United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-1

(Investment Company Act File Number)

Federated Global Allocation Fund

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 11/30/15

Date of Reporting Period: 11/30/15

Item 1. Reports to Stockholders

Annual Shareholder Report

November 30, 2015

| Share Class | Ticker |

| A | FSTBX |

| B | FSBBX |

| C | FSBCX |

| R | FSBKX |

| Institutional | SBFIX |

Federated Global Allocation Fund

Fund Established 1934

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from December 1, 2014 through November 30, 2015. This report includes Management's Discussion of Fund Performance, a complete listing of your fund's holdings, performance information and financial statements along with other important fund information.

In addition, our website, FederatedInvestors.com, offers easy access to Federated resources that include timely fund updates, economic and market insights from our investment strategists, and financial planning tools. We invite you to register to take full advantage of its capabilities.

Thank you for investing with Federated. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Not FDIC Insured • May Lose Value • No Bank Guarantee

CONTENTS

| 1 |

| 8 |

| 10 |

| 44 |

| 49 |

| 51 |

| 53 |

| 54 |

| 69 |

| 70 |

| 72 |

| 78 |

| 84 |

| 84 |

Management's Discussion of Fund Performance (unaudited)

The total return of Federated Global Allocation Fund (the “Fund”), based on net asset value for the 12-month reporting period ended November 30, 2015, was -2.80%, -3.59%, -3.55%, -3.26% and -2.51% for the Fund's Class A Shares, Class B Shares, Class C Shares, Class R Shares and Institutional Shares, respectively. The total return of the Fund's Blended Index1,2 was -3.02%, and the total return of the Morningstar World Allocation Funds Average (MWAFA)3 was -4.13% for the same period. The Fund's Blended Index was composed of 60% of the return of the MSCI All Country World Index (MSCI ACWI) and 40% of the return of the Barclays Global Aggregate Index. The Fund's total return for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses, which were not reflected in the total return of any index.

The following discussion will focus on the performance of the Fund's Institutional Shares.

MARKET OVERVIEW

The U.S. economy continued to expand at approximately a 2.5% annualized pace during the reporting period, similar to the prior five years. However, the engine of growth shifted more heavily to the consumer, where spending was buoyed by continued job gains, rising home and auto sales, declining gasoline prices and emerging signs of wage growth after years of stagnation. Partially offsetting strength in consumer spending was a significant slowdown in manufacturing, which was hurt by a stronger dollar (making U.S. exports more costly to foreign buyers), weak growth overseas, a severe retrenchment in the domestic fracking industry due to collapsing energy prices, and bloated inventories.

Equities

Equity markets experienced significant volatility during the reporting period. Uncertainty surrounding the Federal Reserve (the “Fed”) policy, the impact of plummeting oil prices and a surging dollar, fears over a potential Greek exit from the eurozone, slowing growth in China and geopolitical fears resulted in a tumultuous year for global equity markets.

The U.S. equity market held up relatively well, with the MSCI USA Index4 up 2.73%. Over the course of the reporting period, this index had 17 daily moves of +/- 3%. In addition, the CBOE Volatility Index® (VIX®)5 experienced a spike of more than 200% during the Chinese growth scare in August 2015. Within the U.S., small-caps generally outperformed large-caps, with the Russell 2000® Index6 up 3.51%. Within the large-cap space, as measured by the S&P 500 Index,7 there was a sharp divergence of returns

Annual Shareholder Report

among sectors. Consumer Discretionary led the way, up 14.36%, while Energy and Materials returned -12.05% and -5.04% respectively. More dividend-sensitive sectors also underperformed, with Telecom and Utilities also negative for the reporting period.

International developed markets8 were mixed, but ultimately lower for the year. For the reporting period, the MSCI EAFE Index9 returned -2.94%. Despite weak economic growth, the Japanese equity market, as measured by the MSCI Japan Index,10 was particularly strong, returning 7.65%. The MSCI Europe Index11 had a return of -4.57% for the reporting period, with Denmark, Belgium and Ireland preforming best, and Greece, Spain and Norway performing worst. The Canadian market, as measured by the MSCI Canada Index,10 was also under pressure, returning -20.02%, as the country was negatively affected by falling energy and material prices.

Emerging markets12 were quite weak. The MSCI Emerging Markets Index13 returned -16.99% for the year. Every country in the MSCI Emerging Markets Index, except for Hungary, finished the reporting period with a negative return. China, as measured by the MSCI China Index, returned -5.53% for the reporting period, and this included a sharp rally into late April, followed by a nearly 30% decline, as the government employed a wide array of stimulus measures in an attempt to avoid a hard landing. Brazil, as measured by the MSCI Brazil Index,10 was under even more pressure, returning -45.10%. Brazil was negatively impacted by plummeting energy and material prices, political discord and high inflation.

On the currency front, the U.S. Dollar, as measured by the U.S. Dollar Index,14 continued to rise, gaining 18.04% against the euro, 4.48% against the pound sterling and 3.98% against the yen.

Fixed Income15

During the reporting period, interest rates were volatile but ultimately little changed in longer maturities, with the yield on the benchmark 10-year Treasury note rising slightly to 2.21% from 2.17%. Interest rates rose more in shorter maturities, as the market anticipated that the Fed would begin hiking the overnight federal funds rate in response to tightening labor market conditions and signs of growing wage pressure that could nudge inflation closer to the Fed's 2% target. Two-year Treasury yields increased from 0.47% to 0.93% during the reporting period.

Treasuries and securitized sectors of the bond market (in particular, residential and commercial mortgage-backed securities) significantly outperformed the pure credit sectors (high-yield,16 emerging markets, and investment-grade corporates). In addition, lower-rated bonds significantly underperformed higher-rated bonds, and longer-maturity bonds underperformed shorter-maturity bonds, even accounting for the difference in duration. The credit sectors struggled for several reasons. First, commodity prices fell almost 40% during the reporting period. That adversely impacted the Energy, Metals and

Annual Shareholder Report

Mining sectors within the domestic high-yield and investment-grade corporate market, as well as emerging market issuers that are large exporters of oil, copper, iron ore and other commodities. The second reason was a burst of supply, as companies issued bonds ahead of the perceived start of the Fed's rate hiking cycle. Because dealer balance sheets have contracted, and a large number of investors were already overweight the credit sectors, spreads were forced to widen to entice buyers. The third reason for the weakness in credit was the correction in stock prices and jump in stock market volatility. The last reason the credit sectors struggled was nervousness over the start of Fed interest rate hikes. Corporate bonds typically correct around the start of Fed tightening cycles, but what made this episode particularly painful was that a substantial segment of the investing public believed that with international growth weak, the dollar strengthening and equity markets struggling, a Fed interest rate hike might constitute a policy error.

Fund Performance

Amongst the Fund's core strategies, the International Stock Selection Strategy was the most significant contributor to performance, driven by successful stock selection in Japan, the UK and Canada. The International Fixed Income Strategy also added to performance, driven primarily by currency calls. Finally, the domestic, bottom-up Best Ideas Strategy helped Fund performance as well, aided by stock selection in Consumer Discretionary, Industrials and Consumer Staples.

On the other side of the ledger, the Domestic Industry Group Strategy was the most significant detractor from Fund performance, driven by an underweight to Software and Services, an overweight and stock selection in Diversified Financials and an overweight in Transportation. The Domestic Fixed Income Strategy also underperformed, primarily due to sector calls.

Among the Fund's tactical allocation strategies, the Global Currency Strategy was the most significant contributor to Fund performance. A short position in the euro and both long and short allocations in the Swiss franc were the most beneficial. The Global Country Fixed Income Strategy also helped Fund performance, with long and short allocations to the German bund being particularly successful.

The Global Country Equity Strategy was a net drag on Fund performance over the reporting period. In particular, allocation decisions in France, Italy and Sweden hurt. The Fund's other tactical allocation strategies were also net detractors, most negatively impacted by allocation decisions in the Russell 2000 and S&P 500.

Annual Shareholder Report

| 1 | Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the Blended Index. |

| 2 | The Fund's broad-based security market indexes are the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, which had total returns of 2.75% and 0.97%, respectively. Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index. |

| 3 | Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the MWAFA. |

| 4 | The MSCI USA Index is a free float adjusted market capitalization index that is designed to measure large- and mid-cap U.S. equity market performance. The index is unmanaged, and it is not possible to invest directly in an index. |

| 5 | The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. The index is unmanaged, and it is not possible to invest directly in an index. |

| 6 | The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The index is unmanaged, and it is not possible to invest directly in an index. |

| 7 | The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged, and it is not possible to invest directly in an index. |

| 8 | International investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards. |

| 9 | The MSCI EAFE Index is an equity index which captures large- and mid-cap representation across developed markets countries around the world, excluding the United States and Canada. With 906 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The index is unmanaged, and it is not possible to invest directly in an index. |

| 10 | The MSCI country indexes are designed to measure the performance of the large- and mid-cap segments of the respective country's market. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index is unmanaged, and it is not possible to invest directly in an index. |

| 11 | The MSCI Europe Index captures large- and mid-cap representation across 15 developed markets countries in Europe. The index is unmanaged, and it is not possible to invest directly in an index. |

| 12 | Prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries, and currency risk and political risks are accentuated in emerging markets. |

| 13 | The MSCI Emerging Markets Index captures large- and mid-cap representation across 21 Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index is unmanaged, and it is not possible to invest directly in an index. |

| 14 | The U.S. Dollar Index indicates the general international value of the U.S. dollar by averaging the exchange rates between the U.S. dollar and six major world currencies. The index is unmanaged, and it is not possible to invest directly in an index. |

| 15 | Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. |

| 16 | High-yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and higher risk of default. |

Annual Shareholder Report

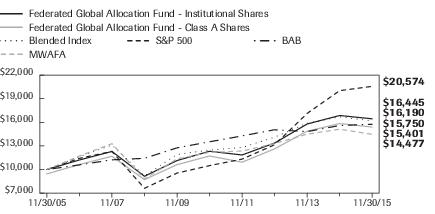

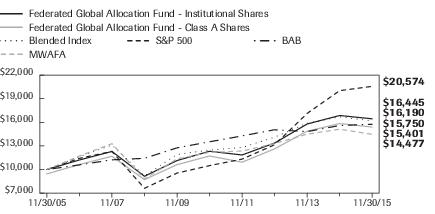

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

The graph below illustrates the hypothetical investment of $10,0001 in the Federated Global Allocation Fund from November 30, 2005 to November 30, 2015, compared to a blend of indexes comprised of 60% of the MSCI All Country World Index (MSCI ACWI) and 40% of the Barclays Global Aggregate Index (BGA) (the “Blended Index”),2 the Standard and Poor's 500 Index (S&P 500),3 the Barclays U.S. Aggregate Bond Index (BAB)4 and the Morningstar World Allocation Funds Average (MWAFA).5 The Average Annual Total Return table below shows returns for each class averaged over the stated periods.

