United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-21822

(Investment Company Act File Number)

Federated Hermes Managed Pool Series

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 11/30/20

Date of Reporting Period: 11/30/20

| Item 1. | Reports to Stockholders |

Annual Shareholder Report

November 30, 2020

Federated Hermes International Bond Strategy Portfolio(formerly, Federated International Bond Strategy Portfolio)

A Portfolio of Federated Hermes Managed Pool Series(formerly, Federated Managed Pool Series)

Not FDIC Insured ▪ May Lose Value ▪ No Bank Guarantee

Management’s Discussion of Fund Performance (unaudited)

The total return of Federated Hermes International Bond Strategy Portfolio (the “Fund”), based on net asset value for the 12-month reporting period ended November 30, 2020, was 9.34%. The total return of the Fund’s blended benchmark (“Blended Index”)1 was 7.03% for the same period. The performance of the Bloomberg Barclays Emerging Markets Seasoned ex Aggregate/Eurodollar Index (“BBEMSAE”),2 the Fund’s broad-based securities market index, was 4.39%. The Fund’s total return for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses which were not reflected in the total returns of the Blended Index.

The Fund’s investment strategy focused on four central factors: (1) the currency denomination of the selected securities; (2) the effective duration3 of the portfolio, (3) yield curve;4 and (4) country/sector selection.5 These market elements were the most significant factors affecting the Fund’s performance relative to the Blended Index.

MARKET OVERVIEW

The past fiscal period was a historic time in global markets that shattered many financial records. In time, it is expected that global economies will heal and volatility will normalize, but sadly, the human toll caused by the novel coronavirus (“COVID-19”) pandemic will be forever etched in history. The reporting period had originally started out with promises of a global recovery, but quickly transformed into the year that would drive economies into recession. In response, many global banking authorities expanded balance sheets by trillions of dollars, provided unlimited liquidity to the banking sector and set up program after program to backstop stressed parts of the financial markets. Nothing was off the table; as the European Central Bank (ECB) famously stated: “whatever it takes.”

During the reporting period, it became apparent that global financial markets ultimately boiled down to a tale of two walls. On one side, there was a wall of worry surrounding the evolution, containment and management of the COVID-19 pandemic. However, a wall of liquidity, tendered by global governments and central banks, counterbalanced this epidemiology event from turning into another financial crisis. In essence, these two contrasting forces became the financial calculus for understanding, and valuating, global risk premiums. With many global equity markets reaching record highs, it appeared that the ‘wall of liquidity’ overcame the ‘wall of worry’ as the fiscal reporting period drew to a close.

The situation was complicated further by an oil production war, triggering the largest quarterly drop in prices on record. By the middle of March, the financial meltdown had morphed into a global liquidity crisis. Historic selloffs of both developed and emerging market fixed-income assets, across all sectors and quality levels, soon followed.

In response, the ECB aggressively eased monetary policies with rate cuts, colossal amounts of asset buying and new programs, such as the Pandemic Emergency Purchase Program. Governments stepped up with material fiscal measures as well. The European Union (EU) cast aside Maastricht rules, and country after country announced large amounts of support. Throughout the crisis, government bonds offered a key safety anchor, despite sharp drops in yields, and investment-grade issuers seized the opportunity to tap them for additional liquidity. But while the colossal stimulus measures reduced the damage caused by the economic shutdowns and Europe began to rebound, the call remained for fiscal support. This finally did arrive in July in the form of the EU Recovery Fund, which strove to establish fiscal unity in Europe. This helped most developed bond markets but was particularly beneficial to European peripheral countries, like Italy and Spain, which outperformed significantly.

The U.K., initially was more restrained in its response to COVID-19, issued an initial stimulus package, and the government committed to helping the recovery through investments in infrastructure and a national job retention scheme. The Bank of England cut benchmark rates and also launched a quantitative easing initiative. In short time, the effects of fiscal stimulus waned and attention again turned to Brexit (the U.K. leaving the EU), with negotiations yet again providing little to no clarity. As the reporting period ended, European data continued to improve broadly, but a resurgence of COVID-19 led to new lockdowns. While these were more targeted and less disruptive, they ushered in new uncertainty to European economies and the U.K.

Annual Shareholder Report

Although not immune to the effects of the pandemic, emerging market countries took decisive measures to help stimulate their economies during the crisis. The focal point of the pandemic and associated containment measures were initially focused on China; the country became the largest contributor towards the global recovery. Countries including Brazil, Chile, Colombia and Peru benefitted from the tailwinds of a recovery in commodity prices following the rendering of stimulus in China. In particular, Chile was aided by a robust resurgence in copper prices due to a combination of greater demand from China and well-founded concerns surrounding potential supply shortages. Furthermore, Mexico experienced a sharp contraction exacerbated by the lack of any substantial government support. Mexico, however, did benefit to some degree as a result of its corporate sector’s heavy U.S. sales-based presence. Overall, high-frequency data, such as retail sales, investment data and industrial output all continued to see improvement in the emerging market complex.

In prior years, the U.S. dollar (USD) used to offer safety, yield and growth advantages. The mighty U.S. dollar used to thrive in a variety of economic conditions and became hard to compete with. However, in the past few months of the reporting period, the U.S. dollar grew more one dimensional and began to offer mostly safety. The aggressive quantitative easing from the U.S. Federal Reserve (the “Fed”) materially eroded the USD’s interest rate advantage. The U.S. dollar began to look more and more like a hedge against volatility and offered little else. Consequently, midway through the reporting period, broad USD weakness ensued as global investors began to diversify their holdings away from the USD.

CURRENCY DENOMINATION

A general underweight allocation to the USD improved Fund performance relative to the Blended Index. Early in the reporting period, overweight allocations to the Mexican peso and South African rand, relative to the Blended Index, decreased Fund performance as the onset of the global pandemic triggered a massive USD shortage. This funding shortage was quickly addressed by the U.S. Federal Reserve and allowed core overweight currency holdings in both Eastern and Western Europe to provide better Fund performance as the reporting period drew to a close.

