United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-1

(Investment Company Act File Number)

Federated Hermes Global Allocation Fund

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 11/30/20

Date of Reporting Period: 11/30/20

| Item 1. | Reports to Stockholders |

Annual Shareholder Report

November 30, 2020

Federated Hermes Global Allocation Fund(formerly, Federated Global Allocation Fund)

Fund Established 1934

Dear Valued Shareholder,I am pleased to present the Annual Shareholder Report for your fund covering the period from December 1, 2019 through November 30, 2020.

While Covid-19 continues to present challenges to our lives, families and businesses, I want you to know that Federated Hermes remains dedicated to helping you successfully navigate the markets ahead. You can count on us for the insights, investment management knowledge and client service that you have come to expect. Please refer to our website, FederatedInvestors.com, for timely updates on this and other economic and market matters.

Thank you for investing with us. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Not FDIC Insured ▪ May Lose Value ▪ No Bank Guarantee

Management’s Discussion of Fund Performance (unaudited)

The total return of Federated Hermes Global Allocation Fund (the “Fund”), based on net asset value for the 12-month reporting period ended November 30, 2020, was 10.70%, 9.83%, 9.87%, 10.31%,11.06% and 11.04% for the Fund’s Class A Shares, Class B Shares, Class C Shares, Class R Shares, Institutional Shares and Class R6 shares, respectively. The total return of the Fund’s Blended Index1,2 was 12.97%, and the total return of the Morningstar World Allocation Funds Average (MWAFA)3 was 5.36% for the same period. The Fund’s Blended Index was composed of 60% of the return of the MSCI All Country World Index (MSCI ACWI) and 40% of the return of the Bloomberg Barclays Global Aggregate Index. The Fund’s and MWAFA’s total returns for the most recently completed fiscal year reflect actual cash flows, transaction costs and other expenses, which were not reflected in the total return of any index.

The following discussion will focus on the performance of the Fund’s Institutional Shares relative to the Blended Index.

MARKET OVERVIEW

Equities

The reporting period began with equities marching towards all-time highs on the strength of the longest economic expansion in U.S. history. Unemployment in the U.S. hit half-century lows of 3.5%, and prospects for growth improved in the wake of a Phase I trade deal that promised to ease tensions between the world’s two largest economies, the U.S. and China.

Then the Covid-19 pandemic hit, and unemployment quickly surged to the highest levels since World War II. Oil prices turned negative driven by plummeting demand and a price war between Russia and Saudi Arabia, and the global economy fell into one of the deepest, though short-lived, recessions in recent history. At its depth, the S&P fell nearly 35%, its fastest decline of that magnitude in history, as investors contemplated the potential for an economic depression.

In the face of the crisis, governments and central banks across the globe unleashed unprecedented amounts of fiscal and monetary support that not only ensured a steady flow of liquidity but helped businesses and individuals to avoid insolvency. As strict lockdowns eased, economic activity recovered sharply, with the third quarter producing some of the strongest quarter-over-quarter GDP growth on record, thus sparking a rally in global equities that saw major indices surge in excess of 50% from the lows in March until the end of the reporting period. While the pandemic is still with us, many global equity indices finished the reporting period at new all-time highs, thanks to the development of a number of vaccines that may very well end the pandemic in the new year.

Annual Shareholder Report

All told, the U.S. equity market produced a strong positive total return, with the S&P 500® Index4 up 17.46% for the reporting period. Small-caps5 underperformed, with the Russell 2000® Index6 up 13.57%. Within the large-cap space, growth outperformed value by a wide margin with the Russell 1000® Growth Index7 producing a 36.40% return compared to a modest 1.71% return for the Russell 1000® Value Index.8, 9

International markets10 also posted positive total returns, with emerging markets outperforming their developed markets. For the reporting period, emerging markets, as measured by the MSCI Emerging Markets Index,11 produced an 18.79% return, compared to a 6.69% return for developed markets, as measured by the MSCI World ex USA Index.12

Fixed Income

The reporting period had originally started out with promises of a global recovery, but it quickly transformed into the year that would drive economies into recession. In response, many global banking authorities expanded balance sheets by trillions of dollars, provided unlimited liquidity to the banking sector, and set up program after program to backstop stressed parts of the financial markets.

During the reporting period, the global financial markets can be summarized by a tale of two “walls.” On one side, there was a “wall of worry” surrounding the evolution, containment and management of the Covid-19 pandemic. However, a “wall of liquidity,” tendered by global governments and central banks, counterbalanced this pandemic from turning into another financial crisis. In essence, these two contrasting forces became the financial calculus by which global risk premiums were being determined.

While the reporting period was extremely volatile for nearly all asset classes, it ended with many major fixed-income assets classes in the black, including corporate credit markets. In fact, U.S. investment grade corporates,13 as measured by the Bloomberg Barclays U.S. Corporate Investment Grade Total Return Index,14 returned more than 9% in total return in last 12 months, and U.S. high yield bonds, as measured by the Bloomberg Barclays U.S. Corporate High Yield Total Return Index,15,16 returned more than 7% in the same period. While much of the positive returns are due to the decline in interest rates, spreads have moved toward pre-pandemic levels since the end of Q1 2020. The recovery has happened, even as Covid-19 cases continue to increase globally and more recently have resulted in a new round of lockdowns in many places across U.S. and Europe. But stronger-than-expected rebound in the economy, very supportive central banks and impressive progress made in Covid-19 vaccine development have all helped support valuations.

Internationally, the flagship global bond index, the Bloomberg Barclays Global Total Return Bond Index17 returned 8.38%. As a result of the pandemic, the European Union (EU) cast aside Maastricht rules, and country after country announced large amounts of support. The European Central Bank

Annual Shareholder Report

aggressively eased monetary policies with rate cuts, colossal amounts of asset buying and new programs, such as the Pandemic Emergency Purchase Program. Governments stepped up with material fiscal measures as well. In July, the European Commission introduced the EU Recovery Fund, which strove to finally establish fiscal unity in Europe. This initiative helped most developed bond markets18 but was particularly beneficial to European peripheral countries, like Italy and Spain, which outperformed significantly.

Although not immune to the effects of the pandemic, emerging market countries took decisive measures to help stimulate their economies during the crisis. The focal point of the pandemic, and associated containment measures, were initially focused on China; the country became the largest contributor towards the global recovery. Overall, high-frequency data, such as retail sales, investment data, and industrial output all continued to see improvement in the emerging market complex.

In prior years, the U.S. dollar (USD) offered safety, yield and growth advantages. However, in the past few months, the U.S. dollar grew more one dimensional and began to mostly offer safety. The aggressive easing from the U.S. Fed materially eroded the USD’s interest rate advantage. The U.S. dollar began to look more and more like a hedge against volatility and offered little else. Consequently, midway through the reporting period, broad USD weakness ensued as global investors began to diversify their holdings away from the USD.

Fund Performance

During the reporting period, the Fund’s security selection strategies generated mixed performance. All four of the Fund’s equity security selection strategies, Domestic Large Cap, International Developed, Domestic Small Cap and Emerging Markets, underperformed. This was somewhat offset, however, from outperformance from both the Domestic and International Bond security selection strategies.

Annual Shareholder Report

The Fund’s stock versus bond allocation detracted from relative performance.

On balance, the Fund’s three systematic macro overlay strategies, however, were additive to performance during the reporting period. The Global Equity and Global Interest Rate produced positive total returns, while the Global Currency Strategy produced negative total returns. The systematic overlay strategies invest in equity index futures, government bond futures and currency forwards to achieve the desired long/short exposures. During the period, the systematic macro overlay strategy, and thus the underlying derivatives19 positions, added 1.20% to total return.

1

Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the Blended Index.

2

The Fund’s broad-based security market indexes are the S&P 500 Index and the Bloomberg Barclays U.S. Aggregate Bond Index, which had total returns of 17.46% and 7.28%, respectively. Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the S&P 500 Index and the Bloomberg Barclays U.S. Aggregate Bond Index.

3

Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the MWAFA.

4

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.*

5

Small company stocks may be less liquid and subject to greater price volatility than large company stocks.

