United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-21822

(Investment Company Act File Number)

Federated Hermes Managed Pool Series

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 12/31/20

Date of Reporting Period: 12/31/20

| Item 1. | Reports to Stockholders |

Annual Shareholder Report

December 31, 2020

Federated Hermes Corporate Bond Strategy Portfolio(formerly, Federated Corporate Bond Strategy Portfolio)

A Portfolio of Federated Hermes Managed Pool Series(formerly, Federated Managed Pool Series)

Not FDIC Insured ▪ May Lose Value ▪ No Bank Guarantee

Management’s Discussion of Fund Performance (unaudited)

The total return of the Federated Hermes Corporate Bond Strategy Portfolio (the “Fund”), based on net asset value for the 12-month reporting period ended December 31, 2020 was 11.88%. The total return of the Bloomberg Barclays U.S. Credit Index (BBUSC),1 the Fund’s broad-based securities market index, was 9.35%, and the total return of the Baa component of the BBUSC (BBUSC-Baa),2 the benchmark against which the Fund is managed, was 9.43% for the same period. The Fund’s total return for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses, which were not reflected in the total return of the indexes.

During the reporting period, the most significant factors affecting the Fund’s performance relative to the BBUSC-Baa were: (1) individual security selection; (2) the allocation of the portfolio among securities of similar types of issuers (referred to as “sectors”); (3) rates selection of securities with different maturities (referred to as “yield curve” strategy); and (4) duration,3 which is the sensitivity of the change in price of the portfolio to changes in interest rates.

Market Overview

In 2020, investors were challenged by the unprecedented shock to the global economy from the COVID-19 pandemic. As the virus spread around the world, federal, state and local governments around the globe began implementing policies that restricted individuals’ movements and large public gatherings, which ultimately lead to reduced economic activity. Specifically, the decline in economic activity was reflected in a -5% decline in first quarter gross domestic product (GDP) and an even worse second quarter GDP decline of almost -32%. In addition, the unemployment rate peaked at 14.8% in the second quarter. During this period of turmoil, investors fled to the safety of the U.S. dollar. However, the liquidity in many fixed-income markets was very limited, since there were many more sellers than buyers. As a result, the U.S. Federal Reserve (the “Fed”) had to re-institute several liquidity programs that were first created in the Great Recession of 2008. Specifically, the Fed intervened to provide liquidity to the U.S. Treasury, commercial paper, agency mortgage-backed (MBS) and investment-grade corporate markets. In addition, the Fed cut the fed funds target rate by 100 basis points to a range of 0.0-0.25%. The U.S. Congress also approved a $2 trillion fiscal stimulus package to help combat the negative economic impact from the pandemic. As the year progressed, the monetary and fiscal stimulus took hold, and the initial phase of the pandemic passed as economic activity improved. Third quarter GDP rebounded and increased 33%, and the unemployment rate improved to end the year at 6.7%.

The other major drivers of financial markets in 2020 all occurred in the fourth quarter and included: (1) the November elections; (2) the emergency use approval of two COVID-19 vaccines; and (3) the approval of an additional $900 billion fiscal stimulus plan. As many had expected, the U.S. Presidential election came down to very tight races in several battleground states. However, the results of the election were resolved in short order, and the risk of a prolonged and contested election never came to fruition. Investors viewed the results of the election as a positive for financial markets, as a divided government with a democratic executive branch and a split Senate is expected to lead to grid lock in Washington and a less extensive progressive agenda or other major policy changes. Despite the deteriorating health and economic data at the end of the year, the financial markets looked through these negative events and focused more on the positive news of the emergency use approval of the COVID-19 vaccines and the approval of the $900 billion fiscal stimulus plan. The Fed also remained extremely accommodative with its 0.0-0.25% interest rate target and purchasing $120 billion of U.S. Treasuries and MBS bonds per month.4

As a result of these events, during the first quarter of 2020, investors reduced their exposure to risk and focused on protecting their capital, with U.S. Treasury rates declining materially across all maturities. The Bloomberg Barclays U.S. Treasury Index5 total return on the first quarter was 8.20% compared to -7.39% for the BBUSC-Baa. However, lower-quality fixed-income markets continued to heal throughout the remainder of the year. For the entire year, the BBUSC-Baa total return was 9.43% compared to 8.00% for the Bloomberg Barclays U.S. Treasury Index.

The positive 2020 total return on the BBUSC-Baa was due primarily to lower Treasury rates. There was great Option Adjusted Spread (OAS) volatility in the year. However, the OAS of the BBUSC-Baa was little changed in 2020 after beginning the year at 125 basis points, peaking at 462 basis points in March, and then finishing the year at 124 basis points.

Annual Shareholder Report

Security selection

In total, individual security selection varied widely in terms of relative contribution to the Fund but combined to be the largest positive contributor to the relative performance of the Fund for the year. Some of the best performing bonds for the Fund in 2020 were from issuers such as the Government of Mexico, Occidental Petroleum, Broadcom Inc., Kraft Heinz and General Electric. The worst performing selections were from the following issuers such as CSX Corp, Barclays PLC, Anthem Inc, the Government of Uruguay and McDonald’s Corp., since the Fund did not have any holdings from any of these issuers.

sector

Sector allocation was a large positive contributor to the Fund’s outperformance for the year. Overweight positions in the Automobile and Independent Exploration & Production sectors and an underweight position to the Government Owned No Guarantee sectors were positive contributors to Fund performance. These positives were partially offset by the negative contributions from underweight positions in the Healthcare, Office Real Estate Investment Trusts and Railroad Sectors.

Yield Curve

The yield curve strategy was a slightly positive contributor to the Fund’s performance for the year relative to the BBUSC-Baa. The Fund maintained either a steepening bias or neutral positioning for most of the year.

Duration

The Fund’s duration, which averaged less than the duration of the BUSC-Baa throughout the year, was a negative contributor to the Fund’s performance. During the reporting period, the Fund used U.S. Treasury futures contracts6 to help manage the duration of the Fund. These positions had a negative impact on the Fund’s performance for the reporting period.

1

Please see the footnotes to the line graphs below for definitions of, and further information about the BBUSC.

2

Please see the footnotes to the line graphs below for definitions of, and further information about the BBUSC-Baa.

3

Duration is a measure of a security’s price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities of shorter durations.

4

Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices.

5

The Bloomberg Barclays U.S. Treasury Index measures U.S dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with 10 years or more to maturity. The index is unmanaged, and it is not possible to invest directly in an index.

6

The Fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional instruments.

Annual Shareholder Report

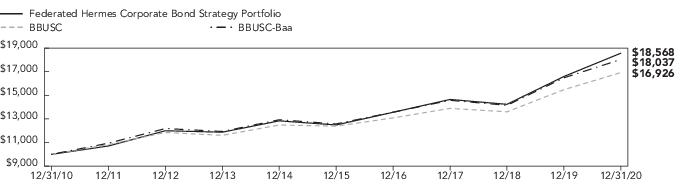

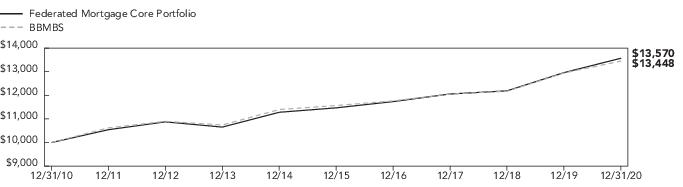

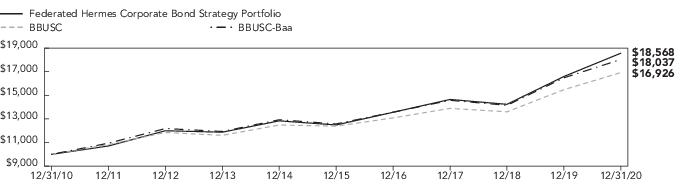

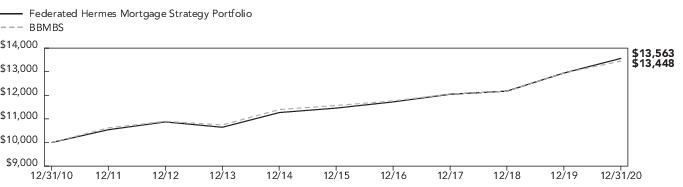

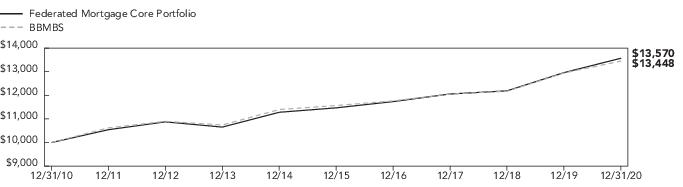

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

The graph below illustrates the hypothetical investment of $10,0001 in the Federated Hermes Corporate Bond Strategy Portfolio from December 31, 2010 to December 31, 2020, compared to the Bloomberg Barclays U.S. Credit Index (BBUSC)2 and the Baa component of the Bloomberg Barclays U.S. Credit Index (BBUSC-Baa).3 The Average Annual Total Return table below shows returns averaged over the stated periods.

