United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-1

(Investment Company Act File Number)

Federated Hermes Global Allocation Fund

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 11/30/20

Date of Reporting Period: 11/30/20

| Item 1. | Reports to Stockholders |

Share Class | Ticker | A | FSTBX | B | FSBBX | C | FSBCX |

R | FSBKX | Institutional | SBFIX | R6 | FSBLX |

Federated Hermes Global Allocation Fund

Dear Valued Shareholder,

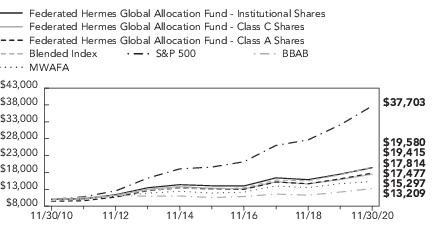

1 Year | 5 Years | 10 Years | |

Class A Shares | 4.63% | 5.19% | 5.94% |

Class B Shares | 4.33% | 5.20% | 5.86% |

Class C Shares | 8.87% | 5.57% | 5.74% |

Class R Shares | 10.31% | 5.94% | 6.10% |

Institutional Shares | 11.06% | 6.69% | 6.86% |

Class R6 Shares6 | 11.04% | 6.67% | 6.69% |

Blended Index | 12.97% | 8.58% | 6.95% |

S&P 500 | 17.46% | 13.99% | 14.19% |

BBAB | 7.28% | 4.34% | 3.71% |

MWAFA | 5.36% | 5.83% | 5.60% |

Portfolio Composition | Percentage of Total Net Assets |

Domestic Equity Securities | 34.7% |

International Equity Securities | 30.4% |

Emerging Markets Core Fund | 9.3% |

Foreign Debt Securities | 6.8% |

Corporate Debt Securities | 6.7% |

Federated Mortgage Core Portfolio | 3.3% |

U.S. Treasury and Agency Securities | 1.1% |

Bank Loan Core Fund | 1.0% |

Asset-Backed Securities | 0.8% |

High Yield Bond Portfolio4 | 0.8% |

Project and Trade Finance Core Fund | 0.8% |

Collateralized Mortgage-Backed Securities | 0.5% |

Government Agencies | 0.2% |

Municipal Bond | 0.1% |

Mortgage-Backed Securities2,3 | 0.0% |

Cash Equivalents5 | 0.9% |

Purchased Options3 | 0.0% |

Derivative Contracts6 | 0.7% |

Other Assets and Liabilities—Net7 | 1.9% |

TOTAL | 100.0% |

Sector Composition of Equity Holdings | Percentage of Equity Securities |

Information Technology | 20.1% |

Financials | 13.7% |

Consumer Discretionary | 13.3% |

Industrials | 12.0% |

Health Care | 11.5% |

Communication Services | 7.7% |

Consumer Staples | 7.4% |

Materials | 6.3% |

Utilities | 3.5% |

Real Estate | 2.8% |

Energy | 1.7% |

TOTAL | 100% |

1 | See the Fund’s Prospectus and Statement of Additional Information for a description of these security types. |

2 | For purposes of this table, Mortgage-Backed Securities include mortgage-backed securities guaranteed by Government Sponsored Entities and adjustable rate mortgage-backed securities. |

3 | Represents less than 0.1%. |

4 | The High Yield Portfolio is a diversified portfolio of below investment grade bonds. |

5 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

6 | Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More complete information regarding the Fund’s direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

7 | Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

8 | Sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— 65.1% | |||

Communication Services— 5.0% | |||

17,612 | Activision Blizzard, Inc. | $1,399,802 | |

995 | 1 | Alphabet, Inc., Class A | 1,745,628 |

979 | 1 | Alphabet, Inc., Class C | 1,723,765 |

47,884 | America Movil S.A.B. de C.V. | 35,753 | |

45,966 | Auto Trader Group PLC | 343,019 | |

628 | 1 | CarGurus, Inc. | 15,731 |

25,190 | CenturyLink, Inc. | 263,236 | |

58 | 1 | Charter Communications, Inc. | 37,815 |

550 | Cheil Communications, Inc. | 10,361 | |

19,000 | China Mobile Ltd. | 113,113 | |

2,287 | 1 | Cincinnati Bell, Inc. | 34,785 |

565 | 1 | Consolidated Communications Holdings, Inc. | 3,164 |

7,311 | 1 | Facebook, Inc. | 2,024,928 |

600 | 1 | Gray Television, Inc. | 10,596 |

3,836 | Hellenic Telecommunication Organization SA | 63,928 | |

397,095 | HKT Trust and HKT Ltd. | 517,959 | |

660 | 1 | Imax Corp. | 9,788 |

12,700 | Intouch Holdings Public Co. Ltd. | 23,312 | |

574 | Kakao Corp. | 191,507 | |

4,500 | Konami Corp. | 234,554 | |

9,501 | LG Uplus Corp. | 102,750 | |

14,309 | Mobile Telesystems, ADR | 123,487 | |

2,586 | 1 | MSG Networks, Inc. | 31,394 |

204 | NCsoft Corp. | 149,571 | |

6,050 | NetEase, Inc. | 110,018 | |

442 | 1 | Netflix, Inc. | 216,889 |

5,164 | New York Times Co., Class A | 221,587 | |

1,600 | Nexon Co., Ltd. Tokyo | 48,417 | |

960 | NHN Corp. | 241,430 | |

500 | Nintendo Co. Ltd. | 284,033 | |

16,670 | Omnicom Group, Inc. | 1,050,210 | |

13,289 | Quebecor, Inc., Class B | 330,920 | |

3,124 | Scout24 Holding GmbH | 238,726 | |

638 | SK Telecom Co. Ltd. | 135,769 | |

1,500 | Square Enix Holdings Co. Ltd. | 92,149 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Communication Services— continued | |||

6,932 | 1 | Take-Two Interactive Software, Inc. | $1,251,295 |

604 | 1 | TechTarget, Inc. | 31,710 |

296 | Tegna, Inc. | 4,265 | |

105,316 | Telefonica Deutschland Holding AG | 290,473 | |

6,223 | Telenet Group Holding NV | 265,204 | |

7,014 | Telephone and Data System, Inc. | 133,126 | |

29,800 | Tencent Holdings Ltd. | 2,169,169 | |

49,355 | TIM S.A. | 124,277 | |

8,620 | 1 | T-Mobile USA, Inc. | 1,145,943 |

2,700 | Toho Co. Ltd. | 114,634 | |

3,606 | Verizon Communications, Inc. | 217,839 | |

20,118 | Vivendi SA | 604,384 | |

14,149 | Vodacom Group Ltd. | 112,324 | |

2,732 | 1 | Vonage Holdings Corp. | 35,134 |

781 | 1 | Yandex N.V. | 54,358 |

1,131 | 1 | Zillow Group, Inc. | 124,806 |

84,875 | 1 | Zynga, Inc. | 700,219 |

TOTAL | 19,559,254 | ||

Consumer Discretionary— 8.7% | |||

10,500 | ABC-Mart, Inc. | 544,307 | |

36 | 1 | Adtalem Global Education, Inc. | 1,031 |

76,840 | 1 | Alibaba Group Holding Ltd. | 2,526,183 |

1,679 | 1 | Amazon.com, Inc. | 5,319,139 |

647 | American Outdoor Brands Corp. | 10,197 | |

354 | 1 | American Public Education, Inc. | 10,988 |

256 | 1 | America’s Car-Mart, Inc. | 26,752 |

113 | 1 | Asbury Automotive Group, Inc. | 12,743 |

348,900 | Asset World Corp PCL | 54,711 | |

4,907 | 1 | B2W Companhia Global Do Varejo | 64,481 |

229,500 | BAIC Motor Corp. Ltd. | 86,078 | |

2,457 | Bajaj Holdings & Investment Ltd. | 104,749 | |

547 | Bally’s Corp. | 24,303 | |

4,379 | Berkeley Group Holdings PLC | 269,279 | |

339 | Big Lots, Inc. | 17,516 | |

31,106 | Block (H&R), Inc. | 584,793 | |

221 | Bluegreen Vacations Corp. | 1,406 | |

6,857 | BorgWarner, Inc. | 266,394 | |

7,500 | BYD Co. Ltd. | 176,487 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Consumer Discretionary— continued | |||

5,470 | Canadian Tire Corp. Ltd. | $699,050 | |

1,426 | Carriage Services, Inc. | 38,801 | |

13,500 | Casio Computer Co. Ltd. | 241,667 | |

82,000 | China Yuhua Education Corp. Ltd. | 77,315 | |

138 | Collectors Universe, Inc. | 10,647 | |

1,586 | Coway Co. Ltd. | 99,550 | |

892 | 1 | CROCs, Inc. | 52,530 |

20,995 | D. R. Horton, Inc. | 1,564,127 | |

307 | 1 | Deckers Outdoor Corp. | 78,159 |

3,232 | 1 | Denny’s Corp. | 37,200 |

540 | Dine Brands Global, Inc. | 34,004 | |

516 | Dollar General Corp. | 112,787 | |

13,145 | Dollarama, Inc. | 538,067 | |

7,402 | eBay, Inc. | 373,283 | |

462 | 1 | El Pollo Loco Holdings, Inc. | 7,240 |

448 | 1 | Etsy, Inc. | 71,994 |

2,789 | Evolution Gaming Group AB | 238,905 | |

93,611 | Extended Stay America, Inc. | 1,283,407 | |

79,000 | Formosa Taffeta Co. | 84,997 | |

24,217 | Gentex Corp. | 789,474 | |

782,000 | 1 | Gome Electrical Appliances Holdings Ltd. | 92,958 |

940 | 1 | Green Brick Partners, Inc. | 20,464 |

303 | Group 1 Automotive, Inc. | 35,999 | |

175 | Hermes International | 170,172 | |

6,595 | Home Depot, Inc. | 1,829,519 | |

143,000 | Home Product Center Public Co. Ltd. | 69,334 | |

84 | Hyundai Mobis | 18,582 | |

227 | Hyundai Motor Co. | 37,387 | |

10,300 | Iida Group Holdings Co. Ltd. | 205,821 | |

8,400 | Industria de Diseno Textil SA | 278,323 | |

607 | Jack in the Box, Inc. | 55,838 | |

30,146 | JD Sports Fashion PLC | 312,627 | |

7,010 | 1 | JD.com, Inc. | 301,540 |

178 | Johnson Outdoors, Inc., Class A | 14,881 | |

3,159 | 1 | Jubilant Foodworks Ltd. | 104,807 |

5,900 | Koito Manufacturing Co. Ltd. | 352,912 | |

10,386 | 1 | La Francaise des Jeux SAEM | 432,250 |

1,702 | 1 | Laureate Education, Inc. | 24,168 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Consumer Discretionary— continued | |||

392 | LCI Industries | $49,306 | |

780 | Lennar Corp., Class A | 59,171 | |

2,492 | Lennar Corp., Class B | 151,264 | |

27,000 | Li Ning Co. Ltd. | 146,823 | |

5,362 | Lowe’s Cos., Inc. | 835,507 | |

182 | M.D.C. Holdings, Inc. | 8,785 | |

13,037 | Magna International, Inc. | 799,466 | |

2,827 | 1 | Magnite, Inc. | 53,713 |

337 | Marine Products Corp. | 5,197 | |

598 | Marriott Vacations Worldwide Corp. | 76,143 | |

20,900 | 1,2 | Meituan | 784,354 |

492 | 1 | Meritage Corp. | 44,354 |

1,729 | Michelin, Class B | 214,656 | |

158 | Murphy USA, Inc. | 20,256 | |

1,873 | Naspers Ltd., Class N | 377,162 | |

47,466 | Newell Brands, Inc. | 1,009,127 | |

5,556 | Next PLC | 484,434 | |

12,100 | Nikon Corp. | 74,610 | |

928 | ODP Corp./The | 26,606 | |

123 | Pandora A/S | 12,277 | |

466 | Patrick Industries, Inc. | 29,377 | |

876 | 1 | Perdoceo Education Corp. | 9,934 |

2,569 | Persimmon PLC | 90,757 | |

31,686 | Petrobras Distribuidora SA | 121,423 | |

31,107 | Peugeot SA | 729,468 | |

4,098 | 1 | Prosus NV | 442,638 |

1,212 | Pulte Group, Inc. | 52,880 | |

1,001 | 1 | Purple Innovation, Inc. | 29,850 |

911 | Rent-A-Center, Inc. | 30,810 | |

183 | 1 | RH | 82,928 ��� |

15,600 | Sega Sammy Holdings, Inc. | 218,277 | |

22,900 | Sekisui House Ltd. | 410,095 | |

4,000 | Shimamura Co. Ltd. | 413,244 | |

400 | Shimano, Inc. | 94,860 | |

1,037 | 1 | Signet Jewelers Ltd. | 31,411 |

102 | Sonic Automotive, Inc. | 4,119 | |

21 | 1 | Stamps.com, Inc. | 3,937 |

807 | Standard Motor Products, Inc. | 37,356 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Consumer Discretionary— continued | |||