Growth of a $10,000 Investment

Growth of $10,000 as of November 30, 2015

| Federated Global Allocation Fund - | Institutional Shares | Class A Shares | Blended Index | S&P 500 | BAB | MWAFA |

| F | F | I | I | I | I |

| 11/30/2005 | 10,000 | 9,450 | 10,000 | 10,000 | 10,000 | 10,000 |

| 11/30/2006 | 11,219 | 10,636 | 11,633 | 11,423 | 10,594 | 11,717 |

| 11/30/2007 | 12,301 | 11,687 | 13,112 | 12,305 | 11,235 | 13,284 |

| 11/30/2008 | 9,149 | 8,720 | 9,209 | 7,618 | 11,430 | 8,815 |

| 11/30/2009 | 11,143 | 10,625 | 11,915 | 9,552 | 12,759 | 11,352 |

| 11/30/2010 | 12,324 | 11,725 | 12,478 | 10,501 | 13,527 | 12,191 |

| 11/30/2011 | 11,852 | 10,933 | 12,802 | 11,324 | 14,274 | 12,350 |

| 11/30/2012 | 13,370 | 12,634 | 14,116 | 13,150 | 15,060 | 13,310 |

| 11/30/2013 | 15,787 | 14,874 | 15,885 | 17,134 | 14,818 | 14,493 |

| 11/30/2014 | 16,868 | 15,845 | 16,695 | 20,023 | 15,599 | 15,126 |

| 11/30/2015 | 16,445 | 15,401 | 16,190 | 20,574 | 15,750 | 14,477 |

41 graphic description end -->

| ■ | Total returns shown for the Class A Shares include the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450). |

The Fund offers multiple share classes whose performance may be greater than or less than its other share class(es) due to difference in sales charges and expenses. See the Average Annual Return table below for the returns of additional classes not shown in the line graph above.

Annual Shareholder Report

Average Annual Total Returns for the Period Ended 11/30/2015

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

| | 1 Year | 5 Years | 10 Years |

| Class A Shares | -8.15% | 5.45% | 4.70% |

| Class B Shares | -8.41% | 5.47% | 4.60% |

| Class C Shares | -4.43% | 5.85% | 4.47% |

| Class R Shares | -3.26% | 6.20% | 4.81% |

| Institutional Shares6 | -2.51% | 6.98% | 5.38% |

| Blended Index | -3.02% | 5.35% | 4.94% |

| S&P 500 | 2.75% | 14.40% | 7.48% |

| BAB | 0.97% | 3.09% | 4.65% |

| MWAFA | -4.13% | 4.76% | 4.73% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Annual Shareholder Report

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: For Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450); for Class B Shares, the maximum contingent deferred sales charge is 5.50% on any redemption of shares held up to one year from the purchase date; for Class C Shares, the maximum contingent deferred sales charge is 1.00% on any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The Blended Index, S&P 500 and BAB have been adjusted to reflect reinvestment of dividends on securities in the indexes. |

| 2 | The Blended Index is a custom blended index comprised of 60% of the MSCI ACWI and 40% of the BGA. The MSCI ACWI captures large- and mid-cap representation across 23 developed markets countries and 23 emerging markets countries. The index covers approximately 85% of the global investable equity opportunity set. The BGA is a measure of global investment grade debt from 24 different local currency markets. This multi-currency benchmark includes fixed-rate treasury, government-related, corporate and securitized bonds from both developed and emerging markets issuers. The indexes are not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The indexes are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

| 3 | The S&P 500 is an unmanaged, capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund's performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 4 | The BAB is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities and commercial mortgage-backed securities. The index is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund's performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 5 | Morningstar figures represent the average of the total returns reported by all the mutual funds designated by Morningstar as falling into the respective category indicated. They do not reflect sales charges. |

| 6 | The Fund's Institutional Shares commenced operation on June 12, 2009. The Fund offers four other classes of shares: Class A Shares, Class B Shares, Class C Shares and Class R Shares. For the period prior to the commencement of operations of Institutional Shares, the performance information shown is for the Fund's Class A Shares. The performance of Class A Shares has not been adjusted to reflect the expenses of Institutional Shares since Institutional Shares have a lower expense ratio than the expense ratio of the Class A Shares. The performance of Class A Shares has been adjusted to remove any voluntary waiver of Fund expenses related to the Class A Shares that may have occurred during the period prior to the commencement of operations of Institutional Shares. Additionally, the performance information shown below has been adjusted to reflect the absence of sales charges applicable to Class A Shares. |

Annual Shareholder Report

Portfolio of Investments Summary Tables (unaudited)

At November 30, 2015, the Fund's portfolio composition1 was as follows:

| Portfolio Composition | Percentage of

Total Net Assets2 |

| Domestic Equity Securities | 28.5% |

| International Equity Securities | 25.8% |

| Corporate Debt Securities | 13.5% |

| Foreign Debt Securities | 9.7% |

| Mortgage-Backed Securities3 | 3.1% |

| Trade Finance Agreements | 2.6% |

| U.S. Treasury and Agency Securities | 1.2% |

| Collateralized Mortgage-Backed Obligations | 1.1% |

| Floating Rate Loan | 0.7% |

| Asset-Backed Securities | 0.3% |

| Municipal Securities4 | 0.0% |

| Other Security Type5 | 6.0% |

| Derivative Contracts6 | 0.3% |

| Cash Equivalents7 | 1.7% |

| Other Assets and Liabilities—Net8 | 5.5% |

| TOTAL | 100.0% |

| 1 | See the Fund's Prospectus and Statement of Additional Information for a description of these security types. |

| 2 | As of the date specified above, the Fund owned shares of one or more affiliated investment companies. For purposes of this table, the affiliated investment company (other than an affiliated money market mutual fund) is not treated as a single portfolio security, but rather the Fund is treated as owning a pro rata portion of each security and each other asset and liability owned by the affiliated investment company. Accordingly, the percentages of total net assets shown in the table will differ from those presented on the Portfolio of Investments. |

| 3 | For purposes of this table, Mortgage-Backed Securities include mortgage-backed securities guaranteed by Government Sponsored Entities and adjustable rate mortgage-backed securities. |

| 4 | Represents less than 0.1%. |

| 5 | Other Security Type consists of exchange-traded funds and purchased put options. |

| 6 | Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund's performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract's significance to the portfolio. More complete information regarding the Fund's direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

| 7 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 8 | Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report

At November 30, 2015, the Fund's sector composition9 of the Fund's equity holdings was as follows:

Sector Composition

of Equity Holdings | Percentage of

Equity Securities |

| Financials | 23.0% |

| Consumer Discretionary | 15.5% |

| Health Care | 13.6% |

| Information Technology | 12.4% |

| Industrials | 12.2% |

| Utilities | 5.5% |

| Energy | 4.9% |

| Consumer Staples | 4.8% |

| Telecommunication Services | 4.6% |

| Materials | 3.5% |

| TOTAL | 100.0% |

| 9 | Sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

Annual Shareholder Report

Portfolio of Investments

November 30, 2015

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—54.3% | |

| | | Consumer Discretionary—8.4% | |

| 800 | 1 | Amazon.com, Inc. | $531,840 |

| 6,030 | 1 | Apollo Education Group, Inc. | 42,572 |

| 5,285 | | Aristocrat Leisure Ltd. | 36,351 |

| 900 | 1 | Asbury Automotive Group, Inc. | 67,590 |

| 1,015 | | Bayerische Motoren Werke AG | 110,753 |

| 4,094 | | Bloomin' Brands, Inc. | 70,867 |

| 13,500 | | Bridgestone Corp. | 480,994 |

| 1,625 | 1 | Burlington Stores, Inc. | 78,179 |

| 6,873 | 1 | Caesars Entertainment Corp. | 58,214 |

| 2,164 | | Caleres, Inc. | 60,808 |

| 1,900 | | Carnival Corp. | 96,007 |

| 10,300 | | Carter's, Inc. | 888,169 |

| 35,100 | | Comcast Corp., Class A | 2,136,186 |

| 4,532 | 1 | Container Store Group, Inc. | 46,544 |

| 5,471 | | Continental Ag | 1,321,663 |

| 5,900 | 1 | CROCs, Inc. | 65,638 |

| 32,587 | | D. R. Horton, Inc. | 1,052,886 |

| 26,700 | | Daihatsu Motor Co. Ltd. | 346,912 |

| 3,866 | | Daimler AG | 345,913 |

| 4,600 | | Dana Holding Corp. | 75,624 |

| 15,200 | | Darden Restaurants, Inc. | 853,784 |

| 4,369 | | Delphi Automotive PLC | 383,948 |

| 6,000 | 1 | Denny's Corp. | 57,840 |

| 16,750 | | Dollarama, Inc. | 1,120,053 |

| 1,100 | 1 | Drew Industries, Inc. | 66,473 |

| 297 | 1 | Express, Inc. | 4,972 |

| 990 | | Extended Stay America, Inc. | 16,939 |

| 63,000 | | Ford Motor Co. | 902,790 |

| 1,221 | 1 | G-III Apparel Group Ltd. | 56,007 |

| 1,626 | | Gannett Co., Inc. | 27,772 |

| 890 | | Gildan Activewear, Inc. | 27,611 |

| 3,200 | 1 | Gray Television, Inc. | 53,600 |

| 1,800 | | Harman International Industries, Inc. | 185,688 |

| 1,971 | | Hilton Worldwide Holdings, Inc. | 45,767 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Consumer Discretionary—continued | |