Growth of a $10,000 Investment

Growth of $10,000 as of December 31, 2020

Average Annual Total Returns for the Period Ended 12/31/2020

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

1

The Fund’s performance assumes the reinvestment of all dividends and distributions. The BBUSC and BBUSC-Baa have been adjusted to reflect reinvestment of dividends on securities in an index.

2

The BBUSC is composed of all publicly issued, fixed-rate, nonconvertible, investment-grade corporate debt and a non-corporate component that includes foreign agencies, sovereigns, supranationals and local authorities. Issues are rated at least “Baa” by Moody’s Investors Service or “BBB” by Standard & Poor’s, if unrated by Moody’s. The index is not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

3

The BBUSC-Baa is a component of the BBUSC comprised of corporate bonds or securities represented by the following sectors: industrial, utility and finance, including both U.S. and non-U.S. corporations and non-corporate bonds or securities represented by the following sectors: sovereign, supranational, foreign agencies and foreign local governments. The index is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At December 31, 2020, the Fund’s portfolio composition1 was as follows:

| Percentage of

Total Net Assets |

Corporate Debt Securities | |

Foreign Government/Agency | |

| |

Securities Lending Collateral3 | |

| |

Other Assets and Liabilities—Net6 | |

| |

| See the Fund’s Prospectus and Statement of Additional Information for a description of these security types. |

| Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| Represents cash collateral received for portfolio securities on loan that may be invested in affiliated money market funds, other money market instruments and/or repurchase agreements. |

| Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More complete information regarding the Fund’s direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

| Represents less than 0.1%. |

| Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report

Portfolio of Investments

December 31, 2020

| | | |

| | | |

| | Basic Industry - Chemicals—0.9% | |

| | Albemarle Corp., 4.150%, 12/1/2024 | |

| | Albemarle Corp., Sr. Unsecd. Note, 5.450%, 12/1/2044 | |

| | Nutrition & Biosciences, Inc., Sr. Unsecd. Note, 144A, 1.832%, 10/15/2027 | |

| | Nutrition & Biosciences, Inc., Sr. Unsecd. Note, 144A, 2.300%, 11/1/2030 | |

| | RPM International, Inc., Sr. Unsecd. Note, 4.550%, 3/1/2029 | |

| | RPM International, Inc., Sr. Unsecd. Note, 5.250%, 6/1/2045 | |

| | | |

| | Basic Industry - Metals & Mining—0.9% | |

| | Anglogold Ashanti Holdings PLC, Sr. Note, 6.500%, 4/15/2040 | |

| | Carpenter Technology Corp., Sr. Unsecd. Note, 4.450%, 3/1/2023 | |

| | Reliance Steel & Aluminum Co., Sr. Unsecd. Note, 4.500%, 4/15/2023 | |

| | Southern Copper Corp., Sr. Unsecd. Note, 6.750%, 4/16/2040 | |

| | Worthington Industries, Inc., Sr. Unsecd. Note, 4.300%, 8/1/2032 | |

| | Worthington Industries, Inc., Sr. Unsecd. Note, 4.550%, 4/15/2026 | |

| | | |

| | Basic Industry - Paper—0.5% | |

| | International Paper Co., Sr. Unsecd. Note, 3.000%, 2/15/2027 | |

| | International Paper Co., Sr. Unsecd. Note, 4.400%, 8/15/2047 | |

| | Weyerhaeuser Co., Sr. Unsecd. Note, 7.375%, 3/15/2032 | |

| | | |

| | Capital Goods - Aerospace & Defense—4.3% | |

| | BAE Systems Holdings, Inc., Sr. Unsecd. Note, 144A, 3.850%, 12/15/2025 | |

| | BAE Systems PLC, Sr. Unsecd. Note, 144A, 3.000%, 9/15/2050 | |

| | Boeing Co., Sr. Unsecd. Note, 2.700%, 2/1/2027 | |

| | Boeing Co., Sr. Unsecd. Note, 2.950%, 2/1/2030 | |

| | Boeing Co., Sr. Unsecd. Note, 3.950%, 8/1/2059 | |

| | Boeing Co., Sr. Unsecd. Note, 4.508%, 5/1/2023 | |

| | Boeing Co., Sr. Unsecd. Note, 5.705%, 5/1/2040 | |

| | Embraer Netherlands BV, Sr. Unsecd. Note, 5.050%, 6/15/2025 | |

| | Embraer SA, Sr. Unsecd. Note, 5.150%, 6/15/2022 | |

| | Hexcel Corp., Sr. Unsecd. Note, 3.950%, 2/15/2027 | |

| | Huntington Ingalls Industries, Inc., Sr. Unsecd. Note, 3.483%, 12/1/2027 | |

| | Leidos, Inc., Unsecd. Note, 144A, 3.625%, 5/15/2025 | |

| | Leidos, Inc., Unsecd. Note, 144A, 4.375%, 5/15/2030 | |

| | Northrop Grumman Corp., Sr. Unsecd. Note, 3.250%, 1/15/2028 | |

| | Textron Financial Corp., Jr. Sub. Note, 144A, 1.956% (3-month USLIBOR +1.735%), 2/15/2042 | |

| | Textron, Inc., Sr. Unsecd. Note, 2.450%, 3/15/2031 | |

| | Textron, Inc., Sr. Unsecd. Note, 4.300%, 3/1/2024 | |

| | | |

| | Capital Goods - Building Materials—0.6% | |

| | Allegion PLC, Sr. Unsecd. Note, 3.500%, 10/1/2029 | |

| | Allegion US Holdings Co., Inc., Sr. Unsecd. Note, 3.200%, 10/1/2024 | |

| | Allegion US Holdings Co., Inc., Sr. Unsecd. Note, 3.550%, 10/1/2027 | |

| | Carrier Global Corp., Sr. Unsecd. Note, 2.700%, 2/15/2031 | |

| | Masco Corp., Sr. Unsecd. Note, 4.500%, 5/15/2047 | |

| | | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | Capital Goods - Construction Machinery—0.4% | |

| | CNH Industrial NV, Sr. Unsecd. Note, Series MTN, 3.850%, 11/15/2027 | |

| | Capital Goods - Diversified Manufacturing—3.6% | |

| | General Electric Co., Sr. Unsecd. Note, 3.375%, 3/11/2024 | |

| | General Electric Co., Sr. Unsecd. Note, 4.250%, 5/1/2040 | |

| | Lennox International, Inc., Sr. Unsecd. Note, 1.700%, 8/1/2027 | |

| | Otis Worldwide Corp., Sr. Unsecd. Note, Series WI, 2.565%, 2/15/2030 | |

| | Roper Technologies, Inc., Sr. Unsecd. Note, 2.950%, 9/15/2029 | |

| | Roper Technologies, Inc., Sr. Unsecd. Note, 3.850%, 12/15/2025 | |

| | Roper Technologies, Inc., Sr. Unsecd. Note, 4.200%, 9/15/2028 | |

| | United Technologies Corp., Sr. Unsecd. Note, 4.125%, 11/16/2028 | |

| | United Technologies Corp., Sr. Unsecd. Note, 4.150%, 5/15/2045 | |

| | Wabtec Corp., Sr. Unsecd. Note, 3.200%, 6/15/2025 | |

| | Xylem, Inc., Sr. Unsecd. Note, 2.250%, 1/30/2031 | |

| | | |

| | Capital Goods - Packaging—0.6% | |

| | Packaging Corp. of America, Sr. Unsecd. Note, 3.650%, 9/15/2024 | |

| | Packaging Corp. of America, Sr. Unsecd. Note, 4.500%, 11/1/2023 | |

| | Sonoco Products Co., Sr. Unsecd. Note, 5.750%, 11/1/2040 | |

| | WestRock Co., Sr. Unsecd. Note, 4.000%, 3/1/2023 | |

| | WestRock Co., Sr. Unsecd. Note, Series WI, 4.000%, 3/15/2028 | |

| | | |

| | Communications - Cable & Satellite—1.8% | |

| | CCO Safari II LLC, 6.484%, 10/23/2045 | |

| | Charter Communications Operating LLC, 5.375%, 5/1/2047 | |

| | Charter Communications Operating, LLC/Charter Communications Operating Capital Corp., Sec. Fac. Bond, 3.850%, 4/1/2061 | |