12,300 | Stanley Electric Co. Ltd. | $359,753 | |

4,900 | Subaru Corp. | 96,448 | |

3,200 | Suzuki Motor Corp. | 170,372 | |

9,072 | 1 | Terminix Global Holdings, Inc. | 444,800 |

4,095 | 1 | Tesla, Inc. | 2,324,322 |

29,999 | The Wendy’s Co. | 659,678 | |

495 | Thor Industries, Inc. | 47,772 | |

173 | 1 | TopBuild Corp. | 30,142 |

10,721 | 1 | Via Varejo SA | 35,521 |

363 | 1 | WW International, Inc. | 10,712 |

2,497 | Wyndham Destinations, Inc. | 105,024 | |

7,207 | Wyndham Hotels & Resorts, Inc. | 414,403 | |

632 | Yum China Holding, Inc. | 35,632 | |

14,500 | Zhongsheng Group Holdings | 108,352 | |

201 | 1 | Zumiez, Inc. | 7,455 |

TOTAL | 33,809,284 | ||

Consumer Staples— 4.8% | |||

11,460 | Albertsons Cos., Inc. | 183,704 | |

3,824 | Alimentation Couche-Tard, Inc., Class B | 126,996 | |

35,344 | Altria Group, Inc. | 1,407,751 | |

70,981 | Ambev SA | 185,223 | |

46,373 | Becle SA de CV | 108,462 | |

12,651 | BIM Birlesik Magazalar AS | 113,071 | |

933 | 1 | BJ’s Wholesale Club Holdings, Inc. | 38,244 |

2,043 | Britannia Industries | 97,454 | |

12,160 | Brown-Forman Corp. | 896,557 | |

383 | Calavo Growers, Inc. | 27,434 | |

1,303 | Carlsberg A/S, Class B | 193,373 | |

76,200 | Charoen Pokphand Foods Public Co. Ltd. | 71,952 | |

20,000 | China Resources Enterprises Ltd. | 148,137 | |

299 | CJ CheilJedang Corp. | 97,839 | |

6,895 | Clicks Group, Ltd. | 104,247 | |

25,770 | Coca-Cola Amatil Ltd. | 239,360 | |

63 | Coca-Cola Bottling Co. | 16,486 | |

400 | Cosmos Pharmaceutical Corp. | 68,998 | |

702 | Edgewell Personal Care Co. | 24,394 | |

2,447 | Empire Co. Ltd., Class A | 66,964 | |

11,500 | Fraser & Neave Holdings Bhd | 92,086 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Consumer Staples— continued | |||

6,930 | George Weston Ltd. | $512,853 | |

18 | Gruma S.A., Class B | 199 | |

56,663 | Grupo Bimbo S.A.B. de CV, Class A | 119,913 | |

5,987 | 1 | Herbalife Ltd. | 286,837 |

1,418 | Hindustan Lever Ltd. | 40,968 | |

7,953 | Imperial Brands PLC | 144,059 | |

84,000 | Indofood CBP Sukses Makmur TBK PT | 58,735 | |

370 | Ingles Markets, Inc., Class A | 13,908 | |

52,105 | ITC Ltd. | 135,428 | |

33,154 | JBS S.A. | 143,263 | |

940 | Kimberly-Clark Corp. | 130,951 | |

69,920 | Kimberly-Clark de Mexico | 110,847 | |

1,100 | Kobe Bussan Co. Ltd. | 38,399 | |

1,755 | Korea Tobacco & Ginseng Corp. | 130,928 | |

3,786 | Kroger Co. | 124,938 | |

10,500 | Lion Corp. | 247,778 | |

11,901 | Loblaw Cos. Ltd. | 588,315 | |

3,476 | L’Oreal SA | 1,268,799 | |

7,792 | 2 | Magnit, GDR | 117,581 |

19,298 | 1 | Marico Ltd. | 95,062 |

6,970 | Metro, Inc., Class A | 320,190 | |

10,386 | 1 | Monster Beverage Corp. | 880,525 |

473 | Nestle India Ltd. | 108,350 | |

13,031 | Nestle S.A. | 1,454,104 | |

7,529 | Nu Skin Enterprises, Inc., Class A | 387,819 | |

54,700 | Osotspa PCL | 65,548 | |

3,300 | Perlis Plantations Bhd | 15,043 | |

900 | Pigeon Corp. | 40,206 | |

39,935 | 1 | Pilgrim’s Pride Corp. | 754,372 |

4,100 | Pola Orbis Holdings, Inc. | 81,531 | |

6,508 | Procter & Gamble Co. | 903,766 | |

31,600 | PT Gudang Garam Tbk | 94,473 | |

193,300 | PT Indofood Sukses Makmur | 96,927 | |

100,820 | Puregold Price Club, Inc. | 88,534 | |

28,022 | 1 | Raia Drogasil S.A. | 135,209 |

777 | 1 | Rite Aid Corp. | 10,256 |

220 | Sanfilippo (John B. & Sons), Inc. | 16,326 | |

11,900 | Seven & I Holdings Co. Ltd. | 375,690 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Consumer Staples— continued | |||

10,156 | Shoprite Holdings Ltd. | $83,511 | |

40,000 | Standard Foods Taiwan Ltd. | 87,633 | |

4,300 | Sundrug Co. Ltd. | 179,944 | |

4,000 | Suntory Beverage and Food Ltd. | 145,650 | |

11,100 | Thai Union Frozen Products Public Co. Ltd. | 5,510 | |

358 | The Spar Group, Ltd. | 4,399 | |

56,000 | Tingyi (Cayman Isln) Hldg Co. | 94,611 | |

3,300 | Toyo Suisan Kaisha Ltd. | 161,991 | |

293 | Turning Point Brands, Inc. | 11,433 | |

1,300 | Unicharm Corp. | 63,102 | |

15,294 | Unilever PLC | 933,134 | |

338 | Universal Corp. | 15,382 | |

8,360 | Universal Robina Corp. | 24,697 | |

138 | 1 | USANA Health Sciences, Inc. | 10,375 |

5,629 | Vector Group Ltd. | 63,270 | |

33,000 | Vinda International Holdings Ltd. | 94,438 | |

68,234 | Wal-Mart de Mexico SAB de C.V. | 179,614 | |

7,729 | WalMart, Inc. | 1,180,914 | |

54 | WD 40 Co. | 13,733 | |

19,056 | Woolworth’s Ltd. | 517,527 | |

1,800 | Yakult Honsha Co. Ltd. | 85,631 | |

26,300 | Yamazaki Baking Co. Ltd. | 436,578 | |

5,000 | Yihai International Holding Ltd. | 58,739 | |

TOTAL | 18,899,178 | ||

Energy— 1.1% | |||

480 | Cactus, Inc. | 11,136 | |

14,803 | Chevron Corp. | 1,290,526 | |

60,000 | China Oilfield Services Ltd. | 45,011 | |

3,000 | CNOOC Ltd. | 2,994 | |

21,396 | 1 | Coal India Ltd. | 36,146 |

11,719 | Devon Energy Corp. | 163,949 | |

13,416 | Exxaro Resources Ltd. | 102,818 | |

1,929 | 1 | Frank’s International N.V. | 4,302 |

1,226 | 1 | Green Plains, Inc. | 18,120 |

24,402 | Imperial Oil Ltd. | 422,389 | |

1,913 | Liberty Oilfield Services, Inc. | 17,791 | |

3,385 | National Oilwell Varco, Inc. | 41,500 | |

4,871 | 1 | Nextier Oilfield Solutions, Inc. | 13,639 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Energy— continued | |||

29,309 | Petronet LNG Ltd. | $97,989 | |

12,899 | Phillips 66 | 781,421 | |

3,740 | 1 | Propetro Holding Corp. | 21,580 |

65,300 | PT United Tractors | 106,519 | |

13,700 | PTT Exploration and Production Public Co. | 43,129 | |

141,900 | PTT Public Co. Ltd. | 185,554 | |

12,079 | Reliance Industries Ltd. | 316,284 | |

362 | 1 | Renewable Energy Group, Inc. | 21,025 |

4,579 | RPC, Inc. | 14,195 | |

273 | Tupras Turkiye Petrol Rafinerileri A.S. | 3,168 | |

10,540 | Valero Energy Corp. | 566,736 | |

1,657 | World Fuel Services Corp. | 47,092 | |

TOTAL | 4,375,013 | ||

Financials— 8.9% | |||

1,441 | 1st Source Corp. | 53,778 | |

12,124 | Admiral Group PLC | 461,359 | |

15,116 | Aflac, Inc. | 664,046 | |

9,975 | Ageas | 489,153 | |

89,200 | AIA Group Ltd. | 974,336 | |

5,257 | Allianz SE | 1,239,586 | |

3,315 | Allstate Corp. | 339,290 | |

7,864 | Ally Financial, Inc. | 233,168 | |

643 | Amalgamated Bank | 8,179 | |

1,733 | American Equity Investment Life Holding Co. | 45,543 | |

3,874 | Ameriprise Financial, Inc. | 717,620 | |

127,600 | AMMB Holdings Bhd | 103,744 | |

3,766 | Apollo Global Management LLC | 164,273 | |

1,500 | Artisan Partners Asset Management, Inc. | 67,500 | |

34,855 | Assicurazioni Generali SpA | 594,547 | |

10,500 | AXA SA | 246,053 | |

22,223 | 1 | B3 SA - Brasil Bolsa Balcao | 232,833 |

36,773 | 1 | Banco Bradesco SA | 148,605 |

968,560 | Banco de Chile | 85,364 | |

2,023,133 | Banco Santander Chile SA | 87,893 | |

935 | 1 | Bancorp, Inc., DE | 11,033 |

22,147 | 1 | Bandhan Bank Ltd | 109,059 |

74,552 | Bank of America Corp. | 2,099,384 | |

161,000 | Bank of China Ltd. | 55,874 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Financials— continued | |||

412 | Bank of Marin Bancorp | $14,296 | |

43,625 | Bank of New York Mellon Corp. | 1,706,610 | |

587 | Bank Pekao SA | 8,843 | |

2,397 | BankUnited, Inc. | 68,338 | |

26,192 | BB Seguridade Participacoes SA | 139,628 | |

299 | 1 | Berkshire Hathaway, Inc., Class B | 68,444 |

2,372 | Brightsphere Investment Group, Inc. | 41,984 | |

120 | Bryn Mawr Bank Corp. | 3,578 | |

18,139 | BS Financial Group, Inc. | 91,941 | |

166 | Camden National Corp. | 5,702 | |

183 | 1 | Cannae Holdings, Inc. | 7,214 |

1,094 | Cathay Bancorp, Inc. | 30,906 | |

17,000 | Chailease Holding Co. Ltd. | 93,160 | |

387,000 | China Construction Bank Corp. | 297,677 | |

345,000 | China Development Financial Holding Corp. | 108,031 | |

251,000 | China Everbright Bank Co. Ltd. | 97,699 | |

167,000 | China Galaxy Securities Co. | 107,334 | |

41,600 | China International Capital Corp. Ltd. | 96,380 | |

77,000 | China Life Insurance Co. Ltd. | 172,516 | |

36,000 | China Merchants Bank Co. Ltd. | 227,993 | |

104,500 | China Minsheng Banking Corp. Ltd. | 57,130 | |

38,948 | CI Financial Corp. | 510,430 | |

49,000 | CITIC Securities Co. Ltd. | 110,482 | |

352 | City Holding Co. | 23,123 | |

140 | CNA Financial Corp. | 4,831 | |

371 | Cohen & Steers, Inc. | 26,256 | |

12,525 | Daewoo Securities Co. | 107,650 | |

15,000 | DBS Group Holdings Ltd. | 278,126 | |

4,111 | Deutsche Boerse AG | 685,345 | |

1,389 | Dime Community Bancorp, Inc. | 20,071 | |

19,078 | DNB Bank ASA | 344,184 | |

2,907 | Donegal Group, Inc., Class A | 40,640 | |

2,345 | Dongbu Insurance Co. Ltd. | 93,124 | |

155,175 | E.Sun Financial Holding Co. Ltd. | 136,988 | |

642 | Eagle Bancorp, Inc. | 23,613 | |

2,461 | 1 | Enova International, Inc. | 51,460 |

7,374 | EQT AB | 163,642 | |

7,572 | Exor NV | 523,319 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Financials— continued | |||