| 2,052 | | Home Depot, Inc. | $274,722 |

| 4,200 | | Husqvarna AB, Class B | 27,358 |

| 200 | 1 | IRobot Corp. | 6,618 |

| 306,924 | | ITV PLC | 1,252,719 |

| 50,600 | | Isuzu Motors Ltd. | 569,888 |

| 700 | | Jack in the Box, Inc. | 51,898 |

| 2,900 | | Johnson Controls, Inc. | 133,400 |

| 208,015 | | Kingfisher PLC | 1,107,171 |

| 4,329 | 1 | La Quinta Holdings, Inc. | 64,892 |

| 2,500 | | La-Z-Boy, Inc. | 67,025 |

| 38,000 | | Li & Fung Ltd. | 25,971 |

| 21,613 | 1 | Liberty Media Corp., Class C | 845,068 |

| 3,500 | | Lowe's Cos., Inc. | 268,100 |

| 3,552 | | Luxottica Group S.p.A | 237,282 |

| 56,400 | | MGM China Holdings Ltd. | 74,443 |

| 4,200 | | Macy's, Inc. | 164,136 |

| 23,706 | | Magna International, Inc. | 1,078,215 |

| 1,041 | | Marriott Vacations Worldwide Corp. | 63,324 |

| 6,100 | | McDonald's Corp. | 696,376 |

| 29,448 | 1 | Michael Kors Holdings Ltd. | 1,266,853 |

| 11,754 | | Michelin, Class B | 1,177,205 |

| 800 | 1 | NVR, Inc. | 1,345,984 |

| 5,300 | | New York Times Co., Class A | 74,624 |

| 1,300 | | Nexstar Broadcasting Group, Inc., Class A | 76,167 |

| 19,100 | | Nike, Inc., Class B | 2,526,548 |

| 129,800 | | Nissan Motor Co. Ltd. | 1,387,590 |

| 2,700 | | Nutri/System, Inc. | 61,938 |

| 1,106 | 1 | Ollie's Bargain Outlet Holdings, Inc. | 19,532 |

| 6,300 | | Panasonic Corp. | 71,600 |

| 648 | | Pandora A/S | 76,717 |

| 3,175 | 1 | Party City Holdco, Inc. | 40,323 |

| 33,902 | | Persimmon PLC | 977,795 |

| 700 | 1 | Pinnacle Entertainment, Inc. | 22,953 |

| 11,400 | | Polaris Industries, Inc. | 1,201,902 |

| 2,332 | | ProSiebenSat.1 Media SE | 122,437 |

| 16,509 | | Realestate.com.au Ltd. | 597,557 |

| 3,359 | | Relx PLC | 60,607 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Consumer Discretionary—continued | |

| 181,000 | | SJM Holdings Ltd. | $134,107 |

| 45,600 | | Sands China Ltd. | 153,266 |

| 4,000 | | Sekisui Chemical Co. Ltd. | 47,716 |

| 2,200 | 1 | Select Comfort Corp. | 51,964 |

| 2,855 | 1 | ServiceMaster Global Holdings, Inc. | 107,005 |

| 262,173 | 1 | Sirius XM Holdings, Inc. | 1,077,531 |

| 2,797 | | Six Flags Entertainment Corp. | 145,164 |

| 9,682 | 1 | Skechers USA, Inc., Class A | 292,396 |

| 3,883 | 1 | Smith & Wesson Holding Corp. | 71,214 |

| 2,400 | | Sonic Corp. | 69,744 |

| 7,289 | | Starbucks Corp. | 447,472 |

| 900 | | Starwood Hotels & Resorts | 64,656 |

| 500 | | Sturm Ruger & Co., Inc. | 26,050 |

| 12,200 | | Suzuki Motor Corp. | 375,479 |

| 5,292 | | TJX Cos., Inc. | 373,615 |

| 14,445 | 1 | Tegna, Inc. | 408,071 |

| 5,000 | | Time Warner, Inc. | 349,900 |

| 17,700 | | Toyota Motor Corp. | 1,097,987 |

| 4,596 | | Travelport Worldwide Ltd. | 61,173 |

| 1,300 | | V.F. Corp. | 84,110 |

| 32,686 | | Vivendi SA | 687,554 |

| 58 | | Volkswagen AG | 8,654 |

| 61,200 | | WPP PLC | 1,414,859 |

| 14,900 | | Walt Disney Co. | 1,690,703 |

| 3,900 | | Whirlpool Corp. | 633,828 |

| 3,300 | | Wynn Macau Ltd. | 4,117 |

| | | TOTAL | 39,712,227 |

| | | Consumer Staples—2.6% | |

| 400 | | Andersons, Inc. | 13,788 |

| 3,100 | | Alimentation Couche-Tard, Inc., Class B | 141,322 |

| 15,723 | | CVS Health Corp. | 1,479,377 |

| 257 | | Cal-Maine Foods, Inc. | 14,009 |

| 1,255 | | Calavo Growers, Inc. | 71,008 |

| 800 | | Casey's General Stores, Inc. | 93,016 |

| 2,349 | 1 | Coca-Cola HBC AG | 56,994 |

| 6,500 | | Colgate-Palmolive Co. | 426,920 |

| 5,877 | | ConAgra Foods, Inc. | 240,546 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Consumer Staples—continued | |

| 3,900 | | Dean Foods Co. | $73,164 |

| 2,115 | | Delhaize Group | 211,759 |

| 200 | 1 | Diamond Foods, Inc. | 8,096 |

| 1,100 | | FamilyMart Co. Ltd. | 49,103 |

| 700 | | Fresh Del Monte Produce, Inc. | 30,597 |

| 6,600 | 1 | Herbalife Ltd. | 381,018 |

| 45,200 | | Japan Tobacco, Inc. | 1,621,280 |

| 6,117 | | Kimberly-Clark Corp. | 728,841 |

| 5,000 | | Kellogg Co. | 343,850 |

| 60,269 | | Koninklijke Ahold NV | 1,310,034 |

| 11,073 | | Metro, Inc. | 318,894 |

| 5,000 | | Molson Coors Brewing Co., Class B | 460,150 |

| 12,060 | | Nestle SA | 893,666 |

| 5,133 | | Philip Morris International, Inc. | 448,573 |

| 6,400 | | Procter & Gamble Co. | 478,976 |

| 38,176 | | Sainsbury (J) PLC | 145,927 |

| 1,000 | | Sanderson Farms, Inc. | 74,810 |

| 21,200 | | Swedish Match AB | 730,730 |

| 300 | 1 | USANA, Inc. | 40,182 |

| 100 | | WD 40 Co. | 9,877 |

| 17,644 | | Walgreens Boots Alliance, Inc. | 1,482,625 |

| | | TOTAL | 12,379,132 |

| | | Energy—2.7% | |

| 3,717 | | Alon USA Energy, Inc. | 65,382 |

| 272,890 | | BP PLC | 1,583,375 |

| 14,500 | | Baker Hughes, Inc. | 784,015 |

| 10,815 | | California Resources Corp. | 44,342 |

| 14,000 | | Chevron Corp. | 1,278,480 |

| 8,261 | | Columbia Pipeline Group, Inc. | 158,363 |

| 760 | | Delek Group Ltd. | 171,036 |

| 2,500 | | Delek US Holdings, Inc. | 69,225 |

| 2,900 | | Devon Energy Corp. | 133,429 |

| 23,770 | 1 | EP Energy Corp. | 134,538 |

| 37,440 | | Exxon Mobil Corp. | 3,057,350 |

| 9,063 | | Frank's International N.V. | 153,165 |

| 3,143 | | Green Plains, Inc. | 74,458 |

| 5,052 | | Halliburton Co. | 201,322 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Energy—continued | |

| 800 | | HollyFrontier Corp. | $38,464 |

| 101,000 | | Inpex Corp. | 1,006,597 |

| 40,447 | | Kinder Morgan, Inc. | 953,336 |

| 10,574 | | Marathon Petroleum Corp. | 617,627 |

| 4,368 | | Nordic American Tanker Shipping Ltd. | 64,646 |

| 538 | | OMV AG | 15,349 |

| 1,828 | | Repsol YPF SA | 23,734 |

| 10,093 | | Royal Dutch Shell PLC, Class B | 251,122 |

| 1,800 | | Schlumberger Ltd. | 138,870 |

| 21,102 | | Suncor Energy, Inc. | 583,072 |

| 1,400 | | Teekay Tankers Ltd., Class A | 9,856 |

| 400 | | Tesoro Petroleum Corp. | 46,068 |

| 5,828 | | Total SA | 289,125 |

| 7,685 | | Valero Energy Corp. | 552,244 |

| 1,800 | | Western Refining, Inc. | 81,468 |

| | | TOTAL | 12,580,058 |

| | | Financials—12.5% | |

| 6,569 | | AGEAS | 287,234 |

| 3,114 | | ARMOUR Residential REIT, Inc. | 65,799 |

| 48,756 | | AXA SA | 1,317,251 |

| 1,969 | | Alexander and Baldwin, Inc. | 74,645 |

| 8,858 | | Allianz SE | 1,568,695 |

| 8,100 | | Allstate Corp. | 508,356 |

| 460 | | Altisource Residential Corp. | 6,090 |

| 4,135 | | American Capital Mortgage Investment Corp. | 61,984 |

| 4,000 | | Apollo Commercial Real Estate Finance, Inc. | 70,200 |

| 199 | | Argo Group International Holdings Ltd. | 12,642 |

| 4,099 | | BBCN Bancorp, Inc. | 77,512 |

| 337,000 | | BOC Hong Kong (Holdings) Ltd. | 1,038,741 |

| 233 | | Banco Bilbao Vizcaya Argentaria SA | 1,932 |

| 2,800 | | Bancorpsouth, Inc. | 75,320 |

| 12,705 | | Bank Hapoalim Ltd. | 65,674 |

| 86,713 | 1 | Bank Leumi Le-Israel | 313,218 |

| 120,000 | | Bank of America Corp. | 2,091,600 |

| 1,600 | | Bank of Montreal | 92,385 |

| 5,915 | | Bank of Nova Scotia | 269,695 |

| 96,000 | | Bank Of Yokohama Ltd. | 565,528 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Financials—continued | |