6

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.*

7

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values.*

8

The Russell 1000® Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values.*

9

Value stocks may lag growth stocks in performance, particularly in late stages of a market advance.

10

International investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards. Prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries and currency risk and political risks are accentuated in emerging markets.

11

The MSCI Emerging Markets Index captures large- and mid-cap representation across 21 Emerging Markets (EM) countries. The indexes covers approximately 85% of the free float-adjusted market capitalization in each country.*

12

The MSCI World ex USA Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries— excluding the United States. With 982 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country*

Annual Shareholder Report

13

Investment-grade securities are securities that are rated at least “BBB” or unrated securities of a comparable quality. Non-investment grade securities are securities that are not rated at least “BBB” or unrated securities of a comparable quality. Credit ratings are an indication of the risk that a security will default. They do not protect a security from credit risk. Lower-rated bonds typically offer higher yields to help compensate investors for the increased risk associated with them. Among these risks are lower creditworthiness, greater price volatility, more risk to principal and income that with higher-rated securities and increased possibilities of default.

14

Bloomberg Barclays U.S. Corporate Investment Grade Total Return Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.*

15

Bloomberg Barclays U.S. Corporate High Yield Total Return Index measures the USD-denominated, high-yield, fixed-rate corporate bond market.*

16

High-yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and higher risk of default.

17

The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.*

18

Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices.

19

The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional instruments.

*

The index is unmanaged, and it is not possible to invest directly in an index.

Annual Shareholder Report

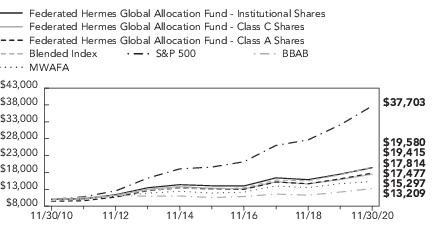

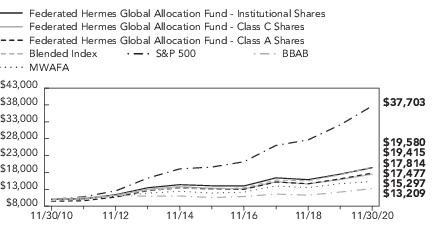

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

The graph below illustrates the hypothetical investment of $10,0001 in the Federated Hermes Global Allocation Fund from November 30, 2010 to November 30, 2020, compared to a blend of indexes comprised of 60% of the MSCI All Country World Index (MSCI ACWI) and 40% of the Bloomberg Barclays Global Aggregate Index (BBGA) (the “Blended Index”),2 the Standard and Poor’s 500 Index (S&P 500),3 the Bloomberg Barclays U.S. Aggregate Bond Index (BBAB) 4 and the Morningstar World Allocation Funds Average (MWAFA).5 The Average Annual Total Return table below shows returns for each class averaged over the stated periods.

Growth of a $10,000 Investment

Growth of $10,000 as of November 30, 2020

■ Total returns shown for the Class A Shares include the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450).

■ Total returns shown for Class C Shares include the maximum contingent deferred sales charge of 1.00% as applicable.

The Fund offers multiple share classes whose performance may be greater than or less than its other share class(es) due to difference in sales charges and expenses. See the Average Annual Return table below for the returns of additional classes not shown in the line graph above.

Annual Shareholder Report

Average Annual Total Returns for the Period Ended 11/30/2020

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

1

Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: for Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450); for Class B Shares, the maximum contingent deferred sales charge is 5.50% on any redemption of shares held up to one year from the purchase date; for Class C Shares, the maximum contingent deferred sales charge is 1.00% on any redemption less than one year from the purchase date. The Fund’s performance assumes the reinvestment of all dividends and distributions. The Blended Index, S&P 500 and BBAB have been adjusted to reflect reinvestment of dividends on securities in the indexes.

2

The Blended Index is a custom blended index comprised of 60% of the MSCI ACWI and 40% of the BBGA. The MSCI ACWI captures large- and mid-cap representation across 23 developed markets countries and 23 emerging markets countries. The index covers approximately 85% of the global investable equity opportunity set. The BBGA is a measure of global investment grade debt from 24 different local currency markets. This multi-currency benchmark includes fixed-rate treasury, government-related, corporate and securitized bonds from both developed and emerging markets issuers. The indexes are not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. The indexes are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index.

Annual Shareholder Report

3

The S&P 500 is an unmanaged, capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

4

The BBAB is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. The index is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

5

The Morningstar figures represent the average of the total returns reported by all the funds designated by Morningstar as falling into the respective category indicated. They do not reflect sales charges. The Morningstar figures in the Growth of $10,000 line graph are based on historical return information published by Morningstar and reflect the return of the funds comprising the category in the year of publication. Because the funds designated by Morningstar as falling into the category can change over time, the Morningstar figures in the line graph may not match the Morningstar figures in the Average Annual Total Returns table, which reflect the return of the funds that currently comprise the category.

6

The Fund’s Class R6 Shares commenced operations on June 29, 2016. For the period prior to the commencement of operations of the Class R6 Shares, the performance information shown is for the Fund’s Class A Shares. The performance of Class A Shares has not been adjusted to reflect the expenses of Class R6 Shares since Class R6 Shares have a lower expense ratio than the expense ratio of the Class A Shares. The performance of Class A Shares has been adjusted to remove any voluntary waiver of Fund expenses related to the Class A Shares that may have occurred during the period prior to the commencement of operations of Class R6 Shares. Additionally, the performance information shown below has been adjusted to reflect the absence of sales charges applicable to Class A Shares.

Annual Shareholder Report

Portfolio of Investments Summary Tables (unaudited)

At November 30, 2020, the Fund’s portfolio composition1 was as follows:

| Percentage of

Total Net Assets |

Domestic Equity Securities | |

International Equity Securities | |

Emerging Markets Core Fund | |

| |

Corporate Debt Securities | |

Federated Mortgage Core Portfolio | |

U.S. Treasury and Agency Securities | |

| |

| |

High Yield Bond Portfolio4 | |

Project and Trade Finance Core Fund | |

Collateralized Mortgage-Backed Securities | |

| |

| |

Mortgage-Backed Securities2,3 | |

| |

| |

| |

Other Assets and Liabilities—Net7 | |

| |

Annual Shareholder Report

At November 30, 2020, the Fund’s sector composition8 of the Fund’s equity holdings was as follows:

Sector Composition

of Equity Holdings | Percentage of

Equity Securities |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| See the Fund’s Prospectus and Statement of Additional Information for a description of these security types. |

| For purposes of this table, Mortgage-Backed Securities include mortgage-backed securities guaranteed by Government Sponsored Entities and adjustable rate mortgage-backed securities. |

| Represents less than 0.1%. |

| The High Yield Portfolio is a diversified portfolio of below investment grade bonds. |

| Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More complete information regarding the Fund’s direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

| Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

| Sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

Annual Shareholder Report

Portfolio of Investments

November 30, 2020

Shares,

Principal

Amount

or Contracts | | | |

| | | |

| | Communication Services— 5.0% | |

| | Activision Blizzard, Inc. | |

| | | |

| | | |

| | America Movil S.A.B. de C.V. | |

| | | |

| | | |

| | | |

| | Charter Communications, Inc. | |

| | Cheil Communications, Inc. | |

| | | |

| | | |

| | Consolidated Communications Holdings, Inc. | |

| | | |

| | | |

| | Hellenic Telecommunication Organization SA | |

| | | |

| | | |

| | Intouch Holdings Public Co. Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | New York Times Co., Class A | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Square Enix Holdings Co. Ltd. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Communication Services— continued | |

| | Take-Two Interactive Software, Inc. | |

| | | |

| | | |

| | Telefonica Deutschland Holding AG | |

| | | |

| | Telephone and Data System, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | Verizon Communications, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Consumer Discretionary— 8.7% | |