| | Charter Communications, Inc., 4.200%, 3/15/2028 | |

| | Cox Communications, Inc., Sr. Unsecd. Note, 144A, 3.350%, 9/15/2026 | |

| | Time Warner Cable, Inc., Company Guarantee, 5.500%, 9/1/2041 | |

| | | |

| | Communications - Media & Entertainment—2.7% | |

| | Discovery Communications LLC, Sr. Unsecd. Note, 4.650%, 5/15/2050 | |

| | Fox Corp, Sr. Unsecd. Note, Series WI, 4.709%, 1/25/2029 | |

| | Fox Corp, Sr. Unsecd. Note, Series WI, 5.576%, 1/25/2049 | |

| | Grupo Televisa S.A., 6.625%, 3/18/2025 | |

| | Grupo Televisa S.A., Sr. Unsecd. Note, 5.000%, 5/13/2045 | |

| | Interpublic Group of Cos., Inc., Sr. Unsecd. Note, 4.000%, 3/15/2022 | |

| | Omnicom Group, Inc., Sr. Unsecd. Note, 3.650%, 11/1/2024 | |

| | Omnicom Group, Inc., Sr. Unsecd. Note, 4.200%, 6/1/2030 | |

| | ViacomCBS, Inc., Sr. Unsecd. Note, 3.700%, 8/15/2024 | |

| | ViacomCBS, Inc., Sr. Unsecd. Note, 4.900%, 8/15/2044 | |

| | ViacomCBS, Inc., Sr. Unsecd. Note, 4.950%, 1/15/2031 | |

| | ViacomCBS, Inc., Sr. Unsecd. Note, Series WI, 3.700%, 6/1/2028 | |

| | | |

| | Communications - Telecom Wireless—4.4% | |

| | American Tower Corp., Sr. Unsecd. Note, 2.100%, 6/15/2030 | |

| | American Tower Corp., Sr. Unsecd. Note, 3.100%, 6/15/2050 | |

| | American Tower Corp., Sr. Unsecd. Note, 3.800%, 8/15/2029 | |

| | American Tower Corp., Sr. Unsecd. Note, 4.400%, 2/15/2026 | |

| | American Tower Corp., Sr. Unsecd. Note, 5.000%, 2/15/2024 | |

| | Bell Canada, Sr. Unsecd. Note, 4.464%, 4/1/2048 | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | Communications - Telecom Wireless—continued | |

| | Crown Castle International Corp., Sr. Unsecd. Note, 2.250%, 1/15/2031 | |

| | Crown Castle International Corp., Sr. Unsecd. Note, 4.450%, 2/15/2026 | |

| | Crown Castle International Corp., Sr. Unsecd. Note, 5.200%, 2/15/2049 | |

| | TELUS Corp., Sr. Unsecd. Note, 2.800%, 2/16/2027 | |

| | T-Mobile USA, Inc., Sec. Fac. Bond, 144A, 3.875%, 4/15/2030 | |

| | T-Mobile USA, Inc., Sec. Fac. Bond, 144A, 4.500%, 4/15/2050 | |

| | T-Mobile USA, Inc., Sr. Sub. Note, 144A, 3.000%, 2/15/2041 | |

| | Vodafone Group PLC, Sr. Unsecd. Note, 4.125%, 5/30/2025 | |

| | Vodafone Group PLC, Sr. Unsecd. Note, 4.250%, 9/17/2050 | |

| | Vodafone Group PLC, Sr. Unsecd. Note, 5.250%, 5/30/2048 | |

| | | |

| | Communications - Telecom Wirelines—6.6% | |

| | AT&T, Inc., Sr. Unsecd. Note, 2.550%, 12/1/2033 | |

| | AT&T, Inc., Sr. Unsecd. Note, 2.750%, 6/1/2031 | |

| | AT&T, Inc., Sr. Unsecd. Note, 3.500%, 6/1/2041 | |

| | AT&T, Inc., Sr. Unsecd. Note, 3.650%, 6/1/2051 | |

| | AT&T, Inc., Sr. Unsecd. Note, 3.850%, 6/1/2060 | |

| | AT&T, Inc., Sr. Unsecd. Note, 4.300%, 2/15/2030 | |

| | AT&T, Inc., Sr. Unsecd. Note, 4.350%, 3/1/2029 | |

| | AT&T, Inc., Sr. Unsecd. Note, 5.450%, 3/1/2047 | |

| | AT&T, Inc., Sr. Unsecd. Note, 6.375%, 3/1/2041 | |

| | AT&T, Inc., Sr. Unsecd. Note, Series WI, 5.300%, 8/15/2058 | |

| | Telefonica Emisiones SAU, Company Guarantee, 5.462%, 2/16/2021 | |

| | Telefonica Emisiones SAU, Sr. Unsecd. Note, 5.213%, 3/8/2047 | |

| | Telefonica Emisiones SAU, Sr. Unsecd. Note, 5.520%, 3/1/2049 | |

| | Telefonica SA, Company Guarantee, 7.045%, 6/20/2036 | |

| | Verizon Communications, Inc., Sr. Unsecd. Note, 1.680%, 10/30/2030 | |

| | Verizon Communications, Inc., Sr. Unsecd. Note, 4.000%, 3/22/2050 | |

| | Verizon Communications, Inc., Sr. Unsecd. Note, 4.125%, 3/16/2027 | |

| | Verizon Communications, Inc., Sr. Unsecd. Note, 4.125%, 8/15/2046 | |

| | Verizon Communications, Inc., Sr. Unsecd. Note, 4.522%, 9/15/2048 | |

| | Verizon Communications, Inc., Sr. Unsecd. Note, 4.672%, 3/15/2055 | |

| | | |

| | Consumer Cyclical - Automotive—3.0% | |

| | Fiat Chrysler Automobiles NV, Sr. Unsecd. Note, 5.250%, 4/15/2023 | |

| | Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 3.336%, 3/18/2021 | |

| | Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 3.339%, 3/28/2022 | |

| | Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 3.350%, 11/1/2022 | |

| | General Motors Co., Sr. Unsecd. Note, 4.000%, 4/1/2025 | |

| | General Motors Co., Sr. Unsecd. Note, 5.200%, 4/1/2045 | |

| | General Motors Co., Sr. Unsecd. Note, 6.750%, 4/1/2046 | |

| | General Motors Financial Co., Inc., Sr. Unsecd. Note, 2.700%, 8/20/2027 | |

| | General Motors Financial Co., Inc., Sr. Unsecd. Note, 3.950%, 4/13/2024 | |

| | General Motors Financial Co., Inc., Sr. Unsecd. Note, 4.300%, 7/13/2025 | |

| | General Motors Financial Co., Inc., Unsecd. Note, 3.500%, 11/7/2024 | |

| | Hyundai Capital America, Sr. Unsecd. Note, 144A, 2.375%, 2/10/2023 | |

| | Hyundai Capital America, Sr. Unsecd. Note, 144A, 2.375%, 10/15/2027 | |

| | Volkswagen Group of America Finance LLC, Sr. Unsecd. Note, 144A, 4.000%, 11/12/2021 | |

| | Volkswagen Group of America Finance LLC, Sr. Unsecd. Note, 144A, 4.250%, 11/13/2023 | |

| | | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | Consumer Cyclical - Retailers—4.5% | |

| | Advance Auto Parts, Inc., Sr. Unsecd. Note, 1.750%, 10/1/2027 | |

| | Advance Auto Parts, Inc., Sr. Unsecd. Note, Series WI, 3.900%, 4/15/2030 | |

| | Alimentation Couche-Tard, Inc., Sr. Unsecd. Note, 144A, 3.800%, 1/25/2050 | |