DURATION and yield curve

The Fund’s weighted average duration at the end of the reporting period was 6.74 years. Fund duration is effectively the Fund’s sensitivity to movements in interest rates; the lower the duration, the less the net asset value of the Fund will fluctuate due to changes in interest rates. Overall, duration management was an active process with lower duration sensitivities to countries with negative interest rates, namely Germany, France and Japan. As an offset, the Fund maintained an overweight allocation to higher yielding Emerging Market securities, relative to the Blended Index, for the better part of the reporting period. Largely, yield curve selection had a muted impact on Fund performance relative to the Blended Index.

COUNTRY/Sector SELECTION

Country/sector allocation decisions were the largest contributors to Fund performance relative to its Blended Index. In response to the COVID-19 pandemic, massive monetary and fiscal measures created overwhelming demand for higher yielding investments. Overweight allocations to Emerging Market high yield6 bonds dramatically improved Fund performance relative to the Blended Index during the reporting period.

1

The Blended Index is a custom blended index comprised of 50% of the Bloomberg Barclays Emerging Markets USD Aggregate Index and 50% of the J.P. Morgan Global (ex-U.S.) Government Bond Index. Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the Blended Index.

2

Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the BBEMSAE. Effective May 26, 2020, the Fund’s investment adviser elected to change the broad-based securities market index from the Bloomberg Barclays Emerging Markets USD Aggregate Index (BBEMAI) to the BBEMSAE. The BBEMSAE is more reflective of the Fund’s investment strategies. The BBEMAI had a total return of 6.53% for the reporting period.

3

Duration is a measure of a security’s price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities of shorter durations.

4

Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. The yield curve is a graph showing the comparative yields of securities in a particular class according to maturity. Securities on the long end of the yield curve have longer maturities.

5

International investing involves special risks including currency risk, increased volatility, political risks and differences in auditing and other financial standards. Prices of emerging market securities can be significantly more volatile than the prices of securities in developed countries, and currency risk and political risks are accentuated in emerging markets.

6. High-yield, lower rated securities generally entail greater market, credit/default and liquidity risks, and may be more volatile than investment-grade securities.

Annual Shareholder Report

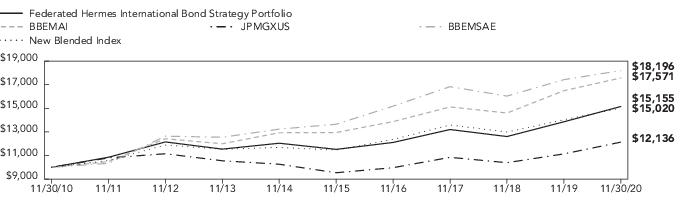

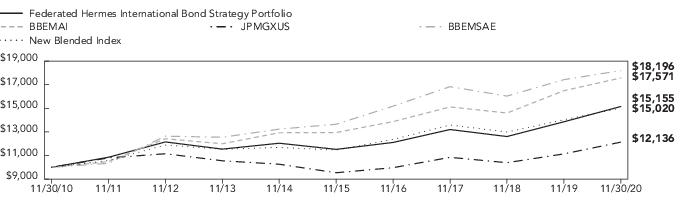

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

The graph below illustrates the hypothetical investment of $10,0001 in the Federated Hermes International Bond Strategy Portfolio (the “Fund”) from November 30, 2010 to November 30, 2020, compared to a blend of indexes comprised of 50% of the Bloomberg Barclays Emerging Markets USD Aggregate Index (BBEMAI)2 and 50% of the J.P. Morgan Global (ex-U.S.) Government Bond Index3 (JPMGXUS) (the “Old Blended Index”), a blend of indexes comprised of 50% Bloomberg Barclays Emerging Markets Seasoned ex Aggregate/Eurodollar Index4 (BBEMSAE) and 50% JPMGXUS (“New Blended Index”).

GROWTH OF A $10,000 INVESTMENT

Growth of $10,000 as of November 30, 2020

Average Annual Total Returns for the Period Ended 11/30/2020

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

1

Represents a hypothetical investment of $10,000 in the Fund. The Fund’s performance assumes the reinvestment of all dividends and distributions. The BBEMAI, JPMGXUS and BBEMSAE have been adjusted to reflect reinvestment of dividends on securities in the indexes.

2

The BBEMAI tracks total returns for external-currency-denominated debt instruments of the emerging markets. Effective May 26, 2020, the Fund’s investment adviser elected to change the broad-based securities market index from the Bloomberg Barclays Emerging Markets USD Aggregate Index (BBEMAI) to the BBEMSAE. The BBEMSAE is more reflective of the Fund’s investment strategies. The BBEMAI had a total return of 6.53% for the reporting period. The index is not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

3

The JPMGXUS is a broad measure of bond performance in developed countries, excluding the U.S. The index is not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

4

The BBEMSAE is the emerging markets debt component of the Bloomberg Barclay U.S. Universal Bond Index and is generally at least 80% non-investment grade. The index is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

5

Effective May 26, 2020, the Fund’s investment adviser elected to change the Blended Index (Old Blended Index to New Blended Index) from the 50% BBEMAI/50% JPMGXUS to 50% BBEMSAE/50% JPMGXUS.

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At November 30, 2020, the Fund’s issuer country and currency exposure composition1 were as follows:

| Country Exposure

as a Percentage of

Total Net Assets2 | Currency Exposure

as a Percentage of

Total Net Assets3,4 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Other Assets and Liabilities—Net8 | | |

| | |

1

The fixed-income securities of some issuers may not be denominated in the currency of the issuer’s designated country. Therefore, the two columns above “Country Exposure as a Percentage of Total Net Assets” and “Currency Exposure as a Percentage of Total Net Assets” may not be equal.

2

This column depicts the Fund's exposure to various countries through its investment in foreign fixed-income securities, along with the Fund’s holdings of cash equivalents and other assets and liabilities. With respect to foreign corporate fixed-income securities, country allocations are based primarily on the country in which the issuing company has registered the security. However, the Fund’s Adviser may allocate the company to a country based on other factors such as the location of the company’s head office, the jurisdiction of the company’s incorporation, the location of the principal trading market for the company’s securities or the country from which a majority of the company’s revenue is derived.