| 143,165 | | Barclays PLC | $481,228 |

| 17,662 | 1 | Berkshire Hathaway, Inc., Class B | 2,368,298 |

| 900 | | Blackrock, Inc. | 327,348 |

| 2,300 | | Boston Private Financial Holdings | 27,830 |

| 6,468 | | Brookfield Asset Management, Inc., Class A | 222,066 |

| 4,400 | | CNO Financial Group, Inc. | 89,012 |

| 10,001 | | CNP Assurances | 139,198 |

| 4,200 | | CVB Financial Corp. | 77,700 |

| 8,744 | | CYS Investments, Inc. | 66,280 |

| 14,100 | | Canadian Imperial Bank of Commerce | 1,058,780 |

| 4,500 | | Capital One Financial Corp. | 353,295 |

| 6,300 | | Capstead Mortgage Corp. | 59,787 |

| 200 | | Cash America International, Inc. | 6,750 |

| 2,500 | | Cathay Bancorp, Inc. | 85,800 |

| 18,700 | | Chugoku Bank Ltd. | 259,572 |

| 10,700 | | Citigroup, Inc. | 578,763 |

| 31,188 | | Citizens Financial Group, Inc. | 830,536 |

| 3,519 | | Colony Capital, Inc., Class A | 71,999 |

| 51,637 | 1 | Commerzbank AG | 568,452 |

| 249,423 | | Corp Mapfre Sa | 682,324 |

| 700 | 1 | Credit Acceptance Corp. | 140,294 |

| 5,603 | | Credit Agricole SA | 67,527 |

| 12,400 | | Danske Bank | 332,245 |

| 20,331 | | Delta Lloyd NV | 146,201 |

| 2,505 | | Deutsche Wohnen AG | 68,919 |

| 13,130 | 1 | Direct Line Insurance Group PLC | 81,434 |

| 7,100 | | Discover Financial Services | 402,996 |

| 14,756 | | DnB ASA | 194,127 |

| 21,400 | 1 | E*Trade Financial Corp. | 651,202 |

| 3,695 | | EverBank Financial Corp. | 63,776 |

| 5,700 | | FNB Corp. | 82,764 |

| 5,567 | 1 | FNFV Group | 62,295 |

| 1,200 | | First American Financial Corp. | 47,328 |

| 3,900 | | First Midwest Bancorp, Inc. | 76,206 |

| 5,066 | 1 | Four Corners Property Trust, Inc. | 100,307 |

| 157,000 | | Fukuoka Financial Group, Inc. | 762,146 |

| 3,032 | | General Property Trust Group | 10,155 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Financials—continued | |

| 28,084 | | Gjensidige Forsikring ASA | $453,157 |

| 1,400 | | Goldman Sachs Group, Inc. | 266,028 |

| 2,362 | | Great Western Bancorp, Inc. | 71,380 |

| 1,600 | | Great-West Lifeco, Inc. | 43,479 |

| 2,194 | | Groupe Bruxelles Lambert SA | 180,162 |

| 2,000 | 1 | HFF, Inc. | 68,740 |

| 274,146 | | HSBC Holdings PLC | 2,184,546 |

| 34,000 | | Hang Seng Bank Ltd. | 615,191 |

| 10,068 | | Hannover Rueck SE | 1,178,287 |

| 7,100 | | Hartford Financial Services Group, Inc. | 324,044 |

| 4,377 | | Hatteras Financial Corp. | 61,628 |

| 1,800 | | Home Bancshares, Inc. | 81,216 |

| 3,359 | | ICAP PLC | 25,750 |

| 2,468 | | InfraREIT, Inc. | 49,780 |

| 667 | | Intact Financial Corp. | 44,462 |

| 23,614 | | Intesa Sanpaolo SpA | 80,775 |

| 8,539 | | Invesco Ltd. | 287,679 |

| 5,477 | | Invesco Mortgage Capital, Inc. | 73,501 |

| 39,785 | | Investec PLC | 338,549 |

| 33,000 | | Investor AB, Class B | 1,256,573 |

| 7,178 | | Investors Bancorp, Inc., NEW | 92,022 |

| 5,100 | 1 | iStar Financial, Inc. | 67,320 |

| 44,140 | | JPMorgan Chase & Co. | 2,943,255 |

| 1,700 | | Janus Capital Group, Inc. | 26,843 |

| 4,487 | 1 | Julius Baer Group Ltd. | 214,258 |

| 13,240 | | KBC Groupe | 789,742 |

| 670 | | Kearny Financial Corp. | 8,442 |

| 3,115 | | Kennedy-Wilson Holdings, Inc. | 81,301 |

| 1,300 | | Kinnevik Investment AB | 39,960 |

| 337 | | LegacyTexas Financial Group, Inc. | 10,282 |

| 315,001 | | Legal & General Group PLC | 1,287,104 |

| 80,642 | | LendLease Group | 745,734 |

| 5,400 | | Lincoln National Corp. | 296,946 |

| 53,500 | | Link REIT | 326,975 |

| 8,700 | 1 | MBIA, Inc. | 57,159 |

| 8,700 | 1 | MGIC Investment Corp. | 82,998 |

| 17,300 | | MSCI, Inc., Class A | 1,213,076 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Financials—continued | |

| 6,483 | | Macquarie Group Ltd. | $380,495 |

| 28,600 | | Manulife Financial Corp. | 470,724 |

| 1,142 | 1 | Marcus & Millichap Co., Inc. | 37,469 |

| 4,000 | | Mitsubishi Estate Co. Ltd. | 84,245 |

| 29,700 | | Morgan Stanley | 1,018,710 |

| 19,863 | | NASDAQ, Inc. | 1,164,369 |

| 1,258 | | NN Group NV | 42,947 |

| 1,700 | | National Bank of Canada, Montreal | 55,718 |

| 5,900 | | National Penn Bancshares, Inc. | 73,691 |

| 4,560 | 1 | Nationstar Mortgage Holdings, Inc. | 62,107 |

| 9,006 | | Natixis | 54,538 |

| 65,355 | | Navient Corp. | 778,378 |

| 6,200 | | New Residential Investment Corp. | 78,864 |

| 6,600 | | Nordea Bank AB | 73,083 |

| 5,203 | | Northwest Bancshares, Inc. | 72,530 |

| 297,664 | | Old Mutual PLC | 936,971 |

| 800 | | Old National Bancorp. | 11,800 |

| 2,000 | | Oversea-Chinese Banking Corp. Ltd. | 12,288 |

| 4,300 | | PNC Financial Services Group | 410,693 |

| 3,105 | | Partners Group Holding AG | 1,120,719 |

| 1,749 | | Pennymac Mortgage Investment Trust | 29,103 |

| 113,647 | | Platinum Asset Management Ltd. | 665,292 |

| 15,300 | | Popular, Inc. | 454,563 |

| 2,100 | | Potlatch Corp. | 70,182 |

| 1,500 | | Primerica, Inc. | 76,860 |

| 1,900 | | PrivateBancorp, Inc. | 83,809 |

| 14,628 | | Prudential Corp. PLC | 339,171 |

| 4,605 | | RSA Insurance Group PLC | 30,491 |

| 5,200 | | Radian Group, Inc. | 74,100 |

| 402 | | Raiffeisen Bank International AG | 6,287 |

| 4,800 | | Redwood Trust, Inc. | 66,144 |

| 600 | | Regions Financial Corp. | 6,084 |

| 24,200 | | Royal Bank of Canada, Montreal | 1,378,663 |

| 5,400 | | SEI Investments Co. | 293,706 |

| 13,631 | | Sampo Oyj, Class A | 674,426 |

| 22,763 | | Santander Consumer USA Holdings, Inc. | 401,539 |

| 25,526 | | Schroders PLC | 1,150,889 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Financials—continued | |

| 16,575 | | Scor Regroupe | $649,549 |

| 1,800 | | Skand Enskilda BKN, Class A | 19,128 |

| 4,842 | | Societe Generale, Paris | 230,757 |

| 3,400 | 1 | St. Joe Co. | 66,028 |

| 4,599 | | Sterling Bancorp | 80,666 |

| 24,700 | | Sumitomo Mitsui Financial Group, Inc. | 943,418 |

| 9,000 | | Sumitomo Mitsui Trust Holdings, Inc. | 34,414 |

| 500 | | Sun Life Financial Services of Canada | 16,489 |

| 40,500 | | Suntec Real Estate Investment | 44,098 |

| 4,433 | 1 | Svenska Handelsbanken AB - A Shares | 59,626 |

| 1,518 | | Swiss Re AG | 144,431 |

| 7,096 | 1 | Synchrony Financial | 225,866 |

| 807 | | Talmer Bancorp, Inc., Class A | 14,744 |

| 23,700 | | The Bank of New York Mellon Corp. | 1,039,008 |

| 153,148 | | Three I Group | 1,158,147 |

| 4,200 | | Tokio Marine Holdings, Inc. | 155,074 |

| 20,600 | | Toronto-Dominion Bank | 841,307 |

| 1,200 | | Trustmark Corp. | 30,300 |

| 14,431 | | UBS Group AG | 276,470 |

| 11,283 | | United Mizrahi Bank Ltd. | 133,400 |

| 700 | | Universal Insurance Holdings, Inc. | 13,825 |

| 2,662 | | Virtu Financial, Inc., Class A | 59,229 |

| 26,934 | | Voya Financial, Inc. | 1,096,214 |

| 182 | 1 | Walker & Dunlop, Inc. | 5,376 |

| 48,400 | | Wells Fargo & Co. | 2,666,840 |

| 1,549 | | WisdomTree Investments, Inc. | 33,691 |

| | | TOTAL | 58,957,528 |

| | | Health Care—7.4% | |

| 1,700 | 1 | AMAG Pharmaceutical, Inc. | 45,254 |

| 14,199 | | Amgen, Inc. | 2,287,459 |

| 4,857 | | AbbVie, Inc. | 282,435 |

| 8,886 | 1 | Actelion Ltd. | 1,245,939 |

| 4,200 | 1 | Affymetrix, Inc. | 39,774 |

| 31,810 | | Agilent Technologies, Inc. | 1,330,294 |

| 600 | | Alfresa Holdings Corp. | 11,906 |

| 2,082 | 1 | Allergan PLC | 653,519 |

| 1,700 | 1 | Amedisys, Inc. | 69,003 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Health Care—continued | |