| | | |

| | Adtalem Global Education, Inc. | |

| | Alibaba Group Holding Ltd. | |

| | | |

| | American Outdoor Brands Corp. | |

| | American Public Education, Inc. | |

| | | |

| | Asbury Automotive Group, Inc. | |

| | | |

| | B2W Companhia Global Do Varejo | |

| | | |

| | Bajaj Holdings & Investment Ltd. | |

| | | |

| | Berkeley Group Holdings PLC | |

| | | |

| | | |

| | Bluegreen Vacations Corp. | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Consumer Discretionary— continued | |

| | | |

| | | |

| | | |

| | China Yuhua Education Corp. Ltd. | |

| | Collectors Universe, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | El Pollo Loco Holdings, Inc. | |

| | | |

| | Evolution Gaming Group AB | |

| | Extended Stay America, Inc. | |

| | | |

| | | |

| | Gome Electrical Appliances Holdings Ltd. | |

| | Green Brick Partners, Inc. | |

| | | |

| | | |

| | | |

| | Home Product Center Public Co. Ltd. | |

| | | |

| | | |

| | Iida Group Holdings Co. Ltd. | |

| | Industria de Diseno Textil SA | |

| | | |

| | | |

| | | |

| | Johnson Outdoors, Inc., Class A | |

| | | |

| | Koito Manufacturing Co. Ltd. | |

| | La Francaise des Jeux SAEM | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Consumer Discretionary— continued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Magna International, Inc. | |

| | | |

| | | |

| | Marriott Vacations Worldwide Corp. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Petrobras Distribuidora SA | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Sega Sammy Holdings, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Standard Motor Products, Inc. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Consumer Discretionary— continued | |

| | Stanley Electric Co. Ltd. | |

| | | |

| | | |

| | Terminix Global Holdings, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Wyndham Destinations, Inc. | |

| | Wyndham Hotels & Resorts, Inc. | |

| | | |

| | Zhongsheng Group Holdings | |

| | | |

| | | |

| | | |

| | | |

| | Alimentation Couche-Tard, Inc., Class B | |

| | | |

| | | |

| | | |

| | BIM Birlesik Magazalar AS | |

| | BJ’s Wholesale Club Holdings, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | Charoen Pokphand Foods Public Co. Ltd. | |

| | China Resources Enterprises Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | Cosmos Pharmaceutical Corp. | |

| | Edgewell Personal Care Co. | |

| | | |

| | Fraser & Neave Holdings Bhd | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Consumer Staples— continued | |

| | | |

| | | |

| | Grupo Bimbo S.A.B. de CV, Class A | |

| | | |

| | | |

| | | |

| | Indofood CBP Sukses Makmur TBK PT | |

| | Ingles Markets, Inc., Class A | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Korea Tobacco & Ginseng Corp. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Nu Skin Enterprises, Inc., Class A | |

| | | |

| | | |

| | | |

| | | |

| | Pola Orbis Holdings, Inc. | |

| | | |

| | | |

| | PT Indofood Sukses Makmur | |

| | Puregold Price Club, Inc. | |

| | | |

| | | |

| | Sanfilippo (John B. & Sons), Inc. | |

| | Seven & I Holdings Co. Ltd. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Consumer Staples— continued | |

| | | |

| | Standard Foods Taiwan Ltd. | |

| | | |

| | Suntory Beverage and Food Ltd. | |

| | Thai Union Frozen Products Public Co. Ltd. | |

| | | |

| | Tingyi (Cayman Isln) Hldg Co. | |

| | | |

| | Turning Point Brands, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | USANA Health Sciences, Inc. | |

| | | |

| | Vinda International Holdings Ltd. | |

| | Wal-Mart de Mexico SAB de C.V. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Yihai International Holding Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | China Oilfield Services Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | Frank’s International N.V. | |

| | | |

| | | |

| | Liberty Oilfield Services, Inc. | |

| | National Oilwell Varco, Inc. | |

| | Nextier Oilfield Solutions, Inc. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | PTT Exploration and Production Public Co. | |

| | | |

| | | |

| | Renewable Energy Group, Inc. | |

| | | |

| | Tupras Turkiye Petrol Rafinerileri A.S. | |

| | | |

| | World Fuel Services Corp. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | American Equity Investment Life Holding Co. | |

| | Ameriprise Financial, Inc. | |

| | | |

| | Apollo Global Management LLC | |

| | Artisan Partners Asset Management, Inc. | |

| | Assicurazioni Generali SpA | |

| | | |

| | B3 SA - Brasil Bolsa Balcao | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | Bank of New York Mellon Corp. | |

| | | |

| | | |

| | BB Seguridade Participacoes SA | |

| | Berkshire Hathaway, Inc., Class B | |

| | Brightsphere Investment Group, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Chailease Holding Co. Ltd. | |

| | China Construction Bank Corp. | |

| | China Development Financial Holding Corp. | |

| | China Everbright Bank Co. Ltd. | |

| | China Galaxy Securities Co. | |

| | China International Capital Corp. Ltd. | |

| | China Life Insurance Co. Ltd. | |

| | China Merchants Bank Co. Ltd. | |

| | China Minsheng Banking Corp. Ltd. | |

| | | |

| | CITIC Securities Co. Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Dime Community Bancorp, Inc. | |

| | | |

| | Donegal Group, Inc., Class A | |

| | Dongbu Insurance Co. Ltd. | |

| | E.Sun Financial Holding Co. Ltd. | |

| | | |

| | Enova International, Inc. | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | Farmers National Banc Corp. | |

| | | |

| | | |

| | First Financial Bankshares, Inc. | |

| | First Financial Holding Co. Ltd. | |

| | | |

| | | |

| | Gjensidige Forsikring ASA | |

| | Goldman Sachs Group, Inc. | |

| | | |

| | Guotai Junan Securities Co. Ltd. | |

| | | |

| | Hannover Rueckversicherung SE | |

| | | |

| | HDFC Asset Management Co Ltd. | |

| | Hong Kong Exchanges & Clearing Ltd. | |

| | | |

| | Housing Development Finance Corp. Ltd. | |

| | Hua Nan Financial Holdings Co. Ltd. | |

| | Huatai Securities Co. Ltd. | |

| | Hyundai Marine & Fire Insurance Co. | |

| | | |

| | ICICI Lombard General Insurance Co. Ltd. | |

| | | |

| | Industrial & Commercial Bank of China | |

| | | |

| | International Bancshares Corp. | |

| | | |

| | | |

| | | |

| | Legal & General Group PLC | |

| | LG Investment & Securities Co. Ltd. | |

| | London Stock Exchange Group PLC | |

| | LPL Investment Holdings, Inc. | |

| | | |

| | | |

| | Meta Financial Group, Inc. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | MetroCity Bankshares, Inc. | |

| | Mizrahi Tefahot Bank Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | Muenchener Rueckversicherungs-Gesellschaft AG | |

| | National General Holdings Corp. | |

| | New China Life Insurance Co. Ltd. | |

| | | |

| | | |

| | | |

| | Oversea-Chinese Banking Corp. Ltd. | |

| | Partners Group Holding AG | |

| | People’s Insurance, Co. (Group) of China Ltd. | |

| | Ping An Insurance (Group) Co. of China Ltd. | |

| | | |

| | | |

| | Postal Savings Bank of China Co. Ltd. | |

| | Powszechna Kasa Oszczednosci Bank Polski SA | |

| | Preferred Bank Los Angeles, CA | |

| | | |

| | | |

| | | |

| | PT Bank Rakyat Indonesia Tbk | |

| | | |

| | | |

| | Samsung Life Insurance Co., Ltd. | |

| | SBI Life Insurance Co. Ltd. | |

| | | |

| | ServisFirst Bancshares, Inc. | |

| | Shinhan Financial Group Co. Ltd. | |

| | Simmons 1st National Corp., Class A | |

| | | |

| | | |

| | Sun Life Financial Services of Canada | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | Taiwan Cooperative Financial Holding Co. Ltd. | |

| | Texas Capital Bancshares, Inc. | |

| | The Bank of NT Butterfield & Son Ltd. | |

| | The First of Long Island Corp. | |

| | | |

| | | |

| | United Overseas Bank Ltd. | |

| | Virtus Investment Partners, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | Yuanta Financial Holding Co. Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | Achillion Pharmaceuticals, Inc. | |