| | AutoNation, Inc., Sr. Unsecd. Note, 4.500%, 10/1/2025 | |

| | AutoNation, Inc., Sr. Unsecd. Note, 4.750%, 6/1/2030 | |

| | AutoZone, Inc., Sr. Unsecd. Note, 3.125%, 4/21/2026 | |

| | AutoZone, Inc., Sr. Unsecd. Note, 4.000%, 4/15/2030 | |

| | CVS Health Corp., Sr. Unsecd. Note, 3.875%, 7/20/2025 | |

| | CVS Health Corp., Sr. Unsecd. Note, 5.050%, 3/25/2048 | |

| | CVS Health Corp., Sr. Unsecd. Note, 5.125%, 7/20/2045 | |

| | Dollar General Corp., Sr. Unsecd. Note, 4.125%, 5/1/2028 | |

| | Dollar General Corp., Sr. Unsecd. Note, 4.150%, 11/1/2025 | |

| | Dollar Tree, Inc., Sr. Unsecd. Note, 3.700%, 5/15/2023 | |

| | O’Reilly Automotive, Inc., Sr. Unsecd. Note, 1.750%, 3/15/2031 | |

| | O’Reilly Automotive, Inc., Sr. Unsecd. Note, 4.200%, 4/1/2030 | |

| | Tractor Supply Co., Sr. Unsecd. Note, 1.750%, 11/1/2030 | |

| | | |

| | Consumer Cyclical - Services—0.9% | |

| | Booking Holdings, Inc., Sr. Unsecd. Note, 4.625%, 4/13/2030 | |

| | Expedia Group, Inc., Sr. Unsecd. Note, 3.800%, 2/15/2028 | |

| | IHS Markit Ltd., Sr. Unsecd. Note, 4.750%, 8/1/2028 | |

| | | |

| | Consumer Non-Cyclical - Food/Beverage—6.8% | |

| | Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 3.650%, 2/1/2026 | |

| | Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 4.900%, 2/1/2046 | |

| | Anheuser-Busch InBev Finance, Inc., 4.900%, 2/1/2046 | |

| | Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 4.350%, 6/1/2040 | |

| | Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 4.439%, 10/6/2048 | |

| | Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 4.750%, 1/23/2029 | |

| | Bacardi Ltd., Sr. Unsecd. Note, 144A, 2.750%, 7/15/2026 | |

| | Conagra Brands, Inc., Sr. Unsecd. Note, 1.375%, 11/1/2027 | |

| | Constellation Brands, Inc., Sr. Unsecd. Note, 5.250%, 11/15/2048 | |

| | Flowers Foods, Inc., Sr. Unsecd. Note, 3.500%, 10/1/2026 | |

| | General Mills, Inc., Sr. Unsecd. Note, 4.550%, 4/17/2038 | |

| | General Mills, Inc., Sr. Unsecd. Note, 4.700%, 4/17/2048 | |

| | Grupo Bimbo S.A.B. de CV, Sr. Unsecd. Note, 144A, 3.875%, 6/27/2024 | |

| | Grupo Bimbo S.A.B. de CV, Sr. Unsecd. Note, 144A, 4.500%, 1/25/2022 | |

| | Heineken NV, Sr. Unsecd. Note, 144A, 4.350%, 3/29/2047 | |

| | Kerry Group Financial Services, Sr. Unsecd. Note, 144A, 3.200%, 4/9/2023 | |

| | Keurig Dr Pepper, Inc., Sr. Unsecd. Note, 4.417%, 5/25/2025 | |

| | Keurig Dr Pepper, Inc., Sr. Unsecd. Note, 5.085%, 5/25/2048 | |

| | McCormick & Co., Inc., Sr. Unsecd. Note, 3.400%, 8/15/2027 | |

| | Smithfield Foods, Inc., Sr. Unsecd. Note, 144A, 2.650%, 10/3/2021 | |

| | Smithfield Foods, Inc., Sr. Unsecd. Note, 144A, 3.000%, 10/15/2030 | |

| | Smithfield Foods, Inc., Sr. Unsecd. Note, 144A, 4.250%, 2/1/2027 | |

| | Smucker (J.M.) Co., Sr. Unsecd. Note, 2.375%, 3/15/2030 | |

| | Smucker (J.M.) Co., Sr. Unsecd. Note, 3.500%, 3/15/2025 | |

| | Tyson Foods, Inc., 3.950%, 8/15/2024 | |

| | Tyson Foods, Inc., Sr. Unsecd. Note, 3.550%, 6/2/2027 | |

| | | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | Consumer Non-Cyclical - Health Care—2.1% | |

| | Agilent Technologies, Inc., Sr. Unsecd. Note, 2.100%, 6/4/2030 | |

| | Agilent Technologies, Inc., Sr. Unsecd. Note, 2.750%, 9/15/2029 | |

| | Agilent Technologies, Inc., Sr. Unsecd. Note, 3.200%, 10/1/2022 | |

| | Alcon Finance Corp., Sr. Unsecd. Note, 144A, 2.600%, 5/27/2030 | |

| | Alcon Finance Corp., Sr. Unsecd. Note, 144A, 3.000%, 9/23/2029 | |

| | Becton Dickinson & Co., Sr. Unsecd. Note, 3.734%, 12/15/2024 | |

| | Becton Dickinson & Co., Sr. Unsecd. Note, 4.669%, 6/6/2047 | |

| | Becton Dickinson & Co., Sr. Unsecd. Note, 4.685%, 12/15/2044 | |

| | Danaher Corp., Sr. Unsecd. Note, 2.600%, 10/1/2050 | |

| | Dentsply Sirona, Inc., Sr. Unsecd. Note, 3.250%, 6/1/2030 | |

| | Laboratory Corp. of America Holdings, Sr. Unsecd. Note, 3.750%, 8/23/2022 | |

| | PerkinElmer, Inc., Sr. Unsecd. Note, 3.300%, 9/15/2029 | |

| | Thermo Fisher Scientific, Inc., Sr. Unsecd. Note, 4.133%, 3/25/2025 | |

| | | |

| | Consumer Non-Cyclical - Pharmaceuticals—5.1% | |

| | AbbVie, Inc., Sr. Unsecd. Note, 3.200%, 11/21/2029 | |

| | AbbVie, Inc., Sr. Unsecd. Note, 4.250%, 11/21/2049 | |

| | Amgen, Inc., Sr. Unsecd. Note, 2.450%, 2/21/2030 | |

| | AstraZeneca PLC, Sr. Unsecd. Note, 2.375%, 6/12/2022 | |

| | AstraZeneca PLC, Sr. Unsecd. Note, 4.000%, 1/17/2029 | |

| | Bayer US Finance II LLC, Sr. Unsecd. Note, 144A, 4.625%, 6/25/2038 | |

| | Bayer US Finance II LLC, Sr. Unsecd. Note, 144A, 4.875%, 6/25/2048 | |

| | Biogen, Inc., Sr. Unsecd. Note, 3.150%, 5/1/2050 | |

| | Royalty Pharma PLC, Sr. Unsecd. Note, 144A, 1.750%, 9/2/2027 | |

| | Shire Acquisitions Investments Ireland DAC, Sr. Unsecd. Note, 2.400%, 9/23/2021 | |

| | Takeda Pharmaceutical Co. Ltd., Sr. Unsecd. Note, 2.050%, 3/31/2030 | |

| | Takeda Pharmaceutical Co. Ltd., Sr. Unsecd. Note, 3.025%, 7/9/2040 | |

| | | |

| | Consumer Non-Cyclical - Supermarkets—0.5% | |

| | Kroger Co., 3.950%, 1/15/2050 | |

| | Kroger Co., Bond, 6.900%, 4/15/2038 | |

| | | |

| | Consumer Non-Cyclical - Tobacco—1.7% | |

| | Altria Group, Inc., Sr. Unsecd. Note, 4.800%, 2/14/2029 | |

| | Altria Group, Inc., Sr. Unsecd. Note, 5.950%, 2/14/2049 | |

| | Bat Capital Corp., Sr. Unsecd. Note, Series WI, 3.557%, 8/15/2027 | |

| | Bat Capital Corp., Sr. Unsecd. Note, Series WI, 4.540%, 8/15/2047 | |

| | Reynolds American, Inc., Sr. Unsecd. Note, 5.850%, 8/15/2045 | |

| | Reynolds American, Inc., Sr. Unsecd. Note, 7.000%, 8/4/2041 | |

| | | |

| | Energy - Independent—1.4% | |

| | Canadian Natural Resources Ltd., Sr. Unsecd. Note, 2.050%, 7/15/2025 | |

| | Canadian Natural Resources Ltd., Sr. Unsecd. Note, 3.800%, 4/15/2024 | |

| | Cimarex Energy Co., Sr. Unsecd. Note, 3.900%, 5/15/2027 | |

| | Cimarex Energy Co., Sr. Unsecd. Note, 4.375%, 3/15/2029 | |

| | Marathon Oil Corp., Sr. Unsecd. Note, 3.850%, 6/1/2025 | |

| | | |

| | | |

| | Husky Energy, Inc., 4.000%, 4/15/2024 | |

| | Husky Energy, Inc., Sr. Unsecd. Note, 4.400%, 4/15/2029 | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | Energy - Integrated—continued | |

| | Petro-Canada, Bond, 5.350%, 7/15/2033 | |

| | Petroleos Mexicanos, Sr. Unsecd. Note, 6.500%, 3/13/2027 | |

| | Suncor Energy, Inc., Sr. Unsecd. Note, 2.800%, 5/15/2023 | |

| | | |

| | | |

| | Boardwalk Pipeline Partners LP, Sr. Unsecd. Note, 3.400%, 2/15/2031 | |

| | Boardwalk Pipeline Partners LP, Sr. Unsecd. Note, 4.800%, 5/3/2029 | |

| | Columbia Pipeline Group, Inc., Sr. Unsecd. Note, 4.500%, 6/1/2025 | |

| | Columbia Pipeline Group, Inc., Sr. Unsecd. Note, 5.800%, 6/1/2045 | |

| | Energy Transfer Operating, Sr. Unsecd. Note, 5.000%, 5/15/2050 | |

| | Energy Transfer Partners LP, Sr. Unsecd. Note, 4.900%, 2/1/2024 | |

| | Energy Transfer Partners LP, Sr. Unsecd. Note, 5.300%, 4/15/2047 | |

| | Energy Transfer Partners LP, Sr. Unsecd. Note, 6.125%, 12/15/2045 | |

| | Enterprise Products Operating LLC, Sr. Unsecd. Note, 3.700%, 1/31/2051 | |

| | Enterprise Products Operating LLC, Sr. Unsecd. Note, 4.250%, 2/15/2048 | |

| | Enterprise Products Operating LLC, Sr. Unsecd. Note, 4.850%, 3/15/2044 | |

| | Kinder Morgan Energy Partners LP, 4.250%, 9/1/2024 | |

| | Kinder Morgan Energy Partners LP, Sr. Unsecd. Note, 6.375%, 3/1/2041 | |

| | Kinder Morgan, Inc., 5.050%, 2/15/2046 | |

| | Kinder Morgan, Inc., Sr. Unsecd. Note, 4.300%, 3/1/2028 | |

| | MPLX LP, Sr. Unsecd. Note, 2.650%, 8/15/2030 | |

| | MPLX LP, Sr. Unsecd. Note, 4.125%, 3/1/2027 | |

| | MPLX LP, Sr. Unsecd. Note, 4.900%, 4/15/2058 | |

| | MPLX LP, Sr. Unsecd. Note, Series WI, 4.250%, 12/1/2027 | |

| | ONEOK, Inc., Sr. Unsecd. Note, 4.950%, 7/13/2047 | |

| | TC Pipelines, LP, Sr. Unsecd. Note, 3.900%, 5/25/2027 | |

| | Texas Eastern Transmission LP, Sr. Unsecd. Note, 144A, 2.800%, 10/15/2022 | |