| 398 | 1 | Anacor Pharmaceuticals, Inc. | $46,459 |

| 3,150 | | Anthem, Inc. | 410,697 |

| 5,800 | 1 | Bio Rad Laboratories, Inc., Class A | 810,376 |

| 1,000 | 1 | BioCryst Pharmaceuticals, Inc. | 10,610 |

| 5,400 | | Bristol-Myers Squibb Co. | 361,854 |

| 19,440 | | CSL Ltd. | 1,404,306 |

| 1,500 | 1 | Cambrex Corp. | 80,445 |

| 2,850 | 1 | Catalent, Inc. | 79,372 |

| 2,570 | 1 | Celgene Corp. | 281,286 |

| 16,972 | | Cochlear Ltd. | 1,160,097 |

| 600 | | Coloplast, Class B | 48,640 |

| 1,700 | 1 | Cynosure, Inc., Class A | 71,502 |

| 2,000 | 1 | Emergent Biosolutions, Inc. | 75,340 |

| 2,767 | 1 | FibroGen, Inc. | 82,291 |

| 14,261 | | Fresenius SE & Co. KGaA | 1,046,403 |

| 13,600 | | Gilead Sciences, Inc. | 1,441,056 |

| 2,100 | 1 | Haemonetics Corp. | 67,704 |

| 4,200 | 1 | Halozyme Therapeutics, Inc. | 74,760 |

| 2,232 | 1 | Halyard Health, Inc. | 71,402 |

| 1,300 | 1 | Heartware International, Inc. | 62,218 |

| 1,395 | 1 | INC Research Holdings, Inc., Class A | 65,983 |

| 467 | 1 | INSYS Therapeutics, Inc. | 14,879 |

| 37,600 | | Johnson & Johnson | 3,806,624 |

| 6,091 | 1 | Juno Therapeutics, Inc. | 343,471 |

| 21,200 | | Lilly (Eli) & Co. | 1,739,248 |

| 1,248 | 1 | Magellan Health, Inc. | 65,707 |

| 1,576 | 1 | Mallinckrodt PLC | 107,026 |

| 2,000 | 1 | MedAssets, Inc. | 60,260 |

| 7,200 | | Medtronic PLC | 542,448 |

| 44,000 | | Merck & Co., Inc. | 2,332,440 |

| 300 | 1 | Merit Medical Systems, Inc. | 5,811 |

| 6,569 | 1 | Merrimack Pharmaceuticals, Inc. | 61,814 |

| 6,283 | 1 | MiMedx Group, Inc. | 56,296 |

| 2,100 | | Mitsubishi Tanabe Pharma Corp. | 36,736 |

| 21,840 | 1 | Mylan NV | 1,120,392 |

| 17,895 | | Novo Nordisk A/S, Class B | 983,759 |

| 1,500 | 1 | Natus Medical, Inc. | 73,170 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Health Care—continued | |

| 6,681 | | Novartis AG - REG | $569,985 |

| 900 | 1 | Omnicell, Inc. | 27,144 |

| 20,500 | | Otsuka Holdings Co., Ltd. | 680,161 |

| 1,583 | 1 | PRA Health Sciences, Inc. | 71,678 |

| 1,300 | 1 | Parexel International Corp. | 88,205 |

| 103,622 | | Pfizer, Inc. | 3,395,693 |

| 2,300 | 1 | PharMerica Corp. | 78,246 |

| 1,270 | 1 | Press Ganey Holdings, Inc. | 41,008 |

| 25,760 | 1 | Qiagen NV | 681,094 |

| 4,700 | | Quality Systems, Inc. | 76,375 |

| 9,412 | | Ramsay Health Care Ltd. | 455,472 |

| 500 | 1 | Regeneron Pharmaceuticals, Inc. | 272,250 |

| 2,000 | 1 | Repligen Corp. | 56,860 |

| 10,003 | | Roche Holding AG-GENUSSCHEIN | 2,674,257 |

| 5,272 | | Sanofi | 468,356 |

| 1,400 | 1 | Sucampo Pharmaceuticals, Inc. | 24,010 |

| 3,673 | 1 | Supernus Pharmaceuticals, Inc. | 59,356 |

| 157 | 1 | Surgical Care Affiliates, Inc. | 5,836 |

| 6,189 | 1 | Wright Medical Group NV | 132,568 |

| 113 | 1 | Zafgen, Inc. | 1,911 |

| | | TOTAL | 34,928,930 |

| | | Industrials—6.6% | |

| 2,800 | | AAR Corp. | 68,768 |

| 2,900 | | Actuant Corp. | 71,804 |

| 2,705 | | Adecco SA | 184,730 |

| 5,100 | 1 | AerCap Holdings NV | 231,744 |

| 16,144 | | Alaska Air Group, Inc. | 1,287,161 |

| 86,500 | | Amada Co. | 852,466 |

| 1,089 | | Andritz AG | 56,950 |

| 2,402 | | ArcBest Corp. | 57,840 |

| 35,062 | | Ashtead Group PLC | 576,725 |

| 180,100 | | BAE Systems PLC | 1,400,998 |

| 2,478 | | Boeing Co. | 360,425 |

| 19,887 | | Bouygues SA | 747,849 |

| 140 | | Brenntag AG | 7,648 |

| 300 | 1 | Builders Firstsource, Inc. | 4,038 |

| 39,674 | | Bunzl PLC | 1,147,257 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Industrials—continued | |

| 57,300 | | CSX Corp. | $1,629,039 |

| 12,398 | | Canadian National Railway, Co. | 740,009 |

| 3,700 | | Central Japan Railway Co. | 661,437 |

| 5,464 | | Cobham PLC | 24,953 |

| 2,700 | 1 | Continental Building Product, Inc. | 49,248 |

| 6,550 | | DSV, De Sammensluttede Vognmad AS | 254,327 |

| 53,000 | | Dai Nippon Printing Co. Ltd. | 518,661 |

| 3,700 | | Danaher Corp. | 356,643 |

| 26,700 | | Delta Air Lines, Inc. | 1,240,482 |

| 30,766 | | Deutsche Post AG | 899,380 |

| 3,600 | 1 | DigitalGlobe, Inc. | 60,840 |

| 46,185 | | Edenred | 955,831 |

| 5,100 | | Expeditors International Washington, Inc. | 247,554 |

| 24,000 | | Fuji Electric Co. | 110,645 |

| 3,509 | | Geberit International AG | 1,171,625 |

| 2,500 | | General Dynamics Corp. | 366,150 |

| 8,800 | | General Electric Co. | 263,472 |

| 8,086 | | Grupo Ferrovial, S.A. | 191,133 |

| 5,900 | | Harsco Corp. | 61,596 |

| 2,000 | 1 | Hawaiian Holdings, Inc. | 72,400 |

| 2,362 | | Hillenbrand, Inc. | 71,545 |

| 619,000 | | Hutchison Port Holdings TR-U | 333,774 |

| 6,100 | | Ingersoll-Rand PLC | 357,887 |

| 1,457 | | Insperity, Inc. | 62,884 |

| 2,669 | | Interface, Inc. | 53,060 |

| 1,356 | 1 | International Consolidated Airlines Group SA | 11,545 |

| 50,400 | 1 | Jet Blue Airways Corp. | 1,246,896 |

| 2,905 | | Knoll, Inc. | 64,723 |

| 174 | | Kone Corp. OYJ, Class B | 7,410 |

| 2,000 | | Korn/Ferry International | 73,600 |

| 5,555 | 1 | MRC Global, Inc. | 82,158 |

| 3,900 | 1 | Mastec, Inc. | 79,677 |

| 5,803 | 1 | Meritor, Inc. | 62,324 |

| 2,300 | | Miller Herman, Inc. | 72,933 |

| 17,000 | | Mitsubishi Electric Corp. | 188,443 |

| 2,295 | | Mueller Industries, Inc. | 72,270 |

| 7,817 | | Mueller Water Products, Inc. | 72,854 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Industrials—continued | |

| 1,000 | | NWS Holdings Ltd. | $1,411 |

| 15,453 | | Nielsen Holdings PLC | 721,346 |

| 20,300 | | Nsk Ltd. | 255,698 |

| 13,219 | | Osram Licht AG | 558,107 |

| 16,041 | | Randstad Holdings N.V. | 1,002,169 |

| 20,968 | | Rexel SA | 286,970 |

| 3,872 | 1 | Rexnord Corp. | 79,105 |

| 2,441 | | Sandvik AB | 25,266 |

| 1,223 | | Schindler Holding AG | 200,906 |

| 2,800 | | Securitas AB, Class B | 42,702 |

| 11,900 | | Singapore Technologies Engineering Ltd. | 24,094 |

| 350 | | SkyWest, Inc. | 7,214 |

| 38,200 | | Southwest Airlines Co. | 1,752,616 |

| 2,900 | | Stanley Black & Decker, Inc. | 316,564 |

| 3,700 | | Steelcase, Inc., Class A | 74,000 |

| 90,000 | | Sumitomo Heavy Industries | 427,464 |

| 4,300 | 1 | Swift Transportation Co. | 68,671 |

| 75,764 | | TNT Express NV | 616,783 |

| 2,304 | | The ADT Corp. | 81,723 |

| 500 | | Toto Ltd. | 17,281 |

| 3,170 | 1 | TriMas Corp. | 68,567 |

| 800 | 1 | TrueBlue, Inc. | 23,432 |

| 18,393 | | Union Pacific Corp. | 1,544,092 |

| 25,819 | 1 | United Continental Holdings, Inc. | 1,438,893 |

| 5,200 | | United Parcel Service, Inc. | 535,652 |

| 357 | 1 | Univar, Inc. | 6,762 |

| 2,450 | | Vestas Wind Systems A/S | 159,579 |

| 18,002 | | West Japan Railway Co. | 1,137,918 |

| 1,900 | | Yamato Holdings Co. Ltd. | 36,360 |

| 4,200 | | Yangzijiang Shipbuilding Holdings Ltd. | 3,264 |

| | | TOTAL | 31,360,420 |

| | | Information Technology—6.7% | |

| 3,285 | 1 | ACI Worldwide, Inc. | 77,263 |

| 2,866 | | AVG Technologies NV | 60,444 |

| 2,400 | 1 | Advanced Energy Industries, Inc. | 70,008 |

| 31,900 | 1 | Advanced Micro Devices, Inc. | 75,284 |

| 1,600 | 1 | Alliance Data Systems Corp. | 458,960 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Information Technology—continued | |

| 867 | 1 | Alphabet, Inc., Class A | $661,391 |

| 10,000 | 1 | Amkor Technology, Inc. | 68,000 |

| 71,049 | | Apple, Inc. | 8,405,097 |

| 6,200 | | Applied Materials, Inc. | 116,374 |

| 5,466 | 1 | Bankrate, Inc. | 79,694 |

| 2,988 | 1 | Benchmark Electronics, Inc. | 64,123 |

| 1,834 | 1 | Benefitfocus, Inc. | 74,314 |

| 7,314 | | CDW Corp. | 315,745 |

| 77,000 | | Cisco Systems, Inc. | 2,098,250 |

| 43 | | Constellation Software, Inc. | 18,455 |

| 2,200 | 1 | Cornerstone OnDemand, Inc. | 79,002 |

| 11,800 | | Corning, Inc. | 221,014 |

| 18,700 | 1 | Cypress Semiconductor Corp. | 202,334 |

| 11,000 | | EMC Corp. Mass | 278,740 |

| 1,700 | | EarthLink Network, Inc. | 15,623 |

| 4,000 | 1 | eBay, Inc. | 118,360 |

| 4,911 | 1 | Endurance International Group Holdings, Inc. | 68,607 |

| 8,925 | | Ericsson LM - B | 86,853 |

| 3,767 | | Evertec, Inc. | 64,717 |

| 4,071 | 1 | Facebook, Inc. | 424,361 |

| 4,400 | 1 | Fairchild Semiconductor International, Inc., Class A | 85,976 |

| 5,900 | 1 | Finisar Corp. | 71,213 |

| 34,000 | 1 | Freescale Semiconductor Ltd. | 1,322,940 |

| 29,000 | | Fujitsu Ltd. | 146,628 |

| 2,343 | 1 | Gigamon, Inc. | 63,472 |

| 226,000 | 1 | GungHo Online Entertainment, Inc. | 698,879 |

| 61,500 | 1 | HP, Inc. | 771,210 |

| 61,500 | | Hewlett Packard Enterprise Co. | 913,890 |

| 35,400 | | Ibiden Co. Ltd. | 555,475 |

| 3,878 | 1 | Infoblox, Inc. | 58,325 |

| 103,700 | | Intel Corp. | 3,605,649 |

| 1,400 | | InterDigital, Inc. | 73,766 |

| 5,362 | 1 | InvenSense, Inc. | 62,146 |

| 34,391 | 1 | Keysight Technologies, Inc. | 1,059,587 |

| 1,500 | | Lam Research Corp. | 117,300 |

| 2,004 | 1 | MA-COM Technology Solutions Holdings, Inc. | 74,048 |

| 2,900 | | Mentor Graphics Corp. | 54,317 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Information Technology—continued | |