3

As of the date specified above, the Fund owned shares of one or more affiliated investment companies. For purposes of this table, the affiliated investment company (other than an affiliated money market fund) is not treated as a single portfolio security, but rather the Fund is treated as owning a pro rata portion of each security and each other asset and liability owned by the affiliated investment company. Accordingly, the percentages of total net assets shown in the table will differ from those presented on the Portfolio of Investments.

Annual Shareholder Report

4

This column depicts the Fund’s exposure to various currencies through its investment in foreign fixed-income securities, currency derivative contracts and foreign exchange contracts (which for purposes of this report includes any currency options sold by the Fund and currency forward contracts).

5

This line depicts the Fund’s exposure to various countries, each of which represents less than 1.0% of the Fund’s Total Net Assets.

6

Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. This does not include cash held in the Fund that is denominated in foreign currencies. See the Statement of Assets and Liabilities for information regarding the Fund’s foreign cash position.

7

Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More complete information regarding the Fund’s direct investment in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report.

8

Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities.

Annual Shareholder Report

Portfolio of Investments

November 30, 2020

Foreign

Currency

Par Amount,

Principal

Amount

or Shares | | | |

| | | |

| | | |

| | | |

| | Australia, Government of, Series 128, 5.750%, 7/15/2022 | |

| | Australia, Government of, Series 137, 2.750%, 4/21/2024 | |

| | Australia, Government of, Sr. Unsecd. Note, Series 148, 2.750%, 11/21/2027 | |

| | | |

| | | |

| | | |

| | United Kingdom, Government of, 2.750%, 9/7/2024 | |

| | United Kingdom, Government of, 3.250%, 1/22/2044 | |

| | United Kingdom, Government of, 4.250%, 12/7/2027 | |

| | United Kingdom, Government of, Bond, 4.250%, 3/7/2036 | |

| | United Kingdom, Government of, Unsecd. Note, 1.500%, 7/22/2047 | |

| | United Kingdom, Government of, Unsecd. Note, 4.250%, 6/7/2032 | |

| | | |

| | | |

| | | |

| | Canada, Government of, 1.500%, 6/1/2023 | |

| | Canada, Government of, Series WL43, 5.750%, 6/1/2029 | |

| | | |

| | | |

| | | |

| | Philip Morris International, Inc., Sr. Unsecd. Note, 2.875%, 5/14/2029 | |

| | | |

| | Belgium, Government of, Series 68, 2.250%, 6/22/2023 | |

| | Belgium, Government of, Series 74, 0.800%, 6/22/2025 | |

| | France, Government of, 0.500%, 5/25/2025 | |

| | France, Government of, 2.750%, 10/25/2027 | |

| | France, Government of, 4.250%, 10/25/2023 | |

| | France, Government of, O.A.T., 5.500%, 4/25/2029 | |

| | Germany, Government of, Bond, Series 03, 4.750%, 7/4/2034 | |

| | Germany, Government of, Unsecd. Note, 1.000%, 8/15/2024 | |

| | Italy, Government of, Sr. Unsecd. Note, 0.650%, 10/15/2023 | |

| | Italy, Government of, Sr. Unsecd. Note, 1.650%, 3/1/2032 | |

| | Italy, Government of, Sr. Unsecd. Note, 4.750%, 9/1/2028 | |

| | Italy, Government of, Unsecd. Note, 1.600%, 6/1/2026 | |

| | Italy, Government of, Unsecd. Note, 3.250%, 9/1/2046 | |

| | Netherlands, Government of, Unsecd. Note, 0.250%, 7/15/2025 | |

| | Netherlands, Government of, Unsecd. Note, 2.500%, 1/15/2033 | |

| | Spain, Government of, 4.200%, 1/31/2037 | |

| | Spain, Government of, Sr. Unsecd. Note, 1.500%, 4/30/2027 | |

| | Spain, Government of, Sr. Unsecd. Note, 1.950%, 7/30/2030 | |

| | Spain, Government of, Sr. Unsecd. Note, 2.750%, 10/31/2024 | |

| | Spain, Government of, Unsecd. Note, 1.600%, 4/30/2025 | |

| | | |

Annual Shareholder Report

Foreign Currency Par Amount, Principal Amount or Shares | | | |

| | | |

| | | |

| | | |

| | Japan, Government of, Sr. Unsecd. Note, Series 122, 1.800%, 9/20/2030 | |

| | Japan, Government of, Sr. Unsecd. Note, Series 153, 1.300%, 6/20/2035 | |

| | Japan, Government of, Sr. Unsecd. Note, Series 44, 1.700%, 9/20/2044 | |

| | | |

| | | |

| | | |

| | Mexico, Government of, Series M, 6.500%, 6/10/2021 | |

| | | |

| | | |

| | Poland, Government of, Unsecd. Note, Series 0726, 2.500%, 7/25/2026 | |

| | TOTAL BONDS

(IDENTIFIED COST $14,698,466) | |

| | | |

| | United States Treasury Note, 0.500%, 3/15/2023 | |

| | United States Treasury Note, 0.500%, 8/31/2027 | |

| | TOTAL U.S. TREASURY

(IDENTIFIED COST $604,539) | |

| | PURCHASED PUT OPTION—0.0% | |

| | | |

| | USD PUT/PLN CALL, Morgan Stanley, Notional Amount $ 1,300,000, Exercise Price $3.750, Expiration Date 1/7/2021 (IDENTIFIED COST $13,696) | |

| | REPURCHASE AGREEMENTS—1.0% | |

| | Interest in $193,000,000 joint repurchase agreement, 0.10% dated 11/30/2020 under which BNP Paribas will repurchase the securities provided as collateral for $193,000,536 on 12/1/2020. The securities provided as collateral at the end of the period held with BNY Mellon, tri-party agent, were U.S. Treasury with various maturities to 5/31/2022 and the market value of those underlying securities was $196,860,635. | |

