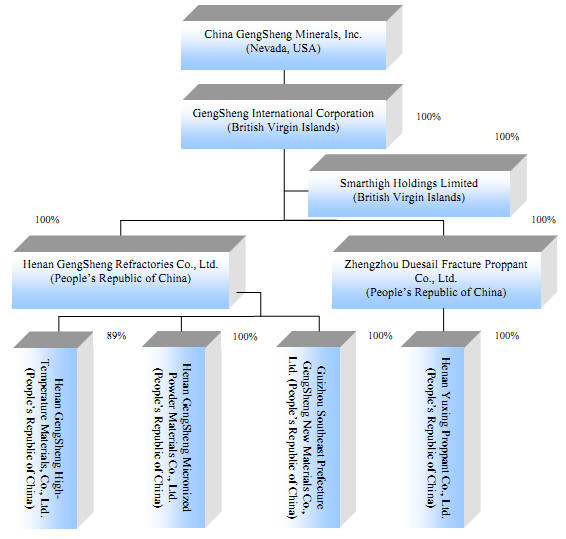

Corporate Structure

We conduct our operations in China through our wholly owned subsidiaries Refractories, Duesail, Yuxing, Micronized and Prefecture and through our majority owned subsidiary, High-Temperature.

The following chart reflects our organizational structure as of the date of this report.

22

Corporate History

We were originally incorporated under the laws of the State of Washington, on November 13, 1947, under the name Silver Mountain Mining Company. From our inception until 2001, we operated various unpatented mining claims and deeded mineral rights in the State of Washington, but we abandoned these operations entirely by 2001. On August 15, 2006, we changed our domicile from Washington to Nevada when we merged with and into Point Acquisition Corporation, a Nevada corporation. From about 2001 until our reverse acquisition of Powersmart on April 25, 2007, which is discussed in the next section entitled "Acquisition of Powersmart and Related Financing", we were a blank check company and had no active business operations. On June 11, 2007, we changed our corporate name from "Point Acquisition Corporation" to "China Minerals Technologies, Inc." and subsequently changed our name again to "China GengSheng Minerals, Inc." on July 26, 2007.

Acquisition of Powersmart and Related Financing

On April 25, 2007, we completed a reverse acquisition transaction through a share exchange with GengSheng International Corporation (formerly, Powersmart Holdings Limited) whereby we issued to the sole shareholder of Powersmart Holdings Limited, Shunqing Zhang, 16,887,815 shares of China GengSheng Minerals, Inc. common stock, in exchange for all of the issued and outstanding capital stock of Powersmart. By this transaction, Powersmart became our wholly owned subsidiary and Mr. Zhang became our controlling stockholder.

On April 25, 2007, we also completed a private placement financing transaction pursuant to which we issued and sold 5,347,594 shares of our common stock to certain accredited investors for $10 million in gross proceeds.

On January 4, 2011, the Company and certain institutional investors entered into a securities purchase agreement pursuant to which the Company sold to such investors an aggregate of 2,500,000 shares of common stock at a price of $4.00 per share for aggregate gross proceeds to the Company of $10,000,000. The shares of common stock were issued pursuant to a prospectus supplement dated as of January 10, 2011, which was filed with the Securities and Exchange Commission in connection with a takedown from the Company’s shelf registration statement on Form S-3 (File No. 333-165486), which became effective on April 28, 2010, and the base prospectus dated as of April 28, 2010 contained in such registration statement.

Our Products

The following table set forth sales information about our product mix in each of the second quarter of 2013 and 2012, and the first nine months of 2013 and 2012.

(All amounts, other than percentages, in thousands of U.S. dollars)

| | | Three Months Ended September 30 | | | Nine Months Ended September 30 | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | Percentage | | | | | | Percentage | | | | | | Percentage | | | | | | Percentage | |

| | | | | | of net | | | | | | of net | | | | | | of net | | | | | | of net | |

| | | Revenue | | | revenues | | | Revenue | | | revenues | | | Revenue | | | revenues | | | Revenue | | | revenues | |

| Refractories | $ | 8,174 | | | 56.0% | | $ | 9,251 | | | 39.2% | | $ | 25,677 | | | 62.6% | | $ | 30,809 | | | 54.1% | |

| Industrial Ceramics | | 269 | | | 1.8% | | | 573 | | | 2.4% | | | 814 | | | 2.0% | | | 1,434 | | | 2.5% | |

| Fracture Proppants | | 5,201 | | | 35.6% | | | 12,840 | | | 54.3% | | | 12,877 | | | 31.4% | | | 18,059 | | | 31.7% | |

| Fine Precision Abrasive | | 956 | | | 6.6% | | | 963 | | | 4.1% | | | 1,641 | | | 4.0% | | | 6,656 | | | 11.7% | |

| | $ | 14,600 | | | 100.0% | | $ | 23,627 | | | 100.0% | | $ | 41,009 | | | 100.0% | | $ | 56,958 | | | 100.0% | |

Refractories

Our largest product segment is the refractories segment, which accounted for approximately 56.0% of total revenue in the third quarter of 2013. Our refractory products have high-temperature resistance and can function under thermal stress that is common in many heavy industrial production environments. Because of their unique high-temperature resistant qualities, the refractory products are used as linings and key components in many industrial furnaces, such as steel production furnaces, ladles, vessels, and other high-temperature processing machines that must operate at high temperatures for a long period of time without interruption. The majority of our customers are in the iron, steel, cement, chemical, coal, glass, petro-chemical and nonferrous industries.

We provide a customized solution for each order of our monolithic refractory materials based on customer-specific formulas. Upon delivery to customers, the monolithic materials are applied to the inner surfaces of our customers’ furnaces, ladles or other vessels to improve the productivity of that equipment. The product benefits our customers as it lowers the overall cost of production and improves financial performance. The reasons that the monolithic materials can help our customers improve productivity, lower production costs and achieve stronger financial performance include the following: (i) monolithic refractory castables can be cast into complex shapes which are unavailable or difficult to achieve by alternative products such as shaped bricks; (ii) monolithic refractory linings can be repaired, and in some cases, even reinstalled, without furnace cool-down periods or steel-production interruptions, and therefore improve the steel makers’ productivity; (iii) monolithic refractories can form an integral surface without joints, enhancing resistance to penetration, impact and erosion, and thereby improving the equipment’s operational safety and extending their useful service lives; (iv) monolithic refractories can be installed by specialty equipment either automatically or manually, thus saving construction and maintenance time as well as costs; and (v) monolithic refractories can be customized to specific requirements by adjusting individual formulas without the need to change batches of shaped bricks, which is a costly procedure. Our refractory products and their features are described as follows:

23

- Castable, coating, and dry mix materials. Offerings within this product line are used as linings in containers such as a tundish used for pouring molten metal into a mold. The primary advantages of these products are speed and ease of installation for heat treatment.

- Low-cement and non-cement castables. Our low-cement and non-cement castable products are typically used in reheating furnaces for producing steel. These castable products are highly durable and can last up to five years.

- Pre-cast roofs. These products are usually used as a component of electric arc furnaces. They are highly durable, and in the case of our corundum-based, pre-cast roof, products can endure approximately 160 to 220 complete operations of furnace heating.

We also have a production line for pressed bricks, which is a type of “shaped” refractory, for steel production. The annual designed production capacity of our shaped refractory products is approximately 15,000 metric tons.