93,000 | Far East Horizon | $98,812 | |

849 | Farmers National Banc Corp. | 10,646 | |

3,262 | First BanCorp | 25,900 | |

492 | First Bancorp, Inc. | 15,439 | |

1,874 | First Financial Bankshares, Inc. | 62,629 | |

8,000 | First Financial Holding Co. Ltd. | 5,972 | |

2,617 | First Foundation, Inc. | 46,478 | |

70,000 | GF Securities Co. Ltd. | 97,151 | |

7,271 | Gjensidige Forsikring ASA | 158,133 | |

2,216 | Goldman Sachs Group, Inc. | 510,965 | |

940 | Great-West Lifeco, Inc. | 21,866 | |

65,400 | Guotai Junan Securities Co. Ltd. | 96,212 | |

31,700 | Hang Seng Bank Ltd. | 551,985 | |

5,021 | Hannover Rueckversicherung SE | 840,418 | |

15,238 | Hargreaves Lansdown PLC | 289,600 | |

2,954 | HDFC Asset Management Co Ltd. | 100,673 | |

9,000 | Hong Kong Exchanges & Clearing Ltd. | 447,628 | |

25,200 | Hong Leong Credit Berhad | 101,465 | |

5,538 | Housing Development Finance Corp. Ltd. | 167,728 | |

132,283 | Hua Nan Financial Holdings Co. Ltd. | 84,277 | |

58,200 | Huatai Securities Co. Ltd. | 90,594 | |

4,289 | Hyundai Marine & Fire Insurance Co. | 87,045 | |

11,502 | ICICI Bank Ltd. | 73,476 | |

5,966 | ICICI Lombard General Insurance Co. Ltd. | 117,874 | |

20,715 | IGM Financial, Inc. | 547,902 | |

175,000 | Industrial & Commercial Bank of China | 109,006 | |

1,370 | Intact Financial Corp. | 153,267 | |

709 | International Bancshares Corp. | 22,979 | |

157,422 | Intesa Sanpaolo SpA | 360,879 | |

4,556 | Investors Bancorp, Inc. | 44,102 | |

11,332 | JPMorgan Chase & Co. | 1,335,816 | |

72,702 | Legal & General Group PLC | 244,402 | |

9,184 | LG Investment & Securities Co. Ltd. | 89,439 | |

3,665 | London Stock Exchange Group PLC | 395,461 | |

2,330 | LPL Investment Holdings, Inc. | 211,494 | |

606 | Luther Burbank Corp. | 5,957 | |

1,726 | M & T Bank Corp. | 201,062 | |

377 | Meta Financial Group, Inc. | 12,479 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Financials— continued | |||

362 | MetroCity Bankshares, Inc. | $5,014 | |

3,579 | Mizrahi Tefahot Bank Ltd. | 76,172 | |

86,862 | MMI Holdings Ltd. | 87,536 | |

8,346 | 1 | Moneta Money Bank AS | 24,865 |

33,926 | Morgan Stanley | 2,097,645 | |

1,205 | 1 | Mr. Cooper Group, Inc. | 32,125 |

2,939 | Muenchener Rueckversicherungs-Gesellschaft AG | 818,907 | |

951 | National General Holdings Corp. | 32,410 | |

24,700 | New China Life Insurance Co. Ltd. | 103,025 | |

654 | 1 | Oportun Financial Corp. | 11,059 |

11,200 | ORIX Corp. | 165,013 | |

1,578 | OTP Bank RT | 62,406 | |

12,100 | Oversea-Chinese Banking Corp. Ltd. | 90,033 | |

90 | Partners Group Holding AG | 95,892 | |

318,000 | People’s Insurance, Co. (Group) of China Ltd. | 100,109 | |

23,500 | Ping An Insurance (Group) Co. of China Ltd. | 275,262 | |

314 | Piper Jaffray Cos., Inc. | 28,941 | |

544 | PJT Partners, Inc. | 37,688 | |

218,000 | Postal Savings Bank of China Co. Ltd. | 122,609 | |

20,581 | Powszechna Kasa Oszczednosci Bank Polski SA | 144,232 | |

290 | Preferred Bank Los Angeles, CA | 10,663 | |

5,734 | Progressive Corp., OH | 499,489 | |

339 | 1 | ProSight Global, Inc. | 4,322 |

14,300 | PT Bank Central Asia | 31,331 | |

15,200 | PT Bank Rakyat Indonesia Tbk | 4,386 | |

1,190 | QCR Holdings, Inc. | 41,495 | |

181 | Republic Bancorp, Inc. | 6,389 | |

1,822 | Samsung Life Insurance Co., Ltd. | 117,740 | |

7,925 | 1 | SBI Life Insurance Co. Ltd. | 90,374 |

8,594 | Schroders PLC | 367,970 | |

721 | ServisFirst Bancshares, Inc. | 27,239 | |

5,343 | Shinhan Financial Group Co. Ltd. | 155,131 | |

1,299 | Simmons 1st National Corp., Class A | 25,331 | |

12,800 | Singapore Exchange Ltd. | 84,875 | |

154 | Stifel Financial Corp. | 10,672 | |

10,249 | Sun Life Financial Services of Canada | 455,117 | |

16,309 | Swedbank AB | 294,641 | |

4,141 | Swiss Re AG | 377,561 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Financials— continued | |||

7,275 | Synchrony Financial | $221,669 | |

171,173 | Taiwan Cooperative Financial Holding Co. Ltd. | 121,980 | |

669 | 1 | Texas Capital Bancshares, Inc. | 37,397 |

1,348 | The Bank of NT Butterfield & Son Ltd. | 42,678 | |

713 | The First of Long Island Corp. | 11,986 | |

8,053 | The Travelers Cos., Inc. | 1,044,071 | |

19,464 | U.S. Bancorp | 841,039 | |

9,000 | United Overseas Bank Ltd. | 149,629 | |

135 | Virtus Investment Partners, Inc. | 24,149 | |

2,156 | VOYA Financial, Inc. | 124,250 | |

1,179 | Washington Federal, Inc. | 27,553 | |

1,121 | 1 | Watford Holdings Ltd. | 38,921 |

51,465 | Wells Fargo & Co. | 1,407,568 | |

182,160 | Yuanta Financial Holding Co. Ltd. | 121,873 | |

TOTAL | 34,888,551 | ||

Health Care— 7.5% | |||

721 | 1 | 89Bio, Inc. | 19,474 |

9,692 | Abbott Laboratories | 1,048,868 | |

9,856 | 1,3 | Achillion Pharmaceuticals, Inc. | 4,534 |

120 | 1 | AdaptHealth Corp. | 3,583 |

129 | 1 | Addus Homecare Corp. | 12,803 |

14,100 | Alfresa Holdings Corp. | 280,518 | |

48,000 | 1 | Alibaba Health Information Technology Ltd. | 141,509 |

976 | 1 | Allovir, Inc. | 38,659 |

5,659 | Ambu A/S | 188,982 | |

609 | 1 | AMN Healthcare Services, Inc. | 39,682 |

12,895 | 1 | Amneal Pharmaceuticals, Inc. | 50,935 |

205 | 1 | Amphastar Pharmaceuticals, Inc. | 3,641 |

2,207 | 1 | Annexon, Inc. | 53,409 |

3,023 | 1 | Antigenics, Inc. | 11,185 |

1,746 | 1 | Arcutis Biotherapeutics, Inc. | 47,352 |

3,600 | Asahi Intecc Co. Ltd. | 131,469 | |

3,265 | 1 | Avid Bioservices, Inc. | 29,777 |

10,773 | Baxter International, Inc. | 819,502 | |

6,320 | 1 | Berkeley Lights, Inc. | 523,675 |

8,692 | 1 | BioDelivery Sciences International, Inc. | 33,030 |

3,708 | 1 | BioMarin Pharmaceutical, Inc. | 291,820 |

1,618 | 1 | Bio-Rad Laboratories, Inc., Class A | 871,293 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Health Care— continued | |||

1,400 | 1 | CanSino Biologics, Inc. | $30,524 |

38 | 1 | Cardiovascular Systems, Inc. | 1,309 |

4,958 | 1 | Catalyst Pharmaceutical Partners, Inc. | 18,146 |

880 | 1 | Celltrion, Inc. | 272,706 |

1,721 | 1 | Chinook Therapeutics, Inc. | 24,060 |

771 | CIGNA Corp. | 161,247 | |

9,836 | Cipla Ltd. | 97,967 | |

524 | 1 | Clovis Oncology, Inc. | 2,578 |

1,166 | 1 | Co-Diagnostics, Inc. | 13,666 |

1,507 | Coloplast A.S., Class B | 225,117 | |

161 | CONMED Corp. | 16,404 | |

604 | 1 | Corvel Corp. | 54,088 |

7,954 | CVS Health Corp. | 539,202 | |

4,474 | 1 | Cytomx Therapeutics, Inc. | 33,644 |

2,338 | Divi’s Laboratories Ltd. | 112,437 | |

1,836 | Dr. Reddy’s Laboratories Ltd. | 119,116 | |

18,837 | 1 | Durect Corp. | 34,848 |

3,400 | Eisai Co. Ltd. | 255,195 | |

9,325 | Eli Lilly & Co. | 1,358,186 | |

357 | Ensign Group, Inc. | 25,658 | |

17,605 | 1 | Exelixis, Inc. | 337,312 |

707 | 1 | Fulgent Genetics, Inc. | 31,758 |

8 | Gedeon Richter Rt | 190 | |

148 | 1 | Genmab A/S | 56,869 |

3,902 | 1 | Geron Corp. | 7,277 |

45,087 | GlaxoSmithKline PLC | 825,026 | |

154 | GN Store Nord AS | 12,500 | |

2,280 | 1 | Gossamer Bio, Inc. | 20,155 |

21,900 | Hartalega Holdings BHD | 77,425 | |

3,895 | HCA Healthcare, Inc. | 584,678 | |

2,200 | Hisamitsu Pharmaceutical Co., Inc. | 128,445 | |

348 | 1 | HMS Holdings Corp. | 10,934 |

3,800 | Hoya Corp. | 506,426 | |

2,127 | Humana, Inc. | 851,906 | |

1,173 | 1 | IDEAYA Biosciences, Inc. | 16,352 |

215 | 1 | Integer Holdings Corp. | 15,499 |

8,481 | 1 | Ionis Pharmaceuticals, Inc. | 428,545 |

2,962 | 1 | Ironwood Pharmaceuticals, Inc. | 34,122 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Health Care— continued | |||