| | | |

| | Emerging Markets Core Fund

(IDENTIFIED COST $34,269,401) | |

| | TOTAL INVESTMENT IN SECURITIES—99.5%

(IDENTIFIED COST $50,081,102)1 | |

| | OTHER ASSETS AND LIABILITIES - NET—0.5%2 | |

| | | |

At November 30, 2020, the Fund had the following outstanding futures contracts:

| | | | Value and

Unrealized

Appreciation

(Depreciation) |

| | | | |

| | | | |

| | | | |

NET UNREALIZED APPRECIATION ON FUTURES CONTRACTS | |

Annual Shareholder Report

At November 30, 2020, the Fund had the following outstanding written option contracts:

| | | | | |

| | | | | |

| | | | | |

| | | | | |

(PREMIUM RECEIVED $17,574) | |

At November 30, 2020, the Fund had the following outstanding foreign exchange contracts:

| | Foreign Currency

Units to

Receive/Deliver | | Unrealized

Appreciation

(Depreciation) |

|

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

|

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

NET UNREALIZED APPRECIATION ON FOREIGN EXCHANGE CONTRACTS | |

Net Unrealized Appreciation (Depreciation) on Futures Contracts, Foreign Exchange Contracts and value for Written Options Contracts are included in “Other Assets and Liabilities—Net.”

Annual Shareholder Report

Affiliated fund holdings are investment companies which are managed by the Adviser or an affiliate of the Adviser. Transactions with affiliated fund holdings during the period ended November 30, 2020, were as follows:

| Emerging Markets

Core Fund |

| |

| |

| |

Change in Unrealized Appreciation/Depreciation | |

| |

| |

Shares Held as of 11/30/2020 | |

| |

Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (SEC), the Fund invests in a portfolio of Federated Hermes Core Trust (“Core Trust”), which is managed by the Federated Investment Management Company (the “Adviser”). Core Trust is an open-end management company, registered under the Act, available only to registered investment companies and other institutional investors. The investment objective of Emerging Markets Core Fund (EMCOR), a portfolio of Core Trust, is to achieve a total return on its assets. EMCOR's secondary objective is to achieve a high level of income. Distributions of net investment income from EMCOR are declared daily and paid monthly. Capital gain distributions, if any, from EMCOR are declared and paid annually, and are recorded by the Fund as capital gains. Federated Hermes, Inc. (“Federated Hermes”) receives no advisory or administrative fees from EMCOR. Copies of the EMCOR financial statements are available on the EDGAR Database on the SEC's website or upon request from the Fund.

1

The cost of investments for federal tax purposes amounts to $50,106,575.

2

Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

3

Non-income-producing security.

Note: The categories of investments are shown as a percentage of total net assets at November 30, 2020.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

Annual Shareholder Report

The following is a summary of the inputs used, as of November 30, 2020, in valuing the Fund's assets carried at fair value.

| | | | |

| | Level 2—

Other

Significant

Observable

Inputs | Level 3—

Significant

Unobservable

Inputs | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Other Financial Instruments: | | | | |

| | | | |

| | | | |

| | | | |

Foreign Exchange Contracts | | | | |

| | | | |

| | | | |

| | | | |

Foreign Exchange Contracts | | | | |

TOTAL OTHER FINANCIAL INSTRUMENTS | | | | |

The following acronym(s) are used throughout this portfolio:

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights

(For a Share Outstanding Throughout Each Period)

| | | | | |

Net Asset Value, Beginning of Period | | | | | |

Income From Investment Operations: | | | | | |

| | | | | |

Net realized and unrealized gain (loss) | | | | | |

TOTAL FROM INVESTMENT OPERATIONS | | | | | |

| | | | | |

Distributions from net investment income | | | | | |

Distributions from net realized gain | | | | | |

| | | | | |

Net Asset Value, End of Period | | | | | |

| | | | | |

Ratios to Average Net Assets: | | | | | |

| | | | | |

| | | | | |

Expense waiver/reimbursement5 | | | | | |

| | | | | |

Net assets, end of period (000 omitted) | | | | | |

| | | | | |

1

Per share numbers have been calculated using the average shares method.

2

Based on net asset value.

3

See Note 5, Investment Adviser Fee and Other Transactions with Affiliates.

4

Amount does not reflect net expenses incurred by the investment companies in which the Fund may invest.

5

This expense decrease is reflected in both the net expense and net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest.

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and LiabilitiesNovember 30, 2020

| | |

Investment in securities, at value including $34,874,345 of investment in an affiliated holding* (identified cost $50,081,102) | | |

Cash denominated in foreign currencies (identified cost $110,466) | | |

| | |

Unrealized appreciation on foreign exchange contracts | | |

| | |

Receivable for shares sold | | |

Receivable for investments sold | | |

| | |

| | |

Unrealized depreciation on foreign exchange contracts | | |

Payable for shares redeemed | | |

Written options outstanding, at value (premiums received $17,574) | | |

Payable for investments purchased | | |

Payable for portfolio accounting fees | | |

Payable for auditing fees | | |

Payable for custodian fees | | |

Payable to adviser (Note 5) | | |

Payable for variation margin on futures contracts | | |

Payable for administrative fee (Note 5) | | |

Accrued expenses (Note 5) | | |

| | |

Net assets for 3,338,349 shares outstanding | | |

| | |

| | |

Total distributable earnings (loss) | | |

| | |

Net Asset Value, Offering Price and Redemption Proceeds Per Share: | | |

$52,036,874 ÷ 3,338,349 shares outstanding, no par value, unlimited shares authorized | | |