| | Williams Partners LP, Sr. Unsecd. Note, 3.900%, 1/15/2025 | |

| | Williams Partners LP, Sr. Unsecd. Note, 4.900%, 1/15/2045 | |

| | | |

| | | |

| | Marathon Petroleum Corp., Sr. Unsecd. Note, 3.625%, 9/15/2024 | |

| | Marathon Petroleum Corp., Sr. Unsecd. Note, 6.500%, 3/1/2041 | |

| | Phillips 66, Sr. Unsecd. Note, 1.300%, 2/15/2026 | |

| | Phillips 66, Sr. Unsecd. Note, 4.875%, 11/15/2044 | |

| | Valero Energy Corp., Sr. Unsecd. Note, 4.000%, 4/1/2029 | |

| | Valero Energy Corp., Sr. Unsecd. Note, 4.900%, 3/15/2045 | |

| | | |

| | Financial Institution - Banking—6.1% | |

| | Associated Banc-Corp., Sub. Note, 4.250%, 1/15/2025 | |

| | Bank of America Corp., Sub. Note, Series L, 3.950%, 4/21/2025 | |

| | Bank of America Corp., Sub. Note, Series L, 4.183%, 11/25/2027 | |

| | Bank of America Corp., Sub. Note, Series MTN, 4.000%, 1/22/2025 | |

| | Capital One Financial Corp., Sr. Unsecd. Note, 3.750%, 3/9/2027 | |

| | Capital One Financial Corp., Sr. Unsecd. Note, 3.900%, 1/29/2024 | |

| | Citigroup, Inc., 4.125%, 7/25/2028 | |

| | Citigroup, Inc., 5.500%, 9/13/2025 | |

| | Citigroup, Inc., Sub. Note, 3.875%, 3/26/2025 | |

| | Citizens Financial Group, Inc., Sub. Note, 144A, 2.638%, 9/30/2032 | |

| | Comerica, Inc., 3.800%, 7/22/2026 | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | Financial Institution - Banking—continued | |

| | Compass Bank, Birmingham, Sub. Note, Series BKNT, 3.875%, 4/10/2025 | |

| | Fifth Third Bancorp, Sr. Unsecd. Note, 3.650%, 1/25/2024 | |

| | Fifth Third Bancorp, Sr. Unsecd. Note, 3.950%, 3/14/2028 | |

| | FNB Corp. (PA), Sr. Unsecd. Note, 2.200%, 2/24/2023 | |

| | Goldman Sachs Group, Inc., Sub. Note, 4.250%, 10/21/2025 | |

| | Huntington Bancshares, Inc., Sr. Unsecd. Note, 2.550%, 2/4/2030 | |

| | Morgan Stanley, Sub. Note, 5.000%, 11/24/2025 | |

| | Morgan Stanley, Sub. Note, Series MTN, 4.100%, 5/22/2023 | |

| | Synovus Bank GA, Sr. Unsecd. Note, 2.289%, 2/10/2023 | |

| | Truist Bank, Sub. Note, Series BKNT, 3.300%, 5/15/2026 | |

| | | |

| | Financial Institution - Broker/Asset Mgr/Exchange—1.0% | |

| | Jefferies Group LLC, Sr. Unsecd. Note, 2.750%, 10/15/2032 | |

| | Raymond James Financial, Inc., Sr. Unsecd. Note, 4.650%, 4/1/2030 | |

| | Stifel Financial Corp., 4.250%, 7/18/2024 | |

| | Stifel Financial Corp., Sr. Unsecd. Note, 4.000%, 5/15/2030 | |

| | | |

| | Financial Institution - Finance Companies—1.4% | |

| | Discover Bank, Sr. Unsecd. Note, Series BKNT, 4.650%, 9/13/2028 | |

| | GE Capital Funding LLC, Sr. Unsecd. Note, 144A, 4.400%, 5/15/2030 | |

| | GE Capital International Funding, Inc., Sr. Unsecd. Note, 4.418%, 11/15/2035 | |

| | | |

| | Financial Institution - Insurance - Health—1.0% | |

| | CIGNA Corp., Sr. Unsecd. Note, 3.750%, 7/15/2023 | |

| | CIGNA Corp., Sr. Unsecd. Note, 4.125%, 11/15/2025 | |

| | CIGNA Corp., Sr. Unsecd. Note, 4.900%, 12/15/2048 | |

| | | |

| | Financial Institution - Insurance - Life—1.5% | |

| | American International Group, Inc., 4.500%, 7/16/2044 | |

| | American International Group, Inc., Sr. Unsecd. Note, 4.125%, 2/15/2024 | |

| | American International Group, Inc., Sr. Unsecd. Note, 4.375%, 1/15/2055 | |

| | AXA-UAP, Sub. Note, 8.600%, 12/15/2030 | |

| | Lincoln National Corp., Sr. Note, 7.000%, 6/15/2040 | |

| | Lincoln National Corp., Sr. Unsecd. Note, 3.050%, 1/15/2030 | |

| | MetLife, Inc., Jr. Sub. Note, 10.750%, 8/1/2039 | |

| | Penn Mutual Life Insurance Co., Sr. Note, 144A, 7.625%, 6/15/2040 | |

| | | |

| | Financial Institution - Insurance - P&C—0.9% | |

| | CNA Financial Corp., Sr. Unsecd. Note, 3.900%, 5/1/2029 | |

| | Hartford Financial Services Group, Inc., Sr. Unsecd. Note, 6.625%, 4/15/2042 | |

| | Liberty Mutual Group, Inc., Sr. Unsecd. Note, 144A, 4.250%, 6/15/2023 | |

| | Liberty Mutual Group, Inc., Sr. Unsecd. Note, 144A, 4.569%, 2/1/2029 | |

| | | |

| | Financial Institution - REIT - Apartment—0.8% | |

| | Mid-America Apartment Communities LP, 4.000%, 11/15/2025 | |

| | Mid-America Apartment Communities LP, Sr. Unsecd. Note, 3.750%, 6/15/2024 | |

| | Mid-America Apartment Communities LP, Sr. Unsub. Note, 1.700%, 2/15/2031 | |

| | Post Apartment Homes LP, Sr. Unsecd. Note, 3.375%, 12/1/2022 | |

| | UDR, Inc., Sr. Unsecd. Note, 3.100%, 11/1/2034 | |

| | UDR, Inc., Sr. Unsecd. Note, Series GMTN, 3.500%, 1/15/2028 | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | Financial Institution - REIT - Apartment—continued | |

| | UDR, Inc., Sr. Unsecd. Note, Series MTN, 2.100%, 8/1/2032 | |

| | | |

| | Financial Institution - REIT - Healthcare—1.1% | |

| | Healthcare Trust of America, Sr. Unsecd. Note, 2.000%, 3/15/2031 | |

| | Healthcare Trust of America, Sr. Unsecd. Note, 3.100%, 2/15/2030 | |

| | Physicians Realty Trust, Sr. Unsecd. Note, 3.950%, 1/15/2028 | |

| | Welltower, Inc., Sr. Unsecd. Note, 4.125%, 3/15/2029 | |

| | | |

| | Financial Institution - REIT - Office—0.8% | |

| | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 1.875%, 2/1/2033 | |

| | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 3.950%, 1/15/2027 | |

| | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 3.950%, 1/15/2028 | |

| | Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 4.900%, 12/15/2030 | |

| | Boston Properties LP, Sr. Unsecd. Note, 2.900%, 3/15/2030 | |

| | | |

| | Financial Institution - REIT - Other—0.7% | |

| | ProLogis LP, Sr. Unsecd. Note, 4.375%, 2/1/2029 | |

| | WP Carey, Inc., Sr. Unsecd. Note, 2.400%, 2/1/2031 | |

| | WP Carey, Inc., Sr. Unsecd. Note, 3.850%, 7/15/2029 | |

| | WP Carey, Inc., Sr. Unsecd. Note, 4.600%, 4/1/2024 | |

| | | |

| | Financial Institution - REIT - Retail—1.1% | |

| | Kimco Realty Corp., Sr. Unsecd. Note, 2.800%, 10/1/2026 | |

| | Kimco Realty Corp., Sr. Unsecd. Note, 3.400%, 11/1/2022 | |

| | Kimco Realty Corp., Sr. Unsecd. Note, 3.800%, 4/1/2027 | |

| | Regency Centers LP, Sr. Unsecd. Note, 3.700%, 6/15/2030 | |

| | Regency Centers LP, Sr. Unsecd. Note, 4.125%, 3/15/2028 | |

| | Tanger Properties LP, Sr. Unsecd. Note, 3.125%, 9/1/2026 | |

| | Tanger Properties LP, Sr. Unsecd. Note, 3.875%, 12/1/2023 | |

| | | |

| | | |

| | Broadcom, Inc., Sr. Unsecd. Note, 4.110%, 9/15/2028 | |

| | Broadcom, Inc., Sr. Unsecd. Note, 4.150%, 11/15/2030 | |

| | Dell International LLC / EMC Corp., 144A, 4.000%, 7/15/2024 | |

| | Diamond 1 Finance Corp./Diamond 2 Finance Corp., Sr. Secd. Note, 144A, 6.020%, 6/15/2026 | |