| | | |

| | | |

| | | |

| | Alibaba Health Information Technology Ltd. | |

| | | |

| | | |

| | AMN Healthcare Services, Inc. | |

| | Amneal Pharmaceuticals, Inc. | |

| | Amphastar Pharmaceuticals, Inc. | |

| | | |

| | | |

| | Arcutis Biotherapeutics, Inc. | |

| | | |

| | | |

| | Baxter International, Inc. | |

| | | |

| | BioDelivery Sciences International, Inc. | |

| | BioMarin Pharmaceutical, Inc. | |

| | Bio-Rad Laboratories, Inc., Class A | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | Cardiovascular Systems, Inc. | |

| | Catalyst Pharmaceutical Partners, Inc. | |

| | | |

| | Chinook Therapeutics, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Cytomx Therapeutics, Inc. | |

| | | |

| | Dr. Reddy’s Laboratories Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Hisamitsu Pharmaceutical Co., Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Ionis Pharmaceuticals, Inc. | |

| | Ironwood Pharmaceuticals, Inc. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Kyowa Hakko Kirin Co., Ltd. | |

| | | |

| | | |

| | Life Healthcare Group Holdings Pte Ltd. | |

| | | |

| | | |

| | Magenta Therapeutics, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Molecular Templates, Inc., Class THL | |

| | | |

| | | |

| | NGM Biopharmaceuticals, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | OraSure Technologies, Inc. | |

| | Organogenesis Holdings, Inc. | |

| | | |

| | Osmotica Pharmaceuticals PLC | |

| | | |

| | | |

| | | |

| | Precision Biosciences, Inc. | |

| | Progenics Pharmaceuticals, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Regeneron Pharmaceuticals, Inc. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | Rubius Therapeutics, Inc. | |

| | Samsung Biologics Co. Ltd. | |

| | | |

| | | |

| | Shanghai Fosun Pharmaceutical Co. Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | Spectrum Pharmaceuticals, Inc. | |

| | | |

| | Supermax Corporation Berhad | |

| | | |

| | Tactile Systems Technology, Inc. | |

| | | |

| | Torrent Pharmaceuticals Ltd. | |

| | Travere Therapeutics, Inc. | |

| | Triple-S Management Corp., Class B | |

| | United Therapeutics Corp. | |

| | | |

| | Vanda Pharmaceuticals, Inc. | |

| | Vertex Pharmaceuticals, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Air Transport Services Group, Inc. | |

| | | |

| | Alfa, S.A. de C.V., Class A | |

| | A-Living Smart City Services Co. Ltd. | |

| | | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Applied Industrial Technologies, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | AviChina Industry & Technology Co. Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Central Japan Railway Co. | |

| | China COSCO Holdings Co. Ltd., Class H | |

| | China Lesso Group Holdings Ltd. | |

| | | |

| | China Southern Airlines Co. Ltd. | |

| | | |

| | | |

| | CK Hutchison Holdings Ltd. | |

| | Comfort Systems USA, Inc. | |

| | | |

| | Country Garden Services Holdings Co. Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Echo Global Logistics, Inc. | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | Expeditors International Washington, Inc. | |

| | | |

| | | |

| | | |

| | Foundation Building Materials, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Hoshizaki Electric Co., Ltd. | |

| | | |

| | | |

| | Illinois Tool Works, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Kansas City Southern Industries, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Masonite International Corp. | |

| | | |

| | | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Old Dominion Freight Lines, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Quanex Building Products Corp. | |

| | | |

| | | |

| | | |

| | Resources Connection, Inc. | |

| | Ritchie Bros. Auctioneers, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Shanghai Industrial Holdings Ltd. | |

| | Shenzhen International Holdings Ltd. | |

| | | |

| | | |

| | Simpson Manufacturing Co., Inc. | |

| | | |

| | | |

| | | |

| | Sohgo Security Services Co. Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Triton International Ltd. | |

| | | |

| | Universal Truckload Services, Inc. | |

| | | |

| | | |

| | | |

| | Weichai Power Co. Ltd., Class H | |

| | | |

| | | |

| | Xinyi Solar Holdings Ltd. | |

| | Zhejiang Expressway Co. Ltd. | |

| | Zoomlion Heavy Industry Science and Technology Co., Ltd. | |

| | | |

| | Information Technology— 13.1% | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | American Software, Inc., Class A | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Benchmark Electronics, Inc. | |

| | | |

| | | |

| | | |

| | Cadence Design Systems, Inc. | |

| | | |

| | Cass Information Systems, Inc. | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Information Technology— continued | |

| | Check Point Software Technologies Ltd. | |

| | Chicony Electronics Co. Ltd. | |

| | | |

| | | |

| | | |

| | Constellation Software, Inc. | |

| | Crowdstrike Holdings, Inc. | |

| | CSG Systems International, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Hon Hai Precision Industry Co. Ltd. | |

| | | |

| | | |

| | Insight Enterprises, Inc. | |

| | | |

| | | |

| | | |

| | Kimball Electronics, Inc. | |

| | Kingboard Chemical Holdings Ltd. | |

| | Kingboard Laminates Holdings Ltd. | |

| | | |

| | | |

| | Lattice Semiconductor Corp. | |

| | | |

| | | |

| | | |

| | Logitech International SA | |

| | ManTech International Corp., Class A | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Information Technology— continued | |

| | | |

| | Methode Electronics, Inc., Class A | |

| | | |

| | MicroStrategy, Inc., Class A | |

| | | |

| | Napco Security Technologies, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Realtek Semiconductor Corp. | |

| | | |

| | | |

| | | |

| | Samsung Electronics Co. Ltd. | |

| | | |

| | | |

| | | |

| | Semiconductor Manufacturing International Corp. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | Information Technology— continued | |

| | | |

| | Sumisho Computer Systems Corp. | |

| | Sunny Opitcal Technology Group Co. Ltd. | |

| | | |

| | Synnex Technology International Corp. | |

| | | |

| | Taiwan Semiconductor Manufacturing Co. Ltd | |

| | Tata Consultancy Services Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Ultra Clean Holdings, Inc. | |

| | United Microelectronics Corp. | |

| | Vishay Intertechnology, Inc. | |

| | Vishay Precision Group, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Zoom Video Communications, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | China Hongqiao Group Ltd. | |

| | China Molybdenum Co. Ltd. | |

| | China National Building Material Co. Ltd. | |

| | China Resources Cement Holdings Ltd. | |

| | | |

| | Companhia Vale Do Rio Doce | |

| | | |

| | | |

| | Ferroglobe Representation & Warranty Insurance Trust | |

| | | |

| | | |

| | Fortescue Metals Group Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | Impala Platinum Holdings Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | Korea Kumho Petrochemical Co. Ltd. | |

| | | |

| | Lee & Man Paper Manufacturing Ltd. | |

| | | |

| | Magnitogorsk Iron & Steel Works PJSC | |

| | | |

| | | |

| | Mitsubishi Gas Chemical Co., Inc. | |

| | | |

| | | |

| | | |

| | Nine Dragons Paper Holdings Ltd. | |

| | Nissan Chemical Industries | |

| | | |

| | | |

| | | |

| | Novolipetski Metallurgicheski Komb OAO | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | | |

| | PT Indah Kiat Pulp & Paper Corp. | |

| | PT Indocement Tunggal Prakarsa Tbk | |

| | | |

| | Queen’s Road Capital Investment Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Tredegar Industries, Inc. | |

| | | |

| | | |

| | | |

| | Worthington Industries, Inc. | |

| | Zijin Mining Group Co. Ltd. | |

| | | |

| | | |

| | Agile Group Holdings Ltd. | |

| | American Assets Trust, Inc. | |

| | | |

| | | |

| | CatchMark Timber Trust, Inc. | |

| | | |

| | China Overseas Property Holdings Ltd. | |

| | China Resources Bejing Land | |

| | CIFI Holdings Group Co. Ltd. | |

| | | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | Country Garden Holdings Co. | |