* See information listed after the fund’s Portfolio of Investments

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of OperationsYear Ended November 30, 2020

| | | |

Dividends received from an affiliated holding* | | | |

Interest (net of foreign tax withheld of $464) | | | |

| | | |

| | | |

Administrative fee (Note 5) | | | |

| | | |

| | | |

Directors'/Trustees' fees (Note 5) | | | |

| | | |

| | | |

Portfolio accounting fees | | | |

| | | |

| | | |

| | | |

| | | |

Reimbursement of other operating expenses (Note 5) | | | |

| | | |

| | | |

Realized and Unrealized Gain (Loss) on Investments, Foreign Exchange Contracts, Futures Contracts, Written Options, Swap Contracts and Foreign Currency Transactions: | | | |

Net realized gain on investments (including realized gain of $361,370 on sales of investments in an affiliated holding*) and foreign currency transactions | | | |

Net realized gain on foreign exchange contracts | | | |

Net realized loss on futures contracts | | | |

Net realized gain on written options | | | |

Net realized loss on swap contracts | | | |

Net change in unrealized depreciation of investments and translation of assets and liabilities in foreign currency (including net change in unrealized depreciation of $894,261 of investments in an affiliated holding*) | | | |

Net change in unrealized depreciation of foreign exchange contracts | | | |

Net change in unrealized appreciation of futures contracts | | | |

Net change in unrealized appreciation of written options | | | |

Net realized and unrealized gain on investments, foreign exchange contracts, futures contracts, written options, swap contracts and foreign currency transactions | | | |

Change in net assets resulting from operations | | | |

*

See information listed after the fund’s Portfolio of Investments

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| | |

Increase (Decrease) in Net Assets | | |

| | |

| | |

| | |

Net change in unrealized appreciation/depreciation | | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | | |

Distributions to Shareholders: | | |

Distribution to shareholders | | |

| | |

Proceeds from sale of shares | | |

Net asset value of shares issued to shareholders in payment of distributions declared | | |

| | |

CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | | |

| | |

| | |

| | |

| | |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

November 30, 2020

1. ORGANIZATION

Federated Hermes Managed Pool Series (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of five portfolios. The financial statements included herein are only those of Federated Hermes International Bond Strategy Portfolio (the “Fund”), a non-diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder’s interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The investment objective of the Fund is to achieve total return on its assets, by investing primarily in foreign government and corporate bonds in both developed and emerging markets.

Prior to June 29, 2020, the names of the Trust and Fund were Federated Managed Pool Series and Federated International Bond Strategy Portfolio, respectively.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

■ Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs.

■ Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market.

■ Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Fund’s Board of Trustees (the “Trustees”).

■ Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations.

■ Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees.

■ For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered, such as: the last traded or purchase price of the security, information obtained by contacting the issuer or dealers, analysis of the issuer’s financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded, public trading in similar securities or derivative contracts of the issuer or comparable issuers, movement of a relevant index, or other factors including but not limited to industry changes and relevant government actions.

If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a reasonable period of time as set forth in the Fund's valuation policies and procedures, or if information furnished by a pricing service, in the opinion of the valuation committee (“Valuation Committee”), is deemed not representative of the fair value of such security, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could obtain the fair value assigned to an investment if it sold the investment at approximately the time at which the Fund determines its NAV per share, and the actual value obtained could be materially different.

Fair Valuation and Significant Events Procedures

The Trustees have ultimate responsibility for determining the fair value of investments for which market quotations are not readily available. The Trustees have appointed a Valuation Committee comprised of officers of the Fund, Federated Investment Management Company (the “Adviser”) and certain of the Adviser's affiliated companies to assist in determining fair value and in overseeing the calculation of the NAV. The Trustees have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing-service evaluations including periodic reviews of third-party pricing services’ policies, procedures and valuation methods (including key inputs, methods, models and assumptions), transactional back-testing, comparisons of evaluations of different pricing services and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Trustees. The Trustees periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for any U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for any other types of fixed-income securities and any OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

Annual Shareholder Report

The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment’s value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

■ With respect to securities traded principally in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts;

■ Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded;

■ Announcements concerning matters such as acquisitions, recapitalizations, litigation developments or a natural disaster affecting the issuer’s operations or regulatory changes or market developments affecting the issuer’s industry.

The Trustees have adopted procedures whereby the Valuation Committee uses a pricing service to provide factors to update the fair value of equity securities traded principally in foreign markets from the time of the close of their respective foreign stock exchanges to the pricing time of the Fund. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment in accordance with the fair valuation procedures approved by the Trustees. The Trustees have ultimate responsibility for any fair valuations made in response to a significant event.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund’s custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Repurchase agreements are subject to Master Netting Agreements which are agreements between the Fund and its counterparties that provide for the net settlement of all transactions and collateral with the Fund, through a single payment, in the event of default or termination. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amounts but gross. As indicated above, the cash or securities to be repurchased, as shown on the Portfolio of Investments, exceeds the repurchase price to be paid under the agreement reducing the net settlement amount to zero.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions of net investment income, if any, are declared and paid annually. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Amortization/accretion of premium and discount is included in investment income. During part of the fiscal year, the Fund invested in Emerging Markets Core Fund, a portfolio of Federated Hermes Core Trust. The detail of the total fund expense reimbursement of $281,468 is disclosed in Note 5.

Federal Taxes

It is the Fund’s policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended November 30, 2020, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of November 30, 2020, tax years 2017 through 2020 remain subject to examination by the Fund’s major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

Annual Shareholder Report

When-Issued and Delayed-Delivery Transactions

The Fund may engage in when-issued or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Swap Contracts

Swap contracts involve two parties that agree to exchange the returns (or the differential in rates of return) earned or realized on particular predetermined investments, instruments, indices or other measures. The gross returns to be exchanged or “swapped” between parties are generally calculated with respect to a “notional amount” for a determined period of time. The Fund may enter into interest rate, total return, credit default, currency and other swap agreements to seek to increase yield, income and return, and to manage currency risk, duration risk, market risk and yield curve risk. Risks may arise upon entering into swap agreements from the potential inability of the counterparties to meet the terms of their contract from unanticipated changes in the value of the swap agreement. In connection with these agreements, securities or cash may be identified as collateral or margin in accordance with the terms of the respective swap agreements to provide assets of value and recourse in the event of default.