1,869 | 1 | iTeos Therapeutics, Inc. | $50,070 |

4,585 | 1 | IVERIC Bio, Inc. | 31,270 |

3,677 | Johnson & Johnson | 531,988 | |

2,700 | Kyowa Hakko Kirin Co., Ltd. | 73,533 | |

2,135 | 1 | Lantheus Holdings, Inc. | 28,097 |

350 | 1 | LHC Group, Inc. | 68,712 |

88,491 | Life Healthcare Group Holdings Pte Ltd. | 90,805 | |

432 | 1 | MacroGenics, Inc. | 9,966 |

532 | 1 | Magellan Health, Inc. | 42,055 |

4,268 | 1 | Magenta Therapeutics, Inc. | 30,516 |

5,599 | McKesson Corp. | 1,007,316 | |

21,500 | Medipal Holdings Corp. | 402,514 | |

557 | 1 | Medpace Holdings, Inc. | 71,497 |

6,026 | Medtronic PLC | 685,156 | |

27,845 | Merck & Co., Inc. | 2,238,460 | |

1,423 | 1 | Molecular Templates, Inc., Class THL | 12,736 |

560 | 1 | Natus Medical, Inc. | 11,715 |

308 | 1 | NextGen Healthcare, Inc. | 5,464 |

2,494 | 1 | NGM Biopharmaceuticals, Inc. | 59,108 |

17,906 | Novartis AG | 1,623,983 | |

11,027 | Novo Nordisk A/S | 740,592 | |

402 | 1 | Omnicell, Inc. | 42,150 |

15,352 | 1 | Opko Health, Inc. | 71,233 |

93 | 1 | OraSure Technologies, Inc. | 1,116 |

7,159 | 1 | Organogenesis Holdings, Inc. | 36,869 |

64 | 1 | Orthofix Medical, Inc. | 2,353 |

3,418 | 1 | Osmotica Pharmaceuticals PLC | 20,918 |

483 | 1 | Ovid Therapeutics, Inc. | 3,304 |

161 | Patterson Cos., Inc. | 4,469 | |

334 | 1 | PetIQ, Inc. | 9,613 |

4,717 | 1 | Precision Biosciences, Inc. | 58,821 |

6,885 | 1 | Progenics Pharmaceuticals, Inc. | 0 |

340 | 1 | Progyny, Inc. | 12,067 |

310 | 1 | Providence Service Corp. | 42,095 |

1,967 | 1 | Puma Biotechnology, Inc. | 22,129 |

13,819 | 1 | Qiagen NV | 665,813 |

519 | 1 | R1 RCM, Inc. | 10,525 |

1,720 | 1 | Regeneron Pharmaceuticals, Inc. | 887,572 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Health Care— continued | |||

5,079 | Roche Holding AG | $1,669,230 | |

3,728 | 1 | Rubius Therapeutics, Inc. | 23,375 |

222 | 1 | Samsung Biologics Co. Ltd. | 159,011 |

9,667 | Sanofi | 972,675 | |

448 | Seegene, Inc. | 76,228 | |

16,500 | Shanghai Fosun Pharmaceutical Co. Ltd. | 69,450 | |

4,700 | Shionogi and Co. | 250,846 | |

3,463 | Siemens Healthineers AG | 159,167 | |

6,759 | 1 | Siga Technologies, Inc. | 46,840 |

287 | Simulations Plus, Inc. | 16,063 | |

9,495 | 1 | Spectrum Pharmaceuticals, Inc. | 44,721 |

267 | Stedim | 96,530 | |

43,700 | 1 | Supermax Corporation Berhad | 97,664 |

305 | 1 | SurModics, Inc. | 11,419 |

232 | 1 | Tactile Systems Technology, Inc. | 10,002 |

38,800 | Top Glove Corp. Bhd | 67,778 | |

1,397 | Torrent Pharmaceuticals Ltd. | 49,364 | |

1,420 | 1 | Travere Therapeutics, Inc. | 32,561 |

483 | 1 | Triple-S Management Corp., Class B | 10,824 |

2,020 | 1 | United Therapeutics Corp. | 267,933 |

7,330 | UnitedHealth Group, Inc. | 2,465,372 | |

4,240 | 1 | Vanda Pharmaceuticals, Inc. | 51,770 |

3,713 | 1 | Vertex Pharmaceuticals, Inc. | 845,636 |

1,380 | 1 | Viemed Healthcare, Inc. | 13,455 |

7,500 | 1 | WuXi PharmaTech, Inc. | 74,576 |

576 | 1 | Zynex, Inc. | 8,041 |

TOTAL | 29,284,348 | ||

Industrials— 7.8% | |||

391 | Acco Brands Corp. | 2,995 | |

11,196 | Adecco Group AG | 676,324 | |

5,904 | 1 | AerCap Holdings NV | 217,031 |

6 | 1 | Air Transport Services Group, Inc. | 184 |

7,758 | Alfa Laval AB | 195,175 | |

153,277 | Alfa, S.A. de C.V., Class A | 120,360 | |

4,750 | A-Living Smart City Services Co. Ltd. | 20,051 | |

9,900 | Alstom SA | 526,384 | |

979 | Altra Holdings, Inc. | 55,568 | |

21,900 | Amada Co. Ltd. | 211,463 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Industrials— continued | |||

61 | 1 | American Woodmark Corp. | $5,338 |

3,427 | Ametek, Inc. | 406,202 | |

356 | Andritz AG | 14,977 | |

150 | Apogee Enterprises, Inc. | 3,936 | |

662 | Applied Industrial Technologies, Inc. | 51,921 | |

380 | ArcBest Corp. | 15,926 | |

71 | Arcosa, Inc. | 3,684 | |

12,860 | Ashtead Group PLC | 543,857 | |

1,027 | Astec Industries, Inc. | 59,566 | |

98,644 | Aurizon Holdings Ltd. | 307,927 | |

172,000 | AviChina Industry & Technology Co. Ltd. | 104,244 | |

719 | AZZ, Inc. | 32,060 | |

256 | 1 | BMC Stock Holdings, Inc. | 12,529 |

8,007 | Bouygues SA | 317,936 | |

302,300 | BTS Group Holdings PCL | 101,214 | |

6,555 | Bunzl PLC | 205,830 | |

766 | Caesarstone Ltd. | 9,146 | |

3,100 | Central Japan Railway Co. | 396,943 | |

140,500 | 1 | China COSCO Holdings Co. Ltd., Class H | 131,969 |

33,000 | China Lesso Group Holdings Ltd. | 58,996 | |

8,000 | China Railway Group Ltd. | 3,939 | |

164,000 | China Southern Airlines Co. Ltd. | 100,431 | |

449 | 1 | Cimpress PLC | 40,244 |

145,000 | Citic Pacific Ltd. | 112,731 | |

8,000 | CK Hutchison Holdings Ltd. | 57,707 | |

514 | Comfort Systems USA, Inc. | 25,900 | |

4,743 | CoreLogic, Inc. | 367,583 | |

11,000 | Country Garden Services Holdings Co. Ltd. | 61,673 | |

11,942 | Crane Co. | 830,327 | |

541 | CSW Industrials, Inc. | 58,044 | |

1,100 | Daifuku Co. | 127,482 | |

2,500 | Daikin Industries Ltd. | 567,247 | |

1,304 | Deluxe Corp. | 33,565 | |

505 | Dover Corp. | 61,625 | |

1,967 | DSV Panalpina A/S | 309,650 | |

952 | Eaton Corp. PLC | 115,297 | |

611 | 1 | Echo Global Logistics, Inc. | 17,346 |

530 | Emcor Group, Inc. | 45,675 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Industrials— continued | |||

666 | Encore Wire Corp. | $34,412 | |

20,592 | Expeditors International Washington, Inc. | 1,840,307 | |

12,581 | Experian PLC | 444,275 | |

1,272 | FedEx Corp. | 364,530 | |

6,234 | Ferguson PLC | 698,322 | |

1,029 | 1 | Foundation Building Materials, Inc. | 19,798 |

37,100 | Gamuda BHD | 32,504 | |

1,209 | 1 | Generac Holdings, Inc. | 260,660 |

8,950 | Genivar Income Fund | 664,686 | |

267 | 1 | GMS, Inc. | 8,338 |

5,571 | Graco, Inc. | 377,380 | |

3,100 | Hoshizaki Electric Co., Ltd. | 305,246 | |

391 | 1 | Hub Group, Inc. | 21,356 |

8,133 | IHS Markit Ltd. | 808,908 | |

8,254 | Illinois Tool Works, Inc. | 1,742,337 | |

574 | Insperity, Inc. | 49,077 | |

583 | Insteel Industries, Inc. | 13,485 | |

6,624 | Intertek Group PLC | 486,753 | |

1,284 | 1 | JELD-WEN Holding, Inc. | 31,060 |

11,400 | JGC Holdings Corp. | 102,316 | |

14,400 | Kajima Corp. | 189,517 | |

4,285 | Kansas City Southern Industries, Inc. | 797,738 | |

567 | KForce Com, Inc. | 23,275 | |

1,632 | Knorr-Bremse AG | 208,663 | |

3,215 | Koc Holding A.S. | 7,253 | |

312 | Kone Corp. OYJ, Class B | 26,132 | |

2,970 | Korea Aerospace Industry | 62,182 | |

1,189 | LG Corp. | 75,996 | |

8,600 | Localiza Rent A Car SA | 107,905 | |

4,416 | 1 | Lyft, Inc. | 168,559 |

3,300 | Makita Corp. | 171,053 | |

420 | Marten Transport Ltd. | 7,405 | |

8,192 | Masco Corp. | 439,665 | |

512 | 1 | Masonite International Corp. | 51,226 |

531 | 1 | Mastec, Inc. | 30,113 |

168 | Miller Industries, Inc. | 5,610 | |

5,747 | 1 | MRC Global, Inc. | 33,218 |

1,006 | Mueller Industries, Inc. | 32,957 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Industrials— continued | |||

493 | 1 | MYR Group, Inc. | $25,207 |

19,040 | NIBE Industrier AB | 535,493 | |

5,805 | 1 | Now, Inc. | 32,392 |

51,400 | Obayashi Corp. | 453,549 | |

1,822 | Old Dominion Freight Lines, Inc. | 370,522 | |

17,153 | Otis Worldwide Corp. | 1,148,222 | |

10,983 | Pentair PLC | 569,139 | |

6,700 | Persol Holdings Co. Ltd. | 121,620 | |

2,093 | Pitney Bowes, Inc. | 11,930 | |

479 | Primoris Services Corp. | 11,616 | |

1,862 | Quanex Building Products Corp. | 38,357 | |

4,950 | Regal Beloit Corp. | 589,248 | |

2,921 | Relx PLC | 67,904 | |

25,828 | 1 | Rentokil Initial PLC | 170,898 |

178 | Resources Connection, Inc. | 2,156 | |

2,001 | Ritchie Bros. Auctioneers, Inc. | 143,923 | |

4,505 | Roper Technologies, Inc. | 1,923,635 | |

255 | Rush Enterprises, Inc. | 9,774 | |

105 | 1 | Saia, Inc. | 18,327 |

9,288 | Schneider Electric SA | 1,288,467 | |

3,900 | Secom Co. Ltd. | 386,509 | |

63,000 | Shanghai Industrial Holdings Ltd. | 93,369 | |

4,000 | Shenzhen International Holdings Ltd. | 6,577 | |

16,200 | Shimizu Corp. | 123,059 | |

2,030 | 1 | Siemens Energy AG | 60,464 |

141 | Simpson Manufacturing Co., Inc. | 12,958 | |

35,500 | Sinotruk Hong Kong Ltd. | 88,236 | |

7,450 | SKF Ab, Class B | 182,887 | |

300 | SMC Corp. | 190,523 | |

5,800 | Sohgo Security Services Co. Ltd. | 309,298 | |

1,922 | Steelcase, Inc., Class A | 23,352 | |

422 | Systemax, Inc. | 12,985 | |

13,300 | Taisei Corp. | 470,147 | |

727 | Terex Corp. | 22,537 | |

606 | Tetra Tech, Inc. | 72,266 | |

3,930 | Thomson Reuters Corp. | 311,507 | |

34,900 | Toppan Printing Co. Ltd. | 473,692 | |

1,800 | Toshiba Corp. | 50,155 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Industrials— continued | |||