| 6,000 | 1 | Micron Technology, Inc. | $95,580 |

| 11,900 | | NVIDIA Corp. | 377,468 |

| 900 | 1 | Netgear, Inc. | 39,699 |

| 4,500 | | Nexon Co., Ltd. | 71,503 |

| 123,000 | | Nippon Electric Glass Co. Ltd. | 682,945 |

| 25,674 | | Nokia Oyj | 184,965 |

| 104,800 | 1 | ON Semiconductor Corp. | 1,148,608 |

| 12,000 | | Omron Corp. | 441,558 |

| 4,000 | 1 | PMC-Sierra, Inc. | 47,320 |

| 4,000 | 1 | PayPal Holdings, Inc. | 141,040 |

| 5,300 | 1 | Polycom, Inc. | 72,239 |

| 2,500 | 1 | Progress Software Corp. | 59,975 |

| 5,200 | 1 | Qlogic Corp. | 67,080 |

| 2,300 | | Qualcomm, Inc. | 112,217 |

| 1,600 | 1 | Red Hat, Inc. | 130,256 |

| 1,658 | 1 | Rovi Corporation | 19,581 |

| 1,605 | | STMicroelectronics N.V. | 11,650 |

| 1,700 | 1 | Salesforce.com, Inc. | 135,473 |

| 1,630 | | Science Applications International Corp. | 81,891 |

| 5,500 | | Skyworks Solutions, Inc. | 456,610 |

| 3,666 | | TE Connectivity Ltd. | 245,952 |

| 21,800 | | Teradyne, Inc. | 453,004 |

| 14,300 | | Texas Instruments, Inc. | 831,116 |

| 7,300 | 1 | TiVo, Inc. | 65,627 |

| 40,900 | 1 | Trimble Navigation Ltd. | 936,610 |

| 1,986 | 1 | Universal Display Corp. | 104,384 |

| 2,700 | 1 | VMware, Inc., Class A | 165,807 |

| 6,213 | 1 | Vantiv, Inc. | 327,487 |

| 1,700 | 1 | Verint Systems, Inc. | 79,645 |

| 6,500 | | Vishay Intertechnology, Inc. | 77,480 |

| 2,786 | 1 | Web.com Group, Inc. | 67,449 |

| 1,600 | 1 | WebMd Health Corp. | 72,784 |

| 2,800 | | Western Digital Corp. | 174,748 |

| | | TOTAL | 31,917,585 |

| | | Materials—1.9% | |

| 100,344 | | ArcelorMittal | 491,550 |

| 38,000 | | Asahi Kasei Corp. | 260,142 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Materials—continued | |

| 2,930 | | Ashland, Inc. | $330,064 |

| 2,580 | 1 | Berry Plastics Group, Inc. | 93,809 |

| 1,500 | 1 | Chemtura Corp. | 46,080 |

| 4,885 | | Commercial Metals Corp. | 72,249 |

| 2,458 | | EMS-Chemie Holdings Ag | 1,000,998 |

| 3,100 | | Eagle Materials, Inc. | 214,148 |

| 356 | 1 | Flotek Industries, Inc. | 4,066 |

| 368,155 | | Fortescue Metals Group Ltd. | 519,456 |

| 21 | | Givaudan SA | 37,846 |

| 2,000 | | Greif, Inc., Class A | 70,940 |

| 3,400 | 1 | Headwaters, Inc. | 65,178 |

| 2,100 | | Hitachi Chemical Co. | 35,010 |

| 2,429 | | James Hardie Industries PLC | 28,789 |

| 91,500 | | Kuraray Co. Ltd. | 1,165,748 |

| 6,216 | | LyondellBasell Industries NV, Class A | 595,617 |

| 1,600 | | Martin Marietta Materials | 251,840 |

| 1,500 | | Newmarket Corp. | 619,725 |

| 11,200 | | Nitto Denko Corp. | 755,667 |

| 13,000 | | Potash Corp. of Saskatchewan, Inc. | 263,125 |

| 8,400 | | Sealed Air Corp. | 381,024 |

| 4,000 | | Sherwin-Williams Co. | 1,104,280 |

| 83 | | Sika AG | 280,725 |

| 2,344 | 1 | Summit Materials, Inc., Class A | 53,373 |

| 6,116 | | UPM - Kymmene Oyj | 116,522 |

| 868 | 1 | US Concrete, Inc. | 50,978 |

| 2,109 | | Voest-alpine Stahl | 68,575 |

| 94 | | Yara International ASA | 4,349 |

| | | TOTAL | 8,981,873 |

| | | Telecommunication Services—2.5% | |

| 611 | 1 | 8x8, Inc. | 7,210 |

| 1,900 | | BCE, Inc. | 81,779 |

| 219,192 | | BT Group PLC | 1,638,905 |

| 400 | | Cogent Communications Group | 13,424 |

| 85,526 | | Deutsche Telekom AG | 1,577,668 |

| 35,300 | 1 | Globalstar, Inc. | 76,954 |

| 555,095 | | HKT Trust and HKT Ltd. | 696,356 |

| 238 | | Inteliquent, Inc. | 4,572 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Telecommunication Services—continued | |

| 24,500 | | KDDI Corp. | $609,141 |

| 66,200 | | NTT DOCOMO, Inc. | 1,257,746 |

| 33,100 | | Nippon Telegraph and Telephone Corp. | 1,230,131 |

| 11,736 | | Orange SA | 202,657 |

| 22,300 | | SoftBank Group Corp. | 1,185,250 |

| 357,300 | | StarHub Ltd. | 918,471 |

| 3,051 | 1 | T-Mobile USA, Inc. | 108,310 |

| 73,690 | | Tele2 AB, Class B | 749,793 |

| 11,000 | | TeliaSonera AB | 53,958 |

| 269,246 | | Telstra Corp. Ltd. | 1,046,001 |

| 10,100 | | Verizon Communications | 459,045 |

| 1,300 | 1 | Vonage Holdings Corp. | 8,385 |

| | | TOTAL | 11,925,756 |

| | | Utilities—3.0% | |

| 86,400 | | AES Corp. | 863,136 |

| 3,422 | | Abengoa Yield PLC | 49,551 |

| 200 | | American States Water Co. | 8,366 |

| 1,600 | | Black Hills Corp. | 68,672 |

| 6,394 | | CMS Energy Corp. | 223,918 |

| 33,874 | | Electricite De France | 504,280 |

| 37,542 | | Enagas SA | 1,116,669 |

| 207,046 | | Enel S.p.A | 912,174 |

| 60,131 | 1 | Engie | 1,046,250 |

| 28,800 | | Exelon Corp. | 786,528 |

| 29,300 | | FirstEnergy Corp. | 919,727 |

| 180,094 | | Iberdrola SA | 1,259,239 |

| 1,200 | | Idacorp, Inc. | 81,648 |

| 4,509 | | NRG Yield, Inc. | 63,757 |

| 77,736 | | National Grid PLC | 1,083,909 |

| 100 | | New Jersey Resources Corp. | 3,005 |

| 1,606 | | ONE Gas, Inc. | 78,292 |

| 14,500 | | Power Assets Holdings Ltd. | 129,681 |

| 15,600 | | Public Service Enterprises Group, Inc. | 609,960 |

| 2,098 | | Red Electrica de Espana | 179,872 |

| 38,648 | | SSE PLC | 834,699 |

| 1,500 | | Sempra Energy | 148,845 |

| 81,848 | | Snam Rete Gas S.p.A | 415,661 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | COMMON STOCKS—continued | |

| | | Utilities—continued | |

| 55,956 | | Suez Environnement SA | $1,059,372 |

| 168,152 | | Terna S.p.A | 827,401 |

| 129,000 | | Tokyo Gas Co. Ltd. | 616,718 |

| 1,300 | | WGL Holdings, Inc. | 80,158 |

| | | TOTAL | 13,971,488 |

| | | TOTAL COMMON STOCKS

(IDENTIFIED COST $237,601,410) | 256,714,997 |

| | | ASSET-BACKED SECURITIES—0.1% | |

| 150,000 | | American Express Credit Account Master Trust 2014-1, A, 0.567%, 12/15/2021 | 149,273 |

| 300,000 | | AmeriCredit Automobile Receivables Trust 2015-1, A3, 1.260%, 11/08/2019 | 299,015 |

| 150,000 | | Navient Student Loan Trust 2014-1, A2, 0.531%, 03/27/2023 | 148,189 |

| | | TOTAL ASSET-BACKED SECURITIES

(IDENTIFIED COST $599,983) | 596,477 |

| | | COLLATERALIZED MORTGAGE OBLIGATIONS—0.3% | |

| 200,000 | | Citigroup Commercial Mortgage Trust 2015-GC33 AS, 4.114%, 9/10/2058 | 206,290 |

| 450,000 | | Commercial Mortgage Trust 2015-DC1 AM, 3.724%, 2/10/2048 | 450,485 |

| 50,000 | | WF-RBS Commercial Mortgage Trust 2012-C6 B, 4.697%, 4/15/2045 | 53,434 |

| 400,000 | | WF-RBS Commercial Mortgage Trust 2014-C25 AS, 3.984%, 11/15/2047 | 409,969 |

| 100,000 | | WF-RBS Commercial Mortgage Trust 2014-C25 B, 4.236%, 11/15/2047 | 102,560 |

| | | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(IDENTIFIED COST $1,254,942) | 1,222,738 |

| | | CORPORATE BONDS—5.3% | |

| | | Basic Industry - Chemicals—0.2% | |

| $300,000 | | Albemarle Corp., Sr. Unsecd. Note, 5.450%, 12/01/2044 | 291,910 |

| 50,000 | | RPM International, Inc., 6.500%, 02/15/2018 | 54,221 |

| 285,000 | | RPM International, Inc., Sr. Unsecd. Note, 5.250%, 6/01/2045 | 268,969 |

| 15,000 | | RPM International, Inc., Sr. Unsecd. Note, 6.125%, 10/15/2019 | 16,591 |

| 250,000 | | Valspar Corp., Sr. Unsecd. Note, 3.300%, 2/01/2025 | 239,763 |

| | | TOTAL | 871,454 |

| | | Basic Industry - Metals & Mining—0.1% | |

| 90,000 | | Allegheny Technologies, Inc., Sr. Note, 9.375%, 06/01/2019 | 90,113 |

| 100,000 | | Reliance Steel & Aluminum Co., Sr. Unsecd. Note, 4.500%, 04/15/2023 | 94,875 |

| 300,000 | | Southern Copper Corp., Note, 6.750%, 04/16/2040 | 269,407 |

| | | TOTAL | 454,395 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | CORPORATE BONDS—continued | |

| | | Basic Industry - Paper—0.0% | |

| $150,000 | 1,2,3 | Pope & Talbot, Inc., 8.375%, 12/01/2099 | $0 |

| | | Capital Goods - Aerospace & Defense—0.1% | |

| 140,000 | | Halliburton Co., Sr. Unsecd. Note, 3.800%, 11/15/2025 | 141,185 |

| 180,000 | | Lockheed Martin Corp., Sr. Unsecd. Note, 3.550%, 01/15/2026 | 182,121 |

| 90,000 | 4,5 | Textron Financial Corp., Jr. Sub. Note, Series 144A, 6.000%, 2/15/2067 | 66,375 |

| | | TOTAL | 389,681 |

| | | Capital Goods - Building Materials—0.1% | |

| 185,000 | | Masco Corp., Unsecd. Note, 4.450%, 4/01/2025 | 181,994 |

| 300,000 | | Valmont Industries, Inc., 5.250%, 10/01/2054 | 258,276 |

| | | TOTAL | 440,270 |

| | | Capital Goods - Diversified Manufacturing—0.1% | |

| 100,000 | | General Electric Co., Sr. Unsecd. Note, 4.125%, 10/09/2042 | 98,042 |

| 200,000 | 4,5 | Hutchison Whampoa International 14 Ltd., Unsecd. Note, Series 144A, 1.625%, 10/31/2017 | 199,570 |

| 100,000 | | Roper Industries, Inc., Sr. Unsecd. Note, 6.250%, 09/01/2019 | 111,685 |

| | | TOTAL | 409,297 |

| | | Capital Goods - Environmental—0.0% | |

| 110,000 | | Republic Services, Inc., Company Guarantee, 5.500%, 9/15/2019 | 121,743 |

| | | Communications - Cable & Satellite—0.1% | |

| 200,000 | 4,5 | CCO Safari II LLC, Series 144A, 4.908%, 7/23/2025 | 203,423 |

| 300,000 | | DIRECTV Holdings LLC, Sr. Unsecd. Note, 5.150%, 03/15/2042 | 288,213 |

| 20,000 | | Time Warner Cable, Inc., Company Guarantee, 8.250%, 04/01/2019 | 23,173 |

| | | TOTAL | 514,809 |

| | | Communications - Media & Entertainment—0.1% | |

| 100,000 | | 21st Century Fox America, Inc., Sr. Unsecd. Note, 5.400%, 10/01/2043 | 107,314 |

| 310,000 | 4,5 | British Sky Broadcasting Group PLC, 3.75%, Series 144A, 9/16/2024 | 308,449 |

| 70,000 | | Grupo Televisa S.A., Sr. Unsecd. Note, 6.125%, 01/31/2046 | 71,639 |

| 200,000 | | Viacom, Inc., Sr. Unsecd. Note, 3.875%, 04/01/2024 | 190,885 |

| | | TOTAL | 678,287 |

| | | Communications - Telecom Wirelines—0.0% | |

| 15,000 | | CenturyLink, Inc., Sr. Note, Series Q, 6.150%, 09/15/2019 | 15,487 |

| 200,000 | | Verizon Communications, Inc., Sr. Unsecd. Note, 4.150%, 03/15/2024 | 209,994 |

| | | TOTAL | 225,481 |

| | | Consumer Cyclical - Automotive—0.1% | |

| 70,000 | | General Motors Co., Sr. Unsecd. Note, 4.000%, 4/01/2025 | 67,690 |

| 200,000 | | General Motors Financial, Sr. Unsecd. Note, 3.100%, 01/15/2019 | 200,300 |

| 200,000 | | Magna International, Inc., 3.625%, 6/15/2024 | 196,677 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | CORPORATE BONDS—continued | |

| | | Consumer Cyclical - Automotive—continued | |

| $50,000 | 4,5 | RCI Banque SA, Sr. Unsecd. Note, Series 144A, 4.600%, 04/12/2016 | $50,579 |

| | | TOTAL | 515,246 |

| | | Consumer Cyclical - Retailers—0.2% | |

| 100,000 | | Advance Auto Parts, Inc., 4.500%, 12/01/2023 | 102,986 |

| 300,000 | | AutoZone, Inc., Sr. Unsecd. Note, 3.250%, 4/15/2025 | 292,801 |

| 131,370 | 4,5 | CVS Caremark Corp., Pass Thru Cert., Series 144A, 5.298%, 1/11/2027 | 141,600 |

| 110,000 | | Dollar General Corp., Sr. Unsecd. Note, 4.150%, 11/01/2025 | 108,865 |

| 300,000 | | Tiffany & Co., Sr. Unsecd. Note, 4.900%, 10/01/2044 | 279,795 |

| 50,000 | | Wal-Mart Stores, Inc., Sr. Unsecd. Note, 3.300%, 04/22/2024 | 51,700 |

| | | TOTAL | 977,747 |

| | | Consumer Non-Cyclical - Food/Beverage—0.2% | |

| 500,000 | 4,5 | HJ Heinz Co., Sr. Unsecd. Note, Series 144A, 3.950%, 7/15/2025 | 511,505 |

| 120,000 | | Mead Johnson Nutrition Co., Sr. Unsecd. Note, 4.125%, 11/15/2025 | 121,630 |

| 150,000 | | PepsiCo, Inc., 2.750%, 4/30/2025 | 146,567 |

| 70,000 | | PepsiCo, Inc., Sr. Unsecd. Note, 4.450%, 4/14/2046 | 72,357 |

| | | TOTAL | 852,059 |

| | | Consumer Non-Cyclical - Pharmaceuticals—0.2% | |

| 300,000 | | AbbVie, Inc., Sr. Unsecd. Note, 2.500%, 5/14/2020 | 298,447 |

| 450,000 | | Eli Lilly & Co., 3.700%, 3/01/2045 | 422,420 |

| 90,000 | | Gilead Sciences, Inc., Sr. Unsecd. Note, 3.650%, 3/01/2026 | 90,851 |

| | | TOTAL | 811,718 |

| | | Consumer Non-Cyclical - Tobacco—0.1% | |

| 24,000 | | Altria Group, Inc., 9.250%, 08/06/2019 | 29,513 |

| 60,000 | | Altria Group, Inc., Sr. Unsecd. Note, 4.000%, 01/31/2024 | 62,790 |

| 400,000 | | Reynolds American, Inc., Sr. Unsecd. Note, 5.850%, 8/15/2045 | 449,643 |

| | | TOTAL | 541,946 |

| | | Energy - Independent—0.1% | |

| 100,000 | | Apache Corp., 4.250%, 1/15/2044 | 90,272 |

| 225,000 | | Marathon Oil Corp., Sr. Unsecd. Note, 3.850%, 6/01/2025 | 202,108 |

| 20,000 | | XTO Energy, Inc., 6.750%, 08/01/2037 | 27,859 |

| | | TOTAL | 320,239 |

| | | Energy - Integrated—0.1% | |

| 155,000 | | Husky Energy, Inc., 4.000%, 04/15/2024 | 147,348 |

| 100,000 | | Husky Energy, Inc., Sr. Unsecd. Note, 3.950%, 04/15/2022 | 96,816 |

| 35,000 | | Petro-Canada, Deb., 7.000%, 11/15/2028 | 43,710 |

| 100,000 | | Petroleos Mexicanos, 6.500%, 06/02/2041 | 95,125 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | CORPORATE BONDS—continued | |

| | | Energy - Integrated—continued | |

| $150,000 | | Petroleos Mexicanos, Sr. Unsecd. Note, 4.875%, 1/18/2024 | $147,705 |

| | | TOTAL | 530,704 |

| | | Energy - Midstream—0.2% | |

| 325,000 | | Energy Transfer Partners , Sr. Unsecd. Note, 4.050%, 3/15/2025 | 279,179 |

| 350,000 | | Energy Transfer Partners , Sr. Unsecd. Note, 5.150%, 3/15/2045 | 265,882 |

| 100,000 | | Kinder Morgan, Inc., 5.05%, 2/15/2046 | 71,832 |

| 100,000 | | Williams Partners LP, 4.9%, 1/15/2045 | 69,711 |

| 300,000 | | Williams Partners LP, 5.1%, 9/15/2045 | 217,117 |

| | | TOTAL | 903,721 |

| | | Energy - Oil Field Services—0.0% | |

| 100,000 | | Nabors Industries, Inc., Company Guarantee, 5.000%, 09/15/2020 | 95,241 |

| 100,000 | | Weatherford International Ltd., Sr. Unsecd. Note, 5.950%, 04/15/2042 | 63,250 |

| | | TOTAL | 158,491 |

| | | Energy - Refining—0.1% | |

| 250,000 | | Marathon Petroleum Corp., Sr. Unsecd. Note, 4.750%, 9/15/2044 | 225,032 |

| 25,000 | | Valero Energy Corp., 9.375%, 03/15/2019 | 30,124 |

| 100,000 | | Valero Energy Corp., Sr. Unsecd. Note, 6.625%, 06/15/2037 | 108,691 |

| | | TOTAL | 363,847 |

| | | Financial Institution - Banking—0.9% | |

| 340,000 | | Associated Banc-Corp., Sub., 4.250%, 1/15/2025 | 342,203 |

| 100,000 | | Bank of America Corp., Sr. Unsecd. Note, Series MTN, 4.875%, 4/01/2044 | 106,407 |