The “buyer” in a credit default swap is obligated to pay the “seller” a periodic stream of payments over the term of the contract provided that no event of default on an underlying reference obligation has occurred. If an event of default occurs, the seller must pay the buyer the full notional value, or the “par value,” of the reference obligation in exchange for the reference obligation. In connection with these agreements, securities may be identified as collateral in accordance with the terms of the respective swap agreements to provide assets of the value and recourse in the event of default or bankruptcy/solvency. Recovery values are assumed by market makers considering either industry standard recovery rates or entity specific factors and considerations until a credit event occurs. If a credit event has occurred, the recovery value is typically determined by a facilitated auction whereby a minimum number of allowable broker bids, together with a specific valuation method, are used to calculate the settlement value. The maximum amount of the payment that may occur, as a result of a credit event payable by the protection seller, is equal to the notional amount of the underlying index or security. The Fund's maximum exposure to loss of the notional value of credit default swaps outstanding at November 30, 2020 is $0. The Fund's maximum risk of loss from counterparty credit risk, either as the protection buyer or as the protection seller, is the fair value of the contract. This risk is mitigated by having a master netting arrangement between the Fund and the counterparty and by the posting of collateral by the counterparty to the Fund to cover the Fund's exposure to the counterparty.

Upfront payments received or paid by the Fund will be reflected as an asset or liability on the Statement of Assets and Liabilities. Changes in the value of swap contracts are included in “Swaps, at value” on the Statement of Assets and Liabilities, and periodic payments are reported as “Net realized gain (loss) on swap contracts” in the Statement of Operations.

Certain swap contracts may be centrally cleared (“centrally cleared swaps”), whereby all payments made or received by the Fund pursuant to the contract are with a central clearing party (CCP) rather than the counterparty. The CCP guarantees the performance of the parties to the contract. Upon entering into centrally cleared swaps, the Fund is required to deposit with the CCP, either in cash or securities, an amount of initial margin determined by the CCP, which is subject to adjustment. For centrally cleared swaps, the daily change in valuation is recorded as a receivable or payable for variation margin and settled in cash with the CCP daily. In the case of centrally cleared swaps, counterparty risk is minimal due to protections provided by the CCP.

At November 30, 2020, the Fund had no open swaps contracts.

The average notional amount of credit default swap contracts held by the Fund throughout the period was $92,308. This is based on amounts held as of each month-end throughout the fiscal period.

Foreign Exchange Contracts

The Fund may enter into foreign exchange contracts to seek to increase return and to manage currency risk. Purchased contracts are used to acquire exposure to foreign currencies, whereas, contracts to sell are used to hedge the Fund’s securities against currency fluctuations. Risks may arise upon entering into these transactions from the potential inability of counterparties to meet the terms of their commitments and from unanticipated movements in security prices or foreign exchange rates. The foreign exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the settlement date.

Foreign exchange contracts are subject to Master Netting Agreements (MNA) which are agreements between the Fund and its counterparties that provide for the net settlement of all transactions and collateral with the Fund, through a single payment, in the event of default or termination. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amounts but gross.

Foreign exchange contracts outstanding at period end, including net unrealized appreciation/depreciation or net settlement amounts, are listed after the Fund’s Portfolio of Investments.

The average value at settlement date payable and receivable of foreign exchange contracts purchased and sold by the Fund throughout the period was $257,752 and $271,181, respectively. This is based on the contracts held as of each month-end throughout the fiscal period.

Annual Shareholder Report

Foreign Currency Translation

The accounting records of the Fund are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the rates of exchange of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income and expenses are translated at the rate of exchange quoted on the respective date that such transactions are recorded. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at period end, resulting from changes in the exchange rate.

Futures Contracts

The Fund purchases and sells financial futures contracts to seek to manage currency, duration and yield curve risk. Upon entering into a financial futures contract with a broker, the Fund is required to deposit with a broker, either U.S. government securities or a specified amount of cash, which is shown as due from broker in the Statement of Assets and Liabilities. Futures contracts are valued daily and unrealized gains or losses are recorded in a “variation margin” account. The Fund receives from or pays to the broker a specified amount of cash based upon changes in the variation margin account. When a contract is closed, the Fund recognizes a realized gain or loss. Futures contracts have market risks, including the risk that the change in the value of the contract may not correlate with the changes in the value of the underlying securities. There is minimal counterparty risk to the Fund since futures contracts are exchange traded and the exchange’s clearing house, as counterparty to all exchange-traded futures contracts, guarantees the futures contracts against default.

Futures contracts outstanding at the period end are listed after the Fund’s Portfolio of Investments.

The average notional value of long futures contracts held by the Fund throughout the period was $2,947,069. This is based on amounts held as of each month-end throughout the fiscal period.

Option Contracts

The Fund buys or sells put and call options to seek to manage currency, duration and market risk. The seller (“writer”) of an option receives a payment or premium, from the buyer, which the writer keeps regardless of whether the buyer exercises the option. When the Fund writes a put or call option, an amount equal to the premium received is recorded as a liability and subsequently marked to market to reflect the current value of the option written. Premiums received from writing options which expire are treated as realized gains. The Fund, as a writer of an option, bears the market risk of an unfavorable change in the price of the underlying reference instrument. When the Fund purchases a put or call option, an amount equal to the premium paid is recorded as an increase to the cost of the investment and subsequently marked to market to reflect the current value of the option purchased. Premiums paid for purchasing options which expire are treated as realized losses. Premiums received/paid for writing/purchasing options which are exercised or closed are added to the proceeds or offset against amounts paid on the underlying reference instrument to determine the realized gain or loss. The risk associated with purchasing put and call options is limited to the premium paid. Options can trade on securities or commodities exchanges. In this case, the exchange sets all the terms of the contract except for the price. Most exchanges require investors to maintain margin accounts through their brokers to cover their potential obligations to the exchange. This protects investors against potential defaults by the counterparty.

Purchased option contracts outstanding at period end are listed in the Fund’s Portfolio of Investments and written option contracts outstanding at period end are listed after the Fund’s Portfolio of Investments.