7,000 | Toyota Tsusho Corp. | $240,228 | |

1,420 | 1 | TriMas Corp. | 37,957 |

87 | 1 | TriNet Group, Inc. | 6,525 |

1 | Triton International Ltd. | 45 | |

404 | UFP Industries, Inc. | 21,675 | |

688 | Universal Truckload Services, Inc. | 14,799 | |

159 | Vestas Wind Systems A/S | 32,264 | |

4,425 | Wartsila OYJ, Class B | 41,510 | |

11,742 | Weg SA | 161,246 | |

54,000 | Weichai Power Co. Ltd., Class H | 110,466 | |

320 | Werner Enterprises, Inc. | 12,797 | |

8,324 | Wolters Kluwer NV | 698,442 | |

66,000 | Xinyi Solar Holdings Ltd. | 118,955 | |

126,000 | Zhejiang Expressway Co. Ltd. | 89,782 | |

99,200 | Zoomlion Heavy Industry Science and Technology Co., Ltd. | 103,085 | |

TOTAL | 30,603,095 | ||

Information Technology— 13.1% | |||

3,038 | 1 | A10 Networks, Inc. | 24,243 |

113,000 | Acer Sertek, Inc. | 91,928 | |

3,717 | 1 | Adobe, Inc. | 1,778,473 |

2,500 | Advantest Corp. | 174,080 | |

858 | 1 | Afterpay Ltd. | 59,948 |

1,357 | American Software, Inc., Class A | 22,282 | |

2,827 | Amkor Technology, Inc. | 41,670 | |

59,889 | Apple, Inc. | 7,129,785 | |

19,479 | Applied Materials, Inc. | 1,606,628 | |

1,848 | ASML Holding N.V. | 800,268 | |

9,000 | Asustek Computer, Inc. | 78,718 | |

3,222 | Atos SE | 294,448 | |

5,405 | 1 | Avalara, Inc. | 928,309 |

1,005 | Benchmark Electronics, Inc. | 24,442 | |

1,027 | Blackbaud, Inc. | 56,577 | |

848 | 1 | Box, Inc. | 15,849 |

20,400 | Brother Industries Ltd. | 387,830 | |

9,543 | 1 | Cadence Design Systems, Inc. | 1,109,851 |

4,042 | Capgemini SE | 558,617 | |

453 | Cass Information Systems, Inc. | 19,221 | |

1,628 | 1 | CGI, Inc., Class A | 120,229 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Information Technology— continued | |||

2,519 | 1 | Check Point Software Technologies Ltd. | $296,436 |

31,000 | Chicony Electronics Co. Ltd. | 92,983 | |

38,619 | Cisco Systems, Inc. | 1,661,389 | |

884 | 1 | Commvault Systems, Inc. | 42,220 |

148,000 | Compal Electronics, Inc. | 100,287 | |

200 | Constellation Software, Inc. | 247,675 | |

187 | 1 | Crowdstrike Holdings, Inc. | 28,663 |

764 | CSG Systems International, Inc. | 33,142 | |

66 | 1 | Diodes, Inc. | 4,485 |

600 | Disco Corp. | 191,340 | |

4,243 | 1 | Dynatrace Holdings LLC | 161,319 |

487 | 1 | eGain Corp. | 5,523 |

337 | 1 | ePlus, Inc. | 28,412 |

552 | 1 | Fabrinet | 37,707 |

4,278 | 1 | Fortinet, Inc. | 527,178 |

3,600 | Fujitsu Ltd. | 501,084 | |

1,100 | Hamamatsu Photonics K.K. | 61,921 | |

11,394 | Hexagon AB | 943,343 | |

18,600 | Hitachi Ltd. | 702,814 | |

35,000 | Hon Hai Precision Industry Co. Ltd. | 101,154 | |

466 | 1 | Ichor Holdings Ltd. | 14,865 |

23,684 | Infosys Ltd. | 356,618 | |

588 | 1 | Insight Enterprises, Inc. | 42,030 |

301 | InterDigital, Inc. | 18,033 | |

7,200 | IT Holdings Corp. | 143,449 | |

753 | KBR, Inc. | 20,911 | |

657 | 1 | Kimball Electronics, Inc. | 10,124 |

28,000 | Kingboard Chemical Holdings Ltd. | 107,340 | |

57,000 | Kingboard Laminates Holdings Ltd. | 92,324 | |

19,000 | Kingsoft Corp. Ltd. | 95,770 | |

7,323 | KLA Corp. | 1,845,176 | |

802 | 1 | Lattice Semiconductor Corp. | 33,564 |

168,000 | Lenovo Group Ltd. | 119,996 | |

678 | LG Innotek Co., Ltd. | 95,250 | |

61,000 | Lite-On Technology Corp. | 102,909 | |

5,555 | Logitech International SA | 490,345 | |

681 | ManTech International Corp., Class A | 52,417 | |

413 | Maximus, Inc. | 29,658 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Information Technology— continued | |||

5,000 | MediaTek, Inc. | $123,743 | |

957 | Methode Electronics, Inc., Class A | 33,514 | |

29,668 | Microsoft Corp. | 6,351,029 | |

123 | 1 | MicroStrategy, Inc., Class A | 42,161 |

2,830 | 1 | Mobile Iron, Inc. | 19,923 |

95 | 1 | Napco Security Technologies, Inc. | 2,897 |

1,151 | Nemetschek AG | 90,978 | |

668 | NIC, Inc. | 15,655 | |

98 | NICE Ltd. | 23,890 | |

99,312 | Nokia Oyj | 395,123 | |

108 | 1 | OSI Systems, Inc. | 9,515 |

7,800 | Otsuka Corp. | 378,097 | |

3,750 | 1 | Paylocity Corp. | 737,250 |

9,091 | 1 | PayPal Holdings, Inc. | 1,946,565 |

10 | 1 | PC Connections, Inc. | 457 |

48,000 | Pegatron Corp. | 110,063 | |

1 | 1 | Photronics, Inc. | 12 |

18 | 1 | Plexus Corp. | 1,345 |

678 | QAD, Inc. | 38,870 | |

2,845 | Qualcomm, Inc. | 418,699 | |

430 | 1 | Qualys, Inc. | 40,854 |

48,000 | Quanta Computer, Inc. | 129,834 | |

406 | 1 | Rapid7, Inc. | 30,426 |

10,000 | Realtek Semiconductor Corp. | 130,325 | |

73,500 | Ricoh Co. Ltd. | 486,906 | |

3,200 | Rohm Co. Ltd. | 265,267 | |

1,558 | 1 | Salesforce.com, Inc. | 382,956 |

26,723 | Samsung Electronics Co. Ltd. | 1,614,346 | |

81 | Samsung SDI Co. Ltd. | 39,149 | |

91 | 1 | Sanmina Corp. | 2,895 |

1,522 | SAP SE | 184,721 | |

46,000 | 1 | Semiconductor Manufacturing International Corp. | 129,383 |

856 | 1 | Semtech Corp. | 57,754 |

2,610 | 1 | ServiceNow, Inc. | 1,395,175 |

3,800 | Shimadzu Corp. | 135,750 | |

1,714 | SK Hynix, Inc. | 151,418 | |

474 | 1 | SPS Commerce, Inc. | 48,855 |

4,040 | 1 | Square, Inc. | 852,278 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Information Technology— continued | |||

14,796 | STMicroelectronics N.V. | $576,022 | |

3,600 | Sumisho Computer Systems Corp. | 215,378 | |

7,700 | Sunny Opitcal Technology Group Co. Ltd. | 151,738 | |

758 | 1 | Synaptics, Inc. | 58,950 |

61,000 | Synnex Technology International Corp. | 95,321 | |

4,723 | 1 | Synopsys, Inc. | 1,074,482 |

129,000 | Taiwan Semiconductor Manufacturing Co. Ltd | 2,178,825 | |

2,482 | Tata Consultancy Services Ltd. | 89,711 | |

2,728 | 1 | TeamViewer AG | 129,866 |

903 | 1 | Tenable Holdings, Inc. | 32,517 |

25,577 | 1 | Teradata Corp. | 560,904 |

11,066 | Teradyne, Inc. | 1,221,022 | |

9,473 | Texas Instruments, Inc. | 1,527,521 | |

1,500 | Trend Micro, Inc. | 81,240 | |

8 | 1 | Tucows, Inc. | 580 |

483 | 1 | Tyler Technologies, Inc. | 206,531 |

508 | 1 | Ultra Clean Holdings, Inc. | 16,073 |

136,000 | United Microelectronics Corp. | 192,029 | |

2,616 | Vishay Intertechnology, Inc. | 50,646 | |

97 | 1 | Vishay Precision Group, Inc. | 2,837 |

97,000 | Wistron Corp. | 101,721 | |

307 | 1 | Workiva, Inc. | 23,022 |

2,111 | Xerox Holdings Corp. | 46,210 | |

26,600 | 1 | Xiaomi Corp. | 91,264 |

16,700 | Yokogawa Electric Corp. | 292,782 | |

806 | 1 | Zoom Video Communications, Inc. | 385,558 |

TOTAL | 50,984,078 | ||

Materials— 4.1% | |||

13,780 | Amcor PLC | 156,127 | |

9,071 | Anglo American PLC | 267,982 | |

3,075 | Anglogold Ltd. | 66,041 | |

1,320 | 1 | Arconic Corp. | 36,313 |

68,000 | Asia Cement Corp. | 103,404 | |

10,912 | Berger Paints India Ltd. | 94,445 | |

28,725 | BHP Billiton Ltd. | 797,648 | |

11,619 | BHP Steel Ltd. | 145,964 | |

1,176 | Boise Cascade Co. | 50,862 | |

7,038 | Cherepovets MK Severstal | 103,650 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Materials— continued | |||

122,000 | China Hongqiao Group Ltd. | $106,332 | |

240,000 | China Molybdenum Co. Ltd. | 112,010 | |

90,000 | China National Building Material Co. Ltd. | 117,334 | |

74,000 | China Resources Cement Holdings Ltd. | 91,662 | |

435 | 1 | Clearwater Paper Corp. | 15,186 |

13,123 | 1 | Companhia Vale Do Rio Doce | 191,062 |

108 | Ems-Chemie Holdings Ag | 98,734 | |

34,873 | Evraz PLC | 179,733 | |

5,107 | 1,3 | Ferroglobe Representation & Warranty Insurance Trust | 0 |

5,844 | FMC Corp. | 677,962 | |

1,169 | 1 | Forterra, Inc. | 21,685��� |

67,532 | Fortescue Metals Group Ltd. | 904,197 | |

140 | Glatfelter Corp. | 2,251 | |

11,981 | Gold Fields Ltd. | 103,635 | |

113 | Greif, Inc. | 5,571 | |

121 | Hawkins, Inc. | 6,072 | |

6,641 | Impala Platinum Holdings Ltd. | 69,624 | |

75,000 | Jiangxi Copper Co. Ltd. | 123,013 | |

3,117 | 1 | KGHM Polska Miedz SA | 123,713 |

6,396 | Koninklijke DSM NV | 1,047,913 | |

98 | 1 | Koppers Holdings, Inc. | 2,653 |

562 | Korea Kumho Petrochemical Co. Ltd. | 70,792 | |

91 | L.G. Chemical Ltd. | 66,035 | |

115,000 | Lee & Man Paper Manufacturing Ltd. | 93,200 | |

1,402 | Louisiana-Pacific Corp. | 47,990 | |

183,148 | Magnitogorsk Iron & Steel Works PJSC | 102,277 | |

9,700 | Maruichi Steel Tube Ltd. | 204,290 | |

589 | Materion Corp. | 34,339 | |

26,100 | Mitsubishi Gas Chemical Co., Inc. | 551,031 | |

1,107 | Myers Industries, Inc. | 18,808 | |

14,107 | Newcrest Mining Ltd. | 280,385 | |

20,223 | Newmont Corp. | 1,189,517 | |

70,000 | Nine Dragons Paper Holdings Ltd. | 91,414 | |

3,300 | Nissan Chemical Industries | 196,400 | |

5,600 | Nitto Denko Corp. | 463,188 | |

677 | Norilsk Nickel | 190,846 | |

508 | 1 | Northam Platinum Ltd. | 5,802 |

26,762 | Novolipetski Metallurgicheski Komb OAO | 67,381 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Materials— continued | |||