| | Crown Castle International Corp. | |

| | Daito Trust Construction Co. Ltd. | |

| | DiamondRock Hospitality Co. | |

| | Easterly Government Properties, Inc. | |

| | | |

| | Equity Lifestyle Properties, Inc. | |

| | Evergrande Real Estate Group Limited | |

| | | |

| | Franshion Properties of China Ltd. | |

| | Front Yard Residential Corp. | |

| | | |

| | | |

| | Guangzhou R&F Properties Co. Ltd. | |

| | | |

| | Kaisa Group Holdings Ltd. | |

| | | |

| | KWG Property Holding Ltd. | |

| | Land & Houses Public Co. Ltd. | |

| | | |

| | | |

| | | |

| | Mapletree Commercial Trust | |

| | Mid-American Apartment Communities, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | Retail Properties of America, Inc. | |

| | Robinson’s Land Corp., Class B | |

| | | |

| | | |

| | Shimao Group Holdings Ltd. | |

| | | |

| | Sunac Services Holdings Ltd. | |

| | | |

| | | |

| | Yuexiu Property Co., Ltd. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | Zhenro Properties Group Ltd. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | American States Water Co. | |

| | American Water Works Co., Inc. | |

| | | |

| | Brookfield Renewable Corp. | |

| | | |

| | | |

| | Chesapeake Utilities Corp. | |

| | China Longyuan Power Group Corp. | |

| | China Power International Development Ltd. | |

| | China Resources Logic Ltd. | |

| | China Resources Power Holdings Co. Ltd. | |

| | | |

| | Companhia de Saneamento Basico do Estado de Sao Paulo | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Gulf Energy Development PCL | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Portland General Electric Co. | |

| | Power Grid Corp of India Ltd. | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | TOTAL COMMON STOCKS

(IDENTIFIED COST $194,376,179) | |

| | FOREIGN GOVERNMENTS/AGENCIES— 6.8% | |

| | | |

| | Australia, Government of, Sr. Unsecd. Note, Series 148, 2.750%, 11/21/2027 | |

| | Belgium, Government of, Series 68, 2.250%, 6/22/2023 | |

| | Belgium, Government of, Series 74, 0.800%, 6/22/2025 | |

| | Canada, Government of, Bond, 3.250%, 6/1/2021 | |

| | Canada, Government of, Series WL43, 5.750%, 6/1/2029 | |

| | France, Government of, 0.500%, 5/25/2025 | |

| | France, Government of, Bond, 4.500%, 4/25/2041 | |

| | France, Government of, O.A.T., 5.500%, 4/25/2029 | |

| | France, Government of, Unsecd. Note, 1.250%, 5/25/2036 | |

| | France, Government of, Unsecd. Note, 1.750%, 6/25/2039 | |

| | Germany, Government of, 0.250%, 2/15/2027 | |

| | Germany, Government of, Bond, Series 03, 4.750%, 7/4/2034 | |

| | Germany, Government of, Bond, Series 08, 4.750%, 7/4/2040 | |

| | Italy, Government of, 3.750%, 5/1/2021 | |

| | Italy, Government of, Sr. Unsecd. Note, 0.650%, 10/15/2023 | |

| | Italy, Government of, Sr. Unsecd. Note, 4.750%, 9/1/2028 | |

| | Italy, Government of, Unsecd. Note, 1.600%, 6/1/2026 | |

| | Italy, Government of, Unsecd. Note, 3.250%, 9/1/2046 | |

| | Japan, Government of, Sr. Unsecd. Note, Series 114, 2.100%, 12/20/2029 | |

| | Japan, Government of, Sr. Unsecd. Note, Series 153, 1.300%, 6/20/2035 | |

| | Japan, Government of, Sr. Unsecd. Note, Series 351, 0.100%, 6/20/2028 | |

| | Japan, Government of, Sr. Unsecd. Note, Series 44, 1.700%, 9/20/2044 | |

| | Mexico, Government of, Series M, 6.500%, 6/10/2021 | |

| | Mexico, Government of, Series MTNA, 6.750%, 9/27/2034 | |

| | Netherlands, Government of, Unsecd. Note, 2.500%, 1/15/2033 | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | FOREIGN GOVERNMENTS/AGENCIES— continued | |

| | | |

| | Spain, Government of, 4.200%, 1/31/2037 | |

| | Spain, Government of, Sr. Unsecd. Note, 1.500%, 4/30/2027 | |

| | Spain, Government of, Sr. Unsecd. Note, 1.950%, 7/30/2030 | |

| | Spain, Government of, Sr. Unsecd. Note, 2.750%, 10/31/2024 | |

| | United Kingdom, Government of, 2.750%, 9/7/2024 | |

| | United Kingdom, Government of, 3.250%, 1/22/2044 | |

| | United Kingdom, Government of, 4.250%, 12/7/2027 | |

| | United Kingdom, Government of, Bond, 4.250%, 3/7/2036 | |

| | United Kingdom, Government of, Unsecd. Deb., 1.625%, 10/22/2028 | |

| | United Kingdom, Government of, Unsecd. Note, 1.500%, 7/22/2047 | |

| | United Kingdom, Government of, Unsecd. Note, 4.250%, 6/7/2032 | |

| | TOTAL FOREIGN GOVERNMENTS/AGENCIES

(IDENTIFIED COST $23,638,588) | |

| | | |

| | Basic Industry - Metals & Mining— 0.0% | |

| | Reliance Steel & Aluminum Co., Sr. Unsecd. Note, 4.500%, 4/15/2023 | |

| | Capital Goods - Aerospace & Defense— 0.4% | |

| | Boeing Co., Sr. Unsecd. Note, 4.875%, 5/1/2025 | |

| | Huntington Ingalls Industries, Inc., Sr. Unsecd. Note, 144A, 3.844%, 5/1/2025 | |

| | Leidos, Inc., Sr. Unsecd. Note, 144A, 2.300%, 2/15/2031 | |

| | Leidos, Inc., Unsecd. Note, 144A, 3.625%, 5/15/2025 | |

| | Lockheed Martin Corp., Sr. Unsecd. Note, 3.550%, 1/15/2026 | |

| | Textron Financial Corp., Jr. Sub. Note, 144A, 1.956% (3-month USLIBOR +1.735%), 2/15/2042 | |

| | | |

| | Capital Goods - Building Materials— 0.1% | |

| | Allegion PLC, Sr. Unsecd. Note, 3.500%, 10/1/2029 | |

| | Masco Corp., Sr. Unsecd. Note, 4.375%, 4/1/2026 | |

| | Masco Corp., Unsecd. Note, 4.450%, 4/1/2025 | |

| | | |

| | Capital Goods - Construction Machinery— 0.1% | |

| | Deere & Co., Sr. Unsecd. Note, 2.750%, 4/15/2025 | |

| | Capital Goods - Diversified Manufacturing— 0.1% | |

| | General Electric Capital Corp., Note, Series MTNA, 6.750%, 3/15/2032 | |

| | Lennox International, Inc., Sr. Unsecd. Note, 1.700%, 8/1/2027 | |

| | Roper Technologies, Inc., Sr. Unsecd. Note, 2.000%, 6/30/2030 | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | CORPORATE BONDS— continued | |

| | Communications - Cable & Satellite— 0.1% | |

| | Charter Communications, Inc., 4.200%, 3/15/2028 | |

| | Charter Communications Operating, LLC/Charter Communications Operating Capital Corp., 5.050%, 3/30/2029 | |