| | Equifax, Inc., Sr. Unsecd. Note, 2.600%, 12/1/2024 | |

| | Equifax, Inc., Sr. Unsecd. Note, Series 5Y, 3.950%, 6/15/2023 | |

| | Equifax, Inc., Sr. Unsecd. Note, Series FXD, 3.600%, 8/15/2021 | |

| | Experian Finance PLC., Sr. Unsecd. Note, 144A, 4.250%, 2/1/2029 | |

| | Fidelity National Information Services, Inc., Sr. Unsecd. Note, 3.750%, 5/21/2029 | |

| | Fiserv, Inc., Sr. Unsecd. Note, 3.500%, 7/1/2029 | |

| | Fiserv, Inc., Sr. Unsecd. Note, 3.800%, 10/1/2023 | |

| | Ingram Micro, Inc., Sr. Unsecd. Note, 5.000%, 8/10/2022 | |

| | Ingram Micro, Inc., Sr. Unsecd. Note, 5.450%, 12/15/2024 | |

| | Keysight Technologies, Inc., 4.550%, 10/30/2024 | |

| | Lam Research Corp., Sr. Unsecd. Note, 4.000%, 3/15/2029 | |

| | Micron Technology, Inc., Sr. Unsecd. Note, 4.640%, 2/6/2024 | |

| | Micron Technology, Inc., Sr. Unsecd. Note, 4.975%, 2/6/2026 | |

| | Molex Electronics Technologies LLC, Unsecd. Note, 144A, 3.900%, 4/15/2025 | |

| | Total System Services, Inc., Sr. Unsecd. Note, 4.450%, 6/1/2028 | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | | |

| | Total System Services, Inc., Sr. Unsecd. Note, 4.800%, 4/1/2026 | |

| | Verisk Analytics, Inc., Sr. Unsecd. Note, 4.125%, 9/12/2022 | |

| | Verisk Analytics, Inc., Sr. Unsecd. Note, 4.125%, 3/15/2029 | |

| | | |

| | Transportation - Airlines—0.3% | |

| | Southwest Airlines Co., Sr. Unsecd. Note, 4.750%, 5/4/2023 | |

| | Southwest Airlines Co., Sr. Unsecd. Note, 5.250%, 5/4/2025 | |

| | | |

| | Transportation - Railroads—1.1% | |

| | Canadian Pacific Railway Co., 7.125%, 10/15/2031 | |

| | Canadian Pacific Railway Co., Sr. Unsecd. Note, 2.050%, 3/5/2030 | |

| | Canadian Pacific Railway Co., Sr. Unsecd. Note, 4.450%, 3/15/2023 | |

| | Kansas City Southern Industries, Inc., Sr. Unsecd. Note, 3.000%, 5/15/2023 | |

| | Kansas City Southern Industries, Inc., Sr. Unsecd. Note, 4.700%, 5/1/2048 | |

| | Union Pacific Corp., Sr. Unsecd. Note, 2.400%, 2/5/2030 | |

| | | |

| | Transportation - Services—1.6% | |

| | Enterprise Rent-A-Car USA Finance Co., Sr. Unsecd. Note, 144A, 5.625%, 3/15/2042 | |

| | FedEx Corp., Sr. Unsecd. Note, 3.100%, 8/5/2029 | |

| | FedEx Corp., Sr. Unsecd. Note, 4.050%, 2/15/2048 | |

| | Penske Truck Leasing Co. LP & PTL Finance Corp., Sr. Unsecd. Note, 144A, 3.950%, 3/10/2025 | |

| | Ryder System, Inc., Sr. Unsecd. Note, Series MTN, 2.900%, 12/1/2026 | |

| | Ryder System, Inc., Sr. Unsecd. Note, Series MTN, 3.400%, 3/1/2023 | |

| | | |

| | | |

| | AEP Texas, Inc., Sr. Unsecd. Note, 3.850%, 10/1/2025 | |

| | Ameren Corp., Sr. Unsecd. Note, 3.650%, 2/15/2026 | |

| | American Electric Power Co., Inc., Sr. Unsecd. Note, Series F, 2.950%, 12/15/2022 | |

| | Appalachian Power Co., Sr. Unsecd. Note, 7.000%, 4/1/2038 | |

| | Black Hills Corp., Sr. Unsecd. Note, 2.500%, 6/15/2030 | |

| | Dominion Energy, Inc., Jr. Sub. Note, 3.071%, 8/15/2024 | |

| | Dominion Energy, Inc., Sr. Unsecd. Note, 4.250%, 6/1/2028 | |

| | Duke Energy Corp., Sr. Unsecd. Note, 2.650%, 9/1/2026 | |

| | EDP Finance BV, Sr. Unsecd. Note, 144A, 1.710%, 1/24/2028 | |

| | EDP Finance BV, Sr. Unsecd. Note, 144A, 3.625%, 7/15/2024 | |

| | Emera US Finance LP, Sr. Unsecd. Note, 4.750%, 6/15/2046 | |

| | Enel Finance International NV, Sr. Unsecd. Note, 144A, 4.625%, 9/14/2025 | |

| | Enel Finance International NV, Sr. Unsecd. Note, 144A, 4.875%, 6/14/2029 | |

| | Exelon Corp., Sr. Unsecd. Note, 3.950%, 6/15/2025 | |

| | Exelon Corp., Sr. Unsecd. Note, 4.700%, 4/15/2050 | |

| | FirstEnergy Transmission LLC, Sr. Unsecd. Note, 144A, 4.550%, 4/1/2049 | |

| | Fortis, Inc. / Canada, Sr. Unsecd. Note, 3.055%, 10/4/2026 | |

| | National Rural Utilities Cooperative Finance Corp., Sr. Sub. Note, 5.250%, 4/20/2046 | |

| | NextEra Energy Capital Holdings, Inc., Sr. Unsecd. Note, 3.550%, 5/1/2027 | |

| | NiSource Finance Corp., Sr. Unsecd. Note, 3.950%, 3/30/2048 | |

| | NiSource Finance Corp., Sr. Unsecd. Note, 4.375%, 5/15/2047 | |

| | Northeast Utilities, Sr. Unsecd. Note, Series H, 3.150%, 1/15/2025 | |

| | PPL Capital Funding, Inc., Sr. Unsecd. Note, 3.950%, 3/15/2024 | |

| | PPL WEM Holdings PLC, Sr. Unsecd. Note, 144A, 5.375%, 5/1/2021 | |

Annual Shareholder Report

| | | |

| | CORPORATE BONDS—continued | |

| | Utility - Electric—continued | |

| | Southern Co., Jr. Sub. Note, Series B, 4.000%, 1/15/2051 | |

| | | |

| | Utility - Natural Gas—1.9% | |

| | Dominion Energy Gas Holdings LLC, Sr. Unsecd. Note, Series B, 3.000%, 11/15/2029 | |

| | Dominion Energy Gas Holdings LLC, Sr. Unsecd. Note, Series C, 3.900%, 11/15/2049 | |