| 355,000 | | Bank of America Corp., Sub. Note, Series L, 3.950%, 4/21/2025 | 351,835 |

| 300,000 | | Bank of America Corp., Sub. Note, Series MTN, 4.000%, 1/22/2025 | 298,370 |

| 180,000 | | Capital One Financial Corp., Sr. Sub., 4.200%, 10/29/2025 | 179,806 |

| 250,000 | | Citigroup, Inc., Sr. Unsecd. Note, 3.300%, 4/27/2025 | 247,685 |

| 100,000 | | Citigroup, Inc., Sr. Unsecd. Note, 4.950%, 11/07/2043 | 105,295 |

| 150,000 | | Citigroup, Inc., Sub. Note, 4.450%, 9/29/2027 | 150,663 |

| 250,000 | | Compass Bank, Birmingham, Sub. Note, Series BKNT, 3.875%, 4/10/2025 | 232,936 |

| 330,000 | | Fifth Third Bancorp, Sr. Unsecd. Note, 2.875%, 7/27/2020 | 331,536 |

| 400,000 | | Goldman Sachs Group, Inc., Sr. Unsecd. Note, 3.500%, 1/23/2025 | 398,286 |

| 5,000 | | Goldman Sachs Group, Inc., Sr. Unsecd. Note, 5.750%, 01/24/2022 | 5,741 |

| 50,000 | | Goldman Sachs Group, Inc., Sr. Unsecd. Note, 6.125%, 02/15/2033 | 60,253 |

| 100,000 | | J.P. Morgan Chase & Co., 6.750%, 1/29/2049 | 108,475 |

| 50,000 | | J.P. Morgan Chase & Co., Sub. Note, 3.375%, 05/01/2023 | 49,675 |

| 300,000 | | Morgan Stanley, Sr. Unsecd. Note, 1.462%, 1/27/2020 | 301,556 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | CORPORATE BONDS—continued | |

| | | Financial Institution - Banking—continued | |

| $100,000 | | Morgan Stanley, Sr. Unsecd. Note, 6.375%, 07/24/2042 | $126,381 |

| 60,000,000 | | Rabobank Nederland NV, Utrecht, 1.850%, Series EMTN, 4/12/2017 | 497,968 |

| 162,039 | 3,4 | Regional Diversified Funding, Series 144A, 9.250%, 03/15/2030 | 83,197 |

| 135,000 | | Wells Fargo & Co., Sub. Note, Series GMTN, 4.900%, 11/17/2045 | 137,797 |

| 40,000 | | Wilmington Trust Corp., Sub. Note, 8.500%, 04/02/2018 | 45,364 |

| | | TOTAL | 4,161,429 |

| | | Financial Institution - Broker/Asset Mgr/Exchange—0.1% | |

| 140,000 | | Invesco Finance PLC, Sr. Unsecd. Note, 3.750%, 1/15/2026 | 142,156 |

| 95,000 | | Jefferies Group LLC, Sr. Unsecd. Note, 8.500%, 07/15/2019 | 111,621 |

| 240,000 | | Stifel Financial Corp., Sr. Unsecd. Note, 3.500%, 12/01/2020 | 239,371 |

| 70,000 | 4,5 | TIAA Asset Management Finance Co., LLC, Sr. Unsecd. Note, Series 144A, 4.125%, 11/01/2024 | 70,890 |

| | | TOTAL | 564,038 |

| | | Financial Institution - Finance Companies—0.0% | |

| 30,000 | | General Electric Capital, Note, Series MTNA, 6.750%, 3/15/2032 | 39,454 |

| | | Financial Institution - Insurance - Health—0.0% | |

| 50,000 | | Wellpoint, Inc., 5.850%, 01/15/2036 | 55,877 |

| | | Financial Institution - Insurance - Life—0.5% | |

| 100,000 | | Aflac, Inc., Sr. Unsecd. Note, 6.450%, 08/15/2040 | 123,242 |

| 100,000 | | American International Group, Inc., Sr. Unsecd. Note, 6.250%, 05/01/2036 | 117,148 |

| 400,000 | | American International Group, Inc., Unsecd. Note, 3.875%, 1/15/2035 | 362,087 |

| 10,000 | | MetLife, Inc., Jr. Sub. Note, 10.750%, 8/01/2039 | 15,825 |

| 330,000 | | MetLife, Inc., Sr. Unsecd. Note, 4.050%, 3/01/2045 | 311,332 |

| 100,000 | 4,5 | Principal Life Global Funding II, Series 144A, 2.200%, 4/08/2020 | 99,274 |

| 200,000 | | Prudential Financial, Inc., Sr. Unsecd. Note, Series MTN, 4.600%, 05/15/2044 | 202,047 |

| 750,000 | 4 | Union Central Life Ins Co, Note, Series 144A, 8.200%, 11/01/2026 | 991,085 |

| | | TOTAL | 2,222,040 |

| | | Financial Institution - Insurance - P&C—0.1% | |

| 160,000 | | ACE INA Holdings, Inc., 3.350%, 5/03/2026 | 159,785 |

| 75,000 | | ACE INA Holdings, Inc., Sr. Unsecd. Note, 3.350%, 05/15/2024 | 75,888 |

| 50,000 | | Horace Mann Educators Corp., Sr. Note, 6.850%, 04/15/2016 | 51,028 |

| 300,000 | 4,5 | Liberty Mutual Group., Inc, Sr. Unsecd. Note, Series 144A, 6.500%, 3/15/2035 | 356,822 |

| 30,000 | 4,5 | Nationwide Mutual Insurance Co., Sub. Note, Series 144A, 9.375%, 08/15/2039 | 45,666 |

| | | TOTAL | 689,189 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | CORPORATE BONDS—continued | |

| | | Financial Institution - REIT - Apartment—0.1% | |

| $220,000 | | Mid-America Apartment Communities LP, 4.000%, 11/15/2025 | $219,870 |

| 300,000 | | Mid-America Apartment Communities LP, Sr. Unsecd. Note, 3.750%, 06/15/2024 | 292,599 |

| | | TOTAL | 512,469 |

| | | Financial Institution - REIT - Healthcare—0.0% | |

| 100,000 | | Health Care REIT, Inc., Sr. Unsecd. Note, 4.125%, 04/01/2019 | 104,945 |

| | | Financial Institution - REIT - Office—0.1% | |

| 300,000 | | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 4.500%, 7/30/2029 | 296,892 |

| | | Financial Institution - REIT - Other—0.1% | |

| 40,000 | | Liberty Property LP, 6.625%, 10/01/2017 | 43,160 |

| 100,000 | | ProLogis LP, Sr. Unsecd. Note, 3.350%, 02/01/2021 | 101,720 |

| 160,000 | | WP Carey, Inc., Sr. Unsecd. Note, 4.600%, 04/01/2024 | 162,539 |

| | | TOTAL | 307,419 |

| | | Financial Institution - REIT - Retail—0.0% | |

| 40,000 | | Equity One, Inc., Bond, 6.000%, 09/15/2017 | 42,537 |

| 30,000 | | Kimco Realty Corp., Sr. Unsecd. Note, 3.400%, 11/01/2022 | 29,929 |

| | | TOTAL | 72,466 |

| | | Financial Institution - REITs—0.0% | |

| 200,000 | | Host Hotels & Resorts LP, Sr. Unsecd. Note, Series E, 4.000%, 6/15/2025 | 193,560 |

| | | Foreign-Local-Government—0.1% | |

| 50,000 | | Quebec, Province of, Note, Series MTNA, 7.035%, 03/10/2026 | 63,910 |

| 255,000 | 4,5 | Queensland Treasury Corp., Sr. Unsecd. Note, 4.000%, 06/21/2019 | 193,993 |

| | | TOTAL | 257,903 |

| | | Municipal Services—0.1% | |

| 140,000 | 4,5 | Army Hawaii Family Housing, Series 144A, 5.524%, 6/15/2050 | 153,938 |

| 100,000 | 4,5 | Camp Pendleton & Quantico Housing LLC, Series 144A, 5.572%, 10/01/2050 | 108,334 |

| | | TOTAL | 262,272 |

| | | Sovereign—0.1% | |

| 30,000,000 | | KfW, 2.050%, 02/16/2026 | 289,061 |

| | | Technology—0.4% | |

| 300,000 | | Adobe Systems, Inc., Sr. Unsecd. Note, 3.250%, 2/01/2025 | 296,767 |

| 250,000 | | Apple, Inc., Sr. Unsecd. Note, 3.450%, 2/09/2045 | 215,561 |

| 50,000 | | Autodesk, Inc., Sr. Unsecd. Note, 4.375%, 6/15/2025 | 49,673 |

| 270,000 | | Automatic Data Processing, Inc., 3.375%, 9/15/2025 | 277,255 |

| 210,000 | | Fidelity National Informa, Sr. Unsecd. Note, 5.000%, 10/15/2025 | 218,074 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value in

U.S. Dollarsi |

| | | CORPORATE BONDS—continued | |

| | | Technology—continued | |

| $100,000 | | Fidelity National Information Services, Inc., Sr. Unsecd. Note, 3.875%, 06/05/2024 | $96,807 |

| 150,000 | 4,5 | Hewlett Packard Enterprise Co., Sr. Unsecd. Note, Series 144A, 3.600%, 10/15/2020 | 151,355 |

| 300,000 | | Keysight Technologies, Inc., 4.550%, 10/30/2024 | 287,242 |

| 380,000 | 4,5 | Molex Electronics Technologies LLC, Unsecd. Note, Series 144A, 3.900%, 4/15/2025 | 365,645 |

| | | TOTAL | 1,958,379 |

| | | Transportation - Railroads—0.1% | |

| 140,000 | | Burlington Northern Santa Fe Corp., Sr. Unsecd. Note, 4.150%, 4/01/2045 | 129,207 |

| 45,000 | | Union Pacific Corp., Bond, 6.625%, 02/01/2029 | 58,238 |

| 135,000 | | Union Pacific Corp., Sr. Unsecd. Note, 3.875%, 2/01/2055 | 120,935 |

| | | TOTAL | 308,380 |

| | | Transportation - Services—0.1% | |

| 75,000 | 4,5 | Enterprise Rent-A-Car USA Finance Co., Series 144A, 6.375%, 10/15/2017 | 81,102 |

| 62,000 | 4,5 | Enterprise Rent-A-Car USA Finance Co., Sr. Unsecd. Note, Series 144A, 3.850%, 11/15/2024 | 62,636 |