| | Comcast Corp., Sr. Unsecd. Note, 3.100%, 4/1/2025 | |

| | | |

| | Communications - Media & Entertainment— 0.2% | |

| | Discovery Communications LLC, Sr. Unsecd. Note, 4.900%, 3/11/2026 | |

| | Grupo Televisa S.A., Sr. Unsecd. Note, 6.125%, 1/31/2046 | |

| | ViacomCBS, Inc., Sr. Unsecd. Note, 4.750%, 5/15/2025 | |

| | | |

| | Communications - Telecom Wireless— 0.3% | |

| | Crown Castle International Corp., Sr. Unsecd. Note, 3.250%, 1/15/2051 | |

| | T-Mobile USA, Inc., Sec. Fac. Bond, 144A, 2.250%, 11/15/2031 | |

| | Vodafone Group PLC, Sr. Unsecd. Note, 4.250%, 9/17/2050 | |

| | Vodafone Group PLC, Sr. Unsecd. Note, 4.875%, 6/19/2049 | |

| | | |

| | Communications - Telecom Wirelines— 0.2% | |

| | AT&T, Inc., Sr. Unsecd. Note, 144A, 3.550%, 9/15/2055 | |

| | Verizon Communications, Inc., Sr. Unsecd. Note, 3.150%, 3/22/2030 | |

| | Verizon Communications, Inc., Sr. Unsecd. Note, 4.150%, 3/15/2024 | |

| | | |

| | Consumer Cyclical - Automotive— 0.1% | |

| | Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 3.336%, 3/18/2021 | |

| | General Motors Co., Sr. Unsecd. Note, 4.000%, 4/1/2025 | |

| | | |

| | Consumer Cyclical - Retailers— 0.4% | |

| | Advance Auto Parts, Inc., Sr. Unsecd. Note, Series WI, 3.900%, 4/15/2030 | |

| | AutoNation, Inc., Sr. Unsecd. Note, 4.750%, 6/1/2030 | |

| | AutoZone, Inc., Sr. Unsecd. Note, 3.250%, 4/15/2025 | |

| | CVS Health Corp., Pass Thru Cert., 144A, 5.298%, 1/11/2027 | |

| | O’Reilly Automotive, Inc., Sr. Unsecd. Note, 4.200%, 4/1/2030 | |

| | | |

| | Consumer Cyclical - Services— 0.1% | |

| | Alibaba Group Holding Ltd., Sr. Unsecd. Note, 2.800%, 6/6/2023 | |

| | Visa, Inc., Sr. Unsecd. Note, 3.150%, 12/14/2025 | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | CORPORATE BONDS— continued | |

| | Consumer Non-Cyclical - Food/Beverage— 0.3% | |

| | Campbell Soup Co., Sr. Unsecd. Note, 2.375%, 4/24/2030 | |

| | Flowers Foods, Inc., Sr. Unsecd. Note, 3.500%, 10/1/2026 | |

| | Kraft Heinz Foods Co., Sr. Unsecd. Note, 3.950%, 7/15/2025 | |

| | Mead Johnson Nutrition Co., Sr. Unsecd. Note, 4.125%, 11/15/2025 | |

| | PepsiCo, Inc., Sr. Unsecd. Note, 3.625%, 3/19/2050 | |

| | PepsiCo, Inc., Sr. Unsecd. Note, 4.450%, 4/14/2046 | |

| | | |

| | Consumer Non-Cyclical - Health Care— 0.3% | |

| | Agilent Technologies, Inc., Sr. Unsecd. Note, 2.750%, 9/15/2029 | |

| | Dentsply Sirona, Inc., Sr. Unsecd. Note, 3.250%, 6/1/2030 | |

| | PerkinElmer, Inc., Sr. Unsecd. Note, 3.300%, 9/15/2029 | |

| | Thermo Fisher Scientific, Inc., Sr. Unsecd. Note, 4.133%, 3/25/2025 | |

| | | |

| | Consumer Non-Cyclical - Pharmaceuticals— 0.1% | |

| | Gilead Sciences, Inc., Sr. Unsecd. Note, 3.650%, 3/1/2026 | |

| | Zoetis, Inc., Sr. Unsecd. Note, 3.000%, 5/15/2050 | |

| | | |

| | Consumer Non-Cyclical - Tobacco— 0.4% | |

| | Philip Morris International, Inc., Sr. Unsecd. Note, 2.875%, 5/14/2029 | |

| | Reynolds American, Inc., Sr. Unsecd. Note, 5.850%, 8/15/2045 | |

| | | |

| | Energy - Integrated— 0.1% | |

| | Exxon Mobil Corp., Sr. Unsecd. Note, 2.992%, 3/19/2025 | |

| | Husky Energy, Inc., Sr. Unsecd. Note, 3.950%, 4/15/2022 | |

| | Petro-Canada, Deb., 7.000%, 11/15/2028 | |

| | | |

| | | |

| | Energy Transfer Partners LP, Sr. Unsecd. Note, 4.050%, 3/15/2025 | |

| | MPLX LP, Sr. Unsecd. Note, 4.125%, 3/1/2027 | |

| | | |

| | | |

| | Marathon Petroleum Corp., Sr. Unsecd. Note, 4.750%, 9/15/2044 | |

| | Financial Institution - Banking— 0.7% | |

| | Bank of America Corp., Sr. Unsecd. Note, Series MTN, 4.875%, 4/1/2044 | |

| | Bank of America Corp., Sub. Note, Series MTN, 4.000%, 1/22/2025 | |

| | Citigroup, Inc., Sr. Unsecd. Note, 2.700%, 3/30/2021 | |

| | Citizens Bank N.A., Sr. Unsecd. Note, Series BKNT, 3.750%, 2/18/2026 | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | CORPORATE BONDS— continued | |

| | Financial Institution - Banking— continued | |

| | Compass Bank, Birmingham, Sub. Note, Series BKNT, 3.875%, 4/10/2025 | |

| | Goldman Sachs Group, Inc., Sr. Unsecd. Note, 5.750%, 1/24/2022 | |

| | JPMorgan Chase & Co., Series S, 6.750%, 8/1/2069 | |

| | JPMorgan Chase & Co., Sub. Note, 3.375%, 5/1/2023 | |

| | Morgan Stanley, 4.300%, 1/27/2045 | |

| | Morgan Stanley, Sr. Unsecd. Note, Series MTN, 1.794%, 2/13/2032 | |

| | Regional Diversified Funding, 144A, 9.250%, 3/15/2030 | |

| | Truist Financial Corp., Sr. Unsecd. Note, 2.900%, 3/3/2021 | |

| | US Bancorp, Sr. Unsecd. Note, Series MTN, 1.375%, 7/22/2030 | |

| | | |

| | Financial Institution - Broker/Asset Mgr/Exchange— 0.1% | |

| | Invesco Finance PLC, Sr. Unsecd. Note, 3.750%, 1/15/2026 | |

| | Stifel Financial Corp., Sr. Unsecd. Note, 3.500%, 12/1/2020 | |

| | TIAA Asset Management Finance Co. LLC, Sr. Unsecd. Note, 144A, 4.125%, 11/1/2024 | |

| | | |

| | Financial Institution - Finance Companies— 0.1% | |

| | AerCap Ireland Capital Ltd. / AerCap Global Aviation Trust, Sr. Unsecd. Note, 3.950%, 2/1/2022 | |

| | Financial Institution - Insurance - Life— 0.1% | |

| | Aflac, Inc., Sr. Unsecd. Note, 6.450%, 8/15/2040 | |

| | Mass Mutual Global Funding II, 144A, 2.000%, 4/15/2021 | |

| | MetLife, Inc., Jr. Sub. Note, 10.750%, 8/1/2039 | |

| | Northwestern Mutual Life Insurance Co., Sr. Unsecd. Note, 144A, 3.625%, 9/30/2059 | |

| | | |

| | Financial Institution - Insurance - P&C— 0.1% | |

| | Nationwide Mutual Insurance Co., Sub. Note, 144A, 4.350%, 4/30/2050 | |

| | Nationwide Mutual Insurance Co., Sub. Note, 144A, 9.375%, 8/15/2039 | |

| | | |

| | Financial Institution - REIT - Apartment— 0.1% | |

| | Mid-America Apartment Communities LP, Sr. Unsecd. Note, 3.750%, 6/15/2024 | |

| | UDR, Inc., Sr. Unsecd. Note, Series MTN, 2.950%, 9/1/2026 | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | CORPORATE BONDS— continued | |

| | Financial Institution - REIT - Office— 0.0% | |

| | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 3.950%, 1/15/2028 | |

| | Financial Institution - REIT - Other— 0.1% | |

| | ProLogis LP, Sr. Unsecd. Note, 4.375%, 2/1/2029 | |

| | WP Carey, Inc., Sr. Unsecd. Note, 3.850%, 7/15/2029 | |

| | WP Carey, Inc., Sr. Unsecd. Note, 4.600%, 4/1/2024 | |

| | | |

| | Financial Institution - REIT - Retail— 0.1% | |

| | Kimco Realty Corp., Sr. Unsecd. Note, 2.700%, 10/1/2030 | |

| | Kimco Realty Corp., Sr. Unsecd. Note, 3.400%, 11/1/2022 | |

| | | |

| | Financial Institution - REITs— 0.0% | |

| | Camden Property Trust, Sr. Unsecd. Note, 2.800%, 5/15/2030 | |

| | Foreign-Local-Government— 0.0% | |

| | Quebec, Province of, Note, Series MTNA, 7.035%, 3/10/2026 | |

| | | |

| | Army Hawaii Family Housing, 144A, 5.524%, 6/15/2050 | |

| | Camp Pendleton & Quantico Housing LLC, 5.572%, 10/1/2050 | |

| | | |

| | | |

| | | |

| | | |

| | Apple, Inc., Sr. Unsecd. Note, 2.950%, 9/11/2049 | |

| | Diamond 1 Finance Corp./Diamond 2 Finance Corp., Sr. Secd. Note, 144A, 6.020%, 6/15/2026 | |

| | Fidelity National Information Services, Inc., Sr. Unsecd. Note, 3.875%, 6/5/2024 | |

| | Fiserv, Inc., Sr. Unsecd. Note, 3.500%, 7/1/2029 | |

| | Intel Corp., Sr. Unsecd. Note, 3.400%, 3/25/2025 | |

| | Keysight Technologies, Inc., 4.550%, 10/30/2024 | |

| | Molex Electronics Technologies LLC, Unsecd. Note, 144A, 3.900%, 4/15/2025 | |

| | | |

| | Transportation - Airlines— 0.0% | |

| | Southwest Airlines Co., Sr. Unsecd. Note, 5.250%, 5/4/2025 | |

| | Transportation - Services— 0.1% | |

| | Enterprise Rent-A-Car USA Finance Co., Sr. Unsecd. Note, 144A, 3.850%, 11/15/2024 | |

| | United Parcel Service, Inc., Sr. Unsecd. Note, 3.900%, 4/1/2025 | |

| | | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | CORPORATE BONDS— continued | |

| | | |

| | Berkshire Hathaway Energy Co., Sr. Unsecd. Note, 144A, 4.050%, 4/15/2025 | |

| | Consolidated Edison Co., Sr. Unsecd. Note, Series 20B, 3.950%, 4/1/2050 | |

| | Electricite de France SA, Sr. Unsecd. Note, 144A, 4.500%, 9/21/2028 | |

| | Emera US Finance LP, Sr. Unsecd. Note, 4.750%, 6/15/2046 | |

| | Enel Finance International NV, Sr. Unsecd. Note, 144A, 2.650%, 9/10/2024 | |

| | Exelon Corp., Sr. Unsecd. Note, 3.400%, 4/15/2026 | |

| | Florida Power & Light Co., Sec. Fac. Bond, 2.850%, 4/1/2025 | |

| | National Rural Utilities Cooperative Finance Corp., Sr. Sub. Note, 5.250%, 4/20/2046 | |

| | NiSource Finance Corp., Sr. Unsecd. Note, 3.950%, 3/30/2048 | |

| | NiSource, Inc., Sr. Unsecd. Note, 3.600%, 5/1/2030 | |

| | Northeast Utilities, Sr. Unsecd. Note, Series H, 3.150%, 1/15/2025 | |

| | Wisconsin Electric Power Co., Sr. Unsecd. Note, 4.300%, 12/15/2045 | |

| | | |

| | Utility - Natural Gas— 0.1% | |

| | National Fuel Gas Co., Sr. Unsecd. Note, 5.500%, 1/15/2026 | |

| | TOTAL CORPORATE BONDS

(IDENTIFIED COST $23,322,018) | |

| | | |

| | Treasury Inflation-Indexed Note— 1.1% | |

| | U.S. Treasury Inflation-Protected Notes, 0.125%, 10/15/2024 | |

| | U.S. Treasury Inflation-Protected Notes, 0.125%, 4/15/2025 | |

| | U.S. Treasury Inflation-Protected Notes, 0.125%, 1/15/2030 | |

| | U.S. Treasury Inflation-Protected Notes, 0.125%, 7/15/2030 | |

| | U.S. Treasury Inflation-Protected Notes, 0.250%, 2/15/2050 | |

| | U.S. Treasury Inflation-Protected Notes, 0.625%, 1/15/2024 | |

| | | |

| | | |

| | United States Treasury Bond, 3.000%, 11/15/2045 | |

| | TOTAL U.S. TREASURIES

(IDENTIFIED COST $4,015,815) | |

| | ASSET-BACKED SECURITIES— 0.8% | |

| | | |

| | Santander Drive Auto Receivables Trust 2020-2, Class C, 1.460%, 9/15/2025 | |

| | Toyota Auto Receivables Owner Trust 2020-B, Class A4, 1.660%, 9/15/2025 | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | ASSET-BACKED SECURITIES— continued | |

| | Auto Receivables— continued | |

| | World Omni Auto Receivables Trust 2018-B, Class A3, 2.870%, 7/17/2023 | |

| | | |

| | | |

| | Trillium Credit Card Trust II 2020-1A, Class A, 0.515% (1-month USLIBOR +0.370%), 12/26/2024 | |

| | | |

| | CNH Equipment Trust 2020-A, Class A3, 1.160%, 6/16/2025 | |

| | HPEFS Equipment Trust 2020-2A, Class C, 2.000%, 7/22/2030 | |

| | | |

| | | |

| | PFS Financing Corp. 2020-G, Class A, 0.970%, 2/15/2026 | |

| | TOTAL ASSET-BACKED SECURITIES

(IDENTIFIED COST $3,004,265) | |

| | COMMERCIAL MORTGAGE-BACKED SECURITIES— 0.3% | |

| | Agency Commercial Mortgage-Backed Securities— 0.3% | |

| | Federal Home Loan Mortgage Corp. REMIC, Series K055, Class A1, 2.263%, 4/25/2025 | |

| | Federal Home Loan Mortgage Corp. REMIC, Series K106, Class A1, 1.783%, 5/25/2029 | |

| | Federal Home Loan Mortgage Corp. REMIC, Series K737, Class A2, 2.525%, 10/25/2026 | |

| | TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(IDENTIFIED COST $1,139,866) | |

| | GOVERNMENT AGENCIES— 0.2% | |

| | Federal Home Loan Bank System— 0.0% | |

| | Federal Home Loan Bank System Notes, 0.500%, 4/14/2025 | |

| | Federal National Mortgage Association— 0.2% | |

| | Federal National Mortgage Association Notes, 0.625%, 4/22/2025 | |

| | GOVERNMENT AGENCIES

(IDENTIFIED COST $834,877) | |

| | COLLATERALIZED MORTGAGE OBLIGATIONS— 0.2% | |

| | Commercial Mortgage— 0.2% | |

| | Bank, Class A4, 3.488%, 11/15/2050 | |

| | JPMDB Commercial Mortgage Securities Trust 2016-C4, Class A3, 3.141%, 12/15/2049 | |

| | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(IDENTIFIED COST $571,639) | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | | |

| | New York State Dormitory Authority State Personal Income Tax Revenue (New York State Personal Income Tax Revenue Bond Fund), State Personal Income Tax Revenue Bonds (Series 2019D), 4.000%, 2/15/2037