2,796 | 2 | Phosagro OAO, GDR | $35,733 |

597 | Polyus PJSC | 113,073 | |

24,500 | PT Indah Kiat Pulp & Paper Corp. | 15,069 | |

105,000 | PT Indocement Tunggal Prakarsa Tbk | 106,444 | |

2,400 | PT Semen Gresik | 1,991 | |

4,315 | 1 | Queen’s Road Capital Investment Ltd. | 1,894 |

5,827 | Rio Tinto Ltd. | 433,944 | |

14,831 | Rio Tinto PLC | 960,989 | |

6,633 | RPM International, Inc. | 583,770 | |

727 | Scotts Miracle-Gro Co. | 127,785 | |

1,364 | Sherwin-Williams Co. | 1,019,767 | |

6,500 | Showa Denko KK | 120,737 | |

3,573 | Sika AG | 910,354 | |

17,126 | Silgan Holdings, Inc. | 578,859 | |

112,111 | South32 Ltd. | 197,663 | |

237 | Stepan Co. | 27,530 | |

5,400 | Taiheiyo Cement Corp. | 145,381 | |

13,700 | Taiwan Cement Corp. | 20,637 | |

35,000 | Tosoh Corp. | 548,495 | |

2,317 | Tredegar Industries, Inc. | 36,632 | |

101 | 1 | UFP Technologies, Inc. | 4,451 |

9,339 | UPM - Kymmene Oyj | 307,194 | |

3,216 | Va Stahl Ag | 103,042 | |

453 | Worthington Industries, Inc. | 23,429 | |

140,000 | Zijin Mining Group Co. Ltd. | 140,412 | |

TOTAL | 16,061,748 | ||

Real Estate— 1.8% | |||

66,000 | Agile Group Holdings Ltd. | 94,791 | |

208 | American Assets Trust, Inc. | 5,968 | |

4,757 | American Tower Corp. | 1,099,818 | |

2,037 | CareTrust REIT, Inc. | 39,579 | |

5,533 | CatchMark Timber Trust, Inc. | 53,061 | |

93,000 | China Aoyuan Group Ltd. | 96,323 | |

5,000 | China Overseas Property Holdings Ltd. | 3,262 | |

4,000 | China Resources Bejing Land | 16,834 | |

134,000 | CIFI Holdings Group Co. Ltd. | 115,330 | |

5,816 | Colony Capital, Inc. | 25,125 | |

822 | CoreCivic, Inc. | 5,828 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Real Estate— continued | |||

106,000 | Country Garden Holdings Co. | $139,375 | |

7,871 | Crown Castle International Corp. | 1,318,944 | |

3,100 | Daito Trust Construction Co. Ltd. | 304,470 | |

2,550 | DiamondRock Hospitality Co. | 19,176 | |

2,327 | Easterly Government Properties, Inc. | 50,403 | |

325 | Equinix, Inc. | 226,782 | |

2,274 | Equity Lifestyle Properties, Inc. | 133,234 | |

51,000 | Evergrande Real Estate Group Limited | 106,907 | |

527 | 1 | eXp World Holdings, Inc. | 28,105 |

192,000 | Franshion Properties of China Ltd. | 98,524 | |

4,076 | Front Yard Residential Corp. | 66,520 | |

1,021 | Geo Group, Inc. | 9,648 | |

31,280 | Goodman Group | 429,063 | |

73,200 | Guangzhou R&F Properties Co. Ltd. | 95,491 | |

14,398 | Invitation Homes, Inc. | 411,495 | |

188,000 | 1 | Kaisa Group Holdings Ltd. | 99,121 |

1,311 | Kite Realty Group Trust | 18,878 | |

68,000 | KWG Property Holding Ltd. | 93,198 | |

14,200 | Land & Houses Public Co. Ltd. | 3,655 | |

4,659 | Lexington Realty Trust | 47,568 | |

59,000 | Logan Group Co. Ltd. | 98,333 | |

24,500 | Longfor Properties | 159,171 | |

152,000 | Mapletree Commercial Trust | 229,834 | |

3,835 | Mid-American Apartment Communities, Inc. | 483,824 | |

2,115 | NEPI Rockcastle PLC | 10,777 | |

1,355 | Newmark Group, Inc. | 9,512 | |

630 | Physicians Realty Trust | 10,931 | |

1,017 | 1 | Redfin Corp. | 48,704 |

4,913 | Retail Properties of America, Inc. | 39,795 | |

274,100 | Robinson’s Land Corp., Class B | 94,575 | |

120,000 | Seazen Group Ltd. | 106,067 | |

54,000 | Shenzhen Investment Ltd. | 19,640 | |

29,500 | Shimao Group Holdings Ltd. | 107,601 | |

35,000 | Sunac China Holdings | 133,542 | |

1,930 | 1 | Sunac Services Holdings Ltd. | 2,973 |

297 | Terreno Realty Corp. | 17,208 | |

2,198 | Uniti Group, Inc. | 22,595 | |

458,000 | Yuexiu Property Co., Ltd. | 95,227 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Real Estate— continued | |||

130,000 | Zhenro Properties Group Ltd. | $80,000 | |

TOTAL | 7,026,785 | ||

Utilities— 2.3% | |||

18,064 | AES Corp. | 369,228 | |

14,461 | AGL Energy Ltd. | 143,378 | |

10,753 | Alliant Energy Corp. | 565,608 | |

391 | American States Water Co. | 28,864 | |

2,069 | American Water Works Co., Inc. | 317,343 | |

424,832 | AusNet Services | 577,198 | |

257 | Brookfield Renewable Corp. | 20,342 | |

1,465 | CEZ A.S. | 31,008 | |

431,000 | CGN Power Co. Ltd. | 92,389 | |

248 | Chesapeake Utilities Corp. | 25,794 | |

136,000 | China Longyuan Power Group Corp. | 114,712 | |

162,000 | China Power International Development Ltd. | 32,512 | |

22,000 | China Resources Logic Ltd. | 104,447 | |

88,000 | China Resources Power Holdings Co. Ltd. | 93,637 | |

251,281 | Colbun SA | 40,237 | |

597 | 1 | Companhia de Saneamento Basico do Estado de Sao Paulo | 4,963 |

12,468 | CPFL Energia SA | 72,959 | |

24,462 | Endesa SA | 698,694 | |

35,181 | Enel SpA | 350,687 | |

10,500 | ENN Energy Holdings Ltd. | 138,421 | |

31,563 | Equatorial Energia SA | 128,375 | |

79,626 | Gail India Ltd. | 110,354 | |

96,800 | 2 | Gulf Energy Development PCL | 111,192 |

55,709 | Iberdrola SA | 759,166 | |

10,912 | Indraprastha Gas Ltd. | 71,880 | |

14,330 | Manila Electric Co. | 83,931 | |

26,271 | NextEra Energy, Inc. | 1,933,283 | |

897 | Northwestern Corp. | 52,026 | |

1,462,027 | OJSC Inter Rao Ues | 98,613 | |

339 | ONE Gas, Inc. | 26,842 | |

114 | Orsted A/S | 20,580 | |

269 | Otter Tail Corp. | 10,712 | |

1,200 | Petronas Gas | 5,349 | |

1,221 | Portland General Electric Co. | 50,525 | |

23,684 | Power Grid Corp of India Ltd. | 61,106 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS— continued | |||

Utilities— continued | |||

7,742 | RWE AG | $321,111 | |

5,935 | Severn Trent PLC | 188,835 | |

17,362 | Uniper SE | 587,731 | |

860 | Unitil Corp. | 35,157 | |

15,539 | Vistra Corp. | 290,269 | |

TOTAL | 8,769,458 | ||

TOTAL COMMON STOCKS (IDENTIFIED COST $194,376,179) | 254,260,792 | ||

FOREIGN GOVERNMENTS/AGENCIES— 6.8% | |||

Sovereign— 6.8% | |||

AUD 1,000,000 | Australia, Government of, Sr. Unsecd. Note, Series 148, 2.750%, 11/21/2027 | 844,909 | |

EUR 390,000 | Belgium, Government of, Series 68, 2.250%, 6/22/2023 | 500,861 | |

680,000 | Belgium, Government of, Series 74, 0.800%, 6/22/2025 | 866,061 | |

CAD 800,000 | Canada, Government of, Bond, 3.250%, 6/1/2021 | 625,592 | |

480,000 | Canada, Government of, Series WL43, 5.750%, 6/1/2029 | 526,621 | |

EUR 6,000 | France, Government of, 0.500%, 5/25/2025 | 7,534 | |

150,000 | France, Government of, Bond, 4.500%, 4/25/2041 | 339,582 | |

400,000 | France, Government of, O.A.T., 5.500%, 4/25/2029 | 721,483 | |

650,000 | France, Government of, Unsecd. Note, 1.250%, 5/25/2036 | 934,354 | |

300,000 | France, Government of, Unsecd. Note, 1.750%, 6/25/2039 | 473,103 | |

600,000 | Germany, Government of, 0.250%, 2/15/2027 | 760,756 | |

300,000 | Germany, Government of, Bond, Series 03, 4.750%, 7/4/2034 | 622,040 | |

100,000 | Germany, Government of, Bond, Series 08, 4.750%, 7/4/2040 | 243,216 | |

400,000 | Italy, Government of, 3.750%, 5/1/2021 | 485,536 | |

680,000 | Italy, Government of, Sr. Unsecd. Note, 0.650%, 10/15/2023 | 833,769 | |

1,000,000 | Italy, Government of, Sr. Unsecd. Note, 4.750%, 9/1/2028 | 1,592,288 | |

950,000 | Italy, Government of, Unsecd. Note, 1.600%, 6/1/2026 | 1,228,894 | |

58,000 | Italy, Government of, Unsecd. Note, 3.250%, 9/1/2046 | 96,959 | |

JPY 142,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 114, 2.100%, 12/20/2029 | 1,620,269 | |

185,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 153, 1.300%, 6/20/2035 | 2,044,020 | |

50,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 351, 0.100%, 6/20/2028 | 485,340 | |

155,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 44, 1.700%, 9/20/2044 | 1,884,319 | |

MXN 30,000,000 | Mexico, Government of, Series M, 6.500%, 6/10/2021 | 1,498,542 | |

30,000 | Mexico, Government of, Series MTNA, 6.750%, 9/27/2034 | 41,513 | |

EUR 450,000 | Netherlands, Government of, Unsecd. Note, 2.500%, 1/15/2033 | 731,409 |

Shares, Principal Amount or Contracts | Value | ||

FOREIGN GOVERNMENTS/AGENCIES— continued | |||

Sovereign— continued | |||

EUR 150,000 | Spain, Government of, 4.200%, 1/31/2037 | $284,223 | |

600,000 | Spain, Government of, Sr. Unsecd. Note, 1.500%, 4/30/2027 | 798,547 | |

590,000 | Spain, Government of, Sr. Unsecd. Note, 1.950%, 7/30/2030 | 833,762 | |

480,000 | Spain, Government of, Sr. Unsecd. Note, 2.750%, 10/31/2024 | 645,994 | |

GBP 200,000 | United Kingdom, Government of, 2.750%, 9/7/2024 | 294,377 | |

430,000 | United Kingdom, Government of, 3.250%, 1/22/2044 | 865,604 | |

350,000 | United Kingdom, Government of, 4.250%, 12/7/2027 | 601,384 | |

270,000 | United Kingdom, Government of, Bond, 4.250%, 3/7/2036 | 550,728 | |

350,000 | United Kingdom, Government of, Unsecd. Deb., 1.625%, 10/22/2028 | 519,673 | |

600,000 | United Kingdom, Government of, Unsecd. Note, 1.500%, 7/22/2047 | 923,926 | |

230,000 | United Kingdom, Government of, Unsecd. Note, 4.250%, 6/7/2032 | 438,660 | |

TOTAL FOREIGN GOVERNMENTS/AGENCIES (IDENTIFIED COST $23,638,588) | 26,765,848 | ||

CORPORATE BONDS— 6.7% | |||

Basic Industry - Metals & Mining— 0.0% | |||

$ 100,000 | Reliance Steel & Aluminum Co., Sr. Unsecd. Note, 4.500%, 4/15/2023 | 107,877 | |

Capital Goods - Aerospace & Defense— 0.4% | |||

350,000 | Boeing Co., Sr. Unsecd. Note, 4.875%, 5/1/2025 | 391,097 | |

145,000 | Huntington Ingalls Industries, Inc., Sr. Unsecd. Note, 144A, 3.844%, 5/1/2025 | 161,532 | |