| | Enbridge Energy Partners LP, 5.875%, 10/15/2025 | |

| | Enbridge Energy Partners LP, Sr. Unsecd. Note, 5.500%, 9/15/2040 | |

| | Enbridge, Inc., Sr. Unsecd. Note, 3.125%, 11/15/2029 | |

| | National Fuel Gas Co., Sr. Unsecd. Note, 3.750%, 3/1/2023 | |

| | National Fuel Gas Co., Sr. Unsecd. Note, 3.950%, 9/15/2027 | |

| | National Fuel Gas Co., Sr. Unsecd. Note, 4.900%, 12/1/2021 | |

| | National Fuel Gas Co., Sr. Unsecd. Note, 5.500%, 1/15/2026 | |

| | Sempra Energy, Sr. Unsecd. Note, 3.400%, 2/1/2028 | |

| | Sempra Energy, Sr. Unsecd. Note, 3.550%, 6/15/2024 | |

| | Sempra Energy, Sr. Unsecd. Note, 4.000%, 2/1/2048 | |

| | Southern Natural Gas, Sr. Unsecd. Note, 144A, 4.800%, 3/15/2047 | |

| | | |

| | Utility - Natural Gas Distributor—0.1% | |

| | The East Ohio Gas Company, Sr. Unsecd. Note, 144A, 3.000%, 6/15/2050 | |

| | TOTAL CORPORATE BONDS

(IDENTIFIED COST $117,555,730) | |

| | FOREIGN GOVERNMENTS/AGENCIES—4.0% | |

| | | |

| | Colombia, Government of, Sr. Unsecd. Note, 3.000%, 1/30/2030 | |

| | Colombia, Government of, Sr. Unsecd. Note, 3.875%, 4/25/2027 | |

| | Colombia, Government of, Sr. Unsecd. Note, 4.500%, 3/15/2029 | |

| | Mexico, Government of, 3.750%, 1/11/2028 | |

| | Mexico, Government of, Series MTN, 4.750%, 3/8/2044 | |

| | Mexico, Government of, Series MTNA, 6.750%, 9/27/2034 | |

| | Mexico, Government of, Sr. Unsecd. Note, 3.250%, 4/16/2030 | |

| | Mexico, Government of, Sr. Unsecd. Note, 3.600%, 1/30/2025 | |

| | Mexico, Government of, Sr. Unsecd. Note, 4.500%, 1/31/2050 | |

| | Mexico, Government of, Sr. Unsecd. Note, 4.500%, 4/22/2029 | |

| | Peru, Government of, 6.550%, 3/14/2037 | |

| | TOTAL FOREIGN GOVERNMENTS/AGENCIES

(IDENTIFIED COST $5,149,954) | |

| | REPURCHASE AGREEMENT—2.2% | |

| | Interest in $1,000,000,000 joint repurchase agreement 0.08%, dated 12/31/2020 under which Bank of Montreal will repurchase securities provided as collateral for $1,000,008,889 on 1/4/2021. The securities provided as collateral at the end of the period held with BNY Mellon as tri-party agent, were U.S. Government Agency and U.S. Treasury securities with various maturities to 5/20/2069 and the market value of those underlying securities was $1,022,038,963.

(IDENTIFIED COST $3,247,000) | |

| | | |

| | Federated Hermes Government Obligations Fund, Premier Shares, 0.01%3

(IDENTIFIED COST $700,235) | |

| | TOTAL INVESTMENT IN SECURITIES—99.6%

(IDENTIFIED COST $126,652,919)4 | |

| | OTHER ASSETS AND LIABILITIES - NET—0.4%5 | |

| | | |

Annual Shareholder Report

At December 31, 2020, the Fund had the following outstanding futures contracts:

| | | | Value and

Unrealized

Appreciation

(Depreciation) |

| | | | |

6U.S. Treasury Notes 2-Year Long Futures | | | | |

6U.S. Treasury Ultra Bond Long Futures | | | | |

| | | | |

6U.S. Treasury Notes 10-Year Short Futures | | | | |

NET UNREALIZED DEPRECIATION ON FUTURES CONTRACTS | |

Net Unrealized Depreciation on Futures Contracts is included in “Other Assets and Liabilities—Net.”

Affiliated fund holdings are investment companies which are managed by the Adviser or an affiliate of the Adviser. Transactions with the affiliated fund holdings during the period ended December 31, 2020, were as follows:

| Federated Hermes

Government

Obligations Fund,

Premier Shares* |

| |

| |

| |

Change in Unrealized Appreciation/Depreciation | |

| |

| |

Shares Held as of 12/31/2020 | |

| |

| All or a portion of the balance/activity for the fund relates to cash collateral received on securities lending transactions. |

| All or a portion of these securities are temporarily on loan to unaffiliated broker/dealers. |

| Floating/variable note with current rate and current maturity or next reset date shown. |

| |

| Also represents cost for federal tax purposes. |

| Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

| Non-income-producing security. |

Note: The categories of investments are shown as a percentage of total net assets at December 31, 2020.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

Annual Shareholder Report

The following is a summary of the inputs used, as of December 31, 2020, in valuing the Fund’s assets carried at fair value:

|

| | Level 2—

Other

Significant

Observable

Inputs | Level 3—

Significant

Unobservable

Inputs | |

| | | | |

| | | | |

Foreign Governments/Agencies | | | | |

| | | | |

| | | | |

| | | | |

Other Financial Instruments:1 | | | | |

| | | | |

| | | | |

TOTAL OTHER FINANCIAL INSTRUMENTS | | | | |

| Other financial instruments are futures contracts. |

The following acronym(s) are used throughout this portfolio: | |

| |

| |

| —London Interbank Offered Rate |

| |

| —Real Estate Investment Trust |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights

(For a Share Outstanding Throughout Each Period)

| |

| | | | | |

Net Asset Value, Beginning of Period | | | | | |

Income From Investment Operations: | | | | | |

Net investment income (loss) | | | | | |

Net realized and unrealized gain (loss) | | | | | |

TOTAL FROM INVESTMENT OPERATIONS | | | | | |

| | | | | |

Distributions from net investment income | | | | | |

Distributions from net realized gain | | | | | |

| | | | | |

Net Asset Value, End of Period | | | | | |

| | | | | |

Ratios to Average Net Assets: | | | | | |

| | | | | |

| | | | | |

Expense waiver/reimbursement4 | | | | | |

| | | | | |

Net assets, end of period (000 omitted) | | | | | |

| | | | | |

| Based on net asset value. |

| Federated Investment Management Company (the “Adviser”) has contractually agreed to reimburse all operating expenses, excluding extraordinary expenses, incurred by the Fund. |

| Amount does not reflect net expenses incurred by investment companies in which the Fund may invest. |

| This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not reflect expense waiver/ reimbursement recorded by investment companies in which the Fund may invest. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and LiabilitiesDecember 31, 2020

| |

Investment in securities, at value including $681,912 of securities loaned and $700,235 of investments in an affiliated holding* (identified cost $126,652,919) | |

| |

| |

| |

Receivable for shares sold | |

Receivable for variation margin on futures contracts | |

| |

| |

Payable for shares redeemed | |

Payable for collateral due to broker for securities lending | |

Income distribution payable | |

Payable to adviser (Note 5) | |

Payable for administrative fee (Note 5) | |

Payable for portfolio accounting fees | |

Accrued expenses (Note 5) | |

| |

Net assets for 11,609,815 shares outstanding | |

| |

| |

Total distributable earnings (loss) | |

| |

Net Asset Value, Offering Price and Redemption Proceeds Per Share: | |

$143,775,389 ÷ 11,609,815 shares outstanding, no par value, unlimited shares authorized | |

| See information listed after the Fund’s Portfolio of Investments. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of OperationsYear Ended December 31, 2020

| |

| |

Net income on securities loaned (includes $18,792 earned from affiliated holdings related to cash collateral balances (Note 2)*) | |

| |

| |

Administrative fee (Note 5) | |

| |

| |

Directors’/Trustees’ fees (Note 5) | |

| |

| |

Portfolio accounting fees | |

| |

| |

| |

| |

| |

Waivers and Reimbursement: | |

Waivers/reimbursement of other operating expenses (Notes 2 and 5) | |

| |

| |

Realized and Unrealized Gain (Loss) on Investments and Futures Contracts: | |

Net realized gain on investments | |

Net realized loss on futures contracts | |

Net change in unrealized appreciation of investments | |

Net change in unrealized appreciation of futures contracts | |

Net realized and unrealized gain (loss) on investments and futures contracts | |

Change in net assets resulting from operations | |

| See information listed after the Fund’s Portfolio of Investments. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| | |

Increase (Decrease) in Net Assets | | |

| | |

Net investment income (loss) | | |

| | |

Net change in unrealized appreciation/depreciation | | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | | |

Distributions to Shareholders | | |

| | |

Proceeds from sale of shares | | |

Net asset value of shares issued to shareholders in payment of distributions declared | | |

| | |

CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | | |

| | |

| | |

| | |

| | |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

December 31, 2020

1. ORGANIZATION

Federated Hermes Managed Pool Series (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of five portfolios. The financial statements included herein are only those of Federated Hermes Corporate Bond Strategy Portfolio (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder’s interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The investment objective of the Fund is to provide total return.

Prior to June 29, 2020, the names of the Trust and Fund were Federated Managed Pool Series and Federated Corporate Bond Strategy Portfolio, respectively.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

■

Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Fund’s Board of Trustees (the “Trustees”).

■

Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs.

■

Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations.

■

Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees.

■

For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered, such as: the last traded or purchase price of the security, information obtained by contacting the issuer or dealers, analysis of the issuer’s financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded, public trading in similar securities or derivative contracts of the issuer or comparable issuers, movement of a relevant index, or other factors including but not limited to industry changes and relevant government actions.

If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a reasonable period of time as set forth in the Fund’s valuation policies and procedures, or if information furnished by a pricing service, in the opinion of the valuation committee (“Valuation Committee”), is deemed not representative of the fair value of such security, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could obtain the fair value assigned to an investment if it sold the investment at approximately the time at which the Fund determines its NAV per share, and the actual value obtained could be materially different.

Fair Valuation and Significant Events Procedures

The Trustees have ultimate responsibility for determining the fair value of investments for which market quotations are not readily available. The Trustees have appointed a Valuation Committee comprised of officers of the Fund, the Adviser and certain of the Adviser’s affiliated companies to assist in determining fair value and in overseeing the calculation of the NAV. The Trustees have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing-service evaluations including periodic reviews of third-party pricing services’ policies, procedures and valuation methods (including key inputs, methods, models and assumptions), transactional back-testing, comparisons of evaluations of different pricing services, and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Trustees. The Trustees periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for any U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for any other types of fixed-income securities and any OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment’s value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

■

With respect to securities traded principally in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts;

Annual Shareholder Report

■

Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded;

■

Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, or a natural disaster affecting the issuer’s operations or regulatory changes or market developments affecting the issuer’s industry.

The Trustees have adopted procedures whereby the Valuation Committee uses a pricing service to provide factors to update the fair value of equity securities traded principally in foreign markets from the time of the close of their respective foreign stock exchanges to the pricing time of the Fund. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment in accordance with the fair valuation procedures approved by the Trustees. The Trustees have ultimate responsibility for any fair valuations made in response to a significant event.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund’s custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Repurchase agreements are subject to Master Netting Agreements which are agreements between the Fund and its counterparties that provide for the net settlement of all transactions and collateral with the Fund, through a single payment, in the event of default or termination. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amounts but gross. As indicated above, the cash or securities to be repurchased, as shown on the Portfolio of Investments, exceeds the repurchase price to be paid under the agreement reducing the net settlement amount to zero.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions of net investment income, if any, are declared daily and paid monthly. Non-cash dividends included in dividend income, if any, are recorded at fair value. Amortization/accretion of premium and discount is included in investment income. Gains and losses realized on principal payment of mortgage-backed securities (paydown gains and losses) are classified as part of investment income. The detail of the total fund expense reimbursement of $319,816 is disclosed in Note 5.

Federal Taxes

It is the Fund’s policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended December 31, 2020, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of December 31, 2020, tax years 2017 through 2020 remain subject to examination by the Fund’s major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

When-Issued and Delayed-Delivery Transactions

The Fund may engage in when-issued or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Futures Contracts

The Fund purchases and sells financial futures contracts to manage duration risk and yield curve risk. Upon entering into a financial futures contract with a broker, the Fund is required to deposit with a broker, either U.S. government securities or a specified amount of cash, which is shown as due from broker in the Statement of Assets and Liabilities. Futures contracts are valued daily and unrealized gains or losses are recorded in a “variation margin” account. The Fund receives from or pays to the broker a specified amount of cash based upon changes in the variation margin account. When a contract is closed, the Fund recognizes a realized gain or loss. Futures contracts have market risks, including the risk that the change in the value of the contract may not correlate with the changes in the value of the underlying securities. There is minimal counterparty risk to the Fund since futures contracts are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures contracts, guarantees the futures contracts against default.

Futures contracts outstanding at period end are listed after the Fund’s Portfolio of Investments.

The average notional value of long and short futures contracts held by the Fund throughout the period was $17,267,344 and $6,642,728, respectively. This is based on amounts held as of each month-end throughout the fiscal period.

Annual Shareholder Report

Securities Lending

The Fund participates in a securities lending program providing for the lending of corporate bonds and government securities to qualified brokers. The term of the loans within the program is one year or less. The Fund normally receives cash collateral for securities loaned that may be invested in affiliated money market funds, other money market instruments and/or repurchase agreements. Investments in money market funds may include funds with a “floating” NAV that can impose redemption fees and liquidity gates, impose certain operational impediments to investing cash collateral, and, if the investee fund’s NAV decreases, result in the Fund recognizing losses and being required to cover the decrease in the value of the cash collateral. Collateral is maintained at a minimum level of 100% of the market value of investments loaned, plus interest, if applicable. In accordance with the Fund’s securities lending agreement, the market value of securities on loan is determined each day at the close of business and any additional collateral required to cover the value of securities on loan is delivered to the Fund on the next business day. Earnings on collateral are allocated between the borrower of the security, the securities lending agent, as a fee for its services under the program and the Fund, according to agreed-upon rates. The Fund will not have the right to vote on securities while they are on loan. However, the Fund will attempt to terminate a loan in an effort to reacquire the securities in time to vote on matters that are deemed to be material by the Adviser. There can be no assurance that the Fund will have sufficient notice of such matters to be able to terminate the loan in time to vote thereon.

Securities lending transactions are subject to Master Netting Agreements which are agreements between the Fund and its counterparties that provide for the net settlement of all transactions and collateral with the Fund, through a single payment, in the event of default or termination. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amounts but gross. As indicated below, the cash collateral received by the Fund exceeds the market value of the securities loaned reducing the net settlement amount to zero. The chart below identifies the amount of collateral received as well as the market value of securities on loan. Additionally, the securities lending agreement executed by the Fund includes an indemnification clause. This clause stipulates that the borrower will reimburse the Fund for any losses as a result of any failure of the borrower to return equivalent securities to the Fund.

As of December 31, 2020, securities subject to this type of arrangement and related collateral were as follows:

Market Value of

Securities Loaned | |

| |

Restricted Securities

The Fund may purchase securities which are considered restricted. Restricted securities are securities that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) are subject to contractual restrictions on public sales. In some cases, when a security cannot be offered for public sale without first being registered, the issuer of the restricted security has agreed to register such securities for resale, at the issuer’s expense, either upon demand by the Fund or in connection with another registered offering of the securities. Many such restricted securities may be resold in the secondary market in transactions exempt from registration. Restricted securities may be determined to be liquid under criteria established by the Trustees. The Fund will not incur any registration costs upon such resales. The Fund’s restricted securities, like other securities, are priced in accordance with procedures established by and under the general supervision of the Trustees.

Additional Disclosure Related to Derivative Instruments

Fair Value of Derivative Instruments |

| |

| Statement of

Assets and

Liabilities

Location | |

Derivatives not accounted for as hedging

instruments under ASC Topic 815 | | |

| Receivable for variation

margin on futures contracts | |

| Includes cumulative net depreciation of futures contracts as reported in the footnotes to the Portfolio of Investments. Only the current day’s variation margin is reported within the Statement of Assets and Liabilities. |

The Effect of Derivative Instruments on the Statement of Operations for the Year Ended December 31, 2020

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income |

| |

| |

Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income |

| |

| |

Annual Shareholder Report

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ materially from those estimated. The Fund applies investment company accounting and reporting guidance.

3. SHARES OF BENEFICIAL INTEREST

The following table summarizes share activity:

| | |

| | |

Shares issued to shareholders in payment of distributions declared | | |

| | |

NET CHANGE RESULTING FROM FUND SHARE TRANSACTIONS | | |

4. FEDERAL TAX INFORMATION

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended December 31, 2020 and 2019, was as follows:

As of December 31, 2020, the components of distributable earnings on a tax-basis were as follows:

Undistributed ordinary income | |

Net unrealized appreciation | |

Undistributed long-term capital gains | |

The difference between book-basis and tax-basis net unrealized appreciation is attributable to the differing treatments for mark-to-market on futures contracts.

At December 31, 2020, the cost of investments for federal tax purposes was $126,652,919. The net unrealized appreciation of investments for federal tax purposes was $16,607,225. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $16,632,737 and net unrealized depreciation from investments for those securities having an excess of cost over value of $25,512. The amounts presented are inclusive of derivative contracts.

The Fund used capital loss carryforwards of $235,812 to offset capital gains realized during the year ended December 31, 2020.

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

The Adviser provides investment adviser services at no fee because all eligible investors are: (1) in separately managed or wrap fee programs, who often pay a single aggregate fee to the wrap program sponsor for all costs and expenses of the wrap-fee programs; or (2) in certain other separately managed accounts and discretionary investment accounts; or (3) to the extent permitted under applicable law, other Federated Hermes funds. The Adviser has contractually agreed to reimburse all expenses of the Fund, excluding extraordinary expenses. Acquired fund fees and expenses are not direct obligations of the Fund and are not contractual reimbursements under the investment advisory contract. For the year ended December 31, 2020, the Adviser reimbursed $319,816 of operating expenses.

Administrative Fee

Federated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. For purposes of determining the appropriate rate breakpoint, “Investment Complex” is defined as all of the Federated Hermes Funds subject to a fee under the Administrative Services Agreement. The fee paid to FAS is based on the average daily net assets of the Investment Complex as specified below:

| Average Daily Net Assets

of the Investment Complex |

| on assets up to $50 billion |

| on assets over $50 billion |

FAS may voluntarily choose to waive any portion of its fee. For the year ended December 31, 2020, the annualized fee paid to FAS was 0.079% of average daily net assets of the Fund.

In addition, FAS may charge certain out-of-pocket expenses to the Fund. For the year ended December 31, 2020, the Fund’s Adviser reimbursed the Fund for any fee paid to FAS.

Annual Shareholder Report

Interfund Transactions

During the year ended December 31, 2020, the Fund engaged in sale transactions with funds that have a common investment adviser (or affiliated investment advisers), common Directors/Trustees and/or common Officers. These sale transactions complied with Rule 17a-7 under the Act and amounted to $762,500. Net realized loss recognized on these transactions was $239,529.

Directors’/Trustees’ and Miscellaneous Fees