(IDENTIFIED COST $300,912) | |

| | MORTGAGE-BACKED SECURITIES— 0.0% | |

| | Federal Home Loan Mortgage Corporation REMIC— 0.0% | |

| | Federal Home Loan Mortgage Corp., Pool C00592, 7.000%, 3/1/2028 | |

| | Federal Home Loan Mortgage Corp., Pool C00896, 7.500%, 12/1/2029 | |

| | Federal Home Loan Mortgage Corp., Pool C17281, 6.500%, 11/1/2028 | |

| | Federal Home Loan Mortgage Corp., Pool C19588, 6.500%, 12/1/2028 | |

| | Federal Home Loan Mortgage Corp., Pool C25621, 6.500%, 5/1/2029 | |

| | Federal Home Loan Mortgage Corp., Pool C76361, 6.000%, 2/1/2033 | |

| | Federal Home Loan Mortgage Corp., Pool G01444, 6.500%, 8/1/2032 | |

| | | |

| | Federal National Mortgage Association— 0.0% | |

| | Federal National Mortgage Association, Pool 251697, 6.500%, 5/1/2028 | |

| | Federal National Mortgage Association, Pool 252334, 6.500%, 2/1/2029 | |

| | Federal National Mortgage Association, Pool 254905, 6.000%, 10/1/2033 | |

| | Federal National Mortgage Association, Pool 255075, 5.500%, 2/1/2024 | |

| | Federal National Mortgage Association, Pool 303168, 9.500%, 2/1/2025 | |

| | Federal National Mortgage Association, Pool 323159, 7.500%, 4/1/2028 | |

| | Federal National Mortgage Association, Pool 323640, 7.500%, 4/1/2029 | |

| | Federal National Mortgage Association, Pool 545993, 6.000%, 11/1/2032 | |

| | Federal National Mortgage Association, Pool 555272, 6.000%, 3/1/2033 | |

| | Federal National Mortgage Association, Pool 713974, 5.500%, 7/1/2033 | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | MORTGAGE-BACKED SECURITIES— continued | |

| | Federal National Mortgage Association— continued | |

| | Federal National Mortgage Association, Pool 721502, 5.000%, 7/1/2033 | |

| | | |

| | Government National Mortgage Association— 0.0% | |

| | Government National Mortgage Association, Pool 2796, 7.000%, 8/20/2029 | |

| | Government National Mortgage Association, Pool 3040, 7.000%, 2/20/2031 | |

| | Government National Mortgage Association, Pool 3188, 6.500%, 1/20/2032 | |

| | Government National Mortgage Association, Pool 3239, 6.500%, 5/20/2032 | |

| | Government National Mortgage Association, Pool 352214, 7.000%, 4/15/2023 | |

| | Government National Mortgage Association, Pool 451522, 7.500%, 10/15/2027 | |

| | Government National Mortgage Association, Pool 462556, 6.500%, 2/15/2028 | |

| | Government National Mortgage Association, Pool 462739, 7.500%, 5/15/2028 | |

| | Government National Mortgage Association, Pool 464835, 6.500%, 9/15/2028 | |

| | Government National Mortgage Association, Pool 469699, 7.000%, 11/15/2028 | |

| | Government National Mortgage Association, Pool 486760, 6.500%, 12/15/2028 | |

| | Government National Mortgage Association, Pool 780339, 8.000%, 12/15/2023 | |

| | Government National Mortgage Association, Pool 780453, 7.500%, 12/15/2025 | |

| | Government National Mortgage Association, Pool 780584, 7.000%, 6/15/2027 | |

| | | |

| | TOTAL MORTGAGE-BACKED SECURITIES

(IDENTIFIED COST $58,511) | |

| | PURCHASED PUT OPTIONS— 0.0% | |

| | Morgan Stanley USD PUT/PLN CALL, Notional Amount $2,300,000, Exercise Price, $3.75, Expiration Date 1/7/2021

(IDENTIFIED COST $24,230) | |

| | INVESTMENT COMPANIES— 16.1% | |

| | | |

| | Emerging Markets Core Fund | |

Annual Shareholder Report

Shares, Principal Amount or Contracts | | | |

| | INVESTMENT COMPANIES— continued | |

| | Federated Hermes Institutional Prime Value Obligations Fund, Institutional Shares, 0.08%5 | |

| | Federated Mortgage Core Portfolio | |

| | High Yield Bond Portfolio | |

| | Project and Trade Finance Core Fund | |

| | TOTAL INVESTMENT COMPANIES

(IDENTIFIED COST $58,806,497) | |

| | TOTAL INVESTMENT IN SECURITIES—97.4%

(IDENTIFIED COST $310,093,397)7 | |

| | OTHER ASSETS AND LIABILITIES - NET—2.6%8 | |

| | | |

Annual Shareholder Report

At November 30, 2020, the Fund had the following outstanding futures contracts:

| | | | Value and

Unrealized

Appreciation

(Depreciation) |

| | | | |

1Australia 10-Year Bond Long Futures | | | | |

1Canada 10-Year Bond Long Futures | | | | |

1E-Mini Russel 2000 Long Futures | | | | |

1FTSE JSE Top 40 Long Futures | | | | |

1FTSE/MIB Index Long Futures | | | | |

1Japan 10-Year Bond Long Futures | | | | |

| | | | |

1S&P 500 E-Mini Long Futures | | | | |

1TOPIX Index Long Futures | | | | |

1United States Treasury Long Bond Long Futures | | | | |

1United States Treasury Notes 2-Year Long Futures | | | | |

| | | | |

1Amsterdam Index Short Futures | | | | |

1CAC 40 10-Year Euro Short Futures | | | | |

| | | | |

| | | | |

| | | | |

1FTSE 100 Index Short Futures | | | | |

1FTSE Taiwan Index Short Futures | | | | |

1Hang Seng Index Short Futures | | | | |

1IBEX 35 Index Short Futures | | | | |

1MSCI Singapore IX ETS Short Futures | | | | |

1S&P/TSX 60 IX Short Futures | | | | |

| | | | |

1United States Treasury Notes 10-Year Short Futures | | | | |

1United States Treasury Notes 5-Year Short Futures | | | | |

NET UNREALIZED APPRECIATION ON FUTURES CONTRACTS | |

Annual Shareholder Report

At November 30, 2020, the Fund had the following outstanding foreign exchange contracts:

| | Foreign

Currency

Units to

Deliver/Receive | | Unrealized

Appreciation

(Depreciation) |

| | | | | |

| Barclays Bank PLC Wholesale | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| State Street Bank & Trust Co. | | | | |

| | | | | |

| | | | | |

| State Street Bank & Trust Co. | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| State Street Bank & Trust Co. | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

NET UNREALIZED DEPRECIATION ON FOREIGN EXCHANGE CONTRACTS | |

Annual Shareholder Report

At November 30, 2020, the Fund had the following outstanding written options contracts:

| | | | | |

| | | | | |

| | | | | |

| | | | | |

(Premiums Received $31,149) | |

Net Unrealized Appreciation/Depreciation on Futures Contracts, Foreign Exchange Contracts and the Value of Written Options Contracts is included in “Other Assets and Liabilities–Net.”

Annual Shareholder Report

[PAGE INTENTIONALLY LEFT BLANK]

Annual Shareholder Report

Affiliated fund holdings are investment companies which are managed by the Adviser or an affiliate of the Adviser. Transactions with the affiliated fund holdings during the period ended November 30, 2020, were as follows:

| | | |

| | | |

Emerging Markets Core Fund | | | |

Federated Hermes Institutional Prime Value Obligations Fund, Institutional Shares | | | |

Federated Mortgage Core Portfolio | | | |

High Yield Bond Portfolio | | | |

Project and Trade Finance Core Fund | | | |

TOTAL OF AFFILIATED TRANSACTIONS | | | |

Annual Shareholder Report

Change in

Unrealized

Appreciation/

Depreciation | | | Shares

Held as of

11/30/2020 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Non-income-producing security. |

| Denotes a restricted security that either: (a) cannot be offered for public sale without first being registered, or availing of an exemption from registration, under the Securities Act of 1933; or (b) is subject to a contractual restriction on public sales. At November 30, 2020, these restricted securities amounted to $1,048,860, which represented 0.2% of total net assets. |

| Market quotations and price evaluations are not available. Fair value determined using significant unobservable inputs in accordance with procedures established by and under the general supervision of the Fund’s Board of Trustees (the “Trustees”). |

| Floating/variable note with current rate and current maturity or next reset date shown. |

| |

| The High Yield Portfolio is a diversified portfolio of below investment grade bonds. |

| The cost of investments for federal tax purposes amounts to $342,459,912. |