300,000 | Leidos, Inc., Sr. Unsecd. Note, 144A, 2.300%, 2/15/2031 | 305,048 | |

215,000 | Leidos, Inc., Unsecd. Note, 144A, 3.625%, 5/15/2025 | 239,387 | |

180,000 | Lockheed Martin Corp., Sr. Unsecd. Note, 3.550%, 1/15/2026 | 204,607 | |

90,000 | 4 | Textron Financial Corp., Jr. Sub. Note, 144A, 1.956% (3-month USLIBOR +1.735%), 2/15/2042 | 64,503 |

TOTAL | 1,366,174 | ||

Capital Goods - Building Materials— 0.1% | |||

125,000 | Allegion PLC, Sr. Unsecd. Note, 3.500%, 10/1/2029 | 137,694 | |

130,000 | Masco Corp., Sr. Unsecd. Note, 4.375%, 4/1/2026 | 151,902 | |

185,000 | Masco Corp., Unsecd. Note, 4.450%, 4/1/2025 | 212,026 | |

TOTAL | 501,622 | ||

Capital Goods - Construction Machinery— 0.1% | |||

195,000 | Deere & Co., Sr. Unsecd. Note, 2.750%, 4/15/2025 | 212,301 | |

Capital Goods - Diversified Manufacturing— 0.1% | |||

30,000 | General Electric Capital Corp., Note, Series MTNA, 6.750%, 3/15/2032 | 40,954 | |

75,000 | Lennox International, Inc., Sr. Unsecd. Note, 1.700%, 8/1/2027 | 75,793 | |

260,000 | Roper Technologies, Inc., Sr. Unsecd. Note, 2.000%, 6/30/2030 | 267,371 | |

TOTAL | 384,118 |

Shares, Principal Amount or Contracts | Value | ||

CORPORATE BONDS— continued | |||

Communications - Cable & Satellite— 0.1% | |||

$ 120,000 | Charter Communications, Inc., 4.200%, 3/15/2028 | $137,878 | |

30,000 | Charter Communications Operating, LLC/Charter Communications Operating Capital Corp., 5.050%, 3/30/2029 | 36,352 | |

265,000 | Comcast Corp., Sr. Unsecd. Note, 3.100%, 4/1/2025 | 291,655 | |

TOTAL | 465,885 | ||

Communications - Media & Entertainment— 0.2% | |||

20,000 | Discovery Communications LLC, Sr. Unsecd. Note, 4.900%, 3/11/2026 | 23,494 | |

70,000 | Grupo Televisa S.A., Sr. Unsecd. Note, 6.125%, 1/31/2046 | 95,043 | |

400,000 | ViacomCBS, Inc., Sr. Unsecd. Note, 4.750%, 5/15/2025 | 463,619 | |

TOTAL | 582,156 | ||

Communications - Telecom Wireless— 0.3% | |||

550,000 | Crown Castle International Corp., Sr. Unsecd. Note, 3.250%, 1/15/2051 | 579,784 | |

80,000 | T-Mobile USA, Inc., Sec. Fac. Bond, 144A, 2.250%, 11/15/2031 | 81,326 | |

375,000 | Vodafone Group PLC, Sr. Unsecd. Note, 4.250%, 9/17/2050 | 460,594 | |

75,000 | Vodafone Group PLC, Sr. Unsecd. Note, 4.875%, 6/19/2049 | 98,802 | |

TOTAL | 1,220,506 | ||

Communications - Telecom Wirelines— 0.2% | |||

364,000 | AT&T, Inc., Sr. Unsecd. Note, 144A, 3.550%, 9/15/2055 | 374,390 | |

105,000 | Verizon Communications, Inc., Sr. Unsecd. Note, 3.150%, 3/22/2030 | 118,213 | |

200,000 | Verizon Communications, Inc., Sr. Unsecd. Note, 4.150%, 3/15/2024 | 221,398 | |

TOTAL | 714,001 | ||

Consumer Cyclical - Automotive— 0.1% | |||

275,000 | Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 3.336%, 3/18/2021 | 276,292 | |

70,000 | General Motors Co., Sr. Unsecd. Note, 4.000%, 4/1/2025 | 77,445 | |

TOTAL | 353,737 | ||

Consumer Cyclical - Retailers— 0.4% | |||

600,000 | Advance Auto Parts, Inc., Sr. Unsecd. Note, Series WI, 3.900%, 4/15/2030 | 690,382 | |

225,000 | AutoNation, Inc., Sr. Unsecd. Note, 4.750%, 6/1/2030 | 270,907 | |

300,000 | AutoZone, Inc., Sr. Unsecd. Note, 3.250%, 4/15/2025 | 327,221 | |

80,321 | CVS Health Corp., Pass Thru Cert., 144A, 5.298%, 1/11/2027 | 85,971 | |

185,000 | O’Reilly Automotive, Inc., Sr. Unsecd. Note, 4.200%, 4/1/2030 | 222,384 | |

TOTAL | 1,596,865 | ||

Consumer Cyclical - Services— 0.1% | |||

200,000 | Alibaba Group Holding Ltd., Sr. Unsecd. Note, 2.800%, 6/6/2023 | 210,622 | |

130,000 | Visa, Inc., Sr. Unsecd. Note, 3.150%, 12/14/2025 | 145,186 | |

TOTAL | 355,808 |

Shares, Principal Amount or Contracts | Value | ||

CORPORATE BONDS— continued | |||

Consumer Non-Cyclical - Food/Beverage— 0.3% | |||

$ 115,000 | Campbell Soup Co., Sr. Unsecd. Note, 2.375%, 4/24/2030 | $120,640 | |

210,000 | Flowers Foods, Inc., Sr. Unsecd. Note, 3.500%, 10/1/2026 | 230,489 | |

157,000 | Kraft Heinz Foods Co., Sr. Unsecd. Note, 3.950%, 7/15/2025 | 173,273 | |

120,000 | Mead Johnson Nutrition Co., Sr. Unsecd. Note, 4.125%, 11/15/2025 | 138,397 | |

370,000 | PepsiCo, Inc., Sr. Unsecd. Note, 3.625%, 3/19/2050 | 469,103 | |

70,000 | PepsiCo, Inc., Sr. Unsecd. Note, 4.450%, 4/14/2046 | 97,627 | |

TOTAL | 1,229,529 | ||

Consumer Non-Cyclical - Health Care— 0.3% | |||

210,000 | Agilent Technologies, Inc., Sr. Unsecd. Note, 2.750%, 9/15/2029 | 229,671 | |

180,000 | Dentsply Sirona, Inc., Sr. Unsecd. Note, 3.250%, 6/1/2030 | 198,264 | |

400,000 | PerkinElmer, Inc., Sr. Unsecd. Note, 3.300%, 9/15/2029 | 447,791 | |

75,000 | Thermo Fisher Scientific, Inc., Sr. Unsecd. Note, 4.133%, 3/25/2025 | 85,312 | |

TOTAL | 961,038 | ||

Consumer Non-Cyclical - Pharmaceuticals— 0.1% | |||

90,000 | Gilead Sciences, Inc., Sr. Unsecd. Note, 3.650%, 3/1/2026 | 102,054 | |

190,000 | Zoetis, Inc., Sr. Unsecd. Note, 3.000%, 5/15/2050 | 211,065 | |

TOTAL | 313,119 | ||

Consumer Non-Cyclical - Tobacco— 0.4% | |||

EUR 870,000 | Philip Morris International, Inc., Sr. Unsecd. Note, 2.875%, 5/14/2029 | 1,264,542 | |

$ 200,000 | Reynolds American, Inc., Sr. Unsecd. Note, 5.850%, 8/15/2045 | 256,267 | |

TOTAL | 1,520,809 | ||

Energy - Integrated— 0.1% | |||

340,000 | Exxon Mobil Corp., Sr. Unsecd. Note, 2.992%, 3/19/2025 | 371,811 | |

100,000 | Husky Energy, Inc., Sr. Unsecd. Note, 3.950%, 4/15/2022 | 102,801 | |

35,000 | Petro-Canada, Deb., 7.000%, 11/15/2028 | 43,622 | |

TOTAL | 518,234 | ||

Energy - Midstream— 0.1% | |||

325,000 | Energy Transfer Partners LP, Sr. Unsecd. Note, 4.050%, 3/15/2025 | 349,664 | |

80,000 | MPLX LP, Sr. Unsecd. Note, 4.125%, 3/1/2027 | 90,288 | |

TOTAL | 439,952 | ||

Energy - Refining— 0.1% | |||

250,000 | Marathon Petroleum Corp., Sr. Unsecd. Note, 4.750%, 9/15/2044 | 279,289 | |

Financial Institution - Banking— 0.7% | |||

100,000 | Bank of America Corp., Sr. Unsecd. Note, Series MTN, 4.875%, 4/1/2044 | 140,341 | |

300,000 | Bank of America Corp., Sub. Note, Series MTN, 4.000%, 1/22/2025 | 335,844 | |

300,000 | Citigroup, Inc., Sr. Unsecd. Note, 2.700%, 3/30/2021 | 302,375 | |

250,000 | Citizens Bank N.A., Sr. Unsecd. Note, Series BKNT, 3.750%, 2/18/2026 | 285,176 |

Shares, Principal Amount or Contracts | Value | ||

CORPORATE BONDS— continued | |||

Financial Institution - Banking— continued | |||

$ 250,000 | Compass Bank, Birmingham, Sub. Note, Series BKNT, 3.875%, 4/10/2025 | $277,940 | |

5,000 | Goldman Sachs Group, Inc., Sr. Unsecd. Note, 5.750%, 1/24/2022 | 5,308 | |

100,000 | JPMorgan Chase & Co., Series S, 6.750%, 8/1/2069 | 111,718 | |

50,000 | JPMorgan Chase & Co., Sub. Note, 3.375%, 5/1/2023 | 53,497 | |

400,000 | Morgan Stanley, 4.300%, 1/27/2045 | 544,418 | |

70,000 | Morgan Stanley, Sr. Unsecd. Note, Series MTN, 1.794%, 2/13/2032 | 70,578 | |

32,417 | 3 | Regional Diversified Funding, 144A, 9.250%, 3/15/2030 | 21,152 |

230,000 | Truist Financial Corp., Sr. Unsecd. Note, 2.900%, 3/3/2021 | 231,047 | |

300,000 | US Bancorp, Sr. Unsecd. Note, Series MTN, 1.375%, 7/22/2030 | 301,515 | |

TOTAL | 2,680,909 | ||

Financial Institution - Broker/Asset Mgr/Exchange— 0.1% | |||

140,000 | Invesco Finance PLC, Sr. Unsecd. Note, 3.750%, 1/15/2026 | 158,162 | |

240,000 | Stifel Financial Corp., Sr. Unsecd. Note, 3.500%, 12/1/2020 | 240,000 | |

70,000 | TIAA Asset Management Finance Co. LLC, Sr. Unsecd. Note, 144A, 4.125%, 11/1/2024 | 79,020 | |

TOTAL | 477,182 | ||

Financial Institution - Finance Companies— 0.1% | |||

210,000 | AerCap Ireland Capital Ltd. / AerCap Global Aviation Trust, Sr. Unsecd. Note, 3.950%, 2/1/2022 | 215,580 | |

Financial Institution - Insurance - Life— 0.1% | |||

27,000 | Aflac, Inc., Sr. Unsecd. Note, 6.450%, 8/15/2040 | 40,007 | |

325,000 | Mass Mutual Global Funding II, 144A, 2.000%, 4/15/2021 | 327,098 | |

10,000 | MetLife, Inc., Jr. Sub. Note, 10.750%, 8/1/2039 | 17,144 | |

105,000 | Northwestern Mutual Life Insurance Co., Sr. Unsecd. Note, 144A, 3.625%, 9/30/2059 | 121,034 | |

TOTAL | 505,283 | ||

Financial Institution - Insurance - P&C— 0.1% | |||

350,000 | Nationwide Mutual Insurance Co., Sub. Note, 144A, 4.350%, 4/30/2050 | 410,248 | |