The average market value of purchased options and written options held by the Fund throughout the period was $4,699 and $21,064, respectively. This is based on amounts held as of each month-end throughout the fiscal period.

Restricted Securities

The Fund may purchase securities which are considered restricted. Restricted securities are securities that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) are subject to contractual restrictions on public sales. In some cases, when a security cannot be offered for public sale without first being registered, the issuer of the restricted security has agreed to register such securities for resale, at the issuer’s expense, either upon demand by the Fund or in connection with another registered offering of the securities. Many such restricted securities may be resold in the secondary market in transactions exempt from registration. Restricted securities may be determined to be liquid under criteria established by the Trustees. The Fund will not incur any registration costs upon such resales. The Fund’s restricted securities, like other securities, are priced in accordance with procedures established by and under the general supervision of the Trustees.

Annual Shareholder Report

Additional Disclosure Related to Derivative Instruments

Fair Value of Derivative Instruments |

| | |

| Statement of

Assets and

Liabilities

Location | | Statement of

Assets and

Liabilities

Location | |

Derivatives not accounted for as hedging instruments

under ASC Topic 815 | | | | |

Foreign exchange contracts | Unrealized

appreciation on

foreign exchange

contracts | | Unrealized

depreciation on

foreign exchange

contracts | |

Foreign exchange contracts | Purchased options,

Investments

in securities,

at value | | | |

Foreign exchange contracts | | | Written Options

outstanding,

at value | |

| | | Payable for

daily variation

margin on

futures contracts | |

Total derivatives not accounted for as hedging

instruments under ASC Topic 815 | | | | |

*

Includes cumulative appreciation\depreciation of futures contracts as reported in the footnotes to the Portfolio of Investments. Only the current day’s variation margin is reported within the Statement of Assets and Liabilities.

The Effect of Derivative Instruments on the Statement of Operations for the Year Ended November 30, 2020

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income |

| | Credit Default

Swap Contracts | | | | |

Foreign exchange contracts | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income |

| | Credit Default

Swap Contracts | | | | |

Foreign exchange contracts | | | | | | |

| | | | | | |

| | | | | | |

1

The net realized loss on Purchased Options is found within the Net realized gain on investments and foreign currency transactions on the Statement of Operations.

2

The net change in unrealized depreciation of Purchased Options is found within the Net change in unrealized depreciation of investments and translation of assets and liabilities in foreign currency on the Statement of Operations.

Annual Shareholder Report

As indicated above, certain derivative investments are transacted subject to MNA. These agreements permit the Fund to offset with a counter party certain derivative payables and/or receivables with collateral held and create one single net payment in the event of default or termination of the agreement by either the Fund or the counterparty. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amounts but gross. As of November 30, 2020, the impact of netting assets and liabilities and the collateral pledged or received based on MNA are detailed below:

Gross Amounts Not Offset in the Statement of Assets and Liabilities |

| Gross Asset

Derivatives

Presented in

Statement of

Assets and

Liabilities | | | |

Foreign Exchange Contracts | | | | |

| | | | |

| Gross Liability

Derivatives

Presented in

Statement of

Assets and

Liabilities | | | |

Foreign Exchange Contracts | | | | |

| | | | |

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ materially from those estimated. The Fund applies investment company accounting and reporting guidance.

3. SHARES OF BENEFICIAL INTEREST

The following table summarizes share activity:

| | |

| | |

Shares issued to shareholders in payment of distributions declared | | |

| | |

NET CHANGE RESULTING FROM FUND SHARE TRANSACTIONS | | |

4. FEDERAL TAX INFORMATION

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended November 30, 2020 and 2019, was as follows:

As of November 30, 2020, the components of distributable earnings on a tax-basis were as follows:

Undistributed ordinary income | |

Net unrealized appreciation | |

Capital loss carryforwards | |

The difference between book-basis and tax-basis net unrealized appreciation/depreciation is attributable to differing treatments for the deferral of losses on wash sales, partnership adjustments, discount accretion/premium amortization on debt securities, and mark to market of derivative instruments.

Annual Shareholder Report

At November 30, 2020, the cost of investments for federal tax purposes was $50,106,575. The net unrealized appreciation of investments for federal tax purposes was $1,657,637. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $1,685,888 and net unrealized depreciation from investments for those securities having an excess of cost over value of $28,251. The amounts presented are inclusive of derivatives contracts.

As of November 30, 2020, the Fund had a capital loss carryforward of $107,969 which will reduce the Fund’s taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code, thereby reducing the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income tax. Pursuant to the Code, these net capital losses retain their character as either short-term or long-term and do not expire.

The following schedule summarizes the Fund’s capital loss carryforwards:

Capital loss carryforwards of $557,569 were utilized during the year ended November 30, 2020.

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

The Adviser provides investment adviser services at no fee, because all eligible investors are: (1) in separately managed or wrap-free programs, who often pay a single aggregate fee to the wrap program sponsor for all costs and expenses of the wrap-free programs; or (2) in certain other separately managed accounts and discretionary investment accounts. The Adviser has contractually agreed to reimburse all expenses of the Fund, excluding extraordinary expenses. Acquired Fund Fees and Expenses are not direct obligations of the Fund and are not contractual reimbursements under the investment advisory contract. For the year ended November 30, 2020, the Adviser reimbursed $281,468 of other operating expenses.

Administrative Fee

Federated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. For purposes of determining the appropriate rate breakpoint, “Investment Complex” is defined as all of the Federated Hermes Funds subject to a fee under the Administrative Services Agreement. The fee paid to FAS is based on the average daily net assets of the Investment Complex as specified below:

| Average Daily Net Assets

of the Investment Complex |

| on assets up to $50 billion |

| on assets over $50 billion |

FAS may voluntarily choose to waive any portion of its fee. For the year ended November 30, 2020, the annualized fee paid to FAS was 0.078% of average daily net assets of the Fund. Fees paid to FAS by the Fund were reimbursed by the Adviser.