30,000 | Nationwide Mutual Insurance Co., Sub. Note, 144A, 9.375%, 8/15/2039 | 52,793 | |

TOTAL | 463,041 | ||

Financial Institution - REIT - Apartment— 0.1% | |||

300,000 | Mid-America Apartment Communities LP, Sr. Unsecd. Note, 3.750%, 6/15/2024 | 325,483 | |

140,000 | UDR, Inc., Sr. Unsecd. Note, Series MTN, 2.950%, 9/1/2026 | 153,097 | |

TOTAL | 478,580 |

Shares, Principal Amount or Contracts | Value | ||

CORPORATE BONDS— continued | |||

Financial Institution - REIT - Office— 0.0% | |||

$ 100,000 | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 3.950%, 1/15/2028 | $115,518 | |

Financial Institution - REIT - Other— 0.1% | |||

180,000 | ProLogis LP, Sr. Unsecd. Note, 4.375%, 2/1/2029 | 221,790 | |

90,000 | WP Carey, Inc., Sr. Unsecd. Note, 3.850%, 7/15/2029 | 101,292 | |

160,000 | WP Carey, Inc., Sr. Unsecd. Note, 4.600%, 4/1/2024 | 177,506 | |

TOTAL | 500,588 | ||

Financial Institution - REIT - Retail— 0.1% | |||

400,000 | Kimco Realty Corp., Sr. Unsecd. Note, 2.700%, 10/1/2030 | 416,836 | |

30,000 | Kimco Realty Corp., Sr. Unsecd. Note, 3.400%, 11/1/2022 | 31,557 | |

TOTAL | 448,393 | ||

Financial Institution - REITs— 0.0% | |||

70,000 | Camden Property Trust, Sr. Unsecd. Note, 2.800%, 5/15/2030 | 77,108 | |

Foreign-Local-Government— 0.0% | |||

50,000 | Quebec, Province of, Note, Series MTNA, 7.035%, 3/10/2026 | 65,543 | |

Municipal Services— 0.1% | |||

132,576 | Army Hawaii Family Housing, 144A, 5.524%, 6/15/2050 | 172,340 | |

100,000 | Camp Pendleton & Quantico Housing LLC, 5.572%, 10/1/2050 | 122,637 | |

TOTAL | 294,977 | ||

Sovereign— 0.1% | |||

JPY 30,000,000 | KFW, 2.050%, 2/16/2026 | 322,530 | |

Technology— 0.6% | |||

$ 400,000 | Apple, Inc., Sr. Unsecd. Note, 2.950%, 9/11/2049 | 456,027 | |

320,000 | Diamond 1 Finance Corp./Diamond 2 Finance Corp., Sr. Secd. Note, 144A, 6.020%, 6/15/2026 | 388,728 | |

28,000 | Fidelity National Information Services, Inc., Sr. Unsecd. Note, 3.875%, 6/5/2024 | 30,836 | |

260,000 | Fiserv, Inc., Sr. Unsecd. Note, 3.500%, 7/1/2029 | 298,220 | |

280,000 | Intel Corp., Sr. Unsecd. Note, 3.400%, 3/25/2025 | 312,104 | |

300,000 | Keysight Technologies, Inc., 4.550%, 10/30/2024 | 340,063 | |

380,000 | Molex Electronics Technologies LLC, Unsecd. Note, 144A, 3.900%, 4/15/2025 | 391,491 | |

TOTAL | 2,217,469 | ||

Transportation - Airlines— 0.0% | |||

140,000 | Southwest Airlines Co., Sr. Unsecd. Note, 5.250%, 5/4/2025 | 159,795 | |

Transportation - Services— 0.1% | |||

62,000 | Enterprise Rent-A-Car USA Finance Co., Sr. Unsecd. Note, 144A, 3.850%, 11/15/2024 | 68,949 | |

160,000 | United Parcel Service, Inc., Sr. Unsecd. Note, 3.900%, 4/1/2025 | 180,880 | |

TOTAL | 249,829 |

Shares, Principal Amount or Contracts | Value | ||

CORPORATE BONDS— continued | |||

Utility - Electric— 0.8% | |||

$ 155,000 | Berkshire Hathaway Energy Co., Sr. Unsecd. Note, 144A, 4.050%, 4/15/2025 | $176,255 | |

135,000 | Consolidated Edison Co., Sr. Unsecd. Note, Series 20B, 3.950%, 4/1/2050 | 166,822 | |

275,000 | Electricite de France SA, Sr. Unsecd. Note, 144A, 4.500%, 9/21/2028 | 328,342 | |

190,000 | Emera US Finance LP, Sr. Unsecd. Note, 4.750%, 6/15/2046 | 239,571 | |

400,000 | Enel Finance International NV, Sr. Unsecd. Note, 144A, 2.650%, 9/10/2024 | 425,383 | |

300,000 | Exelon Corp., Sr. Unsecd. Note, 3.400%, 4/15/2026 | 337,332 | |

160,000 | Florida Power & Light Co., Sec. Fac. Bond, 2.850%, 4/1/2025 | 174,613 | |

140,000 | National Rural Utilities Cooperative Finance Corp., Sr. Sub. Note, 5.250%, 4/20/2046 | 155,297 | |

200,000 | NiSource Finance Corp., Sr. Unsecd. Note, 3.950%, 3/30/2048 | 247,373 | |

400,000 | NiSource, Inc., Sr. Unsecd. Note, 3.600%, 5/1/2030 | 463,370 | |

400,000 | Northeast Utilities, Sr. Unsecd. Note, Series H, 3.150%, 1/15/2025 | 435,238 | |

125,000 | Wisconsin Electric Power Co., Sr. Unsecd. Note, 4.300%, 12/15/2045 | 153,906 | |

TOTAL | 3,303,502 | ||

Utility - Natural Gas— 0.1% | |||

495,000 | National Fuel Gas Co., Sr. Unsecd. Note, 5.500%, 1/15/2026 | 555,932 | |

TOTAL CORPORATE BONDS (IDENTIFIED COST $23,322,018) | 26,254,779 | ||

U.S. TREASURIES— 1.1% | |||

Treasury Inflation-Indexed Note— 1.1% | |||

202,886 | U.S. Treasury Inflation-Protected Notes, 0.125%, 10/15/2024 | 215,372 | |

1,461,049 | U.S. Treasury Inflation-Protected Notes, 0.125%, 4/15/2025 | 1,551,910 | |

708,120 | U.S. Treasury Inflation-Protected Notes, 0.125%, 1/15/2030 | 779,612 | |

456,804 | U.S. Treasury Inflation-Protected Notes, 0.125%, 7/15/2030 | 505,959 | |

759,255 | U.S. Treasury Inflation-Protected Notes, 0.250%, 2/15/2050 | 899,705 | |

139,431 | U.S. Treasury Inflation-Protected Notes, 0.625%, 1/15/2024 | 148,045 | |

TOTAL | 4,100,603 | ||

US Treasury Bond— 0.0% | |||

3,000 | United States Treasury Bond, 3.000%, 11/15/2045 | 3,952 | |

TOTAL U.S. TREASURIES (IDENTIFIED COST $4,015,815) | 4,104,555 | ||

ASSET-BACKED SECURITIES— 0.8% | |||

Auto Receivables— 0.3% | |||

475,000 | Santander Drive Auto Receivables Trust 2020-2, Class C, 1.460%, 9/15/2025 | 481,508 | |

500,000 | Toyota Auto Receivables Owner Trust 2020-B, Class A4, 1.660%, 9/15/2025 | 517,350 |

Shares, Principal Amount or Contracts | Value | ||

ASSET-BACKED SECURITIES— continued | |||

Auto Receivables— continued | |||

$ 281,724 | World Omni Auto Receivables Trust 2018-B, Class A3, 2.870%, 7/17/2023 | $285,866 | |

TOTAL | 1,284,724 | ||

Credit Card— 0.2% | |||

700,000 | 4 | Trillium Credit Card Trust II 2020-1A, Class A, 0.515% (1-month USLIBOR +0.370%), 12/26/2024 | 701,108 |

Equipment Lease— 0.2% | |||

300,000 | CNH Equipment Trust 2020-A, Class A3, 1.160%, 6/16/2025 | 304,626 | |

500,000 | HPEFS Equipment Trust 2020-2A, Class C, 2.000%, 7/22/2030 | 501,434 | |

TOTAL | 806,060 | ||

Other— 0.1% | |||

300,000 | PFS Financing Corp. 2020-G, Class A, 0.970%, 2/15/2026 | 302,097 | |

TOTAL ASSET-BACKED SECURITIES (IDENTIFIED COST $3,004,265) | 3,093,989 | ||

COMMERCIAL MORTGAGE-BACKED SECURITIES— 0.3% | |||

Agency Commercial Mortgage-Backed Securities— 0.3% | |||

123,201 | Federal Home Loan Mortgage Corp. REMIC, Series K055, Class A1, 2.263%, 4/25/2025 | 128,116 | |

496,758 | Federal Home Loan Mortgage Corp. REMIC, Series K106, Class A1, 1.783%, 5/25/2029 | 517,570 | |

500,000 | Federal Home Loan Mortgage Corp. REMIC, Series K737, Class A2, 2.525%, 10/25/2026 | 545,542 | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES (IDENTIFIED COST $1,139,866) | 1,191,228 | ||

GOVERNMENT AGENCIES— 0.2% | |||

Federal Home Loan Bank System— 0.0% | |||

200,000 | Federal Home Loan Bank System Notes, 0.500%, 4/14/2025 | 200,743 | |

Federal National Mortgage Association— 0.2% | |||

635,000 | Federal National Mortgage Association Notes, 0.625%, 4/22/2025 | 642,205 | |

GOVERNMENT AGENCIES (IDENTIFIED COST $834,877) | 842,948 | ||

COLLATERALIZED MORTGAGE OBLIGATIONS— 0.2% | |||

Commercial Mortgage— 0.2% | |||

255,000 | Bank, Class A4, 3.488%, 11/15/2050 | 288,870 | |

300,000 | JPMDB Commercial Mortgage Securities Trust 2016-C4, Class A3, 3.141%, 12/15/2049 | 331,427 | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (IDENTIFIED COST $571,639) | 620,297 |

Shares, Principal Amount or Contracts | Value | ||

MUNICIPAL BOND— 0.1% | |||

$ 250,000 | New York State Dormitory Authority State Personal Income Tax Revenue (New York State Personal Income Tax Revenue Bond Fund), State Personal Income Tax Revenue Bonds (Series 2019D), 4.000%, 2/15/2037 (IDENTIFIED COST $300,912) | $298,133 | |

MORTGAGE-BACKED SECURITIES— 0.0% | |||

Federal Home Loan Mortgage Corporation REMIC— 0.0% | |||

1,062 | Federal Home Loan Mortgage Corp., Pool C00592, 7.000%, 3/1/2028 | 1,205 | |

788 | Federal Home Loan Mortgage Corp., Pool C00896, 7.500%, 12/1/2029 | 912 | |

6 | Federal Home Loan Mortgage Corp., Pool C17281, 6.500%, 11/1/2028 | 6 | |

963 | Federal Home Loan Mortgage Corp., Pool C19588, 6.500%, 12/1/2028 | 1,101 | |

448 | Federal Home Loan Mortgage Corp., Pool C25621, 6.500%, 5/1/2029 | 514 | |

701 | Federal Home Loan Mortgage Corp., Pool C76361, 6.000%, 2/1/2033 | 821 | |

1,619 | Federal Home Loan Mortgage Corp., Pool G01444, 6.500%, 8/1/2032 | 1,892 | |

TOTAL | 6,451 | ||

Federal National Mortgage Association— 0.0% | |||

956 | Federal National Mortgage Association, Pool 251697, 6.500%, 5/1/2028 | 1,075 | |

4,067 | Federal National Mortgage Association, Pool 252334, 6.500%, 2/1/2029 | 4,551 | |

2,802 | Federal National Mortgage Association, Pool 254905, 6.000%, 10/1/2033 | 3,279 | |

2,488 | Federal National Mortgage Association, Pool 255075, 5.500%, 2/1/2024 | 2,782 | |

289 | Federal National Mortgage Association, Pool 303168, 9.500%, 2/1/2025 | 317 | |