In addition, FAS may charge certain out-of-pocket expenses to the Fund.

Directors’/Trustees’ and Miscellaneous Fees

Certain Officers and Trustees of the Fund are Officers and Directors or Trustees of certain of the above companies. To efficiently facilitate payment, Independent Directors’/Trustees’ fees and certain expenses related to conducting meetings of the Directors/Trustees and other miscellaneous expenses are paid by an affiliate of the Adviser which in due course are reimbursed by the Fund. These expenses related to conducting meetings of the Directors/Trustees and other miscellaneous expenses may be included in Accrued and Miscellaneous Expenses on the Statement of Assets and Liabilities and Statement of Operations, respectively.

6. Investment TRANSACTIONS

Purchases and sales of investments, excluding long-term U.S. government securities and short-term obligations, for the year ended November 30, 2020, were as follows:

Annual Shareholder Report

7. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other funds advised by subsidiaries of Federated Hermes, Inc., may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from other participating affiliated funds. As of November 30, 2020, there were no outstanding loans. During the year ended November 30, 2020, the program was not utilized.

8. LINE OF CREDIT

The Fund participates with certain other Federated Hermes Funds, on a several basis, in an up to $500,000,000 unsecured, 364-day, committed, revolving line of credit (LOC) agreement dated June 24, 2020. The LOC was made available to temporarily finance the repurchase or redemption of shares of the Fund, failed trades, payment of dividends, settlement of trades and for other short-term, temporary or emergency general business purposes. The Fund cannot borrow under the LOC if an inter-fund loan is outstanding. The Fund’s ability to borrow under the LOC also is subject to the limitations of the Act and various conditions precedent that must be satisfied before the Fund can borrow. Loans under the LOC are charged interest at a fluctuating rate per annum equal to the highest, on any day, of (a) (i) the federal funds effective rate, (ii) the one month London Interbank Offered Rate (LIBOR), or a replacement rate as appropriate, and (iii) 0.0%, plus (b) a margin. Any fund eligible to borrow under the LOC pays its pro rata share of an upfront fee, and its pro rata share of a commitment fee based on the amount of the lenders’ commitment that has not been utilized, quarterly in arrears and at maturity. As of November 30, 2020, the Fund had no outstanding loans. During the year ended November 30, 2020, the Fund did not utilize the LOC.

9. OTHER MATTERS

An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in late 2019 and subsequently spread globally. As of the date of the issuance of these financial statements, this coronavirus has resulted in closing borders, enhanced health screenings, healthcare service preparation and delivery, quarantines, cancellations, and disruptions to supply chains, workflow operations and consumer activity, as well as general concern and uncertainty. The impact of this coronavirus may be short-term or may last for an extended period of time and has resulted in a substantial economic downturn. Health crises caused by outbreaks, such as the coronavirus outbreak, may exacerbate other pre-existing political, social and economic risks. The impact of this outbreak, and other epidemics and pandemics that may arise in the future, could continue to negatively affect the worldwide economy, as well as the economies of individual countries, individual companies, (including certain Fund service providers and issuers of the Fund’s investments) and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the Fund’s performance.

Annual Shareholder Report

Report of Independent Registered Public Accounting Firm

TO THE BOARD OF TrusteeS OF Federated Hermes managed POOL SERIES AND SHAREHOLDERS OF federated Hermes INTERNATIONAL bond Strategy portfolio:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Federated Hermes International Bond Strategy Portfolio (formerly, Federated International Bond Strategy Portfolio) (the “Fund”) (one of the portfolios constituting Federated Hermes Managed Pool Series (formerly, Federated Managed Pool Series) (the “Trust”)), including the portfolio of investments, as of November 30, 2020, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (one of the portfolios constituting Federated Hermes Managed Pool Series (formerly, Federated Managed Pool Series)) at November 30, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2020, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Federated Hermes investment companies since 1979.

Boston, Massachusetts

January 25, 2021

Annual Shareholder Report

Shareholder Expense Example (unaudited)

As a shareholder of the Fund, you incur ongoing costs, including to the extent applicable, management fees, distribution (12b-1) fees and/or other service fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2020 to November 30, 2020.

ACTUAL EXPENSES

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are required to be provided to enable you to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value

6/1/2020 | Ending

Account Value

11/30/2020 | Expenses Paid

During Period1 |

| | | |

Hypothetical (assuming a 5% return before expenses) | | | |

1

Expenses are equal to the Fund's annualized net expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half-year period). Federated Investment Management Company, the Adviser, has contractually agreed to reimburse all operating expenses excluding extraordinary expenses and expenses allocated from affiliated holdings, incurred by the Fund. This agreement has no fixed term.

Annual Shareholder Report

Board of Trustees and Trust Officers

The Board of Trustees is responsible for managing the Trust's business affairs and for exercising all the Trust's powers except those reserved for the shareholders. The following tables give information about each Trustee and the senior officers of the Fund. Where required, the tables separately list Trustees who are “interested persons” of the Fund (i.e., “Interested” Trustees) and those who are not (i.e., “Independent” Trustees). Unless otherwise noted, the address of each person listed is 1001 Liberty Avenue, Pittsburgh, PA 15222. The address of all Independent Trustees listed is 4000 Ericsson Drive, Warrendale, PA 15086-7561; Attention: Mutual Fund Board. As of December 31, 2020, the Trust comprised six portfolio(s), and the Federated Hermes Fund Family consisted of 41 investment companies (comprising 163 portfolios). Unless otherwise noted, each Officer is elected annually. Unless otherwise noted, each Trustee oversees all portfolios in the Federated Hermes Fund Family and serves for an indefinite term. The Fund’s Statement of Additional Information includes additional information about Trust Trustees and is available, without charge and upon request, by calling 1-800-341-7400.

Interested TRUSTEES Background

Name

Birth Date

Positions Held with Trust

Date Service Began | Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s) |

J. Christopher Donahue*

Birth Date: April 11, 1949

President and Trustee

Indefinite Term

Began serving: